“Disinflation” already ended.

By Wolf Richter for WOLF STREET.

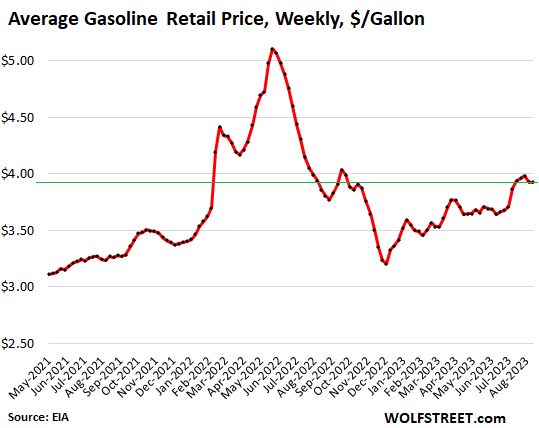

The average price of gasoline, all grades, across the US last week – after surging for three months – exceeded the price in the same week a year ago for the first time since February 2022. According to EIA data this afternoon, the average price at $3.93 per gallon, was up by 1.7% from the same week in September a year ago ($3.86).

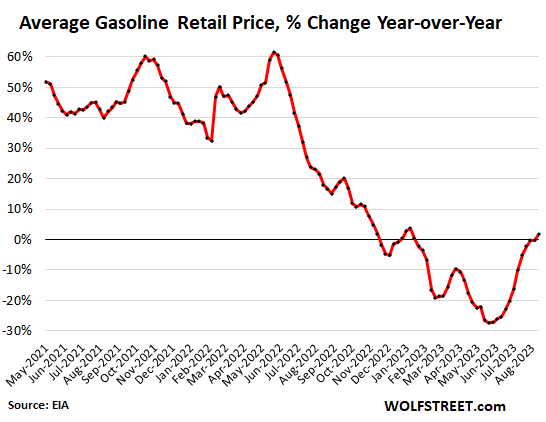

So this is the year-over-year percent change of the average price of gasoline on a weekly basis. And it’s another setback for the Consumer Price Index to come. “Disinflation” good bye. But we already said goodbye to “disinflation” with the July CPI.

The average price of gasoline had spiraled to +60% year-over-year in June 2022. Then prices plunged. By June 2023, the year-over-year drop bottomed out at -27%. And now, gasoline is up +1.7% year-over-year. The great plunge in gasoline prices was a major factor had caused CPI to cool 12 months in a row, from +9.1% in June 2022, to +3.0% in June 2023 – the infamous and now bygone era of “disinflation.”

This comes as the price of crude oil grade WTI has surged by 28% since June.

The surge of the gasoline prices from mid-2020 ended in June 2022 at $5.11 per gallon. It was then followed by a majestic plunge into December 2022, to bottom out at $3.20. And it has since then risen by 23%.

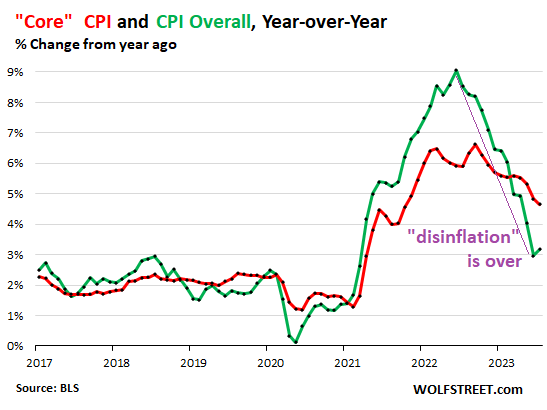

In July, the CPI reversed course and accelerated to +3.3% (from +3.0% in June), driven in part by the smaller year-over-year plunge of gasoline of -20% in July, compared to -26% in June.

For the August CPI, to be released next week, gasoline will still be down year-over-year, but only a little. And CPI will accelerate from July’s 3.3%.

But the September CPI, to be released in October, will reflect the gasoline prices today and for the rest of September, compared to September last year. And it will be in the September CPI when gasoline will switch from a downward force on CPI, although a decreasing downward force, to an outright upward force on CPI.

And the infamous chart of overall CPI (green line) being lower than “core” CPI (red line) will reverse in the second half of this year, with overall CPI being higher than core CPI.

