But the Chinese Renminbi didn’t make any progress at all last year.

By Wolf Richter for WOLF STREET.

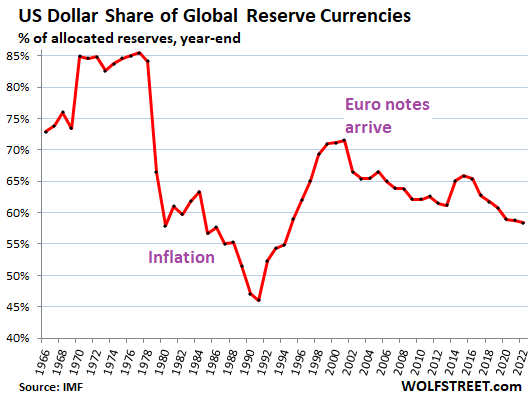

The share of the US-dollar as global reserve currency dropped to 58.4% at the end of Q4, according to the IMF’s new COFER data. This was the dollar’s lowest share of global reserve currencies since 1994.

Back in 1978, the dollar’s share started plunging from around 85% of global exchange reserves as inflation exploded in the US, and other central banks got cold feet holding securities denominated in this stuff. In the 1980s, inflation started to come down. But central banks – and the rest of the world – took a long time to regain confidence in the dollar, and the dollar’s share of reserve currencies didn’t bottom out until 1991, with a share of 46%. Then came the bounce until the euro showed up, which put a stop to the bounce. The chart shows the share of the dollar at the end of each year.

The US dollar as global reserve currency means that foreign central banks and other foreign official institutions hold US-dollar-denominated assets, such as US Treasury securities, US corporate bonds, US mortgage-backed securities, and the like.

These institutions also hold foreign exchange reserves other than dollar-assets. But holdings in their own local currency are not included in foreign exchange reserves; so holdings of dollar-denominated assets by the Federal Reserve are not included; holdings of euro-denominated assets by the ECB are not included, etc. Same for other central banks: their local-currency assets are not included.

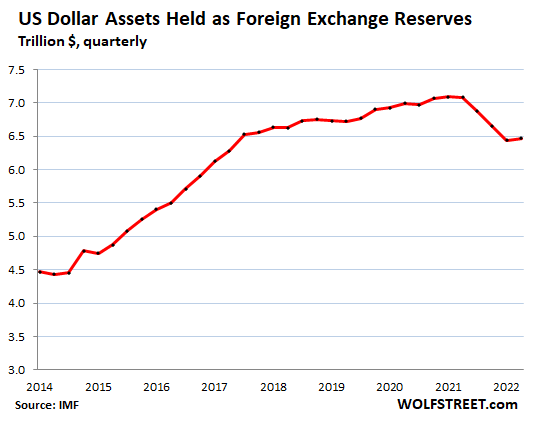

In dollar terms, at the end of Q4, central banks other than the Fed held $6.47 trillion in USD-denominated assets, such as US Treasury securities, US corporate bonds, and US mortgage-backed securities.

Even as the dollar’s share has dropped since 2014, holdings of dollar-assets rose from $4.4 trillion in 2014 to $7.1 trillion in Q3 2021. But then, note the $621 billion drop in USD holdings starting in Q4 2021, which was when the Fed started talking about ending QE and kicking off rate hikes – and by now it has hiked by 475 basis points.

The other major reserve currencies.

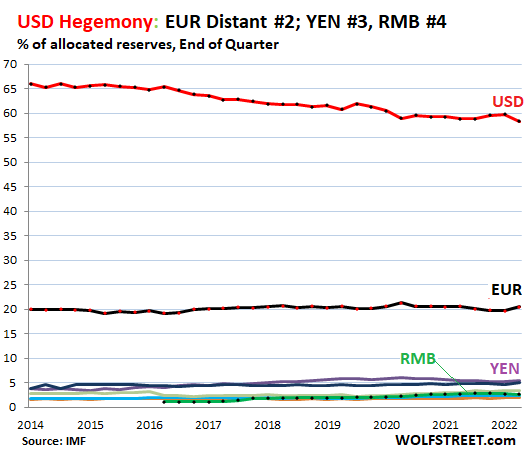

The euro is the second largest reserve currency, with a share of 20.5% at the end of 2022. Back in the day when the euro was created, there was talk that it would reach “parity” with the dollar, but the Euro Debt Crisis brought to light the euro’s structural weakness, which ended the parity talk, and the euro has maintained a share of roughly 20% since then.

The yen, the third-largest reserve currency, had a share of 5.5% (purple line at the top of the colorful spaghetti at the bottom in the chart).

The British pound, the fourth largest reserve currency, had a share of 4.9% (blue line just under the yen).

The Chinese renminbi, the fifth largest reserve currency, lost a little ground last year, with its share dipping to 2.7% at the end of 2022. Due the capital controls, convertibility issues, and other issues, it seems central banks are leery of RMB-denominated assets and are moving slowly or not at all. At this pace, the RMB won’t get close to the USD as reserve currency for decades (green line near the very bottom).

The other currencies in the spaghetti: Canadian dollar (2.4%), Australian dollar (2.0%), and Swiss franc (0.2%). There is a number of other currencies with a tiny share each (each less than the Swiss franc’s share), and all of them combined have a share of 3.4%.

Dollar-exchange rates impact foreign exchange reserves.

The values of foreign exchange reserves denominated in euros, yen, British Pound, RMB, and other currencies are translated into USD figures at the exchange rate at the time, for reporting purposes, so that they can be summed and compared.

For example, the value of Japan’s official holdings of euro-denominated assets is expressed in dollars at the EUR-USD exchange rate at the time. So the magnitude, expressed in dollars, of euro-denominated assets held by Japan rises or falls with the USD-EUR exchange rate, even if Japan’s holdings don’t change.

In other words, the exchange rate between the USD and other reserve currencies impacts the magnitude of the non-USD assets.

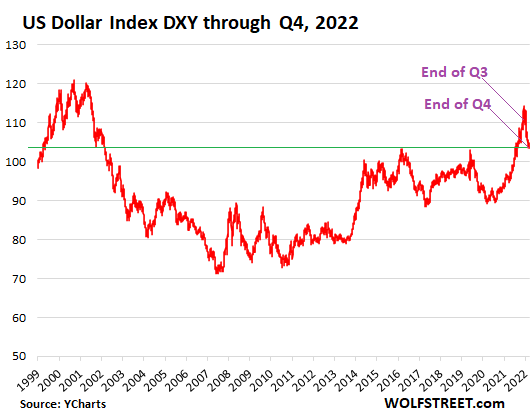

Since 2000, the exchange rates of the major currency pairs have bounced up and down within a fairly wide band, as shown by the Dollar Index [DXY], which is dominated by the euro and yen, but also tracks the British pound, Canadian dollar, Swedish krona, and Swiss franc.

At the end of Q4, the IMF’s cutoff point for this reserve currency data, the DXY closed at 103.4, where it had been in the year 2002, but with a lot of scary rollercoaster rides in between (data via YCharts):

So the dollar’s exchange rate with the euro and the yen at the end of 2022 was roughly where it had been in 2002. But back then, the dollar’s share of reserve currencies had been 66.5%; and at the end of 2022, it had fallen to 58.4%. So the decline in the dollar’s share is not due to exchange rates.

