Powell has been talking about this. Energy cannot plunge forever.

By Wolf Richter for WOLF STREET.

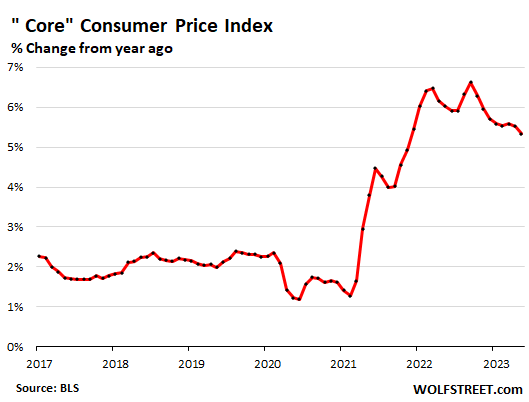

The “Core” CPI has shown no change in direction for seven months, running at an annualized increase of just above 5%: two-and-a-half times the Fed’s 2% target, and it has gotten stuck there. That’s a problem Powell has been talking about for months, and it’s just not changing. This is “sticky inflation.”

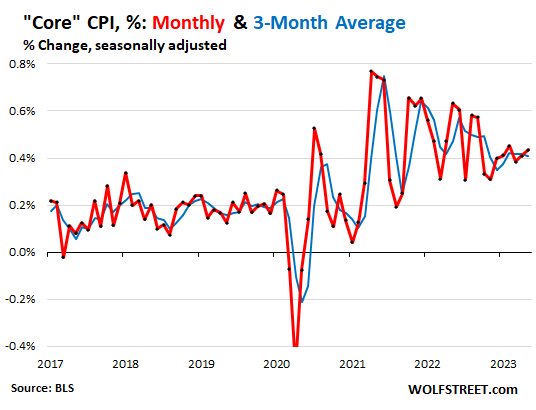

On a month-to-month basis, core CPI, which excludes the volatile food and energy products, rose by 0.44% in May from April, the second month in a row of acceleration, according to data by the Bureau of Labor Statistics today. It has been in the same range for the past seven months, which makes for an annualized rate of just over 5% (red line in the chart below).

The three-month moving average of core CPI smoothens out the monthly ups and downs. It passed through a low point in December and has since then been above it, with the last three months essentially unchanged at 0.42%, a hair above where it had been in November (blue).

On a year-over-year basis, core CPI jumped by 5.3% in May from April, a slight deceleration from the prior months (in the 5.4% to 5.6% range) and approaching the annualized month-to-month rates over the past seven months of just above 5%:

The overall Consumer Price Index (CPI) for April, rose by 4.0% year-over-year and edged up by only 0.1% in May from April, and that’s welcome news, but it’s a mirage produced by a plunge in energy prices (they won’t plunge forever), stalling food and new vehicle prices, and the infamous “health insurance adjustment” that has been running now for eight months, but will end with September. It has now turned the raging medical care services index negative!

Energy prices plunged and pulled down overall CPI.

| CPI for Energy, by Category | MoM | YoY |

| Overall Energy CPI | -3.6% | -11.7% |

| Gasoline | -5.6% | -19.7% |

| Utility natural gas to home | -2.6% | -11.0% |

| Electricity service | -1.0% | 5.9% |

| Heating oil, propane, kerosene, firewood | -5.3% | -28.5% |

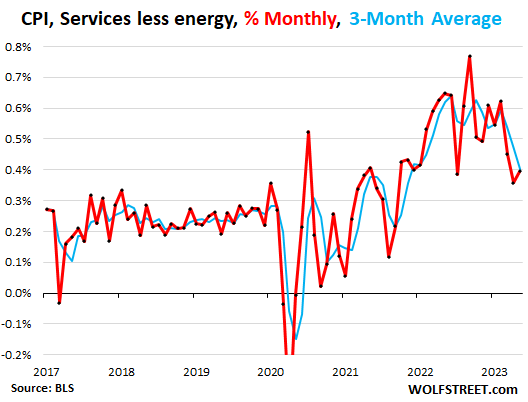

Core Services inflation (without energy services) accelerated in May from April to 0.4% (red line). The three-month average (blue line) also came in at 0.4%, so that’s just under 5% annualized, despite the massive “health insurance adjustment” that has been understating medical care services since October. This adjustment will end in September, and then it may, as it usually does, swing in the opposite direction (more in a moment). Nearly two-thirds of consumer spending goes into services:

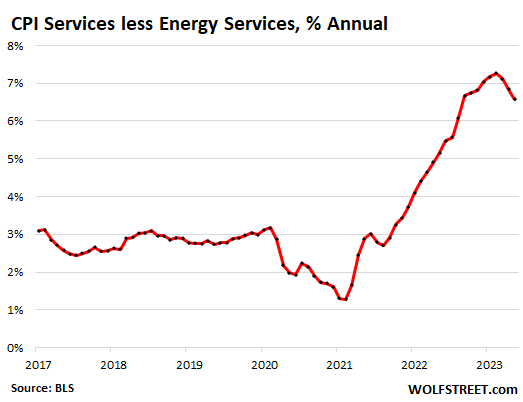

Year-over-year, the services CPI jumped by 6.6%, compared to 6.8% in April. February had marked a 40-year record of 7.3%:

| Major Services without Energy | Weight in CPI | MoM | YoY |

| Services without Energy | 62.2% | 0.4% | 6.8% |

| Airline fares | 0.6% | -3.0% | -13.4% |

| Motor vehicle insurance | 2.6% | 2.0% | 17.1% |

| Motor vehicle maintenance & repair | 1.1% | 0.6% | 13.5% |

| Pet services, including veterinary | 0.6% | -0.6% | 10.2% |

| Food services (food away from home) | 4.8% | 0.5% | 8.3% |

| Rent of primary residence | 7.5% | 0.5% | 8.7% |

| Owner’s equivalent of rent | 25.4% | 0.5% | 8.0% |

| Postage & delivery services | 0.1% | 0.1% | 6.3% |

| Hotels, motels, etc. | 1.0% | 2.1% | 3.7% |

| Recreation services, admission, movies, concerts, sports events | 3.1% | -0.1% | 5.8% |

| Other personal services (dry-cleaning, haircuts, legal services…) | 1.4% | 1.5% | 6.3% |

| Video and audio services, cable | 1.0% | 0.1% | 4.5% |

| Water, sewer, trash collection services | 1.1% | 0.6% | 4.9% |

| Medical care services & insurance | 6.5% | -0.1% | -0.1% |

| Education and communication services | 4.9% | -0.2% | 2.8% |

| Tenants’ & Household insurance | 0.4% | 0.1% | 1.6% |

| Car and truck rental | 0.1% | -3.3% | -12.4% |

| Weight of major categories in CPI | 62.2% |

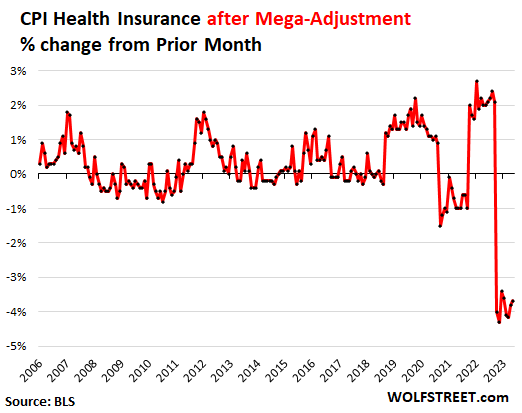

Health insurance mega-adjustment understates CPI, core CPI, services CPI, and Medical Services CPI through September and has now turned Medical Services CPI negative for the month and the year!

