Since QT started, stocks have been on their own, after having been babied by the Fed since 2008. And it’s not working out.

By Wolf Richter for WOLF STREET.

There are some things happening in this inflationary world that contradict well-established previous wisdoms, including that stocks are a hedge against inflation. Turns out, since QE started in 2008, all prior wisdoms had to be thrown out the window, and the new wisdoms are all about QE and now QT: QE makes stocks go up, and QT makes stocks go down, no matter what inflation and the real economy do.

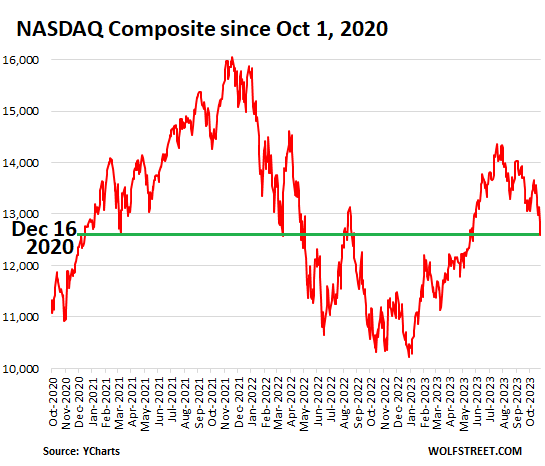

The Nasdaq Composite closed on Friday at 12,643, down 22% from the peak in November 2021, and back where it had first been on December 16, 2020. Despite huge gyrations, it has gone nowhere in nearly three years.

And the huge rally through July 2023, fired up by the Fed’s lightning-fast $400 billion in bank-panic liquidity injection, is threatening to turn into the biggest sucker rally ever. The problem is that the Fed then had quickly withdrawn the liquidity and followed up with record QT, now amounting to over $1 trillion.

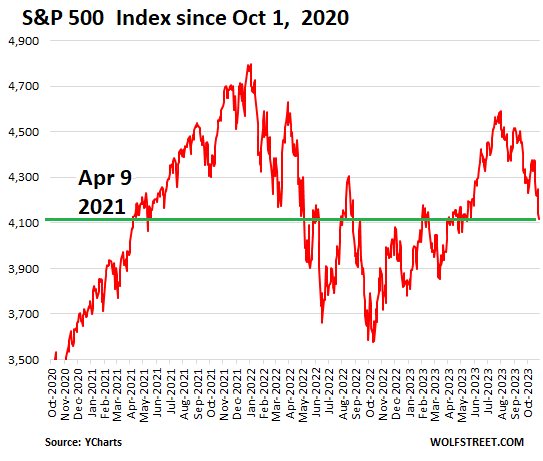

The S&P 500 index closed on Friday at 4,117, down 14.6% from the peak on January 3, 2022, and back where it had first been on April 9, 2021

In other words, despite all these gyrations, it has gone nowhere in about two-and-a-half years. And the huge rally, driven by the Fed’s $400 billion in bank-panic medication, fizzled out at the beginning of August, and it been careening downhill QT Way.

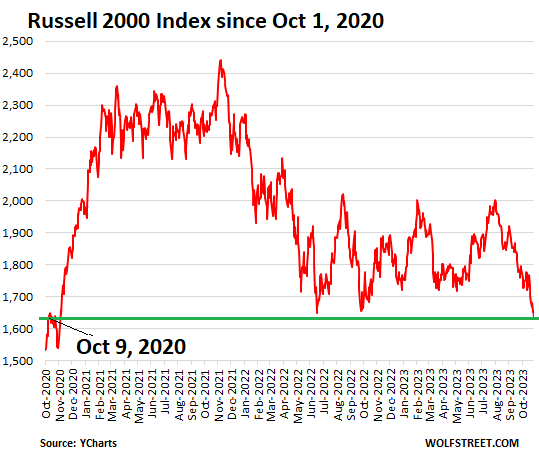

The Russell 2000 index, which tracks small stocks, which often lead the big stocks, closed on Friday at 1,637, a three-year low, down 33.4% from the peak on November 8, 2021, and back where it had been on October 9, 2020. It’s getting curiouser and curiouser.

The small stocks in the index had largely been forgotten by the effects of the Fed’s $400 billion liquidity injection, which caused the biggest stocks to spike by huge amounts – and they came to be called the Magnificent 7, because they and a few other giants largely carried the entire market, until they too sagged.

But this is the small fry:

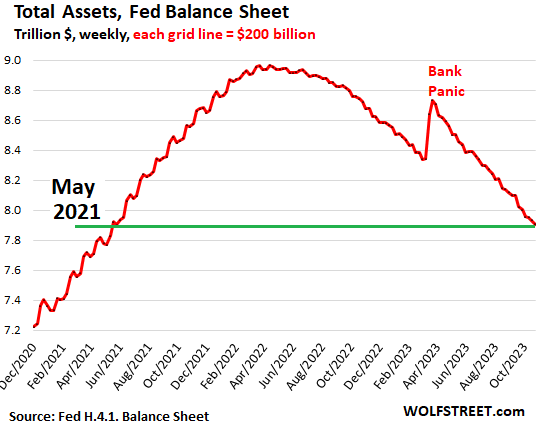

The Fed, over roughly the same period, has fueled the surge in stocks with huge QE until the end of 2021, when it began to taper QE. It ended QE in early 2022; and it started QT in July 2022. Since then, its balance sheet has dropped by $1.06 trillion to $7.91 trillion, the lowest since May 2021.

Stocks and the Fed’s balance sheet obviously don’t move in lockstep. But the liquidity that the Fed throws at the markets drives up asset prices, and it drives up stock prices the fastest, and the withdrawal of liquidity pulls the rug out from under stocks.

When QE was driving up stock prices, everyone investing in stocks was a genius, and people were coming up with all kinds of theories why stocks were going higher and higher, when in fact, the only reason they were going higher and higher was the Fed’s QE.

Then something big broke, the biggest thing the Fed is in charge of: Price stability.

We got the worst bout of consumer price inflation in 40 years, and even the Fed, after being in denial for way too long, acknowledged that this was an issue and cracked down with big rate hikes, bringing its policy rates from 0.25% to 5.5%, and with so far $1.06 trillion in QT.

And there is still a long way to go with QT, as inflation appears to have become nicely entrenched, with suddenly worsening inflation data in the worst parts of the spectrum of goods and services coming out on Friday, which caused me to mutter: Powell’s Gonna Have a Cow When He Sees the PCE Inflation in “Core Services,” Housing, and Non-Housing Core Services.

And so hopes of an immediate Fed pivot, which have been bandied about really since June 2022, have now largely vanished. QT is running along on autopilot in the background, rates and inflation are on the higher-for-longer track, and for the first time in many years, stocks are on their own after having been babied by the Fed since 2008, and it’s not working out for them.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

In the past week I’ve heard Collum and Denninger say (on separate) podcasts that the market is 75% overvalued.

Take out the magnificent 7 and the market has gone nowhere. I think fund managers who are restricted to long side only hide in those stocks because they’re strong and liquid. Doubt if it will end well.

I want to see what the stock & treasuries markets do after the monies (money market, etc) supporting reverse repos get soaked up.

We’re a little over $1T away. That’s when I think the liquidity crisis starts. It has only taken about 5-6 months for RRPO to go from $2.2T down to $1.1T.

So if the Fed is able to keep up its pace of QT, I’d imagine things are going to get very interesting about the end of Q1 2024.

AAPL has some issues

Cool. Some randos podcasting in their jammies said something shocking.

No, two independently wealthy Old Boomers who have seen the originals in Black & White.

Your confidence in a couple of Baby Boomer prognosticators is truly touching. I am almost a Baby Boomer (technically they call people born from 1965- to 1970 “tweeners”) and I would never dream of giving ANY of them that much credit.

Allow me to point out that the Baby Boomers not only got to ride the QE bubble for the past fifteen years… in fact they have being riding the Fed’s easing of interest rates for a quarter century before that. The idea that they have some magic crystal ball that tells them what will happen when “rates and inflation are on the higher-for-longer track” (as Wolf puts it) is just silly. Maybe these two do have such a talisman… but it didn’t come from their generation’s experience.

Let’s apply some actual brainpower to their claims. 20% to 30% of stock shares are owned by INDEX FUNDS. That means they won’t be selling unless their clients are withdrawing funds. Most clients won’t do that because these investments are largely for retirement purposes and withdrawing money from these index funds triggers tax repercussions (especially if you do not re-invest the money quickly).

