But overall and “core” PCE price indexes decelerated, on plunging gasoline prices, a dip in food prices, and a continued big drop in durable goods prices.

By Wolf Richter for WOLF STREET.

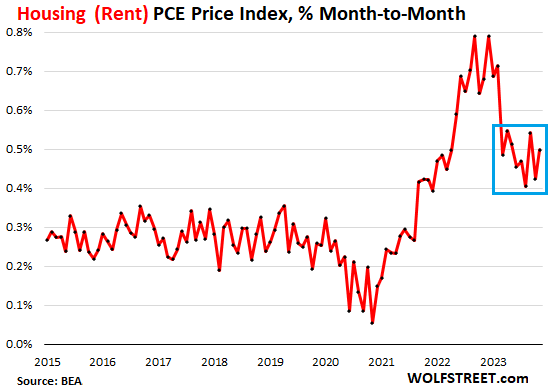

The fly in the ointment in today’s PCE Price Index by the Bureau of Economic Analysis was rent inflation, which accelerated in November from October, and has gotten stuck since March for the ninth month in a row with month-to-month increases that annualized were in the 6%-plus range. This stubborn rent inflation is a blow to the hopes trotted out for 18 months by the Fed and economists all over that it would come down further, that it was lagging, and that “we know it will come down,” etc., etc., but it has not come down further, and today it accelerated.

But the overall PCE price index and “core” PCE price index (without food and energy) decelerated further, driven down by the plunge in gasoline prices, a month-to-month dip in food prices, and a continued big drop in durable goods prices that are coming off their huge pandemic spike.

The PCE price index for rent accelerated to 0.50% in November from October, or 6.2% annualized, and has been in the same range since March. In late 2022 through March 2023, rent inflation decelerated sharply on a month-to-month basis. But starting in March – amid the wild and woolly hopes that it would continue to decelerate, cited by Powell many times – PCE rent inflation has gotten stuck at annualized rates in the 6% range (blue box):

The CPIs for rents, released earlier in December, have shown a similar trend: Month-to-month rent inflation stopped coming down in early 2023 and has remained at around 6% annualized. And that’s a tough nut to crack.

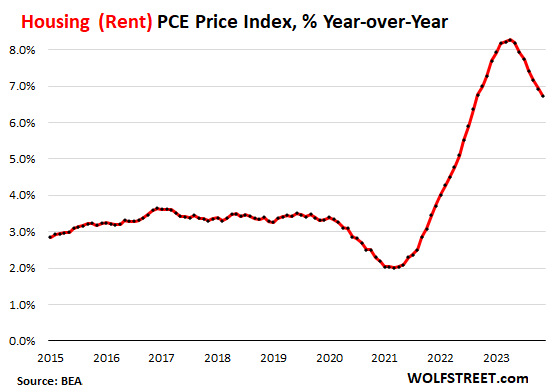

Year-over-year, the PCE price index for rent decelerated to 6.7%. This 12-month deceleration was driven by the sharp month-to-month deceleration late last year and earlier this year.

If month-to-month rent inflation continues on the same trend as since March, the year-over-year downward slope will begin to bend over the next few months and flatten by March 2024 around the 6% mark, close to double where it had been before the pandemic:

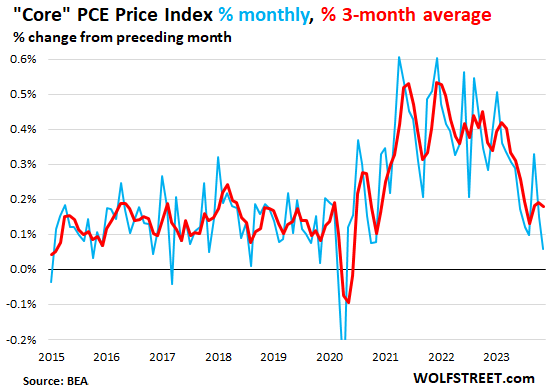

The “core” PCE price index, which excludes food and energy, decelerated to an increase of 0.06% in November from October (blue line), on a big drop in the index for durable goods (-0.43%) that are coming off their pandemic spike.

The three-month moving average, at 0.18%, has been roughly unchanged for the past three months (red). That translates into an annualized rate of 2.2%, which would be close to the Fed’s target range.

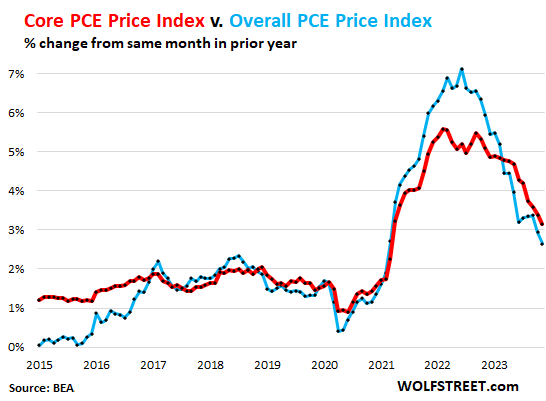

Year-over-year, the “core” PCE price index decelerated to 3.2% (red line). The overall PCE price index, driven down by the plunge in gasoline prices, decelerated to 2.6%:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The PCE numbers from previous months were revised DOWN (as often happens when GDP is re-estimated)

From the October report, the 4 months from July to October were

Core M/M: +0.2, +0.1, +0.3, +0.2

Core Y/Y: +4.3, +3,8, +3,7, +3.5

In the November report, these July-October numbers were revised DOWN to

Core M/M: +0.1, +0.1, +0.3, +0.1

Core Y/Y: +4.2, +3.7, +3.6, +3.4

November had a core M/M of ZERO, bringing the annualized metric down to +3.2% Y/Y.

