Shares, after jumping 12% during the day in anticipation of something wonderful, plunged 22% after-hours, now within a hair of the low in March.

By Wolf Richter for WOLF STREET.

First Republic, the San Francisco bank that started teetering in March when Silicon Valley Bank was felled by its well-connected big depositors, reported earnings this evening. And it looks like it has handled the run on the bank for now: It’s still standing, though its deposits had plunged by 41% (by $72 billion) by March 31, compared to December 31.

But those deposits include the $30 billion that 11 large banks deposited at the bank in March to prop it up and keep contagion from spreading.

Without this influx of $30 billion, deposits would have dropped by 50%. So this was really nip and tuck. The deposits began to stabilize at the end of March and have since then hovered just over $100 billion, it said today.

The bank lined up a lot of cash to cover the past run on the bank and deal with a future run. But it comes at a hefty price: It has to borrow this cash from the Fed and from the Federal Home Loan Banks (FHLBs), and this is expensive money.

For its loans on March 31, the bank’s average borrowing rates were:

- Fed Discount Window: 4.85%

- Fed’s new BTFP: 4.57%

- Short-term FHLB advances: 4.8%

The Fed raised all its policy rates by 25 basis points on March 22, including to 5.0% at the Discount Window, and apparently those new rates have not fully filtered into First Republic’s borrowings by the end of March.

So this is expensive money. And the bank has to post to collateral to borrow this money. In addition, it borrowed from JP Morgan. By contrast, if it borrows from depositors, it doesn’t have to post collateral.

These borrowings combined peaked on March 15 at $138 billion, the bank said in its earnings report. By April 21, these borrowings had dropped to $104 billion.

It had $13 billion in cash and cash equivalent as of March 31, and $10 billion on April 21, up from $4 billion on December 31. Plus it has unused borrowing capacity at the Fed and at the FHLB, giving it a total available liquidity of $45 billion as of April 21, which is more than twice the amount needed to cover the remaining uninsured deposits – those are the ones that are most likely to run.

So apocalypse not now. But the bank is borrowing at high rates and it has to post collateral to borrow at those rates, when in the olden days it was able to borrow from depositors without paying them any or hardly any interest.

In Q1 2022, it paid its depositors 0.09% (near-nothing) on their interest-bearing deposits. For banks, this was truly the free-money era. But it came to an end in 2022, and suddenly money is no longer free, and if a bank wants to attract deposits, or even retain deposits, it must offer higher interest rates.

By December 31, the bank was paying a still ludicrously low 1.63% on average on its interest-bearing deposits.

By March 31, it was paying 2.14%. But that’s still low compared to the rates it is paying the Fed and the FHLB.

For banks, having to suddenly pay interest on at least some of their deposits – they’re still paying near zero on checking accounts – is just a very bitter medicine.

So First Republic’s net interest margin has shriveled to 1.77% in Q1 from 2.45% in Q4 last year. This is the difference between what it pays in interest on its borrowings, such as deposits, and what it earns in interest on its assets, such as loans to customers or Treasury securities it holds. Net interest margin is a key contributor to profit, and it’s shriveling.

But the bank holds low-yielding long-term Treasury securities and MBS that it had bought during the free-money era, and it issued many fixed-rate loans during this era, and their interest rates will not change over the term. But its short-term costs of funding have jumped.

It could issue new loans at higher rates, and it could buy new securities with higher yields, as other banks are able to do, but it doesn’t have the cash to do so.

Instead it will try to shrink its balance sheet and shed assets to use the proceeds to pay down the expensive loans from the Fed and the FHLBs, it said today.

But it cannot sell the long-term securities because that would lock in the unrealized losses and pull the rug out from under it entirely; instead it will have to keep them till maturity, at which point it will get paid face value. But it’s hard to shrink a balance sheet that way. So it’s backing off on lending, and it will focus on loans that it can sell to get them off its balance sheet. This is a long slow process.

And while it’s in that process, it’s essentially a zombie bank. The bank is now looking for “strategic options,” it said. It will lay off 20% to 25% of its workforce in the current quarter, shrink its office space, and trim executive compensation. So the plan is to shrink in order to avoid toppling.

