But history doesn’t repeat, it rhymes: For your amusement, a Nasdaq comparison to the Dotcom Bust.

By Wolf Richter for WOLF STREET.

The year 2022 ended with:

- S&P 500 Index: -19.4% from a year ago, -20.3% from its high on January 3, 2022.

- Nasdaq Composite: -33.1% from a year ago, -35.4% from its high on November 22, 2021.

The whole mess started in that infamous February 2021, with the popping of the bubble of the most ridiculously overblown hype-and-hoopla stocks, the SPACs and IPOs and crypto stocks, and all the other trash that the consensual hallucination of the free-money era had inflated into the stratosphere. They began to plunge beneath the surface of the big stocks and quickly formed the foundation of my pantheon of Imploded Stocks – minimum plunge of 70% from the peak. That was still in 2021.

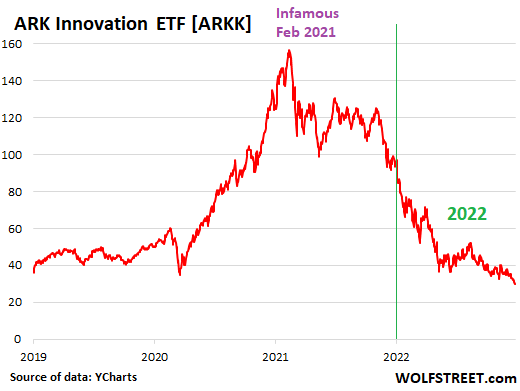

Cathie Wood’s Ark Innovation ETF [ARKK], which elegantly and with utmost dedication tracks many of the worst products of this consensual hallucination, has collapsed by 80% from its high on February 16, 2021. But its bear-market rallies in 2022 were weak and few, so this isn’t the most classic example for my headline – we’ll get to more classic examples in a moment – but it forms the right backdrop for what was going on in 2022 beneath the surface of the major indices (data via YCharts):

The ARK Innovation ETF also includes a few real companies that actually make money, and that have shaken up legacy industries, but whose stocks were ridiculously over-hyped-and-hoopla-ed by a crowd steeped in consensual hallucination.

The star in this group is Tesla, which accounts for over 9% of the ARK Innovation fund. It spent the year 2022 transmogrifying from an object of religious veneration to automaker and still has a long way to go to complete the transformation. Down by 70% from its peak in November 2021, Tesla was inducted in my pantheon of Imploded Stocks the day before Christmas Eve and is still in it at year-end.

Tesla is a great example of face-ripping bear market rallies that then collapsed, having completely annihilated all 2022 bear-market rallies, though the last two rallies fizzled prematurely (data via YCharts):

The Nasdaq is dominated by the US Tech giants. This is how much their stocks have plunged from their respective highs, and the date of the high:

| “Tech” Giants | $ Today | % From High | Date of High | |

| Apple | [AAPL] | 129.93 | -29.0% | 04-Jan-22 |

| Microsoft | [MSFT] | 239.82 | -31.4% | 22-Nov-21 |

| Alphabet | [GOOG] | 88.73 | -41.7% | 07-Nov-21 |

| Amazon | [AMZN] | 84.00 | -55.5% | 13-Jul-21 |

| Nvidia | [NVDA] | 146.14 | -57.8% | 22-Nov-21 |

| Tesla | [TSLA] | 123.18 | -70.3% | 04-Nov-21 |

| Meta | [META] | 120.34 | -68.7% | 01-Sep-21 |

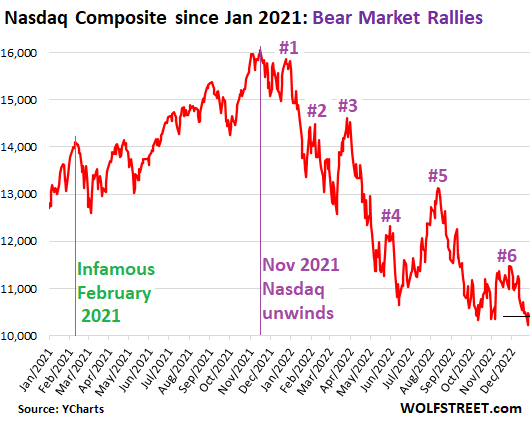

The Nasdaq Composite shows the classic pattern of face-ripping bear-market rallies that then collapse. On December 28, it closed at 10,213, the lowest close since June 2020, having successfully crushed all bear-market rallies in 2022.

Today, after a 100-point jump in the last hour of trading when everyone else had already left for the holidays, it closed at 10,446, still in the red, back where it had first been in June 2020, and down 35.4% from its high 13.5 months ago in November 2021.

By comparison, during the Dotcom Bust, the Nasdaq plunged 78% over a 32-month rollercoaster from heck – more on that in a moment. It isn’t even halfway there yet (data via YCharts):

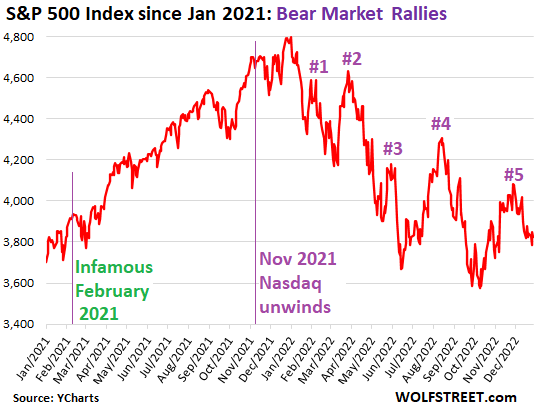

The S&P 500 Index also followed the classic pattern of face-ripping bear-market rallies in 2022 that then got crushed. It closed today at 3,839, down 19.4% from a year ago, down 20.3% from its high on January 3, 2022, and back where it had first been in January 2021. But it hasn’t yet completely crushed the bear-market rally #5 in 2022 (data via YCharts):

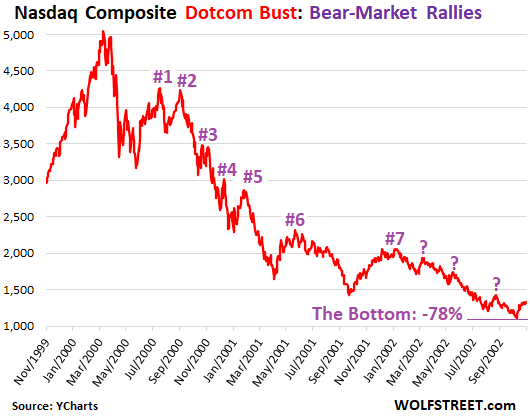

For your amusement, a comparison to the Dotcom Bust.

