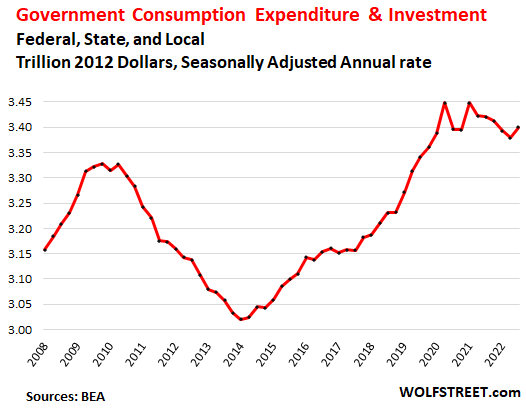

And after five months of declines, government consumption and investment rose again.

By Wolf Richter for WOLF STREET.

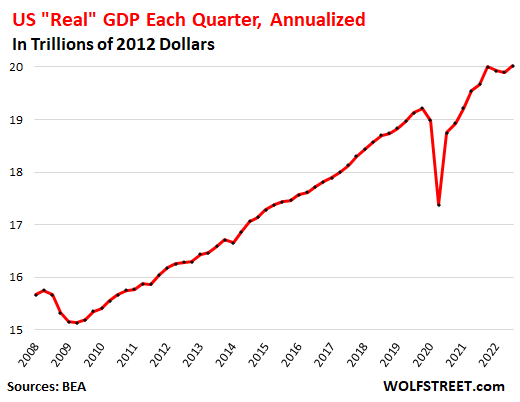

“Real” GDP – adjusted for inflation and seasonality – rose by an annualized rate of 2.6%, after two quarters of declines, according to the Bureau of Economic Analysis today.

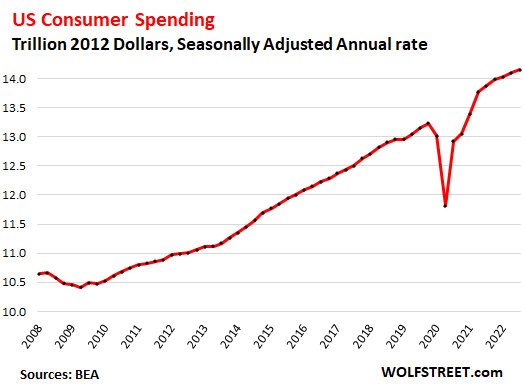

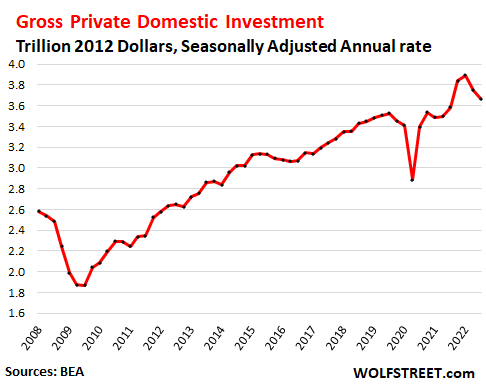

On the positive side: Consumers, still flush with money and pumped up by rising incomes and very low unemployment, continued to outspend this raging inflation. Non-residential fixed investment rose. And after having dropped for six quarters in a row, government consumption expenditure and investment rose.

On the negative side: Residential fixed investment plunged for the sixth quarter in a row.

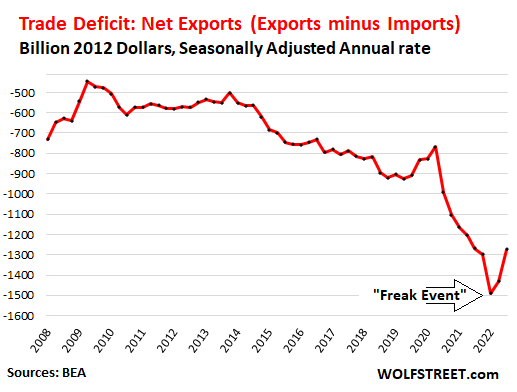

Q3 not as good as it looks, Q1 not as bad as it looked: What really moved the GDP needle was the reversal of the “freak event” that had sunk GDP in Q1, when net exports had collapsed by a historic amount. At the time it was clear that it would reverse, and so I mused in May: “That Q1 GDP Drop Was a Freak Event that’ll Get Unwound in Q2”; well, only part of that freak event got unwound in Q2, and the huge remaining part got unwound in Q3, plus some, and pushed up Q3 GDP by a good margin.

“Real” GDP, after dipping in Q1 and Q2, more than fully recovered in Q3 and eked out a new record of a seasonally adjusted annual rate of $20.0 trillion, expressed in 2012 dollars.

Not adjusted for raging inflation, GDP jumped by 6.7% to a seasonally adjusted annual rate of $25.7 trillion. This is in “current dollars” not “2012 dollars,” and roughly represents the actual size of the US economy in a 12-month period.