Shares, after rising 12% during the day in anticipation of something wonderful, plunged 22% in after-hours trading, to $12.46, within a hair of the closing low in March.

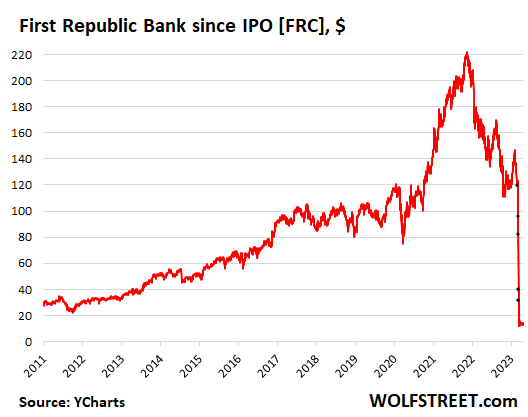

But after the kathoomph the stock already took, the last step is so small it can’t even be seen on the chart. The stock is down 94% from the dizzying high during peak consensual hallucination in November 2021 and is one of the more spectacular heroes in my pantheon of Imploded Stocks:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Nothing worse than going through withdrawal symptoms, if you’re high on your own supply.

“But those deposits include the $30 billion that 11 large banks deposited at the bank in March to prop it up and keep contagion from spreading.”

If I had deposits in the 11 large banks and learned that they are using my money to keep a zombie alive, I would be withdrawing my deposits for lack of accountability and putting my money at risk.

Its farcically the internet’s fault, it makes it so damned easy to panic.

Well to your point Xavier, fear is arguably the strongest of human emotions. It suspends rationality and critical thinking to trigger the fight or flight self preservation reaction.

Sadly, in our times, it is often employed by the …internet and social media….. to achieve nefarious ends.

they were drunk before, tried getting sober only to realize they needed another drink

but punch bowl is down to its last one

Not sure. Without internet, the headlines in papers would have delayed the panic by maybe a week.

Nothing scares people more than long queues at the bank, while who knows what anybody’s doing with their keyboard.

I wonder if fractional reserve banking systems, basically created and expanded during the 19th and early 20th centuries, are consistent with the modern speed of information (eg fear contagion) that is provided by the internet. In the olden days, the fact that it may take a week to disseminate news at least provided some time to make a more reasoned judgement. Now, you get the information, email your friend – panic – and remove your deposits.

Sooner or later the truth always prevails, and so many more banks are in the same predicament ready to go to bank heaven. Which will put so much more pressure on the Federal Reserve. Debt is their life blood, which will ultimately be their demise.

When “Fed the Moneyprinter” and “DC Gun to the Head” tell banks to do something…they do it.

Voila…”industry support”.

Leo,

So, on principle, you would abandon the most insured financial entities on the planet (after the Fed itself), and put your tiny sliver of money “at risk”? To what, send a message? To who, other than yourself? Just curious.

If you found out that the people entrusted with your money were acting in a way that threatened your savings, withdrawing money isn’t ‘sending a message’, it’s saving your money.

It’s easy to transfer your savings to a safer location with a few clicks of a mouse and not deal with the hassle of a potentially collapsing bank.

Phleep, I can always withdraw it and put it in 13 weeks TBills. No bank pays more interest at 13 weeks.

The word that you are looking for is “Holding your bank accountable”.

This 30 b came in the form of uninsured deposits . These large banks would not have made such deposits without some type of guarantee by the Fed /Treasury .

And these deposits are hardly cost free for FRC . Since the banks providing these 30b in deposits can get ~ 5% risk free , it is reasonable to assume that these banks are receiving greater than 5% on their deposits at FRC .

I wouldn’t assume these banks did this for the fees. On the contrary, I would assume these banks got a call from the Fed and were told to do it, a la LTCM. If you look at the short list of banks that made the deposits, the top banks, you would know immediately they got the call. The incentive would not be fees, the incentive is do you want to remain in business, a la Bear Stearns/LTCM.

I am willing to take a position that the financial markets have been rigged by the Federal Reserve Bank of the United States since the so called ” Great Recession ” which was, itself created by their predecessors, Greenspan, Rubin, and Summers.

Like our military strategy. The cover up has become the mission.

