Over the decades, recessions were preceded by spikes in unemployment claims. We keep our eyes on them as the recession watch has begun.

By Wolf Richter for WOLF STREET.

In recent months, there have been many reports about layoffs, but most of those layoffs were small, a few hundred people here and a few hundred people there, and there were a few with a thousand folks or even two-thousand folks getting laid off.

But they were a far cry from the mass layoffs of 15,000 or 20,000 people by company, the way they occurred one after the other in prior recessions.

And most people that got laid off found new jobs very quickly. There are still large-scale labor shortages that are in the news because of the problems they cause, such as the teacher shortage, the shortages of all kinds of staff in the healthcare sector, the shortages of pilots, flight attendants, and ground crews at airlines that have produced massively aggravating snarls and flight cancellations this summer, and on and on.

The most immediate measure that we have of a deterioration in the labor market is the data on unemployment insurance, which the Department of Labor releases weekly. Over the decades, significant and lasting spikes in initial unemployment claims were associated with recessions, and preceded recessions, and so we watch them closely when the recession watch begins.

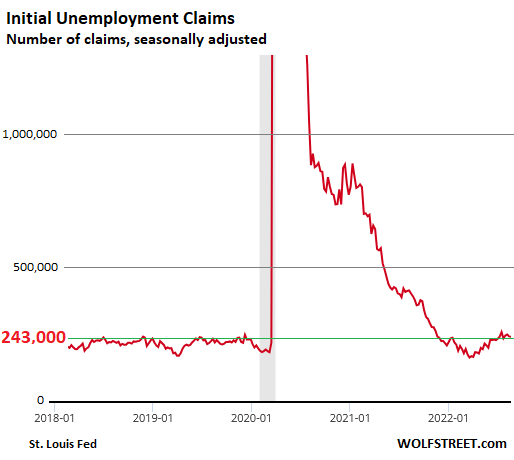

The number of people filing a new claim for unemployment insurance dipped to 243,000, seasonally adjusted, the second week in a row of declines, according to the Department of Labor. These initial unemployment claims were a little above the historic lows earlier this year but were still in the range of the strong labor market before the pandemic:

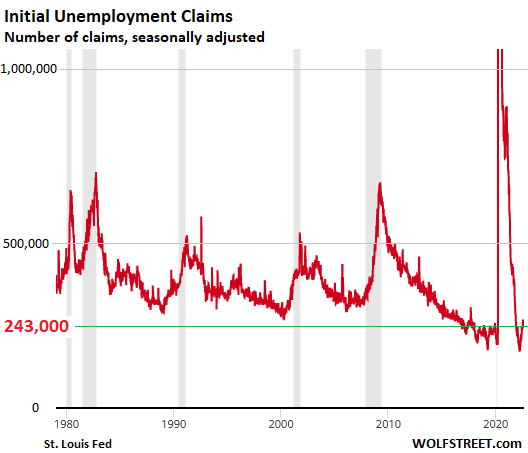

Looking back over the decades, all the way to the double dip recession in the early 1980s, we can see how low today’s initial unemployment claims still are compared to recessionary periods (grey areas) and the periods leading up to the recessions.

Historically, initial claims rose into the 350,000+ range before there was enough weakness in the labor market for a recession.

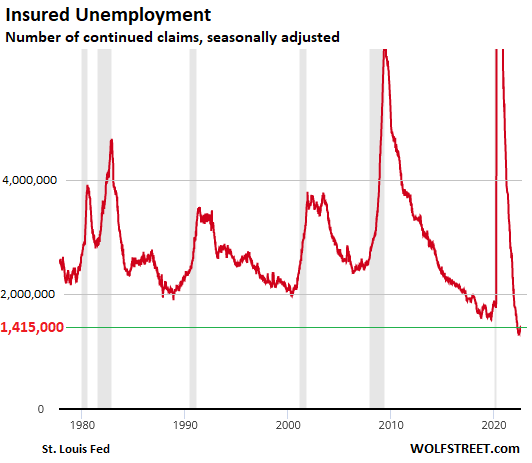

The number of people that continued to be on unemployment insurance after the initial claim – “insured unemployment” – dipped in the latest week by 19,000 to 1.415 million (seasonally adjusted), just a tad above the historic lows in May, and still near those historic lows, and far lower than during any other period. This shows how strong this labor market has been, starting in the second half last year – when “labor shortages” became a thing – through today:

What this tells us.

