Prices drop month-to-month and from peak (June 2022). Days on the market jump. Homeowners with 3% mortgages vanished as buyers and sellers in equal measure, entire market shrank.

By Wolf Richter for WOLF STREET.

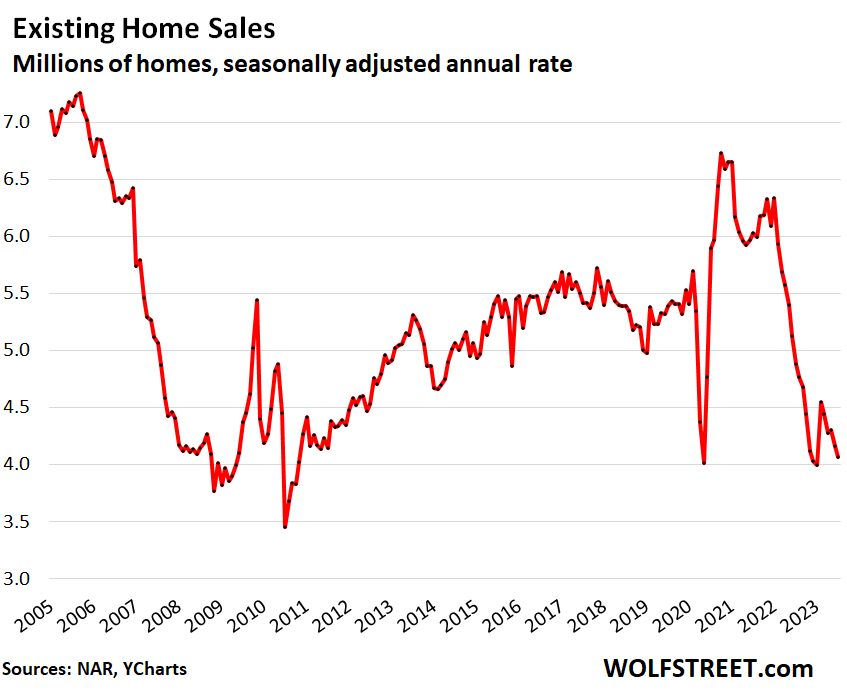

Sales of previously owned homes (houses, condos, and co-ops) fell further, by 2.2% in July from June, to a deep-dismal seasonally adjusted annual rate of sales of 4.07 million, the lowest since January, which had matched the March 2020 lockdown low, which had been the lowest since the Housing Bust in 2010, even as the median price fell, as days on the market rose, and as supply rose to match the highs in 2022, and beyond that to the most supply since June 2020, according to the National Association of Realtors today.

Year-over-year, the seasonally adjusted annual rate of sales fell by 16.6%. Compared to the Julys in prior years:

- July 2021: -32.5%.

- July 2019: -24.5%.

- July 2018: -24.5%.

What we’re seeing is that demand has vanished, and supply has vanished in equal measure because the homeowners who have a 3% mortgage are not buying a new home, and so they have vanished as buyers; and are therefore not putting their current home on the market, and so have they vanished as sellers. I estimated that the entire housing market – buyers and sellers – shrank by 20% because these homeowners vanished as buyers and sellers at the same time. In other words, there is less churn and increasing supply from other sources (historic data via YCharts).

This drop in demand is further documented by the plunge in mortgage applications, indicating that closed sales for August, when reported a month from now, will look even worse than those in July, reported today.

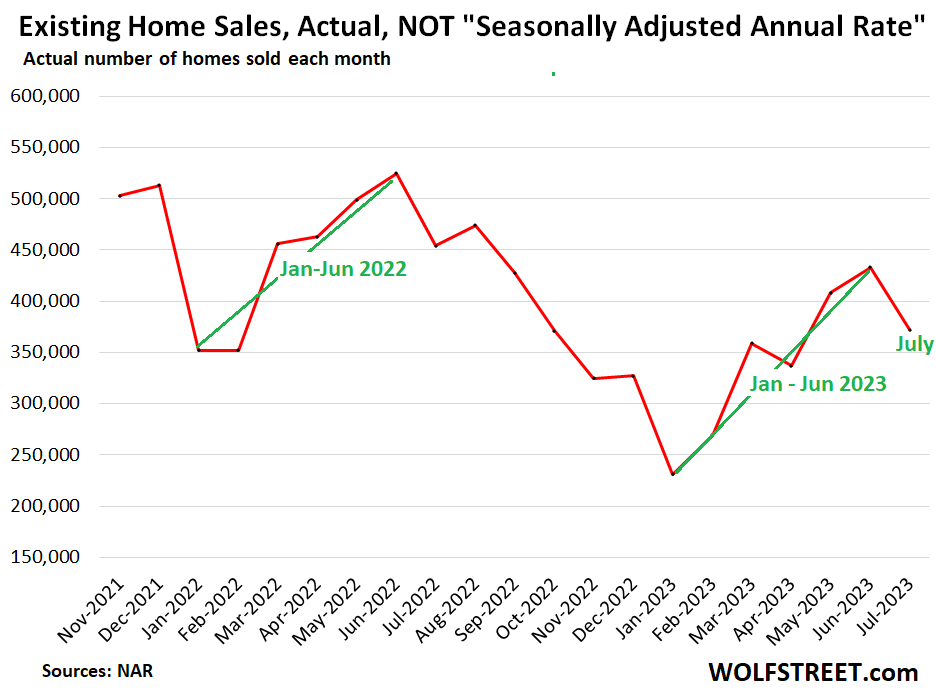

Actual sales in July – not seasonally adjusted annual rate – fell 18.1% year-over-year to 372,000 homes. The seasonal patterns are clear, the “spring selling season,” marked in green is over (data via NAR):

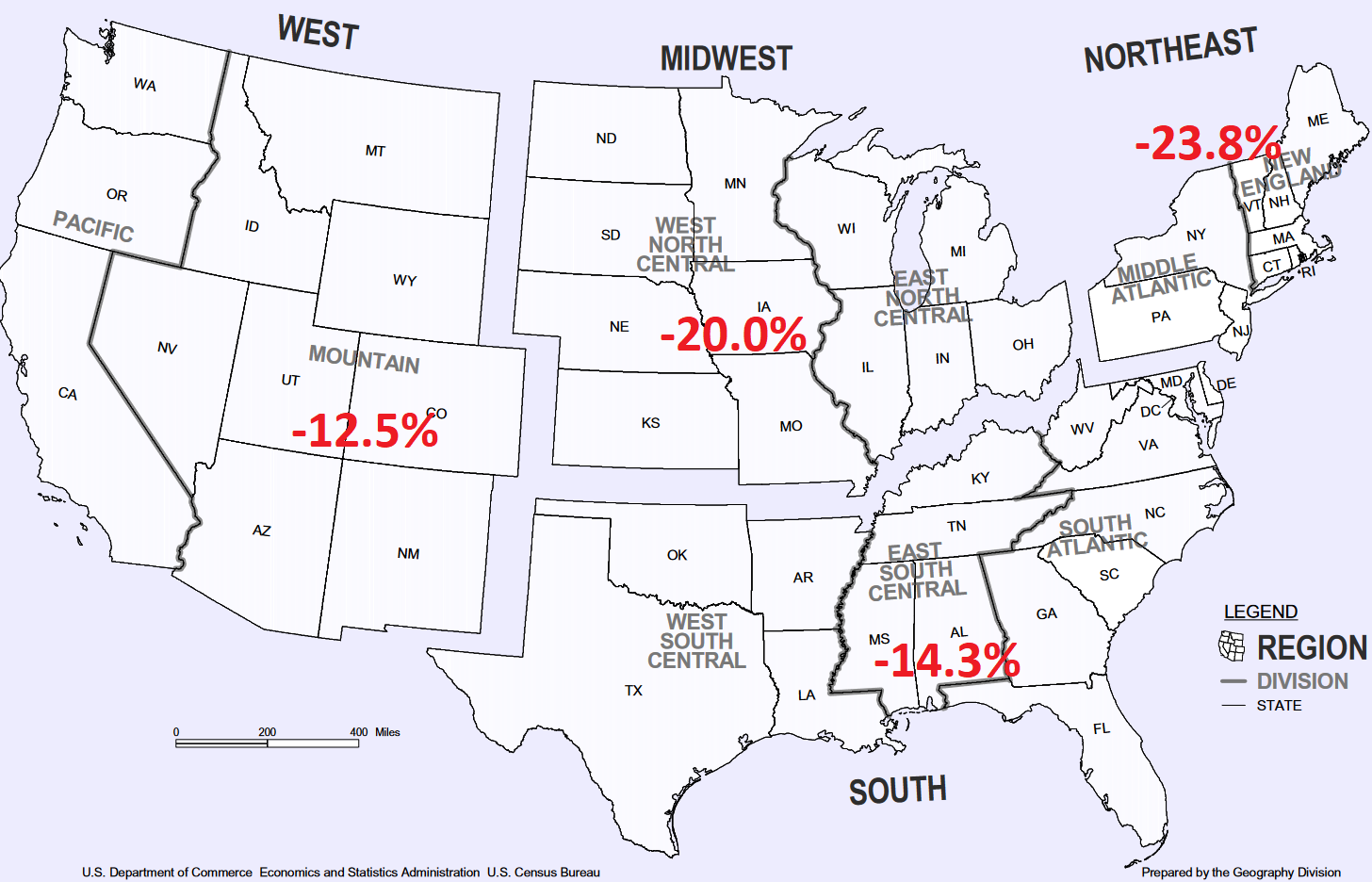

By region, year-over-year sales plunged in all regions:

Cash buyers and Investors pulled back too: All-cash sales – often investors and second home buyers – dropped by 11.2% year-over-year to 96,700 homes in July, or a share of 25% of total sales.

