Even Miami lost ground. Spring selling season is a dud so far. And the banking crisis hasn’t even made it into the data yet. That’s still to come.

By Wolf Richter for WOLF STREET.

Spring selling season is here, but so far, it’s a dud. In some markets, home prices fell from the prior month, despite spring selling season: Miami, Seattle, Las Vegas, Portland, New York City, Dallas, for example.

In other markets, prices ticked up from the prior month, but a lot less than a year ago, and so year-over-year, even in those markets, home prices either fell further, or the year-over-year gain was further reduced. This is based on today’s release of the S&P CoreLogic Case-Shiller Home Price Index today.

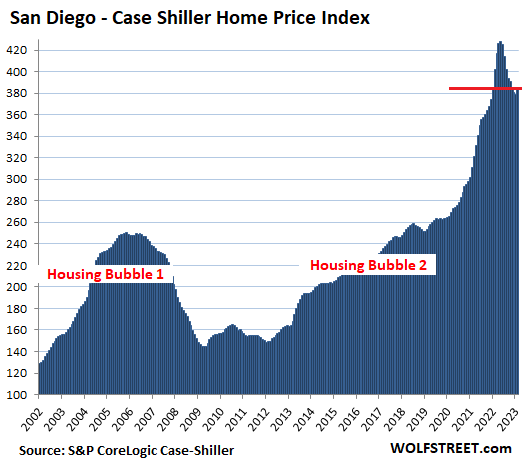

For example, in the San Diego metro, house prices rose 1.5% from the prior month, but because that increase was a lot less than the increase in the same month last year, the year-over-year decline worsened to -4.1%, from -1.3% last month. San Diego’s year-over-year percentage change illustrates the principle of how the housing market is still worsening even with a seasonal uptick because that uptick was less than in the same period a year ago.

The effects of the banking crisis are not yet reflected in the housing market data. These home prices today are based on sales that closed in February and prior months, so the March fireworks at Silicon Valley Bank and at First Republic will make it into the housing data in future months.

Today’s S&P CoreLogic Case-Shiller Home Price Index for “February” is a three-month moving average of home sales that were entered into public records in December, January, and February.

The list of year-over-year price decliners keeps getting longer. Prices are now down in 8 of the 20 metros that the Case-Shiller Home Price Index covers, double the 4 metros a month ago (percentage in parentheses reflects the year-over-year change the prior month):

- San Francisco Bay Area: –10.0% (from -7.7%)

- Seattle metro: -9.3% (from -5.1%)

- San Diego metro: -4.1% (from -1.3%)

- Portland metro: -3.2% (from -0.5%)

- Las Vegas: -2.6% (from +0.4%)

- Phoenix: -2.1% (from -0.01%)

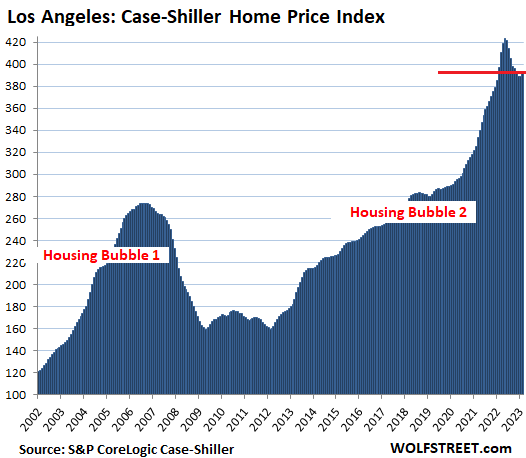

- Los Angeles: -1.3% (from +1.0%)

- Denver metro: -1.2% (from 0.0%)

Prices down the most from their respective peaks (ranging from May to July 2022) in these metros:

- Seattle: -16.5%

- San Francisco Bay Area: -16.3%

- Las Vegas: -10.9%

- Phoenix: -10.4%

- San Diego: -10.1%

- Denver: -8.8%

- Portland: -8.7%

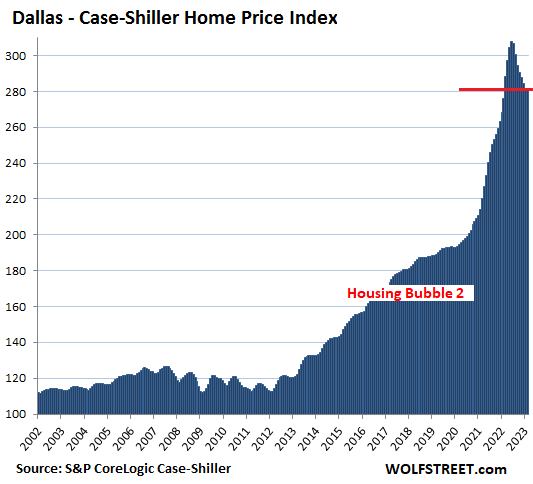

- Dallas: -8.5%

- Los Angeles: -7.3%

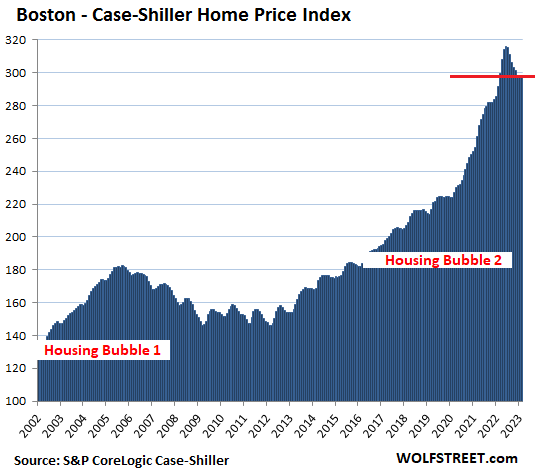

- Boston: -5.6%

Methodology. The Case-Shiller Index uses the “sales pairs” method, comparing sales in the current month to when the same houses sold previously. The price changes are weighted based on how long ago the prior sale occurred, and adjustments are made for home improvements and other factors (methodology). This “sales pairs” method makes the Case-Shiller index a more reliable indicator than median price indices, but it lags months behind.

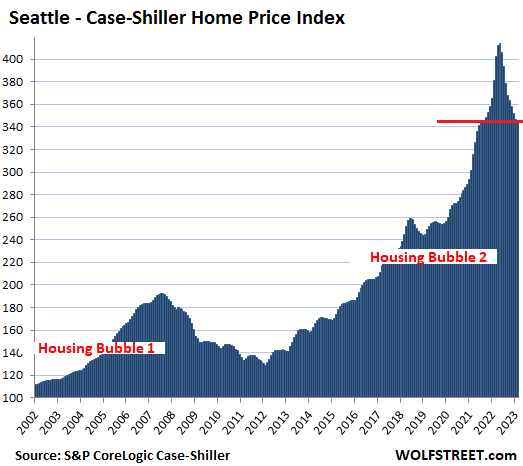

Seattle metro:

- Month to month: -0.3%.

- From the peak in May: -16.5%.

- Year over year: -9.3%, after the 5.1% and 1.8% declines in the prior two months.

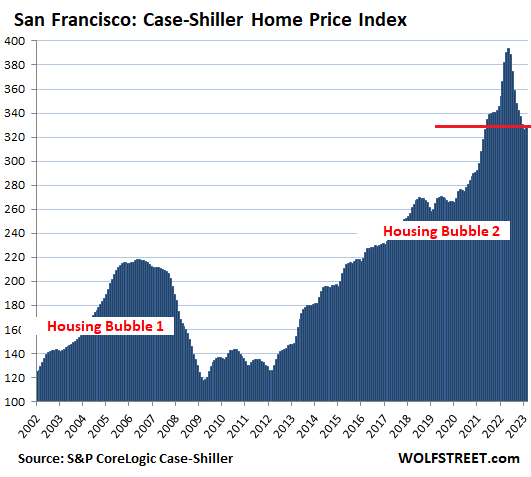

The San Francisco Bay Area:

- Month to month: +1.0%.

- From the peak in May: -16.3%.

- Year over year: -10.0%.

- Fourth month in a row of ever steeper year-over-year declines.

San Diego metro:

- Month to month: +1.5%.

- From the peak in May: -10.1%.

- Year over year: -4.1%.

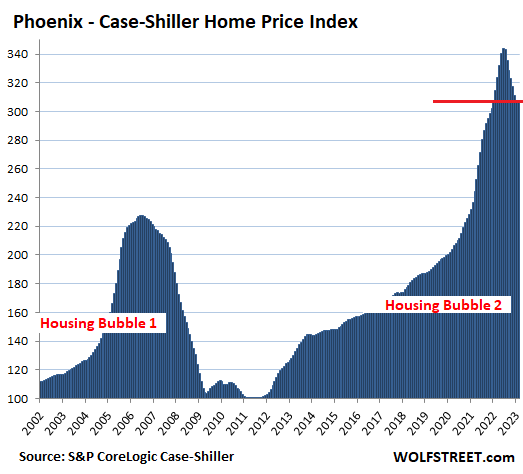

Phoenix metro:

- Month to month: +0.1%.

- From the peak in June: -10.4%.

- Year over year: -2.1%

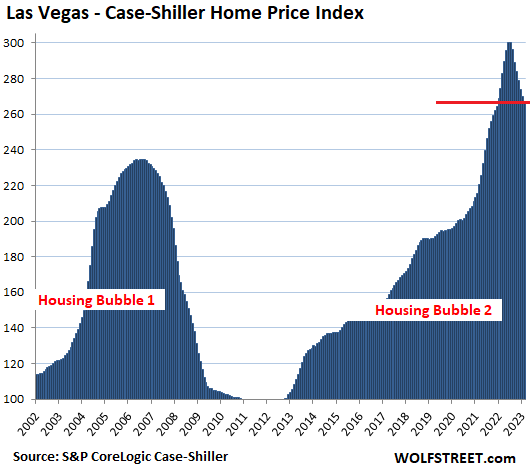

Las Vegas metro:

- Month to month: -0.9%.

