What we saw on Friday was large-scale fear of taking big uninsured deposits into a potentially gruesome FDIC weekend.

By Wolf Richter for WOLF STREET.

What we saw last week in the Treasury market and particularly on Friday was fear – large-scale fear by individuals and companies with big uninsured deposits in certain banks. They yanked those deposits out from their accounts at those banks – millions or tens of millions or hundreds of millions of dollars each – exacerbating the run on their bank. And they moved their money elsewhere, including to other banks, some of which gained a large amount of deposits, and into Treasury securities.

In the Treasury market, there was huge demand that pushed up prices and caused yields to plunge amid whiplash-inducing volatility, and concluded on Friday, with another bout of panic-buying as yields re-plunged, after having jumped on Thursday. But by Monday, the weekend – and the fear of going into the weekend with large deposits – will be over, and yields are due for a massive bounce.

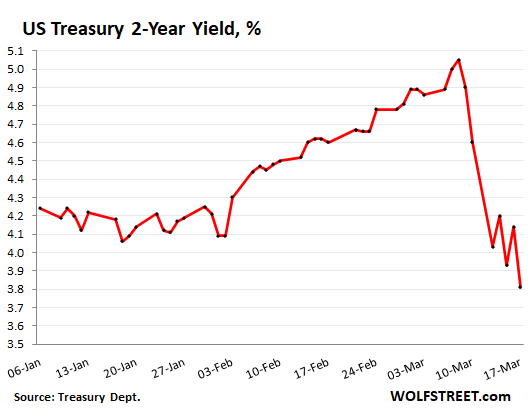

The two-year Treasury yield plunged by 33 basis points on Friday to 3.81% the lowest since September, having plunged by 109 basis points during five-day period, amid breath-taking ups and downs. So this is fear that you’re seeing here – fear of a gruesome banking weekend. And the next move, stimulated by relief that no other bank collapsed over the weekend, knock on wood, should be a big move up:

Those depositors, by yanking their money out and buying Treasury securities and thereby driving down yields weren’t betting on an emergency rate-cut of 50 basis points via Fed teleconference on Sunday afternoon or whatever. It’s just that they didn’t want to enter a potentially gruesome weekend where on Sunday they would find out that their bank has been taken over by the FDIC.

They didn’t want to find out that their uninsured bank deposits would not be available for a while, and that when they would become available, there would only be a portion. They didn’t want to find out Sunday afternoon that their bank didn’t have enough deposits from self-righteous well-connected billionaires with big megaphones and from companies that those billionaires invested their billions in.

They didn’t want to find out that their bank was just a normal bank and not a billionaire’s playground, and that the rules of deposit insurance would therefore be applied to them. And they preemptively yanked their money out, especially on Friday, and lots of them bought Treasury securities.

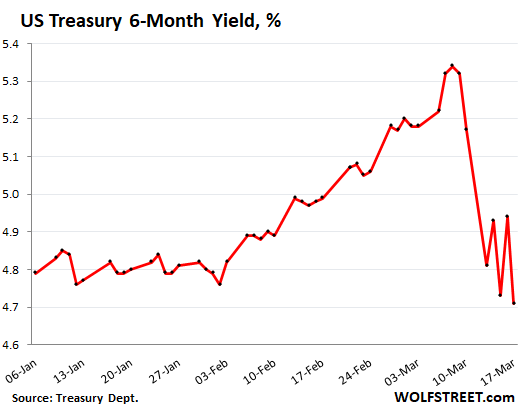

The six-month Treasury yield plunged by 23 basis points on Friday to 4.71% the lowest since early December, having plunged by 61 basis points during the week.

Volatility in yields was breath-taking. On Monday, the two-year yield plunged 57 basis points, after having already plunged 30 basis points on Friday, March 10, when Silicon Valley Bank collapsed. On Tuesday, yields bounced. On Wednesday they plunged intraday and then undid some of the plunge intraday. On Thursday yields jumped 21 basis points, including an intraday recovery of 40 basis points. And then on Friday, there was such massive demand for two-year maturities that prices jumped and yields plunged 33 basis points – fear of a gruesome banking weekend.

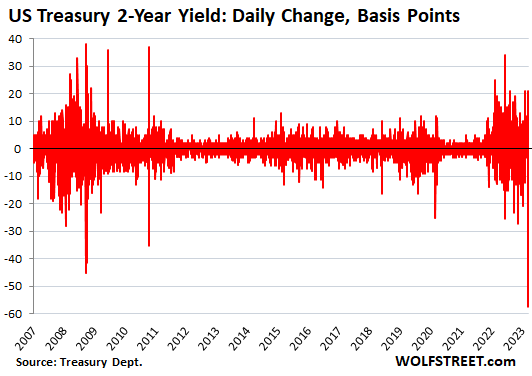

The volatility last week in the two-year yield exceeds anything we’ve seen during the worst moments of the pandemic and during the Financial Crisis. This chart shows day-to-day changes in basis points of the two-year yield. Fear-driven panic buying:

And Monday? It’s now Saturday afternoon, and so far, so good, no collapse-announcement in the news, knock on wood. Some bank-buyout rumors in the news though about First Republic and Credit Suisse, and that would be a good thing. If this relative calm – or rather the absence of new chaos – continues, it’s going to be met with relief in the depositor and banking scene on Monday, and Treasury securities should sell off and yields should produce a circus-worthy bounce.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

CME FedWatch only has a 62% chance of a 25 bps hike on Wednesday, which I think is really suspect–it should be close to 100% with a hawkish press conference.

People panic buying, Bitcoin up 30% in a week. Crazy times. Makes no sense.

It makes perfect sense. There are trillions of speculative dollars in the hands of reckless financial maniacs who are running from bubble to bubble while destroying everybody else’s lives.

Amen. However, while the ultra rich who control US banks are gambling in subprime auto loans, mortgage backed securities, currency swaps per their BIS December 2022 report, etc., these “safe” US Treasuries were their foundation or financial safe harbor, which the rise in interest rates are making worth less, not worthless but substantially reduced in realizable market value from willing, nongovernmental, nonmanipulated buyers seeking the same market rate of return paid by current, newly issued, same term, US treasuries.

Since the monumentally unwise repeal of the Glass Steagall Act and associated protections, the banks’ financial model is to be hugely profitable on limited starting equity investments by choosing (A) to make huge profits from risky gambling like securitizing bad debts that they sell to “dumb” money (like pensions whose administrators are apparently, usually staggeringly, stupidly dumb or maybe(?) compensated by bankers to sell their pension beneficiaries down the river); and (B) holdings of safe treasuries, secured loans, and other types of secured, fixed return securities, all of which had and will have their FMV crater as interest rates rose. Since, to tame inflation, interest rates must keep climbing (absent a war or recession), what banks are not insolvent now may again become secretly, legally insolvent as interest rate hikes make their treasury holdings, mortgage loans, auto loans, etc., crater in FMV even more.

Fasten your seatbelts people, because the rollercoaster is likely to rapidly accelerate its descent! Wheee! I wonder if a political system that is about to cause the USA to default on its treasuries because the sides cannot negotiate a compromise, while we face dire, loud war threats from two expansionist empires, can handle these problems. I doubt it. The government would probability have to allow the bankers’ “Fed,” privately owned cartel to print many, many, many times more dollars than it has ever printed so far to bail out all the insolvent banks.

Thereafter, hyperinflation, here we come! At least, most Americans will never have to truly worry about paying back our existing car loans or student loans anymore, except for adjustable rate loans; hyperprinting of dollars will take care of us; most fixed rate loans will then truly become more and more worthless. Your auto loan may have the same, remaining sum owing as what it would cost to buy a fancy coffee and danish by 2025: $40,000, maybe. We will all be able to afford $100,000 suits by 2026 like our dear bankster aristocrats! Zimbabwe us! LOL

Probably not “probability,” auto spell checker!

RH, What a great comment! I couldn’t agree with you more! Thank you for nailing it so succinctly!

…relentlessly privatize profit and socialize risk and whaddya get?…

may we all find a better day.

Yes, trillions of slush money that must evaporate before any sense of normality returns to markets.

DC

and when they blow up, zip.

Not even clawbacks of bonuses…

“Uninsured deposits” is a form of market discipline.

Yellen is indeed picking winners and losers.

Cant get anybody reading Danielle DB or Bianco to get that.