The final paroxysm of the Dotcom Bubble ended on March 10, 2000, when the Nasdaq peaked at 5,048. Then followed a series of declines, interrupted by bear-market rallies. This rollercoaster from heck lasted until early October 2002, when the Nasdaq bottomed out at 1,114, down 78% from the closing high.

Today’s Nasdaq is 13.5 months into the selloff, and is down 35%. During the Dotcom Bust, after 13.5 months, the Nasdaq was down 66% and in the early stages of another 35% two-month face-ripping bear-market rally that then brutally collapsed again.

History doesn’t repeat, but it rhymes, as they say.

It took 15 years, trillions of dollars of money-printing, and years of interest-rate repression, before the Nasdaq, in May 2015, got back to its March 2000 high. That is not astounding. Lots of stocks just vanished. And many of the survivors — such as Intel, Cisco, MicroStrategy, et al. — never again got close their 2000 highs. And that’s not astounding either.

What is astounding is that the Nasdaq more than tripled in the 6.5 years between May 2015 and its peak in November 2021. This was a huge huge huge move, a ridiculous move, that has started to get unwound.

For your amusement — it sure wasn’t funny at the time, I swear! — here is a chart of the final phase of the Dotcom Bubble and the entire Dotcom Bust in all its glory (data via YCharts):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Superb work Sir!!!!

I particularly like and enjoy the term “consensual hallucination”.

The guy that had the old site on the “Stock Market Mania” needs to be recalled, but your work will do very well!!

Did you wonder why Teala was really kicked out of S&P 500?

Today we have a possible answer.

S&P index fund managers would be taking a sigh of relief looking at Nasdaq.

Tesla is still a part of S&P500 index. It was kicked out of the S&P500 ESG index

Oh, my bad.

Sure 20 percent down from highs in the indexes. But no one talks about how the spx is up aprox 700 percent from the 2007 low My guess back to 2016 levels in the next three years

Some stocks are about there. Many back to 2018 2019 price levels

“Consensual hallucination” is great but I particularly liked the usage of “transmogrifying”. Well done.

“Induction into the pantheon” is a durable giggle

Much more durable than most of these stocks, at the very least.

Wolf gets the “Financial Terminology Award” this year. “Consensual Hallucination” hits the bull’s eye. There will be new focus from the psychological community revolving around this mysterious syndrome. “CHS”

One guy whose video channel contains “Coffee….” shows just how deeply infected some folks have become. Totally lost to the real world. Yet, amazingly, there are those who are devoted to being financially tortured and taken for a ride by flim flam artists, many of whom turn out to be actual criminals themselves, posting their latest “coins”, NFTs, or exchange. It is truly amazing to watch these unfold and take millions of fool’s money and disappear into oblivion.

I guess these would be classified as terminal cases of “CHS”.

Gee, I wonder if Pfizer has a vaccine for this. :-)

Ah yes, CHS, Cenex Harvest States, Inc. By far it is my largest equity holding. A company with Minnesota headquarters that’s in the Ag, energy and commodity transportation businesses.

Just picked up my nice quarterly dividend of fifty cents per share yesterday. Current forward dividend yield is @ 7.29%. CHSCP is the ticker symbol.

For NFTs, David B. Collum who is a chemistry guy at Cornell, just published his 2022 Year in Review. His explanation:

“Can somebody for the love of god explain to me what the f##k nfts are and how they work”

“Imagine you have a wife and your wife is getting drilled by everyone and you cant do s#it.

But you have the marriage certificate. Thats the NFT.”

Happy New Year …

In a disturbing way, that has to be the best description of an NFT that I have ever heard.

Yes. Poignant.

Love that Coffee guy, the stuff he expose like that recent Logan Paul 3 partners is something that functioning mainstream media should be covering…but instead they are busy interviewing Michael Saynor…

Zilla has no shortage of material to keep his channel going. Another day, another con.

“Consensual Hallucination” an offshoot of “mass hysteria”.

a spin on “irrational exuberance”?

Don’t give Pfizer any ideas.

I need to correlate Jim Cramer’s recommendations vs reality and these charts and…gone.

On a positive note, the eggs in my fridge and Tuna/Soup in the pantry are up like 40%.

Fantastic 2022 overlay with 2008–and what we can expect for 2023, maybe sung in another key.

WOLF: “It isn’t even halfway there yet…”

It would be interesting if the smart money started prognosticating to the effect of: “Until the market gets back to fundamentals, like rational P/E ratios, we still have the “other half” to go in 2023, before we reach the bottoms we saw in 2008.”

…and maybe then stocks will be traded at what they are worth based on fundamentals–not what the market will bear. It baffles me the shorts can make billions when so many Wall Street darling companies have terrible fundamentals…nothing more than IPO or Cathie Wood “hype and hoopla”….then again it baffles me that anyone would invest in an asset that is created “out of thin air” with no useful application other than to trade amongst other adopters (victims)–ergo all of crypto.

Correction: Replace all instances of 2008 with 2002.

“…and maybe then stocks will be traded at what they are worth based on fundamentals–not what the market will bear.”

Really? There’s plenty of companies trading what they are worth and less at this exact very moment. Stop being dramatic.

Name one.

The overvaluation of all the major indexes will pull all of those quote fairly priced stocks downward. It’s still a poor trade unless you’re very good at picking penny stocks. Penny stocks are the only place there’s any value if you can find them.

For Wolf: “The force is strong with this one.”

I’m going with CDs/GICs for the next 12 months. The interest will actually be decent for the first time in an eon and inflation will decline.

The problem with the “for your amusement” crutch is it doesn’t commit to whether this is, or is not, a 2000 repeat.

If it is – and it sure does look a lot like it, dun’nit – then the play is QQQ puts all the way down. “It isn’t even halfway there yet.”

But what financial advisor is actually telling their clients to do that? Basically nobody. Nobody did in 2000-02 either, way I remember it.

Now that you figured it out, after 12 months, go ahead and try that play. Let us know how it went.

This was my point.

Is the statement “it isn’t even halfway there yet” correct or incorrect.

Or, is it just presented for amusement.

This article with due humility and honesty is presenting a situation and openly wondering about the open questions (and innate risks and uncertainties) it presents. I have utmost respect for that. I would leave it to the hypesters to “commit,” which makes no difference in how it actually goes. It is for us to “commit” however we choose, bear the risk, and the possible rewards or losses.

