“The value of discipline is currently at an all-time high,” after years when the value of consensual hallucination was at an all-time high.

By Wolf Richter for WOLF STREET.

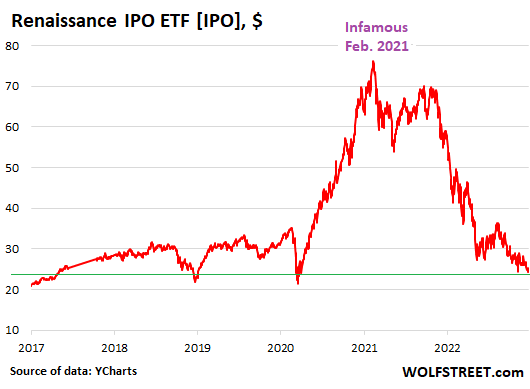

IPOs have had a crappy time since that infamous February 2021, nearly two years ago, when the whole hype-and-hoopla show, fueled by what I call consensual hallucination, peaked and then started coming apart beneath the surface of the broader stock market.

The Renaissance Capital IPO ETF [IPO] peaked on February 16, 2021, at $77.05, and has since then plunged by 68%, to close on December 23 at $24.38, barely above the March 2020 low, and back to where it had first been in May 2017. Five-and-a-half years of gains gone to heck (data via YCharts):

The IPO ETF tracks the largest most liquid IPOs that came to market over the past couple of years. The index is rebalanced on a quarterly basis; older IPOs are removed and new IPOs are added. Its top holdings at the end of Q3 were SnowFlake (10.5%), Airbnb (9.9%), Rivian Automotive (4.2%), Royalty Pharma (3.6%), and Palantir (3.6%).

In Q4, new IPOs were added, including Intel’s autonomous-driving tech spinoff, Mobileye, the largest Tech IPO of 2022.

The IPO ETF index does not include any stocks that went public via merger with a SPAC. That stuff is even worse. The CNBC Post SPAC Index, which tracks these stocks after the merger with a SPAC, has collapsed by 82% from its high on February 9, 2021.

Bad deals are made in good times. Awful deals are made in Easy-Money times. Few deals are made in bad times.

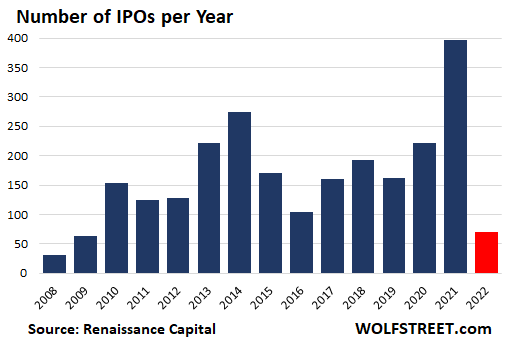

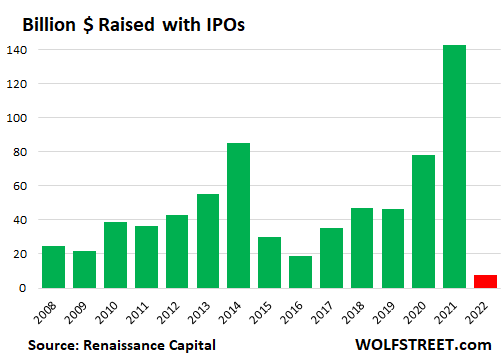

But you have to hand it to the geniuses turned crybabies on Wall Street that are now railing about the rate hikes and QT: In 2021, they were still able to pop out nearly 400 IPOs, the most since 2000, to raise $142 billion, the most ever, according to Renaissance Capital.

And the geniuses-now-turned-crybabies on Wall Street were able to do this in 2021 even as the IPO hype-and-hoopla show had already been imploding since the mid-February-2021 peak, and even after I wondered on March 3, 2021, “Was That the IPO Stocks Bubble that Just Popped?” And even with all this stuff imploding left and right in 2021, forming the foundation for my pantheon of Imploded Stocks, Wall Street IPO mongers were able to raise a record amount of funds and dump these stocks at huge valuations into the lap of the public.

Which is of course exactly what they did in 2000, even as the Dotcom Bust was already in full swing. Back then, it took the Nasdaq Composite two-and-a-half harrowing years to plunge 78%, interrupted by huge sucker rallies, and it didn’t regain its former high until 15 years later, in 2015, six years into the money-printing-and-QE era.