Same goes for the rest of stock ownership… another 20 to 30 percent of stock shares (for a total estimate of 40 to 50% of the market) are owned by “passive investors.” These are PEOPLE who are invested in individual stocks but who do not make many short-term moves (again due usually to tax implications). Lots of them are on a “Dollar Cost Averaging” program and will simply view a drop in stock prices as an opportunity to pick up additional shares of whatever company they choose to invest in.

So how do these two chuckleheads figure there will be a 75% drop in stock market prices when 40 to 50% of all shares owned cannot be readily sold due to legal, contractual, or philosophy reasons? Particularly in a nation and environment where GDP growth is still high?

By way of comparison from your own generation’s experience… at the depths of the “Great Recession” the stock markets “only” lost 55% from their previous highwater mark. Clearly the stock markets are currently overbought by about 25% (based on Price-to-Earnings ratios)… but that is a FAR cry from being 75% overpriced.

@Spencer

That was a lot of words to tell us that “Stock prices have reached what looks like a permanently high plateau”.

I’m not sure what makes me more nervous about the economy, people insisting a market crash is impossible, or shoe shine boys offering me their crypto pitches.

SpencerG,

“Let’s apply some actual brainpower to their claims. 20% to 30% of stock shares are owned by INDEX FUNDS. That means they won’t be selling unless their clients are withdrawing funds. Most clients won’t do that because these investments are largely for retirement purposes and withdrawing money from these index funds triggers tax repercussions (especially if you do not re-invest the money quickly).”

There are several flaws in these statements, but I’ll point out an obvious one. People don’t have to withdraw 401k funds to reduce risk. They simply change investment elections within the fund. There are no tax consequences.

It seems to me you are rationalizing without even modest investigation, which is very dangerous.

@SpencerG: What you said about 401(k) and passive investors is true, the same would have mostly applied in 2000 and 2008 – given that Index Funds have been around for about 50 years now.

In the 2000 dot-com crash, the NASDAQ plummeted 77%. In the 2008 crash, the Dow lost 54% before being “rescued”.

There is no question that there will be a recessionary crash over the next few months. The million dollar question is if the Fed will mount a rescue with inflationary pressures already in the economy and with all the assets being significantly overpriced.

Without a rescue, there is no saying how much the indexes can fall given that there has been a significant amount of risk-taking in the economy based on ZIRP and QE.

Spencer makes a good point.

The float or the amount of shares that trade are probably mostly controlled by some hedge funds. The money in 401ks barely moves or changes investment allocations. Last year during the 20% correction, Fidelity said 96% of their 401k clients did not make any changes to their 401k allocations because they are taught to average cost down. In fact, they actually increased contributions during the downturn.

9 out of 10 of my friends did not make any changes last year even though I told them I went all cash before the downturn and I suspect they will do the same. One that they saw I was right decided to ask hard questions to their financial advisors as to why they did not lighten up before the correction. The advisor told him he is now positioned for the next bull run so all is good. And they were right, his portfolio went up 30% in 2023 because he was mostly invested in the mag 7. LOL

Most investors believe the FED will rescue them and why should they believe differently until it does not happen.

I also read millennials are putting in 16% of their salary into 401k which was an increase for the year before.

@SpencerG: Typo in the first paragraph – should have started with “If”. Here is the corrected version.

==========================

@SpencerG: If what you said about 401(k) and passive investors is true, the same would have mostly applied in 2000 and 2008 – given that Index Funds have been around for about 50 years now.

In the 2000 dot-com crash, the NASDAQ plummeted 77%. In the 2008 crash, the Dow lost 54% before being “rescued”.

There is no question that there will be a recessionary crash over the next few months. The million dollar question is if the Fed will mount a rescue with inflationary pressures already in the economy and with all the assets being significantly overpriced.

Without a rescue, there is no saying how much the indexes can fall given that there has been a significant amount of risk-taking in the economy based on ZIRP and QE.

Sean Shasta…

Yes, index funds have been around for 50 years… but they have not held a significant portion of stock shares until recently. Back in 2000 they controlled only 3.5% of the shares of U.S. listed companies. The investment philosophy of the time was either DITY or put your money in a MANAGED investment fund. A lot of people and funds were investing in start-ups with neither profits nor a path to profitability. Hence the term “irrational exuberance”… which pretty quickly became the “Internet Bust” as people pulled their PERSONAL money out of the stock market.

The bottom line is that with almost 50% of stock shares being “passively” managed then any market downturn should have a self-regulating brake on the extent of that price drop.

PS: I had to laugh at “There is no question that there will be a recessionary crash over the next few months.” That is so divorced from reality that I wonder what you were on as you typed it. Of course there is a “question” about that… in fact it is HIGHLY UNLIKELY to happen. U.S. GDP is currently growing… not shrinking. So are corporate profits. Plus the Fed is on record as saying they are striving for a “soft landing”… AT WORSE.

Bobber: Yes, they CAN change risk profiles tax-free by electing a different fund… but WILL they? People choose INDEX funds because of the SAFETY they provide. In a stock market that has gone so haywire that a 75% market drop is even considered possible… where is the safer haven for them to move their money to??? They can move their money to bonds… but they probably already have bonds as a percentage of their 401K or whatever. Their financial advisers will be warning them against putting all of their eggs in one basket. REITS will be imploding because of higher interest rates. Gold funds and Cryptocurrencies don’t seem a likely choice for people looking for SAFE investments.

So their REAL options will be to withdraw the money and take an IMMEDIATE 15-20% income tax hit (PLUS a 10% early withdrawal “fee”) to their retirement savings (plus the losses due to inflation) with no way to recover because it is VERY hard to put that money back into the tax-protected 401K once you take it out… or they can leave it be and hope the stock markets rebound the way that they always have before.

#SpencerG

The stock maret prices are set by the last transaction. Who hold what and how much do not matter much, what the last transaction is matter all. One share sold at barget basement price and that is the new value of the stock. Untill the next transaction.

@SpencerG: You seem to have provided selective information. You have fairly well-quoted 2000 numbers – that index funds controlled 3.5% of the stock market.

Here is the data on 2020/2021:

What percentage of US stocks are owned by index funds:

According to the Investment Company Institute (ICI), index mutual funds and exchange-traded funds (ETFs) owned 15% of the US stock market at year-end 2020 and 16% of the market at year-end 2021.

Then you suddenly add: “another 20 to 30 percent of stock shares (for a total estimate of 40 to 50% of the market) are owned by “passive investors.”

Where did you pull the 20-30% passive investors number from? And were you in some induced state when those numbers appeared in front of you?

The data we have is probably 20% of the market is controlled by index funds. Even giving it another 5% margin of error, a full 75% is in the hands of other investors.

There is nothing to say that these investors (and even index fund managers) will just watch the gyrations of the market during a downfall and do absolutely nothing.

There are so many dynamics that we cannot really predict how much the market can fall. I wouldn’t be too confident that the market will sail through this with just a 25% haircut. Good luck to you!

Sean Shasta…

Actually I am trying hard to NOT be “selective” in the information that I provide. The problem is that the numbers are all over the place… “unsettled” if you prefer. If you Google “percent of stocks owned by index funds” you get numbers ranging from about 13 to 29 percent due to different methodologies and the year the study was done. So I said “20% to 30% of stock shares are owned by INDEX FUNDS.”

THEN you have to account for the passive investors who Buy-and-Hold OUTSIDE of mutual funds. Googling that gets you ANOTHER range of numbers… which is what I said. In fact I thought I was pretty clear in describing that situation.

I then added the BOTTOM of each of those ranges to get my statement “for a total estimate of 40 to 50% of the market” because saying 60% seemed high. There HAS to be double-counting in there somewhere it seems to me.

The best individual study that I found (from 2022) stated that passive investors controlled 37.8% of the market at a time when the Investment Company Institute (ICI) official reported rate for index funds was 15%. The authors used a new methodology designed to capture the “end-of-day indexers” who rebalance their holdings at the end of each trading day… pension funds, institutional investors, and such. It is important to note that the 37.8% number is a FLOOR on passive investors… it doesn’t capture true buy-and-hold individual investors…e.g. a grandfather who gives each of his grandkids 100 shares of McDonalds, Disney, or whatever that they cannot cash out until they turn eighteen.