The problem with shorting a stock or an index is that both your investment thesis *and* your TIMING must be correct. Shorting an asset involves a completely different level of risk than a buy and hold strategy, especially in a time of mass Consensual Hallucination. We don’t know when the hallucination will end once and for all.

It is more likely to be correct than not for the simple reason that if the central bankers resorted to ZIRP (and NIRP) and QT again, it might well lead to higher inflation especially if the government also keeps on doling out money. As Powell has been stating price stability is paramount. This implies a price for capital which would imply lower market. How much lower is a guess. That it took NASDAQ 15 years to get to its Dotcom highs indicates that it will likely take along long time to get to the highs of 2021.

What would happen if a credit event occurs is another thing altogether. As also if the CBs went for ZIRP, NIRP and QT.

Just plotted the SP500 since 1982 and it clearly shows the bubbles. 2008 just got back to the normal trend line from the 80’s then the money printing kicked into overdrive.

Using the 80s gdp trend (presumably) baseline, this bubble has a lot farther to fall than “halfway there” down to 1400 or so currently. Using the latest bubble money printing binge, the reversion to mean is at 3500.

I was on the plane when the man next to me said he was borrowing money to buy CISCO in Jan. I told him he’d better sell CISCO.

Wolf has captured the year that was perfectly well in the title alone. It was a year of volatility, with marked upward and downward moves.

Even in your wildest dreams, it’s not going to be “QQQ puts all the way down”. You’ve been given ample information to abandon your trading strategy temptations.

I think we’ll see a meaningful upturn now or before long before an opportunity to trade QQQ puts comes around again.

If options did not have a date they expired, then that play would be really sound. The bear rallies take care of the put options for the big banks that write the options. No they’re not gonna let you make a bucket load of cash the easy way on the way down. Sorry.

Actually, Cramer warned about buying the tech dip in 2000. It was very, very tempting to buy into that “correction” in the early part of its decline. I was watching CNBC too often back then. He repeatedly said it’s not going to rebound.

Unemployment rose ~ 50% during the dotcom bust and doubled during the GR. In both cases, it took about 3 years to peak. If we go middle of the road, then unemployment may peak at ~6.2%. The question is when will 1st-time unemployment claims start rising sufficiently to begin pushing up the unemployment rate?

We’re basically one year into the market downturn, but the labor market isn’t showing any obvious signs of cracking. IMHO if the unemployment rate doesn’t start to move up by the end of March, then the Fed will be forced to keep its foot on the FFR peddle, meaning a 7% FFR becomes very possible as predicted by Bullard.

As such, we go back another 20 years, reminding ourselves that this time isn’t like dotcom or GR but rather parallels 1973 – 1983.

There is the distinct possibility that the unemployment rate will never raise sufficiently.

Low unemployment is entirely a result of the asset mania, the loosest credit conditions ever, and the loosest fiscal policy ever.

It’s not the result of demographics and any organic economic boom.

Agreed as to your first paragraph. I’ll guess we’ll see to what extent it could be a function of demographics if Powell can unload assets and keep rates higher for longer.

If a large percentage of boomers don’t return the labor force and the participation rate stays low then It’s part structurally demographics.

I agree. The question is how does the Fed react? Around mid 2023, they Fed may be forced to either continue to raise the FFR towards 7% or make the case that 3.5% PCE inflation is the new normal and adjust their dot-plot Be that as it may, if the unemployment doesn’t rise above 4% appreciably, then look for a significant recession in 2024.

> this time isn’t like dotcom or GR but rather parallels 1973 – 1983.

Good point, but this has features of both. I think a similar point is made and explored (quite bearishly) by Nouriel Roubini in his recent book.

Look at the S&P 500 chart from its peak c. 1968 going forward 24 years. They got some dividends though.

The earnings yield of the S&P 500 is over 5%.

The dollar is weakening.

The earnings yield is irrelevant because earnings are a number on an accounting ledger, not real money.

“earnings are a number on an accounting ledger, not real money.”

LOLWUT?

Cytotoxic, my understanding GAAP rules allow all kinds of adjustments to earnings which will increase the number, but don’t actually lead to money profits.

For example, aren’t companies allowed to attribute “unrealized gains” on assets (including goodwill) as “income?” That of course doesn’t mean the company has cash they can spend on stuff or distribute to shareholders.

Disclaimer: I am not an accountant!

Roubini is now sounding more like Augustus Frost, or vice versa.

If memory serves, the bottom of the dot com crash was the startup of the buildup to the Iraq war. I definitely don’t want that history to repeat or rhyme.

I’m with you and praying we avoid that “Big One” every night, and again upon waking. That’s really such a concern it makes more of a “stock market” collapse seem trifling. I don’t even want to say the word….Pulling for “Main Street” and indifferent to a “Wall street” come-uppance.

Nathan, time for you to read “Alas, Babylon”

There is always some likelihood of an exogenous shock. There are bets to make based on that “fat tail” among probabilities, coming precipitously onto the radar, from left field, piling in upon everything else going on. I do have a sliver of capital committed to bets on that. These bets typically dribble away at capital but then spike up hard when people freak out and, at least temporarily, panic. At such moments, the wide world of conventional steady-payout trades suddenly take big losses. You can see the steep dips on the charts.

Hard to believe so many people could have been sucked into another Nasdaq bubble so soon after the last one. Are memories getting shorter?

Wealth without work is too alluring to think about the past.

@rojogrande, elegantly put.

Most humans crave thinking, at last the world is dancing to my hopes and biases. We have “reached what looks like a permanently high plateau.” (Irving Fisher, Oct. 1929.) Or as Taleb and others have put it, the turkey has most reason inductively to believe in a bright world and the love of the deity, on the day before Thanksgiving.

Ha! I believe I was paraphrasing John Kenneth Galbraith from “The Great Crash,” though it’s been awhile since I read it. Fisher is a classic from the era.

Irving Fisher is ridiculed for that remark, but he was an extraordinarily brilliant guy. Had a difficult life, though, and some misled beliefs.

It is just human nature. In general, human nature can never resist their neighbours (or friends/relatives etc.) getting rich. With the Fed and the government pitching in with all their might (and making it seem as if it will last forever), even a saint might not have been able to resist this “consensual hallucination” as Wolf puts it.

Correct kpl. As Robert Cialdini stated in his book Influence, “we view a behavior as more correct in a given situation to the degree that we see others performing it.”

So, just as many people based their investment decisions on what others were doing during the dotcom boom, many have done the same in crypto and tech companies this time around.

