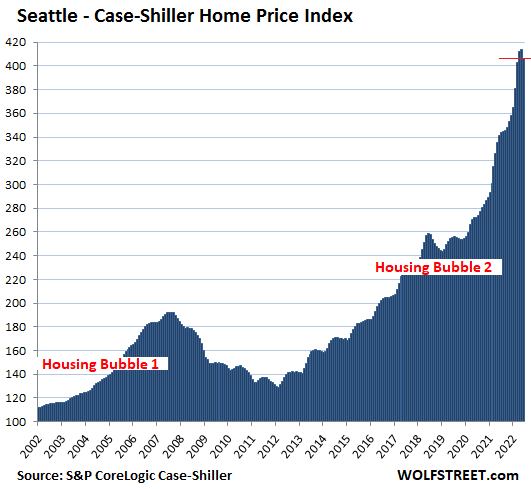

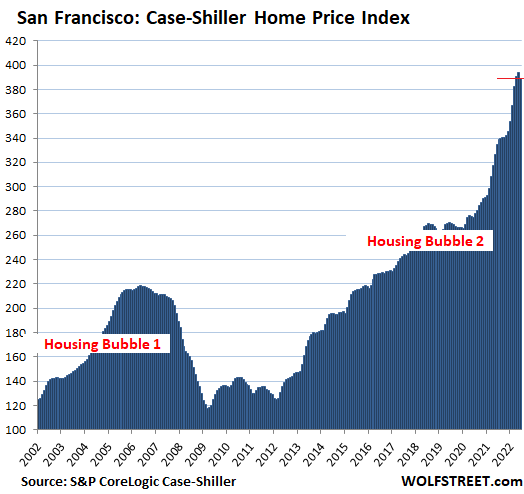

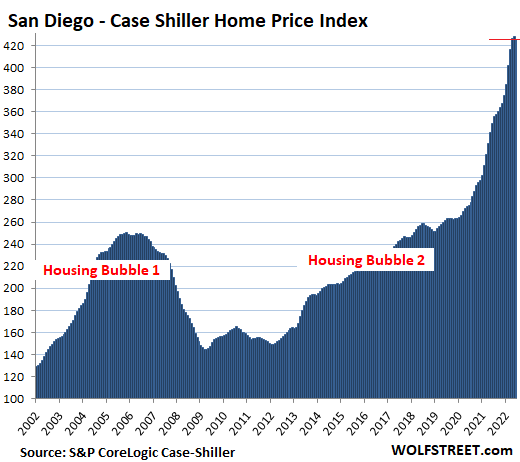

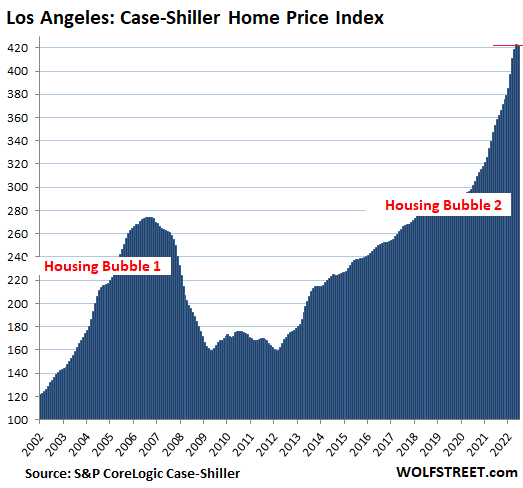

The Case-Shiller index, which lags reality on the ground by 4-6 months, is starting to pick up the price drops in Seattle, San Francisco, San Diego, Los Angeles, Denver, and Portland.

By Wolf Richter for WOLF STREET.

The housing market is going through some navel gazing, as many buyers evaporated at current prices and mortgage rates. They’re still out there, but they’re a lot lower, and many sellers haven’t figured that out yet, though some started cutting their asking prices but not nearly enough, and deal volume has plunged.

Sales volume of existing homes plunged by 20% from a year ago across the US, and by 31% in California, and by 41% in San Diego. Median prices in the West have begun to drop, and in the San Francisco Bay Area fell below year-ago-levels, including by 8% in San Francisco. Sales of new houses plunged by nearly 30% year-over-year across the US, and in the West by 50%, as the supply of new houses has exploded to 11 months, the highest since the peak of Housing Bust 1. And big institutional buyers have started to pull out of this market because they don’t want to overpay. This has been going on for months.

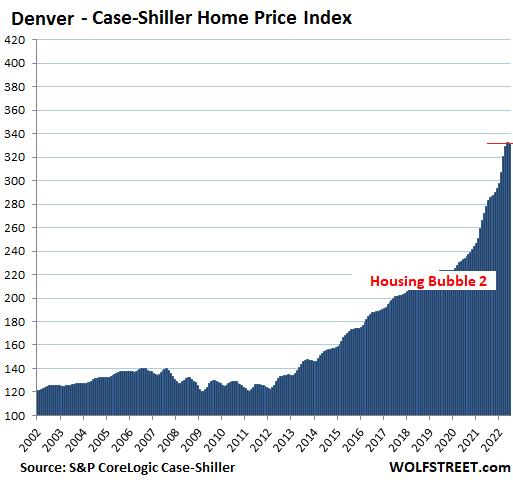

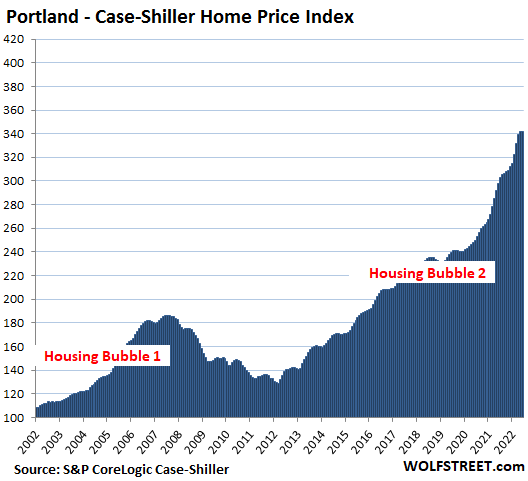

But today, the S&P CoreLogic Case-Shiller Home Price Index, which lags reality on the ground by 4-6 months, finally picked up the first month-to-month price declines – all of them in the West: the metros of Seattle, San Francisco, San Diego, Los Angeles, Denver, and Portland.

Today’s release of the Case-Shiller Index was for “June,” which consists of the three-month average of closed home sales that were entered into public records in April, May, and June, of deals that were made a few weeks to a couple of months earlier, roughly in March through May.

By mid-April, the average 30-year fixed mortgage rate pierced the 5% mark and has stayed above 5% ever since. So here we go.

The Most Splendid Housing Bubbles where prices fell.

Seattle metro house prices dropped by 1.9% in “June” (three month moving average of April, May, and June) from “May,” wiping out in one month the gains of the prior two months plus some. This was the first month-to-month decline since October 2019, after a totally ridiculous spike. It chopped the year-over-year spike down to 9.3%, from 27% a few months earlier.

San Francisco Bay Area house prices fell by 1.3% in “June” from May, below the level of April, and the first month-to-month decline since June 2020, wiping out in one month the gains of the prior two months. This whittled down the year-over-year spike to 16.1%, from over 24% in prior months.

For the Case Shiller Index, the metro consists of the five-counties covering San Francisco, part of Silicon Valley, part of the East Bay, and part of the North Bay.

San Diego metro house prices fell by 0.7% in “June,” the first month-to-month decline since October 2019, after a ridiculous spike. The index dropped below the April level, thereby wiping out in one month the gains of more than two months.

This 0.7% decline reduced the year-over-year gain to 21.6%, from the near 30% gains a few months ago.

The index value of 425 for San Diego means that home prices shot up by 325% since January 2000, when the index was set at 100, despite the plunge in the middle (CPI inflation amounted to 75% over the same period).

Los Angeles metro house prices fell by 0.4% in June from May, which whittled the year-over-year price spike down to +19.4%.

Denver metro house prices dipped 0.1% in June from May, whittling down the year-over-year gain to 19.3%:

Portland metro house prices dipped 0.1% in June from May, which whittled down the year-over-year gain to 14.7%. The month-to-month dip, the first since October 2019, is too small to mark on this 20-year chart:

House price inflation. The Case-Shiller Index uses the “sales pairs” method. The sales in the current month are compared to when the same houses sold previously. The price changes within each sales pair are integrated into the index for the metro, and adjustments are made for home improvements (methodology). In other words, the index tracks the change in dollars it took to buy the same house over time, which makes it a measure of house price inflation.

The Most Splendid Housing Bubbles where prices “decelerated” or stalled.

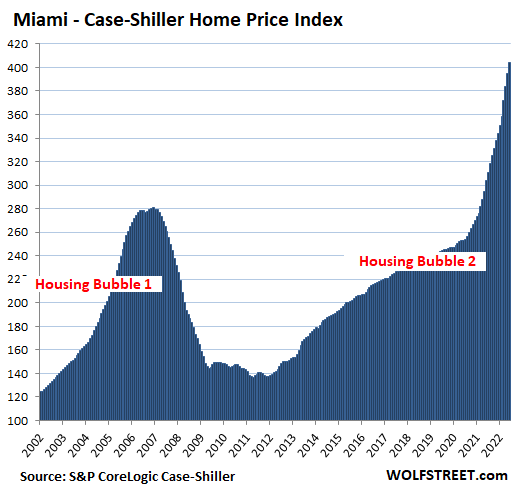

Miami metro: +2.3% for the month, “decelerating” from month-to-month gains in the 3.5% range in prior months. This whittled down the year-over-year gains to +33% from +34% in the prior month, ridiculous mania, all of it.

