A harbinger for closed sales in April and May.

By Wolf Richter for WOLF STREET.

March is with both feet in the spring selling season, when home sales jump and when prices move higher, and where everything looks rosy for a few months, no matter what, after the dreariness of winter.

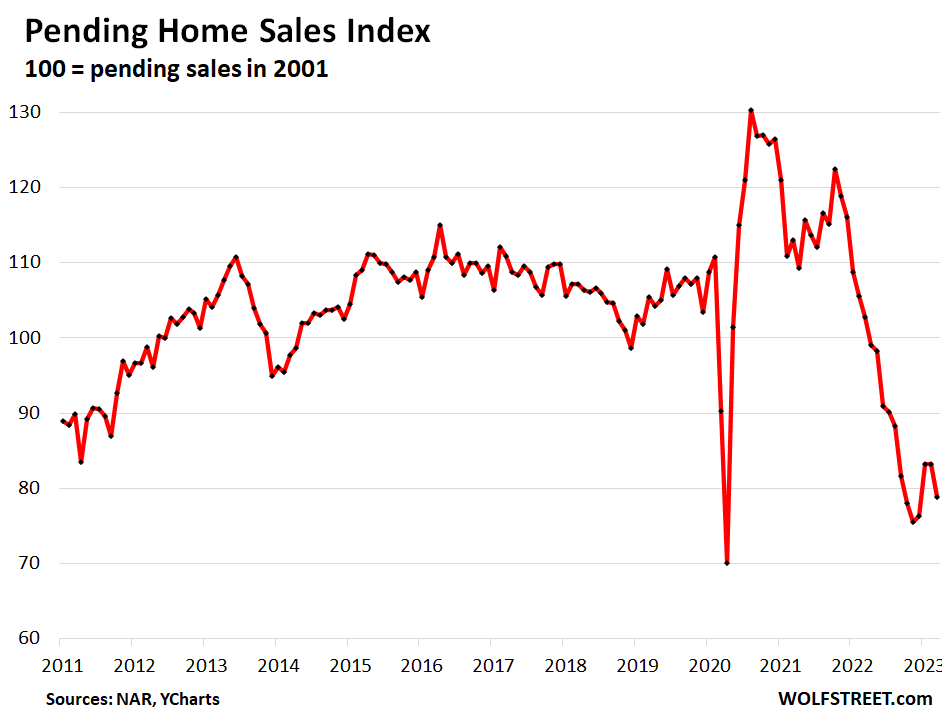

So, well then, here we go again. Pending home sales – which are “a forward-looking indicator of home sales based on contract signings” – fell by 5.2% in March from February, according to the National Association of Realtors today, thereby annihilating the little-bitty gain in February that had sent all the headlines abuzz with hype.

The index value was set at 100 for contract signings in 2001. Today’s value of 78.9 is down 21.1% from the index average in 2001. Compared to prior Marches, the index value of contract signings plunged…

- By 23.2% from March 2022

- By 30.2% from March 2021

- By 25.1% from March 2019.

By the way, as you can see in the chart above (data via YCharts), that little bitty gain in February that had sent all the headlines abuzz with hype was revised away in today’s release, and February was now flat with January.

The NAR defines a “pending sale” as a transaction where the contract was signed but has not yet closed. Deals can fall through for a variety of reasons. If all goes well, the sale usually closes within a month or two of contract signing. So this is a harbinger for closed sales in April.

Banking crisis to blame?

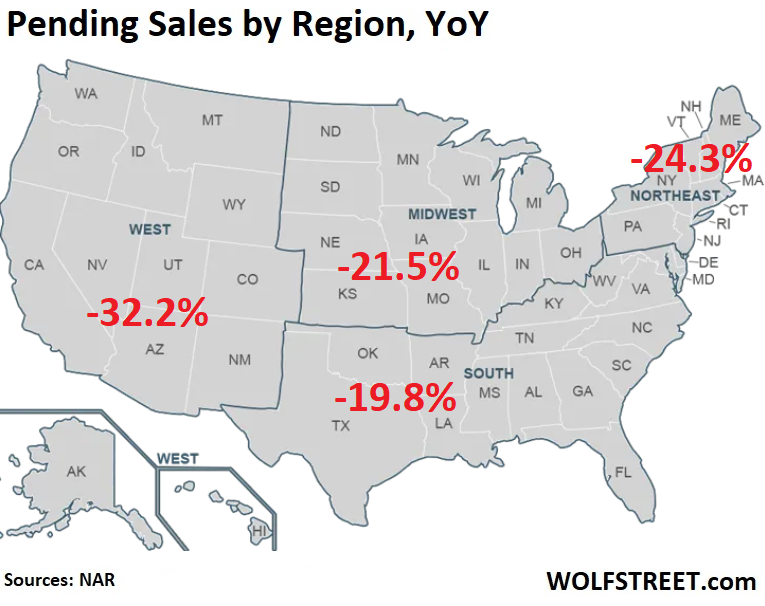

Pending home sales by region, compared to March a year ago, plunged by the most in the West.