I think our military strategy is transparently to uphold a world trade order that favors us.

Has been since the Bretton Woods conference.

Perhaps the banks get first pick in buying the assets?

Shrink and earn out in an impossible interest rate environment.

Bring out your dead, bring out your dead….

Band aid was just ripped off the gaping wound balance sheet.

Someday this war’s gonna end….

The current interest rates are hardly onerous.

My company bought my mortgage interest rate down to 7.5 pct when they relocated me to match my current payment on an ARM. Which took a decade to reach the inflection point where I was paying more for the borrowed money, 3 pct, than the cash earning .001 pct.

Is Yellen going to say FRC’s problems are a systemic risk? What happens to that $30 billion the big banks loaned to FRC, if FRC goes belly-up? Who’s next, Wells Fargo, UBS, Zions, Deutsche? There was a cool website around 2009 called, I think, fuckedbanks.com, or something like that. The guy would list all the banks that failed on a daily basis. Friday was the big day, after closing time.

Can FRC’s imminent demise account for the bizarre behavior seen in this month’s 4-week T-bills? I mentioned a few days ago it might be related to bank problems, but I could only talk about correlation, not causation. I will suggest that when there is unusual action in Treasuries, something unusual has happened or is about to happen in the financial world.

FRC is a punk ass bank that probably should have been terminated at the moment of inception. In my opinion, their description of their reason for existence was always a pile of horse manure, too anyone paying attention.

Search for a CoinDesk article 4 days ago about ‘pv01 max boonen’. Could be a reason the 1-month Treasury is wonky.

The Crypto-bois could be about to disrupt the credit markets more than folks realize. May even redefine the term ‘Bond’.

It will be interesting to see how all of this impacts the Corporate Bond market!

Treasury market is broken and been broken while Yellen can act surprised. Spreads are out of whack. Volatility is extreme. The entire Treasury yield curve trades like a penny stock. If they don’t do something soon, you will be able to take out a second mortgage and buy short term MM funds at a premium spread.

The banks are woefully bad, but its as if $’s were all that good.

Why have all your eggs in 1 currency basket?

Just an amazing story and how did these folks not hedge for higher rates or better why did they not hedge

That definitely is a question for future scholars;

why didn’t the financial businesses hedge their long term risk exposure from an increase in FFR interest rate 0.0 to 4.5 pct in a years time. personally, I don’t think the Fed’s action was excessive. More belated, as the dominant monetarist economic doctrine was proven to be a half idea by a lunatic.

They didn’t hedge because they lived through the previous time (four years ago) when the Fed attempted to change course, and immediately turned back because the markets threw a tantrum.

SVB, in particular, made a huge bet on a Fed pivot by skewing their portfolio so far towards MBS. They chose poorly.

They can’t hedge now because the cost of hedge outweighs the return on the underlying securities.

The difference this time is inflation. I believe Wolf may have mentioned this once or twice.

Now I guess we know why the Fed took so much time to get to 5%. Would have wiped out the banking system if they went twice as fast.

I hear this a lot: “Why didn’t they hedge?”

Please understand what a “hedge” actually is.

Hedging is just taking the other side of your trade. It takes profit off the board if you’re wrong on your analysis, and the trade goes against you, BUT it only ensures that you lose LESS money. If you’re a terrible analyst, make dumb, naive trades and lose money. . .then “hedging” is not a silver bullet or a get outta jail free card. These banks were reckless and bet on ZIRP forever. There’s no magic chicanery that can ensure profitability when you’re betting your entire balance sheet on central bank policy that’s failed for 10+ years. These fools were high on their own supply, and “hedging” can only stave off so many losses.

To hedge you need a sucker, er, counterparty, eh? Who do you imagine was out there eager to take the alternative bet on? And in size?

Which is to say that hedging was going to be expensive, and that means lower profits, so C-suite decided to let the chips fall where they lay and, oops …

I wonder if this information sparks a fresh run on deposits held at the bank.

Opposite? Depositors OK, stockholders stuck in hell?