Consumer spending, adjusted for inflation, grew by a somewhat feeble but still respectable – given the circumstances of the raging inflation – annual rate of 1.4% in Q3, after the 2.0% growth in Q2 and 1.3% growth in Q1. This was well below the normal growth range between the Great Recession and the pandemic. But back then, inflation wasn’t as much of a problem.

The share of consumer spending as a percent of GDP dipped to 70.7%, but still above the pre-pandemic range of 68-69%, as other factors in GDP aren’t fully pulling their weight yet.

Government consumption and investment rose by 2.4% (adjusted for inflation and annualized) after five quarters in a row of declines.

Federal government: +3.2%, after five quarters in a row of declines:

- National defense: +4.7%.

- Nondefense: +2.3%.

State and local government: +1.7%, after three quarters in a row of declines.

Government consumption and investment does not include salaries paid to government employees, transfer payments to consumers (stimulus payments, unemployment payments, Social Security payments, etc.), and other direct payments to consumers. Those payments enter GDP when consumers and businesses spend or invest this money.

Gross private domestic investment plunged by 8.5% (adjusted for inflation, annualized), the second quarter in a row of sharp declines, after a huge surge in 2021:

- Nonresidential fixed investments: +3.7%:

- Structures: -15.3%, sixth quarterly decline in a row.

- Equipment: +10.8%.

- Intellectual property products (software, etc.): +6.9%, ninth big increase in a row.

- Residential fixed investment: -26.4%, the second plunge in a row after smaller drops before.

The Trade Deficit in goods & services improved by $156 billion, after the $58 billion improvement in Q2, more than completely reversing the “freak event,” as I had called it, in Q1 (-$191 billion), all in 2012 dollars, annualized.

Exports add to GDP, imports subtract from GDP. And “Net Exports” (exports minus imports) have been a negative factor in the GDP calculations for decades, as exports rose some, while imports worsened year after year as Corporate America went on an all-out no-holds-barred campaign to “globalize” production to other countries. Additionally, in recent years, overseas vendors have been able to sell directly to US consumers via internet platforms, by passing Corporate America altogether.

During the pandemic, Americans binged on buying goods with the cash they got from everywhere, and many of these were imported, and the trade deficit blew out. Over the past year, consumers have been shifting their spending from goods back to services, and imports got less terrible.

In Q3, imports fell by 6.9%, while exports jumped by 14.4%, driven by exports of petroleum products, capital goods, and financial services:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Just absolutely hilarious that all the “WE’RE IN A RECESSION” crazies have gone underground. Q1 & 2 were inventory / export / import induced negative GDP anomalies, not REAL recessions.

Looking forward to the Nov & Dec 75-basis point hikes by the Fed. They are finally catching up. Not sure if the terminal rate will move above 4.75% much next year. Would expect a January pause by the Fed.

But, we’ve all certainly been surprised thus far. Now, we’ve got all sorts of people screaming to slam on the brakes. The market is going to tank. Housing is going to tank. Jobs are going to tank.

Let us remind ourselves that there’s a massive home affordability crisis out there with the only solution being at least a 20% decline in prices. 30% would be better along with a Fed who’s restrained from meddling with 10, 20 & 30Y treasuries going forward. And inflation is only really going to be tamed by some real increase in unemployment, meaning job losses. Anything else is a recipe for continued inflation disaster.

20% decline in home values doesn’t necessarily make them more affordable considering interest rates have more than doubled.

Interest rates are also halting the development of new homes, so the supply problem will just get dragged out further.

Rates have been too low for too long, but higher rates are not going to solve our housing affordability issues.

Bankster Language Warning:

They don’t sell you a new “home”. What you buy or sell is a house.

You’re the one who makes it a home. Without you and your stuff in the building, it’s just a building, right?

By using the word “home” in this type of discussion, they are duping you into putting on your rose-tinted glasses and throwing rationality out the window.

This is only one of many eConomic-marketing tricks foisted upon us by those who want to deceive us for their benefit:

Credit is not “capital”.

Houses-for-sale are not “homes”.

2% inflation is not “stable prices”.

A money-market fund is not “cash”.

This list could go on and on…

Don’t even get me started on “ESG”.

And how often does it happen that the real effect of a bill passed by Congress is the opposite of the title?

@Wisdom Thinker ….

“What’s in a name? A rose by any other name would smell as sweet.”

Panic —> Depression —> Great Recession —> Downturn …

“Inflation” sounds like blowing up a balloon, and makes graphs that go up-and-to-the-right, which is “good”, right? And for money supply it might be accurate.

But “Consumer Price Inflation” is an abomination – “Devaluation” is more accurate, or as Wolf sometimes charts for us, “Loss of Purchasing Power”. And that’s a graph that goes downhill all the way.

What part of 30% is better did you miss?