The National Association of Realtors didn’t say, but the banking crisis burst on the scene in early March. Silicon Valley Bank imploded on March 10, which shook up the entire startup ecosystem not only in Silicon Valley but across the US. The run on the bank had started weeks earlier, the startup scene was atwitter with it, so to speak; it just culminated in the final few days.

And First Republic in San Francisco hasn’t quite imploded yet, it’s still standing, knock on wood, but it’s in huge trouble after a massive run on its uninsured deposits. It has been teetering for weeks, and its stock price collapsed.

The banking crisis has rattled a lot of nerves not only in the region, but in the overall banking sector, on Wall Street, and among regulators. And for regular people, it turned into a messy spectacle played out in the media in front of them, and some may have gotten cold feet again.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I saw someone on one of the business channels saying because existing homeowners aren’t selling that new home sells are now 30% of home sales instead of normally 10%. Some new home builders are paying to buy down the interest rates so the new buyer doesn’t backout due to 6.5% mortgage.

Probably quickest thing to kill inflation is SP500 dropping to 3000, then the wealth affect would be diminished.

Correct. Until the stock market and housing market are knocked down, and stay down, inflation will continue at 5-9% per year for the indefinite future.

Sales pending closure are down more than 30% in the West this year and RE agents earn on commissions of actual closed sales. If I had a business where revenues were down 30% and resultant profits by 50%, I would be very desperate and demotivated.

Many younger agents haven’t seen a single downturn and don’t know what’s lying ahead.

An honest sales pitch like this wont work:

“Mortgage rates have made houses unaffordable and sellers have still not gotten this message. So any purchase close to listed price will result in underwater home soon. It’s not a good time to buy.”

Many younger agents haven’t seen a single drop and don’t know what’s coming.

They will soon learn what lies ahead. Life is one big school.

This is pretty much every small business in America right now that isn’t vaporware. Inflation keeps on rising and everyone that has physical liabilities that use fuel at any level is taking it on the chin.

Working out perfect for govt knocks down deficit

Where can I get inflation as low as 5-9%? Sounds great! What country are you in?

That is why home builder stocks are making new highs. They are stealing market share from the existing home market. But so far, that increased market share is not enough to offset the huge cost of buying down interest rates. Plus, the builder market share should revert back to mean at some point.

Even with the rate buy downs, affordability is still very low. Prices have nowhere to go but down.

Homebuilders have cut price by a bunch, and they’re buying down mortgage rates, which for customers is effectively a price cut, though it might bite them in the rear later on.

Homebuilders are the pros, they know how to sell something in a down market: you CUT PRICES.

Regular homeowners haven’t figured this out yet. They’re still clinging to their March 2022 prices or are waiting, hoping that this too shall pass. And so existing home sales have plunged.

But new house sales aren’t exactly booming either:

Yep, the “listing from hell” around the corner from me finally sold. It was a new home built on a lot where the previous home was torn down. The price was reduced twice. It was on the market for over 3 months which is a long time for properties around here.

Your comment is spot on, many people fail to understand how slow homeowners are to cut prices.

I was active in the RE business during the last downturn and saw many homeowners sit on their properties for years rather than cut the price and taking current market value.

First the new home builders cut prices, then the forced sellers, then the REO’s, then finally the stubborn homeowners capitulate at the very bottom.

People struggle to understand what’s happening because a real estate crash is not a crash but rather a multi year grind down.

Wolf in one of your previous articles you clearly explained that no one wants to give up the 2-3% mortgage rate for 6-7%. So, no one selling = no inventory, which in turn means prices aren’t dropping as fast as expected.

As a someone who bought a home at 12% back in 1980, I know it took over 8 years and interest rate drops to recover my initial purchase price.

Good luck to the kids trying to but their first home.

“…no one wants to give up the 2-3% mortgage rate for 6-7%. So, no one selling = no inventory”

No no no no no no, I never said that. I said the opposite. I said that if an existing homeowner puts a home on the market and sells it, they’ll have to move, and they’ll buy another home to move into, thereby putting one house on the market and taking one house off the market with zero impact on inventory (+1 -1 = 0 ).