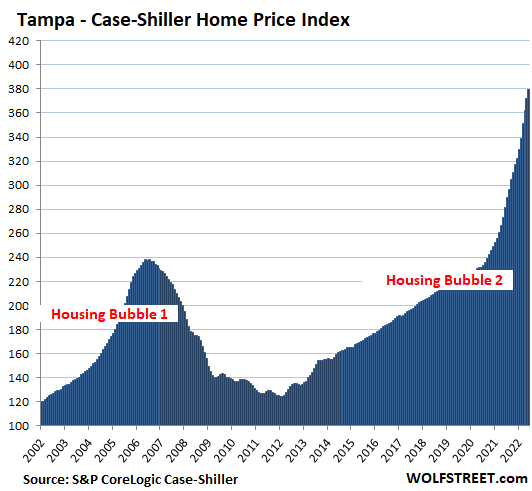

Tampa metro: +2.2% for the month, decelerating from 3.7% earlier this year. This whittled down the year-over-year spike to 35.0% from 36% in the prior month. Mind-blowing crazy.

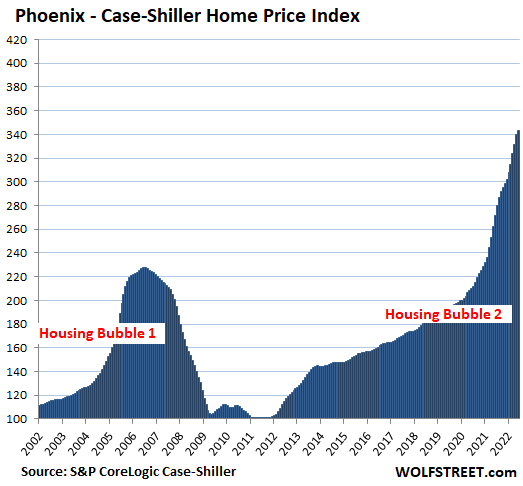

Phoenix metro: +1.0% for the month, decelerating from +2.5% in April, and from +3.0% earlier in the year. This whittled down the year-over-year spike to +26.6% from +32% earlier this year:

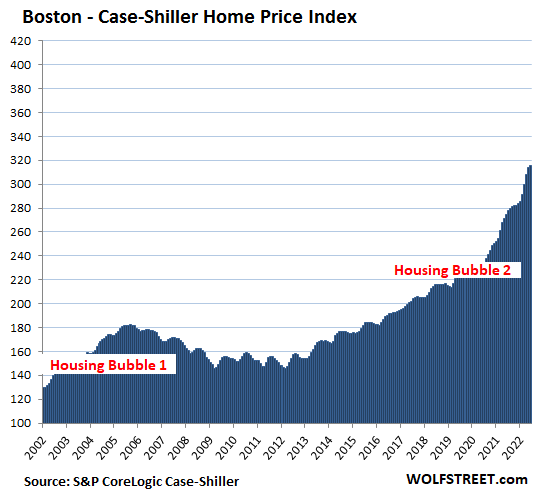

Boston metro: +0.6% for the month, decelerating from 1.9% in the prior month, and from +2.8% earlier this year. This whittled down the year-over-year gain a tad to 14.9%:

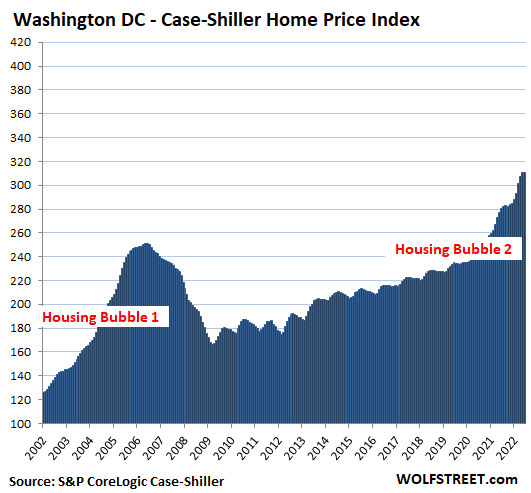

Washington D.C. metro: +0.0% for the month, no change, decelerating from 2.9% earlier this year. This whittled down the year-over-year gain to +10.8%:

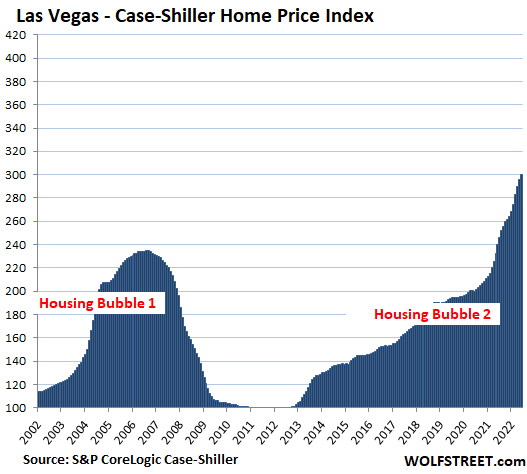

Las Vegas metro: +1.5% for the month, decelerating from +2.1% from the prior month, and from over +3% earlier this year. This whittled down the year-over-year gain to +25.1%:

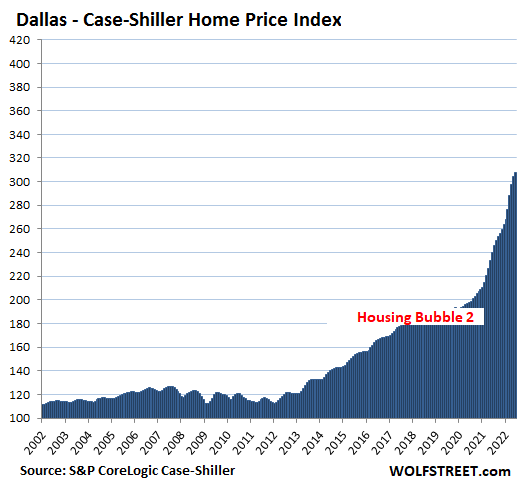

Dallas metro: +2.6% for the month, same as in the prior month, but decelerating from over +4% earlier this year. The year-over-year gain remained at +30.8%:

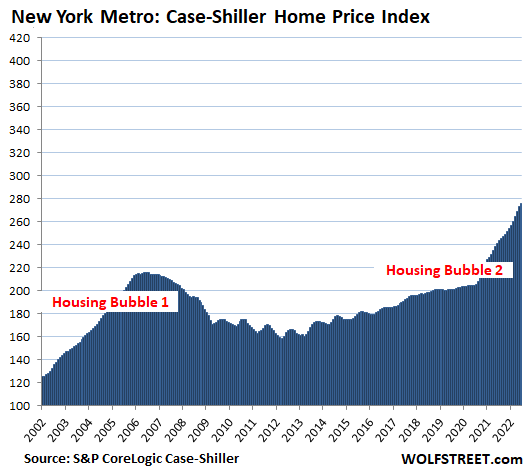

New York metro, the huge market within commuting distance to New York City: +1.1% for the month, decelerating from 1.6% in the prior month. The year-over-year gain of +14.6% has been roughly unchanged for three months.

With its index value of 276, the New York metro has experienced 176% house price inflation since January 2000. The remaining cities in the 20-City Case-Shiller Index (Chicago, Charlotte, Minneapolis, Atlanta, Detroit, and Cleveland) have had less house price inflation and don’t qualify for this illustrious list.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Great data! Thank you!

It appears the peak has been reached in this insane bubble.

However, with a son who wants to buy a house, a 0.1% decrease hasn’t motivated him to leap off his comfy couch yet.

This will be interesting for the rest of the year.

Seattle’s got a bigger drop, no?

Why this data is not published live like stock trades? Why a delay of 4 months?

More transparency will help both buyers and sellers have real expectations and help RE agents close sales faster.

Today, the market in West is freezing due to big price expectations between sellers and buyers.

Yes, it would be nice to have this type of data (sales pairs) in real time.

You can get the data in real time just by looking at random listings on Realtor, HAR, Redfin and Zillow. You prob won’t know the final sale price of the listings you favorite, but it at least gives you an idea. Chances are real good At this point that none of the listings are going above asking.

Sales pairs relying on public records is going to have a lag associated with it. As a real-time proxy you can use average sales price movement published by various entities which rely on MLS data. That more current data has been showing a definite reduction in housing prices on a national level, with a lot of variability between regions (a trend which the Case-Shiller has picked up as well).

Thanks Wolf.

DjReef, looking at random listings doesn’t work in Seattle area as listed prices are crazy high as these are still based on April. However RE agents, who really want to make sale, are themselves advising that the house will sell for 20% – 25% less. Remember 1.9% monthly drop is 23% annual drop, and it’s just getting started. Simply mirror the S curve and it’s easy to guess a 33% annual drop.

Also, please note a conflict of interest. Approaching a RE website for house value os like Approaching a stock broker for stock value.

Max Power, average sales price carries 2 risks : 1. It’s not a sales pair and the mix of Houses can change as crappy properties don’t sell in a correcting market. 2. In Seattle, huge credit is now paid by seller to buyer to prevent sale prices to plunge. This is specifically true for builders who are looking at 12+ months of inventory.

