Bank of Canada’s two preferred measures of underlying inflation accelerated, tripping up widespread expectations of cooling.

By Wolf Richter for WOLF STREET.

Just how tough it is to get inflation down after the easy battles have been temporarily won is now being demonstrated in all kinds of places, including in Canada according to the CPI data released today, and including in the US, where services inflation is in no mood to go away. Services is where the majority of consumer spending goes. It’s the biggie.

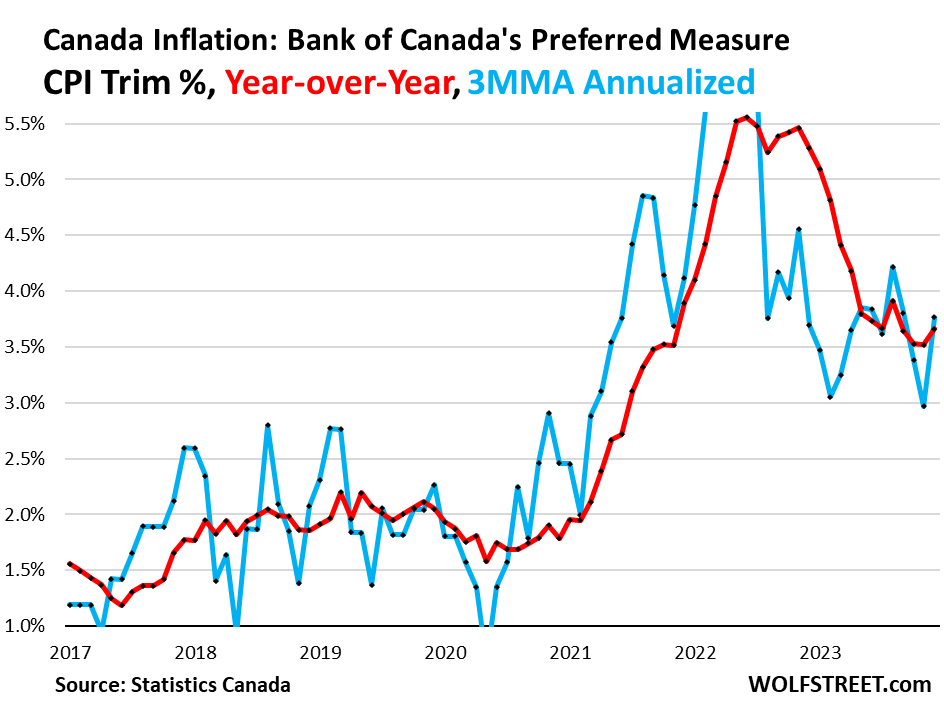

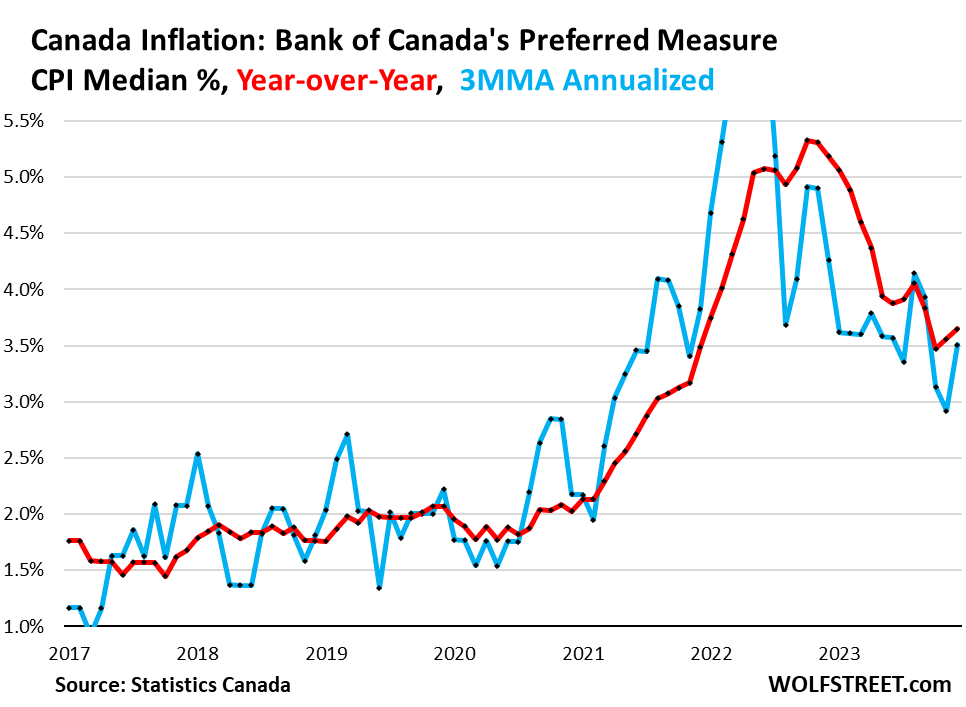

Rate cuts? Today’s data brought particularly bad news after months of hype and hoopla about rate cuts by the Bank of Canada: The BoC’s two preferred measures of core inflation: “CPI trim” and “CPI median” both re-accelerated sharply month-to-month as well as year-over-year, which was very unexpected. This is precisely the kind of surprise that the BoC had been cautious about and has warned about.

Bank of Canada’s preferred measures of underlying inflation accelerate.

CPI trim jumped month-to-month by 0.39%, the hottest since August, and third month in a row of acceleration (up from 0.20% in September). This amounts to 4.8% annualized, which pushed the annualized three-month moving average (3MMA) to 3.8% (blue). Year-over-year, it accelerated to 3.66% (red).

CPI median spiked by 0.38% month-to-month (4.7% annualized), the hottest since August, and the second month in a row of acceleration (up from 0.14% in October). The 3MMA annualized accelerated sharply to 3.5% (blue). Year-over-year, CPI median accelerated to 3.65% (red).

These developments tripped up the widespread expectations of further cooling of inflation.

Overall inflation, core, services, housing, food, energy, durable goods.

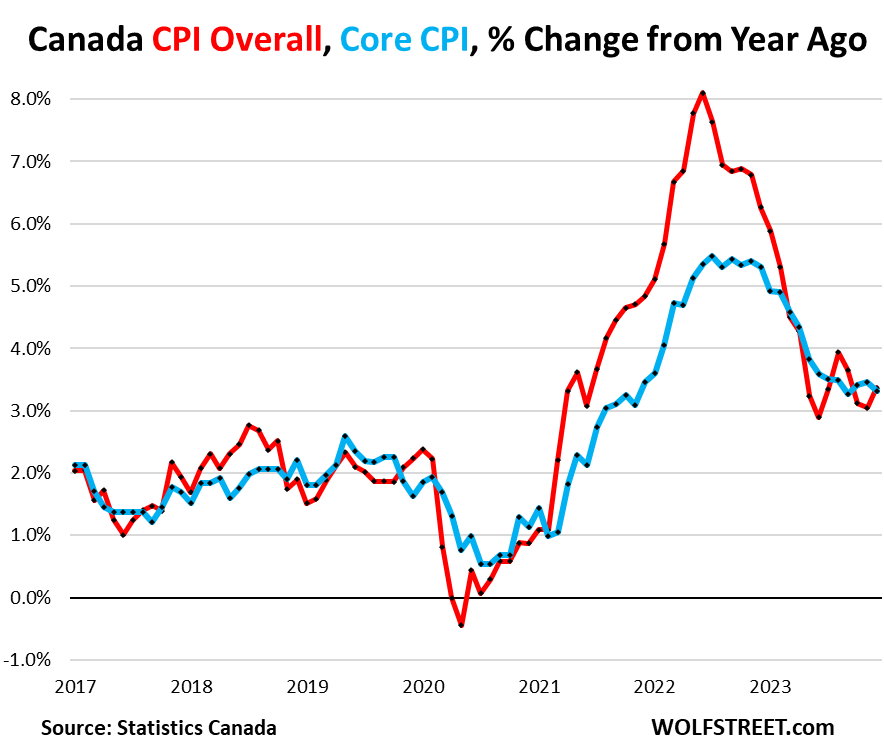

The overall CPI has been in the same range between 3% and 4% since May 2023 and in December was back in the middle of that range. It accelerated to 0.31% in December from November, or by 3.8% annualized, the sharpest increase since August. Year-over-year, overall CPI accelerated to 3.4 (red).

