In California overall, prices dropped year-over-year, as sales collapsed, supply more than doubled. No dear, this isn’t just a seasonal dip.

By Wolf Richter for WOLF STREET.

San Francisco and Silicon Valley are now in the solid leadership role of the housing bust playing out in California with sales collapsing and prices heading south from the peak in April at an astonishing pace.

Just about everything that could come together came together. After a two-year outflux of workers due to working from anywhere, there came the collapse of the startup and crypto scenes, starting in 2021 and continuing unabated, leading to the early entries into my pantheon of Imploded Stocks. In early 2022 came the spike in mortgage rates. In mid-2022 came the downturn in employment at Big Tech. By that time, the Fed had been hiking its policy rates relentlessly, and Quantitative Tightening had kicked off. This was punctuated over the past two months by the chaotic dismantling of the workforce at Twitter and its ecosystem.

Local budgets have fallen into deep deficits – though most are still flush with cash from the pandemic funds received from the federal government and the state.

Vacant office space that is on the market for lease and sublease continues to balloon, while landlords have started to file for huge reductions in assessment values to lower their property taxes, which is going to cut revenues further.

This comes garnished by stories in the New York Times that Twitter stopped paying rent on its leased office spaces, and that it was instructed not to pay vendors. At least one of those unpaid vendors – a Silicon Valley company whose software Twitter had licensed – filed a lawsuit last week in San Francisco Superior Court for nonpayment. It stated, “shortly after Musk’s purchase of Twitter closed, Twitter refused to pay the outstanding quarterly invoice, which was due on November 30, 2022, and Twitter disclaimed any obligation to pay any future invoices…”

These are all signs that the housing market is going to get a lot messier. Prices have plunged the most in San Francisco, followed by the Silicon Valley counties of San Mateo and Santa Clara.

In San Francisco.

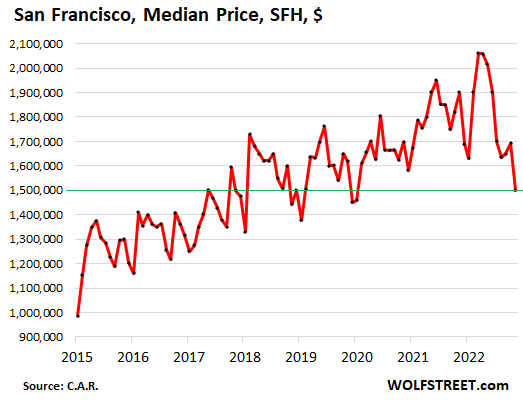

The median price of single-family houses sold in November in San Francisco plunged by 11.4% from October to $1.50 million, and by 27% from the peak in April, according to the California Association of Realtors. A nasty-looking chart:

Condo prices plunged by 4.3% from the prior month, to $1.15 million, and by 9.5% year-over-year. Since the peak in April, the median condo price is down by 15.5%. Condo sales in November have collapsed by 49%.

Seasonally, the lowest months are December and January. So that’s still to come.

But who is going to buy in the spring selling season? Prices normally rise as demand picks up in the spring; but who will be the exuberant tech workers that will want to overpay for a house by borrowing against the collapsed value of their stock options? Those lucky ones that still have jobs and stock options?

The housing markets in San Francisco and Silicon Valley are tied to the boom-and-bust cycles of the startup scene – now combined with the crypto scene and cryptos – and they’re tied to the stocks of startups and big tech and social media companies in the area, to the jobs that have to be done locally, and to the value of the stock options. All of them are puking.

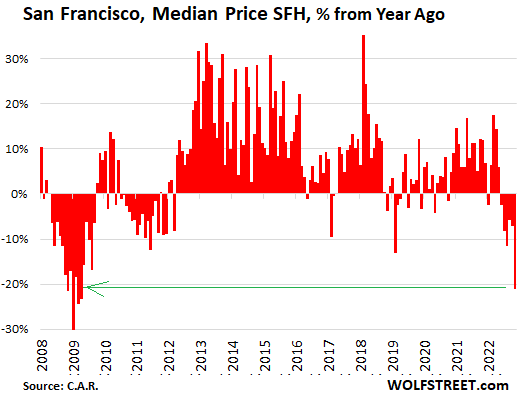

Year-over-year, the median price of single-family houses in San Francisco plunged by 21%, the sixth month in a row of year-over-year declines. It was the biggest year-over-year plunge since the peak of Housing Bust 1:

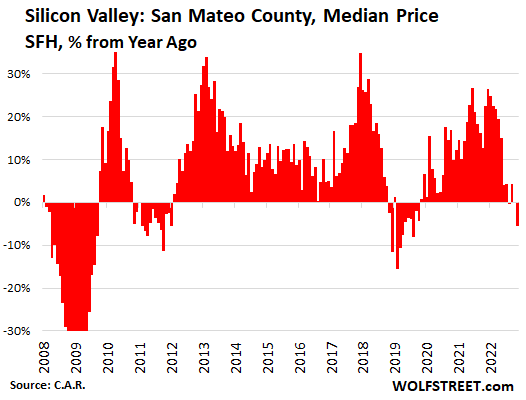

Silicon Valley, San Mateo County.

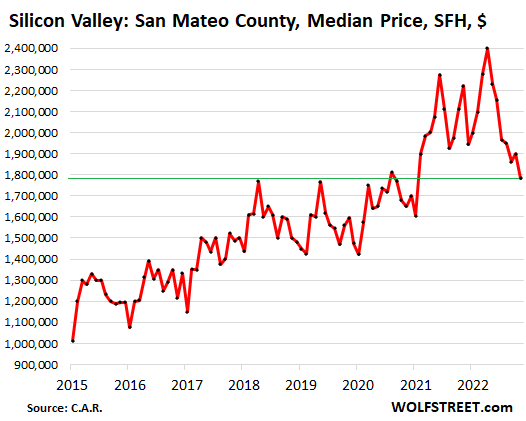

The median price of single-family houses in San Mateo County, which forms the northern part of Silicon Valley, plunged by 6.2% from October to $1.78 million, and by 26% from the peak in April.

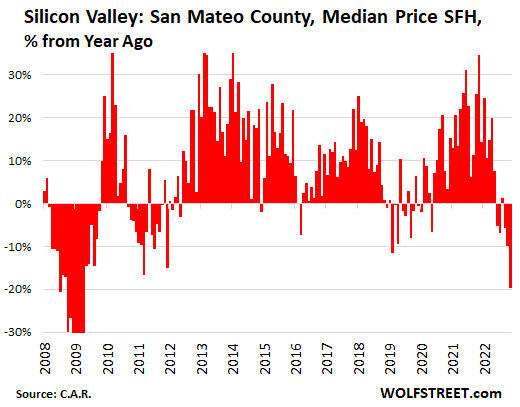

Year-over-year, the median house price plunged by 20%.

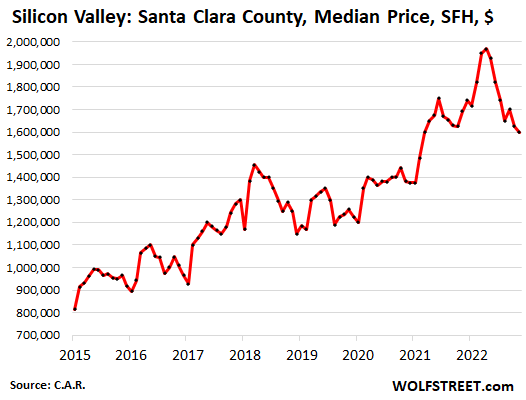

Silicon Valley, Santa Clara County.

Santa Clara County, which forms the southern part of Silicon Valley and includes the Bay Area’s largest city, San Jose, is lagging behind but is moving right along. The median price of single-family houses dropped by 1.5% in November from October to $1.60 million, and by 19% from the peak in April:

Year-over-year, the median house price dropped by 5.5%, the first significant year-over-year decline in this cycle. Prices had already undergone significant year-over-year declines in 2018 and 2019, and were on a downward path until the trillions in money-printing, the surge in the stock market, and the interest rate repression began to boost prices again.

Currently, Santa Clara County lags San Francisco and San Mateo by a few months, it seems.

In all of California.

Sales of single-family houses in California collapsed by 47.7% in November, compared to a year ago, the biggest decline since 1980, according to the California Association of Realtors. Condo sales collapsed by 46%.

Unsold inventory more than doubled year-over-year to a supply of 3.3 months, and days on the market also more than doubled – before sellers pulled the unsold homes off the market again.