You guys see that interview where Sheila Bair ripped them for the bailouts?

I liked it (because I agree with her haha “Confirmation Bias”)

So Peter Thiel would have gotten 45 million back instead of 50 mil. Boohoo, cry me a river! He’s worth like 4 billion, do you even notice 5 mil at that point???

The Fed will raise .25% to keep credibility from both inflation “fighting” as well as “signaling” bank health is not a concern.

I seriously doubt Wolf’s prediction of rates jumping back up significantly on Monday. This withdrawal of funds from banks and buying Treasuries has more room to run and even when it slows down, few are going to rush back to the banks.

Fed will only lose credibility with 0.25% hike after printing $300 billion for FDIC and banks.

I don’t see how Fed can hike lower than 0.50%. Else hyperinflation will start as yields have fallen significantly and bitcoin is rising.

The Fed has credibility? Perhaps you mean so that the consensual hallucination can continue.

Do not forget the reckless politicians spending money like drunken sailors in order to hold their office!

You get what you vote for.

Do not forget drunken sailors spend their own money.

…and you vote with your wallet. Everything is propaganda.

*everything ELSE is propaganda.

BF,

Great comment, even if you blew it. I’m saving it in WS folder.

I’d add that most are FORCED to vote….propaganda is pretty much for the rich.

“Man is not moved by prayer or petition” -Marcus Garvey

Where do you put money ,everything is in a bubble,gold can’t eat it ,treasuries corrupt government,cash is trash .I expect a 90% haircut at some point.History repeats. Sorry being so negative sucks,but I see no way out !!!!!!

The hawkish press conference was before the banking system buckled.

And non-favored entities stuck with souring assets have not been favored with a bailout. E.g. insurance and REITs.

Yes, protecting these stupid banks is equivalent of providing insurance to Fed Pivot bets.

When stupid bets start making printed money through FDIC insurance claims, we can expect more stupid bets.

Welcome to Socialism for Billionaires funded by uncle Sam’s slaves, aka the tax payers.

Leo:

This is nothing new in USA:

Has been, ”Socialism for the rich,,, and Socialism for the poor, and screw ALL the so called middle classes.” for a long damn time, at least since ol ronnie ray gun and likely even earlier.

What to do? Don’t BUY ANYTHING not actually needed…

Just a year or so of that and likely all actual working folks who make or do something real will be OK,,, at least until the next GRAB by and for the rich AND poor.

Both political parties SO full of crooks and wannabe crooks only concerned with increasing their own person wealth,,,

”CLEAN HOUSE,,, SENATE TOO.” was a very popular ”meme” back in the ’80s,,, before meme was a thing… STILL TRUE…

”When will we ever learn” a popular song in the ’60s (maybe the 70s, but I am one who was there in the hyperactive Bay Area,,, and don’t remember stuff. LOL)

Watched Yankee Stacking = gold ,silver trader. He has people coming and buying closing bank accounts,cashing in IRA,and depleting cash reserves.People are scared,better learn to be self sufficient,first can’t eat or drink gold or silver.Jim Rogers says this will be worst downturn in his lifetime .OUCH

VVN,

I knew the Kingston Trio did it pre-hippie days, but it’s now extremely sad where it REALLY started;

Seeger found inspiration for the song in October 1955 while he was on a plane bound for a concert at Oberlin College, one of the few venues which would hire him during the McCarthy era.[6] Leafing through his notebook he saw the passage, “Where are the flowers, the girls have plucked them. Where are the girls, they’ve all taken husbands. Where are the men, they’re all in the army.”[7] These lines were taken from the traditional Cossack folk-song “Koloda-Duda” (Ukrainian: Колода-дуда), referenced in the Mikhail Sholokhov novel And Quiet Flows the Don (1934), which Seeger had read “at least a year or two before”.

NBay – many thanks on the deep background of that song of Pete’s (and I wonder if Sholokhov is still found in jr. and sr. High school libraries like in my day, but I doubt it…). Best to you.

may we all find a better day.

Please delete repeated comment!

Not the taxpayers.

The harm emanates out to all those who hold the dollar. The tax money is spent

Especially insurance and reits not sure how those will be resolved with the losses on their books. As long as they don’t have any massive redemptions they should be ok insurance wise

Black Rock doesn’t seem to be doing too well.

There has to be losers during the “Reaping Hour”. That’s when all the profits are realized. These billionaires have vacation plans and are heading for the exits.

Bitcoin maxis are using these bank failures to really push the “traditional finance can’t be trusted” narrative. The irony is that when SVB collapsed, all depositors were made whole. Yet even within the last 6 months we’ve seen at least as many collapses of crypto institutions, and everyone trapped inside became a bagholder.

The only way it makes sense is when viewed as a cult.

Can it be that many of the bailed out banks, are invested in crypto related “tech startups”?

If yes, that would explain the crazy rally on bitcoin.

It may also mean that “our deposited dollars are now made whole by bitcoin rallies”. What an irony!

FTX

SVB

First Republic

There is a shared geographic commonality, and likely a shared attraction to tech and crypto.

Wolf, you hate Bitcoin back at 28k. Lol

I “hated” (LOL) bitcoin at $65k and at $15k.

I don’t actually “hate” it. That would require emotions of some sort for bitcoin, and I don’t care about it. It’s a scam that I will have nothing to do with. There are lots of scams out there, because people love scams because they can make money in scams for a while, that’s why they exist. And the SVB account holders with uninsured deposits would have gotten more of their money back without intervention than buyers of bitcoin at 65K.

“Wolf, you hate Bitcoin back at 28k. Lol”

Where were you when BitCON was at $15k after being at $66k? You were nowhere. Why are you now here because BitCON went from $15k back up $28k. Are you going to be back here when it’s back down to $15k, “LOLing?”

You shills disappear like a fart in the wind when BitCON starts crashing, then show up in some pathetic attempt to gloat when the price is going up. How do you think the people who bought at $66k feel right now? They got destroyed. You people are a joke. BitCON. This fraud should be illegal.

Stockman put up a long term chart that shows the Fed funds rate has not been able to be a sustainable real positive rate for a very long time. We still have the growing pile of debt. We still have slow growth. We still have poor demographics. I don’t expect the trend to break without something breaking.

We have been gaslighted, since 2009, that Fed Funds belong UNDER inflation. Prior to 2009, this was not the case.

Is this how you win Nobel Prizes? (Bernanke) Suppress rates abnormally for as long as you can?

To quote Wolf “something has broken for 2 years massive inflation “

I wonder if DS’s chart reflects taxes on interest income? If not it appears real positive returns are a pipe dream.

Virtually no one consider taxes when quantifying “real” interest rates.

The majority have been slowly ransacked for decades and there is a lot more of that to come later when the day of reckoning arrives to pay for all this debt and preserve the Empire.

Multiple tax increase proposals which will supposedly be limited to the more affluent. Yes, that’s what they said before, all the way back to 1913 and 1916 with the estate and income tax.

Then there is FACTA, which supposedly is only to enforce income tax compliance. Just wait until the USD really starts crashing. At that point, the USG will issue an ultimatum telling most everyone to bring their money back into the country after which they will be forced to buy UST, all for their own good of course.

AF,

It is (very) unfortunate but the destruction of the macro economy has gone unaddressed for so long (*enabled by QE money printing that mostly benefitted wealthy asset speculators*) that taxation is likely the only way the USD/US macroeconomy can survive.

The ability of fraudulent printing to sorta-prop up the economy has run its course and met its inevitable end – bad inflation.

So whatever funding the G is going to demand (and it is gonna to have to be a helluva lot less despite entitlement promises/lies) more of it will have to come from inescapable taxes rather than fraud/print.

(In addition to tax increases, cut carrier battle groups from 10 to 6, destroyers from 70 to 40, lop 20% off Social Security/Medicare/Medicaid, etc…and you might get back to a macroeconomy that can fund itself…I’m sure that somewhere in the bowels of deepest deep state DC, the math has long been done (you don’t hope to control an empire without having contingency plans).

(Actually there are online calculators that also allow spending cut scenarios to be run very easily)

The battles will all be about the distribution of tax/spending cut burdens (but this time the masses are much better informed, organized, and enraged).

Old school,

Since the peak of inflation in 1980, inflation declined in waves for 40 years, and interest rates declined in waves for 40 years.

