AI hype & hoopla replaces crypto, blockchain, and FinTech hype & hoopla. You’ve got to go with the times.

By Wolf Richter for WOLF STREET.

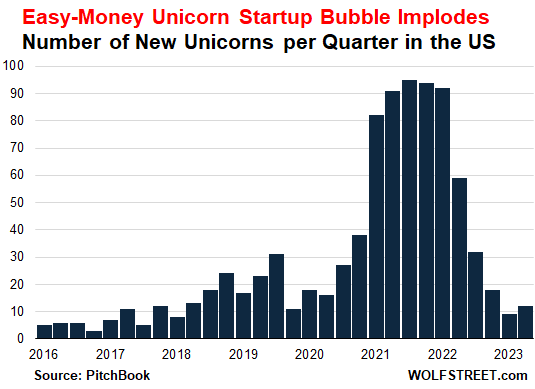

In the second quarter 2023, only 12 venture-capital-backed startups in the US became “unicorns”: meaning they received funding that valued them at over $1 billion. In Q1, 9 startups became unicorns in this manner, the lowest since January 2018, according to data by PitchBook.

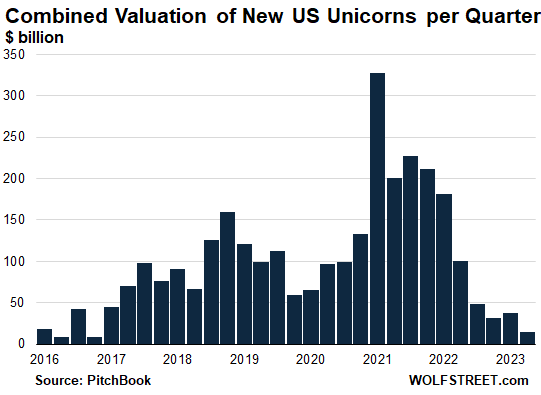

In Q3 2021, the peak of the easy-money unicorn startup bubble, 95 startups became unicorns. In the year 2021 – the last year of the Fed’s easy money – a total of 362 new unicorns appeared in the US, with a combined valuation of nearly $1 trillion!

By Q2 2022, the Fed was hiking rates, and the number of unicorns plunged by 36% from the prior quarter to 59 new unicorns. In Q3 2022, there were only 32 new unicorns. By Q1 2023, with the Fed’s interest rates approaching 5%, unicorn creation plunged by 90% from the peak, to just 9 new unicorns. And now the top end of the Fed’s rates is 5.25%, and more rate hikes are coming. So some kind of normalcy is returning to the startup scene:

So 12 unicorns being created in a quarter is pretty good in normal times. But during the Fed’s easy-money bubble, everything and anything became a unicorn.

As you’d expect, given all the hype and hoopla about generative AI, five of the 12 newly minted unicorns in Q2 (42%) came with “artificial intelligence” labels.

By contrast, during Q3 2021, the peak of the unicorn bubble, only 17% of the 95 new unicorns had AI labels. As you’d expect, popular labels back then were Crypto, Blockchain, Fintech, AdTech, Saas, Marketing Tech, Clean Tech, etc. Hype-and-hoopla has got to go with the times.

Valuations plunged.

In Q2 2023, the 12 new unicorns had a combined valuation of $15 billion, the lowest since Q4 2016, which caused the average valuation per unicorn to plunge to $1.2 billion, the lowest in the PitchBook data going back to Q1 2016.

By contrast, in Q1 2021 – with the Fed’s easy-money policies in full swing with near-0% interest rates and $120 billion a month in QE – the 82 new unicorns had a combined valuation of $327 billion, for an average valuation of $4.0 billion per unicorn.

The Fed hiked rates, unicorn bubble imploded.

By now, the stocks of hundreds of former unicorns and less-than-unicorns that had managed to go public during this easy-money bubble via IPO, direct listing, or merger with a SPAC, have collapsed and have become heroes in my pantheon of Imploded Stocks.

Given this backdrop, and given the hundreds of billions of dollars that gullible retail investors lost on this hype-and-hoopla show, it’s now difficult for iffy outfits to pull off overpriced IPOs and SPAC mergers. And big corporate buyers have cut back too. And so the exits for VC firms and other early investors – when they’re able to sell their stakes to others at a huge profit – are just about closed.

This has had a sobering effect. It put a damper on VC funding overall. It brought down valuations. It led to funding rounds at lower valuations than prior rounds – the dreaded “down rounds.” It allowed recent investors to impose terms that are much more favorable to them, and less favorable to the earlier investors, founders, and other stakeholders.

These are signs that some sort of normalcy might set in again – a dreaded concept after years of easy money that made everything possible and led to some of the worst and costliest decisions and capital misallocations all around.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The money that everyone was raising from VCs a few years ago at insane valuations did provide runway – even with the insanely wasteful spending by many.