Trade surplus and large reserve currency, no problem.

The Eurozone – whose currency is the #2 reserve currency with a 20% share – has had a trade surplus with the rest of the world in recent years, particularly with the US. This shows that an economy with a trade surplus can also have one of the top reserve currencies, disproving some theories that the country with a large reserve currency must have a large trade deficit.

The big enabler: But having the dominant reserve currency enables the US to run up its twin-deficits: the gigantic US government deficit and the monstrous trade deficit, fueled by Corporate America’s three-decade search of cheap labor, products, and services. If in the future the USD-denominated assets lose a lot of share among reserve currencies, both of these deficits will be more difficult and expensive to fund.

China: It is also likely – and I think good for the global and even the US economy – that China’s RMB-denominated assets, given the huge size of the economy, will eventually ever so slowly become a larger player amid global exchange reserves.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“The big enabler: But having the dominant reserve currency enables the US to run up its twin-deficits: ”

Or is this back to front?

The simple reason that the Renminbi is not growing as a reserve currency is that China has no trade deficit and no need to attract foreign money by creating big liquid treasury bills, bonds or quality bank deposits to attact that money.

It is one thing to imagine reserves and investments being pulled out of US.

Quite another to imagine where they might go or which credit worthy borrower would want them.

Good lordy. I debunked your nonsense preemptively in advance, except you didn’t read it, LOL. Read the paragraph about the Eurozone (in bold). OK, since you won’t read it, here it again:

“The Eurozone – whose currency is the #2 reserve currency with a 20% share – has had a trade surplus with the rest of the world in recent years, particularly with the US. This shows that an economy with a trade surplus can also have one of the top reserve currencies, disproving some theories that the country with a large reserve currency must have a large trade deficit.”

The Chinese government very much WANTS the RMB to become a much larger reserve currency. They pushed really hard applying for and pushing through reserve currency status with the IMF and succeeded in 2016, when the RMB was declared a reserve currency, and the RMB’s share rose in the early years but now has stalled.

As all fiat currencies are inflating in tandem, charting their exchange rates no longer give the complete picture.

Dollar may get stronger against Euro and weaker against a loaf of bread. We cannot survive by Euro bills. We need to eat bread for survival.

So these exchange rates are now meaningless as compare one fiat against another fiat.

What is the fiat like dollar and Euro backed by?

1. In theory it’s backed by taxpayers willingness to work hard and productively to pay back the government debt.

2. In reality, US taxpayers cannot be enslaved to payback the debt that was created to bailout billionaires.

The currency markets only determine which fiat to trust more than others, and it turns out that US crap still smells sweeter than most other craps.

That’s about it.

The Russians and North Koreans may be about to introduce a new medium of exchange, i.e. thermonuclear warheads!

Like Zappa said, “It can’t happen here.”

The Eurozone is not a country

“This shows that an economy with a trade surplus can also have one of the top reserve currencies, disproving some theories that the country with a large reserve currency…..”

The Eurozone is made up of countries with vastly different economies and trade balances.

Overall it may have a trade surplus, but that is a result of a few countries and not all of them.

I didn’t say “country.” I said “economy” including in your citation of what I said. And it’s more than a unified economy:

The Eurozone is a unified economic and currency (monetary) area, and in that respect it’s similar to the US. It’s not unified in the fiscal sense because the constitution never got passed, and now it’s unified by treaty in this more limited sense.

The US had trade surpluses in 1970, 1971, 1973, and 1975 when the dollar’s share was 85%. This theory that a country or an economy needs to have a big trade deficit to be the big reserve currency is just pure idiotic BS. I have no idea why it keeps getting cited.

The Duke

Besides, the predominant portion of defense spending in their budget(s) for Europe has shifted to NATO (USA)

No wonder they could spend relatively on healthcare in their respective countries.

“China’s RMB-denominated assets, given the huge size of the economy, will eventually ever so slowly become a larger player amid global exchange reserves.”

It’s reasonable to think that as China’s CBDC makes inroads into oil pricing & its underlying Belt Road initiative that ever so slowly may pick up a fair amount of steam in less than 10 years.

The USA desperately needs to move production of all sorts of strategic goods like pharmaceuticals, solar panels, rare earth metals, etc onshore or to USA friendly countries. This needs to happen yesterday.

Also in the early 1970s, when the USD share was 85%, the US had trade surpluses in 1970, 1971, 1973, and 1975, and small trade deficits in 1972 and 1974.

I was in Detroit in 1971 and everywhere I saw bumper stickers, saying, “Hungry? Eat Your Toyota”.

The difference between Financial/Marketing jerks running a manufacturing industry and Engineers running it….the Japanese wasted us easily. From design to organization (especially corp pay scales).

And it just gets worse. I feel sorry for the rust belt folks, it wasn’t their fault. No wonder they voted to blow up their own democratic government. (talk radio having convinced them the Corps were blameless, and it was the will of God, anyway.)

Still not sure how they pull off the, “God doesn’t mess with government, only evil people do”, brainwashing job.

A comment on the organizational skills. I read that at the Honda Mtr plant, there was only a couple reserved parking spots…for the company nurse and some ambulance room. If Mr Honda himself arrived late, he had a long walk, not to mention the salary differences between all levels of management and custodians.

As a result, extremely co-operative workers gave them lots of help with production, efficiency, quality control, design, etc.

Team play.

NBay – A result of ‘American Exceptionalism’ in one easy lesson…

may we all find a better day.

They would if they could.

What Reserve % is in Gold ?

Gold is not foreign exchange and it’s not a currency. It’s an asset that can be denominated in any currency. And that’s it. It doesn’t belong here into a discussion of foreign exchange reserves anymore than crude oil or real estate belongs into this discussion.

For this millenium, a chart of all fiat against gold will look really bad for all fiat :).

Gold isn’t advertised much, because with real stuff margins are always low.

If you can print trillions out of thin air by pressing a button and then sell that shit as a valuable fiat currency, that’s where the margins are. That’s what is the real marketing skill of Uncle Sam. If you are “in the club”, you enjoy huge margins and infinite marketing budget.

It’s well supported globally as every other government does the same.

Leo,

But you’re comparing paper dollars under the mattress against gold, which in the broader sense is just ridiculously silly. You need to compare dollar-denominated assets to gold, such as stocks and bonds vs. gold. So now redo your math.

The IMF disagrees with you. From the IMF website, Gold and the IMF : “Gold played a central role in the international monetary system in past centuries when currency rates were linked to the price of gold. The fixed currency system ended in 1973, diminishing gold’s role. However, gold remains an important reserve asset and the IMF is one of the world’s largest official holders of gold.” I’ll probably go back into moderation for this post.

No, the IMF does not disagree with me. It agrees with me. You just don’t know how to read the IMF text that you cited. That’s the problem.

I said gold was an “asset” that central banks hold, which is what the IMF said, and agrees with me when it calls gold a “reserve asset.” But it’s not FOREIGN EXCHANGE reserves. That is a very specific type of reserve asset — one that is denominated in foreign currency.