I encourage you to look for alternative data. A robust proxy is a sentiment derived from mainstream and social, available hourly.

Since it’s a leading indicator, equipped with the market mood indicator you can get leverage negotiating the deals. It correlates well with the next 1-2 weeks’ ask prices.

I don’t know the policy here so I won’t share external links, but you could PM for details.

I get nose bleeds reading your home price indexes!

so I’m in Tucson(think it’s in west)

bought home in April for $365k

spoke with realtor

he said that price range has nothing but junk

and my TODAY value is WELL OVER $400k

I don’t care – I paid C A S H

and 50% sales are still all cash today

One of the best sanity checks possible is to ask yourself if any of these metros have seen median household incomes rise by 3x or 4x since 2000 (translating those 300 and 400 index numbers on charts).

The answer is a definitive and resounding, no.

History is going to look back and be astounded at the stupidity of an era that actually had the internet to provide access to a huge array of info.

Hopefully, the future will never witness such vast, unnecessary stupidity again.

Unlikely, but you gotta hope that more info, more widely spread is better. Even Idiot Bubble 2.0 only had about 60% of the sales volume of Idiot Bubble 1.0.

So we got that going for us…

The problem with home pricing isnt just that the prices rose so much, it is that even if the prices had remained flat, the higher mortgage rates would have dramatically increased the mortgage rate.

I think most of the people buying homes right now are financially illiterate or merely trading properties (selling in one location to buy in another).

If banks had to keep the loans they originate on their books, this would never have happened. When the taxpayers are on the hook it makes it far too easy for banks to simply originate the loan for fees and then be rid of it. Frannie and Freddie have always been a bad idea. Securitization of loans is another bad idea.

If you give a salesman in incentive to sell at any price, you will never get market stability.

“Seattle’s got a bigger drop, no?”

If it keeps the idiots away, good…

I live in Seattle, and in arguably the neighborhood that has seen the greatest price increases (bubble). I has definitely slowed down, but a duplex down the street just sold for 1.5mil and it needs work. The real bubble is all these 6 story skinnies being build where there used to be a single family house like mine. There will be an enormous collapse in that market to the tune of literally giving these small units away – unless the City uses my tax money to buy them all and house all the drug addicts. There are also several 400-ft (that’s the zoning height limit) towers that are not sold on Denny, and I believe will be half empty when the dust settles on this colossal bubble. Amazon and Google employees no longer have all that RSU money to throw around.

Could you explain what a six story skinny is.

Is it 6 units? If not, how many units? (In the end, it is the unit numbers that matter for supply, and therefore price).

It has been a while since I posted here. But I continue to see price drops everywhere in Seattle area. Especially for the million dollar plus houses. The number of million dollar houses for sale vastly outnumber the number of buyers that still have that budget. So far the trend I am seeing is that sellers come down some and then cancel the sale and put it for rent. Most sales are happening under million dollar range. You take any million dollar house and chances are very high that it has had some price drop. If i had to quantify – most high priced houses have seen a drop of average 20% to 35% from the peak.

Don’t get me wrong. I am not saying that zero sales are happening. Some houses are still selling at or near peak prices which was April/May. But now they are a minority. And tech stock rally has fizzled out. Rates are back near 6%. Fall is on the way. Once tenants renew their leases and settle down for the year, this fall and winter are set to deliver a deadly blow to house prices in this area if stocks and rate continue on the same path.

I’ve been seeing price reductions since May here in the South (TX) and have posted here, as such. Most started out $5-$10 grand, but now they’re dropping $20,000-$50,000 depending on the starting price and location.

Yep, that’s how these things always go. The sellers haven’t yet internalized that the market has changed. So they mentally can’t bring themselves to sell a house for 20% less than they could have sold it for in February. That’s why these adjustments always take time. There needs to be time for the “peak prices” to be far enough in the rear view mirror that the sellers don’t have that mental block.

It’s one thing to say “I won’t sell for $800,000 today when I could have gotten $1,000,000 in February” and quite another to say “I won’t sell for $800,000 today when I could have gotten $1,000,000 two years ago.” In the latter, the sellers have realized that they missed the opportunity, in the former, they haven’t yet, it’s too recent.

These sellers will eventually come around. There aren’t enough renters out there to pay the owners the premiums they’ll demand for being a landlord and the hassle that comes with it. And most people did NOT buy during the 2021 peak, so they’ll still make a profit, just not quite as big as they would have.

I think all the “Seattle Techies” are at Burning Man.

Reality will hit hard.

Seattle sounds very similar to what I see in Thousand Oaks. There’s relatively little on the market by us, and sales are still happening if the price is at least “reasonable.” The houses that sit are listed at grossly inflated prices. One near us recently listed for $1.4M (which would be a record high price in the neighborhood), and it’s maybe worth $1.2M, and that’s probably going down at this point. It just reduced its price to $1.29M. I’m not sure I’d call that a price reduction, though technically it is, because the original list was so absurd. How do you define the peak in a market like this? I guess you have to use closed sales and not absurd asking prices. You’re right, it may be a dark winter for sellers expecting peak prices.

‘But it’s another thing to say “I won’t sell for $800,000 today when I could have gotten $1,000,000 two years ago.’

But in all likelihood ,they won’t be able to get 800K now, because now market will be 650K.

This sea change after 40 years of declining rates is going to erase more than two years of bubble.

Lack of water will make property in CA, AZ & NV worthless. A literal “forbidden zone”

Ted,

No, that’s a misconception about who uses most of the water.

Households use only a small portion of the water. In the densely populated coastal areas of CA, desal will become more common, but that’s expensive water.

Waste water recycling will also become more common (in CA, after treating the waste water, it’s injected into an aquifer for natural filtration and purification before it becomes tap water from the aquifer). But this is also expensive water.

And industry uses quite a big of water (from the car wash to the power plant).

Agriculture uses about 80% of the water in CA, and without water, or with expensive water, food is going to get a lot more expensive, including in the rest of the US where CA ag products are exported to. FOOD production is the real issue with droughts.

What I see happening in my home town is enviros using the courts to slowly strangle water supplies at the local level. Even though most water, on the aggregate, is used by farms, the economic impact is felt by residential rate payers through increased water rates.

In Santa Rosa, its gone up 17% since 2015 with a further 10% cumulative scheduled for the next 3 years. Install all the low flow toilets and shower heads you can, but at some point lifestyles get impacted and the middle class gives up the ghost and moves out. No wonder home prices skid as the locals figure out the water and power game and realize the high paid tech workers wont be there to rescue them when its time to sell.

as regards water in california housing is the lemon next to the pie…inconsequential. calif has ALWAYS been an agriculture state where ag use the VAST majority of water. households use less than 8% and we are getting better at conserving but even if we cut householder use by HALF it wouldn’t make a difference. Calif is a “first in use is first in right state”. Find the book Cadillac Desert, it’s a good start point for an understanding of where our water goes (or doesn’t). folks like to tell you almonds use a thousand gallons a nut…that’s the typical lazy journalists blather and isn’t even 25% of the story. we have plenty of water except in drought years which are nothing new…tree ring exams tell us they are as old as the redwoods themselves. water ain’t our problem, it’s how we transport it and how we allocate. as you can imagine in california we do it the stupidest possible way…that’s how we roll.

Almonds are the state’s most valuable export crop.

California produces 80% of the world’s almond supply — of which 70% is exported.

One almond requires 1.1 gallons of water.

As of 2015, almond cultivation consumed about 10% of the state’s water.

Almond farmers use roughly 35 times the amount of water as the 466,000 residents of Sacramento.

We’re essentially exporting CA water via almonds.

I’ve often wondered about that almond stat, since something as simple as grass is said to be a much, much bigger consumer of water.

(That is why Vegas will pay to rip out lawns but not trees…the grass consumes much, much more water).

I wonder if it has something to do with lifetime vs. annual water use (it takes forever to a tree to grow relative to grass). But in any given yr, the grass may be sucking up much more water.

If that is the case, the almond stat may be misleading.

BenX

Don’t forget exporting bottled water from CA: Arrowhead, Crystal Geyser, and others…..

Denver is still lagging with drops. However, there is more inventory.

He is patiently waiting on his couch (and doing his income thing since I forwarded this to him).

Denver didn’t experience a massive bubble in 2008. Denver is certainly not immune this time. I expect 10-20% drops in prices.

Are you being sarcastic?

Sellers in Boston area and Cambridge/Brookline think old dilapidated dated money pit condos are worth one million. Newsflash NO 1st time homebuyers (aka 2 millennials with 200k or above combined income) are even REMOTELY interested — based on my unofficial study of friends/colleagues.

$200K annual combined income is pretty damn’d stout, IMO. Shouldn’t be too much that’s out of their range, irrespective of inflation.

Hate to break it to you, but your fictional home buyer isn’t the person buying that dilapidated “condo” that’s the first floor in Brookline. They either make a ton of money or have family money and want to live in those cities for the schools. Your fictional couple lives in Waltham like a lot of my friends. And even that’s a stretch for them.

Inflation measures admittedly are ALL arbitrary because they depend on what weight you give to food versus gas versus vehicle prices versus real estate, etc. While I think that real inflation is much higher than reported under the clearly manipulated-to-under-report, inflation CPI measure in official reports, so that will reduce the degree of the annual RE price hikes shown for each year in real dollar terms by that year’s local, real inflation rate, the prices in those markets are far greater than any CPI measure would account for.

