“Temporary” inflation is suddenly runaway inflation. But the negative-interest rate idiocy and QE are finally over.

By Wolf Richter for WOLF STREET.

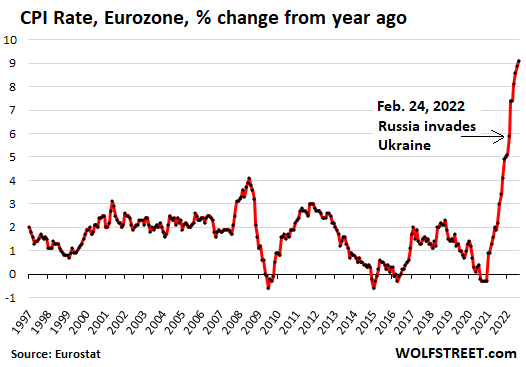

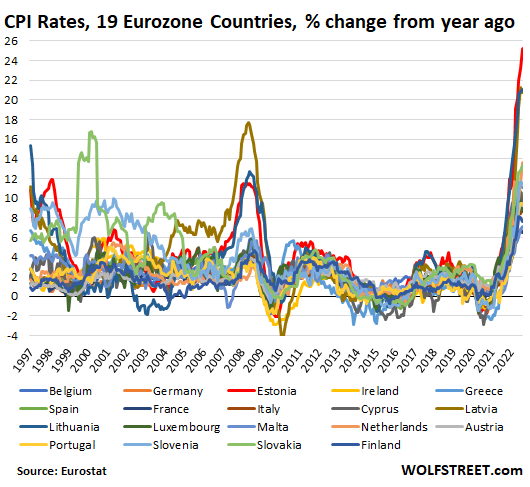

Inflation in the Eurozone jumped to 9.1% in August, a new record in the Eurozone data going back to 1997, according to preliminary data released today by Eurostat. It topped out at 25.2% in Estonia. Germany hit at a record 8.8%.

This spike of inflation started suddenly in early 2021, after years of ECB money-printing that turned into a mania during the pandemic, and after years of the ECB’s negative-interest rate idiocy. For years, it seemed the ECB would get away with these policies without creating runaway inflation, and then suddenly in early 2021, the dam broke, and inflation washed over the land.

By July 2021, Eurozone inflation shot past the ECB’s inflation target of 2%. By August 2021, the inflation rate hit 3.0%, and shooting higher.

At the time, the ECB regurgitated the Fed’s line that this inflation was just temporary, and it unhesitatingly continued with its negative-interest rate idiocy and printed money with reckless abandon.

Energy prices had already started surging in January 2021. From early January 2021 through December 2021, crude oil prices jumped by over 50%. That was a huge price gain.

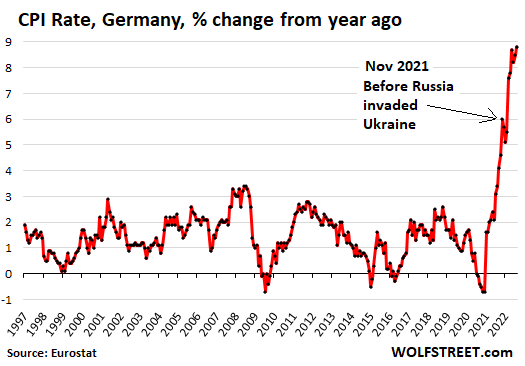

By January 2022, just before Russia’s invasion of Ukraine, the Eurozone inflation rate had shot to 5.1%. In Germany, it also shot to 5.1%, in Belgium to 8.5%. Two Baltic states were already in the double-digits. Inflation had become a global problem, after years of global money printing and interest rate repression.

The majority of the 9.1% spike in inflation occurred before Russia invaded Ukraine. This was then made worse going forward by the energy price spikes, including natural gas, brought about by Russia’s invasion of Ukraine and by the sanctions in reaction to that war.

Russia’s invasion of Ukraine also tore into supply chains that originated in Ukraine, including Ukraine’s exports of iron, steel, cereals, animal feeds, electrical equipment, automotive components, etc.

For example, European automakers relied on wiring harnesses manufactured in Ukraine. But when Russia invaded, production shut down. Suddenly there was a wiring harness shortage that caused further production delays by European automakers, contributing further to the shortages of new vehicles and to price increases of new vehicles, and particularly to price increases of used vehicles, as the shortage of new vehicles increased demand for used vehicles.

And inflation has continued to surge with price increases spreading across the economy.

Governments applied different strategies to more or less artificially push down the inflation rate. And this has kept the CPI lower (at 9.1%) than it would have been without those measures.

For example, in Germany, the government cut fuel taxes and in June began a program of a €9-per-month transportation pass as part of its Energy Cost Relief Packaged that allowed people unlimited travel on rail systems, buses, and trams across the country, which came in handy during the summer travel season, but also for commuting. That program, which contributed to a dip in CPI in June and July, ends today. September CPI will have to make do without it.

Germany’s CPI hit 6.0% in November 2021, well before Russia invaded Ukraine:

Runaway inflation, by Eurozone Country:

| CPI, August 2022 | |

| Estonia | 25.2% |

| Lithuania | 21.1% |

| Latvia | 20.8% |

| Netherlands | 13.6% |

| Slovakia | 13.3% |

| Slovenia | 11.5% |

| Greece | 11.1% |

| Belgium | 10.5% |

| Spain | 10.3% |

| Cyprus | 9.6% |

| Portugal | 9.4% |

| Austria | 9.2% |

| Italy | 9.0% |

| Ireland | 8.9% |

| Germany | 8.8% |

| Luxembourg | 8.6% |

| Finland | 7.6% |

| Malta | 7.1% |

| France | 6.5% |

Even the ECB sees it’s presiding over an inflation freak-show.

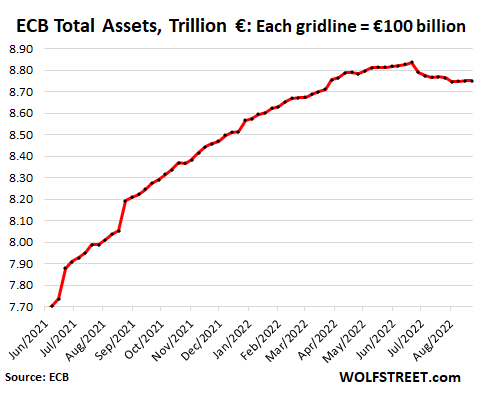

The ECB was ridiculously reckless in its QE and negative-interest-rate policies. But both have now ended.

QE ended in June when its balance sheet topped out at €8.84 trillion in total assets. By its most recent balance sheet, as of August 26, total assets at €8.75 trillion, were down by €86 billion from the peak:

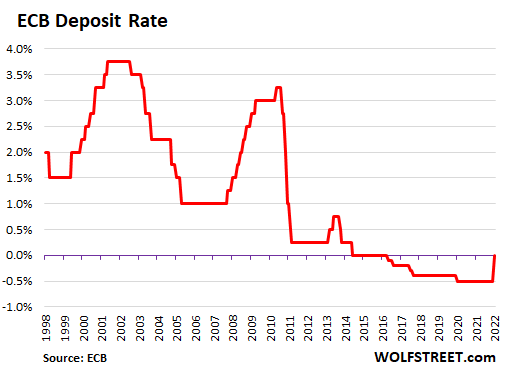

And the negative-interest rate idiocy ended on July 21, when the ECB hiked its policy rate by 50 basis points from -0.5% to 0.0%.

And yes, it sounds just as ridiculous as it is that a central bank finally raises its policy rate to 0% to deal with 9.1% inflation. It’s a horribly bad joke gone awry.

