This crybaby stuff is just funny. So let’s have a look.

By Wolf Richter for WOLF STREET.

What we can loosely call our spoiled-rotten Wall Street crybabies – hedge fund magicians, investment bankers, bond-fund gurus, and what not – that got big and fat off the Fed’s free money, are now whining and crying and fearmongering about the Fed’s QT.

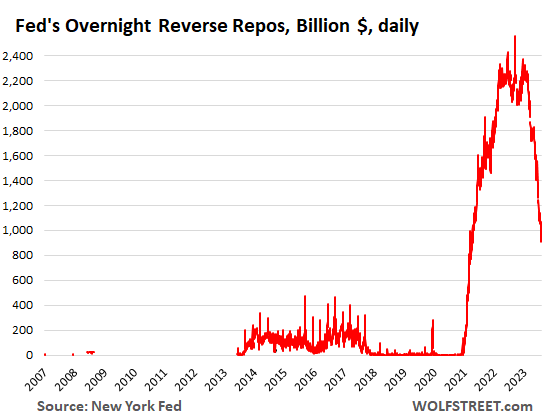

For now, they’ve homed in on the Fed’s Overnight Reverse Repurchase agreements (ON RRPs) that were at $2.3 trillion this spring and are now down to $935 billion and will go to near $0, as QT is draining liquidity from the system.

And they’re saying the banks – the banks, OMG!!! – or somebody will run out of liquidity if these RRPs are drained further and the financial system will implode or whatever, and the Fed MUST STOP QT NOW. Financial reporters eagerly pick up this manipulative BS and run with it, instead of pushing back, and instead of looking at what RRPs actually are, and instead of looking at a long-term chart of RRPs, where they normally are – namely at or near $0. So here they are, and we’ll get into the details in a moment.

ON RRPs are normally near $0. The spike resulted from mega-QE liquidity:

So this is the long-term chart of RRPs, and we’ll get into how RRPs are used by money market funds (MMFs); it’s where MMFs put their excess cash.

Note how the RRP balances rose from near-$0 during the final stretches of both bouts of QE – first in late 2013 and then again in March 2021 when the financial system was creaking under excess liquidity. And now they’re heading back to this near-$0 level, which is the normal level for RRPs.

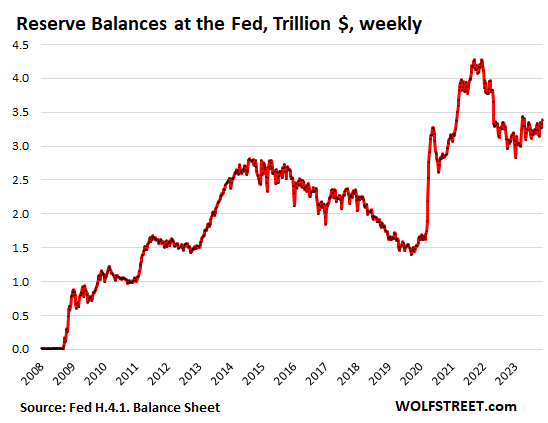

In a moment, we’ll look at a chart of “reserves” at the Fed, which is where banks put their excess cash, and those reserves have risen this year to $3.39 trillion.

ON RRPs at the Fed.

With these RRPs, the Fed takes in cash against collateral (Treasury securities). RRPs are a liability on the Fed’s balance sheet – amounts the Fed owes its counterparties which are mostly MMFs, but also government-sponsored enterprises (Federal Home Loan Banks, Fannie Mae, Freddie Mac, etc.), and occasionally banks.

These counterparties use RRPs to park their extra cash risk-free at the Fed, and the Fed pays them 5.3% in interest since the last rate hike.

This 5.3% is less than what the Fed pays banks on their reserve balances (5.4%), so banks don’t use RRPs much and not for long, though they might at the end of the quarter for regulatory window dressing. They normally use their reserve accounts at the Fed to park their extra cash because they earn more than RRPs, and because they’re more liquid than RRPs.

The dropping RRP balances mean that money market funds are shifting cash from RRPs into T-bills. The primary T-bills targeted by MMFs are at the short end, with maturities of up to 3 months, which are now paying over 5.5% in yield, over 20 basis points higher than RRPs (5.3%). So that makes sense, and MMF holders are making a little more yield as well. That’s how it should be.

ON RRPs, the outlet for excess liquidity.

RRPs are a sign of massive excess liquidity in the system; they’re an outlet created by the Fed to absorb this excess liquidity, and when the system begins its long slow trip back to something more normal under QT, this cash starts draining back out of the Fed’s RRPs into T-bills, which is how it should be.

The Fed started paying interest on RRPs in the spring of 2021, at first 0.05% APR and then 0.1% APR, minuscule amounts of interest but they worked. Back then, it’s policy rates were still near-0%, and it was still perpetrating QE even as inflation had begun to rage.

At the time there was so much liquidity in the financial system, chasing after everything including T-bills by MMFs that were awash in cash, that T-bill yields were dipping into the negative.

MMFs that heavily invest in T-bills are threatened by negative yields; they could cause the MMFs to “break the buck” where the Net Asset Value of the fund drops below $1, which could trigger a run on the fund, followed by forced selling by the fund, the collapse of a fund, contagion from there, etc., etc., the financial panic routine.

MMFs flocked to RRPs because 0.05% and then 0.1% was better than T-bills that had 0% or negative yields. And T-bill yields stayed above 0%. By August 2021, RRPs had shot past $1 trillion.

RRPs as an outlet for excess liquidity stopped the threat to MMFs that 0% or negative T-bill yields had posed.

Starting with the rate hike in March 2022, the Fed also hiked the rates it paid on RRPs. By May 2022, RRPs hit $2 trillion.

In addition, MMFs switched some of their cash that they need for liquidity reasons from their bank accounts to RRPs, since banks paid 0% interest. This shift from banks to RRPs via the MMFs caused the banks’ reserve balances to fall starting when QE ended. More in a moment.

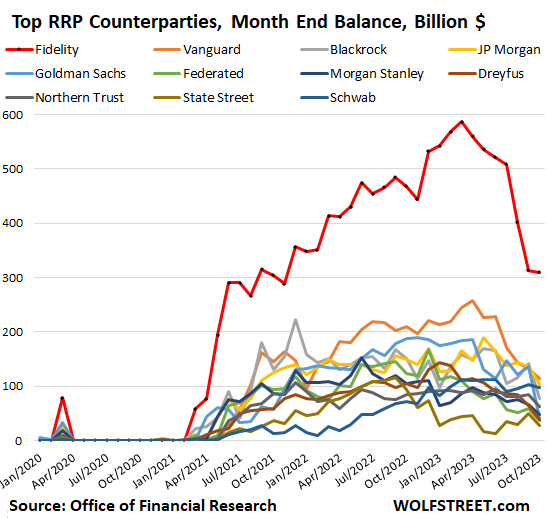

MMFs held over 95% of ON RRPs. Which Money Market Funds?