The financial realities of these investments take a back seat to several facets of human nature during a bubble economic period. Those include scarcity (missing out on a “once in a lifetime” investment), social proof (everyone else is doing it) and authority (if investment “expert” Cathie Wood says it is good, that must be the truth.)

Superb work, Wolf. As usual.

What do you expect people to do when the risk free rate of return is almost nothing?

They got sucked into another housing bubble so soon after the last one, so why not another NASDAQ bubble? And why not a bond bubble and a crypto bubble to go with them?

Not just “another bubble” – ZIRP and CHS engendered the Mother of All Bubbles in Everything

QE has numbed people’s senses. They believe that the endless stream of money will go on forever.

ZIRP is Novocain of the financial world? Good to know! One should proceed with caution when utilized.

Money can flow longer than one thinks possible.

Just read Jim Roger’s book “Investment Biker” from the 90’s describing his trip around the world. Quite interesting his assessments of the economies of the countries he went through.

He was concerned about the US in the 90’s, particularly our $5 trillion US debt and it becoming increasingly “statist”.

I wonder what he thinks about our $33 trillion debt 25 years later.

10 year Treasury pays 2.2 times the income of sp500. In 10 years you know what the price of the Treasury will be. Even if divided grows at 7% the payout will still be less in year 10 fo sp500. Not a sure thing sp500 will be higher in 10 years. Nasdaq is a bigger risk.

With 5% inflation the next 10 years, I’d expect genuine value stocks to handily outperform long bonds. S&P 500 is a different story, as there’s not a lot of value there. MSFT, AAPL, GOOG, AMZN, etc., are not anything close to value stocks in my book.

With buybacks being such an important market factor the past decade or so, you can’t really look at dividends as a return in isolation.

I look at the Nasdaq chart daily and am stunned. Looks like there is no support level on the way down…or perhaps someone here has this all figured out?

Next major support for the US stock market is the March 2020 low.

And it still won’t be even close to “cheap” then either.

Bring it. Quickly, before my puts expire.

I remember ’02 and ’08 clearly. Both seemed far more painful and with widespread panic than ’22. Other than the constant headlines saying “Stocks and bonds crushed in brutal year”, on the ground, this really feels like an ordinary minor correction.

Agree with your point about the lack of panic right now in comparison to recent downturns. The panic phase of this route may last awhile and it hasn’t even started yet.

Lots of anger and frustration out there but most people still have hope. They’ll lose hope soon I believe and that is when selling will take over…both in the markets and RE.

Happens every time.

Finally, some old school reality takes hold. Note, yesterday, WSJ published an article saying home remodel “is in danger of slowing due to rate increases.”

Having spent 30 plus years as a home/ranch builder I was flummoxed by construction still continuing to show positive growth when the multiple construction projects ended in my track of California Ranch Homes.

Many young techies have made fun of those who look at fundamentals. I worked for a young, woke SoCal Contractor for 4 months this year as was amazed to see how things are done now. I asked him if he had ever experience a recession and he said no. After I figured out his grandfather had him working as a contractor in being forced to do so or not get his trust fund money it all came clear how easily this “remodel house of cards” will result in the punishing facial rip and tear that is soon to come to all the hot shot techies who are so full of hubris….

Great deals on trucks will soon be here. Tools will be cheap to buy (already happening at Home Depot). I am waiting awhile longer to have my roof replaced at labor and materials with NO PROFIT.

Let’s see how the young will fair in the “reality testosterone pit.”

I expect a lot of people are going to regret taking on debt to remodel functional kitchens and bathrooms to look like they do on HGTV.

I expect a mass die- off of real estate TV shows.

To make two comments in one, here is a quote from CNBC Jan. 4 2022:

‘The rate jump to start 2022 was the biggest to start a year in decades. Why it isn’t hurting stocks’

This was ‘Pro’ by the way. You had to pay to get this mal- advice. In hindsight the best investment advice for 2022 was to avoid CNBC apart from quotes which it does well. In foresight, it is probably best to ignore its stock ‘buy’ ideas in 2023 as well.

To be fair, someone on CNBC is NOW recommending high- grade corporate debt as an alternative to stocks. But if the inevitable recession is deep, maybe even some of those will succumb. So maybe govt debt is where cash should hunker down.

Credit spreads are pathetic, unbelievable. I even quizzed my Schwab rep to make sure they’re accurate. Why on earth would you load up on A-grade corps for virtually no spread over treasuries, especially if you live in a state with income tax?

I was in Home Dumpo on Tuesday to get two keys cut. The place was a ghost town. Literally parked right in front of the door, cashiers with no customers, and the guy who made the keys was standing around playing pocket pool as I approached.

I’ve not seen that store that empty ever.

“Home Dumpo”…very good!!

I really dislike the place and it’s not very bright people. The managers mostly suck.

I’m fortunate having small, locally owned alternatives 👍😉

Happy New Year to Wolf and the army of commenters 😉😉

ElK – you still have cashiers at your ‘Home Alone’? The one in Santa Rosa went full self-checkout a couple of years ago…(of course, with a couple of ‘assistants’ in attendance…).

may we all find a better day.

There’s always one or two registers open at the “pro” counter gauntlet. The door there is big enough for the thieves to run out of (and it’s always open because Arizona) so it’s staffed. Ditto the garden center. They have “self-checkout” in the garden center as well, but there’s always a clerk hovering to catch those folks who can’t count their plants very well.

=pocket pool=

Ahhh… It is wonderful. The name of real Nintendo game for kids aged 1-4 years used for nefarious purposes. Also the figure of speech “alliteration” is employed – like “smooth silkiness of NPR voices”.

In the military “nut bowling” and “pocket billiard” resulted in sewn trousers pockets which resulted in bulging breast pockets which were supposed to be totally flat… I will stop there… It is too horrible to recall…

Will they say anything if you bring a dog with to browse?

Adam, same in my industry. I’m a private money lender and I invested through the last financial crisis. So funny for me to see these young guys, who were in college during the last one, all flashy, cocky, they can’t lose. I’ve watched all of them aggressively raising money, lending close to 100% of 2021 values, and nearly putting me out of business because I wouldn’t match their crazy high loan to value lending. I see the same “masters of the universe” real estate guru types on the stage at local real estate investor events talking a big game, all of them were in college during the last downturn. (Now some of them are pitching their education courses because they can’t make money wholesaling to a “bigger fool”). And the young private money lenders who have no clue what’s happening in Wolf’s Top 20 metros, they are still lending at 100% loan to value. In fact I saw a deal this week that took me 1 minute to decline had 3 lenders willing to do 100%!!!! I’ve been in a holding pattern on my lending this entire year, having only done a handful of loans, just trying to see what’s around the corner, and keeping my money on the sidelines. Like you, I think a rude awakening awaits many of these young, “master of the universe” types that have never invested through a financial crisis. All I can do is sigh and chuckle.

