Long-term stagnation turns into sharp decline.

By Wolf Richter for WOLF STREET.

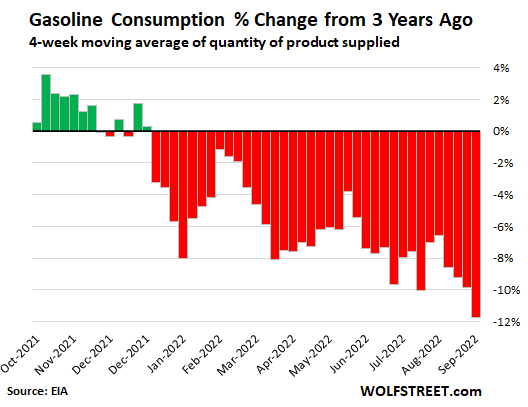

Over the four weeks through September 9, gasoline consumption dropped by 11.7% from the same four-week period in 2019, to 8.56 million barrels per day on average, below the same periods in 2020 and 2021, according to EIA data today.

The EIA measures gasoline consumption in terms of barrels supplied to the market by refiners, blenders, etc., and not by retail sales at gas stations. On this moving four-week average basis, it was the steepest decline so far this year, that has seen nothing but declines from the same periods in 2019.

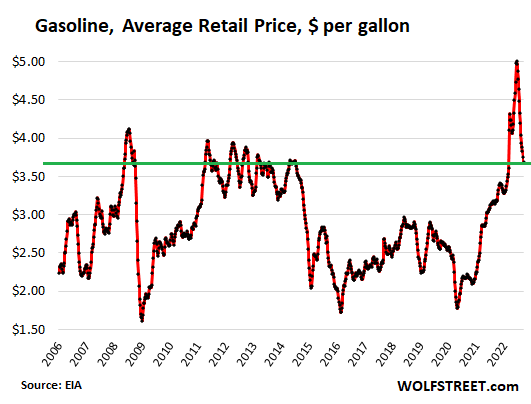

The decline accelerated even as gasoline prices have plunged from the top of the spike in mid-June. This may indicate that the classic economic principle of “demand destruction” – where a price spike triggers a decline in demand that then causes the price to back off – may not just be a blip, but that this demand destruction may have become in part structural.

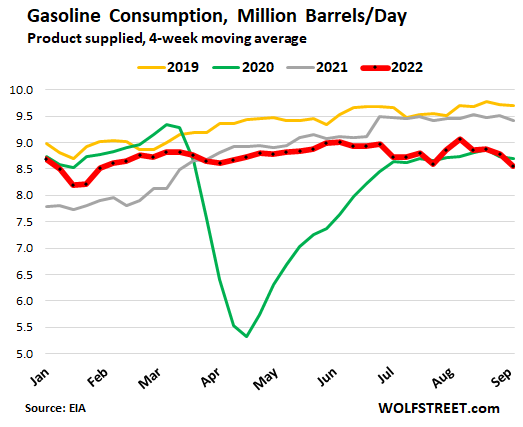

Peak driving season is in the summer. But this year, gasoline demand in the summer (red line in the chart below) was substantially below the summer driving season in 2019 (yellow line) and in 2021 (gray line), and roughly even with the beaten-down levels of 2020 (green line). And then in August and September, demand fell further, and ended below the levels of 2020:

This demand destruction caused by sky-high gasoline prices is happening on a global scale. It’s where price resistance has set in, and people have changed their behavior a little here and there. They cut out unnecessary trips. They’re prioritizing their most fuel-efficient vehicle in the garage. When they buy a vehicle, fuel economy is moving up as a decision factor. Working from home has become sticky, and fewer people are commuting to work every day. And for vacations, people might have chosen to go places that involve less driving.

This demand destruction pushed down the price.

The average price of gasoline in the US, all grades combined, had spiked to $5.00 a gallon by June 13, according to EIA data. This type of price spike – up 63% year-over-year – sent shock waves through wallets and minds. Everyone was talking about the price of gasoline. But the average price has now dropped to $3.69, which is where it had been for years in the past – and yet, demand destruction accelerated:

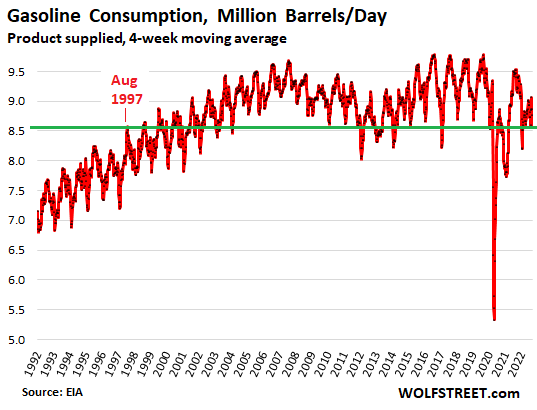

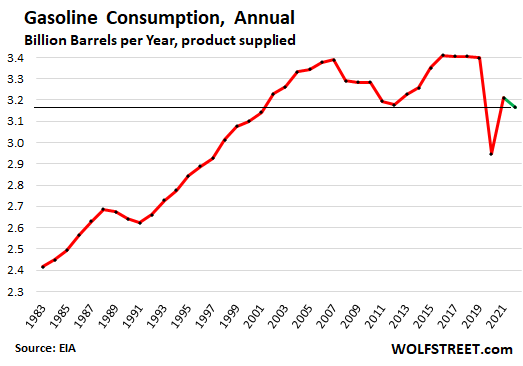

Gasoline consumption has been stagnant since 2007.

Over the long term, the four-week average gasoline consumption of 8.56 million barrels per day was first exceeded in August 1997:

EVs are still only a minuscule part of the 284 million vehicles in operation. There are only 1.8 million EVs on the road, for a minuscule share of 0.63% of all vehicles in operation (my discussion on what Americans are driving). EVs are being prioritized for driving in two-vehicle households to dodge high gasoline prices. And EV sales are booming, with long wait lists and consumers willing to pay whatever. So EVs are starting to have some impact on gasoline demand, but it’s still very small.

Improvements in fuel-efficiency across the spectrum over the past 20 years have largely been responsible for the stagnation in demand through 2019.

On an annual basis, gasoline consumption hit a ceiling in the year 2007 at about 3.4 billion barrels per year, and re-hit that same ceiling in 2016, 2017, 2018, and 2019, with a big trough from 2008 through 2015, and then another trough, but deeper, in 2020 and 2021.

Consumption this year is shaping up to be below 2021. There is a good chance that gasoline consumption may never again hit that ceiling of 3.4 billion barrels per year again (green = my estimate for 2022):

Refineries have long seen this demand trend.

If US refiners have not been investing in the construction of new refineries, it’s because they too have long seen this long-term stagnation and now decline in the demand for gasoline.

Rather than relying on growth in the US, refineries turned into big exporters of gasoline, diesel, jet fuel, and other petroleum products. Even the refineries in the San Francisco Bay Area are importing crude oil and are exporting refined product to Mexico and further south.

We here in San Francisco could see those tankers head out the Golden Gate fully loaded, while we paid over $6 a gallon, and there is nothing like putting $100 into a tank every two weeks to persuade someone to look for alternatives.

Which – following the principle of demand destruction – caused sales of EVs to soar to a share of 15% of all new vehicles sold in California in the first half of this year, from a share of 9.5% in 2021 and 6.2% in 2020.