On October 31, MMFs were counterparty to $1.084 trillion in RRPs, according to the government’s Office of Financial Research which releases RRP balances by MMF provider on a monthly basis.

Total RRP balances on October 31 of $1.137 trillion indicate that only $53 billion of RRPs were from counterparties other than MMFs. In other words, MMFs accounted for over 95% of overnight RRPs.

The biggest providers of money market funds lead the list: Fidelity’s funds with $310 billion; Vanguard’s funds with $114 billion; JP Morgan’s funds with $102 billion; and Blackrock’s funds with $77 billion. Note how they had $0 or near$) RRPs before April 2021:

Banks put cash in “reserves,” not RRPs: $3.39 trillion.

Reserves have risen to $3.39 trillion, the highest since March. Reserves are cash that banks put on deposit at the Fed. They’re a liability on the Fed’s balance sheet, amounts that the Fed owes the banks.

For banks, reserves are assets. Banks call them “interest-earning cash” or similar on their own balance sheets. They use their reserve accounts at the Fed to transfer cash between banks, to do business with the Fed, to have instant liquid cash available when needed, and to earn interest. Since the last rate hike, the Fed pays 5.4% in interest on reserve balances.

Since banks earn more on reserves (5.4%) than on RRPs (5.3%), they normally use reserves to store their excess cash.

It’s reserves that indicate liquidity in the bank system, and those reserves are showing that the banking system is awash in liquidity, and they can drop to close to $1.5 trillion before the first ripples might appear – as we saw in late 2019 when the repo market started trembling.

Rising or falling RRPs and reserves don’t negate effects of QT or QE. They’re consequences of them.

The Fed’s big four liabilities are RRPs, reserves, currency in circulation, and the government’s checking account (TGA). Total liabilities rose during QE in equal measure with total assets. And they had to.

On all balance sheets: Assets = liabilities plus capital. Always, always, always.

When capital doesn’t change much, as is the case with the Fed whose capital is set by Congress, each $1 increase in assets causes liabilities to rise by $1. And each $1 decrease in assets causes liabilities to decrease by $1.

So rising liabilities don’t negate QE; they’re part of QE. And falling liabilities don’t negate QT; they’re part of QT. So neither falling RRPs nor falling reserves negate QT; those declines are an essential consequence of QT.

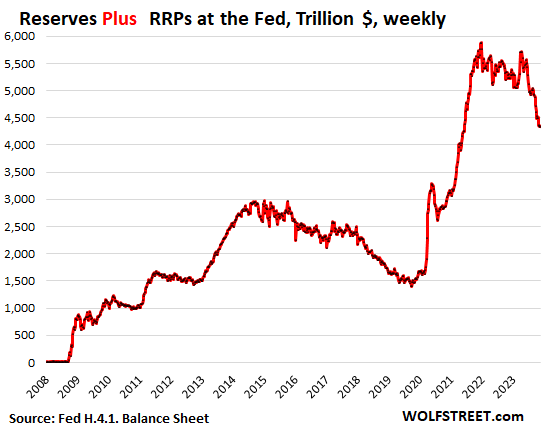

Combined excess liquidity at banks and MMFs: Reserves plus RRPs.

There are big shifts of cash between reserves and RRPs via the MMFs, and it makes sense to look at them together to see the combined amount of liquidity that is getting drained out of the financial system via QT.

Before QE, until September 2008, RRPs were essentially $0, and the then so-called “excess reserves” were minimal, and the combined total was minimal. Then the Fed started QE during the Financial Crisis, and both those measures began to inflate. The reserves inflated with each wave of QE. The pandemic-era QE had inflated the combined total of Reserves plus RRPs to $6.18 trillion in December 2021. On last Thursday’s balance sheet, after $1.1 trillion in QT, the combined total had fallen by $1.8 trillion, to $4.34 trillion.

So this chart shows the progress of QT draining excess liquidity from the financial system. If the Fed had any stomach, and abandoned its newfangled “ample reserves” regime, it could drain them to near-$0, where they had been before September 2008. If the Fed maintains the “ample reserves” regime, it could still drain them below $2 trillion, amid the hue and cry by our spoiled-rotten Wall Street crybabies.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Missing an n. “Since banks ear more on reserves (5.4%) than on RRPs (5.3%), . . . Just above second-to-last chart.

Personally, I do like having “interest earning cash.”

It’s kind of funny to withness mass hallucination and how things pivot so fast. Was watching this one video talking about a survey sent to over 100+ mutual/hedge fund manager and only about 6 % of them think rates will stay higher and longer, 80%+ think we are in a soft/no landing scenario and yet Fed will begin to cut rates by middle of next year…

Kind of like the big shorts, when all the people move to one side of the boat, you bet on the long shot..I would say 6% is about as long shot as it gets..or maybe WS is right…cause we know they have never been wrong before /s

Epic comment.

Well said.

I predict it will age well.

I’ve been “right” so many times, but got the timing wrong.

Wall Street can be wrong longer than most of us can stay solvent.

Rule number 1 – “There are NO rules on Wall Street.”

Rule number 2 – “Wall Street is ALWAYS right.”

Personally, I stay as far away from playing on Wall Street as possible. The game is rigged and the referees work for Wall Street.

Ponzi’s are bad enough but fraud ponzi’s are even worse.

S&P 500 up 20% YTD

Remember March 2023? They will do it again, without hesitation.

Here are the effects of March 2023 🤣

It will come again, bigger bank or two and we will be back to $9 trillion.

Are you praying for a collapse of JPM?

🤣

The fund managers probably say that’s what they believe to push the narrative that rate cuts will supposedly cause stocks to go up because they want more people to buy into their funds and management so they can collect more fees and sell their overvalued stuff. It may be that these fund managers and advisors are being more risk averse with their own money.

Contrarianism is seldom if ever wrong when at the extremes, with that said it is a terrible timing indicator. It’s ironic that when bond investors are fighting the Fed with bets on rates dropping they are not called vigilantes. Conservely, when bond investors are taking rates higher against the Fed they are terrible people and given names like vigilantes and worse.

How does RRP really drain liquidity? You’ve stated several times recently that these MMF monies have been moving into treasuries. If they’re moving primarily into bills, specifically those with 3-month maturities, where does that money go after the bond matures? If it’s simply re-invested into a new 3-month treasury, then my main question is what’s going to happen to RRPs if treasury yields start to fall? Would the money just flow out of treasuries and back into MMFs and eventually RRPs? If this is the case, again, how is this draining the money supply? To me, it seems like it’s just changing form to whatever pays the best interest rate at that time.

