Another indication underlying inflation won’t drop significantly just on its own.

By Wolf Richter for WOLF STREET.

Workers know what they’re doing when they quit one job to take a new job: They’re trying to get a better job, with higher pay, better benefits, etc., because their current employers don’t want to step up to the plate because they have to keep their costs down. In many companies, employment costs are over half of the total costs, and even small increases in pay across all jobs have a big impact on profit margins. But now, workers are arbitraging this tight labor market for their benefit – and in doing so, they’re forcing bigger pay increases on employers.

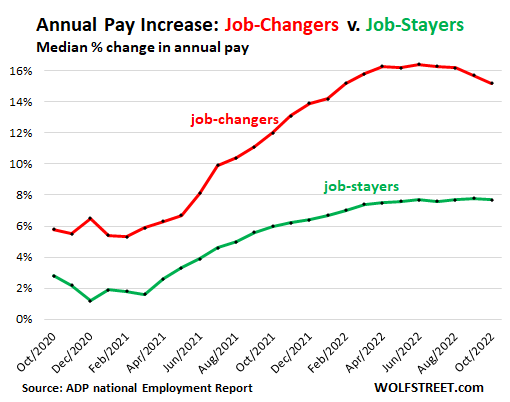

Pay increases have been big this year and last year even for “job-stayers.” But they’re huge for “job-changers.” According to the ADP National Employment Report today, the median change in annual pay in October was:

- Job-stayers: +7.7%

- Job-changers: +15.2%.

To beat CPI inflation that has been raging at 8% to 9% this year, workers have to change jobs; if they’re not changing jobs – the loyal employees who stick it out through thick and thin – well, they might appreciate the pay increases, but they’re just falling further behind.

But some of the job-changer pay-exuberance has been fading just a tad in recent months, as annual pay increases, though still huge at 15.2% in October, are slightly down from the 16%+ range earlier in 2022.

Job-stayers annual pay increases of 7.7% have been roughly the same since June, and have been getting outrun by CPI inflation, which is the normal procedure.

The huge pay increase for job changers is another sign of just how tight the labor market is, and how employers are struggling to hire people to fill job openings, and how they’ve been using aggressive salary offers to fill vacant slots.

The result is the massive churn and job hopping that employers have been complaining about because they’re having trouble retaining people – as other employers are poaching their workers by offering them higher pay – and they’re having trouble hiring people to fill the slots, and they’re having to pay more to hire people away from other companies to fill those slots.

The huge number of voluntary quits, the large number of hires, and the historically low numbers of layoffs month after month have also been documenting this phenomenon, such as the data on quits, hires, layoffs, and job openings yesterday.

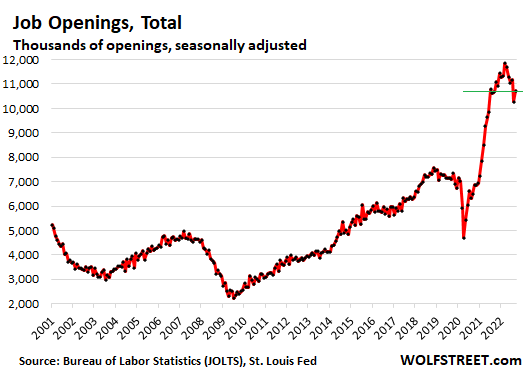

These pay increases are supported by the huge number of job openings, which in September at 10.7 million, were up by 51% from September 2019, according to the Job Openings and Labor Turnover Survey by the Bureau of Labor Statistics yesterday. Job openings increased in all major sectors except wholesale trade, education, and manufacturing. Even in manufacturing, job openings were up by 84% from three years ago. And workers know how to arbitrage this situation for their benefit:

Pay increases by industry:

The biggest pay increases occurred in what is typically a lower-paying industry, Leisure and Hospitality (hotels, restaurants, etc.), where the pay for job-stayers jumped by 11.2% in October, compared to a year ago, according to the ADP National Employment Report (all data for job-stayers):

Goods-producing industries:

- Natural resources/mining: +7.9%

- Construction: +6.9%

- Manufacturing: +7.7%

Service-providing industries:

- Trade, transportation, and utilities: +8.4%

- Information: +7.3%

- Financial activities: +7.8%

- Professional and business services: +6.8%

- Education and health services: +7.3%

- Leisure and hospitality: +11.2%

- Other services: +7.0%

Pay Increases by employer size:

Bigger companies raised wages by more. At the biggest companies, pay increases for job stayers are about in line with CPI inflation.

Smaller companies raised by less. At the smallest employers, pay increases were far below the rate of CPI inflation, in part because for many small employers, every day is a struggle, and they don’t have the financial resources big companies have, and a surge in payroll expenses, on top of the surge in other input costs, can produce an existential crisis:

- 1-19 employees: +5.6%

- 20-49 employees: +7.3%

- 50-249 employees: +8.0%

- 250-499 employees: +7.9%

- 500+ employees: +8.4%

More fuel for inflation.

The other thing these big pay increases show is that underlying inflation – with services inflation now raging at 7.4% – won’t drop significantly just on its own, and that the Fed is going to have its work cut out for it.

Inflation is rarely outpaced by median wage increases. To beat inflation, most people have to get a better job, or get promoted – that’s typically how it is. And these kinds of big wage increases are further fuel for big inflation going forward. And that’s why the Fed keeps referring to various aspects of the tight labor market as an indication as to when enough is enough, and it doesn’t look like it’s enough yet.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Hmmm… tells me what I gotta do.