Ha cheap money! More like appropriately priced money. If banks hadn’t been paying nothing on deposits and wilfully fanning the flames of the asset bubble dumpster fire pre-covid the mess we’re in wouldn’t be as bad. Now they have to come up with sound business models except their customers are so addicted to high valuations that they can’t commit themselves to borrow appropriately priced money for deflating assets. How much do you want to bet that executive compensation is only trimmed nominally?

Exactly. Banks have been cheating depositors for years. Not the chickens came home to roost.

Or both as depositors are bailed in and become de facto stockholders of worthless paper.

They should have bought nice safe Tech stocks.

That graph is EPIC!

Honestly, we need a good many more bank failures. The Fed has to come out of this massive blunder learning some lessons.

If you think these greedy scum are going to learn any lessons, you have been asleep. Despite every horrific outcome frome their policies over the course of the past 30 years, they have done NOTHING to change course, continuing their theft.

Only a complete collapse of the currency and their subsequent downfall will they suddenly get religion – when it is much too late for any sort of apology or repentance.

Kaboom!

The precedent has been set….

All the nation’s $17 Trillion in deposits must get the same treatment as the SVB and Signature depositors.

The magnitude of what Yellen did, at the spur of the moment, has ramifications that will be felt for a long long time.

Time to buy their stock?

Anyone got another 30 billion to give them?

The recitation of the apparent facts are breathtaking. Zombie, indeed.

Should the gluttons be rescued. At some point, it seems to me, the herd is weakened to the point that it begins to resemble the zombies that it rescued.

The bank is dead, not even a zombie. The rest of the deposit base will be gone by the time they report in July. There is no reason at all for anyone to keep deposits there after today.

I’m keeping some of my money there. I’m below the FDIC limit, and I like this bank and hope it survives. I did hedge my bets and open a credit union account elsewhere just in case.

I’m curious why people would like any bank, unless they are profiting from some form of ownership or special client relationship with the bank. American businesses, and especially banks, have evolved a norm of screwing retail customers six ways till Sunday. And they smokescreen the various ways they do that with low-IQ targeted advertising.

Some banks have websites that are more likable, in terms of user friendliness and functionality. American banks are above average in that. But not being a rich preferred client, my basic orientation to all of them is adversarial. They have rip-off savings / checking interest rates, and various sneaky unjustified fees for various services / functions (e.g., foreign transaction fees) — always trying to bite you like swarms of mosquitoes and fleas.

They may pretend, but with regard to actual money policy they just don’t compete for, or care much about, the non-rich retail customer. For example, I had an Expedia branded credit card from Citibank for a decade or so, and had accounts with them dating back several decades. They terminated their relationship with Expedia, and cancelled my card. Yet even with my credit rating in the 800s, months dragged on after I applied for a new card (I had established a new U.S. address, which is also my U.S. tax address, Medicare address, etc.).

Still, it was just continuing B.S. from Citibank agents, often with hard-to-understand Indian or other kinds of accents. I can’t help but think that because I always paid off the card every month (no interest profits for them), they were less motivated to issue a new one. Okay, no problem. Almost all my money is out of their comparatively high interest savings account now. One can get about the same from TreasuryDirect.

Wells Fargo was giving me 88 cents / month in interest while charging $25 / month as maintenance fee. Had some money parked there, and needed cash, which dropped the amount below their “minimum”. Paid the $25 once, after which I said fvck them, took the money out closed the account, Synchrony bank current saving rate is 4.16.

On another note, has anyone seen the slew of “buy gold, dollar is crashing” videos surfacing quite a bit on YouTube?

“…anyone seen the slew of “buy gold, dollar is crashing” videos surfacing quite a bit on YouTube?”

They have been surfacing on YouTube ever since there was a YouTube. That’s how gold sellers promote their services.

I like my bank – I have a checking account there, multiple loans, and a credit card. I am a great customer except for one thing – my savings account is somewhere else making more than 0.01% interest.

Just because I like my bank doesn’t mean that I have to accept zero interest on my savings.

You didn’t pivot from bank to another , did you ?

FWIW – I have [brokered] CDs at Signature Bank, which are still accruing interest. I’m also below the FDIC limit and therefore am not worrying.

I think your right. I would open a taxable brokerage account with a number of citizen friendly brokerages and put the excess reserves from my bank account, which have been earning 17 cents per thousand dollars for the past 15 years to work in a federal money market account and earn 4.4XX pct return.