Core CPI itself will rise even if the usual inflation suspects (services) turn out to be benign – it will rise due the base effect (the base for the year-over-year comparison being last year’s cooling), and due to the end of the odious massive adjustments to health insurance starting with the October CPI, to be released in November.

The year-over-year plunge in energy prices pushed the overall CPI increases below the increases of core CPI. I have pointed out for months that when energy prices stop plunging on a year-over-year basis and start rising again year-over-year, overall CPI will once again climb above core CPI, with core CPI itself accelerating as well this year.

CPI and core CPI through July give a feel of where this is going from here, with CPI already having reversed course, and core CPI to reverse course, just like the “core PCE price index” has already done. And it’s not in the right direction:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I can already here the same CNBC talking heads who told us for the last six months that inflation didn’t matter because it was going down…

“Inflation is going up but it doesn’t matter because core inflation is steady.”

I thought the exact same thing while reading this. Same will happen in the political press, too.

diesel now $4.74

Aug 1 – $3.85

I paid that the other day for gas in tracy, calif. That was cheapest.

Watching CNBC can be dangerous to ones financial health….

= The talking heads will be pumping and hyping the stock market until it crashes.

I don’t understand why anyone would pay attention to the talking heads on Fox Business, CNBC, etc.

They are fine for getting immediate factual news (release of jobs report, etc), but listening to any analysis from them is absolutely silly.

It sure looks like CPI and core CPI are going to go up much further as the year continues. I wish the media would tell it like it is, rather than putting a spin on things. This site gets it right, why can’t the media and all the so-called “experts”?

The media and their owners are heavily invested in getting back to ZIRP and free money to continue to inflate their asset bubbles. Its the primary tool for wealth inequality and they will likely continue to fight for it forever. Future fed chairs will always face pressure to bring us back to the “good days” of ZIRP. Inflation doesnt impact these people nearly as much as yearly 70% gains in the markets.

The real money is made by catching the spillage from the federal government, be it munitions and military, or climate change hysteria…

and the knowledge the Fed will save you and protect your assets

Let’s keep it going until every American has a F-22 Raptor, free Botox treatments, and private education. Let’s see how far the money printer can take this thing.

Most of media is corrupt. Follow the money.

What do you mean by “the media”? The media encompasses lots of entities (including this website). There are plenty of media that get things right and an enormous amount that get it wrong.

People choose the media they consume. If you are distressed by the accuracy of certain media, don’t consume it.

Unfortunately there is lots of inaccurate media out there, but that is because lots of media consumers are not looking for accuracy of information, they are either looking for entertainment disguised as news or are looking for news that will reinforce their worldview regardless of accuracy.

LOL release more SPR. Then no more problems.

That will reduce gas prices just like it did it 21/22.

Also CPI = Confused Petroleum Index?

I guess if you inhale you can get good fill

It’s going to be a “fun” decade

My diesel mechanic has informed me that the deposit I gave him for ordering parts on a major rebuild a month ago wont be enough. Prices went up during the time between the estimation last month and the actual ordering (by alot!).

Yikes! I cant budget for these kind of unpredictable increases!

I would quit farming altogether, if I could. (Same with every other farmer I know). These costs of doing business are unsustainable!

Hang in there –

master XI is doing wonderful in shorting things we need

JIT

These costs of doing business are unsustainable!

so glad we have monopoly after monopoly in big business

Bayer/Monsanto – seed price per acre

Syngenta-chinese

Dow/Dupont

tell me when farmer hasn’t seen double digit price increase in seed

and equipment – wow mil here, mil there

and CANNOT FIX your own equipment

Try buying copper or brass stock for manufacturing. All the metal service centers now have the terms in place that if prices are quoted in the morning, and change by the time the product is shipped in the afternoon they can adjust the invoice to reflect the updated price.

Funny as I’ve just been telling people that Brent crude is up from $76, to today around $90, the result is petrol up 10p+ a litre from £1.33 to £1.48…..

I guess USA oil reserves are running low, so Biden had to stop.

You want to see inflation and no deflation go to CVS MIBD BOGGLING

And for those who want to see the same in the UK, may I suggest visiting your local co-op store. It’s so expensive that even the items that are reduced (due to shelf life expiry )are 50% more than other shops!

The stage is set for round 2 (or 3,4,5… :P)

Should be no less than $5/gal everywhere. Is it worth getting out of the ground anymore for less than $100/barrel?

