Unwound less than half the big jump in October, zig-zagging higher, which is why one month doesn’t make a trend.

By Wolf Richter for WOLF STREET.

Retail sales, reported today, are based on retailers’ revenues. Retail sales cover goods, not services. Prices of services have been surging, and services is where nearly two-thirds of the consumer spending goes. But prices of many goods have been falling in recent months, such as gasoline, used vehicles, electronics, household furnishings, and others. This is where retail sales dipped in November. Retail sales rose where prices rose, such as stores that sell food and beverages and at restaurants.

Another factor were the “inflation checks” that some states sent to residents in the fall. In California, a big batch of electronic deposits went out in October; a second batch went out through mid-November. Another batch is going out right now; and a final batch will go out through mid-January. Some of the early funds got spent in October, adding to the surge in retail spending in October, with smaller amounts getting spent in November.

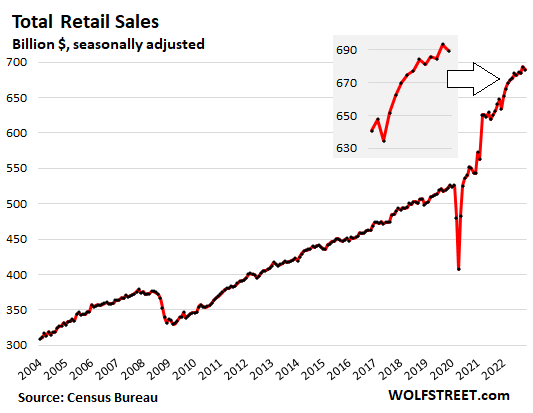

Total retail sales declined by 0.6% in November from October, to $689 billion (seasonally adjusted), unwinding less than half the 1.3% jump in October (from the “inflation checks?”). Year-over-year, retail sales were still up 6.5%. And compared to November 2019, they were up 32%. The insert shows how sales zig-zagged higher, which is why one month doesn’t make a trend:

The Commerce Department obtains this sales data via survey from about 5,500 retail locations, so revenue data from the company’s point of view, and not “spending” data from the consumer’s point of view.

Sales by category of retailer, largest to smallest:

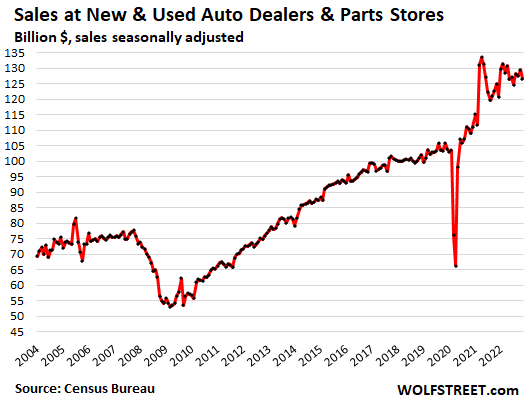

New and Used Vehicle and Parts Dealers: Sales fell 2.3% for the month, to $127 billion, still up by 1.3% from a year ago, and by 20% from three years ago. This is the largest category of retailers.

The CPI for used vehicles fell by 2.4% for the month, after exploding in 2021 and earlier in 2022. The CPI for new vehicles ticked up 0.4% for the month, continuing the price gains. But the number of vehicles sold continues to be beaten down by some shortages and by massive price increases in 2021 and earlier this year that now get in the way.

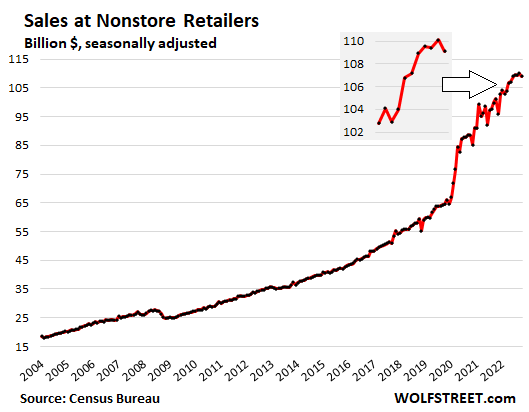

Ecommerce and “nonstore retailers”: sales fell 0.9% for the month, to $109 billion, undoing the increase in the prior month. Year-over-year, sales rose 7.7%, but wait… Compared to November 2019, sales exploded by 69%!

