In tech & social media, the labor market got shot. In the rest of the economy, it remains very tight.

By Wolf Richter for WOLF STREET.

The announcements of global layoffs by tech and social media companies and by startups make all the news. But these are announcements, not actual layoffs, and they’re global, with only part of them in the US. Tech and social media are a relatively small part of the US economy, while companies in much larger other sectors are trying to hire. Boeing, which added 14,000 employees in 2022, said it wants to hire an additional 10,000 people in 2023, most of them in its business units, engineering, and manufacturing. Chipotle said it will hire 15,000 people in 2023. Other companies are trying to hire as well, in a labor market that remains tight.

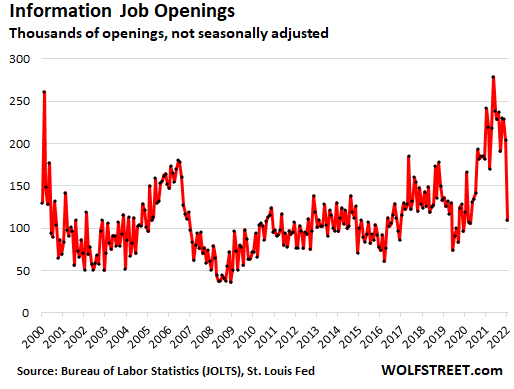

But job openings in the “Information” sector collapsed by half in December, the biggest drop since the Dotcom Bust. The sector includes web search portals, data processing, data transmission, Information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications. Many tech and social media companies are categorized in it (others are in the “Professional and Business Services” sector, that we’ll get to in a moment).

In Information, job openings collapsed to 109,000 in December from 204,000 in November and 229,000 in October, according to today’s Job Openings and Labor Turnover Survey (JOLTS) by the Bureau of Labor Statistics. That brought job openings back down to the middle of the pre-pandemic range.

But “Information” a small sector with only 3 million employees, in the vast US economy, and it didn’t move the overall needle of job openings, as we’ll see in a moment, as companies in other sectors are going on a hiring binge.

It’s in the relatively small tech and social media space — some of which is in the “Information category” — where companies, drunk with Easy Money, were hogging workers and office space for a future that did not come, and now they’re unwinding some of this, which I discussed: What’s Behind the Tech & Social Media Layoffs?

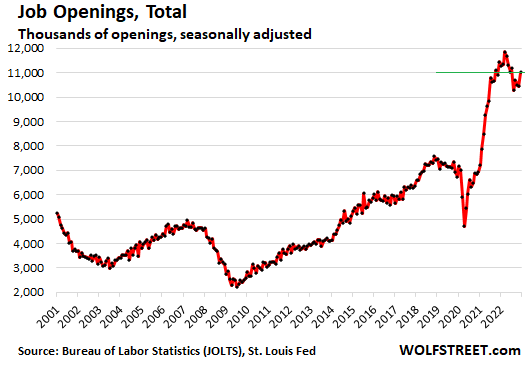

Job openings overall jumped by 572,000 in December, to just over 11 million openings, seasonally adjusted, a number not seen since July last year. Not seasonally adjusted, job openings jumped by 230,000.

Job openings were up by 64% from December 2019, and remain solidly in the astronomical zone, indicating an overall labor market that remains very tight – amid massive hiring binges in some sectors that we’ll get to in a moment.

This data is not based on online job postings, but on surveys of 21,000 businesses and what they said about the job openings they actually have, the number of people they actually hired, the number of people they laid off, the number of people who quit, etc.

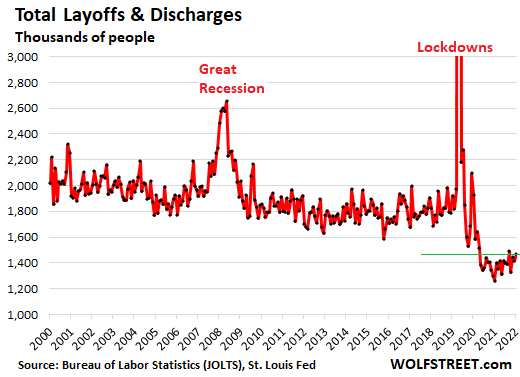

Actual layoffs & discharges – not announcements – rose by 50,000 in December, to 1.48 million, which remains historically low, down 24% from December 2019 and down 18% from the four-year average of 2016 through 2019 (1.8 million).

Every day, lots of companies lay off or fire people for a variety of reasons. This is part of the regular churn as employers tweak their operations. Those layoffs and discharges have ticked up from the record lows a year ago, but remain near record lows, indicating that overall – despite the job shedding in Information – companies are still clinging to their workers, after having had so much trouble hiring them:

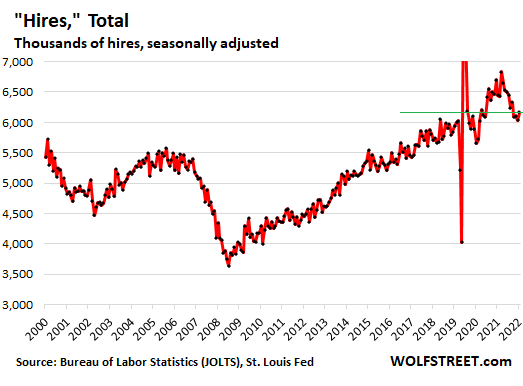

The number of workers hired rose to 6.16 million in December, and has been in the same range for months, up 4% from December 2019, and remains at high levels:

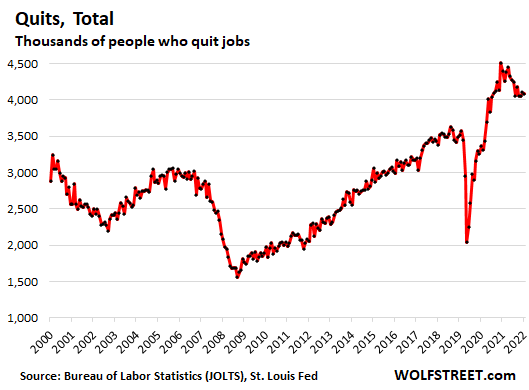

People are still quitting jobs in large numbers to find better jobs, for higher wages, driving employers nuts. In total, employers reported that 4.09 million people quit their jobs, roughly in the same range for the past four months, and up 16% from the already high levels in December 2019, though down from peak-quitting in early 2022.