What part of getting the Fed out of meddling with the 10Y treasury that mortgage rates loosely track did you miss?

What part of there’s not a supply problem but an affordability problem did you miss? On this subject there would be a lot more existing homes for sale if people could afford to move up, so they can’t and are staying put & not selling.

Higher rates absolutely will correct the affordability problem. Let’s see the Fed be forced to sell off MBS to meet its runoff quota. If this happens, there’s no telling how high rates will go. What comes next is HOPEFULLY a massive wave of foreclosures which will further suppress home prices. All of this could easily play out over the next 2-3 years. IF that happens, you’d better bet housing becomes WAY more affordable than people think it can. Just go look at Wolf’s 1,100+ zombie companies post & extrapolate that out to possible job losses once a 5+% FFR comes home to roost next year.

The only way out of this situation is a significant downturn in housing & job losses to kill off inflation.

Otherwise, we just come out the other end with stagnation and PCE inflation that doesn’t fall back near the Fed’s target of 2% which for the foreseeable future is a pipe dream without a real recession.

People really don’t have a concept of how much $13T extra (QE, stimulus, Biden’s spending, etc.) inflation will be spread out over the next 2-3 years along with massive local government spending enabled by extremely high property tax revenues.

Correct. I dare anyone to “adjust” the reporting metrics to eliminate ALL fraud built in. In the reporting, adjusting and creating of GDP for example. We only see patchwork attempts with explanations and Wolf has been very good at that presenting more real understanding, but there is still so much fraud built in at all levels no one can truthfully discern anything that can resemble accurate reality so one can make efficient and high odds assessments. How do Walmart warn and all these Corps warn and we see a GDP print like this. If a city of 10,000 had one billionaire who spent half his money and the rest were bankrupt the GDP would have a misleading result. It’s not the numbers, it’s the reality behind the numbers that count to astute financial individuals. Numbers are for scammers, wall st and politicians. Different parts of the same snake.

“What part of there’s not a supply problem but an affordability problem did you miss?”

Data to back up this oft quoted argument: Per the Census, in Q1 2021, there were 141.5 million housing units, 11.8 million of which were vacant year round. Only 3.2 million of those were available for rent.

I don’t see it playing out the same way as you do. A massive wave of job losses to me means the same people that can’t afford a house now are the ones that won’t have jobs or will be making less money then.

House prices will drop, but those same people won’t be able to afford or qualify for the house at that time. House prices were relatively cheap in 2009 and 2010, but middle income people still were not able to afford them, and that was with low interest rates.

I agree with you that rates need to go up, I don’t agree that it is going to solve the affordability issue for the demographic that currently can’t afford a home. Cash will be king when it comes to purchasing a home, and fund/institutional money is probably going to be eating these homes up.

Chris L,

A lot of politicians these days like to talk about house “affordability” in terms of those easy monthly payments. That way, they can hide the fact that they supported criminal policies, such as QE, which benefitted themselves by causing asset prices to rise far above FMV. Here’s an idea to make houses more “affordable”—government-insured, 1,000- year mortgages.

I find it very annoying that general media dolts are saying housing is not affordable due to high interest rates, when it is housing prices that are the obvious outlier, historically speaking.

The solution to the problem will require years of higher interest rates, accompanied by a gradual lowering of housing prices and inflation, which will result in lower interest rates and better housing affordability a few years down the road. If people can’t wait a few years for that, they are part of the problem, not the solution.

IN my hood, home prices increased in last 2+ year by 50% plus. Even before covid, it was unaffordable. So, 20% price down would do absolutely nothing to affordability.

If you extrapolate case shiller that gives 4 month one data to now, you will know that the houses in West (Seattle, San Francisco, LA) have already dropped 20%.

You will see this in data after 4 months.

Form here on, a 3% – 4% monthly drop will give a 40% drop in 1 year. It may be faster when mass layoffs start in January. Here I say January because, companies still have huge expectations from holliday season. If these expectations don’t pan out, layoffs may start earlier.

From May 2018 to May 2022, my house in Woodstock GA doubled in value which is just absolutely zonkers.

The current interest rates are the problem. It’s the home prices. High home prices have big consequences for your property taxes, hazard insurance, repair costs, etc.

The Fed needs to be barred from meddling in 10, 20 & 30Y treasury prices. That’s a big part of the long-term solution.

Sorry:

“The current interest rates are NOT the problem.”

Well stated, Jay. I think the so called “WE’RE IN A RECESSION” crazies do not fully comprehend we are entering a big fat depression.

Well, we’ll see about that. I think there’s a chance that we go through only a modest recession that lasts longer than what people expect. It’s possibly it takes two years for unemployment to move from low to high then back down to a reasonable level that’s not 3.5%, of course. Or, it could go the other way. I agree with Wolf’s zombie company profile that could become a really big deal. And there’s the usual global interconnectedness of things. China & the EU both have problems that could spill over into the US and make things worse. I’m of the opinion that trying to make predictions more than 2-3 months out is sketchy.

