Nearly two-thirds of consumer spending goes to services. That’s where the inflation action is.

By Wolf Richter for WOLF STREET.

Energy prices continued to drop, and prices of some goods dropped from the crazy spike in 2021, and food prices are increasing at a more moderate rate. We have seen these trends for months. But the element that makes up nearly two-thirds of consumer spending – services – the element that the Fed has been pointing out for months, remained at the worst level since 1984, and it kept core inflation at nose-bleed levels at well over twice the Fed’s target.

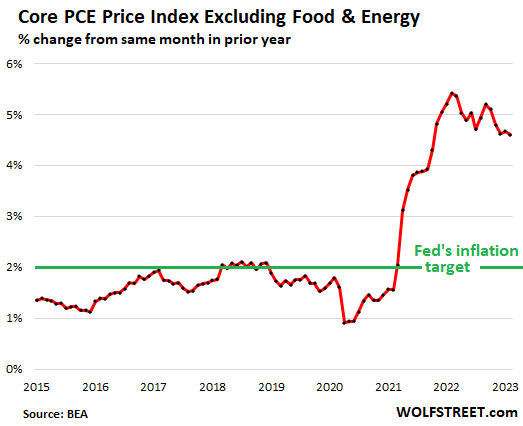

Core PCE price index: the yardstick for the Fed’s inflation target.

On a year-over-year basis, the PCE price index without food and energy products (“core PCE”) jumped by 4.6% year-over-year in February, after having jumped by 4.7% in January, and by 4.6% in December, essentially unchanged for the past three months, according to the Bureau of Economic Analysis today. The Fed’s inflation target is 2%, and it uses this core PCE index as primary yardstick.

Within the core PCE index, the PCE price index for durable goods rose just 0.7% year-over-year, but the PCE index for services spiked by 5.6%.

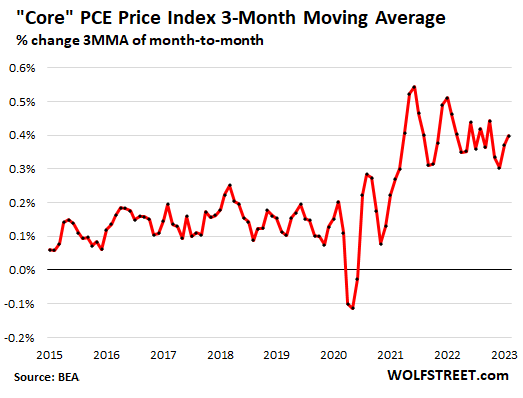

On a month-to-month basis, the core PCE price index has been jumping up and down in the same range since 2021. In February, it rose 0.3%, after the 0.5% jump in January and 0.4% in December.

This chart shows the three-month moving average of core PCE’s month-to-month changes, which smoothens out the month-to-month volatility and shows the trends more clearly:

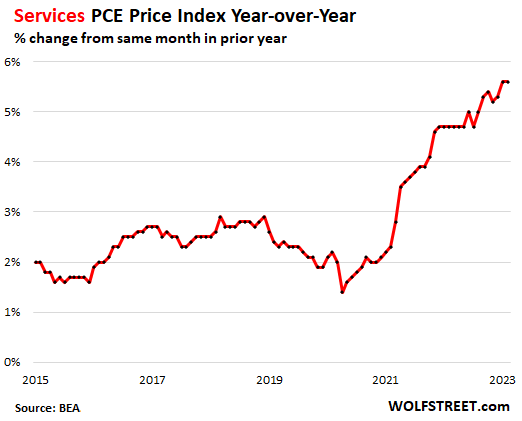

Inflation continues to rage in services.

Powell, in every press conference since mid-2022, has been pointing at the services components of the PCE price index as the hotspot of inflation, where inflation is raging, and where it is very difficult to extinguish. Services account for nearly two-thirds of consumer spending.

The PCE price index for services jumped by 5.6% year-over-year in February, same as in January, and both are the worst since 1984:

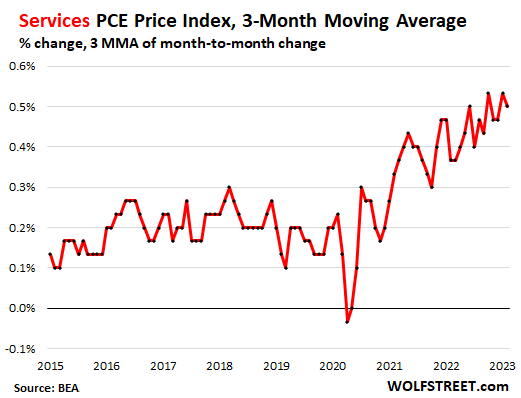

On a month-to-month basis, the PCE price index for services jumped by 0.3% in February from January, and has been jumping up and down in the same high range since 2021. The chart shows the three-month moving average, which smoothens out the month-to-month volatility and shows the trends more clearly:

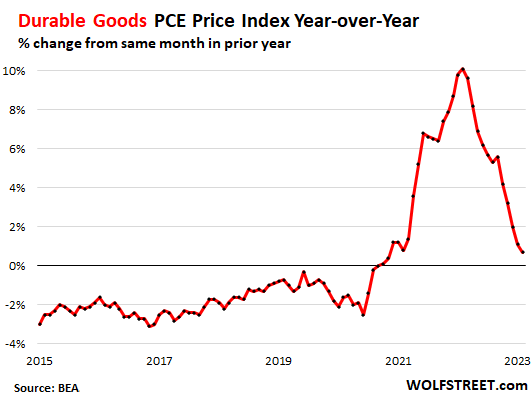

Durable goods prices cool from the crazy spike.

The PCE price index for durable goods – new and used vehicles, appliances, furniture, electronics, etc. – dipped by 0.2% in February from January, having been in the same range above and below the zero-percent line for a year, after the huge spikes from late 2020 through 2021.

This brought year-over-year durable goods inflation down to just 0.7%. A big driver in this has been the sharp decline in used vehicle prices from the crazy spike in 2021:

The PCE price index for energy fell 0.4% month to month, which pushed down the year-over-year increase to 6.4%, the least terrible jump in two years, and down from the +30% range in mid-2022.

The PCE price index for food rose 0.2% in February from January, which pushed down the year-over-year increase to 9.4%, the least terrible since April 2022, down from the double-digits in between.

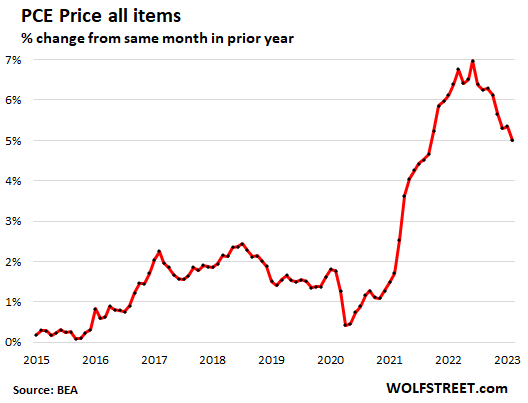

The overall PCE price index for all items rose by 0.3% in February from January, and by 5.0% year-over-year:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Services Inflation Rages at Worst Rate since 1984”

Exactly, yet all the headlines from the Ministry of Truth push inflation is slowing propaganda. It’s sickening. Headline only readers lapping it up.

