But only 8% of Alphabet’s and 13% of Meta’s layoffs are in California: The tally based on California’s WARN reports.

By Wolf Richter for WOLF STREET.

The layoff announcements by tech and social media companies keep piling up. But these are announcements of global layoffs, and they may not all take place in the US.

Many of the tech and social media companies that announced layoffs are either headquartered in California or have large offices in California. We can track the actual layoffs in California because companies with 75 employees or more are required to disclose those layoffs as part of the WARN (Worker Adjustment and Retraining Notification) reports. So we can see actual layoffs in California, rather than just breathless announcement of global layoffs.

How many layoffs in California since July 1?

So far, 65,964 layoffs notices were given to employees at companies with 75 employees or more in California since July 1, when the layoff announcements took on momentum, according to the WARN report released today. This was up by over 10,000 from a month ago (54,679).

The State of California has a population of over 39 million, so the number of layoffs in the WARN reports is still relatively small overall. But they’re concentrated in a handful of counties – and in three of the San Francisco Bay Area counties, layoffs have turned into a major thing.

The WARN report includes a large variety of companies that are not tech and social media, and some laid off workers for their own reasons, for example:

- Two hospitals that shut down due to long-running financial difficulties – a common trait of many rural hospitals in the US.

- An ice-cream maker that shut down temporarily to install new equipment and then brought the workers back.

- Autodesk which moved its headquarters from Marin County (north of the Golden Gate Bridge) to San Francisco. While it had some layoffs globally, those headquarter employees who were transferred to San Francisco made it into the WARN report because the facility in Marin County was closed.

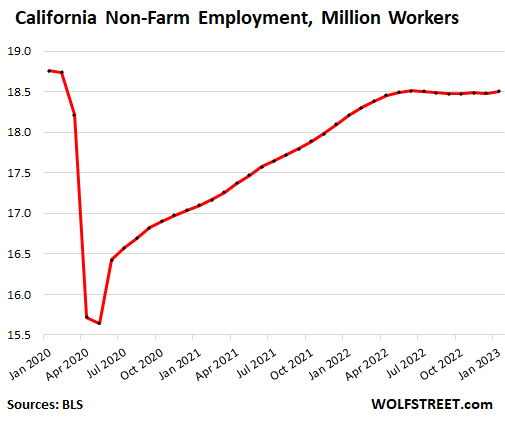

The toll is becoming visible: Total non-farm employment in the state, while still up 1.6% from a year ago, has been roughly flat since June, when the layoffs started to take on momentum and when the hiring freezes started to pile up (Bureau of Labor Statistics data through January; February data not yet available). By comparison, in the 12 months through June 2022, employment grew by 5.3%.

This is the end of the era during which many employers in tech and social media had been outbidding each other for talent that they didn’t need and couldn’t use in what CEOs now admit was a frenzy of overhiring and overpaying, and a small part of it is now getting unwound.

The 10 counties with the most layoffs since July 1.

County size matters: Los Angeles, the largest county with a population of nearly 10 million, is #1 on the list with 11,244 layoff notices in the WARN report, but this amounts to only 0.11% of the population.

By contrast, in San Francisco, with a population of 834,000, the 8,164 layoffs amount to nearly 1% of the population, the highest percentage in the lineup.

Also, the layoffs are by office location, not employee location. So people registered at Twitter’s San Francisco office, but working at home in Nevada or Thailand count as layoffs in San Francisco County.

Note the three major counties with a significant number of layoffs as percent of their population, in bold: San Francisco, San Mateo (northern part of Silicon Valley), and Santa Clara (Southern part of Silicon Valley):

The right column shows the increase since February 20:

| County | Layoffs since July 1 | % of county pop. | MoM increase |

| Los Angeles | 11,371 | 0.1% | 1,992 |

| Santa Clara | 8,730 | 0.5% | 1,661 |

| San Francisco | 8,164 | 1.0% | 1,193 |

| San Diego | 6,640 | 0.2% | 1,107 |

| Alameda | 5,281 | 0.3% | 576 |

| San Mateo | 4,976 | 0.7% | 646 |

| Orange | 4,541 | 0.1% | 947 |

| San Bernardino | 2,283 | 0.1% | 730 |

| Sacramento | 2,214 | 0.1% | 128 |

| Riverside | 1,740 | 0.1% | 145 |

| Total | 55,940 | 9,125 |

The WARN report also shows the effective date of the layoffs, and those stretch through the spring into the summer. So, these notices include layoffs that will happen but haven’t happened yet, such as by Amazon, Microsoft, Google, Intel, and others.