I see ABSOLUTELY no difference between gold and bit coin…..except bitcoin is a lot cheaper to mine.

Sorry jewelry lovers, and it does have some industrial, dental, etc use, but there is more than enough mined for ALL that already.

Useful metals are another story, and fossil fuels the BIG one.

“What Reserve % is in Gold ?”

Doesn’t matter; it’s a different thing. It’s just the settlement of last resort (i.e. the highest money) when nations don’t have hard or reserve currency, can’t get it because their currency is not convertible, not wanted, or worthless, or they don’t have the settlement funds in the counterparty’s currency.

An extreme example is when Zimbabwe wanted to borrow money (i.e. US dollars) some years ago – only $15MM – from the World Bank. They could only get the loan by turning over their remaining gold reserves as collateral.

Similarly, Venezuela’s PDVSA state oil company was only able to borrow US $2B from JP Morgan by putting up gold as collateral. The gold was confiscated when the borrower defaulted.

In 1912 J. P. Morgan said “Gold is money. Everything else is credit.” A century later, it’s still true.

wolf don’t want to hear that

he thinks all fiat has VALUE – but it doesn’t

TRUST that fiat has ability to trade for goods because it is backed by other GOODS/trade/GOLD

“highest money”….that is funny in it’s stupidity.

If you are worried about civilization collapsing, buy .22 bricks and hide out, or look for a winning warlord to join up with

If civilization is collapsing you’ll want something bigger & more reliable than a .22…

It’s not about civilization collapsing, it’s about what collateral will be taken for loans. The borrowers had nothing else of value to offer that the lender would accept.

Lenders are (usually) not stupid.

MM

You must be a city boy. When I was in HS our nearest neighbor was 3 miles away. I also lived off grid, 10 slow miles up a shale road. A 16 year project. Every single weekend and vacation, and 6 years F/T when I quit time clocks for good at 55.

I said hide out, not fight, but I gave you the warlord option if that appeals to ya. I was cut loose with an M-1 Garand when I was 13, if that ain’t an assault weapon I don’t know what is…… Won WW2.

A stupid comment.

Your’s too, Robert…like I said, .22 bricks

Until then, COIN OF THE REALM….at least for the bottom 99+%.

I don’t think China wants to replace $. The costs of being reserve currency are high internally. See industry in last two global currencies — UK and US.

They seem to want bilateral trade in both country’s currency. If this is the case, the share of US $ could even go up because these bilateral trades might not show up in the statistics kept by international agencies — I read something to this effect somewhere. For sure, the Russia-China, China-Iran, etc trades are no longer reported to organizations such as SWIFT and IMF. Anyway again this is just speculation.

I believe that EU can have trade surplus because the Euro is not THE reserve currency. But again I am not an expert.

The three different strengths of a currency in the international fields, share of:

1. global reserve currency

2. international trading currency

3. international financing currency

The USD is still the largest in all three.

The Chinese government would very much LOVE to be top notch in #2 and #3, and they’re doing everything they can to get there. But they cannot get there unless the RMB is also strong as a reserve currency.

The Chinese government very much WANTS the RMB to become a much larger reserve currency. They pushed really hard applying for and pushing through reserve currency status with the IMF and succeeded in 2016, when the RMB was declared a reserve currency, and the RMB’s share rose in the early years but now has stalled.

How important is for the current Eurodollar ledger system the tech behind SWIFT in order to maintain hegemony in #2 and #3? Was the the use of Telex the main driver of the world’s dollarization via the eurodollar? Thanks for your work, Wolf.

China and rest of world are selling treasuries,so fed raises rates to pay them off,now dollar going down the drain they will just introduce a cbdc devaluing the currency again whack a mole . Just my views

Would it be clever to change some EUR for short dated US bonds? I am confused by the recent weeks. Why is the USD not stronger will all this banking crisis and so on? Where’s the EURUSD exchange rate going? I hearing a lot of young German people giving up their career for a better work life balance…

Don’t they have the longest paid time-off in Germany (among developed economies)? And free college? Does work- life balance mean no work at all?

All true, and a few months paid off to take care for new born children. It’s great to live here, good quality of life, but I would not want to run a business here anymore, once the boomers and Y’ers left the company.

I know of some U.S. companies that are giving the husband 12 weeks of maternity leave. What happens when they realize during those 12 weeks, they really don’t need you to come back. LOL

Ru82, every time the company I worked for had layoffs, I volunteered because I always had another job lined up and I wanted the severance package. They never took me up on this offer. I have been retired six years and they still want me to come back. So it doesn’t go the way you imagine.

I live in a “stinkin’ commie fascist hellhole” in Western Europe where we start with five weeks vacation in addition to all the holidays. Yeah, we are all trying destroy capitalism and America!

but seriously, are you truly proud that you work more than us? That you struggle at the end of every month? That a major illness will bankrupt you? That you could end up living in your car?

What does life mean to you? Putting in 100 hours a week for forty years and then dropping dead on fifth green a week after you retire? We like not working, having time for friends and family, having an educated and healthy population. Go check how long we live vs. Americans! You either whine about or mock Western Europe but we are doing fine, thanks. Much better than America!

No one works a 100 hours per week. And average is below 40 hours. We typically do not have as much vacation and retire a bit later. Maybe a year or two on average. And, we typically pay less in taxes with no national value added tax. People drop dead in US because they are too fat. We are most diverse society on planet culturally, ethnically, religiously, and national origin and for the most part actually get along ok given as many potential fracture lines that would entail blood letting in other societies. Perfect? No. But it is home.

The Americans think that long hours is a badge of honour not a sign that they can’t manage their time and be productive. That’s the fundamental difference between us and Europe working culture

Only in weimerica ,print paper for land .food,cars ,everything. Dollars euros yuan all just a medium of exchange.Not enough gold to make it currency again,silver no way to many industrial uses. Will probably end up with a resources based currency = oil ,gold,silver.Scary times

There’s plenty of gold to back currency/monetary units. It only depends on what figure gold is revalued at in any particular currency/monetary unit. They’ve done it before.

That’s why gold bugs are praying for a new gold standard so that the price of gold would have to go from $2k to $2 billion an ounce overnight. It’s just a really fun thought. But not happening.

I wonder if this will change faster now that Saudi is moving to the other side of the fence. Allegedly the ‘petrodollar’ relies heavily on Saudi resonance with US war aims.

Pick a currency that matters, not the Saudi Riyal. It represents a minuscule economy.

The US is the largest oil producer in the world, larger than Saudi Arabia, it buys nearly no oil from Saudi Arabia. The US is a big oil and petroleum products exporter, and the largest natural gas producer and exporter in the world. US fracking killed the petrodollar; it’s a useless relic. People need to get used to what fracking in the US has accomplished globally, how it changed the dynamics of the energy trade.

Wolf, would you expound on how fracking killed the Petrodollar? My understanding is that as nations move away from the Petrodollar, this hurts the USD as a global reserve currency. But if fracking has already done a number on it, maybe the Dollar is more resilient than I’m assuming. Thanks for all your work here. It’s highly educational to a non-financial guy like me.

