Totally Crazy Irrational Price Spike of Used Vehicles in Serious Unwind Mode.

By Wolf Richter for WOLF STREET.

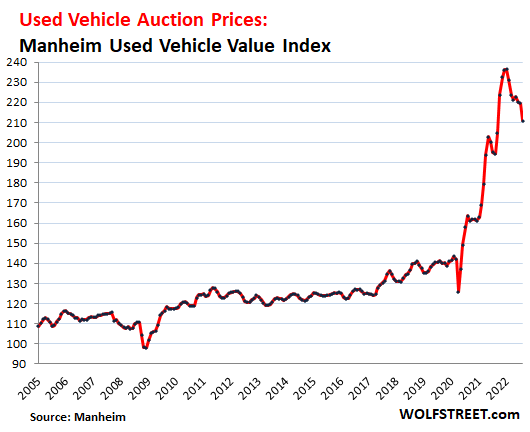

Prices of used vehicles that were sold at auction in August fell by 4.0% from July, and are down by 12.5% from the peak in January, on a mix-, mileage-, and seasonally adjusted basis, according to the Used Vehicle Value Index by Manheim, the largest auction house in the US. But these wholesale prices, despite the declines, remain sky-high.

Dealers buy at these auctions to stock up on vehicles to sell to their retail customers. Their concerns about what retail customers might be willing to pay is reflected in these price declines.

Interest by retail buyers in these sky-high prices has waned, enough people have come to their senses and now refuse to pay whatever, and they realize that they can drive what they already have for another year or two or three. Used-vehicle sales volume has been down sharply all year – though there is adequate supply of used vehicles.

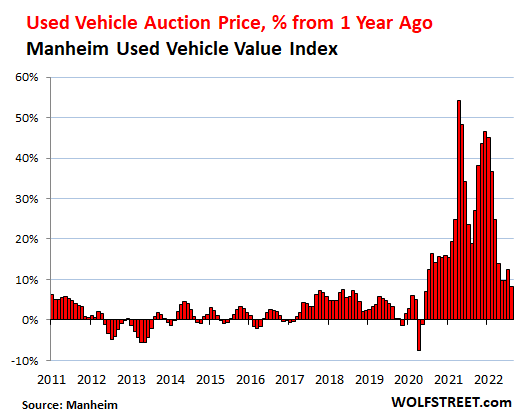

And compared to the totally crazy prices a year ago, wholesale prices in August were still up 8.4%:

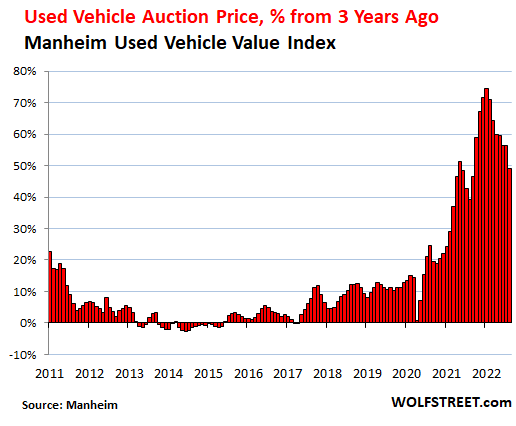

And compared to August 2019, before the crazy price spike took off, wholesale used vehicle prices are still up by nearly 50%. So prices have come down some, but they’re still crazy high.

Used vehicle retail sales in August fell 9% year-over-year, and were down by 19% compared to August 2019, according to Cox Automotive, citing data from its Dealertrack unit, based on same-store results. But July sales had been even worse: down 29% compared to July 2019.

Sales of “certified pre-owned” vehicles, which many buyers see as less expensive alternative to new vehicles, in August were down by 5% year-over-year, and by 18% from August 2019, according to a separate report from Cox Automotive.

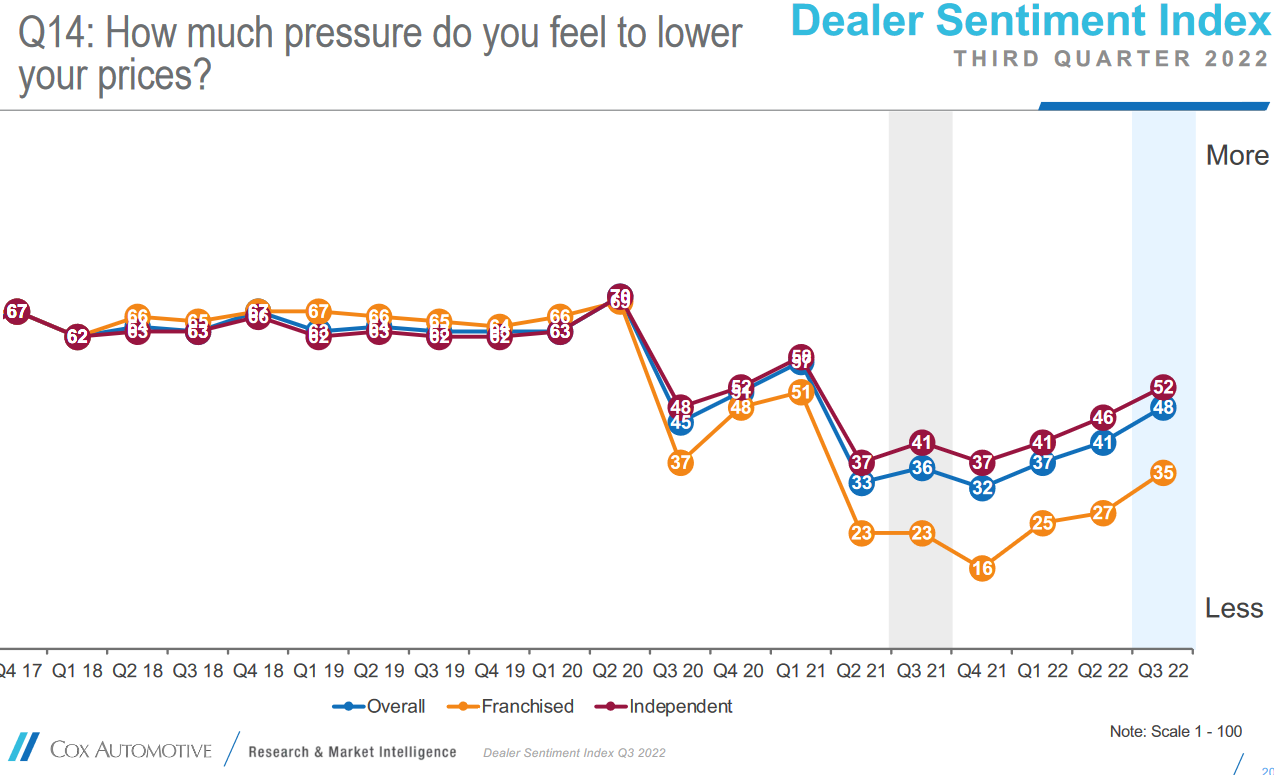

And dealers are starting to feel pressure to lower their prices. Before the pandemic, the pressure to lower prices was high and a daily presence, forced on dealers by competition and by potential buyers that refused to pay whatever.

But in late 2020, the entire mindset changed – as the inflationary mindset kicked in – and buyers were eager to pay whatever, and dealers charged whatever and got it, and when dealers purchased the next batch of vehicles at auctions, they too paid whatever, knowing they could pass on those crazy prices. But this is now changing.

While still relatively modest, compared to the pre-pandemic years, the pressure to lower prices has been growing all year, according to the wide-ranging sentiment survey of auto dealers, conducted on a quarterly basis by Cox Automotive. The current survey for Q3 was released on September 8. The chart shows the increasing pressures that dealers perceive to lower prices; orange = franchised dealers (new and used); red = independent dealers (used only) who feel the biggest pressure to lower prices; blue = overall (chart via Cox Automotive – click on it to enlarge):

The totally crazy and irrational price spike of used-vehicles is now in serious unwind mode, as enough potential buyers have gone on buyers’ strike. But prices have spiked so far, and so quickly, that a major decline will bring out the buyers again as they perceive those lower prices to be great deals, after the crazy spikes, but those prices may still be 40% higher than they’d been three years ago.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wallstreet plans to celebrate this tiny reduction of inflation with a 10% rally on stocks, 50 basis point yield decrease in 10 year treasury and 75 basis points decrease in 30 year mortgage.