“Down rounds” are still very rare from what I see – more common are layoffs (endorsed/pressured by VCs) to lengthen runway with the hope/delusion that things will go back to ZIRP soon enough. Or so they say.

I think a lot of VCs need to keep appearances here for their LPs. They can still use the old valuations as long as their portfolio companies don’t raise another round – so they can hide how bad it is for now while raising for their shiny new AI/ML fund.

Imagine how bad a company is doing that couldn’t justify going public in 2020-2022. Now imagine a portfolio of those companies…

“Imagine how bad a company is doing that couldn’t justify going public in 2020-2022.”

Agreed…but a huge percentage of the IPOs from those years were…SPACs.

Of which a huge percentage couldn’t find acquirees the SPAC holders would okay…so they’ve had to return (most) of the IPO proceeds.

SPACs were a weird beastie from a weird time period.

It was like Wall Street was overwhelmed with incoming funds (PPP? Bond and loan maturities?) and could not actually put the money to work (pandemic impediments? But how does a pandemic stop phone calls, emails, mooching, smooching, and BS’ing?)

The Street will *never* let a dollar pass by…so SPACs were supercharged…as a sort of…drunk tank (?).

But 2 years later…the Street (which has sold poisoned snow to Eskimos) *still* has not been able to put the SPAC money to work.

Which is weird, very weird.

If they were able to sell the SPAC crack in 2021, you’d think they would be able to shove the sacks of crap over the finish line by mid 2023. But apparently not.

If nothing else, at least unZIRP may have been able to break the ZIRP fever dream in this one small corner of the madhouse.

“Imagine how bad a company is doing that couldn’t justify going public in 2020-2022. Now imagine a portfolio of those companies…”

Lol.

Also, 2016 wasn’t normal times, 2016 was ZIRP. Today at 5.25%, 2016 valuations would require a retarded AI to fund it.

I guess the (crappy) mainstream articles can be written by generative AI. Example, when Fed minutes are released, AI can parse it and generate a summary article in seconds. It would have big errors, but that doesn’t matter to mainstream media.

The funny future would be to have AI bots / Algorithms scan these AI written articles to trade stocks. It would amount to “Crap In => Crap Out.”

So, the crappy web content is about to explode, and well written manual articles will become a luxury.

Also, the people spending more time browsing web for info will then have even lower IQ.

“Crap In => Crap Out.”

Let me add an angle. That phrase was the old linear computing world. Now, AI dramatically surpasses old computer in/out by adding fantastic but believable inventions and hallucinations to the outputs, some with plain characteristics of deceit. It is “people-pleasing” in weird, unethical ways. For example, it recently fabricated legal case law, whole court opinions, that a foolish lawyer errantly included in his briefs filed with a court. In that case, humans in the loop quickly caught it. but that extra layer is not everywhere, or forever.

“The funny future would be to have AI bots / Algorithms scan these AI written articles to trade stocks.”

What do you think is happening right now ?

We’re Back to the future, Marty McFly.

Any SPAC AI stocks that anyone has heard of?

I just saw the Pets.com sock puppet with an AI T-shirt !

Nice

Wolf, I realize that your article is focused on Unicorns that went public

IPO’s but I just met my son (41 yrs old) most serious “girlfriend” who is 4 yrs younger than he. I told me at lunch that she spent 5 years in Barcelona and 2-3 years in Rio. I was afraid to ask her what she did during this time.

My son who has an electrical engineering degree has a good job working for a private co. knocking down $150K. I don’t think she has a degree.

My son informed me again at lunch that she works from the house they just started to share, “on line,” & that she knocks down “almost as much as he does!

So I then asked her what does she do?

She said that her “company” started a few yrs ago during the pandemic & has 16 employees spread throughout the country. and they “disperse government funds to the needy and the ‘un-banked’ & the “homeless.” I said, “oh you’re in Fintech!” She said she didn’t now what that was!

My son then explained it to her.

She also said that everyone in the “company makes the SAME salary.”

I said “Oh, equality!” She nodded.

The point of my story?

Seems to me like this is a government program because the funds are FROM the government!

She also seem to think that this will continue forever!

Hmmmm….

I wonder how many similar companies there are that are under the radar that we just don’t know about?

A bizarre story.

Once these government programs start they get their own momentum so may last for a long time.

Seems strange to have a private company in charge to distribute free money. Seems ripe for skimming funds.

To promote small business, there is a government wide goal to award 25% of contracts to small businesses. There are over 10,000 such businesses.

Err…, OnlyFans…

At least its not a “business” that uses the OF acronym… I heard a lot of those were started during the pandemic also.

hmmmm … sorry but i have to say her ‘story’ about her ‘business ‘ is total BS.

That was a lead off story on Hannity’s radio talk show a couple years ago.