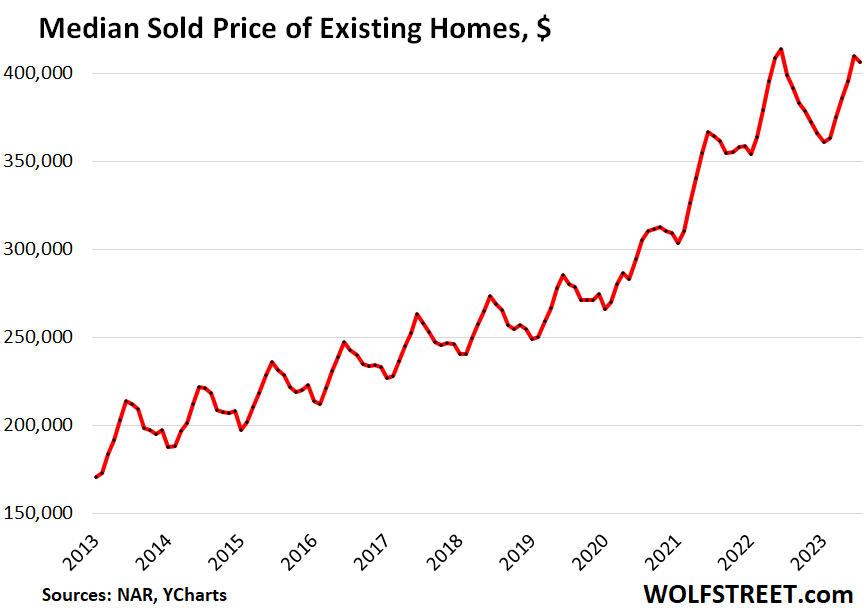

The median price fell to $406,700 in July and was down by 1.7% from the peak in June 2022.

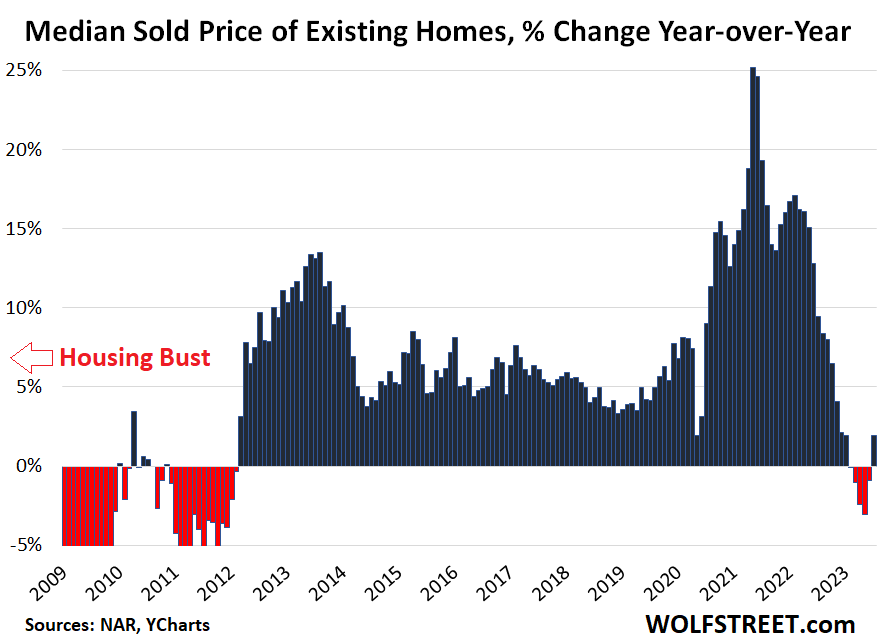

The data today reflect sales that closed in July and were agreed to in prior weeks end months. The data reported a month ago of sales that closed in June and were made weeks earlier reflected the final hurrah of “spring selling season,” a phenomenon that occurs every year when prices and sales always rise, even during Housing Bust 1. Now spring selling season is over. Prices will decline in the second half into January, and it’s just a question of how much (historic data via YCharts):

A year ago, in July 2022, the median price had plunged by 3.6% from June 2022, a huge plunge after a series of huge spikes. In July 2023, the month-to-month drop was much smaller, -0.8%, and so year-over-year, the median price was up by 1.9%, though fell further from the peak in June in 2022 (-1.7%):

For your amusement, note the year-over-year price increases during the Housing Bust. Year-over-year percentage changes do that sort of thing:

Days on the market lengthened year-over-year, by both measures:

- Homes spent 45 days on the market in July before they either sold or were pulled off the market, up from 34 days in July 2022, according to realtor.com.

- Homes that sold, but not including homes that were pulled off the market, spent 20 days on the market in July, up from 14 days in July last year, according to NAR.

Inventory for sale rose to 1.11 million homes in July, the highest since November 2022.

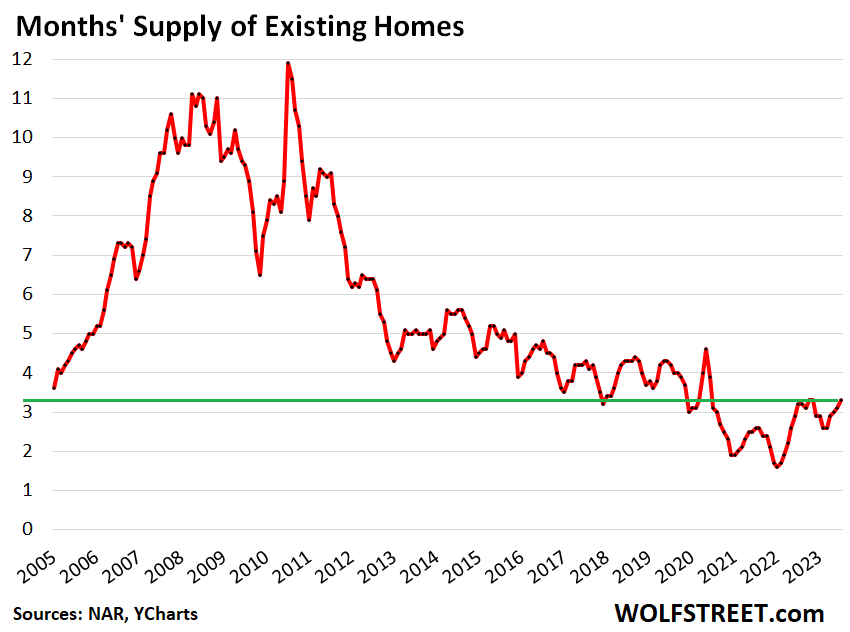

Supply rose to 3.3 months, matching the highs in 2022 (October and November also 3.3 months) and beyond that, the most supply since June 2020.

Supply in 2017 through 2019 ranged between 3.0 and 4.3 months (historic data via YCharts).

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf, I see you mentioned homes being pulled off the market. I am seeing alot if this in my area, we had a dozen or so homes go up on the market in July, and most have disappeared from the market and are definitely empty. How do you keep track of this shadow inventory?

Thanks in advance!

Yes, the shadow inventory is one of the most mysterious figures. I’ve tried to put a number on it derived from Census figures. Now I’m just waiting as it begins to show up.

In terms of homes getting pulled off the market: I have seen this broadly and could document on Zillow, but only home by home, but not in total.

Interestingly, there are a couple of options in addition to just letting the house sit off the market.

What I saw on Zillow: when sellers can’t sell, they pull it off the for-sale market and many put it on the for-rent market at a rent that would cover the mortgage payments and other costs. Of course, that’s way too high, so the home doesn’t rent either, and after a few months it vanishes from the rental listings. A little while later, it may show back up on the for-sale listings.

There is another option, but it doesn’t show up on Zillow, I have seen that anecdotally: Homeowners furnish the home and put it on the vacation rental market (Airbnb, etc.). There are now a gazillion homes listed on vacation rental sites. They’re putting the Big Hurt on hotels and on local tourist taxes because most vacation rentals, even if they should, don’t register and don’t pay those taxes. But they have to get some occupancy too to make that work. We’re going into the slower travel season, and those vacation rentals that are not working out, they’re also part of the shadow inventory and will come out someday after they eat up enough of their owner’s cash.

Yeah these aren’t even coming up as rentals, they are empty and the old for sale signs are sitting on the side of the house or against the fence. Meanwhile their lawns keep growing and growing and no one is living there.

I ask a realtor friend when I see him.

yah yah yah – don’t care what you all think

i have home – I can flip or rent

just waiting for heat to subside

I’ll make more carrying mortgage at 8% than renting

— need $$$ to pay mortgage —- what mortgage

either I get price or I carry at decent rate

want discount for cash – move on

I’ll put in as rental and wait you all out

Joedidee: must be nice to be able to live in that kind of denial. I’m too realistic for that. Price drops all over AZ. Lolol

joediddley,

I bet 75% of the WS readers are insanely jealous of you. (in your head, that is)

You going for 100%?

Yeah this is called pure freaking greed and in most cases, I hope every one of these sellers take a bath and chase the market all the way down.

If you price your home in a more realistic or dare I say a slight discount to market price, you’ll likely get a buyer but nope, they want to get every last penny out of the 20-30% artificial price increase last couple 3 years, then good luck just don’t be surprise the seller end up holding the bag…in this case, unlike what Gordon Gekko said, greed is not good…

This is what happens when the government turns housing into a literal game of Monopoly, whether by design or through gross negligence combined with pure self-righteous hubris.