Now this 40-year period is OVER, and there is a new period of higher inflation and higher interest rates, and comparisons to the past 20 years of declining inflation and declining interest rates give you false results.

You need to compare today to the 1970s, 1980s, and 1990s through the year 2000, and for most of this period through 2000, the federal funds rate was ABOVE CPI.

Stockman should know this. This was in his heyday:

Ever since QE started , there have been few periods in which real rates have been positive .

Yes. QE started in 2008 and ended in 2014. Restarted in 2020 and ended in Feb 2022. Low inflation throughout. Now ever have raging inflation for the first time in 40 years. This is a whole new game that lots of people have never experienced as adults.

It’s crazy volatility. The MOVE index shot up and it’s great if you are a trader.

I was waiting to rotate from my money market fund to a longer duration treasury ETF, and I sure hope that the rate increasing cycle isn’t over yet…

It seems like bond bulls are looking for any excuse to say the fed can’t keep raising, but I hope it will be higher rates for a couple years at least…

Either way, Monday will be a new week to place your bets!

I believe history shows that when you use extraordinary central bank policy you have dug a hole you can’t get out of without killing the economy through inflation or austerity. I think Fed knew what it was doing being late to the inflation party, but the last big fiscal spending bill got them too far behind.

They are going to blow up commercial and residential real estate sometime within next 12 months if rates stay at this level. System is too leveraged for a committee to hit the gas and brake at the right time when you have a 1 year delay in transmission mechanism. Gold price telling you people are getting nervous.

My local credit union is offering 18 month CD’s at 4.6% apy and 8 month at 4.35% apy.

I wonder if that will be the rate next month when my CD’s renew?

Old Ghost: No need to lock up your money that long (unless you want to). Charles Schwab is paying 4.5% with a .35 fee.

Is your credit union money FDIC insured?

NCUA insured. The National Credit Union Administration is the federal insurer of credit unions.

Won’t these violent spurts of yield volatility continue to come and go over the weeks and months (and years?) as QT continues and more banks are inevitably closed?

Unless the FDIC removes limit on deposit insurance, it would seem like any deposits in excess of 250k will always be insecure, at least during these next few years of QT.

They’re not going to remove FDIC limits on deposits. Old Yellern just said so. She admitted in her CONgressional testimony that this was a special event. See: “SPECIAL PEOPLE.”

This is the same woman who came out a few years ago and said we’d never see another financial crisis like we had in 2008 in our lifetimes. And she told us the financial system was strong, even after SVB. Then when she was being questioned by CONgress, she said the FDIC made depositors whole because otherwise the entire banking system would collapse.

ARREST JANET YELLEN FOR CORRUPTION, FRAUD AND INCOMPETENCE.

I fear it is not corruption, but incompetence. It would almost be better if it were fraud because then we could believe she had a clue.

Yellen is clueless, just like Wall Street likes it. Tell her what to do and she obliges.

These people knew exactly what the consequences of ZIRP would be, they also know full well what raising rates will do. The incompetence excuse wouldn’t pass muster in a tribe of Barbary apes. Therefore one needs to accept that Yellen, Bernanke et al have an agenda that is not necessarily the agenda you imagine they should have.

She is getting that Geithner look about her.

These people have known they have been playing with matches on a powder keg for years/decades…but lacked the wisdom/courage/insight/intellectual capacity to be honest with 330 million Americans.

Or to come up with any other path…one that didn’t lead to ntl ruin.

So they temporized us to death

Yup. Lots of big Dem donors. It would be sickening on either side of the isle, but it’s clear who got bailed out here. WITH TAXPAYER MONEY.

Like Russia,China ,USA just another ogliarch,the corporations and billionaires run this ship.Why do you think keystone pipeline was shut down Warren needs to haul oil on trains . Follow the money,

The Federal Reserve’s mission statement for dealing with inflation:

(Scenario 1) Two to five million people might lose their jobs, thus livelihood? No problem. That’s what we want to happen.

(Scenario 2) A few hundred billionaires are inconvenienced by the burdensome emotion of “worry” without taking any actual losses? We’ve got to do something… now!!!

Jeff D

plus 1,000 %

So much this. The Fed is an aristocratic institution inimical to working people, and America is a plutocracy.

Why do you people keep saying this junk, as if the uninsured deposits were all billionaires (and Democrats)? Gimme a fkn break.

People out of work,have bills might take a lower paying job,this scam has been going on too long = business more profitable

@Gattopardo Anger and ignorance, the key qualities of a pitchfork wielding mob.

That’s not to say they are unjustified.

Yes, Yellen doesn’t have a clue. She’s way out of her field of expertise.

But at least she is paying attention to the most important things as Treasury Secretary, climate change.

Old Grandma Yellen 5th in order of succession, in theory.

She’s got at least 3 Pensions…

Univ of CA, Fed, Treasury

and I’ve never heard her say anything of value.

Do they have co-ed jail facilities for counterfeiters?

Old Yeller could share a cell with Benjamin Shalom Bernanke ….

Most of the uninsured SVB depositors who have been backed out using tax payers money are big time donors to Democratic PACs.

Now you get the pic

Ture why were they backed out so promptly working weekends…

DC, you are losing the thread if you are screaming Lock Her Up for *incompetence.* She might make a good sacrificial lamb for your cause but I firmly disagree with that prescription.

Grab a gun, head off into the woods, and join the Oathkeepers if you’re that committed to radical change based on your own understanding of the law and values of this country.

I believe I said lock her up for fraud and corruption. You’re just trying to distort things because your little jimmies got all wadded up. Now go wander off into your little imaginative forest yourself.

“ARREST JANET YELLEN FOR CORRUPTION, FRAUD AND INCOMPETENCE.”

Realllly starting to wonder what you’re actually about, dude, no matter how you might tap into the feelings of the crowd here about what’s happening in the world.

Depth Charge.. I can not quite decide if you spend to much time alone in the woods scanning far right blogs in survivalist mode or if you are just anti women who really does not know how to ask a question and get non biased factual results from google.

FYI These are the responsibilities of the Secretary of the Treasury. Male or female, black, white or purple. The serve at the pleasure of the President and get approved by the Senate.

9 Responsibilities of the Secretary of the Treasury

The Secretary of the Treasury serves at the pleasure of the President and assumes multiple duties, including:

1. Fiscal policy: On behalf of the president, the Secretary of the Treasury helps craft the federal government’s domestic and international economic policy and tax policy.

2. Managing public debt: The Treasury Department manages debt and makes payments on debt owed by the federal government.

3. Tax collection: The Secretary of the Treasury oversees the Internal Revenue Service (IRS), the federal agency that collects taxpayer revenue to fund government operations.

4. Advising the president: The Secretary of the Treasury makes recommendations on fiscal policy and economic strategy, working with White House officials like those in the Office of Management and Budget (OMB). The Secretary also serves as Chairman Pro Tempore of the President’s Economic Policy Council.

5. Law enforcement: The Treasury Department enforces financial laws and regulations, particularly those related to the nation’s banking system. Through the Internal Revenue Service Bureau, the Secretary of the Treasury prosecutes financial criminals.

6. Currency manufacture: Through the United States Mint and the Bureau of Engraving and Printing, the Treasury Department manufactures US coins and currency. Along with the Treasurer of the United States, the Secretary of the Treasury signs Federal Reserve Notes for the money to become an official legal tender.

7. Managing entitlement funds: The Secretary serves as Chair of the Boards and Managing Trustee of the Social Security and Medicare Trust Funds.

8. International finance: The Secretary of the Treasury is the US Governor of the International Monetary Fund, the Inter-American Development Bank, the International Bank for Reconstruction and Development, the European Bank for Reconstruction and Development, and the Asian Development Bank.

9. National security: The Treasury Department enforces monetary sanctions on private banks and central banks of foreign nations as part of an administration’s national security policy.

You can check FED Chair Short term rate increases and the three metrics that they are responsible for here . GDP, Unemployment and inflation here.

https://www.thebalancemoney.com/fed-funds-rate-history-highs-lows-3306135

Trumps Treasury Secretary and Fed Chair all came from hedge funds, Private Equity. Yellen public service. Who do you think is interested in protecting the little peoples money. Not Trump, Not Mnuchin, Not Powell and not the Tea Party Congress. They are why we are once again in this freaking mess. Congress could have takin money off the table they chose to open up the flood gates.