- From the peak in July: -10.9%.

- Year over year: -2.6%

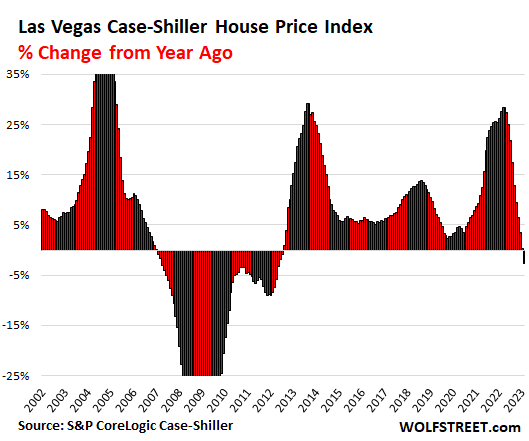

And here are the year-over-year percentage changes of the index for Las Vegas. This was the month the index flipped to a year-over-year decline.

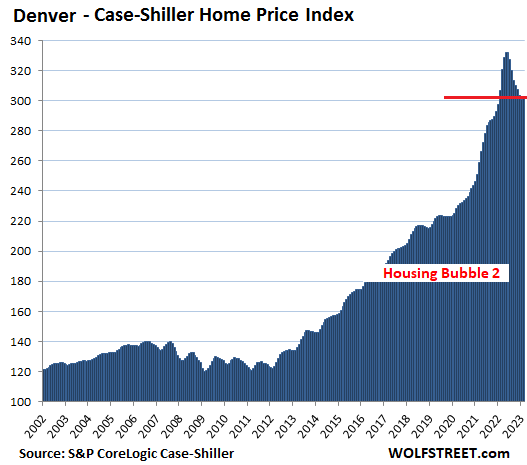

Denver metro:

- Month to month: +0.8%.

- From the peak in May: -8.8%.

- Year over year: -1.2%.

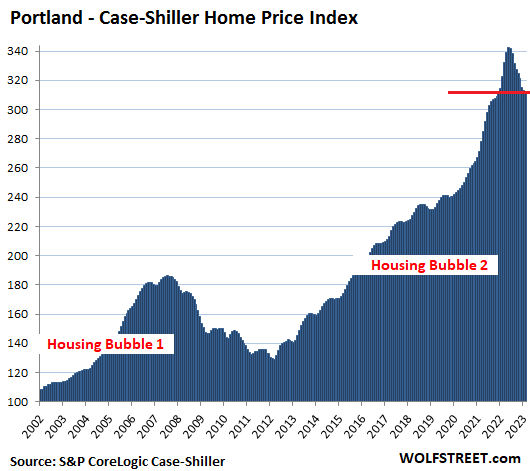

Portland metro:

- Month to month: -0.1%.

- From the peak in May: -8.7%.

- Year over year: -3.2%.

Dallas metro:

- Month to month: -0.02%.

- From the peak in June: -8.5%.

- Year over year: +2.0%

Los Angeles metro:

- Month to month: +1.0%.

- From the peak in May: -7.3%.

- Year over year: -1.3%.

Boston metro:

- Month to month: +0.1%.

- From the peak in June: -5.6%.

- Year over year: +2.2%

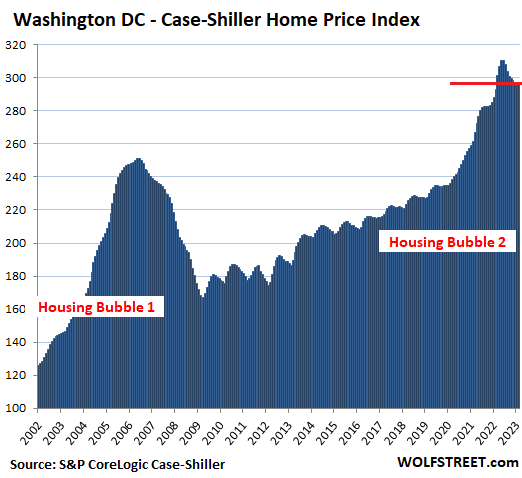

Washington D.C. metro:

- Month to month: +0.4%.

- From the peak in June: -4.6%.

- Year over year: +1.1%

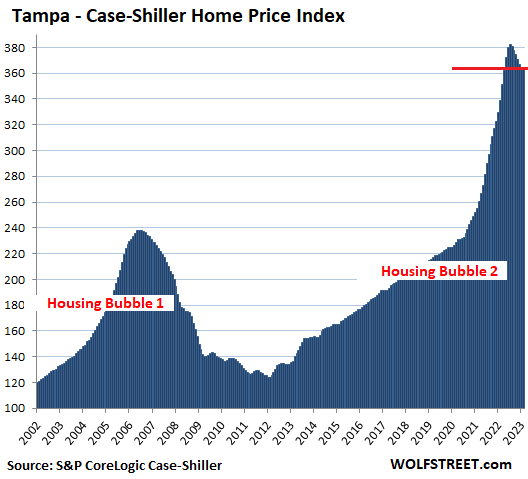

Tampa metro:

- Month to month: +0.1%.

- From peak in July: -4.7%

- Year over year: +7.7%

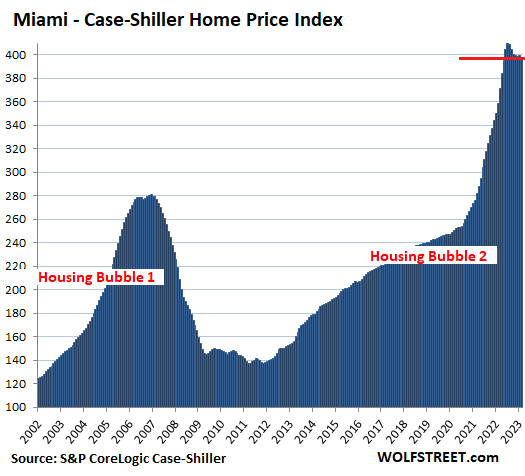

Miami metro:

- Month to month: -0.4%

- From peak in July: -2.9%

- Year over year: +10.8%

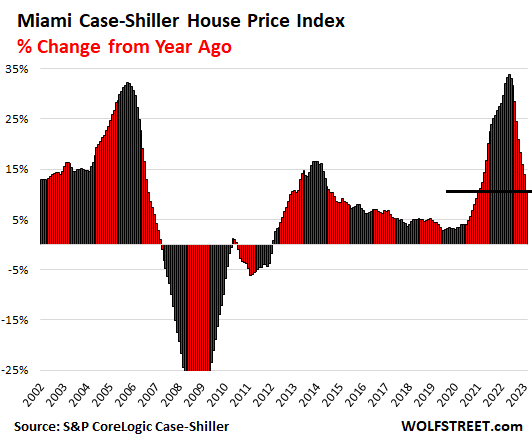

And here are the year-over-year percentage changes of the index for Miami. You can see that the market is about six to eight months behind Seattle:

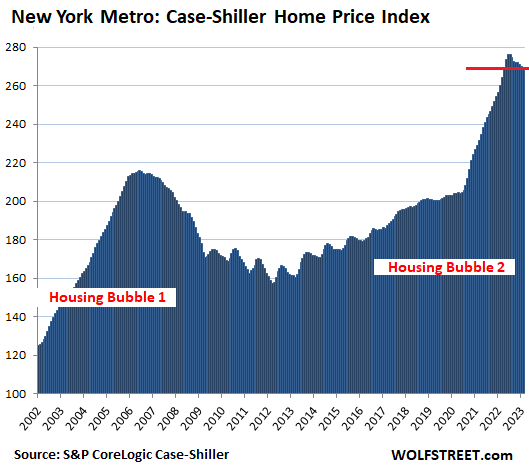

New York metro:

- Month to month: -0.3%.

- From peak in July: -2.6%

- Year over year: +3.6%

The Case-Shiller indices were set at 100 for the year 2000. So that Miami index at 397 points in February is up by 297% since 2000. This makes Miami the #1 most Splendid Housing Bubble in terms of price increases since 2000. Miami has moved into the #1 slot because its prices started to fall later than in the prior #1, Los Angeles and then San Diego.

The New York metro index value of 269 indicates that house price inflation since 2000 was 169%, and though this is still a huge amount of house price inflation in 22 years, the metro forms the tail end of this list of the Most Splendid Housing Bubbles. The remaining six markets in the Case Shiller index have experienced far less house price inflation since 2000, and don’t qualify for this list.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Let’s see how many comments we will get on this article “This is not happening in my neighborhood” this time around…

haha who knows….in SoCal, selected areas still doesn’t “feel” like it…case in point, idiot neighbor upstairs just sold their condo for $515k in LBC area. 1100 sq ft, bought last year for $450k ish and now pending in a week…so I guess there are still plenty of FOMO buyers out there.. This place, I wouldn’t pay $300k for but I guess I am not the majority…

How’s your neighbor the idiot?

Young couples, bought it, thinking they got a great deal at the previous price, and probably got FOMO into buying. Spent quite a bit to fix it up and dealt with many issues, like bathroom pipe leak, incompetent management company and high HOA fees, crazy neighbors surrounding them (one with a howling dog and a bi-polar screaming sister and a hoarder as upstairs neighbor)

Given how much it sold for, I wouldn’t be surprised they barely broke even if not a slight loss…maybe not as big of an idiot compare to if they end up selling with a big loss, still dumb IMHO. Probably could’ve done more homework and avoided all the headaches just to break even. The place is well overpriced for what it is, guess they are just lucky it hasn’t crashed on them yet and got out while the getting is still good as they say…

Now the new owner that just bought…will have to see what kind of genius they are to buy this place with a $500 HOA and all you get is the gardener blowing dirt on your car in the garage or a clueless association that do absolutely nothing to prevent break in at the garage…good luck

That was a lovely advert for detached single family dwellings :-) Anything with HOA is trouble. If you are renting it’s OK because you can just move.