The difference between core CPI = +4.0% annualized and core PCE is now a whopping +0.8% annualized. It’s usually below 0.5% at these levels.

I just find the July-September numbers incredibly hard to believe, ESPECIALLY considering they came from the “outlier” +5% GDP quarter. All that growth and near-zero inflation? Seriously?!

In the coming months, thanks to favorable base effects CPI will likely fall to 3.x% annualized while PCE will fall to 2.x%, and Wall St-FOMC will declare mission accomplished.

All revisions are included in the data here. You’re looking at the revised figures.

Rent inflation music to my landlord ears

You are right, this is the point (the blue box in the first graph, it’s important to stay within range of the box going forward). That’s the reason Why the FED has pivoted and has started to prepare the market for some cuts in 2024. As usual the market gets ahead of itself and wants more than 3. Guess we will find out who is right in 2024.

I mean, the market has been wrong with every cut prediction for well over a year now. Eventually it will get one right and declare victory. Meanwhile, why are there predictions still credible? Complete nonsense.

I wonder what the inflation effect will be of the Red Sea attacks on shipping with some ships sailing around Africa and ship insurance rates suddenly skyrocketing. Should affect Europe more than America, but can’t be a good thing.

Durable goods deflation, falling oil prices (which remains down for the month despite a +10% rebound since the last FOMC meeting), and favorable base effects going forward (+0.6% M/M numbers from early 2023) are arguably 3 major headwinds preventing another significant uptick in inflation indices, despite still-elevated services costs. (And housing is only 15% of the PCE.)

That’s why most of Wall Street & an increasing proportion of FOMC policymakers are seeing the writing on the wall and declaring mission accomplished. CPI & PCE are going to be in the 2’s (2.xx%) some time in 24Q1.

Base case can work against it too. The decrease in energy prices won’t help after the year of lower prices has passed.

Yep. Interestingly, I was reading something earlier today with Bruce Kamich predicting rates would continue to go down for the next couple quarters, before then rising again after Q3 2024. It didn’t break down his thought process in much detail (nor am I saying he’s right), but I wonder if he was thinking along the lines you describe regarding base effects.

Thanks WR for this report.

Market is up and up with no stopping in sight because of these favorable reports.

Inflation is indeed coming down rapidly as Powell said.

By the government’s metrics, maybe.

Most people I’ve spoken to don’t feel like inflation has come down, nor does my anecdotal experience bear it out.

Go buy a used car or a computer or gas at the pump, and you’ll see prices actually fell — not only slowed their increase (less inflation) but actually fell (deflation). But you gotta get out a little and buy something to find out.

Other prices have risen, such as some services. But my broadband got cheaper after I switched.

People never notice when prices fall; that’s selective perception. They just see when prices rise.

Sure. I have noticed gas is down a lot, as is electronics (Newegg, one of my favorite retailers, has had tons of deals). But I live pretty frugally. The stuff I can’t avoid spending money on, like housing, utilities, insurance (health, home, and auto), dental cleanings, etc. has gone up a lot.

People don’t buy car every month but have to pay rent and other services expenses every month

Rent insurance which for my friends have most weight in their monthly budget are still to expensive

Cars have come down along with gas and food but their weight is quite small in comparison with other items

My wife won’t show me the bills. She just kisses me and sends me to work. I think she feels I might have a heart attack and die I was shown the spending that goes on. I’m no use to her dead.

So if prices rise 20% and then fall a couple of percent in the same year, this logic would suggest that inflation is non-existent? Meanwhile, on a 3 year chart I think most rational observers would agree we’re never going to recover the purchasing power stolen from us via money printing.

Jason,

Reduced inflation or negative inflation doesn’t mean “low prices.”

Inflation is a measure of price CHANGES. We’re talking about current price changes and current inflation.

Prices are a measures of price levels. People have got wrap their brains around the concept.

So price levels can still be very high, but if prices are falling from even higher levels, there is negative inflation (deflation).

People who say that high prices, though they have dropped, prove that inflation is still high are either bullshitting or clueless. Sure prices are still up from Adam and Eve, but that has zero to do with current levels of inflation, and how the Fed should react to them.

I’m going to start deleting this BS instead of constantly having to waste my time on it.

Food prices at Aldi & Walmart started to drop about 3 months ago:

Pizza $3.49 to $2.99

Deli Meats

Cheese

Green beans

Walmart 22 oz Oscar Myer Delit Turkey dropped from $9.97 to $8.97.

The price drops are NOT widespread yet, and the reality is that almost everything in the store has see a permanent price increase..

My best example is the Great Value A1 steak sauce knockoff which shot up 178% from $1 to $2.78.

GuessWhat,

There are some interesting changes though. For example, Trader Joe’s came out with its own brand of craft beer earlier this year, $5.99 a six-pack. Brewed by a craft brewer in Wisconsin. It includes a “double IPA” and an IPA. I’m very fond of the IPA. It’s a little more malty than a classic West Coast IPA, but big hop flavors too, which gives it a lot of complexity and a very nice balance. That $5.99 is about 40% lower than other craft-brew IPAs that I like. So my beer costs have plunged by about 40%.

The reason people still feel like inflation is here is because it is in the things you actually need to buy.

It’s great that you can get a TV for a hundred bucks or some home decor for a reasonable price but rent, insurance, and I’ll include food (allegedly flattening out) and other basic needs are sky high and not going to fall like these durable goods items that have much higher profit margins built in.