As more of the Baby Boomers start to sell their expensive real estate in such areas for cheaper, smaller lodgings, because social security and pension payments become more insufficient due to higher inflation for their standard of living, lots of real estate will start to go on sale. Prices for most areas will likely plunge in real dollar terms as supply increases more and more, even if inflation might hide some of the plunge.

If the Chinese economy’s ongoing collapse does not put enough downward pressure on US prices, and it may not as to many parts of inflation, such as consumer electronic goods (which will be in short supply if Chinese factories keep getting closed due to lockdowns), the banksters’ “Federal” Reserve will be in even more of a real pickle. LOL.

It does not want to reduce its banksters’ indirect, inflation profits from the reduction of their liabilities (e.g., depositors’ funds) in real dollar terms due to inflation. It also cannot raise interest rates high quickly, because the US budget deficit is exploding even under what are currently, effectively, negative interest rates on rolled over and new issues of US treasuries due to inflation.

Karma is cruel. LOL

We feel it in SE MA too. The median household income in my working-class, fairly industrial community is under $80,000, but the median home sales price for over a year has exceeded $400,000 (still rising!). And rents are egregious: the median for a 2-BR is over $2,000/mo. I often think of the young working-class and immigrant families around here and wonder how on earth they’re even getting by. When I was young and stupid and living in Chicago 15 years ago, a nice one-bedroom in a bustling, desirable “young adult” neighborhood like Lincoln Square or Boystown would rent at $700-800/month. These days you can’t find a cardboard box renting that cheaply here in a worn out old New England town. Lord knows the wages aren’t much higher, especially at the lower end of the spectrum.

In my area I think homes in the average range have dropped about 5 – 7%. Some have dropped 25% and just a few sell over asking. I get this is by looking at sales prices every few days. Problem homes drop more, but not really- there are good reasons.. These are the homes that try to hide their failing septics, foundations or moldy leaking roofs and plumbing from the buyer. After they get called on it a few times they lower. Then they lower again. Then they go pending, don’t pass inspection and go back on the market lower yet again..

Some people are still trying to sell to the overbidding online cash buyers who never stepped foot in the house. I think most of those buyers just aren’t around any more. Thank goodness, the idiots!

I follow houses in two of my potential next hometowns (one in CA and one in FL). I just browse Trulia and “like” a few dozen houses at a time. Then Trulia automatically emails me when something changes like a sale or price change. For the past month, I’ve been getting nothing but price drop emails, and there are some doozies! But the thing that really stands out is that most of the price drops came when a listing went from pending sale to active. Seems like a deluge of cancelled sales. Anyway, other than drumming up the obvious question of, “How the F could you be contemplating a potential move to CA and FL at the same time?”, I just thought I’d share my anecdotes.

I would go with Florida. I heard they don’t have any COVID over in that state.

Why don’t you move to WA state so that I can sell you my house at $3 million and then buy it form you after 1 year at $2 million.

Believe me, you will be ready to sell your house at $2 million after 1 year when you realize how crazy expensive and unsustainable this place has become despite no significant rise in incomes. The administration has lost touch with real problems.

Preach it! Glad mine sold last month!

Sounds like the deal of a lifetime! Where do I sign?

But seriously, I also should have mentioned that I don’t actually intend to buy anything. I move around a lot and prefer to rent. As a potential house renter, the relative desperation in the market will probably affect rents. Hence my interest.

I live in Florida and there’s plenty of COVID here. Lol. The market here in Tampa is still crazy, even though we’re beginning to see the prices slashed. There’s nothing here for first time home buyers, prices are still off the chart.

Marcus1,

I live in Southern California. In the last month I have noticed a lot more open houses out here. I get the feeling that sellers are getting anxious… then again maybe I’m reading too much into it?

I used to live in La Jolla. Looking at my old condo, the rent has gone through the roof and units for sale have been listed at more than double what they were a few short years ago. I was never happier than living there, but things need to settle down a lot before I would return.

I lived in La Jolla for a handful of years and loved it as well. I’ve been pretty fortunate to have sold a house in 2017 for a 35% profit then sold another house 2 months ago for 50% profit. I’m sitting on the sidelines with a pile of cash waiting to buy again. I think we are about a year out from really good action!

My cousin got married in La Jolla recently (I’m in the Boston ‘burbs) and one drive to Torrey Pines was all it took to convince me that I need to live there. Then one look at the price of housing (rental or buying) was all I needed to convince me that maybe a week long visit isn’t so bad.

I’m in Mission Viejo and keep my eye on the surrounding cities as well. The inventory here had a huge spike during July and early August, with tons of price drops and virtually nothing selling.

Over the last few weeks I’ve noticed a much slower rate of homes coming on the market. Price drops are still common. But a fairly significant number of homes are going into Pending and Under Contract status.

Yet, very little is appearing as Sold (it may just be that the sales haven’t completed). There are A LOT of Back on the Market homes though.

This will be a slow process. Most homes here at current listing prices, even with a 20% down payment, will have monthly payments over $7k per month.

My friend lives in MV and it is a decent area, but not one that support 7K a month people. There are many potential sellers who are just going to need to see home prices fall for the rest of the year before they throw in the towel and cut their prices. By that time, prices will be quite a bit lower.

Where this goes depends upon whether the debt bubbles that were blown around the world all come apart at the same time. It could get very nasty.

Exactly. I think I’m Southern California it will be a good 6-8 more months before we see any real good drops. Sellers are still shooting for the moon here. I moved to Carlsbad after selling my place in Bozeman MT that I bought in 2020. We sold our place in Bozeman for a 50% profit after owning for 2 years. That’s just stupid. Look up inventory in Bozeman and all the recent price drops. It will happen all over the country.

I wanted to retire and sell my home in Houston next Spring, but there was too much to risk. Home advertised at peak of the market and got an offer one day later here in late August, 2022. No way I could have expected the same amount offered next Spring. I will now lease for 6 months as home closes next week, thus maximizing my return on this home by selling now and not waiting.

I can say that Cleveland population distorts numbers for Ohio. It has been in steady decline and Columbus, the capital of Ohio, has a larger population. Due to the CHIPS deal, our residential RE has gone insane. The local NREA are saying we are insulted from any bubble. Cleveland numbers do not compare. Why does CSI still use them?

I wouldn’t get too overconfident about the CHIPS deal insulating the housing market in Central Ohio. The Portland metro area has the largest concentration of semiconductor jobs in the U.S. with a new fab being built every 5 years or so since the 90’s. When they build out the Ohio fab many of the high tech bits will come from the burbs of Portland as well as all the engineering and R&D ( Intels motto “copy exactly) but that did not stop a housing slump in 2008 and it won’t stop it from happening in Oregon as well as Ohio.

I live in Columbus and can tell you there is a huge difference with the housing market here and that is the prices. I signed the contract to buy my 3 br home literally days before the lockdowns so I managed to get a prepandemic price with early pandemic interest rate, and I paid $150k. After two years of runaway housing bubble my home is now estimated to be worth an astonishing, eye watering, unbelievable… $200k. Meanwhile wages seem to be rising faster here than the national average based on my very unscientific observations of the signage on every business that say they’re hiring. There are fast food restaurants here, in a city that still has plenty of $200k housing, advertising $15hr wages. A couple of young Chick-fil-A workers could hitch up and most likely afford to buy my house right now. And we are looking at something like 3000 new jobs from the Intel plant alone, plus potentially more from suppliers that could locate here, all at WAAAYY higher wages than the local average. I’d say there is about a snowballs chance in hell that prices fall back to 2019 prices in Columbus. Not completely impossible, but highly unlikely.

I see no new SFH builds in C-bus for 200K unless you are talking south past Grove City. Most things around the beltway are starting over 350K for new builds. All areas near the CHIPS are starting in low 400K. Yes, our Papa Johns drivers can start at $22 hour, but mortgage companies are sticky on those jobs.

But you have to live in Ohio, possibly the most dreadful place on earth.

Glad to hear that the Cali housing disease hasn’t infected CLE. Very sorry to hear about Columbus. Idiotic behavior in housing is bad, not good. I’ve watched it destroy towns on the west coast. Hopefully the Intel effect will be brief and things will calm down. I’m sure people there think the Intel boondoggle is a good thing, and it certainly could be, but if it drives housing prices beyond what the locals can afford, that would be very bad for the community.

Seattle / Portland RE peaked in 2008 and troughed in 2012…..roughly 4 years. Since history rhymes, we can expect the next trough in late 2026…..possibly at the previous 2008 peak. Are these charts denominated in nominal dollars? Inflation adjusting the squiggles encourages suicidal behavior.

That was 2 years after the unemployment rate peaked in 2010.

nsa,

The chart shows the Case-Shiller from 2002 to 2022.

The index measures the change in value of U.S. single-family homes on a monthly basis.

“Are these charts denominated in nominal dollars?”

No, the charts use index values. As Wolf stated, the start point in each chart’s index value is 100 as of the year 2000. Thus, a current index value of 425 means house prices have gone up 325%. An index value of 250 translates to a price increase of 150%, etc.

NSA,

The country having seen this con game/horror movie once before, everything might/should move much faster than before…many, many, many more people know what rising rates mean when homes across the nation are priced at 3-4 times their yr 2000, pre-ZIRP levels.

The only thing stopping a home price collapse already is the Covid hangover, keeping for-sale inventory at maybe 60% of its normal level.

Once that collapses (inventories rise)…Apocalypse Now.