The year 2021 was full of desperate moves by insiders to unload all kinds of stuff at huge valuations while they still could.

And in 2022, as investors had been taking massive losses on their IPO stocks, there suddenly was a shortage of silliness in the markets, and investors had no appetite for getting clobbered even more than they were already getting clobbered, and IPO issuance tanked.

In 2022, only 71 IPOs made it to market – not counting SPACs and not counting mini-IPOs – according to Renaissance Capital’s 2022 Annual Review. And those IPOs raised only $7.7 billion, the slowest IPO year “in over three decades” (data via Renaissance Capital):

Even during the Financial Crisis in 2008 and 2009, three times as much money was raised via IPOs as in 2022:

Bill Smith, Co-Founder and CEO of Renaissance Capital, in his regular Sunday note on December 25, had some interesting observations about the IPO market, about the trend over the past 10 years – the era of interest rate repression and money-printing by the Fed – and what is now coming of it:

“A couple weeks ago I described 2022 as a year of ‘resets’ but one reset largely hasn’t happened yet: Mark-downs of private companies. While public investors are feeling pain, we’ve avoided the hidden losses of the hundreds of large unicorns that stayed private, even if those losses go unrecognized.

“The IPO Market’s seismic shift over the past decade has been the explosion in huge private rounds at enormous valuations, as a result of the 2012 JOBS Act and years of easy money.

“After watching the post-IPO gains of Netflix, Google, Amazon, and Tesla, VCs sought to capture more upside by keeping portfolio companies private for longer. Meanwhile, founders didn’t want to deal with Wall Street’s focus on quarterly results. The saying went that ‘Private markets are the new public markets.’ Some VCs and PE firms even said illiquidity was a feature, since clients can’t sell at the bottom.

“However, an underappreciated fact is that public markets force a certain amount of financial discipline on companies, and the value of discipline is currently at an all-time high.”

I like that, “the value of discipline is currently at an all-time high” – after years when the value of consensual hallucination was at an all-time high.

Good analysts are formed in bad times?

A decade of Easy Money has given rise to all kinds of mindboggling financial nonsense, supported by all kinds of silly theories, convoluted rationalizations, and outright gobbledygook. It was fueled further by analysts and stock jockeys that had been too young to understand what happened during the Dotcom Bubble and Dotcom Bust, had never seen raging inflation, and came up with all kinds of bizarre stuff to make startup concoctions that didn’t have a leg to stand on sound like the next Amazon. They pulled stuff out of thin air to justify ridiculous valuations and make them seem normal. And they’d never seen how willfully wrong the entire VC industry can be for years when consensual hallucination sets in.

So now those analysts are in it for a learning experience, whose fruits will help avoid a similar debacle in the future?

Bill Smith sees some hopeful signs in this regard (and I do too): He wrote: “Another underappreciated fact: Bear markets make for well-rounded analysts. For the past decade, newer analysts have only known good times. Years from now, as they grow into mentors, those analysts can lean on the experience they gained navigating the ‘post-COVID’ recession.”

Yes, but… there were lots of “mentors” around that learned the ropes during the Dotcom Bust, and that have for years warned about this whole mindboggling scheme while Easy Money was turning brains into mush. And they tried to mentor the younger generation of analysts, but those old fossils were blown off because consensual hallucination was just so much more fun — and earned much bigger fees — than dealing with sordid reality.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Can’t wait for the 2023 # of IPO’s in next year’s report. Is it wishful thinking for it to be less than 12, or one a month?

Possible. The analysts can no longer tell investors to forget about profits and focus only on Subscriber count and revenues.

If there was a serious crash with significant bankruptcies and asset correction, it gives a chance to new businesses to bloom. But we seem far and so 2023 may be a slow stagnation year as well.

If inflation remains at current levels, or intensifies, where will the credit come from? (Assuming Fed hews to stated inflation fighting targets). Has the digital opportunity universe (for the present and foreseeable future) become Consensual Hex….errr…..hallucination?

You know there is nothing like failing to remember a lesson. The amygdala is one of the oldest brain parts. It stores failures, like when our ancestors watched someone getting eaten by a saber tooth tiger; you’ll always remember it.

Some of the financiers could care less about the failures they got behind. They were in and out, as Wolf says, leaving the baggage for those like stock owners.