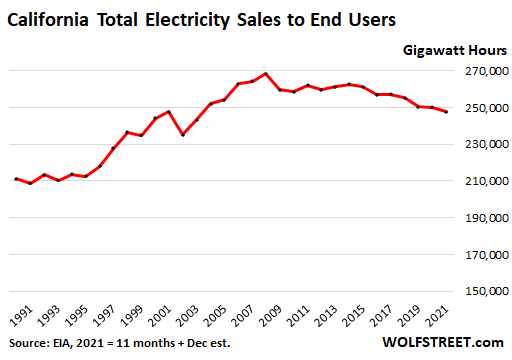

In the middle of the night, electric utilities sit on huge amounts of idle and very costly capacity, and this is when EV owners are encouraged to charge their vehicles because electricity prices are lower and people with garages can just plug them in overnight. Utilities are licking their chops because they too, like refiners, have been stuck in a stagnating business, as consumers, businesses, and municipalities have invested in more efficient lights, appliances, HVAC systems, and equipment.

And those utilities, by selling electricity to EV owners in the middle of the night, are making money off what was their costly idle capacity, and someday this might even get their business to grow again, which would be a godsend for them, but there were still no signs of growth in electricity sales:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I wanted to start out this thread by saying my job is totally dependent on my short-range EV. Started as a pizza delivery driver almost a year ago as an experiment of sorts, and would have long ago quit if I had an EV or hybrid.

My costs for electricity is about 75 cents a day to charge at night.

Besides needing two new front tires and some lights, I have had NO maintenance costs.

Can this be because of office foot traffic dropping? I have seen companies struggle with getting folks to office in hybrid work environment. Wolf had a office traffic chart based on cellular network. It may be useful to see.

I know vacations are more costly now and this could also be a driver as well.

been driving on fumes – need to fill up

of course I just drove 700 miles with big 5th wheel in tow

now back at work = driving my pickup

30+ gallons every 2 weeks

Thought about this too, a lot of the drop in gas demand may simply be the ongoing popularity of WFH. It varies a lot but despite the stories of teleworkers getting called back in, it’s still a more cost effective option for tons of companies than being in the office or cubicle (much less overhead, and without the strain and exhaustion of the commute, most Americans esp professionals are more productive). And for reasons talked about below, it doesn’t really work to offshore either–better to have American workers and professionals on the WFH plan. Probably not the first thought a lot of environmentalists and environmental policy experts had as a way to bring down greenhouse gas emissions, but telework has to be one of the contributing factors here, and good for the environment.

Indeed

You would of quit if you ‘didn’t’ have and EV or hybrid?

the costs of maintenance and gas make the job unprofitable. Granted gas is down but we have had a couple people quit over the costs of rebuilding the whole front end of a car – like the 2 grand for shocks, struts and brakes

We have lots short runs on hills so it’s really hard on ICEs. Regenerative braking takes care of 95 percent of stopping since the engine is doing all the work.

You do realize that your EV has the same front suspension components as an ICE vehicle, don’t you? Bushings, shocks/struts, ball joints…. all wear items. Plus, due to the battery weight, they are more stressed. So…. you save $100 on front brake pads…. the rest of the expense will eventually be incurred.

Is short-range EV a fancy way to say it’s a golf cart?

And now a short message from our sponsors, the “refined” folks at RTGDFA Industries….’You like it, It likes you. Try it, you’ll like it!”.

Your total gasoline volumes were were petroleum gasoline, to reflect consumer consumption you need to add ethanol volumes to the total and other additives, as EPA mandated increasing amounts from 2005 and beyond. It wouldn’t significantly change your conclusions much, but some. Also, some pricing reflects the costs of EPA mandated reformulations for Base petro gasoline, especially in CA, but clearly demand, supply, and crude oil production limits overwhelm minor pricing issues.

Please stop using obscure Abbreviations that are loaded with sarcasm. I am surprised to Wolf not use the shredder. You know what they say about sarcasm?

A few months ago, a commenter here coined the term, RTGDFA, to replace the phrase that I used when people commented on the article without very obviously having read the article (produces bizarre comments). It has become a standard abbreviation here in the comments, seen many times, after I started using it too. But I now stopped using it. It means: Read The G*d Dam* F****ing Article. BuySome used it sarcastically in a different context.

“…there is nothing like putting $100 into a tank every two weeks to persuade someone to look for alternatives.”

I was burning $750 per month mid-summer. $100 every couple weeks would be a dream come true.

My Rav4 Hybrid was great, but my new Rav4 Hybrid Prime is outstanding!

I have heard good things about the Prime. I visited a local dealer that had one in stock.

I can afford a RAV4 ICE ($28k) but the $20k price increase for the RAV4 Hybrid Prime $48k is out of my range. The Hybrid is $32k. The hybrid would be doable. LOL. I can almost buy 2 RAV4 ICE for the price of the RAV4 Prime.

My ‘new’ prime is goig on 2 years old, way before the price hikes. Now, I would not be buying any vehicle.

Fun little side note, the RAV4 prime is the second fastest vehicle in Toyotas lineup.

Unbelievable. A hybrid at minimum is definitely in my future.

Though I do like those Rivians.

To ask a couple based on recent auto industry Wolfies:

Miles driven has ticked up. Shouldn’t that drive demand? Or are vehicles are that much more fuel efficient?

But the average age of vehicles (12.2 years?) is up. Shouldn’t that wear make them less fuel efficient, just like the years have made my shoes and the feet I put in them less efficient?

And light trucks/SUV’s are roughly five-eighth’s of the market. Has that proportion grown, declined or declared a moratorium over time?

If anyone can correct my misinterpretation, I’d be obliged.

Gotta be careful with miles driven: this includes commercial vehicles, delivery vehicles, etc., and that has been a whole different ball of wax, with a big boom in delivery vehicles and commercial trucks.

But yes, fuel efficiencies have risen a lot.

And miles drive — including commercial vehicles — are actually not up a lot in recent years:

Miles driven must be up where I live (metro ATL). Roads are as crowded as ever, if not more so. Especially interstates where I now assume either a slowdown or traffic jam where two interstates intersect. Time of day or day of week doesn’t seem to matter.

Yeild curve inverted, DXY 20 year high, economy consumes less energy, is unemployment going to tick up next ?

Saw an interview that speculated that Powell wants to go down in history as the central banker that got rid of the Fed “put”. I will believe it when I see it, but if so the market has some adjusting to do.

Modern central bankers do a lot of talking. If I remember correctly, Volker was all action and didn’t jaw bone.

Saw Marc Mobius (old emerging market money manager) say Fed ought to raise 1 or 2% at next meeting instead of trying to play catch up with inflation.

“Fed ought to raise 1 or 2% at next meeting”

When they need to raise about 8% just to begin to affect the massive counterfeiting of The Fed.

Real inflation (per 1979 CPI truthful calculation) is at least 15%.

To model the panic and spiral down that would ensue from an immediate shock treatment of that sort, you have to go far back beyond Volcker, to Irving Fisher and Keynes. Rest assured, we do not want to go there. A little side effect called global banks collapse and world war ensued.

If the patient is a sick addict, there is yet a limit to how much hammer and tongs treatments the patient can withstand all at once. I am sure the Fed members, even if they have awakened and become more self-aware, still know and consider this. Poor pacing before doesn’t mean abandon all pacing now.

As far as I can read right now Mark,,, ALL the electrical providers in FL are currently asking for ”up to 15% raises” starting in January 2023…

Not sure those companies will get those raises,,, but with the legacy and on going corruption of ALL the GUV MINT folks on the clear round table where the GUV folks go directly to the utilities here and apparently everywhere these days,,,

Hold onto your pennies,,, and your dollars will just follow into the pockets of utilities and politicians just a short while later.

Imagine unemployment ticks up and wage pressure does not ease?

Give it time. A likely recession will change things.

I’m seeing a lot more electric bikes being used in my neighborhood, at least 4x what I saw six months ago. These are people of all ages. Most are alone, so I don’t think it is recreational.

Electric bikes in congested cities with survivable weather are a great alternative to driving. I know several people that switched to them.

