Monetary Rug-Pull? December dump in the markets anything to do with global QT?

By Wolf Richter for WOLF STREET.

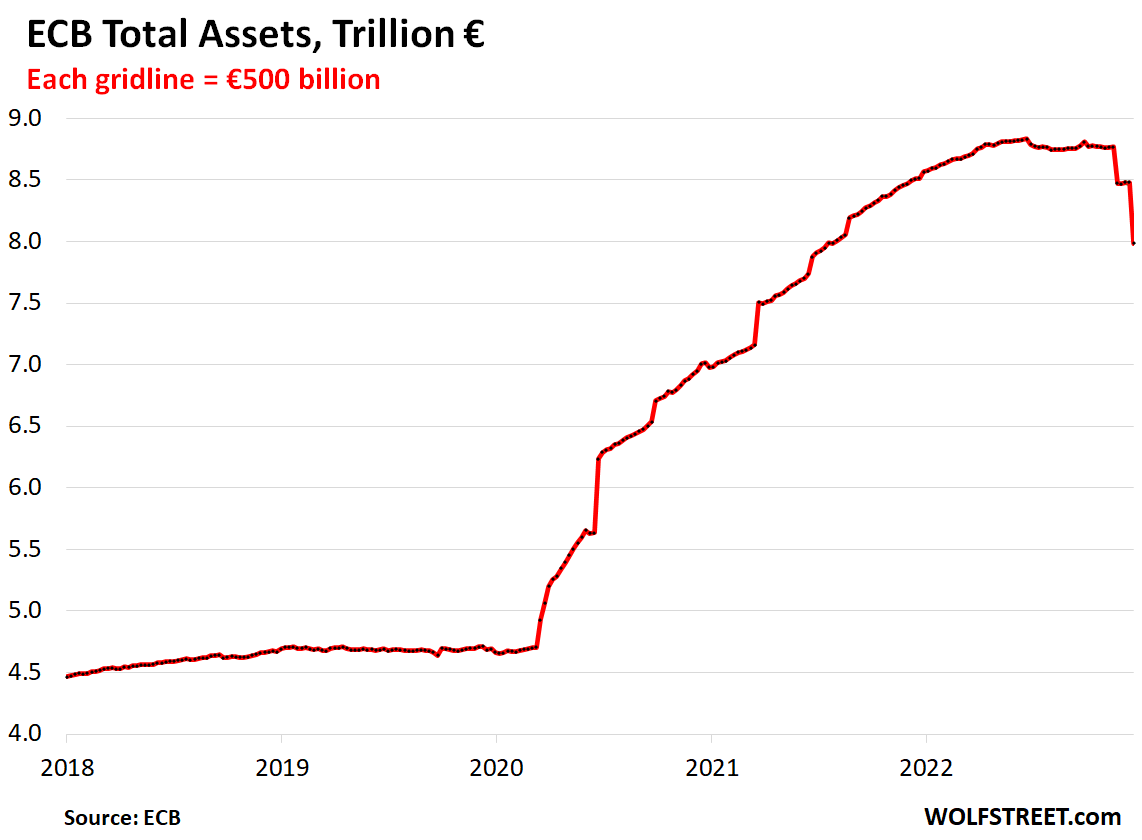

Total assets on the ECB’s balance sheet, released today, plunged by €492 billion from the prior week, to €7.98 trillion, the lowest since July 2021, and are now down by €850 billion from the peak in June.