The food for me and obviously anecdotal, but some things you only buy once every few months or even once every year or so and seeing those prices makes your feel inflation when it’s double what you paid for it last time. Also packs of firewood are now ten bucks at my grocery store. So 40-50 bucks to have a night by the fire pit making s’mores. Not including beers!

Property taxes & insurance ARE GREAT EXAMPLES.

EXPLODING! BOOM!

our new “arrivals” are gonna need a place to occupy….

That’s for sure a problem in Canada where the population has spiked by 3.2% yoy on a huge wave of immigration, compared to the US of +0.5% yoy, and rents in Canada have exploded.

Does US have a good system counting illegal immigration? I’m wondering if the 0.5% increase accounts for it or not compared to Canadas 3.2%

I assume Canada doesn’t have as large of an illegal immigration rate as US?

These are population counts, not immigration counts. The numbers are: population and population growth.

Mission accomplished! Great job FED! Time to start cutting. Don’t worry about the record levels of homelessness and food insecurity. Or the dropping fertility rate because younger generations can’t afford to move out of their parents’ basements and start a family. Asset prices were protected and the stock market is at an all-time high. That’s all that matters.

On a serious note, thank you Wolf for the analysis that you can’t find anywhere else.

A generation of sociopaths. Read it.

In 20 years people will vote to put fentanyl in the water so they can just get it over with.

Well the Strategic Petroleum Reserve

is lower than 1983 levels, approximately half of what it was a few years ago.

I guess it will be refilled after the election.

It may never get refilled unless prices collapse again. The US is the largest petroleum and petroleum products producer in world now, and the question is why we even need it. Back when it was implemented, the US was horribly dependent on OPEC oil, and it was designed to ward off another OPEC oil shock.

Great point indeed. Don’t need it.

From a geological perspective, what happens when the underground salt domes (hollowed out) get close to empty after all these years? Any subsidence risk?

Having spent time with Uncle Sam’s Misguided Children I believe it should be replenished. With both Russia and China puffing at both doors it may be needed.

No politics here just common sense.

Softtail – you’re right, but a general belief that planetary dry powder, in all of its forms, is always available, and inexhaustible, seems pervasive…

may we all find a better day.

Inflation is a rate of change.

It means only prices are going up at a slower rate and a new base of pricing has been established now with evth costing 30% more.

This will continue until next “one in a century event” which is more like one in every decade now, and the system will be flooded with money again, another plateau 30% higher will be established for pricing then the whole discussion of inflation, chain supplies, cost pus and pull will fill the pages of newspapers till next event. Fiat money is about to meet its intrinsic value this century.

“It means only prices are going up at a slower rate…”

No, energy prices actually plunged. The gasoline you buy today is a lot cheaper than it was in June 2022. And durable goods prices have declined for a year. They’re NOT “going up at a slower rate,” but they’re coming down from their highs, and have come down a bunch already. A lot of products in this category have gotten cheaper, meaning lower prices, including computers and related products, used vehicles, appliances, etc.

Services are going up at a slower rate.

I cant post a link here but you can google a chart of gas retail price for California and you would notice that up to mid 2021 price fluctuated between $3 and $4 a gallon +/- then it peaked at above $6 mid 2022 and now is back to between $4.5 and $5.5 which validated the higher plateau I described. While lower than the all time high peak in June 2022 you are comparing to, it still is more than 30% higher than any average in previous years.

Same goes for rents, cars and most other important items, and I am not sure electronics have come down in price, there used to be lots of choice in laptops in $300 range, not anymore.

Regarding appliances I can tell you that I buy a lot of them and keep detailed pricing over years and they are up by more than 50% compared to 2019 , its hard to find the same models and the new ones are lighter, crappier and much more expensive. I have prices on over 600 products all the way to 2005 as we use them in apartment maintenance and I can send them to you, its ugly.

All this discussion of prices going up and down in my opinion is a smoke screen to hide the counterfeit /unearned money doled out by the government and the Fed, for unless the trillions injected are withdrawn, prices will settle permanently at a higher plateau and 2% inflation will take them higher over time from that new basis until next crisis. Prices (CPI +assets) in the long term are direct derivative of the money supply, Friedman was right.

CA gas prices are not a great baseline given the significant taxes and well as the special blends and refinery issues it has had.

I looked at gasoline briefly a couple years ago and it seemed we were quite a ways from peak gas prices in real terms when compared to 06/07. We hit $4+ a gallon in the Midwest back then and that was 06/07 dollars, not 21/22′ dollars. I remember it well when I was young and making $10/hr and my car got 15/mpg

Bunny, I agree with you. Regarding the durable goods, especially the appliances you talked about, and ICT products (mainly computers, including desktops, laptops and other) which I am familiar with, I believe a significant part of the statistical “deflation” comes from “hedonic based adjustment”, which wolf has talked about. And I believe a significant part in it is exaggerated. They may assess the function improvement appeared as evidence of improvement of quality and “pleasure – user benefit – value”, but actually the quality is going downhill and “user pleasure” is negative.

On appliance, it’s easier to broken, not so reliable as before. On computer, it’s more fragile on both hardware and software, easier to brick. And the bloated software eats the increasing hardware capabilities, there is actually not so much improvement regarding things you can do since mobile internet age, just fancier. Overall, the “user pleasure” does not improve as suggested and the hedonic deflation calculated is overestimated.