The bottom line is that I am pretty comfortable with saying that about forty percent of equities are owned by people who are not concerned with the prices of their holdings on any given day. If the market plunges will they start to care? Sure… but they have to have a suitable alternative to turn to before they do anything… and as I said to Bobber… taking into account the Early Withdrawal tax hit, that suitable alternative for retirement accounts doesn’t start until the market fall is thirty percent or so. And until they do make their moves… they operate as a breaking mechanism on the markets in such a way that will prevent the giant selloff that you think is coming.

The one thing that I do agree with you on is your statement “There are so many dynamics that we cannot really predict how much the market can fall.” For instance, the one thing that will probably help your thesis (and undermine my own) is the role that “algorithmic trading” will have… that was 15% back in 2003 but currently accounts for 60 to 75% of stock trades. Do those High Frequency traders slow down in a declining market… or speed up? No one knows…

Still, I am pretty confident in saying that while an individual company’s Price-to-Earnings ratio may be lower than average… stock MARKETS don’t tend to behave that way. Currently the S&P 500 P/E is at 24 and change… 25% above the historical norm of 18. Investors seeking yield have front-run the stock gains… and THEY WILL GET BIT in a slowdown. But we are NOT likely to have a total market meltdown in an economy that is still growing. Certainly not in the next few months (as you said there is “no question” about).

Excellent analysis and interpretation. The sole reason behind all the asset price inflation in last 3 years was reckless and irresponsible money printing by FED. Nothing else. Not even the AI hype.

The purpose of QE was to goose asset prices so that wealthier people would spend some of the profits and stimulate the economy. However, Congress played a role in increasing asset prices when they threw $5 trillion into the air.

Who knew Congress throwing money around could stimulate the economy far more than the Fed? Seems like Obama should have known that when we went through years of a weak recovery will millions needing to find jobs.

If I remember right, Obama tried, but was stymied at every twist and turn by a Republican majority in the House, starting in 2011. Their #1 goal was to block everything Obama tried to do, no matter what. However, there was bipartisan consensus about bailing out the banks and letting the Fed do massive amounts of QE.

Jason B asserted that the sole reason for asset price inflation was money printing by the Fed. I merely pointed out that Congress also played a part by spending money. I did not assert that one action was more important than the other. And as sufferinsucatash noted, Congress also passed a huge tax cut. As I recall, the economy was close to full employment at that time.

Fiscal stimulus only works during the early phases of a deep economic contraction when everyone is panicked and financial markets have seized up. Otherwise, government spending merely crowds out private economic activity. Which isn’t the end of the world because many government provided goods and services are valuable, perhaps more valuable than a marginal dollar of private activity (or perhaps not, it depends). But there is no magic “multiplier effect” whereby government spending can perpetually ensure prosperity.

The Fed can lower rates, but they can’t directly spend money to goose the economy. Congress can deficit spend trillions of dollars. Both had a hand in it and the Fed was complicit by buying so much debt.

Yes the obstructionists.

Now they obstruct each other

The 2017 tax cuts set a lot off.

LIFO: Congress would not be able to spend recklessly unless FED bought the treasury bonds by printing massive amounts of money.

I own T-bills. Don’t those count? What about the Treasury bonds owned by American investors and foreign governments?

Deficits financed by investors buying bonds shouldn’t be inflationary since the money used to buy the bonds offsets the stimulus from the government. 1 dollar in 1 dollar out.

Fed creates money to buy debt. That is inflationary.

Private sector cannot create money to buy debt. If they buy debt, they can’t invest in businesses or real estate.

Private sector cannot “create money” to buy debt…or whatever….

By far the most ignorant comment so far.

But I still like the South Park handle…..staying in character 99%!

(obviously didn’t read “The Art of the Deal”, Re; “creating money”, so -1% for that.

All that is left is money printing with prudence if that makes sense.

Hard-ass material gold and silver in hand alone is a solid asset in times soon coming. Gold is over $2000 now, something is happening. Are we past the point of no return? Paper money in all its forms can evaporate very quickly.

Nope. Yes, gold is up but the miners are still in the toilet. So this run will soon be reversed – it merely reflects Middle East tensions. If it truly was a turning point then the miners would be rocketing upwards.

Did you miss gold hitting an ATH in May? That’s was well before the current tensions in the mid east.

I honestly can’t remember the last time there wasn’t middle east tensions. Obviously they are a matter of degree but almost feels like much of that is baked in unless it really hits the fan. I’m not being insensitive as for many on the receiving end the #$&- storm has been raging for much longer than my life time so I am referring to market impacts.

Paddy, no, I didn’t miss it but it did not last long and neither will this jump. The miners are in the dumps because people do not believe that these gold prices will last very long and they are right. Gold will fall right back where it was shortly unless we get a move higher by the miners.

My coal miners are just doing fine.

EPS is not as good as last year , it is up from PE=3 to PE=6 but plenty of scenario’s were coal prices will go back up.

Alternatives like small scale nuke plants are still several years out and the security and safety of less extensive guarded things has not yet addresses as well so no fear of that energy source competition. And nat gas has it’s storage and transportation cost and issues.

Miners don’t always track gold prices. If their costs increase, it offsets the increase in gold prices. Some are also hedged or have contracts.

The miners probably make more running reality shows.

BTW, Esc is talking about “times soon coming” I commented on that is far below.

With this format you aren’t even safe 3 days behind from it being unclear what you are talking about. Oh well, almost nobody knows what I’m talking about, anyway, (since I don’t understand “Econ 101), but it’s still my 2 cents in media.

And the FN coal miners want to build a huge terminal in the bay to ship it wherever from their “busy” “busy-ness men” mines. Great!

Instead of learning to analyze stocks you morons should read the NOAA website. 110 degrees ocean waterin places off Fla a couple months ago

My bad, I forgot God’s running EVERYTHING and you are all going to live forever, anyway, and don’t really give a shit about the planet…..carry on….go buy something stupid.

Whole QT helped with some stock price corrections and some yields going up, it did not fix the biggest problem in US : The drop in productivity and moral of our working class.

Many people are only working 3 days a week or lesser in the name of WFH. Sure, you can measure productivity in dollars and because they get paid more dollars now, this problem is easy to hide.

But in reality, our first world economy story is based on innovation and we aren’t innovating much.

1. The last big one was cloud (that worked a bit),

2. then online shopping like amazon (apparently the chinese can make websites too – Shein, Temu),

3. then video websites like YouTube (the chinese made tiktok),

4. then crypto and nfts (seems more like spam),

5. then it was VR rebranded as Metaverse ( again questionable),

6. now it’s trained Artificial Neural Network models rebranded as AI.

People are working lot less because there is no real incentive to work harder:

1. Too many executives already promoted in pandemic, who are now insecure and positional. So little chance of getting promoted soon.

2. That average salary can no longer buy the average house in same area! So the young folks can slog and they must still keep renting.

3. Rewards are now based on selling crap as great product, that is easier than making a great product. So the idea of innovation is messed up.

Leo – doubtless spellcheck relentless in its quest to turn the mother tongue into machine language (…all those pesky nuances!), but find an interesting query in wondering how public morals affect its general morale…

may we all find a better day.

No incentive to work harder is false. The incentive is to not have to go hungry, not get evicted, not lose your vehicle, not end up homeless, not have to spend a lot of your money on debt payments, to be able to go on vacation, to be able to help the needy, among many other incentives.

Those have always been primary incentives. When I started out, it was: Make enough money to pay rent and have enough to eat. And as I made more, the incentives changed: make enough to pay rent for my nice apartment, and pay for expensive dinner-dates three times a week, and make enough to go on expensive overseas vacation, and make enough to pay the mortgage of my new condo, and make enough to keep adding to my investments… and so you go up the ladder as you grow into your career — unless you were born with a silver spoon in your mouth. Maybe too young people today were born with a silver spoon in their mouth, and expectations have become colored by that experience.

I’d be more excited to work if the company cut out more layers. Went through a 15% layoffs and there’s still

employee -> manager -> sr. manager -> Dr. -> Sr. Dr -> VP -> VP -> CVP -> C-level -> CEO

Everyone in the chain has 8 or fewer people reporting to them.

I do not see it as WFH productivity issues. I manage a small team and keep them motivated and accountable. My manager largely leaves me alone to his credit.

I completely agree with your assessment in all other areas. Have a different experience with WFH and its correlation with productivity.