On a similar note, when the Fed purchases treasuries, does the treasury have to pay back the bond to the fed? Or is this how the Fed reduces its balance sheet by just letting these bonds roll off and doesn’t require repayment?

Sounds like free money to me.

RRPs are money market cash. Instead of having their cash chase T-bills, it sits at the Fed as RRPs. So it’s not chasing T-bills. The demand for T-bills by MMFs drove T-bill yields into the negative periodically in early 2021. By letting them earn more than 0% with RRPs, that cash chasing after T-bills went into RPPs, where it’s out of the way. This cash in RRPs represents excess liquidity. As money markets shift this cash to T-bills now paying over 5.5%, this liquidity is no longer sitting there as liquidity, but is invested in T-bills.

Where the does the money go after the T-bill matures? It gets rolled over, (new T-bills).

“…when the Fed purchases treasuries, does the treasury have to pay back the bond to the fed?”

It doesn’t matter who holds the bond; when it matures, the Treasury pays face value to whoever holds it, including the Fed and including me.

“Or is this how the Fed reduces its balance sheet by just letting these bonds roll off…

“roll off” means that the Fed gets paid face value by the Treasury when the bond matures, and it then doesn’t buy a new bond, but just destroys the cash that it received for the bond. That’s QT

“… and doesn’t require repayment” is BS.

“Sounds like free money to me” is BS. It shows you don’t understand what happens at the Fed.

I sure wish I did. It always seems like a lot of mumbo jumbo to me. Is there a good place, book, youtube you recommend to try and learn all this? I understand 99% of everything in your posts … except this.

If you didn’t notice, I was walking through my post asking questions to learn how RRPs work. At no point was I trying to say my points were known to be true. Not sure the BS quip was necessary.

If the Treasury IS required to pay pack the face value, then it’s certainly not free money, because the Treasury, I assume, still has to borrow new money to pay the Fed back just like they do with everyone else.

And as far as I can tell, you didn’t answer my question about what’s going to happen with all this money that’s shifting from MMFs to TBills, once rates start to fall dramatically.

Again, from a layman’s perspective, it seems like all that’s happening is that it’s changing form and, of course, being less liquid. But 3 months isn’t a long maturity, IMHO, but granted it’s not overnight liquid like RRPs. And if the rates fall enough, it seems reasonable that this money will move out of TBills back into MMFs. I would assume this would happen during a recession and it’s likely we’ll see QE start up again to some degree based on how bad the recession is.

To me, RRPs vs reserves seems gimmicky. For one, it allows these “excess reserves” to chase treasuries which can manipulate the price of the bonds. I don’t see how that promotes stability over something fairly simple like reserves which, I assume, can’t be invested in treasuries.

Tom S,

I give up, you’re making up all kinds of stuff and wallowing in it and seem to enjoy it. Fine with me.

If you attentively read this and prior Fed articles, you will find your answers, they’re right there in front of you. But it seems you don’t like those answers, so you make up stuff.

Go easy on Thomas (TomS)… I frequently feel like he does, but your honest / frank insights slice through the high brow finance speak that (usually) leaves one no better off.

Whether A … or B…. you posts will help…

(A) It’s possible his “Sounds like free money to me” comment is a way of saving face for lack of knowledge.

(B) Maybe he really believes (even though he should not) the “free money” thing

“roll off” means that the Fed gets paid face value by the Treasury when the bond matures, and it then doesn’t buy a new bond, but just destroys the cash that it received for the bond. That’s QT

This was a huge aha moment for me. I never realized they destroyed the cash.

Thank you Wolf!

TomS…Thank you for asking the question. Even though you got a reprimand I would not have learned this little nugget.

I say this in EVERY single article on the Fed’s balance sheet, and have for years. Most recently on Nov 2, subheading “QT on track”:

https://wolfstreet.com/2023/11/02/fed-balance-sheet-qt-1-1-trillion-from-peak-to-7-87-trillion-lowest-since-may-2021/

Folks really should start reading the articles not just the comments.

Read the article. The charts…..the CHARTS! Thanks Wolf. I felt like I was back in the 80’s and my Swiss rep from Morgan Stanley (bond side) was schooling me. I can’t even believe I’m getting (I think) what you’re saying. I’ll come back to read other people’s comments and YOU’RE comments of course.

Wolf, thank you for laying this out for us.

Though not following all the dots, I get the idea and wonder why the “cry babies” don’t.

Best wishes for Thanksgiving!

The crybabies know all this. They’re smart. They’re just trying to manipulate the Fed to stop QT.

The morons are the reporters that publish this crybaby’s stuff without pushing back.

The reporters are rmorons. They know where their scoop comes feom and who it benefits. If they ever reported the truthabout Wall Street, they would be blacklisted fastwr than a flash trade.

“The Big Short” has an excellent scene where the pritago ists are trying to get the editor to oublish the truth about MBS and he shuts them down for fear of reprisal.

At least 99% of ALL “reporters” are morons. Not just those “working” in Finance.

Every now and then someone publishes the average GMAT or those entering various graduate degree programs.

Journalism is usually second to last. With only “Education” beating them in a race to the bottom.

Just watch “The News” for as long as you can stand it before switching it off. Or try reading a “News”paper beyond the Sports section. They’re both dreadful.

Which ought to make parents wonder about what crap their kiddies are “learning” in public schools.

To QE or not to QE, that is the question…HA

Wall Street is basically shooting themselves in both feet begging for Fed “Tools” at this point in time. Fed isn’t going to take the bait in 2023 or 2024.

Honestly though, what is the sequence “when” Fed tools happen again in the future? 2024 seems tricky with elections, not matter what it could be seen a picking a Pres so I’d guess the Fed will avoid using their “tools” at all costs in 2024. But 2025, 2026, 2027…TBD, as tools will be used during another financial crisis, if deemed systemic.

Lower rates before stopping QT?

Stop QT, then lower rates?

Does the Fed avoid QE “next time”?

Or does the Fed minimize QE “next time”?

Actual trillion dollar questions, and anyone who guesses right during the next financial crisis, be it this week or three years from today, will make a large fortune.

The Game of Fed is exciting…LOL

Any money made by gambling on the actions of a corrupt agency is nothing to be proud of and won’t buy happiness.

Wolf I’ve tried posting several times-new topics and keep getting message that this is a duplicate post. Problem?

Sometimes it helps to do a hard refresh (circular arrow somewhere top left at your browser). Sometimes it helps to delete all the browsing history in your browser. That should be done frequently anyway. Sometimes nothing helps?

Ctrl+f5 if your on windows.

Where did banks had their money if not I n the Feds reserve account before 2008? On the MBS and T bills?

Since there was no QE, banks had a lot less in deposits (cash from customers) and they didn’t need to place that much cash.

In mid-2008, commercial banks had $6.8 trillion in deposits. At the peak of QE in early April of 2022, they had $18.2 trillion in deposits. This has now dropped to $17.3 trillion.

