New all-time highs: Construction, Wholesale trade, Arts & Entertainment, and State government.

By Wolf Richter for WOLF STREET.

Some industries pushed their payrolls to new all-time-high; others shed workers, such as retail which has been structural decline since 2017; at other industries, employment has been roughly level at record levels, for months, after the pandemic spike, such as in manufacturing and professional and business services. We’ll look at employment at the major industry categories and at government jobs, based on the data from the Bureau of Labor Statistics.

On Friday, we discussed how average hourly wages surged for the third month in a row, growing at an annualized rate of 5.0% in November – that Wage Growth was Not Cooperating with the Rosy Scenario of a Normalizing Labor Market; and we walked through the details of the jobs data and saw that the labor market is giving the Fed no reason at all to cut rates.

The private sector.

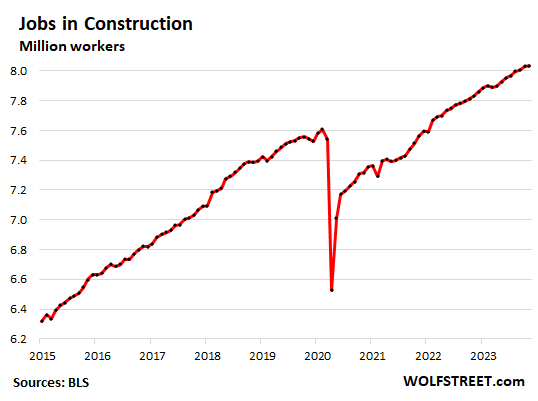

Construction, all types of construction, from single-family housing to highways. We already have been amazed by the eyepopping boom in construction spending on factories. Overall construction payrolls hit a new all-time high:

- Total employment: 8.03 million, new all-time high

- 1-month growth: +2,000

- 3-month growth: +36,000

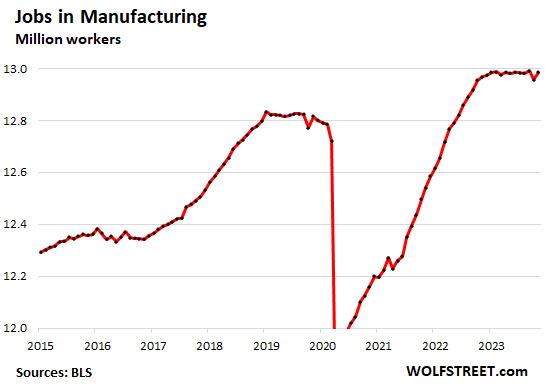

Manufacturing: Employment had plateaued for months after the post-pandemic boom. But in October, jobs got hit by the strikes in the auto industry. In November, many of those jobs came back.

- Total employment: 13.0 million

- 1-month growth: +28,000

- 3-month growth: +4,000

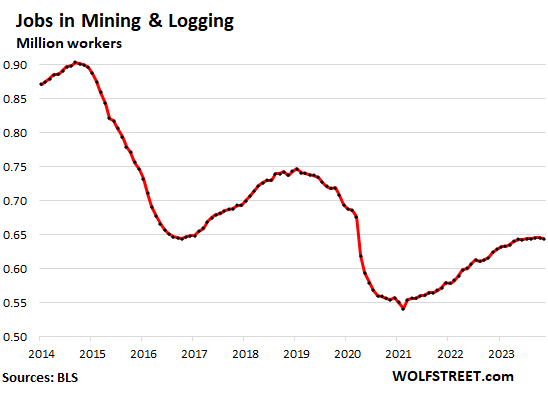

Mining and Logging: This chart goes back to 2014 (all others to 2015) because this sector had its recent employment peak in 2014, which is when the biggest coal mines began to restructure in bankruptcy court and shed lots of workers after the collapsed price of US natural gas had caused the price of coal to collapse, while power generators shifted from coal to natural gas, a trend that started in 2000, and more recently to renewables.

- Total employment: 644,000

- 1-month growth: 11,000

- 3-month growth: 0

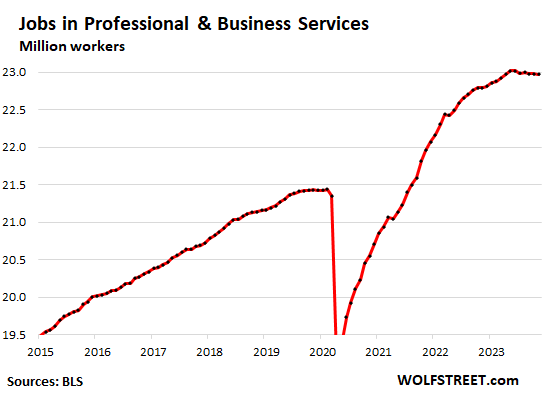

Professional and business services, the largest sector by employment, includes Professional, Scientific, and Technical Services; Management of Companies and Enterprises; Administrative and Support, and Waste Management and Remediation Services.