Here is my discussion of what actually ads to inventory, and it’s NOT existing homeowners. People need to stop citing this garbage. Only brokers benefit when an existing homeowner sells a home and buys a home, because they get the fees on both transactions. For the market, it’s just church.

READ THIS:

https://wolfstreet.com/2023/03/29/how-3-mortgages-altered-the-housing-market-for-years-to-come-a-lot-smaller-but-more-in-balance-than-it-seems-hence-dropping-prices-despite-low-inventories/

Up here in greater Boston the smart sellers are starting to figure out that if they list a half decent home starting at ~25-50k below every other comparable home in the area that they will have 10+ offers after 3 days on the market and likely go 75k over asking. The northeast has too many eager first time buyers who have been sitting on the sidelines since the beginning of the pandemic boom. In my area the willing buyers easily outweighs the sellers and sellers are having a hay day just like they were at the beginning of the pandemic boom. In a world where a foreclosed 3 bed, 1.5 bath crack house is being listed at 300k and a half decent “starter home” is >500k a massive market reset is needed

My next door neighbors home finally sold it seems. I never got a chance to ask him what his bottom dollar on the home was but sales pending at 999k, was up for 1.1, then 1.065, and now 999. Payment is still $7300 a month.

Been on the market almost 9 months now. Asians from Flushing (I’m going to guess Chinese) bought it, go figure.

try 1800

Quick dirty math… S&P PE is around 22. MHO of fair is the median, about 15. So, me thinks S&P needs to drop at least 30%. So, somewhere around 2800 maybe.

There will be a reckoning. None of us know where the bottom will be. But, there’s gonna be a reckoning.

Bottom line, at 4100, I’m sticking with Tbills.

Even assuming earnings were the best predictor of stock prices, it’s vastly inflated from the same bubble inflating the financial markets.

Try applying your multiple against a much lower earnings base.

1800 is closer to but still above “fair value”.

In addition to dropping PE ratio, the underlying earnings of companies should drop by quite alot as consumer pull back and inflation turns into deflation. This is what makes high valuation markets dangerous. As the wealth effect implodes, the economy is impacted too and earnings fall

I agree with spx though prices seem to stay higher for longer without fundamentals as Wolf says this takes years. Over 1 year when QT started.

Hey guys, all the “smart money” is heavily in stocks where the PE ratio is referred to as “NA” or “–” don’t cha’ know. (This is just a stab at sarcasm).😉

Halibut,

You didn’t say Forward or Trailing, but you seem to mean Trailing.

In recent History S&P trailing P/E has hit that only twice.

I believe it was 1995 and 2011.

At ALL other times it has been above that level.

You’re probably thinking of it’s long-term Mean and Median. Those are skewed by pre-1990s levels.

Off the top of my head I think the new mean and median are closer to like 17-18 in recent History.

I WISH you could buy in at those levels. Once every 20 years (during a crisis), so don’t miss it!

Prices need alot more time to come down. Long term rates will rise subsequent to the debt ceiling being cleared or maybe they start rising now.

One of the most beneficial events that could happen to the country to heal the economic disaster currently underway would be if both housing and the stock market crash by 30-50%.

Agree. The Fed made a huge mistake by pumping up asset prices. If they let the gain stand, people will bank on it and reduce savings, putting themselves in a risky situation when asset prices return to Earth. In general, mistakes should be corrected as soon as possible to mitigate damages.

Housing has stabilized. Low inventory and pricing has increased slightly. There is no crash whatsoever in sight for housing. Strong labor market, low inventory and muted demand.

Housing has already gone down and is going to go down more. Deal with it.

Low inventory is complete bs, not even worth addressing.

Thanks CSH for the reply. May I ask: what is your forecast when you say “housing is going to go down more”. What decrease (percentage) over what time? And will your forecast be a function of higher supply and lower demand? If so, how much higher will active listings go from the current level (in your opinion)?

This “low inventory” argument is always so funny. It essentially assumes the low inventory is some sort of endemic structural problem, rather than a direct effect of sentiment and belief. You only have to look at Wolf’s previous articles on sleeper, unoccupied inventory to see this trend. Or just be observant of the rantings of delusional housing bulls, who are dedicated to their ideology with religious fervor. Houses are being held as “assets” rather than places to live, a belief that only works in a bubble or long bullish market, and totally collapses when prices go down even for a few short years.

If houses are inflating by 20% for a single year, and there is a pervasive belief that either house prices will keep going up, or that you can “cash flow” the property for immediate profit, then every single property will be snatched up by speculators because it is the golden ticket to wealth.