When Iwas looking at houses, I refused to consider any properties with an HOA for exactly this reason.

My HOA has worked out alright, approaching 30 years. Worst issue is incessant neighbors’ yammering about things like “all you get is the gardener blowing dirt on your car in the garage or a clueless association that do absolutely nothing to prevent break in at the garage.” Easy enough to tune it out. There are risks and trade-offs to consider, but I have got a new roof and deck, which wouldn’t have been cheap in a stand-alone, and were simply — done.

Murder in Chicago suburb over a leaf blower yesterday. I can only speculate that perhaps the perp remembers when the country didn’t have leaf blowers.

….”crazy neighbors surrounding them (one with a howling dog and a bi-polar screaming sister and a hoarder as upstairs neighbor)”

This is exactly why I left exclusive suburbia for a rural place with real decent folks. Had a very nice home, but the crazies gradually moved in to make it feel like a funny farm full of angry people out to one up each other. Simply becomes intolerable.

If they sold for $515K and bought at $450K, the gross might be $65K, but they most certainly got creamed on the transaction costs.

Just a back of the envelope…

Total realtor fee (sell side), around 6%: $31K

Buyer’s closing costs (conservative 2%): $9K

Seller’s closing costs (conservative 2%): $10K

Federal long-term capital gains (assuming they sold after 1 year): $2K

California income tax (Let’s say 10%): $1K

Total expenses before improvements: $53K

So, unless they spent $12K or less on improvements, then they are taking a loss on this “investment.” That’s why the neighbor is an idiot.

Actually bought for $442K 5/21 and now pending at $515k and I agree with you likely got creamed and best case scenario broke even. Although I doubt it consider how much they put into the place, if not money then definitely plenty of sweat/headache equity…

From what I see where I have been looking to buy a house for the last 3 years (got outbid once), there is not much of anything decent for sale and when there is there are many offers. In a nice suburb of Cook Cty, a bungalow listed at 575k for only 3 days had multiple offers, and more than 50 ppl showing up to a 2 day open house. With Cook Cty taxes and 20% down the monthly payment is 4,000. There are several rehab houses but most ppl can’t afford a gut rehab, so the flippers buy them, still. My agent (who I think is actually good) tells me its the flippers buying these houses to rehab. They will make money even in a downturn. Rehab 2,100 sq ft house for 350k that needs pretty much everything will sell for 800 or 900k. I dont see prices rising here, but do see them stable. There are so many ppl looking to buy a house. Chicago is very expensive, and the only reason why it is said to be cheap here is because they include the worst neighborhoods that are war zones. So if you can get a decent house in a nice neighborhood in the suburbs for 575k that’s a steal. But it really isn’t. 4k a month to purchase is the same as rent. There are just a lot of buyers and not enough for sale. So that is a fact with what is happening where Im at and prices just have not cone down enough with the rates. That same house would have been 550k 2 or 3 years ago w lower rates. Not sure what’s going on.

Lisa,

Western ‘burbs of Chicago here. We’re planning on downsizing to a condo from a smaller house originally built in the early 1950’s. Where we have pretty much replaced everything.

The condos I see for sale on Redfin etc. are S-L-O-W-L-Y dropping in price.

Haven’t even talked with a Realtor yet. But we hope our house is dropping slower than the condos. :-)

Thanks for your report!

Lisa, all that you wrote is so true, even here in Missouri. You can get a home here in St. Louis for 30k but you probably wouldn’t want to live there. Anything decent and not in a crime ridden area is MUCH, MUCH more expensive.

To be fair, those 30K homes are in North St. Louis, arguably one of the biggest murder capitals in the US.

Even if you live in a nice house in St. Louis, that won’t stop the hordes of crime and mayhem from busting through your gate, as the McCloskeys had the misfortune to found out. On top of that, the government has the horde’s back, not yours.

McCloskeys LOL

STL is such a beautiful city, but I’d never consider living their until they ditch the city income tax.

I inquired about a house that looks like a real bargain.. The owner died and left 4 long term residents in the house who don’t want to leave. Needles in the driveway. Caked with mold in the attic, although they did recently cover the entire roof with pond liner.. Can’t really tell from the photos. It’s near a place that has the highest murder rate in 2 counties. And on and on. The realtor ended up being very honest about the place after a few questions and begged me to come take a look. I think the neighbor will end up with the place at an even lower rate. Tons of people interested in it until they see it for themselves.

Looks really nice if you don’t look very closely. If anyone outbids the neighbor I sincerely hope it’s a company or fund that bids cash after just looking online or at algorithms. I think there are a few of them left.

Which suburbs are you looking at? I’ve noticed the same pattern near Arligton heights, mt prospect etc it went from no inventory to now more houses being listed, but with prices of400K+. Similar houses were listed at very least $50k less just few months ago. They also go contingent in couple days (its prime season though). It almost as it seems like all seller coordinated that latest spike or people migrated from California and brought the spike with them lol. I hope its just a “the last stand on Fiji”, but if it keeps going that way, i will focus on building a new house instead.

Have been looking in Evanston for 3 yrs. Very small radius. A client of mine told me houses were moving really fast back in February, in Arlington Heights. People will be moving here for the freshwater.

I’m originally from the Midwest mot that it matters I guess.

Every single homeowner seems to think renters pay $2k and up.

Where do they get that idea ? Sure there are plenty of places that expensive but I live in a moderately expensive midsize city in eastern Washington and my 1 BR is $825.

It’s on the lower end of the spectrum but I dont consider it cheap either.

Different matter: I bought a new home in 1986 near Dallas Texas. Lost money, bad luck: Savings&loan fiasco, oil industry tanked TX economy. Quite a nice home but those circumstances caused prices to tank considerably latec80s early 90s. I list 8% after 10 years.

That aside:

But here’s my point: buyers in 1986 Dallas had a COMPLETELY different experience from the H*** that so many buyers the last few years have apparently gone thru.

Bidding wars ? Never crossed my mind.

Realtors called up prospective buyers !

The Dallas Morning News real estate section had pages and pages of new construction throughout north Dalkas and surrounding cities. Very affordable. I was an engineer making 35k and new homes priced $70k to $130k, most in the $80 to 110k range. So about 2.5 to 3 times my salary. My 1650 ft²

3/2/1 new home: paid $89.5k. Other homes in this Rowlett subdivision were $79k to $110k.

They actually built a lot of new homes then !

Okay I know there is currently a lot of homebuilding in CERTAIN cities, but apparently in many parts of the Northeast, South and Midwest they don’t build hardly any new homes.

Conspiracy of sorts ? It’d be nice if renters in those areas could force (how?) politcians/builders to build more housing… smaller size and more affordable as well.

Typos: Quite a nice home but those circumstances caused prices to tank considerably late 80s, early 90s. I lost 8% after 10 years. (89.5k to 82k… then 3% buyers RE commission ).

And the buyers RE agent got him a new roof (home only 10 years old but Dallas gets serious hail), new garage door opener and I threw in some $$ for any unforseens ( I had zero problems my 10 years except I needed to caulk a few windows, minor water leakage during windy hard rains, patched roof once, and garage door opener was starting to get a hitch in its giddy up… hah and I’m not a native Texan).

We need to quit building houses on productive farm land ,this is just stupidity

Average home price here seems to have gone down somewhere between 10 and 15% would be my guess and still has a ways to go. Sales are slow and inventory building up. People still asking too much for the average well paid family to buy. The medical and other professionals including the doctors are moving out of the area.

Phoenix_Ikki, you are so right!

I appreciate the spirit of Real Estate agents that comment here. Sales pending closure are down more than 30% in the West this year and RE agents earn on commissions of actual closed sales. If I had a business where revenues were down 30% and resultant profits by 50%, I would be very desperate and demotivated.

Many younger agents haven’t seen a single downturn and don’t know what’s lying ahead. What is simply ignorance for them can look like intentional misinformation to us. What else sales pitch can they use. Will an honest sales pitch like this work “Mortgage rates have made houses unaffordable and sellers have still not gotten this message. So any purchase close to listed price will result in underwater home soon. It’s not a good time to buy.”

Former (2004-2022) Princeton, NJ RE agent here with top brokerage. I gave it up last year when I could see this coming. I could not suffer this kind of downturn to my business. I needed to close 12-20 deals a year to survive, and I could tell that was just NOT gonna happen in this new environment (where people are stuck with their 3% mortgages) no matter what I did about it.

I ended up closing ten deals last year which was a minor miracle. But I gave it up in July and moved to Central America where I can live on my social security. There is just not enough business to go around.

So many people got their RE licenses during the lockdown and there is so little inventory that there is now an average of only THREE TRANSACTIONS per realtor per year in the US! Obviously that’s an average and an awful lot of realtors close NOTHING in a given year, but still, there’s just not enough churn to sustain those who profit by the churn.

Wolf needs to have a post/start a comment chain about relocating to Mexico/Central America/Ecuador/Colombia (basically anyplace with a cost of living <35% of the US)…tons of fascinating details that could be hashed out.

Or, we could start with training wheels and discuss relocation to Wichita, Tulsa, Cincinnati, Louisville, Lexington, etc…basically anywhere with a cost of living <35% of NYC, SF, LA)

Pending is not sold. Wait until it closes to see the final sales price. They may not get 515k

Hopefully not, this POS place is not worth $515K…the fact that it sold in a week leads me to believe it sold for asking…let’s see how much after it’s listed as SOLD on Zillow…

Seems like there’s no shortage of suckers in SoCal..