BLS undertakes annual adjustments in how it estimates the costs of health insurance and then spreads those adjustments over the following 12 months. Normally, this isn’t a big deal, but for the 12 months through September 2022, CPI massively overstated health insurance inflation (+28% yoy in September 2022). That overstatement has been adjusted away every month since October 2022 (more here), and this will continue through September 2023.

Then there will be a new adjustment, and in the past, they tended to swing in the opposite direction, as you can see in the chart below.

The Fed’s favored inflation measure, the PCE price index collects health insurance inflation via a different method and doesn’t suffer these adjustments.

The CPI for housing as a service.

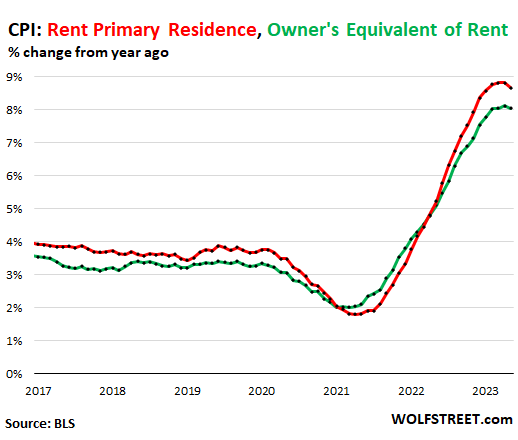

The CPI for housing as a service is based on rent factors, primarily “Rent of primary residence” (weight: 7.5% of total CPI) and “Owner’s equivalent rent of residences” or OER (weight: 25.4% of total CPI).

“Rent of primary residence” +0.5% for May, +8.7% year-over-year (red in the chart below). Over the past three months, the monthly increases have been at 0.5% each time, making for an annualized increase of over 6%, matching what the largest landlords have been saying in recent months, that they’re now getting over 6% rent increases on renewals and new lease signings.

It tracks actual rents paid by tenants in houses and apartments. The survey follows the same large group of housing units over time and tracks what tenants, who come and go, are actually paying in these units.

Owners’ equivalent rent +0.5% for May, +8.0% year-over-year, down a hair from April, which had been the worst in the data (green) and roughly the same red-hot for the past four months record levels. This is based on what a large group of homeowners estimates their home would rent for.

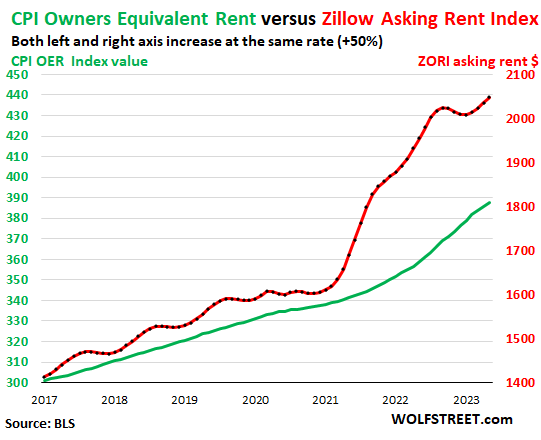

OER Versus “asking rents.” Private sector rent indices, such as the Zillow Observed Rent Index (ZORI), track “asking rents,” which are advertised rents of vacant units on the market. The ZORI experienced a double-digit spike in 2021 through mid-2022 that never fully made it into the CPI indices because rentals don’t turn over that much, and proportionately not many people actually ended up paying those spiking asking rents.

In late 2022, asking rents began to actually dip, and there was a lot of chatter about that bringing down rents, and then they stopped dipping, and this year the ZORI rose again and in April and May hit new records.

The chart below shows the OER (green, left scale) as index values, not percent change; and the ZORI (red, right scale) as index value, expressed in dollars.

I set the left and right axes to increase each by 50% to keep the proportional increase of both lines in sync, with the ZORI up by 45% since 2017 and the OER up by 30%.

The ZORI accelerated far faster in 2021 and into late 2022 than the OER, then it briefly dipped, but in 2023, it reaccelerated. Over the past two months, it increased 0.6% each month, faster than the OER.

In terms of future inflationary pressures buried in asking rents, this is kind of a worrisome chart; it shows that inflation pressures are building up again in asking rents:

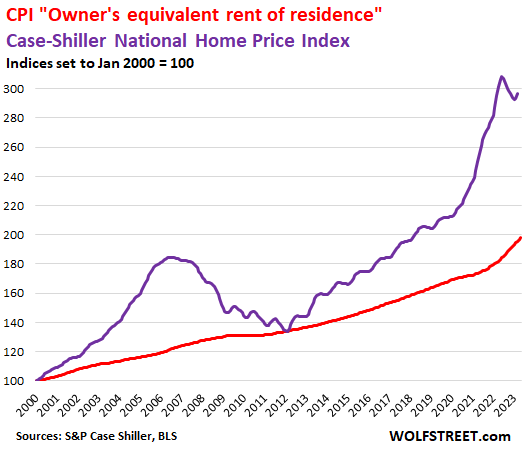

Rent inflation compared to home price inflation: The Case-Shiller Home Price Index peaked with the report named “June” then declined. Over the last two readings, the index ticked up. You can see similar increases in the spring of other years, except during the big blast in 2020-2022. Even during the last four years of the Housing Bust (2008-2012), there were these seasonal upticks (purple line).

The red line represents “owner’s equivalent rent of residence.” Both lines are index values, not percent-changes of index values:

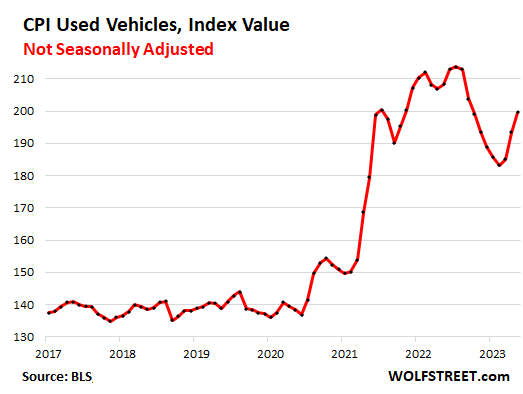

Durable goods inflation rises as used vehicle prices re-spike.

Used vehicles CPI spiked by 9% in two months: +4.4% in May from April, and +4.4% in April from March! A magnificent display of the game inflation Whac A Mole; just after you thought you had it knocked down, it pops back up. The two-month spike reduced the year-over-year drop to 4.2%.