This is precisely what has occurred over the last two years, and the expectation that this regime will continue is why the supply side is frozen right now. If this expectation breaks, in other words, if faith breaks in the regime of never-ending “appreciation,” then the low inventory regime is doomed.

Not to mention that there are 1.67 million housing units currently under construction across America.

I don’t really get what the issue with “low inventory” is. People seem to get offended when low inventory is mentioned. I myself are looking for a house and I am frustrated with high prices, high rates and low supply.

Low inventory isn’t someone’s opinion. It’s simple stats: in 2019 you had over 2M active listings. Today it’s 1M. Pick any city and do historical trends on active listings and you see that low inventory isn’t a made up story. It’s just reality. I don’t like it either but one’s feelings about inventory doesn’t change anything….

There are few buyers. Inventory is low. Sales are low. And prices fell. That summarizes the market. The people that are actually suffering are Realtors because their incomes collapsed.

Speculators who bought to sell at a higher price also suffer. Also suffering are those who had the money to buy, but the prices have skyrocketed and they no longer have enough money to enter the game

+ brokers/lenders suffer. The two revenue sources for them are in trouble. The refi-market is dead and new loan-originations are way down. Some Lenders shut down already or have to consolidate w others. On housing wire they interview lenders frequently and mentioned that most of them planned for a continuation of a low interest/high volume environment. They are in survival mode. Probably more layoffs to come in that sector.

I am in west contra costa county (bay area). Married with several children. I have been renting in one of the safest towns in CA within a top school district. I have been wanting to buy a house for a year, price point of 1.2M. Nothing pops up for that price only, major fixers. I finally gave up and went for a new build in a working class neighborhood. Price 900K. The deal is 25K for upgrades and 18K for a 2/1 buy down. I signed back in February for a premium lot at the end of the street with mountain views. I drove by last weekend and saw that all the other models have now been sold. What is going on? I keep looking for something in the Lamorinda area but everything under 2M sells so fast. Where is the crash?

Inside the heads of grumbling older men who still believe that the world was once “fair” and “fairness” could be restored If Only…

…

But forgetting that in a fair world, they’re among the ones serving the community by going into the stew :).

The only “fair” that you’ll find in this world has a ferris wheel, a merry-go-round, and charges admission.

Sounds like all the rich in Cali trying to consolidate into the remaining “safe” neighborhoods. Why not buy in downtown SF? or Oakland? I hear there are some great deals.

It’s not only in Cali…..

Oakland? Even the A’s are leaving. Too scary to go to the games.

El Katz,

The A’s are leaving Oakland because they didn’t get the HUGE handout they’d demanded, in form of a huge new stadium at the Howard Terminal at the Port of Oakland, built at taxpayer expense. Las Vegas, which is surrounded by desert, was willing to build them something big and shiny at taxpayer expense.

elbowwilham,

There are plenty of vacant apartments in the Financial District (and in SF in general). But they’re not cheap, which is why they’re vacant, and which is why people left SF… it’s too expensive.

To live in the Financial District, you must have enough income. For example at the tower “One Pine Street,” with gorgeous views, there are at least 5 apartments listed for rent, starting at $3,345 and going to $5,600.

Lololol.

This Just In: Expensive places are expensive!

Orinda, Walnut Creek and Lafayette have been expensive forever. Same with Blackhawk, Danville etc.

If you said Antioch, Sacramento, Vacaville, Clearlake or something it would make more sense.

In the next episode we’ll find out Gold, yachts and Caviar are expensive…

What is expensive? That’s the question that needs to be asked. A 2 bedroom condo in Antioch for 350K? I’m not sure you guys understood my question, my grief really. I know I can continue to rent a house in Orinda for 5K or a Moraga apartment for 2.5K but the purchase price has been going up not only in these “expensive” but the area as a whole. I look at the “suburbs” to the south of SF. Daly City, Pacifica, SSF all of which have crappy weather and crap school districts. Those places have not been going down either. So what gives, where is this housing recession I keep hearing / reading about? Oakland (Montclair) has been holding up also. Sorry fellas but I would never consider living in area where I deliberately put myself in harms way. I would not consider moving to another state or another area, I was born and raised in SF and grew up in a gang infested neighborhood in 70’s-90’s.

Sacramento an apartment is going to run you median 2000 to rent and a home anywhere from 2500 to 4000 a month. After selling in Sept 2021 I rented back my suburban 2400 Sq ft on 13000 lot – 3/2.5 for 3 months at 3500 a month.