In science, failures far outweigh positive outcomes, but the failures are documented, so they will not happen again.

However in economics, accountants and CFOs know what the bottom line is, and they choose to dress it up, lie about it, or worse, they laid it out as it was, and no one gave the math any weight during this bubble. Math doesn’t lie.

It all was an illusion with bad magic.

When you’re a hammer, everything looks like a nail.

It’s only a failure if you’re the one to lose tons of money. If you’re “ripping the eyes out of muppets” or conning grandma out of her life’s savings – Wall Street calls you a “canny broker.” After all, you’re the brok-er not the “brok-ee.”

Ha Ha it is all relative, the hammers are outnumbered, but they have access to huge sums of liquidity

Exactly, plenty of people saw it and were worried, but not the FED who was the architect of this bubble disaster. What we know about bubbles is they always burst.

Rumble, a SPAC, seems to holding on but I got to give all the credit to big tech incentivizing alt tech.

Yes, it’s down only 63% from its peak.

Gee, is that all? “‘Tis but a flesh wound.”

Looking at the list, the true value of those IPO’s should be zero. Plenty of downside from here. Same for SPAV which shouldn’t even exist.

I disagree the value of discipline is at an all-time high. The bear market has just started.

As for stock analysts, the reason they make stuff up is because they aren’t actually analysts but salespeople. Their goal is to generate business from corporations which isn’t going to happen with unfavorable coverage. That’s why Wall Street’s “buy” ratings are usually worthless. Practically every stock should have had and still should have a “sell” rating now, since the market has never been more relatively overpriced.

Bravo. Well said, Augustus.

Wall Street analysts? Hahahahaha! Just hucksters. Always have been. Always will be

I prefer “shills and mountebanks”

The value of discipline is at an all-time high precisely because a bear market has just started. That’s when discipline is most valuable.

This comment (and others) reminds me of how hype has been normalized in this country, to the point of being widely seen as foundational to “success.” And not just among finance industry types, though it is tragic to see so many bright young people be led to ditch their moral compass for a literal pot of gold.

I know that many everyday folks resist such temptation but even so, they must be harmed by the continual parade of charlatans and tricksters idolized as successful role models. Such is our culture and we are all the poorer for it, each in his own way.

Information is power. Always drink upstream from the herd.

Man you’re spot on there, my amygdala logged the one time I drank downstream.

Two thumbs up!

I won a lawsuit against Merrill Lynch in 1988 before the NASD Arbitration Forum. I had invested in Ranger Oil in December 1980 when Merrill Lynch projected the earnings would increase by 60% in 1981 when they had dropped by 30%. Ranger Oil in December 1980 was valued at $23 a share and in September dropped to $5. I discovered that Merrill Lynch had used Dark Pools to rig the price of Ranger Oil. I also discovered who was the Smart and Dumb money. The American Stock Exchange where Ranger Oil was traded showed 1 million shares were purchased by Merrill Lynch customers when in fact 2.5 million were. The American Stock Exchange reported 400,000 were sold when in fact 1 million were. The Financial Advisors were on the Sell side and Merrill Lynch retail customers were on the buy side.

I was in Arbitration before a panel of 5 Arbitrators, 2 of the arbitrators were attorneys for Wall Street firms. I later discovered that the Merrill Lynch attorney also served the NASD as an arbitrator and prepared a training film as to how to conduct hearings.

In my lawsuit I requested to examine Merrill Lynch’s research report that was issued in December 1980 projecting an increase of 60% in earnings and Merrill Lynch attorney response was “Their Lost!” The arbitrators shrugged their shoulders.

My case reveals the Crime of the Century. The former CEO of Merrill Lynch, Don Regan acknowledged before the U.S. Senate Finance Committee in 1988 that the “Stock Market was rigged and the SEC was a Lap Dog of Wall Street.” In my case the SEC Shad came from EF Hutton and when he left he worked for Drexel Burnham. I received letter from an SEC employee in D.C. that Ira Sorkin Esq, the former head of the Northeast region of the SEC sent to Shad regarding my complaint against Merrill Lynch. Sorkin told Shad that Marino has a substantive complaint and chose not to investigate for two reasons. One, budgetary constraints and two, the fact that Merrill Lynch did their own extensive internal investigation.

I appeared on CNN’s Lou Dobbs Moneyline in 1990 and Ralph Nader published my case in his corporate crime newsletter.