…I meant “sigh” and chuckle

I thought you meant “sign” (with a one finger salute), “sigh and chuckle.” Keep the faith and maybe take one of these guys under your wing and show them the ropes-if they will listen. We have a lost “smarty-pants” generation that grew up with cell phones, “winning” at home jeopardy because they could google the answers faster than the contestants–and they saw it as a win! Yep. That’s the Silicon Valley generation. A bunch of soon to be unemployed, arrogant, smart asses–like their role models Elon Musk, Larry Ellison, Mark Zuckerberg and Sam the Crypto Guy. Happy New Year and stay Old School and ethical. NASDAQ to 3000!

Big tech had a nightmare collectively losing nearly $4 trillion in market value in 2022. The tree of Liberty getting refreshed in grand fashion. The Feds have a long way to go in tightening the rest of the grift out the system. Asking for layoffs when most of the basic services jobs can barely operate seems ridiculous, but when you think of all the shit QE help create, not so much. I think I will spend New Years drinking my keystone light and searching for used Teslas for sale. The rich assholes have made taking the family skiing in Colorado a pocket draining experience.

At some point, one would think that “trillions of dollars of money-printing, and years of interest-rate repression” would lead to a political problem. If one looks at the “Federal Debt: Total Public Debt as Percent of Gross Domestic Product” (https://fred.stlouisfed.org/series/GFDEGDQ188S), it is pretty clear that there is an unproductive flow of money, with a lot of it ending up in the stock market versus productivity gains, as measured by GDP. In other words, the government is acting as a middle man in transferring wealth to the owners of capital by taking on public debt, but too much of the money is being pocketed, versus being put to use. There is no accountability, as we have for government contracts. Public debt should lead to long-term public good. I guess it’s all too arcane and unemotional to make part of any national political agenda.

Stymie – perhaps a corollary to Carlin’s Postulate when referring to the general population:

“…it’s a big concept, and you ain’t gettin’ it…”.

may we all find a better day.

I predicted from the beginning the US would spend $1 trillion dollars in Ukraine. We hit 10% of that figure recently.

This military spending is another bunch of inflation kindling.

I’m really happy 2022 is finally over. The problem with that is I’m not happy 2023 has begun. How’s that for a dilemma?

Yes huge bear market rally if / when Ukraine war ends though the fighting there has been going on for a decade or more . QT globally will continue to push the asset bubble that’s popped to lower valuations . The tech industry, at least the social media and advertising and software industries, have a monopoly that’s global for cash flows that require very small capex spend for maintaining their businesses vs say energy and manufacturing that have to spend large amounts of money to replace inventory. One area that has always been underestimated is the need for the energy industry to find and develop fossil fuels globally in an increasingly hostile environment. Case in point is the large number of vocal people in the state of CA would love to have most of oil and gas production eliminated. Yet they still have a large fossil fuel footprint!

Energy is the area that is most concerning in my opinion as inflation and ESG is sweeping the globe. Take Wolfs Mississippi barge data due to drought driving USA ag production costs higher!

Wolf, Love love the mentioning of the transmogrifying concept! My son is a big fan of C&H so are we his parents, hence my stage name. Anyway, my son when he was seven asked for a transmogrifying machine for Christmas. I found an used box and magically turned it into one. I should do one for my own wishes and one for the world.

To the current economic situation, I would like to add that the situation is played by people, by humans still, and it will always be. Emotionally the human race has not evolved a bit, absolutely nothing.

The crashes come (and they always do), because one or more of the players keep losing and they throw away the board game; they refuse to play the losing game anymore (one of the many reasons of course). Some players think they are smarter and they join in, only to resign at the end.

As more players throw the board and resign, there are no more players left and it takes a pause until newcomers join the scene.

This is how I see it…

Conflict of interest: I’m a psychologist.

Calvin – sometimes referred to as ‘History’s Wheel’ (but what splendid adventures to be had when transmogrified!).

may we all find a better day.

What you’re describing is “Calvinball”.

Calvinball has no rules; the players make up their own rules as they go along, so that no Calvinball game is like another.

Calvinball is exactly the right analogy here. I reckon the bear market lows won’t be in until Congress and the Fed start playing Calvinball again like they did in 2008-9 and 2020

It’s really really hard to resist comparing today to the dot com Era. The parallels are so stunning I feel like I’m in a time machine.

Tech has fallen, now we wait for the rest of the market, which is relatively untouched. I know this because my DGI portfolio is up 2% for 2022. But no worries, I have been raising cash all year, now at 30%.

Wolf, you make following falling stocks fun.

To Wolf, and all his readers and posters, have safe, and Happy New Year!

+1

1) In the next recession the want of money will rise. DX might rise/ gold might fall.

2) At the bottom of primary wave 1, – Mar 2023 – NDX might popup to a lower high, before the real plunge. It might look like overextended Oct 2007/Mar 2009. A criminal law enforcement student was caught.

3) The Fed will not radically raise rates in order not to reduce them.

4) Gov debt will deflate in real terms.

5) During the crisis RRP might double to provide good collateral to the O/N martket.

6) The Fed might raise assets. // Fed Assets minus RRP = Fed Net Assets.

7) The Fed might pay the primary banks $300B/y – $400B/y on Reserves,

Excess Reserves and RRP. The rest will suffer.

8) Happy new year Wolf and Wolf followers.

The Fed rug pull of liquidity yesterday will definitely help set the pace for a new awakening on 2023 market valuation. IMHO, short-term Treasury rates will go far higher, as equities take on a crypto mining like beating.

Cash is about to become super scarce in our super abundant world. Let every buyer beware

1. I know everyone must exit the stock market now. Please let us know when we can enter.

2. My goals for 2023. Build muscle and burn fat at the same time. Start an investing account with the cash I saved (not much as you may think). Get a real girlfriend. Limit my time on the internet.

3. We visit earth only for 100 years, I do not want to waste it on fighting with others.

4. Look he is still posting meaningless gibberish…

I think you make perfect sense and wish you, Wolf and ALL, a very Happy New Year, with good health, just the right amount of prosperity (as you define it) and most of all, Happiness, in 2023 and beyond!

‘Get a real girlfriend.’

