With the labor force surging, did they all get jobs? No. But many did.

By Wolf Richter for WOLF STREET.

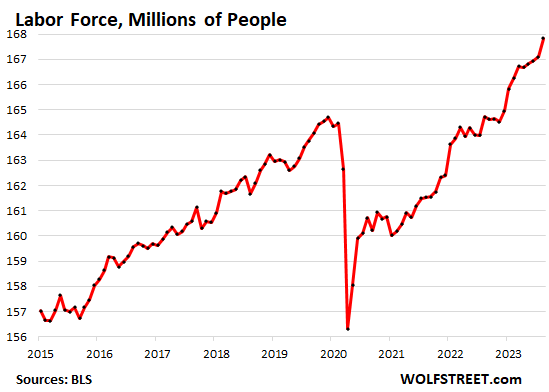

So this is interesting: The labor force spiked by 736,000 people in August, and has been spiking all year. These are people who are either working or actively looking for work.

During the pandemic, the constrained labor force was a huge problem and caused some of the labor shortages and the sharp increases in wages.

So far this year, the labor force has surged by 2.87 million people, according to data from the Bureau of Labor Statistics today. The surge started in December when the supply of labor exceeded pre-pandemic levels for the first time. For employers this growing supply of labor is good:

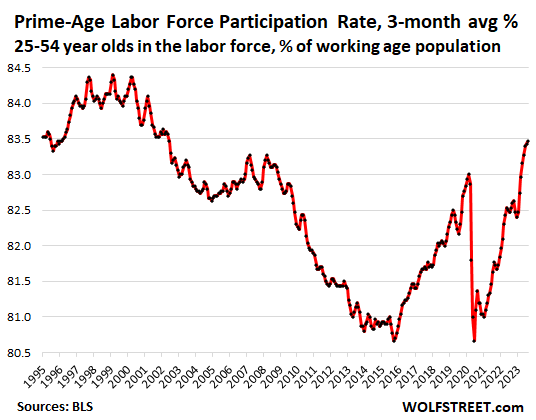

The prime-age labor participation rate ticked up to 83.5% in August, same as in June, and both are the highest since 2002 when the labor market came out of the Dotcom-Bubble period.

These are people aged 24 through 54 who are either working or actively looking for work. People in their prime working age are now participating in the labor market at a rate not seen in 20 years. The prime-age data largely removes the issues of the extraordinary wave of retirements over the past few years.

The chart shows the three-month moving average, which irons out some of the month-to-month ups and downs:

With the labor force surging, did they all get jobs? No. But many did.

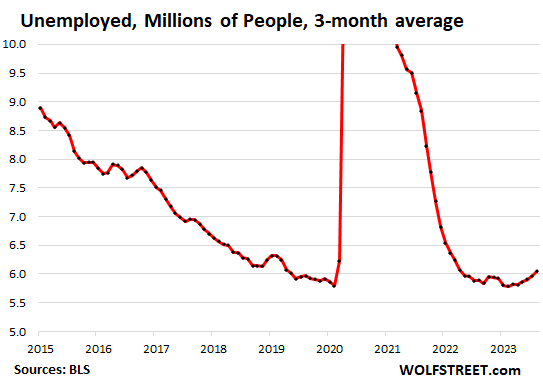

Unemployment is still near historic lows, but rising. The number of unemployed people who are actively looking for a job rose by 514,000 in August, after having dropped in the prior two months.

This data jumps up and down from month to month, so we look at the three-month moving average, which rose by 86,000 in August. And it shows the trend: a slight increase from the historic lows early this year.

The number of unemployed is a function of the surging labor force – meaning, not all the people entering the labor force now on a large scale are getting jobs:

So the narrowest measure of the unemployment rate rose to 3.8%, after having dipped to 3.5% in July. These are historically low rates. The rate has hovered in the range between 3.4% and 3.8% since February 2022.

The employment-to-population ratio was unchanged at 60.4%. It has been in the 60.3% to 60.4% range since March, the highest since before the pandemic.

The ratio tracks the working-age population of 16 years and older. It’s not capped at retirement age, so the growing number of retirees are still part of the working-age population, and so the ratio is now lower than it had been pre-pandemic following the large waves of retirements over the past three years. An aging population does that.

People found work at a solid but not red-hot pace.