This chart shows the index values, not the percentage change. It is starting to be a mindboggling chart, and very worrisome:

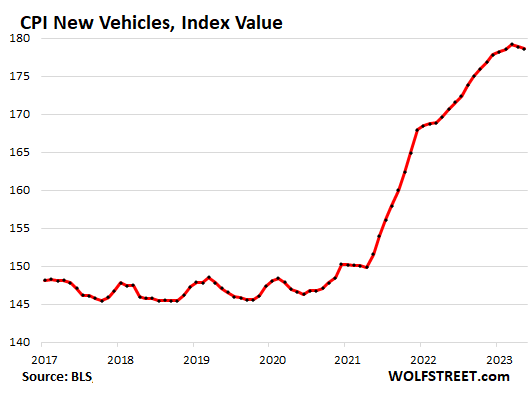

New vehicle CPI dipped for the second month in a row, -0.1% in May, amid growing supply, sky-high prices, higher incentives, promo interest-rates by automakers, and big price cuts by Tesla and other EV makers, undoing just a tiny portion of the ridiculous surge in prices and addendum stickers over the past two years.

| Durable goods by category | MoM | YoY |

| Durable goods overall | 0.3% | 0.0% |

| Used vehicles | 4.4% | -4.2% |

| New vehicles | -0.1% | 4.7% |

| Information technology (computers, smartphones, etc.) | -0.3% | -7.6% |

| Sporting goods (bicycles, equipment, etc.) | -1.1% | -0.9% |

| Household furnishings (furniture, appliances, floor coverings, tools) | -0.4% | 4.1% |

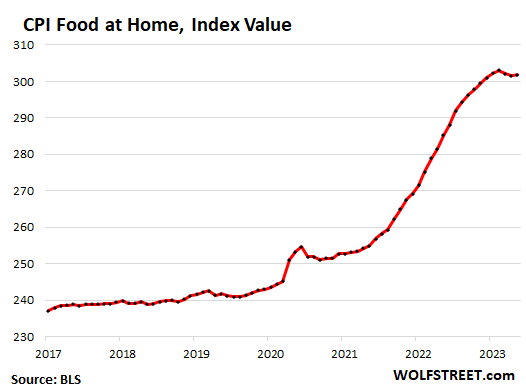

Food inflation.

The CPI for “food at home” – food bought at stores and markets – inched up by 0.1% in May from April, after tiny dips in the prior two months. Over the past four months, it has essentially flattened out, after a huge spike.

Year-over-year, the CPI for food at home rose by 5.8%, the least-hot increase since October 2021.

The chart of the index values (not percentage change) shows the huge surge through August last year. Since February 2020, the index has spiked by 23.5%. Food inflation hits the lower income population much harder as they spend a bigger portion of their income on food.

| Food at home by category | MoM | YoY |

| Overall Food at home | 0.1% | 5.8% |

| Cereals and cereal products | 0.0% | 10.7% |

| Beef and veal | 1.0% | 1.0% |

| Pork | -0.8% | -2.9% |

| Poultry | 0.2% | 2.1% |

| Fish and seafood | -1.6% | -1.1% |

| Eggs | -13.8% | -0.4% |

| Dairy and related products | -1.1% | 4.6% |

| Fresh fruits | 1.5% | -0.5% |

| Fresh vegetables | 1.3% | 2.0% |

| Juices and nonalcoholic drinks | 1.0% | 9.9% |

| Coffee | 0.1% | 4.8% |

| Fats and oils | 0.2% | 11.8% |

| Baby food & formula | 1.2% | 10.1% |

| Alcoholic beverages at home | 0.4% | 3.9% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The “Core” CPI has shown no change in direction for seven months,

Does it mean the FED still have a long way to go, to bring down inflation rate? It would be a mistake to stop rate hiking tomorrow. However, the stock market has ALREADY priced in this factor. Alas.

It would indeed be a disastrous mistake to pause rate hiking at this point with services inflation so sticky and both rent and used cars inflation so dangerously high–Wolf as always has done one of the better analyses of the numbers and it clearly shows that the truly troublesome inflation is persistent and continues to endanger the broader US economy. The volatile energy prices were lower which allowed for the rosier headline number but that’s basically meaningless, will probably be up again anyway with the Saudis limiting supply–it’s the other components that tell us the most about underlying inflationary pressures, and they’re still significant and continuing to do damage. (Homelessness still rising, food and cars getting more expensive) A minimum 25bp rate hike is necessary but if anything 50 bp would make more sense, and a lot tougher QT.

Also not understanding your last point here–“However, the stock market has ALREADY priced in this factor. ” No evidence for this or the idea of “efficient markets” at all, if this or anything else had been priced in we’d have P/E ratios a lot closer to reality, instead price-to-earnings valuations are at record highs, outrageously divorced from the reality of profitability and earnings with more and more zombie companies. The equities markets aren’t logical right now at all, they’re pure speculation due to ongoing excess liquidity and the failure of the Fed and Congress (thus far) to remove a lot of that excess pandemic stimulus and printed money. Not to mention the value of things like crypto and NFT’s backed by nothing, there’s nothing “intelligent” or “priced in” about any of this, just a total myth by the squawkers.

Fed will make this disastrous mistake to please wallstreet. J Pow lacks the backbone to stand up to the market!

I doubt it. They will keep raising rates I think. The FED will likely overdo it rather than pause the hikes.

I agree with you J Powell will flinch even if he raises the rates by .25 today will be another 1.5% in stocks across the board

The conversation on this site has already touched on the most likely outcome: JPOW doesn’t have the tools. Spending/debt is now marshaling the event queue.

With the size of the budget deficit rent hikes will not do it alone. At least not without crashing the economy. There must be changes in fiscal policy, that is the US budget deficit must be cut. Taxes hiked and spendings cut.

Military expenses are one place possible to cut, but will weaken US powers. The condendrum, if the economy crash, the US can no longer afford it’s military expenses.

Also just to answer the original question–no doubt the Fed has a long way to go at this pace to bring down inflation in the US, these price rises are cumulative after all and the USA is becoming more and more unaffordable for a huge percent if not a majority of the country, wages just can’t keep up with this and Powell recognizes it. Again, American homelessness is at record levels and research shows, every $100 average rent increase pushes up homeless levels about 10%, maybe even worse now with the cumulative cost of living rise. Shoplifting and even looting of stores is spiking, many shops are closing and bigger chains are changing policies with the theft of basic items. Hotels, restaurants and service businesses can’t get workers in many parts of the country because rent, food, healthcare and other basics are so expensive that wages can’t keep up. The US birth rate is at a record low and falling (childcare and medical bills also rising), more and more countries are rejecting US dollars for payments and changing reserves into a variety of options, quiet quitting and de-motivation are up as wages lag inflation (hits to productivity), and the writer’s strike is crippling the US entertainment industry at a critical time and productions are moving elsewhere.

There’s a reason they called inflation “the nation-killer” in our econ classes, when it goes so long uncontrolled like this, it distorts and throws an economy out of being functional, and there’s where we are in the US. And it feeds on itself and stays persistent, like we’re seeing. Americans just can’t afford to live and work in huge parts of the country anymore, and the price pressures are only getting worse because of it. Paul Volcker understood this and it’s why he fought inflation so aggressively, and kept rates high for even longer. It’s why not only more aggressive rate hikes, but also tougher quantitative tightening (and sales of those MBS’s) are needed.

