“… to assess additional information and its implications for monetary policy.”

By Wolf Richter for WOLF STREET.

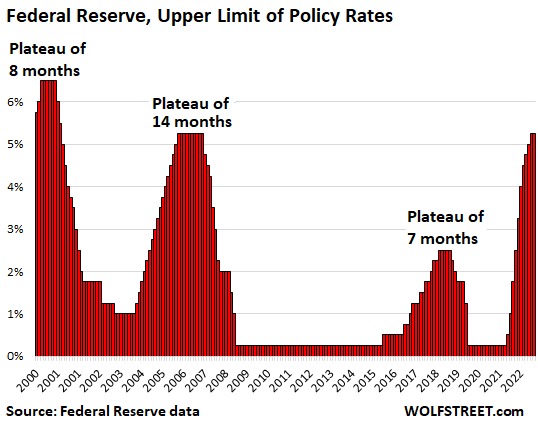

Amid massive expectations of a “pivot” or a “pause,” or at worst, a “hawkish skip” followed by one rate hike, the FOMC decided on a “very hawkish skip”: It kept its policy rates unchanged, with the upper end at 5.25%. With this “skip,” the Fed has hiked by 500 basis points in 15 months. The vote was unanimous.

But it sees two more 25-basis-point rate hikes this year, as per its newly updated median projections in its “dot plot.” This turns today’s decision into a “very hawkish skip,”

The FOMC kept its five policy rates unchanged:

- Federal funds rate target at a range between 5.0% and 5.25%.

- Interest it pays the banks on reserves at 5.15%.

- Interest it charges on overnight Repos at 5.25%.

- Interest it pays on overnight Reverse Repos (RRPs) at 5.05%.

- Primary credit rate at 5.25% (what banks pay to borrow at the “Discount Window”).

The May 3 statement and Powell at his press conference had made painstakingly clear that the FOMC could either pause or hike at today’s meeting, without giving any indication in which direction they would lean, and that the decision would be dependent on the data, rather than run on a predetermined course. It would look at “economic and financial developments” over the intervening weeks.

And those “economic and financial developments” came in fairly hot, including “Core CPI,” which, on a month-to-month basis, accelerated for the second month in a row, and hasn’t improved at all in seven months, running persistently at two-and-a-half-times the Fed’s target range. The banking crisis from March has been moved to the back burner. And hiking at this meeting would have been consistent with the data and with the Fed’s claim that its decision would be data-dependent.

But OK, it already hiked by 500 basis points so far, and waiting another month to see how things develop isn’t going to change all that much. And it does take a while for higher rates to tamp down on inflation. And then hike a couple more times.

New language was added to the statement to explain the skip: “Holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy.”

And it repeated the language that was new at the May statement, which leaves the door open for more rate hikes:

“In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

The “dot plot.” In its updated “Summary of Economic Projections” (SEP) today, which includes the infamous “dot plot,” the median projection for the federal funds rate at the end of 2023 rose by two rate hikes, to 5.625%. Two more rate hikes this year, that was a very hawkish add-on.

This would move the target range for the federal funds rate between 5.5% and 5.75% by the end of the year. And obviously there is no rate cut in the projections for 2023; not a single member projected a rate cut.

Nobody in the dot plot projected rate cuts by year end. Two members projected holding rates at current levels for the remainder of the year (mid-point of 5.125%, for a target range of 5.0% to 5.25%, which is the current target range). The remaining 16 members projected one or more rate hikes by year end, with one of them projecting 1 full percentage point (mid-point of 6.125%).

These are the projected mid-points of the target range:

- 1 expects: 6.125%

- 2 expect: 5.875%

- 9 expect: 5.625% (median)

- 4 expect: 5.375%

- 2 expect 5.125%

Median projections also ratcheted up expectations for GDP growth to 1.0% from 0.4%.

And they’ve kept raising their projections for inflation ever since the rate hike cycle started. Today, they raised the median projection for the “core PCE” price index again, this time to 3.9% by year-end, from 3.6% in the prior dot plot. In other words, they’re watching googly-eyed how core inflation just isn’t coming down, and they’re having to chase after reality.

Banking crisis may help push down inflation: The May 3 statement had discussed the banking crisis and its impact on inflation, that it just might help push down inflation through “tighter credit conditions for households and businesses” that “are likely to weigh on economic activity, hiring, and inflation,” conceding that “the extent of these effects remains uncertain.” In today’s statement, the Fed repeated the same language.

QT will continue on track, with the Treasury roll-off capped at $60 billion per month, and the MBS roll-off capped at $35 billion a month, same as in the prior months.

And here’s Powell at press conference on the New Hawkishness in the Dot Plot and on Inflation: “We See that it Tells Us that We Need to Do More”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

In the middle of chemotherapy, the oncologist decides, “Let’s skip a few treatments and see how the malignancy reacts”.

Good one!

Lol, made my day!

Remember, when “transitory” inflation had new meaning => soon to be entrenched.

I guess now “Hawkish” has new meaning, no prices for guessing.

Sad.

At least one person I considered pretty intelligent is completely on the runaway “magic bullet” train.

Advertising works even better when labor is so divided up, and we are all so specialized.

Yeah, except this isn’t so much a science as an art form. Had chemotherapy only been used a handful of times in the past 40 years, maybe that analogy works, but this is a bit more of an anomaly than something that’s gone through rigorous R&D over the years.

They could have increase +0.25 today or waited, either one is supportable “based on data,” though I think I would have favored and increase just to keep the pedal on the gas for another few weeks.

It’s all over: Just received a mail from a Realtor!

It was touting the accommodation Fiscal policy that changes their housing price prediction to new all time highs by year end.

It also stated that recently started bidding wars would become pervasive again. The right time to buy is now. You can always refinance later.

More Fomo….

Well, that was fast! J Pow look what you have done!