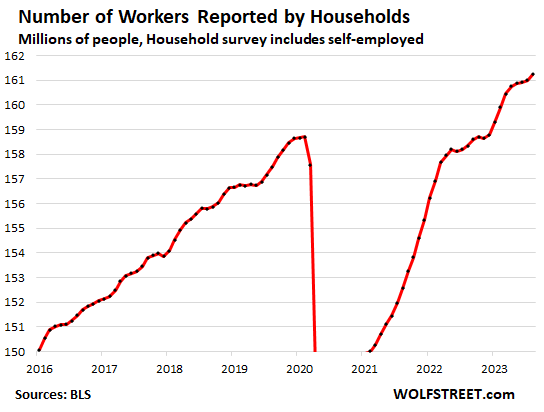

The total number of workers, including self-employed, rose by 222,000 in August, to 161.5 million, according to the survey of households, which tracks all kinds of workers, including the self-employed that are not tracked by the survey of establishments, which we’ll get to in a moment.

Over the past three months, the number of workers rose by 763,000 – which is a substantial increase. The data jumps up and down a lot from month to month, so we use the three-month moving average. You can see the sharp increases early this year, the slowdown in April and May, and now the re-acceleration:

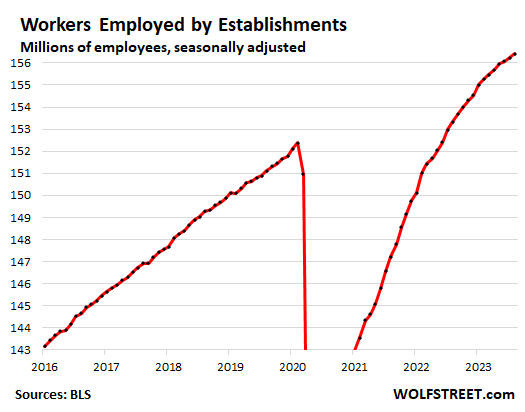

Employers added to their payrolls at a solid pace, 187,000 jobs in August, according to the survey of establishments. The total number of employed by establishments, not including many of the self-employed, reached 156.4 million:

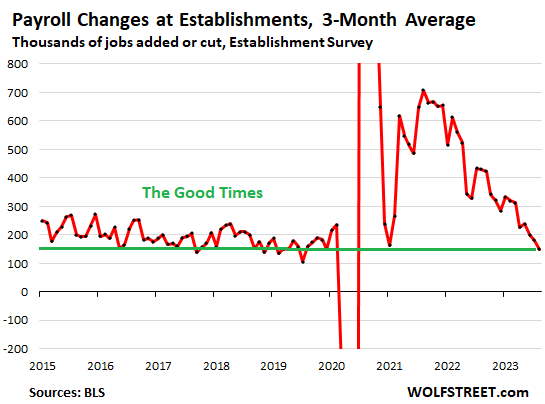

Over the past three months, employers added 449,000 jobs, for an average of 150,000 per month, in the middle of 2019-range and at the lower end of the range in the prior years during the Good Times before the pandemic.

What we have seen in other data is that the massive churn in the labor force has begun to subside, where people quit jobs on a large scale to take on a better job, triggering massive job openings that then needed to be filled by massive hiring. This historic churn is now cooling.

This chart shows the three-month moving average, which irons out some of the ups and downs:

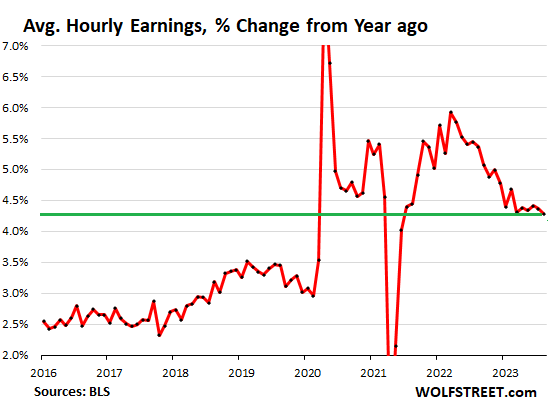

Wage pressures have stabilized at high levels.

Average hourly earnings rose by 0.24% in August from July. The month-to-month increases had ranged from 0.27% to 0.45% for over a year, but is very volatile from month to month.