Do you have numbers on the homeless. Your comments made me go digging for charts and data and from the brief searches it appears there are fewer homeless people now then in 2010. i went to endhomeless.org and USAfacts and they say there are fewer homeless now than in 2010. yes homeless numbers have risen the past few years but the numbers were dropping from 2010 to 2016 because if low interest rates and an improved economy. Thus we have 30 million more people in the US since 2010 and fewer homeless people. So are we at record homeless people per capita.

I agree, things are changing for the worst but look at the bright side, millions of people want to move to the US for the American dream. The US is still has better opportunities than most other countries.

I see more and more homeless people in Minneapolis every year. No joke, some days it seems there is a guy or girl holding a sign on every highway on/off ramp. I’ve seen what looks like a gang member shaking down a homeless person, as a sort of “rent payment” for using a productive, high traffic spot. Encampments of 20 to 40 people under bridges are common. Even the suburbs are dealing with it, shelters are full, people are sleeping in park bathrooms.

I think I am seeing more homeless. I go to the mountains every summer and I think I am seeing more older pickups with campers on them and older RVs. Lots of older people in these living on social security in these. The state campgrounds in New Mexico are very cheap for retired residents and are full of these people. They have to move to a different campground every two weeks. I said to the ranger, “So everybody moves out Sunday morning and moves in to a different campground Sunday evening?”, and he just nodded.

Fiscal policy has ran over Powell. As always politicians think short term. They put enough money out to the states with a date of being spent by 2024.

Since monetary policy works with a lag, we might get to election before we implode, but I doubt it. It’s my understanding that banks see the storm coming and are taking the umbrella away. We are so leveraged that loan growth is GDP growth.

It’s funny, I was just coming here to post on your previous article that I was worried the inane media discourse about ‘plunging US inflation’ may have made you too angry to put up your usual inflation update. But I shouldn’t have doubted you!

I need to calm down. If I keep being angry like this every time I see a pile of media BS, I’m going to get a heart attack or whatever.

Have fun Mr. Wolf and no regrets. Its your website…..Glad I found it.

Serenity now!

Come on wolf, you know this happens before every recession. Media touts to bagholders how only blue skies ahead so big money can unload and buy back on the other side of the recession. Somebody has to hold stocks and real estate on the way down and it won’t be them. Have a drink!

Maybe the hoopla is lasting so long because wallstreet is the bagholders and cannot find buyers.

But at least your hospital bill will be lower than if you had the attack last year! Well, according to that CPI “adjustment” at least…

We need to fix CMS, before Wolf needs to use it.

lolololol!

“… a heart attack, or whatever”

Hmm, a stroke that knocks out your internal filter? Maybe it’s already too late

Uh oh. Let’s not let your life go to hell in a flatline.

Better beat it outta town…go camping in Big Sur or something…or just steep in a hot bath for a hour with some good Japanese lager.

Nah. As long as you keep swimming, walking, etc., you will be fine. A healthy heart will protect you.

Please please please do NOT have any kind of whatever attack Wolf.

WE, in this case the prudent savers and investors WE, really NEED your honest and very helpful reporting!!!

( Saying this after a recent ”episode” put me in hospital for first time in 50 years, and it ain’t fun or helpful.)

( Also, a little off this article, but not much: Please consider that the SF bashing might,,, just might help to bring down the cost of living in SF to at least somewhere near some sort of affordability again, eh?)

I get all riled up too Wolf. It’s hard not to. I think the best solution is to turn it off.

Thanks Wolf. You are the only place that I get reliably accurate information. This morning the Google News robot (AI?) got stuck and wouldn’t pass me on to this article. Is that the next thing? Selective news filtering for every individual?

Could Inflation be sticky because central banks around the world are dumping dollar reserves and all them dollars are coming back here?

The headline at Yahoo Finance was “The Fed is getting what it wants.” You can’t make this shit up. It would be hilarious if it weren’t so exasperating (and if the Fed itself weren’t so likely to play along and actually pause, just when animal spirits are once again swinging from the rafters).

To be fair it’s more and more doubtful the Fed will pause because like what Wolf said here, Jerome Powell himself has pointed out how sticky this inflation is and how much damage it’s causing. Although it’s been aggravating how relatively tepid the Federal Reserve has been with QT and rate increases, as compared to for ex. the toughness Paul Volcker would have had, still credit where it’s due–JPow and the other Fed governors at least have recognized how troublesome the real inflation is (the core inflation most connected to liquidity and interest rates, not swayed by energy volatility). And they know that services and housing inflation are especially sticky and these are causing a lot of trouble for Americans. This absolutely points to the need for more rate hikes.

Hope they pause. I have heard they like to be transparent and said data dependent and they were closing in in ending hikes .

The Fed is happy as long as housing just doesn’t roll over and tank. And that’s not going to happen without modest job losses which aren’t on the horizon. We’re in the middle of the Fed’s soft landing. They won’t say it, but they’re OKAY with 4-5% core CPI. With the sort of deficit spending DC continues to embark on, there’s no other choice. DC isn’t going to cut spending or raise taxes until the absolute last moment and that’s not likely to arrive for at least 2-3 years. You don’t have a recession with $1.5-2 trillion in annual deficit spending. It’s just not going to happen until something breaks like CRE or credit in general.

Looking at the headline of this article it seems that fed would hike rates tomorrow

But along with market we all know that fed would pause and cut rates later on to help their friends

All the talk of fed to tame inflation would be proven lies and hollow if they don’t hike tomorrow

Maybe it is okay to pause and see. Monetary policy has several months of lags. Although I doubt if the Fed as as dovish as the media….a point Powell is likely to make tomorrow

I think the Fed is foolish not wicked :) ……I guess the job requires making predictions of the future which makes them look even more foolish

Gone are the days when monetary policies have these lags.

No more valid now a days with information flowing easily and fast.

They hike the rates and it is reflected everywhere more or less.

Nah. Some rates reset immediately, others take time as loans and fixed income investments mature. The lag was never about “information” (everyone has always known when the Fed changes rates), but rather the time it takes for rate changes to be reflected throughout the system. That’s one reason commercial real estate is currently having problems on a rolling basis as loans mature and require financing at higher rates. These things take time.

I don’t think fed is foolish.

They are extremely smart bunch with 100s of millions in net worth and they want to make sure they make money for themselves and for their friends and family.

This. The hikes are chasing inflation, on purpose. It is not a mistake.

To clarify, I agree it is a plan taking place, but the purpose is to devalue corporate debt, IMO. Powell and friends are get rich only as a byproduct of insider knowledge.

There is good interview out there with former Dallas Fed president Kaplan. He was critical of Fed culture of group think. He said they really don’t like robust debate and contrary opinions. There is a lot of pressure to have unanimous votes.

ElK – have encountered this several times over the last 18 months. Another, now-accepted moral-hazard practice of ‘…begging forgiveness is easier than asking permission to rake off a few more coins (ie: not performing an expected pricing due diligence)…’, or a case of operations not keeping up and in sync with purchasing in this inflationary environment?

semper caveat emptor…

may we all find a better day.