Real Estate agents said the same thing in 1979 – 1980 even at 13% – 14% mortgage rates. Then it was all about “creative finance,” interest only, less than interest only growing principle, longer terms (rapidly become essentially interest only), balloon payments to refinance when rates “are sure to drop” (took over 10 years and was at 10%). However, the purchase price income ratio was nothing like now, but still unworkable with a single professional STEM salary in a secondary city.

The Realtor talk ended March 1981 in my city. They are salesman, and churning feeds them. The only thing that shuts up a Realtor is a long recession, when they disappear into some obscure other line of work or hustle.

The plot of the first Poltergeist movie is the real estate salesman & developer removed the subdivisions tombstones, but left the bodies under the houses. Guess the script writers felt a certain way.

His answer to the one question about housing certainly seemed to confirm my worst fear, namely that when he said last year that house buyers needed “a little reset,” he wasn’t using understatement–he really meant a little.

He showed no concern at all that housing prices are coming back up (or as he put it, seem to have hit bottom, implying they won’t go down further), and he only mentioned a desire to slow the rate at which today’s batshit insane rents continue to go*up*, rather than, heaven forbid, do anything at all to bring them down.

Pea Sea,

Wait a minute… Powell can NEVER say that the Fed is trying to take down house prices or stock prices or whatever. NEVER. He’d be keelhauled. That kind of language is just totally off limits.

Last year, that sort of slipped out. And it was very indirect. And he never came back to it. He caught a lot of heat over it.

So he has to say what he is seeing in the data, that prices have come up a little, that they’re “wandering around at a relatively low level (or growth),” etc.

And he said: “We’re watching that situation carefully.”

Here is what he said, read it carefully, because it’s interesting and nuanced:

“So, certainly housing, very interest-sensitive and it’s the first place really, one of the first places that’s either helped by low rates or that is held back by higher rates. And we certainly saw that over the course of last year. We now see housing putting in the bottom and maybe moving up a little bit. We’re watching that situation carefully. I do think we will see rents and house prices filtering into housing services inflation. And I don’t see them coming up quickly. I do see them wandering around at a relatively low level now. And that’s appropriate.”

All BS from the realtors. Applications for purchase mortgages are in the dumpster. The realtors are desperate. It sucks that they use fear to try to coerce people into buying. In fact it’s disgusting. The recent price action is a combination of the usual spring bump combined with very low volume, which makes the few sales that are occurring a statistically insignificant indicator of future moves.

And there’s a third reason for the recent price bump in housing… there was a period with lower mortgage rates, but that’s ended. It’s really hard to see the 10 year rate (and the mortgage rates) declining going forward, with increased treasury supply and the fed maintaining a persistent stance regarding “higher for longer”. My guess is the 10 year will be above 4% by end of the year and housing prices will resume the decline in response to higher rates and (more importantly) the insane price levels that still exist in many areas.

Realtors are notoriously full of shit period. Has nothing to do with the Fed.

So…eco-markers instead of bio-markers are chosen by ? (paid off experts?) and endpoints (moveable goal posts) that are never followed thru..or just lied about…and a ton of statistics and probabilities for decision making that go into textbooks and are updated on TV and by the detail-men and journal advertising bunch….largely because computers do ALL that stuff so easily and fast….

….give a little kid a hammer and he will find something that needs pounding……..

Still sad.

ecoN markers…I mean

I’d probably have a different view if I hadn’t quit Pharmacy School and was making lots of money to pay (and invest since 1979) for all the stuff my trophy fiancé wanted. Plus keeping up with my whole new set of friends and neighbors.

Perfect answer

Farmer Fed is just milking the cow.

Exactly! LOL!

They are done raising…where I live in socal, every house is once again flying off the market…we are all sooooo screwed with what’s happening…

There not at all done raising. People have been saying this nonsense for an entire year. And have been wrong for an entire year. Here is how Powell explained what they will do:

https://wolfstreet.com/2023/06/14/powell-on-the-new-hawkishness-in-the-dot-plot-and-on-inflation-we-see-that-it-tells-us-that-we-need-to-do-more/

LOL

i, as well as the rest of the readers of WS im sure, are overjoyed that you were so quick on the draw that this comment is the first. simply marvellous.

you couldnt be more correct. the analogy is so fitting, in its hilarity of illustration/comparison and the stark sense of madness to which it refers.

thank you

yep, pause was a mistake, hawkish Fed wouldn’t have paused. this pause doesn’t make sense at all.

Well I would hate to be at the bottom 40% of the population that’s about to suffer as inflation takes off and kills them all over. Best of luck to those folks.

No kidding..

Forget Trump and Biden… J Pow is our new God.

Who needs a president anyway.

A fair amount of the working class may have enough wage pricing power to keep up with inflation. The ones who will really be wiped out are the well to do retiree’s who plan to live the good life on the golf course with the money they have saved up in their Charles Schwab Account.

True, look at Schwab’s, also many of the biggest banks, on their use of the FHLB. No stress there!

Bingo! You just described me to a T. I even live on a golf course. My Schwab account is up 9.25% YTD. But I agree with Kracow its the paycheck to paycheck lower income people who will suffer. I grew up in a low income home and I can relate.

Pausing the inflation battle for just a month is a huge problem. It allows more people to buy overpriced inflated assets, which will be problematic for them in the future. It allows wages more time to enter an inflation spiral. It will put more homeless people onto the streets.

As each day passes, inflation morphs from a temporary problem to an out of control spiral.

Expect record Power Ball sales this weekend,.,

Want to kill inflation .QUIT buying seems to be working for cars

This is what will bring people to the streets

Lovely! Enough time for the sharks to find some bag holders to distribute to.

It’s pretty clear that’s what wall street and the media are doing. They put on their most ominous faces, and constantly scream that the fed will begin cutting soon. This is to trick the rubes into the water and start the feeding frenzy.

Inflation is still being stoked by congress deficit spending. QT debt reduction is less than half of gov’t debt created. Add to that, large corps can still borrow at zirp from japan. And there’s a trend toward foreign trade in local currencies. Fewer willing to offload our inflation for us.

All in all, the US still has loose monetary and fiscal policies.