Compared to a year ago, average hourly wages rose by 4.3%. The increases have been in the 4.3% to 4.4% range all year, and there hasn’t been any meaningful change. So looks like wage increases have stabilized in that range, which is still substantially higher than in the pre-pandemic years.

By comparison, the most recent Consumer Price Index for July re-accelerated to 3.3% — the end of the “disinflation” honeymoon. Pay increases have been outpacing overall CPI inflation this year, after having fallen behind last year.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Perhaps we are seeing the beginning of the dreaded wage-price spiral. Biden just said he is going to increase all civilian federal workers’ wages 5.2% for next year. The next overall CPI number will come in hot because of a 15 percent rise in gasoline prices over the last month. I know the fed likes core inflation rates, but energy costs eventually filter in some form into services.

I interpreted Wolf’s just the fact’s presentation of the reported data in a more optimistic way.

The growth of the supply of the labor force during a period that demand exceeds supply is good for we mean citizens . And wages are rising to attract the talent, as one would expect given the simple rules of the simple model of a perfectly competitive model.

The perfect conditions to ignite social creativity.

As wages go up, prices go up. In the private sector, these wage increases are passed along to the customers. Increased wages can also allow businesses to more easily increase prices, since those workers have more disposable income. There is no free lunch.

which is great when one has to pay off a high morgage

Nonfarm Business Sector: Labor Productivity (Output per Hour) for All Workers (PRS85006092) was up 3.7% in the 2nd quarter.

Maybe some room for wage increases as opposed to capital siphoned from labor.

Good sign, but that only brings productivity to 1.4% for the current business cycle (since end of 2019), below the post-1947 average of 2.1%. Wage increases have been much higher than 1.4% during this cycle. Sustainable without price increases?

Federal employee salaries move with a significant lag relative to inflation. We knew there was plenty of inflation in 2021, but our raise in 2022 was around 2%, give or take (depending on locality). Next year’s increase reflects what was happening in 2022, the last full year we had data. To put the 5.2% in context, consider the increases from the previous several years:

2023 4.1%

2022 2.2%

2021 1%

2020 2.6%

2019 1.4%

2018 1.4%

2017 1%

2016 1%

2015 1%

2014 1%

2013 0%

2012 0%

2011 0%

Wait till all the Realtors @, stagers, and house flippers hit the job. market.

Nah, guess we are headed into a no landing and a ultra soft, plushie and super comfy landing based on these data…Pow Pow did it, mission accomplished

lots of the Government money from the IRA is hitting the economy now and over the next few years. I have no idea if that will boost the economy or just keep a flow under it.

But construction minus CRE and Housing is increasing. I know of a couple of projects that are 200 million and 300 million and 4 billion in my area are just getting started and they all are using the COVID or IRA money

This will end well….as MSM, Zillow and Redfin like to tell everyone, we simply don’t have enough residential houses, we need to build build build…population and buyer demand is exploding..

I sure hope so. My house in fl is worth 3x 2020 levels and I don’t want to give it all back to recession!

Why? Ya like higher prop taxes?

I know, maybe you’re thinking you’ll move and cash out. Well, your target location is probably up a ton, too, so you’re still hosed. Better if prices fall, your taxes are cheaper if you stay put, and if you want to move, hopefully where you go has gone down more. A house is an expense, man, and lower expenses are a good thing.

Regarding the property taxes, I still find it strange that the USA still uses a percentage of the value of the house, as it can mean you pay silly amounts for literally very little….

Doesn’t France have an asset tax on all assets, not just real estate? Property taxes are very common, not just in the US.

That won’t happen until after a financial crisis/stock market crash… and how many “realtors, stagers, house flippers are there really anyways?

Most realtors are contract employees =they do not get fired and become unemployed.

= The key factor is the huge number of baby boomers that are retiring, which will continue to limit the size of the labor pool

= Labor will continue to be able to mount strikes to get much higher wages

= Profit margins will be under pressure……

combined with record stock market valuation levels

= Strong potential for a stock market crash

A lot more than you think, I think last year 1% of all labor force were labeled as “realtors”.

