That’s how it should have been all along. But the Fed’s interest rate repression killed competition for deposits.

By Wolf Richter for WOLF STREET.

People – and I mean massive numbers of people – have finally figured out that they’ve been getting screwed by near-0% interest rates on their bank deposits, and they’re moving huge sums of money around, as deposits have suddenly turned into hot money, forcing banks to respond by offering better deals. And the land is now awash with banks offering 5%-plus on CDs, and people are moving huge sums from some banks into other banks, from money-market accounts to CDs, from checking and savings accounts to CDs, money market accounts, etc., and they’re massively piling into Treasury securities. The goal is low-risk 4% to 5%-plus.

And the amounts and flows are huge between deposits ($17 trillion), regular money market funds, Treasury money market funds, Treasury bills ($4.1 trillion of 1-year or shorter maturities), and Treasury securities with a relatively short remaining maturity.

Banks have been offering high-interest rate CDs through brokers (“brokered CDs”) to get additional cash to make up for the cash they lost from their regular customers.

Now it’s also a battle to keep deposits.

What’s the new thingy now is that they’re offering their existing clients 4% or higher CDs to encourage them to keep their money in their accounts instead of yanking out to put it into a money market fund or someone else’s CDs.

This fight for deposits is something we haven’t seen in many years, not to that extent, but that’s how it should be. People should force banks to compete for their deposits. And the way people force banks to offer higher rates is by yanking their money out that’s earning 0.1% in large enough numbers.

Banks can always borrow from the Fed’s Discount Window, currently at 5% and they have to post collateral. So paying folks 4% or even 5% and not having to post collateral is a much better deal. This is how the Fed’s rate hikes wash into the economy.

There was a little bit of that back in 2018.

Back then, the Fed raised rates timidly, and it timidly trimmed down its balance sheet, even while inflation was at or below the Fed’s target range. At the time, the Fed just wanted to “normalize” its policy rates, and so it eased them up, and it eased its balance sheet down, and yields of money market funds and Treasury bills rose above 2%. I mean, WOW! After 10 years of Fed-imposed near-0% saver-confiscation policy!

And so in early 2018, banks started losing deposits to money market funds and Treasury bills, and so they fought back, well, in kind of a quaint way by today’s standards, offering just over 2% on some CDs and high-yield savings accounts, but nearly all of it was to attract new money.

We talked about this back then a couple of times in April and May 2018. But then President Trump started keelhauling Fed Chair Powell – Trump’s man at the Fed – on a daily basis about these timid rate hikes and QE, and that was the beginning of the end for savers and Treasury bill investors and money-market investors, and they got re-crushed and soon they were back to near 0% yields.

Now it’s different. It’s massive, and it’s costly for the banks.

These higher deposit rates mean the banks’ costs of funding are rising, and their margins are getting squeezed.

But it’s finally some relief from 14 years of financial repression for savers and Treasury bill investors and money-market investors.

The discussions of how to get those 5% yields are now everywhere, even on NPR, which is my thermometer for when a financial concept has become totally mainstream and everyone is doing it.

And that’s how it should have been all along. But the Fed killed the free market for deposits with its interest rate repression.

The average rates across all deposits are still minuscule, just 0.4% in March on average across savings accounts. But more and more banks are now paying much higher rates. CD rates on average are still low, with the average 12-month CD in March of just 1.5%, according to FDIC data, but that’s up from 0.15% a year ago, and the increase is driven by the 5% CDs that are starting to flood the market looking for buyers.

My broker today offered CDs up to five years with the top rates for all maturities at 5%-plus, from all kinds of banks, small and large. The top rate offered was an 18 months CD paying 5.4%. Those are efforts by banks to get new deposits.

One of my banks increased its “high-yield” savings account rate to 3.75%. That’s an effort to keep its deposits.

One of my other banks, a TBTF bank, is offering me 4.25% CDs just to keep my money there – it did so while I was logged in, putting a promo right in front of me to dissuade me from transferring my money to a money market fund that pays 4.6% or to my broker to buy those 5%+ CDs. That’s an effort to keep deposits. I don’t even have any savings products at this bank, just my personal and business operating funds and some just-in-case funds. But it sure wants me to keep those funds there.

Treasury yields go haywire in the fear trade.

This battle for deposits occurs even as Treasury bills have been on a majestic roller-coaster over the past two weeks, with rates plunging on the fear-trade, particularly late in the week as folks want to trim down their uninsured deposits, just in case their bank does a bellyflop over the weekend.

Then on Monday, including last Monday and today, as fear settled down and interest in Treasuries waned, prices fell and yields spiked, but they remain a lot lower than they were.

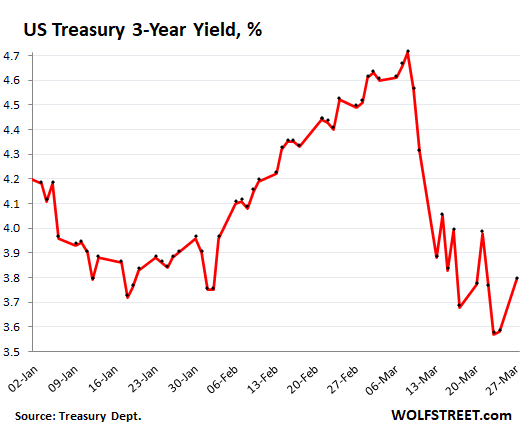

Today, was another crazy day in the Treasury market:

- 3-month yield: +17 basis points (to 4.91%)

- 1-year yield: +19 basis points (to 4.51%)

- 2-year yield: +18 basis points (to 3.94%)

- 3-year yield: +21 basis points (to 3.79%)

- 10-year yield: +15 basis points (to 3.53%)

These huge moves, up and down, occur because of money sloshing around the financial system looking for higher yields one day and getting spooked and looking for safety the next day. I mean, look at this mess:

But this interest income stimulates consumer spending.

So banks are paying more, their profit margins are getting squeezed, and they’re hating it, and a couple have collapsed because they got caught ignoring the rising rates.

But for consumers with trillions of dollars in savings, money-market accounts, and Treasury bills: they’re now seeing a real cash flow for the first time in 14 years. And even though it still doesn’t keep up with inflation, it’s still a cash flow, and some of it is getting spent and is getting recycled in the economy. This is particularly the case for retirees that are often spending every dime in income they get, and this additional income is turning into additional spending.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I’m loving this competition for my money. Finally! Been waiting for it for a long time.

My bank still didn’t get the message, offering 1.7% on 3 month CDs.

So after SVB collapse, I moved 90% of deposits to TBills. It was a blessing in disguise as the fear got me moving!

Did the same.

Leo, you don’t have to settle for the low rate on CDs or the lowish rate in treasuries. You can buy non-callable CDs at over 5% interest at many banks now. I do this through my Schwab investment account which includes a diverse menu of FDIC insured CDs from many banks. So, I do business with one bank but hold funds across many different banks. Of course treasuries are a nice option, but I’ve been rolling out of them and into CDs lately.

But, how safe are those banks that need to offer such high rates.

I am no expert so I am just throwing out the following questions. Fractional reserve lending is great when things are going well but when people want to pull money out, you are in a big bind and it is easy to become insolvent. If you have a 10-1 fractional reserve, in theory once 10% of the money is pulled, you are looking at insolvency if this number keeps growing to lets say 20%?

ru82,

What is your concern? FDIC insures cds up to the $250,000 limit. When I was very young, I received 7.5% interest on my savings at the local bank.