This still speaks of a massive churn in the labor force, as confirmed by employers hiring 6.16 million people, in part to fill the jobs left behind by the 4.09 million people who quit to be hired by another company. And it’s another sign that the labor market is still hot overall but not quite at the frenzied levels a year ago:

Job openings in major industry categories.

We’ve already seen the collapse in job openings in the Information sector. But that was the standout. Here are the major sectors and their job openings.

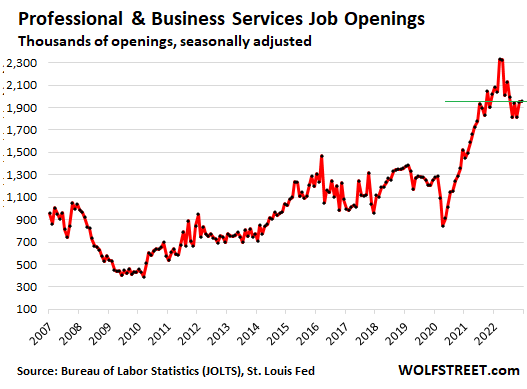

Professional and business services, a big category with 22.4 million employees in Professional, Scientific, and Technical Services; Management of Companies and Enterprises; Administrative and Support, and Waste Management and Remediation Services.

This is where other tech jobs are that are not in the Information category, but they’re combined with a bunch of other professions, and it’s where tech job openings got slashed by hiring freezes, but they were overpowered by job openings elsewhere in this vast sector.

- Job openings: +4,000 to 1.96 million, highest since July 2022

- From 3 years ago: +57%

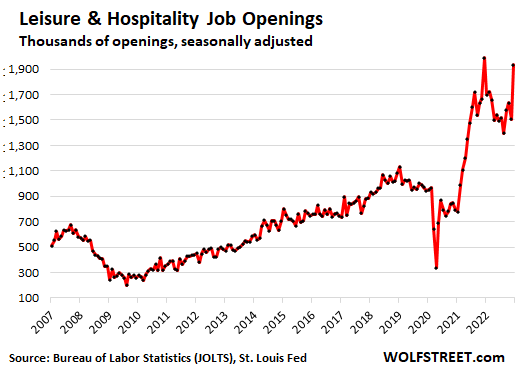

Leisure and hospitality, with about 16 million employees, a big sector still struggling with staff shortages:

- Job openings: +430,000 in December to 1.94 million, nearly matching the record of December 2021.

- From three years ago: +106%!!

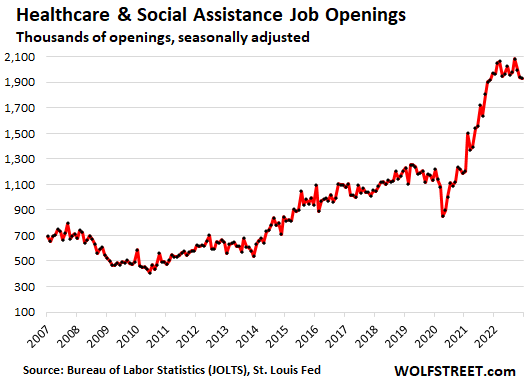

Healthcare and social assistance, with about 21 million employees: job openings dipped for the third month in a row, from the record in September, but remain near that record high.

- Job openings: -6,000 from prior month, to 1.93 million.

- From three years ago: +70.1%

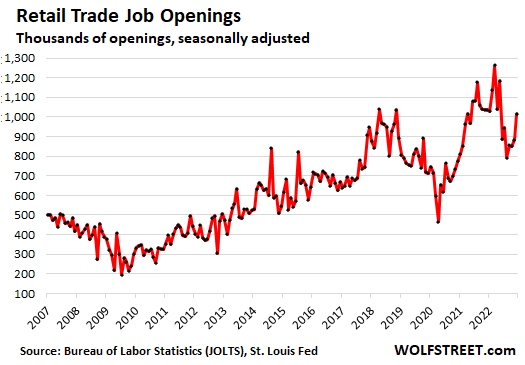

Retail trade, with about 16 million employees.

- Job openings: +134,000 to 1.02 million, highest since May 2022

- From three years ago: +43%.

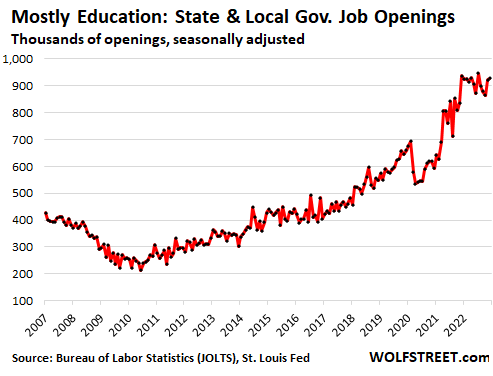

Education – as indicated by state & local government job openings, most of which are in education. The teacher shortage…

- Job openings: +5,000, to 928,000 openings, the highest since July 2022

- From three years ago: +41%

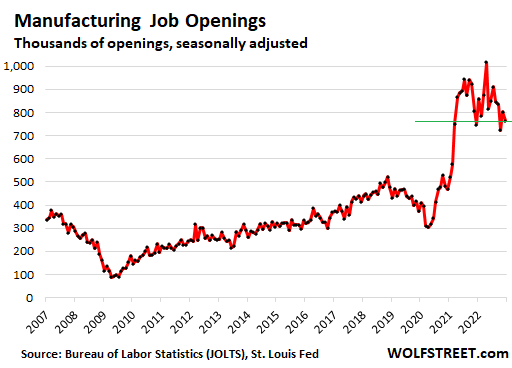

Manufacturing, with about 13 million employees:

- Job openings: -39,000, to 764,000, still very high.

- From three years ago: +105%!