Judging by the time on market, builders are doing a good job on moving their inventory. The median number of month for newly completed homes on the market before they are bought is 2.8 month as of beginning of March. That is historically very low. Meaning they are selling inventory quicker than anytime from 1975-2018. For reference, Shortly after the 07/08 crash, Median number of months on the market for new construction spiked up to 14 month. Let that sink in…..(today we have sky high prices plus 6.5 ish mortgage rates). I assume it’s mainly due to high incentives (rate buy downs and discounts on price) which should impact their margins. On the other hand lumber prices have collapsed which provides a tailwind for builders margins.

Wolf, I know you have said in the comments and on the transcripts before that certain indicators just aren’t there. In fact you have stated lot’s of people have lots of money… I get it.

But your charts are showing something big is brewing out there. There’s an avalanche coming. Is it in the diesel / shipping data? Is it in these pending sales numbers?… unicorn valuations?

I don’t know. But I am one of those who was going to buy (landlord decided to sell and gave a generous 60-days) but honestly, I’m gonna sit this out a while longer. Renting sucks. But not as bad as buying overpriced trash.

Overpaying on rent for a few years is nothing compared to the prospect of losing $10k to $30k a month in home price, which is happening right now in many locations.

Home prices declines should accelerate when the recession hits, stocks decline more, and we see more job losses.

The real stress in the home market will happen once alot more homeowners have lost their equity cushion and the homes are underwater. Job losses will also help that along. Until that happens, the inventory remains very low and prices only slowly decline based on reduced demand.

The case shiller data is indicating very rapid price declines in many areas already.

Right. In Seattle, many folk who bought in 2021 have already lost their down payment. It must be stressful to watch that trend continue in slow motion.

Blame the Fed for buying MBS when housing prices were already inflated. It was a rookie error that never should have happened.

Property will always be overpriced.

What actually happens in the recession, that everyone dreams will redistribute the chips so they can try a few more spins at life’s casino, is that Risk goes up, Volatility goes up, risk of Default goes up!

Someone has to pay for all that risk.

So mortgage rates and mortgage insurance costs goes up until people pay about the same as they would have been paying for “overpriced thrash” as people like to say when they can’t afford something.

People who can’t afford something Now are also not going to afford it during a possible future recession either.

What nonsense. I’ve seen quite a few corrections in my time and I’m not that old. You’re just mad no one will buy your house at 2022 prices. You’ll get over it in time.

Interesting CSH. Do you mind elaborating on corrections, pls? I assume you refer to the housing market. Those corrections must have been good buying opportunities? Since it’s hard to time a market, maybe I can dumb this down to: anytime before 2022 would have been price points significantly lower than today’s market in absolut terms (lower price and lower rates) and therefore good times to buy?

There has really only been one crash and you better believe that the government will do literally everything in its power to prevent another 2008. The dotcom bubble bursting didn’t see housing prices decline at all and the early 90s and early 80s saw only modest price declines. Anyone waiting for another 2008 to get a cheap home in a great area is going to be seriously regretful. If you can afford to buy right now, you should

Why sell at any price? A paid off home is a rent free life. 2022 prices were tempting but I decided to keep mine

Sales might be down but prices are up.

I follow San Diego area and prices were up 5.3% last month.

Inventory has never been lower and when smth comes up bidding wars are back in vogue.

It’s is the truth.

I suspect inventory will dry up completely and prices will go way up again.

When everyone expect prices to go down, be sure they will go the other way.

1. Whatever you’re citing were sales that closed in March but were signed earlier. The actual March contract signings have not shown up in the closed sales data yet.

2. seasonality is huge, that’s what the spring selling season is all about. Zillow has a median price index that is seasonally adjusted and one that is not adjusted. Here is the seasonally adjusted index. If you go to the site, you change to not seasonally adjusted and compare. You need to look beyond the effects of seasonality:

https://www.zillow.com/home-values/54296/san-diego-ca/

I clicked on the Zillow link Wolf posted above. Holy smokes. It says: “ The average San Diego home value is $893,457, down 0.5% over the past year and goes to pending in around 17 days.”

Does that really mean the avg home listed today will be pending in around 17days? 17 days on the market seems EXTREMELY low (meaning it sells EXTREMELY fast). Fascinating IMO, considering rates are between 6-7 percent.

Are you going to buy a house in SD ?

I sold my two rentals in SD last year.

Now waiting for this madness to stop.

I see similar madness in 207-2008 as well.

Wise move. I live in SD, and I’m eager to leave. I know many people who feel the same way. Downtown is a mess, and homeless people are everywhere. This used to be a great place.