I think the fed has screwed up everyone’s sense of normal. It isn’t going to be pretty but the current trajectory for rates should be more reassuring than it apparently is. I welcome some bank failures as we need controlled burns.

I would be far more concerned about the banks that cannot afford to offer higher rates.

ru82,

Assuming the banks assets haven’t declined in value in a significant way, what you’re describing is a liquidity issue, not a solvency issue. The bank has assets of sufficient value to cover the deposit withdrawals, but just not in the form of cash. That’s where a central bank can perform its classic function as a lender of last resort against good collateral in order to allow the bank to fund the withdrawals.

If the value of a banks assets no longer cover its labilities, like in the case of SVB, then you have a solvency issue. It’s not the withdrawals that lead to insolvency, it’s the drop in value of the bank’s assets relative to its labilities.

Rue82,

I’m below the FDIC limit at every bank so the risk is effectively nil. Worst case is a CD gets hung up for a short time during a bank unwind. But I am spread across a dozen banks so very little to worry about in my opinion.

rojo,

good write up.

SVB on thursday had a liquidity issue. not enough cash to pay withdraws so the borrow against their assets from the FDIC. On Friday when they open their. doors, they had 100 billion withdrawal Queue and their 100 billion in treasuries assets we’re probably only worth 70 billion. They can only borrow against 70 billion. not 100 billion. Now they were insolvent and they were forced to close. it was impossible to payout all the withdrawals

2 days is all it took. crazy

SVB did the liquidity to liquidation in 2 days. lol

Fidelity Investments has Gov. Backed MM funds at about 4%.

I gave up, 90 cents per month per $100K deposits. Shut the bank accounts down and went to a competent money manager. Barking for biscuits beats being chained to a post. Don’t have the time to do this myself, my bad maybe.

ru82,

It was absolutely crazy how fast SVB collapsed.

Learned something new. Thank you

I’m not optimistic, so I fear a massive withdrawal of bank deposits and

FDIC could never handle it as they have maybe 1.5% of the funds on deposit

at banks.

I keep an eye on the USD index. BRIC countries & Saudi Arabia have stopped requiring USD for trade, especially oil & gold. If dollar falls, every little thing we import becomes inflationary and much discretionary spending stops. Savings in banks is then needed for lifestyle maintenance.

Just saw a college professor say 10% of banks had more interest rate risk than Silicon Valley had. Its not a problem til deposits decline. Fed & Treasury will have to jaw bone confidence to keep deposits from moving around. A lot of banks can’t pay competitive rates with 5% t-bills or they will be toast.

combine that with lending to commercial real estate that is way overpriced and cant refinance at existing rates. many banks are going to get creamed.

Competition for money that is becoming ever more worthless, ever more faster.

Wonder how long this will last ?

It will last as long as people need dollars to purchase the necessities of life. People still get paid in dollars and need those dollars to purchase food and shelter. I think this will last for a long time regardless of the underlying purchasing power of the dollar.

Exactly Mike. These CD rates you can find today are good improvement over the past 12 years but I am still losing money to inflation. I don’t like that. I want my net wealth to grow vs inflation.

I just have to play other avenues of investments such as selling covered calls or option spreads, etc.

ABSOLUTELY!

It’s a trap. “While people are now not thinking about the next interest rate cut and QE of the Fed, we should because the timing of these is probably less than about a year away and that will have big effects. I think that there is a good chance that it will produce a big decline in the value of money.” Ray Dalio.

Why do people still take hedge fund mangers seriously when they’re just trying to manipulate markets their way?

Thanks for telling the truth about Hedge Fund Managers. The voice they get in the press is mind boggling on why anyone would want to listen to a group that is value destructive to the overall economy. (At least in my opinion) I make this statement because capital from the wealthy are invested in these hedge funds instead of business growth and efficient allocation of capital in the economy. Too much leverage and misallocation of capital through hedge funds plus the favorable tax advantage given to these folks.

hedge fund mgrs lower than dirt, right there with RE agents…..

BS ini – …have always felt the old joke about lawyers and legal firms (‘Dewey, Cheatham & Howe’) was less than inclusive…

may we all find a better day.

Natalie – your name dropped off the post, addressed to you (and Wolf), as well. Apologies.

may we all find a better day.

I feel the same way about real estate agents who say now is a great time to buy.

Wolf,

The money managers pitching pivot are almost certainly talking their own book *but*

1) There is a (questionable) reason that the Fed ran the ZIRP zsychosis more or less since 2002…China has been annihilating the US competitively since 2002 and ZIRP was the one-button “fix” that sorta propped up US economy/employment by artificially goosing up asset returns (see new build SFH, with periodic implosions, etc., also see money losing corps kept alive at 4% debt, soon to crater at 8% debt) and,

2) the astronomical US debt and its budget crushing servicing costs at 4x ZIRP rates (I know you’ve run posts about how the Feds will be able to thread this horrific needle…but they were complicated enough that stepping through them again is probably worthwhile.

3) Trump complaining (when does he not?) wasn’t what flipped the Fed’s rate hikes in late 2018…it was the 20% decline in the SP 500 (the Fed living under the delusion that 10+ years of ZIRP asset inflation could have a “soft landing”). With horrible real asset inflation now, the Fed seems more willing to let the SP 500 tank to a more honest level.

Ray Dalio is clearly suffering from multiple sclerosis, because a month ago I read his article entitled “Cash is king again” and soon I read another article of his with the conclusion that cash is trash. It probably depends on how he woke up and if he made love to his wife before he wrote his next post

Ray Dalio is pushing his book, all hedge fund crooks do it they buy first ,lure you in then sell before bottom falls out = your a bag holder.Stop preferential tax treatment it’s pure theft for wealthy

Don’t get your reference to MS. My mother was diagnosed 30 years ago and it hasn’t affected her mental capacity. However the physical effects can be debilitating.

When Dalio gives advice to “people” he is usually referring to the Supreme Court’s “Citizen’s United” decision defining “people”: Spending is speech, and is therefore protected by the Constitution — even if the speaker is a corporation.

It would be nice if I was one of those types of “people” and could benefit from Dalio’s Bridgewater Associates hedge fund. But I fall a tad short of the hedge fund’s requirements that clients have a minimum of $7.5 billion of investable assets.

Fed Up

and we have been gaslighted since 2009…. to believe FF belong UNDER inflation.

Waiting for my bank to offer me a toaster. LOL

Yes, I’m that old.

remember the beach towel in the detergent box?

S&H green stamps?

Some places you used to get a rifle

I think the people getting sucked into government bonds, particularly long dated bonds are going to get killed (lose principle). Even as the economy crashes, money is going to flee US Treasuries as all the central banks ramp up QT and investors run for the hills as yields ramp.

This will be another year when both equities and bonds and real estate fall at the same time. This is a year when money gets expensive again.

I don’t think banks are going to take the higher deposit costs laying down. If banks suddenly have to pay 4-5% on deposits, including existing deposits, a huge part of their expense shoots up.

They’ll have to offset this with higher revenues. They can’t get more revenue from existing loans and investments, so expect them to jack up rates on new loans and mortgages. The spread between the 10 year treasury and mortgage rates could expand, as this is the only way banks can preserve margin.