Agree, plus there were “required” vs “excess” reserve. No excess reverses prior to QE, then excess reserve blew up so huge that the Fed stopped tracking the difference between required and excess reserved and lumped them together. Then during Covid, required reserves went to $0 anyways so now everything is excess. FRED has a very interesting chart about required reserves, shows just how tiny they are compared to QE.

https://fred.stlouisfed.org/series/REQRESNS

Isn’t GDP roughly double mid-2008 in nominal terms? While that would still be short of the $17.3 trillion, I’m also curious where they stored this cash.

The lent much of it out (which is how banks make their living), and they “stored” some in Treasuries (lent it to the government), and kept some on hand as cash for liquidity purposes. Banks have always done this.

So the whole point of MMF parking extra cash at RRP is to prevent MMF yields from dropping? Because if MMF yields dropped, MMF would be a less attractive asset class, and there might be a run on MMF’s?

So now the MMF’s are buying T-bills, which yield more than RRP.

What is going to happen if the Fed has to drop rates again? Will MMF flood back into RRP? Why is it so important to coddle these MMF’s?

Read the article more carefully. Not “dropping” but “negative yields.”

This is what it said:

“At the time there was so much liquidity in the financial system, chasing after everything including T-bills by MMFs that were awash in cash, that T-bill yields were dipping into the negative.

MMFs that heavily invest in T-bills are threatened by negative yields; they could cause the MMFs to “break the buck” where the Net Asset Value of the fund drops below $1, which could trigger a run on the fund, followed by forced selling by the fund, the collapse of a fund, contagion from there, etc., etc., the financial panic routine.

MMFs flocked to RRPs because 0.05% and then 0.1% was better than T-bills that had 0% or negative yields. And T-bill yields stayed above 0%. By August 2021, RRPs had shot past $1 trillion.“

I’m trying to connect two ideas that seem related (interest on reserves and interest bearing repo market), but I’m admittedly muddle-headed on this:

You re-introduce the term “break the buck,” Wolf.

I remember Lael Brainard and others discussing the idea of “gating” money markets if there were waves of liquidity seeking MMF holders simultaneously rushing for the exit in the event of negative rates. This eventuality was, for a time, sending shivers up the spines throughout “macro-prudential” economic planning academia.

Was it this fear that led to both interest-on-reserves (IOR), as well as the birth of the repo market in the first place?

Also, when IOR and RRPs first came into use, the rates on each were well under 1% in a positively sloped yield environment. Doesn’t the fact that the rates now exceed 5% while yield curve is inverted dictate the use of creative accounting for the Fed’s capital account (i.e., “deferred asset” account)

IOER (now just IOR) started because of the flood of reserves the Fed dumped into the system. All that cash was going to chase something and drive yields negative, so IOER set an interest rate floor. With IOER, banks could earn 0.15% on reserves instead of buying a treasury at negative yield, so it captured a lot of bank cash that could have easily blown up many different systems in the economy. There is STILL too much liquidity which is why IOR is still necessary. The Fed wouldn’t be able to control short term rates without IOR. IOR sets the floor and fed funds rate sets the ceiling for short term rates.

MMFs are short-term bond funds, focusing on maturities of mostly less than 3 months, and they’re usually loaded up with T-bills and corporate paper. So properly run MMFs are stable, low-risk (but not “risk free”), liquid yield investments.

The problem with MMFs is the investor expectation that they never “break the buck.” But they can “break the buck” — so a $1.00 NAV might dip to $0.99 or $0.98%. And today that small move would cause investors would rush to the exit, triggering forced selling, contagion, etc. … over a 1% or a 2% dip.

Regulators have tried but failed to address this issue. Part of the proposals has hinged on the explicit statement that NAV varies, up a little, down a little, and that it would be quoted that way, and is no longer fixed on $1.00. If everyone understands that NAV varies a little, and expects it to vary a little, it would solve the problem.

But it has been a non-starter. It seems, the fund providers want to offer this fixation on the $1.00 NAV so that they can compete with bank savings products that do carry an explicit $1.00 NAV guarantee, backed by FDIC insurance. I think there is a fear among fund providers that their MMFs will shrink as investors would head to bank savings products, and that their fees would decline.

Crazytown-

Thanks.

It appears to me, from your comment, that Interest On Reserves was used by the Fed as a subsidy to the banking system and to persuade them to hold excess reserves?

Sounds like a recipe for unintended consequences For example:

– price-fixing on whatever assets used by the Fed when it “dumped [reserves] into the system,” including treasuries and MBS

– excess bank profits

– zombie-banks that might have otherwise failed

– an engorged Fed balance sheet

– cover for trying the same methods when the next crisis hits

Time was when the Fed’s more modest purpose was to act as a banker’s bank, helping occasionally and temporarily during perceived emergencies.

Looks like bureaucratic mission-creep has struck once again. Thank you Congress!

John H.,

Calling IOR a subsidy to banks is oversimplifying the situation. Yes, the net result is that banks make interest income from the Fed, but the Fed isn’t just doing it to help subsidize the banks.

The Fed flooded the system with liquidity through the banking system. Via QE, they bought securities from the primary dealers and handed the primary dealers cash in exchange. So now the primary dealers were flooded with cash. This is all digital, so it’s not like the banks were sitting on physical cash that they could throw in a vault, they had to actually do something with this flood of cash. Think of it like your bank account, you can take cash out of the ATM to take it out of the bank, but otherwise you can’t just handle the digital dollar yourself – it has to be in a bank somewhere. The options for the banks are to buy securities or park it at the Fed as reserves. If reserves pay nothing, they will go buy securities which would both offset QE – creating a feedback loop – as well as pushing yields negative due to the demand.

So IOR sets a flood on rates. If yields on securities go below this floor, banks will always choose to hold reserves instead. As interest rates have gone up, IOR also has to go up in order to maintain the floor. Check out Wolf’s charts of reserves, if no IOR is paid out, those reserves head to the treasury market and push short term yields below the Fed’s target. So IOR is just a tool to maintain interest rates.

The other piece is that if this was intended to subsidize the banks, it does a crummy job. The banks certainly don’t have excess profits.

So you’re saying that:

The Fed “flooded the system with liquidity through the banking system;” didn’t want rates to go below their (Fed’s) self-determined lower bound; so it started paying Interest On Reserves (or on excess reserves back in 2008) to change market participant behavior; but since “the Fed isn’t JUST doing it to help subsidize the banks,” that it isn’t subsidizing the banks?

Hmmm. Sounds circular… almost a “feedback loop,” like the one you warn against. It sounds like you’re concluding that the subsidization of banks is in this case excusable because it’s not the only reason that IOR policy was adopted.

On your last statement (“banks certainly don’t have excess profits”), to the extent that profits exceed what they would be without interest on reserves, I believe they do have excess profits.