The grass isn’t always greener.

thats a fun one people and employers like to spout. if you’re competent, skilled and driven, grass color doesn’t matter. do the job, make an impact, and get paid more.

after few layoffs from big corporates

I went contractor in 1996

1st gig was Nike, they paid well and I got to travel

Siemens, Delco Remy, Lucent(before crash), Principal Financial, Johnson Control

over span 8 years – Y2K was nice

having great database skill and being large system unix sys admin to boot

after 9/11 they dropped contractors to $35 an hour – said see yah

…just different weeds…

retirees getting shaft as usual under fed guidance

no wonder some 60% or MORE retirees live in poverty

I’ll take my chances. Raised my income over 40% over the past three years by leaving behind the old “loyalty mindset”. Generally if you stay where you are, you’ll be leaving a minimum of 250K on the table over your career. That’s nothing to sneer at.

lot more than $250k

and there is no corporate loyalty

until you get into inner circle and get stock options

then your wages exceed inflation and stock options are retirement

I was lucky, the during the first job out of tech school a coworker informed me that to get paid fairly I would have to change jobs every 1-2 years several times. He said that the ‘bean counters’ could not fathom how an employee could be worth 20% more after a year on the job, but other employers would gladly pay that. Not only that, but the company I quit from would have to pay 20% more to hire someone to fill my shoes.

It seems the ‘bean counters’ are simply not too bright.

There’s no one way to do it. I worked at a company for 10 years doing work they valued and trusted. I eventually left to semi retire. 5 years later the founders of the company asked if I would work for their foundation, because they wanted someone they could trust. They paid me about the same salary for a job that now only requires one day a week. In my case loyalty was the only reason I got this blessing of a retirement gig. File this under Karma, Positive.

If the grass is weed, it’s always greener. :)

The greener grass across the fence may be due to a septic tank issue.

Sometimes the grass has 2,4-D or Round-up.

SpencerG,

Yes, it sure does. At least look around and see what you can get.

Markets celebrating slow down on hikes. 10 year way below Fed funds rate.

Giving me “Deja Vu” from a year back.

Fed said 4% inflation is transitory and held rates at 0%. Now it’s saying 8% inflation can be controlled with a 4% interest rate.

Should we expect inflation to rise to 12% next year so that Fed can then raise to 8%?

“Markets celebrating slow down on hikes. 10 year way below Fed funds rate.”

Every bit of chatter everywhere is about a “FED pivot,” or a “slowing of rate hikes” or a “pause in rate hikes.” I just read a quote from another crackpot economist that Powell’s language just signaled that the FED will be stopping rate hikes while inflation is still high.

We also have Democrats putting massive pressure on Powell to stop the rate hikes. Sherrod Brown and Elizabeth Warren are publicly shaming him and trying to force him to stop. Who’s buttering their bread? Because last I checked they were supposed to care about the little people, who inflation is absolutely destroying right now.

I hate what this country has become. It’s a filthy cesspool of crooked corporations, bankers and politicians who are working hand in hand to loot every last penny from all but the most wealthy among us, which is why I’m in favor of just burning it all down now, then picking up the pieces.

At 8% I am buying 20-year treasury. Or maybe Apple under $40.

I-bonds right now best gig

but I’m raising cash and waiting til SHTF

“…pausing is not something we’re thinking about…”

Jerome Powell, today

A year ago or two they weren’t even thinking about thinking about raising rates either. Just focus on actions, the words are just whimsical musings.

Want to Know the Fed’s Next Move? Pay Attention to This Signal

by Steven Hochberg and Peter Kendall

Updated: December 28, 2018

Most economists and financial analysts believe that central banks set interest rates.

For more than four decades, Elliott Wave International has tracked the relationship between interest rates set by the marketplace and interest rates set by the U.S. Federal Reserve and found that it’s actually the other way around–the market leads, and the Fed follows.

The latest Federal Reserve rate decision on December 19 brought the usual breathless anticipation. Confusion reigned as the U.S. president as well as a former Fed board member publicly urged the U.S. central bank not to raise rates and many wondered if the Fed would “rescue” investors with a surprise decision to leave them unchanged. The Fed, however, did what it almost always does: it brought its rate in line with market rates.

The Fed increased its federal funds rate a quarter-point from 2.25% to 2.50%. As shown by the dashed line in Figure 1, the Fed’s move followed a rise in the six-month U.S. Treasury bill yield from 2.36% to 2.56% and an increase in the three-month U.S. Treasury bill yield from 2.18% to 2.42% since the prior Fed rate hike on September 26. So, market rates remain nearly undefeated when it comes to predicting what the Fed’s actions will be.

This is incorrect. Their claim is one of the classic logical fallacies. Equivalent to claiming that your car is controlled by the right and left turn signals b/c those blink before the car turns.

It’s true that market rates usually move before the Fed acts, but that’s b/c the Fed is communicating those it’s expected actions via forward guidance. And/or the market is looking at the same data as the Fed and knows what they have to do.

When the Fed (or any central bank) surprises the markets, chaos usually ensues. More of that would be good though, because the advance guidance allows those in the know to front-run the banks moves and basically make free money at minimal risk.

Seems like hospitality workers are having their day in the sun, which is great.

I know some folk (myself included) don’t have the kind of latitude to hop around for higher yields given non-compete clauses. I don’t know how much teeth these contracts actually have but have seen at least one colleague find himself professionally hamstrung after leaving his post a few years back.