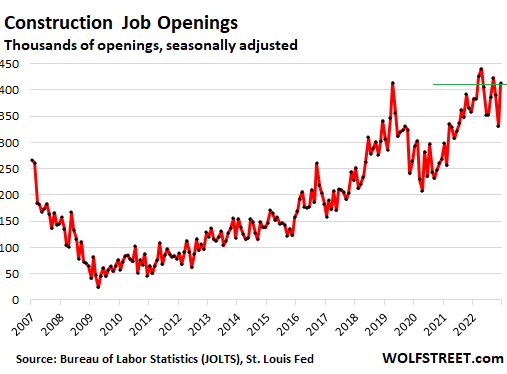

Construction, with about 8 million employees, in all types of construction:

- Job openings: +82,000 to 413,000, the highest since September, and near record highs.

- From three years ago: +56%

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

25 bp. Powell chickening out.

A 25 basis point hike was widely expected and widely telegraphed. And more of them are coming.

The Fed raised by 450 basis point in less than a year, far more than anyone imagined. Short-term rates will be going over 5% this spring. That’s fairly high. Last time the Fed did that, we got the financial crisis.

What’s low are the long-term yields, and that’s a big problem, and it’s problem because it will continue to feed inflation and will continue to push the Fed to raise rates. This denial of the markets is a self-defeating mechanism.

Just looked at the stock market after the announcement…looks like another market Powell Pivot play is in action, half an hour ago, down 200+ pts, now up 6pts, might end the day higher.

Depends on what Pow Pow will say and how hawkish he is and if the message is getting through to the glue sniffing market, the market either will rocket up or end up being a milk toast sideway day. .25% is well expected and only way market can dive is he comes out so hawkish even the braindead cheerleaders can’t deny, personally I don’t see that happening.

Don’t listen to a word of what Powell says, watch what he does. He’s quickly cutting back on the size of his rate hikes, and a pause is coming. Powell’s another Arthur Burns. He’s not the guy for the job. Powell is a swindler and a yellow-bellied coward who caused all of these problems.

Depth Charge,

You’ve been saying this for an entire year, and Powell hiked by 450 basis points and ran $500 billion off the balance sheet. How long are you going to keep saying it?

Or are you just hoping for a total collapse of everything? Because that might make you happy somehow?

Markets are taking off like they were stung–which, in a sense, they were by this “mini-pivot.” Bond yields down across the board. Mortgage rates will probably enter the 5s tomorrow.

Wolf,

You will not find a single instance of me saying Powell was going to pivot, only that I have been critical of his recklessly delusional money-printing and his “too little, too late” policies once inflation really started destroying the working class and the poor. They show up in a minute to hammer rates to zero, but take YEARS to reverse that course.

It is painfully obvious that he has failed to reign in speculators – you know, the very people responsible for blowing bubbles which lead to higher prices and a completely unstable economy. He needed to send a message today and he failed, YET AGAIN.

There is no proof whatsoever that 50 basis points versus 25 is going to “collapse everything.” It’s just not. What it would do is put a little heat on the speculators and start forcing these people to eat massive losses instead of just keeping the casino running, which is exactly what this paltry little hike did. Extraordinary times call for extraordinary measures. He did nothing extraordinary.

I was hoping for a “hoot,” but got a yawn.

We’ve got a hoot alright in these comments here, which are LOL ridiculous, where people with earplugs in are discussing what they imagine Powell said 🤣🧡

Agree with you there, Wolf. Today just seemed like a dud with the 25 basis points. I really felt he had the opportunity to show something and he didn’t, especially given what’s transpired since September. I have no faith in Jerome Powell at all. To me, he’s the enemy. It’s like all of a sudden having to root for your abuser.

Another day, another dissection.

” Powell is a swindler” Well, I basically have to agree with Depth Charge. Anyone who can do basic math knows Powell is still at least 8 points below the actual inflation “little people” are experiencing.

The Fed exists to pleasure the banking cartel and the rich in general. Any “concern” the Fed shows is for their themselves and their buddies.

Just like I said yesterday, it’s off to the moon and beyond for risk assets. Real interest rates are deeply negative. Powell is a con man. He’s no Volcker, he’s Arthur Burns 2.0. His magical “transitory” that turned out to be laughable BS has now morphed into a magical “soft landing” narrative that’s equally laughable.

What Powell is trying to do is engineer an entirely new pricing structure into the economy with his grotesque money-printing – a new floor for asset prices where the working class and the poor can afford nothing in the way of automobiles, housing or any other expensive durable goods or assets. They are locked out for life and will probably require government assistance of some kind.

That’s what his “soft landing” means. It’s a mechanism by which the FED cheats for the rich and allows them to keep their fantastic wealthy while he pretends to be “fighting inflation.” There is absolutely no good reason for him to not have raised by at least 50 basis points to not only continue this so-called “fight,” but to send a message to speculators. He didn’t want to, and we know why.

It’s like a hot air balloon. There is a big delay in elevation direction once you hit the gas. One year ago we were at zero. Leading economic indicators been negative for a while. Whatever tightening Powell does give it roughly a year to bite.

I have said this whole time: Soft Landing = rich get to keep their gains on the poor.

Have to agree with you. He was a banker for a reason. I am still resentful of Trump’s decision to pick him instead of John Taylor four years ago. Even though the whole system is rigged and corrupt, Powell gives off a vibe that makes him more corrupt than the rest. We can only hope there will be divine justice when February comes and the CPI surprises to the upside. Then all hell will break loose on Wall Street.

Wolf, I have written before- Powell could have convinced the market he was serious if he wanted to- and he should want to do that, and soon. He could have done that late last year, too, but didn’t. He bailed out today- no other way to describe the action, the words, and the market’s reaction to it all. Long term yields dropped 11 bp within minutes of the statement. He might be talking hawkish, but going from 75 bp/meeting to 25/bp meeting with rates already at 4.5-4.75 is a significant message of dovishness, and done via action, not words.

Real interest rates – the fed funds rate minus CPI – are deeply negative. This forces investors and speculators out on the risk curve to chase yield. The FED knows this. This is all intentional. Powell is thrilled that stocks are going up, and he doesn’t want to risk them crashing, hence his puny hikes and intent to pause.

Yancey Ward,

As you can tell here from the comments, lots of people have earplugs in, and it doesn’t matter what Powell says. Just read these comments here. It’s hilarious. People have no clue what he said. Powell said the opposite of what they imagine. Markets reflect those comments. Powell was exasperated with the markets today.