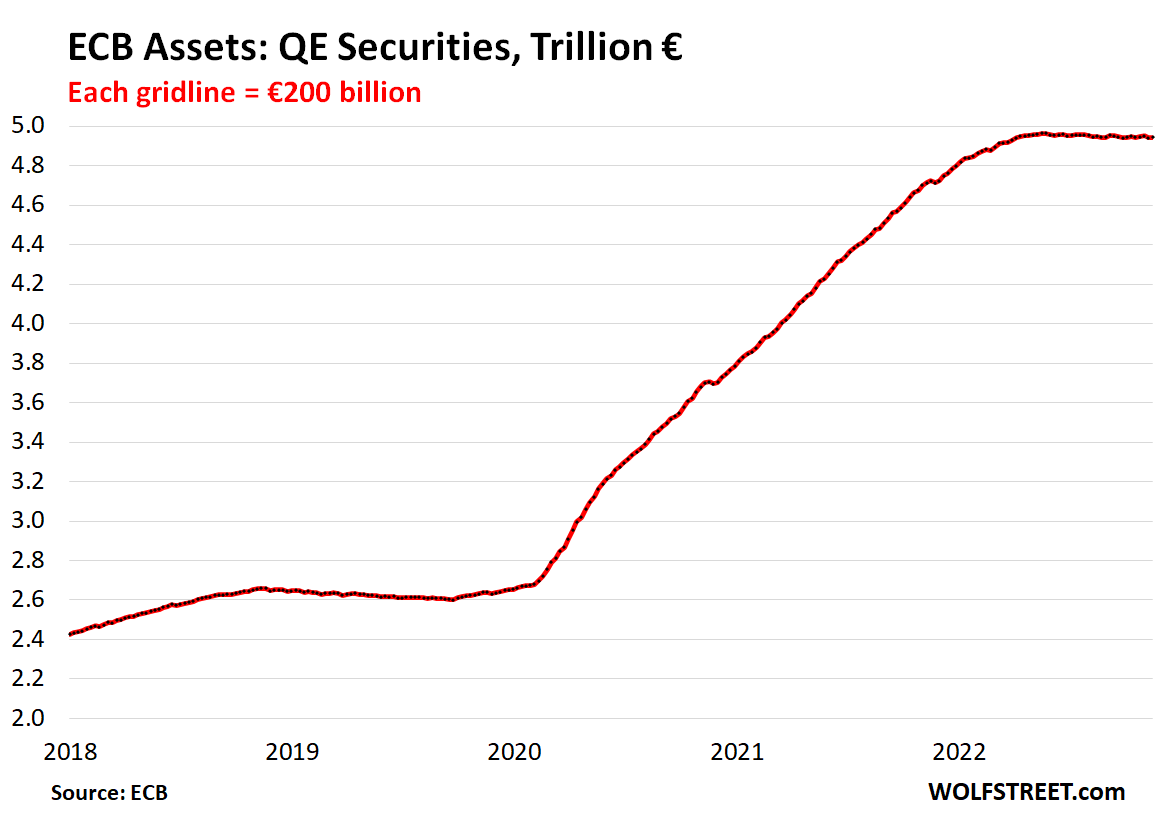

The ECB had two major types of QE: It handed cash to banks via free-money loans, and it handed cash to the bond market by purchasing bonds. Those were the good times, RIP. All this has stopped. And now the ECB is unwinding this stuff.

At its October meeting, the ECB announced Step 1 of QT: Unwinding the loans. At its December meeting, it announced Step 2 of QT: shedding bonds it had purchased. What we’re primarily seeing here on its balance sheet today is the effect of Step 1 of QT – the first big batches of loans got paid back. This looks like a monetary rug-pull:

The loan QT: massive.