Banks can cut dividends and end share buybacks. Here you go. Fixed that.

That’s not going to help their margins, but it’s going to preserve their capital, and they’re going to need it.

– Precisely !!!!

– Those buybacks were made with borrowed money making the banking system much more vulnerable.

– Stock buybacks are already dead/are going to die very very fast with these higher interest rates.

– With dividend yields at say 3% it made perfect (financial) sense to borrow at 1% or 2% for share buybacks.

– But now with rates at say 4% or 5% and dividend yield at e.g. 3% stock buybacks don’t make any sense anymore.

– In that regard the rising interest rates of the last year are having the same impact as a wrecking ball to all parts of a/the (debt driven) economy.

J. Gundlach posited on CNBC today that the financial squeeze on banks would cause the FED to pause and even reduce rates regardless of inflation because “They always did.” I’m not sure this is true. If so, it will likely lead to more significant problems. Buy Gold.

Gundlach has been wrong about bonds and Fed rates since mid-2020, LOL. Bond managers are getting their clocks cleaned by higher yields. The MUST have falling yields. So they ALWAYS clamor for that. They’re trying to manipulate everything their way, and the media plays along.

I don’t even know why anyone still pays attention to them.

I mean, look at Goldman Sachs too. It has been wrong about the Fed rate hikes for over a year, and then when in early March it predicted that the Fed would pause in March, the media took this as the word of god, and spread it all over the place. And when the Fed raised by 25 basis points, the media didn’t say that Goldman is full of BS. No, they just ignored Goldman’s idiocy and moved on to Gundlach and Gross. This stuff is really funny after a few years. These people NEVER stop manipulating, and the media loves them for it.

Wolf…

I remember when banks couldn’t wait to start paying dividends after the Great Recession

They literally were chomping at the bit and wanted to pay BEFORE passing their stress tests.

So directly after a crisis they still weren’t cautious last time…

Also, can you imagine the stock reaction if they paused dividends and ended buybacks??? Schwab got clobbered recently over just fear.

Or, they can continue dividends, share buybacks, and bonuses. And wait for the FDIC to bail them out. Which option do you think they’ll choose?

Banks fight tooth and nail against any regulation that makes them stronger in the long term at the expense of profits in the short term. Systemically large banks are supposed to maintain higher capital ratios, but because that lowers their profit (since they can’t leverage as much) they fought and continue to fight against those regulations, despite their near-death experiences in the GFC.

Until CEOs themselves get bailed in when their bank fails, this behavior will never end. I’d like to see clawbacks of a CEO’s entire fortune, not just a year’s bonus. It can be done, just as it was for Enron and WorldCom executives in the early 2000s.

If SVB’s CEO is actually put in jail, that will give much more impetus for banks to cut dividends, end buybacks, and shore up their balance sheets for the storm that’s coming, than anything else the Fed can do.

Mortgage demand has already decreased significantly. Further rate hikes will make things worse.

Banks can just buy treasuries with CD money, and pocket the difference. Uncle Sam doesn’t need to do productive work to generate returns on investment as it has a big dollar printer. (Probaby why the interest rates remain below inflation).

You do have a good question. Where are the productive investments that generate higher interest returns. The answer is simple: Either corporate America will have to shape up or Fed will have to bailout everyone.

The banks will be just fine. Please shed no tears for them if they have to cut into their profit margins.

Can we move on to shaking up the healthcare industry next? I’m really sick of the guy in charge of the company that denies me basic coverage earning triple-digit millions per year.

Don’t hold your breath on healthcare. An entire population fed poison, prescribed pills til they rattle and worked into the ground is too profitable to give free healthcare to. The slow, steady damage will remain profitable for decades. Congress has long been bought off on this one.

“Healthcare” is a misnomer. It’s actually “sickcare”. There is no financial incentive to encourage a healthy population as there’s no money to be made if everyone reduces their need for medical services.

Absolutely El Katz.

There will be no fix to it. Profit driven by treating symptoms instead of cause creates more consumers. Culturally, healthcare personnel are indoctrinated into a bleeding heart mentality as it makes us easier to exploit. Empathy is critical in patient care, yes, but only hurts patient care in the end. Can’t get quality care out of underpaid, overworked burned out empaths tossed a pizza every few months. But you can get them to take on inhuman number of tasks and personal & professional liability stretching decades after a given patient encounter. And limit the health education they can give to only that approved by the government, lest they risk their license. It has its merits, but as a whole its a racket.

Most people haven’t even heard of Functional Medicine and couldn’t afford it if they did.

The NPR test, love it.

Do let us know when they mention Treasurys are state-tax-exempt, increasing the effective yield over CD’s further.

Tax exempt only for state taxes, though, not federal taxes.

Works for me

I am in CA and in highest tax bracket.

Agreed, I’m loving that part. CA is ravenous in its taxation of income. Just wanted to make sure that it was clear. There is a lot of confusion about this stuff. Some states don’t tax income (the biggie is Texas), and so that’s not a benefit there.

Exactly. A big incentive to buy T-bills. Me too., not because I’m in a high state bracket, but to avoid paying any state taxes.

NPR? For us Europeans is that national public radio

Yes

The only rates abpve 5.4 long term are for “callable” CDs.

Which means if rates go down, they will call them away and hand you back your cash.

And if rates go up, you’ll only get what you signed up for.

If the CDs are non-callable, then my apologies, but I am not seeing these non-callable CDs above 5.1% for 2,3,4,5,10 years

I saw non-callablle 5.35% for 18 months just today. It was Cramerica, or something like that. Whichever next one to go under.

About a week ago I bought a non-callable Charles Schwab Bank CD at 5.4% for 18 months.

Schwab is safe because they are too big to fail. They will be bailed of if needed.

I don’t think the Government wants a company that has 7 trillion in assets under management to freeze up. Yes, it is just their bank that is having issues but people do not know that. You cannot have a 7 trillion run on assets because that would cause some big issues. It would be fun to watch though.

I always buy FDIC insured CD’s, keep under the limit, and spread around investments to different banks, then it safe no matter what. Well not no matter what, but if FDIC fails then your CD’s are probably the one of last of your worries.

This can only bode well for those of us with aging toasters.

Back in the late 1980’s you could buy a toaster and get a free S&L.

Lol, now that was funny.

And now, today, if you get caught speeding on the Dan Ryan, they’ll give you Cubs tickets.

Halibut – according to my wife and her family who mostly moved here (NorCal) back in the ’70’s (Southside Sox fans, though), the Dan Ryan is never sufficiently untrafficked to provide the opportunity to get those ducats…

may we all find a better day.

Love the comment HD:

AND the replies above mine,,, far damn shore…

Folks really need to study UP and understand both the absolute ”negatives” of this current situation,,,

AND the absolute positives of investing in a so called down market,,,

Good LUCK,,, and may the GREAT SPIRITS bless your every efforts…

Been doing exactly as described (shifting $ into brokered cds and treasuries) thanks to this site.

Much appreciated.

So, in brief, is any bank anywhere a good investment (for shareholders)?

First Citizen bank just went up 50% today. Back to all time high at $900.

Yes, for day-traders.

I dunno. With the latest deposit-insurance happenings, I had a dream that come April we would see bank balance-sheets with Shareholder Equity: $1, and then huge savings accounts with bank-capital sized balances in them.