Ask or answer: “who pays for the IOR?”

I only explained the method the Fed uses to keep control of short term interest rates, which is one of their roles in the economy. None of us here created the Fed and most of us certainly don’t like what the Fed did with QE, but sometimes you have to lighten up and learn to play in the sandbox. My holiday season advice is open up a high yield savings account or invest in some treasury bills and then buy a nice dinner and a bottle of bourbon with the interest income that is only possible because the Fed has control over short term rates.

God bless us every one….

This is one great piece of info. Thanks. Love your perspective. ” they are cry babies”. Everyone thinks the norm is . 025 interest. That is a mentality unfit for a “thinking person” who knows anything about the cyclical nature of money. Thanks again for your inputs.

The capitalist always is whining or acting as a bully that in reality is weak and afraid. This is in contrast to the worker in countless trades that builds the society that capitalists infest like roaches in cinder block construction.

Yes nations with no capitalists at all like Cuba and North Korea are so much nicer to live in. Workers get a much better deal for their labor in those places! A beautiful home by the sea, brand new cars, vacations, amazing food… it’s just wonderful. The greatest benefit of worker nations is the early retirement! Too bad Russia went capitalist, their communes were very popular.

Absurd – problem is, a LOT of so-called ‘capitalists’, rather than embracing it, have a working horror of true competition and it’s hazards. If you scratch the surface, many appear to be closer to being closet royalists, or, mirror-image socialist apparatchiks (again, ‘royalists’), always working hard to alter Smith’s ‘…well-regulated market’ in favor of privatizing all profit, and socializing all risk…

may we all find a better day.

I don’t recall Adam Smith arguing for a “well-regulate market”…though in practice the reasonable regulations are in fact necessary.

To 91B20 1stCav,

The people you described are not capitalists. You even admit it in your own writing when you say that they are “so-called” capitalists, which they most definitely are not.

FB – scratched my ear awhile over your rejoinder since I reckon we’re saying the same thing…(semantics and nuance, oh where is thy sting?).

may we all find a better day.

You are making a Fallacy of False Choice.

It isn’t either or.

I don’t know. Many of the contractors I know that do the building are also self-employed capitalists. They have employees, but many times those employees go on to own their own capitalistic ventures. Many of the truckers I know own their means of production (the truck). Some don’t but are on their way to it. For all these people, the biggest problem for them is .gov, not other capitalists.

There you go again Gary…but still no example of it working.

Good timing, just saw an interview of Michael Pento claiming that this was going to cause a crash. He’s not a bull wanting the fed to reverse course, btw.

He perhaps feels it may cause a crash by:

A. Reducing the total deposits in banks (ref last posting by Wolf) causing less lending by banks to the “job creators” or

B. Reducing the prices of stocks because of less cash (bank deposits?) in circulation available to chase stocks, or

C. Blth of the above.

Now, did Mr. Pento say the “crash” was going to be in the stock market or the overall economy? I have a feeling it is the stock market which is the only real asset class the 1% are concerned about. (Hard to afford your second megayacht when your stock prices are declining…).

PS I have learned more about how The Fed creates money here than in all my econ classes.

Au Hound-

I believe that many of the “1%” are mighty concerned about the BOND market too.

Further, you might be conflating “Wall Street cry-babies” with ultra-high-net-worth individuals. They are both a thing, but not the same thing. The former includes many individuals who are stock market cheerleaders with various self-serving motives (e.g. some academics, brokerage firms, or PE managers), but they are not 1%-ers.

Respectfully

The top 10% own 89% of the stock market.

The top 1% own half of the stock market.

IF they top 1% are not in the mood of selling, the market will probably not go down.

Also,

The combined assets of BlackRock, Vanguard and State Street account for about 82% of the S&P 500’s market capitalization, about 25% of shares that voted in director elections at S&P 500 companies in 2018, and 73%-80% of global ETF assets.

“The numbers are staggering: the largest 1% of asset managers control 61% of sector assets — 243 times the bottom 50% and 45 of the 50 largest ETFs,” writes Steele.

So if those 3 are not in the mood to sell, the market will probably not go down much.

ru82, for a long time I had this “if the big players don’t move, the market won’t move; retailers never have any effect” attitude. But after watching the GME fiasco it’s clear that retailers sometimes CAN cause crazy things to happen.

ru82-

Interesting and pertinent comments.

My quibble with AuHound’s comment was not meant to suggest that the stock market isn’t determined by the mood of the wealthiest, but rather that it’s largely the BOND market that determines that mood, and as a result, theirattitude toward stocks.

Also, in my opinion, the nations biggest funds are slaves to their shareholders: if the 99% become frightened (for example by rising rates) and the 1% will damn well try to get out the fund door first…. regardless of what calming pablum BlackRock, Vanguard, and Statestreet regurgitate.

Finally, those three are never fans of a sell-off, as it directly effects their revenues and the personal incomes of individuals who manage their businesses. They are permanently incented to be bullish…. AND to whine when rates rise.

Replying to RU82: Stock prices are set at the margins. If everyone is not selling barring few small retailers, it’d set the price for the whole market.

He didn’t elaborate but my sense is that liquidity would dry up to support bond yields where they are so they would have to rise significantly which would mean game over for a broad range of assets

So the banks make decent money on reserves on the split between what they pay people to deposit money and keeping as reserves? They also would make even more lending it out but less so when interest rates are higher since few businesses/individuals want to pay the extra interest.

Do I have that correct?

Glen, I think you are correct. Higher interest rates > fewer loans > less business expansion > less hiring > less spending by consumers > less demand > less inflation.

This is all about lowering inflation, right? So higher for longer.

The Fed is mandated to have full employment AND low inflation, and (from Goggling) full employment is usually defined as anything less than 5% unemployment their current mandate is only one thing: REDUCE INFLATION! Even if much higher for much longer is needed.

It is not to prop up the stock market, which is why “Our Wall Street Crybabies Want the Fed to Stop QT”. The stock market is to Wall Street, not only everything, but it is the only thing.

Darn typos!!!! And I have Grammarly! (which, for some reason, never wants to capitalize the first word of a sentence LOL)

AuHound

‘”The Fed is mandated to have full employment AND low inflation,”

The Fed is mandated to

Maximum employment

Stable Prices

Moderate Long Term interest Rates

Maximum, not “full”

Stable prices, not “low inflation”.

Subtle but important differences.

Sorry off topic but….

Argentina rocks with big Milei win.

Down with the “Surdos de mierda”

Honed in not homed in, in this context.

Nope. Look this stuff up before you post.

“The missile homed in on the target.” Random House Webster’s Unabridged Dictionary. The context here is that the crybabies are targeting RRPs for now.

Lots of people screw this up.