When the Eighties housing bubble popped, I was in a 24 desk Coldwell Banker Corporate owned office in a wealthy CT town. Suddenly, there were only enough transactions a month to support 10 good agents. When I left real estate, I sold insurance, investments, Toyotas, electronics, alarm systems, cell phones, and a few other things. The end of an era sucks.

https://fred.stlouisfed.org/series/MSPUS

1) It can be informative and instructive to look at past economic cycles for economic patterns, which are based upon human emotions. While every cycle is slightly different, basic human emotions remain the same.

2) When people feel “wealthier” they spend more…. But when their perceived wealth drops below a certain level, they then tend to spend less. And lower consumer spending levels can then have negative feedback loops as businesses spend less and lay off workers, which has a negative feedback effect upon consumption levels.

3) Overall Debt levels/leverage, liquidity levels in the banking system, and stock prices, are also major economic factors that can exacerbate typical economic cycles.

4) Huge inequality in wealth in our society = huge amounts of liquidity owned by the top 10%, with the stock market acting as the best measurement tool for perceived wealth of the top 10%. So, large increases/decreases in stock market levels also have significant feedback loop effects upon the economy. Therefore, it should not be surprising that the surge in stocks this year has boosted spending levels over the last few months…. And it should not be surprising if a crash in stocks causes spending to drop.

5) There was a massive 48% increase in the median value of houses from Q3 2020 to Q4 2022.

= A dramatic increase in perceived wealth for the average American.

6) To put this surge in home prices into perspective during the period from Q3 2003 to Q1 2007 leading up to the last real estate debacle, median home prices rose about 34%.

7) Furthermore, during this recent bubble the U.S. Govt. and the Fed flooded the system with liquidity/money on a scale never seen in history.

5) The last recession started in Q1 2008, just about 1 year after home prices peaked and started declining, when they were down about 9% from their peak.

6) As of Q2 2023, median house prices have declined by about 13% from their peak.

Conclusions:

A) Based on a rapid decline in perceived wealth( based on the decline in home prices), and the lag of about 1 year from peak levels, it is reasonable to expect a recession to start in Q1 2024. If the stock market has also peaked, and starts a significant decline, that would also tend to have a negative effect upon spending and the economy.

B) The average consumer tends to be overly focused on the price of gasoline… The recent increases in gasoline prices and continued increases in the price of Oil will probably also weigh negatively on overall consumer spending going forward.

C) A strike by the UAW would have huge ripple effects upon the millions of other workers at non union businesses that depend on orders from the big 3 auto companies, and upon millions of other people that provide goods and services to auto industry workers.

D) Last but not least, a federal government shutdown would affect tens of millions of people who have govt linked jobs, and upon the tens of millions of people that provide goods and services to them.

Bottom line:

Touting the spending ability and “wealth” of Americans at this time is akin to driving while staring into the rear view mirror…

= You know where you have been, but you have no clue where you are going.

Job market strong but the 3 month average looking for work is rising. No alarm bells as Fed has no reason not to give us another .25 percent please

The Federal Reserve will likely increase rates at least another 1% but that won’t do anything to stop rampant and egregious price gouging.

1%. You sound like Bullard from Dec ’22. I’d love to see that happen, but it’s doubtful. 50 more basis points is maybe 50/50. Hell, the CME Fed Watch shows 94% for a Sept pass as I type this while the Fed GDPNow has spiked to 5.9%.

I agree there’s egregious price gouging, but another 100 basis points is not likely IMO. I’d love to hear what makes you think this will happen. EVERYONE seems to be concerned about an overshoot. Sounds like “transitory” to me.

Granted, the labor market does appear to be a ways off from cratering and housing is certainly un-concerned with 7% mortgages. But, I for one don’t think anyone is getting 7% these days. They’re all temporarily buying it down with either their own money or a builder or they’re getting some sort of ARM.

Would love to see a lot of these rates start resetting next year with higher for longer still in affect.

I think even Powell has realized there is no relationship between inflation and employment rates.

Canada is heading into a recession. 0% growth this month, -0.2% annualized, despite record population growth and the body packers in Ottawa giving student permits like candy.

This is what real estate bubbles do to an economy. America, despite its flaws, is a very innovative and diversified economy.

Also don’t forget that 20% of borrowers at Canada’s big banks are on “negative amortization”. They pay what they can of their mortgage (less than the interest) and the mortgage term *increases*.

TWENTY PERCENT.

And that’s the latest figures, every month more and more people come off their 5 year fixed rate and onto the new rates.