W Wang,

Your comment is total BS because you already forgot and excluded the price spikes during the pandemic from which those prices are now falling, including laptops because there was a laptop shortage. If you could even get a laptop in 2020/2021, you had to pay an arm and a leg for it. There were network equipment shortages, there were shortages of all kinds of durable goods.

There were shortages of new vehicles… with few vehicles left on dealer lots. People had to order cars and wait. Dealers slapped huge addendum stickers on the vehicles and sold them for $10,000 or even $20,000 over MSRP when normally they’d sell them below MSRP.

This instantly caused shortages in used vehicles because new vehicle sales collapsed, and people didn’t trade in their vehicles but kept them, and rental car companies couldn’t get new vehicles into their fleets, so they stopped rotating their older units out of their fleets and kept them. This caused prices of used vehicles to spike by 55%, and now they’re coming off that spike. Prices of used vehicles are actually falling.

Durable goods are dominated by motor vehicles.

There were shortages and price spikes of cross-country skis (personally experienced that one, and we chose not to buy for a year), bicycles, camping equipment, even the WOLF STREET beer mugs, and prices spiked, and transportation costs spiked (shipping costs of our beer mugs by FedEx jumped 35% into 2022, but over the past 12 months, it has declined, but only part of the way).

So there are real declines in shipping costs on a year-over-year basis, and all durable goods have to be shipped, and there are real declines in prices of durable goods, in some cases dramatic declines. For the example the Ram pickup truck that would sell for $15,000 over MSRP in 2021 now sells for $15,000 under MSRP. You do the math on inflation of durable goods!

Your comment is a revision of recent history that that is just stunning. It’s like the shortages and price spikes never happened. And now those prices are coming down (more or less slowly and incompletely ) Were you buried underground during that time?

The bifurcation of inflation continues: durable goods deflate, while shelter & energy continue to inflate.

What happens if overall CPI / PCE get to the Fed’s 2% target, but certain components like rent stay at the 6% yoy level?

The rich get richer and the poor get poorer. As they say in the computer science field, (monetary system) “working as designed”.

Rents can’t continue to rise at these rates. It’s grossly unaffordable for many. The trend of living with family or finding roommates will continue. Meanwhile, think about the surge in housing and multifamily construction Wolf posted recently. As long as home values and rents are sky high, construction will boom. Supply will eventually catch up with demand as it always does. Imo, that could be a huge contributor to service disinflation.

Per fed dot plot inflation is already tamed to 2 percent or so and now they are talking about 3 or more cuts in 2024.

Fed does not look at rent inflation on its own.

Per wr article inflation is trending down to 2 percent .

The economy is doing more than fine with these rates. I see no reason why the Fed should lower them. Doing so is just unnecessary stimulas which will lead to rapid inflation.

But don’t expect prices to fall much. We are at a new level of stupid. Hope your raises keep up.

I agree with the first part. The average consumer is clueless about economics & doesn’t realize the inflation rate has come down a lot in the past year, judging from polls about economic sentiment. They’re not going to be looking up the latest inflation numbers & computing “real interest rates” when taking out loans, mortgages, credit card debt, etc. It seems like the economy has adjusted to higher rates just fine. FFR has been over 4% for over a year, well enough time for policy lags to take effect. In my opinion cutting rates now is wasting valuable ammunition to be saved for a real downturn (and perhaps some people want that so the FOMC will be “forced” to return to ZIRP & QE one day.)

But 14 years of low interest rates have shown that easy money doesn’t lead to consumer price inflation – it leads to asset price inflation. Not enough Americans own stocks, especially in liquid non-retirement accounts, to push up prices for everyday goods.

Jackson Y-

You said “But 14 years of low interest rates have shown that easy money doesn’t lead to consumer price inflation – it leads to asset price inflation.”

That hump on Wolf’s last chart in the article, between 2021 and present, where overall PCE Index jumps to 7%, sure looks like consumer inflation. But your point about asset price inflation is accurate.

Rothbard and others argued decades ago that one of the main problems with monetary solutions is that “the economy” includes the price of everything, and when the monetary applies stimulus, they exacerbate demand for those prices that don’t need help, and when they tighten, they unintentionally dampen industries and asset prices that are already experiencing hard times.

“Prices” within the economy are not synchronous. That’s a lesson in unintended consequences of government intervention.

They were ignored then, and are ignored now.

Correction: “…when the monetary authority applies stimulus…”

It didn’t in the past, because the US exported its inflation to rest of the world, especially China. Nowadays foreigners do not want our inflation. So the Fed will step in and monetize. Totally different game.

These level of rates might be too restrictive, and they are afraid they might break something. Remember that FED has a dual mandate, labor and inflation. As Powell said, risks going forward are balancing both no longer inflation is the #1 enemy.

“These level of rates might be too restrictive”

Thanks for the chuckle.

“These level of rates might be too restrictive”

You should put an /s at the end of your post – your sarcasm is very subtle.

They don’t want a real rate of 3%ish with 33 trillion in debt.

Rates go down and the government punch bowl can stay full simple as that

I doubt it works for long tho because like wolf has been saying for years. Once the genie is out of the bottle, hard to get it back in.

Wages are still rising. Solid pricing power based on corporate profits as wolf wrote on the other day.

Services seem entrenched so whenever we have another commodity spike those yoy numbers will start rising again.

IMO long process of raising rates and cutting rates as inflation jumps around. Fed is slow only capable of reacting.

Good news for the end of the year! The war isn’t over, but battles are being won.

I’m just grateful for another year without a major economic catastrophe or a nasty recession. Could things be better? Always, but they could be a lot worse too!