Most media is owned by billionaires,of course it will feed to your views ,take your pick ,Bloomberg,fox cnn it’s all corrupt to feed you yhere opinions ,I don’t watch the news anymore to depressing

I stopped watching even local news when they started leading with car crashes every friggin night. National news is pretty much along those lines too.

Willing buyers at current fair market price.

Expect another 20-90% rally in the markets, because all news is good news. Youd be insane to not buy in!

NASDAQ already back in the green as Powell continues his “inflation sure is stubborn and surprising and that’s why we’re not doing anything about it for a while” presser.

as is SP500, albeit briefly.

Hahaha, a little breather for now and maybe we’ll be at 5.75% by year end? Our Fed is a joke. Just another action to reinforce the fact the hot inflation was the goal from March 2020. We were never going to actually pay for covid and its myriad disruptions. Inflating it away is and was the main feature. Covid was an excellent excuse to let ‘er rip. Never let a good crisis go to waste, eh?

As if it were ever a question, I think we can now say with absolute certainty that Jay Powell is no Paul Volcker. With jokes like his, I don’t think he’s even an Arthur Burns. Maybe a George Burns?

Maybe a country burns?

“As if it were ever a question, I think we can now say with absolute certainty that Jay Powell is no Paul Volcker. With jokes like his, I don’t think he’s even an Arthur Burns. Maybe a George Burns?”

Hahahah – hardly even George Burns – maybe Irving Fisher ? Volcker went to 20% Fed Funds rate in 1981. That’s what it takes. 10 years of zero interest- this is what you get.

Inflation back then was four times higher than now. Get real!!

4 times might paint an inaccurate picture, Wolf. If FRED data is correct, CPI inflation recently peaked higher than it was in the mid 70’s dip and a lot higher than the first 1970 peak. The 13.5% peak in 1980 isn’t even twice 2022’s 8% figure. Besides, I’ve seen many compelling arguments showing that today’s CPI is not apples-to-apples vs. how it was calculated in Volcker’s time, though you likely have a much deeper understanding of any differences there.

Is this just the first climb? Are we going into the 70’s again with a decade of whack-a-mole inflation ahead after the Burns Fed underestimated their response, or has time compressed putting us already on the 1981 downslope? Who knows, but it’s reasonable to think there could be all kinds of ups and downs ahead.

Note: I’m referencing FRED’s (FPCPITOTLZGUSA) data set.

OK, core CPI was 2.6 times higher in May 1980 than in May 2023

Thanks Mr Wolf. Look forward to Dot Plot articles from you. Looking more and more like the 70 s 80 s could happen again. Be ready folks, get out of debt, live within your means and prosper………

Go all out – YOLO. Market is going on a tear. Let not FOMO. /s

Unemployment is still 3.7%.

This is not a repeat of the 1970s/1980’s.

Exactly. Hotels are doing great. Cruises are full. Airlines said they expect this summer to be great.

FYI….many airline stocks are at or near covid lows. Maybe undervalued.

The interest rates have not all flowed into the economy yet. It may take 5 more months to see the effect of 2023 hikes.

My wife noticed a lot of friends have new cars.

With used car prices as high as they are it often makes more financial sense to buy new for those who can afford it. Especially Toyotas..

2 SF hotels owing 750 million were just handed back to the lender.

The retiree wave is still ongoing with all that runup in assets enabled by the Fed over the last decade in their pockets to spend. Inflation makes that even more tempting – buy now before the money becomes worthless. Covid money is running out per Wolf and the boomer retirement peak just happened so it’ll ease off after awhile.

Years to go before we know.

What can be more pathetic than government by dot plot?

Dot plot is just the old fashioned children’s game “pin the tail on the donkey.”

FED by dot plot, Government by golden goose.

Hawkish comment from Powell. No rate cuts this year and looked very determined when he talked.

Right on. Also :

Upward revisions were also made for 2024 (4.6% vs 4.3%) and 2025 (3.4% vs 3.1%).

Expect everything will be up high a lot longer. Basically, the fight against inflation barely nudged.

But his nose grew about a foot longer.

Can wait for the “Powell was dovish” stuff on Twitter and elsewhere. They’ve got to be out there somewhere by now.

Im shocked you feel a pause is hawkish. I’d say a .5% June hike followed by a .5% July hike is hawkish. The wait and see approach in 2021 is exactly how we got into this train wreck in the first place.

Waiting and seeing once again will just add 6 more months and another 1.0% to the final rate and resolution.

“another 1.0% to the final rate and resolution”

T-bills at 6.5+? Yes please!

100% agree…nothing hawkish about any of this Fed talk …and we aren’t at 5% inflation no matter what anyone says…try 10 to 15%…

You people have been saying the same silly stuff for over a year and have been wrong for over a year.

The “pause” isn’t hawkish. The two coming rate hikes are hawkish. Hence the “hawkish skip.”

The rate hikes were supposed to have been over, according to our soothsayers.

Or look at most of the comments above. All focused on the pause and not on ‘no cuts for years’. And then there is the consensus of more bumps this year.

But JP didn’t bump 500 points at one time so…no Volcker just a wimp.

“100% agree…nothing hawkish about any of this Fed talk …and we aren’t at 5% inflation no matter what anyone says…try 10 to 15%…”

Exactly Volcker’s 1981 Fed Funds rate was 20%, prime even higher.

Everything I’m paying for is plus 15% ( not a Chinese 5%….).

Powell is a joke.

Inflation back then was four times higher than now. Get real!!

Can’t wait to see how MSM will spin today’s skip into the start of the greatest bull market in history to come…

Btw, below is definitely the understatement of the year..but just wait for it Pow Pow is working up his courage to channel his inner Volcker, it will come out anyday now…

“And those “economic and financial developments” came in fairly hot, including “Core CPI,” which, on a month-to-month basis, accelerated for the second month in a row, and hasn’t improved at all in seven months, running persistently at two-and-a-half-times the Fed’s target range.”

Much as I don’t trust and do not like anyone in the political or government sphere I must say after watching the whole press

conference and a few other past ones my impression of Powell is that he is not a bad guy and trust that he and the committee are trying to make up for their errors and get inflation back down.