Some of the tech and social media companies are included, others are in “Information” (below) or in other categories.

- Total employment: 23.0 million

- 1-month growth: -9,000

- 3-month growth: -24,000

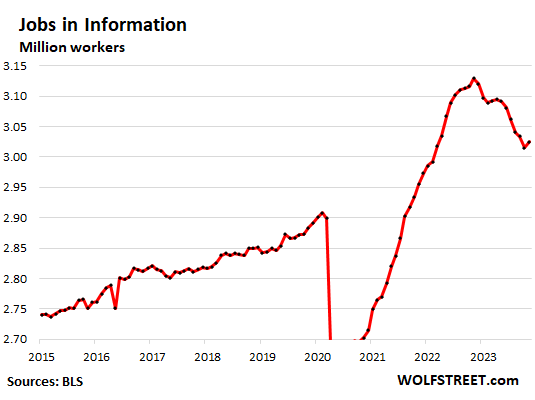

“Information” is a small sector that includes web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications. Some of the tech and social media companies with big layoff announcements are included here.

- Total employment: 3.03 million

- 1-month growth: +10,000

- 3-month growth: -15,000

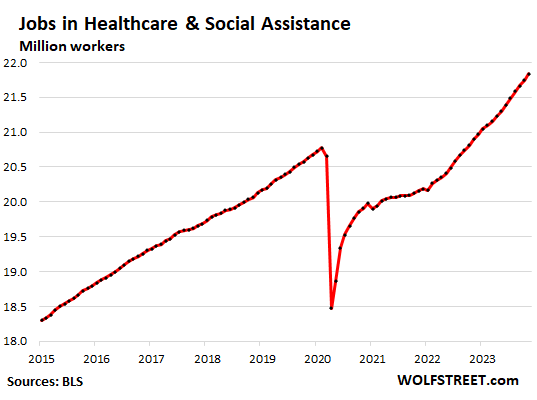

Healthcare and social assistance:

- Total employment: 21.8 million, new all-time high

- 1-month growth: +93,000

- 3-month growth: +254,000

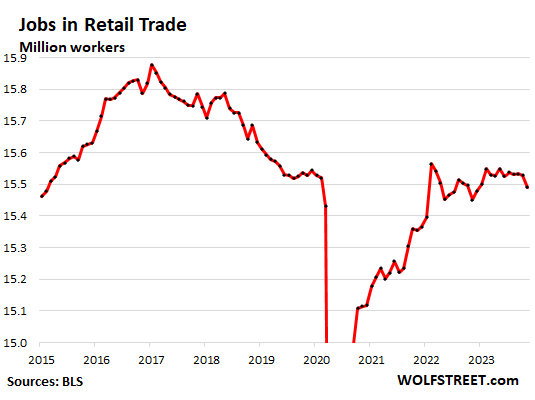

Retail trade includes workers at brick-and-mortar retail stores – malls, auto dealers, grocery stores, gas stations, etc. – and other retail locations such as markets. It does not include the tech-related jobs of ecommerce operations, and it does not include drivers and warehouse employees. A big portion of this sector has been under heavy pressure from ecommerce operations:

- Total employment: 15.5 million

- 1-month growth: -38,000

- 3-month growth: -41,000

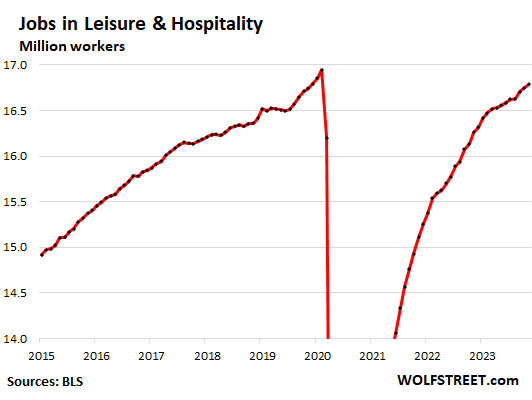

Leisure and hospitality – restaurants, lodging, resorts, etc. – has had a hard time hiring, as working conditions are often tough, including split shifts and weekend and evening work, and pay can be relatively low.

- Total employment: 16.8 million

- 1-month growth: +40,000

- 3-month growth: +158,000

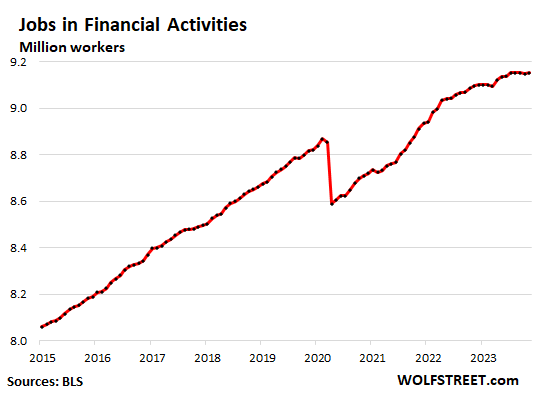

Financial activities include finance and insurance plus real estate (renting, leasing, buying, selling, and management).