But the rate hike marked the end of the absurd and destructive experiment of negative interest rates. And more rate hikes are to come, starting in September possibly with a 75-basis-point hike. Even the ECB understands somewhere at some distant vague level that runaway inflation is a massive problem for an economy and the people and businesses in it.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Now that they’ve dug a hole that is looking more and more like a grave, they can’t even go back and ask old Keynes what to do. He’s dead.

All their massive money infusions have been eaten up by there even more idiotic Green agendas and of course, taxes.

Seems they overspent and now because of their mal investments, the populations have no money to spend other than for fuel, food and energy. And again thanks to their wayward polices, those are headed to the moon and higher.

This is a giant three ring circus now on fire, with the clowns running around in panic tossing buckets of confetti on the flames.

Europe today, is the dark hole that makes US look bright!

I bet the governments in Baltic states with >20%+ official inflation are struggling and will not survive the winter (think gas).

This huge corruption now has a date with Karma.

Baltics stopped buying russian gas years ago.

They have LNG terminals.

Not shure if Gemany, that depends on russia, is going to have better winter.

There was a f-up with market liberalization in Lithuania, but our electricity prices jumped because ze germans are buying all the electricity from nordpool (probs subsidized by german budget) so yeah, thanks, putlerverstehers, for all the sh*t – Baltics and poland told you repeatedly that exactly this would happen (sorry maga yankees, that was not orange man’s idea), but all those warnings were dismissed by shroedingers merkels and stolzes as rusofobish warmongerings. Go figures

For Germany it depends on how much of Nordstream 1 is available.

They need at least 40% of the pipes capacity in use with their current reserves to keep up with the expected winter requirements.

Currently 20% of capacity is in use which basically requires a reduction of 20% of the total energy use of Germany

If the Russians are really spiteful, and not afraid to burn the last few bridges with the EU, and stop pumping gas that will result in an impossible need for a 40% reduction of energy use just in Germany.

Keep in mind that this already factors in that some of the most energy intensive industries have stopped due to idling being cheaper then buying gas/electricity. Gas, Title Transfer Facility contracts, running at ~15x compared to a year ago. Electricity (for Germany) last week broke the €1000,-/megawatt-hour barrier for the year contracts for 2023 or about a 25x increase compared to last year. It was still rising and only dropped to about ~€500,- after the EU announced it was considering plans to suppress the electricity prices in the entire block.

And to complete the depressing news. Basically anything that converts electricity into heat, at the consumer/household level, is permanently sold out in Germany or has a year plus lead time for installation. A few experts have pointed out that the additional electrical heating will result in high stress on the current electrical grid, high enough that there is a serious risk it will trigger blackouts.

So yeah this is going to one nasty winter and not just for Germany, the north and east regions of the EU will have similar problems. About the only ones that won’t suffer badly are Spain & Italy and the countries that are supplied with North African gas through Spain & Italy. But even those will end up paying more.

Since the rational choice is not the one that is going to be made (that would have required propaganda starting about 3 months ago to make it not look like a capitulation to Russia) the only thing that the EU can hope for is a very mild winter, even milder then the 2021-2022 one.

A not so minor update.

The G7 have gone ahead and decided to enforce a maximum price on Russian oil. Including a ban on ship insurance for any ship suspected to carry Russian oil over this price cap, which thanks to LLoyds being headquartered in the UK will basically mean no more insurance (note there are other options but those are limited) since Russia is not going to sell for less just because the G7 demands it , no more insurance means no more shipping of Russian oil.

In retaliation the Russians shutdown Nordstream 1.

Oh and as is proper this is causing a rise in oil prices due to speculation and uncertainty. So Russia gets more profit, at least for a while, while the consumers in the west (well most of the world) pay for this attempt to hurt Russia.

When Russia shuts down natural gas pipeline exports to Europe, it’s not going to get any money for this natural gas because it cannot re-route the pipelines and production to China, and it cannot turn it into LNG and ship it. It will take many years to build the infrastructure for this natural gas to find other customers.

“they can’t even go back and ask old Keynes what to do”

Far better Minsky than Keynes.

“This is a giant three ring circus now on fire, with the clowns running around in panic tossing buckets of confetti on the flames.”

Perfect expression of the past two years in one sentence. You sir win best internet comment for the day.

I always use that line to describe Wall Street. Pigshit ponzi fraud three ring circus sideshow. Better known as Fraud Street.

I hope all do not think I am EU or UK bashing. Not at all. But I fear that the EU and UK are just previews of what is coming for the US as the US Administration pursues the same blind destruction of its energy resources, in favor of Green energy, notoriously unreliable and inadequate. US still world’s largest consumer of goods, (I think) and when it experiences these same things as the EU and UK are experiencing now, the “consumin American” is also beginning to stop “shopping” in order to pay his/her fuel, food, and tax bills same as EU and UK folks are. I honestly hope I am full of pschitt on all this and things will improve sooner than later. But reports of such things as the Irish coffee shop’s 9,800 pound electric bill for 73 days of service, keep showing up. God help us, one and all.

“But reports of such things as the Irish coffee shop’s 9,800 pound electric bill for 73 days of service, keep showing up.”

Saw the same thing yesterday but something about the image struck me funny: Did you notice the part where it said last months bill and that was blank? Made me think it was fake. And if prices are that high generally, wouldn’t the really big places that use tons of electricity in a month be screaming bloody murder?

Euros 9800 electric bill for 73 days

Be real – that is BS.

Euros 9800/73 days = 134 Euros per day / 3 Euros a cup of coffee = 45 cups of coffee sold to pay the electric before staff wages!

Totally not viable and it would make sense to shut the door.

It is still summer so the energy cost would go up when they heat the shop up.

These are fossil fuels that are going to run out one day – and are big contributors to Climate Change. I’m not saying cut them out completely but it makes sense for governments and businesses to invest in R and D and start bringing Green Energy into the grid.

Not so. The “clowns” are getting richer and more powerful in government, business and banking while you are getting poorer. Who’s really the fool – the clowns getting richer or the poor fools voting for them.

Joe2, I grant you that point sir, well said.

Debt centric financial systems create inflation. They create the ‘boom and bust’ cycles because commerce cannot keep up with compound interest costs. Supply disruptions aggravate the inflation embedded in debt centric systems. Supply collapses can cause inflation all by themselves. The ‘money printing’ makes matters worse. But the underlying weakness of debt centic finances is, at day’s end, the cause.

I am only an observer of the passing parade and Mr House may have a point about the energy invoice represented in the recent article on one Irish shop’s energy costs, however, there are many such reports of energy costs rising in the hundreds of percent year over year. We can question the one Irish gal’s shop, but the rest remain.

I don’t think any “business ship” can resist the rising tide of these inflationary costs. I guess that is also why there is such concern for the producer price index that continues to swell, it will flow into the consumer price index with little of it absorbed by producers. Not sure how well newer “earnings” reports are doing, but to keep “earnings” at investable levels, they cannot absorb much inflated input costs.

Help! I’ve gotta stop now, I’m in way over my head here!!

Hi wolf – doing some research I see that at least in the US the fed has rates, qe/qt, and bank reserve requirements all being levers they can pull to handle inflation. I never hear you mention reserve requirements for banks as a tool the fed is using. Is it just because Qe and qt are used instead?

VT,

You’re joking, right?

The system is AWASH in reserves. At the Fed, there are $3.3 trillion in reserves. There is way too much liquidity. There are also $2.2 trillion in reverse repos (RRPs) on the Fed’s balance sheet, which is where Treasury money-markets park their excess cash. Combined $5.5 trillion.