I warned SEC Chair Levitt in August 1998 that the Stock Market would soon crash and warned my clients, family and friends again in 2007. Google my name William V Marino CPA and you should retrieve the email I sent to SEC Levitt. My comments regarding the stock market was published in a Commentary “SEC Office of One Ignores Massive Fraud.” I stated given the Federal Reserve’s embarking on quantitative easing to solve their liquidity crisis, that they would not be able to stop resulting in the U.S. going the way of the Weimar Republic.

Corporate campaign financing of political parties has had a corrupting impact on the U.S. government. Michael Corleone in The Godfather was correct when comparing his family’s conduct to that of the U.S. government.

God help us all. Sadly, the U.S. has gone the way of the Romans.

Great story. Thanks for sharing. Keep fighten!

In my lawsuit with Merrill Lynch, I subpoena Merrill Lynch’s Analyst who stated that in November 1980 prior to Merrill Lynch releasing their December 1980 that promoted the purchase of Ranger Oil stating earnings would increase by 60% in 1981, “THEIR WAS A MATERIAL NEGATIVE UNKNOWN THAT COULD NOT BE QUANTIFIED.”

The Material Negative Unknown was a British Tax Proposal that would place a 15% tax on “Gross Revenues,”

The tax was implemented in 1981 that caused earnings to plummet dropping the stock from $23 in December 1980 to $5 in September 1980. One Merrill Lynch Financial advisor had a $800,000 investment in Ranger Oil in December 1980 and sold out his position to his retail clients who were Senior Citizens, Gifts of Minors accounts etc.

In 1987, McMahon sued Shearson and fought to go to court versus the NASD Arbitration Forum that is controlled by Wall Street. The SEC wrote an Amicus Curiae brief to the Supreme Court supporting the Securities Industry’s Arbitration forum stating “we monitor the cases in Arbitration.”

The SEC is controlled by Wall Street Bankers who have also managed to place their executives and legal counsel serving as Secretaries of the Treasury.

WM – again confirming Carlin’s Postulate. Strength to you…

may we all find a better day.

“Corporate campaign financing of political parties has had a corrupting impact on the U.S. government.”

Utter nonsense. There is no evidence of anything bad coming of campaign corporate finance, which is really just dirty slur for ‘free speech’. You only get money out of politics once politics is out of money.

No evidence apart from the fact that corporations own the politicians.

Maybe you are being sarcastic…..

Hope so.

Si,

I agree with you.

One of the biggest mistakes (and obvious fallacies) the Supreme Court ever made was deciding that corporations are people – they are not. They are a type of business organization for the sole purpose of raising capital by selling ownership in the company to individuals.

No. No estoy de acuerdo.

Yea…cuz lobbyists, unions, etc., have no effect; represent a truly democratic money conduit.

/s

Well, the corporations don’t own the politicians that the public sector labor unions do.

You shouldn’t be able to have it both ways. If corporations are considered individuals, then they shouldn’t be able to bribe politicians for influence; then try to dress a pig up, calling it lobbying.

It is accepted as normal by most folks, yet and it is logically a conflict of interest in favor of the oligarchies.

Cytotoxic,

Blink twice if a corporation is holding you hostage. We’ll come rescue you.

On the off chance that you’re serious, I’ll believe corporations have free speech rights just like citizens when you can hang one from the gallows for their malfeasance, you know, just like citizens.

Cyto – come back and talk to me when the owners of ‘money’ can be drafted in proportionally sufficient numbers to frontline maintain the armed forces that protect it…

may we all find a better day.

VAERS is some strong evidence of something bad.

fantastic read

I won a lawsuit against Merrill Lynch in 1988 before the NASD Arbitration Forum.

Did you receive your investment Back ( I hope at the very least )

Bill,

There is another way to ensure compliance and eliminate fraud (& frauds) from the industry – take names.

Simply take a list of names of those who have wronged you in the industry and then methodically work through that list and exact vengeance for the fraudsters.

If enough people do this – eventually the message will get through to those remaining in the industry.

William — thanks for sharing your story and your insight. Fascinating & disheartening material.

I wonder — what are your thoughts on the efficacy of QT to quell inflation? And failing that, what other tools could be on the table? A temporary wage price freeze by executive order, a la Nixon? Too draconian?