This is what he said today about the markets – he made fun of them!

“I will say, though, it is our job to restore price stability and achieve 2% inflation for the benefit of the American public. Market participants have a very different job. It is a fine job. It is a great job. In fact, I did that job for years — in one form or another. But we have to deliver that. So, we are strongly resolved that we will complete this task, because we think it has benefits that will, you know, support economic activity, and benefit the public for many, many years.”

This whole reaction to what people imagine Powell said is just hilarious. This has been going on for an entire year, and meanwhile Powell raised by 450 basis points and ran $500 billion off the balance sheet. And the show keeps going on.

Wolf, I’m generally in agreement but you’re projecting here as well. Nothing in jpows words indicated exasperation. Nor in his actions.

The casino of crazy is in control and that reflects the country and it’s shattered culture.

https://wolfstreet.com/2023/02/01/what-powell-actually-said/

Also QT is continuing. I think this will affect long-term yields and hopefully push them up! However, some people here think QT should be increased. With that said, the markets are delusional thinking that will be a pivot which equals to cutting rate and doing QE again.

Markets can stay delusional far longer than you can stay solvent

Powell’s problem is that he has a gentle voice. He could be telling the markets that a world-ending asteroid strike is imminent, and it would still make the markets go up.

They should hire Arnie to deliver a written statement for him instead.

He does have a gentle voice.

He should hire me after I find out I’ve been systematically overbilled by FedEx for six months, and then spent two hours on the phone arguing in vain with a chatbot and with a series of service-center guys whose job it is to choose from 12 lines of English. My whole entire neighborhood knows what’s going on, LOL

J Powell

Keep doing God’s work. You’re doing one heck of a job. Now we’ve got to get Congress off their sorry asses and start cutting spending.

Sure. Cut spending. I’m not using the scissors anyway. I’ll be helping to raise taxes. What do I need? A hoist and some rope? A crane?

Two reasons. They say you can cut all spending and still be left with a deficit if you don’t clip Medicare, Social Security, interest payment and defense (CIA, nukes, vets; all of it not just military). I’m told it’s axiomatic but what do I know? All I hear is good luck trying on those four.

If fact, I know old people who rely on part or all four of those and got nothing else. They probably need a raise too, not a cut.

But taxes? All that extreme wealth – just like extreme poverty and extreme anything – needs to be pared back.

All those financial transactions generating extreme wealth? Billions? Trillions? If bankers, traders and agents can exact fees, that’s where you can find and raise taxes.

You want to slow down inflation? Powell is raising rates and taking out liquidity with QT? Stern talk to warn that he’s serious?

Raise taxes high enough and Powell wouldn’t have to say or do a thing.

It’s needed. So you needn’t worry. That’s why it won’t happen.

All those financial transactions

Worked on planes for 35 years, mostly US military but also commercial passenger airliners. Also apprenticed as a machinist and part time carpenter. The FED up and down doesn’t matter a bit when you need to feed your kids.

He is doing exactly what he said. The question now is how long, expect his speach to be hawkish on this.

There will be no pivot in ’22 without a crash, if inflation reignites in the fall they will look like the worlds biggest idiots.

He did what he said and this was widely expected. But the question is: Are these piddly rate hikes helping ?

Financial conditions are getting looser in the last few months. These rate hikes were supposed to tighten the conditions.

No surprise rate hike, no revision of the dot plot, no mention of MBS sales, no football being kicked by Charlie Brown. Maybe next time, right? Right?

Pea Sea,

LOL. The dot plot is released FOUR TIMES A YEAR, at the meeting near the end of the quarter. Last one was in December, next one will be in Mach. I explained that in my Smackdown article, and if you had actually read it, you would know it. But keep your blinders on, and keep your earplugs in.

If they discussed MBS sales, it would come out in the minutes. That’s what the minutes are for. They will be released in three weeks. Powell would never throw that out in a presser. That kind of decision requires careful staging.

I’m shocked, SHOCKED that the market is taking off. I’m sure rising asset prices will really stamp out that inflation! Enjoy you $10 eggs and forget about car and house prices. After all, those are things for the “better” people.

I think I’m done reading financial blogs. So long and thanks for all the fish.

Arya Stark,

Adios.

Are these piddly rate hikes helping?

LOL. They are helping the “right prople”, the ones who own the private cartel called the Federal Reserve….and who own most of the assets in America.

I expect we will see interest rates eventually rise to 20% again, just like they did under the RayGun presidency. Timing for this to be determined.

Arya, come back sooon. Market will crash, by summer time, I promise.

Arya – Winter is coming

Ayra, anyone dependent on $10 eggs deserves them. There’s a reason they were criminally cheap before. When we’re not getting them for free, we’ve been paying between $3 and $5 per dozen for the last decade and that hasn’t changed. Did anyone ever question why factory farmed eggs can get shipped 1,500 miles and still be cheaper than local eggs? Anyone that’s eaten backyard eggs knows there’s not comparison in terms of quality. It’s always been worth the premium for local eggs.

Steve m first look at energy prices = while energy companies reporting excessive profits ,corruption in its finest form

It’s obvious you have to be in stocks to avoid being decimated by inflation. Fed isn’t going to help you by getting rates up. Real estate is reigniting here (central FL) and Fed saying conditions have tightened when they are loose indicates they are finished on inflation. Bubble 4.0 incoming!

So check how much you lost with stocks since Jan 3 2022. That loss is on top of the loss due to inflation.

Not if you were buying in the second half of this year :) It has been great to be a seller of some stuff that has run up 100%. Thanks JPow! Some bears never buy. Out of thousands of publically traded companies there were some great bargains.

Wolf

I am NOT disagreeing with you but dynamics are distorted when considering, ‘front running’ on any perceived rumor/expectation+ indexes appear to zoom up. Perception over reality.

Most of my portfolios are around 50% cash, 5-10% short and the remainder long (mostly in div paying stocks/ETFs) since Jan ’22.

In my largest portfolio (tax deferred) I went 90% cash early last year but started adding (0.25%-0.5%) back to mkts (Equity-income dominant) just before or around ‘front running’ days. This is/was my contrarian strategy.