With the proviso that you have checking writing privileges so you can top off your bank account by writing a check when need be.

I would love to see FRC go bankrupt along with the rest of them. Chase, Wells Fargo, BOA, Citibank – it would be a beautiful day when they are all in ruins and disappear. Good riddance to all of them!

Careful what you wish for: If all the banks collapse and vanish, the lights in your house will go out, and this website will vanish, and you will no longer be able to post comments or buy groceries. The banking system is the financial equivalent to the electrical grid.

I think you could get by for awhile with a couple of soup cans and one hellova long piece of string.

I think we could get by with the existing credit unions and a few banks that do not engage in malfeasance with their customers. I think we could get along just fine with the elimination of the banks I named as well as the other similar institutions. Since they all depend on government largesse maybe the taxpayers should vote on whether they should continue to exist or not?

Credit Unions don’t even pay income taxes, and they’re also insured by a government agency (NCUA), and they benefited from QE and all the other stuff just as much as banks, even though they paid no income taxes, so “they all depend on government largesse” even more than banks.

Well let’s get on with it, then. Because this whole economic model of “too big to fail” is garbage. Banks and bankers are a cancer upon society.

TBTF is beyond reform. Radical cleansing is necessity. Maybe the future won’t need banking at all.

Banks are what I would call “critical infrastructure”. You may not like them, but they are necessary in a civil society.

Be careful what you say. My spouse works for Wells Fargo.

I remember some time back a big German bank that failed miserably during the GFC offered us a mortgage loan of 1% for 15 years. We did not need it, but we were thinking that the bank was crazy. Surprisingly, the negative rates era ended, LOL.

It was still the case until Jan this year. I am in contract in France, I’m the seller, and the very secure buyer almost lost his deposit when his approved (but not locked) mortgage went from 1.15 to 3.5% in a few weeks. Shocking really. Hopefully closing next week. Euro banks are all more or less as zombies as Jap banks.

The rate of the mortgage isn’t the real question; the one that matter is if the bank keep the mortgage in his books or sell it to bond investors. And given the ZIRP/negative rates in Europe, maybe he found enough bagholders to sell the morgage.

If the bank did sell, he didn’t keep the asset and just earned a little revenue. If he didn’t…

Wolf,

I really wonder if a whole lot of this

money rolled into 4 week treasuries,

leading to the recent wonkiness there.

Didn’t some of that line up with the

auction/issue of new 4 week T bills?

J.

Kinda shocked there wasn’t a history of a multi billion dollar stock buyback with this bank.

They messed up.

Mark it a zero because they are dead. Giving money to rich clients in interest only loans for 10 years on their personal mortgages for sh.its and giggles turns out to have been a bad idea. They deserve to go under. And will.

The crazy chart indicates that a mountain of derivatives are now under. Which also means that the balance sheet of the counterparty is also under. Instantly. Now who are they? Where does the daisy chain stop? All the way to Switzerland.

Taking NO questions from analysts when you are fighting for your life is about as bad a sign as you can give.

I have a feeling that if we could instantly look in to the true finances of many banks, retailers, insurance companies, airlines and hotel chains we would see a regular zombie hoard heading our way.

Want to see something concerning? Check out Visual Capitalist,showing the percentage of deposits in each large bank that exceed insurance limits. Citi’s percentage totally freaked me out.

It reminds me of Fannie and Freddie going into 2008, in the sense of big risk and moral hazard, relying on implicit government guarantees.

I don’t see why depositors are unwilling to pay a little for a work-around, spreading deposits across banks, under insurance limits. Then again, I don’t see why bank managers didn’t hedge their interest rate risk. the complacency shocks me, given the background risk.

The amount of uninsured deposits will directly correlate with amount of deposits with large corporate accounts at the bank. We wire tens of millions of dollars around weekly, it is not feasible, desirable, or an internal control best practice to open hundreds of bank accounts.

Couldn’t get the list to populate on my phone. Did you see Wells Fargo??

Fannie Mae stock is worth about 1/100th of what it was in 2007, despite housing bubble numero 2 being such a high flyer, what gives?