Just buy and hold the “asset,” and it is guaranteed to “appreciate,” maintenance or occupancy be damned.

Agree with these sorts taking a bath. I am keeping an eye on an area I am interested to retire and a home popped up priced *way* too high on sq ft basis (and not a fit if it were priced decently). Then I scroll down and find the house sold just six months ago for almost $500K less. I assume they bought a fixer, dumped in $100K and are now trying to flip, but there is NO way they will get their asking in this market.

I plan to watch the listing to amuse myself as they crash and burn.

Agreed totally, good post. I don’t have it in for people trying to make a living and we even have some realtors and flippers in our extended (across states) family. But we’ve lost all patience for esp the big investors, unreasonable landlords, wannabe slumlords and FOMO up-bidders who bought at outrageously expensive prices well beyond incomes with the thinking that prices would only push up higher, and they could either drain tenants into poverty with rising rents or sell at an even higher inflated price. They’re a big reason something as basic as shelter is so unaffordable now, they and the Fed’s short sighted ZIRP and QE distortions created the mother of all housing bubbles and the Everything Bubble in other assets and goods, from healthcare to college to used cars.

These overleveraged slumlord wannabes are also a big driver of the pivot-mongering in the media that’s done untold damage to the US financial system and a big driver of the bank failures earlier this year, with all the “Fed will pivot” talk and failure to listen to JPow’s own words. A lot of them are big investors so even now they even get their nonsense on the front-pages of the big financial news sources. In fairness since I’ve called them on this before, the WSJ for once seems to be starting to get religion here (maybe the editors are reading WS lol). Still some squawking but the Wall Street Journal is backing off somewhat on the pivot-monger cheerleading, they’re even admitting that Americans just can’t afford these surging costs anymore and companies are starting to feel that pain.

Now it’s the Financial Times that’s holding the banner for the pivot-mongering and FOMO crowd with new rounds of hilariously clueless and flat wrong articles and comments. Maybe because FT is owned by Nikkei and Japan is basically the last hold-out now on supporting loose (at least looser) monetary policy and “inflation is actually good” happy talk, and the idea of a “capitalist economy” actually run by reckless central bankers inflating the currency into worthlessness. They’re living in a world of their own delusions now, the US won’t survive for long if even highly paid skilled working experts and professionals can’t buy even a basic starter home on two incomes. Much less the middle and working classes in America who’s incomes fall further behind cost of living with every new week.

Yep, as the old saying goes. Pigs get fat and hogs get slaughtered. No point in being a hog in this market as most home sellers should have some gains in their properties so they need to stop drinking the Kool-Aid and price their properties to move as per another old saying, those that sell first sell best.

another saying – buffet – MAKE YOUR MONEY ON BUY

get paid when you sell

greed – I just take market and make 25-75%

carry mortgage and make more

no hurry had to much work anyway

just trim workload

then I’m off to next one

Yes. And the way down may accelerate if the interest rate hikes ever result in layoffs. As I’ve said before, I think the resiliency of the labor market has been a surprise to the Fed.

Interest rate hikes USUALLY result in layoffs. And a percentage of those who lose their job will be forced to sell – even if they lose their coveted 3% mortgage loan.

However, this black swan is still in hiding. More support for Wolf’s point that “nothing goes to heck in a straight line.” But the layoff swan may yet emerge. The RE market will get quite interesting at that point.

Wolf-

Do you see foreclosures coming down the pike from over extended buyers during the 2020-2022 purchase years? Even a 700k home at 3% carries a hefty monthly bill with taxes, maintenance etc.

You might estimate the “shadow inventory” while tracking re-appearing ads. By comparing case-by-case you can infer the ratio of fresh inventory compared to the stuck one.

Usually, ads would have unique URL ids, descriptions, ZIP codes and other features that uniquely identify them on the market.

Drop me an email if estimating this figure is something important.

That’s only a small part of the shadow inventory, it’s not even actually the shadow inventory, it’s the part that already came out of the shadow.

The biggest part of the shadow inventory is the part that hasn’t been listed at all and is just sitting there, or may be on the rental market, or may be on the vacation rental market, and eating cash in both. We saw it come out of the woodwork in 2005. By 2006, listings had nearly DOUBLED, and by 2007, they hit 4 million, and they stayed in the 3.7 million to 4.0 million range for two years, which is what caused home prices to collapse because there were no buyers for this much inventory.

The shadow inventory is ultimately tied to vacant homes. There are gazillions of vacant homes, but there are some good reasons for some of them to be vacant (remodeling, etc.). So the number that could be the shadow inventory is a lot smaller than the total number of vacant homes. But it’s still huge. I gave this math a shot here, using Census figures:

https://wolfstreet.com/2023/02/02/what-is-the-actual-housing-vacancy-rate-census-bureau/

I bought plenty in ’09 and after

Many STRs are being propped up by people staying in them for temporary housing while they wait to buy or build. The STR market is many areas of the country is not for vacations.

Here in Raleigh our 1 major sports team, the Carolina Hurricanes hockey team (yeah go figure, it’ll be 101 one day this week!),

They want a 5% tax on all occupancy of hotels to pay for a $300 million renovation.

Never mind that the money could be used for more pressing needs.

Sure they’re Mr. billionaire sports team owner, you can have whatever you’d like.

/s

We’d all be healthier and happier if we ditched major league sports entirely and went back to petty village rivalry sporting matches.

sufferin’ – seems the smaller cities may still be less-resistant to the siren-song of subsidizing ‘big-time sports’, a resistance that has grown mightily in the last decades (…still remember the statewide tax proposal in WA in the ’90’s to build a new stadium for the Mariners…(…Seattle prox. 400mi from Spokane…)).

may we all find a better day.

Wolf,

Just FYI, I’ve seen stats reporting AirBnB occupancy rates of about 25% for the past year (ntl average). And that is only counting the days the hosts open for availability (I’m guessing a *lot* of vacation homes get AirBnB’ed…it probably helps with the psychological justification for purchasing a second home in the first place…)

For myself, the vast majority of AirBnB rates are vastly overpriced (see 25% occupancy…) – essentially the equivalent of mid priced motels/hotels (but markedly inferior in quality and amenities).

(OG motels/hotels appear to price to yield 65% to 75% occupancy on an annual basis…which is pretty goofy too…)

As with a lot of contemporary pricing goofiness there may be elasticity issues/yield optimizer games going on here…small true demand leading to (dubious) overpricing…or vice versa.

It doesn’t strike me as a stable long term equilibrium. But it is enough to disrupt markets (sfh, apt) in the interim.

Wolf, speaking of vacation rentals, have you considered doing a story on the Airbnb glut and when and if it will help to bring down the housing market?

All real estate is local. There are only a select few metros where there are enough STRs to throw the local real estate market out of whack. At a national level, STRs have an insignificant effect on real estate dynamics.

Second for airbnb story, I’d love to hear more of your views on that aspect Wolf.

JeddD- Been to Idaho lately? Or Montana? Its not just metros. Or visit any rural community within 2-3 hours drive of those select metros you mention and you’ll find overwhelming numbers of homes that sold in 2020-2022 and were converted to airbnbs. Lots of cash has been sunk into small cities and towns over the past few years to capitalize on short lived- pandemic driven demand. I believe the airbnb glut and its effects on the market will greatly surpass expectations nationwide.

Active listings are near all time low.

That’s enough of a trigger to not post the comment rofl

Richard,

“Active listings are near all time low.”

BS. Why do you keep posting BS? This is RE troll behavior!

The all-time low was February 2022 at 346,161 active listings.

In July, there were 646,698 active listings, up by 85% from the all-time low!

In terms of prior Julys: compared to July 2022, active listings were down by 6.4%; compared to July 2021, active listings were up by 18%!

woohoo first!

Sorry not in my area. SoCal still have bidding wars and everyone wants to live here so price not dropping anytime soon. Plus, who doesn’t want to live in paradise where you get tropical storm and earthquake at the same time..talk about timing… /S

The same thing happened in 1996 during Typhoon Herb. An earthquake hit Taipei at the same time as the storm. More adventure than I planned for…

“Plus, who doesn’t want to live in paradise where you get tropical storm and earthquake at the same time..talk about timing… /S”

I do! /not S

But I can’t afford that market. /also not S ☹️

My neighbor here in Eastern Washington… he grew up just a mile from this apartment complex… he hates the Californians (and others) moving here. I’m a transplant, have lived in 7 states. When I told him I thought the climate here sucked he told me to go back to Ohio.

Well Ohio doesn’t have a great climate either. That said, this year I would bet that 6 if not 7 out of 10 days my hometown there had a better day than we did. And… no wildfires to deal with either !

Easterners are getting some smoke from Canada.

But yes my neighbor… he doesn’t like the newcomers …supposedly. There are a LOT of Californian transplants here, not just recent ones either. A guy at a grocery store told me Texans are moving to Idaho…we are only 15 miles from the Idaho border.

…had to give this a (slight) grin, CA/TX immigrants to the Spokane era in the late ’80’s/early ’90’s were all of the talk, then (I was one). Of course, the talk was how the locals skinned the immigrants on property sales (still a bargain to the immigrants). That changed to complaints among the locals a few years later that property had become too-expensive for their kids to afford…

may we all find a better day.

…’area’, not ‘era’. (…it’s driving me MAD, i tell ya, MAD…).