I know this though. First time jobless claims have been moving between the 195 – 220K range for most of the year which is historically low. I’ve seen a chart of monthly jobless claims overlayed over the length & severity of the recessions going back to the late 1970’s.

Jobless claims will have to push up towards 275K and then 300K for there to be a real recession. As it moves towards 400K determines the severity.

Listened to Steve Hanke interview today. He is the only economist that forecast inflation accurately and published it in Wall Street Journal. Says inflation will still be 5% in 14 months. He says Fed looks as if they are going to tighten too fast and send us into recession and we will still have the inflation.

The Fed needs to send the US into a recession anyway you look at it. PCE inflation, used by the Fed as it’s “target”, isn’t going anywhere near 2% without a recession.

The housing affordability crisis isn’t going to break without a recession or unless 30YFRM stay elevated above 6% for at least 18-24 months.

Now then, that 18-24 months is probably the longest the Fed will be able to hold out before something breaks due to its 95B a month in QT runoff.

Ultimately, the Fed will be forced to make one or more things break, housing & jobs. It’s that simple. The only question left is to what extent do they allow things to fall before they pivot.

Nowadays, there’s enormous pressure from the president, Congress, Wall Street hedge fund managers for the Fed to pivot when they want. Time will tell if JPowell is able to truly put on his Volcker pants.

I’m fine with a big recession sooner rather than later. I’m a 14-year HS math teacher which is uber recession proof. My car insurance just went up 25% which is mind boggling with no claims. My property taxes keep going up. Everything is going up with no end in sight.

Then they better increase QT, eh?

Some concrete numbers:

i%: Interest rate

PMT: Payment per $100k mortgaged

LOAN: Mortgage for $2,000/mo payment (principal and interest)

Δ: Percent price Δ for same payment, relative 3.00% rate

i% PMT LOAN Δ

2.68% $404.53 $494k +4.2%

3.00% $421.60 $474k Baseline

4.00% $477.42 $419k -11.7%

5.00% $536.82 $373k -21.5%

6.00% $599.55 $334k -29.7%

7.00% $665.30 $301k -36.6%

7.50% $699.21 $286k -39.7%

Since costs of everything else are rising, and wages generally aren’t keeping up, the amount many people can afford for a monthly payment is likely to drop, so for a home bought during the July 2020 to December 2021 period of 3% rates to be affordable to a buyer of equivalent means, its price is going to need to fall about 35% from its price in *that* time frame, meaning much, much more than 35% from the recent peak asking prices that were up 30-40% from 2020 levels.

https://fred.stlouisfed.org/graph/fredgraph.png?g=Vl8E

It’s really, really weird that one sees articles in the press saying that homeowners are in great financial shape because they all bought or refinanced at the low rates and now have 35% equity in their homes. In fact, anyone who had less than 35% equity back then has zero equity now, in fact less than zero if they’re forced to sell, considering closing costs.

The flaw with this analysis is you don’t factor in what happens if the buyer gets a pay rise each year. If they are getting ~6% (current private sector wage growth in US) then they will be able to increase the value of their monthly payment each year as well.

You really have to look at the real interest rate with respect to wage growth. For a 7.5% mortgage rate, that is actually only +1.5% (7.5-6), so hardly onerous.

Of course huge question marks all round as to future mortgage rates, wage growth and inflation.

I think this is where the US method of locking in an interest rate for the duration of the mortgage actually falls down. It’s seems like these loans are overpriced on a net present value basis, as it would be a pretty extreme bet to assume they cannot get inflation back to target within the next 25 years.

I am not sure that (given the raging inflation that I opine is being undercounted) the “increase” in consumer spending amounts to a real increase in spending as opposed to customers being forced to spend more, inflated (devalued) US dollars either to buy the same things in smaller packages or the same things priced at higher prices. As to the banksters “Federal” Reserve “catching up” in genuinely trying to control inflation; that will be the day. LOL

The banksters and financiers are losing their hats with each interest rate hike, because they were invested heavily in China: e.g., one of the most evil busines entities in history (reportedly) was heavily invested in CCP-linked companies. LOL Each interest rate rise will be like a Japanese Long Lance torpedo impacting upon the sinking Titanic that is the Chinese economy and will destroy more and more of the “asset” “values” of the CCP’s best buds, the bankster owners of the “Fed”. LOL

(Sadly, I did not do enough research and pay enough attention, and so did not recognize the Chinese company names of some companies held in an investment fund that I have, so I also lost quite a bit– after I had predicted the implosion of the CCP’s economy many months ago, even before they got their presitator “re-elected” {to use that term very, very loosely}, which will be a coup de grâce for their economy.) Schadenfreude bit back.

GDP looks good because inflation is being measured incorrectly. Eventually, this will become obvious, and they will just stop reporting inflation and GDP statistics.