Or restricted states

For the CDs with above 5.2% rates

I am ok with low interest on a demand deposit. That is special money that I can withdraw in 1 minute. CDs better be competitive and in my mind should pay a small premium to a treasury due to tax treatment and not being a direct obligation of Federal government.

Banks know many retail customers are a little lazy about moving money.

I am one of those retired enjoying higher rates. But bank NIMs (Net Interest Margin) will fall flowing through to lower net income and thrashing stock prices. Depending on how long the Fed needs to keep interest rates high to fight inflation (who knows?) there could be a period of months, at least, of increasing or steady interest rates and falling bank stock prices. And probably a recession thrown in for good measure. We live in interesting times. Thanks Wolf, for keeping your readers informed.

Wolf

Thank you for the great article as always!

A simple question about this sloshing around of deposits.

When you move your bank deposit, let’s say to a Money Market Fund where do the reserves that your bank has to send end up?? In another bank (in this case the banking institution that the MMF uses) reserve account at the Fed? Do MMFs directly have reserve accounts at the Fed?

AFAIK only depository institutions, Primary Dealers (which are depository institutions themselves) the Treasury and foreign central banks have accounts at the Fed.

Same thing with buying treasuries…unless you buy at auction (ordinary citizens cannot obviously) your money (with the reserves to clear the payment for the bond) still end up in the banking system somewhere.

Am I wrong?

Thank You!

To be clear for everyone: “Reserves” is what the Fed calls the cash that banks put on deposit at the Fed. Banks call it “interest earning cash” or similar on their balance sheet. Banks don’t have “reserves” on their balance sheet. Only the Fed does.

Reserves are the most liquid funds for banks. They don’t have to sell anything to get their cash from their reserves at the Fed. So if customers yank their money out by transferring it to another firm, banks use their reserves to make those payments via the Fed.

So when I move my money from the bank to a money market fund, the actual money flows from my bank to my broker/dealer/bank where I use it to buy a money market fund. So that lowers my bank’s reserves, but it might increase the recipient bank’s reserves. So overall, the reserves might not change. But some banks, like Silicon Valley Bank, ran out of reserves; while others are drowning in reserves.

Competition is between individual banks and with individual MM fund. So it doesn’t matter that the cash stays in the overall banking system. What matters is that it leaves one bank and goes somewhere else, and if one bank wants to retain the deposits, it has to offer a higher interest.

If an entity transfers funds from a bank checking account at Chase to a money market account at Fidelity, does that money leave the banking system?

It doesn’t matter 1 iota. What matters is that it leaves THAT bank.

When a bank has adequate capital per regulatory requirements but has no reserves on deposit with the Fed, can it still make loans? I think it can, which is why many people think banks create money, when what they are actually creating is liquidity.

A bank cannot make loans unless it has the liquid funds (cash) to make loans. When a bank runs out of liquid funds, it collapses. Capital is a regulatory issue. Being able to make loans is a funding issue (must have the cash to do so). Being able to pay back deposits is a funding issue (must have the cash to do so). If a bank runs out of funds (cash), it cannot extend new loans and it cannot pay depositors when they come to withdraw their cash. Maybe it can borrow money from other depositors or the Fed or other banks, or maybe it can sell assets or sell new shares, but it must get the cash from somewhere to extend new loans and pay back deposits. A bank that runs out of cash collapses. That’s what happened to SVB. If SVB could create its own money, it would have never collapsed. I have no idea why this is so hard to understand.

Wolf

could a bank technically issue more stock to meet depositor withdraw demand?

How would that work?

Im guessing they could use the new capital to then go borrow to then pay depositors….yes?

longstreet,

Yes, but banks need to raise capital (including by selling shares) in GOOD TIMES, when they’re flush with money and everyone is a sleep. A bank cannot raise money as it collapses. It’s too late by then.

SVB tried that, and the moment it announced it, it collapsed because it came as a huge shock, when it was already wobbling.

SVB should have sold $20 billion in shares when its shares were $600. And it should have sold $10 billion in preferred shares. That would have caused the share price to plunge to $300 or whatever, but it would still be around today, and shareholders would still have something rather than nothing.

It waited until it was too late. The people that ran it were motivated by nothing other than quarter-to-quarter greed. Their brains had already been turned to mush by years of QE and interest rate repression.

Just to be clear:

1. The common assertion that a bank “creates money out of thin air” is BS. No bank would ever collapse if they could do that.

2. But modern central banks create money out of thin air, and that’s why THEY will never collapse. And they destroy money with QT.

3. The banking system as a whole creates money and destroys money automatically with the ebbs and flows of collateral values (asset prices) that the system as a whole lends against. Higher asset prices create bigger deposits when the assets are sold, and that money comes from the buyers’ loans. This is how loans turn into deposits in the banking system overall. But no individual bank can create money. In a simplified way, the banking system converts increases in asset prices into money via loans and deposits.

4. Money creation turns into money destruction in the banking system when leverage assets (homes, CRE, etc.) decline in price for long enough.

Good explanation.

I am really interested in seeing BAC next earnings call. Their January call showed that they had 1 trillion in deposits and paid an average of .06% on those deposits.

I am wondering if this rate will jump.

Wolf

Back in the day, an active tool of the Fed was changing reserve requirements eg increasing them during times of irrational exuberance. Why doesn’t that happen anymore? Or is it, and I don’t notice it?

Reserves are currently about 20% already. How high do you want the reserve requirement to be set?

In the past, the reserve requirement was 10%.

The Fed needs to unload a big part of its balance sheet, which would fix a lot of problems.

Also to note, the Treasury’s bank account is with the NY FED. So even when a person buys bills through Treasury Direct, the reserves stay within the banking system. They simply change hats (ownership) from your bank to the Treasury’s bank.

But if anyone withdraws cold hard cash from their bank, real paper money (ha ha, an oxymoron), then reserves are removed from the banking system completely. This is deflationary and almost as good as QT. If every depositer would withdraw cash instead of just transferring deposits from one bank to another, then things would really get interesting. They would punish the entire system instead of just certain banks.

To add slightly to Wolf’s explanation. I worked as a bank Treasurer for awhile at a $3 Billion bank. The bank’s account at the Fed (its reserve account) is balanced daily. All customer deposits, customers clearing checks, new loans, loan paybacks, new investments, investment maturities and any other cash items go through this account at the Fed. After balancing, the amount of Fed funds on deposit in the reserve account is known. If there is an amount in excess of the bank’s reserve requirement, the Bank will loan those excess funds out overnight to another bank in the Fed Funds market, and if the bank is short reserve funds it will borrow that amount in the Fed Funds market, at least as long as other banks are willing to lend them money. This is a simplified explanation from years ago, but I believe it is basically accurate.

I’ve been moving money out of banks and into short-term treasuries for just over a year, before it became all the rage. Note: the four month treasury is back at 5.00% as a result of today’s action. No reason to buy any treasury longer than 6 months until we get some data showing inflation is slowing. In the mean time, ladder, hold to maturity, repeat. I have been occasionally buying some 2 to 3 year brokered CDs just for variety, as long as they get at least five percent. I bought some 3 percent fixed rate I-bonds long ago, and got a nice 12 percent APY (tax-deferred) in the last six month period.

