It has $3.6 billion in real-world debt. The bonds crashed, the stock imploded, reality keeps biting the crypto world.

By Wolf Richter for WOLF STREET.

Crypto exchange Coinbase, which was once upon a time headquartered in San Francisco but is now “a remote-first company” without a headquarters, and which lost $2.1 billion in the first nine months of 2022 as trading activity on the exchange collapsed, and as therefore its revenues collapsed by 75%, announced today another big round of layoffs, 950 people globally, or about 25% of its remaining workforce, after it had already laid off 1,100 employees in June, or 18% of its then-workforce.

“We also reduced headcount last year as the market started to correct, and in hindsight, we could have cut further at that time,” CEO Brian Armstrong told Coinbase employees in a message this morning.

He spelled out the severance package for the workers in the US, said that workers in other countries would receive a similar package dependent on local laws, and that the company would provide “extra transition support” for those who are in the US on “a work visa,” such as H-1B visa holders.

The crypto market “trended downwards” in 2022, he told his employees, winning therewith the award for the most glorious corporate understatement of the year. And he added, “We also saw the fallout from unscrupulous actors in the industry, and there could still be further contagion.”

Meaning “contagion” within the crypto space, this mostly self-contained videogame where rules and laws didn’t apply because it’s just a videogame, and where every entity is interconnected with other entities in it. So far, that’s where contagion has been, including hitting a couple of crypto-focused small banks, such as Silvergate, which recently released the details of its own implosion.

“As part of a headcount reduction like this, we will be shutting down several projects where we have a lower probability of success,” Armstrong said. “Our other projects will continue to operate as normal, just with fewer people on the team.”

Ironically, on May 10, just eight months ago, in its Q1 2022 earnings report, the company said that its headcount had tripled in the year through December 2021, to 3,730 employees, and added: “We expect such growth to continue for the foreseeable future.”

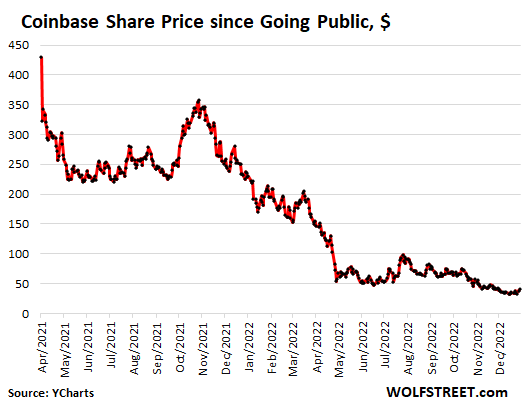

But this “foreseeable future” extended only a few days: On May 17, after the shares collapsed 83% from the high and were inducted into my pantheon of Imploded Stocks, the company imposed a hiring freeze for two weeks. And then in June 2022, the large-scale layoffs started.

Today, Armstrong said: “Over the past ten years, we, along with most tech companies, became too focused on growing headcount as a metric for success. Especially in this economic environment, it’s important to shift our focus to operational efficiency.”

The Fed’s easy-money policies, which started in 2008, have turned investors’ brains to mush and have given rise to what I call consensual hallucination, leading to all kinds of crazy stuff, including cryptos. But now, asset prices that were whipped up during Easy Money are coming unglued as The Price of Easy Money Is Now Coming Due. Armstrong has been formed by Easy Money, and he became a “crypto billionaire” during Easy Money. But Easy Money is now over.

“Despite everything we’ve been through as a company and an industry, I’m still optimistic about our future and the future of crypto,” he said, bravely projecting optimism to his employees.

“Dark times also weed out bad companies, as we’re seeing right now,” he said. “But those of us who believe in crypto will keep building great products and increasing economic freedom in the world” – this being straight out of the videogame that is the entire crypto space, where the official religion is crypto itself that people have to “believe in.”

But Coinbase is generating real-word losses denominated in real-world dollars: Through the first nine months, it already booked losses of $2.1 billion.

And today it announced in an SEC filing of preliminary financial and operating tidbits for Q4 that it will add a whole bunch more to these losses: Including the $149-163 million in restructuring expenses associated with this round of layoffs and cost cuts, its “adjusted EBITDA” will likely be “within the negative $500 million loss guardrail that the Company provided in the Shareholder Letter.”

“Adjusted EBITDA” is Coinbase’s homemade metric. The actual net loss for Q4 when it appears on its financial statement, to be added to the $2.1 billion in net losses for the prior three quarters, will be a sight to behold.

