Not that the losses matter to the Fed, but they matter to the Budget Deficit.

By Wolf Richter for WOLF STREET.

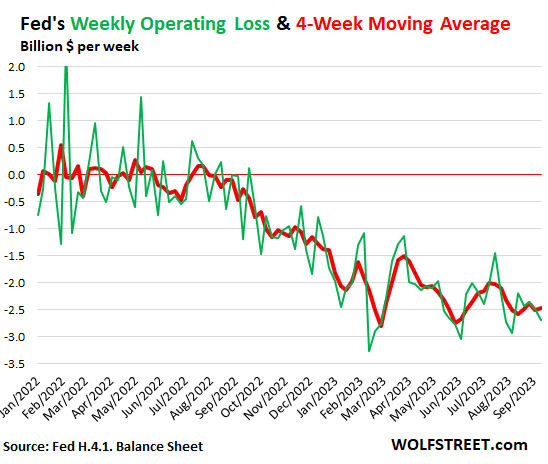

Since September 2022, the Fed has consistently booked operating losses, as the interest it pays banks on their “reserves” and the interest it pays money market funds and other counterparties on their overnight reverse repurchase agreements (ON RRPs) have overpowered the interest income from its vast but shrinking portfolio of Treasury securities and MBS that it purchased when yields were much lower than today.

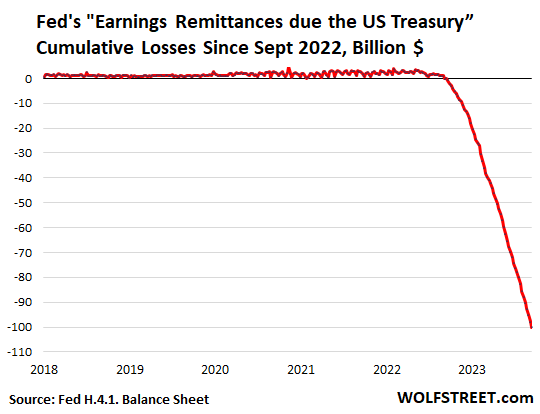

The cumulative loss since September 2022 reached $100.1 billion, as per the Fed’s balance sheet released last Thursday. The losses have stabilized in a wave-like pattern since late February, despite three additional rate hikes since then. And more recently, they have started to diminish. If the Fed keeps rates unchanged this week, those losses will decline further – more in a moment.

The chart shows the weekly losses (green) and the four-week moving average of the weekly losses (red). In August and September so far, the weekly losses have averaged a little under $2.5 billion per week.

The Fed’s losses increased with the rate hikes, as it had to pay higher interest rates on reserves and RRPs. Since the rate hike in July, the Fed has been paying 5.4% to the banks and 5.3% to the RRP counterparties.

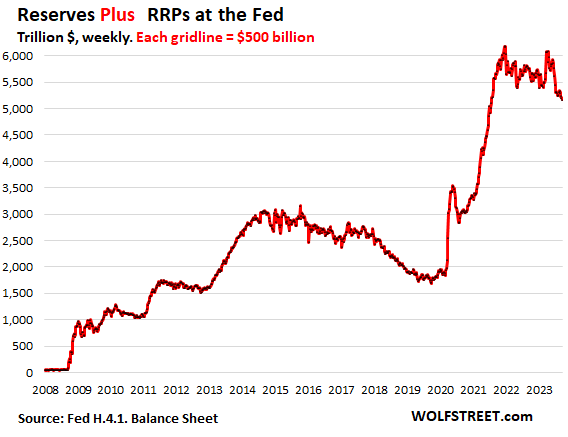

But the balances of reserves and RRPs declined as a result of QT – we discussed the Fed’s liabilities, including reserves and RRPs on Saturday – and there are now over $1 trillion less in combined balances outstanding that the Fed needs to pay interest on, compared to the peak in December 2021.

So the declining combined balances of reserves and RRPs kept the interest the Fed pays in dollar terms roughly level for the past five months in a wave-like pattern. In August and September so far, the weekly losses have averaged a little less than $2.5 billion per week.

As reserves and RRPs continue to fall, there will be less to pay interest on. If the rates remain around 5.5%, total losses will begin to diminish visibly over the next few months as QT continues to drain the combined balances of reserves and RRPs.