I’d bet petro production compliance costs have soared in the past 2 years. Regulation outside of the usual law making process is a favored method of destroying that which is not wanted. Just the opposite of subsidizing that which is favored. Few talk about it in the main stream.

Another important factor: RTO (return to office)

This will keep gasoline prices up now that a lot more people are driving again.

@John Apostolatos

Not really.

“WFH” only really ever was a thing in inner cities. It didn’t reduce gas demand, merely the demand for public transportation.

Using Boston as an example, daily vehicle traffic on Rt-90 & Rt-93 had already exceeded 2019 baseline values by the spring of 2022.

“WFH” also produced a measurable *increase* in inner-city electricity demand.

I live in one of the most heavily trafficked areas in the country (Seattle), and the impact from RTO has been tremendous on congestion. Many workers are hybrid and WFH on Fridays, and you can definitely notice the light traffic on Fridays.

If you add up all such big cities together, the RTO has definitely impacted gasoline use.

@John Apostolatos,

Are you saying Metro Boston *isn’t* one of the most heavily trafficked areas in the country?

RTO happened in Boston a long time ago. Once the Delta/Omicron surge of early 2022 was over – WFH was over.

Perhaps Seattle has a greater concentration of worker among a few employers (Amazon, Microsoft, etc.) who have recently changed their WFH policies?

past weekend we left on friday – camping in mountains

the waves of traffic/RV’s/Horse trailers going up

in 180 miles I’ll bet we saw over 200 campers, 2,000 cars

on way down we had NO ONE behind our 5th wheel going 60 or less

Actually a comment to bigal….RTO has not happened yet in Boston! Financial district is dead!!! 20% commercial vacancy. There are a few more folks, but the business districts are dying. Mayor Au knows and is worried about real estate tax issues due to commercial property devaluation.

Candyman – yeah, but if you drive by any T station parking lot on a weekday, they’re completely full.

I agree the Financial District is weirdly empty, but every other part of town is busy. Good luck finding any street parking in the Seaport, for example.

This morning, my average speed coming into town on 93 was like 20mph… there was that much traffic.

It was lighter over the summer. I’m sure there’s more now with school back in session.

BigAl,

It may be a thing for companies who telework to operate out of cities, but many of the employees come from far away. I got dudes from my work driving 90 minutes each way… and some from across the country if they can’t weasel out of going in that week.

Also, since telework started, people just keep moving further away, so trying to force them back to the office will likely use more gas than before. They figure if they have to drive six hours a day twice a week rather than 2 hours a day five days a week, the little extra time in the car is worth it to get their piece of the American dream (i.e., a house not in some horrible subdivision in the greater D.C. area).

To counterpoint myself, I live an easy 2.5 miles from work in a delightful small city. I stay home (from the office) whenever I can. And to buck the trend, we just increased our telework to 70%. Covid is the best thing to happen to me in a long time…!

Kinda ironic that companies are causing increase in gasoline prices by demanding workers return to the office which results in the need for higher wages.

@MussSyke,

“Covid is the best thing to happen to me in a long time…!”

You may feel otherwise when your reduced visibility to the bosses is interpreted as a reduced barrier to the offshoring of your job.

I was in software engineering for quite some time. WFH *cratered* our productivity. I was glad I took the buyout; because my fed-up company’s leadership off-shored the entirety of the software engineering competency at the end of H1 2022.

I’m going to go out on a limb and say most employers don’t care about the quality of life of their employees. So please heed my warning.

And if you don’t, please heed this one:

Oh my….traffic on 93 this morning (Sept 6) was unbelievable heavy! Nice being in the HOV! Taking the T, horrible service. Cost of parking for three days a week is less than a monthly pass.

The fuel price in the US is heavily fiddled by the ongoing release from the strategic reserve, which at some point will have to stop because I guess the population at large will see the merits of keeping a strategic reserve as intended. Currently at a 40 year low and no plans for replenishment.

See the previous article:

In August, it began adding to the SPR but in tiny increments. Over those four weeks, it added 2.8 million barrels, one-tenth of the four-week pace during the peak of the drawdown in 2022. The refilling is so small that it is barely visible on the long-term chart.