Ecommerce sales include a large spectrum of goods, from food to used vehicles, dealing with the same price drops experienced in various product categories.

This category includes sales by the ecommerce operations of brick-and-mortar retailers, all kinds of ecommerce retailers, along with sales at stalls and markets:

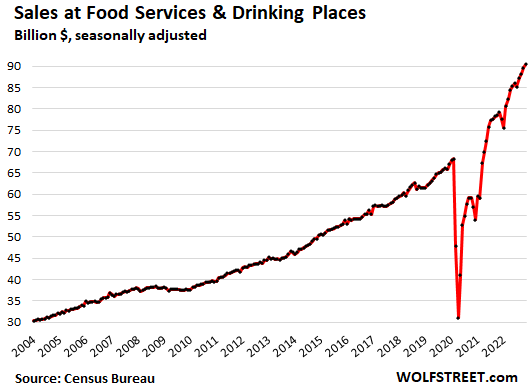

Food services and drinking places: Sales rose by 0.9% for the month (against CPI of food away from home +0.5%), and by 14.1% year-over-year (CPI +8.5%), to a record $90 billion. Compared to November 2019, sales were up 37%.

During this boom at eating and drinking places, sales have leap-frogged food and beverage stores ($82 billion), which is quite something; and inflation at restaurants, though high, has been lower than at food and beverage stores.

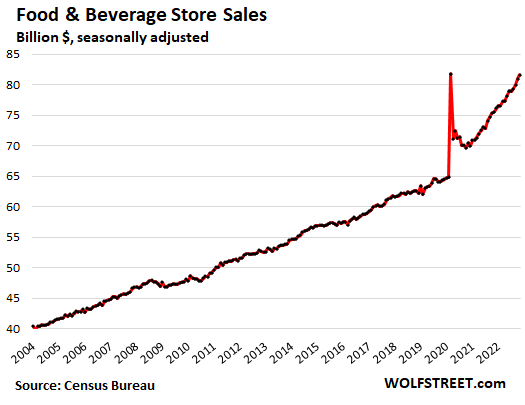

Food and Beverage Stores: Sales rose 0.8% for the month (against CPI of food at home +0.5%) and by 8.1% year-over-year (CPI +12.0%), to a record $82 billion. Compared to October 2019, sales jumped by 27%:

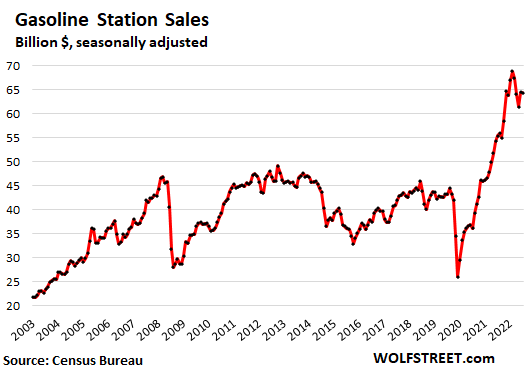

Gas stations: Sales dipped 0.1% for the month, on declining gasoline prices. But at $64 billion, sales were still up 16.2% year-over-year, and by 49% from three years ago, reflecting the spike in gasoline prices through mid-2022.

Sales at gas stations include all the other stuff gas stations are selling, and many of which are convenience stores.

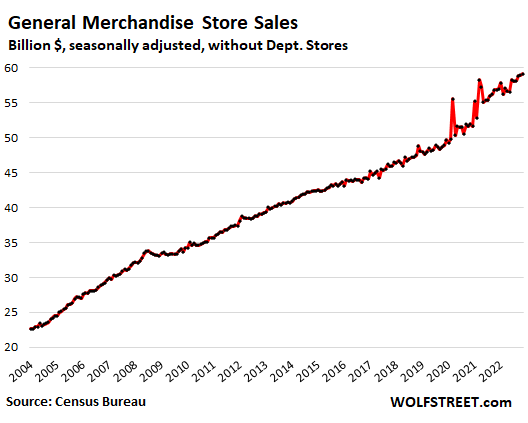

General merchandise stores: Sales rose 0.4% for the month, and by 4.0% year-over-year, to $59 billion, up by 21% from three years ago. This includes Walmart and Target; they’re big grocery vendors, and food inflation is rampant. Walmart, the largest grocery vender in the US, has discussed this in its earnings calls.

