Psychological effect of the barrage of layoff news? Workers give up some of their new sense of power, keep their nose to the grindstone, and quit quitting.

By Wolf Richter for WOLF STREET.

More and more data point in the same direction: After all the breathless headlines about global layoff announcements, and after seeing some actual layoffs, employees have gotten a little more worried about their jobs, and they’re quitting their jobs less than a year ago, and because fewer workers are quitting, there are fewer job openings that they leave behind after they quit, and therefore fewer hires to fill those newly vacated jobs. At the same time, actual layoffs and discharges dropped back to the historic lows of 2022. In other words, all this scary talk of layoffs has reduced the churn in the labor force, and for employers, that’s a good thing.

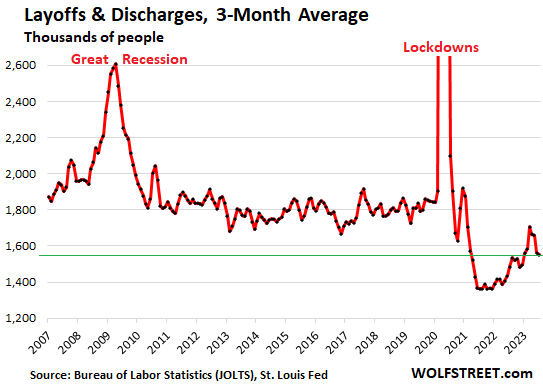

Layoffs and discharges remained in the historically low range of 1.55 million in July for the fourth month in a row, down from the 1.7-1.8 million range in January and March. The chart shows the three-month moving average (1.55 million for July), which irons out some of the artificial drama of the monthly ups and downs.

During the Good Times in 2014-2019, layoffs and discharges averaged 1.8 million per month. That was part of the normal way of business. During the Great Recession, monthly layoffs and discharges blew past 2.5 million. In March and April 2020, they averaged over 10 million.

This data is based on surveys of about 21,000 work sites, released today by the Bureau of Labor Statistics as part of its Job Openings and Labor Turnover Survey (JOLTS). This is not based on the layoff hype in the media.

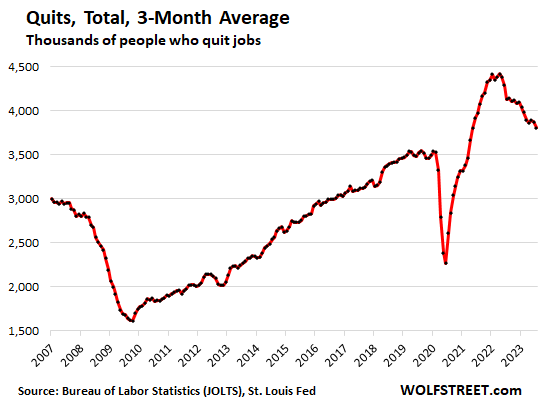

Workers quit quitting: Voluntary quits fell to 3.81 million (three-month moving average) in July, the lowest since May 2021, but still above the Good Times average in 2019 of 3.5 million.

The reduction in quits shows that workers are less confident and less likely to walk out if they don’t like something, and more inclined to stick it out and keep their nose to the grindstone, a big relief for employers, that then don’t constantly need to hire people to fill the newly open jobs. The layoff-hype in the media, and the actual layoffs, clearly had the effect to scare more workers into having second thoughts before quitting.

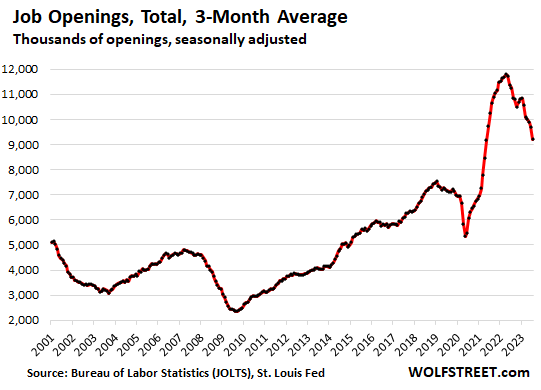

Job openings, driven by fewer quits, fell to 9.2 million in July (three-month moving average), the lowest since May 2021. This is still extraordinarily high, indicating that a number of industries are still struggling to staff up to meet demand, but it’s down from the crazy levels of peak-churn and re-staffing in early 2022.