“Invoosters” are banking (no pun intended) that the unlimited student permits will generate real estate passive income, by packing dozens of people inside a basement on a cash basis.

The slumlordization of Canadian housing is a sickness to the quality of life for a developing country. At least people living in real slums hardly pay any rent. They squat on the land.

All the basements in Brampton and Scarborough are full and at capacity of 15 dwellers downstairs and 15 dwellers upstairs. Soon renters will be living in peoples’ garages. In Vancouver renters already live in tents in peoples’ backyards.

Almost unlimited tax-free income for the land owner class, while the taxes for the working class have to go up to pay for strain on the grid.

A short while ago, some one was trying to rent out a hall closet (just big enough to sleep with a cot – no twin bed) in Vancouver for $1,000/mth

Canada is always in a recession to hear them tell it. Meanwhile they enjoy one of the highest standards of living in the world. Has Canada been on a QE keggar ? Yes they have

Will the hangover be painful ? No doubt.

Canada has all the natural resources required for a fine Canadian life for at least the next two centuries.

The big money is hovering in the wings to buy when the people are forced too sell.

Natural resources mean nothing if the Govt taxes and taxes you for using them.

Coincidentally just before the Bank of Canada rate decision. Figures pulled out of a hat so Tiff doesn’t have to raise in September. I hope the speculators really put it good to the Canadian dollar to teach the Bank of Canada a lesson.

A negative interest rate differential means that parking investments in USD is better than CAD.

Why would someone invest in 5% Canadian bonds, when the US is higher?

Lower loonie means $20 CAD California cauliflower this winter.

100% correct. BoC cannot “pull a rabbit out a hat”. CAD is tiny, they are bound by the market. They are not the USA.

Depreciation in CAD will hit the retired. This will then have political consequences.

There is no easy way out.

A different angle, but companies seem to be overheated with investment, causing these excessive job problems.

“The rule in the US is that corporate bonds are “securities” and corporate loans are not.” Bloomberg.

It seems like these loans are being packaged in funds that small investors buy, the rationale for the “securities” determination. Perhaps making these corporate loans into securities would produce a more prudent flow of capital into those companies, reducing the overheated labor demand.

Good point. Security, for a while, meant an investment which value can be based on a predicable criteria that can be ascertained by analyzing the three financial statements, the income statement, the Balance Sheet, and the statement of changes in cash flow.

Systemic fraud is always solved by slight changes to the accounting requirements. For instance, America’s financial infrastructure was technically bankrupt until the FASB agreed to suspend the mark to market valuation of the balance sheet assets.

The assets the crooks couldn’t sell were the lowest tranche of the MBS that the had sold. The credit quality was so bad that they couldn’t sell them so they sold them to themselves as assets;

Much of the regulatory structure, designed to protect individual investors was codified during the great depression by the Pecora commission.

It’s almost a Goldilocks economy. If inflation is cooling.

According to WR various articles , inflation is not cooling and because of base effects, it’d print higher. The Govt and Consumers are spending like drunken sailors.

If FED thinks the same as what WR is putting out in his many articles, the Powell should shock the system with 50bps hike. I don’t think Powell would do it.

It is my opinion that if not in the near future, then after some time FED would pivot.

I can say it on the basis of 30 year observation of what happened here.

Govt inflation metrics are highly manipulated. The real inflation on the ground is quite high. I don’t say this, but many posters here feel the same.

Thus Govt can easily control inflation use their metrics.

FED would need to keep printing to fund the deficit and keep rates low.

WR does agree with my views and may ban me here :-).

“should shock the system with 50bps hike.”

a 50 basis point rate hike at this point is inappropriate. Rates are already high. Easy does it at this stage. No one needs to be “shocked.” 25-basis point increments are enough. If one is not enough, then another one later, and see what happens.

“FED would need to keep printing to fund the deficit and keep rates low.”

This is your typical BS with which you have started to troll the comments some time ago. The Fed has been doing QT for a year, the opposite of printing. Not sure how you missed that. I block this kind of crap. Post it on X, that’s where BS belongs.

“Rates are already high”

Really ? Powell’s 5.5% Fed Funds vs Volcker’s 20.0% …..

Inflation back then was four to five times higher than it is now.

Thanks WR for your response.

I was drawn to this site in 2016 when you were posting articles about bad state of Miami condo market. I was doubtful even that time but time redeemed me.