So we see that there has been a slight increase in unemployment claims, such as from layoffs, but they’re up from historic lows and are still historically low; and that insured unemployment is still right at historic lows.

What this tells us is that the labor market is still very strong; and that most people who are laid off are able to land a new job quickly, or already have a new job lined up before they leave their old job, and they either don’t stay on unemployment insurance long because they start working again, or never bother to file for unemployment insurance because they walked out from the old job into the new job.

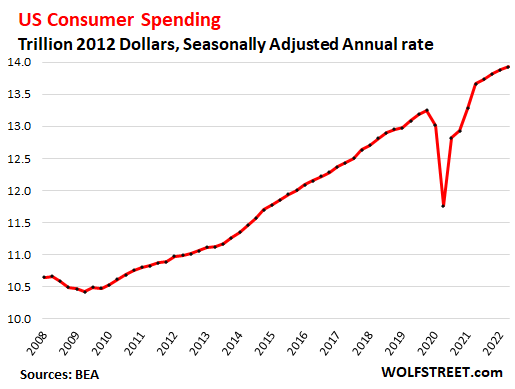

This also shows up in consumer spending: Consumers, though they’ve gotten hammered by this raging inflation, have been able to outspend this raging inflation. This morning, the revised GDP data for Q2 was released, including its inflation-adjusted measure of consumer spending (personal consumption expenditures), which rose 1.5% annualized from the prior quarter, an up-revision from the initial report (1% annualized).

We can see the impact of this raging inflation, and it’s hammering consumers, and it’s putting them into a foul mood, but they’re still outspending it (personal consumption expenditures, adjusted for inflation, expressed in 2012 dollars, part of today’s GDP revision):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Chap (sorry can’t recall his name/title) on Radio 4, here in the UK, this morning talking about the zombie companies and how they may well collapse as interest rates rise. Then we might see an up tick in the number of unemployed? Just a thought.

Hahaha, yes, been waiting for that.

But in the US, most of them were able to refinance their low-cost debts over the past two years to extend maturities way out with new 5-year, 8-year and 10-year debt, and the “maturity wall,” when a large number of companies have to refinance their debts, has moved way into the future. If interest rates are high 3-6 years from now, that’s when we’ll have that problem, not now.

What we will see going forward is a few companies here and there not being able to refinance their current debt, same as always. But the large-scale problem will be triggered if we have high rates 3-6 years from now.

I just want to point out that lowering rates, as some pundits have suggested, will not fix the problem you state, it’ll just push it out later in the future. Instead of the large-scale problem manifesting itself 3-6 years from now, it’ll be 7-10. But we’ll also have massive inflation and other social ills.

I wonder how much of this spending is using free handouts or through forbearance cash.

Forbearance and UBI cannot be permanent as inflation will adjust to nullify them. Oh wait, that has already happened!

People who are actually working are the biggest lovers here: High inflation but no forbearance and no free handouts.

Lovers => loosers

Losers?

The loosers are now tightening ;)

UBI ?

What country do you live in, Canada or Brazil ?

When the aristocracy catches a cold, the working class die of pneumonia” – Jordan Peterson.

> People who are actually working are the biggest lo[s]ers here

Greetings from such a loser. A carefree, even euphoric bailout expectation mentality and lifestyle among consumers, seems to have paid off for quite awhile. Will natural balances ever return?

But I cannot be that carefree fool, no matter how much I might wish for such bliss, just as I cannot be a junkie, living off my neighbors’ value creation. The weird thing since 2008 is the synthesis of a new drug, endless low interest rates and free money. The markets are the battleground right now, and the markets are betting on free money heroin to the horizons.

It has been said, “don’t fight the Fed.” But which Fed is meant by that now? Uncle Fed with free steroids and heroin forever? Or backbone Fed that will try to rescue the system from the quagmire? The markets say it is the former, and that wags the consumer tail. It is springtime forever. I am the old grumbling outlier.

Financial “fake it until you make it”.

DJ

If these zombie companies are not profitable, won’t they need to continue to take on debt in order to meet payroll and service existing debt?

Seems if interest rates are high it would blow up sooner.

What you say makes sense for positive cash flow companies with large debts (like a lot of PE owned companies).