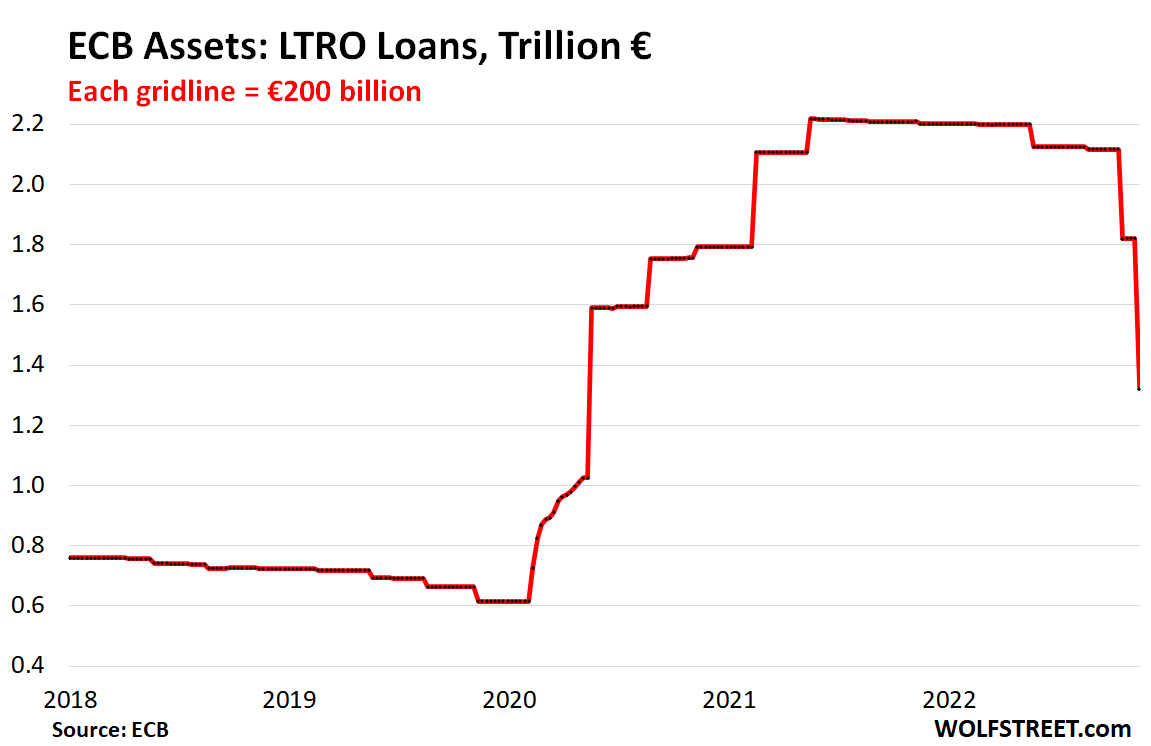

During the pandemic, as part of flooding everything with liquidity, the ECB lent cash to the banks – the Targeted Longer-Term Refinancing Operations (TLTRO III) – which the banks would then spread around. From the beginning of the pandemic through July 2021, the ECB handed out €1.6 trillion of those loans.

These loans came with complex incentives to encourage banks to lend them out to businesses and households, which banks would do, and thereby replace other funding, that they then could use elsewhere, such as to buy other stuff with, such as securities. That’s how these loans enabled banks to buy stuff in the markets globally – which helped inflate asset prices. And when they pay back those loans, they have to shed some of this stuff…. we’ll get to that now.

At its October meeting, the ECB announced Step 1 of QT to “help address unexpected and extraordinary inflation increases,” as it said. To do so, it made the terms of these loans unattractive for the banks, which would induce the banks to pay them back.

The loans have dates at which they can be paid back. The first payback date was in July, when €74 billion in loans were paid back; the second was in November, when €296 billion were paid back.

The third payback date was in mid-December. At the time, the ECB announced that €447 billion in loans would be paid back. Today, it booked €498 billion in loan paybacks on its balance sheet. The total balance of Long-Term Refinancing Loans has now plunged by €896 billion from the peak in June 2021 (€2.22 trillion) to €1.32 trillion today.

This is a huge amount of liquidity that vanished since mid-November, €743 billion in two moves, which could have well helped incite the dump in the markets globally since then:

The bond QT: not yet, but coming.

At its December meeting, the ECB announced Step 2 of QT: It would start shedding its bond holdings in March 2023, initially at a rate of €15 billion a month. Details will be announced after the February meeting, it said. The pace of subsequent declines “will be determined over time,” it said. Since then, there have already been comments by ECB heads about accelerating the bond QT.

The ECB ended QE in June 2022, and “securities held for monetary policy purposes” have remained roughly stable since then. On today’s balance sheet, the securities amounted to €4.94 trillion, down by €20 billion from the peak in June:

When the ECB received the €895 billion from the loan payoffs, it destroyed the money, just like it created the money when it originally made the loans. This is a massive amount of liquidity that came out of the financial system over about the past six weeks. Everything in the financial markets is global. And QT is global. And it’s not just the Fed. And it’s just the beginning.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

How long until the Zobie companies die?

Fed is far ahead of ECB and US has many zombie companies whose stocks have imploded. However, seems like few bankruptcies even today as investors keep funding zombies in hope of Fed Pivot.

J Pow has so far consistently failed to:

1. crush Pivot narrative.

2. Meet inflation targets.

So it’s a very long road for Europe.

isn’t EU always pumping money at end of year

guess they need to strangle few banks

Also very long road for USA Leo,,, just exactly like last crash and all the others this old boy been involved in since 1956 when WE, in this case the family we, lost the farm and a second house in order to be able to keep the house we were living in at the time…

Surely, IT IS DIFFERENT THIS TIME,,,

but only in some aspects,,, as every time

BEST OF LUCK to all you young and younger folks trying to figure out WHICH,,, eh,,,LOL

So…Wolf, when money is paid in exchange for high-priced shares, and then those shares go to Zero, does money die along with the new Zero share price ?

And doesn’t that involve the multiplier effect, in the negative?

If you have a stock with a very good balance sheet and good dividend history you should be able to calculate the value within about 25% or so.

Most other stocks are speculative bets and if the price goes from 100 to zero in a year or two then it was a speculative fail and there was an economic loss to society as real resources were used for a bad business. But some gamblers on the stock price won and some lost.

Stock market price is not real wealth until it is sold unless it is delivering a permanent income stream. Fed running easy money causes too many addictive gamblers to speculate on change in stock price and not focus on income stream. So market price booms and busts hurting society in the process. Amen.

Without the punch bowl it’s not much of a party.

ECB is straight up ripping the band-aid off.

No, ECB is far behind Fed. It’s evident from higher inflation in many parts of Europe and lower interest rates.

No. With interest rates 8% to 12% below inflation, I’d say they are whispering gently to you as they twist the knife.