This will further wealth effect increasing inflation again!

The way I see it is stock price to sales can vary from about 0.5 to 3. We have been hanging around upper end for a while, but a lot of geopolitics and inflation might mean we head the other way. Could be a long way down.

I travel.

For some fun I drive by used car dealers.

Especially the big corporate ones like CarMax.

Packed with inventory.

How wallstreet looks at this: So supply has eased and it will control inflation and this inturn will allow Fed to reduce rates sooner!

Get ready for another 10% rally to celebrate a tiny decrease in inflation.

And the analysts will say “Stocks are looking past the current short term challenges towards bright long term prospects (of Free Money!)”

The difference is that I don’t think the political winds will allow printing to resume and rates to go back to ZIRP simply because inflation has peaked. I think there’s now a sense, that there wasn’t 5 years ago, that money printing benefits Wall Street, and very few others.

yeah, the narrative and understanding on QE and ZIRP have totally changed, even without much inflation the big majority of Americans are angry that they saw next to no gains from all this monetary looseness and they’d have very little support. And of course, they all inflationary and inflation in the US is still severe. Wall St. as usual is being delusional about this but like Wolf likes to point out, nothing goes to heck in a straight line, and the GFC had plenty of bear market rallies too.

it’s simple

WATCH QT – if it’s happening

LIQUIDITY IS GONE to easy money hedge funds

Miller, yes, exactly.

The problem is that the rich and Wall Streeters for whom QE benefited overplayed their hand in the past two years. It wasn’t as noticeable when it was done slowly starting in 2009 but the printing binge that started in March 2020 surely was.

I’ve heard acquaintances, not people who are particularly well informed, say that low interest rates and money printing benefits corporations. They haven’t yet drawn the connection to Wall Street and asset prices specifically, but the sense that financial engineering is benign seems to be gone now.

That means that, even if inflation return to the ridiculous 2% target, I can see there being pushback against low rates and printing unless the economy is actually in a recession and it’s necessary for a short term. In other words, I believe that the days of the “default” being QE and ZIRP are over. Rather, they will have to be justified on their own terms at each time.

”The problem is that the rich and Wall Streeters for whom QE benefited overplayed their hand in the past two years. ”

ABSOLUTE NONSENSE!!!

Been going on at least since the era of Jackson in the early 1800s,,,

Been going on much worse since the USA GUV MINTY gave up and signed on to the oligarchy demands and the FRB started in 1913…

Some want to see the USD ”down 98%” since then,.,,, but in reality, it is down AT LEAST 99% and going down in reality even more every day in spite of the massive propaganda otherwise from all the shills, etc.

WE, in this case the Wolfstreet followers WE,,, can just thank our lucky stars or whatever that WE have at least some semblance of reality reporting.

The two biggest bubbles in all of history. Today’s stock market and the Chinese housing bubble.

Nah, the housing bubbles in Canada, Australia and New Zealand are much worse, that’s even true of most of the regions of the USA that have gotten bubbly. Again just repeating our maxim from having worked years in Asia, never ever make investment decisions about China based on news reported in the US financial press, 80 percent of the time at least it’s going to be wrong and most of that time embarrassingly wrong. US financial journalists in China rarely speak good Mandarin and they get subtle but critical fine-points about the Chinese economy consistently and horribly wrong, like I said before much of my first investment group’s early decisions years ago were basically shorting China based on the “China’s about to collapse” memes already flowing and we got badly burned and lost our shirts. We only realized how terribly the US and British press got things wrong when we had to work there and realized almost none of the American reporters actually spoke even conversational Chinese. They’re literally reporting random guesses about what’s going on financially with nobody to check or correct their accuracy.

China does have a housing bubble but as usual the Western press messes up the key details–the ghost cities which are the main source of the bubble calculations (most Chinese real estate in lived regions is much closer in line with incomes than US or let alone Canadian housing) aren’t just useless investment vehicles to dump money for favored investors, they started as genuine attempts to plan ahead and build for the very large number of Chinese moving from the countryside and into new industrial cities. The specific flows are unpredictable from year to year and many of the planned-for migrations don’t materialize (thats why some of the newly built towns become ghost cities), but the population flows are real and ongoing, and many previous ghost cities have since become settled. This is literally hundreds of millions of people in motion, not only Chinese but also Vietnamese, Thais, Filipinos, Koreans, Burmese and other guest workers across the Chinese countryside, moving into and populating new cities. Some of the pre-built cities even then won’t get filled in the next couple years and will remain ghost cities, but others will gradually start to see more of that housing occupied. There’s no way to predict which housing complexes will fall into which category, but it’s not anything even slightly resembling the bubbles in North America or Australia, and again housing costs outside of Shanghai are much closer to incomes in China than they are here. The reason the US and Canadian housing bubbles are so damaging (and have so far to fall) is exactly because home prices have soared so outrageously far beyond what Americans and Canadians are actually earning. Investors, again, beware and do your due diligence, and do not trust financial news reports out of a country where the journalists don’t even speak the language well and generally have no clue what’s going on.

The cheap money was available to all and everywhere especially in the last 2 years

So the bubbles are everywhere and in every thing.

I’ve been kicking around replacing my 2006 Expedition for the past few years. Bought it at Carmax ironically.

Now, I’m faced with having to drop $5 grand into it for upkeep stuff or trade it in on something.

I love the truck, so I’m heavily leaning towards spending the money to get it back to spec and driving it for a few more years.

Same with my 2008 Escape. It’s approaching 150K. and the transmission in it is known to fail about this time. The engine seems fine, so I’d have to consider a used tranny before buying another AWD vehicle, which I have to have where I live,

My 2005 Mustang convertible just turn 65,000 miles. I put on a new A/C compressor last summer and new tires. I may rebuild the cooling system (water pump, new radiator, hoses, thermostat, etc) and keep it for another decade. By then my kids will be taking my car keys away from me.

“… I’m heavily leaning towards spending the money to get it back to spec and driving it for a few more years.”

Per Tom and Ray (Cartalk – God, how I miss that show!) – you’re almost ALWAYS better off fixing something you already own, even if it costs more than the car is worth!

We just dropped $2,000+ doing some maintenance on a ’95 Explorer Sport we’ve owned for 20+ years – money well spent!

That’s what we’re afraid of too. Really don’t want to even consider buying either used or new now but one of our sets of wheels hasn’t been doing so great lately. Do we pour a few grand into it or cut our losses and pay the inflation surcharge going on right now for both new and used vehicles? (Or call up my uncle-in law with the old barely used shop and cross our fingers he can figure out how to fix it?) Not a fun dilemma.

Another issue is that when we do buy, we’d like the next car to be an EV but feel like prices for those also have a long way to go down as more competition and tech improvements enter the picture, right now they’re still mostly luxury priced. Same with other tech, it’s better to be a not-too early adopter instead of the first to buy, you get better and more improved tech at lowered prices. A Tesla is out of the question now–used to like them but too many friends with Teslas recently having issues and frustrations with parts replacement, phantom braking and charge maintenance, and the promise of actually introducing an affordable line of Teslas never materialized. (plus Elon seems to be losing his bearings more each month and we’d rather not be stuck with a car from a company with one of those brilliant-but-un-moored CEO’s going through his next public flame-out) Been thinking an Ioniq or ID.4, or even a Bolt or Polestar, but even though they’re in a better price range than Tesla, still feel like overall they’re moving to a better price point, and it might be too early to jump in.

I personally think that in another 3 years there will be a glut of new BEV cars and prices will come down fast.