Core CPI has been in the same very narrow range around 3.4% for the past four months. In December, it decelerated to 3.31% year-over-year, from 3.47% in November, and up from 3.28% in September (blue).

What this chart shows is that there hasn’t been any progress in months:

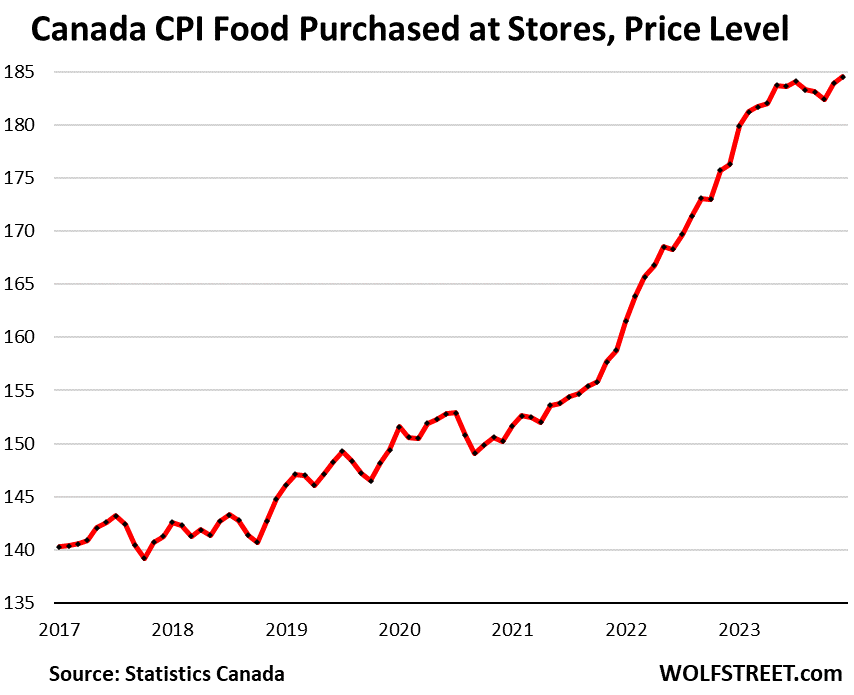

The CPI for food purchased at stores rose by 0.33% month-to-month and by 4.7% year-over-year.

In terms of price level, December’s increase pushed the index to a new record. Since February 2020, before all the stimulus craziness started, the CPI for food has surged by 23%:

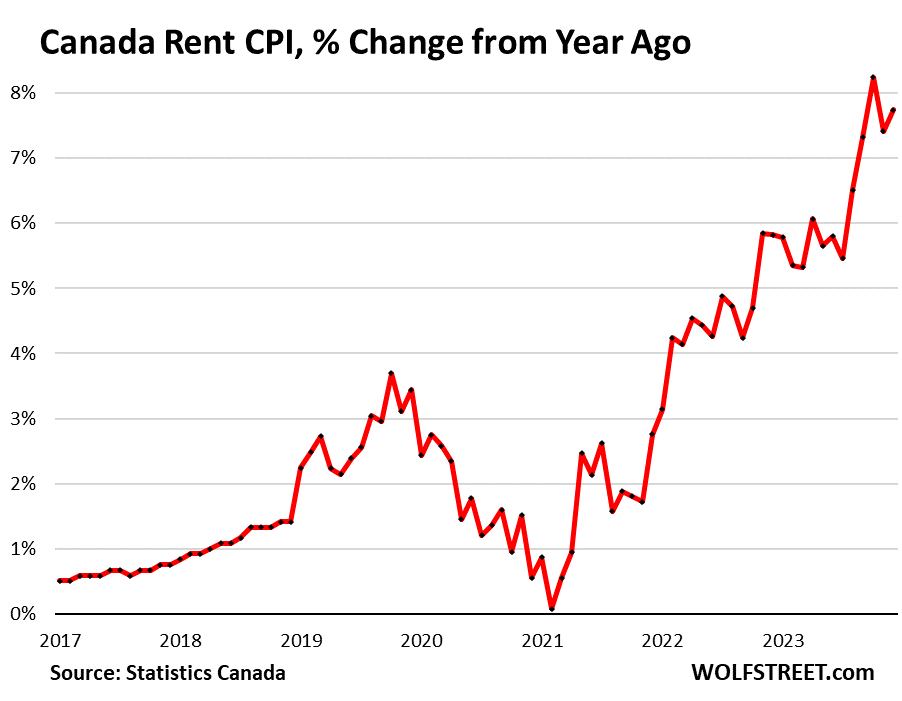

The CPI for Rent remains red hot and accelerated further. Month-to-month, rents surged by 0.74%, or by 9.2% annualized! Year-over-year, rent inflation accelerated to 7.7%, the second worst since April 1983, behind only October. The rent CPI is a measure of what tenants pay in rents.

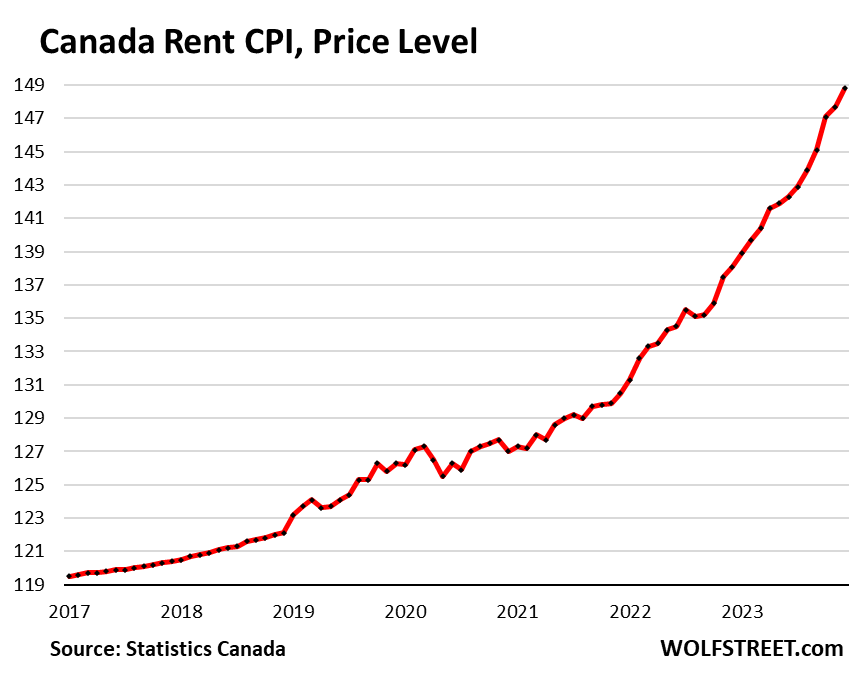

This chart shows the Rent CPI in terms of price level, not percentage change. Since February 2020, the Rent CPI increased by 17%. Over the past two years, it increased by 13.5%:

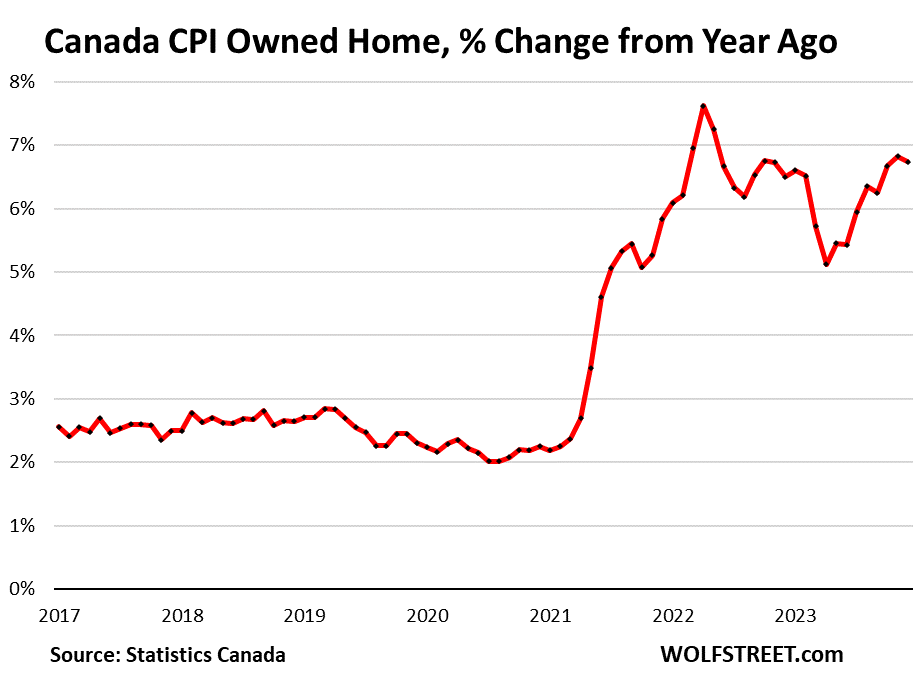

The CPI for homeownership, or “owned accommodation,” has remained roughly in the same red-hot range of 6.7%. There was a deceleration in mid-2023, but in October through December it reaccelerated at the same hot rate as a year earlier.

The index includes the following items that homeowners have to deal with (% year-over-year):

- Mortgage interest cost: +28.6%;

- Homeowners’ replacement cost (the dropping home prices): -1.5%;

- Property taxes and other special charges: +4.9%;

- Homeowners’ home and mortgage insurance: +7.4%

- Homeowners’ maintenance and repairs: +4.8%;

- Other owned accommodation expenses: +0.3%.

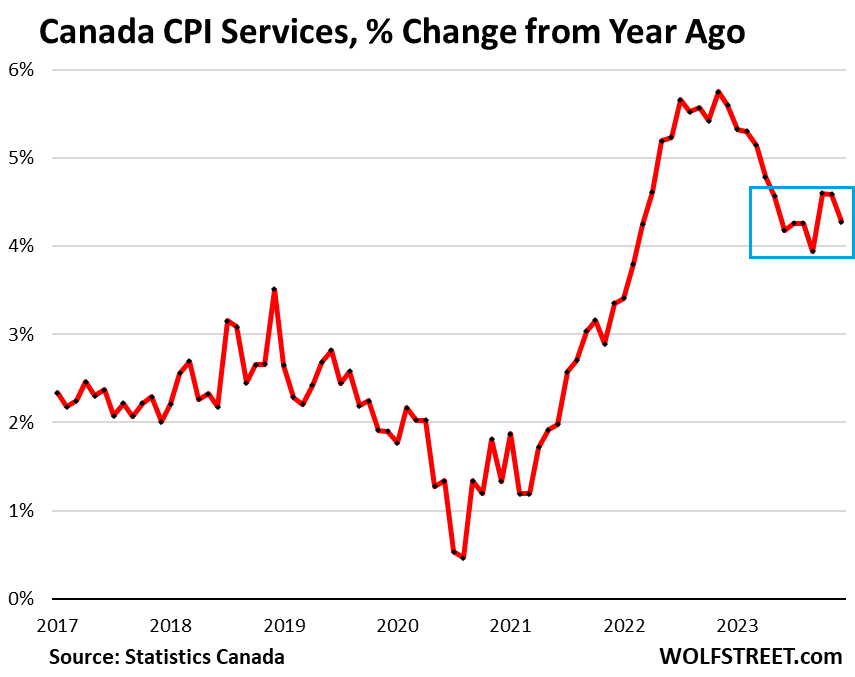

Services inflation decelerated in December to 4.3% year-over-year but hasn’t made any progress since May 2023:

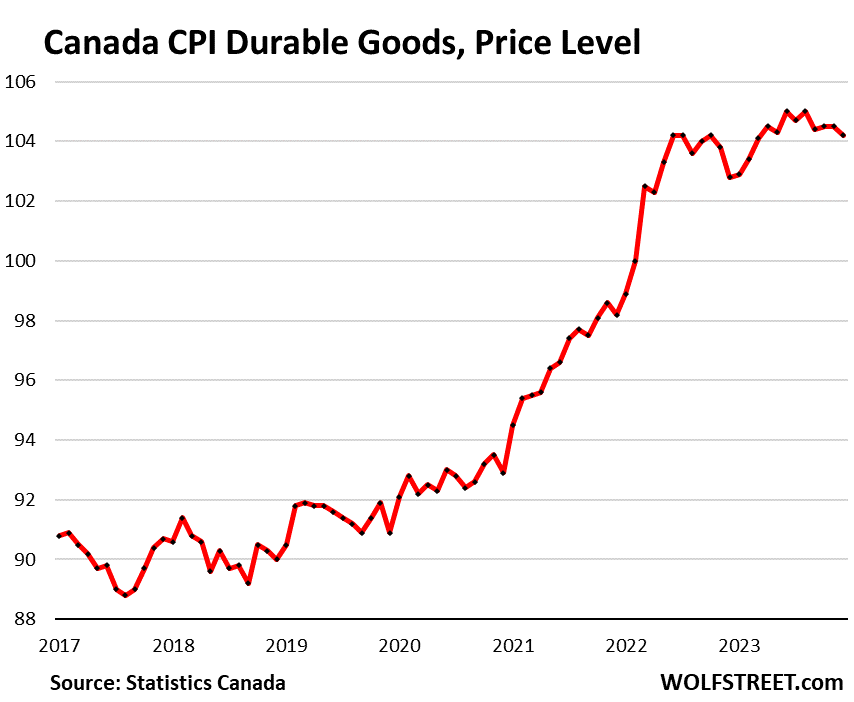

The CPI for durable goods, after the huge surge in 2021 through mid-2022, has plateaued and is inching lower. In December it declined by 0.29% for the month. Year-over-year it still increased by 1.4%. Durable goods are dominated by new and used motor vehicles:

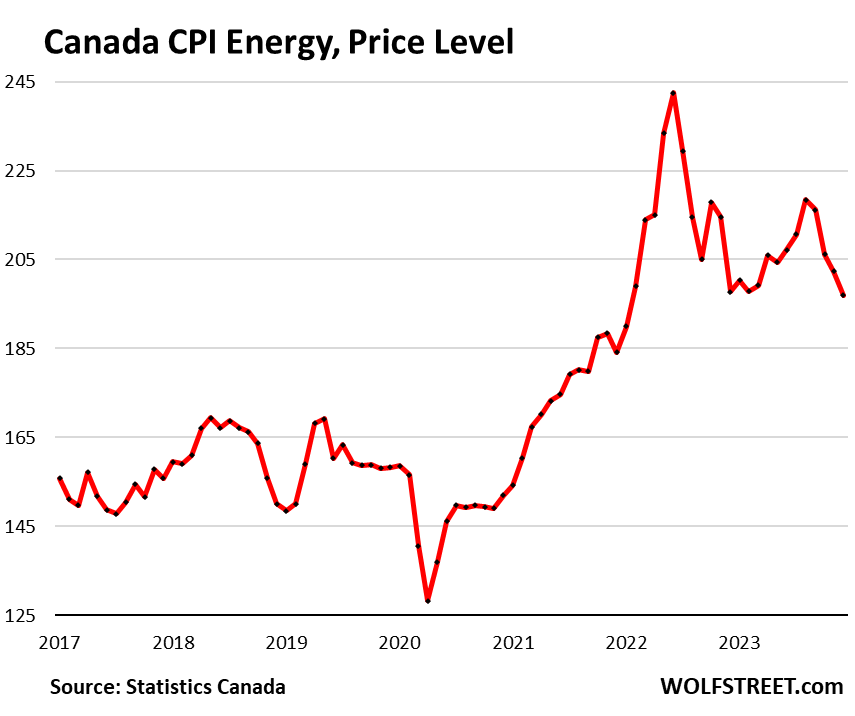

The CPI for energy dropped by 2.6% in December from November, not seasonally adjusted. The index has now worked off the entire spike since February 2022. The well-known and vexxing problem with plunging energy prices is that they cannot plunge forever.

The aggregate includes the energy products and services that consumers buy as such: gasoline, electricity, natural gas, fuel oil, heating oil, other fuels, etc.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Sitting on their hands since, I think, July last year.

Never a good thing to do with Inflation.

You need a hard enough landing you can walk away from because a recession is a great thing for clearing out the deadwood and over indebted.

I have no idea why they fear is so much.

They fear it because they have no strengths left, so they hide behind a mirage of asset bubbles.

Inflation and its distorted measurements help hide the fact that the 90% are getting poorer.

“hard enough landing”

Central Bankers, since 2008, have seemingly and collectively decided that cycles that purge and cleanse ……ferret out the poorly operated and leveraged…..and thus leave conditions healthier……are a nuisance and won’t be allowed.

Central Bankers truly do not believe in free markets, IMO.

And it is questionable that they even care about inflation.

Note, if the new acceptable is 3%, in 20 years the dollar would lose nearly 70% of its purchasing power due to compounding. How can that be considered “stable prices”?

And what of the “overshoot” in prices that occurred here in the US beyond the 2% accepted trajectory? There is absolutely no discussion on wringing that out. (11% to 19% depending on the inflation metric used). All we hear is tacking on lesser incremental increases.

The silence on the matter speaks volumes of CBs true concerns of inflation, IMO.

Because of the unrest and the higher cost of building it all back again.

Remember people are lazy and programmed now to NEVER expect hard times…they would not know how to deal with it. My parents were depression children, so I heard, learned and prepare.

Thus the can will kicked until the 1% gang get well protected, let the carnage and smoke clear then come in and buy it for pennies of the dollar (nickels in Canada – no more pennies).

Wash, repeat..same as it ever was.

Loblaws used to mark down near-expired stock at 50%, but recently they intend to reduce it to no more than 30%.

The discounted section is the new bargain shopping in Canada.

Rent and food are two expenses that one cannot avoid.

This is why many people are complaining that the authorities are fuelling the demand for food and shelter by opening the visa applications like candy.

People on a visitor’s visa are working in Canada, and one balding 50-something guy thanked his consultancy for letting him get a student visa, and a work permit for his wife as soon as he landed in Canada on a visitor visa.

As long as he and his wife are employed in a productive pursuit and not receiving welfare it will be good for the economy.

No it’s not. It’s to the detriment of law-abiding citizens.

There is a reason why countries have borders, immigration laws, and a legal system. The guy came to Canada on a visitor/tourist visa.

In America, people are outraged that in some states, children as young as 10 are being allowed to work on farms and factories.

What’s good for the economy isn’t necessarily good for the average person.

Canada is a dream destination for many people who don’t have good skills, are manual labor and are extremely poor in their home country.

One of the reasons for this is: Good social benefits in Canada and/or any other first world country in comparison with 2nd/3rd world countries.

Completely agree with you Gen Z. Canadians are too much tolerant, not raising their voices. Canadian govt is promoting this cheap labour at the cost of poor, eligible, tolerant Canadian Citizens.

The economic pie goes like this. There will always be CEOs and low wage workers no matter how much equality there is in the markets.

The fraud that goes on in the Canadian visitor visa and student visa program affects anyone who is not a CEO or politician, whether it be getting a job, or finding affordable housing. Canadians who are not the top 10% lose in the end.

I worked summers on a farm starting at 14. Was a paperboy before that for 2 years. Could have done the work at 10, good money at almost double minimum wage at the time and completely safe.

Very good experience being around adults, some smart, some crazy, and learning what I didn’t want to do as an adult. Made me work a little harder in school as well. Plus I had so much extra money I went to France by myself at 17!

Some jobs are better suited for kids – they’re fit and nimble.

DATA? where is the data? This is anecdotal and even so the person came legally. What is the median age of immigrant coming in? What is their median income? What is “not law abiding” about that immigrant? Veiled references to hide behind?

It has been shown over and over in USA immigrants have lower crime rate than citizens.

Same BS different forum.

The issue is so called “law abiding citizens” are too lazy to either do jobs which are in need of workers or have more children at least to fill the labor market. So, immigrants are imported and welcomed with open arms

As long as they fulfill their indentured servitude, depress wages and drive up costs while benefiting their masters then it’s good for the 1%. If they’re out of line then they can be sent back where they come from.

Until they figure it out like everyone else and give up and go on welfare or go back home.

Gen Z,

I enjoy your comments.

I’m glad that you, at least, realize that Canada sucks.

It’s wonderful if you know how to gain the system after you have a nice nest egg in savings..

Remember the system is gamed for the upper and lower class to not pay taxes..only the middle…so if you can’t be middle class, fall a few tax brackets, collect the government hand outs and enjoy your free time, doing some side cash work and viola your back middle class and not paying taxes.

Until the government realizes a lot of people will game the system in Canada like this, it will continue. And with a lack of respect for most government workers, I have zero guilt in not paying my fair share…reduce government 25% Ill start paying instead of taking.

I guess the politicians in Canada read this message board. Canada is working on reducing student visas in Ontario, BC, and Nova Scotia as a response to the housing crisis in those provinces.

In Australia, the recently released figures show 1 in 10 people in Australia are walking around on some sort of Visa. It has produced the same problem, rents are now impossible to meet for the working People earning the average wage/salary.

Canada will never get inflation under control when they’re brining in millions of migrants every year. The economy is under incredible strain, the feds are keeping the house of cards together with more people for now but eventually it all going to crumble.

Canada has never “brought in millions of migrants every year”. Last year the country took in under half a million, and even with the next year added they still didn’t reach a million, combined.

Canada was “flooded” with illegal immigrants last year too. 6,100 of them per the NHI and Border Patrols. Compare that with the USA where 2,500,000 crossed the southern border alone in 2023.

The USA had more illegal immigration across the northern boarder than Canada did. And it’s such a small number that it gets absolutely no political recognition.

KGC,

“Last year the country took in under half a million, and even with the next year added they still didn’t reach a million, combined.”

Your numbers are way wrong. StatCan data:

2023 increase in pop: +1.25 million, biggest ever.

2022 increase in pop: 824,686

two years combined: 2.076 million

Have you ever visited a Wal Mart, fast food franchise or ever heard of the Hudson Bay fulfillment warehouses across Southern Ontario?