“With interest rates 8% to 12% below inflation….”

About the same in the USA ….. interest rates somewhere around

11-12% below the true rate of inflation (15% USA inflation per Volcker’s CPI).

How refreshing, actual QT at a pace that would effect inflation and discourage risk taking.

So how do you get 4 trillion off the balance sheet and out of the money supply….or back to where it “should be” in normal times? Is the problem once the horse is out of the barn, the CB is stuck with an extra 4 trillion floating around? I am not clear on how the CB can go back to an “acceptable/normal” amount of cash on the balance sheet–it seems like there is an extra 4 trillion to burn. Any insights or the cold hard truth appreciated.

Central banks are in the business of serving their 1% masters, whatever it takes. So the want to inflate away corporate and govt debt with very high inflation, while preventing the kind of hyperinflation that will cause the peasants to revolt. So don’t have high expectations.

They cannot Pivot because the hyperinflation threat is still very real as production in units is still below pre-pandemic levels.

How about debtors in general wanting to inflate away debt? In a consumer economy that includes hordes of semi-peasants. And creditors (mostly well-moneyed folks) wanting oppositely to maintain discipline in money’s value? There are players positioned all over the spectrum in an economy as complex as this.

I hope Wolf will make a comment on this and shed some light.

1. My understanding is that the Fed traditionally used to inject money through Primary Dealers (the big banks that essentially own the Fed and work in unison with it). This way the Fed could keep tabs on where the new money was going.

2. During the pandemic however the Fed got stupid and injected money directly into people’s accounts (e.g., credit unions, local banks, etc.). I am not sure how you can get that stimulus money back to where it “should be” like you asked.

3. The only way now the recent printed money could be destroyed and taken out of the system in my opinion is if it is retired through bankruptcies, job losses, asset losses, etc.

John Apostolatos,

Please read this. All the way down. It will at least answer part of your questions:

https://wolfstreet.com/2022/12/01/feds-balance-sheet-drops-by-381-billion-from-peak-december-update-on-qt/

Thanks wolf.

” QT, though it’s slower than QE, will be causing the opposite, and we can already see the effects, with bond and stock prices down substantially from a year ago, crypto imploding, and home prices starting to fall.”

With asset prices down, then the value of collateral should go down, therefore people cannot keep borrowing money against collateral and spending it freely and cause more inflation. At least Powell and ECB are moving in the right direction with QT.

So is Lagarde somehow related to Volcker?

Dang, those are some steep slopes. Nice job, ECB!

JPowell?

re 2., the government injected money into people’s accounts, the FED can only create financial-sector money, not real-economy money.

Real-economy money is the one used by non-financial private sector agents (e.g. households, corporates) to make transactions tha contribute to economic activity.

Financial-sector money is the one used by financial entities: mostly banks, but also pension funds, asset managers and so on.

quoting ALFONSO PECCATIELLO (ALF) on the above

it said it burned the money . so all paid money is gone

Good start. Several trillion Euros to go…We are going to be feeling this “slower than QE”, QT for years to come. No soft landing in sight. Why not just face the music and admit the shit is going to hit the fan in 2023? I guess that’s just not the American spirit to admit defeat in the face of the truth.

The only one saying, that we are going to have it tough, has been the Bank of England….

“Oh when to the heart of man

Was it ever less than treason

To go with the drift of things;

To yield with a grace to reason

And bow and accept the end.

Of a love or of a season.”

… especially when the season in question is the one where cash rains from the sky.

Transfer balance to actual owners not share holders of assets.

Share holders own shares not actual accounts on books.

Credit issued by reserve are from actual account held as reserves which bolster economic options.

Assets must be equal to those liabilities less owners equity held on balance sheet.

Actual bank balance is the account owned by account owner who holds security over lending entity. Actual security accounts also referenced as ‘reserve funds’ are not currency accounts = each number is per share in account not actual currency.

There are very few actual owners or reserve fund owners. Reserve fund owners are those institutional investors who were first deposited upon initial investments. Reserve funds are those funds which own majority ownership within any given bank.

Years ago federal reserve was created to create a viable source of credit to all member institutions via reserve fund accounts. King Edward was an original investor in federal reserve with deposits globally. Some refer as sovereign funds but that term is incorrect. All current owners are not sovereigns. Corporate ownership of banks are generally held under trust organization structure.

“Monetary Rug-Pull?”

Perhaps. I keep thinking about Stanley Druckenmiller’s comments that billionaires like him make a lot more money during monetary rug pulls (during market crashes).

Yet the Pivot crowds keeps holding on to their slim gains, and the bag holders are crying out to the Fed to save them once again.

Who will be proven right? Who do these central banks truly care about?