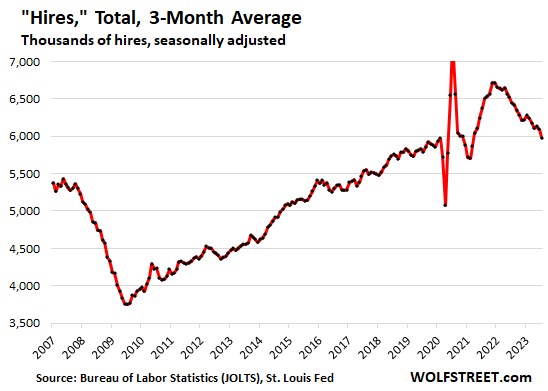

Hires, driven by fewer quits and therefore fewer newly open positions, dipped to 5.98 million in July (three-month moving average), the lowest since March 2021. July was just a tad above the pre-pandemic record:

These are signs – declining and historically low layoffs and discharges, declining but still high voluntary quits, declining but still very high job openings, and declining but still high hires – that the massive churn in the labor market of 2021 and 2022, when it was difficult for employers to hang on to their workers, is abating, in part as a result of the psychological effects of the heavily promoted layoff announcements in the media, and of the layoffs themselves.

It shows that workers have given up a portion of their newly found sense of power in the labor market, and they’re more likely to hunker down, put their nose to the grind stone, and get the job done, rather than quitting for the greener grass on the other side of the fence. All it has done is reduce the churn.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Looks like people are expecting a continued migration back to the 2019 state of affairs. Low unemployment, low growth, high asset prices.

The only difference is everything cost 25% to 50% more, asset values are 30-50% higher, and wealth concentration is brimming.

Quiet Quit Quitting…?

Bobber,

1. growth in 2019 was not “low”: real GDP grew 2.1% which was pretty good for the US.

2. So far in 2023, real GDP has grown a lot faster than in 2019. Q3 so far looks outright hot.

3. Asset prices have come down across the board from the peak in late 2021 and early 2022, cryptos by over 50%, S&P 500 -7% since Jan 2022; Nasdaq -16% since Nov 2021. Housing also peaked in Jun 2022 and has edged lower.

4. “The only difference is…” Nah, the BIGGEST difference is inflation and interest rates, and all they bring. Interest rates are over 5%, and inflation is accelerating again, and interest rates will stay higher for longer.

5. Wages have seen the biggest increases in 40 years, and wage growth is re-accelerating, which will push consumer spending, GDP, and inflation even higher.

6. So Everything has changed.

I agree with all of this, but asset prices haven’t come down even close to enough to restore any societal stability.

Thankfully, this stuff doesn’t happen all in one day. That’s catastrophic. Spread out over many years is the ticket so the economy can adjust to it. There are lots of real-world models for that.

While asset prices remain totally detached from wages there is *zero* point in the vast majority of people trying at work.

I’d suggest that not restoring asset prices in line with wages in short order will be catastrophic.

Please support

It would be nice to see all of the graphs on one composite graph to see the “timing/motion” between each variable.

Bi-Polar labor market?

Today Walmart announces Pharmacist pay and hour cuts on CNBC. Turns out fat reduction drugs created long lines and much lower profit margins due to $1,000 per month pricing. The irony isn’t lost on the $1.38 combo 30oz sugar laden soda and 1/4lb left-over cow parts wieners sold next door at Sam’s club. Everyday low prices, perhaps buy one combo, get one free fat reduction pill???

Yet on June 6, 2022 (per CNBC) Walmart raised wages of Pharmacists in tight labor market.

Yet remember folks, the world’s richest family cares…wink, wink…one wiener at a time…LOL

Ya know, it’s funny but I go to Costco that has similar fare (hot dogs, pizza, and sugary drinks) and I walk by it without batting an eye. So, whose fault is it? The purveyor (who is providing what the customer demands) or the customer (who can’t shut his pie hole)?

I vote the latter.

Our local “gluten free” donut shop (that’s been open about 4 months or so) just folded. Sitting between a Pei Wei and Chipotle didn’t solve the lack of customer demand – probably an offshoot of high cost and a product that was the answer to a question no one asked.

The larger question is why people feel compelled to take a drug to lose weight when simply moving their ample derriere would likely be better for them.