…hm, this comment in response to El Katz farther down the thread, dunno why it landed here – apologies.

may we all find a better day.

Again, totally understand the cynicism but the Fed is looking more hawkish about additional rate hikes (and QT) partly because Powell himself has been getting nervous about how sticky this inflation, esp for services, housing and cars. I agree the Fed has been annoyingly tepid about getting it under control but real damage is hitting the US economy and communities now. It’s all fine an dandy to help out rich billionaire friends, but when the United States is seeing record homelessness and shoplifting, birth rate crashing, faster de-dollarizing as the dollar gets more worthless, workers quiet quitting and productivity falling because their salaries don’t keep up with inflation and then labor and social unrest at top, we’re at that point where inflation is reaching the “nation-killing” phase. Like we learned in econ class, it’s amazing how quickly uncontrolled inflation can unravel a society’s fabric. We’re at that point now, it’s probably partly why the Bank of Canada continued with rate hikes and we have much more serious inflation issues in the US.

Which world are you living in ?

Do you really believe the people in power cares about home less ness and shoplifting?

This transfer is wealth is happening exactly as designed .

Please wale up and smell the coffee.

We should all know for whom the fed and politicians work for

I suspect civil unrest is always a concern for the PTB..

Absolutely, Miller.

And it backfires in some places. No one can afford to rent in some areas and the millionaires and multimillionaires are having a hard time finding people to wipe their relatives’ behinds as all the labor has left. The billionaires don’t care, I’m sure they just build suites for the help and hire full time security. Back to the feudal system.

If he is truly concerned about inflation he will start selling bonds and MBS hand over fist, at the same time keep increasing the interest rate.

He could. That would surely bring about the end of inflation.

I guess the hard job is to bring inflation down without completely destroying the economy. Unfortunately they have been fast and loose for so long that it is unlikely to resolve inflation without some wound to the economy.

I am all for MBS sale….but also understand that a fire sale will likely be worse in the long run.

The Fed will have to do penance like the all of us :)

“…hard job is to bring inflation down without completely destroying the economy”

i really have to marvel at statements like these.. the great depression didnt ‘completely destroy the economy’. bringing down inflation using the fed’s monetary policy actions certainly wont either.

remember 2008? all of wall streets talking heads and the revolving door politicians were telling congress that if they didnt get a bailout, ‘the whole economy would be destroyed’. you sound just like them. do you really want to be associated with those people, flagrant liars and schemers that they are/were?

the fed can try to tightrope walk this dilemma all they want, but it cannot last.. as some have commented here on WS in the past, fiscal policy is ultimately the predicator of the current issues. giant structural deficits, representing ‘business as usual’, a ‘no restraint’ mindset everywhere..

the fed cannot remedy those realities. they can sell their entire balance sheet and jack interest rates to 20%, it wont matter. all the massive money bloat will just move into treasuries for the yield, and the demand for treasuries will EXPLODE, further magnifying the feedback loop for continued debt generation. sure, there will be some negative effects, but even that will not ‘completely destroy the economy’.

everyone is looking at the fed to resolve an issue that is largely beyond their capabilities. is this an apology for their mediocre policy response and kowtowing to the elite millionaire/billionaire class? no. but the legislature is ultimately responsible for the nation’s financial well-being, not the fed.

Great Report Mr. Wolf. Higher for longer, and that means decades to me. FED may pause a meeting or 2 and up we go folks.

In this insane world we live in…market already decided job done. Pow Pow will pause this week then cut very soon…and I bet good money they will be right about the pause part out of this FOMC sadly…

Maybe they think Pow Pow is ready to hang that Mission Accomplish banner on top of a aircraft carrier like someone else once did..we all know what that turned out..

The transfer of wealth from the poor to the rich continues…..at a slower rate. Wage increases lower than inflation, interest rates lower than inflation, after tax. Deficits being monetized. Federal cash flowing to all the friends of friends.

The fed is getting exactly what it wants.

For some reason the people in this country fail to accept that DC has more criminal activity than any ghetto…..it’s just that they get away with it because they make the rules.

dc stands for disgracefully corrupt

Duck-n-cover

Mr. Flintstone. Amen and agree. Would you be a cousin to Depth Charge? HEE HEE

I would like to add that Everyone points a finger at the Fed but the congressional budget debt is inflationary but congress wants to spend and asks the fed to do the dirty work at keeping inflation low. How about we also start asking the Government to have a balanced budget. That to would help lower inflation too.

As is the massive illegal immigration.

In Webster’s Media & Wall Street Edition, “pause” is defined as “pivot”.

pause’ is defined as a ‘revolving point’.

That’s right. The pause was a turning point for BoC and ACB in their decision to continue raising rates after the pause.

Sarcasm

Ground beef at Walmart just went up almost 15% overnight. Sliced bread also up over 10% in the blink of an eye. Canned beans inch up a couple percent every few months. Seems that this is far from over but hey as long as the banks are OK right?

Check your receipts very carefully when you go grocery shopping. I stopped at two stores in the past week. I didn’t purchase much (some infill items I forgot in our monthly shopping trip). In two cases, items priced at the shelf and what rang up were different. While not enough to bankrupt me, one item was $.80 different ($3.49 marked and $4.29 rang up) and the other $1.00 (their maff was wrong….. 2 lbs x 3.49 = $7 not $8).

Both errors were at major chains and they refunded it without a whimper.

Nothing good in this report for the FOMC. Should continue hiking, especially with D.C. hell bent on blowing a massive inflationary bubble courtesy of a new blank check from Congress. Monetary policy still far too loose. Don’t much care if more banks assume room temperature.

Of course what the FOMC should do has nothing to do with what it will do. Won’t be surprised if they follow the failed ‘pause’ attempts of the RBA and BOC.

Wake me when Fed Funds is set at 8%.

“Wake me when Fed Funds is set at 8%.”

What ? Not 20% like Volcker had to do with similar inflation in 1981?

@Mark

First things first. Get to 8% before year-end. Then continue hiking into 2024.

Yes, an election year ahead. Didn’t stop the Fed from raising rates in ’68 or ’72 or ’88.

Owners’ equivalent rent is survey based is it not? In case it make for an interesting pair with Zillow asking rent.

What easier way to estimate rent for a homeowner than look up the Zillow asking rent for a similar house in the same area? It could be owners’ equivalent rent will shoot above rent of primary residence.

So you’re asked in January, how much your house would rent for, and then in July, you’re asked the same question again (that’s how it works, year after year), and each time you get online to do some research to find out where rents are for similar homes in similar locations, etc. So there is some connection there.

But since your home will be different from the Zillow median asking rent home, it’s likely that you cannot establish a reasonable current-month rent dollar-figure based on ZORI data. You probably are looking at 2-4 rental listings of similar homes in your neighborhood, rather than the ZORI.

The end result then may be that owners equivalent rent aproaches asked rent as it is now easier to find what asked rent is. With homeowners report asked rent, instead of some low guesstimate, the owners equivalent rent will push the CPI up.

Zillow’s asking prices for rent and sales are possibly the very worst indicators. A ouije board is probably more accurate. Their sales price data is the only accurate data they have.

