Now they get to deal with the brick-and-mortar meltdown.

By Wolf Richter for WOLF STREET.

Publicly traded mall landlord Pennsylvania Real Estate Investment Trust announced today that it filed for a pre-packaged Chapter 11 bankruptcy, after having already filed for a prepackaged bankruptcy in November 2020, and that as part of the restructuring deal, existing preferred and common shares will be canceled, and that “PREIT will no longer be a publicly traded company,” and that certain creditors – an investor group that had bought the crushed second lien debt, led by PE firm Redwood Capital Management and distressed-debt fund Nut Tree Capital Management – will get the company.

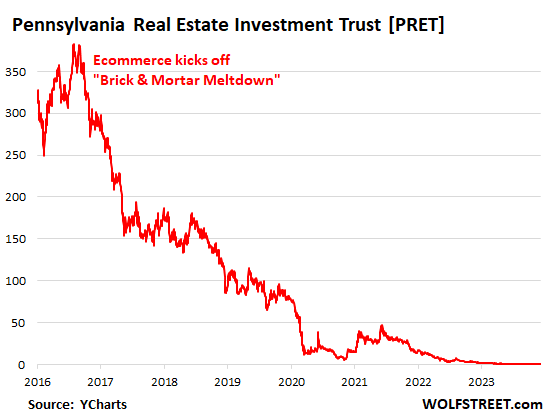

Shares have been trading over the counter ever since they were delisted from the NYSE in December 2022. In June 2022, the company did a 1-to-15 reverse stock split, where your 15 shares become 1 share, but the price multiplied by 15, in order to bring the share price over $1 and stave off the delisting, which worked for a few months.

Shares [PRET] spiked by 81% today, to $0.43, because, as part of the restructuring deal under which they will lose all their equity, preferred and common shareholders will get a consolation prize of $10 million, minus the costs associated with distributing the cash. Of that, 30% will go to common shareholders. There are about 5.4 million common shares outstanding, to divvy up $3 million minus costs.

Two other major publicly traded mall REITs have filed for bankruptcy since November 2020: the SPG’s spinoff, Washington Prime Group and CBL & Associates Properties. There is a huge laundry list of retail chains, from Sears on down, that collapsed into bankruptcy to be dismembered and mostly liquidated, leading to vacant stores and then to zombie malls to be bulldozed and redeveloped into something else, such as housing, or to be left to rot.

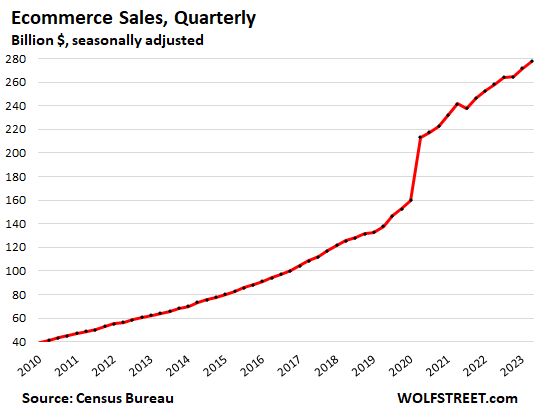

PREIT is part of a structural shift in how Americans choose to shop. And ever more intensively, Americans have been choosing ecommerce, a process that I started calling the brick-and-mortar meltdown in 2016, and that has continued unabated.

PREIT’s share price reflects that brick-and-mortar meltdown. Reverse-split-adjusted, shares traded at $374 in late 2016 and then careened down to nothing:

The #2 bankruptcy filing had been expected just about ever since it filed for bankruptcy the first time in November 2020; it became a near-certainty earlier this year; and it became a certainty in October when the company announced that it was working on a restructuring deal with its lenders, to be formalized in bankruptcy court.

PREIT had $1.8 billion in debt at the end of Q3, despite the #1 bankruptcy filing whose purpose was to reduce the amount of debt. The company has booked net losses year after year, including $168 million over the first three quarters of 2023.

In today’s bankruptcy announcement, PREIT laid out the Restructuring Support Agreement (RSA), which it said was approved by 95% of the creditors.

The RSA includes $60 million in Debtor-in-Possession (DIP) financing to get it through the bankruptcy proceedings and another $75 million in “exit financing” when it emerges from bankruptcy, for $135 million combined, from an investor group led by PE firm Redwood Capital Management and distressed-debt funds Nut Tree Capital Management.

