They don’t matter, until they suddenly do.

By Wolf Richter for WOLF STREET.

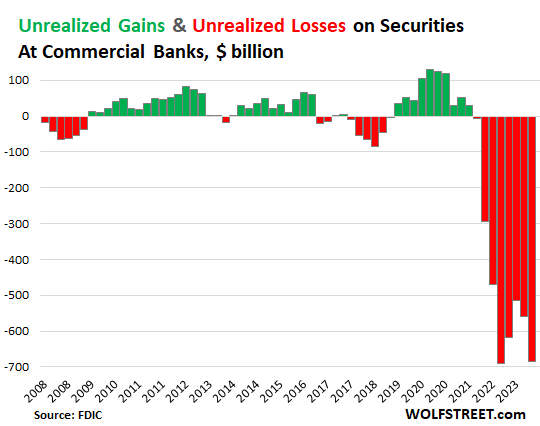

“Unrealized losses” on securities – mostly Treasury securities and government-guaranteed MBS – at FDIC-insured commercial banks at the end of Q3 jumped by $126 billion (or by 22%) from the prior quarter, to $684 billion, according to the FDIC’s quarterly bank data release on Wednesday.

These unrealized losses were spread over the two accounting methods:

- Unrealized losses on held-to-maturity (HTM) securities jumped by $81 billion from the prior quarter, to $391 billion.

- Unrealized losses on available-for-sale (AFS) securities jumped by $45 billion from the prior quarter to $293 billion.

These paper losses occur predictably when interest rates rise. As yields rose in Q3, the market prices of those bonds fell, and the unrealized losses stacked up. For example, the 10-year Treasury yield jumped from 3.81% at the beginning of Q3 to 4.59% at the end of Q3. In periods when yields fell and bond prices rose, banks had “unrealized gains” (green).

“Unrealized losses” on securities held by banks don’t matter because at maturity in 7 or 10 or 25 years, banks will be paid face value, and the losses are only temporary, so to speak. They don’t matter until they suddenly do.

Banks, via a quirk in bank regulations, don’t have to mark these securities to market value, but can carry them at purchase price. The difference between market value and purchase price is the “unrealized gain or loss” that the bank must disclose in its quarterly financial filings, so that we the depositors can see them and get spooked by them and yank our money out, us billionaires and centimillionaires first, on the two fundamental principles of investing: 1, he who panics first, panics best; and 2, after us the deluge.

And thanks to today’s electronic fund transfers, the bank that we yank our money out collapses at lightning speed, see Silicon Valley Bank, Signature Bank, and First Republic.

The accumulated unrealized losses of $684 billion were not a record, but were still $6 billion lower than the record in Q3 2022, because the FDIC took over the three regional banks earlier this year, and sold their assets, including their securities, at something close to market value, and thereby ate those paper losses.

For example, SVB, in its 10-K filing with the SEC for 2022, in a footnote on page 125, disclosed unrealized losses of $15.2 billion on HTM securities and $2.5 billion on AFS securities, for a total of $17.7 billion. These losses vanished from the banking system when the FDIC took over SVB.

The three collapsed banks’ unrealized losses were taken out of the banking system in Q1 and Q2, which is why Q3 2023 wasn’t a huge all-time record.

Those losses v. regulatory capital. The $391 billion in HTM “unrealized losses” amount to:

- 17.5% of total bank equity capital ($2.24 trillion)

- 18.0% of Tier 1 capital ($2.14 trillion)

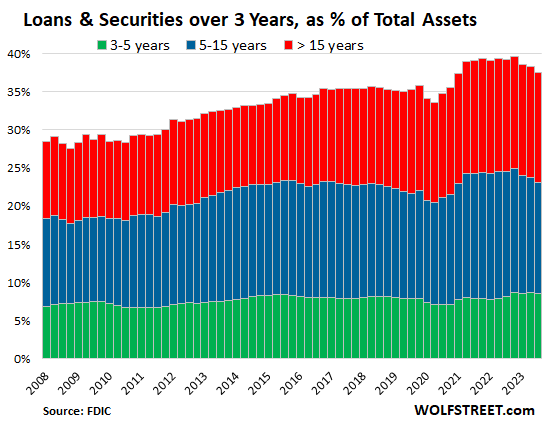

Loans and securities with a remaining maturity of:

- Over 15 years = 14.4% of total assets, lowest since Q1 2021.

- 5-15 years = 14.5% of total assets, lowest since Q4 2020.

- 3-5 years = 8.6% of total assets, roughly stable.