Perfect no and frankly we should not need to deal with this but he seems ok to me.

One thing for sure here on WS is there there are not many that would have that same opinion.

When a guy who, through direct dereliction of his mandate to protect one’s house from fire, saw there was a fire kindling in the house but decided to sit back and “let it run hot” for a while, yet now stands around one’s half-burned house with the fire brigade as they turn off the fire hose to “see how it goes from here”…

,,,that’s not a person one usually refers to as “not a bad guy”.

The Fed has mastered trickle up economics and it won’t stop.

It was designed for that purpose from the get-go.

An important component of “making up for their errors” is to even admit that they made errors.

Forecasts beyond a few months are garbage. Makes sense, sort of, that the market ignores that part.

I once saved myself from prison by talking my way out of handcuffs.

That’s something these Fed Res peeps have never done (handcuffs & prison time).

But liars sure can figure. “Whatever it takes” (Draghi) to save your skin is official bank policy.

The Federal Reserve obviously made a lot of errors in the past, but after last year’s course correction, I think they’re doing an OK job.

It could have been worse. It could have been a lot worse. Wall Street has been screaming about rate increases since lift-off, and progressives (ie the Sanders/Warren wing of the Senate) are opposed to any kind of tightening whatsoever, as in their minds, tightening means throwing people out of work. And they’ve made clear that if they were in change, they would have appointed ultra-dovish FOMC governors who would have kept rates low all this time.

If the current tightening cycle does result in a serious recession, there will be enormous pressure on the Federal Reserve to move the goalposts (eg adopt higher inflation targets) next time, not to mention restart unconventional policies like QE so the government can print another $10 trillion+ in stimulus. The best case for us is a soft landing that allows rates to remain high.

Markets tank after the pause and hold, not before. We’ve just entered the second act of raise, pause, cut. Opportunity for stocks will come during the cut phase.

Powell was extraordinarily pathetic today. He keeps saying the Fed makes decisions based on data (mainly employment and core inflation), but, uh, not this time. Note that he did not answer the first question, but went on with some word salad about a decrease in the pace of rate hikes which had nothing to do with the question. That set the tone for the whole press conference. A complete disaster.

He ended some of his answers with “That seems reasonable”. People who really believe what they say, do not say that. That’s a throwaway line to make it sound like a stupid answer is reasonable.

The Fed talks about a 5.6% terminal rate, but, oh, well, we will just do nothing this month. It almost sounds like Powell has been bought, probably by big banks and Wall Street money. Whatever respect I had for Powell, which wasn’t much, is now completely gone.

As for me, it doesn’t matter if the Fed doesn’t hike now. It just means it will probably have to hike higher later. I am into very short term T-bills, 4 to 6 months. That 5.6%, if it comes to pass, simply means higher rates to come. I don’t see core inflation coming down significantly anytime soon, certainly not to the Fed’s laughable 2%, unless they are willing to send the economy into a prolonged recession or depression. Wall Street will not allow Powell to do that, now that it is clear they own Powell.

Powell looked like a fool in his press conference. It is sad for him because I think he knows it.

I thought he was pretty good. He kept hammering on core inflation not coming down, as I’ve said he would, and he pointed out that their inflation projections keep going up, and having “to do more.” It’s the final level of rates that’s important, not how fast we get there, he said, and that makes sense at this point.

Not sure what you were looking for — lightning bolts and thunder? — but he was pretty good.

“..’final’ level of rates..”

LOL, that’s a good one!

They call this the “terminal rate.” Sounds pretty gruesome.

While he keeps liquidity pumping, (FHLB) added as much to their balance sheet as Fed took out, and this is money that goes directly to spec (crypto exchanges like Silvergate). No mention of financial conditions (loose-r) Its obvious he can’t quell the tight labor market, so he has to pump wall street (his other client?). The difficulty is that higher for longer also means inverted. Today the 20/1 dipped 5 points at one moment, 2/1 is even more ludicrous. You can go broke owning treasuries, ask SVB. Kill off the regional banks, the local economies, and startup tech, and make Jamie Dimon king, or president. sigh

“While he keeps liquidity pumping, (FHLB) added as much to their balance sheet as Fed took out,”

People need to quit saying that. It’s just dumb. It shows that you don’t understand at all what the FHLBs do.

The FHLBs do NOT print money, they cannot! They borrow in the market by issuing bonds (and they issued record amounts of bonds since March) and then they lend the proceeds to the banks that cannot borrow enough themselves. This has ZERO impact on liquidity.

Yeah the labor market will loosen, apparently all someone has to do at the border is claim asylum and they get a work visa for a year. So, lets keep our borders open for more immigrants, then we can stop this pesky wage spiral and livable wages then wallstreet can have its low interest money. Win win

Funny, you can’t make everyone happy. Just a fact of life. Some media is calling the FED’s July-bluff. They want to scream that the rate hike is done and telegraph such message to their sheeples. JP is pretty much not done, he will get 1/2 point before the year end and there will be NO pivot or whatever crap they call it. The inflation fight will continue to next year so better get out the popcorn and watch the show.

If he was pretty good at hammering, why did the market shoot right back up when he was talking? Nobody believes him…

1. Markets do what they do. Trying to explain every little tick in the market is a fool’s errand.

2. The bond market reacted to it, with the two-year yield jumping to the highest in months.

The first press conference question, which was important, was why, given the persistence of a fairly highly level of core CPI, did the Fed decide to not hike today. Powell answered with a history of his rate hikes, first 75, then 50, then 25, and now zero, like that was an answer. But that did not answer her question. If this was a graduate seminar from the old days, I would raise my hand and say, “We know all that, now, please answer the question” It was particularly annoying since he also said that Fed inflation projections are up. Inflation is high and surprisingly sticky, and projections are for it to go higher, yet the Fed chooses to do nothing. To just wait. (Maybe waiting for those lag lengths to kick in, /sarc).