They appear to only hire international students from certain countries.

Many Canadians are complaining about it. Hudson Bay want Canadians to pay $1,000 for a suit, but refuses to hire Canadians.

The only way they can continue to lure them in will be double digit increases in the minimum wage. The housing problem in Canada will only get a lot worse. Soon we’ll see double digit increases in the minimum wage.

Canadian here- we are screwed.

The Trudeau administration has accepted record numbers of immigrants into the country this year; and this is driving up the cost of rental housing. They apparently do not care about the well-being of native Canadians, and would rather assuage their progressive ideology than cater to those who were actually born and raised here.

Bingo! Also tourist towns in the National Parks the cost of living is high. Recent reports of 25-35$/hr is a living wage out west.

The resorts and business owners were scrambling not knowing how to get minimum wage workers after Canadian born workers wouldn’t line up to work for them. So they had 2 options, raise wages to entice Canadians or hire out of country and dangle the Canadian citizenship carrot to work and live in squalor conditions and retained profits. Some new Canadian jobs businesses can apply for grants and wage subsidies.

Today these towns are 30-40% new Canadians. Businesses pay what the federal governments job bank says is the median eg, permanent residence cooks in Banff is 17.00$/hr where living wage is closer to 35.00$/hr. When I was a university student 20 years ago I was a cook in a tourist town out west and my wage was 17.50$/hr and the cost of living was 1/4 it is today.

Countries such as Australia have living wages if you are a cook there you’ll be paid 32-40$/hr. Canada is afraid to increase wages for the indentured servants because the ponzi they created will collapse.

It seems the only wages which are increasing due to inflation are unionized jobs including government pay. Everyone else not a chance.

Sure looks like BoC will need to raise again.

Some of this spike is a result of gasoline price DECREASES in December of last year. And so the year over year increase was somewhat expected. BoC cannot raise rates any further; people already losing their shirts, rents are crazy and immigration levels highest ever, increasing demand for housing esp around Toronto. (I’m Canadian btw)

Gasoline prices nearly always plunge in December from November in Canada (they plunged this year and they plunged last year) and they spike in the summer (driving season).

The BOC always has one eye on the US Fed.

“The area under the curves — which you did for some parameters” — always positive.

If you define an index at 100 for 2017, we can see that even the 2% IR gets compounded, then we hade the big leap (during pandemic; I wonder if that is due to foreign workers leaving or even dying unaccounted) that would give a staircase like jump in the index and then back to 3% annual compounded.

We have to thank the ME Sheiks for giving us the oil like water. They could as well leave it in the ground and extract little at a time. By that that the world would realize the all EV is not a panacea for all uses.

Let us hire Argentine peasants to learn how to live with run-away inflation.

If mortgage rates don’t decrease, since Canadianincomes haven’t increased much in 5 years, isn’t a wave of residential home loan foreclosures likely when mortgages originated 5 years ago at low rates get repriced?

Prices are so high in British Columbia, I live in Nelson a ski town where the cheapest house, a mouldy old early 1900s house was priced at 500k. That said, sales are down over 50% and more expensive properties are not moving at all. We had mortgages as low as 1.5% and the longest mortgages are 5 years. The math of a 700 or 800k mortgage going from 2% to 5% will mean foreclosures and sales out of necessity. On top of that building costs here are at least $400/square foot. We have a serious housing crisis here and it won’t get better.

Home prices shot up so fast – 50% in about 3 years overall – that not all that many people actually bought homes at those prices. The people who’d bought earlier are still sitting on massive home price gains. They can just sell their home, pay off the mortgage, and walk away from the debt, their bank account stuffed with extra cash. They can rent or buy something cheaper. If they do this before they default on their mortgage, their credit will be intact, and no problems.

The issues get tough for a larger number of homeowners when prices plunge by 30%. For Canada overall, a 30% drop from the peak would take prices back to about 2020/2021 levels. So people who bought over the past 3-4 years with small down payments would be underwater, and unable to sell the home and pay off the mortgage. Still the numbers wouldn’t be huge because not that many people bought homes and financed them with small down payments in that 3-year time span. A drop of 40% from peak would do damage to a lot more mortgages.

Even in the great 2008-2010 housing crash in the US prices dropped approx. 25%. Is 40% in Canada realistically possible? It would likely create a massive recession.

That’s a revision of history.

1. The Case-Shiller 20-Cities Index declined by 34%.

2. The national averages don’t matter because that’s not where your house is. Local markets matter to your mortgage and house because your house in Miami has to be sold in Miami; you can’t sell it in Dallas just because prices are higher in Dallas.

3. Many metros dealt with 50%-plus declines. For example, the Case-Shiller indexes for the metros Las Vegas and Phoenix -57%, Miami -51%, Tampa -50%, Detroit -50%. Others in the Case-Shiller index dropped by 40% or more: LA and San Diego -42%, Chicago -42%, Atlanta -40%, Minneapolis -38%. CS only covers 20 metros. The median prices in many metros dropped by more than 50%. For example, the median price for the 9-county San Francisco Bay Area (the CS only covers half of that) dropped by 59%.

No because rates never got into double digits and by my math a 12 percent mortgage rate was needed to break the Chinese stranglehold on housing dating back to 2015. The Chinese had to much built in equity dating back to 2015 for any increases in the Bank of Canada rate to affect them.

While Canada is our northern neighbor, financially it is similar to the US and banking is international. In the 1960s people could get a passbook savings account with 5%. In the roaring 1920s the Federal Reserve’s interest rate was 4%. Today the Federal Reserve is 5.5% and Canada 4.5%. This constant pondering about the nothing these interest rates will do is ludicrous. Especially, considering that the roaring 1920s had no inflation and today’s rate is a joke calculation compared even to the 1970s calculation. Canada and the USA are going to continue burning up the population’s money; wake me up when the Central Bank’s interest rate hits 10%, then we can discuss the advisability of holding.

Wolf or commenters-

It would be interesting to hear any assessment/opinions on the methodology that Canada uses in their quest to measure inflation, as opposed to the methodologies practiced in the US.

Any glaring errors? Anything US analysts could benefit by emulating? Is the measurement of rent changes better in one country of the other?

Thanks for any thoughts, and excuse me if this has already been covered and I missed it (or worse, at my age, FORGOT!)

One big difference is how housing inflation is calculated – though the result is about the same, both measures are high and are pushing up CPI.

The both use two types of measures to calculate housing inflation:

1. Both calculate CPI Rent in a similar manner, actual rents paid by tenants over time.

2. But “homeowner” inflation is calculated very differently. I explained in the article how StatCan is doing it: actual costs for homeowners, from mortgage rates (which declined), and replacement costs (which fell), to property taxes — and they’re listed in the article.

The problem there is that higher mortgage rates (result of rate hikes) add to Canada’s inflation figures. I’m not a fan of this method because it’s directly influenced by BoC policy action (mortgage rates) and home prices (replacement costs). Home prices are asset prices, homes are not consumables, and shouldn’t be thrown in with consumer price inflation. But they should be tracked as asset price inflation (and we do that here regularly including for Canada).

The BLS uses the concept of “shelter” as a service, and so its OER measure is designed to estimate inflation of “shelter” as a service for homeowners. When home prices crashed in 2005-2011, OER didn’t crash with it. It continued to go up and showed inflation in shelter as a service, even as home prices were crashing. If OER had tracked home prices, overall CPI would have been in deep deflation in 2007-2011, which was BS because consumer prices were rising. So that was pretty impressive. That gave me some respect for the OER method. I track OER against home prices with this chart:

Thanks!