I see an increase in the use of electric golf carts in the ‘burbs’!

Those electric scooters that look like the Italian Vespa’s of old are becoming quite the thing in Europe. The only problem is that in most countries you need a separate (motorbike) driving license for them.

I assume the low powered scooters

You don’t need a motor but a scooter driving license (a AM driving license). Which is included in every car driving license. Or you get one with a relative easy test.

@Charly

In Europe, it’s different per country and, as you say, it also depends on the power of the scooter.

It it is a 50cc equivalent, most of the time you can ride it with a standard car license. But the power is very restricted and you cannot ride it on motorways.

However, there are also more powerful models, like 125cc equivalent. These can ride everywhere a car can, but the license requirements differ. For example, in France you can ride it with a standard car licence (cat B) but in the Netherlands a separate motorbike licence (cat A) is required.

The EU is not yet a “Union” in every respect :-)

Segway has waited 20 years to strike!

Wait, is Segway still in business?

I bought a used Segway from the Postal Service in 2012. It had ‘saddle pouches’, and could travel about max 10mph. It was fun to ride after the learning curve, but the local police did not appreciate it as much as I did. As far as I remember, a Chinese outfit bought Segway, and recently stopped producing any of the models.

What is really needed are electric cargo bikes or rickshaw type vechiles = grocery getter,pick up grandkids other miscellaneous errands ,build it I will be first buyer . No common sense in manufacturing

That would probably replace the second car in many urban/suburban areas if they could maintain 30 MPH for 15 miles before recharge.

Citroen ami aka Opel Rocks-e

7k inc. taxes. European regulation requires that such vehicles only have 2 seats

I believe we’re in a new industrial revolution ,to a cleaner more efficient electric model ,will take time but we will achieve it humans are resilient

Have you heard of new APTERA electric vechile quite interesting

Bianchi’s new E-Omnia electric bikes have a Bosch mid-drive system, lights, fenders and a rear rack. They’re quick and have good range. They will not last long at your local shop.

But, the Prairie Rider don’t use an electric bike. Hell no!

“I have my hair high and low

Anywhere the wind blows

I’m doing M.P.H anywhere my soul goes

I’m hell ride — on gasoline feed

That’s all I need for the life that I lead

Yeah! I’m riding alone and I’ve drugged my senses

There’s no one else to take the consequences

See when the day is gone free and the night creeps upon me

I take my ‘talian bike that’s where I wanna be…

I’m a true believer, yes I am”

-D-A-D ‘True Believer’ from 1989’s ‘No Fuel Left For The Pilgrims’

Wolf why not put wind generators on interstate right of way ,then put charging stations in rest areas,along with guick shops for coffee ,food .Allrevenue generating sources . Makes sense ooh forgot .To simple

Just like the one in the ad on the sidebar.

I didn’t get that ad

Demand Destruction leads to Investment Destruction. Why invest in new oilfield exploration and development when the retail prices are falling?

I’m in this industry, and it’s the brontosaurus in every room. By 2050, energy demand from all sources will triple today’s. And the people whose job it is to produce that energy have no clue how it’s going to happen. No matter what we do, there are armies of bureaucrats and enviros and NIMBY’s who make our lives miserable.

And in other news, in the next 35 years we need to produce as much food as has ever been grown throughout human history. Then–thankfully?–population collapse will have set in, and demand will be plunging even on a week-to-week basis.

Hope you guys all enjoyed the 2010’s. As lousy as a lot of things were, it was the best of times compared to what’s coming.

demand destruction leads to investment destruction.

Why invest in new oilfield exploration…

I feel our pain. Somewhere deep deep in the regenerated bowels the earth may stop reproducing useless eaters.

-k

Reads like Soylent Green.

Hydrogen is the future

Hydrogen was the future many future decades ago, and it was the future two decades ago when I dealt with it while working on a fuel cell project, and today, it’s still the future, and it may always be the future. Why? Costs.

Have you read Christopher Clugston’s 2019 book “Blip”, on non-renewable resource depletion? It’s pretty grim. He updated his previous number crunching and gives industrial civilization another 25-30 years before it’s no longer possible to have one.

“It’s pretty grim.”

“Peak oil” mania hype all over again?

As prices for non-renewables rise there will naturally be greater efficiency in their use and alternatives will become more attractive because both will be economically incentivized.

There should be no “most inefficient and idiotic management imaginable” involvement at all. In other words, economics-driven evolution should be allowed to do it’s thing without top-down central “planning” by governments.

Every heard of the tragedy of the commons? Without restraint, the most voracious user will deplete and permanently destroy fisheries, forests, rivers, etc. It is the most privately beneficial path. Then what? Makes Soylent Green look like a walk in the park. There are worse things than a certain level of inefficiency.

Sure, just like buffalo were banished from the Earth to make way for the more agricultural efficient cow. If you put a price on everything, things that are priceless, including natural diversity, clean air, societal harmony and trust, etc are eliminated.

It’s possible to have two horrors at the same time: that there is no possible widely available, highly-dense in energy substance to replace fossil fuels and the fact that those fossil fuels are a declining resource.

If that is true, then the only possible future is one in which humanity must adjust to using far less energy on a per-capita basis.

Absolutely. We have both Boebert and Cruz.

Exactly! Gail the Actuary has been warning of this since the Oil Drum days.

Pretty sure the oil drum was some kind of cia disinformation plot… Predictions were all wildly off, and the people behind it never gave away their real names. Not too say peak oil will never happen, but I won’t ever get suckered into one of these doomer worldviews again. It’s a waste of spiritual energy to walk around believing that crap is happening.

So, I guess I’ll be seeing you on the corner with your megaphone and sandwich sign sometime soon?

I am curious about your statement about energy demand tripling by 2050. Could you provide some source material to back this up? I agree that developing countries will see dramatic increases in energy consumed as they catch up to the lifestyle of the developed countries. But in developed countries?

https://www.modernpowersystems.com/news/newspower-consumption-to-triple-by-2050-mckinsey-report-9655086/

Well stated James: Alice Freideman spells it out quite clearly in

her follow up to ‘ When the Trucks Stop running ‘ in ‘ Life After

Fossil Fuels ‘. She argues that instead of going to Mars we are

going back to a wood age. Her site is energyskeptic.com.

The lifestyles of modern developed-world consumers are a ludicrous cartoon parade of insane waste. It is so beyond ridiculous, so manic and nihilistic, the problem is that humans are too stupid to evade the cartoons being projected into their corralled sheep heads. I live semi-paleo, $20 monthly energy, $20 / week gasoline, $10 per day food, living like a king, taking care of business. If a Malthusian die-off happens, it is 100 percent the folly and vanity of fools who can’t imagine themselves out of the enclosure and plantation they build around themselves and their fellows at their own expense. Look at he cost of an iphone — what an insult and a JOKE. To my eyes it is the saddest self-parody to be sporting such a thing.

Yes it was $3.69 a gallon once before, but that was circa 2014. Back when inflation was running a torrid 2% and drill baby drill had not fully developed.

Yes it has come down, but people were belly aching at $3.50, then the war broke out and people started saying a few pennies more to support embargoes would be okay.

Just my 5.84¢ worth. (1982-84= 2¢)

Nice catch Charlie gee i wonder why?

US vehicles on average in 2022 are around 10-20% more fuel-efficient than in 2007.

US commuting by vehicle in 2022 has slumped 10-30% since precovid 2019.

Less fuel needed + less commuting = less barrels of oil.

I find it funny how much people went into debt buying unnecessary new and used cars only to keep them idle even more than they normally do because of gas prices.

You would crack a rib laughing when you do the math on what some of these suckers are enduring to “own” a brand new 1 ton diesel truck. It’s over $2,000 per month, all costs considered. Some of them can’t even scrape up the money to fill the tank.