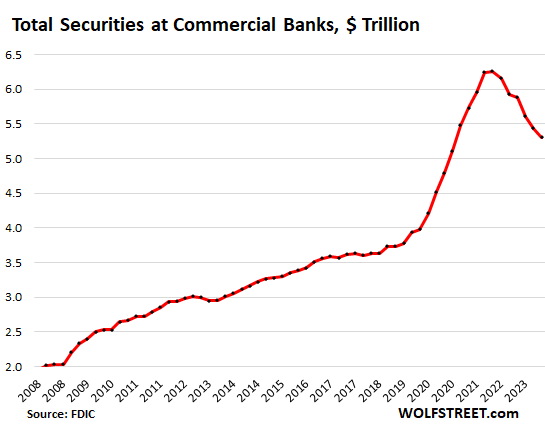

The total pile of securities held by all commercial banks fell to $5.3 trillion at the end of Q3, down by nearly $1 trillion from the peak in Q1 2022, when the Fed’s rate hikes began. They include securities valued at market price and securities valued at purchase price.

Several factors make up the decline, including:

- Securities of the collapsed banks that the FDIC sold to non-banks are no longer part of this.

- Banks have written down AFS securities to market value.

- Banks may have sold some securities.

The $684 billion in unrealized losses above amount to about 13% of the total securities held by banks.

The chart also shows how banks gorged on securities during mega-QE, at the worst possible time just when yields were at historic lows, stimulated by the Fed’s forward guidance at the time of no rate hikes for years to come, even in 2021, as inflation was surging. “We’re not even thinking about thinking about hiking,” Powell had infamously said less than a year before kicking off the fastest rate hikes in 40 years and the biggest QT ever. As has been proven now beyond a reasonable doubt, easy money is like a virus that turns brains to mush.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Double FDIC insurance from current levels would stop a lot of panic withdrawals by mom & pop depositors.

That wouldn’t have helped SVB and First Republic. Their depositors were rich entrepreneurs, VC firms, and richly funded startups, each with millions, hundreds of millions, and even billions on deposit. Those were the people that got bailed out.

Real question is why is the Fed still buying billions of impaired bonds from banks at face valu?

QE never stopped.

The best phrasing I’ve heard is its “yield curve control, but only for banks”

Harsh reply from Wolf incoming.

The total balance sheet of the Fed has dropped a lot. “QE never stopped” is complete nonsense.

Oldtimer,

1. The Fed is NOT buying any bonds from the banks. It’s lending banks against collateral. The banks post bonds as collateral. When you get a mortgage from a bank, you don’t sell the house to the bank; you own the house and put it up as collateral for the loan. Same thing.

2. These are not “impaired” assets. They’re pristine government guaranteed securities that will pay the holder face value at maturity.

3. Your line about QE is ignorant bullshit.

Giving them haircuts would have helped, but we don’t do that anymore. It’s backstop EVERYTHING time.

Some modest haircuts would have been the outcome if the uninsured depositors hadn’t been bailed out. Estimates at the time were around 20% haircuts. Yes, they did open the door to an all-deposits-are-insured banking system.

Wolf,

Did we ever find out how big the haircuts actually would have been if deposit insurance limits were enforced?

I will fully admit that I have not paid attention since the bailout, but I remember hearing estimates of less than 10% and even possibly 0% after the bankruptcy played out (asset sales over many months) at that time.

I am just curious if you know what the actual number was.

JimL,

We can guess by the losses the FDIC took on selling the assets. Those losses would have been spread over the uninsured depositors. Early estimates of losses were $20 billion to the FDIC fund. I don’t think there’s a final tally yet. SVB had $120 billion in total deposits, of which 94% were uninsured, so $113 billion. And $20 billion in losses spread over $113 billion in uninsured deposits would be a haircut of about 18% of the uninsured deposits. It would not have been the end of the world.

From 10 March 2023:

“Roku discloses it has $487 million in deposits at failed Silicon Valley Bank. That’s 26% of its cash.”

“The disclosure only adds to the alarm surrounding tech companies that do business with SVB after regulators shut down Silicon Valley Bank on Friday, marking it as the largest bank failure in the US since the 2008 recession.”

Meh! Move along! Next post!

Ever since the REPO market crash of Sept. 2019, the Fed has clearly signaled they’ll backstop EVERYTHING. It all started in Sept 2008, then after the REPO bust we had March 2020. Most recently, backstop heaven was revisited again earlier this year with the hot off the press BTFP for SVB, Signature, et al.

I remember back in 2019 the Fed was throwing 10’s if not 100’s of billions of dollars in liquidity into the banking system weekly.