“I’m not a fan of this method because it’s directly influenced by BoC policy action (mortgage rates) and home prices (replacement costs). Home prices are asset prices, homes are not consumables, and shouldn’t be thrown in with consumer price inflation.”

While I agree with this criticism, I like that Canada’s Owned Accomodation directly measures property tax inflation, instead of indirectly as US OER does.

On second thought:

Yes, home price should not be a part of CPI. But why shouldn’t mortgage interest? After all, interest is fundamentally the cost of capital, so you’re measuring the inflation of this cost to homeowners.

I’ll take the other side of that issue. I like the Bank of Canada’s method.

To me, it seems very odd to exclude home prices from the inflation tracking metrics used to set interest rates. Homes are the biggest purchases we make. Should we say inflation in our biggest asset isn’t important, simply because we don’t buy them every year? That makes little sense to me. We track auto price inflation in the metrics for rate setting. Why not houses?

In theory, a hypothetical rent will capture the bulk of housing price appreciation over time, and it will smooth out the statistics. But I’d rather have the statistics be accurate. When house prices dramatically outpace rents, the current methodology is inaccurate, perhaps for decades, and it leads to faulty interest rate setting. Look at Wolf’s chart of actual home prices to OER. Things are out of whack.

If home prices had been included in the inflation metrics used for interest rate setting, would the Fed have been able to pursue ZIRP and QE for many years? No way. Would home prices have risen 200-300% in a decade in many areas? No way. Might the economy have suffered a recession during those six years. YES, but recessions are necessary to clean out dead wood.

Also, the OER approach seems to assume the cost of a home can be broken down into two components – a rental service (i.e., OER) and an investment. They then exclude the investment component from inflation metrics, thinking only consumables and services are relevant for interest rate setting.

The problem with that approach is that over 70% of people will buy a home at least once in their lifetime. They view it as a necessity. Renting is not a suitable replacement for them, particularly for larger families. They are forced to buy the total home, not just a hypothetical rental component of it. Something is not really an “investment” if you can’t buy and sell it separately. I think the what they call an investment component is really a luxury component, and there is no basis for excluding luxuries from the inflation metrics. Luxuries are likely a majority of our purchases.

Bobber: but how does the higher home price translate into increased monthly costs?

Here in USA, 30yr fixed mortgages mean the mortgage interest doesn’t go up with rising rates. BUT inflation means my prop tax and homeowners ins have gone up. US CPI measures increases in homeowners ins directly, but only measures prop tax inflation indirectly via OER.

In Canada, higher rates directly translate to higher interest payments, ergo higher monthly mortgage payments for Canadian homeowners.

“Something is not really an “investment” if you can’t buy and sell it separately.”

I agree with this – and to add to your argument, vehicles are a durable good in both CPIs, yet homes aren’t. I recall reading a blurb from Wolf describing the rationale – cars are “consumed” and replaced more often than homes. But it depends who you ask – personally, I plan on owning my current car and home until the day I die.

MM,

Many people who currently rent want to buy. We hear from many such folks on this board. They must save for the eventual purchase every month, and that’s your monthly purchase. As houses inflate, the value of those allocated savings erodes.

Even current homeowners who want or need to upgrade to a bigger or better home face the same issue in an incremental basis. They have to set aside cash flow now to purchase the home upgrade later.

Housing price inflation impacts a lot of people. It should be considered as part of rate setting. I can see a basis for excluding mortgage interest, because it’s a fixed cost and circular, but not housing prices.

The failure to give proper recognition to home price inflation might have caused the 2009 and current bubbles.

Something is wrong. Everybody feels it in their gutt. Homeowners wonder where the windfalls are coming from. Future homebuyers wonder why everything seems out of reach.

The faulty mechanism is the Fed’s interest rate setting, which disregards home price inflation. People can be priced out of home markets with 200% inflation in a decade, while the Fed says “not my problem, home prices aren’t in CPI”.

The New York Fed’s Empire State Manufacturing Survey for January crashed from -14.5 to -43.7 – the worst print in the survey’s history outside of the COVID lockdown. In 2009 the worst reading was -33.

Business activity dropped sharply in New York State, according to firms responding to the January 2024 Empire State Manufacturing Survey. The headline general business conditions index fell twenty-nine points to -43.7, its lowest reading since May 2020. New orders and shipments also posted sharp declines. Unfilled orders continued to shrink significantly, and delivery times continued to shorten. Inventories edged lower. Employment and the average workweek declined modestly. The pace of input price increases picked up somewhat, while the pace of selling price increases was little changed. While firms expect conditions to improve over the next six months, optimism remained subdued.

The -43.7 print was a stunning 10 standard deviations below expectations of a bounce to -5.0…

—————–

Maybe the FED saw this scenario forming and changed their tune in mid December? This is bad or is it a one month anomaly?

That being said most forward indicators are positive:

While firms expect some pickup in activity in the months ahead, optimism remained subdued, with the index for future business conditions climbing seven points to 18.8. The capital spending index increased ten points to 13.7, pointing to some improvement in investment plans.

Thanks for the additional insight to the headline I saw this morning about the sharp drop in the Empire State index. Weak ISM numbers over the past few months have foreshadowed this result. However we do not live in 1974 any more. A recession in the industrial part of the U.S. economy should not cause a recession in the U.S. The consumers or as Wolfe calls them—Drunken Sailors—have too much money in reserve to spend. Curious what Wolfe thinks.

You need to compare the drops during a recession to the current drops. The Empire State index spends a lot of time in the negative without there being a recession.

These indexes are “sentiment” indexes, tracking the sentiment of executives, not actual numbers of production, revenues, employees, etc. The surveys ask: compared to last month, did your company increase, decrease, or not change production. Increase = 1; decrease = -1; no change = 0. So the 0-line in the Empire State Index means that an equal number of respondents said “increase” and “decrease.”

Canadian rent inflation seems higher than USA rent inflaion. And yet Canadian home prices seem to have come down more than American home prices.

I imagine Canada’s variable rate mortgages have something to do with this. Canadian landlords’ costs are more directly impacted by rising rates.

MM, you’re right.

When businesses buy multi-unit residential buildings in Canada – they do so with variable rate mortgages. Part of what is happening in the rental market is a consequence of landlords attempting to cover the cost of higher interest rates.

In terms of the cost of single-family homes, higher rates force price discovery in Canada – at least to some extent. In the US, home owners can just sit on their 3% mortgage rates. In Canada, variable rates mean many homeowners are forced to sell.

We also have some issues with supply, our pop growth is high and availability of rentals in many towns is low which is allowing landlords not subject to rent control to squeeze tenants.

I don’t actually know the numbers behind it but I travel across the country for work, we often have to rent units for the guys and I’ve never seen this before in the last 10+ years, some places we can’t even get rentals at all so we have to use hotels or make longer term deals with AirBnB owners. In some towns listings go same day they are listed, most landlords don’t even respond to emails or phone calls.

Just out of curiosity what happens if a central bank refuses to recognize real inflation and keeps stated policy inflation rates much lower than the real inflation rates at hand?

How would anyone know?

you’ll get more and more inflation until you’re in Argentina. At one point, when they had about 30% inflation, the government of Argentina made it illegal to publish inflation figures. That didn’t last long because the government got thrown out because everyone knew inflation was catastrophic even if they couldn’t put a number on it. Now they have 160% inflation.

Once inflation takes off, you can play all the games you want to, but inflation will just do its thing and eat up everything denominated in that currency until you fight back.

As stated tersely in Fiat Money Inflation In France (Andrew Dickson White, 1896) describing the French inflation that contributed to the French Revolution:

“Paper money is the emetic of great states.”

The dollar (DXY) skyrocketed the last couple of days and annihilated precious metals. Paper money is looking good while the pretty rocks are trash.