It started a real lively discussion with examples of similar things. Probably gave all the listeners an excuse to get drunk to forget the country is going to hell and why.

Net Net; Hannity made money and all the listener’s wives got no lovin’ that night…..to say the very least…….

Oh yeah, almost forgot……..Hmmmmm…….

Hmmm implies “critical thinking”….I think…..kinda popular now, although I don’t know what’s wrong with just “thinking” without that adjective…..but I’m not in that talk radio loop.

And James O has a better post than me.

NBay – agree ‘critical’ shouldn’t be necessary, but over time, it appears a lot of what is passed off as ‘thinking’ more-closely resembles ‘confirmation bias’ without sincere internal debate…ah, semantics, where is thy sting (…why, everywhere, of course!). Best-

may we all find a better day.

Hey, just thought of a “truth” probably 100M+ believe.

“A woke person can’t think critically”

Semantic sting?

BIG OUCH!

I had an Area Recruiting Manager job for the 2020 census… it was shocking for me to drive up in my 20 year old Chevy to some event put on by one of federally-funded “Poverty Agencies” to do some recruiting… and see all the managers of these agencies driving up in new Mercedes and BMW sedans and crossovers.

Clearly I am NOT doing something right in this life…

The lunacy is still there.

CAVA

But a whole lot less of it.

And CVNA, COCO, CCL and hundreds of others. Anytime a company looks to be headed towards BK media pumps it up as a meme stock for the gamblers to buy calls on.

This can’t possibly end well.

You would think so. I keep waiting for some of LBOs funded with ZIRP money start dropping because now they have to refinance their debt at higher interest rates. These LBOs Balance sheets depended upon ZIRP loans to make things work. Higher interest payments will turn their cash flows negative.

I just do not know when this scenario plays out. 1 year…2 years….5 years?

Wow the AI topic is hyped and yet I still don’t really know what it does. I can see what Grammarly does, and it is helpful but not life-changing. But we the people are suckers for advertising hype. I wonder how the landscape looks to private equity? Probably not so good since they depend on borrowing.

AI will be “worthless” soon.

Rife competition between protectionist players on a global market will bring the price down to its true value… which is pretty much the energy, hardware, and UBI or equivalent for the displaced job opportunity… plus whatever margin a player among what will turn out to be thousands, can justify.

There simply isn’t any justifiable way to protect the market for the bubbly enterprises without also nerfing their market.

China will probably have AI on par with Nvidia in a few years if the CCP wants it badly enough… and time will tell how much value it actually has.

Kenny,

You are dead wrong on AI. What you fail to understand is that utility of “AI” has only begun. Most corps are realizing this and the ones that don’t will monetarily regret it only to jump on bandwagon when they realize they should have years ago. TY- “Grammarly” is just the drop in the bucket relative to the plethora of businesses which already and increasingly rely on AI as they realize the extreme cost savings that it provides.

I agree. There will be kinds of AI uses.

Now will there be am bubble in AI stocks over the next year or too. Probably but I feel that hype train is off and running and has a ways to go.

This sounds the same as the Blockchain shills in 2018.

Most people do not realize that AI’s can go crazy, too. But they can.

When that happens, you do Not want to be around. Like in a “self-driving car” that suddenly “decides” that it needs to Switch on the backburner and go Mach 3 when “seeing” a bunch of people in Front of it. Insurance companies still have to Catch up with an AI saying “Sue me”.

Gee. And when I finished biasing, and watched my very first flip-flops, and latches, work on the breadboard, they looked so cool and were WAY better than tubes.

“AI HOUSES” is what they really are now….a big SHITLOAD of them, but that is ALL that’s needed to “house AI”….every bit of it they ever code for! (unless you believe in weird stuff like quantum computing…or quantum anything. That’s just Newton’s stuff running into electricity, and the physics guys making a good living trying to reconcile it all mathematically)

No. I don’t waste any worrying time over that stupid Sc-Fi/movie “SINGULARITY”….much worse things REALLY exist.

Just working on a case where AI disrupts travel by doubling margins using real-time sentiment for revenue management. Numbers are impressive, considering the sheer scale of such enterprises.

And then figure out how many mid-size businesses are across the world, but this will take another decade.

TK admits … “I still don’t really know what it does”.

Let me man-splain it to you because I am an expert since I read a posting or two about it on some obscure websites. 🤪

Anyway … as best as I can tell … it gets “trained” on all that “100% True and Accurate”™️ stuff that is posted on the internet. Then you can ask it a question. And then it will use its near miraculous powers to ANSWER that question.

/ sarcasm trigger warning

If you send me $One $Billion $Dollars I’ll set one up for you.

And you’ll also get some completely dry land in Florida.

But wait! There’s more!

You’ll also receive title to a very famous bridge in New York City!

…

Seriously, I was a “professional computer geek for over 4 decades. As best as I can tell AGI’s are extremely large computer programs that parrot back what their developers tell them to do.