El Katz,

I know why the gluten-free donut shop closed. I had a gluten-free beer once at a restaurants (in Crested Butte, CO?) where that was the only beer they had, and it was undrinkable.

This gluten shit is getting WAY out of hand. Peripheral Neuropathy/zero gluten cure is half in people’s heads and half in their lifestyles…or some combo…..the famed “metabolic syndrome”!

Makes many $$$s, though, which is what our sick society is ALL about, anyway, so I guess I shouldn’t disagree with those achieving the American Dream through gluten/gluten related investments…..sorry.

Except for the gluten effect as demonstrated on South Park…..was pretty bad.

Oh yeah, “metabolic syndrome” is doc speak for you are FD up to some degree, and it’s all beyond any comprehensive understanding….but we’ll give our favorite organs/diagnosis/drugs a shot/Rx, anyway….can’t keep saying lose weight, diet change, and exercise. May not even know what last guy tried…….no big deal.

Thankfully our local cake shop makes selecting our slice very easy: ignore all the ones marked gluten free, vegan, organic or any other code word for tastes like flavored cardboard. Only 1-2 choices left. Perfect!

…think perhaps those questing for free gluten mightily outnumber those questing for gluten-free…

may we all find a better day.

I think you’re correct that some people, mainly those with assets, are hoping for this outcome. However, the combination of high asset prices, high costs, and low unemployment will probably continue to put pressure on wages to go higher. Under those circumstances, I doubt there will be a return to 2019 interest rates. At some point, higher interest rates will impact asset prices.

Is not the real wage important? Higher nominal wages are unimportant as purchase power reduces. In the long this will lead to increased unemployment as long as productivity increases. With higher regulations this can be avoided

Real wages are up this year, they’ve outgrown inflation by a good margin, and they’re re-accelerating.

In my hood, people with minimum wage, their wage has increase by 50% or so and keeping up with inflation.

People on the higher end of wage spectrum ( 200K or more ), they got raise of 15% of so in last 3 years.

Wages may have gone up but inflation wipes it. I got an increase and it’s not even enough to cover the increase in rising costs

The “Number of unemployed persons per job opening, seasonally adjusted” is still at multi-decades low level

https://www.bls.gov/charts/job-openings-and-labor-turnover/unemp-per-job-opening.htm

= The Labor market is still extremely tight

= Why union settlements are seeing dramatic wage increases in new contracts.

Which is not what was happening in 2019

= Investors are delusional……

The U6 is also still below 7, we have people jumping ship to a new position the first sign of ill content.

Investors are not delusional. So far, they have done quite well for themselves.

QQQ has risen 100% in the last 5 years.

People tout the piddly 16% decline in NDX last 1 year or so but the overall trend is going up and up if we can see the trend.

Since last week, market overall direction is going up and up as investor knows very well Powell would bend over backward to keep the party in equities alive.

Don’t take my words, look at the data.

1. Look how markets have performed in last 5 years ( stock market or real estate ).

“Since last week, market overall direction is going up and up as investor knows very well Powell would bend over backward to keep the party in equities alive.”

What’s the basis for this?

To add to my comment, we’re not talking about the last 5 years, which included $5 trillion in printing that no one could have anticipated (other than the Fed governors front running the market).

We’re talking about owning stocks TODAY. Today, one is choosing to own stocks with a dividend yield of what, 1.5%, with P/Es at nosebleed levels, all while the risk-free rate is 5.4%.

Replying for Einhal:

The same basis FED keep ZIRP and QE for last 10 or more years.

The inflation is going down.

Last year it was at 9 plus percent and now it is quite low.

It is not yet at 2% but this can be easily manipulated.

Otherwise, there was no reason for Powell to have a 1 month pause.

” TINA (“there is no alternative”) has been replaced by TATA (“treasuries are the alternative”) – credit provides equity-like returns with little risk or volatility. The 1-year U.S. Treasury note yields 5.529% compared to the S&P dividend yield of only 1.55% – that’s the largest gap in nearly two decades:”

History demonstrates that “price is not truth” as, at times, markets deviate from reality.

So was it in early 2000, in the Fall of 2007 and in late 2021.

===========================

Looking backwards is not the way to the determine whether investor’s current expectations are delusional or rational.