Someday BEV cars will be cheaper than ICE cars, they are much less complex to build and battery costs are the only issue keeping them high, but every year those battery costs are declining as they increase efficiency. Raw material price increases seem to be the one sticking point right now.

My Honda crv is approaching 200K miles. I know that honda has a rep for 300K, but that is optimistic, not all hondas reach anywhere near that. I’d like to get another used vehicle with less miles but instead I’ll probably be looking at a used engine or tranny at some point. I really don’t like the unreliability of a 200K mile vehicle- wheel bearings, CV joints, emission valves etc.

Just wait until new car inventories get back to normal. Those used car prices will plummet further.

I went to a Car Max this summer and I’d say Wolf is right. Even if prices drop they will still be way too high.

Seems like some of these dealers are going to be facing the harsh reality of break-even deals and loser deals just so they can flip their lot. Especially as demand continues to cool into October while they may be holding inventory purchased at July auction.

Maybe they squeak out a profit on the F&I side as the lots begin to resemble ghost towns?

On a side note, my girlfriend works for Marine Max and still sees folks coming in to buy large cruisers to hold as a tangible asset vs. cash. She is on the F&I side and didn’t have to opportunity to build the rapport needed to try to gain the insight to choosing this “asset” vs. your typical precious metal play.

Marine Max and Brunswick both beat Q3 estimates, and it doesn’t sound like turning inventory is becoming an issue…yet. Further, their storage business is strong. They have no available space to dock or store additional boats.

Possibly an additional market to keep an eye on? If the boating world – 75ft and less – begins to slow that may be worth noting, as it may signal that the rich are beginning to clamp down?

However, it may just be a Florida thing and not a good Macro indicator.

100ft+ to super yachts being an obvious non-factor. That market is typically unfazed….juuuuuust in case ya didn’t know.

I had talked with a realtor a year ago and she said she was buying two homes (million dollar or more) because she didnt trust the stock market and inflation was high.

The problem with this analysis is that the value of those hard assets was based on an easy money environment. When money gets expensive again, you want productive assets, not assets that just sit there and decay. And homes are based on monthly mortgage payments, so when those double, you reduce the buyer pool by at least half.

These assets are a trap and going to go bust. This inflation was caused by massive monetary intervention and once some of that is pulled away, the underlying economy is not robust enough to keep inflation high. I actually think that much of the technology revolution will be highly deflationary over the longer term – reducing price monopolies in MOST areas and reducing the need for labor in many areas (AI and robotics replacing workers).

That means they pay all the money for the cars and pass that cost on the customers.

I went to look at a truck today. 2015 Ram 1500 for 26k. Had 102k miles on it.

Toyed around with the salesman for a little while, and left with my lemon. I couldn’t imagine having a $500 a month payment on a truck with 102k on it.

Used car loans have around a 9% interest rate on them right now. So, you get the inflated value of the car, with the high interest rate.

Add on to that gas price hikes after the midterms, and high mileage maintenance costs.

When I was talking out load to the dealer he got extremely annoyed with me hehe.

In 2015 I bought a car with 27k miles on it. When I got it to 55k miles the timing chain went up, which is a $2k + car repair.

Feel sorry for the sucker who buys it (Ram), because the dealer is confident they’ll get it, which they most likely will.

I’ll keep my lemon for now. Only 135k on it, and it’s a V4!

You Dodged a bullet. Chrysler is owned by Citroen by way of Fiat, and their quality has gone to hell.

“Chrysler is owned by Citroen by way of Fiat, and their quality has gone to hell.”

Their quality was always the worst. At least they’re consistent !

But they had rich Corinthian leather!

Yeah, Corinthian leather made by the Radel Leather Manufacturing Company in Newark, New Jersey. LOL!

Great marketing gimmick though.

Click and clack used to say FIAT stands for “ fix it again tony”

I could not imagine having a monthly car payment, period.

Decisions are so much clearer when you are a cash only consumer. Usually the answer is no I can’t afford the new toy.

Or even if I can afford it, why?

Consume less and help save the environment.

9% interest on used car loans? You might want to check with a credit union.

Looking at Navy Federal for example, their best rate for a 2021 and newer vehicle is 3.8% for 72 months (or less on shorter loans). For older cars it’s 4.6% for 72 months (or less on shorter loans). Still pretty reasonable.

Yes, you’re making my point.

The loan rate for a used car is higher than for a new.

The rate for a NEW car is what you are talking about.

In theory, the creditor is going to charge a higher rate on a risky “asset” like a lemon truck with 102k on it.

You forgot to tell everyone that credit unions do not pay ANY form of tax, a privilege granted in return for campaign contributions. Thus, impossible for banks to compete with credit unions in the interest rate arena.

You forgot to mention that credit unions don’t make profits (which in the case of banks would be shipped off to Wall Street). As such, there is nothing to tax.

A V4? Who makes the v4 moron? 9% Apr? Pay your bills on time and you can beat that by at least 6 points. Another person who thinks they know the car business.

This is the disorganising part of recklessly high inflation of the currency, prices are reverse yo-yoing as the mispricing effects spread. And the sequence is lumber price, car price, home price, labour price.

(btw and not connected to this article if Biden restricts LNG flows to Europe to cover up inflation then apart from Europe immediately folding with a double gas blockade, then it will be tantamount to a dollar default as hey you can’t use those dollars).

It’s not an option for US officials because then Europe just opens up fully and openly to Iranian gas, which is maybe the worst fear for both parties, even more than the EU accepting Russian gas. The EU’s already been receiving major shipments of Iranian natural gas through the black market and back-channels, and even Russian exports have been quietly flowing through some of those channels albeit with a discount. And even though the US and EU have stayed united on Russia policy (even most Russians themselves hate the Ukraine war now–nobody wants to volunteer and die in a war to help a bunch of hated oligarchs get another decked out dacha) they are not on the same page when it comes to Iranian exports, and haven’t been for a while. Iran hasn’t invaded a country in centuries and even the loudest warhawks admit it doesn’t pose any kind of real military threat, even if the Iranians get nukes they’d only be doing it to make sure that what happened to Iraq in 2003 doesn’t happen to them. (Iran wouldn’t even be a problem if the Dulles brothers hadn’t gotten dumb and forced the coup in 1953)

So Europe’s never had much interest in maintaining the Iran sanctions. And with European countries’ ruling parties facing a likely bloodbath in the next elections if the EU stays closed to Iranian gas (at least on paper, again in reality a lot of Iran’s gas gets there already), all of Europe’s governments would be under huge pressure to openly accept Iranian gas. The US can only prevent this (at least whatever gets beyond the black market) by keeping those LNG tankers and pipelines flowing into the EU in a massive way, at a discount. Like Bismarck always said, politics is the art of the possible, and with LNG there aren’t really alternatives.

In flyover country, dealers who 6 months to a year ago spaced vehicles on their lots some 30-50 feet apart (if they had any vehicles), now are back to almost kissing them together (on the front row at least), which is sure noticeable now.

Wolf gets mad at me, but I say Ford & GM are intentionally keeping vehicles off lots. They’re still blaming a chip shortage when everyone has been cutting production. GM has as many as 95K cars in lots waiting on chips. Sure, that may be true to a certain extent, but a more full lot means a lower sales price. The future of car buying through an OEM dealer is go in kick the tires of a demo, get your trade-in value which might creep higher some, order & sign an intent to purchase with a rate lock, put down a $500 non-refundable deposit, wait 30 days, bring your car back in, sign the final paperwork and take ownership of your new EV.

Ben: That’s nonsense. Ford and GM do not get paid until those vehicles are invoiced to the dealers. That doesn’t happen until they ship. Lot rot – those cars sitting around – is expensive. Flat spots on tires, acid rain, bird poo, door dings, scratches, risk of hail, batteries wearing down from parasitic currents from the always on electronics, someone to go around and manage the lot…..

If Ford/GM could dump those on a dealer today, you can bet they’d do it in a heartbeat.