Meanwhile … March new house sales BOOMING, to use the opposite expletives in most housing articles and comments…

UP 9.6%

CCCB

I’m getting really tired of this dumb stuff (“new house sales BOOMING”) with which you (and others) are hyping real estate. In know that RE is how you make your living, and part of how you make your living with RE is hyping RE, and I respect that. But here are new house sales, and check and see to what extent they’re “booming,” and this is occurring as homebuilders, the pros, are making massive price cuts and mortgage-rate buydowns to stimulate sales:

Wolf, I think he was being sarcastic and commenting on the dishonest propaganda of these articles still pushing sunshine… maybe…

Yeah, every house in every real estate market in every location in the USA is falling in price and not one is selling for over asking price.

Got it.

/s

The reporting (dec, Jan, feb) is a few months behind what’s actually happening in San Diego and other socal areas. Yes, things are down year over year and down from all time highs, but the more recent observations show were quickly coming off the recent lows, and it’s likely due to extremely limited inventory. The monthly increases are much higher than the dated 1.5% figure of a few months ago, and have been steadily increasing since then. I’ve included a link to a San Diego Union Tribune article, but it’s most likely pay walled.

An excerpt of note is:

“Here’s how the different home types fared in March:

Resale single-family: Median of $880,000 with 1,538 sales, up from $850,000 last month. Down from its peak of $950,000 in April 2022.

Resale condo: Median of $650,000, with 813 sales, up from $625,000 last month. Down from its peak of $663,000 in May 2022.

Newly built: Median of $801,000 with 151 sales, down [up] from $777,000 last month. This figure combines single-family homes, townhouses and condos. It is down from the peak of $890,500 in August 2022.”

The most splendid reports for March April and May are likely going to be full of all sorts of contrary surprises.

Inventory of homes for sale has been decreasing this year in my town and subdivision. I keep track of this on a month to month basis and I was expecting inventory to increase as we got into the spring selling season. Possibilities:

1) Those who were planning on selling to “cash out” maybe realized this is not the time and are holding back. My question is: When is FOMO going to hit?

2) Those who bought in the last 2-3 years are not willing to give up their cheap payments due to the need of buying another home (interest rates too high and prices too high means cash flow would take a hit) or rent would be too high while they “sit this one out” and wait for the market to come back down.

Overall, inventory as a whole has been increasing, but certain areas seem to still have low inventory. No, the numbers don’t show there is a housing shortage. But it seems like sellers are being more cautious at the moment. Lots of homes have been put on the market, taken off, listed for rent, taken off, re-listed lower and so on. A few homes have been listed, taken off the market, remodeled, and re-listed higher and they still sit.

Buyers don’t seem interested in buying at these prices and sellers don’t seem interested in selling for lower prices. When will FOMO hit on the seller’s side, especially those with multiple properties?

I got a robocall asking me if I wanna sell a property… because demand is high, supply is tight, the best time to get on the market is now, and blah blah blah.

Having to spam that message out there speaks for itself!

I get calls like that every week and label them as Spam. But they keep coming!

I also still get mailings from Opendoor, Redfin and others I have never heard of asking if I want to sell my house.

I got a real person call me up to ask if I needed roofing work. He used my real name. I asked how he got my number. He lied and said he got it from a neighbor. I told him no neighbor knows my phone number. I told hm he lied and to try again Then he said he got it from public records. OOps, another lie. I have an unlisted number. Then I told him why should I hire you if you’ve already led twice?? Then I told him to get lost and hung up on him.

Its insanity that thats legal in the US.

why answer phone calls you don’t recognize? Seriously that is what voicemail is for.

If for some reason you must answer, you made it worse by confirming your name to the caller.

AGREE TOTALLY RT!!

Because of some ”glitch” in my latest phone, now an antique because it’s 5+ years old,,,, my ID does not appear to either callers or those I call, or those who call me…

WAS worried for a while until I realized: NO SPAM calls, and don’t have any worries about folks who I actually want to talk to.

They, in this case the folks I want to talk to , must first text me, then, when I come to where the phone is parked pretty much 24/7,,, and the text alert is doing its thing, I text back and then call…

Of course it is ”disconcerting” to some fond folks who want me to fix it.

NOT so sure I want to do that with the peace and quiet of NO spam, etc…

Course, as an old guy whose first memory of ”phone” was the one on the wall with a corded ear piece- had to hold it up to ear to hear, and speak into the phone on the wall,, LOL – and a totally ”party line” where ALL the neighbors could, and some damn shore DID listen in to everyone’s calls…

Everyone wants to think that Miami is different what with all the new money arriving from NYC…but if you really drill down there are countless neighborhoods where prices are already down 40 or 50 percent. Miami has always been a low-income city and a few hedge funds relocating there isn’t going to change that. I saw one house that last sold for 2 million in 2010 and now asking 25 million. But all it takes is one oligarch

Exactly.

If so many people are leaving northeast and bidding up FL and southeast, why’s northeast is holding up nicely?

Someone’s a lion. I think it’s the realtor.

I live in Delray Beach. It’s not different. What happened was a lot of people moved down to Florida during the pandemic and assumed their WFH jobs were permanent. These were people making NY finance salaries, and they bid prices up. Now I’m seeing a lot of them move back to New York (look at houses on Zillow that were purchased in 2020 or 2021 and are now on the market), or take jobs here for much less money. It was never sustainable, and anybody who thought Citadel moving was going to materially impact a metro area with 6 million people was deluding himself.

Brickell, Wynnwood, and to some degree downtown Fort Lauderdale off Las Olas are still holding up, but the rest is collapsing. I’m seeing rental units on the market forever, something that didn’t happen at all the past two or three years.

Where in miami are house prices down 40 to 50 percent? As a Miami local I don’t see any evidence of a drop as steep as you are referring to. You must be referring to prices that were astronomic (and unreasonable) merely falling back to sky high.

Floriduh is a great place to visit,not live high humidity bugs ,alligators and snakes it was mostly SWAMP land . And it will be that in future .

AGREE TOTALLY small bug!!!

Having been a war baby born during the last hurricane to hit SRQ in ’44, I really and truly do NOT understand why otherwise apparently rational folks actually CHOOSE to live in FL.

Between the ”climate” that has not changed much in spite of the HUGE amount of AC pumping TONS of HEAT into every concentration of folks, PLUS the already almost totally DEGRADED ecosphere here, it seems to me that any and every rational person can and will find many other places, such as SoCal a much better place to live.

Of course that summary ignores the ”social issues” that our current crop of antique politicians continue to ignore…

Just one more reason to VOTE to ELECT younger folks who at least appear to have SOME awareness of the environmental degradation WE PEEDONs deal with every day while they swish by in their mega sedans and private planes, etc.

@VintageVNvet

1 – Florida’s oceans are actually nice and warm, unlike California.

2 – ” SoCal a much better place to live” – San Diego is one of biggest real estate bubbles (see article title), so many would probably like to live there, but cannot afford.

I wish more people thought the way you did and would leave.

Few years ago I got talking briefly to an older women in a grocery store here in Eastern Washington. She lived for

awhile in Kansas.

Mind you, I’m from humid Ohio and lived in super humid New Jersey for 3 years.

Anyhow she thought the Kansas summer was unbelievably unbearable between the heat and the humidity.

Something about getting out of the shower for a few minutes only to need another one.

I found her recollection of the experience quite amusing.

Heck I figure she wouldn’t survive a spring in Florida nevermind the

summer !

Prices are still shockingly high. Considering where interest rates, I’m surprised there’s any movement in any of these markets. Lots of last gaspers, I guess. Saw the same flagrant innumeracy in 2009.

Sometimes I wish I lived in one of those cities attached to the charts to see such a tremendous home equity increase. But I would want to have bought the past 2 or 3 years.

I have a friend who moved to Phoenix 7 or 8 years ago. His home equity has increased at least 400k. He probably will retire sooner than later because of the gains and move back to a midwestern city to retire with those HE gains.

They think they’re gonna grab a deal and then refinance once the free money comes back. The free money isn’t coming back, though.

We are not seeing any slow down in Northern Virginia. Houses are selling in days at more than the asking price in many cases. New builders are going crazy and increasing prices every month with no end in sight.

That’s why I give you some actual data so you don’t have to rely on “selling in days” and “more than asking prices” and “going crazy” and “with no end in sight.”

In addition to the data above, to get greater detail, I’m also now looking at the Bright MLS Mid-Atlantic report for March, for Northern Virginia/Washington Metro (Frederick, Loudoun, Montgomery, Fairfax, Arlington, DC, and Prince George), in March:

Sales -29% yoy

Median price: -2.0% yoy

New pending: -28% yoy

Median days on the market: +3 days yoy

Active listings: +19.4% yoy

Showings: -27.9% yoy

Thanks WR for your energy and enthusiastic to reply and refute ‘not in my neighborhood’ people 😀

The Delusion is deep in that one (previous post) master Yoda!

Trolls cannot trick the wolfman!

Clap for the Wolfman

He gon’ rate your record high

Clap for the Wolfman

You gon’ dig him ’til the day you die…

Your assessment is what I’m seeing as this spring being a dud. Lower priced homes are moving fast but the number of sales are way down from a year ago. This fall and winter will be interesting?

I don’t think it will be interesting. I think it will be quite boring.

People forget the seasonal effect. Yes the sales and the prices are a little higher than Christmas holiday days, BUUUT, its is lower Y-O-Y. I don’t want to compare this market with 2008, but if you take a look at 2007-2012 period, every selling season prices were a little higher and the dropped more down in winter. Lower Y-O-Y for many years.

Some people that have FOMO, still want to jump in thinking the nightmare is over.