You “hone” the cylinders with a “honing tool” or a “hone” when you overhaul a motor. Former car/motorcycle guy here speaking from experience.

Wolf – over the centerfield fence and into the upper deck! Thanks 10,000k!

McQueen’s Ghost – my HS auto shop teacher didn’t get this wrong. Don’t think journalists did either before market forces in the wake of the end of the ‘Fairness Doctrine’, combined with the decline in general readership (as in actual reading, even here in Wolf’s most-excellent establishment-i’m sure Wolf is dyeing his hair, if any’s left, by now), pushed even the ‘responsible’ press back into the full-on ‘yellow’ standards of the 19th century…(of course any keeper of the tongue from the Bard’s day would be in agony over the tectonic shifts in language since then…).

(DS – a beneficial practical example, obtain a good Ouachita stone from your local hardware store and learn to hone your kitchen knives, you’ll thank yourself later…).

may we all find a better day.

You must be a journalist? or maybe a teacher?

My take away from the charts is that the Fed is still 2-3 years, at the current rate, from getting the reserves down to “ample”. I don’t think they can consider inflation normalizing while all this excess cash is still in the system. If that’s true interest rates are going higher.

I’m interested in how you get to the 2-3 years number. Commercial bank deposits since the end of 2019 increased roughly 31%, while nominal GDP has increased 26%. Every month deposits flat line is another month this is eroded by inflation + growth.

On my very rough calculation, if deposits had grown at the same rate as nominal GDP they would be just $0.6m lower than they are now. Given QT is continuing and the economy still growing/inflating, it doesn’t seem like there is very much time at all until reserves are back down to 2019 levels. Potentially only 6 months if deposits continue to flatline.

Maybe bank reserves is the wrong way to look at it, but even M2 money supply as a whole increased only 35% over the same period and has been declining in the last few months as QT continues and growth slows. If the trends continue it would also catch up (or down) with nominal GDP in roughly 1 – 1.5 years time.

Completley agree, Wolf! The RRP facility is as you mentioned, first a sign that too much excess liquidity is in the system. The other “argument” by the so called analysts where i could freak out is, when they create a correlation between the RRP and the reserve balances. Reserve balances have nothing to do with RRP, zero!

“Reserve balances with Federal Reserve Banks” amounted at 3.391.713 US-Dollar, that is 263.436 US-Dollar more in comparsion to November 2022. There is more as enough liquidity in the system, especially for banks. and we should remember, the Fed started their “No QE T-Bill purchases” in Oktober 2019 on a reserves level at round about 1.3 trillion US-Dollar.

There are already talks of lowering mortgage rates in Canada, in order to bring back exuberance to real estate prices.

The RE Bubble in Canada appears to be too big to fail. They want lower interest rates to keep the facade going.

These conversations have not stopped. Even from the article above you can see how Wall Street is crying about low interest rates and the suspension of QT

”Free money has turned people’s brains to mush”. ”The consensus hallucination doesn’t want to go away forever”.

But inflation still keeps people’s lustful desires for free money in check

Gen Z,

The Bank of Canada has held no such talks, LOL. And that’s what matters for mortgage rates in Canada.

The always, always, always, comment was nice. For every debit there exists a credit. Always, always, always.

My guess is that each day approximately 1.5 to 2 trillion in transactions are cleared between the Fed banks. These interbank transactions must be money good each night. When the level of reserves were binding the level of reserves determined short term interest rates. Sell treasuries and drain cash and reserves went down overnight interest rates went up. Buy treasuries from the member banks and reserves went up and overnight rates to borrow reserves to clear transactions went down. Do not believe the Fed can drain reserves to near zero without overnight rates skyrocketing. My guess is the Fed is attempting to get back to normal order where reserves are binding…at about 1.5 to 2 trillion. At current rates it will take 2 to 3 years.

In July 2021, in preparation for QT, the Fed revived its “standing repo facilities.” This is how the Fed controlled liquidity, panics, and short-term rates before QE, including during the 9/11 freeze of the markets. But the Bernanke Fed, after starting massive QE, shut down the standing repo facility because it was replaced by QE.

So now the Fed is planning to use the revived standing repo facilities to control rates, panics, market disruptions, etc. — same as before 2009. And in theory it no longer needs the “ample reserves regime,” a doctrine that it came up with following the 2019 repo blowout.

I agree with you in that I think the Fed will stick to its ample reserves regime, under which the lower limit of reserves will be above $1.5 trillion and probably below $2 trillion.

But the point is that the Fed now no longer NEEDS to do this because it’s set up to do it in the way it had done it before 2009. And back then, “excess reserves” were essentially zero, and banks only kept the “required reserves” at the Fed.

Here is my discussion of the re-instatement of the standing repo facilities in July 2021. This was a huge deal in my opinion but didn’t get a lot of mention. It showed that the Fed will favor liquidity facilities to deal with market problems, the way it used to, not QE. And that’s what it put into practice in March 2023 during the bank panic.

https://wolfstreet.com/2021/07/28/my-thoughts-on-the-feds-back-to-the-future-standing-repo-facilities-announced-today/

The issue is whether the Fed uses a binding level of reserves to control overnight rates or interest on reserves and RRP. Normal order would be binding reserves. I would appreciate any information you have on the dollar level of transactions cleared by the Fed system each day? Love you posts.

Continuation of previous comment.

At current rates of draining of reserves it will take 2 to 3 years or more until the level of reserves is binding an determine overnight rates. At such time as reserves are binding, the Fed will no longer need to pay interest on reserves nor engage in RRP.

Howdy Lone Wolf. Understand the basis of your article. Thanks ,,,, Most is way over my head but worth reading. Helps with my Vertigo………

1) The gov roach motel gets your money either by T bills, MM, RRP,

bank’s reserves…

As long as u “behave” and volunteer your money the Fed will not raid

your bank account. There is no need to.

2) In 1934 FDR deflated gold. One morning, FDR, in his pajama, raised the gold price from 20/oz to 35/oz.

3) As long as the dollar was stronger than gold, until the late fifties/ sixties,

European countries parked their gold in Ft. Knox for safety.

4) When it flipped, when Gold > DXY, the Fed offered them a check for 35/oz. That’s why the Fed balance sheet values gold at 35/oz and not at 2,000/oz.

Wolf, you might consider doing a Crybaby of the Week Award. These journalists have no accountability.

The hard part would be sifting through the huge pool of eligible candidates!!

Steve Liesman of CNBC could win every week. The guy is a perpetual pump machine, never recognizing moral hazards.

A perpetual pump machine’s job is to only pump. Also he lives up to his name in the process.

My coverage of the next FOMC meeting will including for sure for sure one article with a list of all the reporters who Powell should have ZZZAPPPP’ed with his Taser, including the stupid, repetitive, manipulative, put-words-into-his-mouth, or Powell-was-dovish-trap questions that they asked that got them Tasered in the first place. I’m looking forward to writing this piece.