Central banks have created so much liquidity that no one knows what to do with it.

And you think that the quaint old notion of 10% reserve requirements or whatever would do anything? Do the math. There are $18 trillion in bank deposits. If there were a 10% reserve requirement, it would only be $1.8 trillion in reserves. But there are already $3.3 trillion in reserves now at the Fed, nearly double what a 10% requirement would require. And that’s still only part of it… what about the $2.2 trillion in RRPs?

Good lordy, these are the modern times of money printing.

What the Fed needs to do, and is starting to do, is withdrawing this liquidity properly through QT.

The same goes for other central banks, including the ECB.

***THIS*** is why I read the comments. Thanks for that info.

But I was told all you need is some batteries and solar panels.

The reason all this $5.5 trillion cash is parked is because there is no productive investment for it that is profitable in real sense (after deducting real inflation).

No new investments leads to reduced production of goods and services that leads to high inflation.

It would be higher if we were not increasing our imports. We initially outsourced for cheaper production. Now, I doubt we can even revert it given our labor productivity.

Someone has to hold it, all the time. It only changes ownership. This will only change if the monetary policy which created it is reversed.

Someone has to hold it, all the time. It only changes ownership. The only way this change sis if the monetary policy which created it is reversed.

US trade deficit breaks records, but dollar index is 20 year high.

Do not expect production in US to grow when dollar is so expesive.

I am afraid that US real sector is hostage of global financial system, that requires more and more dollars to function.

One of the problems you guys have is all the litigation and regulations, only big boys with deep pockets can produce anything, because you can get hit with iron pan in the face with some really nonsensical “intellectual property violation” lawsuit from any direction. That means the leanest, most competitive and most flexible form of production – small businesses – are f-ed even before they try something

Yes. Anecdotal but I was looking for some stainless cable fittings and wanted to buy US made. The US price was about $50 each. I bought Chinese fittings on Amazon for $10 each. They are fine. I have had similar experience with other tech material products such as carbon fiber and the price differential is about the same. Some things like cutting and grinding bits are worth the extra cost for US.

Given the US education system, I doubt the US can return to competition. It seems most of the technical talent is now imported also.

Water and food seem like good investments at the moment. Not sure about the best way to invest in them, though.

All over Europe goverments are handing out support for consumers to pay their electric bills.

This, I reckon, will just increase inflation.

A guess, Latvia, Lithuania and Estonia is on the way to get the same cost and price level as Sweden and Finland. The baltic states used to be low cost cheap places, now they are going to be adjusted to be more close to the EU mean.

The FED could mandate full reserve banking and set the interest on the reserves to zero. Or any other reserve requirement they fancy. Liquidity would then disapear in a blink.

Probably with both foreseen and unforeseen consequenses. ;)

Sams,

Wait a minute. You don’t know what you’re wishing for: “set the interest on the reserves to zero” THAT would cause $3.3 trillion to instantly leave the Fed and chase after other financial assets and cause even bigger spikes in asset prices and it would cause yields to plunge. That’s why the Fed is paying interest on reserves and RRPs, to keep this excess liquidity in-house and from blowing up everything.

Paying interest on reserves is the only way to keep interest in the target range, otherwise it might go lower, banks have too much liquidity, interests easily can go lower.

If interest lower then asset prices higher.

FED has to find funds to pay the interest on reserves, most probably funds come from interest on treasuries/mbs that FED holds.

If so then the interest on reserves is approximately limited by overall interest on treasuries?

Considering current inflation ~8% and rate that FED pays for reserves ~2.4%, most probably real economy has negative grows.

I did write that the FED could mandate full reserve banking or any other reserve requirement they fancy. Ok, that if they have the power to do so.

If a certain reserve is mandated, that it is a legal requirement the bank get. You say there are today $3.3 trillion in reserves and $2.2 trillion in reverse repos (RRPs), a total of $5.5 trillion on the Fed’s balance sheet.

If the FED said that tomorrow the banks where required to hold a total amount of more than $5.5 trillion the banks would have to comply to continue to operate. If the FED did choose to pay no interest that would be bad for the banks, but if the FED have or can get the power to force the banks to hold this reserve it does not matter.

In essence forcing banks (and other financial institutions) to hold high reserves at the central bank is equal to immediate QT. The money gets parked on the side-line.

Probably with both foreseen and unforeseen consequenses.😉

Sams-

In addition to what Wolf said, you have to realize modern finance has moved way beyond the notion of banks holding on to debt. It’s not that simple. So reserves don’t constrain lending as much as they used to.

The vast majority of debt is securitized and sold to others, with various amounts of leverage built-in that is not covered by any notion of “reserves”. Indeed, 90% of “innovation” in finance is ways to get around regulations (often crossing the line into outright fraud). Trust me, they have ways of getting around Fed reserve requirements.

So your concept of eliminating fractional reserve lending might affect little guys who still get small loans from their local bank. But it will do nothing to the big guys have a million other ways of borrowing. Even housing prices won’t be affected much: the vast majority of mortgages are sold to Fannie Mae/Freddie Mac and then securitized and sold on to other investors. The bank that originated your loan is simply a servicer, and doesn’t need to hold any reserves against it at all.

Yes, that securitizing do let the bank of the hook. If the requirement to hold reserves follow the loan the investors holding the securized loan is on the hook.

Or the bank originating the loans can be keept on the hook as the first underwriter. There must be a record of the loans a bank have originated.

If suddenly applied, both options would stress the financial system.

No jokes here, just an honest question likely worded poorly since I don’t understand this all yet.

I was wondering specifically about deposit requirements for banks and your answer clears it up, so thank you.

Few people realize the enormity of a trillion dollars (especially the Fed and the congressional spenders) Here are numbers in perspective:

one trillion seconds = 31,710 years

one trillion dollar bills end to end =96,906,656 miles >earth to moon

one trillion $100 bills stacked up= 631 miles high

Fed and congress could care less about the multiple trillions spent and in reserves.

Next stop for Fed reserves and Congress spending=quadrillions

One quadrillion seconds = 31.688 million years

quadrillion miles = 170.1078 light years

(light year=distance light travels in one year)

What me worry?

96,000,000 miles is distance from Earth to Sun, about 400 times Earth to Moon (which is a mere 240,000 miles, or about 2.5 billion one dollar bills end-to-end if those figure is correct above).

It’s just one more zero appended at the end.

There is a detailed proposal, a complete set of investment rules, for both the FED and the ECB, indeed any such banking institution . . . to use up to 2.4 trillion to create millions of new start-up small businesses, fully capitalised up to 8 or 10 employees; that has been in front of each institution for some years now. Gosh! even Mr Richter knows about it, though he never did acknowledge reading it.

So why not try some new thinking?

Government directing the private sector and choosing winners (whoever is fully capitalized since the “investment rules” will no doubt be gamed to favor pet projects) is not new thinking. In fact, it is very old thinking. There’s also no reason to think it will work any better this time.

Chris Coles FRSA,

Are you nuts to think that I, sworn enemy of QE because of the destructive impact it has, will promote QE, which is what this is? Whether a central bank prints money to buy debt or prints money to hand out directly is the same thing: printing money, and that’s a terrible thing.

Wolf, I agree the Fed needs to really start pulling back this liquidity. What do you think would be the impact of doing that? Would long term interest rates skyrocket much more dramatically?

I am of the camp that the Fed has done very little to suppress inflation, yet inflation measures are already starting to stabilize. There are a few areas – cars for example, where it is still a matter of supply and demand imbalance that will be resolved in the coming six months.