Was going to say something similar but with less aggression lol. It’s interesting how one can take the exact same data and present something different. Though when you read deeper into those “respected” publications you do find hints that all is not as it seems at first glance. I’m glad Wolfstreet exists and just the data is just dished out as is.

I’m tired of it. I’m sick of them manipulating us, sick of the corruption, sick of just about everything regarding Wallstreet and our financial system

The latest bailout gave them the hopium that they desperately needed. Wall Street was on the edge of massive panic. What a messed-up world.

Agreed. It’s almost like we need a law or something that separates the gamblers from the real main street economy. We could call it Glass-Stegall or something.

You’ve got a lot of company.

Maybe why retired people are leaving this country in record numbers

You have my sympathy because, surprise, we are starting an election cycle and it is going to get orders of magnitude worse from this point forward.

My advice, get one of Wolf’s little mugs and fill it with something strong every day and get a good hands on hobby to distract you.

The fed caused inflation cause they didnt hike rates and put it off then they hiked it to fast and almost destroyed the banks meanwhile our government can’t wait to give free money for votes.Maybe if they stopped giving free money inflation would go down.Nut that would make to much sense.

What’s worse is no more rate hikes.

Banks are going to tighten credit due to banks under stress. They all passed the stress test though.

I’m not so sure about no more hikes. I’m thinking one more then a pause is the most likely.

Especially if the markets are rocking and rolling by the next meeting which seems likely at this point

The salvation for the Main Street is next month and May’s CPI number. If it stays above 6, the Fed has no choice but to keep raising the rates and the market will finally crash as we all

have been hoping for.

Inflation is slowing. The services component is set to drop throughout the next 12-18 months.

Housing alone will be a big (huge) drag down and then we’ll see the hit from depleted savings later this year.

Fed will pivot in 2H.

Rents increasing rapidly in the Phoenix area. A friend got a rent renewal rate up 25% for a six month lease, was finishing up a six month lease, so 6 month to another 6 month up 25%. Rents up for all lease terms on a cursory review. Gas is up here significantly.

It will keep going up because Fed keeps failing to control speculation:

1. Bitcoin over $28K.

2. 10 year still at 3.5%.

3. S&P jumped 18% from 10,300 to 12,100 in hope of Fed Pivot due to banking crisis.

4. Fed balance sheet jumped by $390 Billion despite QT in work.

5. Government committing to spend like drunk sailor.

That os Nasdaq not S&P

That “by $390 billion” is willfully outdated. The Fed’s balance sheet already started falling again (it fell by $28 billion yesterday), as the liquidity support that the Fed gave to the banks is already getting paid back by the banks. The balance sheet next week will decline by a whole bunch, probably “by the most ever.” You’ll read about it right here. Watch for the “by the most ever” in the title. If the liquidity support was “QE” (which it wasn’t), than the plunge now would be “mega-QT”, LOL

I would love to see that “by the most ever” decrease.

I would love for wallstreet to see it too.

Who cares how much it falls if they can’t control themselves? We do not have an economic crisis, we have a political crisis, and its been evident since 2008.

What about the black market banking system? I wonder how much that has gobbled up.

The problem is the citizens no longer trust the federal reserve!

There is no way around it.

Only more months of this speculation,but it is 3 rd year in presidential cycle .So who knows,except the peons realize the system is rigged .Makes Vegas look like rome

Tightening Monetary Policy simultaneously with flagrant Fiscal Policy guarantees more inflation.

And once the low-hanging IPO/Wallstreet drug addicts are cleaned out, the remaining survivors of American Industry will be suffocated.

Economics is a slave to Politics. Up until there are no more real assets for money printing to securitize. Full Faith and Credit becomes zero.

The Fed really screwed the pandemic response by running QE for at least 12 months too long. The resulting massive increase in the monetary supply is largely responsible for most of today’s inflation. With that said, Powell and Yellen have publicly stated the Fed’s goal is to reduce inflation and to bring it under control via Fed tools such as QT. Meanwhile the Fed has increased its balance sheet $391.4B since the beginning of March. The link is to the Fed site, set the chart to 3 months.

That “$391.4B since the beginning of March” is outdated. The weekly balance sheet released on Thursday fell by $28 billion as banks started paying back what they borrowed. So now the increase since early March = $363 billion. Next Thursday will be a huge drop in the balance sheet, possibly a record drop, because QT continues and banks are paying back what they borrowed from the Fed. Watch for my headline here Thursday afternoon (my time) that may have “plunges by the most ever” in it.

Why does a “pandemic” require QE? No one has ever been able to explain that. Unless QE was what was needed and the “pandemic” was secondary. What i find curious is that even suggesting that the people who get caught in lies day in and day out would not lie about that. We point out how they lie in business, war, social relations, everything, but not that.

Why did the pandemic require untargeted money thrown every which way, without means testing or determining need? It didn’t. Rent, mortgage & student loan forbearance?

Unemployment assistance already existed – why didn’t that program get fine tuned to solve its deficiencies?

The free money era I hope will be a lesson, but unfortunately we have short memories.

Rent will keep going up as long as the southern border remains completely open. By the time Biden leaves office, there will be 8-10M additional non-us citizens from all over the word. On the flip side, it’s good to see a small % heading north to Canada.

Do rising mortgage rates tend to lead to lower rents?

Think of ‘supply and demand’. If rising mortgage rates keeps buyers from buying, instead keeps them in the rental pool.

More renters chasing rentals, less rental inventory, we’ll there you go.

I wouldn’t say rents are skyrocketing, but the ability to keep them high or continue raising moderately is there.

until massive layoffs creates a renter exodus/collapse.

Not necessarily. There are a lot of apartments and multi-family dwellings being built and completed now, and the additional units will put a lid on increasing rents.

Also, homeowners unable to sell empty unoccupied homes for the prices they want are turning these into rentals as the mortgages are affordable with the low low rates of the pandemic. Granted, this may be more regional and happening more in the west and other areas where home prices are declining.

Another PCE update, another disregard reality day on WS so far…either that or PPT team is working hard today, better not fumble last hour like last time…

Guess the market and those BTFD buyers are really sniffing glue hard and imagine Fed pivot in the next 3 months so get in on the action now..

The conspiratorial side of me thinks the PPT is busy trying to keep gold from closing over $2,000.

Yes, the Fed will keep the pressure on the gold price. The same with silver apparently. I’m happy with the performance of the coins I bought the years before the pandemic but But haven’t bought any since 2019. Too much premium over spot for me.

That is my problem with physical gold and silver. The costs of buying and selling are ridiculous and remove a large part of any profits.

As I understand it, Yellen poached some of the PPT funds for the bailout. We shall see.

Were the PPT traders told that their trading budgets had been cut because some billionaire’s deposits needed to be bailed out? Is that why they’re so pissed off?

Watching the gold price fluctuate this morning, I would have to agree.

They are reading the headlines only and on a pivot/pause hopium high.