These sales do not include brick-and-mortar department stores whose slow death as an American shopping venue we’ll get to in a moment:

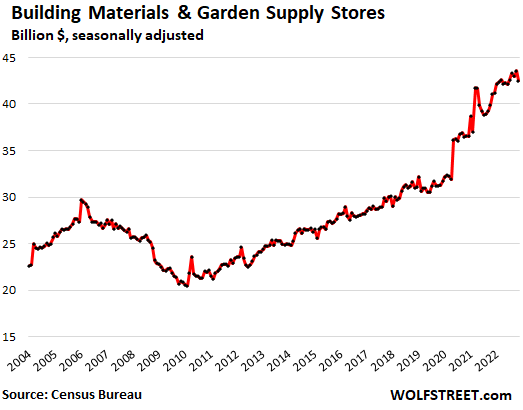

Building materials, garden supply and equipment stores: Sales fell 2.5% from the record in the prior month, to $42 billion, and were up 3.6% year-over-year. Compared to three years ago, sales were up 36%.

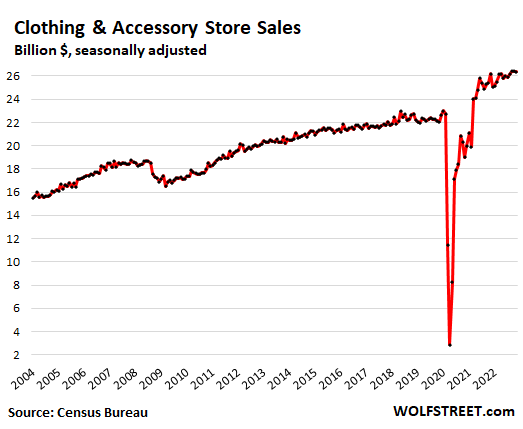

Clothing and accessory stores: Sales dipped 0.2% for the month, to $26 billion, and were up just 0.7% year-over-year, but were up 20% from three years ago:

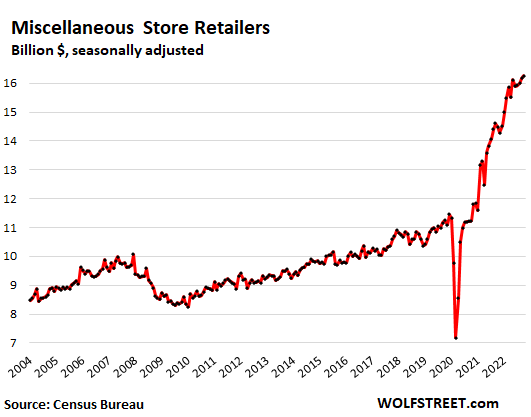

Miscellaneous store retailers (includes cannabis stores): Sales rose 0.5% for the month, and by 12.1% year-over-year, to a record $16.2 billion, up 44% from three years ago:

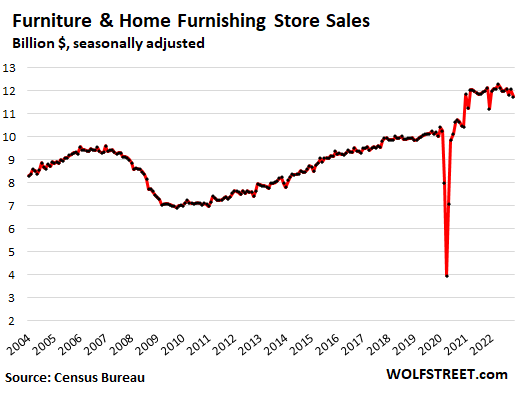

Furniture and home furnishing stores: Sales fell 2.6% for the month (CPI for home furnishings: -0.8%) to $11.7 billion, and 3.2% year-over-year. Compared to three years ago, sales were up 15%:

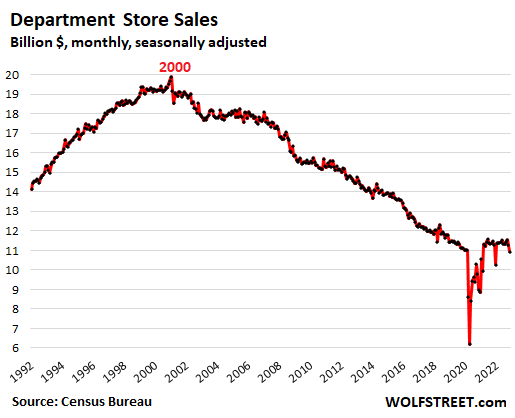

Department stores: Sales fell 2.9% for the month, by 3.0% year-over-year, and by 1.6% from three years ago, to $10.9 billion.