LOL!

“I know everyone must exit the stock market now.”

No no no no, no way Jose, LOL. Each person that wants to exit needs to find someone else that wants to enter. If YOU want to exit, you have to sell your stocks to SOMEONE, and this someone is then in the market, after you exit. For the population overall, there is no exit. Whatever comes must be endured. It’s just a question of who will do the enduring.

Wolf

There are always buyers but they live at much, much lower prices.

And every day the markets are open, there is price discovery.

Unfortunately that’s not the case for housing. Takes quite awhile for consensual hallucination to wear off.

Exactly that’s what I meant when I said, when all don’t want to play anymore (the Calvinball game).

All want to exit sometimes at the same time and very few are willing to enter the game, that’s when the game/market crashes the hardest.

It’s all play and fun as long as you are winning or “feel” you are winning or will win.

Happy New Year everyone!

I am glad u are still obsessed with me, following me, imitating my style.

I ignore my stupid gibberish. I change my mind every day, every five minutes.

Happy new year Cobalt, relax.

Let Michael Engel be. He’s not hurting anyone. Besides if it passes the Wolf test then it’s good enough for me. Happy New Year All.

You gonna keep the doll? Asking for a friend…

LOL!

2022 was actually a great year for those in short term bonds, metals, and value stocks. MSFT, AAPL, GOOG, and AMZN are not a value stocks, and never were. Crypto is fools’ gold.

Nvidia was one of my best stocks ever as I bought it at 20 dollars a share and sold at 120 and parlayed it onto AMD at $6.75.

It wasn’t that long ago when $200B was considered a huge market cap for a stock. I remember it was a huge deal on CNBC when MSFT and AAPL first went over $500B.

The problem is, it’s way too easy for most people to adjust mentally to new prices. When an asset price rises, it’s outrageous at first, but then the new price becomes a floor. I see the same effect with housing.

Few people have the mental presence to recognize this slippage and avoid falling prey to it via the inevitable price crash.

The key is to anchor all your purchase decisions with something tangible like your salary or retirement projections with inflation scenarios built in.

re to Wolf, who wrote in comments [Dec 1,2011]:

A crash in stocks…puts huge pressure on the Fed. But where it really gets dicey is when the credit markets freeze up. When credit markets freeze up, the Fed will step in. Credit markets freezing up ii a very serious thing in an economy that runs on credit.”

And later that day… “My biggest fear is that we have a crash and that credit markets sieze, and that the Fed buckles under that pressure and reverses course and starts the whole shitshow all over again, which would be catastrophic.” And …”with all that liquidity still floating around…But once that liquidity gets drained some more, a crash or some market event might become more likely.”

Regarding liquidity, I add here a coincident crash that is already a suspect, as follows:

FOOD includes air [oxygen] supply and potable water.

All money depends on timely availability of FOOD supply to preclude starvation death. I.e., Money has no value without just-in-time FOOD being available.

All the liquidity and all the reserves can’t put unavailable FOOD supply back together again.

We know what has happened, even decades ago. We know where we ar right now. So what to do going forward?

After reading the first several paragraphs, forced to consider what the the present on-the-ground attitude about sketchy investments is. In lite of the information you have illustrated and discussed:

The image of Monty Python’s Black Knight declaring, “tis but a scratch” haunts my natural tendency to plan for the likely future, expected outcome.

While I am sanguine about 2023, in general, I have a 65 pct probability estimate that the stock market will collapse in a manner similar to the past.

Jeremy Siegel thinks that US stock market will be up by 15 pct by the end of the year, which would put it back to the nose bleed peak, in nominal terms, rather than significantly lower as your charts would suggest if I were to interpret them in a manner of the amateur technical analyst that is a part of the human DNA.

Hat’s off to Dr. Siegel for throwing down the gauntlet of intellectual freedom, discussing an idea in an open forum.

If I heard him correctly, the foundation of his bullish opinion seems to be based on the idea that the empty suit Fed will cut and run, with the 10 year yield being comfortably back at the QE low of 1.75 or so. Which would require a fire hose of liquidity supplying the financial benchmarks.

My opinion carries no where the weight of Siegel’s, because I’m not sitting at the table like he is. Just like everyone else, my predictions are naive in the sense that I have no inside information about what the bureaucrats have in mind like he does.

Is he daft, arrogant, or honest. His is the curse of the burden of responsibility.

I heard Jeremy Siegal say after the GFC when everyone was pessimistic on stocks recommend for people to buy stocks because stocks usually have very long run after a financial crisis. I doubted he would be correct, but he certainly was with SP500 going up around 6X.

Buffet called GFC bottom pretty well too with an article in Wall Street Journal. Buffet always says he has no idea what stock market will be in a year.

Didn’t he say that back then AFTER the Financial Crisis had hit, and AFTER the S&P 500 had plunged 50%??? Now we have a growing economy, no financial crisis, still the bubble of all bubbles that has barely started to deflate, and raging inflation. People are too impatient, it seems. But we are going to get rallies, for sure for sure, as the charts show.

There are those that would suggest that the stock market rise since the end of the GFC, and it’s correlation with the reckless expansion of the money supply, the era of QE, is likely to continue.

A de facto confirmation that the controlling paradigm is still the abundant reserve model, manipulation of the financial markets, as opposed to the fractional reserve model of central banking that tolerated crashes without intervention.

Also didn’t Siegel go on most of the msm platform and cry about FED is raising interest rate too fast and tightening too much?

Think he might be looking for a full time gig at MSNBC soon enough..

“Is he daft, arrogant, or honest?”

All three. He’s an economist.

CAPE ratio on the sp500 is still a nosebleed 28, and interest rates are still rising..

The stock market still has a long long way down to go now that ZIRP is over.

HAPPY NEW YEAR everybody!

What a crazy trip this year was!!!

I’m going to check out here in a minute to deal with a potential liquidity situation in the making. And I will see you in 2023.

feliz ano nuevo

I also have a current liquidity problem that will be solved as soon as I discover where the bathroom is located in this casino.

Most Often found behind a Wall of Slots :

I wish we could just skip 2023 and just start 2024 with a new Crew >

Thanks, Mendo, found it. I think you should be more explicit and describe who are the crew and what their failings are. Not manning up causes internal injuries.

I cannot remember the day, 365.25 days ago, the New Year of 2022. Maybe, that is the point of the holiday.

A day off to celebrate being alive with a license to explore the more foolish tendencies that add the spice.

The New Year may be forced upon us by the Goliath, California, a lumbering giant, like a Montana Grizzly bear.