It is up 7%+ since last June. I tend to agree with Matt.

Bottles of cranberry juice just went to $4.19 from $3.50 a week ago and $2.50 a year ago. Looks like inflation is getting worse, not better. There’s nowhere to run and nowhere to hide.

Den

It’s obvious you have to be in stocks to avoid being decimated by inflation. Fed isn’t going to help you by getting rates up.

LOL. I’m a retired guy that invested in 401 for many years. Have a high balance in low cost Index Funds. Didn’t piss my money off on cars and houses over the 45 years accumulation. In the past 10 years my real return is NEGATIVE. I’m an investor, buy it and hold it….down 20% and pissed about it. You need to do a little research before posting comments

Maybe, but maybe not.

From 1979 to 1981 Volcker raised the Fed Funds rate from 11.2% to 20%. So 4.4% in 1 year.

From 2022 to 2023 Powell raised the Fed Funds rate from 0.08% to 4.5%. So 4.42% in 1 year.

People seem so impatient, like they want a total collapse of the markets and they want it now! I’ve only lived through a couple major recessions and while not at all invested either time since I had nothing back then I still don’t remember those events fondly. I also don’t remember recessions coming “on demand”, maybe this is all Amazon’s fault 😄.

impatient? Look how quickly the bubble inflated and how long it takes to take it down to NORMAL levels.

Harvey Mushman,

Thanks for bringing up the actual yearly pace of how Volcker increased rates as compared to Powell today.

Even though they are an almost identical pacing of increases, I would assume today’s response is much more ameliorated due to the Fed’s gigantic balance sheet as opposed to the miniscule one from the 70’s.

The Fed is still screwing savers with negative rates. Government revenues

still high because of inflation . Boiling

the frog indeed. It may be a soft landing but the hole is a lot deeper.

Government monkeys throwing darts at a board while supervised by clowns!

Thank you Wolf for the reporting you do. You don’t sensationalize anything to drive viewership like so many on YouTube do. So much gloom and doom out there! The yield curve has to be in historical territory as far as how long it has been inverted. If you need a sailing hand this summer I live in Reno and would come crew if you like? Thank you Again, John

Maybe I am not hearing things correctly, but I heard “mission accomplished, we did it” in JPow press conf. Talks about how gratifying it is? Talking about “stories”. Strange.

I was going to post the same Mission Accomplished comment. that’s what it sounded like.

grimp, permaright, Johnny5, Pea Sea, et al

“Maybe I am not hearing things correctly,”

Seems like it. He said the EXACT OPPOSITE.

Bunch of times, including:

1. “…it would be very premature to declare victory or think we really got this.”

2. “Our job is to deliver inflation back to target, and we will do that, but I think we will be cautious about declaring victory and, you know, sending signals that we think that the game is won. We have a long way to go.”

3. “we have more work to do.”

etc.

If you put earplugs into your ears, you won’t hear much. That’s a ground rule, LOL

Forget it Wolf…this is cognitive dissonance to the max. They already decided they hate Powell so everything out of his mouth will reinforce that regardless of the facts.

I mean I hate Pow Pow too but I do see what you are pointing out and agree and hopefully he will get the job done so asset valuation can come back down to earth. The only thing I hate even more than PowPow by 10 folds is the delusional thinking of the market. I hope these dip buyers WS BS bulls will take it up the A$$ soon enough.

Phoenix_Ikki,

The thing is, bringing asset prices down is not his job, but rather inflation. So if he gets his “immaculate disinflation”, even amidst a new bull market in assets, then his job is done.

And if housing prices just go sideways instead of dropping, then eventually the housing services inflation will move into an acceptable range and his job is done.

I think this is why people are upset. It’s not his job to restore the affordability of assets or housing. That’s just a side effect that people were hoping for, and their hopes fade as a new bull market appears to take hold.

I’m hearing the same thing. Doesn’t seem hawkish at all. Felt like some kind of weird pseudo victory speech. He didn’t sound like a frustrated central banker, and that was definitely not a “smackdown”.

There was a “smackdown,” all right–it happened in the stock and bond markets within minutes of the beginning of the Q and A when market participants saw how cautious and weak Powell’s actual stance was.

They raise rate by 0.25%, and the 10-year Treasury rate drops by 0.13% at the same time. Because central bankers are a bunch of schmucks. What else is new.

Central bankers were given a job by Congress. Powell gets a “F” because he caused inflation and then was slow to recognize it. He got himself in a mess and only has himself to blame if he and the bond market diverge on what they think the future is.

Us peons don’t have to speculate and leverage up like the bond market. Heard Hugh Henry say that leverage is roughly 4X than when Volker killed inflation with 20% funds rate so divide by 4 and Powell should be able to get the job done with 5%.

Rising interest rates,rising stock market. This is just another bear market rally ,another 5% and watch out below

“The labor market remains extremely tight”.

Cue the growth stonks.

I think you mean the soon to be bankrupt stocks like carvana. Not much growth in growth companies and value isn’t getting much love.

Consistently high job openings continue to surprise. Perhaps we are forgetting the size of the baby boomer generation and the huge number of them that retired early during covid, never to return? They may at some point be forced back due to inflation and it’s destruction of fixed income. At such an age it’s hard to take the BS you have to deal with on the job these days.

Hearing JPo presser, I can sense the utter dovish tone in it and that’s why market is taking off.

After all, need to cater to masters and rich friends.

Can you give an example? I’m not hearing what you’re hearing.

I see too many logical fallacies here. People are basically saying “If he’s dovish, the market takes off, so if the market takes off, he MUST be saying something dovish.”

I’m not seeing it.

I think you need to hear it yourself.

He was not firm on anything and he said real rates are already in positive territory.

I believe the TIPs rates are. Treasury Inflationary Protection.

You need to watch what Powell does: he hiked by 450 basis points in less than a year and ran $500 billion off the balance sheet in six months, and he keeps hiking and keeps running down the balance sheet, and he emphasized that rate hikes and QT will keep going, and you say he was not firm on anything, LOL.

He got a bunch of stupid-ass crybaby questions that I will ridicule in my upcoming article. And it’s hard to answer stupid-ass crybaby questions without giving everyone room to read into it whatever they want to.