Now we know the current prices of Miami condos in comparison with what it was in 2017.

I love your analysis and awesome data points and appreciate the hard work.

But I think with all these awesome data and analysis you are missing the forest for trees.

You micro analysis is unbeatable for sure.

I hope I am wrong this time 😀

Just because the Fed’s balance sheet, after dropping for years, will eventually start rising again years from now at the rate of its liabilities and the economy — as I said it will many times — you don’t get to keep spreading BS like this on my site: “FED would need to keep printing to fund the deficit and keep rates low.”

You don’t get to promote anything on my site. RE articles bring out the RE trolls. EV articles bring out the oil industry trolls. Articles with San Francisco in the headline, bring out the feces-and-needles morons. Articles about inflation in Europe bring out the Russia trolls. It never ends. And when I lose my patience, I just delete them and block them.

“Govt inflation metrics are highly manipulated. The real inflation on the ground is quite high. I don’t say this, but many posters here feel the same.”

I agree.

The services inflation is way more than what Wolf is reporting. It’s more like double digit and climbing. Most of the data released to the public is from the government. Need I say more.

Using the 1980’s definition of inflation the rate the past couple of years was about the same as it was in the early 1980’s. Guys like Peter Schiff on youtube tell the real story about inflation.

Rico:

No cigar! Inflation, rather than cooling, is stabilizing!

A high level of inflation and Gov’t stimulus is still here. There’s an election in about a year: So government MUST prop up the economy!

They cannot restrain energy prices, wage prices or exchange rates.

Powell is reluctant to keep hiking, and would rather rest, as that makes it easier to pat one’s back.

Also political and economic pressure (banks failing, elections, and the profiteers) are clamoring for the pause indefinitely. Not caring if it is actually fueling the next major bout of inflation.

J Pow is idolizing Volcker, in Bernake’s suit!

Right! Just the past few years, the Fed gave us 20% CPI inflation, 100% asset inflation, and at least 100% money supply inflation. They are expert inflators.

Just about everything in the grocery stores that was priced at a dollar or less has more than doubled in price. I remember back in the 1970’s when a can of pop went from 10 cents to a quarter in the vending machines.

Inflation is increasing, not stabilizing even. The Fed is behind the curve by 2% which may become Volker’s panic if they continue to maintain the asset value bubbles in stocks, bonds, and housing.

Allowing the reflation of the stock market bubble, IMO, was a foolish rookie, unforced error. Powell needs too punish inflation which means to krimp demand, the only hammer available.

Love your comments, dang, but crimping is done with plyers, not a hammer.

SPX 1 month is hugging a support line coming from : Oct 2011 to

Feb 2016 low, forming a V shape at the top.

Sept is outside, but it might turn green and rise for a while for technical reasons.

Corporations are now firing and preparing to fire millions to tens of millions of people and this is particularly true in the financial industries including all major banks.

Wolf: Some questions based on data, graphs:

I don’t know why all numbers begins from 2015 or 2016. But let me ask based on those numbers:

1. Labor partipation increased by approximately 1.5M every year since 2015. We keep hearing, the country is getting old, baby boomers are retiring. So where from we got the increase? Our women started making instant worker age babies, immigration….?

2. Labor participation rate started going up since 2016. King Trump effect? Like pensions taken away, freebies gone, our working population got some religion, inflation not acknowledged then having an impact on the population etc.?

3. Great employment numbers — QE must have been doing wonders. What QT means in that respect?

4. Rate of workers employed by establishments seems to be going down. Perhaps an indication of what is ahead with higher IR. Only low wage jobs go8ng forward?

Thanks.

1. Mainly Population growth, which runs close to that rate.

2. Millennials, the largest generation ever, fully became part of the workforce, Gen Z now following behind.

3. QE did nothing for employment. QT won’t hit employment either.

4. nonsense

That’s an incredibly measured response to very obnoxious (and dumb) questions. Apparently, with respect to #2, DR_ECE_Prof_FinanceGuy doesn’t know Trump took office in 2017, well into the spike on the labor participation graph.

*QE did nothing for employment. QT won’t hit employment either*

Wolf,

Besides a recession, what else could weaken the labor market in your opinion?