Have been jaunting through Scandinavian cities (Helsinki, Oslo, Helsingborg) as well as visiting inlaws out in small town areas (Finland, Sweden).

There are swarms of electric scooters sitting around (credit card activated) everywhere in the cities. It seems to be a major mode of transportation for younger people. These are small scooters that look somewhat like the traditional foot propelled scooter. Sweden has just passed some laws preventing scooter people barreling around on sidewalks and no-vehicle walking streets.

In general, Scandinavia has an entrenched non-ICE transportation infrastructure (electric trains, buses) that far surpasses the United States in quality and in providing access to people who can’t afford cars.

Freedom of movement for ALL citizens used to be a feature of U.S. culture. But now it seems like there is a lot more of that freedom here in Scandinavia.

Freedom of individual(s) TO move has always been and continues to be the case in USA dp;

Freedom TO BE ABLE TO/OF ABILITY TO move has NOT been and IS not still to this day; one way or another, it must be paid for by sweat and/or money, etc.

Surely there have been times where both HAVE BEEN,,, and, equally, times when neither HAVE BEEN ”free.”

Gotta keep some perspective, possibly only earned by experiencing the very thing or close:

Hunger, maybe 10 days without a decent meal.

Hung up hitch hiking for a couple days with NO move, no money, no food.

Hanging with the homeless on the streets for a couple of VERY unplanned weeks,,,

Etc.

2022 was the first year we consciously cut back on summer travel. My wife a 3 kids used to drive (we fly now) from Chicago to Cape Coral every summer to visit my father in law. Plane tickets and rental car priced nixed it this year. We also do 1 or 2 mini weekend trips in the summer. Hotel prices killed that one also. We are fortunate to be able to afford it but we aren’t afraid of letting our kids being bored. We did do some fishing on a bass boat I inherited though. That old 50 horse 2 smoker burns about 12 gallons an hour but it starts every time:)

I watch in amazement how politicians throw out econ 101 when dealing with crisis. Instead of allowing price discovery to kill demand in Europe for natural gas and fuel oil the EU is going to create government subsidies and government directed rationing. Didn’t we learn anything from failure of Soviet central planning?

How much does the US subsidize the fossil fuel industry again? Also, how many barrels were released from the Strategic Petroleum Reserve? Amazed at European subsidies and soviet central planning you say?

A crisis is often a situation where econ 101 principles stop working. Killing demand for necessities may result in killing people (e.g., Putin cutting off gas and poor people dying or suffering in cold winter from lack of heating).

Comparing to Soviet central planning is a false analogy. Soviet central planning was not crisis management. It was standard government policy.

Bingo. It’s like self driving cars. They work for the “typical” case, but enter crisis mode otherwise, and effectively stop working.

How long would it take to shut down those natural gas plants and replace them with non-fossil fuel electricity generating plants? And what percentage of the population is willing to freeze over the many winters to get there? I don’t recall reading about that in econ 101.

Yes, naturally one would shut them all down simultaneously. Because that is how things are done.

Like the nuclear plants in France? Apparently that *is* how things are done nowadays.

Ye, and the whole demolition and excavating would take place using gasoline powered back-hoes and loaders. Most of the construction of the new plants would use a lots of oil made plastic/rubber type products along with metals that are refined in plants using coal, oil and nat, gas.. It is ironic, but understandable that it will take a very long time to become green, but not so long to become greener.

It’s not a binary, Stalin or Rand. The world aint so simple. People have needs today that require some compromises of principles. It is easy to castigate politics and politicians for this. We fumble and stumble and find compromises that get us through this day.

Sorry to inform you exalted one(s), but all, and I do mean ALL y’all don’t actually have any needs beyond those of our species for the last gazillion years or so.

IS and WILL BE fun to watch the differentiation discovery and dis-engagement and subsequent degradation of ???between those needs and the wants WE, in this case apparently ALL or ALL MOST ALL WE the PEONs, have these days.

Kinda like the US gov subsidize/bail out real estate, banks, Insurance, education, energy/oil? There are no free markets we’re all USSR now. Mostly because enormous unnecessary/idle population size.

oh those unnecessary idle people…shame on you

Maybe Europe doesn’t want their poor people to freeze to death this winter?

It’s the nonsensical long term government interventions and subsidies that really bother me, like housing incentives, interest rate repression, farming subsidies, etc. These interventions destroy economies through unintended consequences over time.

Decades of housing and education subsidies have artificially raised prices for decades, to a point where the middle class is now closed off from owning a decent home or getting a good education. Now, the incentives are so ingrained, it is difficult to remove them without creating a deep recession.

Agree totally bbr:

Referring to my last two years college where rent for my apt was 10 hours of my misc./handy labor at $5.

Same place was $2500/mo and similar labor $20:::

TOTALLY UNFAIR…

First purchased land, $3K/10 acres with spring, now ???

First purchased house, $40K, now over $1MM.

EQUALLY TOTALLY UNFAIR…

sorry about caps, but IMHO needs to be shouted loudly and widely BEFORE we have another pitchfork phase, eh

US politicians are just as bad. Price discovery solves a lot of problems in the most efficient way.

Unless it happens to be you that gets the seriously short straw. Then the song changes in a hurry, I’ll bet anything.

1) WTIC weekly was rising between Feb 2016 low and Oct 1 2018 @$76.90.

Thereafter 2 months plunge til Dec 24 2018.

2) Between Dec 24 2018 and Jan 6 2020 WTIC was in a trading range

averaging $60 in 2019, three years ago.

3) From $60 in 2019 to minus $40 in Apr 2020. WTIC in the hospice bed. Liquidity kept the economy alive.

4) In 2022 WTIC prices doubled. Higher prices killed demand.

5) In 2008 WTIC almost reached $150. $100 oil in 2022, in real terms, is about $60, less than half of the previous peak.

6) But F-150 & Silverado more than doubled since 2008. Fill a 40 gallons

tank is $200.

I drive a Honda Civic GX. Runs on natural gas. Been driving these cars since I’ve been a dealer 20 years now even the first generation made in 1998. Cng is $1.80 where I fill up but was as low as $1.27 six months ago. Takes about $10 to fill up. Range is over 200 miles. I can go about a 100 miles for $5 bucks. One of the best cars ever made imho. People are afraid of these because of less stations I presume. Minor inconvenience. They used to be readily available for around $2500-$3500 used. Last few low mile ones 2009 I sold for $10k ish this year but before the pandemic gas surge I was selling them for around $7k. cheap older ones with high miles are still around for cheap. I’ve done the math many times, a typical 35 mi each way commuter can save $2k – $2500 a year on fuel. Times 10 years.. they last a long time. That’s a down payment on a small condo. And I can drive any car I want. I feel a real bad recession coming on. Inflation is very lagging. When Powell finally wins the battle and we are in a bad recession, the economy will continue tanking for at least a year more imho. I hope everyone has years of savings if needed.

Better start checking the expiration date on the certification of those CNG tanks. They, unlike a gasoline tank, have a useful life after which point they can become dangerous.

I don’t know the useful life of Honda’s tanks, but 15 years comes to mind and you’re about there.

El,

Replacing a CNG tank after 15 years is a lot cheaper than replacing the battery (if it is still made) after 15 years.

Greg:

I don’t doubt that the tank’s cheaper. It was only a comment to check the tank as they operate under extreme pressure and the increasing and decreasing pressures can stress the tank. The google says that they operate at 3,000 – 3,600 PSI. Don’t know what impact that would have on the tank fatigue nor the number of cycles it could endure and, at those pressures, it wouldn’t be a slow leak.