As part of the deal, it will pay all vendors, suppliers, and employees during the bankruptcy proceedings.

Holders of first lien debt (banks) will “at their election” either get paid in full in cash, “or their pro rata share of term loans under the exit term loan facility in an amount equal to 101% of their Prepetition First Lien Claims.” PREIT said that these banks “have committed to provide an additional $150 million to recapitalize the business and extend the Company’s debt maturity schedule.”

Holders of second lien debt will get the equity in the restructured company. These are the PE firms and distressed debt funds, led by Redwood Capital Management and Nut Tree Capital Management, that had bought the second lien debt over the years for cents on the dollar. They will get 65% of the new equity; and those second-lien holders that committed to backstopping the exit funding will get the remaining 35%. After the exit from bankruptcy, PREIT will be owned by these PE firms and distressed debt funds.

And it’s up to them to deal with the brick-and-mortar meltdown. Maybe they have plans to bulldoze some of the malls and grade the huge parking lots and build high-density housing on them, thousands of housing units per mall.

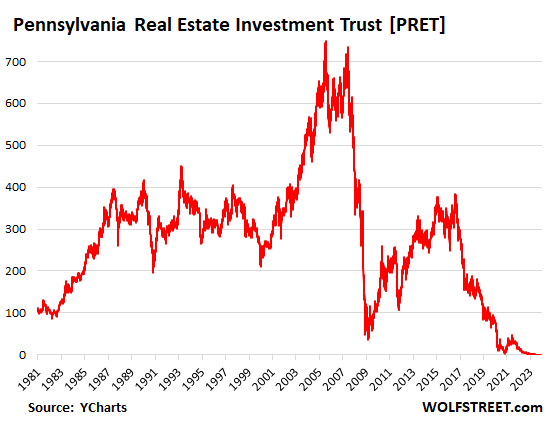

And for your amusement, here is the long-term chart of PREIT, adjusted for the 1-to-15 reverse stock split. It has been a tumultuous ride to heck — but not in a straight line — from 2007 on. Buy and hold:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Although this might be bad news for some people, it is good for the country, I think. There is too much emphasis on real estate in this country and the world. RE should be part of the economy, but not the whole focus. Investments should be diversified in various sectors, mainly tech, innovation, manufacturing and technological farming. Disproportionately diverting investments to RE is not a good way to improve the economy, I think. No country can prosper altogether by buying, selling and renting dirt (RE) to each other in a speculative manner. The investments should be directed to sectors that are generating value such as tech, innovation, farming and construction (i.e. the value of RE should be mostly determined by the building quality, not the land), instead of dirt.

Poor energy did not make the list from greedy landlord . USA built to thrive with cheap energy regardless of the source. Yesterday I checked retail energy prices next 36 months and they are more than double my 2020 price. So my average bill went from 250 a month to 500 a month going forward . Please keep rates higher for longer and a regulatory environment that encourages the lowest cost energy developments

Bs ini, when I mention tech, I mean all kinds of tech, including energy, transportation, telecom, etc. In my opinion, the capital should be channeled into the value producing activities (including energy), and not for speculative land sale/rent. The worst macroeconomical strategy is to incentivize the people/investors/corporations to invest their capital on land/rent speculatively. I think the policy makers should understand that land does not generate value by itself. The value is generated by economic activities such as farming, construction or manufacturing on it. I feel like most investors are being pulled into RE for speculative gain due to wrongful appreciation of land due to poor monetary policies.

GL – a long running tightrope walk. What determines that which might be better-treated as a public utility as opposed to an out-and-out commodity that doesn’t acknowledge, or ignores completely (until it can’t) planetary societal/environmental health and function?

may we all find a better day.

This wisdom would best be operationalized via an LVT (land value tax) — what Henry George called “the single tax.”

But you will never get such an arrangement — too many wealthy opponents to it.

There will be plenty of acreage to be redeveloped into homes etc..

Plenty of work for contractors of all shapes and sizes…

I’ve been trading US stocks since 1979.

I have never seen a stock chart like PREIT, from 374 to Zero

Damn. Thanks Wolf. You’re the best

Amazing stock price movement is refected in the chart. How can people be so inaccurate with their investing decisions? If everybody did a cash flow based valuation method we wouldn’t have these problems. We’re talking about property leasing, not technology IP.

I am watching a CRE REIT looking for a short entry.