Merry Christmas to you Wolf and to you commenters. I always enjoy the amazing articles and the many differing points of view. It’s a great forum.

To be fair, the 2022-23 FOMC has done a heck of a good job. And they did it by ignoring Wall Street’s endless predictions of doom & gloom once interest rates began to rise. If they listened to Wall St analysts & Wall St-aligned talking heads on CNBC, rates would still be stuck at 0.25% and the balance sheet would be over $12 trillion by now.

Wall St is now warning of a massive recession if rates aren’t cut by next year. Seeing as how their previous doom & gloom predictions never played out, I think the economy would actually be fine just holding rates where they are for now.

The only head fakes this inflation has been dishing up is that it keeps coming in lower than expected.

I’m just glad a took a picture of the WSJ bond rate webpage when the 10 year touched 5%. It was short-lived, but a beautiful sight to behold. We may never see it again in our lifetimes.

Is it though? If people truly believed that inflation was conquered, the dollar wouldn’t be dropping with bond yields.

It’s almost as though the market is saying “We know that the Fed is going to rely on these numbers and cut rates, but we don’t actually believe them, so we don’t think foreigners are going to want dollars at the same price.”

This make sense at all? I’m not doing a very good job articulating it.

Good time to load up on TLT if you really believe that.

2.2 percent CPE is getting close to the Fed and with a few more months of QT plus reduction of balance sheet a pause makes sense and wait and see . Higher for longer please.

Wow, I’ve never heard so much happy talk in this site. I think these commentators ought to put their money where their mouth is and join Jim Cramers investment club. It’s a bargain at $299/year. Just pennies per day. GO FOR IT!

Yep, my money is well invested in rental properties in great markets.

To the permabear, negative doomsayers – do as a good friend of mine says…

Go get in your casket and wait, LOL!!!

I am the same . I stayed fully invested in 2023.

This year since March 2023 i went all in magnificent 7 and now exiting my positions gradually.

I work full time a job I love and pays me quite handsomely so don’t have to deal with rentals

Had 2 rentals in socal sd but sold it last year. I still own 2 homes in socal.

I am sitting on assets and loose financial condition help me a lot and people like me.

I don’t see good future for the people who have missed out on housing as having a shelter is important for everyone.

I really want all asset classes to go down in price and housing at least so that people can afford it.

But at the same time I am sure Fed won’t let this happen.

We are stuck at a permanently high prices plateau for essentials of life and fed think that we should be happy with just 2 percent yoy increase on top of this.

If Fed is really serious about price stability then they should work on trimming 50 plus percent off the lifes essentials so that home prices go back to 2020 levels and then add 2 percent to it.

But we all know it is a pipe dream.

Cramer needs 5s and 10s for the midtown clubs.

So the big question is whether or not this is another core inflation head fake like we have seen in the past year and a half.

Seems like consumers are still spending a lot, which should increase demand, which should increase inflation, but we are not seeing it in the recent data. Government data are not particularly reliable (note all the revisions, but then are the revisions reliable?) and the private sector data are always questionable. We shall see. The economy cannot be going gangbusters while at the same time inflation stays relatively low.

I trust what I see, not the data from official sources. This is my lowest buy Xmas year in over a decade. The discounters should post good numbers for the quarter, the rest not so much. Let’s see who is right.

Option #1 : Rent PCE M/M might rise to 2022 swing point (0.65%/0.7%), before dropping to the trading range, or breaching 2021 low, breaching zero.

Option #2 : plunging straight down, like the Dow between Oct 2018 and Xmas 2018.

There’s not enough MSM or political attention to the Fed’s role in exacerbating homelessness across the country. A decade of basement rates led to massive asset appreciation and a speculative housing bubble. Affordable housing was converted to income opportunities for those with “financial access.” And even if you own a seven-figure home, it’s abutted my encampments. We get the country that the Fed facilitates.

“The government you elect is the government you deserve.”

― Thomas Jefferson

Joker said that to Mur-ray, too, with an exclamation point at the end.

The Fed has nothing to do with homelessness in the US (since 99% of the people living in tents in American cities have mental problems and/or chemical dependency issues). When someone that does not have mental issues or an addiction to crystal meth gets a rent increase they can’t afford they move to a cheaper place, or get a roommate (they don’t decide to become “homeless” and quit their job and move into a tent next to the railroad tracks). P.S. We have a huge income inequality issue in America (and a lot of other problems), but I’ve been involved with multiple charities that help the poor and homeless for decades (just last week I had a SUV full of “hygiene kit” supplies) and I’m serious when I say that 99% of what most people would define as “homeless” (aka actually living on the street without a home) are there due to mental problems and/or chemical dependency (not because of QE related inflation or because ZIRP cut the interest on their savings).

There are tons of working homeless. 99% is a bullshit number you pulled out of your ass. While we’re on the anecdotal train, I help with a local food bank and they’ve never seen this level of need before. These are normal people who have never had to utilize the food bank before, not the mentally ill or substance abusers.

but feel free to rationalize all you want “ApartmentInvestor”. This country is cooked.

I agree with phoenix. A lot of renters are living paycheck to paycheck. Any increase will put them on the street or force them to cut back on food. Not everybody has friends or relatives to stay with. Not everybody is a Section 8 welfare junky. Not everybody can switch to a higher paying job in a month, if at all.

Landlords and people like “Apartment Investor” are just trying to hide their guilt (a justified guilt) by saying 99% of homeless are on drugs or mentally ill, when they really know that their greed is increasing homelessness. As I have mentioned before, landlords are scum, one of the worst possible ways of making money, by screwing the poor and lower middle income people.