Since 2000, sales have plunged by 45%, despite 22 years of inflation, as sales have moved from mall stores to the internet, including to the ecommerce sites of the few surviving department store chains. Ecommerce sales by department store chains are included in the ecommerce sales data above.

Back in the 1990s, department store sales accounted for about 10% of total retail sales. Today, they’re down to just 1.8%:

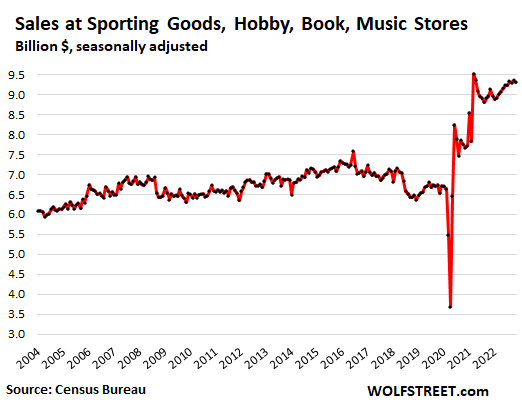

Sporting goods, hobby, book and music stores: Sales fell 0.6% for the month, to $9.3 billion, and were up only 1.8% year-over-year. But compared to October 2019, sales were up 42%:

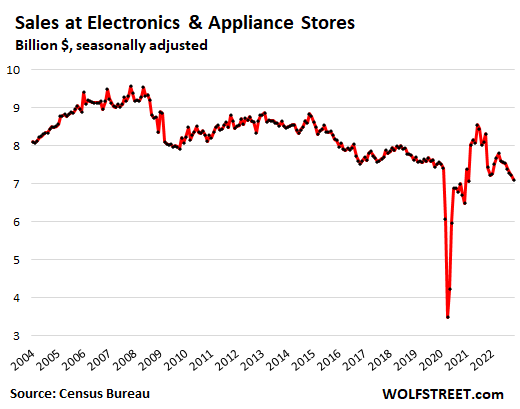

Electronics and appliance stores: Sales fell 1.5% for the month, by 4.4% year-over-year, and by 5.3% from three years ago, to $7.1 billion.

The CPI for electronics fell 1.0% for the month and by 10.8% year-over-year. So these price declines are part of the challenges for these retailers; another part is that their sales have wandered off to the internet.

Only specialty electronics and appliance stores are in this category, such as Best Buy’s brick-and-mortar stores or Apple’s brick-and-mortar stores. It does not cover the electronics and appliance sales at other retailers, such as Walmart, and it does not cover ecommerce sales of electronics and appliances. In other words, the electronics and appliance business is big, but sales have left the specialty stores:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Year-over-year, retail sales were still up 6.5%. And compared to November 2019, they were up 32%.”

And Wall Street is worried about a recession? Sure looks like we are still buying a bunch of stuff!

Probably because of that “strong labor market” thing they keep talking about. As long as people have jobs all bets are off.

Wallstreet clearly sees what is in process and they are more worried about their profits not main street. The cost of necessities are beginning to crowd out discretionary products in mass.

yoel,

Quit dragging ZH headlines/links into here.

This is what actually happened, the actual text from the Philadelphia Fed. In know it’s a lot harder and not nearly as much fun to read than a toxic headline on ZH:

https://www.philadelphiafed.org/-/media/frbp/assets/surveys-and-data/benchmark-revisions/early-benchmark-2022-q2-report.pdf

Early Benchmarks for All 50 States and the District of Columbia Estimates by the Federal Reserve Bank of Philadelphia indicate that the employment changes from March through June 2022 were significantly different in 33 states and the District of Columbia compared with current state estimates from the Bureau of Labor Statistics’ (BLS) Current Employment Statistics (CES). Early benchmark estimates indicated higher changes in four states, lower changes in 29 states and the District of Columbia, and lesser changes in the remaining 17 states.

