The ECB’s horror show.

By Wolf Richter for WOLF STREET.

“We do not see the components or the direction that would lead me to believe that we’ve reached peak inflation and that it’s going to decline in short order,” ECB President Christine Lagarde told the European Parliament on Monday.

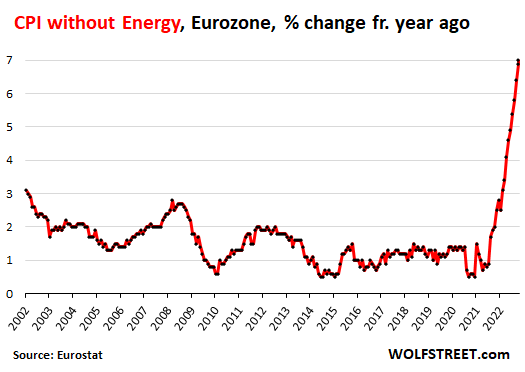

And so it came to pass today: In the 19 countries that use the euro, the CPI without the energy products that consumers buy (gasoline, diesel, electricity, natural gas piped to the home, etc.) rose to a record 7.0% in November, continuing the breath-taking spike.

It had started in the summer of 2021, and by October 2021, it hit 2% and by February 2022, it hit 3.1% and hasn’t looked back since, as inflation has been spreading deeper into the economy, beyond the volatile energy prices. And it’s a bad sign, and it was what Lagarde was referring to:

Inflation in the energy products and energy services that consumers buy – mostly gasoline, diesel, electricity, natural gas piped to the home, and heating oil – was still huge, and the CPI for those components jumped 34.9% from a year ago, but that was less than the 41.5% spike in the prior month, which helped make overall inflation a little less horrible.

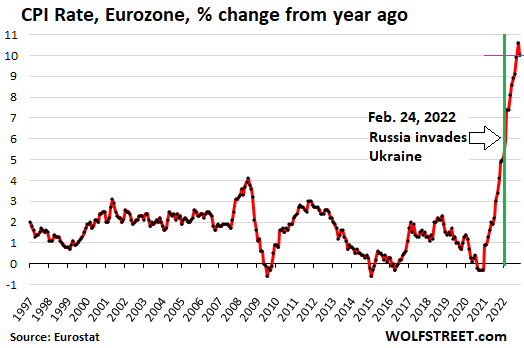

The overall CPI rate, at 10.0%, was the second worst ever, slightly less horrible than in October (10.6%), which had been the worst in the history of the Eurozone data going back to 1997, according to Eurostat data.

Inflation began spiking in early 2021, a year before Russia’s invasion of Ukraine, when inflation broke out globally while the pandemic money-printing and deficit-spending stimulus binge was still raging.

In July 2021, Eurozone inflation shot past the ECB’s target of 2%, hit 4.9% in November 2021, and 5.1% in January 2022 before Russia invaded Ukraine. Russia’s war in Ukraine made the trends worse:

Yet inflation subsidies held down CPI across the Eurozone, as governments implemented all kinds of schemes, subsidies, tax cuts, and price caps to reduce the bite of this inflation, particularly related to energy products and services, public transportation, and the like.

Inflation by Eurozone country.

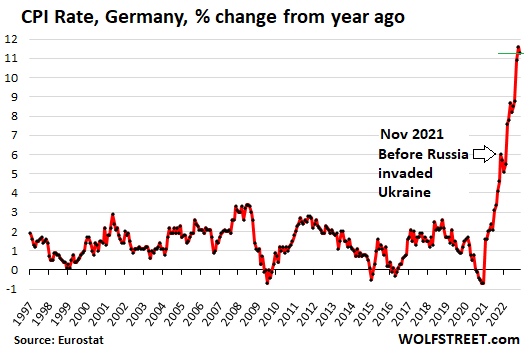

In Germany, inflation was just a tad less horrible than in the prior month: 11.3%, based on the harmonized method used by Eurostat, after the 11.6% shocker in October. By Germany’s own CPI measure, the October shocker had been the worst since 1951. Already in November 2021, well before Russia’s invasion of Ukraine, inflation hit what was then an unthinkably high rate of 6.0%.

In the three Baltic countries, overall CPI inflation still raged at over 21% in November, which was slightly less horrible than the raging in October.

A new high in two countries: Overall CPI hit a new high in Finland (9.0%) and Slovakia (15.1%).

In France, November inflation matched the October record (7.1%).

| CPI, November 2022 | |

| Latvia | 21.7% |

| Estonia | 21.4% |

| Lithuania | 21.4% |

| Slovakia | 15.1% |

| Italy | 12.5% |

| Germany | 11.3% |

| Netherlands | 11.2% |

| Austria | 11.1% |

| Slovenia | 10.8% |

| Belgium | 10.5% |

| Portugal | 10.3% |

| Ireland | 9.0% |

| Greece | 9.0% |

| Finland | 9.0% |

| Cyprus | 8.3% |

| Luxembourg | 7.3% |

| Malta | 7.2% |

| France | 7.1% |

| Spain | 6.6% |

The ECB’s own horror show.