And during 2020 – 2022 all these same companies were touting the increase in productivity from WFH. Some of the big tech companies are still raking in record earnings. How is that still happening with fewer employees than before?

HA-HA, good one dustoff. I thought maybe there was an AI demon from hell just after me. And playing Freudian slip. Anyhow, came Just when I was getting a bit irritated and needed a good laugh……time to eat!

Speaking of expensive overseas vacations, to page right is are great package deals on unsold suites for an Antarctic vacation. When you come back you can tell your friends all about ALL the ice you saw (the fine ass kissing, like in a nice restaurant, is likely assumed, but possibly worth bringing up?) and how nobody should worry about human caused global warming.

What a joke!!!……..and you SAW It first hand (and in luxury). Or maybe you believe in climate change, but you DESERVED it because you started out kinda sorta near the bottom and “hard earned” your way up…..yep, no silver spoons for you!

Many things here need sarc tags….many.

“….times soon coming.” Arrrrgh!

I KEEP ON telling you gold bugs the real pros readying for said times buy .22 bricks. But if you are just sorta wealthy (eg posting here) several pieces of bullion buried under the floor is probably ok…good tax cheat too, done right…but not for a REAL socio-economic blowout.

Coin of the realm……coin of the realm…….

How’d that happen while they’ve been reducing the money supply?

The deluge of dollars gave fuel for the fire but it took buyers naivety and carelessness, unawareness of valuation metrics, auto contributing into 401k funds overweight in big tech, believing the hype and hoopla spread by mainstream media, financial advisors to bid up the prices. Seems tragic and inevitable that many have to learn the hard way but maybe there’s a silver lining.

I contribute to my 401k up to the 100% company matching and for tax deferrals. I’m 90% in the short term treasuries fund. Why pass up on free money? That’s 110% returns per year plus 37% tax savings. It’s also DCA for those invested in stocks. If the market has a 20% correction, I’ll move into stocks and DCA as it drops further. The history of all governments is to inflate the currency whenever there is deflation

While the Fed is going about its QT way quite breezily with nary a worry (or should I say stealthily) it remains to be seen if the Fed has the balls to do the same (higher for longer and QT) if and when the market crashes – meaning a drop of 20% or more in next to no time. 20% in 2 years and 20% in 6 months are two different beasts. Time will tell.

It was not rocket science to figure out that keeping the stock market glued to your money producing teats and keeping the cost of capital at ZERO for ever was really asking for trouble.

However, the question I keep asking myself is whether we would still have QT but for the money printing orgy of the government and shoving it down directly down people’s throat during the pandemic leading to inflation.

A stock market crash might finally trigger the recession which in turn would reduce inflation. So yes, the Fed would consider reducing rates.

The credit markets cause determine growth or recession. A bear market is just a symptom of credit contraction.

The Fed’s second round of QT started in June 2022… before they even realized that inflation was more than “transitory”.. and had clearly been envisioned and discussed for several months prior to that. In fact, the Fed has been well aware of its balance sheet problems since the middle of the last decade… and working to correct the problem for most of that time.

So yes… we would most likely still have QT regardless of the current bout of inflation. Although if we bend history a bit and imagine a world without pandemic spending by the government… then Quantitative Tightening would likely already be concluded by now… AND there wouldn’t be inflation to deal with.

Nitpicking I know. The Russell 2000 isn’t just small cap stocks. It is the 2000 largest stocks which include more than 99% of the stock market by market cap. The Russel 3000, is the largest 3000 stocks minus the Russel 2000. Which is more a description of small caps.

The Russel 3000 is about at levels it had in March of 2021, but up versus 5 years ago. Reached a peak in December of 2021 and is down 18% from that peak.

No. The Russell 2000 is: “Pure small-cap index”

“It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.”

https://content.ftserussell.com/sites/default/files/2022-04/US2000USD_20220331.pdf

You really should start a Wolf Street School!

S&P 500 graphic looks like its as of January 1 2021

Only noticed it because I was trying to mentally overlay that and the balance sheet looking for correlation. Bumpy ride. Rate hikes certainly creating havoc.

Thanks.

Oops! Never mind. I had the 3000 and 2000 mixed up. The Russell 2000 is the Russel 3000 minus the largest 1000 stocks by market cap and represents 7% of the total market cap of USA stocks and is small caps.

My apologies for being a dunce.

OK, thanks.

DRM, you are a dunce only if you fail to learn from your mistakes.

GR – some of the sagest words ever uttered (and a practice that many of us humans seem to abhor, then strenuously deny as we struggle to arise from our faceplants…).

‘…we’re ALL bozos on this bus…’ – Firesign Theatre

may we all find a better day.

The Fed can preemptively intervene on asset prices collapses if there is no inflation (or inflationary conditions). But it cannot intervene when inflation is a possibility.

I doubt if the Fed will be as obliging as in the past if the market collapsed 20% in two weeks as long as it is orderly. Freezing of treasury markets is another matter.

Would be stupid (although understandable based on historical behavior) to rely on the fed to bail out equity investors. Monetary policy has lost its effectiveness since 2000 recession (mostly remedied by monetary policy). 2008 was mix of monetary and fiscal and 2020 was almost all fiscal with Fed just creating confidence by injecting liquidity.

The problem with the Fed is it speaks from both sides of its mouth. Like…

If it wants to intervene it will say “inflation has come down and we are confident it will”

If it does not want to intervene it will say “inflation is too high”

You just cannot put the Fed past anything when it has its hands on the printing press and you have howlers bawling all around “the world is collapsing”

Fed has a credibility problem..yes. It has for nearly a decade supported asset prices which explains why investors want to suckle at their teats.

But let us assume that inflation tomorrow was 2% and nothing else changes. Does that mean the FED will reduce interest rates? Of course not. Why should it. What do they gain by doing that?

But that is not how investors think. It is likely assumed that if inflation were to hit 2% then interest rates would fall along the curve and we can go back to high asset prices. Now that is a long shot.

That’s right. Throughout my career interest rates were 5% and we did just fine.

“But let us assume that inflation tomorrow was 2% and nothing else changes. Does that mean the FED will reduce interest rates? ”

Yes, but they do that in a gradual and hesitant manner IMHO. Federal Reserve now knows that inflation is not just a theoretical phenomenon that can’t possibly happen in the modern age no matter how much money they print; it actually a real thing that is quite painful to deal with. So reducing interest rates remains a valid Federal Reserve tool, but the recklessness and supreme self-confidence with which Federal Reserve has been [ab]using this tool are now gone.

It’s proven that QE is the Fed’s most powerful weapon. GFC only stabilized when the Fed started buying. The same with the covid crash.

@DRM, the top 3,000 stocks (those of the 3,000 largest companies) make up the broad-market Russell 3000 Index. The top 1,000 of those companies make up the large-cap Russell 1000 Index, and the bottom 2,000 (the smallest companies) make up the small-cap Russell 2000 Index.

” … record QT, now amounting to over $1 trillion. ”

For the minions who sing praises of “Record QT” or “Most Stringent” Fed Powell, I got news for you.

A murderer is a saint, if you ignore his murderous sin.

A rapist is a angel, if you ignore his crimes.

Current Powell Fed is Most Stringent Fed ever like Volcker, if you ignore his 5 Trillion printed money in 2 years.

Yes, keep singing his praise. He is an Angel, he is a Saint.

LOL. There’s something you should understand:

I railed against the Fed during QE and ZIRP for years. That’s how this site’s predecessor site (Testosterone Pit) started out, and it continued with WOLF STREET.

When the Fed’s QT took off in 2018, I supported it because it was undoing the damage of QE.

When the Fed bailed out the repo market in 2019, I railed against the Fed.

When the Fed went hog wild in 2020, I shredded the Fed.

When the Fed ignored the surge in inflation in early 2021, still doing QT and ZIRP, I called it “the most reckless Fed ever.” Google the phrase, LOL. And I did for months until the Fed got serious about tightening.

When the Fed started hiking rates and then started QT, I supported it.

Get the drift?

Money printing and interest rate repression should be a crime. If people want a propaganda hype-and-hoopla rag for money printing and interest rate repression, this is not the place. If people want mindless Fed-hater stuff no matter what the Fed does (hate when it did QE, hate when it does QT) or Fed-pivot-mongering stuff, or Fed-is-trapped stuff, people need to go find their happiness somewhere else.