Faced with being the focal point of every social malady that ails man, global warming, environmental degradation, political corruption. This jewel still glitters with the brilliance of the real sapphire which I gave to my wife 50 yrs ago.

I think that music is an expression of that undefinable human trait, love.

Of course that stone is buried away in a safe deposit along with the authentic Nazi memorabilia that my Dad collected during his European tour of duty in 1945.

Someday, it will have historical significance that is more important than the political, at which time I will donate it to a museum, where it will be displayed in context along with Dad’s dog tags.

Inflation Cleansing ? is no Pill for that yet and simple Rate Raise’s a Good tool is not going to get the Job “done alone ” along the river of destruction .

BIG as a House with a short sale sign once called equity , A Once empty warehouse now full of Unemployed Homeless , foreclosed Workers and their Families, Huge Lots of repressed Cars and Trucks going to wholesale actions X Realtors holding on to Foreclosure Sales Jobs at Wobbly Banks . Rows of Homes for sale now heavily discounted Yes 2023 May end up a year to remember the proof is in the pudding . New Years Resolution just skip 2023 > A Whole new Crew to Clean the Mess

1) Happy new year BOJ. Interest rate is still zero, no change, way below the inflation rate, deflating gov debt in real terms, imitating the Fed gibberish of 2% target.

2) Happy new year the DJI. After a close below Sept 2020 high, – a warning sign, – in Oct 2022 the Dow produced the largest green bar. In Nov The Dow retraced 90% of the move from Apr high, completing DM #12.

3) Red Dec retraced 38% of the move. In Jan the Dow might move slightly higher. Who knows, in 2022 we have seen it all, after swimming with the sharks.

4) Really ? Stay flexible.

5) ME & Cobalt entertainment pair are trading on “Wolf Street View”.

The DJI/DIA has looked quite suspicious.

As others have been commenting above, Home Dumpo, has been even more suspicious as it hasn’t shown any signs of weakness in their quarterly reports and filings. I’ve wanted to short them for weeks but have sat on my hands for the same reason as ME mentions – I think DOW will push higher in the first two weeks, or so, in Jan to create a max pain scenario.

It reminds me of the Bitcoin pump towards the end of 2021, before it turned into a T-bone steak tossed to a pool of Pirahna – a collateral pump before the harvest. Or was it a tub of crab legs to the buffet spread?

There is no more collateral left in crypto so is 2023 the year the DOW is liquidated back to 2015ish levels to cover the derivative madness?

Wolf, would you be willing to write a piece on these OTC contracts and what kind of REAL damage they can do? I research and read some other financial blogs and they always talk about them like a financial, end-of-times, weapon of mass destructions – always sourcing the 2008 detonation. However, nothing notable has happened, at least in my spectrum, except the increase in their notional values even as ISDA phase 6 supposedly rolled out. I guess 2023 will hold all the answers, although any info into the market maker world could be vital.

Thanks, Wolf, for helping me better understand this crazy game in 2022.

Wolf Happy New Year!

So reverse repo 2.5 trillion, up 200 million! Possibly 5 trillion max? Mortgage backed securities 2.7 trillion?, I believe not sure. Supply of treasuries are low. So a lower rate. Historically the spread has been between 1.25 with treasuries and MBS’s. Would this be the bottom? With repo 5 trillion an mbs’ gone? Thinking full stop an the pause or pivot with more downside in all assets.

If the Fed tweaks the interest rate it pays on reverse repos — for example by raising it 10 basis points when it raises the other rates by 25 basis points — those RRPs will begin to vanish. They’re just a really good deal. They’re paying 4.3% on overnight money, collateralized too! I’d happily give my leftover cash to the Fed for 4.3% overnight! My high-yield savings account, which is similar in that I can get my money transferred out the next day, yields 100 basis points less (3.3%)! To get 4.3%, I have to commit money for 2-3 months. For Treasury money market funds, RRPs are the best deal in town.

So keep your eyes out for that kind of move by the Fed to tweak the rates it pays on RRPs and reserves.

If RRP and Excess reserves vanish liquidity will flood the markets

during high inflation, depriving good collateral from the dehydrated

O/N market.

Before rates hike, JP sucked liquidity from the markets raising RRP in six months, between Mar 2021 at zero to $1.6T in Sept 2021.

The current RRP is $2.55T, the highest ever. possibly on the way to $4T – $5T next year.

Wonder why the mechanical jaw econ 101 prof still can’t get it.

This is money that is chasing yield and found risk-free 4.3% in overnight RRPs. This is not money that will go into stocks if the yield doesn’t quite keep up with rate hikes. This is money that is looking for low-risk yields. So it will go into banks and will boost reserves, and it will go into Treasury securities with short remaining maturities.

Yes money is no longer trash! So the fed sets this interest rate, not the market. I thought it was part of draining liquidity, or the feds plan of bringing inflation down. (or the start of) The balance sheet is all part of this I thought and using the repo market to do this. Therefore the RRP would vanish. I will look out for them tweaking it though. Thanks again.

The low supply of treasuries is a bit of a mirage. The TGA has gone down from nearly a trillion to under half a billion in the span of six months. And this is before the debt-ceiling Kabuki theater show premiers with a Repub. controlled House in the summer.

Correction: half a trillion, not billion.

In other words, it’s reasonable to expect more treasuries to come to market before the summer.

1) Inflation is down from 9.1% to 7.1%. If the Fed raise rates above the

inflation rate, gravity with ECB and BOJ will drag it down.

2) Within days the Fed might raise rates. The Fed might raise moderately in order not to reduce them later on, stay the course.

3) The cost of gov debt is rising. The cost of paying the primary banks

on Reserves. Excess Reserves and RRP is rising.

4) If companies profit dive they might cut healthcare insurance, before layoffs. United health, the leader of the pack might get a stroke. The

Dow might tank.

Yield curve control means a flat yield curve – deflation in due course.

The irony is that the BOJ instituted its yield curve control because the 10-year JGB yield had dropped into the negative, and the BOJ was worried about the banks, which have a real problem with negative yields. The ECB too had to make special accommodation for the banks to deal with negative long-term yields.

In 2016, when the BOJ announced its yield curve control, the 10-year yield was negative and falling. So the goal was to put a floor under it and keep the 10-year yield “around 0%,” rather than negative. The BOJ later shifted the band to range from +0.1% to +0.25%. And it recently widened the band, moving the upper limit to 0.5%.