>>>””the performance represented is historical” and that “past performance is not a reliable indicator of future results and investors may not recover the full amount invested.”<<<

I don’t agree with this. First, it kept rates at 0 for ten years because CPI inflation was low. Now it’s not “quite low.” It’s actually stubbornly stuck around 5-6%. Second, there seems to be an understanding now among a lot of people, including the Fed (although they won’t publicly admit it) that years of ZIRP and QE were a mistake.

I wouldn’t invest on the bet that ZIRP and QE will be back soon, which is what the equities market is “pricing in.”

jon,

“Powell would bend over backward to keep the party in equities alive”

Either you’re being silly again, or you’re abusing my site to spread BS propaganda (trolls do that).

Where my brother works was$20 a hour to start new hires $18 let’s just say new hires aren’t happy no incentive to work . Equals churn.

Makes perfect sense, as usual. If course, those still high on pivot hopium are already proclaiming that the “weak job market” will cause the Fed to abandon their inflation hikes.

Any day now. Yup, any day now… any… day… now.

I guess some people just don’t get it.

Abandoning inflation hikes isn’t enough. Keeping rates where they are will do tons of cleansing to our zombies, of which there are a LOT.

They’d have to return to ZIRP for the narrative to make sense.

Not even the long-term bond market can come to a consensus whether the pivot is inevitable or hopium.

Over just the last 3 weeks, the 10Y soared 25 basis points (0.25%), then dropped back down. Huge volatility.

Wolf, The charts you provide are a much more realistic way of putting the current situation into perspective. Thank you!

1) Despite less voluntary quitting, the labor market is substantially tighter than anytime in decades, ex of the last 2 years

2) Combined with baby boomers retiring at a very rapid pace, as compared to younger people entering the labor force.

3) Combined with all the govt. reshoring policies, and limited immigration policy.

4) Combined with surveys showing general support for unions at multi-decade highs

= More large companies and industries will see strikes that are settled with very favorable new labor agreements (see recent UPS & airline labor agreements)

= More non-union company workers will choose to unionize

========================

Bottom line:

A continuation of higher wages and benefits for workers

= fuel for more inflation

= lower profits margins for companies

= lower future stock prices

Meanwhile investors have still not put the current situation into

the proper perspective, as stocks trade near record valuations.

= Strong potential for a reckoning…

= stock market crash

I think the slowing in quitting has multiple reasons, not just the “scare” that the headlines created. The self-confident made their moves early and are less inclined to job hop now that they’ve wound up in a better place, many with hybrid or remote working arrangements.

I also think that jobs data misses the impact of gig work. I wonder how that skews the data.

I agree that part of the decline in “job hopping” is because the people that did it now have jobs that are a better fit. Whether that is pay, hours or person interest, etc.

“Thus, the willingness of workers in recent years to trade off smaller increases in wages for greater job security seems to be reasonably well documented. The unanswered question is why this insecurity persisted even as the labor market, by all objective measures, tightened considerably. One possibility may lie in the rapid evolution of technologies in use in the work place. Technological change almost surely has been an important impetus behind corporate restructuring and downsizing. Also, it contributes to the concern of workers that their job skills may become inadequate.” – Alan Greenspan, 1997

^The AI Boom might have something to do with this as well.

The job market in Canada is a mess.

They contract vacancies to temp agencies who pay minimal wages. Canada wants people to work for the lowest wage possible.

And then you have these long lines for minimum wage jobs across the Greater Toronto Area, yet the owners of rental properties expect middle and upper class rent prices.

The “messed up” labor markets have and will create a lot of future inflation, that is obvious daily.

I just mailed a document today and had to pay $28 vs $8 to get it to the govt agency by Sept 1st. I was told priority mail is running many days late so you have to pay 4.5x for 2-3 day service.

This is happening across every industry, every business, and is anything but “transitory”.

All Americans will start to understand if/when all three auto labor unions strike at the same time in September. If I remember correctly per CNBC, asking for 46% pay raise, 32 hour work week, better pensions, etc. Not saying this is good or bad, just saying “Got Inflation?”

Pay 3.5x more, not 4.5x…see good news, inflation is coming down already…HA

UPS just charged me $47 for a 2-day domestic delivery. Ridiculous.

America has a different labour market than Canada.

In America, to get the middle and upper class jobs, a visa is required, and companies have to demonstrate that they did not find a local applicant.

In Canada, they import a million ‘international students’ who will do anything for Canadian work experience. There is a scandal where an ‘international student’ pays a business owner to ‘hire’ them for permanent residency purposes.