They don’t start in weather below 19 degrees ,my gas utility bought them ,Hondas but if inside storage would be ok

My CNG F250 starts at 0 degrees in Minnesota. -20 with a jump. You might be thinking of propane. US versions run at 3600psi, tanks are good for 20+ years. I get about 100 miles per fill up, but my next truck will run on gasoline.

1. We are not entertained yet.

2. As Wolf and others pointed out, the demand destruction is due to several reasons. I would add one more.

3. The population is now stagnant even adding the newcomers. The new marriages are down, which means childbirth will also be down and future gas demand

4. The second would be efficiency of the vehicles are now improved and WFH and hybrid approach in jobs.

5. The electric vehicles might catch up. But I see in garages, EV owners leave their vehicles for 30 minutes are more for charging. If the average ICE owner have to wait for 30 minutes to fill the gasoline, there would be even more demand destruction.

6. For philosophical reasons also.

Idea is too charge overnight while electric utilities are least efficient

Flea,that’s the optimal solution, but what about all the folks, especially in bigger cities who don’t have a garage and all the folks who have to park in the streets, as well as households with roommates that have more than 1 EV.

I had a Nissan Leaf and didn’t have access to charging at night. I got used to those 45 minute Fast Charge stations, but I didn’t like it… There’s something called “Range Anxiety” It is REAL…

I ended up selling it right as COVID began… wish I knew that a few years later it would have been worth a WHOLE lot more…

3. Apparently most/majority folks don’t worry about the marriage part these days cp.

OTT, agreeing with you.

Other thing might be very clear increase in convenience of having stuff delivered instead of having to drive around to various places to pick stuff up.

Seems clear enough that the cost effective delivery systems will increasingly move to most cost efficient vehicles —

that certainly appear to be BE at this point —

charged overnight while being loaded for next day, with charge adjusted according to load/delivery path, etc., with full solar gain panels on roof of vans, etc.

Self driving robo taxis are the future,everything will be ordered on line groceries ,clothes, then take you to any appointments.of course we will pay a subscription fee.just think of savings no car payment,no insurance payment,no maintenance cost ,no fuel cost .Can’t wait for Jetson lifestyle

Sounds like “life in the nursing home” to me.

The US’s Strategic Petroleum Reserve is as low as it was on 1984, and if consumption keeps up it will run out out of sour oil somwhere around march 2023. What then? New spike? And what happens when the US decides to restock the SPR?

1) Loggers come to work with few F-350. The trucks are doing nothing all

day cost $100-$130/each. For them fill the tank for $200 is nothing.

2) A carpenter banging nails all day coming to work with a big van. The $70K van is parking all day while he works. He cares about monthly car payments.

3) An old farmer who had 28 jumps over Vietnam is coming to WMT with

a bang 30Y old pickup truck. Next to him fancy pickup driven by people who can hardly walk. The middle class herd together, imitating each other, buying expensive pickup trucks

5) Demand is falling because the middle class cannot afford $200 gas plus junk food.

6) CASY & MUSA, up. Sheets don’t care about 7- Eleven Speedways.

With reference to your final chart – total electricity sales in California – it would be very interesting to see this on a per-capita basis. California has seen a population decline in the past few years. How much of the decline in energy sales is efficient usage, and how much is a reduced population base?

Electricity sales in California peaked in 2008. The population dipped for the first time ever in 2020. And again in 2021. So the last two years of the chart might be explained in part by the dip in population. The prior 11 years would need another explanation, such as those given in the article.

If your not in that income bracket breathlessly waiting for that 1.6m

house to drop to 1.1m, that pesky thing called inflation should be the easy

answer. Year to year: energy +13.8% , food at home: +23.5% gasoline +25.6%, electricity: +15.8% , insurance: 24.3%.

Not everyone just puts it on the card to worry about another day.

I’m surprised it has not been a steeper drop.

People love to talk about transportation options when they talk about energy consumption. A Tesla in every driveway is not going to solve the world’s energy needs. Transportation is big, but so is energy consumption for creating fertilizer, and the production of food, heating and cooling of buildings, and creation of building materials like concrete and steel.

I have to admit the motorized electric bicycles with no registration or insurance requirements that can be driven on public roads are an attractive alternative.

“no registration or insurance requirements” are attractive alternatives until you mow down a pedestrian.

Dale, that’s exactly why I hate them and think they should require licenses. OK, actually that’s not why I hate them. I hate them because they’re motorcycles that get to operate under bike rules. Unacceptable. And too many riders are zipping around at speeds they’ve never built the skills to handle.

MCD raised coffee prices. Medium coffee in my area : $1.37. DD : $2.75.

SBUX : $3.13.

In the morning rush hour lines are long. Every morning MCD print #order number on coffee cups. DD, accumulated weekly numbers. Multiply volume by $8 for annual sales/store.

Caffeine tablets no waiting, no resource waste, no trash, radically cheap. The only thing it lacks is the ludicrous pretension and chicken-hearted addictive reassurance.

There are caffeine tablets? Sigh…

Weekly demand data is notoriously poor. You need to wait for monthly data (we only have it through June). While demand is down, it is nowhere near as the weekly data implies. Exports are the culprit. This data will eventually get corrected.

1. This weekly data is a rolling four-week average.

2. In June, the decline based on the rolling four-week average, wasn’t nearly as much as it was in August/September. In June, the decline to June 2019 was 7.5%

3. If you look at the year-over-year decline in June, which is what I think you’re referring to, so from June 2021 to June 2022, the decline in the rolling four-week average was 5%.

Revolving credit….I think it just took out the pre pandemic high….

historicus,

Utterly clueless comment. And you keep posting the same BS about it every month, no matter what data and facts I shoot it down with. So one last time: Revolving credit includes the huge amounts in payments that people run through their credit cards that they pay off every month that NEVER accrues interest. Because most people use their credit cards as a payments method, not as a borrowing method.

From my article. Read it:

https://wolfstreet.com/2022/08/03/people-trying-to-dodge-legal-usury-credit-card-balances-delinquencies-third-party-collections-and-bankruptcies-in-q2/

A report from Fitch estimated that the total amount paid with credit cards for goods and services – in the US reached $4.6 trillion in 2021, which would be an average of $1.15 trillion in purchases via credit cards per quarter.

Yet the total credit card balances outstanding in Q2 only grew by $46 billion, which shows to what massive extent credit cards are used as payment method, and to what small extent they’re used as borrowing method, which makes sense, given the usurious interest rates.

The credit card balances of $887 billion in Q2 include transactions incurred roughly in June but paid off in July that are not accruing interest. And this was boosted by the surge in traveling, much of which is paid for with credit cards.

Other consumer loans, such as personal loans, payday loans, and Buy-Now-Pay-Later (BNPL) loans, all combined, rose to $470 billion in Q2, below where they’d been 20 years ago, despite 20 years of inflation and population growth.

Supply is also playing a huge role in this. Oil production is much easier to ramp up than natural gas and money is piling back into the Permian like it was 2010 again. Those who remember the heydays of OPEC, also remember that cartels always fail because members cheat.

The realization that we ARE likely to join China and the rest if the world in a deep interest rate induced recession has speculators and traders playing the down side as well.

“Gasoline consumption has been stagnant since 2007.”

It’s called growth in nothing except pipe dreams.

Better humans play video games 24/7 than travel insanely everywhere and nowhere, depleting the planet and its resources for nothing but vanity and stimulation that will decay in the blink of an eye to nothing.

Ukraine war will be over in less than 6 months. The Russian army is going into full scale retreat. If Western countries had wanted to stop Russia earlier, we could have done it with advanced weapons, but we chose to bleed Putin dry.

Oil prices will continue to fall for the coming year. We have finally reached peak oil on a global basis. Price of oil will be deflationary going forward.

Russia may lose in Ukraine. To let USA win in Ukraine may not be an option. Feel sorry for the Ukrainians…

Our gasoline consumption has been reduced due to the fact that we order just about everything online. No more driving around aimlessly looking for a specific product to be on a shelf.