The 20 Tech & Social Media Companies with 300+ layoffs in California since July 1.

This roster of what we loosely call tech and social media is larger unchanged from a month ago. Only four companies added layoffs over the past 30 days: Salesforce (+55), Intel (+112), Rivian (+479), and Thermo Fisher Scientific (+154).

Combined, those 20 companies account for 25% of the total layoffs in California since July 1.

Meta (headquartered in Menlo Part, San Mateo County) announced 21,000 layoffs so far, but only 13% are in California.

Alphabet (headquartered in Mountain View, Santa Clara County) announced 12,000 layoffs so far at its Google unit, but only 8% are in California.

| “Tech and Social Media” Companies | Layoffs | |

| 1 | Meta Platforms | 2,726 |

| 2 | Jabil | 1,661 |

| 3 | Salesforce | 1,065 |

| 4 | 997 | |

| 5 | 953 | |

| 6 | Cepheid | 948 |

| 7 | Amazon | 890 |

| 8 | Intel | 833 |

| 9 | Cisco | 673 |

| 10 | Snap Inc. | 485 |

| 11 | Sciolex Corporation | 461 |

| 12 | ABM Industry Groups, dba Meta | 434 |

| 13 | Lam Research | 400 |

| 14 | Doordash | 386 |

| 15 | PayPal | 378 |

| 16 | Infineon Technologies Americas Corp. | 375 |

| 17 | Rivian | 830 |

| 18 | Thermo Fisher Scientific | 489 |

| 19 | Tesla | 298 |

| 20 | Shift Technologies | 296 |

| Total | 15,282 | |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So far this data doesn’t indicate significant signs of a broad economic downturn, or even a downturn in tech, unless one believes any negative news that isn’t bullish automatically translates to a downturn.

These big tech companies overhired over the last several years, due to expectations of further growth, hoarding talent during a talent shortage, and as an active denial weapon against competitors.

Interest rate spikes drove down their share prices, and now they are shedding the fat to increase gross margins.

Pandemic and response to it was always going to be a temporary party of free money and a lot of corruption. Been 2 years of wages not keeping up with inflation and now we will try to layoff about 2 million people to kill inflation. Probably five years to work off the damage plus a lower long term growth rate by 1/4% or so. Still a lot of medical problems out there for people.

Executives make the wrong decisions then they own up to these mistakes by laying off employees.

I never saw any executive taking a pay cut say 50/70% to own their wrong doings..

All our tech companies are too top heavy with no executives getting laid off.

Many of the big ones used thier cash to buyback shares to enrich shareholders. Now what? Bail out for “too big to fail” tech companies??

“enrich shareholders” That is exactly what the management of a publicly traded company should be doing. It is a their fiduciary responsibility to “enrich shareholders”.

Asset (sales) prices, as Wolf says, are set at the margins. This class of people drives the high end price increases in real estate and other illiquid assets.

Also, downward trends don’t just rosily unwind themselves. The conditions are now set for layoffs, shedding of assets (commercial space), more layoffs, lower stock valuations, smaller executive bonuses, etc. in a slow spiral (which may or may not speed up). Many consumers are doing their best to fight the Fed and keep up with inflation, but if this class of consumers drops out of the game due to FUD, we’ll all be better off for it.

D D,

Shedding of commercial space was in my local newspaper yesterday.

‘UnitedHealth’s Minnetonka headquarters building for sale’

“UnitedHealth says it will stay in Minnetonka but is evaluating real estate needs because of the move toward hybrid or full telecommuting.”