Escierto-

Over the last 4 years, the DXY has traded between 90 and 113, and closed yesterday at 103. Over the last couple of days it rose about 1%

Over the last 4 years, gold has traded between $1540 and $2100, and closed yesterday at about $2020. Over the last couple of days it dropped about 2%.

“Skyrocketed” and “annihilated” are in the eyes (or imagination) of the beholder, I guess. One man’s “trash” is another’s treasure…

Comparing the price of gold to any currency (with the possible exception of the bitcoin experiment … thus far) produces a positive progression in favor of gold, though its price progresses in fits and starts.

My comment was not meant to promote gold. But the fact that fiat currencies eventually dissolve, and that indestructible gold mined and minted over past millennia still exists and has continued to rise in price, proclaims my point nicely.

Thank you for pointing it out.

DYX is useful to forex traders as it compares the dollar to othrr currencies but it isn’t a measure of inflation.

Compare a 40 year chart of oil priced in dollars vs oil priced in gold. Which one has a consistent uptrend and which one has stayed roughly flat?

DXY* doh…

John H. — fiat currencies “dissolve” when the states that issue them collapse. This is not a circumstance I am wishing for during my lifetime nor my children’s.

eg-

“… not a circumstance I am wishing for…”

Agreed!

My understanding it that the best way to avoid the collapse of the currency itself is:

1. The monetary authority stops creating new money.

2. Congress stops deficit spending.

These steps would involve a different type of pain for our children (grandkids too, in my case), but if it could happen, would be better for them in the long run.

And so, I continually harp (probably ad nauseam) on 1 and 2 above, wishing it might turn a mind or two….

Thank you for the reply Wolf.

After looking at your charts showing absolute prices vs. inflation prices, it’s pretty obvious prices will NEVER go back to pre-pandemic levels for any item.

If that’s the case, is there really a big difference between 2% inflation and 3% inflation? It seems like splitting hairs. If rent went from 120 to now 150, does it really matter if it stays at 150 or goes to 153??? or to 156??? or even to 143???

Agree. If you don’t allow recessions or deflation, you light an inflationary bottle rocket. Don’t be surprised when it eventually goes “bang”, as in 2000 and 2009.

This is the path that central banks have intentionally chosen – inflation. They will protect their precious asset price bubbles at almost any cost. The ultimate cost, which is a total collapse of the currency and country, is a possibility that their hubris and greed will not allow them to recognize.

The central banks of the world have decided to, in concert, create massive inflation in order to enrich the already obscenely wealthy while stealing the fruits of the working peoples’ labor, and to desecrate the poor. They feel that if they debase all of the currencies at the same time, that they will somehow avoid a currency crisis.

They are wrong. All currencies can become worthless pieces of paper. I am sure they have their “digital dollar” backup, but at that point nobody would trust them and they would be fleeing the country. Yellen, Bernanke, Powell and Greenscum are filth. There is a special place in hell for them.

ru82-

An upturn in business activity seems plausible in 2024, at least based on a recent strategy analysis of ISI (Mfg.) PMI recently sent out by my brokerage firm’s market strategist. Pretty convincing argument, part of which relates to the 2022 “pseudo-recession,” which helped “temporarily” slow inflation.

On the other hand, in a recent survey by Bank of America Global Fund Manager “90% believe lower rates are on the way, the highest such share on record going back to 2001” (Almost Daily Grants, 1/16/24). A turn upward in economic performance combined with high expectations for rate cuts will create a sea of disappointment!

Sounds like one of those “heads they win, tails I lose” kind of markets to me. Good to keep plenty of dry powder.

Cheers, and thanks for that info you reported.

Oops-

Above comment was intended as a reply to ru82 8:56 PM comment.

If you want to keep the real rates in negative territory you have two options:lower the rates or push the inflation up.

Or do both,it’s even better!

Wolf,

Do you know anything about the methodology used for calculating rent inflation? I work for a landlord in Ontario, and we have low turnover month to month. Since rents can’t increase for existing tenants in Ontario more than the government mandated amount (for example, during COVID it was 0% – I forget what it is this year, but something like 1.5%), and since, as I said, we have little turn over, our rental receipts are very, very stable. If you look back year over year – we’re talking 2-3% consistently over the last 10 years or so – and that hasn’t changed this year. Consequently, I’m assuming that the government is tracking asking rents (which is a very small percentage of the rental market and not reflective of what most people are paying and the increases that most renters are experiencing); asking rents are also highly influenced by new construction coming on the market (of which there is a lot right now) which seems to target “luxury” consumers. But I don’t know the methodology, so maybe I’m wrong.

Thank you,

Zach

1. You can tell that the rent CPI is not exaggerating rent increases by how LOW CPI rent was before the pandemic (below 1% yoy), and the 0% increase yoy in 2021. So right off the bat, you know that this index is not exaggerating rent increases, au contraire. It may be understating rent inflation.

2. No, the government is NOT tracking asking rents.

3. The CPI rent data is collected from dwellings by address, not people/households. This is a large number of addresses that get the survey. Each address gets the survey twice a year for several years, on a rotating schedule, and whoever lives in it responds to the survey indicating their current rent at this address. This data is then compared to the prior data on this address. This is a very good method to track actual rents paid by actual tenants. It picks up periodic rent increases for existing tenants as well as higher rents when new leases are signed. It also adjusts for improvements to the dwellings.

4. Rent increases in Ontario on current tenants in 2023 and 2024 are capped at 2.5%. There are no caps on new leases. When a tenant leaves, the unit gets leased at market rent, and so there can be a huge jump from a long-term tenant to a market-rate lease. And the survey picks that up. So in Ontario, you have a bunch of addresses where rents only go up 2.5% a year, and then you have a smaller number of addresses with new tenants where rents jumped from the prior long-term tenant by 20% or 40% or whatever. And the survey picks that up as well, and the rent CPI reflects both.

For example, a long-term tenant under rent control might have paid $1,000 a month when he moved out, and then the unit gets fixed up and put on the market at market rent, and the new tenant signs a lease for $1,500. A market cannot escape rent inflation with rent control; only long-term tenants can until they move, and then the unit catches up with the market via a huge jump in rent.

New renters pay market rents which is the vast majority of all immigrants coming to Canada.

I would watch closely how our SCOTUS is going to handle Johnson v. City of Grants Pass. The homelessness issue is coming to a head. I do not know if there is a parallel showdown in Canada, but the tent cities sweeps do show that there is a similar problem in Canada.

As far as I know the closest to a “showdown” here would be mayor Chow in Toronto airing all the dirty laundry out in front of the whole country in terms of housing and services in an effort to get the Feds to to pay up for their immigration policies which are a large driver of the problems in that city. If the Feds do not give any money the city will hike property taxes by quite a large amount, as a result Fed liberals will lose a lot of support, without which I don’t think they can win come next election.

It’s an interesting fight, it’s not really being framed as such but it’s exactly what’s happening, I’ve seen TO handle it that way before lol.

As far as Vancouver goes, they’ve probably the largest “unhoused” 😆 population, they elected a new mayor just before I left BC, I’m not sure what he’s doing about it but the provincial government has been buying up hotels and trying to hide the problem away in those.

Voters in Canada have very. very short memories. Anything can happen in the blink of an eyelash in the days leading up to the 2025 election.

Agree with your comments about mayor Chow. Quite the strategy and quite the timing with the liberals polling low. The argument against Chow is that the city is going beyond its scope (federal jurisdiction) and the current homeless issues shouldn’t be structural. Should be interesting to see how it plays out – I believe the liberals will cave in and fork over more funds… of course, they could be opening the flood gates with other cities expecting such treatment.