- Total employment: 9.2 million

- 1-month growth: +10,000

- 3-month growth: -1,000

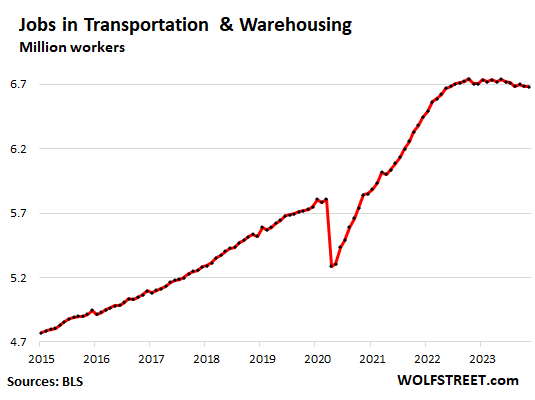

Transportation and Warehousing:

- Total employment: 6.7 million

- 1-month growth: -5,000

- 3-month growth: -5,000

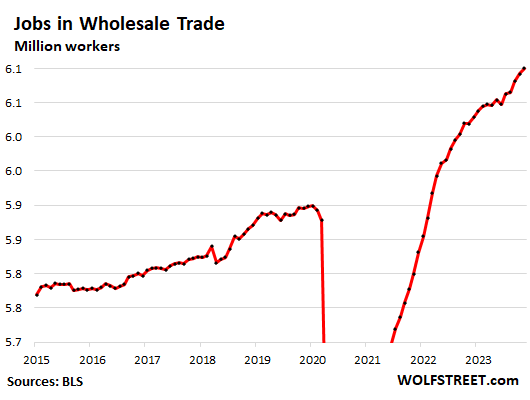

Wholesale Trade:

- Total employment: 6.1 million

- 1-month growth: +8,000

- 3-month growth: +35,000

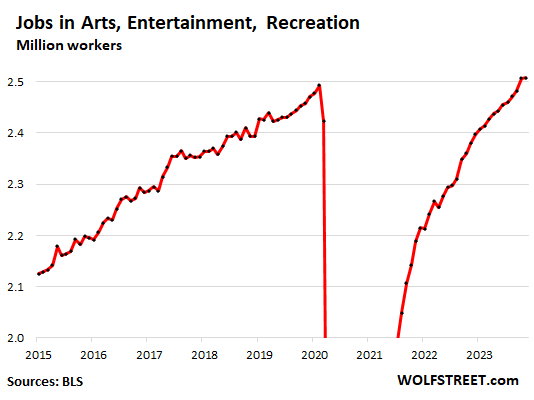

Arts, Entertainment, and Recreation includes spectator sports, performing arts, amusement, gambling, recreation, museums, historical sites, and similar:

- Total employment: 2.5 million, eked out new all-time high

- 1-month growth: +1,000

- 3-month growth: +36,000

Jobs in government.

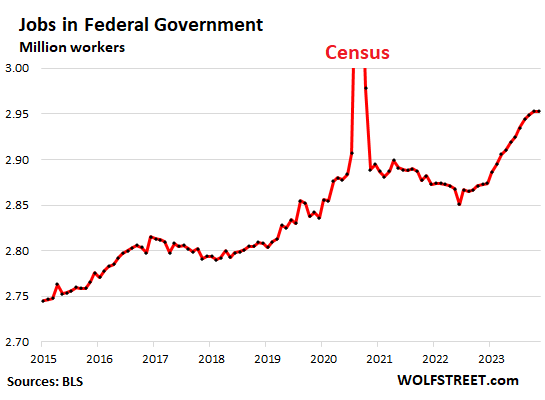

Federal government civilian employment: the spikes occur every 10 years when the census is taken.

- Total civilian employment: 3.0 million, except for the census periods, a new all-time high

- 1-month growth: 0

- 3-month growth: +9,000

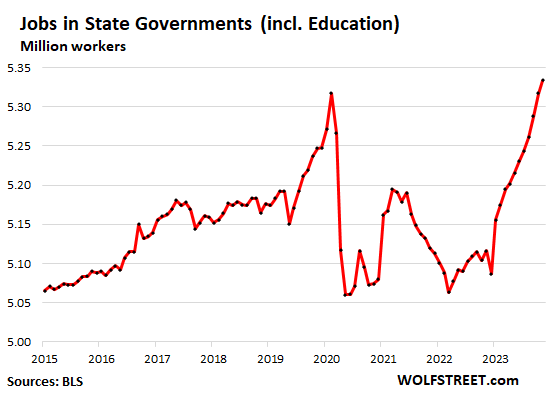

State governments (includes education, such as at state universities).