Thanks:

https://wolfstreet.com/2023/09/05/crude-oil-wti-jumps-to-highest-since-november-as-spr-gets-refilled-saudi-arabia-russia-extend-production-cuts

Biden is no longer the price setter now that the SPR is down in the dumps. See how quickly the Saudis and Russians have cut production ? Its the reason my F-350 is being traded for a Toyota Tacoma. $6 gas by this time next year unless we get demand destruction from a recession

I think that bullet has been fired. Not sure what else Biden could try when gas prices go crazy next year…. They probably try a stimulus of some sort cuz that’s all they know how to do is make the printer go brrrrrr

Election year typically means lower gas prices but oil charts say otherwise we’ll see!

Telsa is going to be selling a ton of cars next year.

@Arnold,

Only if they are importing them from China.

@American Dream,

I think huge SPR outflows will begin again in late February. They are going to have to time it carefully to ensure the sugar shock doesn’t wear off before November.

But let’s not kid ourselves – Trump would do the same thing if the situation were reversed.

Irrelevant. You’re comparing a policy executed since 2021 against a non-verifiable hypothetical.

The responsibility lies entirely with the “big guy”… and all the Kalorama folks deciding current policy.

There is 350M barrels left still.

Plenty if you release 1M barrels a day starting some time in December. All good.

Then replenish in 25 through addition of National gas tax to support infrastructure.

going to be interesting how tings go.

Wage inflation is REALLY going to start kicking into high gear over the next couple years.

Initially, low income jobs were forced to increase wages. McDonalds in my town raised wages 33% up to $20/hour.

Manufacturing and services sector for middle income jobs are in the process of making the same push.

Unions all across the country are renegotiating for 30-50% wage hikes.

Teamsters got huge increases out of UPS. UAW is pushing for 46% wage increases from Automakers to offset inflation.

You’ll see these prices pushing much higher as these companies struggle to cope with labor costs.

The fed hasn’t done enough to destroy the working class in order to prevent this second spike in inflation.

The wage inflation narrative really bothers me because most people seem financially stressed. We went to a chain restaurant over the weekend and it was busy, but nobody looked nicely dressed or well kept.

Only the discount stores seem busy and nobody is embarrassed to shop in them anymore. Everybody looks house and car payments poor. Whatever the wages, it all seems to be going to houses and cars.

What about rent? Isn’t that supposed to be a big adjustment down in CPI due to the lag?

Rents are NOT coming down. They might rise more slowly than they did, rising 5-6% instead of 8.5%, but they’re rising and fueling inflation.

Nice chart. I was looking at an expanded version. Rents almost never go down and if so…barely. I would say they may flatline as housing prices fall after a bubble.

Of course, this is the average across the US. Some cities may see big rent decreases at times.

Wolf….

Does this dynamic mean the FED will be pressured to further raise interest rates??

INDY

They may be waiting for core PCE to go over 5% in direction of their current policy rates (5.5% at the top). Right now both core CPI and core PCE are below 5%. But they’re accelerating on a month-to-month basis. Services are hot. Core CPI will be at 5% later this year. Core PCE, which has further to go to get to 5%, may take a little longer. They know these dynamics, and they can just wait to let them play out. This will give them backing. Right now, it’s hard to politically justify rate hikes as both core measures are below the policy rates. The White House and much of the press keep saying that inflation has been “vanquished,” so the Fed can just wait a few months to let it become apparent for all to see that inflation has not been vanquished.

I would think the Fed values its reputation enough that they’ll act sooner if they think it will be necessary vs waiting until it’s apparent to everyone, at which point they’d be “behind the curve” yet again.

Yes, but I’m concerned that they want to dodge the political pressure that they get when they hike to 5.75% while CPI is at 3.3%. Powell can talk about red-hot core-services inflation all he wants to, no one will be listening, all they see is 3.3% CPI = “inflation is vanquished.” By November/December it’ll be a different story that will give them justification to pull out their hammer again. That’s what I get from the recent Fed head speeches. They want to have the obvious numbers on their side, and they will, they’ll just have to wait a few months, they all know that.

Doc…I’m not Wolf but I would say what I’M PRETTY SURE HE would say RE YOUR QUESTION….”you can bank on it!”

Real estate agents be steaming mad, because they want interest rates to go down back to 0.25% for real estate sales and commissions.

Why take on a 7% mortgage and pay 2022 prices for rental properties, while you can buy low-risk (no risk) T-bills at 5% a year?

The real estate industry has it coming. For decades it’s been non-stop one-way propaganda, influencing people to buy. Maybe they should start directing the propaganda towards sellers. It’s a great time to sell, if you aren’t leveraged out in a 3% mortgage.