That’s not employment, that’s serfdom.

Sure. You need a jeweler’s loupe to discern that ever fading dividing line

It’s another term one bargains for.

after free money covid

we have several hospitals about ready to close

—

it time we have 1 price for everyone in state

only like 400,000 procedures/supplies/drugs

time to stop screwing little guy with retail prices while biggy insurance gets best deal

I’m always willing to pay what big insurance pays

and not penny more

This whole system is pretty much just serfdom in a trench coat. If over half of Americans weren’t stuck living paycheck to paycheck, they might be more inclined and capable to move for better prospects; and since health insurance is so tied to employment, well, you’re pretty much hosed if you just quit. Not that a lot of folks have the luxury of having the time to seek health care in the first place, but still.

Non-competes are not legal/enforceable in many states, most notably CA, but that doesn’t stop employers from pushing them to scare employees. I’ve signed a few over the years, and never given job hopping a second thought. (granted I’ve not held CFO or CEO roles)

Most times the corpse don’t do sheet except send out a scary/pathetic ‘nastygram’.

Annual pay increases have been over 5% for over a year, even for job-stayers. And at least at the S&P500 level, employers aren’t sacrificing profit margins (much) – they’re raising prices.

That’s pretty much the textbook example of the first loop of a wage-price spiral.

Raising interest rates has barely dented the economy, because the money is still there and still circulating. Interest rates shift flows towards savers at the expense of debtors, but people still have the money to spend. It looks like inflation cannot be halted without materially shrinking the actual supply of credit (such as through QT, tighter lending standards, collateral devaluation, defaults, bankruptcies) – but that hasn’t really happened yet.

We’ve got a long ways to go.

Very well said.

All of my business contacts have essentially expressed the same sentiments.

In Canada, the government solves this by restricting construction at the municipal level, and bring in 500,0000 immigrants a year by 2025.

This Ponzi scam economics is enacted to drive down wages and put pressure on housing affordability.

It’s by design to make the elites richer.

“Restricting construction at the local level” is a topic that should be closely examined in a country (the US) where possibly/likely excessive zoning/building code regs helped to triple housing prices in two decades of employment stagnation (at best).

(Employment may be zooming – *now*. But for close to 20 *years* it was fairly crappy in historical terms).

ZIRP did the majority of the damage in the home inflation/wage stagnation tragedy, but unwinding that disaster may really require a close examination of zoning/code changes unjustified by their claimed purpose.

The Ontario Teachers Pension Plan relies on the destruction of the American middle class via creating a return on rental properties through wage serfs. The pension plans are buying up the homes and lobbying the politicians to block new construction.

The Chicago Teachers Union Pension Fund owns a roll-up of formerly family owned independent HVAC contractors in NW INDIANA, still maintaining the former names and independent facade.

Then immigrants coming to Canada most certainly will keep wages down.

The Ministers boasted that the wage inflation will be solved by these unnatural population growth. The future for Canadians living in the cities will be like the cage dwellers in Hong Kong.

It gets cold living in a tent in someone’s backyard in the winter. More people will freeze to death and more floorboards will collapse as they put even more renters onto the upstairs of bungalows. What used to be 10 upstairs and 10 downstairs will be 15 upstairs and 15 downstairs renters.

I fear for the future of Canadians. The government is deliberately trying to drive down wages and worsen the housing crisis to destroy the middle class.

Canadians will definitely own nothing and be forced to be happy or end up in jail for wrongthink . The government is deliberately trying to drive down wages and worsen the housing crisis to destroy the middle class.

I feel like the data is lagging. Every company I have met with in the past 30 days has said they are on a hiring freeze and are preparing to cut expenses. I work in commercial real estate, so this all makes sense, but we are also seeing the big tech companies now restructuring their office leases, which shows layoffs are coming for them as well. My guess is that these job/wage numbers are going to be compleatly different at the beginning of the year, with or without more rate hikes.

And…the 25 to 54 employment to Population ratio *still* hasn’t reached the highs of *the late 1990’s*.

That’s over twenty *years* folks.

And…despite the demographic shrinking of the 25-to-54 year old pool over those 20 years.

Sure, some of it is made up by those 80+ year olds compelled to work due to three asset market implosions…

I’m seeing the same. All the companies I work with are getting cold feet and waiting – and getting to be much more cautious on hiring.

All the indicators seem to be quite lagging.

Yes, as stated often on this comment board (and everywhere else) employment metrics are lagging, maybe even the laggiest of all metrics. Doesn’t mean they’re wrong, use them to help paint the entire picture.

The government just keeps throwing on the fuel for inflation. Now they are rolling out 13.5 billion to help lower-income folks pay heating bills this winter. So they are pouring on fuel to help pay for fuel so to speak.

It’s good if people really are struggling, but we know the government tries to solve things by dumping mountains of money on problems. Then the rich end up with it somehow. So sorry Fed, Congress and the president don’t wanna stop or slow down spending money to help you.

The gutter level truth about how DC *really* works is that for all the public hand-wringing about inflation (a bunch of it due to enormous DC money prints), very few of the Swamp Creatures even point out that Congress could recall a *bunch* of the budget allocations since they haven’t gone out the door yet.

One or two heroic congress people have submitted such bills (must be new to DC and not completely corrupted yet) but we got 435 members of the House.

Single digit speakers of the truth on key central issues tell you *everything* about how DC really operates on a day to day basis.