There is no such thing as the ‘petrodollar’ and never has been as oil is just a commodity and has never accounted for more than 5% of global trade.

Hydraulic fracking has allowed the US to become a net oil producer and rival/competitor to Saudi.

It was never about the dollar ,it was about protection.

“Petrodollar” is a term coined by an economics professor at GU. It is not a real currency. It simply means dollar revenue made by oil exporters. It is greenbacks which are used to buy coke and yachts or recycled into US treasury bonds.

And the US is not a net exporter of crude oil. The US consumes about 20 million bpd of crude and produces only 12.2 million bpd. The US also exports light sweet crude and imports heavy sour (such as 500 kbp of Saudi crude).

But since the US exports about 6 million bpd of oil products, overall it is close to balanced. If (big if) fracking can hold up for another few years, the US can apply for membership in OPEC!

Expat,

“And the US is not a net exporter of crude oil. The US consumes about 20 million bpd of crude and produces only 12.2 million bpd.”

That statement is BS in an insidious way. Because:

The US imports crude oil, refines it, and then exports gasoline, diesel, jet fuel, etc. California refineries are huge in that, as are refineries along the Gulf Coast. For example, the US imports crude from Mexico, refines it, and exports the gasoline, diesel, and jet fuel to Mexico.

Importing crude, refining it, and exporting the value-added refine products is a HUGE profitable trade.

Btw, almost no crude oil gets “consumed.” It gets refined into petroleum products, such as gasoline, that then get consumed.

So if you talk about imports and exports, you need to say “crude oil and petroleum products” because this is gigantic industry, and you’re misrepresenting it.

Several Points on US oil:

They add lots of stuff up to get to the 12.2 Mbd, and lots of it isnt crude, its NGL, Ethanol, refinery gains (increases of volume, not energetic value)

Fracking produces light oil that does not produce much/any? diesel, which is the fuel that makes everything work. Conveniently there are heavy oil imports for blending right up north.

US imports of oil are substantial however, how many countries larger?

Peak oil wolf, US fracking ill be dead soon, the opec is yet in the driver seat.

Peak oil again? LOL

Peak cheap oil will one day arrive.

Peak cheap oil, yes. We’re already kind of there.

One thing that DID peak in developed economies is DEMAND for oil as transportation fuel. In the US, demand growth has been coming from the petrochemical industry.

Don’t mock peak oil. World conventional oil production likely peaked in 2006-2008. Since then it’s been tight oil and tar sands.

Fracking is dying. it is a giant financial ponzi scheme but now the returns on holes drilled is starting to really suck. And they are running out of sand!

so, mock peak oil all you want. let’s chat in 10-15 years.

Dear Wolf

Stocks and Bonds are manipulated by the government differently than Gold is. Gold is suppressed to empower the USD, whereas stocks are inflated for a false impression of growth, allowing us to export our inflation to the world in exchange for goods and services

Foods aren’t a good indicator of inflation either, since over the last 70 year we have exponentially degraded our diets and environment with toxic processes and chemicals to maximize output. Same can be said with almost any industry.

Matthew O,

LOL. Gold is always manipulated down and everything else is always manipulated up, for gold bugs. Gold bugs are the funniest creature in the world. I love gold, but I laugh about the yarns that gold bugs are spinning to manipulate gold up, LOL.

Doesn’t fracking rely on ZIRP? I keep hearing that there is tremendous amount of debt incurred with fracking but very little profit. If the cost to borrow goes up much, the profit goes away.

Frackers are cash-flowing just fine at $70+ per barrel of WTI. They’ve been paying down debts at these prices.

The problem was $20-$30.

Fracking has become a lot more efficient than it was, and production costs have come down too.

Wolf: That is great news. Thanks!

I think what the poster was getting at is there is now a dollar denominated world and there is everything else. That, whether we like it or not, is happening.

As you rightly point out, a continuing decline in the USD share of currency reserves makes it harder to fund our “gigantic US government deficit and the monstrous trade deficit”. At what point will our government’s blind, ever-increasing borrowing be weaponized against us?

Is on-shoring a workable option, or has that ship sailed forever?

The ship sailed the moment we went to universal franchise. All democracies ultimately end this way, with people voting for more and more free stuff.

Einhal. Robert Michels gets some credit for advancing the theory that democracies, like all large organizations, tend to turn into oligarchies.

But one of the classical Greek philosopers (Plato or Aristotle ?) commented on the same over 2,000 years ago.

Looking at the too-big-to-fail banks, and the too-important–to-fail-Billionaires. The people getting the “free stuff” aren’t the majority of voters.

In an oligarchy (what the US actually has), voting has no meaningful impact on policy.

Under the US party system, voters get to choose from two essentially pre-selected candidates. Having a third or additional major party wouldn’t change the outcome either. Activist government is always captured by elites as the highest bidders.

Besides, the electorate are utterly clueless and there is nothing redeeming about actual majority rule anyway. No society of any size has ever had it anyway.

IMHO there is nothing inherently wrong with the oligarchical form of rule as far as (1) interests of oligarchy remains in general alignment with the interest of most of population, and (2) oligarchy rules competently. Currently neither is the case with American ruling class, which IMHO is the root cause of American decline.

To a degree, yes, but universal franchise is, in my humble opinion, how the oligarchs gained power. They were given carrots in exchange for their votes while the oligarchs took power.

I believe the USA will hold the World’s Reserve Currency for a long time. Not forever, but 50 to 200 years or so, thanx to a large Blue Water Navy.

The Rise and Fall of Nations is an interesting read.

More immediate issues and problems are on our door step.

Insolvent banks, huge deficits, massive BUBBLES waiting to implode.

As for the USA losing Reserve Currency Status……Who or what currency would replace it ?

Bitcoin

Euro

China

No other currency comes close, yet. IMO

I assume your comment is a joke. Bitcoin is not a currency, and it’s not a reserve currency, and none of the major central banks hold any of it. Get real!

The total value of all Bitcoin out there is about $540 billion today, after collapsing by 57%, compared to $32 Trillion with a T in Treasury securities. I mean, get real!

BTC was a joke 12 years ago with a value near $0, and is a joke now with a value of 1/2 trillion….but that growth trajectory and potential S curve….may not always be a joke….

No, it will always be a joke to anyone with a brain

Yes, Bitcoin was meant as a joke. My bad.

Good thing I did not make a living as a comic.

I am blown away, as idiots call bitcoin, digital gold.

Wolf, I am very grateful for your insightful thoughts into finance.

Thank you.

Let’s add Burritos and Chimichangas a currency reserves :)

Wolf, I think you misread Steve’s comments. He wasn’t boosting Bitcoin, he was questioning what was going to replace the dollar and trashed the concept of any of the three alternatives listed. (I do agree with your point that Bitcoin is not a currency BTW).

Yes, it seems. I thought he might have been joking about the BTC part, and he confirmed he was, so we’re all on the same page now.

If we tax Corp revenue, disallow trust creation as a non taxable event and tax wealth transfer at 40% I think our budget deficit goes away.

Stop tax and direct subsidy on oil exploration, sell 9 trillion in fed holdings and give to the treasury/state governments.