For all of California, the median price of single-family houses plunged another 3.0% in November from October, which pushed the price down year-over-year (-0.6%). The median condo price fell 2.1% in November from October, which whittled down the year-over-year gain to just 2.7%.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

But but but.

The weather….

Current Trends:

1. Pricing house at Zestimate is the guaranteed way of failing to sell your house as Zestimate are lagging prices on way down.

2. If you really elneed to sell your house due to lay off, consider pricing it at 2019 price as it’s still 50% more EMI than 2019 at same price, due to much higher interest rates. Please note that this doesn’t work for San Francisco and here 2017 price is a much better bet as per charts above.

What you recommend is a depression era strategy, presuming that prices are about to collapse.

The asset price of housing is likely to decline by a significant amount. Anyone at risk should sell their over priced property asap.

rent prices are going to skyrocket. i wouldn’t sell, just rent.

You make a strong point.

Plus, it’s just a gully!

I’m not worried about it. The home I purchased in Santa Clara in 2010 is worth twice what I paid, even with the price drops. Now the two rental homes I bought last year in TX may dip a bit but they’re long term buy and holds so a drop in value doesn’t really affect me much, plus I locked in an interest rate at about half of what you can find now.

The weather in the San Joaquin valley is terrible! Waaay too hot and waaay too cold! But, the San Joaquin Valley is the only place that’s still liveable, even California style, for a working person. The weather is good in California only in a narrow, coastline strip near the ocean.

“As California goes, so goes the nation “, the saying goes, and if this hold true…

The country is getting ready to experience a dramatic drop in RE prices, precipitating a general financial mess that will make the 2008 Great Financial Crisis look like the “Good Ole Days”.

Plan accordingly!!!

SoCal is still hot, good product is moving with bidding wars.

The issue is low inventory.

Don’t forget that prices went up 40% post covid so even if they come back a bit people have tons of equity.

I think that unless Fed retrieves the trillions it printed, we settle at those higher prices on everything, inflation will eventually come down because of comparison to higher prices and wages will keep going up at a brisk pace so if you can afford it, go and buy a house, you won’t regret it.

“SoCal is still hot, good product is moving with bidding wars.”

Hahahaha, I knew some joker would post this kind of ridiculous BS. So I got this ready, just in case, and here we go:

SFH, median price:

Los Angeles county: -2.1%, MoM; -1.3% YoY; -14.3% from peak

San Diego County: +0.6% MoM; +2.0% YoY; -11.3% from peak

Orange County: -5.6% MoM; -4.3% YoY; -17.0% from peak

SFH, sales, year over sales:

Los Angeles County: -44.5%

San Diego County: -44.1%

Orange County: -46.1%

Definitely a joker…probably a Realtor as well :)

+1. I come across similar sales pitch from seller agents in open houses that have been on market for more than 90 days and have failed to sell despite multiple price drops.

These guys need to be more real if they have to make a sale. During QE, you could find a Moron to whom a banks would lend $1.5 million to buy a crappy house. Those “easy” days are gone.

Good call! They’re always optimistic & misleading.

We went through a 50% price decline in CT when the Roaring Eighties ended. I was a Realtor and a True Believer. I ended up listening to the song “Losing My Religion” by R.E.M. a lot. I lost everything. I don’t try to convince anybody of anything any more. They have to learn through experience.

Eastern Bunny is obviously a real estate agent/broker…. Mine keeps calling to let me know what a great time to buy it is right now in SoCal… I’m close to telling him to lose my number

You need a new RE agent. All 3 of the RE agents I know are telling me to wait.

That is SO-CAL probably probably reading the paper from 2020 high on wed getting free stimis from the local govt. stealing 900 worth of products from the stores. What a STATE!

They have to pay that rent somehow..

Wolf – When do you think we will start seeing this kind of larger drops in home prices in other parts of the country?

3 months? 6 months? 12 months?

Can’t speak for the rest of the country, but sales have definitely started to drop in NC. (Talking about SFH only – data through Nov, 2022). Median prices peaked in June, 2022, at $362,100, and since then have fallen 4.8% to $344,900, though that is still up 6.9% YOY. The trends paused somewhat with the advent of lower mortgage rates, but I would expect to see more pain shortly, particularly in the spring as people who have been holding off listing their home will have to. Coastal and higher end properties are holding value better than everywhere else, though it doesn’t show up in those median prices. Unit sales are down 22.7% YOY.

Concerned,

You might want to just Google “year to date home sales” and a state name – more and more places are tracking median prices and sales volumes for residential real estate (including realtor associations…who have to be under competitive compulsion to admit anything remotely negative).

That applies for many states/metros.

We tend to get fixated on CA because it is a far financial outlier and ground zero of the ZIRP valuation freak show.

When do you think we will start seeing this kind of larger drops in home prices in other parts of the country?….That’s what I’d like to know. I’m in the Northern Kentucky area and prices are still astronomical with outside investors picking up most inventory to flip or rent. I’m a first time buyer and can’t find anything in my price range.

I do not think you will see huge price drops. If memory serves more than 90% of mortgages are under 4%. In an inflationary scenario LOW cost debt is an asset of sorts.

Why would I sell my house at less (with a reasonable monthly carry cost) and then have to buy less house for more(due to higher rates)?

I think we enter a housing dead zone where sales are drastically down, no one is selling because it does not make good financial sense and the market just drags out over a few of years

Sort of a slow price slope down while wages gradually increase thus closing the affordability gap.

Now throw in a deep recession and job losses in 2023 and the aforementioned is obsolete

Concerned_guy,

Anecdotally …

In the Chicago collar counties both Redfin and Zillow are showing price drops of between 5 to 10 percent on properties for sale.

The “time on market” numbers seem to be increasing too. But unless you saved information from an old listing you can’t really tell.

anon – is that 5 -10% drop in median sale price or from listing price?

This was the big final tell: “if you can afford it, go and buy a house, you won’t regret it.”

REALTOR.

Replying to David: “I do not think you will see huge price drops. If memory serves more than 90% of mortgages are under 4%. In an inflationary scenario LOW cost debt is an asset of sorts.”

People wont want to sell but would be forced to sell else sales volume to go down to zero. Home prices are defined at margins.

INflationary bout: This inflation came with record high home prices.. so take this in stride as well.

” so if you can afford it, go and buy a house, you won’t regret it”.

I have many friends and colleagues who bought house in 2021 and many already regret it for following reasons:

1. They waived appraisal contingency and had to foot a large balance as appraisal came in lower, as they had already paid huge earnest deposits to make bid competitive. So they feel they were forced to pay more than they wanted.

2. They mostly bought homes far from office, but now see companies reward promotions and bonuses to other employees that show up in offices. Some employers even require people to show up >50% of time and now they spend 2 to 3 hours on road each day.

3. They see similar houses listed at 20% lower prices that is more than 1 year salary and 3 year saving in this area. They see the trend and realize that it will keep going down further.

4. In a hurry with limited choices and bidding wars, they settled for houses that they didn’t really like. So they had to spend money, time and energy on renovation and/or repairs.

5. Bigger Surprise: Their employers didn’t care that they spent their money, time and energy on renovation, instead, the employers are concerned that they didn’t do enough office work. So, some are now worried about layoffs after being put to notice for poor performance.

Imagine how they’ll feel in 12 months when they’re down another 20% and possibly getting laid off

Yeah, they panicked due to FOMO and rushed to purchase, and now are panicking for economic outlook.

Not to mention that many didn’t account for inflation while calculating their EMI, and so are forced to cut other expenses.

At that point people become numb and make it the lenders’ problem by not making the payments anymore.

Which now makes it the FedGov’s problem, not the banks’ like in 2008.

That raises questions like, “Will $5T in payments to MBS holders in 2024 provide enough stimulus to revive the economy, or will it just drive yet more inflation?”

So, since the Federal Reserve now owns all the housing debt via QE purchases, when housing loans default, does it reduce the money supply? It seems like the QE and direct Fed ownership muddies the asset/liability picture. It is a weird situation to me that I can’t get my head around.

So, the Fed created currency to make the home loan, then the Fed created currency to buy the home loan. When the home loan goes into default, it seems the Fed can take the home and just erase all the currency it created because it was all internal to the Fed anyway. Where is the flaw in that reasoning? I need some help understanding this.