Grocery shopping occurs once a month. We bought a massive Yeti cooler and hit three stores in one trip on geezer day where the major chains offer 10% off to those over 55. Fill up the cooler and the other stuff gets tossed in the back seat and that’s it for most of the month – rather than buying food every few days. We have two freezers so we can hold a lot of stuff.

Other trips are combined. It burns more time in a block, but you spend less windshield time and, therefore, burn less fuel.

As an aside, look into the number of injuries reported on those small electric rental scooters. I’d rather pay for fuel than be a cripple. At my age, I no longer bounce when I hit the ground. Those were a “thing” in OC and on the ASU campus awhile ago. They were left everywhere and the cities clamped down on them. I guess Europeans are more courteous and leave them in the designated parking areas.

Here in our community, there are multiple electric bikes for sale on the neighborhood bulletin board. Looks like some peeps climbed on that bandwagon and found them not to their liking.

Careful about resale of stolen electric bikes.

It must be due to people retiring because soon no one will be working from home. Why would someone pay anyone to work from home online if they can hire someone from Bangladesh or Russia to do the same job? Like I said its all due to people retiring.

Hiring people from Russia is not really a thing.

Our company and tons of our clients tried that (hiring someone from Bangladesh, Russia, India as opposed to WFH in the US)–led to total disaster nearly every time. The time-zone differences alone are huge problem, then add to that very unreliable infrastructure (esp in India, Russia, Philippines, Sri Lanka and Bangladesh) with constant network outages at critical moments. Plus very heavy resume-padding esp in India, and cookie-cutter approaches to programming with poor software engineering or business logic sense (several of our clients had to completely re-do their code infrastructure from failed Indian outsourcing attempts, with American employees and contractors–wound up costing far more than just hiring Americans up-front). Plus in reality very very few people in India speak English much less Spanish–the British Empire never really was there for very long and even then in less than half the country, it’s actually like 2 to 3 percent in India and even they have such heavy accents that American customers get frustrated. I bring up the second pt. since any retail-focused company in the US as of now really does need good Spanish customer service (and B2B firms esp if working with small businesses), so ironically the only area where we’ve had any success with offshoring has been to call centers in Latin America for our clients’ Latino customers, which are after all mostly in same time-zone, for most part have good infrastructure esp in South America, and do have better resume-screening and cultural understanding. Philippines is also an option here sometimes, they’re multilingual there with many speaking good Spanish too (the Filipino languages have a ton of Spanish in them), plus servicing the huge number of Tagalog-speakers in the US and Canada.

But otherwise offshoring US corporate operations almost always leads to failure, higher costs and management losing their jobs (and often their shirts, if they have stock options). Telework with American workers is still the best option for a lot of firms and there’s just a huge difference between qualified American workers and overseas workers in an outsourcing hub–not just the time-zones but also the qualifications, understanding of business logic, common experience with American customers and cultural fine points, regional variations, more reliable infrastructure and just better knowhow and accessibility. And with work-from-home, the companies don’t have to bear as much in overhead costs and office space, so long as the American professionals are accessible it’s a good deal for most. (And it cuts down on gasoline usage, to return to topic of this article)

I’d just add the only other category of overseas offshoring and outsourcing that seems to have worked is for outsourcing tasks to Americans or Canadians who are working overseas as expats. Esp if they’re in Europe where again, the infrastructure is on part with the US (often better) and they can get things updated and fixed when they need to. A lot of Americans are using their ancestral connections in Europe to get visas and passports there, and a ton of Euro countries now even have digital nomad passports, iirc both Estonia and Latvia now but also I think Portugal, Spain, maybe even Austria and Italy do. It’s a good option to consider for many Americans, cheaper healthcare of course but also all the quality of life benefits of being in the EU, and still can get paid American salary. Americans in a few Asian countries also do well here but South America is also an option esp if the work requires being in the same time-zone, or close to it.

This winter gasoline consumption will be huge because the people living out of vans have to keep warm in the winter.

Van Lifer’s use diesel heaters. The more efficient heaters can heat for 8 hours on less than a liter of diesel.

And you really don’t need heat over night…just a quick blast in the morning over coffee!

People who live out of their van due to necessity don’t typically have enough money to heat it. A $30 sleeping bag provides enough warmth to get by.

Many van life’s migrate seasonally to avoid the extreme cold and to enjoy new destinations just like sailors do.

Not every problem can be solved, only endured. Inflation is unsustainable and cannot be endured forever.

Temptation is to flounder to try to save as things decline, but decline is appropriate. Its a correction.

Fed reserve needs to raise rates and do nothing while the market and assets reset. We figure out what we will do after. We will die from inflation (political unrest/economic collapse) or die from deflation (war/debt default) or reset with recession.

Why these fund managers and talking media heads and bankers and politicians keep floundering as if they can save this situation is beyond me… their floundering and kicking the can down the road made this problem worse. Rip the band-aid off and get it over with so we can figure out how to rebuild. This is excruciating enduring this slow process.

I think the fed reserve is trying to inflate to the point the bubble equities/assets actually equalize to the inflated dollar. Its not going to work. That assumes a closed environment, but too many variables are going to muck this up, while we sit eating 10%+ inflation because nobody wants to take the blame for a collapse and nobody who is invested in this mad everything bubble wants to take their losses even though only they have anything left to eat this hot potato.

Savers cannot produce enough savings to pay for their debt fueled flamboyance… And the government keeps printing stimulus. Are they trying to destroy the currency so they can argue for government controlled power? Communism or something. How can people be this stupid. Didn’t anecdotally someone ask Stalin how he got people to love him in Soviet Union despite economic hardship, and he said take feathers from a chicken and it will huddle to papa stalin for warmth? It feels similar. If Powell were remotely responsible he would raise rates by 100 bp every 2 weeks, market be damned. These guys are anarchists…

Agree with you here and this is what the tightening deniers just don’t get, the Fed’s hand has been forced because inflation in the US is becoming dangerously uncontrollable, and if it gets to be runaway inflation then the result is complete disaster for the US economy, American geopolitical power and the survival of the country itself. Inflation has wrecked far more great powers and major empires than any war ever has, JPow knows this and all the Federal Reserve governors now know it too, even Brainerd has gotten hawkish and is channeling Paul Volcker. For the mass speculators and the BlackRocks of the country who’ve profited off ultra-loose monetary policy and whining about the Fed doing QT and pushing up interest rates, what they still don’t get is, the choice is either take a manageable hit to their portfolios as asset bubbles pop and values become reasonable again (and they’ll still be filthy rich), or let inflation become even more entrenched and their asset values become worthless and the United States itself dissolves into social unrest and civil war. It’s not even just an abstract possibility anymore–I was back in a SoCal region where I used to work, and crime and homelessness are surging. And this is happening all over the country, including the nasty crimes like carjacking, home invasions and burglaries and muggings, not to mention angrier protests and food banks with lines stretching over blocks as inflation makes it impossible to afford rent and even basic groceries. (One of the southern California newspapers even had a segment on the rising ranks of the “employed homeless professionals” which was really scary–the rent insanity, not to mention the housing bubble really has gotten that bad and it’s hardly the only region)