Private Equity will make a ton off of this deal, as always.

It’s the PE formula. Buy broke, overleveraged, underperforming companies like cheap prostitutes. Load them up with debt (give them their drugs) Sell them back on the street (to retail Wall Street investors through a new IPO), take the money and run to the next buyout before they crash and burn, only to be bought out by another PE pimp. Crude but true.

They won’t be able to sell a mall landlord in an IPO. They won’t even be able to load it up with debt anymore than it already has. The retail category is dead. Banks and CMBS investors have taken huge losses on malls and retail properties since 2017. But they might redevelop some of the malls into housing, and sell those at a big profit. They probably got into it at a low enough of a price to pull it off. They’ve got to have something else in mind other than scraping by with malls.

Here are department store retail sales:

And here are ecommerce retail sales:

Wow – seeing those two charts next to each other is telling.

You are equating the crisis with low-end enclosed malls and large department stores with overall physical retail.

Overall physical store retail is thriving. This year, retsilers have announced plans for 4,500 new locations while shutting 3,500, per Coresight Research. The rate of available retail space fell to 4.8% in the second quarter, the lowest level in 18 years per CBRE. Strip malls are thriving. Outdoor malls are packed.

Tyler,

Store numbers don’t matter. But the kinds of stores. They’re closing big stores, and they’re opening smaller stores. They’re closing department stores and clothing stores, and opening grocery stores. Grocery stores are not dead, department stores are dead. Clothing stores are dead, mall stores in general are dead. Strip centers anchored by grocery stores are alive, and filled with stores that offer services (restaurants, nail salons, insurance offices, etc.). Auto dealers and gas stations are also retail, but they’re not dead either because it’s hard to buy new cars and gasoline online. Grocery stores, car dealers, and gas stations account for about 50% of retail sales. The brick-and-mortar meltdown is happening in the other 50%.

“Available space” dropped because entire malls got shut down, and free-standing stores got shut down to be redeveloped. And their square footage got removed from “available space.” Not a secret.

I really hope this continues and it leads the Fed to grow up and drop rates back to 0 and start printing $120 billion a month ago. The future of our CHILDREN depends on it.

The FED needs to be dramatically neutered. QE should be illegal. If not dramatically neutered, then just abolish the FED altogether. They are a cancer upon society.

The bankers are a cancer too.

“Give a man a gun, and he can rob a bank. Give a man a bank, and he can rob the world.”

“The best way to rob a bank is to own one.”

~William K. Black

@Depth Charge,

“Give a man a gun, and he can rob a bank. Give a man a bank, and he can rob the world.”

This reminds me of Sam Bankman-Fried.

I tend too agree with your sentiment. Any one of us could base an argument indicative of the Fed making horendus, analytical mistakes, from the perspective of the majority, but advantageous too a tiny minority of aristocrats.

Tomorrow, the Fed will announce that the FFR will remain where it is, the QT program will continue as planned. Probably, the best decision that can be made at this juncture. Repairing the very sad decisions the Fed makes when the synthetic, macro market fails.

/sarc

:)

Yes, that would be great. Then we could have 150% inflation, like Argentina.

Too bad the internet came along to spoil the fun. Malls were nothing but a local money pit just for a few people. There were few bargains where floor space was increasingly jacked up in cost by the square foot. The mark-up needed to turn a profit on sales was almost criminal. A backroad warehouse shipping to homes costs a lot less for everyone. Good riddance.

I remember the malls differently than you, probably because I’m a lot older. They once paid their costs, providing a social marketplace.

They just became yesterdays news. Like us all.

Best wishes at this holiday season, to all.

“Left to rot” is usually the most appropriate choice in land management.

If the mall is typical with huge, near- square, no windows, anchors like Wally etc. the only way to re: develop into housing that meets codes is to demolish. You would only do this if there was no avail site that was vacant. That’s why there are lots of malls that have been vacant for decades. Lots of videos made by kids who explore them. Good potential for a horror flic.

Time to get ready for the big flow of $$$ back into Bitcoin and crypto. 2024 2025. It doesn’t have to make sense

Boomers who think everything in the world is OK because interest rates are “back to normal” and then compulsively ingest government statistics uncritically to satiate their bias confirmation would be best served averting their eyes from the bitcoin price.

Things may get painful for you.

Would it make sense to turn malls into warehouses or other types of storage?