So … I’ll confess … that I TOO STILL DON’T really KNOW what it does.

But our elite masters tell us it’s VERY IMPORTANT. So it must be.

Kick back and enjoy a Bud Lite … and God Save The Queen man.

I mentioned above, but the AI hype feels similar to the Blockchain hype last decade. As a “professional computer geek” also (but only 2 decades) the blockchain tech is cool, but its just an iteration of distributive database technology. Its not going to cure cancer or usher in the Utopia, or free us from Central banks and politicians.

And neither will AI…

To put it in simple terms, its just ‘pattern recognition”. However, it doe not imply that the patterns may be the corrects ones, of if the reconition is accurate. It works pretty well on some cases. Mybe in time (years.. decades) it will get smarter. For now the hype compares to BC.

No, it will never get “smarter”. It’s not alive.

Even “alive stuff” doesn’t get “smarter”.

Just “different”

Like I said…only flip-flops and latches………just shitloads of them.

Sounds like you were around in the beginning like me. But after playing with VMS a bit, I got bored, became a field tech, and built an off grid house.

When I learned ADVERTISING is a 100% TAX WRITE OFF, I realized why things are so terribly screwed up. This accepted fact eventually spawned TWO new MONSTER SIZED INDUSTRIES, that just force ever sicker lifestyles (and infrastructure) on us, nothing else.

The government is the only organization with enough power (and it’s fading FAST) to stop these “busy-ness” men from taking “other people’s money” (and TIME), and TRASHING the planet in the process. So of course they are out to destroy the parts they don’t need, (like regulation, rules, and BOUNDARIES to net wealth) so as to more easily take their “profits” from us.

Advertising is not a “tax write-off”; it’s an ordinary business expense, like rent and payroll and paper clips.

It goes like this: you scramble maniacally to get revenues, and you blow a lot of money to get those revenues, and then all the money you blew to get revenues you deduct from those revenues, and eventually what’s left, if anything, is your profit, which is taxable. There is nothing to “discover” about this. That’s how business has worked for eons.

Ok, sorry, wrong term. Was in response to TK’s, “..we the people are suckers for advertising hype”, which is unfortunately truer all the time because they are getting so damned GOOD at it. It is an evil use of science, all human weaknesses, and many other methodologies.

I know/knew MANY (mostly small or first line, and the former is disappearing VERY fast) businessmen/managers and some worked hard and smart including you, but am still highly critical of the damage caused by the two monster industries spawned by this “simple business expense”…..and the present size of them and most all of their customers.

And as a life-long clock puncher my experience with businessmen/managers has been largely negative, so I’m extra prejudiced.

Ferrari sells 13,000 cars a year. The market cap is $60 Billion, more than Ford or GM.

History is very clear about the fate of stock markets where only a few extremely overvalued stocks are leading the market higher.

I doubt there are many human beings expecting a lock limit down day on the S&P 500 in 2023.

I don’t mind being in the minority.

History doesn’t apply to this market. Fed wants stocks up no matter what and that’s what they got since 2008 consistently.

You are not alone. In fact, it will be shocking if US equities don’t take a major hit before too much longer. Of course, I thought the same thing last. With that said, the Fed’s massive excess monetary stimulation will not change the outcome, it will just take longer for the excesses to burn off and the next phase to begin. Lastly, let’s not forget that we are still dealing with the fallout from the everything bubble. Any student of markets and bubbles will tell you the same thing, all bubbles end the same way. Badly!

Yay!! I shorted 1 share just to see where this will go.

What is up with the market so far this year!!! Even zombies like CVNA, UPST are tearing the market up. Crazy bat sheesh.

AI has a number of subcategories just as there is no one thing, “human intelligence ” (or “intelligence ” in general. That said, AIG, general AI, is for some the epitome of AI research).

As for: “AI hype & hoopla “… AI has been heavily researched in the US and elsewhere since at least the 1950s. Its funding has expanded and contracted at different times.

Japan (Nihon) undertook massive AI research in the 1980s in parallel with the expert systems rage here in the US. Just two examples of expanded funding.

Google “AI Winter ” for more info.

The “AI hype & hoopla” is in the financial realm: startup valuations and stocks. That’s what the article is about, not the history of AI.

Wolf,

I think Curious Cats is referring the repeating cycles of AI hype followed by crash, followed by more hype etc.

The “AI Winter” phase is part of that and has been observed for going on 70 years.

The whole thing of NVDA having a price to sales of 40 (4 times higher than what Scott McNealy was ridiculing back in the dot com era) has just taken this whole thing to super bubble levels.

So what is the catalyst for the next crash?

Or are we forced to play the short term treasury/sideways QQQ short volatility hedged position until unemployment goes up and credit spreads widen and then we can watch this bear market rally finally implode?