Inflation damages the USA and our competitiveness in other ways too, a lot of our clients are tech firms and universities, and inflation esp in rents and groceries has been utterly wrecking their ability to recruit talent all over STEM. More and more of the skilled workers are preferring not just some parts of Europe, but also places like Japan, China and South Korea, and the calculation is obvious and rational. For ex for postdocs in a lot of fields, a postdoc fellow, adjunct professor or university instructor almost anywhere in the US or Canada can look forward to (if they’re lucky) a lousy salary of around $50K to 60,000, but now sky-rocketing rents on top of that, and surging grocery prices for everywhere outside the discounters like Aldi, Lidl or the dollar stores. (A lot of those “homeless professionals” in the California article seemed to be adjunct professors or postdocs, as well as tons of Americans bled out financially by the divorce courts here) But if they go to China, they can make well into six-figure salaries even as a postdoc but on top of that, much cheaper rent and affordable housing basically anywhere outside of Shanghai or the most bubbly neighborhoods for Beijing. The US media obsesses about human rights or various abstractions like China’s culture or form of government, but for just about any worker bee or professional, the daily grind is basically the same in the US or China–what matters is buying power and how affordable things are on a person’s salary, and what they care about is that affordability for them and their families, and how much they can save each month. This is why Chinese-Americans are returning to China in droves (not just university students but also professionals who’ve been here for years), and even other Asians from places like South Korea, Vietnam, India and Philippines are choosing more and more to go there too. Why come to the US where cost of rent, mortgages and even food are surging each month and far exceeding the pittance you’re paid, when you can be a postdoc or STEM professional in China and have much more affordable cost of living with higher income and savings? It’s a pretty simple calculation for the big majority of skilled workers. This is one of the less obvious ways where uncontrolled inflation really wrecks US viability and competitiveness across industries, and it’s why the Fed cannot afford to ignore it or move too timidly. The Fed at least has more tools available now than Volcker did (esp QT and the reverse repo market), but it has to move much more aggressively–a 1 percent rate hike at the next meeting at a bare minimum, plus more rate hikes between meetings and tougher QT on top.

I guess that’s a big weakness of our political system in the US, Canada and Australia, it’s too easily captured by interests that basically have as a top priority the endless increase in housing costs and a record housing bubble. I’m not trying to go on an anti-Boomer tirade here and have no problem with modest and manageable bump-ups in value for property (esp. a primary home or small investments) bought years ago, that’s expected as inflation (of the 2% or less variety) kicks in and as more security in retirement. The problem is with the greedy speculators like Blackstone, Zillow and their (much more common) smaller investor equivalents mass-buying up scarce single-family housing, esp the ones who bought at the insane high prices of the past few years still expecting outrageous returns, even basically trying to become slumlords and convert SFH into over-expensive rentals. At least if you’re going to speculate to that level in an Everything Bubble, do it in tulips or crypto where you don’t deprive an entire generation of basics like shelter, healthcare or college affordability. No sympathy esp for the super-greedy who fueled this housing bubble and other insane asset bubbles esp if they’re already coming from money, they deserve to lose their shirts and truthfully they have to if the US economy itself is to survive. (And of course few actually will take that much of a hit since they’re already wealthy to begin with, they’ll be fine–while inflation at this level impoverishes hundreds of millions of Americans, result will not be pretty if it isn’t brought under control)

Residential housing needs to not be banned for investing. It drives up the living costs in such a way that manufacturing becomes overly expensive leading to outsourcing. Asset inflation enriches other nations who with their sovereign funds store money in US equity/real estate/etc as a hedge due to the stability of the US economy.

I think deflation will lead to war, not just in this country but others, because the equity value has outstripped the production capability. This bubble will pop on everyone. This is the fundamental problem. That is why Macron of France said the time of plenty is ending. They have run out of their money and everyone else’s money and now the whole thing is coming down on our heads. And nobody has money to bail anyone out.

Its the equivalent of a hedge fund taking over a company, ripping out its infrastructure, outsourcing jobs, hiring cheap labor, loading the company with debt, pulling the cash out, and offloading it to the taxpayer.

Then it runs out of companies to destroy and its sitting on a massive amount of real estate equity and digital/paper cash hedged with some mineral wealth (which cannot be circulated) that nobody else values or can buy given they are worried about basic necessities that nobody is producing anymore. Then, having choked off the real economy, figures out finally that everyone else was right, that all the wealth they have cannot grow more food (with untrained labor and broken infrastructure), cannot provide more national stability, and ends up trying to invest in military control/political state control to sustain their diminishing leverage as the economy/nation dies. Its how a cancer mass functions. It eats and grows and thinks its going to do well since its growing but its host can no longer sustain it and dies and the mass with it.

If we do not force some action (aka fed reserve interest rates) on the behavior of these cancers, we will not survive. Inflation does not produce more economy even if the GDP numbers adjust upwards and politicians come out and proclaim numbers. It is a deceitful way to hide a dying and sick economy, while simultaneously making it more difficult to recover from.

Carly Fiorina is suspected of doing the same with Hewlett Packard. Weakening the shareholders with dilution with merger with Compaq and saving costs short term by ripping out critical infrastructure long term. Of course, HP had its problems, true. Much cannot be blamed on just Fiorina. But HP may have had a chance. Now when you see HP products in Best Buy (aka showroom/tech support also dying), its using similar sounding processors as Dell and Lenovo but its from last generation. For example a dual core i7 instead of a quadcore i7, last i visited to buy a laptop. Its only hope of competing is to sucker the buyer with similar sounding but less expensive and inferior tech because it doesn’t the margins to compete. The critical failure is the loss of infrastructure/brain drain.

This is the US right now. It doesn’t have the manufacturing or technical industrial capability that it needs to boost mass production to bring down inflation. It needs to find it somehow or tighten its belt to save money. It still has economic bluff and leverage. And it is destroying the hope of finding the mass production capability by intentionally suffering the further inflation of the dollar, trying to outbluff the problem. Short of a new invention, Hoover Dam equivalent, nuclear technology adoption with assorted cheap energy, it will probably fail. It needs to tighten the belt absolutely. Even that may not be enough.

But fed reserve is tightening because it knows it doesn’t have a choice and even then may be too late. We are in some serious trouble. Cut costs. Cut spending programs. Cut waste. In-source industrial capacity. Drop living costs. Block real estate investing or as some people here call it, rentier economy aka feudal lords that own land and rent to serfs, and live off their production. If inflation goes away, even if it may not be ethical, I won’t argue about it. But if so much as inflation is here, Fed Reserve has no choice. It must collapse the real estate market, must rip out the easy money in lending, government must cut spending, until inflation ends AND debt is manageable.

Interesting that demand destruction continues while prices have fallen.

While combining trips may be more habitual and WFH is common now and there are more EVs and so on, I think that’s only part of the explanation.

Me thinks the lower gas prices still look very high to folks who live indoors and eat food and such.

When all the money is gone before you fill the tank, you still act like gas is $6.

Expensive gas may be mercurial, but this transitory inflation is like gum stuck on your shoe.

My house and car insurance went up 25% for the coming 12 months. That cost a lot more than a few dollars more per tankful over 12 months.

Covid introduced the new wave of online grocery shopping Amazon has access to Whole Foods store. Walmart and Kroger free deliveries. I’m retired, wife works from home. 2007 Yukon/2007 Silverado each average 15mpg. No brainer in cost avoidance of $5.00/gal fuel. $260 to fill both more than monthly utilities for home. Demand Destruction is real. Saw many neighbors who bought new SUV/Pickups literally stop driving as gas prices soared. $60-$80K vehicles sitting parked in garage. FWIW beyond the affordability of car notes, I think more will factor in the cost of fuel to operate in the future or switch to EV……inflation continues to destabilize household budgets.

I replaced my gas SUV with Hyundai I5. Now all the cars I have are EV: one small and one big. The electricity/charging is free in public charging place.

I pay zero dollar for EV charging.

Been using EV for last 6 years with absolutely no problem.