I understand that there are bloggers out there that railed against QE. And when the Fed switched to QT, they first denied it, and then railed against the Fed for doing QT, and they railed against the Fed no matter what the Fed does. To me, that’s just clickbait idiocy.

Do you understand people like me who hate the FED with a passion because they see them as their abuser? We love you and your site because of how you railed against the FED (and more). But we are never going to like or trust the FED again. Ever. Because “fool me once, shame on you, fool me twice, shame on me.” We feel that the entire system is rigged against us.

Same here.

Everytime you read Wolf, even if he has railed against the Fed at times, his post always seems to come across as standing by the Fed even though he states at times that if the decline in the stock market or the economy becomes precipitous that the Fed will again resort to QE and he does not want that.

Greenspan helming the Fed was the most pernicious thing that happened to the US. Some people are just born to destroy things singlehandedly. Greenspan can fully take credit for destroying capitalism.

I’d hardly say that Wolf blindly praises the Fed or forgives them for their past transgressions. Even when discussing what they are currently doing, he never fails to mention for too long that their reckless behavior for more then a decade caused this situation. His writing is usually dripping with sarcasm and nuanced mistrust that the Fed truly understands the historical context of their actions.

I’d liken it to him being their parole officer. He knows, unambiguously, that they made a big mistake and that they only owned up to it because they were caught. And now he’s rooting for them, but ever so cautiously because you never know if reform is true and heartfelt or if recidivism is on the horizon. I’m gathering that the Fed has a very long sentence until it can be clear of parole and fully trusted.

You loved this site because it told you what you wanted to hear but now are upset because it tells you things you don’t want to hear?

I read this site because Wolf uses facts to back his conclusions whether they’re popular or not. Sometimes I don’t completely agree with his conclusions but I always learn something.

The Fed isn’t perfect. They could have done better. But had they not done QE like they did then the Great Recession might have been Great Depression 2. So don’t be so quick to hate when different actions may have led to something even worse than we have today. While what-might-have-been is always speculation, it’s still worth factoring in.

In my view, the Fed has been a rudderless ship with a fuzzy uncontrolled mandate (i.e., the best case, assuming no foul motives). Even if the arbitrary 2% average inflation goal were viewed as legitimate, why did we have 20% inflation in three years? That result is so far off target it puts the Fed’s goals and competency into question. Did the Fed really think a 200-300% appreciation in asset levels wasn’t going to massively increase inflation some day?

It seems the Fed’s inflation goal in practice is 2% inflation PLUS whatever permanent inflation is necessary to bail out asset prices in times of stress. That’s really a 4-5% inflation goal that is not being adequately communicated to the public. If the plan is to monetize debt in times of stress and create new permanent price plateaus, it’s not responsible or fair to ignore excess inflation and pretend it doesn’t exist.

Also, QE was sold to the public as an emergency measure. Was the period 2013 to 2020 an emergency, with unemployment at all-time lows and stocks and housing prices going up 20% per year? What was the entire purpose of conducting massive stimulus operations during this time period? A reasonable person might think this was really about fattening bank profits or providing windfalls to other wealthy interests.

And what about Fed independence? How can the Fed say it is independent from Treasury when it embarks on massive QE programs in concert with government stimulus spending? That’s pure debt monetization (money printing). This facade of independence is harming the bottom 50%, which is getting bludgeoned by inflation. The reality is the Fed and Treasury are working hand-in-hand, with a goal of kicking the can down the road with ever increasing debt-to-GDP ratios. It’s worse than two four year-olds left alone in the kitchen.

I pretty much agree with you on the “rigged”, i.e. actions are often taken to protect/enrich the wealthy, not the common man.

However, the Fed is here and it is not going away any time soon so it behooves one to try to understand what and why they are doing what they are doing.

A lot of the reason I come here.

Depth Charge : Ditto

1000 x

The US grew faster without the Fed prior to 1916 than it has since. There is no reason for it if we have hard money.

Oops 1914 sorry

@ billytrip

“I pretty much agree with you on the “rigged”, i.e. actions are often taken to protect/enrich the wealthy, not the common man.”

I know lots of rich people, and pretty all of them think the system is rigged against THEM. Between inescapable taxes, fears of wealth taxes, the state of CA hostile to business, crazy tenant and employee rights… they look to the decades of hard work and risk taking it took to get to where they are, despite The Man constantly working to prevent it. And to those who think inflation doesn’t harm the wealthy, of course it does/can. It depends what they own (a lot have disproportionate allocations to cash)!

@DC, I would not say the system is “rigged” against us, but pretty much every “system” is set up to to benefit the people that set it up (not the rest of us). My goal in life is as a member of the “working rich” is to try and learn more about the “system” that the super rich set up (to get super richer) so I can get a little richer and work less as I get older…

Happy1 is the resident Gilded Age worshipper. And then some…sheesh!

He, of course sees himself as a Horse (or valued servant of one), not a Sparrow.

I think he is just the vehicle the sparrow lifestyle comes packaged in.

His screen name should be Heritage Foundation, I’m sure he is a member…..a tiny one, but still card carrying.

Apt Owner,

You are very socially sick, but at least you ADMIT it.

That’s half the battle. Most here go after straw men of one kind or the other…..like the Fed.

I have heard more than one talking BIG time financial talking head of your ilk, (only MUCH sicker) say, “The Fed is God”.

So it must be worth watching.

So are other things, and they are here, too, so I’m here.

At least most everyone here is educated (in one way or the other) even if mostly sick boomers, (or wannabes) like you.

Don’t make the poor bastards buy EVERY DAMN BIT and then some of your future wealth, OK?

Count me as a Fed-skeptic too.

A central bank is a useful tool if it helps the banking industry to operate more efficiently, for example with money transfers and bridge loans collateralized by solid short-term assets. There is also a place for certain regulatory and compliance functions, though there are some devils hiding in those details. Throw in a dash of macro research, and a mechanism that limits mission-creep, and you’d have a recipe for a functional healthy institution.

My concern is that the Fed’s “stabilization” mandate and size creates a central planning agency. Today’s asset inflation, un-stable bond market, and sky-high federal debt are all a predictable result of world-wide central planning of the global economy through heavy-handed monetary authority.

I’m not an “end-the-Fed” guy, but the Fed’s mandates must be reformed, and it’s size and scope reduced, and it’s role as central economic planner eliminated, in my opinion.

Centrally planned economies have historically not done well. The Soviet Union is one example. The Fed is our central planner, which is why markets dissect every little word that comes out of “Chairman” Powell’s mouth. Too much power concentrated in a few people, people who readily admit their understanding of economic forces is more than a little limited. The Fed seems to spend a lot of time and effort trying to fix what it broke.

+100

A responsible FED is a great thing. Without it we will be back to the bank runs of the early 1900s.

Rightly pointed out that the stabalization mandate is destabalizing. They should just focus on a steady supply of money in relation to the economy (of which inflation is but one signal). And they should start paying more attention to other monetary aggregates as well (credit creation and asset inflation etc.)

Just to clarify, the Fed manadate as of earlier this year:

“ The Federal Open Market Committee (FOMC) is firmly committed to fulfilling its statutory mandate from the Congress of promoting maximum employment, stable prices, and moderate long-term interest rates. “

These goals are mutually exclusive and the actions required for their fulfillment are unsustainable over longer periods of time (as we are finding out…)

Source:

https://www.federalreserve.gov/monetarypolicy/files/FOMC_LongerRunGoals.pdf

John H.,

“Mutually exclusive” is a simplistic interpretation of the Fed’s mandate.

1. A 10-year yield between 5% and 8% is “moderate” and historically in the normal range and has occurred for many years when the US economy was doing just fine.

2. “Maximum employment” isn’t an absolute term, but is defined as employment that is high, but not so high (overheating labor market) that it triggers inflation.

The Fed has explained this a gazillion times, as have a gazillion economists. That’s a tradeoff, so “Maximum employment” means the level of employment that is possible without fueling inflation. There are terms for this, such as the “natural unemployment rate,” which indicates “full employment” without triggering inflation. It was estimated to be 5%, and the US labor market has been below 4% over the past two years.

I wonder if technology has reduced the natural unemployment rate (in a manner similar to the way it has reduced housing inventory) by making matching job-seekers and employers quicker…

Good points, as always, Wolf. My sense of Fed futility, at it’s base, stems from the ever increasing size of the Fed, and its impact on enabling the federal deficits. More debt leads to larger crises requiring even larger interventions, resulting in more debt. The upward spiral.