$684B is literally nothing in terms of what they’re willing to backstop. It’s more like a down payment. Nobody takes a haircut anymore except the poor schleps that own stock.

Throw Jerome to the banks!

Let them have their way with him.

Not one banker arrested or fired.

All executive bonuses paid.

Always the safety net of a full bailout for all big fishes.

There are no consequences for bad decisions.

So…it will never change.

I thought their buddy Jerry was going to do bait and switch

take their underwater Bonds at par and issue new ones with 5% yields

Aren’t these guys rationally doing the thing that is likely to be the best for them personally? They’re basically given a stack of somebody else’s money and asked how much they want to bet on one spin of the wheel, with commission on the winnings.

Calling them bad decisions lets them off the hook too much. These guys are smart enough to know what they’re doing.

@Random50: Maybe we should start calling this “Institutional Crime” a la “Organized Crime”…

SVB and Signature execs were fired. They should have been fired out of a cannon, but it isn’t “not one banker…”

I’ve see CEO’s and CFO’s get fired, just to land better jobs a few months later. Others I have seen just take a break from the stresses of C-Level management (ha) and reap the sweet rewards of being on several boards.

Them getting fired doesn’t hold the same stigma as the bottom dwellers.

You want to punish bankers because they held bonds in the no interest era?

Cmon

Terrible take.

There were bad consequences for the failed banks. Just ask the shareholders of those banks what their shares are worth. That is the way it should be.

1. The “Too Big To Fail” banks were saved by dividing the losses among the nation. Whether it is Treasuries’ monies/debt or the Fed’s cashbox, via their credit card guaranteed by the nation, the usual few are saved by the expense of the many.

2. ” “Unrealized losses” on securities held by banks don’t matter because at maturity in 7 or 10 or 25 years, banks will be paid face value, and the losses are only temporary, so to speak. ”

To the extent that those “assets” are no longer at par value, then those assets cannot be borrowed against at par, so the losses are there, “unrealized” or not.

3. “Banks, via a quirk in bank regulations, don’t have to mark these securities to market value”

Not a quirk. A feature. After robbing the public during the Hank Goldman and Bernanke Save our Buddies days, I believe legislation was rewritten so current losses could be disclosed in footnotes.

Thanks Wolf

ps When Bonds were gaining value over par during the 30 years of suppression of interest rates, were those gains “unrealized” and noted in footnotes or did the Banks happily write those gains into their Net Worth?

So, the banks took deposits hoping to pay 0% interest and then used this money to either create 4% mortgages or buy long term treasuries paying 1%.

But now thanks to TBills the depositors want more than 5% yield. How to do that without losing money and without having to sell those underwater long term investments?

Bank do need to meet reserve requirements, so they can issue 5% CD for new deposits, but what about existing deposit holders who want more interests? There must be a solution given that Dow is at all time high.

Lol, here are the stupid solutions for these zombie banks:

1. Beg for Fed to cut rates or bail them out through SPVs.

2. Crash the housing markets to force sale of houses that allow getting rid of those low yield MBS and new mortgages to be issued at higher rates.

Any other solutions?

There are other solutions. The banks can absorb the losses by taking a hit to their equity capital, which far exceeds the unrealized losses as discussed in the article. Of course, all banks may not have enough equity capital to cover their respective losses, such as SVB, and they may be toast if there is a run.

If that happens to a lot of banks, you and 30% of Americans are out without a job. Clearly you don’t remember 2008. Idiotic solutions!

Ciprian,

I remember 2008 perfectly well. Unemployment peaked at 10% during the GFC, so 30% is a bit hyperbolic. Did you read the article? In aggregate, as the article states, banks have $2.24 trillion in equity capital and $2.14 trillion in tier 1 capital. The banks are well capitalized to absorb the unrealized losses discussed in this article.

How can a solution requiring those who incurred a loss to absorb that loss be idiotic? I’d argue transferring the loss to someone else is idiotic.

Have the Fed do QE for underwater commercial real estate loans. Great for all big cities like NYC, and big banks like Chase, etc.

Please, Please call them Defered Asset, you will upset the natives.

However Bank of America does stand out in this group with $130 billion… Ouch!

However, now the 30 year down cycle in interest rates to afford bigger and bigger Borrowing has turned, Like the Tide and around the World a lot of Central banks and their tied at the umbilical cord Minion Banks are looking at a Wiley Cyote air walk.