I know the party line for all the graph queens is that inflation in goods is stabilizing, but that is NOT evident in my travels. The delta from one quarter to the next is brazen in some instances. I’ve started keeping itemized receipts for the first time in my life.

The corruption is so blatant. They think they are infallible. Not a good place to be for a society.

W. V. M.

I read this article earlier when there was only one comment.

I’m glad I came back to read the new comments.

Having been a stockbroker for 32 years (1982-2014) I can attest to what you’ve written. My boss (branch manager) decided that 10 of us would associate with a new office ML had just opened in our vicinity. I was reluctant to join them as we were “processed” and strongly urged my boss to go back to our prior firm. This was January ’83 and by April ’84 the regional office had closed our office and attempted to keep our clients (unsuccessfully).

As a final note, I will tell you a story similar to yours:

I had followed Mattel Toy Company since the early ’70s and had owned their stock through the 70’s. After Mattel’s Intellivision blew up Christmas of ’82 (along with Atari) by January ’84 the stock was back down to $5/share from a high of $32/shr early December ’82.

I had been talking to my clients about Mattel and we started buying the stock even though ML had a “sell” rating on the stock. They couldn’t have the retail investors buying while the firm was buying for their institutional clients.

William Marino-

Perhaps you missed the required reading: Fred Schwed’s “Where are the Customer’s Yachts?” (1955). Nothing has changed. The wealth transfer from those sheep who have no more burning desire than to hand over the responsibility of managing their assets to brokers has not changed. The brokers continue to consume which is a benefit to our economy.

The Roman Empire fell from loss of political control. Our democracy just endured the attempted act of sedition from a megalomaniac. The tyrannical madman running the Russian kleptocracy is going to lose his war. Just as Sweden and Finland finally contribute their militaries to the west, there is no loss of political control on our horizon.

You are at the right place. By following Wolf Richter you will prosper.

Loss of political control?

What kind of tooled up, intentionally vague, double talk is that?

You betcha….what we need is more political control! 2008 to the present has shown us what a blessing that can be!

“The Roman Empire fell from loss of political control. Our democracy just endured the attempted act of sedition from a megalomaniac. The tyrannical madman running the Russian kleptocracy is going to lose his war.” You certainly have memorized the talking points supplied to you by your handlers in the Main Stream Media. You are a Good Citizen.

When EF Hutton talked, it sounds as if William listened.

It sounds like you were able to use corporate malfeasance to bail out of a bad investment. Even if Merrill et al had not lied, you would still have lost money investing in the oil sector if you bought in December 1980…

They recommend buy while they sell. If they spread false rumors to entice people to buy while they sell, it is called pump and dump, a form of fraud.

I lost money after a friend recommended the Jerry Wenger radio show, “The Next Super Stock.” She was buying penny stocks (mainly start ups). I bought iron mine penny stocks. It turned out the company Wenger promoted did not own the mineral deposit they claimed they were developing. Wenger was indicted for fraud in 1998.

Talk to a federal Whistleblower about government and what it really is, and who they punish. Our Congress has borrowed $25 trillion since year 2000 and since 2008, the FED printed $8 trillion more. That’s a lot of new money sloshing around in the system.

I went thru my old scrapbooks with yellowed newspaper articles which impressed me when I regularly bought & read PHYSICAL newspapers – which I started clipping from circa Oct 1987 Crash. The Big Financial Picture was sort-of-kind-of-dimly-visible but not quite.

Then I stumbled upon a book by noted astrophysicist which perfectly captures the Spirit of Things Financial, albeit in totally unrelated field:

-There are striking examples in nature of what happens when duplicated, biased, or deceptive data is unleashed. Army ants have minimal visual sensitivity but exquisite olfactory and touch senses. Like many other species of ants, they secrete their own chemical navigational and communication aids in the form of pheromone trails—a rudimentary, albeit temporary, externalization of information.

-If an ant finds a trail it tends to follow it to food or other members of its colony, or army. As it does so, it will add more pheromones to that trail, strengthening it. In most circumstances this is a brilliant algorithmic solution to complex problems. If a trail leads to food, no matter how convoluted it is, the back-and-forth of ants to the supply will automatically strengthen that path as being successful. But if an ant, in exploring, circles back onto its own trail, it can be deceived and start following itself in an endless cycle that just further amplifies the mistake.