It will be a list of all the reporters in the press room. I focus on Poowell’s introductory comments and have begun to tune out all the reporters’ questions for reasons you talk about. Reminds me too much of grad school students’ stupid questions after a presentation. BTW, I mis-typed the chairman’s name above, but decided it was perhaps not a mistake.

The issue is that MMMFs are nonbanks, not banks (as the FED identifies them). MMMFs balances are erroneously included in the tabulations of the money stock. That would be double counting if the MMMFs balances weren’t subtracted out of the DFIs balances. But I’m not going to check it because I doubt that there are two different errors.

Man your comment on “reporters” not doing their jobs, is spot on and applies to so much of the media these days…..

I’m certain that’s why so many folks come to Wolf Street to get a reality check.

That’s because the reporters of mainstream media propaganda might have that job much longer if they were honest and critical. The owners of these media companies and their corporate sponsors are the billionaires whose wealth skyrocketed during the QE fiasco unleashed on the world. They make massive donations to the politicians of either side of the uniparty so they will vote through legislation that benefits them among the few (so they think) at the expense of the many. Same reason they don’t ask the Fed leaders real questions but the truth always prevails and sets you free.

Draining the O/N RRP facility is the monetization of the Federal Deficit.

I wonder if the combination of the debt-to-GDP level and large annual budget deficits has any implications on how low the Federal Reserve can take the total amount of reserves and by extension the size of the balance sheet.

Is there some level at which continued QT can negatively impact the stability of the treasury market under the heavy funding requirements the federal government is currently under? Some of the last treasury auctions have been less than stellar.

Wonderfully clear picture. Banks have returned to normal now, with savings accounts paying 4%, the historical norm. I’d wondered where the bank gets the 4%, and Wolf explained it.

It’s a normal wholesale/retail process, like canning food. The bank keeps their cash at the Fed for 5.4%, and they retail it to me in a convenient package for 4%.

“they can drop to close to $1.5 trillion before the first ripples might appear – as we saw in late 2019 when the repo market started trembling”

you dont know that at all. just because the level of reserves required in the system was 1.5 trillion at a point in the past doesnt mean that is the current point at which markets begin to tremble. this is just a horrible assumption.

markets care as much about rate of change as absolute levels. the current rate of change in the RRP plus bank reserves is a red flag everyone on wall street sees. the government overspending versus revenues is also at a different scale and is the core issue at stake here. we also have inflation running hot, which was not a concern in the past. problems in the banking sector also start as isolated incidents of the most vulnerable, and then morph into much broader problems as there are bank runs and the lack of trust builds in the system.

to put an absolute level of what level of bank reserves will cause strain on the system based on a number from the past is just wrong.

So I’ll just repeat part of this here:

In July 2021, in preparation for QT, the Fed revived its “standing repo facilities.” This is how the Fed controlled liquidity, panics, and short-term rates before QE, including during the 9/11 freeze of the markets. But the Bernanke Fed, after starting massive QE, shut down the standing repo facility because it was replaced by QE.

So now the Fed is planning to use the revived standing repo facilities to control rates, panics, market disruptions, etc. — same as before 2009. And in theory it no longer needs the “ample reserves regime,” a doctrine that it came up with following the 2019 repo blowout.

I think the Fed will stick to its ample reserves regime, under which the lower limit of reserves will be above $1.5 trillion and probably below $2 trillion.

But the point is that the Fed now no longer NEEDS to do any of this because it’s set up to do it in the way it had done it before 2009. And back then, “excess reserves” were essentially zero, and banks only kept the “required reserves” at the Fed, which were minimal.

Here is my discussion of the re-instatement of the standing repo facilities in July 2021. This was a huge deal in my opinion but didn’t get a lot of mention. It showed that the Fed will favor liquidity facilities to deal with market problems, the way it used to, not QE. And that’s what it put into practice in March 2023 during the bank panic.

https://wolfstreet.com/2021/07/28/my-thoughts-on-the-feds-back-to-the-future-standing-repo-facilities-announced-today/

Excellent.

I am not sure what the ‘Lords of the Universe’ might be complaining about. I watch steel and copper. Steel is on a nice month long run and threatening all time highs. Copper has been middling-along but is perking the last week and especially today. Things look to be improving for growth and building things planet wide.

I guess the ‘Lords of the Universe’ are psychologically weak people because they don’t seem to ever be able to get enough and don’t have seem to have enough empathy for the needs of others.

The world overall seems to be healing well.

Wolf,

Rumblings are that the Fed is looking at reserves in relation to GDP to define “ample”. At the end of 2019, reserves / GDP was 8%. So if you figure that nominal GDP is say $30T in the 2025, then ample reserves would be $2.4T.

Perhaps this is the high end of the range in relation to your $1.5-$2T estimate. Just semantics — the overarching concept is that QT will still take out another $900B of liquidity from the Banks from current level after ONRRP is drained. That will be very painful for the banks and will lead to more liquidity and credit (by forcing banks to deleverage) problems in the financial system. Those banks have nobody to blame but themselves IMHO.

I can’t think of a reason why anyone wouldn’t look it as a % of GDP. As you point out, it’s one point that is missing from the article. It’s easier to think of in $ terms, but there has been a hell of a lot of inflation and growth in just four years.

Which brings up one additional point – as the economy keeps inflating/growing, the excess liquidity also decreases in relative size. While this happens, and reserves continue to decrease, it does not seem like there is long to go until reserves are back at roughly 2019 levels. We are must be below 2015 – 2017 levels already. QT might not be breaking the banks yet, but maybe in 6 months it will.

The Fed invented the concept of “ample reserves” in early 2020 after the repo blowout in late 2019.

Nobody knows what these liquidity needs are until something begins to shake. There is no long-run history of ample reserves to GDP.

Fed researchers have done some studies on this recently, and they don’t know either how low ample reserves can go. They’re guessing.

Before Sep 2008, “excess reserves” were zero or near zero, and “require reserves” just the required minimum.

The concept of ample reserves is now no longer needed because in July 2021 the Fed revived its standing repo facilities it had killed in Sep 2008 that control liquidity issues.

So I’ll just repeat part of this here:

In July 2021, in preparation for QT, the Fed revived its “standing repo facilities.” This is how the Fed controlled liquidity, panics, and short-term rates before QE, including during the 9/11 freeze of the markets. But the Bernanke Fed, after starting massive QE, shut down the standing repo facility because it was replaced by QE.

So now the Fed is planning to use the revived standing repo facilities to control rates, panics, market disruptions, etc. — same as before 2009. And in theory it no longer needs the “ample reserves regime,” a doctrine that it came up with following the 2019 repo blowout.

I think the Fed will stick to its ample reserves regime, under which the lower limit of reserves will be above $1.5 trillion and probably below $2 trillion.