“Who will be proven right? Who do these central banks truly care about?”

It’s a big club, and we ain’t in it. The FED has billionaires barking at them from all sides. What they want the FED and politicians to do is based upon where their bets are placed. The entire world has turned into a game of Monopoly played by the richest men (and women). They are battling each other for bragging rights, and the rest of us for everything we own. They want it all, and they want it now.

Most of the 735 US billionaires (the overwhelming majority) don’t have the influence hardly anyone thinks they do.

They can influence things like tax policy at the margin but nothing that really matters (like US foreign policy) which may ultimately destroy most of their wealth.

Only a few of them really matter.

Good point. The billionaires do not influence the FED that much, they mostly influence the politicians to write laws that favor their monopolistic industries and tax laws.

Their are always strings attached to politician donations or lack of donations because the big money is going to your competitor.

Actual billionaires number in the thousands most hidden by banks.

Bank Secrecy Act hides billionaires.

Banks hide trillions in hidden accounts.

Does a Trillionaire exist?

1% theory would suggest 1 has existed since 1983 whom is majority owner of US Bank.

FED QE funnels money up to the wealthy class, from the lower classes–the term is ‘allocation.’ But in doing so it runs the risk of asset price inflation, and it pushes loans out on the risk curve. FOMC now pulling in the ropes, so to speak. Congress should have been raising taxes on the wealthy class, not giving them more tax breaks, but that class funds their campaigns. So no tax hikes, which are anti-inflationary.

Give it up, you’re never going to get your wish. Over a history of tax code policy proves it.

High or low tax rates, the only really affluent who pay high taxes are the wage earning tax donkeys. There has also never been a civilization in history that works the way you think it should and there will never be one later either.

In the progressive society you favor where the government sells favors, the highest bidder always wins.

Who do you that’s always going to be?

Per IRS regulations most politicians are lobbying on behalf of wealthy donors limited taxation.

Best example of lobbyists is this:

If account holder has no access then account can not be taxable.

Bank managing account has no reason to grant access and prevents access to actual owners. Hence accounts remain non taxable. My entire inheritance managed without my knowledge seized in 1983 earns interest annually— IRS requested why I had never paid taxes upon account earnings. I never knew about accounts until I began serving within IRS and my manager began my background investigation regarding my asset holdings. I never knew. Accounts managed not by me. My father never told me and never gave me account information. Unless you know account number banks are not required to tell you.

Banks are not required to tell actual owner what they own.

Bank Secrecy Act signed into law by President Trump. Read the law.

European banks have even more security laws.

“Time’s up — Admiral…

Here it come Khan…

From hell’s heart, I stab at thee. For hate’s sake, I spit my last breath at thee.”

+++

“And QT is global. And it’s not just the Fed. And it’s just the beginning.”

Don’t fight the fed is now also:

Don’t fight the ecb

Don’t have a clue what JCB is trying to do, but their last move triggered a reaction like they tightened.

Don’t think anyone genuinely knows what China is really doing… too opaque?

This entire global economic system seems to be connected. The peak of the stock market, real estate market and cryptocurrencies mainly stopped earlier this year.

No matter where, whether it be the NYSE, TSX, Toronto real estate, poo coins; they all appeared to have inflated and also stopped at the same time QE started and QE ended.

No wonder the Canadian government is trying to keep the ponzi bubble when Canadians can’t find family doctors, can’t afford to rent and the shelters are filled beyond capacity.

As I often say around here,

No problem man, this is Canada…

As if…

The connection is the very small pool of people at the top playing slots. Basically, its their very own “World Casino”. The rest of us just get to deliver them their next drink, if we’re lucky.

Had no idea as to amount of reduction of ECB BS. Presume the payback of such loans had to have some impact on Euro bond markets (asset side presumably of bank BS vs. liabs owed to ECB). Took a quick look at rate rises for 10-yr debt of various Euro nations vs. Germany. This reduction in market liquidity did not seem to have impacted spreads to Germany 10-yr yield, other than Italy. US 10-yr T yield rose less over last 30 days than Euro 10-yr yields: this may be due to later ECB signalling as to change in rate policies.

Presume loan/deposit ratios for Euro banks are not elevated and they largely do not need the liquidity to fund much added loan demand. Could be that banks are prone to tightening credit standards, given macro-econ backdrop.

https://www.ecb.europa.eu/pub/financial-stability/fsr/html/ecb.fsr202211~6383d08c21.en.html

EU financial conditions have tightened recently.

Thanks for the note.

The tightening will end when people go back to work and create wealth for their masters.