Since the company has space in two other buildings adjacent to its current headquarters, and since the company sold the 344,000 square foot building in December 2014 to a firm out of New York, LCN, in a lease-back deal for $78.75 million, they decided not to renew the lease. UNH has had their corporate HQ there for 25 years.

It will be interesting to see the outcome of a potential sale. Cushman & Wakefield is marketing the building and 20 acre property.

They do nothing but argue (buy time to invest?) with hospitals, clinics, docs, and customers, etc,etc, over procedure codes and fees, anyway. Can do that from anywhere. Medicare won’t play their game at all, FWIW.

But if they are like Blue Cross, they also like to generate and mail a lot of meaningless paperwork, so you have to have space for all that.

Over 2 million of them would have lost jobs if Dems passed single payer, but ACA mess made sure we didn’t “socialize things”…..Dems need Corp donations, too.

Since the Reagan-Bot and Corps killed unions, Dems had to get money from somewhere……gotta have at LEAST two parties or it …..”looks bad ?”…..gonna be winner take all pretty soon I betcha!

SOWBALL read it in reverse,hahaha

I think it is more of noticable slowing trend change starting with number of hires/layoffs % waning, and the short term forecasts predicting more layoffst in a more risky environment.

Over hiring is another side effect of the Fed’s free money policy. Crazy projects get funded. Even level headed CEOs have to up their hiring, to preserve market share so the crazies don’t steal it. If one competitor goes on a growth binge, the rest have to follow.

Ridiculous Fed Reserve policy was the trigger and the problem.

I’m so glad I got out of tech.

I could tell things were getting crazy like 1999 again. The last place I worked (2021) was flush with VC $$ and hired like crazy. Then, they started laying off about a year ago. Last I heard the fair market value on the stock had plunged like 400%. Most of the people I worked with either left of their own accord or got whacked.

I actually feel worse for the survivors. Getting laid off is a great opportunity to reinvent yourself and do something that is actually useful to society, as opposed to cranking out deliveroo apps or sitting around all day on conference calls.

A big tech company in CA laid off 240 people per warn in last 8 months but not listed here.

Also, thousands of contractors laid off are not captured.

and there are probably multiples of not reported and slowing businesses that all mean the same thing as reported layoffs: the pandemic era free money bonanza fake economy is settling into equilibrium of a real economy. Imho massive layoffs, business defaults and closures, renter exodus/collapse, housing bust, credit crunch, liquidity squeeze etc. will play out to equilibrium. Boom to bust fake to real, consensual hallucination to reality. This is your Fed. Call it whatever, financial engineering, wealth transfer, boom bust, woke, fraud, scam, lies its all the same. Outsmarting the Fed, Wall St and Washington to protect yourself is your assignment, should you choose to accept it.

I believe these companies were using many more contractors with the rise of work from home. I think the layoff or increase in under-employment is higher than reported and it is that contractor/freelance status that masks it.

I only listed the tech and social media companies. There are lots of other companies that laid off people, such as Gallo or Amgen or American Airlines. The total layoffs for ALL companies since July 1 is 65K, as I said. About 25% of them are from the 20 companies I listed.

There’s a Meta contracting firm on the list. They do janitorial work for the Meta’s office buildings. The people are employees of the contractor. Meta cut the contract with the contracting firm.

Contractors (self-employed) should always hustle to find new work/contracts. When a contract runs out, they should already have something else lined up. Contractors cannot be laid off. They might not find a new contract, or their current contract might get canceled. That’s always how it is.

This particular company i am intimately aware with is a Tech Semi Giant.

The lay offs are captured in Warn notices.

OK, I might have overlooked one. What’s the name.

Besides the layoff, many companies in the Bay Area have limited annual “merit increases” to 3% or less in the last year, so employees have not kept up with inflation. Hiring has been frozen for about a year for many Bay Area companies, with new hires offered modest starting compensation since the number of workers applying to good paying jobs has dramatically increased. It’s like the game of musical chairs: the music has stopped, a chair or two has been removed, and the remaining dancers are nervous about the next time music starts… and stops…

What’s worse is if inflation does not go in reverse, people are forced to take on lower paying jobs and the system still screws them over with high costs. Taking out the middle class another way.