Add in that 500,000 newcomers are coming in 2025, mainly educated people who are sold a lie, and you will understand why a job requiring a Master’s is being advertised in Canada for C$15/hr, when in America the employer pays USD$50/hr.

You probably need a wall, too?

No, we won’t pay for it…….but we don’t give a shit if someone promises you that.

Housing prices continue upward, job openings continue down (for whatever reason), core PCE is holding above 4%. Maybe this is the beginning of stagflation. Powell the ZIRP-freak is in a bind.

It makes sense that job opening should trend down from the all time record high of 2021, because there are now about 5 million more people working than at the peak in job openings.

= As companies fill positions, the amount of openings decline.

But, the only way to really put this info into perspective is by looking at a ratio of the number job openings to unemployment

This ratio is near all time highs. 9.2 million open jobs compared to 5.8 million unemployed workers.

= The labor remains extremely tight as compared to anytime over the past 50 years

I read this article a few hours ago, and it makes a lot of sense why we are in the mess that we are in.

“Central bank monetary policy ordinarily relies on two tools: interest rate control and the supply of liquidity. As I have noted previously in this report, then-Fed Chairman Paul Volcker’s effort to stamp out inflation starting in October 1979 succeeded because he restrained the supply of liquidity.

U.S. banks had almost no excess reserves at the time, and when the Volcker Fed reduced the supply of those reserves, they rushed en masse to secure reserves. This sent the federal funds rate soaring to 22%, weakening the economy and stabilizing inflation.

Today, however, the prolonged application of QE has left the US with excess reserves of some $3 trillion, or 1,600 times the amount that existed prior to Lehman Brothers’ failure.”

William Leaked,

Inflation yes but with all of this U.S. government deficit spending and strong employment how do we get stagnation?

U.S. government infrastructure/chips/green energy stimulus isn’t even at full bore yet and companies are putting in more than that to get the incentives.

China is talking today about another stimulus step for their real estate. I think I may be seeing that in hard commodities (non-agricultural).

I find it hard to be a bear at the moment and I was heavily short all last year. I am going to need to see a large gap up in unemployment to get bearish.

For me inflation and positive GDP means own stocks at least until employment drops.

The mantra of the 70s was to own things during inflation and not dollars which deflate in value during inflation.

Housing prices peaked in June and are now headed down with seasonality. The peak in most markets was lower than the 2022 peak…the trend is slow, but down.

My local computer store Micro Center in Suburban Maryland lost all of their veteran technicians. I just had my computer in there three times and they couldn’t even isolate the problem. Went to another Micro Center in Northern VA and they found the problem and I paid for the repair, (Bad motherbord). Lesson learned: If you don’t get good service try another place right away. The labor market is extremely stressed right now for competent people who know what they are doing. There are plenty of incompetents out there.

In tech at least we have had a lot of layoffs which has increased the supply of labor massively. Team Blind is a good source for this information, and how tech workers who got rehired after being laid off took massive pay cuts. I have noticed lately how many software developers and other IT professional apply on LinkedIn and elsewhere. Job postings draw over 100 applicants in two days and some times over 1k in three weeks, a far cry from a year ago.

On the other hand there is a huge shortage for skills in manual labor (welders, electricians, mechanics, etc.), and those jobs pay quite well. Strange times we live in.

Why is it strande times when a man who works with his hands ,gets a good wage . Call a computer geek when your furnace or a/c don’t work ,while he’s there maybe he could unclog your drain strange times haha

When I worked in anodizing in Healdsburg CA (yes it gets HOT there). We had a couple large a/c units. One just mostly cooled the acid bath where the action is. Dumped 4K amps at 14 volts into that tank. It went out, the boss paid an a/c guy extra (we would be shut down and a lot of product/raw alum lost…plus long restart time…continuous coil anodizing) to come out RIGHT NOW. Never mentioned price. I’m sure that’s done a LOT lately with this climate change surge.

Anyway, unit was on west side of tin bldng in full afternoon sun next to 101 freeway fence. I went out, he had a soldering torch going. I couldn’t take the heat there, and went back in.

Not easy work.

We (I) built a “cabana” that covered both, in that damned heat a few days later. But boss let me take breaks inside as needed.

@John the Apostle

“On the other hand there is a huge shortage for skills in manual labor (welders, electricians, mechanics, etc.), and those jobs pay quite well. Strange times we live in.”