All the (older) Canadians I’ve met are rich. They have multiple vacation houses in Florida, Costa Rica etc. Admittedly, this is because their poorer counterparts don’t travel (so I won’t meet them). However, point being; there are quite a few rich Canadians who inflated their real estate by redonkulous amounts. Pretty sure Canadians still get pensions too. Us poor plebs down in US lost pensions years ago.

CEO pay going up nearly 20% a year is never a problem, but waitresses earning 10% more will have the Fed up in arms.

Rich get richer my friend. Accumulate assets before the next bubble arrives. They’re doing a bubble every 10-15 years nowadays.

On another note, Michael Synder from the Economic Collapse just gave a shoutout to Wolf and quoted him in his latest article the housing bubble is popping.

Thank you for your illuminating post. I now have a much better understanding of the effect of EU QT on the world, and particularly the US, financial markets for the past six weeks and future months.

Will be an interesting bond market in 2023. Effectively all the EU nations are planning to run government deficits, spending more than the tax take, except this time they can’t rely on the ECB to print up the difference.

So Spain for example will have to issue bonds to the tune of 80-100m euro into the headwind of the ECB who’s also trying to sell its Spanish bond holding, roughly the same amount.

Thank you for explaining this so well. Gosh you are good at teaching finance.

So to deal with inflation they are raising rates on the loans to support the real economy, while for financing government debt as usual they do nothing. So this is the beginning (or continuance) of government funding requirements crowding out the private sector.

I wonder if this idea that you can always fix inflation with higher rates is even possible with global demographics as they are. If I need to roll over a 20 apple loan (for real terms sake) but my source of funds is a non-working pensioner, they can’t not eat irrespective of the interest rate. So there are only 16 apples available.

There is -no- interest rate increase that allows the loans to be rolled over.

Good food for thought, for second thoughts, as I was leaning toward plunging back in on beat-down big tech, thinking a bottom is in (especially with steep fall in TSLA). Not sure where I’ll go, but this helps temper my thoughts.

Are CBs actually disciplined this time in a deflationary direction? It is so counter to the last 30 years, it challenges the imagination. Is it their perception that the old put regime is truly unsustainable? A 64 trillion dollar question.

I am watching a few stocks too. I have read several different places that bottom isn’t in til Fed is about half way through their cutting cycle though, so patience is a virtue I think.

Stocks remain absurdly expensive. S&P has a dividend yield of about 1.6% and DJIA about 2.1% now. Can’t even rationalize it by ZIRP anymore.

Technically, there is no major support until the March 2020 low which is a long way down.

Look for earnings to tank and dividend cuts to follow, making currently “cheap” looking stocks expensive. Most balance sheets are historically weak too, though the interest coverage ratio is still low for many companies.

“Look for earnings to tank and dividend cuts to follow, making currently “cheap” looking stocks expensive.”

This prognostication makes sense and may be the roadmap for 2023…One commenter previously noted the smart move in 2023 may simply be Government bonds, etc. “to slow the bleeding”. Maybe the best way to weather a recession is to proactively tighten the belt and focus on work if you work, reading, recreational activities which are already invested in and trim out all of the lazy stuff like streaming and convenience items. Over the past 20 years it seems the economy has primarily focused on building “big data”, advertising and dumping ungodly sums of money into zero profit convenience services which have simply made people lazy…Talk about misallocation of capital for the past 20 years.

Nathan,

> reading, recreational activities which are already invested in and trim out all of the lazy stuff like streaming and convenience items.

The most valuable thing I own (after my house) is a set of hand weights I bought at Target 27 years ago. Used them this morning in a power-walk before sunrise. No moving parts. Massive contribution to health, physical and mental.

I agree that overall stock market is too high, but there are some individual stocks that are reasonably valued at current earnings and 4% treasury yield.

But I am assuming a recession or persistent inflation is coming, neither good for future stock prices.

World seems too complacent with nuclear powers playing games in Ukraine. Too easy for someone to make a miscalculation.

Here’s an anecdote: Today a co-worker and I discussed the interest rate on our savings accounts. I can get 3.5% risk free. Sort of the antithesis of talking stocks and crypto in 2020-2021.

They will deflate until rich can buy on the cheap ,think farmland in the 80s .This could be a 10 year thing ,I keep hearing about a reset .That means 90 % of people will be peasants,if we survive

As the world went from Roman Empire to Medieval, former freeholders (mostly soldiers who were paid with some land to farm) fell into debt. They ended up crowded together as landless peasant farm workers, many communally in monasteries and so forth. Sounds familiar?

ECB assets higher lows, before rising higher, if the Dow plunge to 25K/26K.

Huh?

Thanks Wolf! Seems to me the ECB moving more with QT than hiking interest rates. Also, is it dollars or euro’s with the QT?