But what about negative cash flow companies (e.g. in your collapsed company articles) that can now longer get more funding (from VC) or cheap debt? That’s the shoe I’ve been expecting to drop; it shouldn’t be as bad as re-financing debt problem, but it could cause major damage to areas with a lot of those companies.

TonyT,

The Imploded Stocks companies are in a realm of their own.

Part of them are in that group because their shares were driven to ridiculous highs and then collapsed, but the companies will survive with a much lower and stagnating stock price.

The others are in that group because their stocks collapsed because the company has a near-zero chance of making it, no matter what the interest rates are. Most of these companies don’t even have debts. They’re all equity funded. And they’ll run out of money and die. Their only hope was a booming stock market and a high stock price that would allow them to sell more shares in a follow-on offering to stay alive longer. And that source of funding (share sales) vanishes when the stock collapses. It’s not debt that brings these companies down because few of them have any significant debts.

Agreed, but I’d say the lack of new funding (and non-booming stock market) is directly related to higher interest rates and QT, just a different mechanism than debt financing or re-financing.

A unicorn that from the beginning had a plan to eventually raise, say, 4 billion, but has only raised 2 billion so far, will have a harder time raising that additional 2 billion than they expected.

Some might determine that the cost is simply too high and punt, but more likely they’ll just reset their funding plan higher and spend the extra on (higher) interest payments so that they still end up with the amount they think they need to get the company to profitability.

If interest rates were 4% higher 5 years ago, I still think investors would have thrown sufficient money at Tesla to keep it going.

Wouldn’t there be two other variables to consider–a zombie by definition needs cash infusions to operate and stay solvent, not just to service the debt currently on its’ books. So if credit conditions/liquidity tighten, it would be harder for them to sustain. And likewise, there’s the market cost for some of them–an Uber ride is more expensive to try to get to a point of not needing more cash infusions, actual costs increase, inflation, etc. and all of a sudden a cab ride makes more sense. Combined those 2 factors can pull the debt-service issue a lot closer to today for those “companies”

The financial markets can still seize up even with extended debt maturities. The scale varies but in recent times, there is always a large amount of new debt issued and old debt rolled over.

A change in psychology is the necessary precondition, since actual credit quality is in the sub-basement, the worst ever.

Augustus,

Market seizure is an astute observation.

It seems individuals learned from the carnage of the GFC and are for the most part watching their credit more closely. Individuals were punished then, companies seemingly were not, hence the current “drunken sailor” corporate credit expansion. What type of events would trigger a sudden tightening of lines of credit?

The future promises to be interesting.

Wolf, if what you say is true, then it lends credence to the fact that rates are nowhere near what they should be. Either rates are elevated 3-6 years from now, or they get pushed even higher short-term, possibly double digits. I don’t want anyone losing their jobs, but I truly wonder how long before the gig is up since actually rates STILL seem to be negative since the maturity wall is so far out.

I run a real estate debt fund making development and construction loans primarily along the coastal panhandle of Florida. What we have been experiencing and continuing to experience is a booming residential and commercial market. Tremendous migration has ramped up demand for everything. Entry level for homes over $1,000,000.00 and up to $30,000,000.00. No slow down in sight yet. I am 75 yes old and never seen anything like this.

Thank you for your insight.

I believe this too will change. We are quite early in the game as of now.

We may see lots of early retirees rejoin the labor market when it becomes clear social security payments will be cut 30%, absent legislative action.

Plus, it may become evident that future inflation will be 5% consistently, and the Fed may even raise it’s inflation target.

That’s a scenario I’m planning for.

Or a lot more if Sen Ron Johnson gets his way.

He won’t because that would be political suicide.

Think of the current working adults suddenly left to care for and pay meds for their parents, alongside raising their children. A vast inflation buffer for pretty much every family in the USA (and it may feed back to more inflation, sure, but for here and now, bills arriving), is Medicare and Social Security. Does every adult have the stomach (and marriage resiliency) to have sick parents move in?

The whole discussion of “recession” with such a strong labor market makes zero sense. By most measures, we’re either there or soon to be there. But the labor market may take 6-9 months to reach 350K unemployment claims. The housing market, while deteriorating, is still hold up to a certain extent. A small YoY price decline is possible for this month. By September, we’ll definitely see a small negative YoY decline. But, if a 5-10% drop in prices meets a 30YFRM that drops below 5%, the housing market may begin to stabilize in a strong labor market.