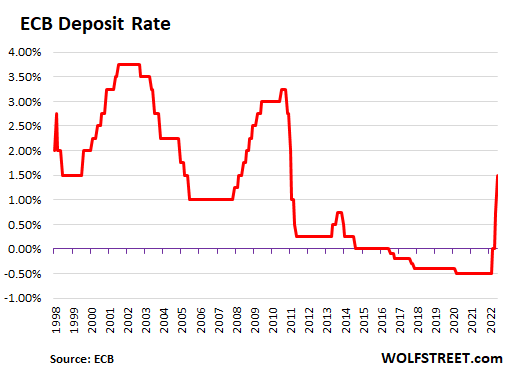

After years of whatever-it-takes money printing and negative interest rate policy – the greatest central bank absurdity ever concocted – the ECB is now facing the results: raging inflation.

The ECB finally got started reversing course. At its meeting on October 27, it hiked its deposit rate by 75 basis points, after 75 basis points in September and 50 basis points in July, for a combined 200 basis points in three meetings, the fastest move in the ECB’s history, as “inflation remains far too high and will stay above the target for an extended period,” as it said. And more rate hikes are on the table.

But it started with the deposit rate at -0.5%, and the 200-basis-point hikes only took the rate to 1.5% — while inflation is raging at 10%.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Energy can’t keep falling forever, so I take this to mean that next month will be higher. Or will the base effect be enough to result in a flat or lower print?

Some conutries in Europe can have a hyperinflationary winter.

Sad to see our ally losing stand to communists, but someone will have to pay for all of ECB’s stupidity.

America tried to rig the price of oil lower which would also affect gasoline prices. That should end this December 5th.

Will be interesting to see what the next round of CPI for US will look like since the market has well moved onto the kinder and gentle FED and the goal posts for FED pivot keep changing..

Wonder if traders in EU are also delusional that ECB pivot is around the corner despite these horror show numbers

They are. The central banks have lost credibility, so no one believes what they say.

Until it becomes painfully obvious they mean what they say.

Powell is out flapping his lips right now, and of course he is already talking about lower rate increases in December. The DOW went straight up as he said it.

I find it hilarious that people think inflation is over with, the FED will stop raising early next year, then everything is off to the races again. The DOW looks poised to set new highs. It’s a laughable situation. That would be the most tepid inflation fight in history.

I’m actually starting to believe that Powell doesn’t care about where the stock market goes. I think he and the FED are worried about cooling the housing market a bit.

Not caring about rampant speculation and the speculators themselves in an everything bubble with raging inflation is to not even understand the problem. Until the rampant speculation is culled, you can’t stop it.

“I think he and the FED are worried about cooling the housing market a bit.”

My theory is, with higher stocks/crypto, it will be hard to ‘cool’ the housing.

And what better way to “cool the housing market a bit” than to bring back rampant stock/crypto speculation and its attendant wealth effect?

The main worry is cooling housing and knocking down rental component….its a carrier that takes a long time to turn…

I think this is a xmas present for Americans, it might be a time to lighten up on stocks with any run into new years

think the next move down will be very brutal

As much as I hate Powell, I know he is not stupid so the fact that he is even hinting at what the market wants to hear and then as a byproduct market shot back up right after therefore loosing financial market condition again is truly mind boggling and incredibly frustrating.

I guess once an arsonist, will always be an arsonist deep down inside…

He basically just admitted he’s a fraud. All of that “tough talk” of the past few months was all bluster. Now he’s back to his yellow-bellied, spineless coward self, talking about how scared he is to fight inflation. “Doesn’t want to crash the economy and clean it up later.” So his solution is to let inflation rage, and keep giving speculators the green light. This guy should be fired immediately.

Depth Charge,

READ HIS SPEECH. Google: Powell speech

Then click on the link at the top of the search results to the Fed’s website. It’s a good speech. Lots of hawkish stuff in it (higher than expected, for longer, rate cuts not even on the table, inflation not going away).

And quit reading CNBC headlines.

At this point, do we even have a market? Isn’t this all a low vol machine driven spike?

Well bitcoin back up pass $17k again even as things continue to blow up…there goes the tough talk on reversing wealth effect..

haha maybe those Crypto dip buyers got this one figured out or nothing goes to heck in a straight line right? Consider this Powell’s early christmas gift to y’all

It appears to me that the tough talking Powell was brought out for the election cycle and now we are back to the wimp Powell who is the guy that Wall Street chose to protect their interests.

I have never heard the Federal Reserve talk about asset inflation, which is the real problem.

Wash, rinse, repeat.

Are you not amused?

Not only is SBF a free man but he’s also on stage with our Treasury Secretary.

If you don’t know who the sucker is at the poker table, it’s you.

Hey, SBF did a good thing: he showed everyone what a huge scam the entire crypto scene is. He should get a whistleblower award LOL

The government has only one tool, the money printer. Not using it requires discipline. Does anyone think the morally bankrupt bureaucracy and political class will choose discipline over profligacy and corruption?

“I guess once an arsonist, will always be an arsonist deep down inside…”

The Fed is interested in protecting :

1. The banking cartel

2. The ultra rich

Everybody else is on their own.

Phoenix_Ikki,

Look at it this way: when financial conditions loosen, the Fed is going to have to raise higher and keep it there longer. Markets are shooting themselves in the foot with these rallies, and Powell knows this too. Let them shoot their feet off until they’re just bloody stumps, he’s thinking while raising to 4.5% in December and to 5% and higher next year, which no one had envisioned a year ago.

These rallies are a good thing. The last thing we need is a crash that would cause the Fed to wobble in its determination to crack down on inflation. These rallies will keep QT going, and they will keep the rate hikes coming.