- Total employment: 5.3 million

- 1-month growth: +17,000

- 3-month growth: +73,000

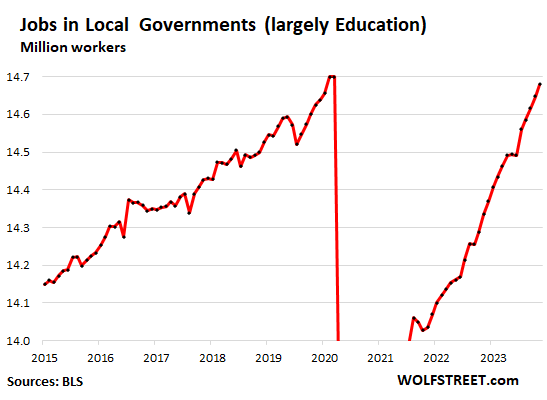

Local governments – employment is dominated by education, such as teachers. After the pandemic, school districts struggled with large-scale teacher shortages. Employment is still not back where it had been before the pandemic, and some school districts still struggle with teacher shortages.

- Total employment: 14.7 million

- 1-month growth: +32,000

- 3-month growth: +95,000

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

typo: shouldn’t the vertical scale for “Mining and Logging:” be labeled “millions of people”?

Logging and mining seems to follow the presidential election cycle.

Really? I mean 🤣🤣🤣🤣 Some people just can’t give it up?

They fell during the first year of Obama.

They soared during the next 5 years of Obama.

They fell during the last 2 years of Obama.

They rose during the first 2 years of Trump.

They plunged during the last 2 years of Trump.

They bottomed out in Feb 2021 (Biden’s 2nd month)

They rose during Biden.

But in overall terms, the dynamics are explained in the article. This is a structural change. You can thank fracking for it. In addition, there is now a lot of automation in mining (think mountain top mining, pit mining, self-driving huge mining trucks, etc.).

IMHO as one who watched levels of employment, in the construction industry especially, for many decades prior to 2020 events, there are many very serious challenges in and suggest by these charts.

NOT at all sure how this is going to play out going forward, so will continue to confine investment to various lengths of treasury securities for now.

Good luck and may we all have a Happy and Healthy and VERY Merry Holy Days season in the midst of the greatest actual economy — at all levels — for everyone who actually WANTS to work!!

There has been massive tech change in logging as well the last 30 years. Machine harvesters and one operator as opposed to 4-6 rigging and landing crew. Processors that limb and cut to length for best market value….one operator and instant production with waste left in the bush. Dryland log sorts with machines able to lift off an entire logging truck load at once. etc etc.

Logging is totally dependent on housing starts, where doesn’t matter, but someone has to need the wood. Plus weather. Shutdowns can be instant. I have seen the market drop and crews given just a few days notice they were out of a job, until further notice. Fire season stops logging, heavy snows, flooding, etc etc.

For years our junk wood went into chips for pulp mills. Then to China for throw away scaffolding and forming during their building boom. Usually most of our saw logs and lumber goes to the States as we supply a large % of your lumber/logs. If your housing goes down, we are out of work where I live.

When the US imposed softwood lumber tariffs our bigger companies bought out many sawmills in both Washington State and Oregon so they could use the logs internally and dodge the tariffs.

Correlation does not imply causation.

sometimes it does. correlation is not necessarily causation.

Paul S: large parts of the Carolinas are being logged clear for shipment to Europe, where “renewable” wood pellets are replacing coal in power plants…

anecdotally, a 12 tornado outbreak here in NE Ohio Aug 24-25 created a hell of a lot of logging jobs in the cleanup…guys in the woods with chainsaws and skidsteers, almost none of it automated, although the large hardwood logs are all being trucked to local sawmills and will end up in Amish built furniture

Jobs in healthcare will probably go exponential in the coming years. Related to the # of drive-thru lanes at fast food joints. I regularly see 2 lanes now and supposedly some Taco Bell has a 4 lane drive-thru with building on stilts above. Great for job security I guess…

For every problem, the market will respond. GLP-1 agonists (Wegovy, Mounjaro, Ozempic, etc) MAY address one of the industrialized world’s greatest problems — obesity. Additionally, as someone with many friends and family in the medical industry, there are many disruptive technologies (CRISPR, telemedicine, robotic surgeries (already utilized in many complex surgeries), etc) that have significant potential to improve outcomes for patients and reduce the number of sick people (and providers).

It doesn’t “cure” any sick people, it just treats the symptoms and turns them into life-long customers. Great for business.

@elbowwilham: Exactly.

Boomers. Healthcare Jobs will go up because Boomers want to live forever (more surgeries and the like).

That tsunami won’t end anytime soon.

The all time high in federal civilian workforce is a disgrace. No hope the federal government will ever rein in spending. It only gets worse. I don’t have words for how I feel about my country anymore.

A fact for you-

the number of federal employees has hovered around 3 million since 1967

the population of the USA has grown from 192 to 340 million since 1967

that’s no additional federal workers for about 150 million more people

but hey, what are facts…

https://usafacts.org/articles/how-many-people-work-for-the-federal-government/

Contractors say what?

Friends that work directly for the government are poorly paid, they could make double as contractors.