I have been saving my crocodile tears for these folks since 2020, more than happy to gift it to them this holiday season :)

Honestly, everyone loved FOMOing into the market, if we had any level of self restraint or buyer strike, perhaps price wouldn’t have gone as nuts so now that the table is turning, excuse me for not having an ounce of sympathy for them period.

While 1 million Americans were dying from Covid-19 through no fault of their own, greedy RE speculators were out there using the crisis and the low interest rates brought about by 22 million unemployed and 4 trillion injected by the Fed to save the economy, to prey on people’s hardship as a chance make a quick buck flipping homes, over leveraging, etc and then brag about it to all their social media loser friends. Sorry, if they are getting burned now in this RE crash, I don’t give a F… about their problems.

No sympathies for their buying into the mania.

Until early 2020 I had been investing into modestly priced local multifamilies (which I self-manage) and renting them out adorably with plans to buy more. This is the slow road to riches. My places are not dumps as I slowly repair and replace everything as needed (I’m a tradesmen in my day job). Tenants work at McDonald’s, a department store, the hospital and in the trades.

Well now there are no affordable multifamilys, and when I have to replace a kitchen or a business vehicle the costs are out the wazoo. I have yet to jack up my rents to cover these costs.

Low priced money has ruined every aspect of the economy for everyone except the top tier of earners.

Don’t cry for me either. I’ll do just fine. But you should worry about the damage that has been done to many many mom and pop landlords and their exodus from the market – without us all rentals would be owned by scum sucking bottom feeders.

There will be no relief for the working class.

You sound like a good man. Got a landlord just like you and recognize it as a blessing. But I try to be a good renter too.

Enough with the “mom-n-pop landlord” jazz. Couching property speculation in homespun terms doesn’t assuage the stink of this ages-old scourge on the landscape.

@bul…The age old scourge of what? Not every resident owning their own home? There should be no landlords? Buying rental properties and renting them out long term is investing, not speculating. You’re on a business website. What a bizarre and nonsensical comment.

Curious how you survived the rent moratoria?

And Bulfinch, my father did the same as Digger Dave, buying small multi units and fixing them up and renting them out. If you think that landlords just sit back and collect rents and do nothing, you’re sorely mistaken. Many after school evenings, weekends, vacations were spent as a family cleaning, painting, redoing plumbing, tarring driveways, shampooing carpets, mowing the lawns, etc.

We hired contractors for big stuff like roofing and carpeting, but pretty much everything else, we did ourselves.

And as Dave mentioned, this wasn’t speculation, it was investment. There is a difference. If you really think all landlords are parasites, feel free to bankrupt them all by buying your own place. I hear prices have come down recently. No one is forcing you to rent.

But if someone doesn’t have enough money to buy a place, what would they do without rentals? Be homeless? I’m sure your option would be the government giving them housing. That’s already there, and it’s called public housing. If you think private landlords are incompetent, try talking to people forced to deal with the govt as the landlord.

Lune,

None of my dozen or so tenants stopped paying rent during the moratorium. My loans are commercial in-house mortgages held by a local bank, so there was no legal right for them to withhold. Now the local courts were moving very slow on evictions, so if I did have a tenant that wanted to play that game, I would have been screwed for a bit.

I’d like to think be treating tenants right and renting to working class people and having them know that I’ll be there to fix anything that needs fixing goes a long way towards creating goodwill.

I did recently raise my rents across the board by 5%. Two of the tenants had not had an increase for 5 years. My taxes and mortgages have been pretty stable. Only utilities have gone up ridiculously lately.

I have been investing in multifamily rentals for 15 years now. In all that time I have never taken a single cent from the properties. 100% of profits stay in the rental account and go towards projects, and when the balance gets large enough, a down payment for the next one. The fund has taken a little bit of a hit lately, but I’ve been taking steps to cut utility costs down.

My day job is in the trades, where I’m self-employed and my wife is a health professional in the trenches – not a high paid one. If we did have tenants walk away from their obligations, even if they all left, we’d be able to carry the costs for awhile. My per unit cost for every apartment was $65k. This is rural America. It’s a different world.

Renters collapse imminent. This same issue that took down countless investors in the last bust will repeat: leveraged investors counting on a renter to be there.

RE/renting is in a way because of good people like you.

If all rentals are owned by big corps think about the control they’d have.

Thank you and hope you take care of your tenants in a good way

Don’t lecture me about mom & pop landloards. Most of them are as bad if not worse than the corporate scum. I’ve got one right next door to me. They rented to some college punks who sublated the rooms illegally and made a killing on the profit. There is zero maintenance being performed on the property and it looks like a royal s$ithole. I’ve spent over 10K just fixing the damage the overgrown vegetation and fallen dead trees have caused to my property. Once again, save your virtue signaling for someone else. I’m not interested.

DD is correct regarding cost of owning rentals for many legacy LLs:

Working for LLs in SF Bay area in late ’60s-late ’80s, as cleaner, handy one, then GC,,, we spent a lot of time doing repairs and rehabs for small LLs, and they all were of the type DD represents, taking an interest in their renters and doing their best to keep places well maintained. (We chose NOT to work for any large LLs and would not work twice for the AH type of LLs.)

Land lords, as with other occupations, are good ones and ones not so good, no matter the area of enterprise or ”profession.”

And even though the hubris of many if not most real estate folks is annoying, we have dealt with some fine honest and competent folks in that biz too, and have been fortunate to be able to discern the good ones, especially lately.

Good man. Honest day’s profit for honest caring work. I had a landlord like you while going to college and he would stop by for coffee almost every Sat morning before working on the triplex. Old house and always something to repair. He made enough of a profit and we loved him. He was a happy man and his family was happy and well taken care of too.

There is no compliment more valuable than saying someone is a good solid person.

My current landlord on my land rental is a corporate wannabe aging coke head. Miserable insecure miserly person who proclaims his “charity” (which benefits no one) loudly. I don’t know anyone who actually likes him.

We’re in the same situation. I fear that this the markets will implode and landlords will be forced into rent control. As high as rents seem to the tenants, our costs on repairs and maintenance have skyrocketed in the last 2 years. It’s been hard to find a balance. Like you, we appreciate our tenants, we’re trying to keep things affordable but it’s been hard to balance the cost increases.

It’s nice that you posted your imaginative grievances here at the wolfstree dot com blog. Vengeance is yours good sir!

Landlords: Adam Smith got it right a couple hundred years ago.

That aside, it’s the propaganda that really rankles — whenever I read language which attempts to impart something earthy & wholesome to such enterprises.

For years, I’ve watched firsthand the negative impact across different landscapes and communities wrought by greedy speculators/infestors – be it Small-time Charlies looking for some passive income, or black hole smash-n-grab REITs buying up entire streets. I’m not a fan.

In a more perfect world, all the work-shy anglers would just all hustle one another on a private island someplace, flipping nice little mom-n-pop NFTs back & forth to each other — all while staying out of the marketplace of basic-human-needs.

My hope remains that there is a day where people are less inclined to buy up SFHs to flip or rent out to working indigents, and instead, invest in more creative endeavors.

BTW – don’t take any of this too personally, because it’s not an attack. I’m certain your rentals are wonderful and that you’re a fair guy who doesn’t screw your tenants.

I don’t but SFH homes. And it’s certainly not passive income. Boiler dies in the middle of the night? I’m fixing it. Toilet leaks? Me again. Snow plowing and shoveling? Landscaping? Cleaning? Painting.

? Replacing windows? Fixing appliances? All me.

Not everyone should own a home. Smith, commenting on post-feudal mercantilism, had much to say about the ownership of land and exploitation thereof. But he made great distinctions from the tradesmen and builders who built the capital of homes who were in his words, entitled to a “reasonable profit,” versus owners of land who reaped undue and exploitative benefits.

I’m pretty sure Smith would not like the current state of oligarchic affairs in the western economy. I’m doubtful he’d take issue with my providing abode to a few people.

‘If you think that landlords just sit back and collect rents and do nothing, you’re sorely mistaken.”

Oh, my thoughts on landlords are quite informed by decades of personal empirical observation and study, thank you. My vantage and analyses may differ from yours, but it’s no less legitimate. Incidentally, my father and his were also involved in both commercial and residential real-estate, so I know whereof I speak. The very word landlord sets forth monotonal feelings of drear and bloodlessness in me. That’s why I think it’s cute when someone attempts to manipulate popular perception by couching it in roots-y verbiage.