It’s not a real stock and they have no capital since they are under government receivership and are not allowed to retain profits.

So why was it worth $60 a share 15 years ago?

Because what I said was not true 15 years ago.

Well, yeah, if you buy another company for $1 billion, you and then the recipient are going to have $1 billion in your checking accounts. If you pay dividends totaling $500 million, you are going to have $500 million in your account. If your payroll is $300 million each time, you’re going to have $300 million in your account. If you have monthly operating expenses of $500 million, you’re likely going to have $500 million to $1 billion in your account. People buy properties, the the cash flows through bank accounts. Bank accounts are hugely important for day-to-day business.

~4800 insured banks. Couldn’t you create synthetic accounts spread over all of them? Computers shouldn’t mind. Business idea?

Know your customer rules make this impossible. Banks have to do due diligence and especially with corporate accounts there are mountains of paperwork and signatures to get bank relationships set up.

This is all a good thing btw

As a mere peasant, it was easy enough for me to fill out an agreement with my bank such that any amount over $250,000 would be automatically moved to another FDIC-insured bank. It is called an IntraFi Network Deposits DDA-MMDA Deposit Placement Agreement. It works seamlessly. It is not much needed now since I moved almost all of my money into Treasuries.

The big boys keep deposits well over $250,000 at a bank probably because they have deals with it, probably regarding loans.

The answer is insured money market accounts and Tbills. Any competent or somewhat literate CFO should manage it.

If I am a company daily passing cheque to supplier, have to meet monthly staff salary, have taken cash credit/ hypythocation loan etc from a bank,I won’t be able spread risk by opening multiple bank accounts. But iam a retired senior living on FD interest income. In my country insured deposit per bank is ₹500k. So I have taken diversification to the extreme by opening Fd in many banks.

Hussman has pretty interesting article explaining that US Treasury issues debt, but the Fed is who stuffed society with cash that has ended up as excessive uninsured deposits in banks.

Jebus. A bank’s value should not increase by 10x in 10 years without getting all sorts of scrutiny / re-thinks.

I’m old enough to remember when banking, insurance, etc. were low-risk low return industries.

And also, get off my lawn.

Any bank that claims it understands or “gets” the needs of today’s startups is a bank that will fail. Startups loved SVB because the bank was just a pawn their game.

A good bank has lots of companies and people that hate it because of tight lending requirements.

Some dude 9investor was on CNBC a few months back when the stock had dropped to $120/share. He was asked if he was buying the stock. He said he was buying on the dip. I wonder what this loser is saying now.

Indeed. If you want a job with zero accountability, be a stock ‘expert’ on TV.

At least Cramer has started to apologize for some of his past advice.

He has to keep coming back on TV every night and face callers.

He is not yet screaming the Bail Out Now signal that he failed to do in 2008.

He is there to “Entertain and Teach You”. The teaching part is partly the school of hard knocks.

FRC has recently suspended preferred dividends .

FRC has been downgraded today by Wall St analysts.

The latest news is that the Fed / Treasury is involved in some sort of bailout for FRC .

Looks ominous for FRC common

As of 10:38 am PST, FRC is at $9.32, down 42%. It is circling the drain. It was one of the more predictable bank collapses. The free lattes did them in.

What the FED and .gov did is a crime. They destroyed pricing and the entire economy in favor of creating the largest speculative mania in the history of mankind – and they did it in cahoots with their global banker buddies. This was intentional.

This great swindle made the already wealthy obscenely wealthy. The working class and the poor who have no assets got nothing. In fact, they got negative returns. They get to pay for it in the way of rampaging inflation – something the central banker pigs called “transitory.” They probably secretly laughed among each other as they conspired to float that lie.

And now here we are, left to deal with the after effects with the most disgustingly corrupt banker and political regime (ALL of CONgress) in the history of the country still at the helm. The people who have caused all of the pain are still in charge and now supposedly are going to make it all better.

I’ve got news: It’s not going to get better at all. Everything will be getting worse from here on out. Inflation rages. And the popular talking point is that there is more money-printing on the way as soon as things start to wobble. We need to get rid of all of the scum who caused this. Every last one of them.

Is that you Tucker Carlson??