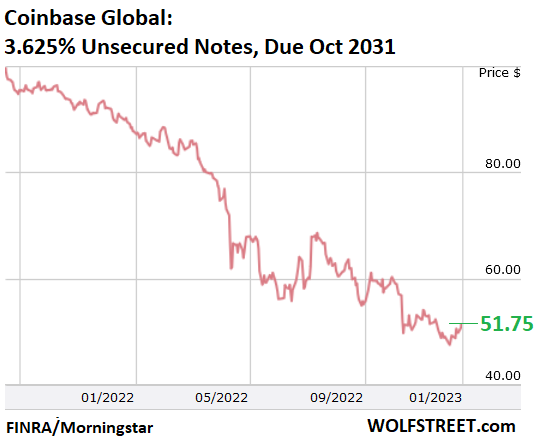

Coinbase had $3.7 billion in debt at the end of Q3. And its bonds have gotten hammered. For example, its $1.0 billion in 10-year 3.625% unsecured notes, issued in September 2021, are now trading at 51.75 cents on the dollar (chart via Finra/Morningstar):

Its shares [COIN], in the time-honored tradition after big layoffs are announced, jumped 8% today at the moment, to $41.44, and are now down “only” 90.4% from their high on their mesmerizing hype-and-hoopla day when it went public in April 2021 (data via YCharts):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Maybe crypto will go back to being what it was the last time it had any utility: an anonymous way to transfer funds across vast distances without any need to pass through banking or wire transfers under the nose of any who would scrutinize the transaction. That’s where its inherent desirability came from. Speculation is ultimately what ruined it. While crypto was highly valuable to some, the barrier-to-entry in learning for most was relatively steep before conventional wallets and modern “gas fees” to transfer things make mid-2000s roaming charges for cell phones look reasonable.

The base product did have demand, did provide a service that people valued, and therefore did have some value. The current monstrosity is a wandering 4-sided-1-pointed 3D geometrical object scheme. I remember all of the Coin experts scoffing at Doge coin and saying it’s a joke coin and that the reason everybody who had it kept on telling other people to buy it is that the second the last ounce of demand had disappeared, the value would collapse. That’s the pot calling the kettle blind, if ever I saw it.

*4-sided-5-pointed 3D geometrical object scheme. I swear I passed geometry.

Pyramid.

I doubt that you passed :)

5 sided, 5 pointed

or

4 sided 4 pointed

It doesn’t matter, all you need to know is that the magic shoots from the top of the pyramid. I stayed at the Luxor in Las Vegas.

After the numerous crypto debacles in 2022, many are calling for regulation of the Crypto market. Regulation means segregation of funds , which will make it much safer for those holding assets at various firms .

BUT regulation means reporting the names of those involved in the Crypto market and acquisition and sale prices .

Cryptos had/ have the advantages of cash transactions without the obvious physical problems involved with large cash transactions .

Regulating cryptos will eliminate demand from those who use cryptos as a substitute for cash transactions .

Given that cryptos are useless as a means of transaction due to its volatility, the legs underlying the crypto market will disintegrate .

Well crypto is a fraud and Ponzi scheme. It could be easily regulated out of existence.

Well share buy-back is a fraud and Ponzi scheme. It could be easily regulated out of existence.

I am not a crypto fan.

“Well crypto is a fraud and Ponzi scheme. It could be easily regulated out of existence.”

The same applies to The Fed………..

I’ve said this before and will say it again (not that I’m a ‘crypto-fanboi’): Blockchain Technology that maintains an ‘immutable record of transaction’ is a very solid, reliable and established technology.

How it is applied is the issue and various crypto’s associated with NFT’s & the fantasy of the ‘Metaverse’ do need to be HEAVILY regulated!

But things like ‘smart contracts’ and the surrounding infrastructure associated with those (Oracles for Data ingestion) are a reality that will not go away.

The Financial whirld is becoming connected via these contracts and regulation will come to hold everyone accountable!

Disclaimer: I am an active holder of Etherum & Chainlink for life!

Thank you, WolfGoat!

Crypto tokens are _not_ the same thing as crypto companies or crypto schemes. Only the first is reliable (because it relies on computers instead of people).

I know nothing about crypto, maybe you can answer this question of mine. Why was/is crypto useful to criminals? I thought crypto (Digital Currency) contains a ledger with a record of all transactions. Wouldn’t that make it easy for it to be tracked and policed?

It wasn’t very useful to serious criminals. They mostly use paper currency, which is the only true decentralized finance.

Even without the ledger, the simple fact that blockchain RUNS ON THE WEB means that law enforcement and spy agencies can track everything. Any serious criminal will understand this fact and avoid bitcoin.

Serious criminals use Deutsche Bank and HSBC. Their fees to launder money are much cheaper than Coinbase or FTX.

Silk Road comes to mind!

The most famous and used currency is bitcoin. You initially mine your own bitcoin or more likely buy it from an exchange like Coinbase. Then you put it in an anonymous wallet. It is true that every transaction is store on a publicly viewable ledger (the “blockchain”) but no one is supposed to know who is on either side of the transactions. So you can see 3 bitcoins going from ID 1234 to ID 5678 but no one should know who is behind ID 1234 and who is behind ID 5678 and why the bitcoins were exchanged.

Perfect thanks! You just increased my crypto knowledge by 1000%

I like “supposed”.

It implies that privacy is a gentleman’s agreement.

Harvey, Like you, I have little knowledge about crypto, but I keep seeing self styled crypto scam “investigators” able to look into blockchain and wallets and see exactly who is buying and selling to whom and when. Supposedly anonymous wallets get identified to specific people by matching transaction amounts and dates.

Are the CIA, FBI, DOJ, and the Fed that dumb that they can’t also track exactly who is selling what to whom, and when?

Seems the chances of your bank closing and walking off with your money is a lot less than some on line Bahama based exchange with 134 affiliates. Maybe I am just too cautious.