William Leake-

So are farmers also guilty parties for screwing the lower and middle class when they charge market prices for their meat and produce?

That puts you on a pretty high horse.

(FYI – I do not own rental properties, and I rent…)

John H

Yes, if farmers were to buy up the entire inventory of food, and then purposely leave part of that inventory to rot while people starved knowing it would be more profitable to sell the reduced supply to those that can afford it than to ensure the entire needed supply is in use, they would be responsible for the resulting deaths. Morally, not legally. And this is exactly what landlord do. They have software that calculates the return relative to raising prices and reduced occupancy. Are all landlords guilt of this? No. Many dont have multiple units or even use this software, but there are plenty that do and it only takes a small shortage of inventory relative to need to start a price feeding frenzy on a necessary good like shelter. What are renters to do? Snub their nose and say “no, i will be homeless rather than pay this rent hike!”. Only the insane would willingly become homeless. And so the price hike is swallowed. And the average percentage of american’s income dedicated to shelter continues its relentless march upward.

@phoenix, I’m not making up the 99% number (in 40 years I have not heard about a single urban “homeless” person living in the street that didn’t have mental and/or substance abuse issues and I didn’t say that 99% don’t work at all, I just said that 99% have drug and/or substance issues and I’ll also come out and say that 99% of the urban homeless are not working at full time regular jobs with benefits (I have heard that some guys that work in full time in South Lake Tahoe in the summer illegally camp so they can send more money back to Mexico and Central America). I’ve employed the “homeless” in the past paying them to do things like power wash in the attempt to connect with them and get them into a detox program before crystal meth destroys their brains. P.S. I also didn’t say that 99% of people that are poor who go to food banks have issues other than being poor.

ApartmentInvestor,

“in 40 years I have not heard about a single urban “homeless” person living in the street that didn’t ha..”

Your problem is that you only factor in a part of the homeless. Homelessness includes people who are couch-surfing, people who live in vehicles, people who live in shelters, etc. Many homeless people are so only temporarily. There is a great flux to homelessness, with lots of people moving into it, and lots of people coming out of it. Only a portion becomes long-term homeless, and only a portion actually lives on the streets.

We had a guy working in our auto parts warehouse. He was homeless. He slept in his car in the parking lot and used the facilities of the warehouse during business hours. He was homeless because he had a garnishment on his paycheck for child support that didn’t leave him enough to even rent the cheapest place. That was in Oklahoma City around 1990.

Apartment Investor,

Google:

“Employment alone isn’t enough to solve homelessness, study suggests” from University of Chicago News.

From the article: “Among unhoused individuals who were not in shelters, about 40% had earnings from formal employment. The findings contrast with common perceptions and stereotypes about people who are homeless—suggesting that even consistent work isn’t enough to help Americans facing skyrocketing housing costs.” Even if that number is high, there are a lot of homeless with formal employment.

If you’re not making the 99% figure up regarding drugs and mental illness, where did you get the figure other than personal experience?

I have to disagree, there are a number of working homeless. I don’t know the figures, but it’s almost certainly higher than 1% of homeless people. In this article Wolf talks specifically about the continued high inflation rates in rent. As you go down the income scale, people often spend more of their income on rent, so that component of inflation hits them particularly hard. Inevitably, some at the very bottom get pushed off the housing ladder all together. Drugs are certainly a problem, but once on the streets mental illness may be a chicken and egg thing. It’s probably hard to maintain mental stability with the stress of living on the streets. The Fed certainly played a role in creating an environment where housing became a speculative asset class pushing prices and rents higher.

@rojogrande I live in the most expensive part of CA (where they keep passing laws every year to make it harder and even more expensive to be a landlord) but despite the high rents here a single homeless guy (or gal) with a full time minimum wage job will have no problem renting a room on Craigslist so they don’t have to sleep in a tent next to the freeway. If they get out of the Bay Area or move just about anywhere else in the US (with the excerption of super expensive “resort” areas like Vail and Aspen) it will be even cheaper and easier to rent a room with a minimum wage full time job. The media keeps pushing the “homelessness is caused by high rents” but never does the math to realize that the $19/hour starting wage help wanted sign on most fast food places in the Bay Area works out to almost $3,300/month and is more than enough to rent a room almost anywhere in the state. We won’t solve all the problems in America here and I don’t know why an increasing number of people seem to have a hard time showing up at a full time job (I know many people with adult kids that have anxiety/mental health/failure to launch issues that would probably be homeless if they were not allowed to live in their old room or above the garage by Mom & Dad).

John H., Farmers do not rent to low and lower middle income people. Most do not rent at all. They are a different part of the economy, having usually little to do with landlords and rents. Farming legally is an acceptable way to make money (I am not including the giant agribusiness corporations here). Herpderp and rojo make good arguments.

“Works out to $3300/month”?

Gross or net?

Apartment Investor,

I suspect it’s hard for a homeless person to rent a room from someone else. Do they have references, first and last months rent, a credit history, etc.? Otherwise, the people with jobs living in cars doesn’t make sense. Are the rooms on Craigslist near employment opportunities? How much does transportation cost? These are complex problems that people want to ignore. So many people blame the homeless and then ignore the issue.

In this regard, where does your assertion 99% of homeless are mentally ill or drug addicts come from beside your own assumptions? It’s pretty clear more than 1% work on a regular basis despite their problems. Honestly, I used to think like you, but I question myself more as I’ve grown older. I don’t think the increases in homelessness over the last decade is entirely attributable to drugs and mental illness.