BOJ – $72 billion + minions

ECB – $80 billion + some very sick Minions

BOE – $189 Billion + some intensive care Minions

Note : thousands of Central Bank Minions are holding “defered assets” which inflation is eating allive like a cancer because if held to maturity they lose opportunity.

You First loss is your best loss but in this case I very much doubt they could want Crystalize it.

while interest rates are now back to NORMAL per se

the decline in value of fiat $dollar isn’t going to roll back prices

Bank of America does have a lot onnits balance sheet. But also keep in mind that those bonds roll over and are immediately replaced with higher yield bonds. Over time (1-2 years), banks will get payed closer to yields above 4%, and collect the coupon. Long term they are winners since even if a recession comes, bond prices recover (those assets appreciate at higher yields), fed lowers interest rates and bank loan a lower rates while collecting high yield coupons. You are thinking too much in the now! Think 5 years from now, and banks become winners after this bad episode.

This is why I keep saying the Fed needs recession to save the banks. It will strengthen the bond market and Incidentally collapse risk assets which now include houses. Rug pull incoming.

More welfare for banksters.

Those losses v. regulatory capital. The $684 billion in accumulated “unrealized losses” amount to:

5% of total bank equity capital ($2.242 trillion)

0% of Tier 1 capital ($2.139 trillion)”

I guess that “0% of Tier 1 capital” is a typo (or perhaps missing a “1”?).

Again, however, you’re double counting the losses on AFS securities, which are (or should be) already reflected on the balance sheet. Assuming no changes to the accounting rules since the last time I checked, the numerator in those calculations should not be the unfathomable $684 billion in total unrealized losses on securities, but rather the $391 billion of unrealized losses on HTM securities. Either that, or you can go through the more cumbersome approach of adding the unrealized losses on AFS back into equity and Tier 1 capital.

So the figure that is not already captured by reported shareholders’ equity and Tier 1 capital is the $391 billion in unrealized losses on HTM securities.

Wrong?

My understanding of accounting rules says you are correct. Unrealized g/l AFS are reflected in income and therefore equity, even if it’s OCI. HTM mtm is merely a disclosure, not presented in ‘value’ on FS.

“AFS are reflected in income and therefore equity”

AFS unrealized gains/losses are not reflected in income on the income statement. But they’re reflected in Tier 1 capital on the balance sheet.

HTM unrealized gains/losses are neither reflected on the income statement nor in Tier 1 capital.

My apologies in terms of the “0%” and “5%.” When the list starts with numbers that have decimal points, the automated html list formatting I use chops off the numbers to the decimal point, and then chops off the decimal point as well. I knew that because it happened to me before a few times, but it was very late when I posted it, and I forgot to check it. Thanks.

My pleasure — thanks for this fix and really for everything that you do.

“Those losses v. regulatory capital. The $391 billion in HTM “unrealized losses” amount to:

17.5% of total bank equity capital ($2.24 trillion)

18.0% of Tier 1 capital ($2.14 trillion)”

Yowsa! 18% of tier 1 capital is not exactly chump change solvency-wise. And it’s a lot worse at specific banks (BOA gets my vote for King of Duration Mismatch Stupidity).

But as you point out, as long as they can attract funding (i.e., deposits) and remain liquid, it doesn’t really matter because they don’t have to dump these assets. It just means they’re stuck holding negative-spread positions until the bonds mature, with the asset valuations trending toward par over time and eventually maturing at par.

Or, they can pray for a return to ZIRP / NIRP and a big bonus in 2024, for their wise capital allocations.

I mean, it’s only $394 billion, Wolf. De-minimis. Non-material. If I dropped $394 billion on the sidewalk, I wouldn’t even bother picking it up. Anyway, we’ll get it all back next year!!!

“Banks, via a quirk in bank regulations, don’t have to mark these securities to market value ”

A “quirk” ? Not sustained and deliberate fraud ? There is a difference.

It’s obviously “deliberate” because it was put into the rules on purpose. It’s not “fraud” — fraud might be a willful violation of those rules.

It makes some sense to value securities at face value if you never have to sell them, never intend to sell them, and never will sell them. My securities at TreasuryDirect are valued at face value or cost plus accumulated interest. They’re not valued at market price. In addition, there is no market price for i-bonds because they’re not traded. So in that sense, it’s OK.

Banks also hold loans, such as industrial loans or mortgages, and though they can be sold, they’re not traded from day to day. The banks carry them at face value until something goes wrong with that loan. That loan may be a 30-year fixed rate mortgage, in which case it behaves similarly to a 30-year bond, but it’s not marked to market either.