A boost in immigration like Canada is trying to do to push down wage growth. Third worlders don’t demand big wage hikes especially the ones illegal in the country. The basements of Brampton house those illegal ones who keep wages at a minimum.

The Real Tony,

*A boost in immigration like Canada is trying to do to push down wage growth.*

My question was,

Besides a recession, what else could weaken the labor market

The increase in immigration does not lead to a decline in the labor market, but on the contrary to its tightening.

Because I see no way other than a recession to calm this market I asked this question.

However, it is obvious that there is no other way than recession.

My takeaway is that high inflation is driving people back into the labor force, which explains the 4M labor force increase from 2019 until now.

What happened during that time frame? The value of savings and pensions lost 25% to inflation. In addition, future prospects are not bright. Aspiring retirees are putting little faith in the Fed’s ability or willingness to control inflation.

The Fed has ALWAYS said it would be vigilant in the face of inflation, and they’ve ALWAYS said they have the tools to control inflation. Yet, we’ve suffered 25% inflation in four years.

Fed leaders, what happened? Why do your actions not reconcile with your words? Your words and expectations seem very unreliable and unrealistic.

I literally talked to a guy last night that had just re-entered the work force.

Prime age (younger than me? Mid-30s?), with the pandemic circus had just decided to hangout with his young family.

NOW, broke: back to work!

Anybody who didn’t put 4% inflation and stagnant stock/bond prices into their retirement forecast is getting a wake-up call.

I shiver to think how many well-paid financial advisors built in 8-10% stock markets gains and 2% inflation. Either they were negligent, or the Fed was negligent.

The problem with that analysis is that savings and (especially) pensions have NOT taken a 25% hit over the past four years. In fact the DJIA is up THIRTY percent since September of 2019 (four years). Basically the markets got ahead of themselves as Pandemic Money hit… but they haven’t exactly FALLEN as a result of inflation… they more or less moved sideways since May of 2021.

And that is exactly what the Fed is trying to engineer with its “Soft Landing” approach IMHO… trying to get asset valuations to remain much the same while they crush inflation. I wish them all the luck in the world but I doubt they can pull it off without a mild recession.

You seem to equate pensions with stock values, which is incorrect. From the standpoint of the recipient, pension income is a fixed payment. If stocks go up, the pension payment stays the same. Many people who retired four years ago saw the value of their pension payment erode 25% as inflation has blossomed. I believe the Fed views high inflation in this debt saturated economy as an acceptable result, if not a desirable result.

That assumes that retirees with pensions don’t have Cost-of-Living Adjustments in their pension plans. But that would be a real rarity. Most defined benefit plans are government-employee plans that have some form of automatic COLA embedded in them… the rest are done as a matter of routine by legislatures.

For private sector workers, unions will have negotiated those in them as well if the company is unionized… and probably have them in the multi-employer union-run plans also.

As for 401K plans (which the majority of non-unionized companies have)… they ride up and down with the markets. As I said above… those markets are roughly even with where they were four years ago. It just depends on how much you took out and when as to whether you are doing better or worse.

That is not to say that some pensioners aren’t hurt by rising inflation. For instance, retirement plans that have been taken over by the Pension Benefit Guaranty Corporation (PBGC) do NOT have COLAs.

This assumes that most retirement savings are held in stocks. They’re not. The bond market is 3 times bigger than the stock market, and this doesn’t even include cash, so by definition, most “savings” are not held in stocks.

Yes… but bond funds haven’t taken a 25% hit OVER FOUR YEARS either. They may be down that much from TWO years ago… but they were artificially inflated during the pandemic too. My guess is that funds swapping out low yielding short-term bonds for higher yielding ones are propping them up. But who really knows? The point is that the damage is not what was stated above.

Here are two examples I found quickly on the internet…

State of Utah Retirement Bond Fund

https://www.urs.org/historical-unit-values?code=D

USAA Mutual Funds Intermediate Term Bond Fund

https://www.thestreet.com/quote/USIBX

Your mileage may vary.”

” high inflation is driving people back into the labor force”

The only way to beat inflation is to stay in the work force, even after retirement. Double/Triple dipping works to combat the price increases which are running way above double digits. You get your retirement income plus the wages which are also going up with inflation, and now you get interest on your savings.

From a strictly financial perspective, this may be good advice, but it ignores the simple fact that most people don’t want to spend the final years of their life slaving away “for the man” or waking up one day to find someone half their age is their boss.