As Wolf said nothing goes to hell in straight line;)

The city of Washington DC is not showing any price drops that I can see. There are so few listings that once a property is listed it is gone. Sleazebag realtors are even putting up signs saying “Gone” once they get a contract on an overpriced house.

Currently selling rental in Arlington / Alexandria not too far from DCA. Lowest per sqft price compared to comps but no bites. 1200+ Zillow views 80 saves in 8 days. 47 attendance at 2 open house. No bids. Realtor was mad that we listed so low but we are moving and not fighting to get “top dollar”. Not certain what’s up. Guess we are all used to the 2021 bidding wars.

I have a friend selling a 650k house in Upper Marlboro for 100k under what the current talking heads think she could sell it for, and like you, she’s getting all sorts of realtor flak. You and she are the smart ones though, imo: see the trend, front-run the trend. Better that than be sitting with a property you can’t sell once prices overcorrect downward.

You need glasses, then.

Washington DC metro, March MLS report. All stats YoY comparison to March 2022:

New Pending sales -28.2%

New Listings -35%

Median Days on Market +3 days

Closed Sales -29.3%

Median Sales Price -2%

Active Listings +19.4%

Months of Supply +64.2%

Showings -27.9%

Home Demand Index -30.8%

In case you are wondering about that last one:

The Home Demand Index (HDI)

captures buyer signals including

showing requests, listing views

and more to let you know what

buyers are doing right now,

before they buy. The HDI is

forward-looking, providing a

picture of what market activity

will be this month.

The Home Demand Index was

created as part of our strategy to

create a nimbler and more

innovative MLS platform that

drives your business forward.

Sorry, SwampCreature, that post came across more strongly than I intended. The March numbers clearly show the trend, and that trend is that either the prices are setting up for a big decline, or Days on Market is set for a big increase….which will lead to the former eventually.

DC is slowing too, just like everywhere else.

It’s the “no end in sight” part that makes me laugh; if you can’t see an end to the bubble you are blind to more macro forces than I can count on fingers and toes. Even the bloated government-workers’-filled NVa corridor isn’t immune.

If I understand these things correctly – and I possibly may not – listings being up while showings are down tells you roughly where we are in the “sellers haven’t relented” story. The moment that “Median Days on Market” rises closer to, say, 20 days or so, things get interesting.

Hi,

I have a recent post elsewhere describing how my homebuying experience in 1986 WAS VERY different from the buyers experiences the last few years.

(Search “Randy” if interested).

But then again my selling experience was also DRASTICALLY different than the last few years.

Very briefly:

1. Bought nice new home $89k in 1986

2. 10 years later: Went with realtor for 3 to 4 months Spring, 1996 to sell. Started 90k, inched down to $86k or so. Only a couple showings per MONTH.

3. Gave up or realtor…she seemed like a good realtor but hardly any showings

4. June: Read up on FSBO and put out signs, 5 line ad in Dallas Morning News. $85k or so.

5. Very few calls… DFW at that time had 3 to 4M people … actually wondered and still do if my inbound calls were diverted or deleted.

6. Summer … a few showings but not many.

One potential buyer talks about very wierd stuff unrelated to my house. Maybe 2 or 3 showings for June, July. Ad running in Dallas Morning News the entire time.

Still only one or two calls a week.

7. Price now at 82.5k. Realtor brings buyer around. Sale. She negotiated a new roof (my insurance company covered that), new garage door opener, and I threw in a little $$ for any unforseens.

Probably on the market 6 months.

Bought $89k, sold $82.5k, 3% buyers agent commission => net $79.5k.

Internet was new… I looked at comparable homes in the area… most were listed in the 90s if my memory is right. My home was in good condition. The carpet looked like it was new. Single person, almost never had anyone over, no pets.

My sellers experience was 180 degrees different from what I’ve read about the last few years. I have a minority last name though that probably wasn’t an issue, but one never knows.

When you get hardly any inquiries…ad in the DMN for 3 months… you do begin to wonder if the CIA might be messing with you. Oh i certainly put my home in a good light in the ad. Who knows.

When I consider what I went thru to sell my home in 96, sure it wasn’t torture, but it was painful… not only do I not have any love for current sellers… I have a visceral dislike for many of them. Attitudes in SoCal, Florida especially but kind of in general across the country.

And I’m not in the market to buy now.

I begrudge the easy $ homebuyers the last 10 years have made. You betcha.

Your experience is unknown to today’s young people. That’s why I think their turn to experience this is coming. There is no market that always grows. There comes a time when he will go down. The mass buys at peaks and sells at the bottom

Wife and I bought our first home in ’04 for $96k. We paid a mortgage payment at closing to walk(sold for $85k). That was 2015. Once bitten twice shy. I’m not going to be a sucker twice.

I just saw another article that is supposed to be reporting on the same data but they say there was surprise bounce in the housing market. Let the good times roll.

With that said it does seems to be an asking price bounce in the market around here lately. I am not sure what is going on with that. I did a little investigating and seems that quite a few houses that have sold recently have all been instantly listed on AirBnB. I am curious how that will work out for them, given how empty the 5 or so AirBnBs I walk past daily seem to be. I will add I live mid size city which in my opinion has little draw for tourists outside of a larger regional hospital.

Starting to see small clusters of AirBnBs being listed as furnished long term rentals, but their monthly asking prices are still exorbitant.

I was going to book a place in Washington near the Columbia for a couple days. The cleaning and other fees added 100/night. Cheaper to stay in a hotel. Not sure what these landlords are thinking.

Thats one of the reasons I don’t stay in airbnb.

Stayed in Idaho springs Colorado ,ARBNB had to clean it ourselves . Never again they can pound sand,way overpriced.

If the economy remains strong, and people have money to spend, then these AirBnBs would stay strong and thus home prices would stay strong or go down slow.

If the economy tumbles, lay offs happen then it’d be a different story.

It’s definitely an interesting story.

I think layoffs have just gotten started.

I just don’t think this can continue. Every single person I am friends with who is making 6 figures has slowed down their spending. We didn’t take a Spring vacation and have refused to buy a second car. We need to buy a house but that has to be before my kid is a freshman in HS next year. Hopefully by then things won’t be so crazy. Who knows, I’ve never seen anything like this in my lifetime. 2008 seems like a nothing burger

Airbnb’s aren’t staying strong though. Super Bowl in Phoenix was an example.

Seeing the tops form on those graphs brings a faint glimmer of hope to my bleak, shriveled heart.

Hopefully next year something comes into reach so I can stop being a rent refugee.

Prices are “normalizing,” I guess, toward more reasonable affordability, hopefully. But look at that variability in those charts. It’s a big, illiquid asset and trade, and hard to “time it” since 2000. As with other assets that vary this much (stocks), there will never be an obvious steady perfect time to buy (or sell. In hindsight, it worked out for me (30 years’ ownership by now). I stayed steady and didn’t extract cash or anyting like that. Each variable like price or inflation changing, helps and hurts someone (like, debtor or creditor). ZIRP and now inflation have helped me as a debtor. That’s one reason I don’t vent too much paranoia about the Fed and banks. I would say “the system” has treated me not too badly.

Supposedly more apartments are being built now than anytime since the 70s so maybe rents will stabilize or even go down in a few locations.

Of course our population has gone up considerably since the 70s which begs the question: why has it taken 50 years ?

Around here, well priced homes still sell within a week. There’s a lot of pent up demand waiting for either prices or mortgage rates to drop.

If people need to start selling/downsizing/foreclosing it could trigger a big slip in the market.

American cities seem to be on track for a correction, but here in Canada, the real estate prices are doing a dead cat bounce.

There are bidding wars and rumours of bidding wars right now in Canadian real estate. It’s a mess.

I’ve done a social experiment about the labour market. I applied for the Amazon warehouse jobs. Indeed shows at least 8,000+ applicants and on ZipRecruiter the job ended before the day ended.

Who is buying Canadian real estate at the crazy prices?

Edit: I changed my username because of those hosers across Alaska appropriating the last letter of the alphabet.

I’ve heard that your government is now doing things to prop up the market. Sad if it’s true. It would be no different than an admission that the market can’t survive on its own. I’ve always adored Canada. Grew up on the great lakes, loved going across to Ontario. I wish you well.

BILD reports a steep decline in new home sales in March, when only 1,277 homes were purchased region-wide. That marks a staggering 70 per cent year-over-year decline, falling 65 per cent below the ten-year average for March sales based on data from Altus Group.

Condominium apartments accounted for most of the inventory sold in March at just shy of 900 units, down 73 per cent year-over-year and 63 per cent below the ten-year average for the month. Only 384 single-family home sales were recorded last month, a 57 per cent decline from last year and 67 per cent below the ten-year average.

You in the US and Canada stop watching the prices and let them crash. Then shop on sale. This will take a long time. Have patience

It concerns Toronto, but it will be the same for the others cities in us and Canada.

>>You in the US and Canada stop watching the prices and let them crash. Then shop on sale. This will take a long time. Have patience

The biggest question is what time horizon we are looking at here.

If we are talking 10+ years, I’d argue that it is VERY bad, way worse people can realize now.

Imagine the whole cohort of people “missing” their 30-40 childless in rented apartments just patiently waiting for the craze to pass. By the time they are ready for kids, have a house they so much waited for, they may not even want to get into it.

I don’t know if it it good or bad, but that’s almost exactly how the Idiocracy movie started lol.

Like I kept saying about even more severe events like wars or political turmoils, one has to always keep in mind that 100 years from now this turbulent period may well deserve just a small chapter in a history book, while for people living in it now it can be pretty much their whole life being shaped by it.

IN

I wonder how people lived in rent until 2020. What has changed that now suddenly in 3 years everyone rushed to buy. Until a few years ago, there were no auctions and hysterical purchases. What changed!?!