Most of the Landlords I’ve known over the years (I say most, because some were accidental, including myself for a summer), set about outbidding and pricing-out potential owner occupants (from whom they turned around and sponged off) because it was easier, required zero talent/less risk and was more immediately lucrative than actually rolling up their sleeves and investing in creative enterprises which enriched the community in the form of utility, employment, or (gasp) local tone/culture. I’m being a little general here, maybe – but only a little.

Again, I’m simply not a fan. I am a proponent of the Land Value Tax, however. If you’re really invested in the idea of renting out domiciles to people, fine; but prepare to have your ass taxed off.

– Agree. Real estate prices in SoCal still have to fall A LOT if they are going back to the level of e.g. 2019. And they will (in due time).

– Why ALWAYS blame the FED for everything bad ? If the FED is responsible for rising real estate prices then prices in e.g. West Virginia should have gone up by the same amount. Also blame people willing to borrow copious amounts of money.

– The most important thing is income/wages. I already have heard the first stories of people being laid off outside the tech sector in SoCal.

The reason we blame the Fed is because they control the money and they are the ones that encouraged the behavior that has created this mess.

“The reason we blame the Fed is because they control the money and they are the ones that encouraged the behavior that has ENABLED this mess.”

Slight difference.

The Fed created this mess by creating the money. They intentionally created a wealth effect to increase inflation, without the knowledge and conviction to control inflation, as they’ve proven. They exceeded their mandate by converting the Fed from a lender of last resort to a constant interventionist, while lacking the tools to ASSUME that responsibility, without consent of the public. In substance, they experimented with a new monetary framework called Modern Monetary Theory, thinking that money-printing would have no long-term consequences, but the policy was foolhardy from the start.

There is no excuse. It’s time to recognize the runaway authority and incompetence and completely revamp monetary policy and its governance.

Legislatures have done an extremely poor job with fiscal management, but that does not make the Fed’s performance any better. Problems don’t offset, they compound.

Powell is moving in the right direction now, but he must correct his mistakes to preserve an iota of credibility. That means reversing the excess inflation that has been created, not just reducing the rate of inflation. Populations must be allowed to see the structural damage caused by decades of unsustainable monetary stimulus and fiscal deficits. You have to face a problem before you can fix it.

Unfortunately the ‘professionals’ (‘economists’) at the Fed are the good guys here! If issuance of currency is left to Congress, we’ll get MMT and hyperinflation faster. Either way, in the end the value of all fiat is the same: zero.

It is going to be interesting what happens. We have been on gambling money since GFC. If everything has to reprice to a party’s over rate then there is going to be a lot of political pressure on Powell when people start losing their life’s savings because of a bad house purchase.

These are expensive homes so I guess some are nonconforming and are on banks balance sheet. Trouble with a mortgage is there are 360 payments and that means you have to make the payment through several recessions. Can be tough to do.

Chinese money came into the west coast but it didn’t come into West Virginia. That’s where the big difference lies. Once the Chinese show up home prices decouple from income.

Even the Chinese know to avoid West Virginia.

All the talk of “Chinese money” reminds me of the Japanese investors who paid top dollar for Rockefeller Center only to sell it at a steep loss a few years later…

Speaking of selling at a loss, I have a very strange listing that recently popped up a few miles from me in NC (MLS # 2486838 if you get curious) – it looks like the house got sold in November for $520k to “Opendoor Trust” and then listed just a month later in December for $463k. I don’t get what the catch is here.

I’m not talking about absolute values here, I just can’t understand what the point of buying a house and immediately listing it for 10% less was…

IN, I’m seeing a few like that too although I can’t tell who bought it to resell as the county’s info is offline and they don’t answer their phones or go to the office much.

Where did you see that opendoor bought it?

Also seeing some sold for ridiculously low prices off market. Never made it to the MLS. Only one said it was part of a multi property sale, but I think several of them were.

EVEN if I accepted this take, why would I want to buy at what you’ve just argued is the TOP of the market????

Buy high, sell low anyone?

Much better deal if you buy when prices are low and rates are high, and then refinance when rates are low again.

Betting that rates will be low again.. but inflation may never get below 4-5% over long term.

You hit every cliche. This has to be parody.

Eastern Bunny,

Thanks for your expert advice, right?

I am sure many will benefit:)

I think if you truly believe in what you are saying/hoping/praying, I highly recommend that you go ahead and do it, because like you said above, you will not regret it.

Based on your advice, if you, Eastern Bunny, already have a home or several homes, you should buy another (or two).

That is my advice to you, since I like to pay back those who give me expert advice:)

Only young children believe in the Eastern Bunny.

True, the inventory is still historically rather low, but what has happened is that demand is now even lower than supply. The shocking point is that ANYONE that has a choice is buying in this environment when you can wait another year for an even greater discount.

Thanks for your report Wolf.

Coming spring would be really interesting for Housing.

Maybe SF will become middle-class. It seems to be heading that way, which is a good thing.

lol, no way. Home prices would have to go down over 50% from peak and as insane as that market has been on the way up, I can’t see it as likely.

At best/worst, it becomes something that doctors post-residency instead of just stock option winners maybe could afford to get into but that’s about it.

Agreed…people really need to learn what median US household income actually is…

SF is about as potentially middle class as Louis the XIV’s Court.

Nah. SF is a crown gem — yes, even despite the anonymous scenes of disaffection, chaos and torture. Also, there’s just too much old money there.

And no, I don’t live there, and no, I don’t want to. I just know beauty when I see it — even when it’s covered in filth.

With the flood of China technology competition, it is not far-fetched that SF could become middle class. China has already exceeded Micron in NAND and Nvidia in GPU. Once they master lithography, all bets are off. Remember Huawei nearly wiped out Apple before Uncle Sam came to its rescue!

LOL!

Where are the sarcasm tags?

If SF becomes middle class, who will pay all the taxes, which are borne disproportionately by the rich?

Good data. It does look like Coastal CA is caught in the perfect storm of declining stocks, rising layoffs, and a population exodus. Couple this with little to tech immigration and rising interest rates, it does seem like a disaster. Good data Wolf. A few questions:

1. When do you think this will bottom out based on Fed’s dot plot. Fed rate will peak in spring 2023 and stay there for all of 2023. Then it will slowly decline over next couple years. In one scenario, stocks can fall another 20% and earnings also 20-50% due to rising borrowing and labor costs. This will ultimately cause massive layoffs in all of 2023. This + higher mortgage through all of 2023 can crash the Bay Are RE market into oblivion, perhaps another 25-50% from this level. Well given that homes in Bay Area are at nosebleed level they can drop by an even higher obscene level. In another scenario, when home values will crater to 2018 levels, people on the sidelines with hard cash will jump back in the prices will stabilize. In this case perhaps another 10% drop. Which one will play out in your opinion?

2. Data shows that remote work will stay for several years. How will this impact Bay Area RE?

3. How do you think So Cal will be impacted, Orange County is tech heavy but not LA so much. How about San Diego. San Diego seems to be holding up well in spite of experiencing the highest price rise during pandemic. How do you justify that trend?

Sweet sweet music to my ears, better than any songs playing for the Christmas holidays.

Let’s hope this will carry over to SoCal and we will get to see this kind of drop soon, I am looking at you South OC, West LA..etc. For now, I do get a laugh out of seeing Redfin ads showing houses either back on market or the funniest one is probably price increase

Yes!!! I also love the price drops from $1,499,000 to $1,485,000. Oooh, now it’s a steal!

Thanks Wolf. I can hear the narratives coming up already. “Oh, the Fed must pivot, pause , stop raising rates.” We are still negative on rates, at least 3.50 with 7% inflation!

Nothing lifts the spirits like a good ol’ fashion bust. Christmas bust is even better. Bah! Humbug!.

I’m interested to see the next Case Schiller report to compare versus the median.

Inventory increase is a big problem for the market, even if at historically low levels.

We just did a renovated rambler $1,450 sq newly renovated in top condition in a very good neighborhood on the border of DC and Mayland. Price $1,350,000. Interest rate for VA just dipped below 6%. There are pockets of RE that have not been affected by all the carnage going on all over the place. The rich are doing very well. Don’t feel sorry for them.

Still trillions of cash and stock equity and rich feeling rich that can create a market. USA has large number of rich and until the USA equity assets are priced accordingly vs the 15 years or so of free money pockets of nice areas will sell.

I don’t believe in this. If this has been true then nicer areas would have been selling like hot cakes and won’t be seeing price correction like we are seeing today.