Most of the questions were idiotic, as usual, and I am sure Powell was happy about that. Based on his previous performances, I thought Powell was fairly genuine. It is clear he is now in a tough situation, and is resorting to “unknown lag lengths” and rhetorical bullshit like diversion to “answer” the tough questions. Like I said, I sort of feel sorry for him. It makes me think now he has been bought.

If he was his own man, based on his past performances, he would hike until inflation got to his laughably small 2%. He once said it is easier to over-tighten and then loosen, than loosen too early and then have to tighten again.

Well, it is only one meeting. Next one should be interesting, especially since it is being broadcast live. We might be able to separate the ass-kissers and bought, from the ones who are really trying to understand what is going on, if there are any.

As for lightning and thunder, yes, I was expecting Yellen to enter the press room, physically attack Powell while screaming “Why the f_ck did you raise interest rates so fast?” and Powell, while holding her down, yelling “Why the f_ck weren’t you watching SVB and First Republic?”

“Powell was extraordinarily pathetic today”

I disagree. Powell was pathetic today, but not extraordinarily so. It even appears that someone has finally gotten it through his skull that trading algorithms analyze his word use–today he made sure to mention over and over that inflation was not coming down fast enough, and to describe the labor market as “tight.”

Apart from that, it was a typically nebbishy performance, especially his anwers to the uncharacteristically skeptical questions from the press corp.

(Uncharacteristic, in that their pushback usually comes in the form of “why aren’t you turning the free money spigots back on?”)

“trading algorithms analyze his word use”

Oh… That explains it. I was wondering why the stock market went down for a while.

People use complex technology in really stupid ways..

In a 2020s update from the 1970s, the new motto is ‘Whip Inflation Tomorrow”.

The Fed would apparently prefer we all forget about a balance sheet still obese with non-treasury assets like MBS, or even where the Fed funds target is, and just focus on how the high Fed funds target will be … someday. The Fed is throwing the average American under the bus for the benefit of Wall Street.

QQQ is up, XLF down, BRK/B had a trigger day. The Fed paused. The Fed need your money. If QQQ turn down more of your money will enter the “gov motels” without raising rates. Jeff Gundlack might recover from the bond massacre.

2 rate increases projected for this year and 4 rate decreases for 2024

doesn’t make much sense to me.

Nobody in the dot plot projected “decreases” or rate cuts.

Maybe some confusion on the “mid-point” of the numbers? They always indicate the “mid-point” instead of the range: 5.125% in the dot plot = mid-point of target range of 5.0% to 5.25%, which is the current range.

Two people projected no further rate hikes, so mid-point of 5.125% in the dot plot, for a target range of 5.0% to 5.25%, which is the current target range.

The remaining 16 members projected some rate hikes, with one of them (Bullard? Waller?) projecting 1 full percentage point (to a mid-point of 6.125%).

Powell said the committee expects the Fed Fund rate of 5.6% at the end of 2023.

They expect the rate to be 4.6% at the end of 2024.

How do you get from 5.6% to 4.6%?

2023

The PPI today looked pretty good to me. Probably taken into the consideration too

Taken into consideration for projecting TWO more rate hikes this year, instead of none or one?

PPI was mostly driven by the plunge in fuel costs. PPI measures input costs for companies, and fuel costs can be a fairly big factor. Everyone knows that energy prices have collapsed. Powell effectively brushed that off today.

Sure. But the labour cost, and other commodities, among other things, are part of PPI too I would guess.

I missed the question. I meant not rising today. Since the CPI was not so good.

We’re seeing construction costs drop rapidly for commercial projects relative to just 60 days ago. GCs are hungrier for new work today, maybe trimming the fat, and a few key commodities are coming down.

And NFCI continues to loosen… yep, still work to do!

Index Suggests Financial Conditions Loosened in Week Ending June 9

The NFCI ticked down to –0.28 in the week ending June 9. Risk indicators contributed –0.15, credit indicators contributed –0.09, and leverage indicators contributed –0.03 to the index in the latest week.

The ANFCI also ticked down in the latest week, to –0.31. Risk indicators contributed –0.20, credit indicators contributed –0.08, leverage indicators contributed –0.06, and the adjustments for prevailing macroeconomic conditions contributed 0.04 to the index in the latest week.

Interesting thing about the NFCI, it looks like leverage is getting tighter, but credit is looser.

I guess the excess money sloshing around is going to loans? With interest rates where they are, I guess that makes some sense!

We may get to 6% before we know it.

I listened to the press conference, and I wish Powell had harped on government deficits being stimulative at a time that the Fed is tightening.

Other than that, I don’t have much to say. The interest rates have moved a great deal in a short period of time, so I can see letting things settle a bit.

On the fiscal side of the house, I think the government blew a great opportunity presented by the debt ceiling episode to contribute to the inflation fight with cuts in the deficits.

Or increase in taxes? There’s two sides to that equation!

DownFed doesn’t say how the deficits should be cut, whether through increased taxes, reduced spending, or some combination of the two.

Wolf, what is the thinking behind keeping QT seemingly low? QE threw that money into the economy about 6x faster.

$95 billion a month makes sense. If the Fed took out $2 trillion in one month, the entire financial world would blow up into fine dust, and you wouldn’t be able to switch the lights on in your home.

$95B per month = $1.14 Trilion per year. I’m not sure what the anchor context is for people, but I view that as a pretty big number. The last time the fed rapidly increased then decreased the money supply was for Y2K. The result was the NASDAQ doubling in about 6 months, then crashing violently beginning around April of 2000. The fed’s mandate is stability, not chaos.

LOL!!! “Hawkish Skip”. More bluffing nonsense from Powell. If he is so hawkish, then raise rates now, do more QT, and SELL MBS. Instead we get a pause? LOL. How sad. Real life inflation hot, house prices (not transactions) very hot and now going up, and stocks on fire. Oy vey.

They’ll just keep tightening slowly so everyone can adjust to it, without blowing a bunch of stuff up all at once. This way, there won’t be any rate cuts and no QE, because the economy is running just fine, so they’ll just slowly boil the frog 🤣

Makes sense to me.