Congress people/the political class exist to be bought and stay bought – essentially *nothing* matters more than the funneling of hundreds of billions to favored classes/donors.

If the national economy as a whole dies…so be it.

That is the operational DC ethos.

Six days before the elections, the White House announced that they will write a check for $13.5 billion to “help reduce energy costs for low and moderate income households.”

So that money comes from Treasury and adds to the deficit, no? Treasury sells bonds and the Fed buys them, no? The Fed now adds $1.35 x 10^10 to its balance sheet, no?

Yes indeed. This is a perfect example of what Russell Napier has been saying, “The power to control the creation of money has moved from central banks to governments.” President Biden is creating a fiscal stimulus when the Fed is trying to rein in their monetary policy.

Napier’s point is loud and clear: “No government is asking permission from the central banks to introduce loan guarantees. They just do it. The crucial thing is we are moving from a mechanism where bank credit is controlled by interest rates to a quantitative mechanism that is politicized. This is the politicization of credit.”

The only part I disagree with is the Fed adds those bonds to its balance sheet. That’s not mandatory and currently they aren’t buying Treasuries (net). Instead the government has to pay an interest rate on those borrowings set by the market. If the market feels the government is too loose fiscally, that interest rate will be larger than it would be otherwise.

That’s what is behind the term “bond vigilantes”. It just happened in England when fiscal authorities got too loose. There can be a price to pay IF, and it’s a very big IF, the central bank stays independent. That’s where the debate is now, will the central bank cave to political pressure or will they follow their mandates.

And, as my reply to Brant is waiting in moderation, I should add that perhaps we are now at a point where Treasury bond offerings to finance Uncle Sam’s prodigious spending doesn’t all go onto the Fed’s balance sheet. So when the USA government lets loose some fiscal stimulus as Brant notes, maybe it doesn’t equate dollar-for-dollar to the Fed’s books.

Brant Lee wrote: “The government just keeps throwing on the fuel for inflation. Now they are rolling out 13.5 billion to help lower-income folks pay heating bills this winter. So they are pouring on fuel to help pay for fuel …..”

Sniff. Boo-Hoo. I really feel for the folks at Big Pharma and the MIC. Just think what they could have done with an extra $13.5 billion.

Extra pay is only great at the lower levels. Sounds elite but at a certain point everything is paid for the excess is just cake.

I look at job description as how many hours am I going to dedicate each week? Is this job fun and fulfilling to walk into every morning and do I have autonomy to run things from the CEO.

Had a friend leave his position as IT director to work for larger company, 3 – 4 months in and he’s working 50 – 60 hours a week compared to his old 30 – 35 week where he’d call on Friday to ask if I’m free for Golf or to go to the shooting range.

Don’t think that pay increase was worth it for him.

The quality of life that goes with a given income level is really important, but in this case “lower levels” is around 95-98% of the workforce. Congrats on being successful & wise enough to not have to worry about extra pay to fund your desired lifestyle for the rest of your life!

I’m becoming a bit nervous about the holiday season. Services inflation will continue, but then I can see another bout of goods inflation as all the excess money gets poured onto the fire in December.

We build storage facilities so people can store most stuff they’ll never use. Seems crazy that everyone is hooked on this . I got off the boat only essentials,a simpler kinder society is what is needed.At some point a lot of middle managers will be garbage men construction workers packing houses.

I guess no matter what they say or don’t say, it will sound ‘pivot, pivot, pivot……

Almost every article or posting on the web with regard to the Fed raising borrowing costs employs adjectives to describe the hike as “jumbo” or “mega” and claims that PUBLIC sentiment is opposed to these “irresponsible” actions. Now this propaganda would be somewhat expected if it was only appearing on financial news sites but it is almost everywhere. I’m surprised that Jose Canseco isn’t railing against it or Skip Bayless. This is scary stuff. The Fourth Estate is completely corrupt.

Just wondering, what do you guys in the comments think is the price worth paying (to the economy, to yourself, etc.) to get inflation under control?

Personally, as a mid-career worker who has has had the experience of being laid off before, I’d say a moderate recession (ie not as bad as 1930 or 2008) is worth the price.

Powell got tired of pivot whack a-mole. He fed all of them rat-killer with today’s actions and comments. It will take a while before they can reproduce. Rats are prolific at reproducing and they will be back. At least Jerome can take a break to let his mallet hand recover.

LOL. Nailed it.

Feel free to delete this. Powell at the press conference said Santa’s not coming yet.

That first graph says it all. YOY salary growth at 7%. That tells me rates are going to have to go higher than the current plan and will probably be openly discussed once the midterms have passed.

Exactly why there raising rates ,got to stop wage inflation,destroy people so wages retreat Walton’s need the money

Close the ‘discount window’ to the Wall Street hoodlums and TBTF financials.

Just updated. Here is the borrowing at the Discount Window, and the current interest rate the Fed charges as of today = 4.0%

https://wolfstreet.com/2022/11/03/feds-balance-sheet-drops-by-289-billion-from-peak-november-update-on-quantitative-tightening/

Powell’s speech was a ground-burner. They have said that they now see that interest rates will peak at a place higher than previously expected. He has said there is no way they are tightening too fast.