Apologies.

may we all find a better day.

North east Ohio checking in. Dealing with smoke from wildfires from canda earlier in the summer. Rainiest July on record and now 3 inches in the last 12 hours has flooded the area.

Ohio weather is humid, rainy (almost as much as Seattle), has snow, only 160 days of sun (40 below the national average), etc.

Terrible jobs, public transportation, nightlife, etc. The population is still declining in Cleveland.

All of this and somehow the real estate market has not gone down a bit. It’s actually up month over month. In this shithole of all places. Go figure

Hurriquake coming soon to a town near you!

For now. It’s hitting the rural areas first as it always does. Then the trickle out. Def. not a “one size”.

Wolf,

Excellent work.

More intended ‘unintended consequences’ of 15 years in solitary confinement for price discovery.

Will have lasting impact on the U.S. economy for at least a decade or at least until home prices correct meaningfully (at least 60% lower from here).

Lots of realtors will switch careers…again. Happens in every bust.

Agreed, a 60% drop and even sharper in some markets. The home price corrections have barely begun esp in the bubbliest markets, from Austin (and just about anywhere in Florida) to Boise and busted boom-towns of the Dakota oil patch and they a long, long way to go down to be anywhere near in line with Americans actual incomes. Especially since the cost of living of everything else has gone up too.

The remarkable thing is the lack of panic listing…so far. Abnormally low inventories are…abnormal.

But the same old “sell” motivators haven’t been repealed (death, retirement, job loss, divorce, etc) and can only be delayed so long.

And the thing about panic selling…is that it cascades…

It is just interesting that most SFH speculators don’t realize it is better to be on the train than under it.

“It cascades” This is correct. I made this point on another economic forum. *in the voice of Lord Elrond* … I was there…. fifteen years ago… when the greed of men failed…. and no one could buy shit.” ok I made up that last part. But… true story, it will cascade. There’s a lot of second homes vacation/rental/airbnb… and these folks if they bought long enough ago, can sell at todays discount and run for the exit on that property and still have a windfall. 15 years ago I had a friend who had a realtor tell him literally last time during the bust (he was trying to sell his home) that he needed to “get ahead/more aggressive” with the price cuts because it would just be lower next month. Basically… undercutting. I think there is an entire second home cohort waiting in the wings… and when jpow raises again…. they are going to get the memo and dump while the getting is good. So… that’s going to be a rush to the exits. That sets up the next round which is all the poor bastards who now bought a home for half of what its worth. Yeah. they got a low payment…. but…. now what… How much is your house worth again? I can tell you this. Life is not stagnant. Change is inevitable. And 30 year mortgages suppose… a lot.

Good perspective, Cas127.

Another element missing from the mix of sellers so far is the corporate seller of single family housing stock: mortgage holders and SFH rental companies.

They may not be “panic” sellers, but they are surely motivated, and they have the same effect on prices…

“can only be delayed so long.”.

But why should the rate increase over that which occurred the past year for instance ? There were plenty of homeowners with low rates who died, divorced, etc the last year. Is there some reason to think a higher percentage of homeowners will have these circumstances forcing a sale ?

“ The remarkable thing is the lack of panic listing…so far. Abnormally low inventories are…abnormal.”

You see the prices – prices are going back up. Why panic sell?

” Is there some reason to think a higher percentage of homeowners will have these circumstances forcing a sale ?”

It will happen when a recession and job losses start happening, but there’s still a lot of excess liquidity preventing that for now.

If this was a different website that you had posted to you’d catch a whole lot of flack…60% ?

Are you MAD ?

I’m not a homeowner but 60% nationwide sounds pretty extreme…HB1 as you know only 22 (27 ?) percent peak to trough.

I haven’t seen any of the “experts” (Zandi, Core Logic, etc) predict anything like a 60% decline.

Why 60% and not 40% or 80% ?

Maybe you’ll be that rare person who got it right ?

Some are already headed back to OnlyFans, where they came from.

Using their prom pictures from the late ‘70s. Whatever Happened To Baby Jane?

AirBnBs used for semi-pro porn sets…”Hey!! That’s my house!”

“They didn’t even take the pictures off the wall !”

Blahahaha. Damn this funny. Thanks.

A 60% correction down in real estate price is not going to happen in the form of price reduction. The reason is that the real estate is the collateral for loans, and as money is debt in our monetary system that is a real bad thing. The collateral can be said to be the backing of money.

On the other side, with “sticking” prices it do not take many years with 10% CPI inflation to correct the prices 60% down relative to wages and other consumer index items. Do not be surpriced to see that the “soft landing” actually is dumping assets price by CPI inflation. The US dollar purchasing power go down, but real estate price go down relative wages and other consumer expenditures.

In my little neck of the woods, I’m finally seeing some small signs that prices are sliding. The number of listings with price drops has become noticeable whereas for a long time they were nonexistent. There is still a fairly low number of listings in the low-end price range I’m following, but seeing any price drop is better than nothing.

My daughter and fiancé’ are trying to find a decent house in their price range before they get married. I’m just hoping they have enough patience to wait a bit yet while things settle out.

insert anecdote about my local market behaving differently despite being provided contradicting data in 3…2…1…

Here we go: In my neighborhood, there are bidding wars all over the place, and houses sell as soon as they hit the market, and prices are shooting through the roof, and there is zero inventory and nothing to buy, LOL.

The funniest part is that this NIMBY rhetoric has gotten so over-used and stale by now that the FOMO and “house prices can only go up” crowd don’t even have to write original posts to claim it anymore. The AI bots from ChatGPT to the old fashioned forum bots from years ago already know the script and will regurgitate wording just like this. It’s practically a reflex by now.

I’m in the NW and home prices are level or down YoY.

That said, my impression is some parts of the midwest and especially the northeast are seeing price increases, even 10% or more YoY. Less new construction in some of these cities and as elsewhere existing homeowners tending to not sell.

I’m still mostly just watching in the

close-in Boston market. I cannot

tell that prices are moving in either

direction over the past few months.

Things that I look at (bottom of the

market) are still selling fairly quickly,

I did however, see one place stay on

the market for nine days. Which is

the first time in a year or so that has

happened to a place that caught my

eye. (“Normal” has been to sell on

the Monday or Tuesday after it goes

on the market. Normal also has most

used house salesmen end listings

with “offers due on Monday, xx/yy”.)

J.

Due to my profession, I get monthly sales figures for a small city in commuting distance of Boston. We’ve been up and down in terms of median sales prices the last few months (strangely condos are going up but we have so few that means nothing statistically) but consistently very few sales and almost no inventory. So half the story above is ringing true, and I think the Boston area might just be more optimistic/foolhardy than other areas. Or have more wealthy people willing to make themselves house poor.

Worcester?

MgSO_4,

I wonder if that optimism/foolhardiness

could be the result of Housing Bubble One

being a very muted thing in the Boston

area, relatively speaking. (And maybe that

was because of caution from the local real

estate gyrations of the 80/90s.)

J

————————————————————-

MM,

I don’t think of Worcester as being that small.

I saw your comment on a EV article a ways

back about electric buses. … Which makes me

wonder, was that the 71 or the 73?

J.

Speaking of that.. does Kunal still around? We can always count on him to give us multi verse version of what’s going in the SF market cause you know bidding war is still a thing…

Who has all this money to buy with?

Just more bets that the housing market will return easy gains in 6 months?

Dear Realtor.Com Forum,

You won’t believe this, but when I first met the two Swedish stewardess home-buyers offering me triple my asking price…

“NIMBY, Not In My Back Yard”

Ironically Realtors are as bad as anyone for not being able to see further than the last couple closings they’ve had.

I’m still not exactly sure what skillset makes for a “good” or successful realtor, but it’s clear the ability to predict the market is almost completely irrelevant to their earning power.

I don’t know why we collectively expect them to have a clue.

Their compensation tells you everything you need to know. They only get paid when a transaction occurs. Price doesn’t really matter, a little higher or lower – little effect on their compensation. Not ragging on them. Just they way they are paid, a consumer needs to know the incentives for any professional they hire and how that might effect their dealings with said professional. Typically, a Realtor is pushing for the deal ASAP, it may be in your interest to wait for better offers. An additional $10K is a lot to you, but peanuts for the Realtor.

No one is good at predicting the market, too many variables (similar to the stock market).

Always Be Closing.

…And coffee is only for closers.

A network of backroom quid pro quo dealmaking with other people in the real estate profession is what separates successful agents from the others. There are very few out there who work to maximize for their customers.

On a serious note, did notice I am starting to get more listing emails from Redfin on home being listed in areas like Chino Hills, Chino…IE. Price is still delusional and once in a while you get a sprinkle of price increase as well I guess to try to drum up that FOMO buying.

You also see different tactics like back on the market after contingency..etc or just relisting after 200 days on the market like my friend that’s currently trying to sell their place in Bakersfield…200+ days, then relist and not even a price decrease significantly since asking is over Zestimate…

This market might be the best Mexican standoff we ever had in modern history…who’s going to win at the end? the logical side of me says buyers will but given all the craziness we have seen in the last 20 years and how much QE, cheap money, and forever-up narrative have rotten people’s brain forever, I wouldn’t rule out sellers will end up winning this standoff

Fortune Magazine has article out today saying housing is most unaffordable since 2006.

hmm….and what happened after 2006? I only remember people telling me RE will continue to go up in a straight line, must have been terrific years after 08-12…I just can’t remember

I mean I agree but I think Fortune magazine will print anything.

I’d take their stuff with large kernels of kosher salt.