My friends in san Diego holding many homes, they say that home prices would never go down here because we have too many rich people but the numbers tell different story.

Most “cash” is actually someone else’s debt.

Stocks have to be sold to someone else first.

It’s another version of “It’s different this time”.

Swampy – Government teat never goes dry.

Except that there hasn’t been carnage all over the place.

It’s certainly not in the real estate market. It hasn’t hit the major stock averages either.

S&P is about 10% higher than pre-pandemic in February 2019. Real estate is still a lot higher.

I don’t know how many have been hit by the crypto collapse, the extent, or where they are based, but it’s only a low minority of the US population where it will be financially meaningful.

$1450/square ft. Wowza 💵😜🥳

Certainly not for the common man.

Looks like to get a modest home in a good location around here, with decent schools, and good transportation you better be ready to fork out $1000/ Sq foot of living space. That’s what I’m seeing. That’s with the current interest rates, double what they were a year ago. Anybody believe Inflation is transitory? If so, let me know, I’ve got a bridge over the Harlem River in NYC I’ll sell ya.

I may add, not only are these pockets of RE defying all logic and still appreciating, making the rich richer, but the loan is a VA loan, which means that middle class and lower taxpayers are subsidizing the loan and helping the rich get richer. If the loan defaults, the taxpayer gets to pick up the insured losses.

This reminds me of the subsidy for $100,000 EVs for rich people.

Bethesda is prospering more than Capitol Heights. It is politics.

Mortgage rates went down five weeks, then an uptick.

That is disgusting. I imagine it’s the same with Fannie Mae and USDA.

Piece on CBC site about a bunch of buyers who put big deposits down on pre- build condos and now can’t get financing cuz no longer qualify at new rates. One guy an Uber driver put down 250K on 1.7 mil and is now stuck. Apparently a Toronto U driver makes about 45 K, but still…seems like a stretch even at old rates.

The group has picketed the builder for lower prices but he says he built at peak rates of everything. He has also sent a letter to one buyer saying they can’t just walk away from deposit, he will sue them.

Canada (my “home and native land”) has never had a full-blown housing bust. Or so we are told. Truth be told: we did … during the GREAT DEPRESSION. Can that happen again? Answer: of course it can.

“One guy an Uber driver put down 250K on 1.7 mil and is now stuck”

Wtf, one hell of a Uber driver to save $250K, must be racking that serious dough driving for Uber..this is where you can fix financial stupidity…buying a $1.7M house as a Uber driver…yippp

Apparently also has a business in India that provides income.

Still interesting to see especially newly arrived immigrants that bought into the “mania”. Without living here it would have been hard to know what was crazy. And if you listened to local “experts” who just wanted to make a sale … you were bound to be taken to the cleaners.

Sad to see but very predictable. Who doesn’t want to have it all … now.

Now … if I go to a new country … I prefer to start small and understand the place first, but that is just me.

You’d be amazed at what you can save in 4-5 years by way of hustling and abstaining. Imposing a poverty effect on your standard of living is one of the secret weapons to amassing a sizable nut. Always worked for me. BUT…it is a drag.

For a lot of working class, the more they make, the more they spend, because a juicier take home enables better and better palliatives and distractions from just how miserable their daily toil makes them. Neck-down work, like Ubering is perfect. You drive, you save, and you plot your evetual takeover of the world.

The house was 2.1 million Canadian or slightly higher with about 95,000 dollars in upgrades. It was in Brampton that should come as no surprise. Those mortgage brokers really earn their money there.

– The AirBnB rentals also have seen a significant drop in demand. There has been an increase in the amount of of these rentals in the past 12 to 18 months (+23%) while at the same time demand seems to have gone down (A LOT). Some people have reported that demand for their rentals have gone down by 80%, 60% and 50% in the last 12 months.

– I blame the falling shares of tech companies that made A LOT OF stock options worthless and that has a (major) impact on what people can spend on e.g. AirBnB rentals.

Sources:

– Business Insider: people-worried-about-airbnb-bust-short-term-rentals-2022-11

– One video from YouTube

The tone of the video is (way) “over the top” but the bottomline of the video remains the same: AirBnB rentals are in a bubble and that bubble is about to deflate (big time ?).

I’m tired of disruption. Before big tech a nightly homestay businesses, had you attempted to run one in your community, would likely have earned you hefty fines via code violations. This is an unlicenced hotel. Where’s your fire suppression system? Your insurance? Illuminated exit signs? Adequate parking? Same thing with ride shares – unlicensed taxi or livery.

But if a tech disrupter comes along and nationalizes the service? Well then it’s just peachy. No licensing issues. Move along peon, rules only apply to you.

Not much of a disruption. Some years ago in Europe, every other house had a “Zimmer Frei” sign (room available). People supplementing their income renting out rooms. An affordable way to vacation, sometimes even meals were included.

I wonder if the AirbnB/VRBO wave has run its course here in the US. With all the fees, rates many times exceed hotel costs.

At the rate hotels are cutting back on amenities, like fresh towels every day and adding extra fees ( ‘resort fee’ ), AirBnB will be able to compete.

Big Question: is this a 2007-9 “repeat”? Or are we into something qualitatively different? The economic context in which real estate is “deflating,” is much, much more dangerous. The “damn-bursting” analogy is apt, only this time we are confronted with a world-wide phenomenon and one which involves almost every asset class, with few exceptions. Can the old remedies, fiscal and monetary, be counted on to “work” this time around? Remember, “work” really means something like “stick a finger in the dyke.” Problem is, not only are the rising waters much, much more massive, they are also different in KIND.

Wall Street journal ran something this weekend charting debt and equity over time in the real estate market going back to pre 2008, and equity ratio is obviously much much higher right now due to rapid recent housing inflation … the harder they try to sell me on there not being a bubble bursting the more I am convinced we are in the midst of it. The question is if and what what will drive forced sales this time, since people aren’t in promotional rate ARMs that need to be refinanced and can’t after prices start dropping. I will be waiting on the sidelines with my popcorn

Aaron-

It wasn’t ARMs in 2008 either. That was the worry, but the Fed ended up dropping interest rates so fast that most people holding ARMs were able to refinance into fixed mortgages that were close to or even below their teaser rates.

What triggered forced sales in 2008-2010 was the usual: a recession leading to job loss. Job loss and divorce (not unrelated) are probably the 2 biggest factors for forcing sales. So the question is whether we’ll see a recession as bad as 2008/2009. If we do, with similar unemployment rates, then we’ll probably see similar forced sales.

There’s a pretty good documentary on the ’08 bust and the larger problems that were involved there, called Owned: A Tale of Two Americas.

There’s one good line in there were they interview a realtor involved in all of that and he basically says that “when somebody buys the house next door for half of what you paid for yours, how are you going to feel about making that next payment?”

Not forgetting that CA is a non-recourse state. Cue the jingle mail.

So I think that the forced selling we’re waiting for is actually forced, but not in the way we’re imagining it.

I’ve always thought that subprime and ARMs were somewhat of a canard. Bubbles pop because they’re intrinsically unsustainable; the actual proximate cause of the pop doesn’t change anything. But people have a large financial interest in believing it does.

You have a really good point. Subprime’s role is exaggerated-there was lots of trouble in ‘prime’ as well. There’s also evidence that the recession kicked off the housing crash rather than the other way around.

“The economic context in which real estate is “deflating,” is much, much more dangerous.” ==> So, the home prices can inflate by 50% or more in last 2 years is OK, but deflating slowly is dangerous ?

On the same vein, I see lot of experts saying, FED would pivot when something would break big time. But I say that something big is already broken: raging/historically high inflation.

Looks like asset owners are complaining a lot.

Agreed, QE and easy money had been going on way too long even before the pandemic. The fed even agreed as they started reducing their balance sheet right before pandemic hit… then reverse course and hockey stick straight up flooding the market with liquidity and no new economic value being created as we all sit at home twiddling our thumbs… I can’t imagine why there is raging inflation

The deflation doesn’t look all that “slow,” although the FED no doubt wishes it were!

Didn’t say—or imply—that the inflation of asset prices was OK.

Quite the contrary.

YUP!

In a way yes. Real estate price falling is bad. Notice that real estate price set the value of the backing behind mortgages. That is the backing behind the a lot of the money printed the last years.

Once there was a gold standard, now there is kind of real estate standard. Money was then backed by gold, now money is in part backed by real estate.

What happen with the value of money when the price, value, of the backing asset fall?

The banks are not nearly as loaded up on badly thought out derivatives.