Craig’s list is probably more accurate. More landlords advertise there, at least in my area. If you want very accurate data watch for which adds disappear as they are rented and note them. This of course still leaves out most “sign in the window” and student housing.

The core cpi a triangle. The pole is 2021 hi/lo. Add the pole to the front

end, 0.7% + 0.4%/0.5%.

Biden essentially looted the strategic oil reserve (intended for natural disasters) for political purposes, though its hard to fault him if he manages to refill it at today’s lower prices. However, the 5% drop in headline CPI also coincided with a $140+ to ~$68/barrel drop in WTI prices, which will not be repeated unless oil prices go negative again.

L12M headline CPI is likely to decline even further, to +3% annualized by the June report (to be released next month) due to base effects. However, the next 6 months of comparables are quite challenging, with 4 of those 6 months having negative M/M changes. So headline CPI is likely to rebound towards year end.

Meanwhile, core CPI/PCE have remained sticky, with +0.4% M/M increases for 6 consecutive months, equivalent to a ~5% annualized rate.

Pause? I think thats a certainty now.

But truth told I think another 25bps would put every forward month dot plot directly on the X axis sending markets wildly higher.

A hike now sounds too much like One and Done and that would bring all the animals out. A pause here actually puts another hike in the realm of plausibility. Some doubt is helpful.

Ha, a hike now would guarantee further hikes. 8-9 percent before year’s end.

Thank you Wolf,

The whole shlt show is orchestrated, Kabuki theatre.

Here’s something I put together earlier:

—

Using 6 hour charts on netdania,com looking at UK Oil & cash Au:

Gold has been in the $1940 area 18 times since about May 25th

UK Oil has been in the $71.75 area about 4 or 5 times since about May 30th

===

The PTB has been pushing hard (trying to break Russia?) but no luck getting lower prices.

They both bounce back with vigor.

One of these bounces will blow Oil to neat $100 and gold to $2000+

I’ve often wondered about the price of Gold and Silver.

How much manipulation ?

What is a fair price for gold ?

I can not use gold to pay my bills.

Gold pays zero interest.

But gold and silver have a 4000 year history of protecting purchasing power.

IMO, it comes down to cost of mining.

Central Banks seem to be accumulating gold, so says the media.

When gold was $200 an ounce, everyone hated the barbaric relic.

When or if gold goes above $2000, many will want to buy.

Any good Mining stocks to buy ?

What is the definition of a Gold Mine ?

A hole in the ground, with a liar standing on top.

– Just stick with gold producers in safe jurisdictions and not penny stock explorers.

– Evaluate gold producers based on AISC, the industry benchmark, that is All in Sustaining Costs in US$ per ounce.

– The gold price has a fairly predictable annual chart. Buy gold or gold producer stocks during the summer lows. Sell if you want during the winter highs.

– AEM, Agnico Eagle Mines Ltd. (TSX, NYSE) is my favourite (AISC ~ $1,100). I save up the quarterly dividends and buy more during the summer stock price lows.

– The majority of mining deals are made via, Toronto. After the Bre-X Minerals Ltd. scandal in the 1990’s, Canada passed strict, comprehensive legislation to protect and regulate the industry. Try to be that liar now.

Retired gold geologist here.

Do your own due diligence.

Wolf,

It does seem that mid to long term treasury yields have been steadily moving up– is the bond market forecasting a second wave of inflation?

Do you see a second wave of inflation brewing, and if so, how do you see this playing out?

I don’t forecast inflation. That’s a crazy game. But big inflation like this can come in waves, and the historic year-over-year charts show those waves.

So it’s very possible that we’ll get a second wave.

I’ve also noticed the 10 year rate rising. Maybe the supply of treasuries has gone up now that the debt deal has been done. Many people think that this could drive up rates.

Wolf,

2 to 20 year treasury yields have been steadily moving up. Does this indicate a second wave of inflation is brewing?

What do you think, and how do you see this playing out?

In my mind, long term yields are just slowly catching up — they’re still too low for the current inflation.

Things may be easing for new cars. After 2 years of looking I finally found the car I wanted at a reasonable markup over invoice. My 25YO car was about to strand me somewhere and I had to replace it.

Over the span of 2 days the dealer went from insisting on huge *market adjustments* and document fees (amounting to around 9k), to dropping all that entirely. The reason — supposedly the boss said clear the lot. Sure, okay.

I was at Jeep dealer this weekend. Minimum $8K discount off MRSP. I was also getting prices for a Ford Expedition elsewhere. I have a family member who works at Ford and the price quoted for the Expedition is below what the employee pricing is. This is including all the incentives.

These are vehicles that are currently not selling, being discounted heavily and will continue to get discounted as inventory keeps piling. The vehicles in demand are still commanding MSRP with some dealers tacking on $2K in BS fees like a “protection package” which is window tint, door handle anti scratch film and all weather mats.

Jeeps day supply for some models is over 365 days. Renegade is around two years grom what I read elsewhere. They really, really need to “clear the lot”, but it will take massive help from the manufacturer to make that happen, plus a loss to the dealer for every unit so they can stop paying floorplan interest. When I was in the industry, we’d get nervous when it was over 90 days on most models.

JimK,

I agree and I am surprised it has gotten this far. Back in 2018 Honda Accord Hybrids were just sitting in dealer lots, not selling. MSRP was $26K for the base model, I was able to walk in offer $22K and after 30 minutes of back and forth, the deal was done. They did not have any of these Accords on the actual lot, they had them in an offsite lot.

Like Wolf says, maybe the dealers are thinking “this too shall pass” and interest rates go back to 0% or 0.9% for 72+ months. And people will then be OK with paying inflated prices because “it’s 0% man, it’s free money, why wouldn’t I buy it?” That statement was verbatim what some people have told me in the past 2 years when buying a new car.

From today’s Automotive News daily updates:

Increased incentives expected as year goes on depending on brand:

Incentives reach yearly high in May, according to Kelley Blue Book. Analysts expect incentives to grow with certain brands that experience high inventory in the second half of 2023.

But wolf, dozens of very smart people™ on Twitter are telling me that if you just remove half the stuff from the CPI calculation, and substitute some of the other stuff for other stuff, then inflation is actually right at the Fed’s target!

Alpha – ‘muricans LOVE stuffing…

may we all find a better day.

As $30T in treasuries continues to turnover and auction off at 5+%, imagine what is going to rapidly happen to our interest payments…..

Which is why the FED should not screw around with pauses and 25bps hikes. They are running out of time.

The consensus of comments on this site so far, along with Wolf’s view, is that the markets are full of crap. The markets are praying and begging for the Fed to pause and cut, like some junkie hooked on ZIRP. The problem the Fed faces is that a pause in the face of very high and sticky core inflation and robust employment would be seen as capitulation to the stock market. All their credibility (assuming they had any) would be flushed down the toilet. Powell said it is easier to overshoot tightening and then loosen, than to loosen too early and then have to tighten again. Furthermore the Fed funds rate and 30 year fixed mortgage rate are not much different than their averages 1971 to 2022. Powell has to go higher, otherwise he is a wimp, jackass, and an enabler.