Home prices to fall by 50%. As mortgage rates hit 8% by Jan, the demand side will completely dry up. I would say that home prices fall 10% from now until Feb and another 10% from Feb to middle of next year. Total of 30% down by end of next year, on top of the 10% they have already fallen from the peak. The loss of home equity will burn down spending, as people stop feeling rich. State governments will be forced to cut spending dramatically. States like California are doomed. Once the Republicans win both houses of Congress the hand-outs to support overspending at the state level will be gone.

To borrow words from another blogger. Shouldn’t have blown the bubbles, now enjoy the bust.

Not true. There are so many extremely rich all cash buyers out there, the market will never freeze.

I’m not normally so flippant… but;

“Nuke the site from orbit, it’s the only way to be sure”

When the stimulus arrives, it won’t be to BTFD’ers or front-runners, but weary investors… that is when we know it’s all over.

“Wages soar?” Er no, I think you meant “Real wages shrank at 0.4% after inflation”. And of course the ostensible “increase” of 7.7% was taxed at the (higher) marginal rate.

Even the job-hoppers who sound like they’re making out like bandits, they upped their gross wage by 15.2% but how much did they collect after tax? Maybe just enough to keep up with inflation eh.

It is amazing that NOT one reporter at today’s Fed’s Q&A with the press, brought to the notice of Chairman that b/c of on going demographic changes – From 2010 to 2021 – 1.2 M below 55Y vx 22 Millions above 60Y (dominant 65y-75) will result in TIGHT labor mkt in the foreseeable future! It will be a strong head wind for the Fed in containing inflation

No one challenged him that recent rate of wage growth still lag behinds the rate of inflation.

No real hard ball but soft ball questions from the Presstitute members of the Press. Just as usual.

Haven’t they brought enough people via immigration to ‘replace’ those who ‘retired.’

As Europe has not fully discovered yet, importing people doesn’t mean they will work.

If they replaced the current corpse media and did nothing all day, it would be a big improvement.

Could you expand this a bit please sunny: ”From 2010 to 2021 – 1.2 M below 55Y vx 22 Millions above 60Y (dominant 65y-75)” ?

Not sure what you mean.

Thanks.

I believe Sunny is saying that there are 1.2 million less people under age 55yo and 22 million more people above 60 years old in the united staes population between the two dates specified. I know that is is ballpark correct, but I don’t know the specifics. Wolf has argued in the past that population growth is not needed to maintain a stable economy, with arguments about productivity. I beg to differ since less employees to service available work *needs* means a labor shortage that drives up inflation. I am unaware of a machine that picks up old people when they fall, wipes their ass, and helps them navigate complex issues as they lose their physical, memory, and reasoning skills in old age. Those all require outsourced human servicing.

I don’t think that’s right.

Last time I looked, the 20-something’s entering the workforce outnumber the 60-something’s exiting.

And in any case the participation rate issue is much deeper than simple age demographics. There’s a lot of discretionary not-working at all age levels.

Not true, the 20 something generation is MUCH smaller than the Baby Boomers that are retiring. Zeihan has cited these numbers repeatedly in four books over 10 years.

In that case you should find a different author who isn’t wrong. I’m looking at the US Census data (via Wikipedia), population by age, year by year, and what I see is every age group (20, 21, 22, 23…) from ages 20-42 has more population in it than any of the groups from age 43 on up.

Secondly, most of the people in those younger age groups go into the workforce, whereas not everyone over age 60 leaves the workforce – since not all can afford to retire.

So there are in fact more 20-somethings going into the workforce than over-60’s leaving it.

There is also a FRED.stlouisfed.gov dataset “Working Age Population ages 15-64 all persons for the US”. It did have a wobble in it from 2020-2021, but in 2022 it’s back to record highs. And other than the one wobble, it’s gone up every year since before 1980. Currently it shows 2 million more working-age population in 2022 vs. 2021.

Finally, don’t forget immigration.

Wisdom Seeker:

I checked my sources and you are correct about there being (presently) more 20 somethings than Baby Boomers. Seven million Baby Boomers died in the last 10 years which allowed he Millennials to surpass their numbers.

Thanks for the correction.

How can you bring inflation down when you get offers in the mail for free financing for one year on big ticket items. I get one every other day. In fact, I’m getting ready to replace my 30 year old stove with a new one exactly the same brand and size from Home Depot. No interest, free delivery, put the whole thing on my Home Depot Credit card. Powell is going to have to work a little harder with reducing the balance sheet and dumping these MBS a little faster. These puny interest rate increases 4% below the rate of inflation or 12% below the real rate AIN’T GONNA CUT IT! Until then I’m spending like a drunken sailor and enjoying every minute of it.

Better keep 30 year old stove at least it will lat ,new appliances are junk . Lifespan for my ge fridge 10-13 years ,broke down at year 10 got on utube fixed myself we’ll see how long it goes

Twenty years ago, I replaced my stove with an Amana brand unit (nat gas). Thirteen years ago, I put in a new igniter, but five years ago, the control unit on the thing went out. Two choices: $360 for a new control unit, or $450 for a new stove; similar, nat gas, and also Amana.

Dinner just came off the five year old stove.

Agreed. I wouldn’t replace an old appliance, hot water heater or boiler unless I absolutely had to. Everything becomes smart phone crapified. I asked a heating contractor to be in the look out at any tear downs for a ~ 20 year old hot water boiler with standing pilot light and cast iron burners and absolutely no digital junk/chips.