How would you know that?

Consider:

Credit Suisse, down 79.4% from post-pandemic high, looks like the first systemically important bank to join Wolf’s Imploded Stocks List.

Citigroup, down 42%

Bank of America, down 33%.

Wells Fargo, down 30%.

KBW Bank Index, down 33%.

Yet the S&P500 is only down 19.5% so far. (All data include dividends here.) The S&P500 financials as a whole are about the same as the broader index.

Why are the banks down so much more than other financials?

They’re down for the same reason everything else is you’re just grasping.

If people can’t afford the monthly, then the price will drop. Period.

I am eagerly waiting for Kunal to reply, I really need a good time before the holidays, wonder which factor he will cite now to back up his pricing will remain strong narrative…me patiently waiting…

I wonder who Kunal really is. I don’t think he really believes what he says.

It is like having a front row seat with the only human with a crystal ball focused on the the financial future.

It is hard not to prosper.

Let’s get that median SFO SFH price down from the current just under $1.8M down to early 2015 levels, and then we can get a little excited.

For now, it’s still just wiping off 12-18 months of froth.

“wiping off 12-18 months of froth”

Well stated, James. You’re upsetting a lot of hustlers, I mean realtors…

When I look at the housing market, I always look at the price per square foot as the benchmark. Geez, houses in the Frisco Bay are still crazy expensive compared to the homes I ride past along the Mississippi river in St Paul & Minneapolis with For Sale signs on them.

If a median SFH in San Fran is now $1.5M, compare that to what’s across the river from me on 555 Mount Curve Blvd, St Paul 55116. A beautiful Mid-century modern from 1948 with 5,050 sq ft for $1.59M. It’s been on the market for over six months and is listed @ $316 per sq*ft.

Half a million buys a nice crib in my hood. Of course, when I rode my gravel bike today, it was 8F, snowing lightly and the streets were caked with ice and packed snow. Perhaps there is cause and effect at play? Oh by the way, it’ll be nasty outside in a couple days; got to enjoy days like today, eh?

Good skate-ski weather for your new gear today Wolf.

And checking today to get a better feel of the very local market I commented on, I see a place built in 1940 a couple blocks to the north that’s 3,240 sq*ft for $600k. That is not bad at $185 per. Nice looking and on the market two months.

Local, local, local …

PR –

Looked at the listing – what a strange place. Not mid-century at all; it’s a modest colonial that’s had an enormous ultra-modern addition attached. Very “high-style” throughout; will look exceptionally dated in a few years. Original asking was $1.895mm now $1.595.

I know nothing about the area, but I’m not sure who the house is to appeal to. Doesn’t look like a “family” house at all.

And while i think that curb appeal is an overblown concept, from the outside it looks like a modest, center-hall colonial.

Ed S.,

You’re right, and it is a mix of architectural styles. I got the mid-century vibes from the kitchen, living room and definitely from the view in photo #3 of the rear of the house.

The front street-side is very colonial.

I grew up in a Carl Graffunder home designed for my family in 1969, built in 1970, and see some of this style, especially in the kitchen.

I think you nailed it pretty well Ed.

On mid-century modern: My mom and her second husband, Jim, had Win and Lisl Close design their retirement home just on the outskirts of Santa Fe. Win and Lisl also were Professors of architecture at the U of MN with Graffunder, and were in the mid-century modern style. Since Jim and the Closes all played in a classical music quintet together for years, the house was built for acoustics and has a large high-ceilinged living room in a pentagonal shape to avoid standing wave resonances.

Curious!!!?? Why do not business owners of buildings that the Twit bunch refuses to pay just change the locks? Or hire some beefy sorts to stand in front of doors too? Are Twits commanding that much power over landlords?

They’d rather have the money. It’s not like anyone is signing leases right now.

Something tells me it isn’t all desperate first time home buyer professional couples with kids who’ve been priced out for years cheering this on in the comments but a bunch of sly old foxes playing in the RE market for profit?

Looks like California will have to live without Mark Wahlberg. He is selling all his mansions in California and moving to no-tax Nevada.

CA state income tax of 10% does seem very high. It makes you wonder where all the money goes.

California is the 4th biggest economy in the world.

That’ll change. They are entering the same spiral that Detroit did. Silicon Valley is not as important as it likes to think it is. There are other innovation-tech hubs and they are more affordable to live in.

California is much more than Silicon Valley.

Yes! SF will be New Detroit 10 years from now. Things are moving so fast these days that the decline will be a collapse. People had the same kind of hubris 50 years ago and now there’s no one to tell that tale anymore.

So what? China is the 2nd largest economy in the world. Does that make it a great place for the average person to live? CA is great for people of enormous wealth, but not for a person working and saving for retirement.

California income tax exceeds 10%. I think it is 12% at the top bracket,

Actually it’s 13.3% as a top rate.

And no capital gains rate (everything is ordinary income).

Any chance a realtor will finally say maybe it’s not a great time to buy?

Buwhahaha… have they ever said that before even during and after 08? If I have to bet, I am sure anything resemble a RE agent was probably telling people It’s a good time to buy even during the Great Depression

” maybe it’s not a great time to buy?” Mute Realtors : become job seekers most I have met without actual Skills at all or retired

How about A Developer ? > A Builder ? > A Supplier ? > a Lender ? > A Banker ? > A Credit Union ? > A Loan Shark ? > A Factory Worker ? > A CD Broker ? >

Only choice is to secure income to try to offset inflation losses to cut losses . Long term CD’s ( insured ) Cash Jobs , Cut expenses but for most unable to do such will fail and lose out.

Foreclosures will become Markets in time its an Induced Cycle

nothing new except the current Date

That would be like a stock broker finally saying maybe it’s not a great time to buy stocks. Where are the Customer’s Yachts?

People can have their own agenda who post here as others have pointed out. California is a special case so best to think about the rest of the country. It can be difficult to get good information because it is not only selling prices, but days on the market, and whether or not additional work is negotiated that the seller has to do after inspection and prior to closing, i.e. the terms of the contract. Contingencies were often waived last year. Getting true market metrics can be difficult. Another problem is that taxes, maintenance, insurance might have gone up depending on location which is another cost of home ownership that is not figured into the selling price. Real estate is tricky market.

RE seems easy on the east coast. Just watch what is happening in the west, and prepare for that to happen in the east. Worked for a long time.

Wolf, could we have an article on Australia’s housing bubble at some point?

I did several already. Here is the last one for sales and prices in October:

https://wolfstreet.com/2022/10/31/the-pop-of-australias-housing-bubble-remained-orderly-in-oct-prices-dropped-across-the-country-sydney-10-from-peak-8-6-from-year-ago/

Houses in this part of California still sell very quickly. But where else can you buy a renovated 3-bedroom for 279k. Only 90 minutes to Malibu and the air pollution is really only a problem in the winter. If you can stomach all the Trump supporters, that is

Real Estate : Nothing complicated at all, it’s a Market same as a Retail Store . Overpriced stagnates and the expiration date becomes relevant

So what’s most interesting to me is that looking at the charts, the first time these prices were reached was in 2017/2018. After that, prices were higher and lower, cyclically going up.

Now, with the usual caveats that median selling price data doesn’t account for changes in mix, this means that a lot more people are underwater on their houses (if not yet on their mortgages) than we believe.

The common wisdom is that even with these big price declines, because of the rapid appreciation we’ve seen, only people who have bought in the last year or so have lost money. But the truth is, lots of people from 2017/2018 onwards bought at prices higher than this. Probably well over 50% of people in the past 5 years (assuming that larger volumes of sales occur in the spring/summer months which represent the peaks of the pricing charts) are facing prices lower than what they bought at.

That doesn’t necessarily mean they’re underwater on their mortgage just yet: new buyers would have put in 20%, and earlier buyers probably have paid down at least a little bit of their mortgage. But if prices decline another 20% (which, based on the trajectory so far, may just be another 6 months), we’ll start seeing a large number of people — not just recent buyers — start going underwater on their mortgages.

And that tends to be a huge trigger to really start the downward cycle: when nervous banks start to foreclose to recover their loan values, and underwater homeowners are less motivated to hold on to a net negative asset.

Agree Lune, and will add the question of how likely it is that the GUV MINT will mandate some kind of ”forbearance” to the mix either late next year or well before the 2024 general election.

Don’t doubt it is already being considered by the oligarchy, or some other ”bunch of sly old foxes playing in the RE market for profit.”