I’ve noticed Fortune magazine changes its stance on the housing market from week to week. One week it’s crashing, the next they say home prices will never go down.

That math would be very easy for you to check.

Avg House cost (all carrying cost)

Avg Wage

You’ll get a multiple, avg is house is 4.2x avg wage or whatever.

Lance Lambert (Fortune) was not downbeat on the RE market last week. He was interviewed and even said something like buyers may need to get used to these prices. I didn’t like hearing that but he probably influences a lot of people. He writes articles quite frequently for them. Has for at least a year.

Im watching the number of for rent listings on apts.com. If it continues to increase that means the renters are buckling and rents will come down. They are holding up prices. I’m also keeping my eye on stocks which I theorize that all the massive gains over the last 5+ years have fueled the investor speculation in housing to a large degree. A stock bust should halt a lot of prior speculators. Lastly I’m watching psychology, which if it turns from say constant negative news articles, then housing bubble 2 might finally fully enter its long decent. I dont trust the Fed at all whatever they say or do, to me they have lost credibility.

I live in NW Indiana where everyone is fleeing to from Illinois because of the higher Illinois property taxes. On a local Indiana realtor’s web site that that keeps their listings nice and fresh, displays all of the newly listed homes that have been listed for one week then the home drops out. About 2 months ago there were about 21 pages of listings within 3 counties, now there are NONE!

Rents in Raleigh have leveled off. I’m hearing of actual normal rent increases in $10 increments!

In the word of Harry Caray “Holy Cow!”

The home market is still strong here in the rural red south. It isn’t 2021 hot, but it’s still strong. And with so few quality/turnkey homes for sale, many people are building owner-financed custom homes.

I had a contract on my last home in two hours with a cash closing in two weeks with no concessions. Last year, I built my dream second garage with an apartment above it, and we start framing the home in October. The basement is already poured.

NIMBY is strong with this one.

We should start a similar version of slug bug (Punch buggy) in the comment section but instead of getting punch for spotting a VW bug, every time we spot a NIMBY commenter, we get a punch in the arm…

Have a feeling I might get a sore arm real quick…

“All art is propaganda. It is universally and inescabably propaganda; sometimes unconsciously, but often deliberately, propaganda.”

Upton Sinclair

Wolf,

What the housing markets desperately needs is a mechanism allowing those with 3% mortgages to transfer them to other properties so as to jump start the housing market. I’m seeing inclinations of this already happening as sellers are willing to finance to make a sale in a sort of mortgage sublet situation. I’m surprised that some nationwide realtor hasn’t capitalized on this to boost closures. I believe it would be worth diving deeper into the housing market to track this trend to provide a more finely grained view of just what is going on behind the numbers.

“What the housing markets desperately needs is a mechanism allowing those with 3% mortgages to transfer them…”

No-no-no-no, not at all. You completely missed the entire point. The people with 3% mortgages VANISHED AS BUYERS too. That’s why demand is down by 24%. They have no impact on inventory. When they sell a home, they also buy a home, and inventory remains unchanged: +1 -1 = 0.

Only Realtors get hurt by these 3% mortgage people because Realtors make money off the churn, they get commissions twice each time a 3%-mortgage-person sells a home to buy a home. That’s why Realtors and the NAR spread this BS that the problem is the people with the 3% mortgages not wanting to sell. That’s only a problem for Realtors’ commissions, and not for inventory. And I’m tired of this BS, and I’m shooting it down.

The whole entire market, buyers and sellers, shrank by about 20% because the 3%-mortgage-people have vanished. So there is little demand, and supply is rising from other sources, and prices are coming down, and it takes longer to sell a home. The pieces are all lining up.

I linked the article that spells this out. But it seems you didn’t click on it. So here it is again. READ IT:

https://wolfstreet.com/2023/07/21/entire-housing-market-buyers-and-sellers-may-have-shrunk-by-20-25-because-of-the-3-mortgages/

“You completely missed the entire point. The people with 3% mortgages VANISHED AS BUYERS too. ”

Didn’t Tom mean that people with 3% mortgages would be happy to be buyers, if they could only transfer their current mortgage rate to the new property?

Why would any lender have any interest (pun intended) in doing that for anyone?

The 3% mortgage people don’t need to be buyers. They’re happy with their mortgages. Quit blaming them for the inventory. Those people retreated into their corner and are going on with their lives.

Lenders HATE the 3% mortgages. If they try to sell them, they lose their shirt. The banks that hold them now are in trouble because of their unrealized losses on those mortgages. No way in hell will they allow you to transfer the, for them, toxic mortgage to another property. That would just force the banks to perpetuate their losses on that mortgage. No way in hell. If you want to move, you sell your home and pay off the mortgage at the full amount of the remaining principal and get a new mortgage at 7.5% to buy a new home, and save the banks a lot of trouble. That’s how that works.

All this whining about trying to hang on to a 3% mortgage while moving to a new home is just silly and tiring. Is that a sign of a new “entitled generation?”

If the 3% mortgage people want a change of scenery, they’ll get a 7.5% mortgage and go from there. And if that doesn’t work, they don’t change the scenery.

Of course, the government could do anything to buy votes, from forgiving student loans to letting government-backed mortgages be transferred at taxpayer-rip-off so that a new “entitled generation of whiners” that got their student loans forgiven at taxpayer-rip-off can now hang on to their 3% government mortgages at taxpayer-rip-off so that they’ll vote for these crooks.

How in the hell would that even work? In a real estate market where prices have just started to spiral down (and at these rates there is along way to go) these 3% sellers would still have to unload their properties to buyers assuming 7-8% mortgages? And buyers would buy at the same price point that the 3% loans were made? Follow the logic from here. I can’t see that this makes any sense.

So they want more ZIRP to go with their inflation?

Logically, though, the prices must come down. And the banks will take a hit on those 3% ‘assets’ when cash yields 5%.

Higher for longer, until it breaks. Until then, it’s all soft landings and Unicorns.

Yes, I did mean exactly that!

I’ve been trying to buy a house in the hottest housing market in the country for the past two years and witnessed these sellers with 3% mortgages desperately trying to cash in on their home equity only to see their houses languish on the market for extended periods because no buyers can afford the payments on a 7% mortgage for a million-dollar property. And, the vast majority of properties in this market ARE over a million dollars!

The housing markets will not move until a mechanism is developed to allow those who already have 3% mortgages to somehow transfer those to their new property. The market needs to find a way to bypass the Federal Reserve to provide cheap money to buyers to break the property market logjam.

Remember, every seller that cashes in on their home equity by selling their house, must then become a buyer to have a place to live.

The very fact we’re even talking about schemes like this shows how very, very far down the rabbit hole we’ve gotten. If I went back 30 years and told any economist of the things that have been normalized in today’s world, they’d lock me up in a padded white room.

As for blame, I’m just going to lay 90% of it on the Federal Reserve and Congress; the former for printing money and distorting price-discovery, the latter for helping force that to happen through willy-nilly spending (both parties).

Tom –

“these sellers with 3% mortgages desperately trying to cash in on their home equity only to see their houses languish on the market for extended periods because no buyers can afford the payments on a 7% mortgage for a million-dollar property. ”

Maybe not 1m for long. Prices were artificially inflated b/c of the low rate. Now we return.

“They have no impact on inventory. When they sell a home, they also buy a home, and inventory remains unchanged: +1 -1 = 0. ”

You’re correct that inventory remains unchanged, however…

I’d counter that with the fact that liquidity matters in ANY market.

Market opt-outs may not change inventory stats, but it could drastically change the perception/experience of buyers and sellers.

Realtors play a little bit of a market maker role, the easier they can match buyers with sellers the more likely the market will function efficiently. That function tends to increase based on the number of market participants.

Rob B.

A housing market is by nature illiquid, and it’s hard to sell a home under normal times (which is why you pay someone 6% to do it). During the bubble, there was a lot of craziness, and that created “liquidity.” But that’s drying up in a hurry. So the market is crawling back to a normal housing market where it takes a lot longer to sell a home, and you don’t get for it what you want to get for it.

The real problem is the “pay whatever” mindset, which is a new fad that has been a decade in the making, thanks to the Fed. I’m not sure it will be quick to go away, since there has been almost a generation of no tether to reality.

You pay 6% to sell a house?

Around here it is between 1.5% and 3%, paid by the buyer. I sold and moved last year. Since the house I sold was in the low price range the realtors did just offer a fixed price to do it, working out to about 1.5% of the sale.

Is there any data regarding mortgage assumptions, particularly the assumption of these 3% mortgages?

Almost no mortgage allows that. It would have been stupid for the lender to offer it, so the buyer would have to have had the forethought to negotiate for it. (I sure didn’t).

Wolf,

The one thing I understand about the free enterprise system is that it ALWAYS finds a way to bypass obstacles, whether they come from the government, the banking system, or whatever. Bankers hate 3% mortgages. Got it! But, guess what? Home buyers love them, and the market isn’t moving right now! Screw the bankers and what they want! The bankers can go pound sand as far as home buyers are concerned right now. They’re sitting on the sidelines until the ridiculous prices starry-eyed home sellers are trying to realize come down to reasonable levels, AND the ridiculously unaffordable mortgage rates come back to earth.