I think I’ve read your expectations that some day the public says enough is enough, and politicians listen, but I can’t imagine how that happens. (I recognize that just because I can’t imagine it, doesn’t mean it can’t iron itself out….)

A convincing article that identifies the mechanisms and necessary activities, that get US off of the debt escalation treadmill would be invaluable.

‘ Money printing and interest rate repression should be a crime’

True but let’s not focus on that.

Instead, let’s focus on what you and I should do to financially insulate and even gain from this criminal policy behavior fact-of-life.

When I say, “during big bouts of QE, you hold your nose and buy stocks, and before QT even starts you sell those stocks,” I’m not giving financial advice obviously, I’m just repeating mechanically and without thinking what I thought I read in this article and prior articles about this topic 🤣

YEAH! What good is learning if it don’t make you richer so you can buy more and better stuff to show off? Or be able to go on vacations and have other people constantly serve you and kiss your ass and even eat your shit when you get upset?

Damned if I know why I wasted my entire youth having fun rather than building wealth?

Unusual amount of honesty here……but still sick planet killers, sadly, even at this likely too late date.

“Money printing and interest rate repression should be a crime. ”

+ 1 zillion. Weimar aka Modern monetary theory in action.

“Money printing and interest rate repression should be a crime.”

I suggest it IS a crime.

Article I, sect 8 of the Constitution says Congress has the power “To coin money, regulate the value thereof,…..”

So how did the Fed, created to be the lender of last resort for banking emergencies, morph into an unconstitutional power of creating (coining) our currency?

There is also a Constitutional mention of punishing counterfeiting…

You should about read the battle to establish the Fed. I don’t remember much but it was a good read……typical lobbying stuff, though. I saw lots of lobbying (All MIC stuff, no banking) on Hilton Head Island……not far from Jekyl. (Creepy name, makes writing your own spin conspiracy theories easy)

Start with wikipedia, (make sure you do some chasing around for side stories, easy to do) have found that site evolves fast, considering the citations/proof requirements. Book/textbook is dead end though, although try reviews, google author, etc.

Although Fractional Banking is printing money and where all this shit started…..damned goldsmiths with their only safes in town.

Creative bookkeeping was around a long time, too, I bet.

The FED should be hated. They are duplicitous, manipulative, theiving bastards who do the the bidding of their masters, to the detriment of prudence and morality.

That describes nearly every institution and big company in the US. You’re gonna walk around stuffed to the gills with hatred.

Wolf, you have identified what’s warped the culture and country. The most corrupt and larcenous being rewarded for their grifting success. Sociopaths, Inc.

It doesn’t bother me in the least to be a hater of those bastards. I think any other outlook would be unhealthy.

It’s harder on YOU than the ones who deserve it, cb. Go exercise, play sports, learn something, try a physical/mental challenge……look at a Hubble pic or Earth from moonshot days.

I’m preaching’ to myself, too!

I believe the mechanisms by which QE appeared to inflate asset prices, QT contracts them and on-going contraction may lead to an asset price buckle (in the engineering sense of the word) are all materially different.

Asset prices inflated vastly beyond their underlying values because of a widespread *belief* that owning those assets was better than owning cash. QE merely provided the lubricant that permitted assets to be exchanged at ever increasing prices. According to my numerical models, QE is neither necessary nor sufficient for asset price inflation. All that is critically necessary is a widespread belief that owning assets (shares, real estate, crypto or whatever) is better than owning cash.

QT deflates asset prices because the treasuries, which become increasingly attractive as yields improve, compete with other assets for investment dollars and reduce the demand for those other assets. Indeed as treasury yields increase, some people are encouraged to sell their previously appreciating assets and buy treasuries, thereby increasing the supply of those assets against a shrinking demand. This would be especially true among retirees who tend to underrate the capital component of yield and value mainly the dividends. In any case, effect on prices should be obvious.

As the prices of the previously appreciating assets start to come down, the original *belief* that owning those assets was better than owning cash is materially undermined. Once that belief is compromised, prices collapse in much the same way as an overloaded beam buckles.

Finally, this whole trajectory seems entirely unavoidable because the government must continue issuing treasuries on pain of withdrawing services — which, of course, would be political suicide — and the Fed can no longer buy them — on pain of worsening inflation.

Jonathan, not a bad summary of John Hussman’s monthly comment “When the Bough Breaks”. He makes many other important points, but you got the gist.

What else could possibly inflate asset prices? How about near 0% rates for years which allowed Corps to borrow on the cheap to buyback the shares that were awarded to the Exec as compensation. A very nice positive feedback loop for them 1%’s

Share buybacks with borrowed money do not in and of themselves increase stock prices, and may depress them. While buybacks increase EPS (since there are fewer shares), the increased debt increases the beta of the stock and therefore depresses the value of the stock by an amount that offsets the increased EPS. By more if the level of debt materially raises the risk of financial distress. There is no free lunch.

k – the case of ‘net xx (xxx?, xxxx?) days’ stamped on the invoice?

may we all find a better day.

with zero percent or very low interest rates, there is a free or nearly free lunch.

Corp and dynastic money have been writing their own free lunch laws (Fed/State/County/City) since Lincoln’s day. They got especially mean after FDR had the gall to take some ownership of the country from them and try for some democracy again.

At his dog and pony “trial” Soros said they now can have laws written faster than you (gov’t) can write law to regulate or stop them.

Lots of good points, Harry. You’ve got a few things misstated. Needs some editing. Example: “High-interest rates and lower landing standards reduce the credit demand. This causes asset prices to fall.” “Higher” lending standards are restrictive, not “lower” ones.

I’m no economic guru, I’m just a regular guy out here in Flyover country. It seems to me that all this talk about the money supply and inflation is leaving out a big piece of the puzzle, and that is fuel cost. Deliberately restricting the fuel supply -crude oil, refined petroleum products, coal, and natural gas- increases the cost of production and transport of goods at every step of the process. Heck it costs the workers more money just to get to work and back. I remember the 1970’s and how the increase in fuel cost drove inflation, no matter what the money managers did. I believe that a big part of getting inflation under control is the Government taking their Boot off the necks of the fuel producers.

To me, another big piece of the puzzle is Federal overspending. We’re what….. $33,000,000,000.000 or so in the hole, and going down at a rate of $1,000,000 every 15 to 20 seconds. That has to have SOME effect, does it not?

Someone who understands the system better than I do, please chip in and explain this.

“Deliberately restricting the fuel supply -crude oil, refined petroleum products, coal, and natural gas…”

Not in the US, LOL, such BS. Where do people pollute their brains with this stuff?

The US is the largest producer in the world of crude oil and petroleum products, it’s the largest producer in the world of natural gas, it’s a big exporter of high-value petroleum products (gasoline, diesel, jet fuel, etc.), it’s a huge exporter of natural gas via pipeline and LNG, it’s a huge exporter of other gases, such as butane, ethane, etc. It has the largest petrochemical industry in the world and is a huge exporter of products made by the petrochemical industry.

Oil and gas production in the US has been a BOOMING and HUGE business for over 10 years, with record production. 2023 will likely set another record.

“Where do people pollute their brains with this stuff?”

AM radio….

Still a man hears what he wants to hear

And disregards the rest

Simon and Garfunkel

Vietnam War caused that, and burning food in your huge truck is stupid.

Hope that helps.

Both things can be true. Just because the US is breaking production records does not mean we can’t produce even more. The current administration is under political pressure to reduce fossil fuel usage, so it’s disingenuous to ignore decisions that are less friendly to fossil fuel production. Stopping the keystone pipeline, reduced leases on federal lands and offshore, extended times to obtain permits, ect., all impact the cost of fossil fuels.

Reduced oil prices would help with inflation and current geopolitical issues, with Russia and Iran depending on oil for their economies.

While there is no doubt that the Biden Administration is somewhat hostile to increasing oil production… that is not the same thing as saying that their policies are having an impact on oil prices (or “the cost of fossil fuels”).

Unlike coffee or corn, oil is NOT a “commodity traded on a free-and-open market with buyers and sellers determining a market price” but rather is controlled by a cartel (OPEC) that is itself controlled by one nation… the Kingdom of Saudi Arabia. It has been that way for literally 50 years from now… since the oil shocks of 1973.