I personally think that as home values plummet back down to 2020 levels and then start to head well below those levels, people will stop feeling rich and the economy will really stall and that will kill any additional inflation. Do you think that home values have a strong inflationary bias for other purchases?

So if specific categories like cars and energy are at the end of their inflationary cycle, do you think service inflation will continue to rise without goods inflation?

I have said before that I think the real story is that the Fed will start QT and inflation will drop pretty fast as the economy really slows and the Fed will get nowhere near to eliminating all that excess liquidity before things turn ugly in the economy.m I guess I am saying the debt is now structural and unless we are willing to go through a massive depression to reduce it, it isnt going away.

When I say start QT, I mean really start selling off larger amounts.

“money printing” never reached the broader population but inflation sure did. Good talk.

The Fed has other levers as well, including the “macro prudential” regulatory powers. The Fed could enforce a significant tightening of lending standards (not just reserves) if they so chose. But that takes real detail-work, and getting deep into the banksters’ business, and creates a lot of friction…

On the other hand, maybe the Fed should’ve pushed for better lending standards already. There are tons of companies dependent on leveraged loans (floating rate debt) – they’re gonna be hurting as those rates rise.

The next booms will be in “Going concern” warnings, followed closely by bankruptcy attorneys’ fees…

The FRB is not the sole banking regulator in the US.

As you indirectly stated, the FOMC is not performing banking supervision. There is a vice chair on the FOMC, but that doesn’t mean that the staff actually performing bank examinations will necessarily consistently enforce any internal policy “directive” toward tighter lending standards.

After 2008, it happened due to the numerous bank failures and the “blowback” from the bank bailouts, but there is no sign of that, yet. I wouldn’t count on this happening again until something similar happens.

More importantly, the Federal Reserve Board Regulation T sets margin requirements. Why hasn’t the Fed substantially raised margin requirements to reduce leverage throughout the system? If you want to reverse the wealth effect, that’s a simple knob to control it.

The other problem Europe has is that the only thing as inflationary as money printing is skyrocketing energy prices.

Money printing is like stacking dry kindling on a forest floor.

Energy inflation is one of many things that can set that kindling off.

Food prices in Germany up 16% YoY.

Just wait until they can’t cook food this winter ,it will change everything,cold and hungry people do awful things

I assume he was being sarcastic. Otherwise, the claim is ridiculous.

Wolf, can the ECB fix the energy crisis with inflation rates?

I don’t think so.

Your monomania couldn’t be more wrong here.

Hang it up.

I think you were asking whether a central bank, by raising interest rates, can help to fix inflation driven by supply shortfalls.

On the surface, no. Not directly, and not in the short term. But when you take a closer look and a longer-term perspective, then absolutely yes. An economy reflects the behavior of many individuals, and interest rates affect that behavior, just as prices do.

The single most valuable benefit of higher interest rates may be in capping the print-and-spend and borrow-and-spend proclivities of government policymakers. Austerity is coming, and will lead to more pragmatic policy priorities.

re “But when you take a closer look and a longer-term perspective, then absolutely yes. An economy reflects the behavior of many individuals, and interest rates affect that behavior, just as prices do”

that is just another way of saying that the Fed must induce deep demand destruction (thus deep recession) to counter a deep shortage of supply.

as such, look out below… you all should join Wolf in shorting this bear market rally.

Why has Lagarde not been relieved of her duties? This woman has absolutely destroyed the standard of living of the masses.

The road to heck is paved with “compassionate” intentions.

Lagarde was useless or corrupt in the her previous jobs too. A leopard doesn’t change it’s spots.

Don’t confuse Lagarde as being part of the brain trust. She’s merely a muppet that makes sounds when the hand up her kiester moves.

That is a very good question. Does anyone know of any high ranking EU bureacrat that was declared incompetent and relieved of duty ? If none was, perhaps this is the reason why these EU bureacrats do all thing of insane things – they know that they will not face any consequences.

you could ask the same question at any government run department anywhere across the world. The worst that would happen in the uk no matter what you do is that you would get 3 months fully paid gardening leave.

Blaming the government is the lazy man’s excuse for thinking.

Perpetual Perp,

Nice thought stopper, but you failed to address the point. Do you think governments are effective at removing incompetent bureaucrats?

Surprisingly, there seems to be one member of the ECB Board that “gets it”:

“Both the potential and costs of the current high inflation are, overestimated, uncomfortably high,” Schnabel said. “In this environment, central banks need to act coercively. They have to bow down with determination against the risk of people starting to doubt the long-term stability of our fiat currencies.”

Isabell Schnabel at Jackson Hole.

I wonder where people will turn once the doubt of the long-term stability of our fiat currencies sets in.

It is much more awkward.

And consequently continue to be President of the ECB. You could not make it up. No relevant CV politics only.

Same reason why Greenspan was never fired. They don’t serve the masses. As long as the bankers are happy with them, they can stay till they die in office.

To ask is to answer.

“Even the ECB understands somewhere at some distant vague level that runaway inflation is a massive problem for an economy and the people and businesses in it.”

I’m sure they finally do “get it”. Problem is their number one mission is to preserve and support the eurozone and “European Project”.

The ECB is going to throw the public, economy, and markets “under the bus” to preserve the Eurozone and “European Project.”. This is independent of the problem where the EU accommodates US foreign policy objectives contrary to local interests.

It’s always up to the little people to “sacrifice” for the supposed greater good – the war machine. Notice how pols start saying things such as “it’s a sacrifice we all need to make.” They always fail to mention that they are so wealthy that inflation isn’t even making a dent in their own standard of living, but if you can’t afford food and heat in the winter….well….tough shit.

Maybe some second thoughts are circulating right about now. But signing everyone into the front end was easy. I’m just glad to be an ocean away in a place that has domestic hydrocarbons.

In today’s interconnected world, I don’t think oceans matter as much as they once did.

Right, but…

Don’t Pay in UK…

“We are a movement against the rise in energy bills

We demand a reduction in energy bills to an affordable level.

We will cancel our direct debits from Oct 1, if we are ignored.

We will take this action if pledges reach 1 million by then.”

After these massive blunders, perhaps it’s more likely the public and legislators will throw the ECB under the bus.

We in USA were fortunate we got this governance and union, such as it is, pulled together in a different time. The ECB was a wonderful idea with clouds of high hopium but the implementation is looking pretty ragged.

Only if other countries follow Britain’s lead with Brexit. Not aware there is any broad movement anywhere else to do that.

Is this sarcasm?

Sorry AF, missed the context of your response.

Europe, as a single entity, would only work if all the States would give up their sovereignty, and that was never going to happen. The single currency may have worked again provided they enforced the rules they set forth to insure equality of economies, which again, has never, and will never, work.

Ego, tradition, and all the old, never to be forgotten, “injustices”, along with an inability to develop a common language (God forbid we use one that’s not ours!) will doom the idea of a European “nation” forever.

You know why AI & the machines will win? They all use the same language.

Energy crisis no cant be fixed with inflation rates. But ECB and negative interest rates need to be adjusted above the rate of inflation. Which in this case is probably 12 percent or so.

Energy crisis can be fixed by investing directly in the EU oil and gas companies and providing incentives for new exploration. Increase supply coal and oil can be increased quicker than NG> Just import some oil generation capacity.

Restarting those shut nuclear power stations would help I think.

Maybe there is no direct link, but France has the lowest inflation on the list and domestic nuclear energy contributes near 70% of its energy needs.

France is very aggressive in using subsides to reduce consumer price inflation, which is not that hard to do because the state controls the main electric and gas utilities, and much of the healthcare system, and other biggies, and the state can subsidize prices.