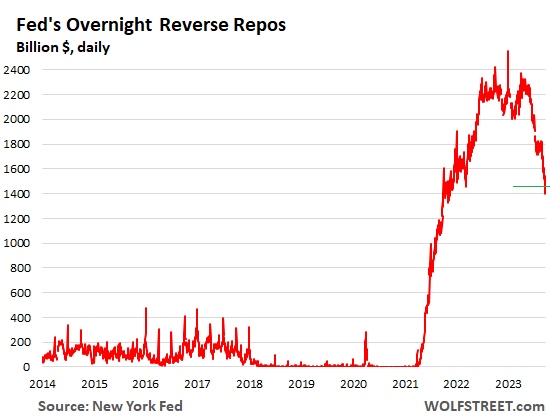

RRPs may eventually return to zero as QT continues. They’ve already plunged by 45% to $1.45 trillion as of today’s New York Fed data. So interest payments to RRP counterparties are now plunging as well:

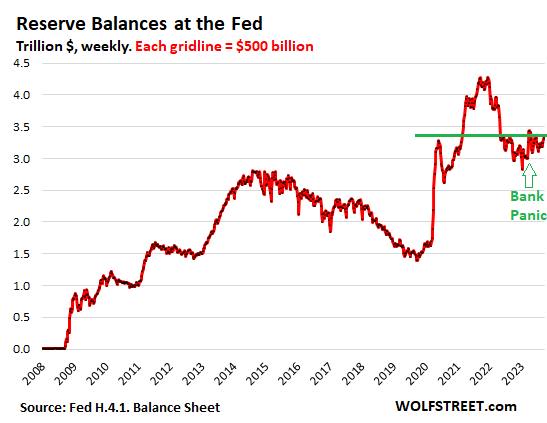

Reserves might fall below $2 trillion as QT continues. They’ve already fallen by 30% from the peak, despite the recent uptick, to $3.34 trillion.

Losses don’t matter to the Fed.

The Fed creates and destroys money as a matter of routine. Because it can create money, it can never run out of money. So its losses don’t mean anything in particular for the Fed. It just accounts for its operating losses in its liability account, “Earnings Remittances due to the US Treasury” – money that it owes the US Treasury.

This liability account, “Earnings Remittances due to the US Treasury,” where the Fed tracks its operating losses, has a negative value of $100.1 billion. Funniest-looking chart ever:

Note that these operating losses (expenses exceed interest income) are different than the unrealized capital losses on its bond holdings, which don’t matter either for the same reason, plus another reason: the Fed will not sell its Treasury securities, but hold them to maturity at which point it will receive face value for them, and will not incur capital losses.

There was some discussion by some Fed governors that it might eventually think about selling some MBS to speed up the process of QT, and it would then realize capital losses on those MBS that it sold, but those capital losses won’t matter either for the Fed.

It already sold all its corporate bonds and bond ETFs that it had purchased in 2020 and made a profit of $512 million on those sales.

But the Fed’s losses matter to the US budget deficit.

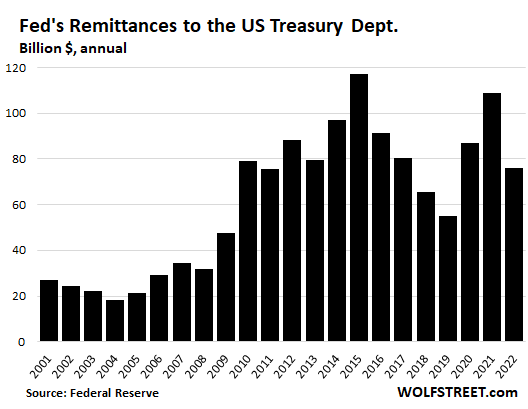

The Fed remits nearly 100% of its income to the US Treasury Department, being in sort of a 100% income tax bracket. In 2022, it still remitted $76 billion to the Treasury through August. But then it started making losses and there was no more income to remit.

We track this on an annual basis in January when the Fed releases its preliminary annual income statement.

Since 2001, the Fed has remitted $1.36 trillion in income to the Treasury. That gravy train has now derailed. Those remittances will be zero for years to come:

Now the Fed has losses and won’t remit anything. Even when it starts making money again years from now, it won’t remit anything until all the cumulative losses – already $100 billion and growing – have been earned back. This will take many years. Over this period of losses, and then of income to earn back those losses, the US deficit will be worse by the amount of the missing remittances.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The Central Bank should be solvent because they are the printers of money.