And yes, I’ve read all of your articles concerning the housing market because I’ve been trying for the past two years to buy a house in the hottest housing market in the country. I’m tracking everything I can in the hopes that some sanity is just around the corner that will allow me to buy a house at a reasonable price with affordable payments. I’m tracking that the houses in this market went from $200K – $300K in 2021 to over a million dollars before the market stalled when interest rates shot up. Homeowners here are smoking the hopium that they can cash in on their home equity to make a bundle, so they’re keeping their prices artificially inflated seeking that sucker willing to finance their retirement. Meanwhile, we buyers are sitting it out on the sidelines saving up our downpayments waiting for reality to bite them in arse. If we time it just right, the bottom will fall out of the housing market, especially with multiple townhome and apartment projects starting to come online putting further pressure on prices to fall, and we’ll be ready to pounce with our continued savings having grown to the point where we can buy without the need for a mortgage in the first place.

The only thing that has allowed the sellers here to keep dreaming of cashing in at ridiculous levels is the flood of refugees from Commiefornia pouring in with cash, but even they are starting to become more cautious as they smell a reckoning coming. No one wants to get caught overpaying for a property with an outrageous interest rate to boot when they start sensing that a reckoning is just around the corner. So, they also wait.

Well, I think it was the fed that did a report that stated someone lost $440 Billion on the 3% and less mortgages. Mostly thru cash out refi’s. Because at the time of these low rates there was not much inventory.

I’m not sure whom lost the $440 billion, was it the economy, realtors or the fed?

Or perhaps it stimulated the economy when it needed it?

My impression is in many localities buyer demand (though lacking) in ratio to (historically small) active sellers is creating a sellers market.

Suppose most of the 4% and below mortgage holders put their homes up for sale. And concurrently went house hunting.

(Not all will decide to buy which would mean less demand, but suppose they all did).

If this 4% and lower crowd is substantial… then by adding this number to BOTH number of buyers and to number of sellers the net effect is to LOWER the ratio of buyers to sellers. By adding this to both sides it puts the numbers more in equilibrium. As such it would be less of a sellers market.

Here’s a more detailed description…

Before: B is number of buyers

S is number of sellers

Let N be the number of homeowners with a 4% or less rate that decides to sell (and buy as well).

Currently we have:

Ratio of B / S implies sellers market as

B is sufficiently large relative to S to make it so.

However:

Ratio of (B + N) / (S + N) is closer to 1 than

B / S.

As such buyer (demand) is now closer to equilibrium (closer to 1 for sure) with sellers. Hence less of a sellers market.

If we reverse this thinking its clear that the loss of 4% and below sellers increases the ratio of buyers to sellers enhancing the sellers (edge) market.

The above argument ignored the fact that a small portion of sellers will choose to not buy. But this also would also lessen the effect of buyer demand.

Again, if reversed, more of a sellers market.

Bottom line: if there are a substantial numbers of sellers choosing to not sell (because of low mortgage rates) this increases the ratio of buyers to sellers

versus the alternative (the sellers not holding out).

This increased buyer to seller ratio creates more of a sellers market.

I remember assumable mortgages that used to be sort of common in the 1960s, 1970s. Basically the buyer could assume your mortgage (and your interest rate) when you sold your house.

Yeah. That worked great unless the mortgage balance was far less than the sale price and the new buyer couldn’t come up with the difference. Then the new buyer had to qualify on his credit.

Then there were them fees, so it wasn’t as advantageous as you might think. It wasn’t all that and a bag of donuts.

Yeah… I bought a house that way in 1991 when I got home from a deployment and had a lot of spare cash. 9% assumable in an area that desperately needed Single Family Rental houses. I rented it out for good profits for about eight years… and then I got that one tenant who so totally damages the house that it wipes out years of profits.

And THAT, boys and girls, is why I will never do residential real estate rentals ever again!

No, the mart does not need a mechanism for another entitlement. The price of money fluctuates, tough luck for all!

This does seem counter intuitive from the standpoint of a financing organisation. What sort of sweetener would be needed for them to take on the loss between the previous rate (say 3%) and the new rate ( say 6%) for a new loan?

Unless the seller stayed with their original lender and topped up/paid back the difference between both loans, with a commitment to join the lenders variable rate in, say, 2years on the total value of new loan.

But very few people are going to go for that sort of thing after the last year or so of interest rate rises, right?

I was thinking more of a mechanism where the seller and the buyer both had 3% mortgages and could basically swap properties with one paying any price difference with a much smaller 7% additional mortgage. Not an ideal situation, but creative financing is needed to move the markets. The best solution would be an arrangement that removes the Federal Reserve from the entire equation by creating a secondary money market for housing transactions. When the government becomes the obstacle, the market needs to find a way to bypass that obstacle. That is free enterprise in a nutshell.

Tom,

I agree with Wolf. no lender/bank will allow this because they would lose too much money.

I like the idea that the mortgage rate and loan belongs to you and not tied to the house that is purchased. Mortgage rates today are tied to the house as collateral. The rates are lower because they are secured by the house by contract. You could take out a personal unsecured loan today and according to a web search, pay from 9% to 25% interest rate for the loan. That loan could be moved from house to house but it would not be very attractive. Tying the loan to collateral makes it cheaper. If you had 500K in the bank, you could use that as collateral and likely get a much lower rate. There seems to be tax advantages and portability advantages with securing loans with cash. As long as you have it….

From a bank perspective, if someone signs a mortgage contract, they are obligated to pay off the loan when the house sells.

A 3% mortgage on a 500K house yields the bank 259K in interest over 30 years. This is what the banks are stuck with.

A 7.1% mortgage on a 500K house yields the bank 710K in interest over 30 years. This is what the banks would prefer.

This is a 451K “loss” for the bank/lender over 30 years if they allow someone to violate the mortgage contract. I think it would be hard to convince the bank to break the contract for anyone.

I think this 451K “loss” is interesting. If I was a bank, I’d like to dump these loser 3% loans as fast as possible.

What motivates people to sell?

1) Death. – The banks won’t kill you. The banks have to wait.

2) Divorce – The banks won’t send in a drama divorce team to break up your marriage. Though this may be a good Netflix drama.

3) Job loss or transfer. I suppose if you worked for the bank, they could lay you off or transfer you to Siberia so you had to sell the house.

4) Maybe you’d really like to live somewhere else but feel proudly trapped with your 3% mortgage. Why can’t the banks offer you 50K to you to sell now? You get 50K and they save 400K by luring you out of your loser 3% loan . Win-Win for everyone. Well, except for you who will be lured by money now in order to be trapped with a 7.1% mortgage for 30 years and pay that extra 450K over time.

My parents rode with their 6.5% assumable mortgage from 1975-1995. That was when mortgage rates were 12%-18%. I’m sure they could have found a buyer but what then?

I just got back from “resort country”, sorting out a family members estate. I saw what I suspect to be the beginning of a bursting real estate bubble. A huge number of properties have gone on the market this summer. This includes some abandoned properties that have sat unused for probably 10 or 15 years at least. At the very least, people are probably putting second homes or family properties on the market. Some of the shadow inventory is making it to market finally. It may be too early to say whether this is the start of a major bubble bursting, but I honestly have not seen properties on the market like this for a long time. It seems to have happened all of a sudden. So anecdotally, my experience backs up the headline.

Where is this “resort country” if I may ask?

Tulsa, OK.

We just went under contract last Saturday, but there was no FOMO, we got under asking on a gorgeous forever home with character and privacy (and a ridiculous pool) after a price drop. If all we needed was a place to live, we wouldn’t have done it. We already have a condo with no mortgage. But as two elder-millennials at mid-career (mfg engineer and data science), dual-income, no kids (ever), no debt, we wanted to get to living for all our hard work. The economy can do whatever, if rates go down enough to refinance, we’ll do that. If asset prices fall, our wages won’t. Housing isn’t an investment for us, it’s where we can relax and enjoy not being at work.

Be very careful of the term ” forever home”. A friend of mine does high end metal work for late career or retired folks building their dream homes. In every case over the last 15 years these have been ” forever homes”. These are very high end with stuff like ” whiskey rooms’ and elevators. But in every case he can think of they end up on the market in 3 to 5 years.

Not a build, existing home. Nothing fancy like elevators, and not so big we can’t clean it when we’re old. It’s fancy for us, not fancy as far as houses built after 1977 are concerned. lol.

Yeah one of the big drivers of home sales in the US is divorce, at over half of US marriages, one of the highest divorce rates in the world–though monkee and spouse might be in better shape as DINK, seems it’s the stresses (financial and others) of having kids that really drive the US divorce rate up to disaster. Anyway, that’s indeed why the “forever home” concept is flawed, there are plenty other reasons for having to move too, from basic things like getting a new job or helping family, and not to mention the string of natural disasters taking out whole neighborhoods in the US these days. But divorce remains a big one, it’s a reason even the Americans who got their mortgages at 3% fixed have to be careful (and for many of them the high cost means their monthly payments are too high anyway), that forever home may not wind up being so much.

And divorce is a very, very nasty finance wrecker in America, in fact in the USA, it’s probably the most damaging event to the finances of even rich upper-class Americans and high earners, even worse than a long illness or injury. You look at those life expectancy stats, even wealthy American households have lower numbers than Euros and the wealthier Asian countries do and I have to wonder if the nastiness of American divorce (and it can get really nasty when there’s a lot of asset wealth) is a big part of it. The media doesn’t get into it much, but that’s because divorce is actually a huge and very profitable industry in the United States, not just for the divorce lawyers but also the divorce courts and states themselves. They have ways of getting a cut of the extracted money from alimony, court fees and child support, and the cash cow if you’re a high-earner is you. I’ve had more than a few very high earning friends, even surgeons and company execs get ruined in divorce and prenups can be tossed out on a whim, it’s the surest way to go from riches to rags in America. The family court judges can impute ridiculous amounts, little option for due process or appeal, based on a bumper year that’s atypical–see Robin Williams for a scary example. Not to mention the emotional trauma, losing your kids, home and prized possessions and assets.