France’s nuclear energy and the French ignorance about the actual state of their nuclear fleet is a big part of the problem.

Their plants are all from the 1980’s, they are now aging out and getting near the end of their design life so expected problems like cracks and unobtainable components are showing up. It seems that nobody expected nor planned.

This has caused France to turn from massive exporter of electricity over the past 20+ years to importer this year.

The replacement is a modern 1980’s design, the EPR reactor, which EDF is building at the Flamanville Nuclear Power Plant, panned to be in full operation in 2012.

That project is not going well.

They are now 10 years behind schedule, they have a cost overrun of 15 billion EUR so far, and the estimated cost to completion is 19 billion EUR.

This happened because of numerous design problems and flaws in materials were being discovered during construction and had to be rectified as change orders, always a contractors Bonanza Game. Maybe that plant will be online in 2023, if nothing else happens.

Apart from that specific project being a mess, investors must now have developed some grave doubts about whether all of the necessary design-, materials- and manufacturing- skills to build these plants to the required quality are in fact available in “The Market” and whether the expected lifetime actually holds up in practice.

I think the outcome is that nothing “nuclear” will be funded and built in the future unless backed by the most generous and unbreakable of government guarantees. Taxpayers are on the hook again.

fajensen,

Just look at the nuclear boondoggle in Georgia, USA. Seems like they operate using the same playbook. Years behind schedule. Re-wiring the entire buildings due to contractor error. Price over-runs and costs being pushed to tax payers

During the construction of Vogtle’s first two units, capital investment required jumped from an estimated $660 million to $8.87 billion

The question arises, with a lot of liquidity sloshing around, why have there not been large investments in oil, gas and coal production?

There have been no shortage of money for investment, but noth that much have been invested in the energy sector. Why?

Sams…. the oil and gas industries have been punished financially for years. Now they are having a bonanza, and their shareholders are saying “Pay us!”. And the oil and gas companies are starting to do share buybacks, rather than invest in new infrustructure. What would you do if the world kept saying “No more oil and gas” I also may hesitate in capital expenditures

“But the negative-interest rate idiocy and QE are finally over.”

Too late. The damage is done, and now the high-powered financial extraction can take over.

“The issue which has swept down the centuries and which will have to be fought sooner or later is the people versus the banks.”

– John Emerich Edward Dalberg-Acton, 1st Baron Acton

That fight is over. Guess who won?

I’ve been telling people that we already had a class war and the rich won. All that’s left now are the mopping up operations where the rich take every last crumb. Life doesn’t “pencil out” anymore for the working class. Now the hedge funds are putting together massive capital reserves to buy up all the housing and corner the entire property market.

“You will own nothing and be happy.”

~A Certain Revolting Individual

The rich has indeed already won. Let’s see if the federal reserve can at least have the moral backbone to bring down inflation as their saving grace for the middle class and low-income workers.

Lol! Powell was shaking like a leaf delivering his sensible Jackson hole speech that should have been delivered six months ago. You can’t build out to a moral backbone if you are missing the base material.

That is probably why MMT will gain traction and be endorsed by the rich. The Hamptons do not have any defensible positions to stop the pitch fork carrying poor people.

You print money to make them happy….or should I say less miserable.

I’m not sure what sort of psychedelics you’re on, but MMT and money printing are what CAUSED the problems for the poor and middle class. You think that’s a solution? Good lord man….

Those “capital reserves” by which the wealthy exploit the rest of us are precisely what QT is targeting.

Drain the excess reserves, and there will be fewer crony-capitalists living high on the hog. Fewer vampire squids relentlessly sticking their blood funnels into anything that looks like money (to quote Taibbi). And honest work will be worth more in comparison.

The world needs QT, and lots of it, and faster than the current schedule.

If the system breaks here and there, that can be fixed, but the cancer and rot have to be squeezed out.

Agreed.

You guys, you understand.

Problem is that the crony-capitalists and vampire squids are the ones running the system. I mean, look back over the last several decades, and you’ll see that it really doesn’t matter which party is in power… Both have leaned hard toward spending without ways to pay for that spending. We had one faint blip near the turn of the millennium where we ran a barely balanced budget and the power brokers put an end to that pretty quickly.

They may play the QT game for a little while, but the minute that QT starts to threaten the supremacy of the crony-capitalists, they turn back to the money printer. If not the central banks, the politicians will distribute the sugar. They’re already doing it… As much as $500B is basically being handed out in the form of debt “cancellation,” sort of counter-acting at least the next few months of QT.

“Now the hedge funds are putting together massive capital reserves to buy up all the housing and corner the entire property market.”

Wage slavery and debt peonage weren’t enough, because nothing is ever enough, so now they’re going for rent slavery to make the US a collection of company towns. There’s serious talk about solving the ‘labour shortage’ by putting children back into the factories and getting rid of SS to get those lazy retirees off their pampered asses.

You might think there isn’t anything left but with the coming food shortages they can still gear up Soylent Green production for fun and profit, and now that just about everybody has enthusiastically bought into the telescreen thing you can be sure the slave classes will learn to love their chains.

What time is it on a bright cold day in April and all the clocks are striking thirteen?

At the risk of asking a dumb question, does any of this have an effect on exchange rates between USD and EUR? I know USD has strengthened against EUR lately, but it is difficult to unravel (at least for MY brain) all the potential causes.

If the ECB matches the Fed with rate hikes and QT, it will likely keep the euro from falling further against the USD. But the ECB is way behind.

This is my usual one note tune. For several decades now every energy decision for Europe has been based on one over riding reference, reduce carbon dioxide, ie. Fossil fuels. Sadly Europe will spend this winter in their homes in the coats, hats and gloves taking comfort that they have reduced their carbon footprint. Insanity on parade.

And every monetary decision based on the Euro ideology…

We will find out how much ruin there is in the countries of Europe.

Ervin,

No doubt, Europe is in for a rough winter and their energy policy was not prepared to lose their NG supply.

At the same time, the consequences of global economic growth on the back of unfettered fossil fuel extraction is undeniable and we are definitely overshooting the 1.5C target.

My understanding is there’s a multiple year lag to bringing new supply online. The industry is going to demand a return on investment meaning production some number of years additional.

I’m personally horrified at this retrenchment to the status quo in the face of deeply painful climate change. Since this is your one note tune, I’m curious how you reconcile this conflict in the long term.

Thanks

Most Americans still do not get “climate change”. As a result the US economy is still a global monster in its negative impacts on the planet.

Hopefully higher inflation and interest rates will slow the over consumption (are the storage lockers and garages full yet?).

What is needed are creative and productive ways to employ these excess funds that actually transform the economy/society into something more sustainable.

There is a ton of waste in the economy that is there because the market does not charge the full cost that destructive consumption can cause. (externalities)

When I can but something from China for 99 cents with free shipping, something is obviously wrong.

“At the same time, the consequences of global economic growth on the back of unfettered fossil fuel extraction is undeniable and we are definitely overshooting the 1.5C target.”

the issue is credibility. the ability of the people who set these targets to predict anything is questionable at best. they have been wrong about all of their predictions in the past and have an obvious political agenda in promoting targets.

the political instability caused by overly zealous green policies is causing real harm now not on some hypothetical timeline promoted by so called experts.

Yossarian… I agree 100%. The proclamation that we can not go above 1.5 degrees above the 1850s preindustrial global temperature was started in 2009 at the Copenhagen Accord – United Nations Framework Convention on Climate Change with stated mandate of not going above 2 degrees. In 2015 at the Paris Accord adjusted this goal to 1.5 degrees. This temperature target was taken from writers at the Blue Planet, an ecology foundation and adapted by the U.N.