Preach on.

Stay in denial bubba That always helps

Fed Reserve needs to bite the bullet and raise rates. The fake economy will of course go into a recession but its a harsh but necessary medicine needed to clean out the garbage.

This is a lack of political will. People are trying to avoid the painful rebuild that is necessary.

I think the inflation is intentional. However, I don’t think the economic malaise is intentional. Powell and company inherited this problem just as much as they are contributing to it. I don’t think they actually planned this. They just lacked the courage to acknowledge it and face it down and when faced with bad choices, opted for the cowardly way out and pretend inflation is less than it actually is.

Unfortunately for us, we are just going to be worse off for it because we made a society that believes it doesn’t need to work. It can just work out at the gym for vanity, spend borrowed money, dump that debt on other people… this only works when there are enough honest people. Now the tumor has taken over… short of a targeted attack on the tumor itself, this body is going to crash.

Enjoy your life. Life is short. Don’t save for a future that doesn’t exist. Maybe the reckless spenders are right after all…

Probably a30% stock haircut ,,then rate cuts in 4 th quarter ,followed up by 10% + inflation. Then depression In 2025. They outsourced our country,now they go down the same toilet as us peons

During the most recent bank runs, many of the account holders of the banks that experienced the run, never visited the bank. They were on their iPhones and used mobile banking Aps to make the withdrawals. Word is out that many were so panicked that they didn’t have time to get off the toilet when they made the withdrawals.

Note that Rex Tilleson was the first Cabinet Appointee to be fired while he was on the toilet. Now we have the first bank run, not from depositors lined up outside the bank, but rather originating from the toilets.

Get a mop!

It’s good for banks to compete for deposits. Competitive advantages could be higher interest rates or the illusion of more security (i.e. why all the deposits flowed to Chase). Junk banks like SVB and FRC don’t deserve deposits if they are going to run their bank terribly.

Bank runs have for decades taken place electronically because it’s the uninsured deposits that are at risk and that are getting yanked out. But you’re not going to line up at an ATM or at the branch to yank out $3 million. You get on your electronic device and transfer the money out, as you normally do in smaller pieces, but this time you move most of your money all at once.

What was new was the coordinated nature of the run, a form of collusion via social media, discussion boards, messaging systems, and instructions from VCs down to their portfolio companies.

First Republic stock is now down 44% this morning!

I’ll know the government is out of the banks when I can get a toaster, a radio or a coat hanger tree again for opening or renewing an account. The good old days.

In 1997 ( I was fresh from the boat , having moved from HK after china hand over) , I got a ice box ( travel type) from CALFED for opening a checking account. They were doing promotion in the street in Burbank. Good old days indeed.

Ok,

1 Zombie Bank…….should we panic ?

Depends, how many other Zombie Bank will be found ?

Empty Offices, Commercial Real-Estate loans going South.

Auto Loans defaulting.

I’m scared……That is until the Fed returns to ZERO or Negative Rates.

Bull and Bear Cycles……….Life Happens

I’ll be scared if the Fed *does* return to zero rates.

Don’t mess with my 5% CDs.

Mr Magoo,

Zombie bank for stockholders, NOT depositors.

Read the article — not just the headline — and you will understand.

When FRC goes bankrupt, it will be interesting to see what FDIC is going to do about that $30 billion in “deposits” given to FRC by big banks. If FDIC treats deposits like a normal bank collapse, they will only get $250,000 back per company. If they want it all back, Yellen will have to declare FRC is another “systemic risk”.

“Some of the biggest U.S. banking names including JPMorgan Chase, Citigroup Inc , Bank of America Corp, Wells Fargo, Goldman Sachs and Morgan Stanley were involved in the rescue, according to a statement from the banks.”-Reuters

‘In nineteen twenty- nine, the banking structure was inherently weak The weakness was implicit in the large numbers of independent units……one failure led to other failures and these spread with a domino effect.’

J.K Galbraith, The Great Crash, Causes.

Before the Depression, with a much smaller economy than 2023, there were so many US banks that the number of the failures alone in the next 4 years were almost 10, 000, suggesting that starting a bank was an American hobby.