“Fed pivot in the next 3”

Tbh the so-called market perceives that pivot already happened with the bank bailouts and other liquidity measures taken in last couple of weeks. They are certain pivot is just a formality at this point and at worse case, if no pivot, everybody will get a bail out. Win Win

I guess the question is, are they really wrong? On one hand, the Fed says that it’s willing to tolerate a recession if necessary to get inflation down, but on the other hand, the Fed is willing to “use its tools” (which means printing money) to prevent it from being disorderly (i.e. a bank collapse). So the market is reading that to mean that the Fed will only tolerate a mild recession.

Since the market doesn’t believe a mild recession is possible, the choices left are “resume printing and let inflation continue unabated” or “have a deep recession and a lot of pain.” The market rightly doesn’t believe that the Fed, despite its rhetoric, will accept the latter.

So the former it is.

Anyone disagree?

The liquidity support that the Fed gave to the banks is already getting paid back by the banks, and the last balance sheet (yesterday) declined. The one next week will decline by a whole bunch, probably “by the most ever.” You’ll read about it right here. Watch for the “by the most ever” in the title. If the liquidity support was “QE” (which it wasn’t), than the plunge now would be “mega-QT”, LOL

If you look at tried and true recession indicators, they’re all saying one is imminent and markets are acting like they always do before recession finally hit. This is the distribution phase into the hands of the dumb money aided by the media.

Wolf, totally understood, but let’s say the bond market completely seizes up for some reason. Is the Fed willing to tolerate that, or will they open up new facilities, including ones that aren’t so temporary?

The market believes they will.

Ok…the fed is getting paid back from money they created from nothing. What a deal for the fed.

Plus, what concessions did these banks make for the fed to offer

“assistance”?

The fed was intervening in SVB months before it became a media hit! They knew all of this probably for years. Wells Fargo is in a similar position! And Deutsche Bank is in the same situation.

We have 60 days until this whole crisis becomes very real. Get ready.

WS is hailing this as it knows that FED has no spine to fight the inflation.

If the service inflation is really this high ( which I believe it is ) and is stickier per WR then FED would not raise by piddly 25bps but by 50 bps and be more aggressive when it comes to QT.

So far, FED has shown that they are not serious about taming inflation and are working for rich and elite.

Agree. Powell and the rest are too weak to really show a resolve in bringing inflation to heel. Scared like children with a bit of tremors in the banking sector.

I don’t agree about Powell scared like children.

When these kind of crisis happens, Fed is happy as they get more excuses to inject liquidity in the market/economy and help their rich masters.

We should know by clearly seeing for whom the FED works for.

People who think that FED is working for the common joe are either stupid or naïve or both.

Don’t go by what the FED is mandated to do. Judge them by what they have done so far.

jon,

The liquidity support that the Fed gave to the banks is already getting paid back by the banks, and the last balance sheet (yesterday) declined. The one next week will decline by a whole bunch, probably “by the most ever.” You’ll read about it right here. Watch for the “by the most ever” in the title. If the liquidity support was “QE” (which it wasn’t), than the plunge now would be “mega-QT”, LOL

Relying to WR:

I agree with what you said and I read your articles.

It’s not about what happened. It’s about optics.

The FED sent a message to market that it’d bend over backwards to make sure this melt up continues.

If needed, market knows that FED would pivot in a heart beat.

There was absolutely no need to save the un insured depositors of SVB. By doing so, a message has been sent out loud and clear.

My guess is SVB has a lot of dirty offshore money and I would guess some in congress and their sponsors have had some strong financial interest in it.

We will never be able to stabilize this country until congress decides to cap foreign and global investment in our basic resources, especially our housing and medical. It will next begin in our food.

But what are the chances of that when both parties have their fingers in the cookie jars? Most politicians are heavily invested in stocks and RE. The entire US can go to hell in a burning ball of flames before they will cut their own personal losses.

Had..

Energy is making a comeback….10% rise this week alone.

We all know what happens if this continues.

Yeah, that’s the problem with inflation. I call it the game of inflation Whac-A-Mole: when inflation finally backs off in one price category, it rears its ugly head again in another. I’m waiting for used vehicle retail prices to start rising again; wholesale prices have risen for the third month in a row.

Whac-A Mole LOL. When will paycheck to paycheck people run out of money or credit? I for one am cutting out a lot of things or doing them myself. The quality and service keeps getting worse and worse and the price is adjusted up and up? $25 for a gallon of Mineral Spirits and it’s not even a gallon. Over $10 for a Whopper, fries and a coke! I must be old as I remember 99 cent Whoppers. There has to be a breaking point?

From my observations, everyone around has simply too much cash. Even if prices double overnight, I’m afraid consumption will keep going unabated.

Yep on used car prices . Friend in the used car business is quitting after 30 years in business. Says he can’t find reasonable prices for used cars to sell. He finances them himself and shoots for the under 12k market but none to be had anymore so he’s quitting . Just like Wolf saying pricing rising in used cars

used vehicles at auction just showed their first dip. First time I’ve seen good, better deals since 2019. No calls. Buyers are few. Eerily dead. Dealers all loaded up with overpriced inventory they cant sell. I’ve seen some same ads running for a very long time Many small dealers hurting and will be going under quickly now. The whole economy is contracting much faster than what people think or any stats are showing yet.

LOL. Fiction? That’s not at all what Manheim, the largest auto auction house in the US, reported in their mid-month update. They run something like 8 million vehicles through their auctions a year. Lots of dealers bidding up prices as they’re trying to restock their inventory. If the rest of March is on the same track as the first half, it’ll be the fourth month in a row of wholesale price increases. The final March data will come out in a few days, and I’ll make sure to cover it.

Dealers reported HUGE per-vehicle grosses during the pandemic price spike through early 2022. Then retail prices came down for 12 months, and wholesale prices plunged in 2022. And grosses remained huge.

But in December, wholesale prices began to rise again, and March looks to be the fourth month in a row of price increases amid very strong demand from dealers. They’re bidding up prices to restock, and on the retail side, they’re giving up grosses to get volume, so it reduces these HUGE pandemic grosses, but they’re still way above normal. The vehicle market is in the slow process of normalizing.

Can small used-vehicle dealers compete with big dealers — with the big chains? Maybe that’s the question you’re raising. That’s a legit question, and I see lots of reasons why life is increasingly tough for small dealers, especially note lots. But that has nothing to do with consumer spending, but with HOW and WHERE consumers prefer to buy used cars.

There’s probably a lot of regional differences. The towns around where I live in far northern Ca are getting full of boarded up shops. Lots of working people still moving away as some rents still go up which is causing a labor shortage, especially for skilled blue collar labor. Downtowns are depressing. Homelessness increasing.

10% change in a week sounds seriously unstable to me. When an electrical control circuit starts wildly oscillating it then pegs and burns out.

If we all have to hedge everything to smooth it out, things will get very complex very quick. Except for banks of course.

Wolf – you edited out the best part. Reminds me of when was a junior engineer and needed to document stuff. I was such a bad writer I was assigned a full time tech editor.

Wait until we go Cashless transactions ( ? Starting April ? any info on that )

then negative interest rates to stimulate the economy whats the world coming to

Quit reading sites that dish up lies like this on a daily basis.

BTW, most transactions have been “cashless” for many many years. Many people don’t even carry cash anymore. Even little stuff. When was the last time you bought something online and paid with cash?