Our estimates incorporate more comprehensive, accurate job estimates released by the BLS as part of its Quarterly Census of Employment and Wages (QCEW) program to augment the sample data from the BLS’s CES that are issued monthly on a timely basis. All percentage change calculations are expressed as annualized rates.

Read more about our methodology. Learn more about interpreting our early benchmark estimates.

In the aggregate, 10,500 net new jobs were added during the period rather than the 1,121,500 jobs estimated by the sum of the states; the U.S. CES estimated net growth of 1,047,000 jobs for the period.

Payroll jobs in the nation remained essentially flat from March through June 2022 after adjusting for QCEW data:

• Less than the 3.0 percent growth indicated by the sum of the states

• Less than the 2.8 percent growth indicated by the U.S. CES estimates

Over the cumulative three-quarter period ending with this 2022 Q2 vintage — which includes additional QCEW data changes affecting the prior two quarters — payroll jobs in the nation grew 3.5 percent:

• Less than the 4.1 percent growth based on the sum of the states

• Less than the 4.2 percent growth based on the U.S. CES estimates

Current U.S. CES estimates indicate job growth was 4.0 percent over the 12-month period through September 2021 and 2.8 percent over the four months since June 2022.

Next time you’re bored and inebriated, maybe don’t hop on the internet.

I read 48% of 19 to 29 year old people are living at home with parents. This plus many do not have to make their student loan payments, they have a lot of disposable income and this is helping retail sales too.

This is the highest percentage of young adults living at home since the great depression. Interesting.

Three days ago the Dow was 6.4% from the top, but today at the low,

when the Dow breached Nov 2/3 trading range, almost 11%.

Retail sales are down but only after the ZIRP. Forecast for Fed is 0.5 percent GDP vs what for 2022? A shrinking GDP but not recession yet and only half of the Oct Nov gains were wiped out. Sales vs prepandemic 2018 are up 32 percent. The Fed would probably like to be more hawkish but this move is similar to the august move down after the meeting in Jackson Hole. Wonder why they don’t meet in Branson Mo where there is mountains trout fishing and plenty of hotels. PE was 19 on spx before today on forward earnings and the Fed just signaled declines in earnings . No more evaluations on sales without expenses or capex.

I thought aluminum siding salesmen went to Branson, not supply siding salesmen.

we are buying less stuff and paying higher prices 100 units x $10 = $1000 sales 2019 now total sales of $1260 … 90 UNITS X $ 14 BIGGER SALES … LESS MERCHANDISE

Agree inflation is most of the story. Tracking dollar sales is a good metric with stable prices, but the formerly clear conclusions have gotten foggy with rampant inflation.

One small example… Our company sales (truck equipment) are up 14% Y-o-Y. That is an all-time record high dollar sales level, landing 38% above our 15-year average annual figure. BUT unit sales are down -22% in that same time, 7% below the 15-year average.

Measured by dollars, people are buying like crazy, and everything looks great. But unit orders have slowed dramatically as customers are resisting high prices now and there are still some supply bottlenecks slowing down the industry.

I suspect record company profits are due in part to dollar printing more then company greed.

Yes, it would be nice if we had volume data from both retail and restaurants. Without knowing if there are more or less receipts, it’s hard to tell whats really going on.

Mark King, random guy 62, Chris L

Cut out the BS.

PRICES OF MANY GOODS DROPPED in November from October.

RTGDFA (Read The G** D**n F***ing Article)

Inflation has moved on to services now, and retail sales don’t cover services.

This BS is just exasperating.

Another factor which may not have been accounted for in the move of inflation from goods to services is the poor quality of services across the board. I was complaining about the poor service from my insurance company handling my claim and I just talked to a dude who has insurance with State Farm. He was just rear ended. He called the claims adjuster and was routed to a WFH dude in India. They guy could barely understand what happened or even begin to give guidance on handling the claim. This is another form of inflation, which I call dimunation of quality of service.