Watch what he does: hike rates, and run off the balance sheet. Which is exactly what he said he would do.

He flat out said that financial conditions have not eased.

In fact they are as loose as early last year.

Again, strange with a little gaslighting feel to it.

His overall tone was quite dovish and hence the reason for the market to go higher.

He did what was expected 25bps hike, he could have gone for 50bps if he wanted as the financial conditions are quite loose now.

But he had to bat for his friends and this is what he did.

everyone knew 25bps hike is coming, what market was waiting for his tone and he sent a message to market loud and clear in his tone.

Then why isn’t he doing higher than 25 or ramping up qt? He should know that his words have no meaning.

He didn’t say that. You’re spreading BS.

Here is what he said:

1. “financial conditions have tightened significantly over the past year. [which is correct] I would say that our focus is not on short-term moves but on sustained changes to broader financial conditions and it is our judgment that we are not yet as a sufficiently restrictive policy stance, which is why we say that we expect ongoing hikes will be appropriate.

2. The financial conditions haven’t changed much from the December meeting until now. It is important that the markets do reflect the tightening that we are putting in place as we have discussed a couple times here.

Financial conditions have to do with the credit markets.

Stocks are not considered part of financial conditions.

“financial conditions” are things like spreads, such as the high-yield spread, etc. For example, since Dec 15, the high-yield spread moved from 4.5 percentage points to 4.3 percentage points, which is not big, considering that it was 3.1 percentage point at the beginning of 2022. So financial conditions tightened through much of 2022, and then started loosening. Most of the loosening was done by mid-December, and there hasn’t been a huge change since. That’s what Powell was referring to.

Pull out your earplugs. That might help.

I think we are getting a rate cut by June 23. Thanks for playing, Powell.

Hussman says major market crashes happen AFTER the first rate cut.

Nah this time is different. Transitory, soft landing and all that.

Powell reiterated: two more hikes this year, possible more, no rate cuts in 2023. He said it a bunch of times. If you had pulled out your earplugs, you would have heard it.

What everyone heard Wolf, was Powell claim that

financial conditions had tightened substantially.

It’s sheer nonsense, since overall conditions are the same as they were before he began hiking. This reminds me of Powell claiming last August that ‘we were at neutral’ on inflation, which he had to later wall back at Jackson hole. The market has been told that the Fed need not tighten because we’re already ‘tight’.

Powell’s either senile, suffering from long covid or most

likely playing games with the market so his Wall

Street buddies can all get rich(er)!

The real question you should be asking is that if

conditions are so tight where are all the speculators

getting the money to bid up stocks and bonds?

The yield on the 2 yr treasury will tell you what the terminal rate projection is. It’s not 5% it’s 4%!

“overall conditions are the same as they were before he began hiking.”

THAT’S BS.

In early 2022, when he started tightening, the NFCI was -0.55. It then ran up to -0.03 (almost 0), but then started dropping again last Oct and now is at -0.35, which is substantially tighter than when he started (-0.55), but not as tight as it was in Oct (-0.03).

Carvana up answer 40% lol let’s give it a little time.

The fact is the data won’t lie. If the markets are right inflation will quickly head back down to 2%.

11 million job openings and the next couple months of CPI data forecasts (via Cleveland Fed) says differently🤷

“Carvana up answer 40% lol let’s give it a little time.”

This is the byproduct of a speculative orgy of the FED’s making. They printed too much, and the money is still out there. The Nasdaq is up 16% in a month. The DOW is less than 2k from its all-time highs. It’s all intentional. It’s exactly what the FED wants.

Market don’t care about what Powell is doing today. They want this runup sand gotta to have this runup. Lot of folks will be smiling bc their 401K are doing great. What not to love.

Everyone is FOMO except those reading financial.

Carvana will file for bankruptcy. BBBY will file for bankruptcy. They’re up 100%+ in a couple of weeks. People will lose all their money. But it doesn’t matter. Powell will keep hiking.

All that doom and gloom, while others make money. It’s a traders paradise out there.

We are still clearly in the territory of Negative Interest Rate, and Powell already signaling Neutral stand coming.

With over -2% interest rate, of course the labor market is STRONG, and Economy is still growing!!! Perhaps, this simple math logic is too difficult for a Lawyer to understand.

And we have minions clapping hands for Powell / Fed doing a good job, even though they are 1+ years late in raising rate and STILL dragging their feet along.

“Back-to-Back Market Smackdowns Coming from the Fed and ECB. Could Be a Hoot”

Or could be that you lack understanding of reality? I’d be interested to read your comments in light of that article.

Reality is this: he hiked by 450 basis points in less than a year, including 25 today, and ran $500 billion off the balance sheet in six months, and he keeps hiking and keeps running down the balance sheet, and today he emphasized that rate hikes and QT will keep going.

The fact that people (you, commenters, markets) have earplugs in and cannot hear what he says, and just stick to what they imagine, just shows how silly this whole thing has gotten.

Powell was exasperated today with the market reaction.

Sure, facts, but you didn’t answer the question. There was no smackdown today. It’s in your interest to figure out what you missed when you wrote that article.

Wolf wasn’t talking about right after Pow’s speech. He is talking about long term market moves. Long Term trend now is down.

“Powell was exasperated today with the market reaction.”

May be it’s just an act.

Wolf, there is an old saying that goes something like, “It’s easier to fool a man than it is to get him to believe that he has been fooled.” I am seeing quite a bit of both in the commentary. Give up on your re-explanation effort. Your time is too valuable. Work on that next story.

Well said!

I can’t figure out why the markets did what they did today. I don’t think Powell talked about pivoting, on the contrary he said the tightening isn’t done! Wolf, is this just more of the game of chicken we’ve been seeing between the market and the fed? You’ve written about this; you also have written the Fed will win this in the end.

Invertebrate zoology is often used to analyze Fed statements and actions.

I write off today’s activity as pre-damage control, anticipating incoming deficit and default drama. Theoretically, as market’s digest that pending debt chaos, it’s likely that environment won’t be conducive to pricing (more) risk into overvalued stocks.