The pitch should be, sell your home now if you need the gain, because the gain is set up to evaporate.

Since FOMO works for buyers, Fear Of Losing Out should work for sellers. Well, unless they are happy with their Forever Home, have an ultra-low mortgage payment, and of course, haven’t died or divorced.

I can see the RE slogan “Who wants to be a Millionaire!” Sell now and I will make you one.

“The pitch should be, sell your home now if you need the gain, because the gain is set up to evaporate”

I guess but only if one can use all those dollar bills for shelter. It’s super hard to buy right now. I had a friend and his wife get outbid again with 22 offers all over asking on a starter home last weekend in the Boston metro area.

As a matter of fact, GOOD realtors are very happy right now.

A huge number of inexperienced and non-producing agents are leaving the industry and going back to wherever they worked or didn’t work before, leaving business to the best and more experienced agents, who actually know what they’re doing.

One problem is that a lot of agents are Suzy Homemakers who sell houses out of boredom, not a need for money. They don’t quit. They suck up a good percent of the business, making it hard for somebody who needs a job to pay the bills.

“They suck up a good percent of the business, making it hard for somebody who needs a job to pay the bills.”

I’m not sure if you’re a Realtor, but I hear this from my Realtor friends. Too many Realtors suffer from a scarcity mindset. But if someone is that good, they should be able to win the business from a client , be it Suzy Homemaker or Shiny Suit Realtor Dave with the brand new Audi and cufflinks.

“As a matter of fact, GOOD realtors are very happy right now.”

Yes, the top 10% of agents and their top 10% loan partners are eating well right now. The other 90% are living on Chef Boyardee and Campbell’s soup.

Howdy Gen Z. That ZIRP thingy was disastrous and someone will get a prize for it. Probably already did get a prize…..

@Gen Z

Real-estate agents are becoming irrelevant where I live (Metro Boston). And so are mortgage rates

It’s mostly institutional buying here now w/ all-cash settlement.

I’ve actually had two such buyers *ring my doorbell* in the past month. I refused and the responses were…not cordial.

It’s starting to seem like those old stories in 1870s America where thugs hired by the rail roads would ask, then demand a homesteader sell his house to the railroad. And then burn it to the ground if they didn’t.

@Bobber: A grat time to sell at the peak, before the high interest rates cause real estate prices to go down.

@CCCB: True. The hustlers will have to find a job now that the bonanza is drying up.

@Debt-free Bubba: ZIRP enriched the stonk hodlers and caused real estate speculation, while cash savings gained a 0.10% yearly interest.

@BigAl: This means that speculators are banking on flipping the property or collecting rent if it’s in a campus town.

@Gen Z,

The institutional buyers are not speculating.

*All* the purchases are buy-to-rent right now – regardless of whether it’s a campus town or not.

That they are making these purchases in cash suggests that there is cut-throat competition among them for the few houses on the market.

How few?

I live in a town of about 26,000 people with about 5,000 saleable properties.

On August 1st, there were exactly *4* properties up for sale.

4.

… And we can expect even higher rates in the near future, once rising fuel prices push inflation up another point or more.

The fed should raise rates again in September to get ahead of the curve, but they always follow the market.

*The fed should raise rates again in September to get ahead of the curve, but they always follow the market.*

On the contrary, the markets believed until the end that the Fed would pivot. But instead, they are now following the Fed and we are seeing 10-year Treasuries rise.

CCCB,

Raising interest rates will only work if demand destruction follows.

Outside of, say, visits to Disney amusement parks – there’s no real sign of that anywhere in the economy.

Everything that uses hydrocarbons (except for domestic manufacturing) – has seen robust demand for the stuff.

“The Fed should raise rates again in September to get ahead of the curve, but they always follow the market”

Carter’s 1st Fed chief William Miller who had no experience in banking tried this in 1977. It didn’t work then and won’t work now. We wound up with double digit interest rates and double digit inflation at the same time. History will repeat itself.

LOL……after going thru transitory when the Eccles crooks and morons did not recognize inflation and the current acceleration from wage demands (just starting and not yet evident in the numbers) the ISM services index shows…….acceleration last month to 54. Yep…the recession is right around the corner. Sarcasm for those that don’t read my posts often.

Sure good to know the feds program of delay and transitory is working great. We ought to see 6-7 CPI readings soon for reasons Wolf so beautifully laid out and the labor market demanding more pay.