I have never Bought anything online for Cash ? I don’t think you can unless you meet the seller in person perhaps ? So Sweden is not Cashless then ?

I hate the Idea of Cashless BTW and understand that most transactions are Cashless nowadays That said However the Right

to own and have Cash , if someone want to have Cash then that’s their right I think / I dream of a Mattress stuffed with good old Cash $ > I think Cashless id BS

Don’t worry. The paper dollar will be around. No one is going to take it away. There are now more than ever out there. If a website tells you that the Fed will do away with the paper dollar, they’re lying to you (to sell you gold or cryptos or whatever?), just don’t go back to that website.

There are lots of things to worry about in this world, but this isn’t one of them.

My “Gas Station from Hell” just posted $4.69 for regular gas. $5.69 for premium. This is happening while the price of crude has declined significantly. What the f$ck is going on!

Grift & Greed, friend.

Because they feel they can get away with it. Just like banks that charge near zero-rates.

Blame and invest in refiners. All of them are safe and doing well. Buy on the dips though to this day, I don’t know why they are somewhat volatile based on oil price. It is volume that should be the concern.

Oil has bounced around a bit but gasoline futures have been more stay and are up 15%, YTD based on April contracts so not much help at the pump and maybe more pain imminent… But we can always tap the reserves if oil rockets up… Oh what it’s almost empty lol

I dont know where you see the price of crude dropping. On 3/20 we reached an intraday low of 64.36. Today we closed at 75.70. Over 11 bucks in less than 2 weeks!

Don’t know 2.84 for regular and 3.04 premium in NE Texas today but prices did jump 10 cents .

With the recent increase in crude to over $80/barrel, look for my “Gas Station From Hell” to post a double digit price increase in the next week.

Service inflates won’t end until employers,grow some balls and start firing people,go to many retail outlets most people slowly stocking shelves,or on phone wandering around .Need a reversal of management. Weak management weak employees .But can’t replace anyone .Not Looking Good

“…go to many retail outlets most people slowly stocking shelves,or on phone wandering around.”

It’s called Quiet Quitting — people doing as little as possible and as slowly as possible for their paychecks.

People producing less and demanding more dollars, to me, is the central driver of “services inflation.” This drives the whole flywheel around: the Fed hikes rates, the banking sector destabilizes, the system grows unstable. It’s all greed, and blaming the bankers alone (as was done in 2008), or regulators alone, or whoever, misses the point. We have met the enemy, and it is, crucially, the greedy, lazy masses.

Indeed which makes all the lecturing the corporations and the government do even more nauseating.

Yeah. I’ve listened to a lot of congressional testimony from people in high political positions and from what they seem to understand about their jobs, they too are Quiet Quitting.

Back in my day, we wrecked our physical health to help our employers exploit and underpay us, and we were proud of it!

Yeah. Me too. There has to be a balance somewhere.

There’s a shop by me that the owner sold to the employees in some sort of trust. They have a personal stake in things. It’s not doing so well- none of the shops here are, but the people working there have been relaxed and helpful and work hard when they actually need to. They have pride in their work, even though their pay has to have decreased as the economy isn’t so great. I hope they survive. I prefer to support them vs the other shops that sell the same things.

2% inflation is price stability.

Inflation is too low.

Inflation is transitory.

Holy chit, higher for longer.

Smart gang.

Zero inflation is price stability.

A bit utopian, I think. The real world does not have perfectly flat streets, perfectly pure water, etc.

phleep,

From Fargo to Grand Forks, the real world does have perfectly flat streets. The only hills are the ramps up to the overpasses across I-29.

Though, it gets a bit windy sometimes. And when you’re towing your combine, be careful with gusts hitting you as you come out from under the bridges, eh?

Are groceries a service? Because our latest few grocery bills are up so much to induce sticker shock every time. I have zero idea how people less well off than us can even manage it.

Year-over-year food inflation is around 10%, depending on the index. The PCE price index for food discussed here is up 9.4%. A bunch of stuff we’re buying costs less now than a year ago, including beef.

Yeah, it has stabilized some, but I don’t think Wegman’s or Giant have gotten the memo – or, perchance they are “taking advantage” – because our dietary choices are relatively unchanging, but the bills have consistently gone up. I’m wondering under these conditions just how long we have until the average Janes and Joes break, because we’re solidly above-average middle class with discretionary funds, and it’s beginning to hurt.

Don’t forget that food manufacturers have been aggressively charging you more money for less food for years now, regardless of rates or inflation. They introduce new smaller size and that becomes the regular size and then the previous regular size is now a Family size and then gets phased out. But the prices never go down.

Food inflation is more like 12% to 15% or more YOY. I buy, or try to buy, the same 15 items every time I go to the same grocery store. Some are up 25% YOY and other are up 5% to 10%. Examples: My olive oil just went to $13.75 from $10.75 a year ago. Pepper crackers from $3 to $4 a box. The list goes on. Most of the largest inflation is from the items who’s country of origin is Europe. The government’s food inflation figures are BOGUS and way under the real figures. You can’t argue with the receipts. The numbers there tell it all.

I’m actually saving on groceries. You just have to really get in there and use high brain thinking.

Save save save lol

Oh, and in case anyone wants a daily dose of spin, here ya go, from the chief economist over at realtor.com:

“Signs show that buyers are active in the spring housing market, even if they aren’t as numerous as they were during the pandemic. Amid fewer new choices on the market and still rising home prices, home shoppers have shown that they are very rate sensitive, only jumping back in the market when rates dip, and so what happens with rates this spring will likely play a strong role in determining whether the housing market bumps along or picks up speed this year,” said Danielle Hale, chief economist for Realtor.com. “With so much built up equity, home sellers are still faring well, but many are sitting on the sidelines. The usual seasonal pick-up in buyer demand appears to be underway, one of several factors that make spring the Best Time to Sell. With an uncertain market ahead, it may be even more important for potential sellers to aim for this year’s seasonal sweet spot.”

It’s almost as if “buyers” are just shrugging off inflation in their lives…

Buyers this close to the peak of the biggest housing bubble in history are a self selecting sample of the desperate and the dumb. It’s no surprise that they’re getting into bidding wars again, at least in some markets–they have been foolish enough to show up for a spring selling season where the sellers didn’t show.

We’re seeing a pickup in home sales activity here in the Swamp. But most of the first time home buyers are venturing into crime ridden neighborhoods to get their starter homes. That’s all they can afford. Most if not all of these properties are new construction or completely renovated Condos. I was in one the other day and Ms Swamp was approached by a neighborhood watch officer, who wanted to know what the hell we were doing in that neighborhood.

I see that markets are up again today. My theory is that money is leaving the banking system (deposits) and is being put into Treasuries and money markets. This has allowed Treasuries to hold up while some money rotates out of Treasuries into stocks, which is pushing stocks higher. People are demanding to be paid for their deposits.

I have previously explained that the debt ceiling is also causing a lack of debt issuance, so that helps to prop up long duration bond prices (lower yields), which takes pressure off stock prices. And in recent past months the BOJ and China’s central bank were stimulating so that there was actually a trillion more stimulus going into global markets. Much of the QT performed by Fed was offset by the reductions in the Treasury balances. So we have really not even started to see the impact of reductions in the balance sheets of the central banks.