How will the inflation even slow down if every homeowner is still a gazillionnaire on paper.

I still see them spending like there is no tomorrow.

What does the market value of one’s house have to do with spending on other things at all?

Wealth effect.

If your home prices are quite high you feel confident about your net worth and can spend..even take heloc or cc loans to spend..

Same with other asset classes

@socalbeachdude, some people use the equity in their house as a bonus check. Some people draw on heloc to get that newest surf board, tesla, and such.

Pretty sure heloc volumes have crashed and stayed crashed.

Very few.

Completely true, not-made-up story:

I went to my local Porche dealer, and told the salesman I wanted to buy a new Porche. I told him I didn’t have any actual money, but I had a gazillion theoretical dollars from my home equity. To my surprise, I was unable to buy a car with these theoretical dollars.

Then I went to the grocery store and tried to buy some groceries. Once again I tried to pay with some of my gazillions of theoretical home equity dollars, but the manager told me they don’t accept home equity for payment.

Weird – why doesn’t anyone accept my theoretical home equity dollars as payment for goods or services?

Sorry to hear this. Luckily theres some traction in getting society to accept your gazillions of theoretical home equity dollars as real. Local tax offices and home insurance companies are spearheading this societal change. The arc of the moral universe is long, but it bends towards justice.

Talk to your bank about converting those theoretical home-equity dollars into actual Porsche dollars, backed by a lien on your first-born, with interest payable to the bank at prime plus out-the-wazoo %.

No.

Wall street having a cow over central bank rate cut hype pushback. Looks like wall street propaganda has been tempered slightly for the past few days, at least temporarily. I hope it continues (doubtful because wall street can’t take no for an answer) but will enjoy it at least for the moment.

I noticed the CPI for homeownership has property taxes increasing at 4.9%. This is already guaranteed to increase. Numerous municipalities / cities have released tax increases and it seems average is around 6% to 8% with Toronto and Vancouver being higher. The municipality where I live will increase this year by at least 50%. The year has only started – don’t mean to be overly pessimistic- but there’s already doubt (throw in wage inflation) about trying to get inflation down to 2%.

Tax increases of any kind are most certainly not ‘inflation.’

Property tax increases are factored into CPI. Not sure about America, but is in Canada. Considering that property taxes only go up, it certainly is inflationary.

US CPI measures it indirectly via OER, but not directly like the Canadian method.

Yes they are. You’re paying for a service (schools, roads etc). No different than inflation in other services.

Wrong.

Aside from the whole infinite growth in a biosphere with finite resources thing, my general hypothesis is that the central banks all over the globe have been coordinating their printing efforts, unlike the situation 50 or so years ago, certainly prior to the 1971 “Nixon shock” $hit. Anyway, yes, The Fed has shrunk it’s balance sheet and M2 over the last year. BUT other central banks, and especially our European (eurodollar) allies (proxies for the Fed) have more than made up the difference. It’s a global market, global debt and money supplies have been growing exponentially. Most humans don’t understand basic math, let alone exponential. In addition, Canada has vast untapped resources that the global market wants. Inflation isn’t coming down anytime soon. Unless there is a debt jubilee soon, global hyperinflation is baked in. Just a matter of time. I wonder if the bankers will distract us with a war, again…

“BUT other central banks, and especially our European (eurodollar) allies (proxies for the Fed) have more than made up the difference.”

🤣😍 I report on the ECB’s balance sheet regularly. It has plunged (in USD terms by over $2 trillion):

https://wolfstreet.com/2023/12/28/ecb-balance-sheet-qt-e1-94-trillion-from-peak-down-to-e6-9-trillion-shed-47-of-pandemic-qe-assets/

The ECB isn’t the only proxy Wolf. I know you know that, show me global money supplies, the global money supply is still growing, exponentially.

It will be higher for longer. I don’t think the “market” has figured it out yet…

Did you listen to Jamie Dimon speaking at Davos? Every once in a while a little bit of truth leaks out from these oligarchs.

This is why I stop your arguments: when your initial arguments gets shot down — in this case, “other central banks, and especially our European (eurodollar) allies (proxies for the Fed) have more than made up the difference” — you change it [in this case, “global money supply”].

So let me straighten you out on this: All central banks except the BoJ that committed QE are now reversing QE and are doing QT. Japan has now ended QE, it seems. That’s how I shot down your initial argument about “central banks” and “the ECB.” And now you’re coming back with “global money supply.” But money supply is a factor of many things other than central banks, and didn’t used to even involve central banks in a major way. QE and now QT changed that, which is why they’re so disruptive.

So this is where the argument stops.

Btw, FYI, M2 of combined US, Euro area, Japan, and China is down a tad from March 2022, nearly two years.

Yes to your point that it will be “higher for longer.”

Got a story for ya.

My daughter has a rent controlled 2 bedroom apartment near Toronto that she has occupied for 9 years. She is searching for a job change.

She was interviewed by a company about 80 miles from her current location. Of course she would need to rent in that new location at current rental rates. After searching rentals in the area of the new job, it was quickly realized that her rental costs would be $6-700 / mo more, or $7200 – $8400 per year more. Add in income tax, the before tax salary would need to be about $10000 more, just to stay even.

This shines a light on the devastating effect of rising housing costs. Employers have to pay more to recruit relocating talent, or only recruit within their community, therefore bypassing some talent. Higher payrolls would require higher pricing of the employers products. Workers are not as mobile so talent doesn’t get to where it’s most needed.

It’s just one example of the circle of inflationary costs to society that are not so obvious.

I’d say that the problem here is the rent control more than the inflation.

Such systems will always lead to distortions and inefficiencies that are never mentioned by the politicians who are selling this stuff to the public. Fixing high prices by fixing the prices, genius idea.

The solution to high rents is not rent control but easing regulation for zoning/building.

I agree re your thoughts on rent control.

But also consider, the frozen housing mkt (at least here in USA) also has the same effect: preventing folks from moving due to the higher housing expenses at the destination, canceling out the pay increase a new job might offer.

Forget Canada. Inflation is taking off again here in the good old USA especially in services. CNBC guru Jim Cramer just announced a 33% increase in the cost of joining his investment club. Price just went from $299/yr to $399/yr. ENJOY!

Yes, but can’t you substitute that service with a momentum indicator and get the exact same result for less cost? Or, maybe a palm reader?

Probably cheaper to just buy the jim cramer ETF LOL

Or…have your paychecks direct deposited into Jamie Dimon’s account.

Or…maybe 50% to Jamie Dimon and 50% to Ken Griffin to diversify your trickle down.

Noticeable inflation south of the border. I’m in Mexico and prices are higher. They all kicked it up significantly the first of the year like everybody got the memo.

If manufacturing here took part in the party you can expect it to effect some prices in the States.

good!!!

BOC kept interest at 5% and economists suggest inflation dropping to 2.5%.

Any thoughts on this?

Bank of Canada’s two preferred measures of underlying inflation accelerated, tripping up widespread expectations of cooling.

“Bank of Canada’s preferred measures of underlying inflation accelerate”

CPI trim jumped month-to-month by 0.39%, the hottest since August, and third month in a row of acceleration (up from 0.20% in September). This amounts to 4.8% annualized, which pushed the annualized three-month moving average (3MMA) to 3.8% (blue). Year-over-year, it accelerated to 3.66% (red).

CPI median spiked by 0.38% month-to-month (4.7% annualized), the hottest since August, and the second month in a row of acceleration (up from 0.14% in October). The 3MMA annualized accelerated sharply to 3.5% (blue). Year-over-year, CPI median accelerated to 3.65% (red).

These developments tripped up the widespread expectations of further cooling of inflation.