The relationship between layoffs and recessions always looks pretty strongly correlated when looking at the charts over a long period of time, but with charts what looks simple can be more volatile if you zoom in. Unsure if we have parallels historically, and I don’t trust my memory from the last few cycles on whether we had a lot of false signals or unexpected delays.

So, I think it’s way too early to make any definitive calls on how this is going to go. Also, history is an imperfect guide in the best of times and this is a weird period. Businesses are likely reluctant to press the layoff button because the last time many did, they found themselves understaffed and competing for the same pool of a limited number of workers they contributed to. They will layoff when their financial situation tells them they must, like tech, but that doesn’t seem the case and no one wants to be the leader.

Also, I don’t think we have a great handle on the folks that were pushed or voluntarily retired due to ageism and COVID. Retirements may have been front-loaded and ageism/fat 401k porttolios discourages reentry.

Finally, this is an age where a lot of our peers are experiencing declines in their working age populations. Unlike previous cycles, there is not an up and coming country with a ton of young working people competing for share. Can you offshore if there is not a big market to offshore to? As a lot of jobs are service rather than manufacturing, you cannot simply open factories and hire translators. Cannot offshore plumbing jobs.

Finally, immigration. Part of the reason USA has maintained its share in agriculture and avoided Japanese stagnation is because we have enough legal and illegal immigration to replace workers lost with declining birthrates. Immigration is being cut back. So where are those workers now going to come from?

That’s a long winded this time may be different or the relationship between recessions and economic contractions, bear markets, etc. Usually that prediction ends up being wrong but things do sometimes change in history. Many historians think the black plague, that wiped out a quarter of the population, was the biggest reason for the end of serfdom. Peasants voted with their feet and the employer-employee relationship changed permanently.

Great comment! I am not aware from history that everything was exactly the same in each part of the up and down cycle. There is room for nuance and for humanity to make adaptations from past experiences.

> There is room for nuance and for humanity to make adaptations from past experiences.

Yes, but there is room for the lessons of history to be forgotten and repeated. A huge bunch of folks in the USA seem to be ready to live in heavily marketed, cherry-picked fantasy (reality TV), blinkered versions of history. This is being legally codified in areas of the USA. Human cognitive deficits (augmented by new tech) can be steered into completely synthetic, siloed, cartoonish stylized realities, as history so sharply shows.

Nate: This is something that I have been wondering about as well.

How much does the Demographic Oddity of a one-time Event like the largest generation in the history of the world (Baby-Boomers) all mass retiring, all together (I’ve read somewhere that the majority of Boomers were retired this year)…and what this generational change do to distort, say, “number of existing job openings”, “credit availability sourced from Boomer investments that are shifting from high to low-risk in retirement” or “property hot spots” in places that, unsurprisingly, just happen to be the hottest retirement spots as well?

Thanks for anyone’s thoughts on this…maybe I’m overthinking this, but IMO there are larger external social forces that haven’t existed before and aren’t really market created so much as simply a natural trend of what retired people do (switch from hi to low risk, start living on savings instead of seeking the best returns on all one’s passive capital, property adjustments, etc. etc.)…only happening en masse, and to a generation whose size and investment power we will likely never witness again on earth…

Also (speaking as a boomer facing imminent mortality), the boomers’ vast troves of assets will be transferred. To whom, is an interesting question, for the future of such things as the distribution of wealth, opportunity, etc. But many patient youths are in for a windfall. Instead, online, I have heard plenty of doom scenarios from that cohort.

The world has found many ways of not ending, for many people, for eons.

Your incorrect about the lack of younger workers.

25% of the US population is younger than 20.

Your last 2 sentences -yes.

James Burke’s ‘Coonections’ show in the ‘70s discussed that history.

A brilliant BBC series. The 1st one, “The Trigger Effect” is available on YouTube. It covers our long-standing dependence on technology and what happens when it fails as in the NYC blackout of 1977.

I have no idea where the economy is going. It all depends on the FED.

Legal immigration has slowed down. Illegal immigration is at its increasing by a lot the past 2 years.

The following are encounters by the Border Patrol. It is a dataset you can access. These are encounters that resulted in either Expulsions or Apprehensions.

Year

2020: 645k

2021: 1.92 million

2022: 2.2 Million through July. On a pace of 3.5 million by the end of year.