If they go too fast, the whole over-leveraged house of cards will come down, and then they’d cut rates to control the damage, and the whole BS would start all over again – the last thing I’d want to see.

I like the way you type Mr Wolf. Since the beginning , higher for longer was the repeated phrase again and again. This could take years to unfold.

10 bumps in a year and rising and this will take years to unfold? Deutsche Bank thinks bust arrives 2024.

wolf, i wonder if you really believe in the possibility of a so-called ‘soft landing’? it seems you do, but the very concept implies a degree of control that the fed does not have.. sure they can raise rates and reduce the balance sheet, but they cannot impact the fiscal side of things. and that side is flagrantly spending money that isnt there to begin with at an ever-more increasing pace. some other commenters have alluded to this and it is correct to point out. now that inflation has taken hold, there MUST be limits on the fiscal side to ‘win’ the battle, in the current situation. youve made a point to address the increase of interest income paid to bondholders getting ‘spent’ back into the economy. raising rates more at a ‘moderate’ pace simply amplifies this effect, ‘baking it into’ the feedback loop of inflation, so to speak. a shock raise might disrupt this effect, but the fed will not ever do it. so all they can do is put on a show and make everyone believe that ‘moderate’ action is going to fix things. but that is a flawed conclusion when looking at the total picture. there MUST be a shock, either from the monetary or from the fiscal side, to ‘tame the beast’. the economy WILL NOT land otherwise.

Right now there is NO LANDING at all. I don’t believe in anything. But I see. And there is NO LANDING. And core inflation measures aren’t coming down, that’s what I see.

Why is there no landing? Lots of reasons, including, as you point out, fiscal policies (such as deficit spending).

This is 1995 all over again. (The best bull market ever, until 2000) when the Fed put on the longest rate hike pause ever. Big tech got even bigger when the supply of funds to startups dried up and they were bought out, (on the cheap). If Apple can make the same move as Microsoft in 5 years it will be a $2000 stock. Productivity is at a low for the last two decades, when it begins to rise, the bubble around AI will just get bigger (even while correlation is not causation – who cares?) The lost decade of subpar growth in the 20teens is over. And demographically speaking the investor class gets smaller while the float of stocks shrinks (buybacks) and crypto crazies get religion. Treasuries are toxic, and when that trade blows up you want to own stocks. Just pause Jay, Mr. Market can take it from here.

If AAPL has a $30T market cap in 5 years that means we will have massive currency devaluation issues.

The law of large numbers suggests it’s not possible for Apple to be a $2000 stock in five years unless there is hyperinflation. At $185/share, Apple’s market cap is about $2.9T. At $2,000/share Apple’s market cap would be around $31T, quite a bit higher than current US GDP. All in 5 years. Color me skeptical. I also don’t understand how a shrinking investor class, if that does in fact happen, is positive for stocks.

…perhaps AI is learning how to invest on its own without consuming its tail?…

may we all find a better day.

“Law of large numbers” is one of those mathematical terms (like “exponential”) whose use in common parlance has become almost totally disconnected from its mathematical meaning! (Yes, I’m a maths nerd.)

I’ve always understood the “law of large numbers” to mean that as something something such as market cap grows larger, it becomes more difficult to maintain the level of past growth on the much higher base that currently exists. I’m guessing you’re saying I used “law of large numbers” incorrectly, but since you didn’t provide any further detail, I looked it up. This is what I found about the “laws” application to finance and I think the principle applies to likely future growth in Apple stock as it relates to past growth. This is from the site “builtin.com”:

“FINANCE

We can use the law of large numbers to make predictions about the future performance of investments based on their past performance. Suppose you have data on the historical returns of a stock and you observe that the average annual return has been 15 percent. The law of large numbers predicts that if you were to extend the time period over which you observe the stock’s returns, the average annual return will approach the true expected return of the stock more closely.”

Apple, which already has the highest market cap in the world because of extremely high past growth, is unlikely to see an acceleration in growth that increases its value by 10x in the next 5 years. I guess I used the “law” incorrectly in that it is not the high base (market cap) that matters so much as the elevated level of past growth that the law of large numbers predicts will moderate in the future. In any event, the outcome is the same since the high base is a function of high growth in the past.

From what I read, the law of large numbers can have different applications in different contexts such as statistics, engineering, finance, and gambling.

Wolf, I didn’t get a chance to listen to the conference due to work. I looked at CNN for a summary and for fiscal policy they said JPow didn’t comment much, but they put in this line: “But he said the Fed would ‘under no circumstances’ finance any of America’s debt.” What was the entirety of that subject and actual language? Does that mean no more QE by saying that?

Interestingly, the Fed’s balance sheet H4.1 in table 1 under “Reserve balances with Federal Reserve Banks” was up $10.346bb from a year ago to $3.349T. Thanks to TGA drained (and some other deposits) offsetting QT over that span. Not surprised markets higher than a year ago given more liquidity from the balance sheet changes.

Powell was asked an idiotic question by a reporter (Fox Business?) about the huge amount in debt the government will sell: “Is there any conversation about the Federal Reserve financing some of that debt?”

Instead of answering, Powell should have just zapped the reporter with his Taser and bellowed, “Next!”

Here is his exact and entire answer, verbatim:

“NO. UNDER NO CIRCUMSTANCES, YOU MORON.” ZAPP

Just kidding, about the Taser ZAPP, but that’s what he wanted to say and do.

What he actually said was, “No. Under No Circumstances.” And the microphone was yanked away from the reporter and handed to another reporter. The whole scene was absurd. I have no idea where they pick up these reporters.

No QE EVER! Right. He has a purpose in asking that question from a political basis. Powell got really defensive, and I am sure that fiscal conservatives are going after him on this.

So SEP shows Fed expecting core inflation to end 2023 at 3.9% this year, while unemployment will only rise to 4.1%.

And 2.6% core inflation next year with 4.5% unemployment.