This QT program makes about as much sense as a garden hose used against a raging forest fire.

Seriously….over 8 trillion in printed cash and they are maturing 50 billion per month. So it should take about 7 years to soak up HALF the fed balance. Yep, that garden hose has a good chance of putting the fire out.

The crime, and it is, is that the eccles crowd knows everything Wolf has laid out and reads the news and sees labor settlements of 5-10 percent increases. The UAW is about to get a whopper. They are asking for 46% on top of a 32 hour week for 40 hours worked.

The fed response is pathetic.

Interest rates are starting to flow cash to bond holders to offset most of the inflation……which stirs more inflation.

Yes. In addition, with short term T-bills yielding over 5% why in the heck would anyone keep their money in their local bank while making decisions on re-balancing their portfolio? Hence, even more trouble for the local banks…

Sandy Spring Bank in Maryland just announced 5% interest for their savings accounts. I understand their motive but I am wondering if it is a signal they are in trouble.

No, that’s not the signal. The signal is that they’re willing to pay 5% for cash to lend it out at 7% for mortgages or at 8% for auto loans, or at 18% for credit card loans.

This is a great point. I completely agree with fred. FED almost instantly printed 4.5 trillion on top of another 4.5 trillion it printed in the last decade. Inflation will surely continue to increase. I am seeing that hourly wages are almost doubled since pandemic in northeast and workers are still unhappy, because housing cost is more than doubled. It is the best time to switch job. Don’t believe in layoff stories – they are mostly invented to push the stock prices up. Corporates are still hiring like crazy.

And just like fred said, fed is “fighting” the inflation laughable “QT”. Burning just around 50 or 60 a month. It is like extinguishing the wildfire with beach buckets, with the match on the other hand. They instantly printed 300 billion in March – pushing QT six months backwards. Just like a joke. I think banks are sure that FED can reduce the balance under 6 trillion. So, they are giving money like drunken sailors.

I would say: “And just like fred said, fed is “fighting” the inflation with laughable “QT”. Burning just around 50 or 60 a month. It is like extinguishing the wildfire with beach buckets, with the match on the other hand. They instantly printed 300 billion in March – pushing QT six months backwards. Just like a joke. I think banks are sure that FED can NEVER reduce the balance under 6 trillion. So, they are giving money like drunken sailors.”

QT since last September has been running around 70-80 billion a month. But I still agree with you guys that it is puny and ridiculous. At the very least it should match the rate they did QE – around 120 billion a month. This was deliberately designed to prop up the stock market when we actually need a stock market crash to reset the system and let Wall Street feel the pain.

Definitely agree with Kevin. When CPI hit 9% in 2022 summer, FED was still buying mortgage BS from the market, to replace the ones that are paid. That is absolutely insane.

Yes….Greenspan/Bernanke/Yellen did a number on all of us.

So long as gov’t spends and spends and spends (as Wolf routinely notes)….and the consequent debt/leveraging continues unabated….the Fed basically cannot succeed without crashing the whole house of debt cards.

There is plenty shared responsibility to go around.

“the Fed basically cannot succeed without crashing the whole house of debt cards”

Agreed

The FED has to do the equivalent of what a famous commander in NAM once said:

“We have to destroy the village, in order to save it.”

Sometimes I sit and wonder though what would have happened in 2008 if the Fed didn’t print to bail out the banks. Would it have really caused a worldwide crisis? Or maybe the fed really did the right thing and saved the economy for the time being.

I mean theoretically, is QE really a “bad” policy? It just reshuffles the deck of cards, it doesn’t really hurt people outright.

I think you are right that things might have spun downwards out of control if the FED did not act, however it is also possible that they could have acted a different (less harsh) way to also save the system. QE may have saved the system, but there were consequences that will be paid for for a really long time.

We’ll see what the CPI is next week. Very clear graphs and narrative, Wolf. Gasoline/oil prices (and by extension overall prices) are at a transition point where the downward trend is ending, and (probably) an upward trend will soon begin, but August is not likely to show a large increase, if any, and September though starting off with an increase, is usually a declining month for gas prices with decreased post summer driving/flying and the switch to cheaper winter blended gas. This point in the cycle is always fun to watch.

The government is facing another shutdown on Sept 30th which will be adverted and deficit will increase.

It looks like the deficit will double from 1 trillion last year to 2 trillion this year. Deficits are supposed to go down during good economic times.