I have many friends and family who work for the federal government, and the pay is exorbitant. Not to mention they work no more than 40 hours a week and have extremely generous perks plus civil service protection the private sector doesn’t have. You won’t win this argument with me. I’m not comparing to contractors who are also a drain on the system, and many should not exist.

Did you not look at the chart above? Did you not see the gigantic upward trend? I don’t care about your link and what you think are facts. What I do know is there are way too many federal employees making way too much money, doing way too much unnecessary work if they are working at all. Many jobs in the federal government should not exist periid,

60% of those civilian workers are employed by the Department of Defense/VA/Homeland Security.

Things are rosy in construction,but going into winter tons of layoffs . Then we have Christmas retail soon to be tons of layoffs . Always hope for the best but prepare for the worst

Well, as you pointed out, retail is very seasonal every single year. Retail sales, not seasonally adjusted, plunge about 22% from December to January. They do this every year, and so we know that, and we figure it into the scenario with seasonal adjustments. We also know that retail sales spike in Nov and Dec every year, and we also figure it into the scenario with seasonal adjustments. This is totally routine. Happens every year.

Construction is impacted by all kinds of stuff. Early this year, in the West we had the huge snow storms, rain storms, snow melts, floods, etc., that hit the construction industry in the West in Jan, Fed, and Mar. That was only in the West, but it was big enough to flatten national construction employment for these three months, and in fact caused it to dip in March – which caused the recession mongers to jubilate. But it was just the weather.

My area experienced a weather event some weeks ago which destroyed our brand new car and damaged a large percentage of the area homes. As a result, the car, roofing, siding, and glass businesses are booming. This blip is visibly boosting the local economy, but it is not going to last. The restaurants are full, and the cars look newer, but the folks look shabbier.

Outside of this anomaly, jobs and salaries, are dropping. Homes are dropping in price too, but still largely unaffordable.

High housing prices have put home affordability close to historical lows.

But if you listen the big builders earning calls (TOL and PHM) they are very bullish. Crazy

Let the good times roll! My son and I went out for brisket with all the fixings. Would like to say I am a drunken sailor but only had 1 pilsner. Yolo. Employment mostly looking super solid. Rezone a bunch of retail real estate and put in more housing and keep it going.

Unless you are in logging/mining or retail, the charts look pretty good.

No reason to cut interest rates.

No reason to stop QT.

At least for now anyways.

Trucking market is pretty crappy right now. Speaking as an out of work trucker at the moment. But trucking always sucks. One way or another.

Wolf,

On your Tesla Model Y article, you give the Ford F-150’s share as 3.5% in the text and 3.0% on the chart. Based on the chart, 3.0% appears to be correct. I would post on that article but I’m not sure if you’re still checking the comments after several days.

Regards

Thanks. 3.0% is correct, 3.5% was a typo.

I read all comments in chrono order in my commenting software. So you can comment on an article that was published 9 days ago, and I will see it as soon as I look at the comments.

That’s the kind of artisanal service one becomes accustomed to around here. Reminds me of my favorite record store (yes, such things still exist), where the owner pulls me aside to recommend stuff he knows I’ll like based on my purchase history.

Makes the rest of the www seem like a vast, uncaring wasteland.

Big tech has been trying to emulate that for years with results that are various shades of abysmal. It’s why Amazon constantly bugs me to look at women’s shoes because my wife bought a pair of slippers three months ago.

The graph of jobs in art, entertainment and recreation certainly supports the “drunken sailor” spending level Wolf has previously noted. That industry would not be doing so much hiring without it.

And that is a discretionary expense category. Interesting that consumers continue to thumb their nose at the recent interest rate hikes with spending patterns such as that. What will it take to get their attention?

Americans have always been good at living for today, very short sighted and excessive. I know some who did that, spent, spent, spent, and now are on the dole in old age. I always saved, saved, saved but even with the good amount I have accumulated, I don’t feel secure. I’m spending as little as possible. This will end badly for us, I firmly believe.

I see. Only YOUR type of people should be allowed to vote.

Tell me, do you base who should vote on bigotry, misogyny, xenophobia or rascism ?

OutsideTheBox, where did you get that from my comment?

“The fundamental problem is that everyone is allowed to vote…”

Your words.

So it follows that you would exclude groups based on your personal prejudices.

Again, you stated that NOT everyone should vote.

Tell the group WHY you hate democracy.

I’m a saver as well, and routinely struggle with some of the same issues you point out. But your response here and your outlook would seem to indicate that your perceptions are based more on fears than reality.

Reminds me of some of the people who call Dave Ramsey after a lifetime of frugality, and when they actually have the financial independence they always sought, they still continued to scrimp and save, and fail to enjoy life.

Saving is a skill. But so is spending. I’ve taken to being frugal on crap that doesn’t matter, and chosen to be outrageously generous with the people I care about. I think it’s a good compromise and has changed my outlook considerably.