I kind of like inflation. Stock-o-philes say I am behind because of inflation. But because my principal is big enough, five percent yield gives me good income (with no risk) without eating into my principal. If I want to play in a casino, which I don’t, I’ll head over to a local Indian reservation.

If inflation is 7% and you are earning 5% interest, you are losing principal in real terms.

If inflation is 7% and you lose 10% in the stock market, you are losing 17% in real terms.

If you lose 10% in the stock market, didn’t you beat the inflation?

:-)

…some who wander ARE lost…

may we all find a better day.

Inflation of 7% is an estimation for the average consumer. It is different for each individual, depending on the individual’s consuming habits (not everyone buys $100k pickup trucks, ridiculously expensive breakfast cereals, pizza’s sold for ten times their ingredient price, etc.).

For ignorant, undisciplined, and/or hedonistic consumers, personal inflation expenses are likely to be significantly higher.

For disciplined, smart and well prepared/established consumers, “inflation” is likely to be significantly lower. I would probably be at least breaking even if I get 5% interest on all my cash.

Eventually inflation gets you. No matter how savvy you are. You cannot run from it. It’s eating your dollars.

It’s like a time traveler went over your life and made you lose your job 5 years sooner. Or kicked you in the cuhonees on that day you were supposed to close a big deal at the office.

It’s brutal.

And all the morons can talk about it getting back to QE. Pshhh

@sufferinsucatash:

An early historical definition of monetary inflation was: “a change in the proportion of currency in circulation relative to the amount of precious metal that constituted a nation’s money.” To finance the American Revolution, the Continental Congress, and individual States, printed so much paper money that in “1781, a dollar in paper was worth less than two cents in gold coin.” Now that sounds brutal.

Later, in 1919, a Federal Reserve Bulletin stated: “Inflation is the process of making addition to currencies not based on a commensurate increase in the production of goods.” So, monetary inflation is not a given natural law. It is not as inevitably going the “get you” as, say, death.

On the other hand, price inflation is more complicated and can have various causes. For example, basic causes include: change in value (fluctuation of real costs of production), labor costs, natural disasters, a country’s currency exchange rates, and people’s expectations.

Sure, you can’t run from price inflation, but the value of dollars you have left after it eats into your cash savings depends on 1) how you have spent those savings, and 2) the prices at the time you choose to buy the optional goods or services.

drifterprof

Agreed

Inflation varies from person or family depending lifestyle. I consider myself lucky that I’ve managed to insulate myself from the ravages of inflation for the most part. I’m probably breaking even or losing a little. I can live with that.

in reply to your reply (because your reply has no reply button):

That is some pretty cherry picked statements about inflation. Yes they are “Definitions of your choosing”. I’m of the opinion inflation is extremely dangerous. sure, inflation affects us all differently but overall it is still making your money worth a lot less. You can hark the carols and sing about your 5% your cash is making. But overall inflation is sliding us all backwards. And it is making a generation or two very pessimistic about the future. The generations some of us need to make more money.

I think the fed should go for broke and just up the rates to 11, meaning be more aggressive. Rip that band aid off! Otherwise, inflation is slowly bleeding us. Looking back, some here may say the same statement but in 10 years. “Gee golly that Powell should have been more aggressive, those were horrible years for me.” And we’ll never hear the end of the gripes, speak up now. tell Powell to put this sucker into gear and quit hedging.

sufferin

the Fed must extricate about $4 Trillion from the system

Rates are a sideshow

QT is whats important IMO

No one wins forever, and of all things, even fifty billionaires with huge megaphones, there is no complete happiness in life

Indeed Juliab. On a long enough timeline, those billionaire `phonies finally shut their yaps..for good!

I guess it depends how you define “complete happiness,” but I think some people are able to achieve it. The first step is realizing it has almost nothing to do with money.

I’m getting 5 percent on my money now, I was getting .5, so 1000 percent raise. I think that beats inflation.

Ron, too bad you were receiving .5%. If only you had been getting .1% you’d now be beating inflation by 5000%! 😂

P.S. Please see my reply to Dearieme below on comparing absolute percentages to rates of change.

I’m with you and am in the same situation, have enough principal so good income and low risk. I can sleep at night, a definite plus. I don’t listen to those who say you are losing to inflation. This works for me.

Yep, it depends on what you spend your money on. To me, the inflation of stock prices seems borderline insane. Nobody seems to want to talk about that much. I have an old (2013) Honda with low mileage which runs fine, so no inflation on that. I see prices going up on food, insurance, gas, electricity, but I can easily handle that if I can get 5 percent on my fat principal, especially since I was getting maybe 1 or 2 percent a year ago. So, yes, inflation effects are different for everybody.

The average federal funds rate since 1950 is about 4.5 percent. If the Fed cuts, I doubt if it will ever go much below that again. Perhaps the Fed has learned its lesson. All that free money was not really free, it came out of the accounts of savers.

When interest rates and values of sovereign debt start gyrating it can be an early sign of a developing currency crisis. As issuer of the world’s reserve currency the US is protected against the classic form of currency crisis. What’s left is a great deal of uncertainty as to US inflation due to the fiscal stimulus of huge U.S. budget deficits that have no end in sight and whether the Fed will monetize them or allow interest rates to rise across maturities.

I always wondered who was buying long-dated Treasuries at rock bottom interest rates. Now we know.

Who else other than the banks bought this garbage? Are life insurers the next shoe to drop, or did they do a better job of matching the duration of assets and liabilities (i.e. bond income vs. annuity payouts)?

According to Ed Dowd excess deaths are way up, it makes me wonder what might be going on in the life insurance industry. As I recall, one of Dowd’s stats was precisely from an Indiana life insurance company.

essentially these banks buying those long maturities shorted interest rates at ALL TIME lows

College student novice here. Just wondering what actions institutions typically take in order to match the durations of assets & liabilities to avoid interest rate risk other than entering into IRS contracts?

Wolf, you have taught me more in a year of reading your daily articles, than almost four years of undergrad schooling as a Finance major. Thanks for that!

“Bank profit margins are getting squeezed”. Boo-hoo and screw you bankers. You stuck it to us savers/retirees for years, welcome to our world.

and with the 2009 gift of being paid interest on excess deposits……a lock …..as they pay zilch on deposits

sb “excess reserves”

So I’m seeing $3 trillion of reserve balances paying 4.9%, and $2.2 trillion in overnight reverse repos paying $4.8%, for a total of $5.2 trillion the Fed is paying the banks almost 5% on.

That compares to commercial bank deposits of $17.5 trillion the banks will have to pay interest to depositors on.

Do I have that right?

Joe

I think the securities the Fed uses for reverse repos still pays to the Fed, though the Fed then pays interest to the reverse repo counter party. Perhaps Wolf can expound or correct me.

Joe, slight clarification. The FED is paying the money market funds the interest from the reverse repos instead of the banks. The funds are then passing a significant portion of that interest on to the investors.

So the banks are only indirect recipients by way of increased deposits of the reverse repo interest.

Joe C.,

“Do I have that right?”

Part of it.

reserves = bank cash

overnight reverse repos = mostly cash from Treasury money market funds

re … interest rate repression killed competition for deposits…

In effect, that seems a stealth bailout, payable by all citizens via inflation increments on necessities. Bankers’ compensation and bonuses became independent of deposits/depositors.