AS for the mkts, there is strong hopium led investors, kept active by the repeated positive narrative from Wall St that pause or pivot will appear in spite Mr. Powell throwing cold water on that during Q&A

Front running will remain daily if not on alternate days until rate goes above 5.25% and stays there for longer time. By appropriately calibrating the response for those, expected whiplashes/re-bounces, one can keep the risk on or off at appropriate levels on one’s portfolio.

I still regard that perception matters most than reality, like the 13yrs, which I failed to discern. Now I am more than aware of that in spite of absence of Fed’s put.

Powell is saying that it is soon to to talk about pausing. The denial is over. Watch markets plunge from here.

Our job is going to require some resolve and patience. Meaning we might see double digit interest rates by early next year.

Soft landing window has narrowed. It becomes harder to see the path to a soft landing. So that means a hard landing. That means we are going to tighten until the consumer finally starts to collapse.

I don’t see any signs of a recession around here. The traffic is terrible, lines at the supermarket. Supply chain problems are coming back. I have trouble finding good contractors to do work. People are spending like there is no tomorrow. Interest rate increases by the Fed are doing nothing to dampen down inflation. In fact, I’m starting to see some of the things that Germans experienced in 1922/1923 Weimer Republic. Prices are changing so fast that they can’t keep them posted correctly on the shelves. This has happened twice in the last week. I asked the manager about this and they said they don’t have enough help to update the posted prices.

Once inflation gets bad, the only thing that stops it is economic recession.

Was just barely alive in the early 80s but hoping from now to 12 months down the road the fed does what Volcker did in the 1980s just raise the rate to a point that severely impacts inflation or else it’s going to decimate this economy long term.

https://wolfstreet.com/2022/11/02/fed-hikes-75-bpts-to-3-75-4-0-pivots-even-more-hawkish-very-premature-to-be-thinking-about-or-talking-about-pausing-markets-tank/

This results from this report alone state clearly that the Fed needs to continue with 0.75% hikes. The downshift is a mistake.

The key to successful job-hopping up the pay ladder is to do it with *famous brands* on your CV. Seeing a name people recognize makes other companies much more likely to hire you. A relative worked for a small “no name” firm, and he struggled to move jobs in his 20s. He got a lucky break via an outsourcer at VW (cars) in his 30s, and has now job-hopped 6 times into his 40s, via Mercedes, Shell, etc. He’s not particularly good at his job (accounting), failed some of his professional exams first time, had to retake, but HR people see a big name on his CV and assume he’s some kind of finance wizard. He’s now topping 200k a year, a decent salary that would have been unthinkable for him just a few years ago. Good luck to the job-hoppers. Get that famous brand on your CV.

Here is a comment that I haven’t seen yet: WHERE THE F ARE ALL THE ROBOTS?! Seriously, since I graduated high school I’ve been told that there will be no jobs in the future due to all the automation. And then I read that even office jobs won’t be safe due to AI developments and software improvements. And then I heard politicians and pundits going on and on about how we NEED a Universal Basic Income guarantee because there just won’t be enough demand for labor in the future because job destruction will skyrocket any minute now and everyone will be unemployed and society will have trouble functioning without a UBI to support demand. Year after year the fear mongering got louder and more extreme in its pronouncements. Now here we have the result of all that innovation: virtually nothing. Several companies are now announcing they are giving up on self driving cars now (Uber and Ford the biggest ones); Amazon has killed both its air drone delivery plans and its ground vehicle delivery robot project. A few years ago Elon was saying that Tesla factories would turn the lights off because they were going to be so automated and then as the Model 3 was going through “production hell” they ripped half that junk out and Elon had to admit that “You can’t underestimate the flexibility of humans” when it comes to employment even in manufacturing. Oh and then he announced a magical robot that can do anything a human can do and so far it can’t even walk, so… yeah. My big rhetorical question is how the hell do we have MILLIONS of more jobs than there are unemployed people to fill them when everyone was saying that robots and software and AI were going to kill off entire industries by now? If companies aren’t motivated to invest and upgrade to using this amazong technology to destroy jobs with the labor market this tight then it is safe to say it will never happen. I know some idiot will reply “but, but, White Castle has a robot that cooks French fries now.” My god! One single solitary task in a job that requires dozens of other similar individual tasks. Does the robot walk into the freezer to get the fries out too? No? Then how much labor is it saving them? One tenth of an employee? The point is the narrative that technology is going to magically destroy job growth is dead.

Let’s be honest with ourselves, we all already know the answer to my question: the labor demand problems of the past were caused more by sending jobs to China than they ever were by automation and today is the proof. Robots and AI and software are all supposedly more advanced than ever but tarrifs and sanctions are being applied to China, there is now talk of “decoupling” and “reshoring” and what do we have? A tight labor market. Surprise surprise.

If I’m wrong and the robots and software are still coming for our jobs than for the love of God start destroying some jobs already!! We need the productivity growth to allow these wage increases without commensurate price increases. We can have our cake and eat it too if we get rising productivity but that’s not what we have because the technology has not delivered and now we have to figure out how to make all these consumer goods without either the endless supply of cheap Chinese labor or mythical super robots and AI.

Aaron,

“WHERE THE F ARE ALL THE ROBOTS?! Seriously, since I graduated high school I’ve been told that there will be no jobs in the future due to all the automation….”

Your diatribe is one of the most ridiculous I have read here in a long time.

The robots are everywhere. The robots run this website that allowed you to comment. This website is completely automated. Every website is. They run on servers and software — DUH. When you call Comcast, and you get their chatbot instead of a real person, well, that’s a robot replacing countless humans in a call center. Factories in the US are highly automated. Go into an auto assembly plant. There are still some workers, but the amount of automation is just astounding.