You will say inflation has changed. Yes it is high but from 2015 until now housing inflation rose every year until 2020 when it took off. And then there was no such hysteria about real estate. If so, do you think now is the time to buy? I do not think. And if I have to, I’ll live in rent for another 10 years. At some point this bubble will deflate, as all balloons deflate sooner or later. Therefore, patience is the winning move.

If so inclined search “Randy” in these comments for my drastically different buyer/seller experience of the 80s, 90s versus last few years.

“There are bidding wars and rumours of bidding wars right now in Canadian real estate. It’s a mess.”

Doubtful. Rumours lol

“Hurry, BUY NOW!!!”

-Every Realtor™ Ever

Warren Buffett said, “Don’t ask a barber if you need a haircut.”

Relying to IN above about: Imagine the whole cohort of people “missing” their 30-40 childless in rented apartments just patiently waiting for the craze to pass.

Let me tell you out of my own experience: It is perfectly fine to raise kids in a rented home / apartment.

Owning home ownership for raising kids is hyped up by real estate lobby to extract $$ from people’s pocket.

In my area, southwestern Ontario with view to the US, sales picked up in the last month.

Houses below 400 k sell fast even if hundred years old, small and not renovated in the last 50 years.

For expensive houses bids are rare and they sell slow if at all.

It’s very much worth noting that it took another 4-5 years for house prices to stop declining once the Fed actually started lowering rates prior to the Great Financial Crisis really gathering steam.

This market is NOT the stonk mkt where prices turn on a dime.

As the current economy continues to weaken, and eventually break (you all know it’s coming… again), only then will the Fed stop raising rates and begin QE again. But at that point it’ll be too late and we’ll slide into the abyss again.

Keep your powder dry and await the asset fire-sales with bated breath.

Rightly said, it’d be a slow moving process.

Last HB, HB12 took 5 years to find its bottom.

There won’t be a housing bust of the (national) level of 08/09+ this time around. Largely due to that prior bust resulting in too low and slow growth from 2007 to pre-2021. Now there are pockets of overpriced housing (primarily in Cali/Florida) but most markets are still very affordable. This is especially the case when compared globally.

Most markets are not very affordable. Right? Especially not with current rates.

The condo I’m living in was purchased 6 years ago with a monthly payment of 1.9k. Someone coming in today, at today’s estimated price and rates would have a monthly payment of 3.4k.

Dude, that’s approaching double. In 6 years.

That’s not very affordable. It’s not even regular affordable. The vast majority of people in seemingly the vast majority of US cities couldn’t comfortably afford their own house if they had to buy it today.

Price increase does not equal unaffordable. Home price to income ratios are key (and of course income vs payments).

Those ratios suggest US housing is more affordable after the recent run-up vs:

Canada (by a factor of about 2x)

Virtually all of Europe

Australia/New Zealand

Of course virtually all advanced economies in Asia (not saying much)

While real estate markets are regional / national, you can still make these comparisons.

Pockets of the US are indeed unaffordable (eg California) – that is, income-adjusted they look closer to Northern Europe (though still cheap vs Canada).

But affordability in the US is still very good. Combined with lack of widespread fraud, ARM usage, and multi-home private speculative (domestic) investment ala 2005-2007… there will be no collapse.

I would post the address if Wolf would let me, but I bought a house in Austin in 78731 on nearly an acre of land for 450K in 2013. That same house is now Zestimated at about 1.5 million.

Yes, the new owners did a bit of remodeling but rather than preserving what was an interesting architectural work, they tried to make it look like a Hilton Garden Inn

Truth, how do you explain the current rate of decline, which is much faster than what occurred during HB1?

Ridiculous comparison in the above post between the US and those even bigger bubble countries.

Longer term, rates are destined to “blow out” since the interest rate cycle dating from 1981 almost certainly turned in 2020. This is just the beginning of a multi-decade rise in rates, like the last one from the 1940’s to 1981. The fundamentals are also far worse, credit quality and credit standards are in the gutter, and the USD is a lot more likely to lose a lot of value versus the currencies that will matter most. E.g., the currencies of the countries which actually produce real stuff and aren’t based upon services with inflated wages which are likely to be a lot less competitive in the future.

“Those ratios suggest US housing is more affordable after the recent run-up vs:

Canada (by a factor of about 2x)

Virtually all of Europe

Australia/New Zealand

Of course virtually all advanced economies in Asia (not saying much)”

I am so tired of people just putting mindless info out there.

You would not talk how in EU, health care and collage education, etc is free/affordable so they don’t have to spend literally tens of thousand and thousands of their income annually on these things. Yes housing is more expensive there but there are lot of other things that are free/less expensive there which cost tens of thousands annually in US.

And the reason why you dont talk about it, is cause you dont know jack sh*t. You just read some sh*t some where, and start posting it in other websites as it suites your agenda.

You are trying to compare apple and oranges. Completely different dynamic, income, expense, etc.

Similar thing with Asia too.

@Truth:

“Price increase does not equal unaffordable. Home price to income ratios are key.”

Of course it’s key. Which is why I showed the mortgage payment figures doubling. Unless you think incomes for americans have also nearly doubled in the same six years?

Going back to this condo I’m sitting in right now:

In 2017, this condo would’ve cost 28.5% of the city’s median gross income, not including hoa fees, utilities, etc.

In 2023, that jumps to 45%!! After hoa and other housing-related expenses, you’re talking 50+ percent of GROSS income for the median earner. This is not some luxury high-rise. This is a 120 year old co-op with outdated central heat, no in-unit laundry, no dedicated parking… See where I’m going with this?

If we assume the median wage earner is taking home 70% of pay, after all deductions, retirement, taxes, etc, then that leaves a monthly budget of less than $1500 for everything else. Food, drink, car, fuel, insurance, pet costs, home maintenance, travel, entertainment. And remember, all that stuff now costs 15-20% higher than it used to.

No matter how you cut it, it’s a big change in financial feasibility, and hence, a big reduction in affordability.

@Zest I wish there were thumbs up here. I’d give you a few dozen. It stymies me how people are continuing to afford what inflation has wrought. Rents are just as obscene. How can this continue? Even if inflation were to come to a standstill, the level we’re at now is unaffordable. Is everyone just living on credit? And what happens if the BRICs take away some of the USD’s reserve currency status? All of this is concerning.

Those citing other attributes in those markets – consider how they diverse they are. Also, consider tax rates and mortgage interest treatment deductibility. Both of those elements favor the US market’s affordability (lower income taxes and reduction in actual cost to borrower).

I get what your saying but current rates are still good historical rates. Housing prices need to drop to be considered affordable.

I think we will be lucky to ever get below 5% range again. The problem you get when Mortgage rates drop below 5% is that banks do not want to hold those loans. The GSEs are the only buyers of mortgages that low.

How far can house prices drop? Construction costs are up over 20% compared to 3 years ago and up 25% over 5 years. So a 400k house 5 years ago costs 500k now. Not many peoples salaries have increased 25% but inflation is sticky and don’t count on construction costs to go down. The floor under housing is what it costs for the land and the construction costs.

So the solution to build more $400k home again. But the builders need to reduce the size of the house to 25%. Instead of 4 bedrooms they need to build 3 bedrooms. etc.

To Truth below:

So if murder rates are up everywhere … wherever its up the least is pretty darn good, eh ?

If inflation is quite high most countries, if its only up say 7% in your country you should feel privileged. Hey you got all of 10 years before prices double.

Username does not check out. Sounds more like used house salesman truth.

“There won’t be a housing bust of the (national) level of 08/09+ this time around. Largely due to that prior bust resulting in too low and slow growth from 2007 to pre-2021… most markets are still very affordable.”

That doesn’t make any sense at all. If most markets are still affordable, how do you explain sales tanking everywhere, like in the last bastion of east-coast hope, Miami. Sales have cratered 41% YoY there now. Guess where prices are soon to follow. Shouldn’t sales continue unabated if prices were still affordable, as opposed to being almost halved?

The Everything Bubble is far larger than anything seen during the GFC, so how you’re extrapolating that this particular bust won’t be as bad as that one seems like wishful thinking. Or possibly untruth.

“There won’t be a housing bust of the (national) level of 08/09+ this time around. ”

I thought the same in 2008 :-).

Affordability trumps all.

It is possible, there may not be any crash of there are no lay offs, all get big pay hike and rates go down big time. I see none of these happening.

Lol not to that extend the income haven’t increased. If that was the case, we wouldn’t have people being stuck in starter homes.

As Zest posted – $1,900 to 3,400 would mean salaries should have doubled in last 6 years.

They haven’t and in fact, despite highest salary increases in last three years, those are still behind inflation so do the math. Now, i’m also going to bet that average rent in that area is below $3,400…

“Affordable” I feel like you don’t know the meaning of that word…

There is a “Housing Affordability Index.”

Wanna guess what the Housing Affordability Index shows?

*Spoiler* it ain’t good :P

“Housing affordability falls to record low in Q4 2022” says:

“Just 38.1 percent of homes sold during the fourth quarter of 2022 were affordable to families earning a typical income, down from 56.9 percent in the first quarter of the year, according to the latest National Association of Home Builders/Wells Fargo Housing Opportunity Index.”

I agree with you, I’m in your team.

I work in a DC area Land Records office. Volume is still massively down the past several months and not getting any better. I’m surprised that the drop is only 29% year over year myself for the region. Thanks for the stats Wolf, informative as always.

This data is lagging by a couple of months. You’re current situation will reflect a report in about another 60 days or so(dont recall the exact time period).

Prices are declining but i still see some people fomoing. I can not understand why. Are they being mislead into fomoing by realtors?

I think it’s because of the “low inventory” narrative. People need to live somewhere and they don’t want to rent. There’s just a lot of ppl who want a house to buy. But the more affordable houses in high tax areas have very high monthly payments. I don’t know how there’s so many bidders on the most affordable houses. How the heck are avg income folks going to pay for that with all the other expenses? It absolutely cannot last.