Unless there are massive job losses people aren’t going to sell their homes. As long as they can make the payments, they stay.

Most homeowners either bought with a low mortgage rate or refied into a low rate. No one wants to give up the lower payment for higher rent or a higher payment.

“No one wants to give up the lower payment for higher rent or a higher payment.”

Its not quite so cut and dry.

I live in the Inland NW, medium size city, lots of home price appreciation last 10 years. I’m a renter. And not a lender, not really that familiar with mortgages.

Still, this is pretty accurate I think:

Mortgages at 3 to 3.5% here typically have a mortgage payment from $1250 to $1700 for homes 350k to 600k.

My 1 BR rent is $825. Water paid for, small apartment less heating expense.

Yes this is on the low end of the apartment costs in this area unfortunately.

But $825 is certainly less than $1250 or $1700.

Sadly, we (tenants) all have to shovel a lot of snow in this complex’s parking lot.

That is another story…

600k, 120k down, 30 years, 3% =>

$2023 per month. The high end here.

More than twice my rent.

Apples and oranges comparison ? True.

But just on cost its twice as expensive.

Median home was $450k here but I believe has slipped to $420k or $430k range.

If I were a retiree, single person, or married couple without kids, sitting on a greatly appreciated home, I’d sell it to secure the gain and my financial future. I’d put the money in US treasuries paying 4-5%. Then I’d invest the wad in 2-4 years into stocks and RE at much lower prices.

You lose wealth by financing a huge declining asset, even if the finance rate is only 3.5%.

Right now, in Seattle, the cost of renting is WAY below the cost of ownership. The buy/rent decision is extremely distorted in favor of renters.

Renting for a few years makes great sense if it allows you to add hundreds of thousands or a million to your wealth. You have to make sacrifices to build wealth. No way around it.

3.5%?

Everyone I know locked in at 2.5%.

Phone call to California Legislature: “A Great-White-Picket Fence shark just turned up in coastal waters!”. Response in unison: “Looks like we’re gonna need a bigger low-emissions bulldozer and a catchy marketing line.”.

Anecdotally, does anyone know tech or forced-back-to-office urbanites who are selling their pandemic impulse or second homes in Western non-urban areas? I ask because they screwed the places I like and don’t seem to be budging. There’s still too much money and WFH, and while sales have slowed, they created a housing shortage locally. That means they can still rent the places at new exorbitant rates.

The drought is apt to change all predictions and for the worse, it’s sobering to read the notes from Colorado River meeting last week

Climate a challenge in Inland NW, medium sized city eastern Washington state.

This year:

Very chilly Spring.

Summer…

Per AccuWeather: 44 days >= 90° high.

9 days >= 100°. Yes hot. Smokey late summer, early fall.

October nice.

November average high… yes high …38°

(can you say rapid drop in temps ?).

Winter arrives:

Have had about 28 inches snow.

Mid week, weather forecaster has high 0, low -15.

How did this become Las Vegas by summer, Minneapolis by winter ? I dont know but I wish it would stop it.

(Last year, again per AccuWeather data, I counted 50 days with highs >= 90°, 10 days >= 100°.

And we are about 950 miles north of Atlanta. Atlanta is much more humid than us, but not quite as hot the last two July and Augusts. Amazing.).

I laughed reading the 9 days over 100 degrees. This past summer we had 58 days over 100 degrees in San Antonio. This place is becoming uninhabitable but Republicans say it’s a paradise lol

Richland? Yakima….found 2 good Mexican eateries visiting auto clients up there

but then u mention above Atlanta?

with Lake Mead and Powell headed to dead pools….water rationing for all So Cal residents this year….its going to get ugly in Vegas and Phoenix, Great salt lake is drying up…..

this will make all the hurricanes to ever hit the US look like play school….

better hope La Nina doesn’t go for 5 years, the death of the west will be here

Neighbor who got a job assignment elsewhere plans to hold on to the house he bought sight unseen but if he can’t cover his costs with rent which will be very tough with a poor job market in my rural area he will have to sell. Good riddance!

My experience is that those who bought second homes prior to, or during, the pandemic are retiring to those places flush with cash from selling the homes they owned for 20+ years and the businesses they used to run. The places they are selling, or sold, are in the States they left.

Bad news for those in the less expensive, less urban, areas as that’s actually going to limit the depreciation of properties in those areas. The recent arrivals set the prices, and they can afford to keep them higher for the folks attempting to follow. It doesn’t help that guys like Bill Gates are buying millions of acres of farmland (not to grow stuff, but to have a seat at the table for water rights).

The California housing cycle has been a fact since at least 1980 when I moved to San Francisco. I was priced out of the housing market until 1994 when I finally figured out how the California housing cycle was working and bought a 2 br 1 ba condo for less than what it would have cost to rent near Santa Barbara, Ca. and then a second 3 br 2 ba condo in the same area in 1996. My wife and I moved into the 3br and rented the 2br until 2004 selling the 2 br 1ba for 250% of purchase price and purchasing a new construction 3 br 2ba house in San Luis Obispo county for cash. Then sold the 3 br 2ba condo in 2007 at the top and retired to SLO county just before the 2008 crash. This cycle will probably continue. You can benefit from it too. Watch for the low when the price for a purchase mortgage is close to or below the cost to rent and then pounce. Free advice. The beat goes on.

Yes, it’s always the same cycle.

Bought in 1986 at $36K, sold in 2000 for $98K

Bought in 2012 for $47K, today it sits at $285K

Just wait for the crash, because it always does. Forget about the interest rate. If it’s high, you can refi later. Buy a home, not an investment. And never, ever be “house poor”.

Japan’s CB is up to something…

Yes. They let the yield-peg for the 10-year rise today by 25 basis points to 0.5%. They left the short-term policy rate at -0.1%, unchanged.

Kuroda’s term ends in April, after the fiscal year ends on March 31. Here’s my guess what’s going to happen: The BoJ will then be under a new governor, and they will do a “monetary review,” and a couple of months later, they will release the monetary review, and it will say that we no longer need to do this Abenomics-thingy, we need to worry about inflation.

The balance sheet has already declined. We’ve already seen the first indications from the government a little while ago that there will be monetary regime change at the BoJ. Now they lifted the yield peg by 25 basis points. under the new guy, bigger changes will come.

BOJ still owns a whopping 50% of all government bonds. How much QE did they binge on?

Japan electronics already lost its competitiveness to South Korea. With the US technology war, they now have a determined China with which to contend.

Heck Japan’s GDP/capita has already fallen below Taiwan. They also now running trade deficits with China! Japan is in a bind. Their arrogance and stubbornness will be their undoing!

Linkz – an examination of history confirms your last sentence for most civilizations. The West is just as vulnerable as the East (or the North as the South, depending on your worldview…).

may we all find a better day.

Wolf’s guess is probably the best guess about what the Japanese Central Bank is likely to do, going forward. The increase in the value of the dollar and the expense of the basic commodities is increasing the cost of living for anyone living in an economy priced in a sovereign currency, like Japan. Inflation is the bug that infects all confligrate economies practicing QE.

BoJ just raised. more pains to come.

Wolf – I live in Central NorCal. Home sale transactions are definitely way down say around -45%. However, unfortunately there is very little resale inventory on the market, and new listings are anemic. If a nice home comes on the market, it sells quite fast actually. Prices are actually holding up quite well. Sure the crazy high list prices have come down, but that’s about it. Definitely no “price crash” or even major correction here.

Give it some time. I just looked at some of the bigger counties in your direction. In almost everyone of them, there prices are down year-over-year.

Housing Busts take many years to find a bottom. Last one took about five years. This has just started.

I doubt whether the Cali prices will collapse but are likely to decline at a rate that is related to the perceived value.

San Mateo, a higher low, got support from 2018, 2019 and 2020 highs.

AAPL line chart is shortening it’s thrust : Sep 30 to Nov 9 and to yesterday close. A bounce to a lower low might be coming to San Mateo

and AAPL, testing 2021 highs.

1) SF Phillip curve : the higher the inflation rate the lower it’s unemployment rate. In recessions, when inflation is low or negative, unemployment rise.

2) SF employment change of character might lead to a bust.

3) Tel Aviv, last year winner of a city with the highest cost of living in the

world, became number #2 behind NYC and Singapore. SF and Los Angeles are not far behind. At the bottom, Damascus and Tripoli Libya.

4) The next few years will humble the top sleaze meter.