I was involved with distribution in Chicago for an auto manufacturer many moons ago. Once it starts snowing, the lot rot gets worse. The freeze thaw and ice that coats the cars – then slides off when the thaw hits only to freeze again… when the ice slides off the “wrap guard” (aka the white stuff on the horizontal surfaces) provides little, if any protection.

Thanks for laying this out. Really does make sense with this in mind, that just having the models sit in the lots would absolutely not be good for the maker. “Lot rot”, gonna add that one to my dealer term list.

BenW:

A whole lot of dealer franchise laws are going to have to be changed before the legacy automakers can go direct-to-consumer. The automotive lobby is quite powerful, well funded, and has more than a few dealers in politics at the state and national level. NADA, AIADA, political action committees abound.

I can hear the but but but Tesla! Tesla got a get out of jail free card in some states because no one ever thought they’d amount to a hill of beans and they were an EV so the greenies could say they did something. Try and buy a Tesla in Texas without jumping through flaming hoops. (You can do it but it’s not without its challenges) Last time I checked, there were still 6 states where you couldn’t purchase one directly from Tesla.

To your point: Ford announced the EV or ICE choice .. but they letting the dealers make the choice. Cadillac offered a buy out (as did Buick) to pay the dealers who don’t want to be EV dealers, and make the investment necessary to do so, to go away.

There appears to be a bunch of confusion as to how auto manufacturers make their money. It’s not from selling cars. That’s only a part of it. The selling of the cars only allows for the factories to produce vehicles – which is where the money is actually made. Most don’t know it but manufacturers license their trademarks, intellectual property, patents, etc., to the plants (note that the plants are usually a different corporation) and the mothership gets those dollars. Then the factory sells the cars to the sales arm (eg., Toyota Motors Japan / Toyota Motors Manufacturing / Toyota Motor Sales) who also has to pay patronage to the mothership for use of the trademarks as well. TMS then sells the vehicles to the franchised dealers (and the one independent distributor remaining in the U.S.)

Spare parts are a huge contributor (as an example headlamp for our technomobile was over $1,100 to replace) – which will become a smaller portion of the business without the need for new crankshafts, seals, spark plugs, and oil filters consumed by ICE engines. Technicians will primarily fire their “parts cannon” at any broken E-vehicle because there are “no user serviceable parts inside”. Without dealerships, where do you think your car will be serviced? Look at how many Tesla service centers there are in the U.S. at present. Service facilities are capital intense and it’s always been to a manufacturer’s advantage to not own or have to build, staff and supply them. Tesla has maybe 160 nationwide. Now go look how many Ford dealers there are. There are very few independent EV repair shops and the manufacturers fought tooth and nail against “right to repair” legislation.

Customers undervalue automobile dealers. They are easy to hate. Few people go to the dealer service department for the free coffee… they go because something expensive broke. Often the dealership is the only repair facility with the technology and training to fix the current crop of technology laden vehicles. Most small shops can’t afford the subscriptions to the multitude of shop manuals, scanner subscriptions, and special tools to fix multiple brands of vehicles (try and get a BMW 4 wheel alignment without the “special” wrench to adjust the steering angle sensor. If someone other than a dealer did it they either didn’t reset the steering angle sensor or they damaged the adjuster in the process. No, Discount Tire doesn’t have one.).

Just in time works until it doesn’t. The floods in Thailand in 2008 or 2010 (forget which) brought that to the forefront as assembly lines were idled over (drum roll, please) chips when the semiconductor plants got drowned. Now Covid. To keep plants running, the manufacturers were chartering aircraft to bring the parts stateside. I just waited 7 weeks for a $60 wiring harness – and I had “pull” at my old place of employment that located one for me.

People are impatient. They want what they want and they want it now. New vehicle purchases are, for the most part, emotional decisions, not practical ones. No one needs a new car. They want one. Look at the TV ads. Do you see some geek in a white coat holding a clipboard talking about range, crash safety, paint thickness, airbags, crush zones, or build quality or do you see happy families with their children sitting in the back seats mesmerized by the entertainment system while Mom and Dad make goo-goo eyes in the front seats?

Lastly…. the cost of bespoke vehicles will add to the cost of the new car. Vehicles are built in lots. Imagine having to change the paint color in the robotic spray booths multiple times per day. Those are the efficiencies built into the plants. Take that away and there will be costs associated with it – or it could return to the “any color as long as it’s black” mentality.

EVs require a lot less maintenance than ICE vehicles.

Wolf & El Katz:

Will it be that in the near future, the prices of EVs will dramatically drop, I mean dramatically? I’ll wondering if it’s a corollary to what happened to computers, cell phones, calculators – all electronics – that capacities and components became far more efficient and capable over time. Will EV dashboards, aside from branding, become commoditized and, effectively, stamped out? Will the software become so similar that a universal OS will come to pass or, if not, a LINUX-type alternative will be available?

The external appearance (and internal) is so similar among today’s cars that you really have to strain yourself to tell much difference in the cars and trucks on the road. Of course, the puffery that comes with knowing the infinitesimal differences in these cars will always be there, but, to a reasonable mind, they’re nearly identical. Will EVs go the way of microcomputers?

There are already what they term as “skateboards” – which is the battery, drive system – essentially a very large skateboard. There are also prototypes that have interchangeable body parts. Need a pickup? No problem. SUV? No problem. Sedan? No problem. The issue, though, is likely crashworthiness.

Software will likely be the differentiator between manufacturers and I doubt that any manufacturer will give away their secret sauce to a competitor.

Costs come down? Probably as all manufacturers cannot compete in a narrow band of pricing. Large(r) middle class families can’t fit in a Leaf and not all can afford a Rivian or Tesla. It will depend on the advances in battery technology, amortization of R&D (at my old alma mater, we didn’t see profitability on a new model until the third year of production due to development costs and tooling), and so on.

Oh… and another possible reason not to hate dealers is that the manufacturers are requiring the EV only dealers to put in charging stations – which is not an insignificant cost to the franchisee. I would imagine that would be available to owners of that brand for recharging (though not free).

I read a recent article that said that Toyota, Honda and Nissan are “not focusing” only on EV’s at this time, but continuing to redesign existing products. Makes you wonder what they know that the others don’t. I recall when the auto pundits were making fun of Honda and Toyota @ 2015-ish for still building and developing passenger cars and not focusing exclusively on light truck. I guess the current state of affairs was the reason. Fuel economy is cool again.

Large middle class families? You might want to check in with the millenials.

60% of millennials do not have any children under 18.

I’ve never been sure, but agree I have seen that “in transit” label used a lot more than ever expected. And something seemed a little off about it.

No, I went to a car dealer and all the cars coming in are already sold. Give it another 4 months and the inventories will be back. There will be a ton of trucks for sale, but the cars selling will be gas efficient.

The industry will overshoot on production in the next year and be running plenty of sales

I see the same thing. local jeep dealer has been close to empty fo two years. The last year sometime i would see zero new jeeps models.

Now over 100 at least. Plus 8 PHEV jeeps. But the PHEVS cost $20k ($62k and up) more than gas ($40k and up)

Local Hyundai dealer had 1 or 2 Santa Fe on lot 3 to 4 weeks ago and i was told 1 to 3 months if ordered ago now have over 23 on lot and 10 in transit.

Seems like the same issue with housing.

Sure sales will collapse and prices are “moderating” some but there aren’t any deals with rates being much higher. Unless you’re a cash only kind of buyer, this doesn’t mean much for any kind of affordability.

Time will tell if stuff becomes affordable again but for now, my local market has a 50% increase in housing inventory in a matter of a couple months and prices have dropped maybe 10-20k average in a 500k median price market. While rates are up double.

It would be nice if someone kept statistics on actually housing affordability. Say monthly mortgage payment on the median house price compared to median wages for household income. Also with autos. I’ve done the numbers myself but it induced such a strong sense of depression. So strong I forgot the stats somewhere.

National Association of Realtors (NAR) website has an article dated August 12, 2022.