“Everything in the financial markets is global. And QT is global. And it’s not just the Fed…”

Wolf, just to be clear regarding your comment about QT being global, you’re not just referring to the fact that all major CBs are engaging in QT now. You’re also referring to the fact that when foreign CBs like the ECB engage in QT, this not only puts downward pressure on Euro-denominated assets, but it also puts downward pressure on Dollar-denominated assets. Correct? The logic being that, as Euros are destroyed through ECB QT, the supply of Euros goes down, forcing investors to sell Dollar-denominated assets to get Dollars to buy Euros? This is probably too simplistic of an example, but is that the rough idea?

The example you’ve previously wrote about, where the SNB has to unwind its Dollar-denominated holdings to buy back Francs and destroy them (the same Francs it created through QE) to support its currency, is what comes to mind when thinking through this logic. Obviously, the case of the SNB isn’t apples to apples with the ECB. Instead of the ECB buying dollar-denominated assets directly when it engaged in QE, Euro banks and dealers that received the Euros created by ECB QE bought dollar-denominated assets with their excess Euros.

I would appreciate any feedback on this question, thanks.

Seems to me that the only way the Fed knows how to stop the psychology of inflation – which fuels increased inflation – is to show definitively that demand will slow, unemployment will increase which will stop the inflationary pressures of wage increases, and prices will stabilize (or maybe fall) because the buyers can’t afford to buy discretionary stuff. It’s a sobering process and, as any drunk knows, it comes with head and body aches.

If the Fed pivots too soon, inflation will continue to compound. The longer-term effects of rate hikes are not clearly known, so it’s a tough set of decisions for the Fed.

Thanks, Wolf, for raising our collective consciousness about what actions the ECB is taking at this juncture.

The ECB doubled the money supply in two years and now have taken back what 15% of that. There is just so much printed money sloshing around the world as everyone got paid to sit around without producing for two years. I laugh when I read the Fed is so far ahead of the ECB in withdrawing liquidity. It’s like that boat which sinks slowest is best. This is just a start of QT, if we are lucky. Either the Central Banks withdraw this money before it circulates or it eventually comes out of the bank vaults as inflation.

According to WSJ, there is about 30 Trillion in Home Equity in the U.S. For comparison, during HB1 we peaked at 15 trillion Home Equity.

This number is a few years old but ss of 2019, 78.7 million out of a total 122.9 million households own their homes.

So 30 Trillion divided by 79 million households, that is an average of $379k Home Equity per home owner. Of course the average is skewed and most is probably on the coasts or areas like Austin or Denver.

There is still a big wealth effect out there.

I heard a smart guy say there is only one way out of this mess without a lot of pain and that is some technical innovation that increases productivity. Otherwise the debt burden is just going to slow growth and result in managed interest rates so the interest payments can be made.

I have the answer to everyones questions.

Why not have a FREE market society?

You know, built on individuals freedoms?

BubbaJ – please describe your list of ‘rights’ and how they will be embraced, practiced and maintained for and by ALL, given the seemingly-infinite ability of our species to define, then game and cut corners, of ‘rights’ for SOME (hmm, sounds like the issues the Founders wrestled with, probably not even able to imagine how the results of their work would take things from the zeitgeist of their day. Yeah, I know, events are always driven by the cold equations of adaptation and evolution on this space rock against which there is little, truly long-term, success by ANY species…).

may we all find a better day.

“Rights”. The framers considered “rights” and generally described them as “life, liberty and the pursuit of happiness”, similar to the French: “liberty, equality and fraternity”.

Libertarians only recognize one of these: “Liberty”. They don’t think any other rights are worthy of consideration. But, if they were to lose their advantages (and wealth), they’ll be first in line to demand that the other rights be paramount.

What did you expect? Dr. Philips and Dr. Keynes were from Great Britain.

Your 2) contradicts your 1). The US treasury issues bonds and receives money from investors, per your 2). The US treasury then “spends” this money back into the economy.

Your 4) is just wrong. When a US treasury debt security matures that is held on the Fed’s balance sheet, the US treasury pays that money to the Fed (not the investor). And in doing so the debt security is extinguished and the money paid to the Fed is destroyed (QT). The US treasury pays for these maturing debt securities either by issuing new debt securities to the public or by raising taxes. Either option removes money/liquidity from the economy.

QT will continue to look like a senior citizen picking up pennies in front of an ice-powered steamroller.

In my opinion, short-term treasuries are a fine place to hide during the next 8 months.

Wolf,

Many, many thanks. Had no idea.

One wonders though about the effects of this rapid monetary policy shift. Were any of the banks using the monopoly money to trade less liquid assets? If so, then these might be facing a liquidity crisis or worse.