San Mateo most important trading range is it’s first 2021 high and

low : 2,300,000/1,900,000. Sam Mateo might get a higher high,

an upthrust after distribution, to fool home buyers. With 4.5%-5%

Fedrate buyback cannot go too far.

I wonder how the owners of property in Ft Myers Fla are doing with their RE.? You don’t hear much on the news about homeowners who were wiped out and are still trying to collect from their corrupt insurance carriers. Nothing about those who survived and now have their premiums doubled or cancelled. Or those who gave up and moved out permanently. Of course, there is no crime or looting. Everyone is helping everyone. The RE lobby makes sure this is the only narrative that makes it through the filer of the mainstream media. It’s time to Buy, Buy, Buy as Jim Cramer and Lawrence Yun are fond of saying. Go for it!

Some people have not been visited by their insurance adjusters yet. There was flooding. The Sanibel Bridge collapsed. They already repaired it. The Sanibel Lighthouse is still there. The keeper’s house washed away. People drowned in Ft. Myers Beach from the 15 ft storm surge. There are still blue tarps on roofs in Cape Coral. Utility crews from all over the nation arrived to quickly restore power to most areas. Hotel rates are above average with out of town contractors working in the area. I watched a recent YouTube video by a senior real estate pro. He reported Sarasota prices are in a downturn. Many homes under construction. Not many foreclosures at this time.

You got to be nuts to buy RE in Ft Myers or anywhere on the West coast of Florida. The temp of the gulf water is 3 deg above normal. That means hurricanes will be more frequent and more intense. Even if you are lucky and don’t get blown away in the next hurricane or tornado you will see your insurance rates quadruple. The crooked RE agents down there will never tell you the truth about the Meterological Risks of owning property there.

“That means hurricanes will be more frequent and more intense.”

There is no evidence that hurricanes are becoming more frequent or intense, at least in the Atlantic.

What Mr Swamp Creature said was that warmer water (“+3 deg above normal” in the Gulf) made hurricanes more frequent and more intense.

Cytotoxic

I have a Masters deg in Meteorology and 13 years experience in the field. MY specialty was tropical meteorology. I was in the tropics for 3 years forecasting weather for the military. As a lay person I still keep informed on Climate issues and severe weather events. What are your credentials????

I know a super RE lady in Ft. Myers moved out of California because of the nuts running the place

“That means hurricanes will be more frequent and more intense.”

The federal government and the Weather Channel have been pushing this lie since 2004.

Another sort of related issue; in many parts of California, even right near the coast, you either can’t get any fire insurance at all or it’s prohibitively expensive. Like Lyods of London at the high end.

Earthquake insurance is another factor.

Too much schadenfreude here. Most people bought houses because they needed a place to live. They couldn’t wait until the optimal time when the market crashes. Cheap apartments really don’t exist.

Recent home buyers may be having the last laugh in the mid term. If the dollar continues to crash and inflation stays high, having your money invested in stable housing at a fixed rate is not the worst ‘life’ investment.

We’re only one COVID mutation away from the the Fed scrapping its interest rate policy and sending the dollar to the gutter. Don’t drink the COVID is just the flu cool-aid. The current policy can change in a snap.

We have a vaccine, and there’s no reason to believe we’re going to see a mutation that evades it that much and even if we did we 1) have medicines we didn’t have before and 2) can make another vaccine! The fed is not relenting.

On the West Coast, lots of wealth is being lost in Tesla stock and other newbie tech darlings. Throw in a pink slip or two, and it’s a clear recipe for a home price crash in the previously hot areas. The big tech companies are in a clear downsizing mode.

The path of the RE market over the next few years seems obvious to me. Perceived wealth is evaporating at a sure steady pace. I don’t now why most people have such a hard time recognizing it.

When Boeing collapsed in the early 1970’s Seattle turned overnight into a small West Coast port who’s largest industry was the University of Washington. The Friday night HS Football game was the big event of the week and the headline in the Seattle Times Newspaper. I rented palace on Summit Ave Capitol Hill for $150/month.

If this tech wreck continues, I wonder what Seattle will look like.

As we all know, real estate is local. Roswell is an upscale community in north Atlanta and its still Hot, hot ,hot! My son’s best friend just sold his house for 700K all cash. He paid 310K in 2011.

What’s so hot about that market? The only sale last week sat on the market for 6 months and sold for $176/sq. ft. The median price for the area is up 5.9% year-over-year. I’d call that stable, not hot.

Honestly, every one with a stake in real estate is thinking the same: ” It is local and my locality won’t be impacted”

My take: If it has increased in price outrageously in last 2 years or so, then it’d go down more than that.

“It” is an enormous, amorphous noun used by wankers to obfuscate.

Ft Myers FL will be in the news before Nov 2024 election.

As my mind automatically was trying to organize the import of the possibilities the data suggest, a couple of potential comments seem logical.

a) That price is always at the top, like a Dutch auction. The screaming is always from the fringe, layers of speculators as the onion is peeled. Like the hurricane wind, the Banshea, or the virgins enticing Ulysseus, one shouldn’t become enamored with their songs. Housing has been a favorite asset of the Fed policy since their primary mission became bailing out their clients from going broke after the collapse of the previous housing bubble.

2) As emotionally stunning as the data is, I consider it may be just the blow off top in the journey of SFH prices to equilibrium. To me, the most stunning thing is that SFH prices doubled from 2015.

c)

c) I propose a thesis that asset price inflation is the precursor to whatever inflation the current inflation is called, general inflation ?

The missallocation of capital has a disastrous history. Consider that, according to a Harvard genius who, single handedly, created austere economic plans ( game plans) that harmed billions of people, based on fabricated data.

Human beings have never experienced zirp, as near as we can tell, for the measly 5000 years man has been able to record the measurements they were making.

I tacitly agree with John Hussman that the Great Financial Crisis (GFC) ended when the Financial Accounting Standards Board (FASB) suspended the mark to market rule for the criminal banks which would have made many of them insolvent. The FASB recognized the banks own estimate of the value of their MBS securities rather than the market price which was, in some cases, negative.

Welly. We find ourselves faced with the same decision we had 15+ years ago increased by the gross excess that QE policy that sober people considered obvious would create the fine fix we seem to be in.

I think, maybe, the swash buckeling gamblers will lose. Deflation of the four asset bubbles, stocks, bonds, housing, and the military budget will cause pain.

It really brings me back to the foundations of the various concepts of society. Capitalism, socialism, communism, religionism, all a single point in the fabric of humanity. Eddy currents within the normal distribution.

At the current slice of history, America seems to be the top dog like Britain used to be who followed Italy.

My point is that there is a point. California seems to be the top dog who have no reason to engage with the lesser enclaves except the Eastern Complex that calls the shots in America, the mob.

Before I can interpret the apparently terse data from the brilliant colossus on our western shore, I have to clear my mind of any anti Californian biases.

Having just arrived from the mind clearing ritual, what I recommend California should do is make non recyclabe packaging illegal.

America seems to be afraid of the very principle that defines it’s pièce de résistance available through our system of democratic socialism.

“Conscience doth make cowards of us all.”

― William Shakespeare, Hamlet

Which is an appropriate statement for any period of history that I can think of. Heroes are often judged as cowards.

Hopefully we won’t have to live through an experience like the one caused by the defeat of the largest army in Europe, the French, being defeated by the German army in less than of a month. They have never been called to account.

Does anyone have insight into whether there has been a slowdown of Chinese buyers in West Coast real estate markets?

Yep, there has been. Hard to quantify it and I think it fluctuates, but I think definitely less. They don’t like to invest in a declining market. I have a sneaking suspicion there has been an influx of layered offshore Russian money into the US RE market trying to avoid sanctions, but that it isn’t on the massive scale of Chinese money. I don’t have anything to prove the Russian money thing, just have seen small things here and there that lead me to suspect that.

Housing prices are largely driven by what the monthly payment is. For people with jobs, the amount they can pay doesn’t change when interest rates go up. And most banks and mortgage companies insist on certain ratios of income to monthly payments. So housing prices will have to account for the impact of higher interest rates and higher monthly payments. This “slow down” is gonna last for a while. For people who lose their jobs, there is a high likelihood of financial pain.

I expect to see some foreclosures hit the market in in summer 2023 since it takes a while (90 days plus) for the lawyers to get the legal paperwork moving. So the real news about Bay Area housing is 3-6 months away, followed by a longer term reset. BOL

Well, that could be welcome news to potential house buyers who can now purchase a home.