-For army ants swarming across the landscape, this can result in a spectacular phenomenon called a SPIRAL OF DEATH, or in more muted terms a “mill”: hundreds, if not thousands of ants swirling around and around, following their ever more potent chemical trail. The largest reported instances of army ant mills have been over a thousand feet across, with the outermost ants taking upwards of two hours to complete their pointless circuit. UNLESS SOMETHING BREAKS THE PATTERN, such as a falling branch or a new nearby food source, the ants can circle UNTIL THEY DIE.

Bottom line:

Expect more of the same for the next 100 years. RE skyrocketing… RE plummeting… FED loosening…FED tightening…Everybody does SPAC & IPO…Nobody does SPAC & IPO…another face-ripping rally…BTC to the Moon…BTC to the Center of the Earth…AD INFINITUM !!!

Good stuff. I sense an Edward O Wilson student, here. Appetite & stupidity know no taxonomic bounds.

The stars are laughing at us.

😁

Not exactly student – I am not blessed with a college degree – but a grateful reader of Mr Wilson’s wholesome pop sci books.

Also I recently discovered what is behind all those never-ending market rallies.

At midnight google “market biggest movers”. And you’ll see some obscure dormant stock in a $1-$10 price range, which lost 98% during the past 3 years and has negative EPS(!!!) – suddenly go up 385%.

This is embarrassing… If I can see it – the whole f… world can see it too.

“…some obscure dormant stock in a $1-$10 price range, which lost 98%>..”

Before you get carried away too far galloping along on top of your wild theories, let me just remind you that those stocks are NOT in the S&P 500 index, and they’re not in the DOW. And if they’re in the Nasdaq Composite, which is market cap weighted, they’re so minuscule, that they cannot move the index at all.

In others words, the commonly looked-at indices — therefore “the market” — don’t reflect at all those drunken midnight observations.

Brent – Richard Feynman?

may we all find a better day.

No, my friend –

Astrophysicist Caleb Scharf:

“The Ascent of Information: Books, Bits, Genes, Machines, and Life’s Unending Algorithm”

Yet another over-educated-super-ultra-smart Brit working in the US.

Brent – thanks. (recalled Feynman recounting in his autobiography about employing the ants’ pheromone track to lead them back out of his kitchen…).

may we all find a better day.

Cathie Woodshed to the rescue. She’ll be there for the 2023 recovery.

🤡💸🤡🤕💸🤕🤡

Good article..thanks Wolf

A youngish guy I know, who is sure he knows everything/more/better than anyone else bought into the SPAC frenzy.

As he smugly told us one evening of his investment genius, I just sat there and did not say a word. No reason for me to argue with the genius who was telling us all how he was about to become wealthy.

Ended up as just another choice in his long line of failures.

Almost exactly a year ago, an old friend lost his job. He asked my advice regarding his life savings (which would need to last from here on out). I suggested the most conservative approach. Then, he told his “financial advisor” to be as aggressive as possible.

Today he texted me that I was right and he had lost almost half of his money.

No joy whatsoever in being “right” here. I’m sick about it.

You can do your best to help, but sometimes people have to learn the hard way.

Sadly, this friend is not “youngish”.

So very sad. Well, you tried your best. He has still half his money, and perhaps he’ll listen to you now.

Then again….he still had the freedom to make individual decisions.

Did your friend explain why he decided to act as he did?

Wild guesses: overconfidence bias, greed (wish for something-for-nothing), lack of due diligence.

Re: ‘He asked my advice regarding his life savings (which would need to last from here on out). I suggested the most conservative approach. Then, he told his “financial advisor” to be as aggressive as possible.’

There is an ancient and wise saying:

‘Give the student only one piece of the puzzle. The rest is up to them.’

(Save your breath for few will listen.)

As they say, a financial advisor’s main job is to figure out how to get your assets transferred onto his balance sheet.

Sounds like your friend’s “advisor” is having a nice Christmas while your friend is facing financial ruin. A story to warm the hearts of every sociopath who runs free on Wall St.

People stopping to share bearish sentiment, talk down friends who go all-in was the true sign of the peak bubble.

Superb article!

I completely agree that privately held companies are the next shoe to drop in valuation now that the frothy NASDAQ and tech sectors have meaningfully corrected. The PE and VC firms believe they can just “hold their breath” through what they think is a temporary downturn and then cash out and go public when markets revive in a year or two.