Make tax avoidance a jail able offense.

We messed up in not joining international taxation so irs wouldn’t be arbitraged. Right size military spending & shrink global foot print.

Budget deficit no longer an issue, grover norquist can drown it in a bathtub

“Make tax avoidance a jail able offense.”

Is it not already? I assume if I stop paying my taxes, I’ll eventually end up in jail. Is this not the case?

How can you make tax avoidance a crime? That would make me a criminal for one thing since I choose to live abroad and pay taxes abroad (which I then don’t pay to the US). Anyone who moved to a lower tax state would be subject to arrest, let alone anyone who wanted to move abroad for any reason.

perhaps you mean “tax evasion” which is a crime…unless you are rich.

Words have meaning:

Tax avoidance = legal

Tax evasion = illegal

Following the tax laws enacted by Congress to >avoid< taxes is not an illegal act. Tax lawyers and accountants practice this daily.

Evading otherwise legitimate tax that is owed, IS illegal, and results in fines and penalties.

Bitcoin holders are desperate for someone to buy their bags so always spamming other sites.

I’ll take the under on your prediction. I’m 58 and don’t expect the USD to remain global reserve currency past my life expectancy, maybe sooner.

The reasons? First, financial disorder from the biggest asset mania which it’s end will lead to the biggest economic chaos in centuries. We are after all talking about the greatest asset, credit, and debt mania in the history of human civilization.

Second, US monetary, fiscal, and foreign policy have gone totally “off the rails”. This is for starters at minimum. Look at the budget deficits since 2008, QE and ZIRP since 2008, and the country’s inglorious foreign misadventures since at least 2001. This is for starters. Going by news reports, the US is trying really hard to get into a hot war with Russia which is completely idiotic. Other countries share some of these characteristics, but they don’t have the global reserve currency.

Third, the US isn’t actually a nation anymore. It’s a geographic political entity with a Tower of Babel monoglot culture. Deranged monetary and fiscal policy hold it together (for now) but that’s not going to last another 50 to 200 years, nowhere near it. Fake social cohesion held together by a fake economy and fake financial markets.

What would replace it?

Don’t know at this time. There is no economic law that says there has to be a global reserve currency at all. Global reserve currencies are the result of fiat currency and central banking. There was no global reserve before both. Buyers and sellers dealt direct either bartering or using metal coins. No society ever “ran out” of FX reserves because the concept didn’t exist.

Another alternative is a global currency under the future global socialist totalitarian superstate.

Important point, no economical law states that there have to be a global reserve currency. The demise of the US dollar as the leading reserve currency may as well be the demise of reserve currencies.

Does world has to have a reserve currency ? I understand that world needs a common way to settle trades, but if all countries will aim for balanced trade, will there be a need for reserve currency ? I am not an economist, so I apologize if I asked a naive question.

SDR? It is the banker’s goal to place the entire planet under their centralized global monetary control. Seems a “one world global” monetary unit, not directly connected and dependent on any one country, would be the eventual solution to realize the goal. Local currency unit for national trade but the SDR basket for international trade, so as to not give any particular country too much power. If any country is in trouble or otherwise disruptive (economically, politically, etc), the SDR basket can be reweighted accordingly.

Seems likely that resolution of trade and government deficits would affect the dollars reserve value. Corporate reshoring and near Shoring, and budget defict hawks lead the way. The Mexican peso has been rising, harbinger of things to come?

It appears that holders of reserve currency vastly prefer not to have autocratic leaders of reserve currency countries. Likely why a consortium of China, India and Russia banding together for there own reserve currency is problematic.

If China and Russia become reserve currencies, the oligarchs will steal everything and move the money to Switzerland.

Singapore is where it will be. A maritime transit way passes right by. A Formula One nighttime race on the streets. A great Symphony Orchestra. And a banking system that is what Switzerland’s once was, but no longer is: private.

But one caveat: follow the rules and customs when in the public domain of the city-state.

Except its 90 degrees with 99% humidity every single day of the year. No thanks, the billionaires can have it. Sounds like hell on earth to me

@ Kernburn.

90F + 99% humidity = dead. Even 80F + 99% humidity is absolutely brutal.

NAH catpard:

”95 degrees in the shade,,, and NO shade” is now and has been the case in the summer in FL since at least when I started noticing such things in the 1950s Surely the humidity can and does change, but most if not all of the paying construction work was always ”waterfront” in those days when the vast majority of folks in FL lived close to water.

Now,,, 99 per cent humidity happens most days in the summer for most of FL, south of I-4, versus LA ( Lower Alabama) , at least for part of the day, with a breeze, it is almost like a swamp cooler.

BTW, FL has now and always has had many seasons::: Early early Summer starts in January,,, Late late summer ends in December,,, middle middle summer is July and August,,, you can figure the rest of it out, eh?

Still think Ron should get his crew to pass a law saying any and everyone wanting to move to the Free State full of something must spend a full summer here – NO VACAY,,, before actually moving.

Singapore will die in 15 years. Too hot, too humid. Can’t live inside all year long!

Singapore is wonderful, but it’s privacy laws have turned it into a gigantic money laundering center.

The rules have been relaxed. Even coke has been somewhat decriminalized to cater to the largest concentration of millionaires and billionaires in the world. Of course, don’t shout “The PAP sucks” out loud! That is still verboten.

Hey, they could make huge deposits at Credit Suisse!

(Sorry, I just can’t help myself).

There won’t be much need for reserve currency in the upcoming resource wars. The planet is finite, human species greed is not.

That was a very popular concept back in the 1970’s.

I’m really missing your Value of US dollar since 2000 chart. I feel like it’s been few months

Maybe the current inflation will accelerate the decline of the USD as a reserve currency just like it did in the 1970s and 1980s according to the first graph. Thanks for the update Wolf.

This time, Europe/Euro has an inflation problem too.

That’s one. Another is weaponizing the USD through sanctions and extra-territorial application of US law. Apparently, the US government doesn’t know that US law doesn’t apply anywhere else. It’s more visible in the last year but that was hardly the beginning.

I suspect foreign elites and governments are a lot more fed up with this behavior than is visible to most Americans.

I would also add another consideration against USD continuing to be the dominant reserve currency – the very obvious decline of USA in the industrial and military spheres. Military decline is particularly toxic to USD IMHO.

The US used the Foreign Corrupt Practices Act to arrest a French salesman of a French reactor company while he was at an airport in the US. The US alleged that the French company had bribed the Indonesian government. From what I remember, the French salesman spent a few years in a US prison.

No doubt there are others like him out there. The US has done its best to extend its laws to foreign countries to police transactions that don’t even involve US nationals or US companies. No clue how the US compares to the former imperial powers in terms of evil deeds. The US certainly takes the cake when it comes to moral righteousness, though.

They only arrest people like that when they bribe more than Westinghouse or GE and win the contract.

US laws can be applied wherever the US can send gunboats or strangle the economy. And no foreign laws or courts (ICC, for example) applies to Americans for the same reason!