Another quarter percent hike will help amplify the concept that rates will be higher, longer, so even if that’s not a shock, it’s better for the Fed to have acted gently and fatherly today, even if the wisdom seems irrelevant.

As for tight labor market, it’s demographic gravity that will continue to need fatherly love

Article on social media ,that states fdic insurance will only cover 1 cent of every dollar in savings . Whole wonder gold,silver are inflating massively.

Flea,

I should have just deleted your FDIC BS.

These kinds of “articles on social media” about the FDIC are gold-buggery braindead ignorant and idiotic.

Gold is a legitimate long-term investment, but this kind of ignorant BS about the FDIC gives gold investors a bad name. These morons who post these “articles on the social media” about the FDIC don’t understand even the basics, or if they do, they’re lying to you.

1. THESE IDIOTS NEED TO LEARN HOW INSURANCE WORKS. If all cars in the US fatally crash all at the same time, all auto insurers are instantly bankrupt.

2. THESE IDIOTS NEED TO LEARN HOW THE FDIC WORKS. When the FDIC takes over a bank, it instantly bails in all equity holders and preferred equity holders and contingent convertible bond holders. They lose everything. Then it sells all assets, and the proceeds from the sale will cover the senior liabilities and most or all of the deposits. The FDIC is only out the money for deposits that it cannot cover from asset sales. In many bank “resolutions,” the FDIC loses little or no money.

3. THESE IDIOTS NEED TO LEARN THAT THE FDIC IS A GOVERNMENT AGENCY, AND IS BACKED BY THE GOVERNMENT, AND THE GOVERNMENT IS BACKED BY THE FED, AND THE GOVERNMENT THEREFORE CAN NEVER GO BANKRUPT.

Nice textbook explanation. However, that’s not what happened in 2009. Fed and Treasury stepped in to bail out ALL the major banks especially Wells, Wachovia, BofA… all big holdings of Warren Buffett. The he got a sweetheart deal with Goldman preferred shares to bail them out. I’ll scratch your back and you scratch mine.

Then creative accounting was used to say that the bailout loans were paid back.

Remember how the GM bankruptcy was handled? I still think they must’ve put a gun to the bankruptcy judge’s head on that one. ALL the rules went out the window on that one.

When SHTF, the rules get changed.

Lots of iffy stuff in there. I just pick out one: The GM bankruptcy.

In the GM bankruptcy, shareholders and many bondholders got totally wiped out. Other bondholders got huge haircuts. Dozens of facilities were shut down and sold (the “old GM”). Tens of thousands of people were laid off. The government provided Debtor in Possession (DIP) funding to fund operations through the bankruptcy process. DIP funding is standard in bankruptcy, and a big bank or private equity firm might have provided it, but probably at a higher rate. DIP funding is on the very top of the capital structure in a bankruptcy and rarely blows up even if the company gets liquidated. The government got warrants and shares of the “new GM” in return, and sold those profitably later.

This was not a bailout, but a harsh bankruptcy in which shareholders lost everything, many bondholders lost everything, other bondholders got haircuts, and many stakeholders lost their shirts.

The government/taxpayer made money (interest on the DIP and profit from the share sale). A private sector lender would have done the same thing.

The rules that were bent in the GM bankruptcy have to do with the capital structure. I don’t remember all the details now, but union pension funds were given priority over other bondholders, and these union pension funds were made whole or took a smaller loss, while regular bondholders took a bigger loss.

just anecdotal facts and observations of the southeast usa – we live in walking distances of 3 areas designated “entertainment districts” we enjoy them and most nights they are PACKED wed-sat – spent some time in nc several cites – all construction sites and packed hotel’s /airbnb’s restaurants – friends who have 16 properties at the beach tell us they 100 % booked and he they make more $ on their rentals then they do as dr’s ! one is a family practice the other is a dermatologist – and that is how we roll and rolling

There is no slowdown in consumer spending.

67% of USA gdp is on consumer spending and it is not slowing down at all.

Crazy spending at all level.

I read the Chinese have 2trillion in Covid lockup savings. Similar to when the US. came out of covid lockdowns.

I read all the typical chineses vacations spots are booking up fast

You’re seeing a collective and protracted last supper. People are grabbing at anything to feel alive & happy.

Yeah, but I”m still gonna wait a couple more months until the snow is gone for the season until I upgrade to the Ferrari. 46 day, 22 hours and 25 minutes until the vernal equinox, eh?

Gosh, how miserable that must be. Some people are waiting to be able to afford eggs again.

Just a bit of spring fever on the Ferrari.

I did roll my car & motorbike today in the garage to prevent flat-spotting the tires.

Not all @ warp speed in SE.

We spend time in the panhandle.

Business owners here are saying they are back to pre pandemic levels.

And they are happy.

I’ll ride VPMAX to $160 and sell to match 52 wk high. $13 dividends paid last December. Damn it boys it is Risk On feel today, the Hot Light is on at Krispy Kreme and I’m buying. S&P pushes to 4200. Wall Street rallies off a Bear shitting in the woods. Rates go up and markets in tandem. March 2020 to April 2022 peak America was oversold Tangible Assets Automobiles and Homes, the buffet ended no one needs a home or a car right now, over indulgence and wants fuels demand in America.

Two calls in a week from Merrill Lynch. ‘Associate Vice Presidents’ wanting to talk. Asking touchy-feely questions like you would get at the car dealership. In all the years I’ve had two previous calls from ML. I’m small beans.

When does a VP, Associate or otherwise make cold calls? And they weren’t really very good at it either. I wonder if their boss was listening in on the call? I’ve had lead gen reps that were better.

I was a sales account manager before I retired years++ ago. This program from ML signals other things to me.

We have other issues no one speaks of here. 1) If you look at the level of Reverse Repos, you can see the Fed is still providing significant liquidity 2) The Federal Government is not slowing spending and in fact, it project to rise into the stratosphere in the upcoming years

What this tells me is 1) The Fed is still quite involved in stimulating the market as it feels it is not yet strong enough to go it alone 2) Long term yields will not likely rise as people will have huge supplies of Treasuries to buy and they have not walked away despite lower yields than current inflation

1) Fedrate : the next 2 dots might be glued to today rate.