“Maybe I am just too cautious.”

I think your caution is warranted!

I think crypto is very useful to criminals and terrorists.

Someone would have to monitor the 22,000 crypto currencies available to monitor a global transfer of $3M from anonymous User A to anonymous User B. Everything is unregulated in crypto and unlike regulated banks that know I have had 3 deposits per month, nobody knows User A or User B.

As far as a global currency, there aren’t 22,000 government currencies today. There are 22,000 crypto currencies.

It is like massive counterfeiting with each counterfeit bill holding some value. It the case of BTC, each coin currently hold $17K in value.

Some may argue that BTC is like art or any commodity (ie beanie babies or tulips). The advantage of BTC over any other commodity is that it can be shipped anywhere in the Universe within milliseconds without any specific tracking. Personally, I don’t need that (though I am slightly annoyed with bank wire fees.). However, if I was transferring illegal money or funding terrorists, I would find this very convenient and relatively inexpensive.

There is no barrier to entry. Anyone can create a “coin” (because it’s actually nothing) and start a crypto “business”. That’s the only barrier that’s relevant to this article.

Trannies? Would you use the N word to refer to certain people? Why are these transphobic comments allowed? Maybe you can spread your hate around to everyone who is not heterosexual, male and white?

“That’s where its inherent desirability came from”

I would argue that the inherent value is based on finite dilution (unlike dollar).

Finite dilution of zero remains zero.

Puke…Shame they died for people like you…smh

If you wake up every morning with such atrocious, backward, and deplorable thoughts, then I relish the day you don’t wake up.

Or, perhaps, someday you will wake up and smell the 21st century. One can hope.

Who you been robbing since I been gone

A long tall man with a red coat on

Wealth-from-nothing-baby you’ve been doing me wrong

Who you been robbing since I been go-ow-one

Who you you been robbing since I been gone.

Who’s been messing around with you

A real kool kat with eyes of blue

AirCoin baby are you being true

Who’s been messing around with you-oo-ou

Who’s been messing around with you

Somebody saw you at the break of day

Dining and a-dancing in the cabaret

He was long and tall, exchanging plenty-o cash

Sold his red Cadillac and his black moustache

He held you in his hand and he sang a love song

Who you been robbing since I been go-ow-one

Who you been robbing since I been gone.

(Apologies to Warren Smith/Bob Luman/Robert Gordon)

NOT INTERESTED IN STUPID CRYPTOCURRENCY

Jan is obviously interested enough to come here and post a comment though…

History shows that it is a mistake to have easy money and encourage speculation. Crypto implosion is a first inning unwind of the easy money policy.

Take Japan. Speculation ran the PE of stocks up to 70 or earnings yield to about 1.4%. Obviously in hindsight this was delusional as there was no way that the asset price reflected a reasonable long term economic investment.

Same for USA in the 1920’s. In hindsight it is easy to see. At the peak of the asset bubble in 2021, early 2022 we were above the peak in the 1920’s on many measures, but we can’t see the forest for the trees. We seem to be reassured because we can print money these days if assets crater in price.

History rhymes. The current president is said to see himself as the next FDR using government spending to reshape the economy. Government deficit spending is always stimulative and inflationary in the short term.

Politics is going to determine who gets poorer. It’s going to be the speculator and debtors or the savers. It’s going to be those getting a government check or those who are working in private sector.

Powell has absolutely no choice but to convince the market he is going to kill inflation before it gets embedded in the system. Market is betting he is going to break something at about 5% funds rate.

My guess is Fed is bluffing. They know there is only a statistical tail that they can stay at 5% for a year without blowing things up, but they need to tighten up money today, not one year from now so it’s all about the staying tight for longer narrative.

Bitcoin was, in my opinion, invented as a recruitment tool by the TLA’s.

You’re using it, having some off-brand fun, and now there’s a permanent record of it.

Some time later maybe you have risen to some importance and then someone will ask for a few favours, which, based on your permanent record that They happen to have, would be easier and all if you help out. What is left to negotiate about is the pay and conditions.

The inflation in coins have made the TLA’s work a bit harder but not that much, They have about infinite computing resources!

I wonder if Coinbase is going to pay the employee’s severance in crypto?

doge coin

So is this Armstrong guy ‘remote’ somewhere unknown never to be tracked down?

I looked at his vita at the bottom of his announcement. From Software engineer at airBnB to cofounder of coinbase in a single bound. That is quite a leap if I read it correctly.

In hollywood and the “tech” industry they call it selling your… You honestly believe the landscape is about meritocracy? Who you call God, and if you perform “rituals” is a whole lot more important to being CEO in the software industry than anything else.

It’s a small club, and you ain’t in it!

While is that such an incomprehensible leap?

Do you know how Jobs or Gates started out?

Not a good time too catch a falling knife. BEWARE

You mean Poop coins!

We are moving to block chained tokens for money transactions but IMHO it will most likely be issued from CBs and Governments.

Most of the current landscape will be used of games, loyalty promotions, and other odd transactions.