A little long Wolf but sometimes I just get tired of the non thinking, non solution whining responses. Especially after you post pretty explicit detailed data.

Yeah. DC mostly just invents good anti-Fed adjectives and side stories and generally just mimics Wolf’s criticisms of it. But it allows him to drop his right wing stuff in now and then.

Probably no worse than myself and everyone else…..the plutocracy and nations that want this country to struggle and to ultimately fail have worked hard to make this is a VERY divided country. Quite a PR job, for sure.

I sure don’t envy the moderation job, but so far so good. Of all the “hard earned money” stories I’ve heard here, running this site is right up there.

I’m sympathetic to a lot of the frustration out there right now, but how did my question about yield volatility turn into a petition for jailing the treasury secretary?

Johnny5, there are a lot of people who think that throwing individuals they don’t like in jail will fill that gaping hole at their center. They’re angry and often can’t even rationally explain why they’re angry.

First – reiterating the importance of asking: “…and then what?…”. No matter what type of sweeping response, there will be no magic subsequent to it…

may we all find a better day.

“Unless the FDIC removes limit on deposit insurance”

Have they not set a precedent? If a small bank goes toes up, and deposit insurance stops at $250K…….and the depositors sue……they would win.

There is a thing called “equal protection” in this country. Or is that an old fashioned notion?

Old fashion notion there is no equal protection under the “law” as I have seen plenty of cases where the Justice department is relentless in pursuing big claims when the supposedly white collar criminal is jailed and fined millions for the purpose of promotion for the prosecution. Our Justice system is now run like a private practice law firm for huge awards. Big wins big promotions forget equal Justice

NEVER been ”equal justice” in USA, YET bsini.

OJ proved that rich black folks can get away with murder as have done SO many rich white folks,,, AS LONG AS ya have the dough…

OTOH, poor folks of all colors, ethnic origins, etc., etc., can not ever expect our legal system to provide any kind of actual justice, just judgements against us.

Been that way,,, of course with the ethnic origins formerly corrupting the whole system totally, back in the day.

Defacto , there is now no limit on deposit insurance .

The much bigger problem is that there may still be a $250k limit for some banks but not for others. Regulators and politicians are going to make arbitrary decisions based on noise by billionaires with big megaphones, and not based on the same rules for everyone.

Love the Wolf term “a billionaire’s playground”, which seems to be the state of the world at the moment.

I agree with the EU, the US used a sledge hammer to kill a fly in terms of infinite FDIC insurance for the SVB bank that has 95-97% of depositors holding above the $250,000 limit. This could be a function of how fragile the entire global financial debt ponzi scheme really is behind the curtain, and/or simply oligarchy behavior that usually doesn’t end well when so transparent and offensive to the masses.

The fact is the moral hazard it real, and the anger toward the entitled class is worrisome as people don’t like when the govt picks winners and losers. Yet citizens really, really dislike when the govt lets the wealthy elites win regardless of circumstances, and change the rules after the fact so the controlling wealthy class can never fail no matter how many rules or societal norms are broken in the process.

Equal protection guarantee long vitiated by “protected class” and other judicially created exceptions.

See also “rational review” non-standard (no rationality and little review actually required) to justify government regulation.

The courts have long castrated themselves when it comes to reining in State power. Either fear or idiot faith…likely both.

Great nations are lost when the mechanisms of balance lose faith in themselves/sufficient moral force to persuade a mass of citizens.

Some people are more equal than others.

Four legs good, two legs bad

The other event that may cause treasury volatility is the raising of the debt ceiling. When this happens, the market will be flooded with new debt. Right now, it is debt rollover and QT while the government spends down its bank account. When they have to refill their bank account, treasury debt for sale will include QT, rollover debt, new debt, and foreign sales of US treasury debt for local currency stabilization.

So far this fiscal year US debt has gone from $31.2T to $31.4T. If the deficit is approximately $1.2T that means that for the last 7 months of the fiscal year the government will need to issue $1T in new debt. That’s $140B per month. In addition to QT. Unless the law of supply and demand is repealed, interest rates should go up significantly.

The government has been issuing new debt to the public market just fine. What it hasn’t done is issue new debt in form of non-marketable securities that government pension funds and the Social Security system buy. That is the borrowing that is NOT taking place due to the debt ceiling, even as the cash from the contributions keeps rolling in. All those nonmarketable securities will be issued with the click of a mouse the day when the debt ceiling is raised, and I’ll write one of my classic post-debt-ceiling articles with the headline: “Gross national Debt Jumps by $600 billion in One Day,” or whatever.

So generally, the debt ceiling, if resolved in a reasonable time, doesn’t contribute a lot to bond-market volatility. But if it drags out to the very last minute, the bond market gets nervous.

Speaker MCCarthy will be voted out unless he agrees with the demands of

the rebellious Republicans . And an important part of their demands is fiscal responsibility . Given Bidens stance , there is a good chance that the debt ceiling will NOT be raised by the House

So, fiscally responsible Republicans are labeled as rebellious Republicans, good to know.

nick,

I can’t take any congressman seriously as fiscally responsible if they voted in favor of any/all of the Covid largesse. Guess how almost all these guys voted? Yea. So this “fiscal responsibility” stuff is purely political, to deny Biden his agenda. If these congressmen are that concerned, let’s see them offer to slash defense. Yeah, wouldn’t ever happen.

nick,

The party jumped the shark in 2016, although ratings had been on the decline for some time before that point. The new guy cast in the lead role brought some much needed energy, but his arrival was like curing depression with meth and steroids.

AWESOME Thanks for the report.

@todays_article

“If this relative calm – or rather the absence of new chaos – continues, it’s going to be met with relief in the depositor and banking scene on Monday, and Treasury securities should sell off and yields should produce a circus-worthy bounce.”

If the bank bailouts stop more runs on the bank, then I would say this is the first time that I will have benefitted from a bail out.

How so? You’re paying for it through inflation for the Fed’s balance sheet and through bank fees / worse terms for FDIC assessments.

You’re also not profiting from bad actors taking on new risk in their banks if all deposits are guaranteed by you.

Apologies if you own shares in a bad bank — then yes you benefitted from the bailout ;-)

I was only referring to interest rates on T-Bill remaining elevated. Meaning if people feel confident about the banks, they will stop piling into treasuries. If they stop piling into treasuries, then the rates should stay the same or increase.

Guess Who – Trust in Govt & Banking ?

1. Greg Becker, CEO of failed Silicon Valley Bank also was on the Board of the Federal Reserve Bank of San Francisco.

2. Barney Frank former D of MA was Board member of failed Signature Bank of NY. Also author of Dodd-Frank legislation

Big bankers in a region will tend to be on their regional fed board. In the 2000s, Dick Fuld of Lehman Brothers was a member of the NY Fed Board. But Lehman was allowed to fail. (My source: newyorkfed.org)

You’ll never guess who rolled back parts of Dodd-Frank in 2018.

Hint: It wasn’t Dodd or Frank

Guess who bailed out Frank’s bank? Hint: it wasn’t the guy in 2018.

You’ll never guess who was among those lobbying for those rollbacks.

Hint: It was Frank.

My favourite characters in all of this are the Realtors here (at least) in Canada saying the bond market is now pricing in rate cuts from the Bank of Canada based on these yield drops. Yeah, that’s right, it’s all rational prediction of future interest rates from a market that has predicted exactly nothing correctly about rates for at least the last year. Panic does not equal prediction. Quite a few of them are geographically confused and don’t realize it’s American banks (and the perpetually crappy BadCredit Suisse) at issue. Hopium. So strong.

They believe the narrative that smart money invests in those. RE Agents do not realize that it is the same players as elsewhere and if yields were actually forward thinking then they would have been higher BEFORE CPI came in higher than the Federal Reserve expected.

How much fun would it be if the Fed raised rates by 50 points? All the WSCB (Wall Street Cry Baby’s) would probably have a well deserved and simultaneous heart attack. Dare to dream…

I think the new dot plot comes out this week. Maybe .25 and higher and much longer dot plot to fulfill your dream?

I agree I think the dot plot will again be higher for longer.

The question is how long does it take markets to agree with the Fed.

.25 is really kind of joke . Using a non-Chinese CPI (Volcker’s legitimate CPI calculator) we’re at very similar inflation now, around 15%.

Volcker’s response was taking the Fed Funds rate to 16% in 1982.