Interest rates terminal rate around 5 percent plus based on an estimate. Services are what 60 percent of the PCE and housing still increasing just a snippet of data around the county but wife’s gym membership going up 40 percent because the small gym rent increasing in Jan.

We’ll see how China re-opening affects commodities in coming months. This could create a second wave in goods inflation.

Dow daily : dma50 > dma200. The weekly : in order to move lower there

must be a close below the weekly low. In order to move higher, there

must be a close above the weekly high. We don’t know what the Dow will do next. But it might move higher reaching the 35.3K area, for fun and entertainment only.

I think a Ouija board would be nearly as fun and entertaining as the it will go down or it will go up drivel you delight us with.

Yes, this zinger seemed like +1 -1 = 0.

As in, zero information content. Much exhalation about nothing. You don’t even need the “entertainment only” disclaimer, to disclaim non-advice.

I prefer Pierpont Morgan’s pithier, more elegant quote: when asked where he thought prices will go, JP said, “they will fluctuate.” It doubled as a sort of “kiss off” rejoinder.

PPP giveaway’s. FTX and crypto pyramid schemes. Demand/Supply curve. Large McDonalds coffee still $1.00 in Denver but $2.00 in Oxford, MS. It is What it Is? Participate or stay inside. Caniac combo now $16 @ Raising Canes, chicken strip inflation. Filled the tank at Shell gas station yesterday selected E85 for $2.85, my receipt read $3.35 didn’t both going inside to ask questions.

That was a great, succinct cartoon of the circus we have come to live in. It is a fun-house mirror image of what once was so world-leading.

I can still be free, mostly by abstaining, and enjoying what is truly worthy. Epictetus, writing in the year zero, could have told you the same. He lived in a similar circus.

I saw a claim today (again) that one third of poll respondents would be shocked at a $400 emergency expense. Not sure of the methodology though.

They should sell those $400k median houses for liquidity.

Gas price if with car wash?

The headline sales chart is interesting. Obviously a lot of pent up demand from 2020 was unleashed in 2021, but that money has gone into the market now.

I wonder how much impact mortgage rates have had? Personally, I’ve gone from being on the verge of buying to being completely priced out of the houses we want long term, so we now have more of down payment than we need. We’re *not* splashing that cash, but I wonder how many in our situation are?

As an aside, it looks like current sales have spiked very close to the long term trendline from before the 2009 crash. Just a coincidence, or is there some fundamental reason that would make sense?

count me in.. I waited a decade to pool up the money and for other personal reasons.. and now I am waiting on the sidelines.. I can’t jump into the firepit knowing the consequences.

Americans are very short-sighted and spend nearly every dime they put in the bank, so they will continue to spend until the bank accounts dry up and the credit cards are maxed out. Some Americans are already at that point, but others have lots of cash to spend. I think in six months we are in a very different situation. With plunging home prices destroying the wealth effect, further reduced portfolios and layoffs and wage cuts happening.

And with Republicans in charge of one house, there will be no big spending bills passed through. Also local and state governments will see tax revenues take a hit from the tax loss harvesting, so cuts in government are coming too. And pension plans are going to start to run into problems. But I would say it is late 2023 and 2024 when we see the full impact of the whiplash effect from this over-consumption.

I would like to know how much of the Miscellaneous category are pot sales. Seems that some people are enjoying life…eating out, drinking, smoking pot and engaging in hobbies. Those categories still are doing incredible. Is it the newfound freedom of work-from-home?

I wonder if WFH is actually a big reason why spending is so much greater? People have cash in the bank and dont have the pesky boss to monitor their time at an office, so they can get out and buy and also buy from home.

I wonder if anyone is looking at this correlation.

I think that was the reason for Wayfair stock to skyrocket about 12-18 months ago, now crashed down about 90% off high.

For those homeowners who refied at 2%/3%, they have extra money to spend. For home buyers who got low mortgage rates and wage increases due to inflation, they have money to spend.

There are many ways a household could find or make extra income today.

So exactly what and when does the Fed mean “before inflation is entrenched”? Sure feels like it to me. Everyone doing the pricing ain’t letting up and looking for ways to continue.

Dozen eggs were $4.25 yesterday and I left mine at the store. BS!

Seems rather odd. Every category is still above the long-term trend line.