The Central Bank are covered because the gold on their balance sheet is not valued at the current market price.

The Central Bank makes a profit because it charges interest on loans.

1. “The Central Bank should be solvent because they are the printers of money.”

Yes, central banks that create their own money cannot be insolvent because they can never run out of money because they can always create more money.

2. “The Central Bank makes a profit because it charges interest on loans.”

🤣🧡 RTGDFA

What if the fiat money becomes worthless? They would be technically insolvent.

No, you started out with a fake premise. And then you twisted this fake premise into fake nonsense — to do what, make a joke? Fiat money cannot become “worthless.” That’s the beauty of it. But it becomes “worth less.” See Argentina. You just get more zeros on your peso bills. As for the USD, after 100 years of the becoming “worth less,” the USD is still a valuable currency, you just need more of them to buy something.

The Federal Reserve owns practically zero gold metallic stuff.

Hey cashboy… you sure all that is correct?

Question regarding it not mattering if they were to sell MBS and realize losses.

Is there any legal minimum capital base the Fed has to maintain? Technically their capital would go down and potentially negative? I think the Fed today shows ~$50B in capital.

And is this the same for the ECB and BOE? I think I read somewhere that the BOE might require a capital infusion.

Thanks

Wolf, is it true the UK Treasury has to cover BoE losses each year? Maybe that’s what Peter G is referring to about BoE needing capital infusion. Seems the opposite of what is done here in the US. Losses by the Fed are not covered immediately by the Treasury. They will just wait for the Fed to make up for their losses in the coming years than having to send them money now to fill the gap.

The capital doesn’t change much. It’s set by Congress. Any losses go into a deferred asset account, where they linger and don’t bother anyone, such as the one I discussed and showed two charts for.

Hey cashboy you sure all that is correct? Sounds somewhat fishy to me

What is the average cost for the FED purchases?

If they bought at a par or below and they hold to maturity, aren’t they money good?

RTGDFA. In this article, we discussed the operating losses — where the interest paid by the Fed exceeds the interest earned by the Fed.

You’re referring to capital losses.

Even the title says “operating losses” — you should at least read the title before commenting.

Oh, so they can’t make it up on volume?

🤣😍

Foreign central banks doing QT by continuing, as they have, to sell US Treasuries, and not buying more, may help the Federal Reserve by increasing the interest rate for new Treasuries. Jerome Powell said to Congress it was the demand holding down rates. For all those Treasuries rolling off above the Fed’s monthly ceiling, the new replacement interest rate would then improve the Fed’s portfolio.

What would have happened if the Fed had raised interest rates and then not given the banks the funds to pay the interest? If the Fed can hold non-government securities, they can be insolvent, as a matter of principle.

What non-government securities has the Fed held? If you’re referring to MBS, it’s federally guaranteed MBS, so it’s not functionally any different than treasuries.

QE is a corporate subsidy, by analogy more of the debt is non-governmental debt. Fannie Mae was insolvent, the Fed solution to insolvency is liquidity. Do you believe that?

Another great article! Thank you!

I had a side question. Where do the operating costs for the Fed come from? Ie salaries for the governors and the staff, accountants, building heating, cooling, etc?

Are they paid with the interest/income collected by the Fed, or are they paid with taxpayer money? Is the Fed income being skimmed with overhead costs?

Are they significant costs?

The Federal Reserve Banks are self-funded. They earn interest and pay all their operating expenses, including interest expenses, and remit what’s left, if anything, to the Treasury, as I discussed in the article.

I linked my report on the Fed’s income statement in the article. Here it is again. It explains all of it, with dollar figures too, so you can see the different categories of expenses:

https://wolfstreet.com/2023/01/13/despite-losses-since-september-the-fed-still-made-a-profit-for-the-whole-year-2022-remitted-76-billion-to-us-treasury-dept/

The relevant section from my January report on the Fed’s income statement:

Interest income surged by 39% to $170 billion in 2022 on its holdings of securities, mostly Treasury securities and MBS, up from $122 billion in 2021.