A friend in La Jolla is also looking to leave. She grew up there. Raised her kids in the Silicon Valley and returned for retirement. Was nearly the victim of a follow home crime a year ago. Last month she returned to her condo on Mt. La Jolla after skiing for a week. The unit next door had been cleaned out, while the elderly neighbor was out of town. Police noted South American gangs are now targeting such complexes. She now refuses to leave the house at night alone, in La Jolla! She notes the party line has always been San Diego is not like the rest of CA. It turns out, it is just a few years behind SF and LA.

Seriously, San Diego used to be one of the best cities in the USA. It was still pretty good in the 2000s. It has fallen far from those days. I left more than a decade ago now, having had an inkling of what was coming after the GFC. It’s really shocking how homelessness spread all along the West Coast.

CSH – it’s not that amazing that folks of insufficient means tend to move, at least for the early Fall-to-Spring seasons, to areas that usually stay clement and above freezing…

As for San Diego, the homeless situation is nothing new. Having left in ’76, I came back for a month in ’14 to assist my sister with my mother’s dying process. My mother’s apt. was adjacent to Sports Arena Blvd., where, even then, it would fill from the late afternoon with the RV’s of the nomads, moving off during the daylight hours, as those without wheeled shelter could be found around Rosecrans (a huge change from the MB/OB Midway Drive-In days of the ’50’s-’70’s…).

may we all find a better day.

Agreed, SD definitely up from our lows of last year, but still has a ways to go to get back to those highs. What I’ve seen recently, though, is the greedy meter going off the scale. Some asking prices are ridiculously high and sellers are knocking back what they’re asking by a lot after the place sits for several weeks. However, stuff priced right is doing exactly what others are noticing, bidding wars and going into escrow in short order. Anytime any of us say anything about San Diego, though, we get blasted as RE cheerleaders or San Diego is different hypers, etc. The fact is that we live here and are seeing it with our own eyes. Stuff priced right and in good areas is going fast, junk is sitting, stuff priced too high gets marked down and then sells. There is no inventory here so we can’t even keep up with local demand, then add in the dual income engineer/biotech millennials and over achieving gen Z folks coming in from all over the world, retirees paying all cash, and second home buyers and you’ve got a tight market. This is all on top of the city of SD’s insane bonus adu laws and density pushes which have sent developers on house buying sprees just to collect and combine lots for future work. There’s a very complex micro real estate market going on here and I’ll go ahead and say it: San Diego is different. Somebody had to say it, may as well be me. Ask anyone here what things cost south of the 94; that alone should be all one needs to see to realize something’s going on in this market.

In 2006 the average home price was $300K. In 2022 almost $500K. It’s down to $475K after SLV panic,

SF and SD are noise, C/S highest harmonies, spaced out above all.

Chicago is a fallen angel. In the rest of the country the trend is up with a tiny bump in 2023, so far.

Plenty of nice housing available in Chicago. Mostly 1 – 3 units along the boulevards. 100 year old gray stones which could never be replicated today.

Plenty of carjackings, robberies, homicides, high taxes and zero Aloha in Chicago. It’s a shitehole and can’t wait until my husband retires from CPS so we can flee. A terrible place to live

The guy in TN is trying to build about 1000 tiny homes per year in the $20K – $100K range. They are not allowed in probably 99.9% of jurisdictions because of building codes so people live in cars and tents and on peoples couches.

The county he is in has allowed him to do developments and he probably has 250 homes at one site with another 250 being developed. He is trying to do developments in other states, but by the time you satisfy the planning board the added things they require run the cost up so that it is no longer affordable to lower class.

Raleigh, NC is having housing affordability problem. They just approved an affordable housing apartment project. The project pencils out at about $225K per unit. You are not going to solve housing crisis unless you can get the cost down lower than that. People require shelter, not luxury shelter.

Wolf, any thoughts on Pulte’s quarter? They crushed it! Gross margins of 29.1%. Also, Lennar in my region of SW FL are back to allocations. In other words, they only release a few homes to the market in each community every week.

I’ll just repeat it here:

Homebuilders have cut price by a bunch, and/or are buying down mortgage rates, which for customers is effectively a price cut, though it might bite them in the rear later on.

Homebuilders are the pros, they know how to sell something in a down market: you CUT PRICES one way or the other.

Regular homeowners haven’t figured this out yet. They’re still clinging to their March 2022 prices or are waiting, hoping that this too shall pass. And so existing home sales have plunged.