There it is stated:

“June’s affordability index figure of 98.5 is the lowest since June 1989.”

It was at 149 in October, 2021. Consistently dropped with spring-summer rate hikes.

They also state:

“As of June 2022, the national and regional indices were all above 100, except in the West, where the index was 69.6”.

I didn’t read much else; don’t know if they

describe how they compute affordability.

I also don’t remember if Wolf has covered this already, quite possibly.

“The NATIONAL ASSOCIATION OF REALTORS® affordability index measures whether or not a typical family could qualify for a mortgage loan on a typical home. A typical home is defined as the national median-priced, existing single-family home as calculated by NAR. The typical family is defined as one earning the median family income as reported by the U.S. Bureau of the Census. The prevailing mortgage interest rate is the effective rate on loans closed on existing homes from the Federal Housing Finance Board. ”

Above is the definition. Apparently, it doesn’t include property taxes and insurance which vary widely, and I assume have increased at least as much as housing prices even as mortgage rates consistently fell until recently.

Essentially, it’s a measure of prospective debt serfdom.

Affordability generally is figured by costs of the mortgage (rates), home prices, and taxes and insurance, compared to the area’s median income. I don’t cover it anymore because it’s circuitous BS. The California Association of Realtors has a state index based on this.

Low mortgage rates CAUSE house prices to shoot up, which triggers the entire affordability issue. Mortgage rates need to go to 8%, and stay there, and home prices need to sag 50%, and stay there, and then incomes need to catch up, and then affordability has normalized. That’s the opposite of what the NAR, the CAR, etc. want to happen.

Love it. Probably not gonna happen though, cause debt is never, never, ever going to normalize in this country, short of total default.

Fed’s new target inflation is going to be 4% by end of 2023.

> Seems like the same issue with housing… Unless you’re a cash only kind of buyer, this doesn’t mean much for any kind of affordability.

I was a cash buyer and got an affordable home thanks to not competing with buyers who needed to finance but also crucially thanks to the mortality of its previous owner. That’s a big turn off for US buyers.

Since then, I noticed it’s optimal in my case not to spend on US healthcare which bring what I need for retirement down by 50%.

I find that to increase quality of life it’s easy to get rid of burdens that don’t deliver as supposed to engage in yield chasing. My home country spends 1/11th of what the US spends on healthcare while achieving the same mortality. The key is to shift resources from end of life healthcare towards maternal care and kids under 5, so from the end to the very beginning.

Focusing on the nutrition for pregnant women and kids is key too, if you saw lately public school lunches, you get what I’m saying, they aren’t being provided with health-inducing food. The system in the US in ensuring a continuous supply of sick people to the US healthcare complex that should have been prevented with high-quality food.

RW, I’m wondering what “home country” you’re from. Sounds like they care about the citizenry; here, most citizens are treated like open mouths that swallow without chewing.

Once prices decline maybe 10% by sometime next spring and the 30YFRM moves below 5% about the same time or before, the housing market will stabilize and prices will once again move higher, al beit not at double digit growth. This will be because of two things: the labor market is going to be more resilient, meaning the uptick in unemployment is going to be minimal, 1.5% at most, with about .6% just coming from people re-entering the labor market as was the case in August. Also, the Fed next spring will be forced to come to terms with higher inflation in the name of climate change. The new normal / neutral rate will be at least 3.5%. To get back to 2%’ish will require significant deflation.

Unless a black swan event comes out of no where, there’s not going to be a housing price crash in the next 18 months. And the Fed will take the FFR up to 3.5% later this year, pause and then will proceed up to 4% by next spring. At the very most 4.5% is the top, but it won’t say there very long. It can’t. The interest expense on the debt is already starting to explode. Prior to FY 2022, the average total (public & intragov) was $545B annually. I looked at the fiscaldata.treasury.gov web site, and it appears the current FY is at $668B total with September still to be reported.

May need to update the drivers in your crystal ball…

LOL, good one, I’m going to steal that.

BenW,

Black swan events seems to be happening more frequently than in the past. Perhaps we should all plan accordingly.

Once you have the black swan plan in place, a red swan will appear.

Agreed, and IMHO a lot of that is just because too many sellers are still delusional about the prices they can maintain, and home price declines have far, far, far lower to go to be in line with US incomes. Eventually even with the higher rates, prices will fall so low (as they did in the GFC) that affordability will rise again, and buyers can reasonably take into account the possibility of refi down the road. But prices should never have been allowed to get so ridiculous out of range of incomes to become with, that’s the price of ZIRP and especially QE, an historic mistake that will hopefully not be done again.

There is a very specific reason housing prices take time to fall or rise. Comps. There is always negotiating leverage to have a price not fall too far away from the comp prices that have recently happened. So in this market, the naive buyers are looking at comps and thinking they got a good deal for a 30K discount, when in fact, if they looked at affordability versus median incomes in the area, they would see that prices have a long ways to fall.

This is really not much different from stocks, where people pay a price for a stock based on the trading charts, instead of a true valuation model.

When you have really good valuation models, you can predict the direction an asset will take and buy when the market undershoots and sell when it overshoots.

Miller, I really like your commentaries. But this idea: “When you have really good valuation models, you can predict the direction an asset will take and buy when the market undershoots and sell when it overshoots”, how is it that the Federal Reserve, with its super-abundance of PhDs, fail to see 3 major asset bubbles inflate while they sat on their haunches? Why could none of them create a valuation model?

Whoops… that was gametv’s comment. Sorry, Miller. But still…

I remember when a second hand 1994 Toyota Land Cruiser sold for as much as a 2-year-old 2015 Toyota Land Cruiser in 2017.

Same goes for Bitcoin, Pokemon cards, stonks, etc. the middle class are fooled into HODLing the bag for the rich to become richer.

Don’t even get me started with rural Canadian real estate. A plot of land in the middle of nowhere appraised for C$10,000 sold for C$300,000 in 2021.

A great observation; it’s the upper-middle class, the ‘aspirational rich’, the ones buying overpriced purses in airport duty free shops, drinking $10 Starbucks coffees/milkshakes, buying $2000 Apple laptops to look at facebook….all charged to one of their many credit cards. Insiders are waiting in cash, biding their time…

Trucker Guy:

That’s a really good observation. So what if the price reduces 20 percent and the payments are the same because of an interest rate hike?

From a buyers viewpoint, so what?

Buyers can refi if rates go down. They can’t adjust the purchase price in the future.

Besides Refi possibilities, taxes are lower and your down-payment goes farther. And savers will be getting better rates.

If you look back at what happened in 2008, real estate fell for a couple years and then finally hit a bottom, but part of that bottom was a result of the Fed dramatically reducing interest rates so affordability went way up and increased the pool of potential buyers.

This time around, we dont have as much selling pressure, but we have much less demand. So we will have smaller price declines in the beginning. But as owners see their home values drop for 12 straight months, they start to wise up and then get very aggressive about selling. If rates dont come down quickly, the lack of demand will last longer and prices will need to fall further this time around.

Good points.

But,

In 2008, many were forced to sell when their mortgages reset or they lost their job as the economy was starting to crash.

My question is who are the owners who will sell after 12 months and give up a low fixed interest rate and move into an apartment hoping that prices drop and rates drop?

If your correct, then this is bullish for apartments REITS

Watch out! The recent rent hikes aren’t flying. Occupancy has dropped 9%. That’s big. For multi-unit buildings to go from 98% to 89% cause “concessions” to take hold; rates are back to where they were a year ago (parts of Virginia and No. Carolina). Incidentally, all the multi-unit owners watch and follow what their local compatriots do and follow suit.

“enough people have come to their senses and now refuse to pay whatever, and they realize that they can drive what they already have for another year or two or three..”

My people! I am among the watching and waiting, and to emphasize, patiently so…no hurry.

Glad to see it. Let’s hope prices fall back down to pre-FOMO levels.

I think the prices will not go down as much as you will like if in California.