In addition, the Fed made some small amounts – small by Fed standards – including $500 million in fees from services, mostly paid by the banks, and $108 million in net income from its pandemic era emergency programs.

But interest expenses exploded by a factor of 19 to $102.4 billion in 2022, from $5.7 billion in 2021. This is the amount it paid on reserves and RRPs.

In addition, the Fed had other expenses – bringing its total expenses to $112 billion:

The Fed paid $1.2 billion in statutory dividends in 2022 to the shareholders of the 12 regional Federal Reserve Banks. These 12 FRBs include the New York Fed, the St. Louis Fed, the San Francisco Fed, the Dallas Fed, etc. Their shareholders are the largest financial firms in their districts.

Hi. This means increased Bond supply to fill the gap caused by zero Fed remittance. Hence there will be pressure on Bond Yields.

Is the inference correct? Or not significant enough!

Thanks

yes, the government has to add about $100 billion in debt a year to fill the hole left behind by the remittances.

I remember some time ago when you stated that IOER (Interest on excess reserves) was “sit on your behind money” being earned by the banks.

It appears that each future interest payment that is used to offset these losses has the same effect as QT as money is collected by the Fed and destroyed.

On the other hand, the interest the Fed is paying currently is stimulative (ie, similar to QE).

Before I get flamed for saying this, bear with me here, as I’ve been trying to get my head around what this actually means.

John Hussman’s latest market commentary: “Central Bankers Wandering in the Woods” is basically a synopsis of his past couple of commentaries put into a presentable form for (in my estimation) his audience of Fed bankers.

His argument is relatively simple: the size of the Fed balance sheet reflects an amount of 0% base money (cash and equivalents, etc) that has been pushed out into the economy. Thus it is the availability/scarcity of this 0% money in the economy as a proportion of GDP that actually determines private sector interest rates. As an aside this is an interesting angle to the back-and-forth as to whether the Fed sets interest rates vs the argument that it simply follows what markets are already pricing them as. Wolf seems to generally argue that this is a result of banks front-running telegraphed Fed policy decisions before hikes/cuts – but I think the explanation that balance sheet as a % of GDP driving private market interest rates with “official” interest rate decisions making official what this balance is targeted to be is more nuanced, and more interesting (which doesn’t exclude 3rd parties front-running announcements in the short term)…

Anyway…Prior to the era of QE the size of the Fed balance sheet never exceeded 16% of GDP, and Hussman provides compelling charts linking this metric to the prevailing interest rate at the time.

What Hussman argues is that with the pursuit of QE after the 2008 recession the Fed balance sheet expanded beyond any historic relationship vs GDP. Under what is termed the Fed’s “Ample Reserves Regime” their balance sheet is now currently around 36% of GDP.

Thus, the Fed is pursuing extraordinary measures in order to create a market interest rate of 5.5% or whatever, instead of simply letting the supply of 0% money in the economy produce this interest rate in the private sector via shrinking their balance sheet to an extent to provide enough of a scarcity of 0% money that credit becomes expensive between private parties.

So this is what I’ve been trying to get my head around:

The negative liability on the Fed balance sheet that will need to be offset in the future with cash that is then destroyed (as you point out) functions as ‘new money’ that is now entering the economy, and thus is actually stimulative.

But how stimulative, and what does this mean? One thing that’s struck me is where the amount of this ‘stimulation’ fits with other metrics.

Some napkin math (just going to use round numbers):

Fed balance sheet = 1/3 GDP

Interest rates paid by Fed = 6%

So new money entering the economy = 1/3 * 6% = 2% of GDP?

Inflation = 4% and GDP growth = 6% (again these are just round numbers for argument’s sake). The difference between inflation and GDP growth just so happens to be the same as the amount of this new money? Is this meaningful or just a coincidence?

I’m not making an argument here (and if I am, I’ll admit that it’s misinformed), but I am genuinely unable to figure it out, and it’s been on my mind all week.

The follow-on question is whether it’s even possible to have a recession, regardless of Fed-dictated interest rates, until the Fed balance sheet is reduced to be in line with historical norms (ie much less than 16% of GDP)? And if so, am I an idiot for not putting all of my savings in speculative assets, even though it defies common sense? Because it sure seems like a reasonable explanation for why interest rates haven’t seemed to have made as much of an impact on things like unemployment as many people have expected…

Monetary (and fiscal) policy in the US over the past 20 years has really made a mess of things, and it’s made navigating very simple things like trying to save money very complicated for me…

Again, I’m not attempting to promote any BS theories, but am curious if my line of thinking is actually correct…

I think you are on to something in the 1st paragraph of your comment.