But new house sales aren’t exactly booming either:

Was just in PHX AZ 2 weeks ago in the west valley – Goodyear to Suruprise, AZ – visited a builder with my son that had spec homes with $80k in incentives so they are dropping prices or providing a bunch of incentives to new buyers or combo.

To buy or not to buy that is the question…

The fundamentals of this new era of money is so frustrating. I guess I’ll continue to guess on when to purchase a new home or maybe I’ll finally hit the lotto and not have to worry about overpaying for that first home.

Come on Lady Luck 🍀

2010 my father in law, a man I appreciate and respect, told me to not buy a house because he was scared it would continue to get worse. We bought the house. Made us a lot of money. Now we are back in the Midwest waiting this one out. I think I’ll begin looking again when everyone finally says it’s only going to get worse. I don’t know but thankful for Wolf and his insights! Be patient is all I can say

@The Dude, Are you able to purchase and still be comfortable from a financial perspective or would it be a stretch and you end up living paycheck to paycheck without any safety cushion? I ask because: timing the market successfully is an extremely rare occurrence. and what model/forecast would you go off of in order to attempt timing the market? Maybe it helps to ask yourself What’s the worst thing that can happen when you buy? You lose your job right after the purchase and can’t make the payments. Or, there is a black swan event that crashes the economy and pulls housing prices down significantly + job-loss recession. But what if you and your partner have stable incomes and have somewhat recession proof jobs? And what if you can comfortably afford a home and still be able to save money for a rainy day? You also should ask yourself are you planning on staying in that house for a long time or move within the next 5 years? I gave up on trying to time anything but I do know that when the masses are so sure of something it sometimes does not occur (take the forecasted recession for instance, I can’t remember a time when so many people, economists, companies, news outlets predicted a recession). Point of all of this is: sometimes it’s better to cut out the noise and do what’s right for you. hope it helps.

First Republic has problems, which could reverb to other regional banks. There are vast amounts of uninsured deposits, all across the system. But if there are bank runs, where would the deposits go? Presumably, they would fly (in a never-before-seen compressed time) to the huge TBTF-systemic banks. That much money moving around all at once could create huge problems. The FDIC fund could be drained immediately, with holes on hundreds of balance sheets, and sorting/saving client banks to process. The Fed could create money to backstop the regionals, but in such vast quantities, the system would be deeply disrupted at best. Then, local credit would be deeply interrupted. It seems a fairly salient risk to me. Does that make sense?

All of everybody’s lives there has been constant change, but one thing remained firm (your rust belt may vary) in that ‘safe as houses’ was just that, a mortal lock to go up in value.

If everything is dodgy in banking circles and you don’t want to deal with wall street, that leaves one obvious option, ala Housing bubble Numero Tres!

$10 million 3/1 charmer in El Segundo within view of the Hyperion Plant, why not?

Seems like the FDIC and the other regulators are quite good at dealing with bank failures. They certainly had a lot of practice during HB1. I’m actually encouraged by the lack of failures during this tightening phase, but maybe we’re still in the early innings.

…..”but maybe we’re still in the early innings.”

Bottom of the first inning , 2 outs

An early 1970’s 3/2 SFH much to the owner’s chagrin, sold itself recently only using ESP (it was a 70’s thing) and actually never was listed on the market, the buyer communicating their wishes telepathically on an Android. They requested a 45 day close.

Not in my neighborhood….lol //s

Wonder if there’s anything from this march report that MSM can sell on the narrative that we’re on an uptrend just like they spinned it last month..will be interesting to see and I full expect some people will still argue this is an uptrend or just flatten out..

The “temporary” loans to banks have not been dropping. As of the last report those two lines on the balance sheet are up by 2 billion for the week, not dropping. This was supposed to be temporary liquidity, but it is not. It is structural, as the regional banks cant raise depositor funds and will take time to reduce loans and asset balances.

This is expensive money and it is bad for profitability of any bank that is impacted. I think it is likely that there is more bank stress to come in future quarters as even more depositors move their money to interest bearing assets.

“The lack of housing inventory is a major constraint to rising sales,” said NAR Chief Economist Lawrence Yun. Then he said “It is always a good time to buy a house.”

My crusty old boss once told me to especially avoid three kinds of people, as they were all degenerate liars: lawyers, stock brokers, and realtors.

And that disgusting word… politician.

Don’t forget engineers!

Doctors!

…in the immortal words of the Firesign Theatre:

“…I think we’re all bozos on this bus…”.

may we all find a better day.

In my little piece of fly over.

Phone went quite/dead in early – mid march.

Since then it has been steady. Lions share is for new construction.