The problem for banks arises when there is a run on the bank, and people yank their money out, and banks first pay off those withdrawals from cash on hand and from the cash they have on deposit at the Fed, and then by selling liquid assets, and by borrowing from the Fed, the FHLBs, etc. if the run continues, they might have to sell their HTM securities to come up with the cash to pay the depositors. That’s when these securities that they never intended to sell have to be sold, and when the bank has to take the losses. If the bank run continues, the bank collapses.

Bank runs are part of the nature of deposit-taking banks, which is why there are heavy regulations, including reserve requirements and capital requirements, and deposit insurance – to prevent bank runs. Deposit-taking banks are inherently unstable because they borrow from depositors by offering them instant liquidity (can withdraw their cash anytime), while the banks invest that cash from the deposits in long-term often illiquid assets, such as loans. Borrow-short-lend-long is risky. But that’s what banks do, and they make their money off the spread. It works pretty well until there’s run on the bank.

Reserve requirements are currently 0%. From what I’ve read small banks are holding about 5% and big banks around 2.5%.

There is no market for i-bonds, so it makes no sense to talk about their market value. They do not trade. You can tell how much they are worth each month using the Savings Bond Calculator at Treasury Direct.

Accountants do all sorts of goofy stuff with arbitrary rules made by somebody, perhaps Congress. All bank annual balance sheets should reflect mark to market value and value if held to maturity. That way we can see which banks might be having trouble, like Signature Bank.

As for raising the insurance limit above $250,000, FDIC bailed out the big depositors (>$250,000) at Signature (they should not have IMHO). This signals they will do the same at other banks, meaning insurance coverage is pretty much infinite now. This is a classic case of moral hazard, as is any FDIC insurance in fact. This leads to all sorts of distortions in the banking world. I think some small or regional banks will be in trouble because of increasingly risky decision making (but not their depositors now). They can do whatever they want without worrying about a bank run, because the FDIC has backstopped all deposits, from one dollar to over a billion dollars. Of course they still have to worry about going bankrupt, but one of the big brakes on overly risky behavior, a bank run, is now a thing of the past.

“Deposit-taking banks are inherently unstable because they borrow from depositors by offering them instant liquidity (can withdraw their cash anytime), while the banks invest that cash from the deposits in long-term often illiquid assets, such as loans.”

Lend long and borrow short sounds inherently unstable, as you say. It has been a recipe for ever-increasing liquidity infusions from a paternalistic authoritarian Fed, and relentlessly increasing systemic debt, eventually leading to currency demise, alla Argentina.

I appreciate your optimism, Wolf, but current and historical facts paint a bleak landscape for our central planners at the Fed.

Are credit unions in the same boat? A lot of folks I know have moved money from banks to credut unions.

As a depositor I’m just not going to worry about this stuff. I keep my accounts within FDIC limits and don’t lose sleep over them. Credit unions are insured by the NCUA, same limits. I have three brank failures under my belt. Never lost a dime, never actually noticed any difference except a name change.

I had a couple banks go under during the 2008 shtshow. One was GMAC which became Ally. Went smoothly back then. Hope it would go as smoothly if it happens again.

Just remembered, I also had a 6% countrywide CD lol.

I had two CDs at signature bank when they collapsed. Only thing that happened is the name changed in my brokerage acct. Bot have since matured and I was paid out.

Both*

The next bank run will occur on the toilets, not in the lobbies of the major banks. Big net worth depositors will wake up in the early morning hours and turn on the news and hear about a large bank going under and panic. They will go to their i-phones and do their electronic withdraws in a panic while on the toilet.

The main problem is that “market value” is just an opinion, and opinions can vary. Most assets do not have a publicly traded market with sufficient liquidity to guarantee that any holder of the asset can immediately unload the asset at a given price. The important thing is that financial statements provide enough information for investors to form their own opinions of value.

Wile this is an accurate statement, the term Securities has specific meaning in the context of a bank balance sheet. These assets do have known values and are very liquid. Loans are unique and there are very specific regulatory rules and measures for required loss reserves. Loan portfolios are very hard to value from a MtM perspective which is why they don’t do it and they’re classified separately. Securities have a CUSIP, for example.

Now, apply this reasoning to crypto “investments”.

There are two structural mitigants:

1) If we enter a recession, credit losses (of all types) will start to be significant. But rates will also come down and unrealized losses will shrink. A 100 basis point decline in the 10 year will have significant impact.

2) I doubt that banks are buying more long term treasuries or MBS. The maturity profile of those portfolios is therefore getting shorter with the passage of time. If and when the yield curve normalizes, medium term securities will appreciate as they approach maturity.