It’s gotten so bad we’ve even had financial advisers tell us that if you really want to protect your assets and savings from the financial wreckage of American divorce, at least if you’re not DINK and want to have kids and start a family, your best solution may be to go expat and leave the US especially if you’re professional, saved a nest-egg and have skills you can market elsewhere. I still don’t really understand the legal machinery but basically in countries with common law tradition, that means ex. the US, UK, Canada or Australia, divorce has a way of becoming a profitable industry, with high frequency and utter misery for the spouses caught in it. However in countries with courts and judicial authority from civil law, you can’t profit from divorce like that, so things like shared custody are the norm and support payments are sharply limited (with several forms of community support where needed). It’s why for ex. Europe, South America and most of Asia have more boring divorce proceedings and less of it, you can’t make money off it. Maybe not so great for the lawyers and profit-seekers but much safer for spouses in case things don’t work out as planned.

100%. This again comes down to distressed selling. During the GFC there were tons of layoffs. So that’s easy to figure out. But like you said…. life situations will happen. Divorce being a big one. Case in point I know folks who snapped up a beautiful home for a fraction of its worth 10 years ago —all due to divorce forcing the sale. In the last few months… I really actually have been wondering how many married couples will be sleeping in different bedrooms now… they both signed that paper and got that 3% mortgage. Will the 3% make them roommates at this point (if they weren’t already). lol

True Miller. In the 2014 documentary “Divorce Corp.”, the divorce process in the US is compared to the same process in the Scandinavian countries. Scandinavia has a much easier, less costly and more equitable approach.

The divorce “industry” (for lack of a better word) was at $50 billion in the US at the time that documentary was made. I’m sure it is larger now.

The divorce lawyers are one group that is doing very well at the expense of these ended marriages. They’re making out like bandits.

Any US man considering marriage should watch that documentary first. Sobering, to put it mildly.

I have not had the pleasure of going through a divorce, but I do not understand why I would need a lawyer. My brother unfortunately got divorced a few years back, and they started with a lawyer. I asked/suggested that they get rid of the lawyer and use a COMMON SENSE approach to the divorce. Luckily, they got rid of the lawyer and did approached it sensibly.

Putting aside the need for an attorney being required for property/asset transfers, what does a lawyer do in a divorce case besides fill his pockets?

A nice write Miller. 53% of marriages end in divorce and we can easily assume that at least half of the 47% that don’t get divorced are miserable and just stay together because it’s too costly to divorce. Makes you wonder why anyone even gets married anymore.

But to the point of the discussion most of the houses “and other assets” owned by divorcing couples will probably end up being sold, no matter if it’s a 3% mortgage or not.

Actually the highest chance of divorce is if the woman is college educated. It has nothing to do with kids. I don’t know why, but that’s what the stats say.

College-educated women have careers and are financially freer to do what they want to do, and so they don’t have to put up with our crap forever. That has been pretty well established.

GenX is called the Turnkey generation for a reason.

Turn the key over to the next buyer in 5 years.

Paint their smells off and you’re good.

I love your level your level of optimism to put it nicely..

“The economy can do whatever, if rates go down enough to refinance, we’ll do that. If asset prices fall, our wages won’t”

monkee,

“If asset prices fall, our wages won’t.” Even if you are a government worker that assumption might not be true. As Phoenix points out, that may be the optimism of youth.

maybe they haven’t learned yet that wages can go to zero and stay there for a while. Hopefully, it will never happen to them.

Wages may go from $200k to $0 overnight (-100%). They don’t go down more or less gradually, like assets. Assets might go down that much too, but rarely overnight, though some cryptos accomplished that.

Agree and as Wolf said your income can become 0 overnight but apparently everyone can think they are somehow the exception until they are not.

This to me is another sign we are at the height of the bubble, when everyone think the dam won’t break and double down on why they are so special..

“If asset prices fall, our wages won’t.”

anyone who says that isn’t over 40. Wolf got the reply correct. Personally he’s more generous than I. I look forward to these people losing their asses. I’ll say it again, schadenfreude is real.

“mfg engineer and data science”

These are likely two of the most solid professions you can have for the next decade if you are average or better at your job.

“anyone who says that isn’t over 40”

True, but times have changed. Demographics favor an excessively strong job market over the next decade as Boomrs finish retiring. The people under 40 have a point.

This assumes no unforeseen illnesses/death, no midlife crisis, no changes of heart, no latent desires for progeny manifesting at the 11th hour…

The reality is that no matter how solid your footing seems to be, no concern involving people is ever static. And the more confident you are that it is, the more traumatic things will be should things go sideways. I uh…know whereof I speak.

Meanwhile, I hope Mr & Mrs Monkee can beat the odds and be content swanning about in their ‘ridiculous’ pool until the lights go down.

Dick (couldn’t reply to your comment below), why would you want these “Elder Millennials” to lose their asses? That’s mean. I think doing one’s best to achieve one’s dream is the best one can do. And I hope the timing works out for them. Not like they’re going out of their way to screw someone else in the process.

Good for you. I think you made a wise choice.

What is an “elder millennial?” How can you predict your wages won’t fall? This sounds incredibly risky.

Isn’t this lack of housing also going to keep the job market tight? Unless the job is remote or offering an amazing relo package no one is really applying for the job unless it’s people already local. Given these people are probably happy at their jobs, any open position will have to keep ratcheting up the pay to try to pry someone local or entice someone non local.

Would the lack of fluidity in the housing market also increase inflation?

I’ve applied to some jobs and they were not remote. They ran through the interviews with me and everyone else and had to repost the position. These positions are going on 6+ months of being opened.

yeah that may be a good point, and the WSJ was reporting today that despite the recent news of higher wage demands and some concessions the unionized workers have gotten, overall companies are scaling back pay packages and paying new hires less. Not really sure what to believe yet so I’ll wait and see and how that goes–services inflation seems awfully sticky so I’m skeptical. But your overall point does make some sense.

The wacky rental costs and housing prices throughout the US greatly reduce any incentive or reward for moving, at least for those with good job prospects where they already are. So it would have to be a very nice pay package and relocation bonus to get Americans to move. I think they’ve been saying that Americans mobility from state to state is one of the lowest they’ve ever measured recently, even well after Covid and all the pandemic stimulus programs reducing evictions and foreclosure protections. That might seem to back up what you’re saying.

“WSJ… overall companies are scaling back pay packages and paying new hires less.”

That was a BS article based on job listings on ZipRecruiter, which are very self-selective and represent only a small portion of all job openings. That’s the most BS-data anyone can dig up. And they didn’t even dig it up.

ZipRecruiter likely went to a WSJ reporter with this stuff to get its name in the WSJ in order to pump up its stock price, which has been languishing: direct listing in March 2021, first trade at $20, today at $16.

I brutalized the WSJ publicly several times already for the BS they’re occasionally printing, and I was tempted to do so today.

Good to know, thanks for confirming my skepticism on that. WSJ seemed to be flying in the face of every other data point and indication coming out with that article.

Wolf,

I concur with your analysis. I just read an article describing how new grads are demanding higher starting pay packages and willing to walk away when they aren’t forthcoming. Hiring managers are recognizing the need to boost pay packages to compensate for the rising inflation resulting from Popsicle’s economic policies. Pay is definitely on the rise, and articles such as the one from WSJ are the establishment’s pathetic attempt to gaslight everyone into believing them instead of our lyin’ eyes.

Cash buyers will ultimately win. They know prices will drop eventually and most can simply wait. Meanwhile individual cash buyers can get 5.5% in T-bills. Builders will also win, until the economy goes into recession. It will be interesting to see when and how quickly it all pops. Since we had over a decade of a fake economy (ZIRP), historical patterns may not be so much help now.

This seems like a great strategy.

Wolf, what do you think will get us out of this stalemate where there is balance between buyers and sellers (none of either)? In other words, where is the pressure to drive house prices down to a more reasonable level for the current interest rate environment going to come from?

There is already a balance — hence slowly dropping prices, slowly rising supply, more days on the market.

If potential sellers start flooding the market with properties, there won’t be any buyers at these prices, and the market will be “out of balance,” and sellers will have to cut their prices to where the buyers are, and each wave of sellers will have to cut more to find new buyers, and prices will plunge.

in USA, I read somewhere that we have 15 million homes vacant and in STR.

Unless recession hits hard, I don’t see prices going down substantially.

Yeah but all you ever hear on MSM and he’ll even on NPR today is we need to build more houses..build build build cause we have a shortage and this is only way to fix housing affordability..

Everytime I hear a talking point like that it reminds me of putting up a picture hanging nail and using a jackhammer as the tool…utterly stupid

Why is it so stupid ?

If the vacant houses aren’t active listings and for whatever reasons aren’t likely to become active listings…however unfortunate (unethical even?) that may be …then new construction may be the only practical assistance for buyers now.

I watched a video a year ago…some guy walked thru Manhatten or one of the NYC boroughs and he showed all the vacancies. I was kind of amazed.

Every 3 or 4 buildings another vacancy.

One didn’t get the impression, I guess from what the guy was saying, that many of these empty sites would be inhabited soon (by business or tenant).

These were prior business properties mostly.