Not strange at all!

For years young people have been told that a college degree is needed to get anywhere in life. It was as if it was their only option. Vocational training was totally disregarded. College isn’t for everyone, just like the trades aren’t for everyone.

+1

Working conditions for welders, etc, should by LAW be as good as a GS trader’s….yeah, probably would cost a little more…….

Had a friend around ’70 who was making good bucks in welding shop. Bought nice home, wife didn’t work, two young girls (diapers in toilet stage). Building a T-bucket in garage….made good union money.

He QUIT to apprentice as a ROOFER. You start on the hot crew. Most of the nasty burns you see on roofers come from dumping big blocks of roofing tar in hot kettle, plus sloppy mops work. Anyway, after 10-15 years he finally made it to tile crew, then as foreman, then later estimator for ALL jobs.

The POINT: Ever weld (especially production) 8 hrs? Ever weld in a tight space? Ever weld at ALL? Nasty fumes….short life.

Screw Rubio, etal…..they should try it.

The problem with the tech sector is that while huge numbers are drawn in through the visa system on demand, when events turn down there is no mechanism to reduce potential applicants.

In the UK people switch exactly the same way over to plumbing etc No offense to plumbers, electricians but its certain a unique application of the visa system when they get more money than system engineers. All supply and demand play your cards well youngsters!!

My experience at our shop of around 100 people squares with this article.

The overstimulated economy and its inflation wave burned through our company like a wildfire, and most of the flames have died down now. Now on the other side, we’re finally staffed to match our workload after significant wage hikes to stay on par (or slightly ahead) with the local market. We were heavily understaffed for over two years, and last week, our plant manager closed our job postings for the first time since early 2021. We are still using overtime than we like, but most Saturdays are back to voluntary like they should be. Half the shop hates OT and half loves it.

Everyone here is making far more USD/hour than in 2019, except for us, the owners. That is mostly because formerly-profitable product lines are not yet back to profitable in today’s cost environment. Most of that is being addressed through engineering by eliminating “exotic” steels and rethinking laborious parts. Slow and steady…

I amazes me that people think we are going back to the moon ( let alone mars) with a space program that has a small fraction of the budget of the Apollo Program. Almost all critical material, components and labor are so much more expensive ( even relative to other things) than they were back in the 1960’s. You can carve a lot of the costs out of ordinary things here on earth but when you have to cut back and use cheaper alloys, wiring connectors and such you end up with one-way lunar travel.

One word: reuse. Imagine how expensive air travel would be if after every flight your airliner was discarded into the ocean.

Not looking to bicker, but I couldn’t agree less. Designing, prototyping, and production of high-quality parts is drastically easier today than it was in the 1960’s due to advancements in communications, computer modeling, and CNC machinery.

It’s less profit compared to historical highs. We can’t really use that as a baseline. Still profits/GDP are still above the historical average.

CNN: Amazon CEO tells employees to return to the office or their days may be numbered…

Why did the stonk market and crypto markets turn green today at the dismal job markets report?

Do unemployed people use their gambling money into stonks and crypto these days?

It’s a sucker’s game to try to tie the daily ups and downs of the markets to ANYTHING.

Pure wisdom dispensed daily.

Today Garth Turner alluded that interest rates are at its peak, and now’s the time to buy Canadian bank stonks. Sounds like FOMO coming from a politician turned long-term wealth management advisor.

Garthy is a salesman.

Never forget that.

It does feel that the economy is slowing down in Canada. TikTok and YouTube show videos of very long lines for job fairs, and people complaining that they can’t find jobs in the major cities like Toronto, Vancouver, Montreal, Calgary.

The peak of the Canadian housing bubble was 2021-2022, which means that 2026-2027 is renewal time for mortgages with higher interest rates.

Absolutely hopefully your readers will listen

Because they think the Fed will pivot on a less than hot jobs report. Not a bad report, mind you, but a less hot report. They are so desperate for QE and lower interest rates to keep their corrupt casino going. They expect QE and NIRP even when it’s not needed. It’s pathetic and truly disgusting. I pray for the catalyst that takes down the entire house of cards. So done with it.

Just to add to above, at the very least, they expect ZIRP but would be over the top with NIRP.

great info and comments – on a related subject I am seeing a actual slow down in real estate sales – even beach/mountain properties are slowing and there have have bee ” DRUM ROLL” price cuts ! interesting to see if this a ” new sheriff in town” or just housing market taking a breath before sprinting higher

The series of job reporting going back the last year looks like something right out of 1984.