Western -style “banking” has been gamed into pseudo-banking. Surely the syphilitic Woodrow Wilson gave a huge boost in that direction when he birthed the Federal Reserve system in 1913 at the impetus of Warburg et al. The 1912 election shenanigans with ex-Pres T. Roosevelt splitting the Repub votes got WW elected. It’s just ancient history down the memory-hole.

As for the Old Money family dynasties, they cannot be expected to admit their status was wrongly acquired. They surely have bought sufficient indulgences to keep on keeping on into their deserving hereafter free of peasant classes.

Wilson birthed the Fed

Loaded up the Lusitania with war materials

In both instances unknowing passengers victims

promoted the 17th amendment

1) Madam ECB and JP have to cleanse the filth under their own mattress. Halfway TA, halfway fun & entertainment, skip :

2) JP will take the Dow down to the space between Oct 2022 low and Mar 2023 low and that’s good enough. SVB and CS bs will be over shortly and the Dow will make a new all time high in 2024. Recession, forget about it. When everybody is depressed it’s time to invest..

3) Halfway : JP will take the Dow halfway between Oct 2022 low and

Mar 2020 low. A lightweight recession. Nothing wrong with that.

4) The global central banks lost control. The Dow will make a round trip to Oct 2007 high and drink Grande Latte IV to restart.

An almost fair return on money IS an economic engine

Peolpe will spend that money

Under interest rate suppression it was the government who got to spend the money from the imbalance of rates.

And now it is the govt who is pulling capital from the private sector with these now higher ( still under inflation) rates ….people pulling bank money and lending it to the govt with treasury purchases.

This isnt a healthy situation either.

We are heading quickly to a system of nationalized banking and a central bank digital currency.

So people buying gold will have no way to sell it,it’s not digital = worthless

Flea, by that logic someone trying to sell a used car also would get nothing since the car isn’t digital.

Only digital transactions,so I would get digital capital for gold ,or barter car for gold

What happens when the power goes out?

You may say that the interest rates don’t keep up with inflation. But the increase in interest paid far exceeds inflation.

That will stop when interest rates have levelled out but until then a rise in annual interest rate from (say) 0.1% on your money to 4% is a forty-fold rise in your interest income.

dearie me,

What an inane comment.

So what if acceleration is higher?

A loss is a loss. Closing the gap is fun and all… If it closes.

We got 25bps and a maybe pause in May.

Losing money is real. While acceleration is fun, it doesn’t pay your bills or fund your retirement.

Call me when acceleration is sustained above the Fed Funds Rate and I get positive real yields.

Dearieme, please be careful when trying to compare absolute percentages with a percent change in the absolute percentages. For example, if inflation goes from 8% to 7% it is correct to say that it went down by 1% (on an absolute basis) or that it went down by 12.5% (on a relative basis), but it would be incorrect to mix those two types of basis and conclude that since 8% (the original inflation rate) minus 12.5% (the relative change) results in an inflation rate of -4.5%, right?

I give this example because in your scenario the absolute inflation is being compared to a relative change in interest rates.

Another – a very significant nuance…

may we all find a better day.

The fact that one of those slopes is steeper doesn’t matter, as there is still a spread. 5% interest with 7% interest means your purchasing power still declines by 2%.

If you’re arguing that interest rates *eventually will be* above the rate of inflation – I certainly hope so, but we’re nowhere near that yet.

5% interest with 7% inflation**

100 years ago there was no such thing as “retirement”. Ok, a few more years back, you lost your eyesight, so you just talked, like Milton, but you were still working, and your daughters chronicled, with no idea whatsoever, the f u were saying.

100 years ago, life expectancy in the US was around 57. In the 1880s it was only 44. Now it is around 77.

The way most banks offer their higher interest rates is by creating a “new” kind of savings account while keeping the “old” savings account at near-zero interest.

When I saw my bank was advertising higher rates several months ago I called and had to close and open a new account to get the rate.

Higher yield is nice but important to remember these banks are criminal.

We’ve been preaching (laddered) brokered CDs for a long time. Only pausing when they drove rates deep into the dirt. I noticed yesterday that the yield on nine month notes was higher (5.38) than the one-year (5.2), which I do not recall ever seeing before. To the point Wolf makes here, the Treasury market is a big hot mess. So hot, I might take off all my clothes.

I’ve been laddering 3, 6, & 9 month CDs lately. You’re right that 9 mo seems to be the sweet spot right now. Yield curve very interesting lately.

UFB offers 5% on savings…. Fdic insured as well you just have to check it often and open new account if the rate changes.

5% Interest on all the cash you mention ($17 trillion) is a heck of a lot of money to go somewhere into the economy instead of bank profits.

Will this make inflation burn hotter?

The inflation Reduction Act will increase the burn.

There a ought to be a law about naming bills in Congree

Brant Lee,

$17 trillion in deposits include transaction accounts, such as payroll accounts and corporate checking accounts. They will never pay much if any interest.

Savings accounts and CDs may be less than $10 trillion. But it’s still a lot of money.

But banks are lending out money at much higher rates. Credit card rates are close to 20% on average. My TBTF bank is trying to get my company to open a $100k line of credit at “prime” + 1.5% = 9.5% variable rate. So it pays me 4% on a CD and charges me 9.5% on a loan. That’s still a big profit margin, but it’s half of what it was when it got the money at 0% two weeks ago and lent it out at 9.25%

“The average rates across all deposits are still minuscule, just 0.4% in March on average across savings accounts.”

I found this to be one of the most interesting points in your article. Wouldn’t savings accounts pay more than payroll and corporate checking accounts? In this environment where banks get almost 5% parking cash at the Fed, many of them must still be doing well if these are the average rates they’re paying depositors. If their profits are under pressure in this environment it seems like a management issue.

Maybe it wasn’t super clear. There are three categories in this paragraph, the two in the line you cited plus one:

1. “The average rates across all deposits are still minuscule” (meaning near 0%)

2. and “it’s just 0.4% on average savings accounts” (meaning this higher than near 0%)

3. and “CD rates on average are still low, with the average 12-month CD in March of just 1.5%”

Thanks Wolf

You can get Very Close to 5% High interest rate savings now ” Liquid ” day in day out accounts like Bask Bank as example at 4.45 APY

Great Post Wolf I am still looking for your mentioned “over 5 % CD Rates” they are not that easy to find for me .

I am hoping to see something like a 3, 4, or 5 Year 5.5% CD Rates.

With the Banks Need for Deposits with not having to post collateral

Perhaps we will see 6% by the years end but its crazy with inflation higher then that your still getting a minus % . In other words making Nothing really minus dollars its just an offset your almost forced to take

I expect someone running for President saying they will fix all that once and for all will get elected ” just like that “end of story

Now a Government CD Rate at say 14% for 3,4,5,6,7,8, Years or more where you can put Large deposits in would be Nice but to fix the Fed is the real answer ? Why its so hard smells Very Fishy and it just continues is this the new norm perhaps never ending ?

To find 5%-plus CDs, you need to have a brokerage account. Any of the major brokerages list them. These are “brokered CDs” — lots of people here have discussed buying some of them. I just bought a 5.4% 18-month CD from some bank on the other side of the country through my broker, to replace a maturing 3% CD.

“To find 5%-plus CDs, you need to have a brokerage account.”