To are too many bad actors still in this space. Too easy to hack and steal

That detracts from the very concept that made these currencies “valuable” in the first place….anonymity. These currencies became valuable precisely because people valued them for the lack of scrupulous oversight from outside bodies. And certainly not all of the uses for the currency was for silk-road era nonsense. Two wallet holders were able to easily transfer coins between one another. It was the glamorization of this that got idiots involved, and where idiots go, vultures aren’t far behind. The rampant overvaluation is what ultimately ballooned and crashed crypto. When people can buy and sell your currency that was built on anonymity on Robin Hood, I’d say you have lost control of it to speculators.

The “value” came from a speculative mania, not any utility.

BTC would have the same utility if it lost 99% of it’s still inflated value.

ru82,

It seems central bank digital currencies aren’t going to be on the blockchain.

China’s CBDC is NOT on the blockchain.

The Fed hasn’t decided yet if it even will come out with a CBDC, but it hasn’t been warm about blockchain tech either.

The reasons are obvious: Blockchain is by design an immensely inefficient method for very large volumes of transactions (billions per day).

OG blockchains like Bitcoin and Ethereum have trouble with large volumes of transactions like you said, but more recent blockchain tech should be up to the task, should a central bank choose to go that route.

Right now, Visa’s average transaction bandwidth is less than 2k tps, but they can handle 10 to 20 times that. There are a number of blockchain technologies that are at least that fast and getting faster.

Entirely anecdotal, but it’s sometimes difficult to be less efficient than Western Union or SWIFT.

Have you ever tried to send a wedding gift to extended family across a third-tier currency cross?

Sharding baby! Next release of Etherum!

A little clarity here Wolf, all digital currencies are on a ‘Blockchain’. It’s just a matter of whether in is a ‘distributed chain’ (distributed nodes) or a ‘centralized chain’ (all nodes controlled by an entity like the Fed).

China’s e-CNY does not operate through a blockchain-based decentralized ledger; rather, it is a centralized operation, issued and supervised by the PBOC.

https://digichina.stanford.edu/work/lets-start-with-what-chinas-digital-currency-is-not/

PBOC officials have confirmed that it does not use distributed ledger, or blockchain, technology because it would be unsuited to handle anticipated transaction volumes. Setting it apart from many blockchain-based digital currencies, e-CNY requires that users associate some piece of identifying information with their digital wallet before they can store or transact the currency, under a principle PBOC officials call “controllable anonymity.”

https://digichina.stanford.edu/work/chinas-digital-currency-and-blockchain-network-disparate-projects-or-two-sides-of-the-same-coin/

Again, anything that is consider a ‘Digital Currency’ runs on a Blockchain. Whether it is a Public (open) or Permissioned (private) blockchain.

Permissioned blockchains use an access control layer to govern who has access to the network.

In contrast to public blockchain networks, validators on private blockchain networks are vetted by the network owner (China, the Fed, whomever).

They do not rely on anonymous nodes to validate transactions nor do they benefit from the network effect.

Permissioned blockchains can also go by the name of ‘consortium’ blockchains’.

I’d call China a consortium!

I think what folks get hung up on is the term ‘Distributed Ledger’. I don’t think China let’s their ledger get ‘distributed’… but it is still a blockchain.

If it walks like a duck and quacks like a duck… then I guess… it is probably an ‘immutable record of transaction’!

NO, NO, NO, NO BLOCKCHAIN. Read the articles I linked. You don’t need blockchain for this stuff.

However, China is working on a parallel effort not for a CBDC but a platform, and THAT effort involves blockchain. Maybe you’re confusing those two. Read those articles I linked. They spell that out.

IMO they will never use a blockchain backbone because everyone will know what they are doing, just like they will know what everyone else is doing. A blockchain CBDC would a fair system so, no way they want that.

Also just FYI, check out hashgraph technology vs blockchain in regards to volumes of transactions.

That is because blockchain doesn’t have any utility *at all* for regulated transactions. We know how to do that and having centuries of experience in the field helps.

Blockchain even makes very normal “finance” things like just handling millions of transactions per second or unwinding “fat-finger” mistakes or audits much harder than a normal ledger running in a normal database.

Regulation is just messy, squishy and must be interpreted for the occasion, setting off the code-bros autism and driving them into “distributed ledgers”, “smart contract” and whatever the heck they think The World needs to be clean and predictable :).

Gee, is it time for Pfizer to announce a vaccine for Consensual Hallucination Syndrome?

Wonder if anyone is keeping count of the numbers of -all- crypto imploded firms private and public, along with a count of the real money taken down with them.

This comes to mind: “A billion here, a billion there, and pretty soon you’re talking real money.”

Everett Dirksen

You’re in luck. They’re working on a new class of Neural Solidification Compounds (NSC). NSC’s help reverse the effects of brain mushification, but initial trials have shown high levels of toxicity and resistance among those patients in most need of the new treatment. It has been noted that many patients are incoherently muttering “pivot” as they leave the trial.

Noteworthy is that side effects match those of Pfizer’s entire product line: anal leakage, sporadic schizophrenia, dry heaving during sex, and a condition known as “hot dog fingers”.

Even if they invent one..since we are in Murica, and the market is just nuts…I would imagine moat people suffering from this consensual hallucination be chanting…”My body my choice…”

In some ways it’s a shame. Hal Finney and Gavin Andressen were so close to establishing a currency that was not government controlled.