Yes, and another area where Paul Volcker had so much foresight and still doesn’t get enough credit, he knew that if the inflation of that era wasn’t tamed, it would steadily and rapidly erode the value and respect for the dollar and damage the US’s own capacity for capital investment and even social stability. Volcker wrote many books and articles, one of his best being “Keeping At It” where he lays out why sound money with controlled inflation is critical to have a unified nation without social unrest. And for whatever it’s worth, Volcker would not have agreed even with the 2 percent inflation “target” that was considered acceptable before the current inflation surge, he was a strong advocate of price stability and would have suggested that maybe a tenth of that inflation level would have been more than sufficient. He’s from an old German family with a lot of relatives caught up in the Weimar hyperinflation and he knew full well how inflation unravels entire societies, and cripples the value of hard work and savings. So when he fought inflation so aggressively in the early 80’s, he was doing it with the full knowledge that asset holders domestic and foreign were not going to hold on to a depreciating asset, which the USD was at the time. And this was at a time when the US was far more dominant economically than now (the USSR and ruble were already falling apart, and this was pre-euro).

That’s what the current Fed at least since Greenspan has failed so utterly at, realizing that the dollar has to be a rock of price stability or the very idea of a reserve currency or even a national currency falls apart. The currency is supposed to be the safe place where you store up the fruits of your hard work, without having to worry about constantly studying up and shifting assets around in ways that no one with burdens like a job and family actually has enough time in the day to do. Greenspan, Bernanke, Yellen, Congress and the Supreme Court (Citizens United was such a disastrous stupid decision) have failed utterly at recognizing that, in inflating the Everything Bubble they’ve both ruined the value of the USD and the ability to make basic price discovery for assets, even ruined the very idea of a home as shelter. Just look at what’s vexing us so much here and on the investors forums, with the dollar losing value so relentlessly we’re wondering how to protect our hard earned savings, except that most assets (and certainly real estate in this outrageous housing bubble) are losing value even more. It’s a terrible situation for Americans because we literally have no safe place to store our earnings, our savings and the value of our work are being stolen from us and we have no place to park our earnings. Part of why we’re hearing so much about quiet quitting, and the devaluing of hard work and even having kids is that Americans are seeing that their salaries lose value every week and are increasingly insufficient to purchase basic goods esp housing and food (and for us in the US, healthcare and school tuition which we have to pay out of pocket), all the while a few well connected oligarchs make even more billions sitting on their behinds and trolling on Twitter.

And Americans on the street are right, this is exactly the society-crippling societal effect that Volcker warned about with inflation eating away at a currency’s value. At least Powell has been finally taking a stand against inflation for the first time since Volcker, but still too timidly, and the rest of the world sees that too which is de-dollarization is picking up pace. As bad as it is for Americans holding dollars and USD-denominated assets evaporating in value, foreigners holding those assets see a betrayal of trust, and they have more choices and options in where to put their wealth. Even if inflation isn’t cured overnight, there has to be some show of commitment to make sure the dollar stays stable as a store of value (and while we’re at it, to get rid of the dumb myth that 2% inflation is supposed to be a target–it was literally an idea out of thin air by some New Zealand bankers who were basically procrastinating for a meeting). The rise in value of BTC and crypto is ridiculous but it’s more of a symptom than anything else, of how the supposed adults in charge have failed to guard the value of the dollar. I know China gets a lot of flak and being fair on our business trips there, development was very very uneven–we’d go from gleaming high-tech cities among the most advanced in the world to grinding poverty in many villages, so yes they have a way’s to go to be fully developed. But they did get some important things right, they value savings and thrift there, they hate debt-based consumerism and unnecessary debt in general, they actually do have elections at the local level and the officials pay attention to local needs (they’re kicked out if they don’t) and there’s at least the idea of meritocracy in government. And above all, there’s this belief that a currency should be a safe and sound place to store what someone has earned from a hard day’s work, without the risk of those savings being inflated away. We used to have that belief here and Volcker certainly made a strong case for it, but somewhere along the way this foolishness about “inflation is good” became part of economic theory (and probably many economists being paid off by American oligarchs with a lot of assets), and now here we are.

Hear, hear. Couldn’t agree more.

And on top of it all, this declining dollar is more and more being weaponized to force people and nations all over the world to bow to the USA. I am in Europe and can testify firsthand that people here are getting sick and tired of this.

Interesting times ahead.

Excellent comment. Thanks.

Miller – excellent post. Volcker is truly the last decent central banker we had and Jimmy Carter should be credited with hiring him. And Ronald Reagan should be blamed for firing him. Actually I believe Volcker was fired because he was against deregulation of the financial sector. Although I am a fiscal conservative, Ronald Reagan is among my worst presidents list for kicking off the whole “debt doesnt matter” philosophy among traditionally conservative Republicans.

The only thing I would debate is that China doesnt have debt bubbles. The property bubble in China has been pretty huge. They have not have developed financial markets, so people put money into highly overvalued real estate.

Real estate is the very tip of the debt-fueled bubble that we need to destroy. A home should be a cost of living, affordable to all, not a retirement plan. Investment in productive resources (companies) should be encouraged, not investment in speculation (real estate prices). The cheaper land becomes, the more the construction industry grows because the cost of the land is not prohibitive in the overall cost.

Great comment Miller, I always appreciate your take on things.

Earlier this Week:

A) PetroCNY: CHN completed their First Intl CN¥-Settled LNG Trade btwn CHN’s CNOOC and FRA’s TotalEnergies of UAE Sourced NatGas via the Shanghai Petroleum+NatGas Exchange; and

B) IND declaring that they will begin prioritizing settling their Intl Trade in IN₹.

In February, IRQ, short on Local Mkt U$Ds (where did all those pallets of Benjamins go?), decide to settle CHN Imports in CN¥ and start carrying CN¥ in their Banks as Foreign Reserves.

The shifts towards Multi-Polar Geopolitics and Multiple Reserve Currencies are gradually happening.

That’s how it should be. That’s what a big currency is for — so that you can buy stuff with it.

So, there is still a lot of mileage left in the dollar and our ‘Leaders’ are still yet taking every advantage of it. Why even think about a balanced budget when you can print to high heaven, being the world reserve currency? it’s not a sound practice but the U.S. is still sitting at 58+% with no horse even closing in.

Keep voting em back into office and enjoy the ride.

Best house on a bad block, still? China still seems to be trying to extricate itself from a series of problems touching on governance issues that might concern reserve currency holders. With competitors like that, who needs cooperators all that much?

How much does inflation effect the share of dollar holdings?

Trade deficit up, exchange reserves down? Trouble brewing.

Here come the BRICS Don Yuan. Sooner than you all think. I bet $1 Wolf is way off on this. Just like when he says the PPT didn’t exist.

Ha. Yuan gonna be the petro exchange. New coming very soon. BRICS are uniting in BPD flow. Starts today, eh.

LOL

Keep hearing about labor to soft spread and things will get start to get ugly in 4 weeks,but don’t understand these things . Maybe a good article?

Wolf above question was to you

Libor to sofr

I ❤ autocorrect: “labor to soft” for LIBOR to SOFR

Sent me for a spin there.

Flea, I’m not going to worry about it. They’ve had years to get this worked out, like Y2K. It’ll be fine.