Assuming this is a bear market rally (which I believe to be the case) it will be the longest one since 1930.

The next phase will likely be absolutely brutal.

@ Bond Vigilante Wannabee

I tend to think the same, but calling the turn time (when the stock market goes into a consistent long term decrease as opposed to the recent up/down/up pattern) has made fools of many people. Including myself. At the beginning of this year, I strongly believed the economy would be in a recessionary condition by now.

Who would have thought a period of aggressive interest rate hikes would overlap with a stock market increase? One financial headline today reads “blistering stock returns make the case for a strong second half.”

Despite that surprising pattern, I continue to believe there must be an end game here. Asset prices continue to be so inflated that an adjustment seems inevitable. But when?

This situation reminds me of an old quotation from Michael Evans, the founder of Chase Economics. He said “the problem with macro (economic) forecasting is that no one can do it.”

“… what is the catalyst for the next crash?”

Would the Fed ALLOW a crash? Or would they “pivot” to 0% interest, trillions $ in QE, and bailing everyone out as a Dodd-Frank “systemic risks”? Doing that might limit even a 2008-magnitude crisis to a brief selloff and recession (followed by massive rally) like COVID.

The Fed has been rigging everything in favor of the stock market since 2008. Allowing Americans to save money is a step forward but I won’t believe we have a free market unless the Fed allows it all through the business cycle, including recessions. The stock market won’t normalize unless the Fed normalizes the rest of the economy.

The stock market is selling at 25X GAAP earnings because traders know that the referee is on their side and he has promised that they will win, no matter what!

The top is already in. We are merely sucking up some of the loose change before the bottom falls out. The question you should be asking is “What is the catalyst for the Nasdaq 100 to break out to a new high?” Apple’s $3500 Virtual Reality Headset? NVDA going from 40 times sales to 100 times sales?

I do not give Microsoft one thin dime. I use Open Office, which is a free version of Microsoft Office. I hate Microsoft. I have to save internet downloads on a chip and print them off of another offline computer because Microsoft will not allow printing on a computer that has Open Office (odt) files on it. Microsoft will try to wipe out any storage device that has Open Office (odt) files on it.

David Hunter will throw his hands up and say, “OK, I overestimated the peak of the blow off top, but I was right on the subsequent crash.”

Can’t reply to Harry Houndstooth…so I will reply from here. I have been using Open Office and Libre forever on my Microsoft OS loaded on my computer. I can print anything I want and have no idea what you are talking about not being able to print. My odt files are unaffected by the Microsoft OS and have never lost one. I also would never pay Microsoft for their Office 365. My open source works very well and for free.

John Galt, ultimately, markets are bigger than the Fed. The stock market behaves the way it is because of confidence and the perception that the Fed won’t allow it to fall.

But the Fed is not a magician. Reality always eventually asserts itself.

@Cold in the Midwest – I think we would be in a recession if the Fed and Treasury did not bail out the banks and depositors like they did, changing the rules on the fly. This created more bubble psychology in investors, just reinforcing the idea that the FED and Congress will bail them out when they need it.

Wolf thinks the FED will not pivot, but I am not as confident. Congress will spend whatever to save the wealthy. Who will win in that fight if the market starts to really crash?

As I wrote “Google AI Winter”.

First sentence in Wikipedia’s article:

“In the history of artificial intelligence, an AI winter is a period of reduced funding and interest in artificial intelligence research.”

It goes on from there providing an example of two of reduced funding.

As for Japan (Nihon)… I believe they called their 1980s research effort

“Fifth Generation “. Don’t have dollar (yen) amounts invested but quite substantial. It was meant to rival US research efforts.. I dont know how successful it was.

Again from Wikipedia, regarding Japan’s

Fifth Generation research in the 1980s:

“The project ran from 1982 to 1994, spending a little less than ¥57 billion (about US$320 million) total.[5]”.

A few sentences thereafter the article states that IBM spent 1.5 billion dollars in 1982 alone. It is unclear to me if that was for all R&D (probably) or specifically AI related research.

” It was meant to rival US research efforts.. I dont know how successful it was.”

I asked ChatGPT and it said:

“Overall, while Japan’s investment in AI during the 1980s had some successes, it also faced challenges and did not fully realize all of its ambitious goals.”

Jeffrey P. Snider

@JeffSnider_AIP

Both ISM & SPG agree on the state of US manufacturing: deeply recessionary. According to SPG’s numbers, “Backlog of Orders Index remaining at a level not seen since early in the coronavirus pandemic.” That’s why layoffs are really getting going.

Most intelligent money managers, even if they are extremely bearish, will not try to short the market. The bottom falls out so fast that they cannot move quick enough to capture a profit.

Snider is regurgitating BS which he does a lot, because he’s clueless.

Here is the ISM: it’s below 50 a LOT, recession or now recession. But Snider doesn’t know that.