Former Malls aren’t great for warehouses.

When you build a warehouse, you would pour a thick, reinforced concrete slab so it can support a higher weight on each square foot. You need that to be able to support the storage racks of a modern warehouse. Helps make sure that the forklift trucks don’t crack the floor as they run around loaded.

The floors in most malls simply aren’t strong enough.

The CRE market bubble is collapsing and is, as one would have it, being resolved in a manner that doesn’t threaten the underlying debt market.

Apparently. Yet.

It seems to me that short treasuries is the correct perch for those who have lived long enough to remember 50 pct retrenchment in asset prices.

The critical point that all these jokers are missing is that PREIT’s malls are the ones people actually shop at — and have some of the highest occupancy rates in their regions (Cherry Hill, for example). PREIT made poor financial decisions on some loans many years ago, that have come back to bite them. That’s really the only issue here. The property portfolio is solid and their malls are not dying.

There are still people out there that believe that malls aren’t dying? They are dying. Each time a mall dies, other malls get the remaining business so that they can hang on a little while longer, and then they too die. Ecommerce will take them all out. See my charts above about department store sales and ecommerce sales. Not hard to see the trend.

Brick and mortar retail in America is dead, but not so much in the rest of world. The big retailers in Europe are still popular destinations as are places like Dubai. In my opinion, it’s about security. The malls and shopping areas in America became high crime areas starting in the 2000s and have gotten increasingly more dangerous. I never go shopping alone, never, and I mainly visit average priced stores.

The mall landlords shot themselves in the foot when they cut operating expenses to the point where the gangs lived rent free in the malls. I grew up working class in NYC, and I know dangerous when I see it.

This REIT reached its high value in the early 2000s, that is right inline with my observations concerning the decline of the American shopping experience.

In terms of Europe, we just went to Germany in October for the first time in a dozen years, and brick and mortar is dying there too. I was surprised how bad it was. For example, in the historic center of Nuremberg (Altstadt), the big and formerly glorious department store Kaufhof sat empty. Kaufhof had built the multi-story building in the 1960s, and because of its special architecture, the building has been put under protection and cannot be torn down. The owner of the Kaufhof chain, the Austrian company Signa Holding, just filed for bankruptcy. The famous shopping streets in the Altstadt had lots of closed stores. But the cafes and restaurants with lots of seating outside in the pedestrian zone were packed with people. So there were lots of people around, strolling too, but they were not there to shop. Maybe it’s different in other European countries, but that’s what I saw in that little corner of Germany.

“Maybe it’s different in other European countries, but that’s what I saw in that little corner of Germany.”

Is the same in Eastern Europe.

malls in winter are full of people walking around but not buying. Summers are empty.

There is life only in large grocery chains and pharmacies.

Brutal graphs. Pictures really do tell a thousand words. Thanks Wolf.

There is no reason to cut or increase rates, causing chaos into an already chaotic market trying to resolve the chasm between price and value.

One suspects that the drama of it all is contrived.

Turn all of places into those Halloween decorations stores,

1) Dept stores sales : the last men standing will be doing well.

Lets assume that 2020 bottom was 5B. The wave down from 2008 high was : 17B – 5B = 12B. The wave up from the bottom was : 12B – 5B = 7B.

7B/12B = 60%. In a few years the surviving Dept stores might sell 14B/15B

2) A few of them will be very profitable.

3) E-commerce might have reached a high plateau. E-commerce is boring.

E-commerce has no salesmen that can pull credit cards out of customers pockets. Bad items and return for credit have to be liquidated in stand alone stores, or in shopping centers, with salesmen/saleswomen. No self service.

Anyone who categorically says brick and mortar is dead is falling prey to a media narrative. Certain kinds of retail (i.e. enclosed B malls in bad locations) are dying out. Other kinds of retail (i.e. well-located open air centers with good retailers) are doing great. There have been hardly any new additions to supply for 15 years, a lot of retailers are opening more stores than closing them, and the vast majority of shopping continues to be done in-store. Try telling Walmart or Ross or Ulta that retail’s dead. They’re public companies, you can see their results.

“Anyone who categorically says brick and mortar is dead is falling prey to a media narrative.”

LOL, it was me in 2016 who started the narrative of brick-and-mortar meltdown — google it — and I was pooh-poohed all the way along, and I was proven righter by the day.