Well said JD. Saving consistently can be commensurate with more effectual spending.

I’ve spent quite a bit on gifts for my nieces and nephews for the upcoming holiday. No regrets. And it was actually consistent saving that permitted me to do that now.

No, where did you read that it would be based on race or gender?

Projecting, are you?

And yes, I do hate democracy when everyone aged 18 with a pulse is allowed to vote.

Voting is irrelevant. Look at what the majority of Americans want and look at what laws get passed. There is no correlation and of course approval ratings are always terrible but by all means, proceed forward with the definition of insanity. Most Americans didn’t want all wars going back almost 80 years nor rounds of massive tax cuts but we got them. Universal health care, affordable quality education and so forth nowhere in sight.

Aha ! So you DO hate democracy !

Thanks for having the fortitude to admit it.

Fortunately, you will NEVER have the power to end democracy.

Galling, isn’t it ?

Ahhh, yes. I agree with outside of the box. I am also outside of the box where no thinking happens and I can confirm you are a bigot. My astute observations and academic training has honed my skills in identifying bigots these days. I can’t believe how many there are now compared to say, 5 years ago. You would think we were living in the 60’s or something, that word is so timeless. Anyway, the biggest clue that someone is a bigot is that they are different from you and don’t hold the same opinion. My bigot detector goes off all the time when I’m out and about in places that aren’t in my safe zone (bed). I do agree that no one should be so arrogant as to dismiss the ideas and rights of others do to self-perception of intelligence……………….but………………there is still truth in what the original commenter said. Try to relax or at least improve your vocabulary a bit because the word bigot is so overused and misapplied that it’s like listening to a teenage valley girl say ‘like’ and ‘literally’ over and over.

Glen, “universal health care” is a poor idea that is only made possible with universal franchise.

Everybody wants free stuff, but they want other people to pay the bills. No one volunteers to pay more taxes for any of their pet spending.

Too bad there’s no ignore feature, as OutsidetheBox is acting like your typical petulant leftist moron.

E

You admitted you loathe and hate democracy. Great admission.

Yet you can’t publicly admit who you would exclude.

Why is that ?

Yeah Einhal. Don’t beat around the bush. Tell us who you hate. Everyone hates someone, no one is a saint these days. You don’t like beethoven do you. I bet you’re a motzart fan. Disgusting. I can’t believe the level of bigotry. And the lack of outrage by others here is outrageous.

There are those of us who worked, scrimped and saved and are realizing that, quite likely, we have more money than time

Make that analysis and live accordingly

Great Xmas charts. No recession in sight. Mike Johnson will salivate on Wolf’s charts. The healthcare industry must be cut. They harm people.

The radical left in the high tech, the pro/anti Palestinian state hates each other so much they are fighting in the cafeteria.

To preempt $3T maturity HR might cut head count in several sectors. In construction will slow down b/c 1M multi units 5+ will be completed. The rate of construction will decline.

The gambling industry or the amount bet per person is always the very last thing to go before a recession occurs. No signs of that today.

Great comment. Ice cream cone goes up, sun makes it come down. Furloughs coming for moon rockets. 10W-40 motor oil on sale at Auto Zone through Sunday. CEO says no more coffee in break room, all reports coming in later this week. Just joking. I think there are people here who can decode your comments and appreciate what they have to offer. I’m trying to get the robot talk to translate in my head properly.

Micheal E has been a long time contributor to the comments section. Someone, perhaps Wolf, coined the writing style as Engel-ish.

TXR – always a good reminder for the new patrons of Wolf’s fine establishment…

may we all find a better day.

91B20 – Yes always a good reminder thanks. Can’t comment as much anymore cause there are some smart guys on this site including you with your succinct but always pertinent comments.

And I have found the better days…

Thanks. Needed my daily word salad and deep thoughts post.

I’ve been in and out of several companies in the much publicized tech sector over 15 years or so…

Three major patterns that make me think the trend won’t reverse back to boom times anytime soon regardless of what happens in the broader economy:

1. One person is getting as much work done as teams used to accomplish while drastically reducing the superfluous meeting overhead to get everyone on the same page.

2. Much of the work being done is connecting a services of a vendor or open source library to your own special sauce so there is actually less work to do since the hard part of solving unique problems has a much narrower focus. Infrastructure, testing, HR, sales, marketing, etc. all have a handful of platforms that other companies make and all the people are doing is managing that platform now. Lots of the slack I’ve seen was created by buying a tractor but hiring like you’re going to do all the farming by hand. Those days are gone and people are used to the tractor now.

3. The platform is the where all the tribal history

is stored. Meaning that these people are increasingly replaceable – or in lean times someone else can manage the platform that’s not a specialist in that domain and have access to almost everything the specialist knew.

10-4 WM, at least certainly on your first point:

Worked in a team of 10 doing large project bidding in ’84; did approximately 10 TIMES the dollar volume in ‘2008 — BY MYSELF.