Unfortunately by 2016 the battle was lost and control was ceded. It was then marketed as a get rich quick MLM scam to the retail investor. Coinbase caters to this retail customer who have been hurt the most. Crypto’s use case remains illicit activities. This industry needs to be burned down and maybe something can arise from the ashes. Though I doubt it will be Coinbase.

You hit the nail on the head, complete summary of the truth of the situation in a few sentences.

i dont know how coin base is loosing money. they have the highest fees any where. and compared to e toro. their coins are 10 cents higher than most. 10 cents! wouldn’t that mean millions in padding? check e toros atom price and then check coin base. over a 10 cent difference. if e toro could sell atom in usa. people would buy from etoro and then flip on coin base. or maybe that is what people are doing who aren’t in the USA and why coin base is loosing so much money.

How much have Coinbase’s trading volumes fallen?

“were so close to establishing a currency that was not government controlled”

Bitcoin and alt coins have certainly been _marketed_ as digital currencies, but they never were. They lack the most important characteristics of coins and banknotes: instantaneous payment. That is, no need for a clearing and settlement infrastructure. Bitcoin et al have the worst infrastructure imaginable, everything has to be cleared and settled, in effect, by a network of miners. Also, we do not know who are _behind_ the 5 biggest miners in Bitcoin, but we do know they have regular meetings to protect their interests. Do we want this $&it to play a prominent role in our societies? NOT! A much better approach is electronic cash, assuming we use advanced cryptographic techniques to make it technically anonymous (which Bitcoin is not), that is, unlinkable and untraceable. We know how to do that. Toss in threshold signature techniques, potentially TPMs for offline spending for low amounts, etc etc etc etc etc and we have a vastly superior solution: instantaneous, private, and secure (yes crypto can deliver that while also achieving genuine privacy). In practice other risks will need to be addressed, notably traceability at the network layer (especially by the same govt agencies that are surveilling all our internet traffic, due to mandates backdoors built into all OSs etc, see Snowden etc) and so electronic cash should never replace coins and banknotes but merely be an additional service just like credit and debit card payments but much better suited for online payment. The whole Bitcoin et al debacle has been one massive cesspit that should have been banned from the outset; the only reason Bitcoin prices started rising is thru constant manipulation from the very outset by “whales”, as an example just google on how it rose from 100$ to $1200. Back in the late 19th century such manipulators were put behind prison bars for a very long tine, but in the past two decades we really have regressed back, in the online world, to the era of robber barrons.

Currencies, Noelck, by definition are indivisible from law and therefore government. Don’t confuse them with commodities.

It’s mind-boggling that even unsophisticated retail investors, of which I must admit to being, could not see that crypto had not asset base with Bonati-fide value.

Bona-fife value.

…cue the drum corps?

may we all find a better day.

Boned-fide.

Not really. Greed puts blinders on people all of the time. They are pushed over the edge into following that urge by crypto pumpers who benefit from fools buying the garbage even though a minority were pointing out reality.

>We also reduced headcount last year as the market started to correct<

Yup, the crypto market is correcting and will donw correcting when all tokens are at zero and coinbase is banko!!!!

I believe Coinbase went public through a direct listing rather than a traditional IPO. It’s interesting because in a direct listing only current insiders and shareholders are selling shares. Though insiders may sell shares in an IPO, at least some capital for the company is being raised through the issuance of new shares. What a disaster for the first public buyers, but hey some insiders got to lock-in some nice gains.

Yeah, and the WSJ portrayed the direct offering as indicative of strength (which it probably was) – very few companies have the buyside relationships sufficient to not have to rely upon the Vampire Squid to…squid. (But then again, if you cut the Squid out of the action, he won’t ever provide price support during the bad times).

Coinbase’s own customers may have been the largest buyers of the direct offering…which creates feedback amplification between Coinbase trade volumes and share holdings/prices (ie, as traders stop trading, volumes fall causing share price to fall, causing even fewer trades as savings deplete). Rinse repeat, deplete.

(A bit of an analogy to the FTX dual token scheme here too…FTX’s primary token was in theory partially anchored to the “collateral” value of its FTX’s secondary token…whose own intrinsic value was based upon its use case as a trader’s discount off fees on the primary FTX exchange – in its own failed way, the scheme was actually kinda of inspired – if doomed. At least these players were trying to bootstrap intrinsic value at low cost (ie, right to trading discount on exchange). But feedback/cascade failure risk is extreme for bootstrapped intrinsic values – a similar feedback failure might apply to Coinbase trader-share holders as well.

Crypto reminds me of a Far Side cartoon, where a cow stand up and shouts to the other vows: Wait a minute – this is grass! THIS IS GRASS WE’RE EATING!

So, too, with crypto: the somewhat touching faith that minting one’s own unregulated currency would lead to paradise. Unregulated financial markets always attract scammers, who “rip the eyes out of the muppets” and then make off with all their I’ll gotten gains.

In his employee message Brian says they are ‘well capitalized’. He must have a homemade metric for that too.

I was going to say he meant the company’s name in the letterhead, but they must have changed it recently from all-caps to all-lower-case. Fitting, I guess, and reflecting of their actual capital.

Coinbase exists purely because of human greed.