As long as the Saudi cost of producing a barrel of oil is $5 to $6, Russia’s cost per barrel is $20 (with the help of Westerners to produce that oil), and the American frackers cost is $40 to $50… American politicians can only tinker around the edges of prices. And American frackers, their bankers, and their investors know it… they were taught that lesson TWICE in the last decade by the Saudis who opened the spigots just to sabotage and bankrupt them.

So it is the SAUDI’s who use oil prices as a geopolitical tool… the same as the Chinese use their dominant population and the Americans use their dominant military and economic power to shape the globe to their liking. The Saudis don’t just use that power against Russia and Iran… they have been openly hostile to Joe Biden ever since he publicly declared their Crown Prince to be a “murderer.”

At the moment, keeping prices high (above $80/barrel) does nothing but benefit the leadership of Saudi Arabia… when that changes (i.e. sanctions are removed on Iranian oil) then you will watch them open the spigots again and depress the price so that their adversaries don’t benefit from high prices for THEIR oil. What American politicians do to help or hinder America’s domestic oil production has little to do with the price of oil.

Growing debt is a concern but the straw that will break up the camel back is the percentage of gov. revenues to service the debt-currently about 35%.

I foresee a big problem once this percentage pass 50% of gov revenues.

The economy cannot support 2% interest rates (or less) for long. Debt becomes too attractive and asset inflation rises far beyond fair value. The “boom” part of the “boom and bust” cycle. I don’t know if it’s all intentional. I do know that it’s been chronic. I also know that these episodes funnel wealth from labor and small businesses up to the wealthy class. It’s called the ‘allocative effect.’ Similar to the effect of serial tax cuts that benefit the wealthy.

You do know that even after the “serial tax cuts”, the “wealthy” pay significantly higher marginal Federal income tax rates than others? Or have you not done your homework?

So? Besides the fact that the rich’s effective tax rate is always lower than the legal one through creative accounting, remember that the marginal tax rate above 200k in 1950 (about 2 million today) was 90%.

Anything less than that is the cause of Western societal decay.

Naren,

Venezuela is this way –>

You are gonna love it, comrade.

Actually, the creative accounting that you refer to is a relic of the 1950’s era, and was mostly eliminated by the 1986 tax reform act. The “wealthy” pay a disproportionate share of Federal income taxes. It is the poor and middle class who benefit most from deductions and lower rates and pay little or no taxes. You would know this if you were well-informed.

So, with your reasoning, Naren, a person who has NO assets or very little should pay for the protection of their zero assets (through the military, police, national guard, Congress which protects property first and people second, infrastructure – highways, bridges, airports, harbors, and other economic generators and protections) relatively equally compared to a billionaire.

Consider insurance: if your home is valued at $100,000, should you pay the same premium as someone whose home is worth $5M? Of course not. So why shouldn’t the wealthy pay one hell of a lot more in taxes for the value they get from the totality of government services which protect their great wealth and facilitates their ability to get more?

HowNow..

If you think about it, the less wealthy consume much more “value from the totality of government services” in a disproportionate amount. Think police (likely less policing activity at that $5M mansion than in the ‘hood), fire department (likely more ambulance / paramedic activity), schools (the $5M house guy’s kids probably go to a private school), etc., and so on.

The $5M guy in CA probably pays $70K per year in property taxes and the $100K guy pays……?

The nominal rate was 90%; the effective rate was much lower.

The rich pay much less of their income in taxes now. They bought that, and even folks of modest means support it, and say it is communist to have real progressive tax rates.

I find it funny as during the 50’s with those high tax rates, we also had the most rabid anti communism actvities. So, please don’t tell me high tax rates will turn the USofA into ‘commies’…That is just silly.

dougzero, this lie is really getting old.

First, the “working rich,” meaning the professional couple making $500-$600k a year, pay a ton of taxes, and they have no “loopholes” to take advantage of. Most of the very wealthy don’t pay much in taxes because they can harvest all sorts of losses through their businesses. That isn’t true for the wage earners who are the ones targeted by the proposals to increase the ordinary income tax rate.

Second, the 90% tax rates in the 1950s were barely paid by anyone, because of the deductions and other workarounds available at the time.

Even if they did, do you think confiscating 90% of someone’s income is reasonable?

Wait!! So the system makes it so, someone wealthy from 1X Wealth -> 5X Wealth. (5 is just to illustrate a point, but it’s a multiplier/opportunity not available to bottom 90%).

They were already in the highest marginal bracket. They have the most resources available to exploit all the nooks and crannies left in tax code. And I’m supposed to do homework, because the share / amount of taxes they pay overall went up.

May be do your homework first.

Here’s a link that may help you more:

https://wolfstreet.com/2021/12/27/my-wealth-effect-monitor-wealth-disparity-monitor-for-the-feds-money-printer-economy-december-update/

Here’s another link:

https://time.com/5888024/50-trillion-income-inequality-america/

Context matters. Wealthy pay more because they have acquired far far far far more. What homework is left to do, pray tell?

I’d be very happy to pay a marginal tax rate of 25%, please send a billion dollars my way! It’s a tax rate unheard of in my would be circle. Then you can point me to me and tell others to do more homework.

Wolf, thanks for the update on Mr. Market. Seems that if there is still a punch bowl, it is no longer spiked and it is draining via QT. I wonder if it will end up with the old average P/E ratios of 15 more or less.

This is inevitable. 50% lower stock indices.

I highly doubt it goes that low. The lowest the S&P has gone in the modern era is like 38.1% or something like that and it rebounding like crazy in a few quarters after that.

It’s stocks, just do not sell them low. Sell. Them high right before retirement or whenever you feel they are high enough. It’s a winning strategy.

The problems with human nature is that you do sell and lose all the gains when they rebound plus go to new highs. People usually buy on the way up when all the other people are getting back in and then you’ve missed tons of gains.

Due to changes in corporate accounting throughout the decades it should be quite a bit more than 50 percent. The P/E ratios today are much higher than they appear to be.

Helps to explain JD’s sale of JPM stock as well. (Don’t be last out of the gate.)

He’s selling them in a year. Which means he’s confident that in 1 year they will be solid.

He’s the biggest banker on earth. I think he may know a thing or 2.

You mean to tell me that, for the first time in a very long time, there’s a slight hint of a possibility that economic fundamentals could actually govern the price discovery function underlying the general behavior of the stock market again?

“Say it ain’t so, [Wolf]! Say it ain’t so!”

The 1929 crash was a 89 percent correction from top to bottom. From all the graphs and charts I look at the stock market is more overvalued today. There’s still a one in a million chance the bankers will let the stock market fall to fair market value.

TRT – …in an atmosphere of billions and trillions, the one-in-a-million scenario becomes more of a possibility…

may we all find a better day.

The banks tried to stop the Oct twenty nine crash, An agent for Morgan went out on the floor and bid substantially OVER market price for thousands of US Steel, then went on with other key stocks.

It worked briefly and everyone loved the banks. But the tide of sell pressure swept it away in a dew days. People hoped the banks would try again but now the banks looked to their own skins. Now people hated the banks and rumors of bank short selling swirled…in at least on case true.

For a great examination, no better than Galbraith’s ‘The Great Crash’

He avoids singling out any one factor but the closest might be the Investment Trusts, a type of mutual fund. The Trusts would buy stocks in actual companies, but the stock of the Trust itself traded just like the companies it contained. For a while if you added up the assets of the Trust, it would be less than the value of the Trust.

If this seems odd. the reason given was that this premium was what the buyer of shares in the Trust was paying for the genius of the Trust’s managers, who knew how to pick stocks.

But the Trusts started creating other Trusts, so the contents or assets of the sponsoring Trust would contain not just shares of normal companies, but also shares of another Trust.

When the wave of selling hit in late Oct, the shares of productive companies: US Steel. Deere. RCA, etc. fell, but the Trusts fell much more as their leverage went into reverse. The shares of the Goldman Sachs Trust went from 101 dollars to 1.50 cents.

The G S Mother Ship survived, and afterwards tread very carefully.

The banks are not going to risk their lives to save the stock market, then or now.

Unrelated: it is a mystery why bailing out depositors in SV bank etc.

was seen as stimulus. As I understand it, shares and bonds weren’t covered. So ..,net zero.

Nick Kelly-

Interesting comments. Thanks. Galbraith was an excellent writer (though I don’t agree with much of his economic theory…)

One of my favorite ironic “gallows humor” quotes from the book you mention:

“Two men jumped hand-in-hand from the roof of the Ritz. They had a joint account.”