Aren’t you just a cute little troll trotting out all the BS fake news drivel about shadow unemployment, market manipulation, and explanations of things you can’t understand (like how oil prices and gas prices are not always directly correlated) and immediately go to this brain dead script about men behind curtains.

Sorry you fell on your head and qualified for disability in your 30s, but if you keep going with this BS, Wolf is going to give you a matching dent on your can as you get kicked out of here.

Glad to hear things are starting to make sense, I don’t know what to make of talk of covid money fueling huge new investment, if true great but wasn’t that $$$ 3 years ago. It wasn’t socked away? Wasn’t spent, New covid money, what am I missing?

The bogusly named $1.3 trillion ‘Inflation Reduction/Boondoggle’ Act which is pouring fiscal stimulus into the US economy with borrowed money which vastly increases the federal debt.

I got a grand total of zilch. All these people who got free money should be paying all of it back to bring the inflation rate back down. I could have filed for disability in Canada at age 35 but I didn’t and retired at age 35 instead almost 30 years.

“By comparison, the most recent Consumer Price Index for July re-accelerated to 3.3%”. Yes, from 3% in June, but down from 3.8% in May and 4.3% in April. Aren’t you playing a little fast and loose with the numbers here, Wolf?

What’s your problem? CPI bottomed out in June and is going higher from here for the rest of the year. Everyone knows that: base effect, end of energy price collapse, and end of health insurance adjustment in October.

As you’ve made abundantly clear, Wolf. I can’t think of any other source that has identified that likelihood.

Thanks for the reminder. It’s easy to lose perspective reading one article after another.

Thank you for saying that. I literally wouldn’t know about any of those if I wasn’t reading WolfStreet.

I don’t know what inflation will do next year. It has surprised me many times already. But I would take a bet that August and/or September will fall this year.

You’re in the right place Rick – I’m surely not the only person here willing to take your money.

A cheaper option for you would be to copy the following into a search engine:

“wolf street” “base effect” “energy price” “health insurance adjustment”

I went by my “Gas station from hell” yesterday and didn’t notice any price increase. Regular is still $4.79/gallon. Crude has gone up $15 a barrel and no price increase at the pump? What’s going on here?

The world price of gasoline declined from around $2.80 to $2.59 during the month. The man behind the curtain must be manipulating the price of gasoline to stave off any recession.

It’s easy to forget that gas prices have a strong seasonal component which is highly (but not perfectly) correlated with miles driven. In “normal times” one expects US gas prices to peak in Jun/Jul (driving season) and trough Jan/Feb (nesting season).

An optimistic observer might see signs of a return to “normal times” in this data. I’m not there yet.

And logistics, sometimes very local ones. But especially when rivers force barge to run half empty, or a storm takes out a railway there are often locally higher prices without a change in the crude price.

Swamp “no price increase at the pump? What’s going on here?”

Maybe because the price is already inflated. We are paying minimum $3.29/gallon regular in North Texas.

First of all, gas prices are dependent on oil prices and oil prices are subject to the manipulations of OPEC… not a “free market” at all. In fact as I write this the headline at OilPrice.com is “Oil Soars Above $90 as Saudi Arabia Extends Deep Output Cuts”

Secondly, there is less driving going on as kids go back to school in August.

Lastly, crude prices are NOT up $15 a barrel. You have to go back two months to find crude prices below $75 a barrel… and gas prices were much lower two months ago as well according to the EIA.

Today’s tight labor market in part reflects a postpandemic shift in bargaining power. Businesses boosted worker pay as they struggled to staff up following lockdowns. Americans surveyed by the New York Fed in July expected annual salary offers in the subsequent four months of about $67,000 upon receiving a job offer, well above $60,000 a year earlier.

——-

11% increase.

Wolf, what do you think the mutual interaction of wage increases and increased mortgage interest rates do to HB2? Do you think the market will continue to unwind from the peak over the next several years, or will increasing wages counteract the burst?

This story is a Rorschach test.

Ppl who view the strength of the US economy is from Main Street see this as good news. Those who see our strength from Wall Street view wage gains as a mortal threat.

There is a bigger story beneath this one abt the velocity of money on Main Street (from wages) vs on Wall Street (from investments) and their impact on GDP.