Reverse repo provides good collateral in the overnight market.

Reserve balance in the Fed does nothing good for the economy.

VIX is comatose.

Target stock is screaming recession.

Target’s stock is simply reverting back to pre-pandemic levels. I wouldn’t call that recessionary. It’s a return to normal.

Funny money and since I don’t have that, sitting tight in the Tucson, AZ desert hoping that the housing prices will tumble (going down is not enough given the run up). Meanwhile enjoying the rental house as rents have not and cannot catch up with the housing prices as many charts from Wolf show.

A sensible plan. I wish I could do the same but I own a socially unacceptable number of cats so I need to own my home.

#CatRichbutHousePoor

From yesterday’s comments WR: “The Fed should never engage in QE, period. We now see how that ends: massive inflation.” With all due respect, the government injected massive amounts of fiscal stimulus into the economy after COVID: Hero’s Act May 2020 for $3.4 Trillion, Consolidated Appropriations Act December 2020 $990 Billion, and Americans Rescue Plan Act March 2021 for $1.9 Trillion. We cannot disentangle how much of current inflation is due to QE and how much to fiscal stimulus. I’m not advocating QE or fiscal stimulus. This will be the subject of PhD dissertation for many years.

It’s puzzling why bankers have come up with these new ways to lose money when the old ways were working so well.

The Federal Reserve used to be the biggest single contributor to the US Treasury as it rebates 94% of its profits each year to the US federal government but alas that gravy train for the US Treasury has come to an end as there are no profits now at the Federal Reserve.

The Treasury should sell debt to cover the Fed’s losses. Then the Fed can buy it via QE. If rates keep going up, this becomes an infinite loop 🤣😬

As far as I know the Federal Reserve does not report remittances on a cumulative manner. Each week is an individual remittance.

Just because you don’t know doesn’t meant the Fed doesn’t do it.

Go to the Fed’s weekly balance sheet H4.1

Go down to table #6

Go down to “Earnings remittances due to the U.S. Treasury”

Look for the column “Total”

see: “100,120” which is in millions

The Fed also reports the annual total remitted in early January, which is when I also report it:

https://wolfstreet.com/2023/01/13/despite-losses-since-september-the-fed-still-made-a-profit-for-the-whole-year-2022-remitted-76-billion-to-us-treasury-dept/

Here is the Fed’s press release on its annual 2022 remittance:

https://www.federalreserve.gov/newsevents/pressreleases/other20230113a.htm

All very instructive. The graphs are particularly scary. The comments are also instructive, even the ones that are wrong-headed, which are instructive in a different way. I’m looking forward to the insightful clarifications in the comments.

Now then. Fifteen years on from the GFC and the fat-fingered Fed is still half-heartedly trying to pick up the pieces.

Moral hazard has become systemic: most banks don’t hedge against interest rate hikes because they know they’re backstopped, so why bother? Meanwhile, Big Bank corruption has become the new normal, common-sense reregulation is nowhere in sight, the impotence of enforcement has been optimized, and the BIS still knows as little as possible about the shadow banking system.

Q: How can a recession be avoided if the coming government shutdown prevents the addition of trillions in new debt needed to keep the US ponzi economy going?

A: Say what?

Tick tick tick tick . . .

If the Federal Government only lost $100 billion in the last 18 months it would be considered the most fiscally prudent government in a quarter century.

If Fed losses account for interest paid on deposits (to various financial institutions), then presumably, that money will eventually be invested or spent. So is it sort of postponed inflation?

Thank you Wolf!

I also appreciated your prior reply before the edit.

So even if we’re expected to hit 1T in annual interest debt payments AND Fed losses resume from future QE/QT cycles (structured around inflationary climate), I assume Fed independence isn’t threatened by the sheer nature of its TBTF stature. Everyone pretty much reveres them as Oracles planted at the top of Olympus.

That pretty much ties the faith/credit of the dollar/Treasury bond market with the Fed right?