This cycle is going to turn down very soon. Roubini says that most banks are technically near insolvency. I think this is very true. Real estate is still holding value, despite alot less demand. This will need to collapse soon.

The problems of excessively loose monetary policy and too much debt are soon going to hit the system. When it implodes watch out below.

A person buying stocks doesn’t mean that money is leaving the banking system. The seller is likely taking the cash and depositing it into banks or buying treasuries.

Einhal, Well, it all depends upon what the person who sells the stock does with the money. If they put it into a bank deposit, then there is no change in bank deposits. If they put it into another asset class – real estate, Treasuries, bonds, stocks, then it does leave the banking depositor base.

Alot of money is leaving bank accounts that pay no interest and going to someplace that pays interest or has the ability to appreciate. This is inflationary, so the Fed cannot stop raising rates now.

This is why stocks are headed higher now. But people jumping into stocks now are placing a suckers bet.

Pullback coming on stocks IMO

Time always knows

I am still not sure if the amount of liquidity Central Banks are removing (QT), is less than the amount of new debt Governments are issuing. I have not check those numbers.

I don’t know. It could be a wash in the long run?

Example. In looking at the CBO forecast of $40 trillion in Gov debt by 2030, that is an 9 trillion increase. If the FED could reduce their balance sheet to zero by 2030. Than liquidity is a wash? But, I would think a currency would devalue as debt keeps going up. Real inflation might not be that high but if the buying power of your currency drops than that is inflationary.

Plus, as we a lot of manufacturing is supposedly being de-globalized, wages in the US are higher than places like Asia. This also should lead to wage / service inflation?

You mentioned “ This cycle is going to turn down very soon.” which factors do you think will cause this?

1. Bank insolvencies – Banks are sitting on big commercial real estate loans that cannot be rolled over and still be profitable. So many REITS and commercial owners will just walk away. This will cause stress to the whole system.

2. Go back and look at what happened when the last debt ceiling was raised. This is key. Look at how long term interest rates were being suppressed right until that debt ceiling got raised. Afterwards (2 weeks later) long term rates shot higher and speculative stocks sold off. This is simply because supply and demand shifted when the Treasury was able to restock its balances with massive bond sales. Think of this as similar to when the biggest owner of a stock decides to liquidate. For a short while, it doesnt impact the price as the big whale sells, but at some point the big whale needs to sell more than the market can absorb. Keep in mind, the Fed and other central banks can override all other buy/sell signals if they want. But they are now trapped with high inflation and need to reduce their balance sheets. Also look back to the last time the Fed tried to sell off balance sheets (I think around 2018?). The stock market dropped 30%. That was when balances were much lower. People dont realize that the Fed has trapped us in a horrible place by buying all those bonds, caught between raging inflation and bubbles and a future crash.

3. Coming crash in residential real estate. Only a matter of time. Monthly mortgages are too high. Give it another 6 months of prices declining by 1-2% a month and after summer selling season and more people will put homes on market to get out with equity. Last time it took 5 years from top to bottom. Smart owners will sell ASAP.

4. Collapsing demand. We are still living in a time where bank balances are swollen and credit card debt is about average. Look back at charts from Wolf. Bank balances are dropping and credit card balance are starting to shoot up. Give it another 3-4 quarters and credit card debt will be through the roof, similar to 2008. Demand drops once people who are living paycheck to paycheck run out of credit to spend and pull back expenses.

5. Geopolitical problems. China will be a real problem and it will end up hitting alot of stocks. Chinese consumers will stop buying Teslas and iPhones, etc. Lots of companies have real problems with their supply chains being in China. Rising labor costs to move production means higher inflation which must be killed with higher interest rates. China will try several approaches to take over Taiwan before our next Presidential election. They want to do it while Biden is still in.

6. Lapping deflationary trends. Right now we have some reversion to mean in durable goods pricing and maybe other consumer products as supply chains get sorted out. Once we absorb those declines and lap over them, those deflationary forces will turn back into inflationary forces.

If you look at what the Fed has done so far it is basically only raise short term interest rates. Long term interest rates are not up that much. Central bank balances are still huge.

I see the current drop in long term rates as merely a supply and demand issue as there is not as much issuance and people are pushing money into safe assets that pay interest. Once long term interest rates start to shoot higher, everyone will be dumping them because they will wake up and see that their principle losses outweigh the measly interest.

We have much carnage to go.

GTV – I always appreciate your insightful comments.

Bond vigilantes could come back too…

I’d say it all comes back to interest rates.

Once the markets are forced to face the fact that service inflation isn’t going away and there will be no rate cuts this year yields will have to rise and prices will have to fall.

The longer we go without recession the harder the fall will be for asset prices that is.

Once it’s clear that recession is the only way out then we can get some good ole capitulation… I’m so excited for this day!

Good time to buy long term Treasuries. Get a good yield plus capitol gains.

I believe a big chunk of Core PCE is housing, and housing inflation takes a while to show up in PCE – I saw one estimate suggesting it takes 18 months, aka housing inflation in PCE would peak Q3 this year, pretty much regardless of what the Fed does today?

1. “Core services without housing” is spiking worse than ever. That’s what Powell has been pointing out. “Core services without housing” is something like 55% of core PCE.

2. There is a lot of HOPE that housing inflation will go away. But housing inflation never picked up on the 15% spike in asking rents, and now that the spike in asking rent is unwinding, the housing inflation measures will not pick up on it either because it had never included the spike in asking rents in the first place. Asking rents are just asking rents, not rents that people are actually paying. The housing inflation measures track what actual tenants are actually paying over time. So I’m kind of leery of buying into that hope lock, stock, and barrel. Too many such hopes about inflation going away have been dashed already.

Wolf,

All these rent data that is published doesn’t mean much when lawbreaking has become the norm. Landloards here are jacking up rents so fast it will make your head spin. They are even violating local laws prohibiting userous rent increases. They jack them up, and wait to get prosecuted which never happens. In one case, close to home, they claimed they were selling the house to get the tenant out and then didn’t sell and rented it out way about the legal amount.

Judging from the charts, only a few more years and inflation will be back down to 2%

That’s what you get from them? I see that if nothing changes inflation will stay exactly the same. The record is going to keep playing the song “4,5,6% inflation”, it’s an oldie! The fed needs to go Vlocker on this economy to fix inflation.

“The fed needs to go Vlocker on this economy to fix inflation.”

I agree. Volcker’s Fed Funds rate in 1982 was 16% .

Imagine rates at 16% and how many Silicon Valley Bank-type situations we will see, and within one business day. This is bigger than the S&L crisis which Volcker’s hikes brought to a head. The Reagan admin was able to kick that can for 8 years until it finally collapsed under Bush I. But do we have the resiliency and resources to handle a bigger crisis now?

Nouriel Roubini is saying hikes will drive the banking system into a crisis, a solvency problem: the long term assets in banks are too low-yield, in the form of both low-yield treasuries and low-yield loans outstanding. He sees us in a dilemma between inflation and bank crisis, a downside payoff of the printing regime since 2008, that only papered over the problem, until it could go no further. But I would love to buy a 30 year treasury bond paying 16%! That is, unless we go Zimbabwe.