Under the hood, the USA buys stuff from other countries, then resells it at higher prices to consumers who borrow money to participate.

GDP growth in the USA, right now, is akin to driving a few more miles on an engine that hasn’t had an oil change in the last 50,000.

jimbo,

Polaris of Medina, Minnesota just reported earnings this week.

“Our results were bolstered by easing supply chain headwinds that enabled us to increase ship volumes and take advantage of our strong pricing strategy, resulting in record sales this quarter,” said Mike Speetzen, Polaris’ chief executive.

Sales in the off-road sector up 33% to $1.7 billion. Sales in the on-road sector (Indian brand motorbikes, made in Iowa, for example) up 30%. And where Polaris has been expanding by acquiring manufacturing companies, boat sales have increased 42%. All told, revenue grew by 32% to $2.34 billion.

At least in some segments here in the USA, manufacturing is alive, well and growing.

Great, adult toy makers are doing well. Smattering of applause…

A slump in new sales and a rise in second hand sales of Jet skis and dirt bikes and other toys are the signs of recession.

While these go up the economy is booming.

More tightening to come.

Not adjusted for raging inflation, GDP jumped by 6.7% to a seasonally adjusted annual rate of $25.7 trillion.

——————-

Hahaha. That is the key point. Not adjusted for inflation, my salary goes up and I still can’t buy a house. I am sure can feed myself in 2012 but not 2022.

But since GDP went up, it must mean for something. The nightmare never stops.

It will be interesting to see whether the Net Imports (trade deficit) continues to return towards balanced-trade. Some supply chains are being onshored back to the US. Others are being reshored away from now-adversary nations, to friendlier nations. Wolf has noted the global energy trade is very, very different now than 2 years ago. But it’s not just energy, now it’s semiconductors, food… and sadly weaponry.

On the other hand, Net Imports (of goods and services) means Dollar Exports (of currency). Despite the surge in Dollar Exports, the dollar is near record highs vs. other currencies. So demand for dollars is off the charts!

I guess the numbers don’t lie, but any upticks in pay/splashy behavior are just not readily perceptible to me among friends/colleagues & random slobs in my travels. Maybe it’s just less razzle-y dazzle-y items that Americans put off during the pandemic, like furniture steamings, haircuts & oil changes…

Consumer spending increased by 1.4% annualized… that’s not exactly “splashy behavior” — it’s less than normal growth.

That said, I sit in a touristy part of the US (San Francisco), and people are throwing money around like there’s not tomorrow. This is spending on services, not goods.

San Francisco — I can maybe see that.

I suspect the spending on services is a mix of people trying desperately to claw their way back to some kind of normal doings post-pandemic, and then also people trying to get things done ahead of whatever recession may be in-store in the coming quarters — sort of hording services ahead of a storm: “I may be unemployed, but at least the pools shocked, the carpets dewormed & my backs been waxed”

Austin, TX doesn’t look like a downturn either. People are out in droves. But the university and medical industries never downturn and tech salaries have been going through the roof. Companies are still fighting for employees.

I see the danger. The Fed seems committed.

But the downturn hasn’t come to live in peoples minds yet in my neck of the woods.

It’s strange the dichotomy between people’s behavior and the gloom in the financial press and executive suites.

Ed7,

The crowds at last weekend’s Formula One gathering in Austin were amazing! Over 400,000 in attendance for the three days. I reckon that pumped a few bucks through the local economy.

It’s been a busy month, what with ACL and the Formula One race, but what was on my mind was just last night, which I think was a regular Thursday night. I was downtown and then on South Congress. All the restaurants and bars I passed were absolutely full.

(This was the second year I’ve gone to see the Formula One, though we went Saturday and so watched only practice and qualifying. I learned my second son really enjoys Ed Sheeran concerts. The racing, eh, it was just okay.)

There is a good chance that USD weekly have reached it’s peak in

Sept 26 @ 114.75. Today USD closed @ 110.45, below Sept 26 low @ 111.54.

Michael,

I think the important date to keep track of is Sept 25th. Maybe 27th. Definetly not 26th. Attention to details is important, you know.

How much of Q3 GDP growth was government spending, Ukraine, and LNG exports, also due to Ukraine?

Look at the chart

GDP is a poor way to measure societies success…emphasis on “poor”…

America is getting “poorer” by the second as we just hit $750 billion per year in interest payments on the national debt!

Federal Govt Interest Payment History Chart:

https://pbs.twimg.com/media/FgGG7xCWAAQ1_eM?format=jpg&name=medium

hahaha, some of those interest payments go to me, finally! And to many people like me. And to financial institutions. And some of us actually spend these interest payments. So more spending, more economic activity, and more taxes collected. You gotta keep the other side of debt in mind. Your debt is my interest-earning asset…

Hey Wolf, I was talking w/ a friend today about the weapons going to Ukraine…as they were paid by US tax $’s and we’re giving them to Ukraine for free…I’m guessing that this is still considered as part of the GDP for exports and is helping raise that number a bit… But… SHOULD it be? I have no idea of how that sort of give-aways as opposed to arm sales to countries works…

Can you enlighten me?