So this is the third time that I’m posting this here within something like 24 hours:

1. The ISM index contracts a lot, recession and no recession (below 50 = contraction).

2. And it contracted down from its historic biggest-ever manufacturing bubble…

3. This is month to month, executives are asked how was June in relationship to May. So when you come off this huge bubble, you have these dips month after month as you step down from the bubble, because effectively, you’re returning to normal in monthly increments:

So what’s a better way of looking at this data? Use a 3 month moving average? Or just eye-ball the chart to visually see the overall trend?

It looks like manufacturing PMI levels on the chart below 45 correlate with recessions and the Covid crash; the rest is noise. We seem to be getting pretty close to that level now. If trading algos give a significant weighting to this data point, a sub-45 report could trigger a big down day and related pivot-mongering. Does this correlation persist going back before 1993?

No they don’t. There were instances when it dropped to 45, below 45, or near 45, and stayed there and the economy was booming, such as mid-1990s, late 1998, in 2003 (the 2001 recession ended Nov 2001), and 2016. The index goes back to the 1940s. So you can look at the data.

What is true is that IF there is a recession, the manufacturing PMI eventually drops to 45 or below. But it drops to around 45 just fine without a recession. So it’s not an indicator or predictor, but an occasional result.

The ISM’s services PMI was just released, rock-solid 53.9, fastest growth in four months — it covers a far bigger part of the economy, including retail, and it expanded strongly. Why don’t people scream about that?

From Yahoo several days ago:

“ Fidelity has further slashed the estimated worth of its holding in the social platform Reddit and the chat app Discord as well as SaaS startup Gupshup, giving a preview into how one of the world’s largest asset managers sees the impact of the ongoing slowdown in the public market on privately-held startups.

Fidelity Blue Chip Growth Fund valued its holdings in Reddit at $15.4 million as of May 31, according to the fund’s monthly disclosure released Friday. That’s down 7.36% from the $16.6 million mark at April’s closure and altogether a slide of 45.4% since its investment in August 2021. The updated share value suggests a $5.5 billion valuation for Reddit.

Fidelity marked down the value of its Discord’s holding to $1.7 million, down 13.4% from a month ago and 47% since the $3.3 million initial investment. (Worth noting that the vast majority of markdown in the value of Reddit and Discord holdings by Fidelity predominantly occurred last year.)”

Creeping up on 50% haircuts. I’m sure there’s plenty more where this came from, though the names & numbers are a lot smaller in size & recognition.

Waiting & watching to see $ARK implode yet again…

Neither Reddit or Discord are public, so any numbers Fidelity is using are just fantasy. We could substitute in $0 and be just as correct.

It’s hard to say crypto has been “replaced” when Bitcon is still over $30k per, for imaginary nothings.

Most shitcoins etc have imploded, so I’d agree the hype train has moved on.

Seems like there is a concentrated movement with people dumping sxxtcoins and switching and trading to BTC and ETH. BTC has increased its market dominance.

Amazing how resilient BTC Is and with major players like Blackrock and fidelity trying to start BTC etfs.

“replaced” in terms of startup hype-and-hoopla.

Btw, BTC is down 55%.

Yes, but after a meteoric rise and for a product that is imaginary nothings. ZERO intrinsic value.

I’m not arguing with you, LOL. Just putting things into perspective.

The AI hypesters are much smarter than the bitcoin hypesters.

With bitcoin, the sucker spent months learning the bizarrely complex details of the “system”. After mastering the various buttons and levers, the sucker inserted his life savings and nothing came out. It was a busted vending machine.

Altman has made the AI learning curve utterly painless. Anyone can try Chat, and anyone can get real results. It actually vends art and text and code, as advertised. The real cost is borne by all the artists and writers and programmers in the world, who are losing their IP. The cost is invisible to the sucker. It’s free!

Oldest rule of selling is Sample The Product. Get people to try it out free (or cheap) for their own purposes. When they see that the product solves a real problem, they’re ready to pay big money.

Yes it’s IP theft of a sort, just as 99% of human artists plagiarize previous works. But isn’t the genie out of the bottle now? I never paid for my ad-blocked google usage and I doubt I’ll ever have to pay for ChatGPT level generative AI.

On crypto I never understood why so many people invested in so called cryptocurrency exchanges rather than the major cryptocurrencies themselves. That’s the kind of hoopla that hype unfortunately leads too.

Basically AI is a great tool but I wouldn’t invest in nVidia.

During the gold rushes, they people who sold the shovels and picks are the ones who made all of the money.

Sounds like you’ve caught a fever there Arnold!

…just like the CIOs who didn’t want to miss the hype train and ordered a surplus of nvidia hardware. Shouldn’t take too long for them to realise that the bottleneck is the data sets and data scientists needed to train the algorithms and then the purchases of hardware (and nvidias share price) will probably drop off.