This yield curve control put a bottom under yield when it went negative. But over the past few years, the 10-year bounced into the top limit, not the bottom limit, which changed the nature of this yield curve control.

Note that the JGB yield curve is NOT inverted, like the US yield curve.

Happy 2023!

My goal for this year, is to not look at models, data, news stories or believe that I understand economic or financial stuff. I’m going to dumb down core concepts about valuation and analysis. Any fire sale opportunities will be suspect. I think we’re about to enter a period, where virtually every corporation and government will come to terms with pandemic overshooting.

Too much money and nonlinear thinking pushed everyone down the path of excess, accelerating plans, purchases, pushing out flawed products, shortcutting, adding liabilities, ignoring risks. The insanity of the pandemic gave us this environment, but heading back into reality, at a fast pace will mean everyone pays. The global depression that was bypassed by global stimulus has been delayed by a few years, but now it’s time to pay the piper…

Looking back at the Everything Bubble, it’s important to realize that virtually every metric used for financial analysis was broken, distorted or misused. The lesson after the dot-com bubble was to realize that doing excellent due diligence didn’t matter, primarily because corporations actively misinformed the sec and public with false financial reporting.

If the market falls into a tailspin soon, the idea of picking up bargains seems alluring, but that’s the exact sentiment that’s been a sirens song for all the falling knife crypto stocks, that are either down 70% or joining a growing pile of bankrupt morons — connected to a very long string of pension funds and 401k passive investors that will have substantially less asset value through 2023.

The entire spectrum of financial participation, from super quant hedge fund rocket science geniuses to biotech genetic wizards, crypto savant anomalies, Warren Buffett, etc — are all noise to tune out.

2023 is a year to be very patient

Happy New Year Wolf! That rain gives SF a nice fresh start to the year. Nice way to start. I sure hope I see the same towards the end of May.

I’m looking forward to the New Year. I’ve been practicing for over 75 years.

Best wishes.

The rain stopped a few hours before midnight Dec 31, and it has been beautiful and sunny ALL YEAR so far.

I went on my first swim of the year this morning… the Bay was just gorgeous, the sun was warm, there was no wind, and no chop. Couldn’t ask for more.

Ooooooph. Wet suit?

Just me, my Speedo, goggles, and a thermal cap to keep my brain from freezing up. It’s adictive.

I thought this Reuters article about Sovereign Wealth Funds and Public Pension Funds getting whacked might be of interest to Wolf and others here.

“Denmark’s ATP had had the toughest year anywhere with an estimated 45% plunge that lost $34 billion for Danish pensioners.”

“”If financial markets continue to fall in 2023, it is likely that sovereign funds will keep ‘chasing elephants’ as an effective way of meeting their capital allocation requirements,” the report said.”

That last quote seems kinda worrying. Is that really a sound paradigm?

Yes. Some of the leveraged British pension funds nearly blew up the gilts market a couple of months ago, remember? Leverage is a killer for pension funds. But in the ZIRP and NIRP environments, they took on huge risks (leverage) to get to their returns, and now the shitshow is coming home to roost. Everyone has known for years that NIRP and ZRIP have that effect.

The whole pandemic freeze followed by the explosion of free money fomo has now reversed. For stocks, real estate, cars, luxury items (like the Rolex index) , even airplanes tickets and airbnbs.

I’d like to know how many people are leveraged to their eyeballs just as they are about to lose their jobs (and their benefits).

Blood in the street is coming. When it smells like cadavers I’ll buy.

Michael Burry says we’re headed for a bad recession in 2023 followed by a Fed pivot, including stimulus like in 2020 and renewed unabated inflation. The more things change, the more they remain the same.

Happy New Year

> Michael Burry says we’re headed for a bad recession in 2023 followed by a Fed pivot, including stimulus like in 2020 and renewed unabated inflation. The more things change, the more they remain the same.

I personally would love to see that!

Burry was a QT denier and predicted that the Fed would pivot in the summer of 2022. This was among the Wall Street jabber that caused the Fed-pivot rally in June/July. And then the Fed replied with more 75-point rate hikes.

Burry was probably situated to take advantage of the pivot rally then dump those securities into the lap of his Twitter followers.

Burry is a hedge fund manager. Whatever he says, he says to make himself money on his short-term trades.

I forgot about Webvan, a great opportunity during the Dotcom Bubble:

Bankruptcy

The company lost over $800 million and shut down in June 2001, filing for bankruptcy and laying off 2,000 employees.[18][1] As part of its shutdown process, all non-perishable food was donated to local food banks.[19]

And now, as we enter 2023, the Everything Bubble will be like a grand 4th of July fireworks show, with a climactic pyrotechnics display, with exploding collateral, lighting up the dark night. Fairly soon, we’ll see more banks, pension funds, corporations and billionaires all connected to an insane skyscraper of fantasy, that has absolutely no value. As cash becomes scarce, these morons have nowhere to hide,

Provident Bank (still late reporting to shareholders on crypto losses) a great example of an entity trying to buy time and hoping nobody cares…

“The company said its expected loss is linked to a partial writedown on cryptocurrency mining rigs that were repossessed in exchange for the forgiveness of a $27.4 million loan. Excluding that loan, Provident said its digital-asset mining loan portfolio totaled $76.5 million at the close of the third quarter.”

I was just looking at pension and crypto correlations, and came across a few stories from 2021 era, but one story was about a Goldman Analyst, in 2021, screening for companies that have exposure to crypto. Of course, that was the exciting time to get in and chase mindless, risky stuff. His list is great and hints at how widely connected this mess was, as it was being pumped higher and higher.

Here’s the list of stocks (starting with stocks with the highest exposure):

Marathon Digital Holdings (NASDAQ: MARA);

Riot Blockchain (NASDAQ: RIOT);

MicroStrategy (NASDAQ: MSTR);

Silvergate Capital (NYSE: SI);

Square (NYSE: SQ);

PayPal (NASDAQ: PYPL);

Overstock (NASDAQ: OSTK);

NVIDIA (NASDAQ: NVDA);

InvestView (OTC: INVU);

Ideanomics (NASDAQ: IDEX);

Tesla (NASDAQ: TSLA);

JP Morgan(NYSE: JPM);

Visa (NYSE: V)

Bank of New York Mellon (NYSE: BK);

Facebook (NASDAQ: FB);

Mastercard (NYSE: MA);

Broadridge Financial Solutions (NYSE: BR);

IBM (NYSE: IBM);

Coinbase (NASDAQ: COIN)

They had to have a market cap of 1 Billion or greater, thus a lot of names that have exposure aren’t listed, but…