Layoffs in Seattle area are picking up too.

Per the WARN report, Microsoft is purging every month:

March 2023 – 878 jobs

April 2023 – 617 jobs

May 2023 – 689 jobs

Amazon cut 2,320 local jobs in March 2023.

Meta cut 726 in January.

Twitter cut 257.

There were likely good paying office jobs, many in six figures.

Bobber,

Thanks for this info. Just a brief search tells me Facebook has about 7,000 employees in the Seattle/Bellevue area. Does that sound right to you? Any idea where I can get better numbers?

Thanks as always for your input.

7,000 employees sounds about right. I heard Meta has over 3 million sq ft. of office space in Seattle.

They’re gonna try exporting all the value adding engineering and hope it causes deflation. In my view, hugely inefficient and inflationary. No pivot in sight.

I haven’t seen anybody ask why all these layoffs are happening at this time? A couple of companies cleaning house, I can understand. But so many doing the same thing together for the same reasons — over hiring and over paying — and that too without an immediate trigger from macro economic conditions makes me wonder if these companies were getting Covid related money that has now dried up.

Poor management, like with SVB, which itself served the tech community. Tech companies are trying to deal with their own stupidity by firing people. Nonetheless, the numbers Wolf shows suggest these lay-offs are insignificant relative to the size of the labor force. They might be harbingers of future larger lay-offs, or they might not be.

You nailed it.

Poor management, has no clue what to do and is dusting off the management books from the 1950’s and reading chapter 1 “Layoffs”.

There is probably a lot of poor management out there, but I think in general business just tries to grow and they react to demand.

If demand is hot, you try to hire bodies to help you meet it. If demand dries up you have to cut bodies or go under. In many ways business is a derivative of government fiscal and monetary policy.

Seems like in this age of digital news and social media, everything is driven by herd mentality.

Talent shortage? On no, let’s hire because everyone is hiring.

Bank run? Oh no, let’s get the money out quick before the others.

Layoffs at competitors? Oh yeah, let’s let some of our hoarded talent go, and fatten up our margins.

House prices are increasing? Oh let’s buy asap and waive all conditions because we are never going to be able to buy a house again.

Yep. That’s the good part of being very long term investor or a contrarian. You generally are going against the crowd. If everyone is interested in it, it is overpriced. If you are patient you want to buy an out of favor asset if you really understand it.

I almost bought a gold miner a few weeks ago when gold got to $16xx. But it didn’t quiet hit my target. I wouldn’t buy now with gold at $2000 because people are doing the fear trade. It might go higher, but I want to buy when gold is not in the headlines.

Thing that bothers me a little is I am all in at the front end of the treasury curve for a couple of years and that is getting too popular, but stock valuations are not pricing in recession in my opinion. I hope to have the courage to buy stocks when nobody wants them.

I have never seen so many people so susceptible to marketing either. It’s like a large school of fish.

Some companies probably used that free pandemonium pandemic money to shore up their companies for the inevitable slowdown.

Others probably took more risk that didn’t end well. We will see when the liquidity tide rolls out

Terrible thing to say but I can’t wait for it to hit the work from homers in Sac and the Valley; specifically, the Bay Area transplants who have driven up our cost of living and driven locals out of the housing market.

Medical professionals who used to do pretty well here can’t even afford a starter house anymore thanks to these Bay Area techies who work 5 hours a week.

There was an article on BBC news about same problem in rural England. Locals getting priced out of housing due to second home purchases and AIR BNB.

Local governments were looking at how to fix the problem with very high taxes on the BNBs.

Central bankers messing up the whole world.

This has been an issue since before the pandemic. It’s also why the “Golden Passport” schemes are shutting down in a number of countries that spent most of the last decade trying to bring foreign dollars into their countries.

What nobody talks about is the tens of thousands of properties owned by banks who can’t sell them because the loans against those properties are more than the place is worth. Selling at local value would require the banks to write off the loans, and they can’t do that and remain solvent.