There was a time when markets tried to force the Fed’s hand by crashing. Now markets are supporting the Fed in its crackdown and they’re enabling the most hawkish Fed in 40 years. It’s fascinating to watch this.

The last thing I would want is a crash and a credit market seizure because that might stop the Fed from moving forward.

The tone of the jpow speech and the Q&A was a little surprising to me considering he deff knows what the market reactions will be. Maybe he just already knows the dot plot in two weeks will kill the vibe 🤷

Listening to him felt to me like he was patting himself on the back.

Seemed like he should have had a big mission accomplished banner behind him…. Looking at you George W.

Overall though:

labor market tight AF

Inflation high AF

Markets dumb AF

On to PCE tomorrow and NFP Friday.

To Wolf, thanks and that’s why I like reading your stuff. Helps me keep a good perspective of the market, regardless of how insane and frustrating it is. I guess my thinking always give the market a benefit of a doubt they will at least be wise enough to play dead long enough so daddy doesn’t crack the whip as hard…but too much credit was given perhaps, my mistake…

Market kept being delusional, wonder when and how ugly the chicken will be when it comes home to roost.

I agree with Depth Charge. I actually watched the Q&A, all of it. I heard the ghost or Arthur Burns speaking. I would not short the market now, even after today’s 4.5% one day runup. He made his real intentions clear — stop early at the first sign of real trouble rather than risk causing damage.

He sounds like they have inflation under control. Smaller interest rate hikes.

Too many Boomers retiring and not enough immigrants to take their place

Housing will drop once they build more houses.

You’re twisting what he said. Read his speech. They do NOT have inflation under control, he has no idea where it’s going, and core inflation might go higher next year, he said, and he pointed at reasons why.

They’re worried about the tight labor market. The labor market is tight in part because of high demand for goods and services, and in part because of excess mortality in the working age population, excess retirements, and slower immigration => but these retirees are not returning to the workforce and more people are retiring, he said. So they NEED TO REDUCE DEMAND FURTHER, he said.

If you read his whole statement it actually says that their expectations for the rate at the end of tightening are higher than in Sept, not lower. That statement about slowing of interest rates increases in December is the ONLY statement that is dovish. Yet the market went crazy for it.

Next week will be a bloodbath, as the inflation number does not include the healthcare adjustment that was in the October inflation measure.

The big boys on Wall Street are trying to sucker the retail investor to buy their shares before the plunge to come.

These central banks still have enormous balance sheets and noone is talking about getting these back down to Pre-Covid levels. I think that the large balance sheets basically prop up financial markets and have caused the great wealth inequality. Sell off those balance sheets and the REAL economy would finally be seen by all.

I hope you are right, the market, especially pumpers like Tom Lee deserve a good christmas punch to the face, metaphorically speaking maybe..

You said it!

My first thought upon getting the abbreviated version of what he said was “How did they misread his statements this time to ignore something more hawkish?”. That said, unless he was looking to jawbone the market higher, he still should have known better.

All’s it takes to get the markets rocketing are several “aligned”- colluded large positive bets post fed statement to get the ball rolling like a bad rumor; until their algorithms are programmed again “sell” in an orderly fashion. It is an illusion/ delusion

@Adam,

He said he was going to stop QE well before he was close to a “tight” threshold. He said the swings in liquidity were very large and he would keep a pad sufficient to account for that. Well, those swings can be a trillion dollars, as we’ve seen with the over $1 trillion recent drawdown in a short timeframe.

https://m.youtube.com/watch?v=GSDegbB21QI

15 minutes, 30 seconds into this video, he begins the QT discussion.

In the section, Powell very briefly discusses the “ample reserves regime” that will limit how far the Fed can draw down the balance sheet.

I have covered this in detail here couple of months ago:

https://wolfstreet.com/2022/09/05/by-how-much-can-the-fed-cut-its-assets-with-qt-feds-liabilities-set-a-floor/

Wolf,

I consider the article you linked as one of your finest ever, indicating an absolute floor of $5.2 trillion for liabilities. Attempting to summarize your linked article with another excellent article you posted earlier this week, https://wolfstreet.com/2022/11/27/the-feds-liabilities-under-qt-november-update/ , I calculate $5.2 trillion floor + $1.5 trillion slack (likely Powell buffer) = $6.7 trillion likely Powell floor vs current $8.58 trillion liability, meaning roughly $1.9 trillion of burn left in the QT coffer. I don’t completely understand how balance sheet runoff works, but it seems like the QT buffer could be gone by the end of 2023. And I’m guessing they would need to restart QE when that buffer is depleted?

2% inflation target is just a slower rate of institutionalized theft, something they openly admit intending to do, ” forever”. (Well, as long as central banks exist.)

The most ridiculous aspect of it is that it’s considered “legitimate” under “public policy”. Hypocritical double standard.

“….he is already talking about lower rate increases in December”

would that be the start of a pivot ? Wall Street sure thinks so.

Depth Charge,

No one read his speech, it seems (hawkish: higher than expected, for longer, rate cuts not even on the table, inflation not going away, core inflation might get worse next year…). Just algos reacting to a CNBC headline.

And with impeccable timing, as you might expect.

Right when the $SPY was about to double tap a support line (or maybe it did, depending on your artistic rendition), JP’s magical words casted a spell and Skynet pushed the $SPY up towards two lines of resistance.