My only idea is that they are betting on rates going back to 3% shortly (which is a Stupid gamble), hence lowering their monthly payment. Otherwise, i can’t make heads and tail from this phenomenon.

Rates are going back down is exactly what the realtors are selling to naive young millenial buyers.

Mortgage brokers running ads saying “you can refinance for free with us next year when rates drop” is fanning the flames of hopes that rates will be 3 or 4% soon. I personally know someone who purchased a house banking on refinancing in a year, not a good situation.

An article in “Fortune” magazine today said the housing correction is over due to a modest month over month increase in sales volume and price. They said this based on one data point with zero context. This kind of lazy “journalism” is why. People believe what they read and most of what people read these days is only half of the truth. And that’s being generous.

Healthcare worker forums are starting to uptick with posts warning travel RNs where not to work due to dangerously low staffing and gross inaffordability of local housing/rents. Some agencies do cover housing costs but not all and even if they do, the local staff shortage is akin to holding your license over a fire. Travel nurses are doing the math and starting to refuse assignments.

Hospitals have been leaning heavily on highly paid travelers due to staff nurses leaving over burnout, local inaffordability and poor staffing post pandemic. Given healthcare is one of the top employment industries particularly for women, when the travelers making $150+ an hour won’t accept an assignment bc its too expensive to rent and/or facility too understaffed, that’s a huge red flag. Especially in more rural areas where the hospital is the main employer and anchor of local economy.

With Boomers retiring and downsizing, they’re not going to want to move to an area with a collapsing healthcare system. And that’s just one industry that affects people’s downsizing/relocation decisions. Education is its own ball of wax, and so on. Nothing’s feeling sustainable for the working class these days.

I heard the same thing.

I guess we need to bring in some H1B nurses from other countries like we do with Tech workers.

I am sure we can get a lot from India and China.

ru82, the Phillipines. Huge exporter of travel RNs to the US.

Amen. This is why I switched my specialty to something that won’t put my license on the line. They can bring in whomever from whatever country to work the ER. By law is supposed to be a 4:1 ratio there. It’s more like 7:1. RNS are bailing unsafe depts in droves.

The avg or below income folks will have to rent. The new normal. If you in the lower 1/3 quartile of income, the odds of ever owning a home are dropping.

Low-income homeowners comprised a smaller fraction of all homeowners in 2020, at just 27.2%, down from 38.1% in 2010.

That was in 2020. The 27% is now lower.

My apartment size interior is 570 ft²

Not too big, not to small. Have balcony, storage unit. Lower utilities than much bigger home.

Rent $825.

I can’t buy a home this small.

Not even close.

Most homes are 2000 to 4000 ft².

Mortgages $2k and up for that.

I’m better off buying stocks, CDs than buying a home. That has been my experience for 32 years.

Owned a home for 10 years…search “Randy”

for my buy/sell experience in the 80s, 90s.

Much better buy experience vs. today’s buyer (though eventually lost money on my “investment”), much worse sell experience vs. 2 or 3 years ago seller and probably today’s seller even.

I think there’s a lot of cash sloshing around in the system…some from stocks, some from Boomer parents…my daughter and her partner FOMO’d on basically an overpriced fixer thanks to a hefty down payment from said Boomer parents, resulting in a monthly mortgage payment 40% lower than current rent, which wad going up, and for now they’re enjoying fixing up their own place. I was happy to dump some cash into it, although I squawk at the price….what else was I going to do with it? Save for my future….

Please come east asap. Pouring concrete diy to make more room in house for babyyy

-10 to 20% needed for affordability

Wolf/others – how long do you think it will take to erase pandemic gains?

My guess is 2 years or so.

Last housing bubble, it took 5 years or so to find its bottom.

This time, if no huge lay offs happen, may be home prices may never crash but affordability is terrible atm.

Here in the Coachella Valley there is limited inventory on the market. Prices have skyrocketed here due to the work from home movement as well as the prevalence of investors buying SFRs for short term rentals. Prices in middle class neighborhoods have almost doubled over the past 4 years. I moved back here last year, and hope that prices start dropping soon so it will be possible to stop renting and that I can finally purchase a house.

I hope all the investors who took opportunities away from actual families get crushed

All depends on people ability to vacation.

This year, it’s $500 the ticket for one weekend of Coachella festival. People ready to put this kind of money on a festival don’t mind the AirBnb nightly price, it’s all going to ballooning credit card debts anyway..

Depends on how miserable you can keep the working public, since only truly miserable people seek a vacation from their regular doings.

Ticketmaster and other ticketing outlets charge well over $100 in additional fees for an event like this so the actual cost of those Coachella tickets were closer to $650. Over $100 in fees alone! Welcome to late stage capitalism.

Grasshoppers dance in the sunshine, since ancient times. Ants are thrifty and save. These are perennial and eternal. Tell the Coachella story to the kids heedlessly racking up debt on the credit card in 2004, the folks at parties talking big plans in 2004 or 1928. But since 2008, Uncle Fed deepened this thinking (more kindling piled up for the conflagration) by bailing everybody out (VERY quickly in 2020). But one day that cupboard is dry. And on that day, other stuff breaks too. Like 1939.

I think it depends on the price points in the Coachella Valley. Very little available that’s in an affordable range. But there are ton of Palm Springs luxury homes on the market between $1M-3M. Not sure if they are selling many of them.

Isn’t the sub-story here that some smaller and/or warmer cities are attracting disproportionately more domestic migrants than the largest property markets have in the past, and therefore are experiencing more consistent housing demand and stable property values?

This appears to be the case in the hood where my pup and I walk every day in the saintly part of TPA bay area CE…

Houses on our particular block, all w exact same footprint when built in 1950 were selling for about $100/SF in 2015-6, and are now holding at about $350-400 IF livable; ”tearer downers” now going for far less, and newly rehabbed more, and new construction more yet, up to the $500/SF range.

There has been some slight decrease in older house last few months, but nice hood, and most stuff goes pending first week, closes in 30-60 days.

Traditionally undesirable markets are seeing minimal corrections and/or quicker appreciation rebounds. “The” real estate market appears to actually be separate, regional real estate markets.

It’s incredible how the same axiomatic sentiment, prognostications and even stock language like “keep your powder dry” echoes almost exactly the type of commentary I’d see throughout finance & Real Estate centered blogs back in ‘08-‘10.

I sensed even back then that the reflation of the housing bubble was in the cards. Crazy to see it finally somewhat widely acknowledged/denied and starting to totter.

Stock market naysayers were yelling sell with Dow at 7k… I was yelling sell before the drop but once all hell was priced in, it was clearly a long-term buyer’s dream.

Real estate in 2010 was also a buyer’s dream. Many markets had fully corrected by then (don’t believe the use of average data – median prices were at their lows for most regions in 2009). This over-correction was necessary but also lumped together impact of systemic panic/issues with fundamentals.

The recovery made it clear the noise around absolute lows was just that, noise. Buying in late 2009 through 2010 was a smart long-term move.

I had conversations in 2011 or 2012 with some others who also (and more famously) correctly predicted the crash. Problem was they were fixated on that now-resolved narrative. Couldn’t move away from it as the facts changed.

I am not a bull or bear and certainly not a real estate cheerleader. But the facts and trend suggest a modest correction and no crash (outside some regional pockets). Would I buy in California today? No. I would not have bought pre-covid price surge either, to my short-term detriment.

Man — 2009-10 was absolutely not anything like a bottom – certainly not in the markets I was looking in. Not by several hundred thousand dollars. This is not conjuncture or bias. I still have the price histories I tracked back then to prove it.

1. Very low interest rates by Fed…too low (?) many claim, I’m not sure… starting with HC1.

2. I guess some forbearance for certain homeowners (PBS had a segment during HB1 in which a homeowner squatter bragged he had lived the last 18 months in his house w/o paying a dime. Different segment: Boston homeowners chanting how government was not going to foreclose on them, no way). Renters get kicked out but homeowners, certain ones, felt entitled to their home whether they paid or not !

3. Homebuilding, new construction, dropped very low. Slowly restarted. Today in high gear some areas but I’ve read still pretty negligible in many parts of the Midwest, NE, and South.

4. Free pandemic $$, supply shortages (did Trumps rhetoric cause some of this… read the Opium Wars), WFH movement.

5. Investors buy homes more than before. 5% 2000, 2001 to 11% 2011-2019, to 19% 2020, 2021. Per Washington Post graph. No government regulation. Politicians tacit approval as rents skyrocket in some western metros and homeless increase. Dallas County 2021 42% investors, Tarrant County 52% investors, Atlanta 33%.

6. NIMBYism as always. No manufactured housing allowed in the county I live as I was told by a MH representative a few years back… they built a subdivision in the adjacent county instead, right on the county border.

I’m an anomaly… nobody is upset politicians allowed so many investor purchases.

I think it was unethical… I’m not as upset with the investors as the politicians (senators, representatives, governors, mayors, even city councils) for letting the

INVESTORS essentially HAVE PRIORITY over INDIVIDUALS in many large urban areas.

So lots of factors.

On the positive: lots of Americans bought houses at low interest rates.

Biggest negative… more wealth concentration. Those who could not buy a home saw their rents go up (often drastically) and no politician gave a hoot.

Very discouraging: neither homeowners nor the media nor politicians seem to give a hoot about points 5, 6 above.

Observation: identity politics seems much much more important to Americans than class politics. Ones ethnicity, race, sex, religion (played down) is given HUGE emphasis by the media… ones class is IRRELEVANT. I find this quite interesting.

It might change slowly. Class warfare, not violent of course, but more indirect might emerge. Right now middle class seems reasonsanly satisfied economically. Poor not so much. Perhaps politicians and media distract the poor very skillfully.