Inflation may drop but I am guessing fed fund rates should not drop below 3% again. Mortgage rates will most likely see 5.5% to 6% as a floor?

But, who knows if there is another crisis or big bubble that pops and is contagious. I never though NIRP (negative interest rates) that was implemented in Europe was even economically feasible. Crazy but during NIRP, some home owners had banks actually pay the borrower a monthly interest payment on their home loan. LOL

Judging from the charts, only a few more years and inflation will be 10%, driven by services?

That’s Wolf just like I think as well !

Not sure how you get that from charts but ok . Remember that commodities hit a point and stop deflating especially energy. Replacement costs for energy as the exiting energy depletes at a rapid pace are high . Likewise for goods . Folks don’t sell those items at a loss. They go out of business in a year or less depending on inventory cycle times. Hence the focus on services. Energy is very volatile and lead times for new energy can take a decade to develop globally .

Roubini wrote yesterday that the entire banking system is nearly out of equity (i.e. insolvent) if you mark loans and investments to market value.

That’s an interesting observation. It means the banking system is dancing on a precipice. Will the Fed have any choice but to reduce rates, to prop asset prices? The bond markets seems to think so.

But the only real lasting solutions are increased taxes, reduced spending, permanent debt write-downs, and fall in stock and home prices.

They can kick-the-can another year or two by reducing rates and stalling QT, but then we might see inflation right back up to 10%.

Who were the “leaders” who put us in this position? That’s a matter of opinion, but I don’t think we’ll see the faces of Greenspan, Bernanke, Yellen, and Powell carved into the next Mt. Rushmore.

Perhaps the blame should also be pointed towards the “venerable” Financial Accounting Standards Board (FASB), which lost its spine during the last recession and changed bank accounting rules to eliminate mark-to-market in banking, in order to mask a crisis.

The Fed and FASB are supposed to be independent, not subject to market whims.

This assumes that banks HAVE TO SELL ALL THEIR ASSETS in one day. A lot of companies that have to sell all their assets (inventories, accounts receivables, factories, delivery vehicles, etc.) in one day will be insolvent because they’ll only get something like 50 cents to 70 cents on the dollar. Market value is truly irrelevant for stuff that you don’t have to sell. People need to get realistic about that.

Yes, but if there is a depositor run, it happens in a day. Interesting to ponder though, where to run to?

I think that’s the floor under these bank runs.

Only so much cash can fit under your mattress before you have trouble sleeping at night.

In hours ,the internet will kill world economy.Try getting money out of China,

Broker/dealers are required to file monthly focus reports that goes to the SEC and FINRA. Each firm is required to market to market all securities held in firm’s trading and investment accounts. On top of marking to market, a discounting factor is also used with govies getting a very small discount, and speculative stocks getting haircuts of up to 60%. Since it is impossible to know if a bank really will hold its govies to maturity, they, too, should be required to mark their holdings to market.

Why is everyone in the financial media hoping for a drop in interest rates??? Frankly, I’m sick and tired of watching inflation over 15% going up and no one reporting the actual figures and wiping out the savings of every American for the last 14 years. Let’s get the interest rates above the REAL inflation rate. Let’s let the banks who over extended themselves go under. Who the hell cares??. I sure don’t. We need another Paul Volcker. J Powell is not the person to take this on. If it takes 15% rates to bring down inflation then so be it. Bring it on!!!

Financial repression may fully contain inflation in about five years, if they keep rates up, and QE stays dormant.

The interest rate “crisis” for banks is simply a return to a real interest rate structure. If overall inflation demands even higher rates, then more damage will happen. But hey, banks might just be worth a whole lot less with real competition. Gee, hoocoodanode?

There is a lot of fat to be rendered through competition, and fat margins are begging for competition. Realtors, bankers, big tech, lol.

I find the fear of a cashless society to be comical. Like using cash is some magic talisman. And that government really cares about a fricking yardsale. The sheer scale of the drug trade alone is far more than most of us can imagine. Yet, Walmart won’t take cash!!! The gummint will limit how much cash you can take out- Pat Boone told me so!!!

Someday this war’s gonna end…

Cit AlM,

Cash is what I use to make my grocery store, gasoline and farmers market purchases. Yeah, I could charge it to my credit card and get my 1% refund. But the merchants I deal with, I like, and this way they don’t have to kick in the extra 3% fee to VISA (my farmers market growers don’t have credit card readers anyway).

Target has their 5% discount ‘Red Card’ and I do use that when shopping at Target.

But using cash just feels better to me. It’s a good option to have, and provides a sense of anonymity and freedom that you don’t get when every purchase and every item you buy is on a digital database.

Don’t forget that PayPal has done some account shenanigans to certain individuals recently. That is a potential issue for CBDC only commerce in the USA. And now some United States Federal Parks will not except cash from guests and visitors to pay for fees associated with using them. That is a bad trend.

“In God we trust; all others, pay cash.”

Mendocino Coast,

Sweden?

I recently bought some SACD recordings from BIS in Åkersberga. They would only take Euros digitally since I was in Minnesota. That seemed easier than flying to Stockholm and taking a train to buy them in person.

I few local convenience stores will add 50 cents on any purchase below $5 with credit cards. That is at least a 10% markup. So I pay cash when I buy a $1.25 fountain drink there.

I have replaced all of my fountain drinks with water, bottled in home.

I ‘d have canned drink once in a year or so. I don’t crave for these so works for me.

Paypal has gone full evil, they revised the ToC to have the ability to basically fine an account if the operator says something they do not like (I think $2500 per instance, no cap). This was made a big deal last year, and they backed off, then silently slipped the change in a few months later. I have since canceled my account (I would recommend all free speech loving people to do the same) and felt dirty using them as a merchant service processor for Wolf’ donation.

Venkarel,

That’s one reason that my twice-yearly contributions to Wolf Street Corp are done via US snail mail and a personal check. This requires Wolf to make a deposit to his bank, but every penny donated goes to his Media Empire directly.

Venkarel,

OK, now I gotta check that out. I gotta look at the language.

Cash can be a sign of corruption. Sure cash saves you a bit maybe and the merchant a bit. Legitimate businesses will report the income so it does not make any difference coming in as cash, credit card, check, Venmo… yadda yadda yadda.

However corrupt business owners will pocket the cash and continue the process of corruption. The little “nudge nudge say no more” to other business owners that obviously “you shouldn’t pay the man, heh heh”. Because they will never report the cash in their invoices or accounts receivable.

There is a pride to being incorruptible as a business owner. No one can find a crack in your armor. You are successful.

I’m quite concerned that the Federal Reserve will eventually raise its inflation target to something above 2% PCE.

To be clear, I think the odds of it happening in THIS business cycle are low, as they’d have a credibility problem. But once the next deflationary recession arrives, they could certainly enact a policy change as they did in 2020.

Every day, there are multiple articles in the financial media advocating for a target increase, because “the tightening likely required to bring inflation down to 2% – an arbitrary threshold – is not worth the economic & human costs.”