Tough guy Powell’s Fed Funds rate is what ? 4.75% ? With identical 15% inflation.

Do the math. How could anything reverse course with a Fed Funds rate around 10% below true “little people” inflation ?

The billionaires own Powell.

Buy I bonds then?

Mark,

Your inflation number is your own fantasy. Don’t apply that BS number to me. There are some items that went up 15%, and there are lots of items that went up 3% to 8%; and there some big-ticket items where prices actually fell, including used cars and electronics, including the big monitor I bought recently.

Should go to 500 … at the least!

NYT has an article where they talk about unrealized losses due to bonds being worth a lot less. And some bank’s cash on hand was very low compared to the amount of bonds they held.

A few have staggering unrealized losses but the new programs shore them up. So yep fingers crossed!

I’m hoping the fed holds course because the market will just react if no hike. The market is like your odd uncle when chickens go on sale out of the semi trailer out at the old mall.

did you really look to the new york times to help you figure out what has been obvious the past week? and the non-obvious the NYT won’t point out.

“A few have staggering unrealized losses but the new programs shore them up. ”

The Fed conducted a cattle drive to push the securing of yields out the curve. BUT, those who followed the Fed live under different accounting and in a different reality.

The ramifications of long maturity portfolio declines for the Fed are different for those in the “real world” . Those who “ran with the Fed” got trapped in a different reality than that which the Fed is allowed.

Big selling indeed. And including many other credit layers. Treasuries, MBS, A through C bonds, and preferreds. Fun to watch in a weird way. Some good deals for yield seekers (not treasuries though).

As you point out, this is subject to developments over the weekend. On the same proviso and for what it’s worth, I agree with you and anticipate this projected high velocity move extending out to the 10-year. Not up to October’s 4.25% however.

a con artist elderly woman, who looks like a troll out of the Hobbit, trying to talk it all up like it’s fine. Lol what about Pow pow ? Lol

More likely, the Fed will show its true colors. While Lagarde boldly hiked 50 basis points into the face of several major bank panics in the EU, in the overriding interest of getting inflation under control, the spineless unserious Fed will likely pause.

Powell has erred on the side of capitulation whenever any semi-serious breeze of a challenge appeared. Risk asset pricing looks suspiciously casual to me at the moment.

JeffD

Mr. Powell is NO Mr. Volcker either in integrity or credibility.

He is captive to ‘special vested interest groups’ just like all the other Bank regulators.

His recent QE5 or QE extra lite, special wiped out the last 2 months QT reduction. Is it more inflation or bailing banks one after another, since 2nd moral hazard has been committed without shame?

Volker had Reagen,s backing . Powell doesn’t have Biden,s backing or Yellen belly. So no change have to keep the working slaves poor,billionaires better learn to grow food,have clean drinking water ,raise livestock.They have no life skills except to Steal Wealth

As a follow on to my comment, “the Federal Reserve uses Open Market Operations to adjust the supply of reserve balances so as to keep the federal funds rate–the interest rate at which depository institutions lend reserve balances to other depository institutions overnight–around the target established by the FOMC.” The idea is to keep the rates “smooth”, without large jumps. The Fed has allowed the one month T-bill rate to fall to 4.30% from 4.73% the week before. Now, given that the FFR could be adjusted upward by 0.25% in *3 days*, why on earth would the Fed allow this large spread? I get that the one-month T-bill rate is set at auction, but at COB the day after the auction, the rate was still at 4.30% despite OMO trading trying to keep a “smooth” rate environment

If you’re curious about anything related to IORB go to the Fed Liberty Street blog. There’s several excellent posts by the managers of the trading desk, who explain everything.

And for God’s sake don’t post a link to those references

Dr Duration,

You have Zero understanding of the IORB. I have deleted several comments about it. The Fed SETS this interest rate as part of its rate hike decision. You make up BS theories about it because you goof off digging through stuff on the internet that you don’t understand, and then you try to post this crazy stuff here, and I religiously block it.

So let me repeat what I said elsewhere: As you know, I now delete many of your comments because what you do doesn’t work on my site. I hate to do it, and it takes up a lot of my time, but I have to do it. Your thing is that you dig through the internet and find something that you don’t understand and get all mixed up, and then you post it along with some crazy theory. You do this several times a day. I no longer have the time to point out the errors and misunderstandings and mix-ups. When I get to the first line that shows that you don’t understand what you’re citing, I delete the comment.

So I have a strong recommendation for you:

Start your own blog, and post your findings and thoughts there, and not on my site. It can be free and fun, and you can put all your stuff on it, ten posts a day, if you wish, of whatever kind. And maybe some day your site becomes big and famous.

To start out, I recommend WordPress with free hosting. It’s super-easy to set up. You can check out the free version of WordPress and hosting here:

https://wordpress.com/free/

Sounds like the final word on the matter.

Wolf-sama – love how you pick up those 7-10 splits! (…and, to ALL of us here, and echoing Wolf, in the words of olden days’ KSAN’s ‘Scoop’ Nisker: “…if you don’t like the news, go out and make some of your own…”).

may we all find a better day.

Your description of how the Fed “defends” its policy rate is 15 years out of date — instead of using open market operations they simply pay interest on reserves.

The IORB and ON RRP rates are the primary tools the Fed uses to implement monetary policy. The level of these rates can be adjusted, relative to the target range, depending on conditions in money markets. Such a technical adjustment is an effective tool to reposition the EFFR within the target range.

JANUARY 12, 2022

How the Fed Adjusts the Fed Funds Rate within Its Target Range

Gara Afonso, Lorie Logan, Antoine Martin, William Riordan, and Patricia Zobel

Since the EU wasn’t dovish, I highly doubt the Fed will be dovish.

They patched the banks and I think they know the risks in a pause or a dot plot with any signs of rate cuts would be a melt up.

The fed and ecb seem pretty coordinated, although that could just be because of the similarity in the economies.

Then there is the jcb, which seems drunk.

You will go broke before the JCB becomes “sober” in your terms.

The number one mandate for the ECB is to preserve the “European Project”, not inflation. Both may align from time to time but not necessarily.

When it doesn’t, public living standards will be sacrificed without reservation to preserve it.

I’m not used to all this optimism from Wolf. I thought he was bearish on stuff. Did he discover a new cannabis shop in SF?

In Wolf’s possible defense, there has been some rather heavy deflation in regards to 420 with a lid selling for about double the early 1970’s price @ $50.

It would have been $400 back in the day around the turn of the century.

$50 per lid in early ’70s xc???

Even though I don’t remember much about that era,,, one thing I will never forget is the neighbor who asked for help whenever he had to divide a key into lids…

He told me he paid $100 for the kilo,,, sold the lids for $10.

Of course it was just meh i can mixtures of leaves and flowers, NOT the sensimilla that is still priced much higher in places where pot is restricted to black market.

Last I heard from friends there, ”legal sens” is around $50 per oz in shops in OR and WA.

baloney. please stop this drivel.

Umm, the US Treasury Secretary just yesterday said if they didn’t bail out SVB depositors there would have been, and I quote, “a collapse of the banking system.” Her own words.

Does that sound like a strong and healthy banking system to you? Because it doesn’t to me. It sounds like, well, “a collapse of the banking system” which I just mentioned.

You may as well go turn on Sesame Street or something. Your little eyes and ears can’t handle the truth.

Why would keep Substantial deposits in small, medium and regional,

Where there is currently no protection beyond per Ms.Yellen, clearly stated during Q&A session with congressional lawmakers. Only ‘special’ TBTF banks get the royal treatment insurance coverage beyond 250K.

Besides these small banks are NOT giving interest/dividend beyond 0.5%, unless the bank run continues, seek better interest and protection. All those ‘NOT special’ citizens should seriously think, why stay with ‘NOT so’ special banks?

Stay with the smaller banks because the small businesses get the personal banking expertise with the small town banks. The 250k with raging inflation is probably lower than needs to be .

No, it’s far higher than it should be. No one is entitled to a subsidy at someone else’s expense, rich or poor.

Rural bank in Nebraska ,is giving equipment loans to my brother,son . Used to borrow in Omaha ,but too much bullshit paperwork.size of a small paperback book. Went rural 2 pages they love the change

Flea-

Thank you for your comment. It is invaluable.

eg – well-observed and stated, but given the relative explosion in online sports betting, as well as broadly-legalized gambling, i must wonder if at least some of the citizenry isn’t getting exactly what they want, beneficial or not…

may we all find a better day.