It’s better today with a mere 5000 separate units or about 50 times per person that of Canada, but the domino effect still pertains. As smaller dominos topple they can topple bigger dominos. The metaphor of an avalanche may be better.

“Cascading counterparty failures” is the phrase you’re looking for. In 2008 AIG was about to trigger such a cascade, and the bailouts, massive money creation and ZIRP were the result. If similar tremors start to occur over the next few weeks or months, there will be very rapid responses (like the BTFP) from the Fed to try to limit the total monetary response, but if necessary the Fed will cut rates deeply and quickly and pray that inflation doesn’t blow up. Wall Street is expecting this, which is why the market is so resilient. If the Fed can nimbly manage future wobbles and tremors without cutting rates and inflation persists, the market should eventually reprice down in a big way because the yield on the 500 is currently very low when compared with Treasuries.

I cant imagine why depositors are not pulling out more cash right now. Even if your money is insured, why keep it in a zombie bank?

I just wonder if the bank starts losing money with too much compression of the interest margins to survive.

Zombie bank for stockholders, NOT depositors.

Is FDIC going to bail out all uninsured deposits at FRC, like with SVB?

“At March 31, 2023, excluding the $30 billion of deposits made by the large U.S. banks, our estimated uninsured deposits totaled $19.8 billion, or 27% of total deposits.” – FRB Earnings Release Q1 2023 – Newsroom | First Republic Bank

Sounds like about $50 billion are uninsured.

No where to put it ,cash is trash ,housing to high ,gold ,to high,food good idea LEAD looking good

Its all relative. There are probably a few stocks that can do well in this environment. McDonalds did ok. Maybe a Walmart or Dollar stores as people trade down.

I think the most obvious is just to collect the 4.8% you get on cash til the Fed cuts rates a few times. I think the rule of thumb is wait 3 rate cuts before getting interested in risky assets.

People might have been smart to have bought the 10 year at 4% plus betting on a recession, but to me you are betting on Powell to kill inflation dead and I wasn’t going to bet on that.

I am forced to keep some of my funds in Wells Fargo because they are the only game in town around here. The other big banks are worse than Wells Fargo if that were even possible.

It is time to construct an iron maiden with Jerome Powell’s name on it, and start parading it around the homeless camps in all of the big cities. Maybe that will get some attention.

First Republic stock just crashed 10%. They are going under. Frankly, I don’t give a flying f$ck if they do. In fact I’m going to celebrate. It’s time to stop bailing out these flunkee banks run by morons. Who are idiot banks that lent them money. I want a list. We should pull our deposits from them for being so stupid.

The FED and .gov have shown their hands. They are working for the wealthy 100%, using taxpayers to bail them out on their bad bets. Socialism is alive and well for the rich, rugged individualism and bootstrapping for the poor.

We’ve got to get rid of the wealthy. We’ve got to destroy them. We have to take their money and put them in prison. We have to remove them from the government. Asset seizure and imprisonment are the only answer at this point.

First Republic was the poster child for a bank of the wealthy for the wealthy. There is going to be hell to pay if Yellen decides to bail them out when they have another run on their deposits and the stock goes to zero which is probably going to happen. Especially, when they let some small town bank in a farming community go under with no help from anyone.

We have class warfare going on, and they’re not even hiding it. This is why taking everything the wealthy have is the only option at this point. They need to be taught a lesson. Modern day robber barons are not acceptable.

I’d think failure is the one absolute cure for consentual hallucination syndrome. Why then are all these “rescue schemes” trotted out?

If there are few if any real consequences for mal investment, then mal investment continues.

Does anyone see this coming down to a war between Janet Yellen vs. Jereme Powell? Janet helped push the fiscal packages through making Powell look foolish for being so slow to get off of Zirp.

I read Powell is determined to take away the Fed put and never cut to zero again. If so, politicians going to have to suck it up and give the country the bad news that welfare/warfare era is over and done.

The FED has so badly destroyed the economy that BitCON is considered safer than banks.

I am starting to get resentful of my tax money (via various Gov departments) being used to keep the consentual hallucination crowd from feeling any consequences for their mindless investment policies. I’m all for wealth building and the one percenters, but when they act stupidly with their money, it should be THEY who bear the consequences, not me.