To play in the 2015-2022 home buying madness (2.0) at all, you kinda had to be a speculator/daredevil/nitwit at heart…nobody in that group is particularly known for leisurely strolls to the fire exits.

There is a huge difference now. Rents have gone up substantially during the pandemic. In 2008, I was renting in East Bay California for $1000/month. A new owner bought my apartment complex in 2012 and jacked up rent by $500/month, so I immediately bought a condo for $245K. I sold it in early 2019 for $620K (worth ~$770K now).

The point is that this time, rents have been jacked up *faster* than house prices, and rents tend to be extremely sticky,since they are set by real world ability to pay. Ownership is a luxury, and thus always higher priced. Rent is a necessity driven by market forces (historically).

One complicating factor…after years of too slow response, there are a significant number of apartments currently under construction. Those will add to supply shortly and put some badly needed downward pressure on the mkt.

Scoffers like to point out that new apts are usually the most expensive.

True.

But…they drop all existed apts down the price totem pole and *anything* added to supply increases downward price pressure.

Thank god, because the past 18 months have been rent insanity and the price spikers probably do deserve to get undercut.

(Some landlords are arguing Covid recoupment…but tens of billions in rent make goods got printed up by the G so I suspect double dipping may be going on in large amounts).

For many years my wife was a firm supporter of market prices. “They are what they are”, she often said, to justify interest in a high-priced home she was looking at. After seeing the ridiculous price spike in 2020 and 2021 in the West, she’s finally accepted the notion that the housing market might be speculative in nature, and you can lose a lot of money if you buy at the wrong time. Attitudes have changed.

She must not have been paying much attention during the last 30 years

Cognitive dissonance.

It is a short walk from “C’est la vie” to “screw that” when the bills hit home.

Agree with the bubble idea, but….

this is different this time because of two things

1. Replacement costs are sharply higher.

Materials and labor.

Bubbles that popped in the past did not have this.

2. Mortgage rates STILL well under the inflation rate. Bubbles that popped in the past did not have this.

1) Market price of X is determined by the balance of supply and demand for X not the sunken cost of producing X or the cost of replacing X.

During housing bubble 1, surplus houses were demolished (i.e. were worth less than zero) due to lack of demand. Similarly for houses in blighted parts of cities like Detroit and Baltimore. The market value of empty office towers all over the US is less than the cost to build / replace them since there is no demand for that space today.

2) The typical mortgage is held for 5-10 years so the real mortgage rate should use the expected inflation rate for next 5-10 years (approx 2.7%) not the current inflation rate of 8+%. By this measure real mortgage rates are approx. +3%

“the expected inflation rate for next 5-10 years (approx 2.7%) ”

is this a post from J Powell?

Replacement cost IS a consideration in determining value. SQ FT construction costs all time highs….still.

2.7% was (at the time I wrote the post) the bond market expectation of US inflation for next 5-10 years aka breakeven inflation rate (T10YIE and T5YIE on FRED).

It has since dropped to the 2.5-2.6% range.

I just provided multiple examples of why market value IS not determined by replacement costs – see my previous post. Can you provide any data or evidence to support your position?

I think I have heard that somewhere before , “different this time”

If people can’t afford to buy the homes, prices have to come down. Bottom line is the monthly payment.

You’ve used replacement cost as a reason in prior posts. You were wrong then and you are still wrong now. See the post above mine.

“Real” mortgage rates are irrelevant. Buyers pay housing costs with nominal dollars, out of their income and savings. Wages and incomes aren’t hardly ever indexed to inflation either and when it is, not exactly to the arbitrarily determined CPI index generally used as the measure of inflation.

It’s always different in the sense that it’s never exactly the same as the last time. It’s never different in the sense that those who participate in a bubble or mania are going to be exempted from reality, the reality of declining or crashing prices.

Housing (the structure) is a consumer good with a long shelf life. If you live in it, it’s not an “investment”. Claiming it is one is a rationalization, usually to “justify” paying more or buying more house to consume than the buyer needs.

Anything will appreciate measured in a depreciating currency if the currency debasement is big enough, like used toothbrushes which presumably increased in value back in 1993 in Brazil on my last visit when inflation was 40% per month.

Agree.

See my post querying if median HH incomes have gone up by 3 or 4 times in *any* of these 300+ 400+ index metros.

Answer, no.

Viability/sustainability of those price increases is almost wholly contingent upon perpetual ZIRP (itself doomed by inflation/FX collapse effects – the world will not sell valuable, real asset intensive goods to the US forever, in exchange for debauched printer money that is useful only to buy…what? the cutting edge industrial mastery of Detroit? Cleveland?, Pittsburgh? Even sunny CA will give you skin cancer if you get too much of it…).

ZIRP *is* inflation…and no ZIRP, no 400 index.

Is this a sign of things to come in places other than the west coast? I hope so. I’ve seen prices double in many areas of New England the past few years and while homes are staying on the market longer, prices have barely budged.

Housing bubble one looks like nothing compared to housing bubble two in a lot of these charts. It’s stunning.

Lucca,

I was thinking the same thing. I’m scrolling like a mad man back and forth between the charts. For example, Dallas didn’t even have a bubble #1.

A big reason why these charts look stunning when you compare bubble 1 and bubble 2 is because the scale of these charts are linear and not logarithmic. To explain this in plain English, a move from 100 to 200 does not look as impressive as a move from 200 to 400, although they both represent the same doubling in price. This visual distortion is what tricked me into never considering the biggest housing bubble in California since the 1970s. This occured from 1975 through 1990 when housing prices increased 5.4x!

Having said that, these charts are still impressive and I believe that as long as Powell continues to push interest rates higher to fight inflation, putting upward pressure on mortgage rates, we will continue to see a downtrend in the housing indexes.

beatleme,

Hahahaha. Sure enough, got another one who wants to hide reality. In finance and real estate, every time someone clamors for log charts it’s to HIDE REALITY. Reality is hard to stomach sometimes, but hiding it with log charts doesn’t make it go away. Log charts in RE and finance are just an intellectually elegant way of lying about reality.

Overlaying a Median Home Price / Median HH Income might be interesting on those charts.

Data purists might also quibble about the suppressed zeros on the graphs – starting the vertical axis at 100 instead of 0 amplifies the visual effect of the upward movements.

For most of the cities with graphs, prices are up 3-4x from 2002 to 2022. But the visual presentation with 100 as the minimum value makes those changes look more like 10-20x.

Wisdom Seeker,

“Data purists might also quibble about the suppressed zeros on the graphs”

Nonsense. The index was NOT set at “0”; it was set at “100” for Jan 2000. That’s why the horizontal axis on my charts = 100 = Jan 2000. This also allows for easy calculation of % change since 2000 (one glance, index number minus 100), which is the qualification for markets to make this list. Read the article.

The index doesn’t go back to zero at all. Some of them may go back to close to 60, and that’s it. I made 20-year charts, instead of 22-year charts. There is no zero. But there is 100, for Jan 2000 = horizontal axis.

Also what BS is this anyway? Do you start your S&P 500 index chart at zero??? Sheesh.

“Data purists,” my ass. Data idiots.

No need for a graphic overlay of median incomes really, a simple index number or coefficient will do.

Nationally, my semi accurate WAG would be 1.3x since 2000 for national median HH income growth (130 index) – and a *lot* of that gain coming only in last 4 or 5 years.

Without the madness of ZIRP it would have been impossible for housing bubbles in various places to show +300 to +480 numbers…HH income growth was nowhere near enough to support non-ZIRPed monthly mtg pmts at those insane sale price levels.

(There are only so many Chinese factory millionaires smuggling export proceed USD into the CA housing mkt…)

The bubbles would have self aborted if reliant upon US incomes.

(But pretty soon we’ll here the Fed Redux of how you can’t stimulate primary investments without stimulating speculative investments in the secondary mkt…)

Wolf, I have to disagree log charts are not always about lying. They are especially useful when working with percent changes since the make the data symmetric around 0, instead of being asymmetric around 100.

Hi Wolf,

Boikin reply seems pretty reasonable.

I’m not used to looking at log graphs and probably many others aren’t either so despite its advantages that is something to consider.

Lots of people hate the fact that I even include charts to show what is happening. They don’t want anyone to see this. They want me to show some kind of straight line, with data adjusted for whatnot and then put on a log chart. Log charts serve their purpose in science, not in finance and real estate. Log charts are TOXIC in finance and real estate.

Totally with Wolf on this one. Logarithmic charts of prices are just propaganda.

>>a move from 100 to 200 does not look as impressive as a move from 200 to 400, although they both represent the same doubling in price.

Uh, no. That 2nd doubling was twice as big.

Another pet peeve: People who want to adjust inflation for inflation. Well, isn’t that special.

In terms of what you get for your labor, housing, stocks and bonds hit all time highs thanks to Fed policy. Now the Fed is going to make you look foolish if you bought any of these this year.

I’ve been saying that since S&P 3,000 or so. Those prices are only justifiable if interest rates were to remain 0 forever. Since that isn’t possible without eventual massive inflation, as we’ve seen, prices were not justifiable.

Ultimately, no one is willing to lend money out for free unless the government is distorting the scale. Thus, any asset price that assumes money is free forever is eventually going to implode.

Asset prices (including housing) are inflated mostly due to increasing debt which is only possible because of artificially low rates and (sub) basement credit standards.