I have no doubt this will slow down.

Stagnation setting in. Reluctant sellers by the few. Many, many buyers still waiting. same book, different page.

I wonder if/when the NAR will start overcounting and massaging the data again, like they did starting in 2007 for the last big cycle.

Many years of Zirp meant that money was free and assets and cash flows ran ran hot. If you were foolish enough to plan your life on that being permanent you will take some big losses.

Only question really is how much of the losses will get socialized. The way education and housing is financed I would guess a lot.

“Banking crisis to blame?”

Naa, absurdly low sub-3% mortgage rates for a couple years followed by rate increases are the recipe that caused this. There are 13 houses for sale in my area, and 12 are pending. The 5 houses listed under $400k went pending faster than the realtors could stick signs in the ground. The rest are spread between $550k-$975k, so even the higher end of the market is still moving a bit in my southwest outpost.

Nobody with a 2.7% mortgage wants to sell and purchase their next house at 6.5%. They’re stuck, so inventory for used homes remains very low. Somehow the buyers still appear to be out there, but there’s not much to choose from and they have to stomach a more historically normal rate. Ofcourse volume is down. But against all odds, price continues to rise around here.

That is true (low rates take away the motivation to sell and sign up for 100% increased rate). it’s incredibly frustrating. We are trying to buy a house and sellers are not willing to negotiate much. Switched realtors more times than I wanted to. They often don’t even want to negotiate/write an offer at or below asking price because they tell me we won’t have a chance. I also contacted the sellers agent directly and made low-ball offers. Before you know it the houses went into pending.

You a slow learner aren’t ya

I bought my retirement home (starter home) 6 years ago. I actually work from it so that when I retire at the end of 2024, I’ll already be here. Originally, when I bought the house it was going to be a stepping stone to a slightly larger home in the same area, but medical events intervened 4 years ago and now this is my retirement home. I love the area and the location. Everything is close by. Restaurants, bars, shops and all my doctors. I got a 3.99% rate on a 15 year lone. I took out a lump-sum distribution from a former employer, which when I get the check I plan to deposit into my current 401K. Next summer, 2024, I may pay off this house as I wind down my working life. I have no plans on selling and I get numerous solicitations every month from strangers that want to by my house. After I die, this house will belong to my wife and she can do anything she wants with it.

Maybe I misunderstood your comment but…. if YOU get the check and touch it, you’re not going to be depositing it in your 401K or IRA. Those funds have to move between those accounts exclusively, untouched by you. To add insult to injury, that distribution will be a taxable event.

Or maybe you knew that.

I just moved some funds from a 401K to my IRA…. it was quite the orchestration… and that was within the same broker/custodian.

I believe you have 60 days to redeposit without penalty, unless the rules have changed. It is that way with an IRA account moved between different institutions.

We’re not even a year out from the most insane 2 year meteoric rise in home prices. It’s going to be a long bumpy ride back down.

As for San Diego, the weather is great but it is otherwise pretty over-rated by many and at the current price level it will see an outflow to more affordable pastures. School enrollments are generally down by a significant amount and many areas are slowly morphing into God’s Waiting Room as young families can’t afford the area. The trajectory of San Diego in many categories is not a good one.

When they started washing the SD streets with bleach, I decided it was no longer a place I would choose to visit on purpose.

“at the current price level it will see an outflow to more affordable pastures. ”

More affordable pastures likely means lower salaries and other disadvantages like bad weather.

It’s easy to discount weather in online discussions but not that easy to actually move away and live through bad weather. Some people just don’t want to put up with brutally hot summers, or snow shoveling and black ice in the winters. Nevermind bugs and humidity.

Over the past decade, traffic in California has only declined briefly during the Covid shut down (like everywhere else). Needless to say it’s back to daily traffic and busy lines at restaurants indicating that the so much quoted CA exodus is not translating into anything meaningful. But this “outflow” and “exodus” will continue to be referenced for years and decades to come. As a CA resident I would welcome the often predicted CA exodus, but I don’t hold my breath.

I am in San Diego and I share your sentiment. Absolutely not a place for middle income earner to raise family.

Too materialistic to my taste if you ask me,

But san Diego is full of real estate humpers who think come what may prices wont go down ever.

It does not matter WR shows it has gone down by showing figures and facts.

I lived all around USA and yes, weather is over rated.

I don’t think the banking crisis has anything to do with it. Aside from a week of panic no depositor lost money. Sure, shareholders in svb and frc lost money but that’s a tiny amount.

This is part of the economic cycle, which means the declines are going to continue.