You will know the bottom is in when the private market capitulates.

Fully agree. It may be a long breath hold. Hope they are prepared…

I never forgot the Dotcom bust. Nasdaq peaked in March 2000, I believe. I was trading making six figures and lost just about everything-about 90% of my money. Too stupid to take a loss and sell earlier. I had to go back to work. lol. Now, I have no problem taking a loss. It’s called preservation of “remaining” capital and don’t take it personally.

Fortunately, I started a business after all hat, made six figures again and got into real estate. Now, I work part time again a few days a month. IDK what to say except sometimes bad times teach you good lessons in life.

Stay grounded and humble. You never know when life is going to throw you a punch in the guts.

Any experience is good experience.

… depending on when it arrives. There is such a thing as “too late” and “all out of E tickets.” (The latter is an ancient Disneyland ride tickets reference — out of the great tickets to the big, fun rides.) Or, as I was told is a German proverb, “old too young, smart too late.”

I heard, “How soon we grow old and how late we grow wise.” quite a lot in my first few decades phl.

Not sure how old one must arrive to before the wisdom kicks in???

Now suspecting it just looks wise when one is too feeble to get into trouble.

I usually tell folks, “Try to stay out of trouble,,, just try, in spite of the fact ya can’t.”

”Bad news travels like wild fire, good news travels slow.

That’s why they call me wildfire everywhere I go.”

Phleep/VVNV – R.A. Heinlein’s observation was:

“…curious how often ‘mature wisdom’ resembles being ‘too tired’…”.

(…speaking only of myself, of course…).

may we all find a better day.

Not always!

And the top in 2000 mirrored the top this year closely. Good enough for me to figure we were going into a bear market and get out. Carnage in bonds convinced me this near is going to be biblical

Good for you to clearly remember the dotcom bust. I remember it vividly as well and see many similarities between that time and the present. And just as during the dotcom boom/bust, there were a small number of voices in the crowd who consistently said “this is not based on financial reality and cannot last.” Like Anthony and Michael Perkins’ book “The Internet Bubble” did back in 1999.

What amazes me is how some of the millennials (and apparently some older investors as well) seem to have completely disregarded that period and its lessons. I suppose it sometimes takes a firsthand experience to get the point across. A punch in the wallet, so to speak.

Cold – seems like the only thing that is never different is the belief in ‘this time it’s different’…

may we all find a better day.

On the heels of the dotcom bust (and 9/11 attacks), came the classic 21st century bailout: one more iteration of the Fed put. That was back when the barn was still full of hay (lower federal deficit/debt, etc.). What is different this time, IMO, is that attempted use of the put will set the barn afire, or to switch metaphors, push us back onto a slippery sloping ski-jump, of inflation.

You made risk decisions that fit your tolerance level.

Not stated critically – I did same last year when my intuition was markets were gonna drop significantly (and that I wasn’t market savvy enough to sort winners from losers). Capital Preservation is exactly how I thought of it – inflation notwithstanding. I ended up down 2% for the year. Coulda done better, but parked money in higher interest opportunities while working to an understanding of the gameplan for the next several years. Problem is committing to a new strategy!

In the wide spectrum of wall street financial engineering, from IPO to, space, crypto or anything resembling FANG, every single entity is marking time and hoping they can wait out the recession hurricane.

The pandemic party barge will capsize and the only survivors will be entries that make sustainable cash versus the massive amount of zombie con artists that have grown used to burning excessive amounts of cash, while pretending to be successful.

As the clock ticks forward, during the hurricane, it’s going to be increasingly challenging to play on the beach.

Agree. Could take years though.

Jeremy Grantham said in an interview that some young whippersnapper made fun of his big ears when he warned everyone about the “Everything Bubble” bursting and the danger of crypto investing.

And yet the ETF price is still 20% above its 2017 price!!!! I expected the chart to show it was down 70% from the IPO price … or lower.

Just goes to show, gamblers will always keep the WS house whole and profitable. When one batch leaves broke, a new one arrives flush with cash to feed the machine.

It was so systematic, what a sausage factory, what a sucker factory.

But a concentrated bet in something like this was always a gamble. It lacks real, serious diversification, because it is so context-concentrated, so dependent on many variables going just right. Never has such a broad cross section of such innovators come up all roses.