Everything is costing the government more than they thought and the following was probably was not in any projections.

– Debt interest payments

– The government is going to give out some big raises.

– Ukraine war aid was never in the budget

– High undocumented immigration numbers. (At the start of 2023, the net cost of illegal immigration for the United States – at the federal, state, and local levels – was at least $150.7 billion.)

– IRA = The inflation reductions act is going to cost at least 1 trillion more than predicted.

– COLA for current government retirees plus Social Security payments.

This is just for 2023. This is inflationary.

America pay ‘triple’ for anything to be done because the media entrenches the psychological inflation narrative, then redo the work at 1/3 lifespan because it was never done right, 3 times the material, 1/3 the usage, triple the price, great for a not recession, recession. Everything multiple 10x but while the people producing the necessities, food and housing, get payed half due to manipulation. Land of the slaves for bullshit financial gurus and shills on tablets

Just a note: I tank up with ethanol free gas (better for an ICE). The price at the pump per gallon started to increase at least 2-3 months ago.

Where do you find e-free gas?

We have plenty of ethanol-free around here, coastal central Florida, because of the large boating community. Many stations have a dedicated nozzle for “Rec-90” as it’s called. 90 octane, no ethanol.

Ethanol-free 90octane Rec fuel, add Stabil and your generator and bail-out gasoline will last eighteen months or better in temperature controlled storage. That’s two hurricane seasons, run it through your vehicle if you don’t get a storm. about four bucks a gallon locally.

Crude just took a big jump today. This may explain the markets crashing. I believe we’re in Jimmy Carter 2.0. Next, I can see a price freeze on gasoline prices and shortages all over the country, followed by gas lines. They may bring back the country western song “The gas line blues”. It was a big hit back in the late 70s.

This weekend gas was over $6.00/gallon at every Tahoe station.

I jut looked at my Gas Buddy app on my phone and regular is $6.09 in Tahoe City and $6.19 in Truckee.

Gas is about $1.00/gallon cheaper 20 miles east of Truckee in Nevada

I posted this under my crude-oil article. We might have sat next to each other at the River Grill. I was the one that the bartender loudly called Willem Dafoe, such as “Willem Dafoe liked the hamburger,” and everyone had a blast. Wife sez I look better than Dafoe.

Gas station from hell, Tahoe City, as seen on Sep 3. Shell station behind it had the same price. EVs everywhere, and regular at $6.09 a gallon: Those go two hand-in-hand.

I noticed Wolf took my advice and changed his

“gas station from heck” to

“gas station from hell”

This was a good move.

I also noticed in the photo that the Diesel’s second digit was missing. This is because they can’t change the price fast enough. This is starting to resemble the Weimer Republic.

4-6% inflation representing the Weinmar Republic is similar to requiring someone to wear shoes in a public restaurant representing Germany.

It isn’t even close and just shows an ignorance of history.

Gas tax.

Cap and Trade tax.

Sure hope they resurrect a windfall profits tax!

CA….land of hope and dreams.

Washington State recently enacted a carbon tax and our gas prices instantly went up 50 cents a gallon. Paid $5.24 for premium just the other day.

Gas in OR re GONE IS $ 5+ LOL

Wolf,

Care to comment on how and why the inflation calculation changed in the 80’s? Is shadowstats BS? enlighten us.

Do you really believe that the things that make for a good quality of life really changed? Why change the metrics?

Everything changes in 40 years. I mean, look at your hair, LOL!

The main change was the introduction of “hedonic quality adjustments” in the 1990s.

The logic is that these products have gotten a lot better over those years, for example, going from three-speed automatic transmissions to 10-speed computer-controlled transmissions. The hedonic quality adjustments remove the costs of these quality improvements from the CPI.

Hedonic quality adjustments make conceptual sense if you want to measure inflation in the monetary sense, where inflation metrics measure how many dollars it takes to buy the same product over time. The 1980s POS car is not the same product as a 2023 model. So this price difference is not due to monetary inflation, which CPI attempts to measure, but due to the costs of quality improvements.

Here are the details, including my infamous chart F-150 v. Camry v. CPI

https://wolfstreet.com/cpi-hedonic-quality-adjustments-for-new-used-vehicles-consumer-electronics-other-products/

I’m not going to argue hedonistic adjustments – honest! – but can you mix it up with your examples? I don’t really get excited about the addition of an extra gear for my transmission, although I prefer that to having a lousy CVT!