(except for actual ”bid day” in ’08, when 3 people were needed to run the hundreds of faxes to me; faxes now mostly gone I am told…)

“One person is getting as much work done as teams used to accomplish while drastically reducing the superfluous meeting overhead”

The exact opposite is happening in the federal government civilian workforce. Teams are not quite getting as much done as one person used to accomplish while drastically increasing overhead.

I recall a senior gov’t IT boss passing to me one day (several years ago) “Gov’t IT is a white collar employment service.”

Grade inflation is unbelievable. I know many people working civil service. It used to be, before the excesses of the late 1990s and then the 2000s (GWB was one of the worst offenders), you accepted a lower salary to work in government in exchange for a pension later in life. Not anymore. It’s quite the gravy train at the expense of the taxpayers.

My take as well: gov’t pension system has always been the pot at the end of the rainbow. However, one had to toil in the trenches 25 years or more to reap the benefits. That’s changing.

During my last stint supporting government what I witnessed was a much more aggressive approach by younger civil service workers to reach GS-15 status at a young age (e.g., late 30s). Small political alliances would form with the leading light gaining the “inside” information to help the cabal move into the next step up opening.

I used to go to the local popular lunch digs once a week where civil service types collected just to watch who was dining with whom so I could figure out who was aligned with whom – and possibly a threat to me. It was a fairly good barometer!

What the data doesn’t capture is the unproductive time spent mastering government employ laws, EEO procedures, HR staffing, etc., etc., needed to play the system or, conversely, avoid becoming a victim.

Phillip:

Yes, I’d never go into management in the government. EEOs are the name of the game there. If you are in management and you, heaven forbid, ask your employees to work, chances are you’ll get an EEO filed on you.

Most federal workers, not the private contractors, are paper pushers and not required to be productive. Many are rewarded with bonuses for kicking the can down the road and not spending on required projects. They also receive training in pushing costs onto vendors and contractors. Their bonuses are based on what is left over in the pot at the end of the budget year, usually September.

I wonder what sort of metrics the Air Force would have? number bombs dropped? Aircraft shot down?

The last two systems I had to interact with were written in the 1970s but that is government for you. Some of the code is written in languages nobody even still knows and there is no documentation. On the positive side keeps unemployment low as each of these has had atl minimum of 3 modernization attempts, all of which failed badly. Admittedly private sector is mostly solid.

Nearly all large federal, state, and local government IT systems are developed, maintained, and eventually replaced by private sector IT companies.

Private sector is solid? The failure rate of private sector IT projects is exceptionally high…it’s widely reported.

The gambling industry is always the last one to go before there’s a recession. No sign of that today.

Since the 1948/1949 recession, 11 recessions ranged between (-)0.3%

in 2001 and (-)5.1% in 2007/2009. That’s 75 years. Historically it can

get much worse.

Landlords don’t like to lose money, but after a few years of falling

properties prices, in real terms, they adjust, during the glut…

Worker #1 calls and leaves a garbled message about a toxic screening program. Holy cow! Am I in trouble? I call back. Worker #2 has to figure out who to relay this to. Worker #3 asks me if I think I was exposed to toxins in the military. Jeez! No way would the army tell me that stuff. And now someone’s asking if I know. Let’s see….C-rations, spam on white bread, floor wax fumes, diesel, gasoline, asbestos tiles, explosive compounds….oh, and the insides of those old missile bunkers where they previously kept some atomic payloads. So what’s the answer? How the hell do I know? That’s three workers peddling air space. Some day I’ll be dead and my phone won’t be connected anymore…Twilight Zone not withstanding. That’s three people employed in nothing. Here’s an idea for wasting government money…just cut me a $1.97 million settlement for the potentially undisclosed death warrant from existing in a uniform. Then those three workers can go find a freaking job figuring out how to build advanced monorails connected to buildings where people can live with green spaces all around them. And Mr. Musk can switch over to building electro trams or golf carts when we dig up all the darn freeways that won’t be needed. Or he can join the “refugees seeking asylum” on planet Mars where there’s lots of open space to build crapshacks and be politically perfect polly’s…another PPP program. Meanwhile, the dollar is not only losing value but we’ve got the whole damn business world saying they won’t take those pieces of paper with serial numbers which were forced onto us by the government. No, it’s got to be electro credits that have no substance, questionable accounting, and easily controlled to force you to buy what they want to sell at prices that are inflated on a whim. Enjoy the ride to hell.

Man i hope it’s a free ride at least. My stimi checks are all gone.

I am retired. I no longer view job growth/loss metrics with keen interest as I used to do. I sure don’t miss the commute. I am now a gentleman investor/gambler. 😎

Rank amateur here, but a number of charts seem to show continuation of pre pandemic trajectories. I just visually extend the trajectories past the pandemic dips and some current data appear to be right where they would be without the dip.

Worrisome in my opinion, is Fed and State employment. I have a bad feeling their pay and benefits as well as job security are above the private sector. Maybe I’m way off base, its just a “gut feeling”. Maybe a necessary evil, but one paid for by the “producers -tax payers- of the world.