Simple reasonable diversification (hold mostly broader ETFs) would diversify away this risk. A thin slice of one’s portfolio in this would have been reasonable for a short time: a bet further out on the risk curve, that macro conditions will stay crazy long enough to produce the fantasized returns, in at least enough of its members. But VCs who use that sort of model (knowing lots of losers will happen, alongside hopefully a few super-winners) do diligence on each component. They don’t just throw darts at a board.

This bet, as presented, was pure bigger-fool theory, a casino bet that more fools will buy the gambler out. So, something of a zero-sum, ponzi dynamic was here. Which always ends badly, inherently.

Last one out turn out the lights. The greatest creation and disappearance of wealth many will ever see in a lifetime. The thrill of victory for some, and the agony of defeat for others. The game is still being played as Wall Street sets up the next folly. Inflation seems to be transitory, the termites are coming for the long over due brunch on home equity. Water, food, and electricity are uncertain vital resources in some areas of the so called richest country in the world.

List Games…

*BINGO

*COINO

*SWIPO [ie, Suckers Welcome-Investors Piss Off]

*BANKO/RUPTO

*GLOBO/THRMO/NUWAR

Can’t find Tic-Tac-Toe!

This is one of the best comment lines I have read. Thank you. My two cents is that clients are told there is money to be made in securities price discovery (thar is gold in them thar hills). However, in our world, a lot of marketing happens in that process. Just like consumer products, promoters try to convince us why we need them. But we can’t see and touch equities nor can we know what management is thinking. Though publicly traded companies disclose their finances, there are countless ways to omit and distort. So we are stuck relying on others who don’t suffer if we lose money. The only truism I can think of is that the Fed has a major impact on the cost of capital. Period. I worked for a large public Company. Over in the confidential boardroom, there was talk of a PE buyout (KKR and CDR). We worked for many years to make the business successful only to have PE suck out the equity for themselves. They borrowed every possible nickel against the assets. Then closed and sold the less profitable divisions. Their goal is to dress it up and take it public once again. Just like flipping homes. But the investing public doesn’t hear this story. Instead, they are fed “reduce corporate taxes to save our Country.” We only ever paid 5% which is nothing compared to what PE sucked out. A comment above stated that Wall St was rigged in the 80s. I think it got worse. The beasts like ML manipulated customers against each other. Today they do the same and secretly plot with PE. And our politicians are an accomplice. Politicians even trade on non-public information and nothing happens to them. So when financial advisors ask – what is your risk tolerance? I say terrified. If all people thought like me, the markets would be flat and boring and Companies would have to impress with actual results – no hype. Happy new year to all.

Wolf, your term “Consensual Hallucination” needs to be enshrined in the finance world’s lexicon. Just a few examples.

IPO

SPAC

MBS

Add to the list “CH” to universally describe the investor of today. It is brilliant and why so many read your column.

Tesla down another 9% today. Seems like is dropping 5-10% every day – a genuine falling knife. Shareholders are finally starting to understand the risks.

Is there any convincing reason why Tesla should be above pandemic lows of $32? That’s another 60% drop from here.

“Is there any convincing reason why Tesla should be above pandemic lows of $32?”

Isn’t that TRUE for most stocks, housing and everything in general?

This stagflation won’t end. Too much money was created.

As I recall—coming from the “Sgt Sunshine, Hippy Dippy Weatherman, wear flowers in your hair” era when going to San Francisco, consensual hallucination was a sensory based phenomena, often commune based after sharing LSD, and sometimes manifesting in hominids thinking they were birds and flying off the Golden Gate to inadvertently feed the lurking sharks, Great Whites. You know, Wolf, tune in, turn on, and drop out. “It’s all good,” while meeting one’s libertarian marginal utility preferences on Stanyan Street. It appears to be back, only with a consensual delusional aspect which is cognitively based, as in existential bad faith; I have no choice or NOIA. Thanks to the pill, or Roe V Wade, or “free money” now I do have a choice. So what was good for Ken Kesey’s toilet bowl Jesus and the Hell’s Angels for pissing in is good enough for Marx, Mao, Mohammad,——-fill in the blank, but preferably in American Standard or Toto while mandated for all public gender neutral bathrooms. Eg., the visage of DNI. Sec. James Clapper finally makes it to the crapper and urinals at the Top Of The Mark. Funny how keep America green grow grass got recycled from Kesey’s bus to windmills and EVs. Merry Christmas.