Here in the UK, the limit on bank deposit protection is 85,000 GBP.

In European Union member countries I believe the limit is 100,000 EUR.

Both equate to approximately 100,000 USD.

…I managed to trigger a misfire on comment placement here, replying to eg’s sagacious comment far below referencing the casinoization of the ecomedy (…not that i EVER consider ANY of my prose as deathless…).

Apologies, and may we all find a better day.

The problem is speculation on when the great bond turning is going to happen. Everyone wants to buy bonds because they think rates are going to normalize near zero again. What if rates stay this high or higher? That would be…

NORMAL!

Wolf; Of greater concern to me is what appears to be a move to short term paper. I would be most interested in the ratios of various treasuries/bonds of different durations, say a year ago versus now. Is that information available at central banks? I fail to see how long term financial decisions can be made and how economies can grow if everything is short term. Do you have any thoughts on this topic?

Ed

Move to short-term paper by who? Short-term is where the yields are highest. But lower yields on the long end of the curve mean that there is huge demand for long-term paper, which drives up prices and drives down the yield.

Wolf, so is this demand for long paper in anticipation of the FFR dropping soon?

Depositor fear/panic created demand across the Treasury maturity spectrum at this point.

I believe a lot of this mess could’ve been avoided if we’re Glass-Steagall act, not been repealed

I am all for glass-steagall, and I think Marcus is probably cited in Revelations.

But I haven’t seen a good explanation for why g-s would have prevented svb. This looks like really dumb herding to some banks that couldn’t figure out what interest rates risk is, and that our universities really need to tighten up the fundamentals on basic cash management.

One regional bank has all the liquidity???? You cannot make payroll for a multi-million dollar company???? WTF does the CFO do all day, pornhub???

I mean….the hot topics at sxsw to bring up at the next executive meeting are CDs, Treasury Direct, and vusxx. JFC, GTFO

As I understand Glass Steagall from my college days, it separates commercial banking and investment banking. So I think it would have prohibited a commercial bank, SVB, from financing, either by equity or loans, private equity investors, and therefore would not have allowed SVB to exist at all.

No, it would have existed in a different form. Glass-Steagall wasn’t intended to address mismanagement of interest rate risk and inadequate liquidity.

It’s not possible to successfully use regulation to prevent the consequences of moral hazard forever. That’s the root cause.

So, while you will hear about this or that regulation, regulatory capture, and regulatory oversight failure, eventually when enough people lose confidence, it’s irrelevant.

The financial system is designed to ultimately fail, but virtually no one wants to admit it or has a clue. Most everyone just wants to “kick the can” to a future date, usually under belief that there is something for nothing when there isn’t.

That’s what every single past regulatory reform has done. In this event, per Yellen, all deposits at somewhat bigger banks are being guaranteed and the reason it’s necessary is because without, customers will flee to the TBTF banks.

Why will they do this? Because of the response to the last crisis, the GFC.

So, one distortion leads to another until eventually the entire edifice will collapse in a future “fat tail” catastrophic systemic failure.

There is a non-zero chance the CFO was, in fact, on PornHub all day.

But yes, being a genius, morally-bankrupt, sociopathic, ambitious programmer and entrepreneur with the right connections, all qualities cherished and encouraged in the technocracy of the Valley, does not necessarily mean competence with finances, especially in an environment we have had for the last decade of relative stability under ZIRP and an implied safety net due to the gravity of the accumulated capital.

You don’t have to go that far back. The loosing of regulatory conditions on smaller banks which Congress passed back in 2018 enabled this crisis. Now the Fed is discussing undoing most of that loosened regulation through its own rule-making process.

“I believe a lot of this mess could’ve been avoided if we’re Glass-Steagall act, not been repealed”

I think a lot of this mess could have be avoided if the Treasury and FDIC had repeatedly said “we will not insure over $250K”. There seems to have been an attitude by those with bid deposits that they would be saved, don’t worry.

Why are these bailout “unconditional”? Bonuses for the past 12 months should be an automatic clawback, if not some salaries.

If you are going to wipe out the 250K limit, the why not a sliding scale of the extended coverage…ie 50% of the next 250K, then 25%, etc.?

Good. This entire selloff was absurd in the sense that the market decided all amortized/htm items should suddenly be marked to market. Every bank is not SVB, this is one of the biggest mispricing events ever. Thanks algos.

” large-scale fear by individuals and companies with big uninsured deposits in certain banks. They yanked those deposits out from their accounts at those banks – millions or tens of millions or hundreds of millions of dollars each – exacerbating the run on their bank. ”

I see the events in a different light, a light that shines on the preceding events that would naturally stimulate a suspicion that this was a coordinated financial crime. There is more than one way to rob a bank.

Ill gotten gains fleeing for the safety of the Fed is, at a minimum, ironic.

One will get you life in prison the other will force you to agree to not do it again.

We shall see.

A really interesting scoop is my experience this weekend with my treasury direct account. I could not make any changes to a maturing security from Saturday through Tuesday the 14th.

Maybe the banking issues are more significant than we mere mortals suspect.

Support for interest rate suppression is waning as we enter the next stage of the return to reality grande tour. Soon, people will demand several more percentage points of interest to assume the obvious risk.

The financial industry (circa 2008) and the tech/startup industry (circa now) are willing to throw their dearest held principles aside when it comes to saving their own hides. And unfortunately the fear of contagion infects both people in these circles and their revolving door friends at the regulatory level.

This fear driven reactionary involvement is what makes it hard to correct the asset bubble. The people pushing for these choices and making them keep claiming, matter of factly, that what was done needed to be done to save something (their wealth) and that these actions are saving a second great depression, which is pure BS for so many reasons.

There is so much wealth tied to assets that even if values of everything fell 50% in high wealth areas, these people would still be well off. And these people are so hyper-dependent on services (and seemingly unwilling and incapable of doing things for themselves) that the trades and service ranks would swell (both in the above-board and underground economy).

We need a great reset. There was an article in the NYT today about a start up company owner (using tech to improve daycare options) fretting about making payroll because of the SVB failure. I just couldn’t help thinking about how useless a company this is (daycare is hyper local and the people that provide these services are priced out of the overachiever entitled communities where they are wanted the most). No tech company is going to solve this problem but apparently there’s money to be extracted from desperate parents. The real solution is that real estate prices need to crash so that multigenerational families can live close together. Anyway, she referred to herself in the first-person as a “founder,” which was cringeworthy (like the ones that fought the British?), like they’re some protected class. This whole dumb startup economy needs to go down hard and take assets with it or its going to be a long and hard slog to get inflation down. If the FED turns around and starts feeling bad about taking away gains that should have never been there in the first place, then we’re all screwed.

I have to admit there were times in the previous seven decades that I didn’t have a similar misunderstanding about the ” then we’re all screwed” hypothesis. Thanks for your primitive rant. Honesty is only established by listening to ones own voice or reading one’s own words.

The civilian economy is moving in the right direction of a fully, productive, well paid workforce.

The four asset bubbles need to be deflated in a manner that minimizes the potential financial destruction that we dealt with in 2008 by increasing their table stakes. Gambling is a wicked lover.

Hmm. Primitive. You commented on your own comment.

I do stand corrected, thank you for enlightening me.

You mean how we minimized the financial destruction in 2008 by letting people lose jobs but let executives and corporations save face? How did that work out? And even larger asset bubble and further speculation buying up entire neighborhoods of single family homes.

You can’t keep inflating a balloon beyond what it can hold and think you can slightly ease off and things will just work out fine. Except the way things are going with hyper concentration of wealth you’re toying with fascism, civil war and destruction of civil society. What will all those assets be worth then?

An open concept sometimes occupies mind. Like wrestling with the flimsy economic concepts of productivity, wages, versus the profit margin.

There is only one American population that made it possible. The only American heroes live in the neighbor hoods.

The only provision in the foundational documents of America that is conspicuously absent it is the rights of wealth superseding the rights of the general public.

I dunno, the reset might just be that tech has to turn a profit rather than dumping to give the illusion of efficiency.

A lot of the second wave businesses can’t make money. Heck, even amazon never really makes money off of competing with, lol, Walmart on price they make most of their money from selling the shovels to the internet diggers.