Government spending, like consumer spending, is counted as part of GDP.

GDP = Consumer_Spending + Government_Spending + Business_Investment + (Exports-Imports)

The military equipment going to Ukraine counts as GDP.

(There is not automatically sense to this equation. If we tore down all the country’s houses and rebuilt them every third year, our GDP would be enormous. But the results after some years of this would be really bad for quality of life. The housing construction would crowd out other activities.)

in the $25 trillion (with a T) US GDP (current dollars), $5 billion (with a B) in weapons exports to Ukraine don’t really matter much.

The first week the Ukraine war started I said the US will pump a trillion or more dollars into the place like we did in middle eastern wars. Maybe when our debt service grows larger than defense budget we will dial it back.

Anyone old enough to remember the so called peace dividend?

What Wolf said… ‘National defense’: +4.7%.

Sure, some of it may be for new uniforms but maybe we should call it ‘World Defense’!

No, (national) offense department.

If you take everything into consideration, it’s obvious that those both in control of foreign affairs and pushing recent changes in military culture are obviously not worried about any (potential) military threat to the US.

Used to be called War Department, you know Orwellian language. Just like US debt management department is the Treasury department. Our biggest asset is $1.7 trillion of student loans. Oops about 25% of that is going to buy votes.

Here in Naples, FL – still spending like there’s no tomorrow. Of course, most of us know that ‘the economy’ is not a defined thing everywhere and and the ‘economy’ is quite diverse’. In some areas where there is money, yes it is booming because people believe there is going to be a good economy regardless of what some may call ‘macroeconomic’ events.

People should probably turn off the news and just try to observe what is happening around them. For example, in the 60’s the news was full of doom and gloom because of the Vietnam War, but the reality in my neighborhood was that life just went on – people were happy, enjoying barbecues and little league baseball. Yes, it was quite different in other places in the world, but that was not what I was observing locally.

Observe locally – ENJOY locally. And no, there will never me a one sides fits all environment.

I live near Tacoma. Thanks for the laugh.

Further proof we need a 700 basis point emergency rate hike tomorrow morning, Wolf. Just kidding.

Boy oh boy, those speculators squealing for a FED pivot are mean-mugging now. Think “bitter beer face.”

Remember Linus waiting for “The Great Pumpkin?” That’s how I picture them. Time to grab a blanky.

I wonder how many people are like me? I feel more comfortable spending a little more now that my money is locked into safer assets (like brokered CDs) and earning around 4%. Even though I was earning more in the stock market, I didn’t really feel like that money was mine until I sold.

Not that I am going on a spending spree, but I sleep better at night and I can afford to buy that $15 cheeseburger from time to time.

Not many. You sound like you are easily in the top 10% if not 1%. The number of people living paycheck to paycheck or on credit is shocking. They are not sleeping well at night.

I’m in the top 10%. Not comfortable at all with $15 burgers. Maybe THAT has something to do WHY I’m in the top 10%.

I’m not feeling good about 4% return in a 10% inflation environment. Not at all.

Depends how much you have invested at 4% vs. how much you’re buying that goes up 10%. 7 figures in a 4% yielding investment can easily cover ones inflation tax on their PCE/CPI basket depending how much they spend. I.e. $1mm making $40k a year covers the increased cost of spending $50k (CPI/PCE) that goes up $5k in that 10% scenario. Absolute dollars it’s not bad. Plus asset values going down to make it better, too.

Z33,

You are forgetting that your $1M principal suffered a permanent loss of 5%, or $50,000 due to inflation of your basket.

If you are in the top 10% and a $15 burger is an issue, you must be leveraged to the hilt. I think the main thing I have going is I have no debt and I don’t spend more then I make. That alone will put you in the top 10% eventually. And if you make decent investments that can help.

I wasn’t feeling good about making 20% in a zero inflation environment, because I knew it was fake and would end in tears.

If you feeling bad about just being able to keep your growth from the last 12 years, then I think you have bigger problems in life.

The appropriate reaction to a $15 burger is a buyers strike. I can get one pound of hamburger meat at Von’s this week for $2.50 ($2 3 weeks ago), meaning the most expensive ingredient in a half pound burger only costs $1.25, at retail prices for the meat.

DC,

Have to disagree. I think many sleep just fine. Not because you’re wrong, just because it’s the 2022 American way.