These are the one that are caught. Estimates are about 1000 a day are not caught. So the board patrol is stopping 80% which is good.

Those caught are either expulsed (sent back) or apprehended. If apprehended, they most likely apply for some type of asylum and are released in the U.S. until their hearing. Which could be 6 months to several years. Some just stay and never show up to their hearing. I think from what I read is about 1/2 fall into the apprehended category thus are admitted in the U.S.

Anyway…..according to economist, these immigrants will help the labor force and reduce the help wanted signs and also help keep wages from rising.

I guess that will stink if inflation keeps going up and your wages do not. It may put a strain on the low income housing availability. But hey, Walmart will be happy.

ru82-…and, as always, someone is hiring them…

may we all find a better day.

The economy and job market are entirely dependent upon credit conditions. It doesn’t take much of a change in psychology for the trend to change.

it makes sense cause the unemployment rate, as it’s measured, only correlates to economic output. recessions shouldn’t even use GDP as a measure, cause gov deficit spending distorts real output. if real output/ relative dominance globally has been in decline for decades, how can recessions only be in months? the numbers are all fudged and the narratives are lies.

Home refinance loans are down 83% vs a year ago, per Diana Olick on CNBC. How that does not translate to at least 30% job losses at those companies is a mystery to me.

Can there be a recession with low unemployment?

I’m thinking it’s retiree’s with savings that are spending…the more that retire, the less there is to fill their position…and when they do, it’s for less pay…even if it’s equal pay…inflation has killed any buying power for younger adults.

That’s my thoughts…I’m going on gut feeling

Cheers

This may be the first recession that skips right past the middle class.

With the price of private jets and yachts skyrocketing, this may end up being a Richcession.

Is the price of yachts skyrocketing?

There’s really nothing under $20 million any more.

Our local country club (40 years old, 5 golf courses) now has a membership wait of 2 years (estimated). $50 K entrance fee, $900/month for golf membership.

Our other private course (2 courses) is not even taking applications, and the monthly is $2,600 ($100 K entrance fee) . Plus you need to spend $600/month in dining.

This is not California or New York.

No recession here.

To collect unemployment, the individual has to qualify by having earned sufficient wages in the last year (or year & 1/4) . Many of the millions of people exhausted their benefits in the last two years, and won’t qualify for file new claims. In most states, they can go online to get confirmation they won’t qualify. That is one reason why the current numbers are low. I spent 36 years in an unemployment agency, and have seen this occur several times.

Great insight. Thank you. That really changes the conversation around these numbers since such a huge percentage of the working population was “laid off” during Covid, unlike any other event since the Great Depression.

JeffD,

No, not “great insight” but made-up stuff. I debunked it below.

Wolf;

Those unemployment numbers don’t tell the whole story and you know it. Some people never file for unemployment and just ride out the storm. I’m 60 years old and not once in my life have I ever filed for unemployment. There are millions of unemployed people not included in those numbers. People whose benefits have already expired, people who gave up looking for jobs, people who work under the table, people who are self employed. Your statistics don’t tell the whole story. Facts are stubborn but statistics are more pliable.

That is ALWAYS the case, all the time. This is not new, and it’s not a change. It’s the trend that matters, and changes in the trend. People get tangled up in the exceptions and miss the trend and get run over by realty. So good luck.

Also consider that much of the labor in single family construction are not eligible for unemployment benefits as they are undocumented immigrants.

In some places they exceed 40% of the labor force in SFR construction.

Marco,

1. These are “initial claims” not approved amounts paid out. This is before anyone approves them.

2. Your statement is not correct. And I’m not going to debunk your theory with facts.

I just checked at the EDD in California. You must have worked SOME over the past 18 months. And you must have earned some money. There is NO requirement to have worked 12 months.

So I put into the UI calculator that I started working in Sep 2021 and worked for the rest of the period at a steady salary of $4,000 per month. They figure the highest-page quarter ($12,000), and based on that I would get the highest amount = $450 a week.

https://edd.ca.gov/en/unemployment/UI-Calculator/

By September 2021 already, there were labor shortages and unemployment was super low and unemployment claims were super low and job openings were spiking. So your whole theory has been debunked.

Great to know that about California, however, California is not the rest of the USA.

Can you do it for the other 49 states too?