Nate – our contemporary case of the tools (okay, unintended jest) becoming more important than the actual production of that which they were intended to aid…

may we all find a better day.

“If the FED turns around and starts feeling bad about taking away gains that should have never been there in the first place, then we’re all screwed.”

Right. Real estate and stocks soar…..easy money….

then any substantial downtick and its whining and a systemic threat.

Everyone seems to expect a “ratchet” effect.

Bad decision making must be held accountable….but they all seem to get big bonuses (SVB European branch)

Founder is the Valley’s Job Creator, a particularly American status symbol bestowed on those champions of capitalism, the risk takers, the leaders of the new economy, the captains of the ship, what have you.

All I see are self-entitled, delusional technocrats (or those posturing as such) building platforms to hoover up revenue at scale into their pockets and to support their enclaves. Their solutions and systemic disruption (note what is left off by anyone cheering how they are “changing the world!”) are only in a sense that profits them and the way they view things.

I don’t know what a great reset would look like, probably thermonuclear war, but I know who would make off like bandits were it to occur without proper safeguards, which I do not anticipate anyone alive or in government has the political capital or competence to ensure.

I have Vanguard long term treasury fund. At this time, should I be buying or selling it?

The question you should be asking is what’s your time horizon for that money.

This right here is the ultimate question and thankfully everyone is thinking about it. Time has a money value. It is a variable that no one seem to of taken into consideration at SVB. First you must question what are your alternatives? not a fan of bond funds them selves, because really lots of work to figure out the bonds that they hold, their duration, etc. Better off just buying the individual bonds yourself on a cyclical basis through something like Fidelity or even treasury direct.

Again, the key is asking yourself where you can get a higher yield but manage risks. Recently in August 2022 sold an appreciated real estate asset, though it was returning 7% after expenses, concerned that the underlying asset would drop in value which it did.the money was then placed in a series of six month, and one year treasuries through Fidelity, yielding 5%. Real estate folks will tell me about the value of depreciation, etc. etc. but now no more midnight phone calls about broken toilets.

Financial advice from a bunch of bloggers can be dangerous I don’t offer an opinion except to do your own homework.

I agree with the premise of the above article.

Moreover, going forward long-term rates are going up because war is inflationary. And the Ukraine War shall generate a lot more inflation for reasons too numerous and complex to explain in a brief comment.

No doubt that there will be ups and downs along the way for the U.S. bond market, but the trend is now up. And anybody who isn’t positioned for war-time inflation, supply shortages, currency controls and government & Federal Reserve intervention on all levels – anybody not ready for war-time economics – could get a financial haircut and a shave.

Did it escape your notice how gold jumped up right along with U.S. Treasury paper? Will gold now go back down on Monday? Perhaps. But long term gold is going up, too. Why? Many reasons, e.g., because China is buying gold to replace its U.S. Treasury paper. Why? Because war is coming. And China won’t fund its enemy by buying its debt. China selling U.S. debt will add to the trend of rising interest rates.

The bottom line is the low interest rate party is over. And that’s the side of the trade I’m on and have been on and will continue to be on unless the Federal Reserve panics and cuts rates.

Gold has gone nowhere the past 3 years despite high inflation.

true, and I’m anxious to sell mine. dead asset.

Then sell it.

It’s returned over 9% for 20 years ,do your homework

lol! Gold is at or near all-time highs against every major currency.

Three year results:

UP 25% vs. the EUR

UP 19% vs. the USD

UP 22% vs. the GBP

UP 28% vs. the JPY

Etc.

Try doing some cursory research before opining on the topic next time.

Not trying to burst any bubble,,,

How some ever, when this kind of thingy happens,,, majorly busts usually follow/ occur over the last couple decades…

Just saying, as I am one who will buy PMs whenever they are ”affoardable”… OK, spelling error, far damn shore,,, but the basic concept REMAINS….

Are you betting money that treasury yields are going up in a banking crisis?

Hey comrade losing is a bitch

The wave of financial malfeasance is being rounded up while the financial cops testify, unconvincingly as to the soundness of the financiql system.

Great article as usual. These first few bailouts cover some very important butts with plenty of clout- Gavin pals and contributors to the cause. If this occurred in Omaha City or Mobile Ala, we’d see a very different response.

Exactly! Seems like everything is political.

What if its anticipation of future disinflationary data that is taking yields down?

Banks may curtail lending more after this chaos. Causing more economic slow down. Causing inflation to fall. Thus yields to plummet.

Let me take an opposite position. First banks no longer make loans in the historical sense they process the loan application and sell the mortgage to Fannie or Freddy

Disinflation is no where on the horizon, the least of our worries.

The current turbulence across the debt market is disconcerting but not surprising. Predictably the rats are the first to exit when the ship anchors.

After 15 years of interest rate suppression at zero percent interest, or in the case of the EU, negative interest rates.

I loved the insolence of the ECB, trying to convince everyone that the euro is really a tootsie roll and not a turd floating in the toilet.

Your graphics are correct, capturing the chaos in the fixed income market which was the target of QE.

The reason the interest rate curve is inverted is a bearish talisman. I am astonished that the stock market refuses to collapse. I suspect the Fed put is still intact through it’s bloated balance sheet.

The AI automatons they are unleashing on society is a grave danger to the freedom we currently enjoy.

The artificial intelligence algorithm mimics authoritarian tendencies. It is not a benign development. It is an offensive weapon developed by the American defense industry that have run out of enemies and have repositioned themselves that the civilian population is the enemy.

Rats need to be voted out of office ,quit electing billionaires,millionaires.Boy people are stupid

Flea you can thank Citizens United for that. Money has ruined our elections, making it impossible for anyone to get elected without either being wealthy or beholden to their monied benefactors.

I actually think Powell has integrity. My sense is he is a good guy. Difficult position but genuinely good guy. His predecessors not so much. Am I insane?

And wolf you are a treasure. Your articles cut straight through. I know you are told this frequently but credit where credit is due, even in the middle of a banking crisis…

In what way can Powell be considered a “good” guy. How corrupt does the Fed have to be before they are called too account.

Powell has presided over the most corrupt Fed in recorded history. Several insiders including the vice chair, the chief legal council, and three presidents of the regional federal reserve banks were fired for corrupt practices. No patriots among em other than their pretension.

LOL what is your definition of a “patriot,” dang?

I hope Powell after years and years of high pressure financial and political games finally found a true purpose. He seemed like a normally timid and compliant type of guy, subject to browbeating and willing to turn a blind eye to (or join in with) insider antics, until he was finally convinced inflation was a real problem. Now he seems more the vacuous, empty, drunk, ex-uncle-in-law who is forced to pick up the sword and shield and slay the dragon through circumstance. I think that he is actual trying to get this crap done, with active conflict from the political or financial oligarchy, and minimizing the absolute monetary, fiscal and financial carnage that by rights should ensue. But I have the fear constantly in the back of my mind that I might be fooled again.

I am impressed by Wolf’s unflinching optimism about the consequences of these shenanigans by the regulators, the government, and the bankers. Far from feeling comforted by these attempts at market distortion, they only make me fearful. The logical consequences will be the failure of a fair number of small, medium, and regional banks. The unintended consequences, which we do not know of course, should also give one pause.

Well, I am not too fearful, I have moved nearly all my money to short-term treasuries over the last eight months. I was not anticipating this mess, but just looking for the highest rates possible in a no-risk investment (I hold to maturity).

While analysis based on historical data is all we have (and I thank Wolf for his fine graphs), there is this concept of “structural change” which suggests caution when making predictions. I hope Wolf is right about Treasury rates on Monday, if only for my own self-interest.

i think a comment of mine above is waiting for moderation because i mentioned a certain news paper name. could that be the case, Wolf? I was not of bounds in my comment. If I have offended, I will exile myself, to a certain not-named MX town around 3K feet, with quick access by bus to a local good beach.

LOL, the explanation is very simple: you put a typo in your email. This turned it into a new login waiting for approval.

You’re not alone. Login typos are fairly common.