Coinbase stonk goes up because of laying off employees. Makes one wonder whether investing in the stonk market is antithetical to the American working class.

Crypto was designed in a way to fleece the life savings of the Americans in order to make billionaires at the expense of everyone else.

Gen – that bastion of Wall Street, the pre-Murdoch WSJ, said as much editorially some years ago, proclaiming unemployment in the U.S. should be maintained at a steady ten percent…

may we all find a better day

Charlie Munger noted “We do not need a currency for kidnappers.” He compared it venereal disease. Scumballs.

“Partly fraud and partly delusion… crazy and demented.”

Like fairy dust.

Charlie’s good buddy Warren has been investing in Blockchain and as usual, those two tend to live in a fantasy world, where they talk down crypto on one hand, while buying with the other hand– just like Warren spouting off about derivative deals, which his reinsurance uses like oxygen…. Then of course, Warren accounting irregularities that have gone on for at least three decades.

Are those two more trustworthy than crypto con artists? I think they’re all highly suspect, just like wall street, but as we all keep hearing:. It’s a crooked game, but it’s the only game in town. Warren and Charlie wear cleaner dirty shirts than crypto slime, so what?

I’m convinced it was created for high-end international human trafficking and the tax evasion that goes along with it. With the added benefit of being very useful to drug traffickers and all kinds of crime and money laundering. The techno- algo- sciencey “blockchain” aspect is just genius marketing. It won’t exist in 20 or 30 years so I’m not sure why so much attention is paid to it

I’ve always been a crypto skeptic. But some believed, not completely crazily, it might evolve somewhere (other than the grift it has). Coinbase, from the point of view of its starting days as an entrepreneurial experiment, was interesting. It aimed from the start to occupy a regulated crypto (and publicly traded financial) space, and until late this year, hoped (and probably still hopes) to survive as last one standing, from that business model. That is still a sketchy place, but looks like whatever might survive in the crypto sector. It was making less profit and buzz than its perennial rival, Binance, which was offshore and skirting regulation regimes from the start, trying to be a fully virtual ghost enterprise (and Binance.us was, IMO, just a shill, a stub, to placate and distract regulators, and maybe someday compete here with Coinbase, if regulation did prevail). I reckon the aim at Coinbase is to slim down but still try to make it to that far shore, a regulated crypto sector. Not that I put a dime on it. If crypto can be legit, it looks to me somewhat like Coinbase.

Yeah. I am not sure there is much more to gain for the average guy and cryptos. I use a $50 smart phone to run my financial life including banking, portfolio management and tax preparation. I get about one piece of mail per month.

Buy a $500 phone card once a year to have more data than I need. No computer or internet required. It’s already too easy to move a lot of money around. Sometimes you have to remember it’s your life’s savings you are zipping around.

I’m still scratching my head as in WTH do all those people do? I did a little Bitcoin trading, and when I needed customer support it was practically non-existent. So they can’t have been there for CS functions.

I look at what Musk did with Twitter, canning 50% right away with little degradation of service, and now things continue to get better.

COIN should be able to operate with at most 2-300 people.

Yea the company grew at a pace to show growth just by hiring when number of employees made a company look legit . Another hallucination!

It’s highly misleading to point at the price of Coinbase bonds as an indicator of investor sentiment. The company did a great job of securing low interest debt and treasury rates rose so high that it doesn’t make sense to buy that debt; that’s why the bonds are so cheap. It’s a reflection of treasuries not faith in the company.

Nah. They’re junk-rated, yield over 13%, and the spread to Treasuries has widened from 2 percentage points a year ago to nearly 10 percentage points now, meaning that investors think that the risk of a default is substantial — that’s what those bonds tell you. They lost half their value in year. Ignore the bonds at your own risk.

“It’s shares [COIN], …” in the last paragraph would read “Its” instead as a possessive pronoun.

Thank you for the article. It’s incredible that it managed “10-year 3.625% unsecured notes, issued in September 2021.” Reminds me of the 100-year bonds Argentina absurdly managed to issue in mid-2017 at a 7.9% yield,

Yes, I had some fun with those Argentina 100-year bonds.

When it sold them:

https://wolfstreet.com/2017/06/20/argentina-sells-100-year-dollar-denominated-junk-bonds/

And two years later when it was getting ready to default on them:

https://wolfstreet.com/2019/08/12/brain-dead-investors-get-crapped-on-again-by-argentina/

Totally ridiculous.

By your reasoning, this applies to a huge volume of distressed debt.

Well I personally don’t see any way one can have enough food ammo water and solar and share with the rest of the world. I would quickly run out of ammo if I were attacked by the towns population of 200k . And if they don’t attack then I would have to feed the 200k with my food stash because I for sure can’t see children starving to death.

Oh well, Coinbase stock up 13% today after this…as they say it works 60% of the time everytime after a layoff annoucement..

Everyone is getting back in during the “crypto winter”.

Absurd levels of fake money(unearned, printed) caused the consensual hallucination. Tons of fake ipo’s and even crypto and a fake universe(metaverse) are all now getting crushed by reality. Now watch the fake housing market and all the fake jobs(I estimate as much as 50%) blow with it. Tulips made entire fortunes until reality showed up. Nothing wrong with dreaming, but eventually you have to wake up and the dream is over. The key is using wisdom and overcoming greed ahead of time to foresee what is fake and what is real. This is where Warren Buffett excels. Going with that which has passed the tests of time. Pet rocks and crypto…not so much.