Charles quintupled the Royal treasury of the prince of wales during his tenure. He’s all in on the affluent making cash.

People around the country say the same thing about Californians.

1099 and C2C contractors muddy the waters. Know quite a few who got laid off, and they were making really good money plus overtime.

Twitter, FB, and MS had a lot of them.

Zuckerman never Meta layoff he didn’t like.

Accenture just announced a worldwide layoff of 19k which is the biggest layoff in tech so far I believe. I haven’t see any reports on the impact of the Bay Area or the US. It does seem like the layoffs are accelerating. If the big consultant firms all copy, there can be another 100k in short order.

A lot of these layoffs are in India and Pakistan. Twitter laid off 90% of its office staff in India. This has zero impact on the US.

Another bunch of these layoffs are US visa holders. If they cannot find another sponsor for a visa within a certain amount of time, they’re outa here.

I work for a company which has got 10s of thousands of employees in USA and India.

The primary reason to cut employees is to cost cost/opex. So company seeks to cut expensive employees , not the cheap ones usually.

In my company’s history, for the last decade or so , it was always US employees where were let go, never employees from cheaper cost center.

For Twitter, Musk cut 180 employees/90% in India but approximately 8k from USA and Europe.

Total cut in twitter is about 90% of employees.

“…in what CEOs now admit was a frenzy of overhiring and overpaying…”

You should never have “frenzies” of anything in a healthy economy. This is just one example of the outrageous excesses the FED and .gov created with their disgusting money-printing schemes.

This “overhiring and overpaying” fed directly into the rampant inflation. Further, a lot of these people leveraged these bloated salaries into massive loans on houses, cars, RVs, etc.

We need a great cleansing – a mass deflation event. The economy needs to reprice everything back to what it was before this despicable largesse was unleashed upon the system. We need a total wipeout in pricing.

LOL at you. Sometimes I want you elected, sometines in a straight jacket.

Is it wrong to picture you driving a taxi cab around NYC while talking about the Great Cleansing?

I call it hysterical hyperbole.

There he goes……pounding away as usual.

A cyberstalker says what?

+ 1000 % Nobody says it better than Depth Charge .

Can we term the “money zombies” wolf describes as “brains turned to mush”?

I like money zombies , but I’m not really fond of zombies. So now I’m torn. Lol

😆 WGAS? Again….the first time unemployment figures are BELOW forecast, whats new?? Nothing.

Layoffs? LAYOFFS? We aren’t talking about Layoffs.

Perhaps this is an indicator that we’ve finally reached peak woke, and are now on the downslope.

LOL. This stuff is just hilarious

It’s a mental illness at this point. Literal hallucination.

You want people to be asleep?

I imagine that woke is just more fantasy kept afloat by ZIRP. With reality returning fantasyland is coming to an end.

This is just the beginning, a rock rolling down hill, gradually picking up momentum. When it reaches bottom, who can say. Let’s just hope it doesn’t become an avalanche.

The only good news here is that the Dreyer’s shut down was temporary. That stuff’s delicious!

Are the total salaries listed anywhere? And do local tax incentives get adjusted? because the community or state is benefiting less.

According to the graph California non-farm employment hasn’t yet reached pre-pandemic levels. The tech over hiring didn’t make up for other job losses.

The labor force is still well below pre-pandemic levels. Among the reason are that California lost population and that working from home allowed people with jobs in California to live somewhere else.

Classic lord Farqwad tactics… I am selecting a team for a special mission to rescue the princess…. some of you might not make it back, but that’s a risk I am willing to take.

I personally know of past large layoffs where there was no WARN notices given. So what is the enforcement of the notices?

Seems you’re in Florida. I’m not sure what the situation is in Florida. This is about California.

Sorry, this happened in the Bay Area before we left a few years ago. Otherwise I would not have commented.

Cisco avoided a lot of the bad press and getting listed among others because they cleverly named their layoff, not a layoff but a ‘reskilling’ exercise. It was just a layoff and yes, amazingly they could have prob avoided it by cutting their excessive exec pay packages momentarily.

Cisco is on the list: #9