AAPL reached 3T four months after SVB bank collapse.

NVDA, the future of AI, is only 20 miles south of the Lebanese border.

The startups plunged, the old unicorns took over.

FOMO investing ….. get into AI stocks now!

This entire push seemed orchestrated to me. (it’s the contrarian in me)

I just want to do what the head of Blackstone does…..posted a $220 million compensation for last year.

With rates north of 5% and all this going on…..I forget why rates were near zero for 12 years. Anyone remember?

I am starting to view this much same way – coordinated.

Back in 2011-ish, eating lunch with some work friends, chatting about stocks. One of my colleagues had a friend working on Wall Street. The guy said to “buy DDD cuz it’s going to skyrocket”. He wasn’t saying the company or the tech was the future of the world. He was saying the big boys were going to throw their weight behind it, so buy some. The company never really lived up to the hype but the stock briefly did. I never really thought much of it until a few years ago seeing all this financial lunacy.

Now I take screen shots of my google news feed to look back on later at what I suspect and pump and dump schemes. AI is back in vogue after waxing and waning for decades. It was crypto for a few painful years. 3D printing before that. Etc etc. Oldest trick in the book.

I have read that pump and dump clubs were common in the 1920’s and eventually banned. Aerial fireworks are banned in my state too but my horizon was covered in them for 3 hours last night…

We all love a good unicorn. It’s the Sparkle ponies you need to look closer at.

And on cue the Atlantic Council releases a preliminary report recommending “reform” in Department of Defense procurement processes to make it easier for venture backed startups to gain access to DoD contracts.

I wonder if fanduel is taking bets on the date of the first security breach involving a firm with “conditional special” approval.

Don’t forget VR and meta/omni verse, Wolf.

I’m sure there are others that were easily forgotten.

Nvidia appears to be doing well on the hype, possibly becoming a bit of a Tesla, valued today as if they’ll be the last man standing in 10 years.

If the FRB does a BofE in a few weeks, and goes 50bps, this bubble will be getting a further firm prod.

Where to rotate to next? It’s like a magic roundabout, round and round we go, lower and lower each time.

I just hope the Fed doesn’t cave to Wallstreet and pivot into an economy that needs no intervention like they’ve done so many times before.

That’s what worries me.

…what constitutes the line between Smith’s “well-regulated” markets and cb/gov’t ‘intervention’ in them?…

may we all find a better day.

I think what happens next is really tough to determine. When every financial asset and company is built in a time of easy money, I just don’t think you can undo it without doing an incredible amount of damage to real economy. Is Fed going to let 20% of companies fail? I am expecting whatever it is to happen fast just like $40 billion left a bank in one afternoon. Information age now means panic can happen in one day.

Yes companies failing is part of the business cycle when those companies can’t manage cash flow and business they need to fail, layoff everyone and get bought out for pennies on the dollar, rinse and repeat.

The days of refinancing debt for 1 to 1.5% are over.

I think the UK is somewhat of a model for what’s in store for the US and much of the rest of the world, especially developed world.

Offshore much of your production, lax immigration, and hyper financialization. The US hasn’t screwed up as badly but it’s bad enough.

There is a day of reckoning in lower living standards ahead for the US, no matter what the FRB or USG do or don’t do. Much lower for much of the population. Neither create any actual wealth and can do nothing to stop or reverse it.

The interest rate cycle almost certainly bottomed in 2020. Interest rates are destined to “blow out” years from now. Other market to watch is FX, value of USD. That’s the constraint on what the FRB and USG can or cannot do. Same for every other country.

Barron’s: ChatGPT’s Traffic Drops 9.7% in June. It’s the First Decline Since the Launch…

”Legendary investor and British billionaire Jeremy Pantham predicted that the market is headed for a bubble burst, similar to the markets in 1929 and 2000. Before him, there is 70% of The reason for this is that the fund will continue to operate

The inventor is convinced that the stockpile has created an “ideal environment” for bursting bubbles, but the advent of artificial intelligence has slowed the burst, writes Fortune.

He also commented that he is “safe” from the emergence of such a baked mini-bubble, which is the result of the movement in the technological industry. Microsoft businesses, which are increasingly talking about “artificial intelligence”, have noticed a significant increase in the price of their shares

The target falls on a similar quote, and the wealth of the chief executive officer Mapĸ Zyĸuppĸg is around 40 billion dollars in his pocket – thanks to the shares he owns in the platform opma. This is why he stated that he wants to flow into artificial intelligence and similar programs and trials.

The infection expert says that the emergence of technologies such as RTG is the reason why he has reduced the forecast for the future of the stockpile (to 70%) from 85%.”