Maybe Armstrong knows Andrew Neumann (of WeWoke fame). Sure sounds like they could get along. Getting tougher and tougher to find companies that actually produce something that is beneficial. 😉👍😬

It’s Minsky Time! As Wolf observes its been defined by Easy Money up to this point. I diverge in my belief that the Easy Money has forestalled the necessary panic/consolidation that crypto needs to evolve beyond the snake-oil it’s become, but that’s what Easy Money does. 1870 railroads, 1997 Internet.

I see utility to salvage from the ruins that doesn’t require occult religion to believe in. Avoid the videogame inspired “consensual hallucination”, and stop conceptualizing it as a currency. Crypto is a bookkeeping innovation. As revolutionary as double entry accounting, lot’s of utility but ultimately a yawn inducing backend tool that supports business rather than defines it. Vendors who enable it can profit in much the same way as accounting/custody service providers do today. It’s not sexy, but it works for all the reasons double entry does. Web3 and DiFi may carve out small niches but to me present as over-engineered solutions to problems that don’t exist. The future is as boring as rail/internet networks that are mostly ignored except on the rare occasions that they break.

I think Armstrong/Coinbase are presently best positioned to pivot and capitalize on what crypto becomes, though not without significant management risk. I also thought AOL(mildly profitable rent-seeking gatekeeper) was a better bet than Amazon(niche book retailer with persistent negative cashflows), so take that with a grain of salt.

ARW – mebbe. An aspect of the digital age is that the tools developed and their potential usages become so-much-more dazzling than the vital, but mundane, missions they were ostensibly created to assist (think of the ratio of brilliantly successful backyard engineering efforts to the much-larger, generally-underreported, number of fails…).

may we all find a better day.

There are now more than 22,000 CRAPTOCURRENCIES out there. Will that number be up or down by the end of 2023?

I prefer “corrupt-o-currency” myself.

$5 billion found in ftx bankruptcy? This should placate the crypto believers for a while

So, here we are with a wide range of crypto related things, down about 90%, headed to evaporation.

That’s hard to quantify, especially with the thesis that crypto is contained, as a fantasy video game that uses laundry tokens, which were purchased with (trillions) dollars.

The disconnect that I’m curious about, is, what happens to all the people that are still playing this game, especially after the world of real dollar-based equities also enter the fire pit?

Obviously a rhetorical and abstract thought, but there’s a lot of people looking to get rich asap and that seems unlikely to pan out.

Mike Wilson:

“The full-year estimate has got to come down,” he added. “Negative operating leverage is really starting to flow through to the income statement from the balance sheet… This is a very underappreciated development during Covid. We over-earned during the pandemic because there was positive operating leverage.”

The answer to all your questions is that the majority are destined to become poorer or a lot poorer.

Silvergate got an under-the-table bailout from the FDIC, according to Naked Capitalism today (11th). This is beyond annoying.

That’s braindead ignorant clickbait BS. What goes on at NC, stays at NC. Do not drag this BS into here!

They sold CDs like any other bank, and those CDs are insured by the FDIC, like any other CDs issued by banks. That’s NOT a bailout, but normal banking.

If the bank’s capital ratios fall below a certain level, the FDIC swoops in and takes possession of the bank, annihilates all stockholders, and “resolves” the bank. That’s not a “bailout” either, but a “bail-in” of the stockholders.

READ THIS:

https://wolfstreet.com/2023/01/05/crypto-bank-silvergate-details-its-own-implosion-much-of-its-equity-capital-wiped-out-im-waiting-for-the-fdic-to-show-up/

Wolf,

Kudos for highlighting the bond prices. Deep into distressed debt territory, odds of recovery almost nil.

Consensual hallucination indeed describes the Coinbaste crowd. Apparently no one bothered reading the prospectus prior to the direct listing. Artificially low float of 40 MM shares or so but page one stated up front “This prospectus relates to the registration of the resale of up to 114, 850,769 shares of our Class A common stock…”

Got much worse near the back of the prospectus when they divulged an alphabet soup of share classes, all of which were convertible into common shares…along with the outstanding options which were due to be exercised. No company-imposed lockups either, just standard SEC impositions.

A Ponzi from Day 1.

Re: Contagion. Are these lenders like Silvergate and investors using “real world” currency? How can there not be a direct contagion link between the video game and real world? Or does that “moat” protecting lenders and investors from “contagion” only exist when the game world is crashing?

Sounds like the perfect unregulated space for cons and scammers. Oh, wait…………….

Crypto related stocks that are drifting around with 90% haircuts are actually an interesting metric for super insane risk exposure.

If you’ve been converted to crypto religion and pray the future includes you as a wealthy, smart and innovative investor, the evangelical realities to overcome are enormously overwhelming.

If one steps back from the hallucinating, and looks at old fashioned (bon-fantasy) Treasury spreads, I think we see the Treasury curve flattening into a very unprecedented range, which indicates unprecedented future uncertainty and unprecedented future risk.