The US is the second largest manufacturer in the world accounting for about 17% of global production by value, behind only China (which has 4x the US population). And most of this manufacturing is done in highly automated plants.

Even agriculture is getting automated with automated equipment, from harvesting to packing produce (I saw one of those packaging robots in operation… cute!).

You need to get out a little.

I get out plenty. I wasn’t saying there are no robots whatsoever, if that’s how it came off then I was misunderstood. The entire point that I was making is that the promised level of automation and artificial intelligence was said to leave massive permanent unemployment and it clearly hasn’t happened. Go look back at Andrew Yang practically foaming at the mouth about UBI for years. I get that there is automation out there already but it is also obvious to anyone but you apparently that it isn’t killing industries or jobs as all the fear mongering touted. For example: I remember people saying things like TurboTax and other software was going to kill the entire accounting industry eventually and yet there are more accountants than ever today. If AI is so incredibly capable of killing jobs then the Fed wouldn’t have to raise interest rates at all at this point would they? No, because every company would just snap their fingers and replace all those workers demanding pay raises and wouldn’t bother with this hiring struggle. In ten years we’ll have even more advanced robots and AI and software and I’m sure there will once again be people fear mongering about how there won’t be any jobs available and “this time is different” and all the teenagers might as well start filling out welfare paperwork now because they certainly won’t be able to get a job when they graduate… and we’ll probably still have labor shortages or at a minimum plenty of jobs available in spite of it all.

A big part of the best-paid jobs are in tech — software, hardware, industrial robot design, etc. Automation has created a HUGE number of highly paid jobs that design and maintain systems that automate lower-level activities. That is why many economists have said that automation creates high level jobs even as it reduces lower level jobs.

So it’s not that automation just takes jobs away. It’s that it takes some jobs away and creates other jobs, and those new jobs cannot be filled by people whose jobs disappeared.

The thousands of call-center employees that were replaced by a chatbot cannot suddenly shift and start working on AI for chatbots (and I hate chatbots, they’re absolutely the worst example of AI and automation).

Soul searching would have been a good respose to what I wrote. I hope you did some of that. You know my comments were on point!!

Your comments were total BS. Just plain dumb nonsense. BS comments attract BS comments. Yours exceeded the BS limit.

I realize now why my original comment was misunderstood, it was entirely my fault as I wrote it in frustration over the fact we have labor shortages today that were supposedly impossible just a few years ago, so allow me to apologize for any rudeness in my other comments and re-explain them in a calm and more thoughtful manner. You can delete that second comment entirely as it was a knee jerk comment.

When I was saying ‘where are all the robots’ I meant we have 4 million more jobs than unemployed people available to fill them, so if all the fear mongering I had been clubbed over the head with for my entire adult life were true, then certainly we could just destroy all those jobs with these mythical super robots we were not so much “promised” as practically threatened with. But that fear mongering turned out to be BS. Automation doesn’t kill industries or result in unemployment it allows companies to pay more to get the workers they do need without having to raise prices a commensurate amount, thus it is deflationary to a degree (as evidenced by the pre-covid trend in manufactured goods prices that were lagging overall inflation in most years). Many of the projects that were offered up as evidence that everyone would be unemployed in the near future turned out to, at a minimum, be FAR more difficult to develop and deploy than anyone had previously predicted. We probably won’t have completely autonomous anything anytime soon and even when we do it will just free up labor to do something else, whatever the other bottlenecks in the economy are at the time. And I went off on the fry cooking robots in particular because I have seen so many articles recently use those as examples that there won’t be ANY fast food jobs soon enough, and they are really just robotic arms that pull the fries out when they are done, not exactly something that can replace all workers in a restaurant in the near future, so those claims are just more fear mongering.

The China section of the first comment was in regard to reports that supposedly claim that automation “destroyed” more jobs than trade with China did. As far as I’m concerned that is clearly BS. When you replace workers with machinery or software then you are increasing productivity, and you still have the majority of your employees at least making as much as they did before the new equipment. When you send a factory overseas those jobs are basically just gone. Even in terms of trade, the significantly lower wages means that those Chinese workers aren’t consuming as many goods and services as the Americans who were replaced, and so aggregate demand functionally goes down in the near term. Now, don’t get me wrong again here. I am not anti-trade and for a long time I bought into the idea that as wages in China caught up they would in fact be buying more from us and we would end up far richer in the future so it could be viewed as a kind of investment for the long term. But then geopolitics got in the way. Turns out China isn’t going to liberalize and democratize like many, many scholars had predicted. There were entire books written about how a growing middle class would make China turn to democracy. But those scholars didn’t predict that Xi would just decide to stamp out said middle class before it gained enough power to threaten his position. So now between Xi forcing more restrictions on the private sector, the West finally deciding to take seriously the reports of egregious human rights abuses within China as well as persistent instances of intellectual property theft and WTO violations, and the US strategic worries about China (now more authoritarian than ever by the way) becoming a rival power, we are seeing all that actual job “destruction” being undone with sanctions and tariffs etc… So, instead of seeing a richer, more democratic China gradually over many years buying more from the West and fueling those long sought gains from trade, we are seeing the West, especially the US, scrambling ASAP to try and move production either back home or at least to countries that aren’t as problematic like democratic India. Ironically this might kill an industry in the US as I doubt the “Gig economy” (think DoorDash and Uber) can survive in a world without ultra abundant cheap labor with wages held down by sending jobs to China, since the people who would have taken a job delivering food now have better offers with salaries and benefits to choose from and the prices needed to keep those workers in these “Gigs” will probably be seen as prohibitively high by consumers. But time will tell whether I’m right on that one.