The people I’ve known like you are usually post-trauma; they’re on the other side of a messy divorce or a death, and they become fatalistic about their lifestyles & their spending; they’ll buy a 25 dollar hamburger and eat half of it, spitting the other half in the street. There’s something cathartic in pissing it away for some folks who’ve suffered in certain ways; it’s a way of laughing at the system and into the flames which they feel are about to engulf them; taunting their own fears of bankruptcy & dispossession. It could be that you’re witnessing something similar in the spending habits of Americans post-Covid…most properly rich bastards I know throw their money around like manhole covers (HT S. McQueen)…

“The people I’ve known like you are usually post-trauma; they’re on the other side of a messy divorce or a death, and they become fatalistic about their lifestyles & their spending; they’ll buy a 25 dollar hamburger and eat half of it, spitting the other half in the street.”

What?

“What?”

It’s not a literal example. Like someone lighting a cigar with a hundred dollar bill; people who’ve stopped caring/stopped being fearful because they’re post-trauma often exhibit fatalism in the form of extravagance.

The only other reason someone may be inclined to spend 15 dollars on a decidedly blue collar victual is something called the Chivas Regal effect; charge a shocking amount over actual cost for a good or service & people start to believe they’re getting something truly premium (you see this in practice in college tuition rates).

Bullfinch,

Graceful of you to spell that out for our friend, RECEO. He’s been having trouble processing well thought contributions on this site today. Earlier dismissing another comment as “word salad” but with no thoughtful contributions of his own.

He may be lost and needing redirection back to tiktok.

So, the numbers look better than expected right before the midterms. Hmmm.

But they wouldn’t fake the numbers, would they?

No, only China, Russia and others do that.🙄🤣

Dang. You beat me to it.

It looks very suspicious to me. Hard to trust these numbers RIGHT NOW.

Are US exports of military equipment related to the war in Ukraine included in the governmental GDP consumption data? The US purchases the equipment and ships it. The “sale” of this equipment to Ukraine and NATO, if classified as an export, must overwhelm the other data.

Yes, but in the $25-trillion (with a T) US economy, $5 billion in military equipment exports to Ukraine just isn’t a whole lot.

US DOD states that as of 9/9/22, $ 14.5B in assistance had been provided to Ukraine, including $ 12.5 in military equipment. Only $ 2B for the government.

This was a GDP question. GDP is quarterly. How much in Q3 2022?

Whatever the amount, it just small fries in the US economy and in US exports: The rate of exports from the US to the rest of the world in Q3 GDP was $3.06 trillion with a T.

Is adjusted for inflation really adjusted for inflation?

We had a few amazing GDP reports when the fed first turned on the printer – but seems like most of that was just “growth” that hadn’t been eaten up by inflation in the future yet.

1) The temp inflation is sticky. It might osc between 9% and 2% in the next few years..

The Fed is behind the curve, not just one curve, but behind every curve, with Anti inflation doses, like a trader. Next year, y/y the inflation might be negative, otherwise it will be above 10%.

2) It’s a system control with a negative feedback loop. The highest osc

are in the front end. The front end might be (soon) behind us.

3) The housing market is deflating, but in real terms, due to inflation accumulation, the decline is steeper. C/S pairs will not show it.

4) Druggie “I will do whatever it takes to keep negative rates” is over. Gravity between US & the German yield curve pull them together. UST10Y minus UST3M dived to (-) 0.17%.

5) US & Germany front end are anchored, but the long duration have a freedom to pulled together. If Druggie was still on US10Y minus DET 10Y might have reached 4%, because JP will not stop…

Risk off : B61 two weeks training drill will be over this Sunday.

B61 replaced old junk. B61 will be station in Europe in Dec.

The other side ended the same exercise yesterday. The current gov

follow the footsteps of the former administration…

Wolf:

Can you make a Michael Engel Secret Decoder Ring available with a donation?

THAT… was funny (and better than the thought I had about it.. lol)

Learning to understand Engel-ish is like the quest for the holy grail.

He types with a Chinese accent.

I’ll take a stab at deciphering this one. The B61 is a nuclear weapon that is dropped from an airplane (a gravity bomb) and they are kept in Europe, mostly as symbol of the unity of the NATO alliance. In any plausible scenario for actual nuclear war, nuclear missiles would be hitting targets by the time the first airplane was just flying out of sight of the airbase. Look up “B61 nuclear bomb” on Wikipedia and it notes that the latest and greatest version of the key to the doors of hell is now updated to the B61-12 model.

NATO and Russia are shaking nuclear sabers by conducting drills with nuclear weapons, which is “risk on” news. If the sabers are put back in their sheaths, and the nukes are put back in storage once the drills end, that is “risk off” news.

Thanks, that was very helpful. Feel free to keep these translations coming. When I put ME’s text into Google Translate, it sent me to a listing of psychiatrists in my area.

Surprisingly, this is the first time I’ve ever understood all his bullet points in both posts! PS ME, (1) the B61 is still very destructive, and it works just fine (2) if only the data was real time, you could slap a PID on the financial sytem and damp the oscillations.

This would be ACTUAL irony.