But the point is that the Fed now no longer NEEDS to do any of this because it’s set up to do it in the way it had done it before 2009. And back then, “excess reserves” were essentially zero, and banks only kept the “required reserves” at the Fed, which were minimal.

Here is my discussion of the re-instatement of the standing repo facilities in July 2021. This was a huge deal in my opinion but didn’t get a lot of mention. It showed that the Fed will favor liquidity facilities to deal with market problems, the way it used to, not QE. And that’s what it put into practice in March 2023 during the bank panic.

https://wolfstreet.com/2021/07/28/my-thoughts-on-the-feds-back-to-the-future-standing-repo-facilities-announced-today/

Great point Wolf about the SRF! I didnt even notice that back then. They are really setup to drain reserves from the system in droves.

You should change your name from Wolf to GOAT!

Wolf, what will happen when BTFP expires? Will the Fed just renew it? Honest questions.

Powell was asked about this at the last press conference, and he said, “Good question.”

There is an effort by the Fed to get banks to use the discount window instead. Powell talked about this. Apparently, the collapsed banks weren’t prepared to use it, couldn’t use it, didn’t have it set up, etc. He exhorted banks to get this system set up and do small-value transactions every so often to test the system.

Thx

What’s truly insane is the hype over rate cuts. And this is something that FOMC members have been pushing back against in their speeches, and yet hedge funds are scrambling over each other to try to front-run the rate cuts.

How do you get from +4.9% annualized GDP growth, +150-200k NFP/month, CPI & PCE still increasing at a ~3% annualized rate in recent months, to rate cuts by March 2024 (that’s 4 months & 3 FOMC meetings away), I have no clue. But it’s what markets are pricing in right now & it seems they’re ready to throw a tantrum if they don’t get it.

What would cause a UST-invested MMF to go negative yield/NAV? Would that be if FFR unexpectedly went up again after the few pause decisions?

Is their a non-zero likelihood of MMF “breaking the buck”? I am debating getting out of MMF entirely and getting brokered CDs.

“What would cause a UST-invested MMF to go negative yield/NAV?”

1. Negative T-bill yields. But T-bills are at +5.5% now.

2. any surprises in a badly run MMF. But a well-run fund shouldn’t have any bad surprises in it.

3. a really bad “run on the fund” for some reason.

“Would that be if FFR unexpectedly went up again after the few pause decisions?”

No that would have no impact on NAV because these are very short-term securities that mature in mostly less than 3 months, at which point the holder gets paid face value, not matter what the EFFR.

But the MMF yield would begin to rise a little within a month of that rate hike.

“Is their a non-zero likelihood of MMF “breaking the buck”?

Yes. If you want 100% guaranteed face value, shift to T-bills, FDIC insured CDs, savings accounts, etc.

Wolf, I have tried and tried to understand this stuff, and this and your responses/comments have brought me the closest yet. I am now a bit more worried because all of my Fidelity account sits in SPAXX, which is their Government MM fund that invests in “safe” government debt and repos. I have long assumed that I am pretty safe, but these whispers, here and elsewhere, that they could break the buck have me questioning myself. I have no problem losing 1-2% as mentioned, because I make my money on conservative options trades (using SPAXX as the collateral), but I do worry when I see words like “run” and “contagion” associated with the ON RRPs. Should I be thinking of moving to safety from the MM to treasuries or short term CD ladders, or is this talk very speculative and not appearing on the immediate horizon?

You could diversity a little into T-bills. They ARE safe. You can buy them through Fidelity at the Treasury auction. They pay more interest than SPAXX. And they even come with tax advantages.

You can also buy CDs at Fidelity. If you stay within FDIC limits, they’re safe.

The funds you need to have liquid could stay in a money market fun.

All this talk is meaningless. You have over 40% of the US population who get payed 5% in their savings (which did not happen since the late 80s) and can continue to spend, especially on the account of the last decade of lower interest rates. There will be easy real growth of 1-2% growth (3-4 nominal) going forward for a few years to come, pay attention to forward indicators. This discussion is ‘noise’, prepare your portfolios accordingly.

“The Fed’s big four liabilities are RRPs, reserves, currency in circulation, and the government’s checking account (TGA).” Everything makes sense except: ‘currency in circulation’

When I was a kid, we had silver certificates – not federal reserve notes. So, the silver certificates were a liability to the treasury because each could be redeemed at the treasury for a quantity of silver – that promise was printed on the silver certificates, i.e., the piece of paper could be redeemed for something real with actual intrinsic value. Essentially an IOU silver from the treasury to the citizen.

I have looked at federal reserve noes and do not see any promise that they can be redeemed for anything. Essentially an IOU Nothing from the FED – true fiat money. So how is ‘currency in circulation’ a liability to the FED?

Banks regularly send and receive vault cash to/from the Fed in giant Brinks trucks. So it is most definitely redeemable for something, but something in this case is just dollars in different form (cash or reserves)

Where this is all headed is one thing. There is room for differences of “informed” opinion.

Wolf couldn’t be more spot on on one observation attendant to all of this: there has been a swelling of “fear porn” pundit analysis, mailers, text messages, professional articles, TV “journalism”, etc., for nearly a year now. It has been accelerating lately. It is affecting behaviors – have a conversation lately with a neighbor who confides they are stocking up on food for next year? Passive aggressive behaviors becoming more frequent in your locale? Can’t decide whether more or less gold, more or less tech, is the way to go?

It’s getting to be a real cluster [you know what] just trying to stumble into ground truth.

Unless it’s happening within a 3-6 block radius of my house it’s all fear porn to me. Fun to watch once you know it will never impact your life.

Combined excess liquidity at banks and MMFs: Reserves plus RRPs.

1)Wolf would it be wrong to suggest that this represents the margin of safety that the treasury has to sell debt into the market, without sapping other asset classes of liquidity? With foreigners net selling us DEBT and the Fed selling, and the US goverment needing ever more, could the fact that RRP returns were allowed to fall below treasuries be subtle manuevering by the Fed to push money into government debt.

2) would it also be wrong to suggest that temporarily as RRP and Deposit money in net moves into government debt and thereby increases balances at the treasury, sustaining higher government spending, the monetary environment can be considered stimulative?

Your #1: RRPs should go back to $0 where they used to be. Reserves could easily go back to $2 trillion or $1.5 trillion; so $2.5 trillion-plus in additional QT will do that.

In terms of the Treasury selling the debt: let me just remind you that yield solves ALL demand problems with Treasuries. If there is not enough demand at 4.2%, there will be a lot more demand at 5%; and we’ve seen that. This is how lack of demand will be solved, when it shows up finally: higher yields. The whole world will be clamoring to buy Treasuries if the yield is high enough. They will never run out of buyers. But the yield may be higher.