In 1980, You could buy a push-button digital telephone for $100. Everyone did. They were cool. Then in the mid-1980s, someone at AT&T came up with the idea to put a telephone into a car and put some very tall antenna towers out there, one every 25 miles along major highways. Those telephones cost about $2,500 installed. So how much inflation was that per pre-hedonic quality adjustments? 2,400% over five years.

I had one of those. There was a big black box in the trunk, which was connected to the box bolted between the front seats which cradled the handpiece of the phone with the microphone and the speaker. And there was an antenna on the roof. I was like the coolest dude in town (company paid for it), making phone calls to France while cruising on the turnpike from Tulsa to OKC (there was a spot where the signal faded out halfway between Tulsa and the tower at Midway).

Then a few years later, someone at Motorola (?) decided to shrink down the thing so that people could actually carry the telephone in their pocket. And so now they had a telephone in their pocket, and pretty soon they could use it to send text messages, and pretty soon they could use it to take and send photos, etc.

And pretty soon, that telephone was a super-computer in your pocket that could do everything, and run your entire life, from finding dates to managing your finances, it became a universal map and navigation device, it can be used to pay for stuff, it plays music, shows videos, it can live-translate from spoken Mandarin into spoken English, it does absolutely everything. And during your lonesome moments, you get to talk to Siri. And so it’s still a telephone, but with a gazillion improvements.

And it might cost $500 or $1,000. So how much inflation is that compared to the telephone of 1980 which cost $100?

You see, that’s what happened more or less suddenly somewhere around the 1970s: technology just exploded all over the place — made possible by semiconductors, fiberoptic communication systems, the internet, wireless technology, etc. All these improvements cost money. So in reality, with tech products, there has been a constant and natural deflation.

And the system to track monetary inflation (CPI) had to capture those quality improvements that had started to come at a very rapid and accelerating pace in the 1980s. By the mid-1990s, these folks figured out how to do it, and they called it “hedonic quality adjustments.” Maybe they could have chosen a better name.

You could buy a laptop 15 years ago for $1,000, and you can buy a laptop today for $1,000 but there is no comparison in terms of speed, power, capacity, etc. That $1,000 laptop today represents power and capacity you might have gotten in a $5,000 desktop 15 years ago.

So when you compare prices from Laptop in 2008 and Laptop in 2023, and both cost $1,000, you have to remove the costs of the quality improvements to figure out monetary inflation – how many dollars it takes to buy the same product over time – and with tech products, invariably and naturally you get deflation.

I bought my first computer in 1984. It had two floppy drives, 640k RAM, a multifunction board that included a clock and five other similarly fancy functions. I also bought a daisywheel printer. The whole package cost about $4,000, which I borrowed from my credit union. Think of what kind of computer you can buy today for $4,000!

So there has been massive and natural monetary deflation in tech products, but you can only figure that if you use hedonic quality adjustments, otherwise a $4,000 computer of 1985 is the same as a $4,000 computer in 2023. And that’s just nonsense.

People who conceptually vituperate against hedonic quality adjustments and want their “Volcker CPI” (LOL) back have a screw loose. But we can argue over the extent to which hedonic quality adjustments are applied.

I find it puzzling that the price of gasoline would mean so much to so many people when it constitutes such a small part of the overall cost of ownership. After all, you just spent 40 to 50K (or more) on a car plus the costs of regular maintenance and automobile insurance.

In light of all that:

Driving 100K miles with a car getting 25MPG, fuel costs @ $5 per gallon would still be less than half the initial price of a car.

Seems to me it would make a lot more sense to bitch about having to own a car in the first place. That’s a much bigger tax than $5 gas.

yeah, yeah, freedom I always here. Freedom to roast the planet and retire in poverty and ill health because everyone drives instead of taking public transportation.

If you drive 30,000 miles a year, including lots of urban stop-and-go traffic, and get 30 mpg, you’re burning 1,000 gallons, and if they each cost $5, you’re burning $5,000 a year, and after 10 years, it’s $50,000 in gas for a $30,000 car.

And you can probably get some money out of the car when you sell it after 10 years, but the gas money is gone forever.

I drive less than 10,000 miles a year and most of it is business related and as such it is totally tax deductible. My historical Toyota gets 25 miles/gallon. So the price of gas is a negligible item in my budget. I couldn’t care less what the price of gasoline is.