It’s an unholy alliance between progressives & Wall Street which has proven to be very influential. The 2020 policy change from “2% hard ceiling” to “flexible average inflation targeting” was made as a result of their lobbying.

If House Reps were smart, they’d pass a bill amending the Federal Reserve Act defining “stable prices” to be something in line with the 2020 framework (eg “long-run average inflation of 2% PCE”) and dare Biden to veto it. It’ll be politically harder to do this once inflation is out of the headlines.

If the Fed raises the target above 2%, it will keep its rates higher for even longer, and long-term yields will spike because everyone will see that 2% is a pipedream. Right now the bond market thinks inflation will be back to 2% by next year. Raising the inflation target will blow this illusion out the window, leading to higher yields for longer. Fine with me.

Nobody has ever really given a credible explanation as to why 2% inflation, or any inflation at all, should be a target.

Inflation is necessary to keep the economy and governments running. The world runs on debt, both financial and real (raw materials and energy). If you have stable prices or deflation, then everyone goes broke because everyone is in debt. Inflation lets you borrow for free if you can borrow at or below inflation.

Politicians and economists scream that deflation will lead to a depression because we once had a depression associated with deflation. Of course, the causation is the wrong way around but everyone nods and agrees, “Gosh, can’t have another Great Depression! Gotta have the inflation.”

Setting the target at 2% made sense in a low inflation environment. It allows debt to inflate away slowly. 2% seems like nothing, right, but like all geometric progressions it works its magic over time.

2% only becomes the target when inflation goes well over that level. In reality US inflation has been nearly 4% for the past fifty years, probably higher if we measure real prices for real things.

Basically it’s governments, banks, and businesses stealing from people dumb enough to be savers…like me.

I have been in software contracting for ~30 years. In the last 18 months we have pushed rates up over 45%. (We have never been cheap, often sitting at 2x to 3x the “normal” rate for “our geographic area”.) From 2000 up to 2021, even a $5/hour bump in rates would be met with howls. Now a $10/hr or $15/hr bump isn’t even questioned.

In addition, the PO amounts are getting much larger. Used to be a $50k PO was a big deal. Now folks are going to the well for several 100k at a time and are looking to lock in for as long as a year.

SW contracting has always been boom or bust. The best times to be a contractor are when the economy is booming or crashing. When things are stable it is usually much harder to find work. (My opinion.)

I don’t see this slowing down…

The headlines seems to imply that only service inflation is raging; which might sound like inflation is cooling in other areas. Absolutely not… Its going to cost me 12 grands to put a new 16 seer AC, which used to be 8 grands just 2 years ago. Now that process involves purchasing the thing and getting it installed. Both have gone up significantly. The scumbag middle men make things worse. But hey, we have to save silicon valley bank by printing more money because that is more important.

You can buy AC systems online and have them shipped to you for less. It’s a hassle dealing with the trucking company and finding “a guy” to install it. But it is warranted and overall prob under 5k. I’m not promising smooth sailing but just pretend you are a general contractor and problem solve.

Man I looked into that… Half the places are sold out, the others that have stock have models that dont have good reviews. Some of online retailers dont even have a working phone number to call if you need to talk to someone. Big name local contractor quoted 20K for the same unit that I found elsewhere for 12.

Its a pain to get the attic air handler swapped out so I want something that will last for atleast a decade if not more. My current Trane lasted 15 years. I don’t think 5k is realistic any more, maybe a couple years ago. Here in Phoenix you need something that will stand up to 120 degrees in summer… and believe it or not deal with frozen lines in winter. My Trane used to trigger the defrost cycle regularly through Dec and Jan. I know because I sit 5 feet from the condenser, it made a weird hissing noise when the defrost kicked in, and there was condensation at the base of the unit shortly afterwards.

Anyhow, what I was trying to point out to Mr. Richter is that the article title might lead some folks that wear rose colored glasses to think inflation is cooling off elsewhere, and it is not.

I hear ya!

Good luck with the AC troubles.

My furnace has lasted 50 years so far. AC for 30. The unit should last longer than you describe if ductwork isn’t undersized and install is done correctly. A good company will be more expensive upfront but not long term when factoring in repeated installs every 15 years. Go with a company that uses software like wrightsoft and looks at the house as a system. Home performance contractor is the Crème de la crème. There are significantly different levels of quality in the HVAC industry.

Somehow I can’t get too excited about all your “suffering”. Maybe I lack empathy?

Peachy you have equipment that was engineered to last,these new high seer rated junk are efficient because all the electric motors have been downsized,and manufacturers need junk.to break down every 10-15 years .

SomethingStinks,

The costs of getting the AC installed are services.

The cost of the actual equipment when you buy it at the store and load it onto your truck yourself, that is part of goods.

1) The June PCE y/y might drop.

2) PCE ma(3M) is losing it’s thrust, possibly an ending triangle

3) PCE y/y All Items retraced 38% of the move from 2020 low. In June it might retrace 50%/62%.

4) Service : the last 2 dots are glued together. Service is losing it’s thrust

since the 2021 congestion. The inelastic might become elastic. In June Service might drop to the congestion area,

5) Durable goods might dive underwater. The Durable goods fad peaked in 2022 after 3 waves up. The downtrend speed is slower.

Does TA work on inflation data historically?

Watching the financial news this morning made it sound like inflation was finally under control and on its way down. I kept trying to reconcile that with the numbers they were showing. If it weren’t for Wolf’s column, I

would be totally befuddled about where we are. I share everything Wolf writes with my brother in Florida who thinks his commentary the only honest financial news out there, too.

A strawberry topped boston cream cake in Pittsburgh is now $18.99…one dozen donuts price is $11.99.

Two weeks ago cost was $9.99 and $6.99 respectively.

Lucky us that food prices are least terrible since ’22.

At last some effort is done to fight the obesity epidemic.

Maybe these are the “invisible hands” of the “free market” I always hear about? Maybe I should have more faith in it?

My innate cheapness has been a driver of better habits for a few decades. I swear by it. The recent price rises were a wind at my back helping me drop a few pounds. I imagine also being calm and positive will add a few additional months to my life, and much sweeter months at that. And I have stopped piling up consumer junk in my home.

In your “Least Geeky Explanation” article on February 27 you said, based on what Fed Governor Philip Jefferson said at his talk at Harvard, that the Fed’s 2% target is based ton the total PCE, not the core PCE. Keeping in mind your comments in that article about this issue, it seems that today’s article contradicts what Mr. Jefferson said at Harvard. With all that rides on the issue of the Fed’s 2% target, it seems resolving this benchmark issue is important.

Yes, that was interesting, and we discussed that disconnect in the comments back then. It was very unusual what Fed governor Jefferson had said — and which I quoted in the article:

“… the Federal Reserve’s inflation objective is defined in terms of the total PCE price index, but the Fed monitors the core PCE price index, as well as other inflation indicators, in order to identify evolving inflation trends.”

Powell and others have been saying that the Fed is looking at “ALL” inflation indices, and he discusses different ones during the press conference, including his favorite now, “core services without housing.” But when it comes to the target, they’re officially tracking it via core PCE.

I think the Fed is trying to avoid the accusation that they’re ignoring the costs of food and energy, which hit many Americans brutally last year. And core PCE ignores food and energy.