2) M1 is down, because RRP is down by 500B since Dec 30. RRP dumping might cont later in 2023.

3) The Fed raised rates, but all US and German rates are down today, including the 3M.

4) The Nasdaq and IWM popped up, SPX barely closed above Sept 12 high, but the Dow failed to close above Aug high.

5) DXY might reach Mar 215 high and popup.

6) If SPX weekly fail to close above last week close : risk is high !

I’m seeing a lot of hiring signs around Seattle/Tacoma. They may not be white collar, but based on what I’m seeing with contractors everyone’s trying to find qualified employees.

The level to which commenters hear what they want to hear and believe what they want to believe, it almost feels like the response to an EV article.

FWIW, Powell did what he said he’d do. He doesn’t control the market reaction to the rate increase or his press conference. Inflation is coming down slowly, so it makes sense he’d stick with what’s already been signaled. I’m withholding judgment on Powell to see what he does if we face real economic pain before inflation is down to 2%. In the meantime, the markets are sure making it easy for him to stay the course.

Maybe Powell felt compelled to keep it low at 1/4 point with money supply shrinking.

Negative real rates are inflationary. And shrinking money supply is deflationary.

Sounds like Powell is between a rock and a hard place.

1) The French are protesting, because Macron raised the retirement

age to 64.

2) The days of mass happiness in Europe are long gone.

3) To avoid default the Euro zone might dissolve. After completing a rd trip to Mar 2015 DXY will takeoff.

4) US primary banks will park in the Fed. RRP and Excess Reserves might create a bubble. only zero rates.

Are you making bets that the DXY will hit 120 again? I don’t see that happening. In fact I would say a trip down to 80 is more likely but I am not putting any money on it.

I remember last year when my local In-n—Out had a help wanted sign at $17/hr and I thought holy moly! Same sign was back up last weekend at $19/hr. $38,000/yr with 2 weeks off, for dunking the French fry baskets.

u cut the punch line.

I will use an analogy. If you are standing on the beach and it’s a beautiful day, it’s very hard to believe that a hurricane is going to hit in 24 hours and you better get in your can and start driving.

Funds rate is closing in on 5% and QT is running. Economic indicators and money supply and yield curve telling that recession is imminent. Congress saying no more big spending. 10 year Treasury down nearly 1% so easy money already been made buying that.

All the stocks that I think I can value have ran up to where they are pricing fair weather, no recession. Market sentiment is really strong right now. Seems misguided, but if you can ride it up and get out first you can win the lottery.

The Speaker just came out of a meeting with Biden, and was asked what was accomplished. He said they agreed to talk again. Wow! This is already starting to sound like the meetings in Paris to end the Vietnam War in 1968. At those meetings they spent 8 months talking about the shapes of the negotiating tables.

Time in the market vs timing the market?

Everyone who believes the market is in a bubble is absolutely correct.

The problem:

Federal Reserve may not care and may not be willing.

If they can get away with high inflation by calling it minimal inflation

If they can inflate the value of the dollar and kill its purchasing power

Then the stock market value and other assets may not crash due to inflation aka soft landing at the expense of everyone who holds cash or gets paid in cash.

I now understand that the government is going to inflate the dollar while pretending its not, by denying the truth, and there is nothing anyone can do about it.

Powell lied out of both sides of his mouth. They have successfully repriced everything to multiple times the price. They might actually pull it off and it makes me very unhappy.

It all depends on the liquidity. There a lot of bluffing to suck in retail and hurt shorts. Attempts will be made to try to outlast this.

Either:

-fed reserve succeeds in soft landing and gamblers win big, or

-fed reserve fails and everyone loses with cash losing relatively less, or

-fed reserve does the ethical choice and sacks the gamblers helping those responsible with their money.

I’ve been hoping for the last option but I am thinking its going to be the first or second… was thinking it was going to be second, but after Powell and the recent CPI and CPE, maybe possibly the first via some trickery and treachery/ and misdirection.. ugh

My grandfather worked for 10 cents per hour around 1915, but it was a silver dime. I started out at $1.60 in fiat currency in 1973. Now starting wage is about $15. Lesson is Fed can add a zero to prices if you give them a couple of generations. Happens faster in Turkey and Venezuela.

My grandkids may be making $150/hour for a starting job?

I hope SS keeps up in my retirement. Otherwise, I may be asking “Do you want fries with that?” when I’m 80. Good thing I have a fixed rate mortgage now. At least I won’t be living in a $100K tent in the park.

They can always manipulate the data per their liking the way they have been doing for ever.

What exactly is a job opening? The last two companies I worked for before turning self employed had ads running basically permanently with recruiters working on the roles. But the vast majority of the time I was there, there was realistically no job opening. Sure, they would have employed if a gift from heaven fell into their lap (aka an outstanding candidate with a very poor sense of their own worth), but they weren’t really genuinely looking to fill a role.

Would these have ended up classed as “Job openings” in the official stats?

I think this approach has become commonplace in some industries.

This has been something I’ve also been wondering about.

“What exactly is a job opening?”

Sj and eg:

Here is what job openings are, quoted from my article:

“This data is not based on online job postings, but on surveys of 21,000 businesses and what they said about the job openings they actually have, the number of people they actually hired, the number of people they laid off, the number of people who quit, etc.”

Thank you and sorry for missing that

In the meantime, they are getting the work done by contractors. So they have hired someone for the work, but it’s total BS that they have these job openings hoping for the unicorn who will join them for cheap.

Why so aggressive in the language? Particularly because you’re completely wrong in this case.

Essentially, they were looking for people that would come in and do all the work to expand the business for them while they took most of the rewards.

I don’t know if they would have reported them as job openings though.

What Goes Up Also Comes Down: The Heavy Hand of Bubble Symmetry

The dot-com stock market bubble circa 1995-2003 offers a classic example of bubble symmetry, though there are many others as well. The key feature of bubble symmetry is the entire bubble retraces in roughly the same time frame as it took to soar to absurd heights.

This process often takes about the same length of time that it took for the bubble mania to become ubiquitous. If it took about 2.5 years for the bubble(dot com bust) to expand, it takes about 2.5 years for the bubble to pop and the market to return to its pre-bubble level.

(h/t Charles H. Smith)