I think there will be a different result from that in California.

The point was to debunk a silly blanket theory for the US. And I did.

Retiree spending is more dependent upon fake “wealth” than any other demographic. The same psychology that will trigger a bear market in stocks and other asset classes will also trigger an economic recession.

There has never been a mania bigger than the one which exists now.

But retiree spending is lean to start with.

Bobber, for the middle and lower middle classes, absolutely. For the upper middle class retirees who have seen their $3 million stock portfolios balloon to $10 million (just an example), there is a huge amount of spending. I’m firmly of the belief that the top 10-20% are driving inflation.

But Augustus is right. If that $10 million portfolio drops down to $5 million (say, where it was in 2017), a lot of the discretionary spending by the upper middle class retirees will dry up. This is especially true for things like boats, fancy cars, Rolexes, and so on.

The numbers and article summary sure enforce we are not in any type of recession, but something sure doesn’t seem healthy with this economy. Like a feeling in the air (which means squat)

Agree with the “feeling in the air.” I think this has to do with this rampant inflation, the distortions we’re still seeing in so many aspects of this economy, and the huge amounts of money still circulating.

In late 2020, with all this stimulus and money-printing, I thought, “something Big is going to break.” Turns out, this something Big is inflation.

If inflation is the price to pay for avoiding massive layoffs or homelessness during COVID, are we sure it was a bad call? I mean, yeah, maybe we were just delaying the inevitable and amplifying some crashes, but until it all plays out I am not sure we should prejudge history.

I remember a lot of the house is in fire so fuck inflation arguments. Stimmie checks and PPP were very popular. So, sometimes I think we might just be complaining about having to pay a higher water bill when we look back in five years.

Rather, I hope that’s the case. The abyss is not pleasant.

There is never something for nothing. The “can kicking” policy decisions just guarantee that the future economic contraction will be much worse when it arrives.

What’s all this talk about “we”.

The government printed money and allocated it to a few winners, and everybody else was a loser. The public did not benefit as a whole.

To the contrary, I’d say we are much worse as a result of the arbitrary wealth re-allocations, the rampant program fraud, and the fiscal lunacy. Based on what we’ve seen the past couple years, can people trust government to be logical, fair or efficient?

Augustus, to simplify, I agree you can’t get something for nothing. I am unsure if the actual price, however, isn’t the inflation now we’re all paying for because it isn’t wage inflation driven, a small economic contraction, asset declines, etc. Definitely paying more for everything sucks and seeing paper profits go down is a bummer. But considering the alternatives, maybe liquidating the economy or eating a severe recession was not the better option?

Sometimes you can play with fire and not get burned.

This response required restraint to type. HELL YES it was a bad call. PPP in particular.

When I think of all the partisan fighting over $1-$100b bills over the years, the things we didn’t fund that might have had some value…only to then GIVE AWAY trillions with hardly a thought, to kick the can….just wow. And we know so much of that PPP was total fraud. And we know even more was just wasteful, unneeded money that bought stuff or just fattened bank accounts. It’s far, far worse than the blanket stimmy checks were.

You can look up where the PPP money went. I looked up our small town’s zip code and saw the full list. It’s unbelievable. Everything from realtors to interior designers to asset managers. BIG chunks, too, not just $10k-$20k.

We should all be outraged over this and demanding retroactive taxes on those gifts. Say 25% recovery, spread over 10 years. All those recipients should be STOKED to only have to pay back 2.5% per year.

I think the average person doesn’t understand how fraudulent the PPP loan program really was.

I agree that there was a lot of fraud, but focusing on fraud leaves out the fact that many to MOST legally legitimate claims were made by companies that did not need the money. Not only did they not lose any revenue from the pandemic, many of them saw business boom!

This is entirely on Congress. I don’t blame people for applying for what Congress doles out. Congress is supposed to have the power of the purse, and that means exercising restraint.

And as to massive pandemic fraud…where is the Manhattan project to claw it back?

The fact that there really isn’t one tells you *everything* you need to know about DC.

DC is just fine with bridges to nowhere…even multi trillion dollar ones.

(That is one reason why people called it a Plandemic…DC never lets a crisis stop the “waste”).

Ditto the large, as yet not fully spent monies from the three mega stimmies (multi year outlays) – any DC talk of recalling/cancelling them?

Of course F’ing not.