This is readily apparent on a long-term chart of debt/GDP (which is also inflated by debt) and household net worth/GDP (or incomes). Both ratios have increased noticeably over time, accounting for most supposed increased “wealth”. Same thing with accounting bookkeeping entries known as earnings which are also substantially inflated by increasing debt and which make the actually meaningless P/E ratio look reasonable.

The country isn’t actually that much wealthier.

Mr. Frost, in spite of the run-up of valuations, from the debasing of currency and amped-up debt, the “standard of living” of Americans has certainly improved. You’d have to ignore the improvements in the quality and convenience and the increased quantity of material possessions, to argue against it.

This is not to say that we aren’t hitting the wall on the consumption of resources.

HowNow,

The primary reason living standards have increased to the extent it has occurred is due to a combination of lax credit standards and artificially low rates.

It’s not because of “organic” or “natural” economic growth from domestic production. The country isn’t remotely that much more productive or actually wealthier.

I’m not debating that the country doesn’t consume more versus the past (an example being before I graduated from high school in 1982).

To the point you are bringing up, an increase in interest rates and tightening credit conditions (not identical) is what will reduce consumption. That’s what I see coming though the impact might not be visible immediately.

I’m assuming the credit cycle from 1981 turned in 2020, regardless of what any central bank does or doesn’t do. With it, I’m also predicting that over time, credit will become a lot more expensive and a lot harder to get.

As a society, Americans have proved they will run their debt tab up if someone will lend them the money to do it. That’s the only way most Americans can even maintain their recent consumption, never mind increase it.

Resource constraints are another factor, especially in necessities subject to global market pricing. I also believe that these (most anyway) are possibly going to become a lot more expensive, for a variety of reasons.

AF is correct – Americans have been living in a debt fueled fantasy land for decades (encouraged/compelled by a corrupt government).

The honest, underlying economic fundamentals of the US are an absolute nightmare, the country consuming far more than it can produce (import driven trade deficits) and having done so for 50 years.

And the G has made trillions in promises (SS, Medicare, etc) over those same decades, that it has no way to make good on.

All this was true before the pandemic and things are significantly worse post pandemic.

The only reason these catastrophes aren’t more readily apparent is because the G uses continent wide macroeconomic manipulation (money printing to gut interest rates, etc) to run from fire to fire, trying to fix messes of its own creation.

(The G/companies also used engineered inflation to appropriate 80% of the societal gains from China’s unprecedentedly low sales prices post WTO – consumers realized a tiny fraction of what otherwise might have been available to them).

It is like watching a bad old variety show where the plate spinner tries to keep half a dozen wobbling plates in the air before they all go smash (known as gravity).

Other countries can’t use a reserve currency as a credit card to buy crack – they have to run semi-balanced import/exports over 4/5 yr periods because exporting nations don’t sell to perpetual deadbeats on credit…internationally, nobody wants mountains of paper promises/IOUs in exchange for costly-to-make real goods.

The US has gotten away with self-deluded murder because of,

1) Its fast vanishing historic asset base advantage (USD needed for US assets) and

2) The also fast vanishing historic trust advantage the USD had over the banana Republic currencies (read, currency prints for political advantage) of other nations. But the US is the perpetual banana republic now, and has been for decades.

I think that Cali imploded first during hb1. Maybe somebody here can confirm or deny if that is correct. Cali could be the canary. The market is obviously turning down.

SocalJohn,

I think the canary should be Phoenix, Las Vegas, and Dallas.

Probably South FL too. Many of those buyers are from “periphery” (Latin) markets which should be impacted by tightening credit conditions at least as much as the US if not substantially more.

Elsewhere, I still expect previously and currently “gentrifying” areas to fare worst. Frequently or disproportionately undesirable areas to live but with close proximity to the core.

No joke, opendoor + offerpad own ~10-12% of homes on the market in the Phoenix area. They basically own at least one home in every neighborhood in the metro area. Imagine the power their behavior alone has on home prices, which are determined at the margins.

They were paying top dollar for many months then turning around and listing for even high prices.

Brilliant business model as long as prices are going up. Now they appear to be the quickest to lower their prices.

The last bubble canaries were Phoenix and Las Vegas. They dropped 50% by the end. Resort areas also plummeted.

The current canaries should be still Phoenix and Las Vegas. Also add in Boise, Denver, ABQ, and Salt Lake City since they have experienced the bubble this time. Also any resort areas. They deflated quickly during the last bubble. Key West, Outer Banks, NJ Shore, Tahoe, Mammoth, Colorado Mountain ski towns, Utah ski towns.

Doesn’t Boise get the Blue Ribbon?

California definitely took it hard on the backside during housing bubble #1. As a bay area native, I saw homes go from for example 8-900k all the way down to 400k. Literally half of what they were in peak 2005-2006 prices. It was brutal here. The tech sector seems to be the last group of morons to know that their investments are losing value, but the first to take it in the shorts.

Anecdotal, but I have a teacher friend who purchased in 2010 in Mountain View.

Prices then became affordable to her. Now she is a multi-millionaire on a public elementary teacher salary. Crazy or sane, you decide.

She has ultimate job security at this point. Nobody will take a job as a teacher at current house/rent prices.

Bob,

May I inquire as to her age bracket?

What you’re describing is locking out multiple generations of people in the bay. Basically anyone over the age of about 35-40 had the ability to earn enough in their career to buy into the market here. If you’re younger than that, like me(34) you’re basically hosed. It’s pretty sad, and it cannot go on forever.

John,

Late 50’s. She had been teaching and renting for 15 years.

The GFC was an opportunity to buy a fixer house.

Yes, San Diego and Rancho Santa Fe in particular peaked in late 2003. But it was the first city out of the gate after Greenspan cut rates post 9/11 with a 20% annual gain which up until that time was unheard of and I believe was on the cover of either Forbes or Fortune. I don’t think they are the canary this time, it’s whoever went nuts first, maybe salt lake city or boise?

Denver charts shows some insulation from bubble 1 as it was mostly unfelt however, the current one is another story. The market has been inflated for too long at too steep of a rate to hold and since the interest rate surpassed 6%+ the local market has tapped the brakes a bit. This slowing showed first in 1M+ properties and will slide into the 750K realm, in pockets. It will be interesting to follow over the next 2’ish years.

My son is sitting on his comfy couch waiting for the insanity to end in Denver.

I think prices will fall 10-20% within the next 4 years if history repeats itself. Inflation will rise 10-30% during this time like in the 80’s-90’s for home prices. It will be an equivalent 40% drop.

I am waiting on an intersection of Homeowners equivalent of rent CPI with Case Schiller. This happened in 2012 and then diverged.

I am not driving this train so if the Fed has other political pressure like in 2019, they may stop any drop in the housing market by lowering rates.

We live in a controlled economy for better or worse.

As inflation goes up, home prices go up. A 4% inflation rate helps put a floor under asset depreciation. You are talking about near guaranteed price increase of 30% over four years if there is 30% inflation over that time frame. It’s foolish not to buy at these inflated prices if what you are saying is true.

High interest rates are negating inflation.

Real houses prices will be flat or slightly dropping/increasing while inflation is rising.

It is the only way the Fed can escape without a mass of Jingle mail and a housing price collapse. This is a soft landing.

A housing price collapse could happen if housing prices drop 30% or more. People will be jingle mailing in the keys while prices crash. IMHO, the Fed will lower rates if this happens.

Housing is NOT an investment with a 5-30% ROI. It is a place to live for 10-15 years. Either scenario above will be good for people who have purchased a place to live and don’t panic.

For middle class or poorer people high inflation (food, utilities, transportation, etc) consumes more of their income quite possibly leaving less for housing.

This assumes their wages, income aren’t keeping up with or even exceeding inflation.

Strangely people don’t mention regional housing busts. One hears

“The GR is the only time housing went down dramatically.” True nationwide

but Texas (Dallas, for sure, I experienced it as a homeowner) RE dropped 20 to 30% from 1986 to 1989 where I lived.

My interest rate on my mortgage (1986) was 8%.

The Savings & Loan and oil industry problems hurt the Texas (and I believe Colorado ?) economy. At least one underwater owner walked away from their home. Some lots never got built out in our subdivision (Rowlett, TX), 1986-87.

Scott Burns wrote an article in the Dallas Morning News around 1990

(+/- one or two years) about Boston RE losing quite a bit of value… he went so far as to say that condo owners could not sell them for half what they had paid for them.

Boston RE had a large run up sometime in the 80s I believe.

Here in Chicago NW suburbs many price cuts, many successive but only latest shown as “price cut” on Zillow listing. One went from contingent at $729k in May to $649k now, but only latest $20k cut shown on photo.

jm commented on Chicago NW suburbs …

Here in Dupage County it’s pretty similar. I’ve noticed price cuts since the beginning of June. But only the most recent ones appear on Zillow/Redfin.

We were lucky our unused, but available , 7-year HELOC was due to expire in June. We ‘renewed’ it for another 7-years (even though we’re hoping to downsize before IT expires). The appraisers estimate in April made me want to rush out and buy a Maserati … even though I would probably need a stairlift to get in and out of it. VBG.

My wife did let me buy us an expensive steak dinner out however.

anon:

Absolutely LOVED the, ”even though I would probably need a stairlift to get in and out of it. ”

Thanks for the very clear image of what some of us have begun to experience ALL too Clearly!

Had challenges far damn shore to decide if wanting to ”crawl down into vehicle” OR ”climb up into,,,”’

Finally found an older pick up truck that, so far, seems to have exactly the same space INSIDE while very clearly much smaller on the outside???