Chomsky has a well-written book (or two) on your final points.

Well-said.

SocalJim here. Hate to rain on your parade, but here is a market recap for last weel from Teri Adler, a prominent Wellesley, MA realtor below:

Each week I think to myself, maybe things are slowing down and perhaps inventory is higher than I think. Then I sit down and do my research and take a hard look at the numbers and realize pretty quickly we are really in the same place we have been. It’s still a struggle to build up that inventory. Not many drastic changes to report.

Here is a tale that nicely demonstrates where we are. This adorable house (not my listing) sits beautifully on a side street in downtown Wellesley.

As soon as it was listed there was a rush of people with 5 days of packed showings and pre-inspections. At a listing price of $1.3M it was attractive to many, many people from first time homebuyers to empty nesters. 22 offers later it sold nearly 30% over asking. I am proud to say it was MGS Group agent who led their clients to victory. It was underpriced to begin with, so a good agents told their buyers not to get too invested if you only wanted to spend up to $1.5M. This is the reality of house hunting for those searching under $2M in our area. According to the watch group Inman, “homes in the lower tier of pricing are still 8% more expensive than at this time last year — and inventory has barely budged, according to a new analysis released Thursday by Zillow.” And the Boston Globe was reporting, “the median price in the first quarter climbed 13% in the Metro West region which include Framingham, Needham, and Wellesley according to the Greater Boston Realtors. Ditto in Central Middlesex County communities such as Concord, Lexington, Sudbury and Weston.”

In Wellesley, of the 24 houses on the market right now, two thirds are over $2M and most are north of $4M. The 8 properties priced in the lower tier will most likely sell by the time you read this. Just today we tried to book showings at a few adorable houses in Wayland priced around $1M that came on days ago, had multiple offers immediately. The number of houses selling far outpaces new listings being introduced in all the towns mentioned above.

Welcome back! don’t disappear – we miss your insight. I certainly do :)

Not all homes in New England are selling like you described. In Newburyport, MA, a highly sought after area, a brand new home, 3700 sf 4 bed, 4 bath with a two car garage has been sitting on the market for over 64 days. They just lowered the price 101k. You can look it up on Realtor. They keep holding open houses and no one is buying it.

I forgot to mention, the home in Newburyport, MA is listed at 1.7 million.

SocalJim,

This is called a “sponsored post,” meaning a form of advertising that Teri Adler put together and is trying to spread around. How much did you get paid by Teri Adler to post this?

Why not delete it?

Normally I do, but I saw it too late, people already replied, including Lucca’s comment, which was interesting, and so I decided (maybe wrongly) not to delete it but to explain it.

Blog spam is a disease. Much of it is porn, but there is other stuff too, most of which I can block and delete with my brains tied behind my back.

But RE is much more sophisticated. Teri Adler put this out on purpose, she knows what she is doing, this is a very slick thing to do, and she pulled it off well, so I kind of admire the skill of it, and that’s why she is successful selling RE. But if Teri Adler wants to advertise on my site, she can contact me and buy a banner ad for example.

Because it’s humorous? I certainly hope nobody would fall for it.

“Because it’s humorous? I certainly hope nobody would fall for it.”

I don’t find it humorous at all, I find it disgusting. I find realtors disgusting. Shilling for high house prices in order to extract the largest commission possible at the expense of buyers and society as a whole – intentionally lying while trying to inflate shelter prices – is a despicable act.

I think it’s time to call out all the perps in this housing bubble scam, from the government and corporate cronies to the FED and the entire real estate industrial complex. It’s a massive scam. And it’s built upon fraud. The people who were spouting nonsense about how “lending was solid this time” are about to get their clocks cleaned with truth as this entire sham comes apart.

DC, I agree with you.

Curious if it was the real SocalJim. If yes I don’t think this is his way to make money. And if it were, then things must have gone really bad :)

If SocalJim didn’t get paid by Teri Adler then he performed unpaid labor for her.

with all due respect Wolf, I have very hard time believing that Adler would hire SocalJim to come back to this site because she so badly wanted to advertise to us readers :)

The ads aren’t for us long-time readers, they are for people who stumble upon the site. Cannot let the truth slip out so you have to fight it every step of the way.

Not surprising – Wellesley is full of people with way too much money. Exactly the types who would fomo into an overpriced property.

Even if this all is true, here’s the only way it makes sense to me:

Inventory is so strapped that the only people left on the demand side are folks with exceptional incomes, too much cash set aside, or too stupid to know they can’t afford a $1.5m house.

If you restricted inventory in Wellesley to only one SFH of moderate quality, all those same folks would bid it to the moon anyway.

Eventually the market will jostle itself loose, inventory will expand, prices will fall, and average people will finally be able to buy something without betting so heavily that the next ten years of raises will lift them to the point where they can start going on vacations again.

For me the big question is, how fast will inventory loosen up again. If it’s gradual, we could see a prolonged period of just slightly reduced tension for average buyers. If prices drop enough for panic to set in among would-be sellers, we could find ourselves in a buyers’ market overnight.

I don’t disagree, and perhaps could have worded my comment better.

The type of person looking at property in Wellesley, is exactly the type who would overpay.

Yep, yes let’s use Wellesley MA as a measurement for the overall housing market in the US. Next up, comparing Martha’s Vineyard to Brockton MA.

This is comedy right?

EXACTLY Kmf:

Such a really and truly indictment of MSM.

Many many folks in MSM are truly needing direction if they actually want to do other than a fantasy…

Sure I know ”THEY” won’t, just as exactly as I know most if not all MSM are doing what their owners dictate.

I just checked out of curiosity – Wellesley is the 10th wealthiest town (by per capita income) out of 351 towns in the Commonwealth.

Nearby Weston is *the* most wealthy town in Mass by this same metric.

Nice cherrypicking by OP.

My favorite part of this stupid BS is where she says the $1.3 million dollar price was attractive to first time buyers. On what planet?

It is cheaper to live in Natick.

…and I haven’t seen anybody factor in the cumulative 12-14%+ 2+ years of FJB inflation.

Yes! I said something similar about inflation adjusted prices pushing towards -30%, but it was deleted.

I deleted it because I already explained a gazillion times that the Case Shiller IS AN INFLATION INDEX, of HOUSE PRICE INFLATION, that measures how many more dollars it takes to buy the SAME HOUSE, which is how you measure the purchasing power of the dollar, which is what inflation is. And I explained a gazillion times that it is conceptual BS to adjust one inflation index (Case-Shiller house price inflation index) by another inflation index (such as CPI or your own silly inflation index), or adjust for example, the CPI by the PCE price index, or adjust a wage inflation index by a wholesale inflation index. I’m so sick of having to explain this every frigging time.

The mistake I made is not seeing and deleting Javert James’s comment.

And I use the Case-Shiller Index in my coverage of CPI inflation. So this is the CS HOUSE PRICE INFLATION index (purple) and the CPI RENT INFLATION index (red):

https://wolfstreet.com/2023/04/12/services-inflation-rages-durable-goods-prices-rise-again-after-6-months-of-declines-food-inflation-backs-off-energy-plunges/

Alec,

And if you read the article, which is obviously too much to ask, you would have seen this:

“The Case-Shiller indices were set at 100 for the year 2000. So that Miami index at 397 points in February is up by 297% since 2000.”

This index gives you the house price inflation rate since 2000 for each market.

This chart should make anyone hot for buying a house take a fistful of aspirin. Especially seeing the 25% drop from 2008 – 2012 which is a 4-year period of house price decline. Add to that the absurd home price inflation from 2012 to the present.

They might want to read Carlo Cipolla’s, “The five basic laws of human stupidity”.

George Carlin: ““Think of how stupid the average person is, and then realize half of them are stupider than that.”

Sorry, Wolf. I see your point now.

I recently viewed the data directly on Case Shiller website and saw they have both nominal and real.

I’ve been looking at a number of small to mid size cities for retirement and have not seen a significant price drop. This bubble pop appears to be limited to the super popular cities.

No, it is spreading widely at this point. The CS regions are pretty big. I suspect that many people think it isn’t happening where they are looking because prices are still really high, and that’s true… but they are coming down, at least in the areas where they ran up a bunch.

Frank..

agreed.

Everywhere I would wish to move….nothing for sale or just junk.

IMO, there is still way too much money in the system ($4 Trillion too much) and the Fed has essentially done nothing of any significance to reduce it.

QT terribly slow….12 months in now.

Agreed. They’re not trying in good faith.

Seattle is set to crash the hardest and fastest this time (usually it is late to the crash parties) after the greatest over build of RE in history here when the City junked their application process and allowed developers free range.

The artificial market that the City created was for these tall-skinnies, a dark space full of stairs. Put six or even seven at a time, on a single lot, Let them be priced north of 600k. Totally illiquid. Can’t even rent them to cover the mortgage payment. For at least a year now.

The city is full of these hastily built Lego-block looking abominations. Maybe these things are worth 200k.

City gained a 100k peeps in the decade before COVID but that’s backed up to near-zero growth from the 2020 census.

With more big layoffs coming, might be like ‘68 bust all over again…., I can stay and turn the lights out.

I turned out the lights in Seattle in 1973. The happiest day was when I left and drove across Idaho visited the sight of Custer’s last stand and made my way all the way to DC where I’m still living and working. I noticed in my Google search that the block I lived on Summit Ave E, Capitol hill is now all different. Don’t recognize a single building. Lots more apartments.

The “replace entire neighborhoods with hideous apartment blocks” thing has happened in every city it seems like. Same thing in two cities I was in (San Diego and Minneapolis). Neighborhoods I remember from the old days look completely different now.

Interesting to hear that about Capital Hill. It used to be a Bohemian kind of place with record stores and such. Well, I have about zero interest in visiting Seattle anymore.