Your #2:

Yes, see chart #2: Loans and securities with a remaining maturity of:

And chart #3, total securities down by $1 trillion from the peak.

Fed’s forward guidance at the time of no rate hikes for years to come, even in 2021, as inflation was surging. “We’re not even thinking about thinking about hiking,”

And the inflation is transitory nonsense which is why I don’t trust they won’t turn on the easy money spigot again. I hope they don’t, but I don’t trust them.

Easy money turns brains to mush and into monsters.

If they even cut interest rates a bit (without doing QE) inflation will skyrocket.

All markets started with Wall Street looking forward to this.

After that, however, they will have to raise interest rates above the levels they are at right now to keep inflation under control.

Until the markets believe in “higher for longer”, there will be no interest rate cuts.

Correct. The Fed has enabled the fleecing of the middle class, enriching CONgress and the 1%. Ironically, the Fed’s own data documents this over the last 50+ years. Now the Fed is telling CONgress to get their fiscal house in order because it is “higher for longer”…

Interesting times.

You will know when monetary policy is sufficiently restrictive when congress cuts spending. Deficit spending fuels inflation. Any other measure is temporary.

How is the situation now with the yields dropping? Will the banks be saved by the market without being forced into a situation where they will have to turn those unrealized losses into real losses? It seems like the majority of Wall Street thinks so…

The 10-year yield today is up actually, for a change, and is now at 4.32%. If the 10-year yield stays there until the end of Q4, then the accumulated unrealized losses would decline a little from Q3 because at the end of Q3, the 10-year yield was 4.59%.

A lot of these securities were bought when the 10-year yield was below 1% and another big batch was bought when it was below 2%. So for those losses to go away within a year or two, yields would have to drop back to those levels. That’s not likely.

Sounds like unintended quantitative tightning..

Mr markets press loves skewing context w stories like “no Q1 rate cut” when every single is that Powell intends to hold at this rate for at least next 3 quarters, assuming he doesn’t buckle and maintains qt, equities will experience increasing earnings expense and multiples should contract, at least that my hope.

@Blam 35: “intends to hold at this rate for at least next 3 quarters, assuming he doesn’t buckle and maintains qt..”

intends… assuming….these are the ginormous “ifs”

Certainly Wall Street press believes the Fed is attempting to skate by on their jaws. It’s as if there’s some secret signal that the arm waving for the lower classes is concluding and we can all get back to the happy 20% annual increases on our brokerage statements.

Hey Wolf,

I believe that the BIS changed the tier asset structure with the signing of the Basel III accord. Is this correct? U.S. debt used to be a tier I asset, but what is included in “Tier I” now?

Perhaps a new title; “Tier I assets are tier I until they suddenly are not”…

Sure, you can hold these bonds until they mature, and you not lose anything and collect the interest, but this assumes that your bank is still around in 10-30 years, so many paper F’n promises….

Banks need to go back to being just banks, F’em!

I believe gold was made tier 1.

Yes, but what about sovereign debt? The U.S. debt market, as I understand it, remains the largest liquid bond market, so this is critical. I don’t worry about the Chinese renminbi becoming the world’s reserve currency in the absence of a bond market, BUT I do see lots of assets competing with U.S. treasuries now. Basel III seems to be accelerating things, and I am simply trying to protect/hedge my portfolio. Talking to the average financial advisor, they say Basel III is “irrelevant”, but I don’t agree.

Wolf said- “And thanks to today’s electronic fund transfers, the bank that we yank our money out collapses at lightning speed.”

Bank asset drains have taken different shapes at different times, and across the various layers of our centrally-supported banking system.

At the risk dredging up ancient history, the potential drain of bank assets seems akin to the drain of gold from the banking system in 1971. The barbarians were at the gate, the gate was closed, resulting in a drastic revision of dollar purchasing power.

How exactly will the Fed respond to bond vigilantism (internal and international) is anyone’s guess. Odds favor sporadic and dramatic episodes of stimulative money production and currency devaluation accompanied by severe price volatility.

I think that the answer to your question depends on who holds those bonds and whether or not they are proxies for the Fed.

More and more it seems to me that business and trade are by-passing the only thing the Fed actually controls, the FRN. True markets serve an important function in price discover. The Fed and CONgress have effectively killed price discover, so no surprise that business goes somewhere else.

“Full FAITH and Credit” same as it ever was.

Like your comment. What a ride we are in for before the BUST. British Guilts, Argentine Peso, German Mark, etc. But now I need a time horizon. Now, ten years from now,…..