Also as someone further up in the comments noted, good luck to European nations in funding budget deficits now. Fiscal discipline? Ooh, the pain and howling that lies ahead.

J. Powell: Teddy Bear

C. Lagarde: Grizzly Bear

High and rising inflation has very negative impacts on Banks and other long term lenders. Inflation must be reduced to protect the profits and capital of long term lenders. The purpose of Central Banks is to protect the interests of their member banks.

Meanwhile the omnibus bill is in the trillions. Would that be an inflationary?

Yes. All government spending via debt is inflationary. Increased debt will devalue the currency which is inflationary.

You got to hand it to the outgoing house in getting the bill passed, but upping the debt ceiling. It forces the new Congress to have to pass the debt limit for something they would not have voted for.

I think the DC crowd want a debt crisis or they wouldn’t be running up the debt so fast. A crisis is when they can get people to accept higher taxes or cuts in benefits.

Are there parallels between TLTRO III in the Eurozone and Overnight Reverse Repos in the US? The balances of the former are being drained efficiently and at speed while the same cannot be said of the latter.

AB,

You misunderstand the relationship between ONRR usage and market liquidity. Increased use of ONRR is a form of QT as it takes money supply out of circulation.

So the higher ONRR goes, the more restrictive this becomes for market liquidity.

ONRR usage has risen $184 B in the past two weeks. Today’s operation hit $2.3 T.

That always goes up at the end of each quarter. Next week it will drop by a lot.

The Fed’s balance sheeting is barely coming down. Not even $43bb came off the books the last 4 weeks. Anemic. It will never go below $8T. They’ll pivot by then.

Z33,

You’re spreading ignorant BS about the balance sheet. The Treasury roll-off happens mid-month and end-of month, which is when Treasury notes and bonds mature. So the next balance sheet will show the roll-off for the end of December.

From the peak in April through the end of November, total assets on the Federal Reserve’s balance sheet dropped by $381 billion, to $8.585 trillion, the lowest since November 3, 2021.

On the first Thursday in January, I will report on the end-of-December balance sheet, and it will have dropped by about $460 billion from the peak.

The Fed’s balance sheet will drop below $8 trillion in June or July.

This is through November:

https://wolfstreet.com/2022/12/01/feds-balance-sheet-drops-by-381-billion-from-peak-december-update-on-qt/

One thing seems clear to me is Powell is trying to tighten money as hard as he dare while Congress is trying to deficit spend as much as they dare roughly 5.5% of GDP or 1.4 or 1.5 trillion.

Seems like incoherent policy when you have just gotten over a decade of zirp and 4 trillion debt monetization because of the last big screwups.

I agree that this is a pathetic rate of QT. They are basically only willing to let things roll off, they dont want to take the hit from selling assets at a loss. Assuming that inflation comes back down, they will be able to lower interest rates in the near future and then continue to slowly liquidate the balance sheet. If, on the other hand, inflation proves more entrenched or bounces back up, then the unrealized losses could skyrocket. And since they are paying out higher interest than they receive, there can be big losses even if they dont liquidate it.

My guess is that something else breaks before we are out of the woods. I think that major losses in the housing market are the next shoe to drop.

HR01

Thanks, but I’m still confused.

ONRRs are a product of QE. An overprint of money that was subsequently taken out of market circulation, but done so by the Fed paying, rather than charging, interest on the balances.

The Fed acquired bonds and lowered market rates as a consequence of the QE that subsequently gave rise to ONRR. Sure, ONRR prevented short-term rates going into negative territory.

But in the round, a rising ONRR balance, plus interest payments, cannot drain the Fed’s assets because, when traced, substantially and ultimately, they are the Fed’s assets. Money is not being destroyed. This is in contrast to TLTRO III in the Eurozone.

ONRRs do not logically meet the criteria of a net money draining facility to my mind, but at the same time, I share your point about market liquidity.

AB,

Let me put this way: the drop in the TLTRO IIIs and the current increase in reverse repos both drain liquidity from the markets. Both are a form of QT.

Reverse repos are a liability on the Fed’s balance sheet, not an asset. So when they increase, as they are right now, liquidity drains from the market to the Fed. But when assets increase (under QE), liquidity flows from the Fed to the market.

“unexpected and extraordinary inflation”

“unexpected”, Really???

Why are these people in charge of the monetary system!

Well, the interest rate on deposits at my local bank and most banks is 0,01 % for a 1-year deposit, while inflation is 10,4 %.

A few days ago the CEO of the biggest bank bragged how they are “flushed with money”, so there is no need for money anymore and deposit rates will stay at that level “for years”.

The QT from the ECB doesn’t seem to filter through …

What’s happening with EU interest rates and capital flows?

Will there be another Eurozone Crisis similar to 2009-2010?