I think we’re seeing a lot of news outlets trying to make Joe Biden look good. Lately there’s been a steady flow of OpEd articles in my local newspaper about how good the economy is and how Biden isn’t getting enough credit for U.S. economic performance. Paul Krugman just recently published an article stating this.

The CPI index value took it’s final big jump this time last year. May to June saw a 1.4% MoM (4 point) jump and then it basically flatlined from June through December. I would not be surprised to see next month’s June print on headline CPI at under 3% (~2.97%). But as Year ago comps flatline from June through December, YoY headline will creep right back up, 3.3, 3.7, 4.0… We might even be back close to 5% by December.

Next month’s headline number is going to be Wolf in sheep’s clothing.

Inflation won’t stop or slow until we have a true recession.

We won’t have a true recession until interest rates are substantially higher.

We won’t get substantially higher interest rates unless inflation continues to run high for a continued period of time. It will, especially when energy prices finally bottom out.

There is still time to unload assets before all this happens.

I agree. I think the Fed does not want to interfere in the political scene by forcing a sizeable recession at this point in time. And I think that they’ve got the media committed to a pause, so they don’t want a big market reaction to a hike. Their primary objective, in addition to tamping down inflation, is to keep things “smooth”, as in “soft-landing”.

Replaying Volcker’s stutter-step on interest rate hikes is probably in the cards. Volcker stopped hiking, briefly, before the all-in on hikes. If Powell follows with a pause here, it will already have a precedent.

I’m not unloading any assets, but I am on a buyer’s strike and have been for almost two years now.

my business (used truck dealer) is completely dead, no calls at all. I now have some of the lowest prices within 500 miles on really good stuff…nothing. any dealers that are raising their prices good luck. did see some dealers still trying to get nosebleed prices but good luck I’ve seen some ads now for getting close to a year. just got noticed they were raising my office rent $80 a month more. I won’t be paying it but moving out.

Do you have a website where you list your inventory?

Autotrader only.

Just moved out of my office in May. My office was in a small two-story suburban-style commercial office building outside of my city’s downtown area. My office was ~1200 square feet. The landlord had raised rent right before Covid, then raised it again last year. I tried to negotiate, but nothing; they wouldn’t even talk to me. Last year, I had made a counter offer to their rent increase and got no response. Last December, when I gave notice of my leaving this May, then all of a sudden they wanted to know what they could do to keep me. I could have stayed, but they were such jerks, there was no way I would even consider an offer.

So do you have a website of your inventory??

No matter what the Fed does tomorrow, the big boys win.

Pause – Markets continue climbing, oil will jump, inflation heads back

upwards.

Raise – Those in over their head will have to downsize sooner than they

wanted to and guess who is there with cash to buy the bargains?

Oil may drop a bit but the damage to the big assets will accelerate.

Dammed if they do or don’t.

I say they error on no hike as where is the cash going to come from to eventually service the masses with food, shelter, jobs and hope.

One day at a time, hope you are debt free and financially secure.

Book it Danno

“One day at a time, hope you are debt free and financially secure.”

As an old fool, I went crazy during ZIRP 0%, it taught people there was no reason to save $$$. Whenever asked where I am from, my response has been “the old planet earth.”…..

I think the Fed will PAUSE tomorrow. Maybe in July also.

Congress just raised the Debt Ceiling.

Congress will always raise the Debt Ceiling.

A Second wave to inflation is coming, followed by a Third and Forth.

Fiat money backed by Political Promises.

The Fed says they are draining liquidity, and retuning to a normal rate environment. At least until the next Financial Crises, and Rates drop to ZERO.

If the Fed pauses tomorrow, this rate hiking cycle is over. It’s almost over anyway. Government, society and the population are much different today than the 1980s, and there will be no Paul Volcker to crush inflation now. Debt to GDP was around 38% in 1980; it is about 120% today. It will be reduced or stabilized by inflation rather than by austerity.

Bond Market is saying go ahead and raise and yet they’re likely to pause. If they were going to raise we’d almost certainly know by now. They’ve been very clear on not trying to surprise the market.

Is it a mistake? Probably! But also a short time with only 6 weeks before the July meeting so I get it but still what’s another 25bips?!

The real question is how hawkish is the dot plot and the press conference. Are they leaving additional hikes totally up in the air or are they going to essentially commit to more hikes.

June heading CPI is expected to come in around 3% core stuck at 5% is that enough for more hikes🤷

While congress spends ,like drunken sailors. No offense to sailors

All of this is great – thx Wolf. Yet The FED is pausing, will deliver some tuff talk, bluffs, etc. They are done raising rates folks. Pathetic “fight” against inflation. Never got the MBS sales or significant QT. So sad to see what they’ve done to our currency.

Bring back the good old days of the 1970s.

If only Powell had President Nixon who took the World off the gold standard in 1971 and therefore still had the momentum of a recently honored Bretton Woods agreement.

If only Powell had an industrial powerhouse USA as Europe and Japan still were recovering and with an Iron Curtain stifling the competition. If only China was still not “opened” by Nixon and Kissenger? If only Powell could dance to the Disco Duck record while stalling any interest rate cooling off of inflation, and stall some more until Volcker “white knuckle,” barely stopped hyperinflation.

If only Powell didn’t have to face reality of having burned out his Quantitative Easing (QE) discredited money printing for the whole world to see. If only there was just newsprint, rabbit eared TV, and Shortwave radio to comment on the Federal Reserve’s failed policies instead of instantaneous worldwide telecommunications to everyone.

Poor Federal Reserve with policies on inflation a half century behind the times; and with a glaring decade long real life history still in the minds of living people whose early adulthood was indelibly damaged by that very same dollar brand money printing private corporation.

S&P heading toward 4400, bull market saying RISK ON, time and pressure will burst a steel pipe. Gomer Powell head is on the chopping block, I’m sure he will consult with Jamie Diamond over @ CHASE before making a sound decision….the Bear is no longer growling in the woods. Seems that we are owed at least 10 years of QT. “Daylights Burning”. “ My name is Wyatt Earp and it All Ends Now”

It does not matter to me what Powell does tomorrow. He is my enemy. A 25 basis point hike does nothing in the grand scheme of things. A “pause” is, again, just “meh.” The FED destroyed everything.

Depth Charge, the Fed Funds rate is now 5.25% and at least equal to the annual inflation rate, CPI and PCE.

We will see a year out if this is still the case if the Fed keeps the rate at no less than 5.25%.

A kid born today enters the world with a $200k federal debt over his head, asset prices in the stratosphere, and zero right to step on any land or eat fruit from any tree.

You might has well be a buffalo calf born in the Serengeti with a dozen lions standing around.

If the fed pauses inflation will come back with a vengeance and become even more sticky. Especially with a inflation induced stock market rally that we have witness based on ai.. which is premature at best. I get the sense they really don’t know what they’re doing and I’m not surprised the market and media is trying to force a pause. Inflation when sticky is disastrous.

Instead of the Fed raising rates either 0.25% or not at all, how come they just don’t raise it 0.125% ?

Joe C, with that type of compromise approach, might as well raise it 0%.

1) After 7 months there is no close above Dec 2022 high. Yesterday close

was below Aug 2022 high. QQQ put a smile on investors faces, make them happy during the ULTRA long run.