Hey if someone could answer my question would appreciate it, couldn’t find the answer online- Can I extend the reinvestment on my T-bill on Treasurydirect after already having set the reinvestment to the max 2 years, for example: If I buy a 6 month T bill and set the reinvestment to 3, then after say 7 months when the reinvestment in managedirect is down to only 2 can I set that back to 3? Or does the money have to go from my Treasurydirect account back to my bank account after 2 years and then I can purchase again for another 2 years? Would prefer for the money to never leave my treasurydirect account at all to get max interest if possible, but not sure if this is allowed. Thanks

You can continue to adjust the number of reinvestments up or down as time goes by, within the max limitations they set. I do it all the time in both directions. I set it to zero more often than anything, just remember to give a few weeks lead time, because nothing is immediate on TreasuryDirect.

Thank you for your help JeffD

This past week’s Thursday auction for 1- and 2-month T-bills was cancelled and rescheduled for Friday, yesterday. The 1-mo bill was auctioned to yield = 4.304% YTM, a 43 basis point decline from the prior week; the 2-mo bill’s price was 4.556%, a 38 bp decline from the prior week.

Reuters’ published a brief story on Mar. 16 regarding the cancelled auction, writing “It [the cancelled auction] comes after the Treasury said earlier that it was experiencing a ‘system issue’ with the bill auctions.”

I know nothing more beyond that.

On Thursday March 16, the T-bill due 4/11/23 traded wildly — the bid-ask spread was 12 basis points! At the time at which the new 28-day Bill should have been auctioned, this Bill due 4/11 traded at yields as low as 3.54% and as high as 4.14% — crazy volatility for a T-bill due in 26 days.

Before Friday’s close I took a picture of Fidelity’s market price quotes for US Treasury bills. Many of them — 25% ? — were quoted 10 basis points wide, which is not normal.

My guess is that regional banks must be hitting the bid on their T-bill holdings in order to raise cash to meet depositor withdrawal demand.

The T-bill due 6/22/23 was 98.833 bid (4.596%), offered at 98.872 (4.440%) — a bid-ask spread of 15.6 bps, which is nuts. I reckon that spread is about 7x – 10x wider than normal.

The quote for the current 10-Year UST looked normal, a bid-ask spread of 1-2 bps.

As CS crashes in the sunset how many more primary dealers will follow???!! Cash starved Primary dealers will have a hard time buying their mandated increasing supply of treasuries!

The Fed broke the real estate market…

and now for the other markets…

What is what? A question no one can answer.

Meanwhile, I just read a news story that 200 banks are at similar risk and their Treasury

Portfolios are under water by $2 TRILLION

LOL. Lots of manure is being spread on the fertile grounds of the internet so that these idiotic stories bloom and thrive.

So there are unrealized losses, but the number you cited is ridiculous BS.

1. ALL BANKS in the US combined have $23 trillion in assets.

2. ALL BANKS in the US combined hold only $1.6 trillion are Treasury securities in total. So they cannot be “$2 trillion underwater,” LOL. Those are their total holdings of Treasury securities, including Treasury bills which are NOT underwater and very liquid, and including notes and bonds that have only a year or two left before maturity, and they just a hair underwater (because in a year or two when they mature, holders get paid face value).

3. If you add all Treasury securities, MBS, and government agency securities, all banks combined hold $4.4 trillion. This includes bills, which are not underwater, and bonds that have only a year or two left before maturity, and they just a hair underwater, and securities that mature in three or four years, and they’re just a little underwater.

4. Banks have been unloading their long-term securities since Q2 2022 (Q2: -2.6%; Q3: -4.6%, Q4: -12.9% data does not include Q1 2023). So they have a lot less than they used to have.

All you have to do is look it up

https://www.federalreserve.gov/releases/h8/current/default.htm

Unrealized losses on securities of all types:

Total unrealized losses on all securities at banks: $620 billion at the of Q4, 2022: As of today, those losses would be lower, because prices of long-term maturities have risen since the end of Q4.

This includes:

Unrealized losses on held-to-maturity securities: $341 billion

Unrealized losses on available-for-sale securities: $279 billion.

Data via FDIC:

https://www.fdic.gov/analysis/quarterly-banking-profile/fdic-quarterly/2023-vol17-1/fdic-v17n1-4q2022.pdf

Fantastic data!

Sir, what then in your opinion, is the current risk for our banks over the next few quarters given the assumption the FED with continue QT (maybe slower than originally planned) and Clown Show we call the federal government will continue to spend without remorse.

Thanks

Two banks failed in 2023, a few more might fail out of the 4,500 banks.

There are nearly always bank failures in every year, except during the pandemic free money era:

2015: 5 bank failures

2016: 4 bank failures

2017: 8 bank failures

2018: 0 bank failures

2019: 4 bank failures

2020: 4 bank failures

2021: 0 bank failures

2022: 0 bank failures

2023: 2 bank failures

Bank stocks are going to be lower for longer, LOL. That’s the main thing to take away here.

I don’t think the risk lies only with the banks. Since 2008 hedge funds took in a lot of Treasury securities.

https://fred.stlouisfed.org/series/BOGZ1FL653061105A

Remember that during the 2020 COVID panic and the dash for cash, the redemption-prone nature of hedge funds was exposed. In Mid-March 2020 they were forced to sell Treasuries to meet redemptions. It caused treausury rates to spike and not act as the safe haven during panic moments.

I have seen data that is still similar to the numbers that you published . However , this data only addresses losses on securities and does not

consider potential losses on banks loan books. For example , commercial real estate loans are a huge potential disaster , but few have been written down to realistic levels

Yes, CRE loans are a disaster for a small number of small-ish banks whose assets are heavily concentrated on CRE loans.

Most of the CRE loans are not held by banks but by CMBS investors (bond funds, pension funds, etc.) and directly by institutional investors, insurance companies, etc. The overall banking system only holds $2.9 trillion in CRE loans (among $23 trillion in total assets), thanks to the financialization of everything. People complain about financialization, but there are positive sides: risks shift from banks to investors.

This story relies on a ‘report’ which caveated its own ‘research’ saying no hedging has been taken into account. Given an existence of a hedging or lack of thereof is pivotal to the problems created at SVB it speaks volumes of the quality of the ‘story’, ‘research’ and the ‘report’. Put differently, fear mongering clickbait nonsence.

My concerns haven’t changed from years ago. The problem is that a tiny percentage of people own so much of the country’s wealth. So protecting “the system” means also protecting the wealth of the top .1%

I haven’t seen anything from the central bankers indicating that they’ll do anything to protect the system while also allowing asset prices to correct.

I am as well, very concerned. I am still waiting for an Alexander to present a simple answer to the Gordian knot that is wealth accumulation. Right now it is hard to imagine a solution that does not result in a form of government I detest or massive social upheaval.

1) SVB depositors 200B. US GDP 26T. 200B/ 26T ==> a blip.

2) Loans/ deposits. Large banks 100% in 2000 and 110% 2008, today 60%.

3) Loans/deposits small banks : 110% both in 2000 and 2008, today 83%.

4) The banks are safe. 2008 was nadir. SVB had one type of depositors :

the global tech elite. Other banks have all kind of customers, spread in many regions, in US and all over the world.

5) The 2Y built a Lazer tilting down. It might popup after closing a gap,

but one day the 2Y might reach/breach this Lazer again. Investors might do what they can to avoid the 10Y.

6) DXY didn’t care about the SVB bs.

Wolf, the clock was changed

No, on the contrary, the problem is that the clock was NOT changed, LOL. The site time stamp is based on UTC-5, and I don’t change it when the time changes in the US. My little act of rebellion.

SO clear!

Really and truly ”hope” that sooner rather than later ALL understand there are only 2 real times:

1. GLOBAL time common to all; UTC or Zulu or GMT… make no difference what the name. Shown on all devices everywhere exactly the same, and NUMBERS only.

2. LOCAL time, shown only in WORDs on all devices per either when you are there,,, in zip or other LOCALLY designated destinations/locales, or when you want/intend to be there…

ALL the rest of the ”time challenges,” including especially the total anachronism of ”daylight savings time” versus ”standard time” is just another colonialization effort and should be stopped ASAP.

Wolf/VVNV – second the motion.

may we all find a better day.

Einhall, asset price deflation is baked in the cake of higher interest rates. Especially long term bonds.

Finance 101, the current value of a bond falls as the risk free interest rate rises, for 30 plus years, interest rates have fallen. Now we barely touched 5% and had an earthquake.

Look at how mortgages now cost an arm and a leg compared to 2021.

The monthly nut determined who can pay a mortgage and the levitation implied by sellers holding off is not infinite.