I still can get in and out of my Mustang convertible. And I played 18 holes of golf Sunday. Not bad for an early 1940’s guy. Two new hips though! LOL

Anon,

Regarding the Maserati. In 2017 my old boss bought a brand new yellow Corvette convertible. It was beautiful, and had 600+ horsepower. He is a big guy and that Corvette was very low to the ground. Watching him get in and out of it was painful! He ended up selling it about two years ago. Now he is driving his old Yukon again. :-)

The Yukon is from the early 2000s and has over 300K miles on it. I’m sure his knees are thanking him for getting rid of the Corvette!

Not doubting that a crash can happen but it is going to require a lot more homes to be on the market. HB1 inventory was much higher at this point. Sales of new homes are up but inventory of existing homes are still historically low and showing signs of leveling off. Outside of a deep recession or some black swan event I see a crash in transactions and not in prices.

It doesn’t matter how many or how few homes are on the market if there are no buyers at these prices.

In my mid sized town in Minnesota, I see price drops everywhere and longer time on market. After the reduction of price, they are selling though. The higher prices homes are not moving like they were a couple years ago. Inventory’s are starting to build a little bit.

It’s not a bubble until it burst! The numbers on rental properties haven’t made sense in Chicago for years. It’s nuts.

I would like to see these bubbles adjusted for actual monthly payments on what they are buying. This may reflect lower prices at high rates and high prices at lower rates.

I used to comment on the splendid housing bubble series with the calculations for approx. monthly payments making certain simplifying assumptions (it’s complicated by tax considerations which vary quite a bit). But Wolf strongly disagrees with this methodology so I don’t do that any more.

However, you can look at the NAR’s Housing Affordability Index (HAI) to get a rough idea of where things stand today. HAI compares monthly mortgage payments (excluding property taxes and insurance) for the median priced home against median household incomes.

The latest HAI from NAR (for July) shows affordability at a 33 year low – lower than at any time during housing bubble 1.

I really don’t see a trigger for a fast hard housing decline until recession causes job losses. Really need a lot of job losses. That could easily be 6 months to a year away. Then it takes time for the rent or the mortgages to not be paid and the processes of eviction and foreclosure. It will take a while for all this to play out.

I see this as inevitable. The fed is no longer buying or replacing its MBSs under its QT plan. Coming soon, corporate earnings compression, leading to recession leading to job losses.

Job losses are really the key as far as I can see.

Then this could get really interesting. There are a lot of properties that were bought in the last few years by private parties, by flippers and renovators and private equity and pension funds.

Lots of homes bought with short term money by PE groups to rent. When the rent stops coming in? When the loans need to be rolled over for higher interest rates? Flippers won’t like the higher rates either.

It appears to me that a perfect storm is brewing and anyone who realizes it soon, may get out. As Wolf has shown, the prices have stalled and inventory build is already starting.

It could all happen faster than I think it will but most likely it will take 2 to 3 years or more to see a bottom. All depends on a lot of variables and that good ole human emotion > fear. When does worry and hope turn to fear?

Actually, the Fed has still been buying MBSs to the tune of about half a billion dollars per business day the past three months. That’s supposed to end tomorrow (unless they do some some sort of ‘taper’ down to zero purchases throughout next month).

Max Power,

You got this partially wrong.

MBS come off the balance sheet not because the mature (they won’t for years), but because of the passthrough principal payments from mortgage payoffs, refis, and mortgage payments, that are passed through to holders of MBS.

The Fed bought $100 billion in MBS in May before QT just to keep the balance level by making up for the pass-through principal payments that the Fed received on its MBS.

In August, it was buying about $7 billion. Passthrough principal payments have slowed a lot due to higher mortgage rates, but they’re still flowing.

If these pass-through principal payments, which are unpredictable, exceed the cap that the Fed put on the MBS runoff, the Fed will buy some MBS to keep the runoff below the cap. If the pass-through principal payments are less than the cap (expected to happen particularly later during QT), the Fed will not buy any MBS.

This sounds like a good plan for a soft landing.

People are not doing refi’s when they have a 2%-3% mortgage so the roll-offs have slowed.

People are not buying as many new houses. Not as many new loans.

Some are doing HELOCs at a higher rate to pull out all of the cash they can from their house. Either to live :-( or out of paranoia from 2008 so they can walk away with their cash, boat, RV, and mega-truck, while ditching their house to foreclosure.

There is a drag on the Fed income from MBS’s

The last thing the Fed wants is to have people walk away from their house and keep their Mega-Truck, RV and boat. They will control rates by controlling the MBS buys and using their super-computers to prevent this.

We saw this before in 2008 and that is not a soft landing.

em, I agree almost completely.

The Fed doesn’t seem to recognize bubbles forming until they’re truly obscene, but they sure as hell recognize (and will prevent or at least stop) crashes. I imagine that home prices will decline, but not a crash. The FED cannot allow stocks or major asset classes crash. There’s too much interconnectivity to let a significant asset class cave in.

This is basically the “Fed is going to pivot to help stocks” argument. I thought the Fed had disabused everyone of this notion in the past week.

You are grossly exaggerating the Fed’s convictions and the steadfastness of stock investors. Remember Graham’s warning that Mr. Market is manic/depressive. So is the FED, imo.

There is a global slowdown in growth and soon to be negative. Same goes for the U.S. For the FED to keep raising rates in spite of this is unfortunate as their cajones are caught between a rock and a hard place. But, if inflation takes a few downward turns, there will be no cigar for Mr. Powell, and he’ll be singing the QE blues.

It’s entirely psychological. Almost no one seems to ever consider that QE in Japan, Eurozone, UK, and anywhere else made minimal or no visible difference to stock prices. China didn’t do QE, but the country has been on a credit binge since 2008 and the stock market is still over 50% below the 2007 peak now. China’s credit expansion went elsewhere, primarily real estate for households.

@Augustus Frost

re “China didn’t do QE”

not true. They did as much QE as the FED, just indirectly by backstopping/bailing out/securitizing local bad debt issuance and NPL.

I hope lying season finally comes to an end, voodoo accounting and slight of figures. It’s like a three ring circus sideshow every quarter. I don’t know how some of these companies can keep a straight face after they publish earnings some of these companies have purported to have made.

” I don’t know how some of these companies can keep a straight face ”

How about the SEC ?

Increased “risk off” can easily crash other asset classes such as stocks and junk bonds given how absurdly inflated these markets actually are now and for most of the last 2+ decades.

That will accelerate the real estate market weakness noticeably.

The Fed wants to temporarily reduce/reverse the wealth effect to suppress demand. Let’s see if temporary is as long as transitory was. I sincerely doubt it, and so do *most* others. Even El Erian doesn’t think the Fed will stick it out, in spite of the fact that he thinks they should.

I live in Seattle, and in arguably the neighborhood that has seen the greatest price increases (bubble). I has definitely slowed down, but a duplex down the street just sold for 1.5mil and it needs work. The real bubble is all these 6 story skinnies being build where there used to be a single family house like mine. There will be an enormous collapse in that market to the tune of literally giving these small units away – unless the City uses my tax money to buy them all and house all the drug addicts. There are also several 400-ft (that’s the zoning height limit) towers that are not sold on Denny, and I believe will be half empty when the dust settles on this colossal bubble. Amazon and Google employees no longer have all that RSU money to throw around.

No surprise there all the money flowed in from Vancouver, Canada to Seattle when the Canadian government slapped a vacant home tax on empty homes in Vancouver.

The old adage “slowly and then suddenly” definitely applies to these charts.

1. No privacy, free speech, or human value in exchange for soul-less, wasteful, sub-human technology.

2. No value in housing as the last frontier in investment. Harvested for rentals, vacation units, student units, shine-this-1935-turd shack or inflation investment etc. Unprecedented tax generation without even basic property right protections, just politics. And parallel to 14 years of destruction of housing supply and closing of housing manufacturing across the country, see ProBuild for reference. Coupled with unprecedented fees and regulations. Non-occupied or limited occupied structures while the basic need of shelter is overlooked as print-2 trillion on 3-25-2020 policy. Communities now shaped for capital extraction while the communities aren’t allowed to build for themselves and the new inhabitants come from elsewhere. There’s no bubble or inflation without 14 years of fake gov stimulus, let’s be honest WOLF.

3. No healthy food for profit first, trademark/advertised hypnosis and drug/medical payoffs down the road. Physical and mental plagues from the simple logic that ‘you are, what you eat’. Even get basic peroxide, ammonia, and chloride for cleaning now are mislabeled! Shady to infinity and beyond…for profits. Call it what it is high fructose corn syrup isn’t fruit ‘juice’.

4. No free energy for climate ‘change’ while we could move hundreds of thousands of tons of material with one coal car behind a steam engine. They re-buried coal after digging it out of the ground in 2012, they used fossil fuel powered bull dozers to put it back in the ground. They destroyed coal plants to rebuild natural gas plants (a different fossil fuel) at current inflated values, while politicians family members got the jobs to do so. And China got the manufacturing all fueled by coal, most likely sold and shipped a few plants across half the world on crude powered ships to re-set-up so the wind could blow the toxins back to us. We could heat homes and fuel-steam-cars with dead trees that lay rotting from coast to coast. Free fuel readily available left to fuels massive forest fires, only to destroying more housing, lives, etc and be torture by MSM crisis actors regarding such ‘phenomenon’. They want you driving a $60k compact car/battery that weighs 4000 lb, to save energy, by law. You could of changed the injectors in a $20k, 2500 lb car and saved the transmission losses, capital losses, rare earth strip mines, gov paperwork and subsidies, and rebuilding of plants…see how easy.