…from climatechange.anewcanada.ca

“we are definitely overshooting the 1.5C target”

There’s already enough CO₂ and other GHGs to overshoot the 2 °C target. Reducing emissions by half by 2030, according to plan, therefore, wouldn’t save the 1.5 °C target. GHG emissions are still accelerating so these targets are just window dressing and wishful thinking.

IPCC projections are regularly exceeded because the models the IPCC uses are unrealistically and woefully conservative for a number of reasons. They don’t want to be dismissed as alarmist. The influence of the fossil fuel industry over IPCC projections is decisive. And they don’t want to discourage mitigation and salvage operations because that’s really all that’s left.

Heat waves, desertification, ocean acidification, ocean current changes, weather pattern changes, crop failures, wildlife die-offs, food shortages, glacier and ice sheet losses are already in play and are increasing. Major population displacements and mass human population die-offs come next. TPTB are aiming for population control through totalitarianism as a primary means of preserving their privileged status, motivating political extremism, but that is expected to fail. The Mad Max future will have a lot of air conditioning. The collapse of civilization has already begun but it will take a few years to advance the process. Ecological collapse comes a little later.

It’s not as if any of this is any secret. The US DoD published initial projections to these effects years ago in its assessments of future national security postures. Numerous assessments since then haven’t changed anything.

People don’t want to believe it, so they don’t. I myself don’t bother debating climate change deniers and fossil fuel flacks any more because it’s futile, although I do sometimes find it entertaining in a morbidly nostalgic sort of way. Otherwise I’m unamused.

I’ll leave you to it.

Move to Duluth, Traverse City, or maybe even Canada. That will buy you some time for a while.

This is all conjecture, unsupported by theory or observations.

Dwayne

I guess my reference is that not one of the predictions over the last 30 years has occurred. Polar bears are fine, no island nations has disappeared, the world grains output has steadily increased, no Arctic ice free summers, hurricanes have not increased in size and frequency, the Great Barrier Reef is as healthy as before. Trillions of dollars spent on “renewable energy” has resulted in sky high electric cost where ever it happened. And lastly, since carbon dioxide makes up just 0.04% of the gasses in the atmosphere, it seems to me that if it increases to 0.05% the world will not end. That 0.04% makes life on this plant possible.

It’s amazing that almost every statement in your comment is false. Polar bears are disappearing, island nations are disappearing (google Kiribati), hurricanes are increasing in force and severity, the Great Barrier Reef has lost half its coral, Arctic Ocean ice free areas are steadily increasing. I thought it was sarcasm but I guess it’s willful ignorance?

Sinners in the hands of an angry Gaia

Ervin,

Cite your sources. From what I read – and I read widely – almost everything you claim is wrong.

I think the self-inflicted sanctions might have something to do with the energy shortages of fossil fuels in Europe this winter.

“For example, European automakers relied on wiring harnesses manufactured in Ukraine. But when Russia invaded, production shot down.”

I remember that till the ’70s or so French auto maker Peugeot made every part for their cars in-house. Even the knobs on the dash. With production of key parts for every manufacturer now farmed out all over the globe, we’re probably going to see more parts insecurity.

How many key components for example come from China?

Ford did the same at the Dearborn, MI plant. Made everything.

Then came the Treaty of Detroit, saddling car firms (and not just in autos; it set a national standard) with lavish packages for workers, that ultimately turned those companies into giant underfunded pension funds with car companies attached. Those were the (ultimately unsustainable) middle class “good old days,” also underwritten with cheap imported oil. By the time the late 70s came along, the morale and laziness was so bad, the products were awful. Hence, financialization.

I worked in manufacturing in Detroit in the 1970’s. It wasn’t nearly as bad as you make it sound. But it really went to hell in the 1980’s.

Bologna. You get lousy workers with longstanding policies of worker repression, like wage theft, slavery, beatings, and open warfare.

Other countries don’t have problems with lousy workers because they cultivate their workers and no longer abuse them, whereas in the US they’re treated like disposable commodities. Other countries gave up slavery relatively peacefully but in the US that required its bloodiest war and the country has never gotten over it.

US corporations like to whine about the cost of labour but auto workers in Japan and Germany are better-paid and have government benefits besides.

All such problems are ultimately management problems. Managers are in control, not workers. Crap management practices should make this obvious to just about anybody.

Blaming the victim is dishonest. Have you no shame?

Perhaps the ECB wants hyper inflation.

Devalue its enormous debts.

Germany went for decades seriously holding the line. This will be an interesting phase to watch.

I need a data scientist to tell me whether high inflation leads to a recession.

If consumers are paying more for basic needs, and the basic needs are either owned by the government or the select few, doesn’t that stagnate the economy?

I can’t buy a new computer if I have to pay the grocery store conglomerate in Toronto my entire weekly paycheque for a month’s supply of groceries.

Then one and a half week, sometimes two weeks goes to pay rent. Some Canadians pay as much as 60% of their salary towards rent.

Wait when hydro rates skyrocket.

Maybe we’ve been doing that for awhile: getting more and more freshly printed money to hand over to oligopolies. Without true, independent capital formation, that would keep us in our place! And the rocket scientists can fine-tune how much consumption tickets appear in our inboxes. It’s a Brave New World.

What is the purpose of life just to work and hand over your money to the elites who own all of the basic needs like food and shelter?

I hope America still has free markets and no restriction on what can and cannot be grown for food or how to live. If not, then that is not freedom.

The EU, despite its flaws in monetary policy, doesn’t work their citizens to the death and live paycheque to paycheque.

Most industries are monopolies. Mom and pop middle class store owners are almost all gone.

I know my state at one time said you can only own one liquor store. That has prevented all the stores being owned by a few. Great idea, You may pay more as it is not as efficient, but the money stays in your local community instead of flowing to Amazon (Seattle) or Bentonville (Walmart).

The small town I grew up in did not allow any chain stores or restaurants. The towns both 30 miles on each side of us allowed a Walmart, Pizza Hut, Dairy Queen, and McDonalds. Within a few years there downtown were boarded up, the all the houses started to need repairs.

My town had a thriving downtown. The Pizza place, the burger joint, grocery stroes, the hardware store, the restaurants were all owned locally. They were the upper middle class for the town. They are the businesses that would support the local little league baseball teams, boy scouts, etc. Money stayed home.

When you lose that middle class, the area goes downhill.

The Burger King takeover is also taking over small towns in Ontario. There is no escape for corporatism.

We the serfs have no freedom to start our businesses due to red tape, while the corporations get a free pass for everything.

Walmart gets a caution for selling expired milk, while armed SWAT teams harass farmers for selling raw milk. I heard that happened in Utah of all states.

My grocery store is owned by the few elite families. They were also given a court order for price fixing bread a decade ago.

That’s inflation.

Thats precisely the scam of it. The government prints and spends the funds, the in order to control inflation induces a recession through increased rates amongst low income workers, who didn’t get any of the printed funds.

You can see in student loan debt agreements. They all have debt servicing set at RPI (retail increase) but they don’t get the printed money in the first place.

So many saw the idiocy of the central bankers.

“It is absurd to place important decision making into the hands of those who pay no price for being wrong.”

T Sowell

Now you know why Britain chose to Brexit…

The EU just lurches from one financial crisis to another.

Europe’s biggest problem — and has been for decades — is their “one size fits all” ECB interest rate policy. It is clearly not working.

Britain is in a worse state than continental Europe. The UK didn’t leave to help their economy, they left because the elite in the UK didn’t like Europe’s worker’s rights, human rights, and anti tax haven laws. If Europe has flu, the UK has pnuemonia. Btw I am a Brit.