They don’t predict core inflation dropping below 2% at all in next few years but their target is to average 2% over the business cycle which means that inflation needs to be sustained well below 2% for several years to balance out the massive overshoot from 2021-2023.

Since the Fed is planning just 50bp more hikes this year and cuts next year, does this mean that they have now officially abandoned their published target?

If only Powell could control the gouging. I just paid $8.50 for a gallon of Clamato up from $6. And I know I can get for 5.50 at another store.

Instant Brands went bankrupt, credit terms and higher interest rates as reasons for the filing.

So hike prices until……….

Clamato ,at two times gallon of gas forget about it

“I just paid $8.50 for a gallon of Clamato up from $6. And I know I can get for 5.50 at another store.”

Folks, this is why we have inflation. Half corporate price gouging, and half consumers lacking discretion in their purchasing behaviors. Sure, for some commodities there aren’t alternatives and you have to bite the bullet when prices get jacked. But if the average consumer were willing to make minor sacrifices, or understood the difference between want vs need, we wouldn’t be here. The sailors are still drinking and you can bet your ass they aren’t buying Admiral Nelson!

James Bullard of St. Louis plugged today’s macroeconomic numbers into the Taylor Rule and the recommended FFR policy prescription is between ~5.0% and ~6.5%. The median dot, 5.75%, would be right in the middle of that range.

One cannot help but come to the conclusion that they’re now more concerned about the banking system than they are about inflation.

And that they’ve just tacitly backed away from the 2% inflation target because they were so spooked by the failures of SVB and First National. And so now they are terrified about the health of the banking system.

You, Wolf, would know better than I. But it certainly seems the case that another few hikes could push a few more regionals over the edge into collapse.

Anyway, this should all be good news to Peter Thiel, David Sacks and Bill Ackman. (Not that they needed to worry anyway. All they need to do is tweet, and UberYellen is on the way to their house with a delivery.)

This pause though is not so good for a retired guy who sees food and services continuing to rise.

When they say “hawkish,” the mean “dovish.” Both sound better than limp, weak, or useless.

For an entire year, after every Fed meeting, the comments here have gotten swarmed by people that promoted the nonsense that “Powell was dovish,” and for an entire year, they have been wrong, and they’ve got egg on their faces, and they continue to be wrong. This stuff is just silly. I don’t even get mad about it anymore, like I used to. After a while, it’s just hilarious.

“And that they’ve just tacitly backed away from the 2% inflation target because…” No they did not. On the contrary, they seem to be digging in their heels. Read this:

https://wolfstreet.com/2023/06/14/powell-on-the-new-hawkishness-in-the-dot-plot-and-on-inflation-we-see-that-it-tells-us-that-we-need-to-do-more/

How are we going to pay for our wars if we are forced to also pay interests on the debt ?

Oh, of course, we can borrow the interest payment and add to the debt.

But I least I can collect 5% on my deposits I’ve moved out of the banks and leant to the Treasury.

Even if 5% doesnt cover the inflation loss, I’m cutting my expenses fast enough to make up the difference.

Clearly this is the best of all possible worlds and nothing can go wrong.

You’re making a much appreciated sacrifice for our betters on Wall Street — Pangloss

Just imagine S & P at 5000 as the Fed figures out how to fix their inflation measures.

🤣 at QT

That joke never gets old.

Powell is just kicking the can until he can

pass this mess onto the next patsy. He worked for the banks, not for Joe Sixpack.

Nothing like seeing the wealth transfer up

close and personal.

“Nothing like seeing the wealth transfer up

close and personal.”

Powell’s personal piggy bank contains over 100 million dollars. A true man of the people. With such veracity of statistics, no less.

HAWKISH my asz. What a scam this reckless FED is. There was absolutely positively ZERO reason to pause. This is an out-of-control megalomaniac and his cronies destroying the people of the US.

If you listen or read it DC, he was pretty evasive on housing inflation but stated that they thought housing was now “low and appropriate”. Which is a cold cold stance concerning all those still unable to afford housing or who have to migrate to god knows where and do god knows what because of housing costs.. There is an email contact page on the fed web site where you can make a comment. A comment certainly would not hurt. I imagine almost ALL of the comments they receive are from banks and the well to do. A few contrary but polite comments might do some good.

We have entire communities here where they can not staff volunteer fire depts or find people to hire for gas stations, construction or health care because those people can not afford to live there anymore. The ultra wealthy who remain will have no one left to hire to wipe their relatives behinds eventually.

“if you listen or read it DC, he was pretty evasive on housing inflation…”

Yes

“but stated that they thought housing was now “low and appropriate”.

He did NOT say that at all. Read the transcript!!!

They said no such thing. He talked about price GROWTH and rent GROWTH, not prices per se, this being an inflation topic, and price growth is what inflation is all about, not prices themselves. He did NOT say “low an appropriate” but said, referring to price growth and rent growth — they were fused together in the discussion: “I do see them wandering around at a relatively low (growth) level now. And that’s appropriate.”

But that’s just as bad. It’s basically comes off as “It’s appropriate that prices are no longer climbing, but we don’t care about reducing housing costs so that people can actually afford housing again. For those who can’t pay the increased 40% rents over the past two years, too bad, too sad.”

The whole section was very confusing because between the reporter and Powell, they kept mingling and switching between and combining rents and prices, and they kept skipping the word “growth.” Skipping the word “growth” is typical for inflation discussions between insiders. But now people are reading into it whatever they want to. It’s kind of meaningless except that Powell was reiterating that he believes rent growth will soon be at low levels — but that has been questioned by the current real-world landlord and CPI rental data, as I have pointed out elsewhere.

“I do see them wandering around at a relatively low (growth) level now. And that’s appropriate.”

But that’s not appropriate at all. Jerome Powell has absolutely zero grasp on what’s going on in the lives of those most hurt by inflation – the inflation HE CAUSED. The entity sworn to protect price stability destroyed it, and is working to continue destroying it.

Jerome Powell will go down in history as the worst FED chair to ever occupy the seat. If the rule of law existed, he would have been arrested for corruption long ago, along with all of his day-trading cohorts. Jerome Powell is the enemy of the American people.