Perfect logic Wolf. The conspiratorial part of me says the Fed doesn’t care about PCE or CPI, only the core versions. This hurts the working class, which is what the Fed has in mind for a “soft landing”. 100 banks failing is a crash for Wall Street, 200 million Americans being slowly eaten by inflation is a soft landing.

Last line on whitehouse.gov briefing about latest PCE report reads like this,

“The last thing our economy needs right now is the reckless threat of a chaotic default. Those threats must be taken off the table.”

I am not sure what the govt means by this.

Nick, my guess about the govn’t posting this was about not resolving the coming debt ceiling and the supposed government default that may/may not follow it. Just speculating?

This “default” would be the consequence of Congress not fixing the “debt ceiling.”

Okay, I was worried about bank defaults :)

That doesn’t rule out a marvelous cluster of all the above “defaults” at once. Happy spring!

Whitehouse wants a “clean” no negotiations no conditions increase or elimination of the debt ceiling. They think that if you don’t agree with them you are chaotic.

You don’t know what chaotic means=CHAOS

Rent prices seem to be a huge problem anywhere in the developed world.

The rent and grocery store prices are rarely going down.

People in Canada and the USA can’t sleep at night because they fear having to pay current market rent which is way above what they can afford.

It seems so less offensive when inflation is viewed on a yearly basis. But add a few of those years together and you’re looking at 30-35% over a five year period. Now that really hurts!

There is no market. It now consists of hucksters and shills. And the Fed with it’s Citadel type partnerships at the controls. Yes, Gold will be sat on when trying to punch through $2,000…

In last 5 years total inflation is around 65 percent or so.

The government numbers may tell you some other manipulated metrics

Jon,

Yep,

The last 20 years inflation is 100%. I checked all my records going back to the year 2000. Averaged out, everything has doubled. A dollar in 2000 is worth less than .50. I’m looking at things like property taxes, health/home ins premiums and other non-volitile price increases.

With 14 years of zero interest rates after the GFC savers have gotten wiped out. I don’t want to hear any more sob stories from whining dogs in the CNBC and the financial shills in the media and elsewhere about rising interest rates.

If TIP Breakevens drop, there could be some real opportunity there.

My experience is that capital spending is freezing. Some companies on the second round of layoffs. Raises way behind inflation. Bonuses have gone to zero. Relative calm before the shitstorm.

Corp earnings to drop, p/e to rise from current moderately high levels without price corrections

Inflation is a tough one.

You can measure it accurately with fuel, energy etc, because it’s always the same.

But food, services etc?

We see cars get hedonistic adjustments.

Is anyone looking at how rubbish lots of stuff in the baskets of goods has become over the last decade?

Ie, look at a coping saw for £10 you bought in 2005, vs one you bought for £20 in 2022.

The £20 is worse, despite costing way more than the inflation should have adjusted its price by over those 17 years.

Everything is the same. Including food to some extent. Cheaper oils, cheaper packaging, smaller sizes, rebalanced ingredients (less good stuff, more filler).

Is anyone measuring this stuff meaningfully? Or adjusting for it?

“Hedonic quality adjustments ” LOL. Even the Germans know there’s a limit to how much you can improve something. A coping saw is a coping saw. Quality is quality. Way too often people buy by price.

Hedonic quality adjustments are used for motor vehicles and tech products, such as smartphones. They’re not used on other products, including coping saws. That was an absurd argument to put forward there.

Quality deterioration is massive and very visible when comparing well-preserved houses from the past vs. new homes.

But the same can be said about durable goods:

– cars are made of composites vs. steel

– watches use steel instead of solid gold

– clothes are polyester instead of wool or cotton

My wife has a Channel bag, the one from the ’90s has a gold-filled chain, while the new one is just a base metal.

CPI/PCE does not reflect such changes, not a single iota.

Cars today are 1000x better than the shit we were forced to drive 30 years ago. Get used to it.

How do you like your 10-speed automatic transmission that’s standard in every F-150? The ABS? The power, the performance, the fuel economy, the durability, the backup camera, the hill-start assist, the safety features…

OK, now I can see your argument coming. You’re going to tell me that the 1985 Buick that you still drive is the best vehicle ever made. And then I will just go ahead and feel sorry for you LOL

The car, motorbike and bicycle I enjoy owning & using today are so superior to what I had in the eighties and nineties it’s remarkable.

Those machines were great for their day, and still very enjoyable and capable. But the steel road bicycle I successfully competed with in 1990, and was state-of-the-art then, is a slow dinosaur compared to my 2020 carbon-fibre road bike.

Cars are much better but also heavier and filled with much more plastic and copper. Enjoy them while you can.

Services Inflation Rages :

I Expect Gold will Hit $2000 This year and sit some then rise

Senator Warren and J. Powell March 23 Hearing Talks clear on Inflation it seems however To accept some perhaps 2 Million people without Jobs and a recession VS Lowering Interest Rates again to be a issue we have

Job’s Vs Inflation

Sometimes Wolf allows a Link ?

https://www.warren.senate.gov/newsroom/press-releases/icymi-at-hearing-senator-warren-calls-out-chair-powell-for-feds-plan-to-throw-at-least-2-million-people-out-of-work

Wolf, why no mention of the fed’s preferred measurement of inflation: “super” core (ie core ex. housing services or whatever the hell Jay said it was). Or was that only their preferred CPI measure?

I cannot find the actual data on that. But I have the charts that Powell has shown in a speech, and I’ve posted those here a while ago. That’s where inflation is raging right now.

1) I had a good day today, because I got $20.85 discount on my new blue jeans.

2) I couldn’t find my size, but it fit well anyway, because I gained weight.

The price used to be about $39, but now it’s $69.50 before a discount.

The total : $48.65, but I don’t care, because lettuce is down from $6.99

three months ago to $2.99.

3) The sickie inflation was elastic on the way up, it might be elastic on the

way down, like the durable good fads

4) What looked great on Mar 31 might look bad after Apr first.

“2) I couldn’t find my size, but it fit well anyway, because I gained weight”

Girth Inflation? LOL Yes, that’s a thing

“2) I couldn’t find my size, but it fit well anyway, because I gained weight.

The price used to be about $39, but now it’s $69.50 before a discount.

The total : $48.65, but I don’t care, because lettuce is down from $6.99

three months ago to $2.99.”

Methinks I do espy a Two-Birds-With-One-Stone solution here. Only, you may need to purchase a belt for $500 or whatever they cost now.

So much for “cool” energy prices. Fresh 1.1 million cut from OPEC +. Surely bringing cheer to US banks and the fracking industry.

It’s time for those 1% rate cuts that the market is pricing into the market (sarcasm). At least the indexes are taking the OPEC cuts pretty well….

This is really all so puerile and pointless, though. I know that many people take all this seriously, our host not least, but it’s just a giant game of people running on big hamster wheels, stealing from each other and destroying our future.

I have given up trying to understand economics or stock markets. I suppose we are back to bad news is good? Or good news is bad? I truly doubt Wall Street and investors writ large are smart enough to think: “Oil up is good for fracking which will save the banks even more than higher rates. Besides, inflation is about 40% profit-driven so big deal.” Well, maybe there are a few smart enough.