Great article and thanks for all the chart work, it helps us visual types.

The problem is NOT that the public sector pays too much.

The problem is the private sector pays too little.

That’s too many absolutes in a universe where all things are only knowable based on relativity (and I don’t mean einsten’s general or special relativity even though there is no contradiction to include them in what I am referring to). It seems like a problem if the private sector is paying less than the public sector because the government is not a producer so there is no justification in a capitalist system to have a non-producing entity providing a greater payout than elements of the society and economy that do materially contribute to production. It can be similar to the feedback loop of inflation, where people only start to seek government jobs and essentially it becomes a whole system of keeping people artificially busy regardless of the original purpose of the institutions. A comparison I would make to it that I have observed in a foreign country of highly educated people where there is not enough jobs to employ so many highly educated people……….many of the young people go to college and if you talk to most of the people in college, they want to become professors. Why? Partly because that’s all they’ve known and seen in their lives up to that point as an example of someone earning money from their investment in their self. The point is that we can’t be building and funding massive university systems that only turn out people who want to become teachers of people who want to become teachers to people who will grow up to be teachers…………..no one actually knows practically how to build anything or work on anything or fix anything or come up with something functionally new.

Well, the irony is we have a great shortage of teachers, especially in STEM. And while we have a lot of entities that produce things, by and large, the ones that control those entities don’t produce anything either. The idea that a capital cycle would simply feed the next capital cycle in simple terms has mostly disappeared. GM, for example, spending profits not to invest in EV but to buyback shares to increase the returns for those that have nothing to do with the production of the car. Admittedly it will likely raise share prices so execs with options can cash them out.

good one Glen,,, and, as per my reply to WR above re ignoring the past,,, it would certainly seem appropriate at this time to regale investors with the stories so very similar about what was happening in the late 1920s SO very similar to these days…

OF COURSE it is different this time,,, it is always different, in SOME WAYs,,, each time,,

while also very similar in SOME WAYs, eh

No doubt a pig at the trough

It’s not one or the other. There are definitely private sector jobs that have been gutted and now worse off than public sector, but that blame can be found (in some cases it’s private equity that did it). No need to pull the others/public workers down to that level, but rather try to get those in private sector back up. I read recently Biden admin looking into this issue in healthcare with PE has been rolling-up small medical groups to then end up basically corning markets and making costs higher for patients (while also making the medical practices now basically sweat shops for those of us who work in healthcare and know these groups).

“It would be interesting to compare the inflation calculation methodology of the 1970s and 1980s with the…”

🤣🤣

No it would not be interesting. It would be somewhere between silly and stupid, and certainly a waste of time.

Life has changed. Today we routinely buy goods and services that didn’t exist in the 1970s or 1980s and weren’t in the CPI basket back then. And many of the goods and services that were in the CPI basket back then don’t exist anymore today. And the products and services from back then that still exist today have completely changed. All measures have to adjust to what consumers are actually doing, and not cling to what they did 50 years ago. Life moves on. Measures have to be adjusted constantly to account for the changes, or else the metric becomes useless. Trying to cling to how it was done 50 years ago is oldfartism.

As a certifiable old farter Wolf, I respectfully disagree with you on this:

Certainly for any ”metric” of life, no matter which and when and where, proper reference and reverence for the old time, older times, and oldest times is a good thing…

What was the meme repeated for ever?

Those who ignore the past and don’t learn from it are doomed to repeat it???

”There’s nothing new under the sun.” etc., etc.

Something like that IMO continues to be not only a basic guide for investors, but a basic guide to all young and younger folks, including myself in my late, but young 8th decade and our beloved Wolf…

That’s just irrelevant to consumer spending on today’s products and services. That’s what this was about, not a lesson on how to live your life or whatever.

If I get another comment like this, I’m going to delete this thread.

The buyback era is over. The cost of financing buybacks is too high.

The ratio market cap/buyback might not boost owners shares.

Buybacks might reduce CEO performance.

Perhaps, but it’s my opinion that by allowing the stock market to act the way it has, Powell is implicitly promoting inflation.

Buybacks feed a lot of company executives wealth gains though. Executives do not get paid dividends on their options. They may let the company take a small hit in profits to keep the value in their options price growth?

MW: US Treasury’s $50 billion 3-year auction goes badly, trader says

Excellent charts Wolf, and shows how jobs have been created since 2021 by investing into infrastructure, clean energy, transportation, roads, bridges, public transit, ports, internet, communications, defense, airports, schools, technology, medicine, transit buses, EV charging, etc, etc.

This creates good paying jobs and all those wages will be taxed and help reduce the deficit over the long haul.

The “Trickle Down” nonsense of huge tax cuts to the rich has NEVER worked in the US or ANY other country, – but still many believe it’s true.

The policies of investing into the USA and middle-class made USA great, and started by FDR and is now jump-started once again, and is WORKING! – We all have benefited from those policies!