Building is slow and not keeping up. Immigrants are doing a good job of holding up the market and add all the hedge/equity/institutional buyers and you will still face difficult competition as they will swoop them for cash prices…. I’ve been a builder for many years and NEVER have I seen such a slow but sustained construction of homes that keeps inventory low and prices on the higher end.

Man, he is talking about cars, not RE.

LOL. Low wage immigrants are not buying houses. The population has barely grown in the past 5 years. The housing price inflation is due to one thing, excess demand and suppressed interest rates. Period.

according to the 2020 Federal census, one in 10 American homes are vacant. Granted, the Career Criminal hiding out at Mar-a-Largo was never known for his competency, but the US census at one time did do a real good job of tracking (and following up on) vacant housing.

“16 million

At a time when household units are forming faster than homes are being built and many Americans can’t find a home at all, it may come as a surprise that nearly one in 10 American homes — more than 16 million in all — were “vacant” when the 2020 census was recorded. In some states, the vacancy rate exceeded 20 percent.Mar 10, 2022”

I agree with your sentiment on vacant homes, but the gratuitous anti-Trump comment really didn’t add any value.

@old ghost.

The good thing is the number of vacant homes have been dropping since 2010 when it was over 19 million. The number is now down to 15 million.

This number is misleading, as the vacant home number includes homes in the process of being sold. This number also includes a lot of vacation homes that are really not were middle class jobs are located.

If you go back 20 years the US had 14 million homes vacant and the US population was 40 million fewer people. The number of vacant homes should be higher if you do a regression analysis.

IMHO….we need a recession that will force people to sell. Job loss,

There are a lot of newbie landlords that have to go through a recession and experience tenants who cannot pay during stagnant or dropping home values.

Plus let’s see how many AirBNB stick around if there is a slowdown.

Those are the groups I see selling 1st…. not home owners with low fixed rates.

IMHO

Maybe. System is unsustainable with national credit growth expanding faster than income growth for a long time. Look no further than Japan and Eurozone when you hit the stuck at too much debt – no growth trap. Future outcome highly uncertain.

A Tesla roadster has 2 billion miles on it and counting. (The one Musk shot into space.)

A little over 2 years ago I bought an LA Water & Power auction 2001 F250 Pick Up (66K original miles) for 8,300 cash. Sold the racks/tool box for 300$ so paid 8K.Recently, after Newsom’s speech on EV by 2035 and looking at the empty car lots I decided to get my money out before everyone decides to sell their old trucks at the same time. Drove it 7K over two years replacing only battery/wipers as this was a super clean old truck. Sold it for $7,500 cash then started looking for a new Toyota. No inventory so started to look at KIA Telluride at 32-34K basic only to find a premium of 10k more to actually close the deal. No way….Keeping my Prius for now.

It seems the jawboning is to achieve rapid conversion to EV that no one can afford so it appears major disruption of life in ahead due to the constant “jawboning” of our Democratic majority.

I am curious if those here now living in California are planning to stay long term given all the changes coming? I live in a neighborhood of million dollar homes and of the 19 people in my cul de sac about 2/3rds are retired or about to be and health and expenses are starting a turnover that is strange to see as everyone pretty much stays in their house. In sum, most of the older baby boomers in CA are going to face unwanted decisions about living here much longer….

You do realize that there will be a “major disruption of life” in quite a few places unless the switch away from carbon takes off, right?

Phoenix and Miami come to mind quite quickly.

Western Europe and US going back to stone age v.s. China & Asia

growing carbon footprint. We will see if carbon will turn us into swimmers or scorpions .

It’ll be scorpions. Culturally, we’re halfway there.

” unless the switch away from carbon takes off, right?”

James,

You do realize that there is no chance in hell of that happening, right?

Humans will consume everything in sight so good luck trying to figure out how usa reduction in carbon footprint is going to change the world consumption. Especially if hydrocarbon prices drop because of lower demand from CA.

Mankind will adapt but government mandates will destroy the status que let Mother Nature take its course

Europe is proving when it comes to freezing to death people would rather burn wood, coal and fuel oil and worry about the climate later. History teaches when you get cold enough you will burn your furniture if you have to.

If they are thinking about Texas, that boat has sailed. I did my own calculations and found the tax burden in Massachusetts is less than Texas. Then I read an article that did a comparison of California and Texas – California had a lower tax burden. So any of you thinking about Texas – first figure out how you are going to pay your annual property taxes of $30,000 and your annual house insurance of $6,000. Not to mention the fact that housing prices have doubled or tripled here. Did the mention the high crime and poor infrastructure?

Taxes are much less in the rich in Texas than in California. One major reason Elon moved to Texas.

If you are poor or middle class, you will being paying more taxes in Texas than in California. There is no prop 13 in Texas and your property taxes are adjusted up every year. Between property taxes and insurance, you will be paying 2% every year.

You are right about the rich. Because Texas has no income tax, the rich do well but everyone else is screwed. 2% is in the rear view mirror. An example of an actual house for sale in San Antonio. Price is $499,999. 2% would be $10k a year. The actual property taxes and insurance are $15,492. That’s actually low here – many are up near 20k and a more expensive house you are looking at 30-40k in taxes and insurance.

Texas has no state income tax. That’s the draw.

California’s prop 13 caps assessment values at 2%. So, a homes property taxes can increase 2% each year.

Texas doesn’t tax our cars as much as California (or some other states). My yearly tag is $72 and I could be driving a Rolls Royce.

Yep, totally. Even parts of Hawaii are cheaper.

I am a California farmer. But the long term drought, warming, regulations, taxes are devastating on farming.

I am considering hanging it up, too.

Ccat

We’re on the precipice of economic collapse after one last huge stimulus in my opinion. The debt market has been smelling the stench all year and that may go away temporarily, but I think 2023 is going to be a shock most will not be prepared for. The auto industry like all industries will crater “cue Bob Segar and the Silver Coin Band” like a rock.

The terminal decline is picking up speed & desperation is starting to mount. Has anyone given much thought as to why the Government is still warning people to get those Covaids boosters? Or why the Government hired 80,000+ IRS agents to steal as much as they can from everyone? It’s time to implement the next phase of their totalitarian regime plan.

Without getting political, these are bad, bad people in charge – both parties. Evil is a better word. They have essentially destroyed the US. I think it’s over except for the shouting. There’s no way out of this.

Crooked Jay Powell and his “soft landing” BS is laughable. What he and his buddies did with their deranged money printing while “allowing inflation to run hot” for over a year and a half was a crime. He should be in shackles in a cold cell awaiting trial, especially after the realization that they were all day-trading their own policies, front-running Wall St. These people used a public health crisis to line their pockets.

I was reading something recently where a large part of the IRS audits will be focused on people making less than $25k. If true, that’s how sick these people are. Supposedly those are the “rich people,” they’re just not reporting the income. Uh-huh, I’m gonna buy that.

We’ve been getting lots of promises from the enemy of the American people lately – The FED – that they will not stop until they’ve beat inflation. They’re so serious that they never even so much as considered an emergency rate hike. That’s because they wanted this inflation, they’re just not going to admit it.

Too much doomerism; all countries face what the USA is facing; the top 20% are doing just fine; if you’re part of the top 20%, you are enjoying healthy asset appreciation, your debts are manageable, you are waiting for everything to go on sale.

Without getting too political, the world faces gigantic hurdles; increased frequency of climate change disasters (mega droughts, floods), China slowdown, Russian invasion of Ukraine pushing up energy and food prices (this one could be over soon), long term demographic shifts (aging populations in developed economies putting ever more pressure on social support programs). Even though these problems are global; so much depends on how US midterm elections and 2024 elections pan out.

Hey Nicko2-

Nice to see someone else understands that America now exists to service 20% of their population.

Once you know that , it’s easy to interpret the UniParty of multi-millionaires on both sides of the aisle.

I don’t believe most in the top 20% income are also top 20% of the wealth distribution. Never seen this demonstrated anywhere.