Even if you were to accept your ridiculous pulled out of thin air statistics….

Abstractly I would argue our government as a whole including the Fed and it’s terrible trickle down economics have created plenty of drug abuse that have lead to homelessness and crime. While they didn’t put the needle in between the toes they are still responsible for the state of homeless and food insecurity in this country.

…craft the zeitgeist to ease, favor and accept rampant speculation, and whaddyou get?

may we all find a better day.

@Wolf and American Dream There are many people that want to “expand” the definition of “homeless” to anyone that does not actually “own” a home or has their name on a lease as a renter. A report came out in 2022 (quoted in most major papers in the state if you want to Google it) that said 20% of CA Community College Students were “homeless” since they fit the new “let’s make people homeless by making everyone that does not own a home or have their name on a lease count as “homeless”. Under the “new” definition of “homeless” I found out I was technically “homeless” for half of my undergrad years and also for the six months I lived in a friend’s grandmother’s Atherton pool house (since I didn’t sign a lease). I don’t have a political “side” and when I say 99% of what most people call “homeless” actually living on the street or in a car have mental and/or substance issues it is like when I say that 99%+ of the “rich” in America didn’t get rich by buying lottery tickets (because it is true). I know that guy recently won a billion in the lottery and there are guys like Wolf’s auto parts guy living in a car, but if anyone talks with people like the Mercy Pedalers (Catholic Nuns that ride three wheel bikes with baskets of supplies to help people living on the street) they will tell you that WAY less than 1 in 100 of the people in cars in the street on in homeless camps by the river have full time jobs (because it is hard to hole a job when you see demons and/or are high on crystal meth)…

Rents and services will continue to rise until wages stop increasing.

Just my two cents. Rental prices are in a whole other ballgame when you own rentals. This is from a mom and pop landlord view.

Rents need to rise more IMHO. Property taxes and Insurance increases are hitting me for 2024 and these are up a lot (35% increase in property tax and 10% increase in insurance. This means I need to increase my rent by at least 9% to just cover those two price increase. I only see rents dropping if property taxes, insurance, and handy man, plumbers, and HVAC service people start dropping their prices. Probably not going to happen.

Best scenario is if these expenses just flatten out but so far that does not look like it is happening.

I don’t seee how most landlords will be able to cover their costs without comtinued rent increases.

…sounds eerily like the dilemma small ‘family farmers’ have been struggling with for some time, now (they produce something a society must have, but the nominal profits are being more and more consumed by those services related to development, maintenance and distribution of said product…scale monster, perhaps?).

wishing everyone a better day, as well as a pleasant holiday season…

Rents and housing were increasing faster than general inflation long before wages increased, and long before COVID. The national housing shortage must be addressed with massive construction efforts. Until theres enough inventory to allow people to move elsewhere in pursuit of lower prices, all rents will increase. The alternative is homelessness and theres always another renter to replace you.

There is no dearth of housing inventory.

Home prices have doubled in last 8 to 8 years but population has not increased in the same proportion.

The big issue is financialization of homes by Fed policies and thus it no longer is a place to provide shelter but to make money.

I have friends who are owning many homes vacant but won’t sell as they believe prices won’t go down and so far they have been proven correct.

Str has excarbedt the issue.

Dont blame the people aka players but the game as facilitated by Fed.

I am one of the folks having so much assets but still hope the assets go down in price for the better ment of this country and people .

A doubling of demand doesn’t translate into a doubling of price. It’s not a linear relationship. It makes me angry to have to type out something so obvious.

Historically low unemployment and healthy economy yet inflation is falling like a stone. Truly ‚a miracle’.

Therefore, despite that goods and services (partially) coming down, because the asset prices are extremely elevated. Without a correction of housing, rents will continue to climb up. FED and govt made another huge mistake putting a pillow underneath the asset prices in April. Now the bulls are completely in charge and not allowing the assets (stocks, bitcoin, housing) going down.

Higher for longer makes sense. I am curious as to why the federal reserve members are thinking about cuts. Americans are spending, corporations getting good profits, folks are getting returns in CDs and high yield savings. Supposedly the FED members are not discussing rate cuts per Powell, but the plot shows members are at least thinking. But why are they thinking?

Maybe the Fed’s actions actually have no or very little impact on the economy. I am not saying this as a fact, I am just saying it is a possibility. I know it is heretical to even suggest it. The economy functioned before 1913, somehow, without a central bank.

William Leake-

“Maybe the Fed’s actions actually have no or very little impact on the economy.”

If you meant to say:

Maybe the Fed’s actions actually have no or very little NET POSITIVE impact on the economy, then I think I agree with you.

As your statement stands, though, the Fed has had huge redistributive impacts on individual players within the economy, while transforming the national debt into a disgrace and instrument of national self-immolation (through interest rate suppression).

I won’t make the argument that rates need to come down to convince younger workers that only if you work hard and long enough the American Dream can also be yours. Glen Z actually did better overall in owning houses at a young age but with higher interest rates that will likely reverse.

I seem to recall that rent has increased pretty significantly as a percentage of income, yet the weights in the CPI and PCE have not changed for a long time (maybe since the ’60’s). Is that still true? If so, what would these indices look like if the weights for rent (and other components) reflected actual expenditure patterns today?

“…yet the weights in the CPI and PCE have not changed for a long time (maybe since the ’60’s). Is that still true?”

In CPI, the weights change constantly, and the weight of rents (rent of shelter) have risen as rents took up a bigger part of the budget.