If the dollar went to 45% of the World Reserve currency in 1990 and it is just under 60% now, this does not seem to be an additional external force that would stop Jerome Powell’s inflationary actions.

Isn’t everything connected to the US dollar these days?

So if the USD collapses, everything else will, excepting a few dictatorships which export huge amounts of natural resources as a cartel named OPEC?

If the US economy collapses, demand for everything goes down, and this may result in a great depression worldwide. That’s my theory.

The US dollar can’t just collapse into nothing and everything will be fine.

There is a political effort going on worldwide to shift the world from unipolar system to multipolar one. In multipolar system, failure of one of the “pols” won’t have a major negative impact on other “poles”. But multipolar world hasn’t arrived yet, we still live in a unipolar one, and it is indeed like you described it – everything connected to US and USD.

AK:

This is true and one result of the incredible reduction of the global manufacturing base almost everywhere but USA during WW2.

That, along with the challenges for the British empire from age and that war led to USD predominance.

With respect, I agree that it would be better for USA for other currencies to share reserve status, in spite of the very clear ability to trade globally before any such thing or the central bank scams, both continuing to harm working folks.

Every year that passes the power of OPEC wanes. The explosion of fracking in the US has made it one of the top producers and if prices remain higher than today, the production from the US will increase, while every year the demand decreases as we transition cars to electric and utilities increase renewable production.

There comes a tipping point at which the low cost producers like Saudi Arabia will be a much larger percentage of production, but only because the demand is so weak and they are the only producers who can profitably add new production. We just need to reach the point where the demand falls faster than the output from existing production sources falls, so that basically only the most efficient producers will need to drill new wells. Over the next five years, we should cross over this threshold.

Oil will be produced for many decades into the future. It just wont be nearly as valuable.

Oil will continue to be valuable gt, but not for fuel…

WE, in this case the species WE, have been wasting a very precious substance that will be needed for many many years to make appropriate replacement parts for our physical bodies until our theoretical physics catches up with various and sundry prophets.

At that point, our causal and spirit bodies can or will be fully informed on the practices needed to keep the physical body healthy as long as WE chose to do so, and replacement parts will no longer be needed.

Have we already ”burned” too much of this precious asset???

Time will tell, eh

I fail to see what will be driving demand for oil lower? If it is sobriety, then everyone loses power over the market. ME production costs are somewhere around 5-9 $/bbl for now…supposedly.

Saudi exports about 6 million a day. That number will probably drop by 50% in ten years. I don’t see much in the way of new production that can compensate for their dropping existing production and increased domestic demand.

If oil is produced for many decades, it will be like the scene in Mad Max, not industrialized production.

These updates are always amazing in how shallow the average understanding of international trade is among nonprofessionals. On the other hand, it was much the same in the profession.

That, more than anything always amazed me. Our politicians are even worse (Rand Paul is not even near to reality).

For anyone who desires a long technical explanation, read Barry Eichengreen, Exorbitant Privilege, or any of his more recent, much more technical papers. His how Global Currencies Work should be required reading in basic econ classes, but hey, we still teach utter free market crap as gospel.

I will not see the end of the dollar in my lifetime, nor will most of the commenters.

Someday this war’s gonna end…

USD share of the global…retraced 50% of the move up from 1990 low.

it might make a zigzag up, test Oct 1973 dent.

If so, forget about oil, gold and Shi silk road.

One of those articles filled with the facts I’ve never considered in their entirety and the ramifications. I think I have mindlessly spouted slogans about the ordained value of the US dollar. Will have to read this article three times to feel comfortable making assertions.

One thought that came to mind is the tight correlation of all of the currencies, sans yuan, with the dollar which questions their status as an independent currency.

The current alignment of the currencies in the basket seems more like the product of contemporary drama among friends than realignment.

Ultimately, the value of any currency, or pseudo currency like BK, is measured in terms of the exchange rate with the dollar. The US has tolerated the deviations in the relative value of the currencies as a matter of policy.

There is a good argument to made that policy hasn’t been founded in sound economic policy for multiple decades including the recent decade and a half.

Gimme, gimmy, gimmy, i want now, me, me, me.

All anyone needs to understand is that there are a bazillion dollars out there in the world. This is how the US maintained its “wealth” after we gave up a real economy.

Once a sizable portion of the world no longer has faith in the dollar, they will come crashing home. Yes there will have to be other systems in place to conduct international trade. That is already in the works and includes a partial gold backing of key commodities.

And no, the US will not be the world leader in oil and natural gas production very much longer.

After QE, QE2, QE3, QE4, QE Pandemic, several years of real NIRP, inflation of 9%, and indefinite projections of 1.5T to $3T fiscal deficits, the world has not lost faith in the USD.

The more captivating issue facing us now is Gwyneth Paltrow’s court appearance.

Looks like the y-axis on the second chart is mislabeled.

>>Looks like the y-axis on the second chart is mislabeled.

Yes, looks to me like chart2 y-axis unit should be trillion USD. What say you, Wolf?

The third chart title (‘USD Hegemony..#4 RMB’) omits the GBP.

RMB should be #5?

No it does not omit the GBP. It’s the blue line below the Yen. I labeled the RMB so people could see it. I didn’t label the other currencies, including the GBP because I explained it all in the text above the chart, with percentages and rakings.

From my own article, text above the chart:

“The yen, the third-largest reserve currency, had a share of 5.5% (purple line at the top of the colorful spaghetti at the bottom in the chart).

“The British pound, the fourth largest reserve currency, had a share of 4.9% (blue line just under the yen).

“The Chinese renminbi, the fifth largest reserve currency, lost a little ground last year, with its share dipping to 2.7% at the end of 2022….

“The other currencies in the spaghetti: Canadian dollar (2.4%), Australian dollar (2.0%), and Swiss franc (0.2%). There is a number of other currencies with a tiny share each (each less than the Swiss franc’s share), and all of them combined have a share of 3.4%.”

Wolf,

Please read what I said again.

My point was that the GBP was missing from the chart TITLE.

Not the chart itself – that’s fine.

My sincere apologies if I failed to make this clear.

Bobber, I disagree. Look at the increase in foreigners buying U.S. stocks or real estate. They’re doing so because they don’t want to hold dollars.

What’s the difference? All of those things are priced in US dollars and real estate values in dollars are in a deep freeze plunge. Many stocks are similarly affected already and will be more so in the upcoming future.

The US dollar is remarkably stable and has been increasing substantially over the past 10 years and is now around 103 on the DXY and headed much higher.

Mike R.,

The US does have great agricultural commodity production.

But we also have short-sighted idiot politicians, and companies with powerful lobbyists. They have turned corn into ethanol for gasoline. And now this cartel of virtue-signalling stupidity and greed is in the process of turning huge quantities of soybean oil into biodiesel.

Tip of the hat to the Farmer-Citizen Movement in the Netherlands.

For 20+ years our townships were lectured about saving prime ag land. The state rolled out their smart growth planning.

Several hundred acres of our top ag land will have a new crop this year….solar panels. The north 1/2 of our county is sand. They must not grow well in sand.

US ethanol production is an indirect subsidy to the agro industry and farmers. It is also a crime against humanity as is bio-diesel. US ethanol has a negative ROEI. Ignoring other considerations like CO2, the only rational place to make ethanol is Brazil.