Maybe tomorrow, the experts will finally RTGDFS, and the $SPY will get rejected or we thrust further into bizzarro world, and the market treats an announced rate increase like a decrease.

Not so long ago, the market crapped its pants over 50bps and now its champagne bubble baths.

Oh, and for the DOW? No clue. With the secret collateral hideout AKA bitcoin getting liquidated, it may be back to the Blue Chips which may be why the $DIA is taking a sharper turn upwards?

Charles Payne on Fox business must have read his speech. He said the housing market is heading south big time. Nothing can stop it now. Also, he brought out the explosion in credit card balances and the massive decline in the savings rate. The whole economy is hollowed out and will follow Europe into a recession or mini-depression.

Wolf

Compare his speech in contrast to what 3 other FOMC Members ( a few days ago) with 100% hawkish remarks including Mr. Bullard the most ‘dovish’ member!

Striking difference!

No difference. They agreed: 50 in December, more next year to 5% and higher, and stay there longer, rate cuts not at all on the table, inflation trajectory unknown, core inflation might go higher next here, need to have positive real rates across the spectrum, etc. He hit all the buttons today.

We saw the rigging of oil prices which by some magic coincidence coincided with the midterms. So come December 5th oil and gasoline prices should rise. They took a page out of the rigging of Wall Street for that one. Of course the feeble public will be duped into thinking inflaiton is falling when the drop was artificially caused.

It must be quite a bit of surprise for ECB to see that relentlessly printing trillions of Euros for a more than a decade can lead to inflation.

I have older relatives in my family who 1000% believe EVERYTHING they see on the “news”. Any time I’ve posed the idea that inflation comes from the tidal wave of funny money, they routinely flip out and start blathering about “corporate greed”.

Really? So they’re only greedy NOW, but they weren’t “greedy” under Trump? Or Obama? Or Bush?

And that’s why Central Banks get away with this. Because they have millions of unpaid volunteers running interference for them

Sammy – I feel your pain. I have given up trying to have discussions with many people about their political beliefs. They just are not capable of hearing anything that doesnt jive with what the “authorities” tell them through major news media.

I actually think the younger people are more brain-washed than the older people today.

Lagarde will take it seriously next time, won’t she.

I think as long as the dollar is world reserve currency, the rest of the central banks have to follow the Fed or they get ran over by the market.

US money velocity, demographics and private economy better in USA than Europe, Japan, China, but US still a stinky shirt in the hamper.

Those graphs remind me of the great prophet Buzz Lightyear: “To infinity and beyond!”

Another of the prophet’s great quotes could well apply to the ECB:

“There seems to be no sign of intelligent life anywhere…”

Do you ever wonder why big telescopes are pointing away from earth when they are looking for intelligent life? LOL!

I am a Dutchman living in France. From my own experience I can attest that the published CPI figures, at least for those 2 countries, seem to be a bit on the low side, to put it mildly. Not to say complete fabrications.

Shopping is becoming a nightmarish experience, with lots of prices often being up more than 50% since the beginning of the year, packaging contents being stealthily reduced, or even both.

One also experiences changing attitudes in people. Traffic incidents and road rage are off the scale. Police, care providers, shop personnel and so on are complaining of mounting aggression from the public. Rumors about coming electricity blackouts and shortages abound. To the people in the street, there seems to be no end in sight to the bad news.

I really do wonder what is in store come January/February next year, when the Christmas money has all been spent, the temporary stopgap measures like gas tax reductions have ended, the weather is generally cold, wet and awful and the bills are piling up.

Allow me to cite that old cliché of the fuse and the powder barrel…

Britain’s economy is in the dumpster.

Concurrently, the FTSE 100 is at or near an all-time high, though still basically flat with either 2007 or 1999.

Jos,

Here in the Twin Cities (Minneapolis & St. Paul) there’s also been more aggression and road rage. Since the Covid lockdowns began two and a half years ago it seems like a small percentage of the people had a behavioral switch flipped out there on the roads. I am not alone in this observation.

Most people are still “Minnesota Nice,” but those drivers that had their switch flipped are speeding and running red lights/stop signs. Funny that traffic fatalities increased at the same time the roads became less crowded.

And Target, headquartered in Minneapolis, recently reported in their quarterly earnings statement, organized crime thefts have dramatically increased and affected their bottom line profits.

We have inflation, but Minnesota also has the lowest unemployment rate. I agree with you and the cliché, and wonder if the fuse is going to blow the powder keg again, as did the killing of George Floyd.

There are a lot of visible homeless tent encampments too. Being without a house or shelter in Minnesota’s winter ain’t easy…

Europe has energy needs that we in the USA, thankfully, do not. My energy costs this winter will be higher that last year, but no where near as much Germany, France or the UK.

Thank you for your insights into the situation in Europe. The same things are happening in the United States. Falsely low readings on the CPI due to the method by which it is calculated. Grocery prices through the roof. “Shrinkflation” everywhere, along with outright shortages. Social strife in virtually all aspects of interaction. Scary stuff. Not sure where it’s going to end…

Watch what happens in Europe and it will all happen here.

Wolf, can you help us assess this? Powell just now signaling that the Fed will pull back on hikes (dec now will NOT be 75 bp. Will it be 50 or even 25?