2) The Dow might drop below Mar 2023 for a sling shot up to a new all time high.

3) The Dow might lose it’s grip and drop below Oct 2022 low, possibly in a deep dive.

4) QQQ : AI will lead us to the skies.

5) QQQ : AI smile, but QQQ might drop near/ or below 2020 low, ski downhill on a steep trail, for funfunfun.

lol at rent cruising at 4% inflation since 2017 at least. It was ok though because eggs were cheaper back then.

Eggs suffered the biggest price drop in 70 some years, according to the newz. I bought a dozen for $.87 at Safeway.

We need another round of lockdown people. Remember when oil futures plunged to negative territory? Those were the days. I mean the stock market will be destroyed, but CPI will drop faster than you can say lockdown.

2 points.

1) inflation hurts the poor the most: it’s assault. Vicious.

2) RE is in a bubble. Big time. Still.

Reading the above comments, it seems to me that most of the people posting here see the FED ( a private banking cartel) as the only way to tackle inflation.

Maybe it is time to consider alternatives? ?

Bust up some of the big corporate monopolies.

Raise taxes on the wealthy. Tax excess corporate profits. Tax speculation in the casino.

Wage and price controls.

Direct “investment” away from speculation, and towards people & firms that actually produce goods for sale.

Other ?

Of course, anything other than “rate hikes” by the private banking cartel would require a functional (and honest) central government (something the USA has not had since about 2000 ).

No Thanks. I will take Limited Government for 100 Alex.

We do not have that category Redneck.

Yup — all the heat and light generated over monetary policy is a distraction from the real game which is fiscal policy.

Cresus,

1) Yes. Those with enough cash can avoid higher financing costs by avoiding loans altogether. Poorer folks who need financing and/or are cashless get crushed between increasing prices of critical goods and increasing debt expense. The poor have nowhere to hide.

2) Very hard to identify a bubble. Is housing expensive because existing homeowners overleveraged themselves? Many of Wolf’s articles say “no.” Debt vs. disposable income is very low right now. Homeowners are able to pay their mortgages. Many homeowners own a house outright and aren’t really affected by house prices or mortgage interest rates. They’re also getting sizable interest income for the first time in a long time. Commercial RE is a different story, but homeowners are largely looking pretty good. Rents will increase until the market can no longer bear the increases forcing landlords to ease up. A GFC style job loss event could shake a bubble out, but it’s not clear that one will happen soon. How/when?

Basically, as long as the job market stays stable, we have nothing but 70s/80s-style inflation ahead. The fed printed too much money and refuses to remove that money with sufficient speed. 0.25% rate hikes wouldn’t have stopped inflation 40-50 years ago and they won’t stop inflation now in the 2020s.

Good points: but one of the things I use is the equivalent rent CPI graph. And the cost of ownership is basically 50% higher than renting.

That’s a huge red falg in my book. And I absolutely hate renting. I’m an owner of lots of stuff. But as is, it’s far far far better to rent for now.

So relatively speaking RE is bubbly. For me. Even with my bias.

“Raise taxes on the wealthy”.

What if they raise taxes on savings?

It’s already been shown here, how rate hikes benefit savers but probably help to prop up inflation.

So why not raise taxes on savings?

After all, ‘people with savings are wealthy’

/sarc

Up 500 basis points and as soon as Fed. Funds gets above CPI its game over?

The federal reserve can’t be trusted to pause? After spending May talking about 6,7,8% fed. Funds? Nothing has changed except the unsustainable lack of desire to move from the TRANSITORY language of 2022?

The chair is handling things like a lawyer would!

We learn today how committed the Fed is to bringing inflation back to target. Yes, it is energy that has caused most of the lower plateau of inflation, but that is almost completely played out with the SPR drained down by 50%. I suppose the SPR could emptied completely by this time next year, but I don’t expect it to add much more to lower energy costs.

Middle class is for the birds nowadays. Just a cow tit for federal spending. You need to be on welfare or a speculator if you seek any quality of life here in the good ole USA.

Given this latest 20% inflation hump for 2020 to 2022, which is now permanently built into prices, as well as the additional 15% hump coming over the 2023 to 2025 period, as well as the 100 to 300% increase in home prices and stock prices over the past decade, it appears young people entering the work force today are destined to see a dramatic reduction in living standards, unless they have wealth parents.

My hope is they have access to medical care, at least.

Meanwhile, Powell piddles with debates about .25% rate increases, and whether to sell MBS (which never S/H/B bought in the first place).

Mr. Powell, don’t you think the Fed has done enough to expand wealth concentration? Why does the Fed insist on supporting highly elevated and artificial asset prices?

I find the housing frenzy somewhat comical. Prices grossly above intrinsic value. It’s as if buyers trust our gov’t to ensure their property rights. Perhaps it would more prudent to direct those funds toward hard survival and prepper assets. Whether shit hits the fan, or not, they still maintain value and appreciation.

I assume you havent spent the last decade watching your rent go up 5-10% every renewed lease.

People buying houses know they are overpriced, but they are the cheapest housing will ever be for the rest of their lives. You either buy now or spend another 40k a year on rent. Then 44k, then 49k… Shame you didnt buy that house 3 years ago…. its already gone up another 55%. Blackrock just paid cash for it… starting rent 5k.

I get that, in terms of personal property. You have to live somewhere. My response was geared toward spare cash allocated toward RE investments. You’re putting a lot of faith and eggs in a basket, with trust in a gov’t who can’t even get a handle on inflation and potential verge of de-dollarization, not to mention mandating possible rent controls and regulations in the near future. In my neck of the woods (and most others) RE investors have significant concentration risk.

RE: Heyjagoff

Based on Wolf’s other articles the investors have backed off a bit. And in may metros, prices are down due to mortage rates increasing. But actual mortgage payments are still up. I dont suspect we will ever see mortgage payments retreat to pre-2020 levels at any time. Properties will become more attractive to “investors” eventually and the race to make a nation of debtor serfs will continue.

I will reiterate that if the Fed “skips” today with a tough love statement it will inject nothing but doubt into the forward looking rate prediction.

A raise today would put the market into a One and Done Fed market feeding frenzy. 4600 by EOM easy.

The zombie banks are selling high quality tranches of loans and mortgages of people with good income and good Fico. The zombie banks are stuck with bad assets, with zombie payers and zombie mortgages. Bad is bad.

The zombie banks are doomed, buying time.

The stark realization is that the Fed can’t control inflation in this environment. At high enough debt and deficit levels, it has become a choice between fiscal-driven inflation and lending-driven inflation.

BRK/B failed to reach it’s min target. QQQ and SPX have reached their

targets.

Wall street whales are using Fed days, CPI days… to buy or sell.

has anyone accounted for reduced Oz, weight, or material for the products in the declining prices as well? A bag of chips with 15% less Oz but same price doesn’t seem a lot like inflation is cooling.

Inflation data has from day one fully accounted for quantity, not packaging. Prices of food, gasoline, etc. are measured by quantity, such as ounces, pounds, gallons, quarts, etc. The packaging is irrelevant. And so inflation data has from day one fully accounted for “shrinkflation.”