It is important to view the economic stats, and not get caught up in UK media hysteria. A lot of the UK media supported Bremain (like the FT) — and they lost. They get salty.

UK average wealth per head is almost 2 times higher than mainland Europe ($290k vs. $175k). UK GDP grew a decent +3% YoY in Q2 2022.

UK is doing just fine.

EU today has hyperinflation in several states (and rising).

So all the drum banging about exponentially rising energy bills, even pubs and chippies having to close because of costs, is just fine? I think Britain, as usual, has just played a more deft sleight of hand in hiding its monumental incompetence/graft/greed re energy than the EU….we’ve already installed new efficient radiators, considering getting a generator for the blackouts, and even thinking about a wood burning stove….it’s fine only if you’re not paying attention

The UK is in serious trouble. I read the macro news and I am informed by my friends/family back home. It’s the macro economic news which concerns me more. I don’t think the UK has any way out of it’s current malaise, it’s only going to get worse, imho.

Btw the wealth per head may be 2x that of continental Europe, but the cost of living was more like 2.5 times that of continental Europe, before Brexit.

No. A lot of Brits did not like losing their sovereignty to Europeans.

Why are you talking about Brits? There are no Brits. There are English, Scottish, Welsh and Irish each of whom have quite differing agendas! When you say Brits you mean the English who control the UK government. This will not last. Alba gu brath!

From what I know, the UK is the most over financialized economy on the planet. That’s probably their biggest problem. They don’t make enough real things anymore.

I’ve also read they have had very loose immigration policy for decades. If true, they don’t need that either.

Although admittedly, the ECB and the Euro have had massive negative effects on most European economies especially those around the Mediterrean.

R2D2,

Well, OKay, but UK inflation = 10.1% now. And according to estimates, could hit 20% pretty soon.

20%? Wow, from everything I’ve read about hyperinflation that’s exactly how it starts, then before you know it it’s 100%, then 1000%, etc.

Yeah, I don’t know what kind of hopium R2D2 is smoking, but I’d like some of it. The UK is in for a seriously painful winter.

All we know is that the UK had 17,410,742 million reasons for Brexit and this gives the UK government the space to continue with spouting catchy slogans and blame Labour, The French and Germany for their troubles.

Also Italy has to issue 200 billion of debt this year and from the look of Italian debt yields currently at 3.8% and heading up, all of it has to be soaked up by the ECB whether there is a restructuring or however Italy is managed.

The UK also absolutely screwed through the same dopey money printing.

Whats causing the tide to go out is that Powell has the almighty dollar rate set higher than the UK or EU can face so the currencies are heading down. The wheels are coming off, its a disaster. Businesses are now shutting down in the UK because not possible to operate with such high energy costs. I’m sure the same all across Europe.

Sure the ECB has been reckless. But the US is also exporting US inflation to other countries by stirring up conflicts on Russia and China’s border and then letting everyone rush to buy dollars as the reserve/safe harbor currency.

Printing too much money is only bad when there isn’t enough demand for it. And demand booms for USD when when there is chaos and diminishes for other currencies.

Saw a bunch of Euros on the beach the other day. No inflation in bikini size thankfully ;)

After Samoa, the US that saw the biggest inflation in bikini size in last 30 years. I bet the Fed doesn’t know anything about that.

The ECB is a wonderful idea but it is new. Instead of killing each other they try and work it out. The kinks will take decades to work out.

They have had 4 decades already and are nowhere near “working it out”. The game they are really good at is passing regulations that everyone ignores.

Lockdown mock clown.

“Suddenly … the dam broke, and inflation washed over the land.” Great phrase. Sounds biblical. I guess Wolf is our prophet.

Not prophet. Just the hindsighter. I just report what happened, not what will happen.

Biblically speaking, Wolf, that’s what a prophet most often is. A truth-teller.

And you’re one of ’em.

“But when Russia invaded, production shot down.”

I can’t tell if that is a typo, or an intentional pun.

Autocorrect humor :-]

Imagine if the people who built the autocorrect software are the ones working on driverless cars… .. .

Actually both are kinda powered by Machine Learning, the less fancy term for AI. Very simple autocorrect software can be built without AI, but it can only detect very simple errors.

The thing is, getting a word correction wrong generally does not cost a life. Getting driverless cars wrong though …

Lol

I am a book publisher. I am seeing a 40% year-over-year inflation in my printing costs. The quotes now have a disclaimer – “This quote is valid for 15 days, excluding material increases.” If materials increase during the 15-day period the quote is not valid…so is this really even a quote? I have no real estimation for the cost to print a book. In the nearly 20 years I have been publishing books I have never seen anything like this.

BP, realistically, aren’t the actual “manufacturing costs” of the production of a book a small part of the final “retail” price? Book “production” used to include royalties, photo or illustration costs, printing & binding, admin. (permissions, sales/marketing, warehousing, etc). Then there was the mark-up, by retailers and book sellers, that ended up with a cost to a customer of maybe 10x the cost of manufacturing?

I’m a big time reader — probably my primary hobby. I love to read and have been an avid reader since childhood. Two or three books a week. I have library cards at two different county libraries and I buy books online. And I visit bookstores, thrift stores, etc, in search of new material.

But I haven’t bought a NEW book in decades. Who can afford them? If there’s a new title I want, I wait till it shows up on the second-hand market. Thank you Ebay, Alibris, et. al.!

I buy all my books used through Abe’s Books. Great deals on slightly used books.

HowNow,

Here is a breakdown. Let’s say I have a book with a retail price on Amazon for $20. First, to sell to Amazon you have to give Amazon a 55% discount off list price. So Amazon’s cost for that book is $9.00. I have to give Amazon free shipping to their warehouses. Four years ago to print a full color 300 page paperback book (8.5” x 11”) in the USA with a print run of 3,000 was about $5.00. Today it is about $8.00. Take that $8.00 printing cost and my shipping costs to Amazon and then there is no profit margin. So what can I do? I can either A) print the book in China (which I won’t do) or B) raise the retail price of the book. But to make up for the difference in printing costs I actually have to raise the book from $20 to $30…since Amazon takes a 55% cut. At $30 retail price, Amazon’s cost is $13.50.

But, bottom line, book publishing (printed material), has been devastated by digitalization.

My sympathies.

HowNow,

I also sell lots of eBooks and online content. But 50% of my business is still print books. Many people still like a book in their hands.

MiTurn,

Book publishers sell to library wholesalers. When patrons go to libraries, they are supporting book publishers. Most library systems purchase through a library wholesaler so they don’t have to deal with hundreds of publishers. To sell to a library wholesaler, the publisher must give the wholesaler a 55% discount. See my explanation about how Amazon purchases books in a previous comment.

“And yes, it sounds just as ridiculous as it is that a central bank finally raises its policy rate to 0% to deal with 9.1% inflation. It’s a horribly bad joke gone awry…

And more rate hikes are to come, starting in September possibly with a 75-basis-point hike.”

Like trying to stop a charging rhinoceros with a spitwad. The ECB still shows no sign of recognizing the seriousness of the problem. It’s tempting to conclude its mission is to make the US Fed look sane. At least the Fed is talking the talk and has actually taken meaningful steps away from its reckless ZIRP forever policy.

Doesn’t it make you think that they know something we don’t. To have all the global central banks in such disarray. It either is a comedy of chance or planned at a macro level. How could so many “smart” people get this wrong. My gut tells me they game planned this out.