I realize it may be annoying to use unprecedented too many times, but go look. The long-term spreads and short-term spreads are both screaming about future growth risk — while crypto is going bankrupt.

Only an idiot would drink Kool aid that twists your brain into believing that the riskiest financial ponzi laundry tokens are going to explode higher. If anything, every crypto coin is soaked in jet fuel, headed to a bonfire.

I don’t know if Fred links are allowed, but here’s a picture worth 1000 BTC, but it looks best on a really BIG screen, because the distortion on the Treasury curve, is unprecedented!

https://fred.stlouisfed.org/graph/?g=YDK4

“If anything, every crypto coin is soaked in jet fuel, headed to a bonfire.”

I mean, you can believe this all you want, it’s just not so. But go ahead, short every coin you can with abandon, including the ones pegged to gold and the USD.

The Coinbase bonds are remarkably underpriced at $51.75, yielding around 12%.

Typo? “overpriced.”

Appears Silvergate got some real world help from FHLB of SF according to their website? $4.3B worth as of 2022/12/31.

Guess my question would be what gets pledged in return for short-term advances?

” Wholesale Funding

At December 31, 2022, the Company held $2.4 billion of short-term brokered certificates of deposit.

At December 31, 2022, the Company held $4.3 billion of short-term Federal Home Loan Bank advances.”

I discussed this in detail a week ago when Silvergate released the info:

https://wolfstreet.com/2023/01/05/crypto-bank-silvergate-details-its-own-implosion-much-of-its-equity-capital-wiped-out-im-waiting-for-the-fdic-to-show-up/

Only comment I would make is the point about Coinbase bonds.

The bonds were issued a while ago when rates were lower. At 50 cents on the dollar, the bonds yield 7.3%. While this is high, it is not yet truly distressed.

The point is the collapse of Coinbase bonds is likely attributed to two elements: decrease in Coinbase credit quality and general increase in market rates of interest.

How much of each would be a guess at this point. Once Coinbase stock gets down around $1 (a couple of weeks?) we should have a clearer picture of how crummy the Coinbase house is….

As I said above…

Nah. They’re junk-rated, yield over 13% (your bond-yield calculation is not how it works), and the spread to Treasuries has widened from 2 percentage points a year ago to nearly 10 percentage points now, meaning that investors think that the risk of a default is substantial — that’s what those bonds tell you. They lost half their value in year. Ignore the bonds at your own risk.

And those bonds were further downgraded today, on default risk.

With due respect, a yield to maturity calculation generating a 13% number is not appropriate when the assumption is the bond will NOT pay out at 100% on maturity.

As stated, we have yet to see the amount of credit impairment with Coinbase.

While I am NOT proposing there is no credit impairment, I am stating we don’t know the extent of credit impairment because market interest rates have risen dramatically, which rise has had an impact on Coinbase (and everyone elses) bonds.

IF one wanted to do rough math, you could look at the 10 Yr Treasury – its price has decreased by about 16% in the last year or so…this is the impact of rising interest rates since the credit risk is unchanged. Using that as a baseline, about a 20% decrease of a corporate maturity of similar duration would tend to isolate the delta from market movement.

Yes, it’s clear Coinbase has some deteriorating credit quality, but my point still stands: we don’t know the full extent until Coinbase gets down to $1 per share.

Crypto is math. That’s not religion, though you can get carried away into religion with it.

You know what’s a really zany religion? The notion that a government monopoly on money can be stable and won’t result in massive devaluation and/or distortion of the economy. Now that’s madness.

What got devaluated by 75% in 13 months was crypto, and that’s against the dollar that you hate so much. The dollar got devaluated 8% over the same period. So in absolute terms, crypto got devalued by 82%. “Now that’s madness,” as you said so aptly.

There’s very little doubt that crypto zealots that have been drinking the kool aid for years, will continue to be evangelical, pontificating about the mathematical foundations of ponzu accounting.

I read a few crypto books way back, as I (hate to) recall, one had a Google title, upside down and it was an introduction to blockchain religion.

I forced myself to consider the possibility of crypto and blockchain being a super dominant social evolution, but I gave up reading about 3/4 in, because it seemed obvious that all of crypto structures are based in dollars.

The only take away from that thinking was for me to buy (with dollars) a small stash of DOGE coin at Robinhood two years ago.

I thought DOGE would be like owning the Peso, a currency, that in the past, has often been the equivalent of fun money, that tourists use while on vacation in Mexico. I thought there woul eventually be enough adoption that it’s future value might increase, as more tourists bought fun money laundry tokens.

That concept may play out in several years, especially in meta verse fantasy destinations, but dollar denominated play money that uses ponzi engineering as its core foundation, has no basis in reality, regardless of any pseudo mathematical delusions.

I sold my DOGE a few weeks ago and closed my Robinhood account, the end.

“Cuts another 25% of Real-World Staff”

_____

Love the snarky headline.

“So . . . is this real money?”

“Kinda. But also kinda not. Crypto is real money, like tokens at the fair. If you’re at the fair.”

“Are you losing real money, or tokens?”

“Oh. Our losses are real. That’s real money.”

“And your cost cuts?”

“We’re firing real people.”

“Why can’t you keep them, and pay them with some tokens?”