Is Powell wimping out big time or is this what you expected? From reading you, I don’t think you expected Powell to lose his nerve so quickly

50 in December, more next year, to a higher rate than they’d projected in September. That’s what he said. He also said that inflation is unlikely to back off, and they’re not being influenced by just one monthly downtick after two monthly increases. He said downticks have been followed by upticks, and that it’s likely to happen again – the guy looks at my charts, LOL.

There was nothing new in what he said except that they will go higher than expected and stay there longer. They’re gonna go to 5% or higher, it now looks like and stay there longer.

And rate cuts aren’t even on the table, he said.

The September shocker meeting is now coming true, except even higher and for longer:

https://wolfstreet.com/2022/09/21/powells-whatever-it-takes-moment-our-policy-will-be-enough-to-restore-price-stability-fed-hikes-by-75-basis-points-in-shocker-sees-4-4-by-end-of-2022/

I read the headlines, then say to myself and my wife they are probably BS. Then I read Wolfstreet and your comments for the truth. LOL!

JP and the other 3 didn’t say anything new since previous Fed meeting.

I know its wishful thinking but they should just shut it and wait until next meeting.

I can’t wait for Wolf to go over Powell’s speech today, because some of the nuggets coming out of it are pure speculator gold. The market just turned on a dime and is going parabolic as Powell “doesn’t want to over-tighten,” “might slow rate hikes,” etc. “Another Volcker?” LMFAO. I knew this guy was a fraud. You can’t stop inflation until the fed funds rate is ABOVE CPI. This guy just went “transitory” again. Prepare for hyperinflation.

There is nothing new in his speech. Everything was already priced-in. They were expecting a 0.5 increase in December a few months ago. This is a fake move by the market. But Powell not speeding up QT is criminal and the reason why there is still so much rampant speculation in the market.

If “everything was already priced-in,” then you wouldn’t have this face-ripping move up, Kevin. Come on, think about it. It’s Powell’s language and choice of words.

I agree with you. He is choosing his words deliberately. The worst chair in Fed history.

Are you listening to the same speech I am? Because I am seeing far more hawkishness than speculator nuggets.

This is guy the algorithms doing what they do.

Einhal,

Yes, agreed, lots of hawkish stuff in the speech: rates will go higher than expected, stay there for longer, rate cuts not even on the table, inflation not going away, core inflation might get worse next year, need to reduce consumer demand further to bring it in line with the supply of labor.

Good speech actually. But no one read it, just reacting to a headline on CNBC or wherever.

The shocker of the September meeting is coming true: 4.5% by December, 5% and higher next year:

https://wolfstreet.com/2022/09/21/powells-whatever-it-takes-moment-our-policy-will-be-enough-to-restore-price-stability-fed-hikes-by-75-basis-points-in-shocker-sees-4-4-by-end-of-2022/

if inflation doesnt come down, it will only mean that interest rates stay higher for longer. the fight will not end for a very long time if they dont take it seriously.

Jeeze! And I thought he was the “working man’s friend”! You know: reconnect the market to the “real” economy. What there is of it and such as it is!

Yes. Hyperinflation indeed. There is no escaping it, at this point, based on what I’ve seen.

If we pull back and watch the whole story, from the beginning, it seems deliberate. All the transitory talk mixed with all of the “oops”, “we had no idea”, “yikes”, and other miscellaneous BS.

They are great at acting the fool when they are anything but.

Europe is still a vassal of the USA. The architect of the Border Lands debacle Victoria Nulands said it on a hot microphone plainly and accurate. ” Fu$k Europe”. Keep being a vassal Europe and keep listening to “leaders” like that IMF criminal Lagarde. Seargent Schultz in Germany has also been really helpful. Eurocide is helping keep my inflation at bay here in the USA. The Inflation Reduction Act passed by the Congress had a nice little earley Christmas gift to the USA paid for by Europe ,European industry. Thank you. The loss of the worlds largest precursor chemical plant that BASF is moving to China due to European leadership “success” is just the start of replacing the Marshall Plan by dusting off the Morgenthau Plan that’s been sitting un-used on the shelf for 70+ years. It’s a great read.

And in the Netherlands the Dutch will be closing more farms to prevent global warming or now the climate change mania; at least you could eat tulips during the 17th century Tulip Mania and the Maunder Minimum little ice age, although the Caribs were still doing cannibalism, the noble savages, and without high tech Solyent Green.

Europe is in a world of hurt. What is really sad is that at this point there is no plan to make things any better. Energy is the main driver of inflation, and so long as Europe is dependent upon expensive imported energy, they are looking at serious economic times.

EU has thrown their public under the bus to support the US Empire, the supposed international liberal order. That’s what the sanctions represent.

The “printing” and deficit spending associated with the pandemic got it started, but the sanctions made it worse.

This. Europeans are being betrayed by their “comprador elites.” Wonder how long they go on sleepwalking before they revolt?

Wars have been started over energy access. And they’ve been lost over it too.

Seeing the DOW within 5-6% of ALL TIME highs is really something to behold. No reason there can’t be a few +3% days to punch into record territory the way this market is behaving. If I had anything to sell, I might be thinking about it..

Makes some pundits look like geniuses.

United Health weighs over 10% of the 30 Dow stocks now, Apple weighs less than 3%. The Dow is a screwed up average of stock prices. Don’t pay attention to it.

United Health is also headquartered in the Twin Cities. My portfolio is over-weighted with local companies, and it seems to me that investing in businesses in my back yard makes sense (preferably cents x 100).

Devil’s advocate.