For heavens sake they simulate the Super Bowl 30+ million times on the best super computers to determine the chances of victory. This had to be fed into the worlds best computer models. They are playing the dumb card to perfection

I’m sure the bankers taking the opposite positions to anything that made sense since 2009 or 2012 had a lot do with things. They got the playbook, they know what the public will do and they short what the public will do. This has been going on for more than a decade. This has to be one of the main reasons.

I recall watching the ECB Forum in Sintra on YouTube and I have the impression that Legarde was glancing around for confirmation while struggling through any semi-tough question and Powell at times looked like he was holding back a panic attack, but kept it composed.

They done messed up.

“I think we now know better how little we understand…” — JPow

“The curious task of economics is to [teach policymakers] how little they really know about what they imagine they can design…”

– F.A. Hayek is chuckling, somewhere in the ether

“I think we now know better how little we understand…” — JPow

These are intelligent people with all the think tank resources. This statement above sounds like a way to say “we screwed up” without really taking blame for the big mess they created.

I am a Dutchman living in France and although I have never been a fan of the French paternalistic model of government, I must confess that I am now very glad they have put a cap on energy costs. On the other hand, the authorities know very well that if they hadn’t, the guillotines would probably be back and waiting for them in short order.

Of course this cap is economic ridiculousness, because ultimately the money has to come from somewhere. But the French have never been as sanctimonious about rising government debt as the Dutch, for example. They’ll happily kick the can down the road. “Après nous la deluge” is not for nothing a French saying…

In the meantime I have installed a second woodstove, prepared a ridiculous amount of firewood, set up and tested a generator with ample fuel supply and bought a micro car that runs 45 mpg on gasoline.

Things are going to get a whole lot worse than they are already when winter arrives. I really see no way out of this except a complete breakdown of historic proportions.

I just hope I am wrong…

I think you are wrong….there will be no breakdown of historic proportions. This like covid hysteria….and they are ‘prepping’ people for another round of ‘easing.’

I really do very much hope that you are right and I am wrong. But from where I sit, the signs are not encouraging. There is an all-too real shortage of gas, prices of everything explode, half the French nuclear power plants are down for maintenance, and the politicians are flailing about without a sign of structure or strategy.

The French president gave a speech on television, telling the peons that rampant inflation, exploding energy prices, shortages and hardship are “the price of freedom”. Yeah right. In reality of course it’s the price of incredible political fu(kery. And more and more, the population starts to notice this.

If this is “prepping” people, they are not doing a good job of it.

How much of Europe’s CPI increase is a result of a shortage of energy (natgas, oil, etc) and how much is due to “money printing”?

Given the volume of “money printing” that went on for a decade before the current inflation, I’d guess the real resource shortages are the short term cause.

I also wonder about who has all that money which was “printed” over that decade? I’m guessing it’s not the households that will struggle with heating and food prices this winter.

Good guess!

Wolf

Once again thanks for your efforts .

Would love to know your insights about US current account, the current level and how does it compare to the bottoms it had late 1980s and 2000s specially that they were followed by crashes.

Regards

A possible take-away:

Be smart. Be Swiss.

Landlocked in the Eurozone and yet they might as well be nestled upon the top of Olympus.

Switzerland’s inflation problem seems miniscule compared to their neighbors. “Seems” is the key word, for me, as they use points as a unit of measurement for some of their specific inflation metrics. Further, the data they choose to include in their measurements differs, some, according to Credit Suisse.

Switzerland’s current CPI chart is following the same, general, trendlines as the Eurozone’s however Switzerland’s Inflation Rate is roughly, a little over, 1/3rd of the Eurozone’s number.

I know the article is about the Eurozone, however, I can’t help but compare it to Switzerland. Since the start of its independence in 1499 it’s amazing how its commitment to neutrality has served as a forcefield throughout history. Like the character Cartmen, from South Park, says “Respect my autonomy!”.

Forget about these gazillion dollar mansions in Holmby Hills, the south of France, and the other trendy, status-lifting, hotspots. While dreaming of my perfect utopia, I’d gladly consider a humble home in the least expensive part of Switzerland and be the poorest rich person on the planet. Got to stay humble :)

Maybe it’s time for book “for anyone trying to understand the enigma of the riddle inside of Swizerland”? If there isn’t one already.

Definitely an interesting Country. Kind of like Greenland.

It’s hard to respect a country that promotes bank secrecy and tax evasion.

You’re describing a political crime, not a real one.

To my knowledge, Switzerland treats tax evasion as a civil matter. They don’t find a need to incarcerate anyone for every (supposed) offense against the state.

As for bank secrecy, I’ve also read it can be pierced for activity which is considered criminal under Sweiss law. Yes, I’m aware that didn’t always happen though I disagree with common interpretations of it.

Otherwise once again, if an activity is not illegal under Swiss law, they have zero reason or accountability to assist law enforcement from somewhere else to prosecute or gather evidence.

Contrary to what most Americans seem to believe, US law doesn’t apply anywhere else.

Germany has had experience with runaway inflation during the 20th century that lead to a very dark time for all of Europe and beyond.

We all know that Europe is slipping down and down into recession or worse. We can all keep discussing the same issue into infinity.

How does any one plan to take an ‘advantage’ this situation, to improve their portfolio? Just hand wringing, right?

Utility company sent me a letter this week. Basically apologizing for the future heating bill coming up this winter. They said we do not make money on Nat Gas. We just pass the cost through.

Uh-oh

$9 nat gas or higher is going to make a lot of peoples heating bills double from last year. We produce more nat gas than we need and the cost could be as low as $5 but we need to help out Europe and their mess.

ru82

Cost of defending ‘Freedom’ right?

(sarc)

Was at the Coinstar machine today to cash in all my loose change. You know inflation is out of control when you pay 12.5% commission to have a machine count all your change. I calculate that my time is worth more than the 12.5% I have to pay to get rid of all those worthless coins that don’t buy anything anymore. I used the total cash receipt less 12.5% to pay my grocery bill. The cashier didn;t even know how to credit the Coinstar receipt total $25.50 to my grocery bill and had to call for help. They will probably raise the commission to 15% soon and people like myself will gladly pay it. There were even a few counterfeit coins among the coins I put in the machine. I threw them in the trash can. Welcome to the Weimer Republic 2022.

Counterfeit Hennig nickels are numismatic rarities and bring good prices from collectors. Much better than most genuine Jefferson’s and Buffalo’s.

Henning, not Hennig. Mea c

No Poland in EU? Great :D

Article is about the Eurozone = the 19 countries that use the euro. Poland still has its own currency the złoty. Poland is in the EU, but not in the Eurozone.

Could it be that France has the lowest inflation because it has the most nuclear reactors to produce electricity.

The ECB QT program has an interesting twist, namely the Transmission Protection Instrument (TPI). In essence, the ECB will buy Italian bonds with funds from maturing German bonds to try to keep Italian (and other non-core members) interest rates from blowing out.

Initially, German liquidity would go down, Italy’s would stay the same or increase. But what prevents the newly printed “Italian” Euros from surging back to Germany? Looks to me, with TPI the ECB QT program has the seeds of its own failure.

The TPI transfers money between countries. It doesn’t monetize debt. It’s a political fudge.

Latest news in Norway. Farmers have started to plough down this year’s vegetable harvest. The cost of harvest and keep the vegetable refrigerated from time of harvest to sale make them loose money due to the price of electricity.

The price the farmers get is fixed for this season, not the cost and they do not have to harvest…

Dear Wolf

You are too negative. The ECB does the best it can, given that there’s no federal budget… The EU is not a country… Comparing it directly to a country, is like assuming that planes flap their wings when they fly…

“The ECB does the best it can…”

Sure, but for whose benefit??? Go look around a little.