Historically a 2% interest rate will cause a rush of speculative behavior. “Boom and Bust”, a Global History of Financial Bubbles/William Quinn and John D. Turner.

Wolf, what in your opinion is the impact of this news regarding a jump in banks’ unrealized losses on the Fed’s BTFP program which is *supposed* to end in March 2024?

“There’s mouthing more permanent than a temporary government program.”

This is kind of funny, to me. It seems that there are a lot of mechanical complexities that banks haven’t dealt with… The Fed has been trying to get banks to switch from the BTFP to the Discount Window and to the Standing Repo Facility (SRF), which is set up in 2021. Powell talked about this at the last press conference. Apparently, getting set up to borrow at the Discount window isn’t easy and automatic, the system is “clunky,” as Powell said, and banks need to set it up beforehand and use it periodically with small-value transactions to make sure it works when needed. Powell also said that banks should “pre-position” collateral for use at the Discount window. The SRF requires that banks apply for and are approved as counterparties. Only some banks have done that, including the big banks, representing a fairly large percentage of the banking assets, according to Powell. So it seems like the banks are not fully doing their part to get these liquidity facilities set up, and Powell has to keep exhorting them to do so.

In terms of dollars, the BTFP really isn’t a big deal with $114 billion (green line) in the $22-trillion US banking system. Discount window borrowing (red) is more expensive in terms of rates and collateral than the BTFP. If the Fed makes BTFP loans less attractive than Discount Window loans, they will eventually go to zero. That would be one way of getting rid of the BTFP.

Appreciate your comment, but my question was intended to inquire on your thoughts regarding the health of the banking sector more so than the Fed’s management of their balance sheet. It looks to me (and I’m just a layman – this isn’t my area of expertise) like BTFP still increasing and unrealized securities reported by FDIC (which i assume are securities that have *not* been loaned to the Fed via the BTFD) also increasing are signals that the banking sector has not yet recovered from the interest rate bomb that plagues their balance sheets. Is that a fair assessment?

Banks borrow to lend. That’s what banks do for a living. They borrow to buy securities, which is also what they do for a living. They make money off the spread. So banks look for the lowest-cost source of funding. And that’s usually the depositors. But with competition from money markets and T-bills and other banks, a portion of deposits have gotten expensive. So banks go where they can to get the cheapest and most stable funding. For some banks, the BTFP is cheaper than a 5.5% CD and offers other advantages. It’s also cheaper than the 5.5% loans at the Fed’s discount window. They’re stuck with their HTM securities. They cannot sell them. So they can put them up as collateral to borrow at the best possible terms. All the Fed needs to do is make the terms of the BTFP less attractive, and those loans will vanish.

” because at maturity in 7 or 10 or 25 years, banks will be paid face value”

Sounds pretty sure of that. 25 years is a long time.

Q4 should be comparably better.

Since Ackman covered, T’s have charged higher.

That bet may have already run its course. Ackman busy right now getting out of his Treasury longs and going short again? 10-year yield is up 6 basis points so far today.

What a difference a day makes.

Powell hinting the Fed is done.

Buy the Russell 2K

1) Someone made a LOT of money convincing bank CFOs that rates were at their cyclical peak in 4Q22. If you look at the amount of cash that went into “held to maturity securities” at that time, it’s uncanny how many banks followed the same strategy;

2) This was a failed strategy, but more importantly, this is not how commercial banks are supposed to make money. Taking long bets on securities is the domain of investment banks. Commercial banks should be making money from net interest income and fee income;

3) The Fed has, largely, filled in this hole with various credit facilities, which provide the guilty banks with a liquidity lifeline, albeit at much higher rates;

4) the end result is the guilty banks will suffer lower share prices as a result of lower earnings from their far costlier capital structure, but I doubt it will result directly in additional failures.

5) Caveat emptor.

“The Glass-Steagall Act was intended to separate investment and commercial banking activities. It was established in the wake of the 1929 stock market crash….The Glass-Steagall Act prevented commercial banks from speculative risk-taking to avoid a financial crisis experienced during the Great Depression. Banks were limited to earning 10% of their income from investments. The regulation was met with criticism and was repealed in 1999 under President Clinton….The repeal of Glass-Steagall was at issue during U.S. Senate Finance Committee hearings after the collapse of Silicon Valley Bank. The 16th largest U.S. bank failed in March 2023 after heavily relying on insured deposits for investment, and the massive withdrawal of deposits led to liquidity problems. The Federal Reserve intervened following the collapse to improve confidence in the banking system and prevent future failures, including establishing a Bank Term Funding Program.” – Investopedia.