The ‘dovishness’ was there NOT to exasperate the FTX/Crypto fallout…perhaps?

butters,

the only “dovish” thing is in people’s wishful imagination. What he actually said was that rates will go higher than expected, stay there for longer, rate cuts not even on the table, inflation not going away, core inflation might get worse next year, need to reduce consumer demand further to bring it in line with the supply of labor, etc. Read his speech.

The Christmas buying season and boxing day sales. It’s all a smokescreen once boxing day is over inflation will take a second leg up with energy prices spiking again.

The German CPI is 12%, but in Germany the 1Y%, the highest, is only 2%. At negative minus (-) 10% Germany is cutting debt.

With negative rates Germany can finance Ukraine ordnance and energy coming from US.

Dow is really taking off. No need to worry about a soft landing, no landing needed as we are going straight up.

Dow doesn’t matter. It’s price-weighted and not market cap-weighted (not even going into the very few companies in it). S&P’s moves mean a lot more and 3%+ today was another ridiculous algo run-up. The only reason I think media talks about the Dow is the number is bigger and bigger numbers catch readers eyes.

Powell just delivered a little pre-Christmas surprise to all of the working class and the poor struggling with inflation – COAL.

If only, at least you can burn coal for heat. I don’t know how well dollars burn (let alone crypto. to be fair, gold and silver don’t burn that well either).

Depth Charge,

Enough of this BS. You’ve spread it enough. Enough is enough. Take a deep breath and read his speech.

Wolf – I thought this was one of my better comments. :) And I am going to read his speech right now.

I commented the same thing many months ago as I expected this to happen and it did. Just like I commented about the midterms and the price of oil and consequently gasoline prices magically falling. Welcome to the real world it wasn’t magic.

I think you missed the message of DC’s use of coal:

Lumps of coal, that formerly could be and were picked up on most RR tracks, were put into poor folks ”stockings hung up for Santa Claus” back in the day when there was nothing else.

It’s kinda an obscure reference these days of diesel fueled trains,,, so maybe DC showing a bit of age???

Darn! And I thought the Naomi Prins’s of this world were just making stuff up!

What was she saying?

Today definitely gave me a pause. Powell said the right things and he was kinda hawkish tbh. But he knew very well which words to choose and he wanted this to be interpreted certain way. He accomplished that…makes you wonder he was never to be trusted to begin with.

He specifically said he’d hold rates at the “terminal rate” for much longer. And for that, the 10 year treasury went down by 10 bps. That doesn’t really make any sense. This is all the same nonsense we’ve seen for six months. Watch it reverse later this week.

Honestly it was a net nothing speech. Yeah inflation is bad, but it was better in oct which is good…obviously covid destroyed the labor force, but let’s hope wages don’t go up too much otherwise we’re effed. Just a bunch of contradictory nonsense, so the market heard what it wants to hear. Consumers still spending is all that matters, the day that stops you’ll hear some real kicking and screaming.

Yes, Jpow purposely delayed raising rates and purposely delayed stopping QE and now only did it to make it look like they are trying when they are not. They know what they are doing. They won’t let their assets drop too much. He even said he wants to see more people unemployed…those people are not asset holders like him. Its no wonder people like him hold their conferences in Jackson Hole, WY (Teton County, largest income and net worth disparity in the US). There is no chance they will do any significant QT or rate raising and will rather let inflation run and hurt us laborers while he and other asset holders do fine as inflation doesn’t affect them. Printers will go back on when they feel like they’ve done enough so sometime next year.

Yep, I am seeing a likely repeat of 1970s again. Of course it’s never exact, but it always Rhymes.

I read that in the 70s, Fed was tepid in raising rates. Whenever economy slowed, they pivot or paused. The Inflation rose again, and they again Purposely behind the race to raise rate. It kept going on and on, with savings WIPED OUT, just like RIGHT NOW.

Until a strong man Volcker came along to seal the deal. Powell is not Volcker, whatever he claimed he wants to be like Volcker.

Powell is Inflation Arsonist!!

By 2024 Inflation comes down to 2%, prices would have risen 50%. Savings WIPED OUT!

Legitimate question: what are they doing differently in each of these countries to explain the spread in inflation. This isn’t a small spread its 21.7 in Latvia but only 6.6 in Spain. That’s a 15% spread. If the ECB rates/money printing were the only factor every Euro country would have precisely the same inflation rate. So it would be nice to know what on Earth Spain is doing right and Latvia is doing wrong to explain their drastically different outcomes from the same central bank policy.

The Spaniards are probably more audacious liars.

All 3 Baltic countries have a lot of imports, way less sufficient than Spain. This adds up.

Plus very low state budgets, and a lot less window dressing than in Spain, Germany, etc. If consumers pay the whole price for electricity, transportation and so on, compared to Germany for example, this makes a difference in CPI readings. This is Consumer price index, not Overall price index.

For better picture, look at EU countries PPI, where almost no subsidies as of now, this one is really ugly.

How many people in Europe have pension payments that are fixed in perpetuity? I know most defined benefit pension plans in the US have fixed payments.

With inflation at 10% to 25%, shouldn’t these people be out rioting in the streets?

This is why everybody is looking at the Germans. They are all in on cash savings and rent they don’t have that housing asset.

Apparently they are sucking it up because of war guilt but I don’t know, compounding 10% real loss per year is a fair old amount. The northern euro members are the same, you sometimes read the Dutch saying they should be out.