And the politicians are not short-sighted. They wrote the ethanol legislation so it would guaranty them many years of support from their big contributors.

Is there a credible scenario under which a substantial portion of the trillions of dollars deployed internationally might fairly suddenly wind up back in the USA bidding on tangibles here? Inflation would hit a blow off top. A traditional currency crisis would seem implausible as long as primary reserve currency status is maintained.

“Dollars come crashing home” is short for dollars become increasingly worthless. And yes, there is a very credible scenario for that to occur. It’s called physical gold and it is already starting to gain traction. When loss of faith in dollars begins to cascade, the only readily available and internationally recognizable alternate store of weath is/will be physcial gold.

That is why Russia and China both are planning on establishing a new trading currency regime that consists of sovereign currencies backed in part by physical gold.

The ruble is a bad joke.

How about the Yuan? Is Gold a worthy asset?

Dollar is decreasing because I am doing Quantitative Tightening. I can explain what I’m doing. I find companies I don’t like, such as Silicon Valley Bank, and take their dollars so they are bankrupt. Then I burn the dollars in my fireplace and our int’l dollar % goes down a little. I would print more $ to make our % go up, but there are a lot more companies I need to take dollars from first. Gotta clean house.

OPEC cutting oil output.

US increasing oil output. US is largest producer in the world. US producers are loving that little bitty price uptick that the OPCE announcement caused LOL

I’ve done some international shopping this past year, best deals for me are out of Canada. My savings are up to 50%. I’m a light weight as an international shopper but the fashionistas I follow say Europe is the place to shop these days. The exchange rate for them is boosted by the refundable VAT. The discounts for them exceed 20%.

High fashion and discounting don’t seem to mix. Isn’t the objective to pay more, and be seen doing it?

I’m broke and aspirational.

P.S.

Nobody’s cheaper than rich people.

Wolf said: “US dollar as global reserve currency means that foreign central banks and other foreign official institutions hold US-dollar-denominated assets, such as US Treasury securities, US corporate bonds, US mortgage-backed securities, and the like.”

——————————————

How about stocks? Are they acceptable dollar denominated assets to be held as global reserve currency? (ie Switzerlands stock holdings)

The SNB buys and sells stocks. They’re not considered reserve assets. They’re a trading asset to manipulate the currency or make some money on the side or whatever. I know of no other major central banks that buys foreign-currency stocks.

https://wolfstreet.com/2023/02/09/snb-cuts-holdings-of-all-its-top-50-us-stocks-in-q4-apple-chopped-by-8-since-q2-msft-goog-amzn-tsla-xom-all-of-them/

Another quality article, thanks!

What we have to conclude is that the USD will continue its role for the foreseeable future, not because it’s perfect but because every alternative is measurably worse.

To a point. But what the dollar (and other fiat currencies) can buy will increasingly decline.

Paul, I agree. I learn so much from Wolf Street, and I especially enjoy reading the comments. Some pretty smart commentators here.

Perhaps we should acknowlege Wolf as Herr Professor Doktor Richter.

Where did the holders of Euro foreign exchange reserves get the Euros to hold, if Europe didn’t run a net trade deficit to sell them Euros for goods?

The only thing I can think of is somehow the holders of the Euro Forex managed to borrow the Euros somehow. But I’m not sure that makes any sense.

They buy foreign equity and debt for euros too.

The Gold Standard was eliminated in 1968 because of the U.S. trying to be the world’s policeman. Today’s exploits are even larger.

The so-called ‘gold standard’ was a very brief 60 year failed experiment in the USA from 1873 to 1933 at which time it was totally eliminated in the USA for any domestic applicability.

I’ve been thinking of wallpapering my office.

The wife wants an artsy print pattern.

but…..I’am going to use dollars. Its cheaper that way.

The only decision is if I use 100 dollar bills or 20’s.

In the meantime gold is breaking thru 2000 the ounce. Buying more in the AM.

Send any leftover worthless-trash dollar bills to me. As a special free services to you, I will dispose of them properly so you don’t have to do it.

LOL…….OK……but I might shred them first so my grandkids don’t steal them for their monopoly game

Gold’s fundamental mean value is less than $456 per ounce.

Where do you come up with rediculios number,cost yo mine gold is higher than that

Where can I buy gold for $456/oz?

I don’t think of the decline in use of dollars as a reserve but it is interesting how the Petro dollar is under attack.

There is no such thing as the ‘petrodollar’ and oil has always amounted to less than 5% of global transactions and still does.

“How did you go bankrupt?” Two ways. Gradually, then suddenly.”

― Ernest Hemingway, The Sun Also Rises.

Last year central banks bought all-time record amounts of that other “global reserve currency” that worked for thousands of years.

I guess we have a winner.

Nope, and central banks continue to own only about 35 metric tonnes of that non-productive yellow yuck.

Where do you come up with this nonsense? Do you just fabricate it? I can use google and see that central banks bought in 2022 alone 1136 tones of gold. The US alone holds over 8000 tones of gold.

Thank you. You beat me to it.

Sometimes comments get deleted on this site. Strangely enough, the yellow yuck above wasn’t.

If it’s absurd enough, it’s clearly humor, and humor can be appreciated.

Us gold belongs to who you know? N enough to pay the trillions in debts?

Since the “non-productive yellow yuck” is now making new all-time highs practically daily versus all paper currencies but the dollar (which it already did on the monthly and quarterly chart and soon will on the shorter term) those central bankers having bought it probably have a golden smile on their faces now while other people are enjoying life on a SoCal beach while they can.

Inflation and the Dollar:

I think serious Thinking needs to be addressed to the Fed & the Decline of the Dollar. The reappointment of current Fed Members seems a disappointing Factor.

Currently and with Inflation still Hi and upcoming new hi Gas Prices forecast. Future may look to Gold for support close to 2000 already .

The Rich got richer and the perhaps New Poor are joining the old .

Wolfs US Dollar Share of Global Reserve Currencies Chart tells a story

“We have what we consider to be an effort to prevent the repeat of 2008-09 when we had oil prices collapsing.”

–Ed Morse, Citi

Folks of course China n Russia currently under western countries led by US sanction will definitely push US$ out. Than also the Latin America block many in the process. Latest ASEAN finance ministers meeting on discussion with China….they likely boot US$, yen, euros, pound from each other’s trading account….why use a third currency? And OPEC….of course they could offer great discount s to buyers using non US $………The momentum is rather silent….with little America media coverage of course……Bonds of US$ is a huge concern n like credit sussie the caving in will snowball fast.

This kinds of stuff is just hilarious. I understand it’s wishful thinking by some folks, but it’s just pure comedy.

Saudi Arabia accepts Kenyan shillings for oil sale to Kenya (instead of USD)

Hilarious oh yes…wait…what is macron n wonderlion doing in Beijing …hmmm yuan n euro….mmSoon Malaysia sells commodity to China n accepts yuan…then uses yuan to fund projects. To those far away this cannot happen. Many ASEAN countries workers are paid in the host countries currency than remit home in their country currency. Other forms of transactions can be done easily