Wolf, there are several non-brokered Bank and Credit Union CDs over 5% available. Do you mean by ‘need’ that brokered CDs are superior since early withdrawals might not incur a penalty ?

A brokerage account lets you choose from hundreds of CDs from dozens of banks across maturities and interest rates, and you can keep everything under the FDIC limits even if you want to invest millions of dollars into CDs. And you can do that with a few clicks of the mouse in a brokerage account.

Sure, if you love your credit union, and whatever they offer you, that’s what you love, and if you can keep it under the limits, fine, great.

One of the best things about brokered CDs is that you can cash out without paying an early withdrawal penalty. All banks have early withdrawal penalties (some draconian) and some only allow you to cash out the entire account before maturity (no partial withdrawals). With brokered CDs there is a small fee if you sell before maturity (there is no fee to purchase a CD), and you will likely lose principal if interest rates are higher than when you purchased it.

I have been contemplating the current set up with cash, stocks and bonds in the skate to where the puck is going kind of way.

It’s a very unusual situation that cash pays 5%, 10 year pays 3.5% and S&P pays 1.8%. Powell has everybody running toward high interest cash. With cash being the obvious choice, where will we be in 12 months?

With M2 going negative inflation could be over in twelve months and we could be all flipped to look like cash paying a normal 2%, long term treasuries paying 3% and SP500 @ around 2100 paying around 3%. That would be a more normal setup to build a recovery off of.

That assumes Powell is going to be tough on inflation and kill economy.

When I was ten years old (long ago), I took five dollars to the local bank, opened a passbook savings account, and got five percent interest. Two percent interest on cash is not normal. The average federal funds rate since 1950 is about 4.5 percent. Two percent interest on cash is abnormal. We are now seeing the consequences of this aberration.

Thinking OS means 2% ”real” interest WL?

Grand mother took me to bank about the same age, mid fifties, and we opened a savings account at 6% with the cash she paid me for working in her yard and misc. maintenance help.

( To be sure, it was mostly her teaching me stuff, but she was paying me to ”work” to teach me the value of work in my opinion many decades later.)

By the time I started college 8 years later, there was enough cash in the savings to pay all my first year expenses; then I went into Navy, and learned more skills that helped me earn enough to pay the next three years college with small private loans and GI Bill help.

Will we have a bifurcation in banking between the “too big to fail” banks that continue to pay 0.1%, secure in the knowledge that they will be bailed out if needed, and the other banks that have been scared into raising rates to depositor?

My TBTF bank is now promoting 4.25% 8-months CDs when I’m logged into my account there.

While I agree Trump browbeat Powell and his followers are slow to absorb the deficit spending and ZIRP impacts under his watch, he is not accountable for the current mess. The Fed (and Congress) from Greenspan/Bernanke onward adopted inflationary balance sheet and interest rate actions that resulted in the current debt fiasco – as a matter of bogus Keynesianism and skewed monetary theory.

The “current mess” is the result of the free money mania that took place since 2008ish, spanning multiple administrations. It was a game of musical chairs as far as administrations were concerned, and the music stopped on Biden’s watch. The Covid Cashtastrophe began on Trump’s watch.

Back in 1970 when I started work at a bank the old man that ran the place since 1932 had some rules

1. If you made a long distant phone call you needed advanced permission

2. More than one pencil on your desk needed explanation

3. All employees except his 79 year old brother had all pension money in equity until age 60

4. He ran the place with a 4.4 return on assets, most today are below 1.0

5. Warren Buffett bought the place and used to sit in an old scroungy place across the street for lunch with the old man to learn his management techniques.

6. He bought the best technology and attractive facility for the customers but the employee areas were crap.

7. He paid the lowest compensation but expected top performance.

8. No performance……no job.

8a. No reason to worry about your job….if you were hired and you worked hard, no layoffs….ever.

9. Never needed government help thru all problems…..extremely conservative lending. His capital was like Fort Knox…..rumor was he kept some gold bars in a lock box.

10. But…..he died in 1980 at the age of 80.

When he died…….something changed and I wish I could call it better.

At the time I hated that old man…….now I miss him and respect him greatly.

I bet the employee toilet paper was thin as can be.

@Fred,

Good story, thanks for sharing!

fred f. – did he ever frontline soldier? (serious question).

may we all find a better day.

1) TNX for fun and entertainment. In the 1930’s and the 40’s TNX was hugging zero.

2) From Jan 1977 the 10Y rose sharply to 16%, retraced 62% of the move, bounced back up to 14% in 1984, before gliding to zero in tranquility. Between Jan 1987 and Oct 1987 it popup between 7.5% and 10.2%

3) In 2022 the 10Y was high on drugs, in the middle of accumulation. In order to save the regional banks JP have take the ten down again, to extend accumulation.

4) The 10Y might rise to 7%/10%, before investors take it down for re-accumulation.

5) Inflation might send the TNX to it’s backbone : Jan/Apr 1980 ==> 13.65%/9.47%.

Just like the olden days. This is how it use to be and never should have been what it was. Govern ment is pure evil, and what is coming because of THEM ???? Watch out folks, you ain t seen nothing yet.

Yep

All the ‘make things happy” buttons already pushed

Balance sheet ecpanded

Money supply expanded

Rates pushed below inflation

National debt exploding

Even Keynes said stimulus must STOP at some point

But the Fed was like a boxer who didnt hear the bell

I’d say the Fed is like a child trying to fit the square peg into the round hole. We keep explaining, but the child won’t listen.

Pretty soon the child will be crying and throwing the toy against the wall. Even after the child is put in a corner, and the logic becomes clear to him, he’ll pursue spite and stubbornness before admission and change.

Hussman once described the Fed’s policy as child-like. I have to agree.

It just puzzles me when people say Government is bad/evil/pure evil. The Government just reflects who we are as a people.

So what’s the alternative, can we go with no government?

If we want to improve the government, we have to improve as people – get more knowledgeable, more involved and helpful, less greedy, etc.

Just repeating the phrase ad nauseam doesn’t get us anywhere.

Guess thats why I have no friends.

CD’s, treasuries are a trap.

You choose your evil. Which is worse? That’s the choice in this environment.

Is that the long or short of it?

Was asking Rick

So I go into my local/regional bank to check on their most recent CD rates, only to discover that in order to receive the newest! the mostest! the highest rate!, I.. as their banking customer.. can only aquire such rate IF I troll some potential NEW mark into starting up an account at said bank All for the exquisite timed 3yr CD rate of 4.1 %. Otherwise, I get to pound rocks at 3.3%

Humm….

Open a brokerage account. I like Schwab because their initial list of CDs are only non-callable. You have the option to buy callable CDs if you are nuts. Vanguard includes callable CDs in its initial list, which makes it look like you are getting better rates. If you buy a callable CD, and rates go down, expect it to be called.

Wolf, is there a way to get a sense of if (and by how much) the Federal Reserve is still suppressing bond yields? I would guess that the roll-off for QT doesn’t evenly match all the assets the Fed bought during QE that need to be rolled-over. That is, so much of those assets were short-to-medium term, wouldn’t a lot more of it be maturing than can be evaporated by QT? Presumably the other central banks are in a similar situation?

Thanks!

TEMPLE

The financial system is sick.

It keeps having heart attacks and requiring surgical interventions to keep the system alive. This month, several banks imploded and required urgent care. One of these days, the system will seize up, and the policymakers won’t be able to resuscitate it.