Sorry for my bad google translate

No. It will be:

No landing for 1%

Soft landing for 10%

Hard landing for 90%

Yes, that’s basically what this article says

AI will, of course, use bitcoin. What with both being native to the internet. Besides fiat hasn’t the speed, even in the form of CBDCs (which’ll be hampered by AML rules anyway).

The world has changed and will continue to do so at an accelerating rate. There’s no going back to normal. As is said, the revolution will not be centralised. So nobody will be leading it waving a flag.

Understanding decentralised is hard when you’ve lived all your life in a centralised world. Might be worth reading Lewis Carroll’s “Alice Through the Looking-Glass”.

🤣😍 You have no idea how funny you are.

Wolf, you have one of the most informative websites I have ever found. I find it very thought provoking and I have learned a lot reading it the past few months (I am more of a stock guy, most of my knowledge about bonds and interst rates was all theory). You have had a fairly decent influence over the way I think about the economy in some of the craziest economic times in generations.

I highly have highly recommended your site to a few people who I think would greatly appreciate it.

That said, you attract some of the craziest posts. From Fox News conspiracy nuttiness, to Weinmar comparisons, hucksters, systems, and what not. Crazies.

Don’t get me wrong, I completely understand it is the nature of the material. Discussions of interest rates, the FED, and high end economic material will always attract the crazies. Nature of the beast. And to be fair, you also attract some very good posters who are knowledgeable and contribute a lot. Don’t get me wrong, I greatly appreciate this site and many of the posters.

But man, it can sometimes really get crazy around here.

I write to inform, to educate, but if all it does is make you smile, that’s fine too :o)

I’m recalling when crypto pumpers spat out the word “fiat,” while figuring ways to game more slow/ordinary folks out of THEIR “fiat” in exchange for magic fake money and a brave new dream-world to come.

I think Jay Powell was analogously, for the same era, a bit cavalier and contemptuous toward the poor beat-down fiat money. His fiat (issuance) was a bit too goosed up.

BREAKING NEWS which seems to have been ignored in the press.

ECB balance sheet declines by 471 B euros in the week ended June 30.

TLTRO III loans outstanding declined by 500 B euros…which should surprise no one. Maturity date for most of these was June 28 IIRC.

Gonna leave a mark.

Is it really fair to call it the end of easy money?

Nominal interests are high, but real interest rates are still low. In 2019, the effective federal funds rate was 2.3% vs. core PCE of +1.7%, a net of +0.6%. Right now, the effective FFR is 5.1% vs. core PCE of +4.7%, a net of +0.4%.

Stock investors know this, which is why 100+ P/E tech stocks are commonplace again.

No, nominal rates are not high. 2001-2022 was abnormally low, especially considering actual credit quality since at least 2008 which is the lowest in history.

This is a stock pickers market. Debt is going to suffer because the FED is halfway to a soft landing and really wants it. They are not going to risk a debt recession. They are trying to give debt time to work it out. Buying big index ETFs will be ineffective because many stocks and sectors are dead. For instance baby diapers, milk, … Population is shrinking or on hold.

I like big miners with a history of good dividends and mor speculative green mineral and metal ETFs and companies.

I see this sector, GREEN, as long term growth that will outpace inflation. Look at all of the money that governments around the world are pouring into it. This is a secular bull market.

Pick your sectors

The 10 year is heading to 4%. Look for mortgage rates to spike as a result. I see 7 1/2% before the next week. One lender I recently dealt with was deliberately slowing down the closing on a deal in order to get past the 30 day lock on the interest rate promised the client. These lenders are not to be trusted. They are out to gauge every last dime out of the borrower. and then some. They want it all.

People being lazy, bad at jobs and inefficient is normal.

I seriously doubt they were “deliberately slowing” approval.

I’ve personally done 6 mortgages in my life and the banks/loan officers always suck and are slow. Not really a surprises.

Kinda like saying “the DMV was deliberately slow” or “water was deliberately wet.”

No.

AI’s are Not “computer programs” because they contain no code in the traditional sense. Which is a Problem if something goes wrong because you cannot fix it. What happened is that about 30 years ago a few geeks thought “why don’t we write a program that models the human brain, with “brain cells” and “synapses” (that is, Connections between them)” and call it a “Neural network” since the brain cells are called “Neurons”. Then we give this”brain”, say, a picture of an elephant and tell it: this is an elephant, which will make the “synapses” arrange themselves to recognize this picture as an “elephant” (which to the AI is just a bunch of letters). We do this over and over (second generation AI had feedback loops to correct errors) until this thing recognizes this picture is an “elephant”. Surprisingly, that thing will then also identify other Pictures of “elephants” as – elephants. Nobody knows how it works, but it does – most of the time. Even more surprisingly (and nobody talks about this) in very rare cases you can present it with a picture of an elephant and change just a few Pixels in it, and suddenly it will tell you it’s – a turtle !

But you won’t read that among the hype, and “mostly it works” -somehow.