Anecdotally, many of the top 20% measured by net worth are older with incomes noticeably below the top 20%. Much of or most of their wealth is also in home equity.

Anecdotally, many of the top 20% measured by income are noticeably below the top 20% by net worth. (Younger) professionals with expensive overhead.

Half of the top 20% are in the 81st to 90th percentile, usually a household with two wage earners where only one of them gets paid well above the national median. Most of them also live where the cost of living (especially housing) is (well) above the national median.

The 91st to 95th percentile in both are well-off or affluent. The 95th percentile and above are rich. By any sensible definition, most in the 81st to 90th percentile (yes, in both) are middle class.

AF, if these figures are based on what Pikkety wrote, the wealth calcs are probably way out of kilter at this moment. Postal workers, car repair people, who happened to have owned a home in one of the metro areas that saw hyper-inflation of their homes, are now millionaires, severely changing the wealth/income ratios.

Totally agree, D.C., but our system is so corrupt at this point, including the Judicial System, that it is going to take one heck of an economic sinkhole to get enough Americans mad enough to work for change. Two sets of laws and two approaches to enforcement. That doesn’t last for long without unrest in some fashion. What about escrowing our tax payments in Zurich??

” focused on people making less than $25k. If true,”

That is patently not true, though it has been floated widely in the right-wing media for mass consumption, part political BS, and part of the efforts by the high-income coddled population to fight the funding of the IRS. The wealthy would like nothing more than the abolishment of the IRS. So they lobby to reduce its budget, which is the next-best thing. This budget increase really galled them.

Think about it: people earning $25,000 pay very little or no income taxes, just the way the tax code is set up (thought they pay SS taxes). There isn’t a whole lot to audit – and next to nothing to find to justify the manpower needed.

But someone with a complex financial life, with various activities and investments, who makes millions a year, there is a lot to audit. And they’re also trying to do more corporate tax audits, which are super complex and require lots of manpower. That’s who they’re going after.

If there is an increase in audits of folks making less than $25K it will most certainly be aimed at those claiming the Earned Income Tax Credit which has a high potential for fraud. That’s not necessarily a bad thing.

If you don’t claim it then I don’t think there is anything to worry about audit-wise at those income levels.

The only reason I could think of regularly auditing people with gross income less than 25K of income is Earned Income Credit fraud. I am a firm believer that a certain portion of audits should be random, the IRS might be doing this, so that could also be a reason.

Earned Income Credit can be audited with a computer program.

As the name implies, it’s a credit against taxes paid. If you don’t pay any taxes, you can’t receive the credit.

Pretty simple.

Apple,

That’s incorrect. The earned income tax credit is a “refundable” tax credit. That means the taxpayer gets it even if the credit exceeds the taxes owed, creating the possibility of a negative federal tax liability. The child tax credit is another example of a refundable tax credit.

And a huge portion of those hires are administrative, not just auditors. Maybe we’ll actually get better customer service, you know, like someone to answer a question when you call. Nah, probably not!

They also increased the Financial Crimes Enforcement Network (“FinCEN”) budget by 30%. That might have several global investors panties in a bunch as well.

Or is that included in the total?

My father used to do taxes for the public with one of the popular companies. He said there were definitely people that games the EITC hard. At the time the max payout above what was paid in was about $4200 or so, and some people knew they should quit working when their income hit a certain point for the max payout. The government closed a loophole where people let relatives borrow kids for more EITC. Mom claims two, aunt claims two, grandma claims two, etc. He said it was baffling, they would do all this to get the maximum payout but then always want the rapid refund which would cost a few hundred dollars versus waiting a few days.

Why did the IRS need to hire more workers? Here’s why, I mailed off my taxes the first of April (single no dependents, pretty straightforward). I just got my refund in the mail a week ago. They had my money for so long that they gave around thirty-six dollars in interest on top of my refund. They don’t have the bodies to do the everyday things that need to get done, that’s why the hiring.

The fact that taxes are still done using paper and the US Mail in 2020 is pretty crazy.

As an insider, I can tell you the IRS has been defunded for decades and it’s dying. Most employees are looking to retire, they could not care less about extracting those taxes.

The poor are not paying taxes because they don’t have any (declared) income, the very rich and corporations don’t pay because they bought their laws, politicians, lobbyist and lawyers. The only suckers that are paying taxes is the working class.

The new IRS employees will just squeeze the suckers harder, can’t go after the poor or ultra rich.

You can do taxes online…. but their electronic system locks you out if you previously filed on paper and they have to review your return for some reason. That’s what happened to us.

I do on-line banking, pay my bills mostly on-line, but on my taxes I’m old school and still like to use paper. I’m not too trusting of filing online as yet. Same reason my computers at home are hard wired with cat 6e cable and not wireless. I don’t trust it.

When federal enforcement agencies, directed by people with an “agenda”, get an infusion of funding, of course we should feel safer.

Joe & Yellen say no more Audits than “historical average ” for incomes below 400k. Of course this is only accomplished by directive from treasury secretary. Can be changed at ANY time.

The amendment to take that wording from Yellen and put it in the bill was nixed. I’m sure it was because the agency is more trustworthy than the tax cheating scum trying to stay below the 400k.

Two monopolies in DC passing laws written by donors.

We should all sleep better.

DC

EXACTLY!

Regarding the IRS:

Did you see the post by, if I remember correctly, the Clay County Sherriff’s Dept about the hiring of an additional 80,000 IRS agents?

Instead of paraphrasing, I’m going to try to find the quote. The perspective they provide sums it up perfectly.

From the Clay County Sherriff’s Office:

“Did you know?

With the combined salary of the 87,000 new IRS agents ($81,456 average annual salary), you could put a police officer ($55,117 average salary) in every public school in the nation (97,568) and still have 31,007 police officers or $1,709,012,819 left over:

Now you know. They’re not interested in safety or security, they’re after you!”

I wasn’t really a Seger fan – his band could rock it, he wrote a good song, and his success was hard earned and well deserved. I much preferred the Steve Miller Band. But I think we’re all gonna miss him when he goes. An icon and a nice guy.

Time passes. Bob’s old and frail now. People are like markets – they rise and then, sooner or later, they fall. Makes you think about what it’s all about.

Er, it was Bob Seger and the silver bullet band.

Must have been wary of vampires, no?

I’m interested in who the IRS will audit, too. (Not for personal reasons, mind you!) Can you remember who’s making the case for a focus on low, low income audits? It seems fairly counterintuitive.

I was reading something recently which reported that Donald Trump was Queen Elizabeth’s favorite President of the 12 she met. They cited Greg Kelly of Newsmax who based it on a photo of the two together.

Yes, totally agree, lots of BS is floating around out there, including about the IRS audits. What they will audit more (after essentially not auditing at all) are the wealthy and corporations. That’s what this funding increase was all about. That’s why those two groups planted so much BS in the right-wing media, to stop this from happening.

Wolf is 110 percent correct about the IRS future audit customers.

As a tax prep expert having done 100+ returns just last year the low wage earners will not be audited by IRS they owe no tax. The earned income tax credit for those earning under 25k do get paid by government which is a form of subsidy by government for poverty wage could easily be eliminated by statute if the IRS thought there was a lot of fraud.

The IRS already has a high level of review of anyone claiming earned income tax credit . 95 percent of my customers would come in the same day w2 are generally available online early to mid Jan yet IRS does not process any of these returns until after mid February to ensure the amount of fraud is at a minimum.

ITS audits for business and the super wealthy will be the biggest bang for their buck and will be the targeted crowd.

The largest number of audits are correspondence audits which are what most will get as it is easy low hanging fruit for people who are clueless about IRS reality in fact. I worked in the TAX realm as in training as CPA to become Tax Attorney due to the advantage of attorney/client privilege which NOTE the CPA does not have this advantage.

At the higher end the quality of CPA and income variance or unusually high expenses will trigger.

If any business relationships are terrible tax cheats this trail can and does lead to those connected in some way as vendor/customer or ???