The Ministry of Plenty.

Have you seen the revisions?

Thera are ALWAYS revisions, up and down, in every data series, every month. They occur because the initial data is preliminary, and as the data gets more complete, the results are revised.

If you get hung up on revisions, rather than just taking them in, you’re new at this.

For example, GDP for Q1 was revised up by a huge amount. Retail sales for July were revised up by a huge amount, etc. Where were you then??? Why didn’t you comment then???? Did you just wake up????

Fair point, Wolf. However, I also think it’s fair to point out the labor revisions have been decidedly one-sided.

Not drawing any conclusion, but that’s a fact.

Where are you getting your numbers that you think it is a “fact” that all revisions to the jobs report for the past year have been one-sided?

Great article but I’m not sure media hype can be blamed anymore than a myriad of other reasons unless that was in jest.

Graphs show jobs opening fell a lot. That alone will dampen workers feeling they can move as they will see less opportunities during casual searches. General economic sentiment is lower too so it’s not surprisingly many are choosing to stay put than take the risk of a new job in what they feel may be an uncertain economic future. Few volunteer to be first on the chopping block.

“Graphs show jobs opening fell a lot.”

1. they’re still extremely high.

2. I told you WHY job openings fell: fewer workers “quit.” Every time someone quits, it creates a job opening that has to be filled. When fewer people quit, there are fewer job openings, and fewer people need to be hired to fill the job openings. Massive quitting the way we have seen in 2021 & 2022 creates massive churn. What you’re looking at is the reduction of CHURN, because fewer people quit.

The question then is why did fewer people quit?

That people have a little more stick-to-it-ness is a good thing all around. Churn is very unproductive for the economy. Everyone is just spinning their wheels when there is a lot of churn.

Is there any method or tracker to segregate job openings due to churn vs those due to new job creation? Seems like one could remove the quits from the job openings but not sure that feels right for “created jobs”

Geopolitics is the solution to this economic labor shortage problem. The Mexican president in the last three weeks has stated they are not going to join BRICS that heavily courted them. They are going to concentrate on the North American market and integrate Latin America (with plenty of workers) where Mexico sees itself as the natural leader.

Helping our friends, and common history peoples, as well as geopolitical expediency, south of the border to increase their industrial and service providers should help eliminate this labor shortage strangling and inflating us. Easy to solve with free trade agreements, many in place, as well as guest worker programs. Surprising that the Mexican embassy isn’t more active in getting more investment; maybe even sending some of Biden’s “green energy” programs to Mexico to reduce that excess liquidity as well.

Mexico’s unemployment rate is around 3%. The people that are coming over the border are not Mexican.

So we have 1.5M layoff-discharge, 3.8M quit, Total about 5.3M.

While the hiring is 6M giving a net of 0.7M.

Which somewhat matches the decrease in the job openings.

Our labor work force is still out of whack. Employment will be full for awhile. Don’t see a recession until the layoff # going to > 2M. JP will have to add another 1/2 point or more before the “pause”. I don’t see rate going down until later next year at the earliest. Yeap, higher for longer and longer.

The only thing keeping the Fed in control is it’s 2% inflation target, yet the Fed isn’t making strong progress toward that target. We are almost two years into tightening and inflation is running way higher. Is the Fed really trying to fight inflation, or is it’s primary goal to keep asset prices at nosebleed levels?

Trust the results of Fed policy, not the words.

Also, how can the Fed fight inflation if it doesn’t understand inflation? The Fed refuses to believe inflation results from increases in money supply or increases in asset values. The Fed focuses on CPI readings, which are a lagging indicator. The Fed let inflation embed for decades in money supply and asset prices, and it was just a matter of time before it showed up in consumer prices.

Wolf!! Despite higher employment and higher gdp why are the tax receipts lower? I am confused. Please explain.

No reason to be confused. This is well-known. Capital gains taxes plunged this year because 2022 was a shitty year for the markets, and when it came time to pay taxes on capital gains by April 15 and later, there wasn’t much. But they plunged from the crazy high levels in 2021 (paid in 2022), and are now back to about pre-pandemic normal. During mega-QE, capital gains blew out all valves and generated HUGE capital gains taxes. But that ended.

Article coming.