Retailers are closing big stores, and they’re opening smaller stores. They’re closing department stores and clothing stores, and opening grocery stores. Grocery stores are not dead, department and clothing stores are dead, mall stores in general are dead. Strip centers anchored by grocery stores are alive, and filled with stores that offer “services” (restaurants, nail salons, insurance offices, etc.). Auto dealers and gas stations are also retail, and they’re not dead either because it’s hard to buy new cars and gasoline online. Grocery stores, car dealers, and gas stations account for about 50% of retail sales. The brick-and-mortar meltdown is happening in the other 50%. I have been saying this since 2016 and, as I said, have been proven righter by the day.

Walmart’s online sales grew 24%, and grocery sales grew on price increases, everything else dropped. Go read their earnings reports. Macy’s online sales are growing strongly and brick and mortar sales have been falling for years.

Now gas station sales are declining as people are switching to EVs, so pretty soon gas stations will be included in the melt-down segment. Grocery sales are already wandering off to ecommerce as well, but that transition is very slow.

“Available space” dropped because entire malls got shut down, and free-standing stores got shut down to be redeveloped. And their square footage got removed from “available space.” Not a secret.

Agree 100% with you but few here are understanding the causes of the retail apocalypse because few talk about the retail ecosystem. As a kid, I went to the mall because it had an arcade, a movie theater, a food court, shops selling stuff and my friends were there.

Today, the movie theater is at my house with a big screen TV and endless streaming services. The arcade is also at my house with a PS5, Computers, and endless gaming options. The shop for me is Amazon and has everything I can ever want delivered to my house same day or a day or two. Note that I also order most of my grocery store items from Instacart or Amazon. I still do like to pick my own produce and meats so those items I will go to the grocery store and buy by myself.

That just leaves my friends and these days we just take trips together usually overseas and we stay in touch online with FaceTime, social media, email, etc so that it feels like we’re never far apart.

Why does anyone need retail shops these days other than for niche items?

I’m with you. I never go into a mall anymore (or movie theatres for that matter). The only brick and mortar locations I go to are grocery stores, restaurants and a hardware store. That’s it — everything else is online.

And I’m a late adopter to this model, but Covid permanently changed many of my habits.

How in the world are common shareholders getting even a token recovery if the preferred aren’t being made whole (par value = $25/share?)

That sounds like a black-letter law violation of the bankruptcy code. Unless I misunderstood what Wolf wrote.

Rule of law you say? LOL! Wolf may disagree, but it seems like Blackrock and Vanguard have become “untouchables”, operating as fiduciaries for The Fed as of 2020. How is something like this “legal” in a democratic republic?

Easy monetary policy for the top 1%, “market” interest rates for everyone else?

There is no rule of law when you don’t let bad DEBT clear and you don’t punish bad behavior.

AIG and Goldman Sachs should have gone bankrupt and their assets sold off to pay their bills! That’s what would have happened if there was any “rule of law”!! LOL.

Increasing CRE coming on the market, with winter settling in. Who is paying to heat these places or have they drained all the plumbing and turned off the power?

Just more evidence of the massive mis-allocation of capital and resources that has been facilitated by ZIRP.

Higher for longer, much longer. QT will continue, at least until the balance sheet is below 7 trillion, maybe 6 trillion, but no lower…

that’s how I see it anyway, based on the data provided by Wolf.

CRE is worsening in LA. We are presently tracking 235 notices of default and or foreclosures in LA . Most recently a large high rise apartment complex defaulted on $90m loan.

Speaking of bankruptcy, it looks like Yellow will be paying back the US Treasury loan with interest. A small win for Uncle Sam.

One clothing item that I want to buy from a brick and mortar store is shoes. I don’t buy the same kind over and over. I buy what’s on sale and I can try on to make sure it fits right because returning is a hassle and wasteful to you and the seller. Somewhat applies to other items as well such as jackets or coats for example, to again check fit and quality if unfamiliar.

Turns out, surprisingly, once you figure it out and understand your feet and read the reviews, buying shoes online is easier than in the store because you have unlimited choice, and there’s always a deal somewhere. I now buy all my shoes on line, from hiking shoes and ski boots, to running shoes and leather dress shoes. Flipflops even

I’ve also started buying clothes on-line after some horrific experiences at my local Westfields mall which I never go to anyway. Shoplifting, armed robbery, murders, hit & run accidents on your car, incompetent employees etc. The list goes on.