That’s a great plan, Jon… up until the tipping point of more people seeking the free public charging than there are places to plug in. At my old alma mater, we had rows of charging stations that were in use. People would park there, plug in, and then disappear for hours on end. Other people, who needed to recharge, could not due to the cars being in the slots and the cords being too short to reach their car. Security finally had to start tagging the cars with the big ugly orange stickers over the windshield to change those bad habits of the “me first” generation.

yeah that’s a problem, and admittedly it’s probably a good reason why EV’s still haven’t fully caught on and gone mainstream yet, at least in the US. We have a lot of family in flyover country, skilled blue collar workers but not the types to read up on or adopt the latest in tech. When we brought up the EV option recently (including our own interest in getting an EV for our next purchase), they rolled our eyes and asked point blank if they could reliably get the car charged wherever they need it. Esp for those renting or out in the country with less charging stations. A lot of Americans it seems are interested in EV’s but afraid off what you’re talking about, would they be able to reliably get it charged in a pinch, all over the country? Even with shortcomings of ICE vehicles, a huge advantage is that you can comfortably be assured of finding a gas pump in most even modestly settled parts of the country (though even then not in some parts of Appalachia or the big SW desert we’ve been to recently), spending a few minutes filling your tank and then you’re off, without long lines. While right now, a lot of Americans are genuinely worried that if their car gets low on charge, or if they’re stuck renting or in a townhouse where it may be harder to charge overnight, would they be able to reliably find a charging station and be able to pull in and out in a few minutes? This is probably what needs to be solved–or at least, better publicized in the media–to get real adoption by mainstream of US populations and neighborhoods.

Yeah we’re looking at an EV for our next car purchase and an Ioniq is high up on the list. Either that or an ID.4, Bolt or maybe Polestar. (Used to be up for a Tesla but scratched that off the list with all the recent problems in getting parts and maintaining charge, plus all the failed to materialize promises and Elon in general going off the rails) The Hyundais esp seem to be the closest thing to actually providing the benefits and convenience of an EV while making it somewhat affordable. Vehicle price ranges right now are nuts so we’re trying to hold off on buying in general until this inflation is reigned in. But for EV-shoppers, Hyundia-Kia seems to be one of the best options for now.

You believe EV charging is free? Wow, what a dolt!

Demand destruction for hi-test will hiccup in our area two weeks from Sunday when nine thousand plus classic and vintage cars and hot rods show up for Cruising the Coast. Their collective thirst is so great it throws a shadow. Under $3 for cornygas now, the cruisers pay a good bit more for the no-eth higher octane and use more of it. Boat owners too. There’s a guy who showed up last year with a Dayglo orange Geo Tracker that had an eye level blower and he said developed over a thousand horsepower but that wasn’t regular gasoline either.

Everybody is driving less, these are just holograms around me on the way to Lowes? they really look real.

Wolf, as you expected, it looks like the Fed doesn’t plan on making any further MBS purchases [I’m basing this on the fact that they did not release a schedule of MBS purchases after the current schedule ended on the 14th].

Will you be writing any sort of obituary to mark this occasion?

I might write an obit. It’s kind of big thing in terms of milestones. Last scheduled MBS operation was yesterday. And you’re correct, none were scheduled for today and going forward.

Oil prices should be much lower because we are funding dictators abroad who oppress their citizens and buy Toronto real estate to make Canadians homeless.

OPEC is price fixing and no one can do anything, but if an American did that they would be in prison for collusion and conspiracy.

When you say, ”abroad” gz, can we assume you mean the bean counters ”there” as opposed to ”here”???

Inquiring minds want to know what difference it makes where dictators are, no matter at what level: personal, family, community, region, ”political state/nation”, global?

As long as the dictators control the mass or vast majority of the various and sundry propaganda machines, which ”they” do, WE the PEONs will comply willingly or obediently, makes no matter which.

I know Wolf does awesome work on these posts, but, I call BS on Demand Destruction & The thought that gas use is going down… I live outside of NYC, Rockland & Orange Counties is where I do my driving. The Roads are CLOGGED! Seriously Clogged, Rush Hour home begins around 3PM, 2PM on Thursday, Friday for some reason very little traffic. Monday & Tuesday they all learn to drive all over again and traffic is the worst. I know Wolf uses all the best data, but traffic here is Much Much worse than before Corona…… I don’t get it…. And all the vehicles are getting bigger! And they drive at crazy speeds, this all adds up to more gas use. And Tesla’s not that many…. Giant PU’s with big tires Yes…. What I see is opposite what statistics say….

My dad lives in Tuxedo. He says NY 17 is heavier traffic than he ever remembers before.

Same here in Texas near Houston. Worst traffic ever and more large pickups than ever. I have been here 30 years.

For five PM, I-87 and tappan zee bridge are not congested at all though. Maybe there’s something to this. Hope so. There’s no substitute for a buyer’s boycott to get the vendor’s attention.

Was there at 3 pm on 15th, traffic was not bad, but last week a totally different story. I travelled to cape May from Boston, never saw so much traffic. Actually stopped on the bridge. Bumper to bumper for 96 miles from Cuomo bridge down garden st. Pkwy.

“Giant PU’s with big tires Yes…”

It must be a requirement to buy these monsters to ride somebody’s butt as close as possible.

LOL 🤣

just-a-boy,

Yeah, happens to me too. Every time I get stuck in traffic here in San Francisco, the epicenter of WFH and population decline, I swear that this GDF data on fuel demand, WFH, and population decline has got to be wrong.

But then, we live on a big four-lane street where they used to convert the parking lanes to drive lanes during rush hour (turning them into tow-away zones, tow trucks lining up every day). But they stopped doing that, and those lanes are now parking 24/7. And from up high, rush hour traffic isn’t anywhere near as bad as it was, even with those additional lanes missing.

Much less rush hour traffic in Denver. But weekend traffic to the mountains is bad as it ever was.

Seattle traffic is nowhere near the problem it used to be. It varies across the country. Don’t reach conclusions based on one location.

I was responding to Justaboy.

My only question in regards to Electric cars: How will the “road tax” get collected by local/state governments that are currently being included in the price of the gasoline?

Extra fees at the DMV. This is already being done.

The governor of this failed state increased registration fees for EV’S Hybrids. I should know I own a hybrid. He did it though to discourge people buying cars without ICE.

We need conservation. Increase in mass transit and increase WFH if you can. Also, people like to buy big SUV’s and like 60 miles from employment centers. This remind me of people who smoke and then die of a heart attcack , or people who made fun of Covid 19 vaccines and they got Covid 19 and died.

As Pogo would say, we met the enemy and the enemy is us.

Mass transit. A joke. Here in Boston, entire orange line shut down for a month. Using shuttle buses. So much for gas reduction.

It is not a joke . It has been made a joke on purpose to as to discourgaes. 90 % of Americans used to ride trolleys at the start of the 20th Century.

What happened was the car companies and others bought the trolley lines and closed them so people would have to purchase autos. Then, President Eisenhower built up the interest highway system to get us addicted to cars.

It was not natural evolution, it was planned.

I’m doing my part to prop consumption up. We left Georgia for Maine last Saturday and we will start heading back in the morning. We were going to fly, but we didn’t trust the airlines to get us anywhere on time. My wife scored an invite to eat at The Lost Kitchen, and we couldn’t risk having our flights changed or cancelled.

My 21 Expedition is ecm tuned and takes 93 octane, and I paid as much as $5.15/gal for it in MA.

And FWIW, the Maine coast is packed with tourists from Kennebunk to Belfast, and most are retirees.

On the McDonalds 2 for $3 menu, the Doublecheeseburger succumbed to supply & demand pressures and increased to a whopping $3.29 – also McDonald’s was giving away free large fries all summer. Whoduthunkit? Lol. Ronald Mcdonald has single-handedly been the best inflation fighter America has seen in the last 2yrs. McChicken sandwiches are currently 2 for $2 in my area. Its truly a shame though what they did to the Filet-o-fish,, its so small now its the size of one canned sardine.