Wolf, yes, that’s where I got that impression. I’m sure you can read it with more clarity, but did read it and watch it, and I looked closely at anything to do with housing and this is what I was commenting on;

June 14, 2023 Chair Powell’s Press Conference PRELIMINARY

Page 18 of 25

“CHAIR POWELL. So, certainly housing, very interest sensitive and it’s the first place really, or

one of the first places that’s either helped by low rates or that is held back by higher rates. And we

certainly saw that over the course of the last year. We now see housing putting in a bottom and maybe

even moving up a little bit.

You know, we’re watching that situation carefully. I do think we will see rents – rents and house

prices filtering into housing services inflation. And I don’t see them coming up quickly. I do see them

kind of wandering around at a relatively low level now, and that’s appropriate”

The key word for me is “now”. This makes me think that he thinks housing prices right now are just fine. Where the word “help” is used is an indication to me as well.

Yes, I’m being picky, but then, he is trying to choose words carefully.

I do think there will be a lag effect. And the inflation on housing costs do effect people I think more than he realizes so ultimately it might not matter- they should go down further anyway.. But I don’t see him as striving for people in the lower parts of the economy.

He’s also using the word “prices” in a way that, to me, equates prices with growth.

Dont be stupid thats why they just open the border again, to hire asylum seekers who will be glad to take jobs thay Americans are too lazy to take for low pay. While our government gives them welfare.

If all MBS were sold in a span of say a month what would the result be in the market ?

you wouldn’t be able to turn on the lights in your house because the entire financial system will have gone up in smoke, including the payments systems, and everything needs the payments systems to function to pay their bills, and so things begin to shut down, from grocery stores to server farms (your crypto vanishes) to credit card functionality. A financial collapse is not to be trifled with.

This sounds exactly like the Hank Paulson scare tactics that started QE to begin with. Nah, I don’t buy into that BS anymore.

Sometimes, DC, you sound like a broken record, with your Fed hatred. You really really want the whole entire financial system to blow up, you said this many times, and some of it is kind of funny. But sometimes, it gets just a little old.

You CANNOT destroy $2.8 trillion in liquidity from the financial system in one month without massive consequences. It’s just stupid to even entertain that idea. The financial system would collapse even if the Fed just said it would do it. This stuff is just NUTS. Get real!

Wolf – selling all the MBS in a single month is absurd, but there is no reason the FED cannot sell all the MBS just as quickly as they bought it. For whatever reason, you are sounding more and more like a FED apologist. I don’t get it.

Wolf-

What is the fastest you think MBS could be unwound without destroying the system. Not what is prudent. What is possible? We know it’s more than what is happening now, but less than $2.8T. What is your estimate?

MattF,

In the future, if and when the Fed cuts its rates, there will be a torrent of refis, and those MBS will come off automatically in not time, without having to sell.

Currently they could probably sell and let roll off a combined $60 billion a month or so without causing too many problems.

“This sounds exactly like the Hank Paulson scare tactics”

As the government was debating whether to bail out the banks, he famously said: “If we don’t do this tomorrow, we won’t have an economy on Monday.”

Fed won’t sniff 2% inflation until they kick the stock market squarely in the nuts. 3000 is what it will take. Til then they’re just farting around.

I agree. At the risk of sounding like a broken record, I believe that current inflation is due to the top 10% living high on the hog on their stock gains. They believe the Fed won’t ultimately allow asset prices to correct, and therefore, if they planned for a $3 million retirement portfolio in 2016, now they have $7 million. They are “spending those gains,” which is why restaurants and hotels are packed.

This is the “wealth effect.” They need to go backward.

Bead and Einhal, sure as heck makes sense to me.

The only silver lining in all this is that some of those housing units being built are sold yet kept empty- which is a disgusting shame, but at the same time, eventually they will become available for people to actually live in when the cycle tips the other way. Right now it’s still just “wandering around”.

I despise large aspects of this current era, but still; Living through a paradigm shift is rarely peaceful and fun for the involved

– hence nothing I desire, and certainly not for my family and friends.

The most recent headline CPI number is 4%. The most recent headline PCE number is 4.4%.

An overnight rate of 5.25%, and a top short-term treasury yield of 5.4% implies a “real” headline interest rate on the order of 0.85-1.4%.

When was the last time we had a zero-risk headline real interest rate that was that positive? I’m not sure I can remember, maybe the 1990s? That’s gotta be hawkish compared to the last 20 years.

I know the Fed often discounts the headline numbers as fast-moving but if the indexes are working as designed, then they do reflect real prices that real people pay, and that has to have a real impact.

Energy price collapse drove down headline inflation. But it’s meaningless in terms of the dynamics of inflation because an energy price collapse ends. But inflation in goods and services can go on forever.

Core CPI is above 5% and core PCE is just below 5%. So based on core measures, rates are barely in restrictive territory.

After the energy price collapse has run its course and the base effect is over, headline measures will once again be higher than core measures. You only get that inversion with an energy price collapse. So if core is 5%, then headline will be 5.5% or more, typically.

Treasury has created 500 billion of new debt in just two weeks.

I don’t know what “more data” anyone would need.

Providing the Fed goes ahead with a 25 bps hike in July, what difference does a 1 month skip make in the long run? It’s difficult for me to see why so many investors are so worked up over a 1 month skip.

I suspect the skip was chosen in order to insert more uncertainty about the next rate announcement.

Suspect Fed wanted to raise interest rates this time based on core inflation but decided to give the mid range banks more time to get their shit together. Powell doesn’t want to admit this or be blamed for a crisis he contributed to by subjecting the banks to a worse case stress test with an upper bound fed rate of 2.5% just before some collapsed. Keep raising, we need to cool the core.

Transitory inflation, hawkish pause. What’s next? Dovish hikes? The fed likes to get cute coz they they think they r too smart to make simple common sense decisions. AI may be overhyped but replacing the Fed with the Taylor rule would save all of us a lot of pain!