So plenty of room for a 75 bps hike next week and continued hawkishness right? Blackrock disagrees but we’ll see.

BlackRock is a bond fund manager. Their bond funds have gotten annihilated. BlackRock manages the TLT Treasury bond ETT, which is down 43% from the high. BlackRock would say anything and do anything to get bond yields to come down, or at least stop rising. If you listen to them, you’re just carrying their water.

BlackRock owns Credit Suisse. I’m surprised they haven’t taken a stock hit. Don’t drink the water! LOL

BlackRock Water,

BS. BlackRock is a fund manager. The investors who have bought stock mutual funds and stock ETFs managed by BlackRock are on the hook for Credit Suisse losses. Credit Suisse can go to zero, and BlackRock itself doesn’t care and won’t take a loss. It just rakes in the fees from managing the stock mutual funds and ETFs. But the holders of its stock mutual funds and stock ETFs might care, same as with all stock funds.

It’s your stock mutual fund in your 401k that loses money on Credit Suisse, not BlackRock.

Where do people pick up this BS that BlackRock lost money on Credit Suisse? Who is circulating this braindead BS out there? Don’t people understand even the basic principle of what a fund manager is? If any site says this sort of garbage, don’t ever go back there because they’re lying to you.

Gonna need an updated list of imploded stocks with AMZN cratering Wolf!

Yyyyyyyeeeeeewwwwww!

I think a lot of investors forget when companies get large their terminal growth rate is limited to nominal GDP growth or they will eventually eat the whole economic universe. Once your market cap is $2 trillion how fast can you grow stock price?

Maybe another way to say it is if company grows large enough the PE is probably going to be around 15 in normal economy. Got to be careful paying a PE of 50 plus for growth.

Amazon’s retail numbers are dismal but the damage has been done.

Remove, Amazon’s AWS business from the equation and AMZN’s stock

would be trading at under $2.00 a share.

They saddled me up with 303 packages on Tuesday and sent me into the foothills of SLC, I was going to quit.

I should have obtained my CDL a long time ago, I am the fool.

Wolf: are you still “short” (the entire market) from awhile back? Just curious.

Yes.

Calculating ‘real’ GDP involves taking out the effects of inflation on nominal or ‘current money’ GDP. This is done using the GDP deflator. The BEA reports this as “price indexes” (table 4 in the stats release).

For GDP as a whole in Q3, this was 4.1%, which looks very low indeed – it was 9.0% in Q2, and 8.3% in Q1. This tallies with the “implicit price deflator” for GDP at the foot of the table.

It’s not uncommon for GDP-def to be below CPI, but usually not by very much. The latest number looks remarkably low.

CPI was very low for Q3 on that basis — the three month-to-month rates of July (-0.02%), August (+0.1%), and September (+0.4%), and then annualized.

Thanks. So the GDP-def is change IN inflation, Q on Q, rather than inflation itself, as in Y on Y? That’s surprising.

How will Fed bring down asset prices with these kinds of results? Stocks will shoot up once again. Is FED losing the battle?

The cure is to pause at about 4-4.5% to buy time for supply chain restoration. The rates at that level will allow for private savings to grow and ‘hedge’ against taking on more debt. The only way to quell inflation is to restore supplies. Disaster Capitalism which creates mass unemployment is not needed. Also, raise taxes on the wealthy. Income Inequality destabilizes an economy. Four decades of tax cuts created the inflation. The pandemic lit the fuse.

Yes, people are still spending. But a good portion of that — especially vacations and travel — was probably locked in many months ago. The question is, will it hold up next Spring, after people have already taken their long-delayed trips this past summer and through the winter holidays, are now worried about inflation and job cuts? Are that many people making their Spring Break reservations now, or have those started to slow? As for the goods side of things, the 4Q data will be interesting to see, but even if not bad, I doubt it will continue through next Spring and Summer.

Basically, more than the entire GDP rise was due to the changes in exports and imports. I don’t see that continuing into the future to that degree (if at all), although energy exports will likely remain high, so 3Q GDP is a bit of an anomaly, which means 4Q GDP and beyond is likely to be much worse.

Look at the front running everyday and the indexes keep zooming up. Is it b/c they are ‘speculating’ that some thing will break, any day, if Fed keeps on raising the rate? Strong hopium out there.

Perception vs reality ‘bets’ in the casinos run by Fed! If Treasury mkt breaks, all bets are off.

Shaky Treasury mkt!?

A crisis in the Treasury market is likely much greater than the Fed realizes. That is why, according to Bloomberg, there are already potential plans for the Government to step in and buy back bonds.

September’s liquidity strains may have sharpened the Treasury’s interest in buybacks, but this is not just a knee-jerk response to recent market developments.”

If something is breaking in the Treasury market, it will likely be time to buy both stocks and long-dated Treasuries as the next “Fed or Treasury Put” returns.