Glass-Stegall was repealed by the Bill Clinton administration. He also brought us NAFTA which destroyed a big chunk of domestic agriculture. We used to be told, when in Mexico, to not to eat fruit grown in Mexico.

Thanks Bill for the “gifts” that keep on giving. /sarc

I had a question about the causality of Fed interest manipulations. I’ve looked at graphs from the Fed that seem to show short term interest rates increasing just *before* the Fed increases overnight interest rates. Is this a differential delay in reporting? A reflection of people knowing what the Fed will do before it does it? Or is the Fed sometimes actually following the market?

The Fed communicates months in advance what its policy might be. The closer to the meeting it gets, the clearer the message. Right now, the messaging for the December meeting is a hold. If the Fed hikes in December, that would be a surprise. But there are rarely surprises. And market yields, when they get closer to the meeting price that in.

There were some surprises, for example in March this year, the Fed hiked by 25 basis points during the banking crisis when markets were expecting no hike or even a cut, and you can see the gyrations that this surprise caused, but then over the following month, it all went back on track:

Seems reasonable. It’s hard to imagine how to test this, though. I remember back in the day, there was a newspaper strike and the NYT stopped publishing it’s science section for a number of months, even though they still commissioned the articles as usual. It was then possible to test whether the appearance of a scientific article in the science section affected eventual citations rates. It strongly did.

I wonder what kind of unrealized losses the holder of my 2.7% mortgage has incurred…

MM, thats’ a great question. Give it 5 minutes, and surely the trusty ole fed will pull out another tool in its big tool box and fix that too!

This fed is like the best goal tender hockey has seen. So many stick saves, so little time.

Brutal when you realize their 2.7% yield might not even be risk free.

Are credit unions subject to the same risks (asking for a friend)?

Yes.

Yes, they just don’t pay income taxes.

Was worried at first, but at only $700 billion dollars the losses could be added onto the Federal Reserve’s balance sheet without anyone really noticing. Not a problem.

Fractional Banking at its worst- Banks using their reserve currency (Treasuries) to create fiat currency with debt with the interest rate increasing decreasing the value of their reserves. When will the dominoes start to fall?

One question I have not seen answered is: “Why didn’t J-Pow let the banks know he was preparing to raise interest rates up so high?” I am fairly sure banks and the Fed talk regularly, and rates may have come up as a topic of discussion.

Could the answer be: “J-Pow and the Fed didn’t think the rates would (or could) get as high as they did.” Maybe everyone at the Fed thought the economy could not take more then a 3 percent interest rate on the 10 year before all markets crashed. But as we have seen, markets have roared higher forcing the Fed to raise rates. Banks were expecting what the Fed expected, but neither got the expected outcome.

Given the large losses in long bonds, it seems a bridge has been burned. Nobody is going to be suckered into a long bond again that pays less than 3% interest. It won’t matter how poorly the economy is doing. We now know – the risk of mindless Fed money printing will always be present. The Fed makes huge mistakes, and it can flip on a dime.

The Fed allowed moral hazards to build for 30 years. Anything can happen now.

According to this chart, the loses of 2022-2023 are significantly higher than the loses during the financial crisis of 2007-2008.

Is not it scary? or am I missing something here.

During the financial crisis, banks had “credit” losses. Those are actual losses, with loans blowing up left and right. That’s what blew up banks.

Unrealized losses due to higher rates (rates were getting cut) were nearly nothing and then turned to unrealized gains in 2009 due to the rate cuts and QE showing up in market values.

The Dow (DJIA 30) was up 520 points today on all this good news!

The Nasdaq was down on all this good news!

On a more serious note, I love those S&P500 spikes from red to green in the last 30 minutes of the last trading day of the month.

I usually laugh at the almost daily S&P 500 run-up starting at 2PM. Likely in-part due to my 401k and others having orders being filled at that time after the noon deadline for retirement funds to place an order for that day.

All I know is that the current prices for stocks are totally unjustifiable unless a pivot is imminent (and not a pivot based on a recession). Do the big boys know something we don’t?

BAC prices were virtually flat from 1974 to 1983 and muddled through the Volcker interest rate increases relatively unscathed. With their low yield bond principle now fully backed by the Federal Reserved upon sale, why should I worry says Pollyanna to Chicken Little? Seriously

I want to believe that all these unrealized losses mean something, but I’m not so sure any more. Now all they may indicate is the size of the next fed bailout, plus another $10T for good measure to keep the party going.

It’s the regulatory regime that is determinative and all of this is just noise overtop of that.