The major stock market averages remain all-time overvalued… The Federal Reserve is actively trying to pop the bubble… The U.S. government is the most in debt it has ever been… And war has returned to Europe.

Perhaps most important, “FOMO” (the fear of missing out) has turned into “JOMO” – the joy of missing out. We can now sit on the sidelines in Treasury bills and get paid about 5% interest for holding cash and watching from afar.

So this month, I have a question for you…

Why would anyone want to own stocks or bonds or any risky investment under these circumstances?

Welcome to the decade of Fear and Loathing, in honor of the late great Hunter S. Thompson. He would have a field day in this environment.

“Why would anyone want to own stocks or bonds or any risky investment under these circumstances?”

If the Fed lets loose its dovish tendencies, people will regret having all their firepower in fixed income. They’ll be left behind rather quickly. The Fed has a history of capitulating to modest pressure, and now, the Fed has an unstable banking system as cover for a regurgitation of dovish policy.

It’s hard to say which way things will go over the next year. It depends on Fed conviction, and I wouldn’t blame anybody for believing the Fed is spineless. Many people are simply extrapolating from the Fed’s past behavior, which is reasonable. Plus, there appears to be some runway left for the Fed to kick the can another year or two before everything explodes into total chaos. The Fed could reverse course this year, as the market expects, then it’s off to the races until the next bigger blowup.

I’ve always maintained you must have some share of your wealth in stocks, even if its just 20%, because nothing is sure in this world where irrational thought is often rewarded.

I’ve recently been buying 9-month brokered CDs @5.35% and 17-week T-bills around @4.9%

Good amigo of mine bought the Comerica 9mo just today at that rate.

Better hope they raise debt ceiling or bye-bye

UNIparty is going full steam ahead. THEY are only speeding up and will never slow down. Until the USA crashes of course.

30 minutes ago I put the AV8R Misfortune in a 1yr Bond ladder.

About an hour ago now I put the AV8R Misfortune in a 1yr ladder.

Wolf

Haven’t seen anything recently about the spreads between Investment grade and junk bond yields. Some updated charts would be great.

“These huge moves, up and down, occur because of money sloshing around the financial system looking for higher yields one day and getting spooked and looking for safety the next day. I mean, look at this mess”

The mess is the amount of “money sloshing around the financial system” period. That’s what the FED fails to acknowledge, and why their rate of QT is an insult. They have willfully ignored the damage they have done.

All assets are near their peaks, and we don’t even have a hint of a recession. We were told it takes 12 months for rate hikes to work their magic, yet we’re near month 13 and nothing has happened.

T-Bills no longer than 1yr and physical Gold/Silver in Your Possession. Anyone transferring deposits into TBTF ; BAC; C; GS; JPM; WFC; MS are walking into a hornet’s nest buzzing with Ten’s of Trillions in Derivatives ready to Blow Up. The Bank Contagion will run into Pension Funds; Insurance Companies etc….however, it’s the Derivatives that are the ticking time bomb that will blow everything up.

The system is corrupted beyond repair. There is no rule of law for the wealthy and well-connected anymore. If there were, we’d have thousands of these people going to prison.

One thing that really caught my eye recently was when Elizabeth Warren, of all people, started crying about rate hikes. It was like “whoa, whaaaaat?” The woman who pretends to champion the poor and downtrodden is now advocating for worse inflation?

When you start digging around, you find that the WaPo did an article back in 2019 where Elizabeth Warren had already collected more than $2 million in “consultation fees” from corporations and financial firms. It is commonly accepted that “consultation fee” = BRIBE.

Congress is now the enemy of the American people. Our own government is our abuser. We have arrived at “let them eat cake, 2023.”

The system is no more corrupted today than it was 100 or 1000 years ago. The difference is that we are more aware of it. Sites like this with productive discussions draw back the veil of ignorance so we finally all understand just how badly we are being screwed.

That said, people are better off now than they have EVER been. Ever! Sure, there are bubbles and busts, but the past 70 years in the US, Canada and Europe have been the greatest golden age for the largest number of people ever. Too bad it all ends in 15-20 years. Fun while it lasted.

If Congress is our enemy, stop voting for the same people. Stop voting for Democrats or Republicans. Vote for Green candidates or true Independents.

…careful Expat, you’re offering a positive (if PITA) path, but one that requires wholesale abandonment of one’s closely-held outrage as the only necessary civic engagement…

may we all find a better day.

Treasury yields are a mess, indeed.

Today the Treasury auctioned off bills with maturities of 7 and 17 days.

The auction-price bond-equivalent yield of the 7-day T-bill due 4/6/23 = 4.121%.

The secondary market ask price for T-bills due 4/11/23 is = 3.65% YTM.

The auction price for the 17-day T-bill due 4/17/23 = 4.789%.

The current secondary ask price for T-bills due 4/18/23 = 3.932%.

So, the newly created 17-day T-bill due 4/17 yields 86 basis points more than the ask price for T-bills due 4/18. I think that change is wild.

The yield curve could move higher quickly if the “flight to quality” is over.

https://treasurydirect.gov/instit/annceresult/press/preanre/2023/R_20230328_2.pdf

I would really like to see an article/discussion about the u.s. dollar losing it’s reserve currency status. It seems to be coming faster than most think.

Here you go (published right here in January):

https://wolfstreet.com/2023/01/01/status-of-us-dollar-as-global-reserve-currency-usd-exchange-rates-hit-foreign-exchange-reserves/

I update this every quarter, next one coming pretty soon. Lots of charts in the article, including these two:

Egypt is looking to import at least 1.5 lakh tonnes (lt) of rice from India through the rupee trade route in view of the difficulties it is facing to make payments in dollars, trade sources said. Pan Asia trade is nowadays in yuan rupee etc not in $. All African countries want to trade in

In yuan rupee. Russian oil to India is not all in $.srilanka due to collapse of their currency adapted indian rupee for external trade. List in growing.

“But then President Trump started keelhauling Fed Chair Powell – Trump’s man at the Fed – on a daily basis about these timid rate hikes and QE …”

Ugly behavior, but in all fairness Wall Street was doing its share too. A point worth making because while we don’t have the the White House public spectacle now, we do still have the Wall Street contingent on the case. It’s in the business of selling stocks and now TINA (there is no alternative) is dead. Its Fed given right to soaring bonuses is under siege, and it’s filling the media with pleas for the Fed to back off.m

Eventually the Fed will be forced to follow the bond market, but Wall Street wants its cherished “pivot” first.

yeah, I’m one of those who has let many $100Ks of cash just always sitting in my stock trading accounts. that was OK during the ZIRP years, but I was not paying attention to the fact that brokers/banks were not raising their rates with the Fed, still keeping them near zero. The SVB collapse had me review all my accounts to derisk, and then realize that the Fed cannot pivot any time soon, so started moving my cash to chase higher lower risk rates.

In my schwab , I’m moving almost all my cash to SWVXX MMF which is giving 4.66% now, and is v. liquid w/ just a 1 day buy/sell delay, and is SIPC insured.

etrade suck, they force 0% cash seep accounts. I’m moving 50% over to IBD as I’m tired of getting abused with legacy broker/bank NZIRP. I’ve literally missed out of $1000s of interest income being asleep at the wheel all these years, esp. the last year. No more!