So, in summary: yes we are getting more robots, AI, etc… but don’t waste your time telling your kids they don’t need to study since they will just get a UBI when they are older, because quite frankly there will probably never be a point where automation will actually destroy every last job, and it will probably take a lot longer to get all the amazing advancements we were promised if they come at all. And next time I won’t be as flippant with my comments and take the time to fully flesh them out rather than rage at fear mongers like a jerk and then insult you in return. Again my apologies, and keep up the good work with this blog and keeping the information rolling.

Pro tip: never call Comcast

Been to a grocery store lately all self checkout,gas stations fill your own car vacuum cleaners that operate on there own .It’s a slow process

I remember when Bush I almost fainted when he first saw a grocery store checkout scanner. At least he didn’t vomit.

It’s important to separate automation from shifting of burden. The store employee used to do the checkout work that has now been pushed onto the consumer. Same deal with full service vs self service gas. Similarly, Uber pushed business costs that used to be incurred by the company onto the drivers, and this is not an increase in productivity or automation, but merely a shift of cost burden.

I have repeatedly warned in these comments that we’re in a crack-up boom. The only way to stop the positive feedback loop is to constrain credit and let interest rates to climb way above inflation. This would bankrupt most western nations. No central bank is able or willing to do so. Hyperinflation will follow.

I posted a comment about the labor market being tighter than is even being reported. I stand by my statement that the government figures are total BS. I don’t trust or believe any of the figures coming from the Bureau of Labor Statistics and other government organizations.

1. A lot of workers in key essential jobs are working “Off the books”. They are not counted at being in the workforce.

2. Those who are talented in their profession and who have critical skills are so overbooked with work that they have to work 12 to 18 hours a day just to keep up with the workload. They could demand higher wages or higher payment for their services, and no one would bat an eyelash

3. None of the increases in interest rates have done a thing to cure this shortage, and none will, given the Fed’s current puny rate increases.

4. Employers will hold on to their best workers and pay whatever it takes to keep them, even if it means double digit wage hikes.

I see wage inflation taking off like never before for workers in skilled jobs that cannot be outsourced, and cannot be automated with Bots and robots. Those who are in jobs that can be outsourced overseas, or automated out of existence will see their wages crushed by inflation or eliminated altogether. We’ll see an increase in inequality like we have never seen.

Swamp Creature,

Your #1 is BS. You don’t understand how the data is gathered, and you’re spreading BS. “off the books” workers are included in the BLS household survey. Those workers are only off the books for tax purposes. Everyone else knows they’re working — as do you. And so these workers are included in the data.

I normally delete comments that spread made-up BS like this. But your comment also includes some interesting stuff, so OK

I deleted part of your conclusion — just too much BS. If you don’t know fine. But don’t spread it here.

Wolf,

For clarification,

I’m one of those dudes who works off the books mostly for tax purposes. I work for free to help Ms Swamp run her business. She works “on the books” in a very stressful job, and is considered an essential worker. I do her tax return every year. I’m lucky to get money from her to put gas in the car.

Because of the shortage of workers in her field I have to spend 20 to 30 hours driving around in the DC Swamp in dangerous crime ridden neighborhoods. Her job is a TWO PERSON job. Add to that all the back office, (computer support), operations to run a business. So, it comes out to almost a 40 hour a week. I’m not sure if the government has any way of tracking this. A lot of people are doing just what I’m doing, and my point was that the labor market is much tighter than is being reported. I’m in the workforce but am invisible. No one has every called me for any household survey and if they did, I would hang up on them. So how can you trust the household survey data?

1. If you don’t get paid, you don’t count as worker for the labor data. If you do volunteer work, you don’t count as worker. If you redo your garden, though that’s hard work, you don’t count as a worker. For the labor data, a job is something that pays you for work. The hairdresser that works off the books gets paid, and she counts as a worker.

2. No one will ever “call” you for the household survey. That’s not how that is done. You will get a postcard in the mail that explains to you that you’re “compelled” to complete the survey, either on line or by calling this number; and it gives you the log-in info. Then you go through and answer a bunch of questions about various things that will go into different data sets, including the employment data. Takes about 15 minutes. No biggie.

Personally, I consider it my civic duty as an American to complete the Census surveys, and I do (you only get a few in your lifetime, given that the pool of people to ask = 133 million), just like I try to be an informed citizen, and I vote, and I pay my taxes (but not more than I have to according to the tax code). But that’s just me.

I will cite one personal example which makes my point above.

For a dozen years I used to take my Propane tank to a gas station across from where I worked. They filed it up and I paid them while I filled up my car with gas at the same time.

Then a few years later they hired some moron that gave me a tank which was only half filled (exchanged). Anyone with a third grade education could tell by the weight that it wasn’t full. I took it back and they told me they had outsourced the propane sales to a third party. In other words, they said they were not responsible for the error, even though it happened on their property. I told them to get lost at that was the last time I would ever have my propane tank filled there or even buy gas there.

Now I take my propane tanks to Home Depot. The process is similar to buying golf balls at the driving range. Totally automated. No humans involved. Works great. Takes less than one minute start to finish.