ALL brought to you by wallstreet and government ‘the crisis actor’ for endless emergency stimulus. Shills, cockroaches, and all assortment of feckless hacks gambling away the future to claim there own piece of consumer, dictated investment hell in the short-term present. Demons of unimaginable waste and destruction, cloaked as heroic leaders in clown ‘finance’ world run amuck. ALL guaranteed by the next crisis waiting in the wings. Buy moar plastic or we will destroy your social credit ‘little’ people! Endless waste and destruction sold as modern sophistication, LMFAO

Any analysis done on sellers just converting to a rental, which might keep prices high. Either sellers sell for their price or they rent it out and make a nice return.

With rent prices so high and very few places to put your money(stock market is very volatile right now and bond yields are negative), I can guarantee people are making the decision to get 7-15% yield on renting. If you bought before 2019 in any of the hot markets, your mortgage+tax/insurance +are going to be much lower than the current value of the rent.

As an example, buying a house for 200k a few years back, which is now “worth” 400k. That is 250k in equity give or take. 250k @ 3.2% 2 year treasury would give you 8k a year(being generous bc selling a home comes with fees etc so you wouldn’t get all the equity back). Only issue here, now the rent on that home is 2.5-3k a month, and my cost is 1.2k excluding maintenance. Conservatively, would give me between 15-21k a year.

Don’t think this has been discussed enough, rents are supporting these price levels in a big way.

It is useful to compare rent inflation with house price inflation.

Wolf has a good chart for that (but not in this article) showing house prices rising much faster than the official CPI measure of rent inflation both before and after the pandemic.

The price to rent ratio is still in the stratosphere.. so I doubt it’s going to be affected much. Unless prices really start to come down it will remain the highest it’s ever been.

Conversion to rentals are probably providing some support, but as carrying costs increase via higher taxes, insurance and maintenance plus vacancies occur the aggravation will eventually cause most of these landlords to sell.

A 7% return is obliterated with one month of no rent, add in two months rent as cost of make ready and now your 7-15% yield, lacking 25% of income, is now a loss.

A homeowner can go 20 years without requiring major repairs, a landlord can go 7 years at most. The management company will make money regardless.

Not to mention that money aside, being a landlord is a huge pain in the butt. Anyone doing it for a 3-5% cap rate is insane, and there’s been a lot of that in the past few years.

It might be a good stop gap for some people, but this idea that people who need to sell won’t and will just rent it out forever, is a fantasy in my opinion.

Traditionally, according to long term buy and hold landlords with lots of properties I have discussed ”maintenance” with in past decades, one must figure 10% annually to keep properties from becoming run down/ slums.

Don’t know if that has changed materially in the last few decades due to better caulks and other similar materials, but, if anything, I would think it would go UP due to labor increases.

Any of the big ticket items (AC, roof, lawn replacement) can and will eliminate expected profits unless properly budgeted for. As of recently the extreme inflation in the costs has made this rental rate challenging to guesstimate. Having a pay to immediately replace an Air Conditioning unit at $20k in Southern California can be HELL

Owners to renters? That can happen until this inflationary environment leads to earnings compression which leads to job losses.

We had an amazing increase in the money supply over the last few years (actually since the crash in 1987) that created this amazingly high rate of inflation. That is now in the rear view mirror but a lot of that money is still sloshing around the system. Inflation is great at first as it affects assets and people feel the wealth effect. It also creates very unstable business conditions. If let go it will destroy a currency and society.

Powell is determined to stop it.

Stopping it means bringing demand down below the level of production. The only way known to do this is with reducing the money supply which means recession. The way to do this is to not only slow the creation of new money but for a time actually stop it. This will cause a recession.

Recession means job losses and eventually not only assets no longer going up in a parabolic way but actually reclining to a more usable, more equitable level. Where money has meaning and value. Where a people who do the jobs that keep society working can actually afford to live and eat and maybe even prosper.

Powell has no choices. There can be no return to exaggerated high prices as those just continue to exacerbate the problems in our system. If people can not afford to live where there is employment, the entire system collapses.

So get ready for lower house and stock prices. The exaggerated wealth created by inflation is going to come out one way or another. What Powell is doing is going to be harsh but way better than the alternative of societal collapse.

Jpjpjp,

The math of that article is only half of the equation. And it leads you to the wrong conclusion.

So, about 10% of home sellers are now trying to become landlords, good luck. This is a little higher than normal.

But in terms of keeping prices higher, no, that’s the wrong conclusion.

Converting a vacant house for sale to a rental and filling it with a tenant takes one household out of one housing unit and puts it into a another housing unit, and so there is a new vacant housing unit on the market — maybe rental, maybe owned… I know someone who sold a house at the peak of the market because she saw this coming, and then moved into a rental.

In other words, converting a for sale home to a rental and filling it opens up a new vacant home somewhere else. For the overall market, there is no change.

What drove up home prices in part were vacant homes that were not on the market, that people had moved out of to move into the new home they’d bought, and they’d hoped to rise up the price spike all the way with both homes and then sell it. And now they can’t sell it , so they’re trying to rent it out.

The key part is that now the home won’t be vacant anymore, which takes pressure off the housing market.

I love the delusion of riches by renting out your old home rather than selling it. A renter treats the place like trash, and the next actual buyer can see it from the moment they walk in the door. Result, lower offered prices or a big restoration bill to get the residence up to par. Some portion of what you thought you gained from the rents are lost at re-sale.

economicminor wrote: “Owners to renters? That can happen until this inflationary environment leads to earnings compression which leads to job losses. ”

I have seen, as many owners join the elderly, that the property can deteriorate fast. Lawns don’t get cut, trees take root in the roof gutters, bushes (and trees)start growing up into the eves, etc etc.

One reason I had for selling was to prevent this. I wanted to get out before I was too old for basic maintenance. I am happy to be a renter. Landlord takes care of the grunt work, all I need to do is worry about the inside.

I would say the numbers I used are fairly conservative in terms of a return, which brings me back to my main question. In this inflationary environment, where do you safely put your equity when you sell if they aren’t selling to buy a new house. Netting 7-12% yield with the added potential upside of valuation increase(as unlikely as that might be) is not a bad deal. Putting it in the stock market gets you the same risk as a housing market crash. Bond yields are currently to low to compete and with rising fed fund rate, face value is going to get crushed.

And I would also argue that converting a for sale into a rental isn’t a zero sum. People moving from an apartment to a single family rental for example are taking a housing unit that could be owner occupied and renting it; while removing it as a for sale housing unit and lowering the current supply of for sale units.

I’m not disagreeing that housing is overvalued at this point; but everything is overvalued. Assuming this is peak for housing prices, selling at the peak and sitting on cash/treasuries might net you the same as collecting rent and selling at the 10–20% reduced price in 2-3 years. If treasury rates continue to rise, I think this equation changes for alot of folks

In a deflationary environment, cash is king.

Or cash equivalents like gold.

People tend to envision the future the same as the current past. Just project it forward.

We have inflation now so many (most) see inflation in the future but history says that inflation will lead to deflation. Just like in Minsky’s Equilibrium Theory nature abhors imbalances and will eventually re balance.

When you have high inflation, then you get deflation. We did in 2000 and again in 2008.. The lastest hyper parabolic rise in asset values will become a deep dive into deflation before this is over.

You’ve hit on the age old question: How to preserve your wealth and buying power in old age. The only answer I have is to do so carefully. Educate yourself on the options, and undergo a process of self discovery: what risk are you really trying to mitigate and what are your hopes and dreams? In the end though, you must come to peace with the reality that ‘no man is an island’, and not all risks can be hedged away.

Unfortunately, I still get many unsolicited “offer on your property” calls per property I own in a ‘hot’ southeast housing market every day so there is still a lot of investor money out there trying to get into the housing market.

Note that while these calls are robodialed, live people handle them. At this point, the FCC’s attempts at reducing spam robocalls appear to have started working as I do seem to get a lot fewer ‘expired auto warranty’ and other sundry scam calls nowadays. Unfortunately, the reduction in volume of these calls has been more than made up for by these annoying “I want to make an offer on your property” calls.

As for the property market itself… there does seem to be a bit more inventory on the market and prices appear to have finally stopped rising. We’ll have to see if the west coast price cuts make it over here to the East. So far these have been relatively rare but as we enter the fall season hopefully there will be more of them coming.

I get these robocalls too, and I don’t even own a house!:(

I don’t even answer my phone anymore if I don’t recognize the caller’s number. I figure if it’s important they will leave a message. I bought a new phone last summer (el cheapo Samsung). And it does something that my old Motorola didn’t do, it will say “spam likely” for numbers that it thinks are spam. I don’t know if all newer android phones do this, but it works really good. Its a Samsung Galaxy A12. Android version 11.

On Apple phones, just turn on “silence unknown callers”. Only numbers in your contact list will ring, others can leave a message. This is the only way to own a cell phone in the 21st century. Serenity.

So it would seem we’ve still got a long, long way to go, I know

About 18 years, so whatever you planned to do with your life, sooner would be better than later. There’s no time but the present because most of the future has been used up to pay for the past.

And some would call your time estimate very optimistic.