The US was poor as dirt then. Not the leader of the world. It took both of the WW2 wins plus besting the soviets to propel us to this poll position. We all had grandmas and great grandmas who lived thru that era. They mix water with their ketchup much to your dismay while trying to eat your French fries. But they were good people!

Not gonna happen.

US richest in world. All others went hugely into debt in Round One. US emerged only creditor. UK France, Germany had also lost most of their young men.

Thanks Wolf

Qt and fed rates rising. Creating a new demand for treasuries and less for stocks. Higher rates for longer. Feds PCE index is higher like you have told us. In your opinion should the fed raise another quarter point this week? Stocks falling now before the fed meets. I don’t like the phrase priced in.

Still curious to see how govt spending (up $123 billion in the last three weeks) will counter the Fed’s QT…..

We already know: higher yields on longer-term Treasury securities. I’d like to see 10-year yields near 6% and 30-year yields over 6%. That would be about right. I think we might get there. And that would be good. Those maturities will then finally be investable again.

Couldn’t agree more.

@ Wolf –

Would you buy a 30 year treasury at 6.25%?

Not me.

I must have tried to explain QE and QT to dozens of friends and family members. They stare at me like a deer in the headlights because their financial advisor does not tell them about QE and QT.

So I direct them to Wolf’s site, but they never go. They are going to experience the further decline in stocks and wonder what happened.

But their financial advisors are never wrong, they think. Credentialism is overrated.

Howdy Jon. A true Rebels tale you just told. Immediate family are important and keep trying with them. If everyone were a Rebel? Then there would be too many of US. Bask in your wisdom and just watch what happens…..

Way to go Lone Wolf see what you did? HEE HEE

The same with my acquaintances.

When I talk to them about inflation, Qt, qe and central banks, they laugh and say that as inflation rises asset prices will rise. Property prices will rise forever and ever and that there will always be buyers.

Currently, in my country, the third quarter of 2023 set a record for the fewest real estate transactions on an annual basis since 2010.

However, everyone around me is optimistic about the future.

The most optimistic is the press, which continues to irradiate the common population.

In Canada the answer to everything is apparently always right around the corner.

My circle of friends is getting smaller and smaller as a result of most people choosing to be spoonfed by mainstream media. I can hardly tolerate people who make no attempt to educate themselves. That applies to family as well. I’d rather be alone on holidays than to listen to them drone on about what Cramer said the other day.

Howdy Fed Up. HEE HEE, you are just getting older is all. Govern ment made sure politics got to the dinner table using Gores internet.

Fed Up,

Here is what I learned the hard way, and these are my ground rules that I try to stick to: don’t discuss finance and the economy with friends and family, same as with religion and politics. Talk about your hobbies, what you did, and ASK about their hobbies and what they did, ask about their family members and friends, ask about their house and their vacation and their pets and their job or whatever. They will love you for showing interest in them, and everyone will have a great time.

And alcohol, lots of alcohol!

Howdy Lone Wolf. Absolutely correct. Wanted to add, the weather should be avoided also. Now a days , one mention of the weather, and your stand on global climate change must also be talked about. Best to let everyone else talk and just act like a mute?

HEE HEE

@Wolf, great advice, but I agree with Debt-Free-Bubba and now stay away from the weather since in Northern CA more often than not it will lead to a “climate change” discussion (and people calling me a “climate change denier”). P.S. I was recently at an event where two Dad’s (who had about 100 things in common) somehow found one of the few thigs they didn’t have in common to argue about. When I was in college 40 years ago I don’t remember anyone ever arguing about politics and I don’t know who anyone I ever dated voted for (or if they were even registered to vote and voted). A friend just told me a friend cut him off do to political differences and he was surprised that I had no idea who my five closest friends have voted for or if they have ever even been registered to vote and voted (I do know that they are not very “political” and maybe that is why we have been friends for so long).

@Glen,

“And alcohol, lots of alcohol!”

Careful! after a few drinks you may slip up and start talking about:

– Gun Control

– Politics

– Abortion

– Finance

@ApartmentInvestor,

Californians can turn ANY conversation into a political one. I never have understood why that state has such a high proportion of people who firmly (and loudly) believe they have all the answers to the world’s problems.

Any other US state:

“It is a nice day, isn’t it?”

“Yes, it is.”

California:

“It is a nice day, isn’t it?”

“Yes, though the temperature is one half degree higher than the statistical average for this time of year. Now if only the government would crack down on carbon emissions….”

Cold in the Midwest,

LOL. Ever even been to California? ever been in conversation in California with a Californian? Or do you get your info about California from ZH?

Politics and finance inevitably pop up at my family get togethers. Hard to change the subject with certain people. But, yes, setting ground rules is a necessity if you want a peaceful dinner.

In my experience, it’s liberals who are unable to control themselves in these conversations.

I will mention that I had lunch at Chick-Fil-A and someone will inevitably bring up that its founder doesn’t support same-sex marriage.

@Wolf,

Yes, I’ve spent a substantial amount of time in the Golden state. My parents used to live out there during the winters. Also have other family now living in the Bay area and have made several visits.

It wasn’t just the time in CA though. I went to Arizona State as an undergrad and that school had a large population of Californians, some of whom I got to know.

Also met quite a few relocated Californians when I was on a one-year work assignment in Boise (where the locals were generally tolerant of people who had relocated to Idaho from other states but HATED the transplanted Californians. In the local’s words, they had “too much money and an attitude.”)

So I have had quite a bit of exposure. I personally don’t hate Californians. But I’ll stick to my point. Californians tend to get up on their horse quickly about politics and other subjects (like climate change.) Your advice to simply avoid certain topics is the way to go.

Cold in the Midwest,

Talking down on Californians is like THE favorite thing to do in the other 49 states. You clearly enjoy it. That’s why we’re just brushing this stuff off with a smile.

Cold – check the proportion of your state’s population to that of our overall national residency. Then remember that NO state (yours included, wherever it is), despite the best efforts of our entertainment (in the broadest definition)-based news (their operating revenues all based on ratings since the ‘Fairness Doctrine’ fiasco), is automatically 100% in the hands of any one party, but rather reflective of its contemporary local needs (often more emotional than practical) being addressed more effectively by one or another, when not ground to a stalemate by a poorly-defined ‘…will of the people…’.

Then get back to me.

may we all find a better day.

Holidays – Scrooge (Alistair Simm), George Bailey, Steve Martin and John Candy and that leg lamp movie with my 2 dogs and I’m all set!

I think I have seen “Planes, Trains, and Automobiles” about 25 times.

Really, so you oust people who care about you just cuz they listen to CNBC?

Did murdoch put you up to this?

Sounds healthy

Read my comment again. No where did I say I would oust anyone. I said I’d rather be alone, meaning I would not go to get-togethers And who says they care about me lol. Family and caring don’t necessarily go together. Depends on your family.

And, no, I don’t listen to Fox News.

@Fed Up: Not to get into a sermon or anything like that, but you may want to consider the following:

“You don’t see the world as it is. You see the world as you are.”

Everything is perception.

This ‘MSM’ paranoia is overdone, especially when mere yap is conflated with journalism.

Cramer is not a journalist. His bla no doubt has disclaimers but even if it didn’t, investment advice is not news reporting. I have worked as a journo albeit for small papers but even there, if you are reporting, you damn well better not make a mistake, as in a factual error. The big outfits, CNN etc. use fact checkers. I guess Alex Jones doesn’t. Using them would have saved Fox over 700 million.

The old time printed sources: Vanity, Atlantic, NY, and big newspapers are even tighter, maybe cuz once printed is forever. You can’t correct it once delivered. A substantial error might mean a pink slip.

I explain it as QT is the reversing of all the damage QE did to the world economies since 2008 especially the United Kingdom.

1) 5% LOL. The Fed will not raise rates while the Dow is falling in wave A

down.

2) After wave B up, to a lower high, the downturn might resume in wave C down, below Oct 2022 low, to close Nov 2/9 gap.

3) That low will be point B.

4) From Point B the Dow will rise to a new all time high in a sling shot up.

5) Point B might be breached when the Dow will test Oct 2007 high.

6) This option will be cancelled if the Dow rises > Aug 31st 2023 high in Xmas 2023 rally.

A(-)—–B(+)——C(-)—–(C=B)—–B(+++)—-XMAS!

Got it! Thanks Michael!