The PIIGS are glad for the debt relief.

NDX is a big boy today. It celebrated a Bar Mitzva. DM #12 was a year ago, in Jan 2022.

Five minutes ago the cry was these folks had no revenues. What happened to that?

You’re as dumb as those who bumped the markets today. You might be more dumb

I’m 63 now, but when i was but a lad of 18, i pumped gas and stacked groceries in a small town store in saskatchewan. I bought gas for about 30 cents a canadian gallon, which is about 4.5 litres. My wages were 4.50 an hour as i recall. So… each hour of work would have bought me 15 canadian gallons of gasoline or 67 litres of gasoline. At 1.80 a litre (the current price of gas in the yukon) a kid pumping gas would need 121 DOLLARS AN HOUR to keep up with my wage in saskatchewan in 1978!

Our buying power is toast in canada too!

what i really want is for the Fed to be forced to sell ALL of the debt it has acquired within 5 years and the federal government to be put on a balanced budget within 5 years. and make social security and medicare cut benefits to where they are funded for the foreseeable future.

then let the economy fall as far as it will, so we can get back to REAL free market dynamics of natural supply and demand.

maybe people would only buy a new iphone when the old one broke (like me)

This economy has become a matter of stumbling forward, maybe tumbling forward, goosed with whatever juice they can concoct. The razzle dazzle is so distracting though!

Or maybe do without one (iPhone) altogether.

You can’t be serious, gametv, that you want the entire US Federal debt retired — that would reduce $USD in circulation to zero (by definition) not to mention making pricing of other assets extremely difficult since there would no longer be a “risk free rate”

That’s exactly the problem I see motive, and why I feel we are now quite overdue for some serious changes in the relationship between costs of living and wages.

Having to work my way through college, I was fortunate to have a very nice studio apartment for $50.00 per month and be able to work as much as I wanted for $5.00 per hour…

Last I heard, that apt is now $2500.00 per month and wages for similar work about $25.00.

So 10 hours a month for rent in 1970, 100 hours a month for rent in 2022.

NOT fair to youngsters far damn shore, and needs to be fixed ASAP…

motiveunclear

16 years before that I handled hay bales, each one twice, for a penny. This equated to 1,000 bales and $10 for a 12 hour day.

I drove a tractor for 60 cents per hour, again a 12 hour day.

That 60 cents would allow for a Sunday matinee and a soft drink and hamburger. Another dime would also allow this for my date.

Cheap date I know but times were different in SEMO back in the 50s. Gasoline was 17 cents a gallon if I took it from the farm fuel tank, 18 to 25 from a station.

A country gravel road drive and park for a nice view of the stars. All of this is a fir piece from today’s world. But it was fun! back then.

I sold free games on pinball machines as far back as age 4. I never had to spend any money when I was a kid.

This is stupid BS. Read his speech before posting garbage about his speech.

Sold my Intel today- nice 30% return in about 5 weeks. Will look to buy again at $20/share.

Someone is going to be badly wrong about the stock market, but the path right now seems to be up.

B/c Mr Powell has chickened out by talking DOVISH ‘slow rise in rates in Dec and possible pause early next year. So Front running crowd has started the party.

Mr. Powell is no Mr Volcker.

On a lighter side of things…it’s always nice to see oligarch throw their temper tantrum..especially this genius 4D chess playing master…guess the bounce in Tesla stock today isn’t good enough, need to take it back up to Mars again..

““Trend is concerning. Fed needs to cut interest rates immediately. They are massively amplifying the probability of a severe recession,” Musk wrote.”

Everything is the biggest, worst, most looming, with him now, each day. All catastrophe and epic struggle all the time. He has caught the twitter brain rot condition.

Wolf

Appreciate you keeping us up to speed with the Eurozone CPI and the antics of the ECB.

I gaze at the MSM, at best, so you and a few others are the only people I let shape and refine my POV on the geo-financial landscape.

Plus, it seems like it’s been crickets and tumbleweeds in the European finance and energy news feed ever since reports started surfacing over European energy companies receiving bailouts. OR I haven’t been paying close attention lately – probably the case.

Lastly, I did notice a recent chart showing a buck-wild swing in the Weekly FED Remittance to Treasury.

Maybe an article with details coming to Wolfstreet tomorrow? Next-day?

Or ‘do your own research’?

I cover remittances to Treasury once a year in January, every January, when the Fed releases the annual total. That’s enough. Not many people read these articles. It’s not hugely significant. The Fed remitted $1.2 trillion of its profits over the past 20 years, and in 2021, it’s not going to remit anything because it’s going to run a deficit. No biggie. But maybe this time when I cover it in January, I can find a more exciting title so people click on it?

Great article and lots of interesting, insightful comments! However, let’s try taking a longer view and examining the “big picture” of what the current monetary and fiscal situation is in the United States. This is NOT the 1970’s. The federal debt is much, much higher. And it CANNOT be financed with high interest rates. The government simply cannot afford it. The more likely scenario is that the Fed will accept much higher inflation than 2% because they have no choice.

The ONLY way out of this mess is to inflate away the debt without creating a hyperinflation panic. That has been the strategy throughout hundreds of years of financial history. By the way, has anyone given any thought to what the market will do in the long run if inflation continues? If you are invested in companies with real assets, a wide moat, and making products that people need (not just want), then inflation is only going to raise the price of those assets. That does not mean that the stock market cannot take another serious nose dive. But, think about it. With everything increasing in price, in the long run will the value of the type of companies I have mentioned decrease? Unlikely.