The IRS loves to identity the “candyman” accountant as all they have to do is get the client list and start digging for gold as the candyman files for bankruptcy.

Correspondence audits are easy peasy way to scare into payment. That is what will be done with this group

– Agree. Dealers buy their stock / second hand cars from those auctions.

– The more expensive, gas guzzlung cars are piling up in the inventory of car dealers. To get rid of those cars, car dealers can send those expensive cars to auction to be sold. But then those car dealers have to accept a lower price in order to “move the metal”. And those lower prices will also be offered to customers who want to trade in their used cars for a new one. Then instead of offering say $ 30,000 the car dealer will only offer say $ 25,000 or say $ 20,000.

You are correct in your observation that the trade in values offered to customers attempting to purchase a different vehicle will also decline – which may have the effect of making it a comparable out the door cost to the customer. Yes, it will provide relief to the cash buyer with no trade, but those buried in extended term financing are pretty much screwed. Plus, it will be difficult to push the negative equity into the new loan as the interest rates are higher.

One other positive note: The phenomena of customers buying their off lease vehicles at residual and then flipping them for a profit may be coming to an end. That will change the tide of vehicles available for sale as it will no longer be possible to make the flip pencil after incurring sales tax, licensing, title costs and the like.

The leasing companies have loved the last few years as their residual losses are probably zero and, if anything, they made substantial profits on those that they took to auction or auctioned through the private auctions / website to their dealers.

@ EL Katz,

The model I’m talking about isn’t direct to consumers. The dealers are still the middleman, maintaining a small inventory to let buys test drive vehicles & kick the tires. They’re still going to get paid, but maybe not as much.

Also, the choice being forced upon them is less about the car sales than the back-end repair shop. The shift to all EV is going to be very expensive from a repair learning curve & diagnostic / repair stand point.

Again, the model I’m talking about is already being spoken about by the CEOs of both Ford & GM. They might have not yet laid out the complete strategy, but it’s there.

And I am sure vehicle financing costs are higher as interest rates continue their march higher under a Powell Fed Chair that finally got the message on inflation. Vehicle prices being an outstanding example. Even with the potential for higher gas mileage on a more modern ride, the carrying costs just don’t justify paying 40% more out the door.

Most Virginia resident were mortified when they got their Personal Property Tax bills this Spring based upon January, 2022 NADA prices and less and less credit for the infamous Car Tax Reduction at the Richmond level that is waning per vehicle as more vehicles enter a given county.

My pristine 2003 Forester XS and my 2010 Ranger XL will last me to Valhalla. Going to do the Viking burial ceremony if I can get EPA approval. Kidding of course, old dingy with a sail will work just fine, will just have to make a big contribution to local Fire & Rescue.

Good used cars will remain on the high side due to the fact that new car production to 1979 levels for more than 2 1/2 years. With out new car production good late model used cars will bring a premium

Re Carvana, (perhaps just a little off topic):

Here it looked like Carvana might be able to pull in a profit. But wholesale used cars prices are way up (assume this causes their inventory input costs to be way up too), but the market is trending down.

Seems like this would this increase their losses for a while longer? Not sure their financing arm will be able to fill the gap.

Carvana is selling at pandemic highs. I sell used trucks and am 40% lower than Carvana. I’m still not getting much calls. People are short on money or afraid. I expect lots of dealers to go belly up this time around, just like last time. My only edge is low overhead and doing much of the recon myself. Also, that model of buying without seeing like vroom and all those is about dead now. Which I say there is lots of pandemic business models that are now defunct. Watch these drop like flies. Remember the big True Car? Housing and vehicles sinking very fast, along with others as money is connected everywhere.

Carvana’s business model was to provide in house financing so that they could jack up vehicle prices well beyond what their true market value was, then saddle idiots with loans that were oftentimes almost DOUBLE what the vehicle is actually worth.

The financialization of the entire US economy is one of the most disgusting paths a once great country has ever taken. The banker bailouts brought this to you. Having paid no price for their fraud and lies in the past, instead getting to keep all of the ill-gotten gains, they doubled down on their financial atrocities.

Market for off-road worthy SUVs is still red hot. I went shopping for such car yesterday in here in LA. 3 year olds with 30-50k miles are just 3-5k below MSRP for brand new ones.

Dealers still not selling anything new at MSRP either, asking for huge premium – 5k for Lexus GX460, 10-15k for Jeep Grand Cherokee, and mind-blowing 20k for Land Rover Defender. One dealer was asking 104k for base model Defender with nothing in (MSRP 64k). No thanks…

Posted this on the previous thread:

I’m seeing prices come down pretty good OCONUS on used vehicles. I think they’re have been a lot of repos based on what lucky Lopez on YouTube and others have noted and that inventory is coming onto the market. I would say there aren’t any screaming deals yet, but the outrageous prices of the past couple years are gone. Compared with RE, where there are still crazy asking prices in my area here and there.

Wolf has posted the hard data which refutes Lucky’s claim that repos are exploding. Lucky seems a likeable guy, but for an industry insider he really hasn’t done the research and seems to be just another clickbait artist. I was very surprised to see Danielle DiMartino-Booth take the bait and have him on as a guest.

What’s become clear to me is that all of these false narratives like “car repos are exploding” are just social media statements on Twitter, Youtube and the like, that go viral without any basis in reality. Kind of like the “FED pivot” BS. FAKE NEWS.

PS – Lucky is essentially e-begging for a hedge fund to give him tens, if not hundreds, of millions of dollars to open up his own car dealership and both fund the cars and carry the paper on the loans so the financing is in house. Those people aren’t stupid. Would you want to plow that kind of money into a business where the guy doesn’t even have the right data? I’d give the money to a guy like Wolf who knows what he’s talking about.

Iona,

The “explosion of repos” story is braindead clickbait BS. Delinquencies are ticking up from record lows and are still way below the Good Times:

https://wolfstreet.com/2022/08/02/auto-loan-delinquencies-and-repos-are-not-exploding-they-rose-from-record-lows-and-are-still-historically-low/

I don’t understand why the price spike was or is crazy and irrational.

Shortage of supply with similar demand dictates higher prices. Higher prices encourage production to meet demand.

Not everyone could keep driving old cars. Some crash. And the rich can pay dealer premiums and don’t care.

All car makers are scared of the Tesla production juggernaut and are making cars as fast as possible so as not to lose market share.

Even if they can design a decent EV, it remains to be seen if the can mass produce like Tesla. Tesla looking to build lithium refinery I’m TX or LA. They will lock in raw materials supply and produce the batteries themselves. Vertical integration cost advantage won’t go away. I like the Sorento Plug in and RAV4 plug in and f150\hynrid and Lightening. But I won’t pay 20k extra over gas equivalent. Hopefully they can produce more soon cuz Tesla ain’t slowing down.

I’m content to put another 176k miles on my ride and then buy a new car for cash @ 14% back of MSRP like in days of olde.

It’s not only cars. I’ve seen significant price increases in motorcycles over the past two years. Large capacity german touring motorcycles are priced equivalent to – or higher – than brand new Toyota Corolla’s (mid-range). There’s just no way to justify those MC prices. And I’m seeing a lot of ’22 models unsold.

It’s everything. I know a guy who sells RVs. He said the cheapest models – NEW, not used – increased in price by over 50%. These kinds of economic distortions should never, ever happen.

Car prices should continue to fall for the same reason real estate prices shouldn’t totally crash. Trading up or down results in higher payments.

Most commenters dont want to buy new or newer used cars because their payments and associated costs would increase dramatically. Most homeowners dont want to sell and buy even a cheaper home because their re taxes, insurance and mortgage payments would go through the roof.

In my case, even if I bought a house valued at 50% less than my current one, my taxes would more than triple from $10,000/year. I’ll stay where I am and keep my paid off car until both markets adjust.

Difference is, car manufacturers are dumping a lot of depreciating new cars on the market every day. Homebuilders have already cut back substantially and will continue to cut back even more. Existing homes will have to make up the difference.