The fundamental housing factor of zoning, mostly political, doesn’t get much news coverage. In California several laws to encourage housing construction went into law, but no information is available about their impact. Around the country Jackson Hole, Wyoming recently made news as to worker housing problems, but it was another of some other layer of government’s authority with no reporting from anyone with the actual authority.

There is no end of land to build on, no end of cheap sticks, and gypsum for the walls is one of the most abundant US minerals mined in huge open pits. If cities can be built in the desert, certainly California could tap into water flowing unused to the Ocean, running through a house, treating it to clean/safe and then let it flow to the Sea.

In CA, they want you to build a casita in your backyard to offset the “housing shortage.” Some local city governments are suing the state because the state is forcing them to push this law onto residents. Absolutely ridiculous way to improve housing supply.

Casita is a nice name for a shed. This modern techno-fuedalism is baizarre and twisted. I can imagine that the Lords of the Land will just be hanging out and relaxing on their property as they milk their personal peasant who comes and goes from the property to their relatively low wage jobs. The Accessory Dwelling Units (ADU’s) sound like as step in some kind of direction to do something but when I think of what it really will look like when fully brought to fruition as a very large scale policy for housing, it does seem like some degenerate feudalism and a further slide towards having social aspects very common to third world countries. I’m very critical of a lot of things because I spend a lot of time trying to figure out how some issues can be handled through various approaches and the ones that are often promoted never seem that great in comparison to ones that could actually have real benefits but never are seriously considered. First off, this country needs to build houses better. Building dwellings from materials that really only last 50 years creates spiraling cycle of decay that pushes too much of the cost onto the next generation while also having many negative social impacts.

BRW – …it might be argued that planned obsolescence/advertising-based dissatisfaction with anything perceived as ‘old-fashioned’ in as many things as possible is what grew the mighty ‘Murican consumer society…

“…and that old house we lived in, the roof is cavin’ in, like every other one along the block. Took twenty years to pay, and ten to rot. Now dad says it’s all better just forgot…”. -rodney crowell: ‘Home Sweet Home (revisited)’

may we all find a better day.

Gary – CA already tapped then-unexploited Rocky Mountain water resources and built in the coastal deserts of SoCal decades ago, and depends on the no-longer reliable annual Sierra Nevada snowpack, as well. Please let me know about your location and sources re: ‘water flowing unused to the ocean’, and your knowledge about the effects of overdrawing rivers on commercial fisheries and healthy riverine ecosystems (this includes cities located on rivers, surely there’s a lot of ‘unused’ water there better removed and placed somewhere else?).

may we all find a better day.

I think a huge discount here, in post pandemic economics, is the new inflation adjusted thinking, narrative or philosophy that buying homes at these highly elevated levels is normal, or the way things will continue, at least sometime into thr immediate future.

That perception is flawed and distorted, primarily because people don’t have incomes to support or sustain that level of financial stress, the structure of the economy won’t allow for people to pay excessive prices, unless wages explode exponentially, or there’s a massive amount of wealth transfer.

This can’t continue IMHO

Its not the median income earner today (5 months ago ?) who buys the median priced home. Its a household at the 60 or 65% percentile.

Extending that thought… if the top one third in wealth devoted all their resources to buying residential real estate and politicians did nothing to stop them… my guess is they could buy all the residential homes for sale… outbidding the lesser 70% as necessary.

As such, it would be IRRELEVANT that the median income person was not able to buy a home.

Well of course unless an insurrection took place.

That’s ok, I can adapt to anything coming. Should your scenario come to fruition and the pigmen gobble up everything, I will be happy to rent from Blackstone, Blackrock, or whoever.

When it starts to get chilly in the winter, I will start feeding the woodstove – illegally installed of course – with the hardwood flooring to keep myself warm. When I burn through all of the flooring, next will be the kitchen and bathroom cabinetry. Once that has been exhausted, I will start dismantling the framing of the house in the far corner of the garage and cutting it into firewood. You get the idea.

Once my habitation is complete and I decide to move on to a new “rental” (unbeknownst to them and under the cover of darkness), they will be left with a teardown.

In my area, I see the month-to-month and the year-to-year “closed sales” continue to decline. However, the median sales price keeps increasing–although the sales price is much less than the list price.

This tells me that only the very expensive homes are getting sold. If you want a home, you’ll pay through the nose for it. Maybe these are professionals who use larger homes to use as businesses, like a CPA or a chiropractor. Or maybe it’s just the super wealthy who have no need to worry about price.

I think we are entering an era where the concept of appreciation in real estate value will be looked back on with the same kind of Nostalgia we now have for white wall tires and free food at happy hour.

During the housing craze, Americans and Canadians who cashed out ended up buying homes in Mexico, Ecuador, Paraguay and Belize for hundreds of thousands of dollars without the benefit of a second citizenship like St.Kitts or Dominica.

Rural communities in Mexico had houses selling for hundreds of thousands of USD in anticipation that those locations will become tourist traps for AirBnB rentals.

Ironically, countries such as Brazil, Venezuela, Argentina didn’t get as much hype.

Do it the Canadian way:

Ottawa considering a cap on international students to ease housing pressure, says Fraser

Canadians are fully aware that the majority of real estate investors are buying up houses to rent them per head in rooms to profit.

Hence, streets that used to have a car or two on the driveway now have several parked on the lawns and on the streets.

Quiet cul-de-sacs where you met your friendly grandmother have transformed into modern-day ancient Rome overcrowdedness.

All empires both modern and ancient “like Rome” ,devolve in to a late stage where everyone wants to become a ” coupon clipper” as opposed to to worker or craftsman . Thus the desire to be a landlord, RE investor or crypto flipper. This period usually means that empire is near its end.

True. In an era of low interest rates, becoming a slumlord for a guaranteed quota of international students (like Canada), or flipping real estate for gains (like America), or buying up houses in rural communities for AirBnb rental income is a harbinger for a Great Depression to come.

Literal Rent-seeking has to be one of the most destructive ways to destabilize an economy for generations.

“Literal Rent-seeking has to be one of the most destructive ways to destabilize an economy for generations.”

Yes this should be a headline in itself. We were talking about this on some previous threads and it’s true, the 18th century economists were even saying this way back. Rent seeking is very dangerous to actual industrial economies because it forces the costs of everything to go higher, including what workers have to demand just to live–they’re not necessarily doing any better financially, it’s just that when profiteering landlords, home sellers and rent seekers elsewhere (healthcare and college in the US) charge higher prices, more money is needed to cover basic costs. It’s why most people I know have never paid much attention to all the boasts of how one American city pays higher salaries than another city (much less comparing internationally)–that’s basically meaningless unless we know the cost of living. If rent, cars, healthcare and food are much higher in City X than Y, then the higher salaries in City X get us nowhere.

But the ultimate price of the rent seeking is much worse, because those rent seeking cost increases translate into higher prices for businesses just to break even with their goods and services. Which makes them less competitive, and they start to fail against other regions and countries with less rent seeking costs. It’s what we saw in the GFC. Even though the US is supposed to have more competitive businesses and productivity, we had a ton of our businesses bought out and controlled by European and Asian competitors because things like their healthcare and college costs are a lot lower than the US. So even though employee salaries were lower, cost of living was lower too so workers didn’t need as much to afford things, and the ultimate price was American businesses falling apart.

Now it’s even worse with the US housing bubble and Everything Bubble, even though it can be bad in other places healthcare and college are even more outrageously expensive in America and then rent and housing on top. It means our businesses have much higher costs, and other countries (even with highly paid workers) can more easily compete with less costs for their goods and services. The only way to solve this is to take the hard medicine Volcker prescribed and allow home, rent, healthcare and college prices to go way down, closer to incomes and costing much less. But it’s just hard to see that happening with all the corruption and the rent seekers basically controlling a lot of US politicians the way things currently are.

I read & agree with everything you wrote.

High rents affect business because of increased fixed costs, and also employees demanding higher wages because of their rents.

Now this is where the Canadian government use cheat codes:

They allowed ‘international students’ on a student visa to work 40 hours a week like the average 9 to 5 worker, while at the same time, Canadian high school students and Canadian single parents can’t even get a part-time job.

Now this is dire in Toronto, the financial capital of Canada, because government jobs and business jobs are being insourced with staffing agencies who lowball wages.

I asked one unionized how much the union wage starts at, he replies C$35/hr, and how much the temp agency pays, he says about C$15-16/hr (basically minimum wage).

I asked him how could anyone afford such wages, and he quietly told me that while the average Canadian prefers to live in a 1-bedroom apartment by themselves, the temp agency hires people who are comfortable sharing a room with several other people.

@Miller

Comments only nest so deep. Just wanted to thank you for such quality posts recently. Worthy of much thought.

“Literal Rent-seeking has to be one of the most destructive ways to destabilize an economy for generations.”

And yet so easy to fix. Eliminate all investor tax breaks for home ownership. The owner-occupiers don’t get those tax breaks, and the investors shouldn’t either. The result would be some much needed selling, and a lot less hoarding. Houses are not for HODLing as an empty store of value.

“And yet so easy to fix.”

You honestly think so? Eliminating depreciation is going to solve everything? Do you know what it will solve? The elimination of rental housing. Apartments will turn into condos or co-ops, single family will become available – but not in the *hot* neighborhoods with the excellent schools and the ocean view. The tax code is a bazillion pages. Trust me, there’s a loophole in there somewhere for your “easy” fix.

That “easy fix” is about as deep a thought as “build build build”. Build build build won’t get you affordable housing… it will just get you tract whacks on postage stamp lots built with cheap materials by unlicensed subs and still won’t be affordable.