That means that those of you who are sitting on the sidelines and holding cash, are losing a lot of money. Holding a CD or bond paying 4% when inflation is double that, means you are losing money. Personally, I am invested in manufacturing, fossil fuels, precious metals, and tobacco. Quality companies with wide moats who pay a decent dividend. The market is not simply going up due to clueless retail investors and day traders. In the long run, the market will continue to rise, especially in an inflationary environment. That doesn’t mean it might not take a deep dive in the short term, but in the long run value stocks will rise. I love Wolf Richter, but try reading some of Lyn Alden’s stuff to add to your knowledge base.

The bottom line, is that in the LONG run, those who try to time the market end up losing out. Equities have performed quite well over time, but those who try to day trade or speculate do not perform as well. Most investors are their own worst enemies. Try reading “The Anxious Investor” to better understand this.

Comparing previous investment period is foolish and moot since:

-when was the last time Fed instituted QE before March of ’09? QE had no prior record or research!

When was the last time Fed suspended ‘mkt to mkt’ accounting standard?

When was the last time FFR was suppressed all the way down to 0.25 before ’09?

When was the last time Fed bought MBSs and also Corporate Bonds, before ’09?

When was the last time the total Global debt was over 300% or USA’s over 130%?

When was the last time the Fed’s balance sheet was 31 Trillions?

Answer NONE!

So don’t pontificate. Those books are irrelevant now! when Free mkt capitalism has been replaced by Crony/Predatory capitalism since March of ’09

(been in the mkt since ’82)

“Equities have performed quite well over time,”

Because of money printing. It took 7 years of QE to July 2015 to get the Nasdaq back where it had been in March 2000. That’s 15 years in the hole, and only a huge amount of money printing got it out, and now we have raging inflation. So yes, if your stocks are down 40% in three years, and they lost 15% in purchasing power during that time, you’re down 55%.

The Nasdaq plunged 78% in 2000. That was the last real stock bubble we had, before this one.

If you’re investing in tobacco, as you said, you’re nuts — for all kinds of reasons. Sure the dividend is nice, but the long-term share price decline is not nice. At least invest in something that has a future.

I only believe in cash flow and dividend (stocks/ETFs) from the stock mkt at this time. I only buy when the mkts go down. I reduced my short positions significantly b/c of front running.

I was too naive to believe all the logical and rational, until March ’09. This is when the so called our good ole ‘ genuine free Mkt Capitalism ceased to exist.

Until Mr. Powell and all the FOMC members declare UNEQUIVOCALLY that there will be discussion of pause until inflation is contained, front running will go on.

Mkts are still calling him a ‘bluff’ It will be roller coaster ride but strong hopium and wishing for a pause will keep this mkt going. Slow rate increase already promised by Mr. Powell.

“The ONLY way out of this mess is to inflate away the debt without creating a hyperinflation panic. That has been the strategy throughout hundreds of years of financial history. “

Indeed.

Your comment re moats and dividend stocks makes sense; but only with the proviso that even dividend aristocrats can be overpriced.

You forget the negative spread between interest rates and the inflation rate. This is what causes people to go broke and is the reason for falling corporate profits.

I see so many comments about pro/cons on Mr. Powell’s speech today.

Bottom line:

Is he really WALK following his TALK or just BS!?

Mkts called him bluff again today. Possible ‘pause’ made the mkts zoom up, as I have always predicted, lately.

It is all about perception and FRONT RUNNING on thw whisper any thing from Mr. Powell regarding slowing down the rates in Dec Etc. Compared this to 3 FOMC members hawkish comments for the past several days! Some disconnected with Mr. Powell and his FOMC fellow members. Again proving Mr. Powell is NO Mr. Volcker, just a shadow.

The strategy of betting on ‘front running’ has been profitable with the power of perception over the reality.

I bought and buying various ETFs and stocks with meaningful dividends, anticipating this ‘front running’ virtually every day. Of course with hedges.

This is going to be routine ‘roller coaster’ until mkts tank 30% or more, very unlikely with this ‘chicken’ Fed.

I have no trust in this Fed lead by Mr. Powell, irrespective of what Wolf is pontificating.

I want the real WALK (action) to follow the TALK (speech) Hawkish means nothing when he has already spoke possible slow increase in rates or possible pause.

Though everything about this post is illogical, my favorite part was “… as I have always predicted, lately.”

‘illogical’

yeh. Tell it Mr. powel!?

And keep looking at the indexes!

Remember that inflation is insidious. Always looking to emerge. From my time in the low margin wholesale food business, we looked for any excuse, rationale, fear, etc., – to raise prices. Part of the game. Just like the car commercials say – BUY NOW for best price. We used to add fuel surcharges when fuel prices went up 10%. We claimed shortages and mfg. recalls and even blamed the weather regarding veggies. So now, people expect inflation and businesses will keep raising prices and everyone will blame Washington. But at least the customers are not blaming the Companies and Washington is always an easy scapegoat. So it follows that more and more price increases can be expected. People will need to reduce buying before inflation stalls. My Wife told me she really likes shopping whether we need the stuff or not. My Grandfather used to say “we need another great depression.” to change the mentality. We the consumers are the true reason for inflation. Think about it.