But I don’t think that PCE changes the weights.

In 2014 Germany won the world cup, after beating Brazil 7:1 and

Argentina 1:0. Germany celebrated.

In Dec 2023 the German U17 won the world cup, after beating France.

The Germans aren’t happy.

I can’t wait to hear the probing questions about this painful housing inflation from the press corps at the next FOMC presser.

(Just kidding; it won’t be mentioned at all)

I think some lose sight of that 2 dollars in 1800 had the same purchasing power as 1 dollar in 1900 do to technology in the US. Oh, and no fed was present. Now look what we have for perspective.

I have a local theory on why rents are increasing.

The local rental market here is still very tight. Lower wage workers have difficulty finding anything affordable.

However, lately I’ve been seeing some condos and houses trickling into the LT rental market that are listed at a premium that are fully furnished, including dishes and silverware with all utilities paid including gardening and snow shoveling.

I think these are conversions from ST rentals and are offered at a higher rent since they include everything.

That could explain why rents are increasing. More is now covered with the monthly rent for these conversions.

If a glut of ST rentals enter the market, then rent prices will either fall and/or landlords will have to eventually sell their money-losing investments .

Short term rentals, like Airbnb, certainly drive up rents be removing rental units from the market. They operate like hotels and should be taxed and regulated exactly like hotels. We see the Airbnb market starting to dry up because localities are trying to get rid of them, or at least tax them so they can make money off of them. The sooner they are gone, the better.

Agreed!

If a landlord can no longer offer their property as a short term AirBnB, what will they do? They can sell and increase the supply of houses for sale in the market. They can leave it vacant and hold it waiting and hanging on for prices to increase. Or, they can rent it long term.

The recent long term houses/apartments I have seen listed have likely been short term rentals. They are fully furnished down to dishes, pots/pans, silverware, artwork, etc. ALL utilities are paid by the landlord. The utilities alone can average $500/month.

If rent was $2000/month for an unfurnished rental that did not include utilities before, $2500/month including utilities for a furnished STR is very reasonable.

That means that the PCE rent index went up 25% for this case. More of the costs are covered in the rent than before but if you are just looking at rent prices, it is an increase of 25%.

Locally, rents are going up but because utilities are included with these STR conversions, the actual cost of renting is flat.

Inflation is not coming down nearly enough, if you even believe this report at all. And we desperately need deflation after the three years of inflation that never should have happened.

Thanks Wolf,

So wolf what type of inflation are we having besides rent and services? Demand pull would have been the earlier 9% inflation. Cost push inflation with all the government spending next? Also the issuance of government debt? Cyclical inflation is lower now with oil and gas. Higher for longer they said. Or is it all just volatility with rate? Will the Fed ever run out of their bag of tricks?!

The inflation numbers might indeed be setting up for a head fake.

I think odds are good that the drawdown of the reverse repo facility is a result of the money market funds buying bills from the Treasury directly since it has been offering higher rates than the RRP facility since May.

Previously sterilized while held within the confines of the liabilities column on the FED’s balance sheet, that $2 trillion in cash is now escaping into the economy and multiplying in the fractional reserve banking system.

In this way, the RRP drawdown is stimulative.

This is likely why the total commercial bank deposits stopped shrinking with QT in the April/May timeframe. By June and July, deposits had actually recovered some, and by that point the RRP drawdown was well underway.

The shrinking (deflating) commercial banking deposits helped cool inflation. They would also eventually lead to a crisis.

That phenomenon has ended, and maybe even slightly reversed. Overall, this is inflationary, but it will give cover to the FED to continue QT for as long as no major economic event occurs.

Poncho-

Yours are thoughtful comments.

I’ve always been confused by the concept of “sterilization” (other than it sounds painful and something to be avoided in person).

Is it akin to “robbing Peter to pay Paul;” or perhaps related to check-kiting?

Makes me think of Jacque Reuff’s famous line “Deficits without tears.”

By sterilized money, I mean money that the FED created through QE (“from thin air”), but which has not been encouraged to be spent into circulation.

The money remains parked at the FED instead of being used to buy stuff and end up as new commercial deposits in the bank accounts of people and organizations.

Once it lands in someone’s bank account as a “commercial deposit,” then the banks now have gained access to that money, by which they can create new loans and multiply the deposits (through more loans).

When $2 trillion was “sterilized” by being parked at the FED in overnight RRPs, it was not being used to buy stuff.

There was potential “leakage,” however, represented by the interest paid on that cash by the FED through the RRP facility.

At 5% annually, that “leakage” interest would amount to about $100 billion that trickles into the economy to be spent. Or, it could be redeposited at the FED and compounded in the RRP investments.

Trickling $100 billion in new money into the economy in a year is inflationary, but 20 times less than a massive injection of $2 trillion in under a year.

Think of the $2 trillion in RRP money as time-delayed QE. If the active QE of 2020-2022 was the booster rocket, then the RRP drawdown is the sustainer engine.

Expect inflationary pressures to be sustained, or even grow.

Thanks. Poncho. That helps.

Correct me if I’m wrong, but sort of a stimulus-on-the-shelf, ready to be injected into the banking system for multiplier effect, and without a lot of fanfare.

Happy Festivus to one and all!

Rent inflation will continue to remain high while interest rates are high until either rents match a price that will cover current interest rates, or interest rates come down. Either way, elevated Fed rates are actually driving rent inflation. I personally think the Fed is reacting to slowly to bring rates down (around 4%), just like they waited too long to stop QE. I was saying it wasn’t good at least 6 months before they started to ease up.