Every voted billion is some douche-bag Rep’s golden parachute. Such things never get unwound.

(The seething sphincter of DC, once dilated, never recalls its progeny).

Until unavoidable, true hyper inflation hits, DC doesn’t give a sh*t about undermining the currency, so long as print stimulated economic “growth” keeps the public from coming to DC to hang them from lampposts.

Even now, notice the massive radio silence coming from DC concerning historically unprecedented hikes in rent (#1 largest personal expense by far).

Even in the face of wild inflation as a 15 month old, inarguable, accomplished fact, DC’s primary instinct is to ignore it in favor of DC-business-as-usual (spend to purchase political support).

The stimulus they provides during covid was the right one.

The mistake was it went on for too long.

It is all by design to help friends of central bankers .

Hindsight is always 20/20… It’s easy and disingenuous to claim that you know some other path would have been better. Who knows what would have happened without stimulus. Nobody. I find these kind of armchair economist discussions to be a waste of time. If you can do better, run for office. On the Internet, every dog is an economist or policy wizard.

All inflation means is a higher water bill? Try telling that to one of these families whose new grocery store is a food bank!

Ch.3/azfamily.com: St. Mary’s Food Bank on track to break all-time monthly record as inflation skyrockets

PHOENIX (3TV/CBS 5) — As inflation has hit many across the state, Arizonans are turning to food banks in times of need. St. Mary’s Food Bank is on track to break an all-time monthly record for families served, heading toward 150,000 families helped in August. The Knight Center facility near 31st Avenue and Thomas Road has served over 25,000 families this month alone.

Maybe the best answer is that our standard of living will fall, but not so easy to determine how it will play out via inflation, job losses, drop in market value, credit unavailability, etc.

Hopeless muddles serve the unaccountability goals of this nation’s architects of ruin.

For instance, that is how we ended up with 15 “intelligence” agencies and a $2 trillion, 20 year lost war against Afghan tribesmen.

DC is the longest established, permanent floating circle jerk.

“in the air”

Like Wily Coyote, over the side of the cliff.

Holding an Acme anvil.

Prognostications of imminent doom are the cheapest and most easily inflationary things, far beyond the inflation of money, whatever stats one accepts. Yes, ultimately the sun will go super-nova and it will all be an academic point. Yes, some absolutely improbably thing could wipe us all out any moment. What is happening at the moment, if the stats have anything to tell us, is not imminent doom. This silly thing is staying aloft.

Over the last 20 years, a lot of things our betters claimed could “never” happen, did. Those betters then float off into whatever sleazy sinecure their corrupt behaviour secured.

To perpetually engage in reckless public policy behaviour until the easily foreseeable catastrophe is *actually upon us* is selfish and infantile.

There is no Gov “magic” and it is never different “this time”.

Q2 GDP was revised up to negative .6% from .9%. Getting closer to tipping positive, but probably won’t be able to do that on the second revision. The revised number does look more consistent with the labor market and consumer spending.

What counts is the distribution, across the population, of each individual’s balance between income and expenses.

In both recession and inflation, the balance trends in the wrong direction of declining living standards. In a recession the hit is mainly reduced incomes, but with inflation the hit is increased expenses.

So regardless of whether there’s a recession, the inflation is destroying living standards for many millions of people whose incomes aren’t keeping up with rising costs.

Correct, obsession over whether there is or isn’t a technical recession is irrelevant.

It’s obvious the majority of the US population is becoming poorer now, regardless of whether GDP is statistically positive or negative.

GDP isn’t an accurate indicator of aggregate economic prosperity. It’s a statistical abstraction.

Bananas 31cents at wal-mart there delicious with water

And canned green beans/slimy canned spinach taste like crap, but they are cheap and abundant, so nothing bad can be happening according to the Soviet era policy brightsiders posting.

The park near me not being overdeveloped is true wealth. The nearby third world city not growing and emitting more untreated sewage and toxic waste is true wealth. If that is “poorer,” I am thrilled to be poorer.

Define Recession.

Two or more quarters in a row of negative growth.

How dare you…

2banana,

You’re citing ZH’s braindead fake definition.

A recession is a broad-based decline in the economy, and it includes the labor market. The NBER, which calls out recessions, spells that out clearly, and has spelled that out clearly for decades, and it hasn’t changed in decades. People just need to read it and not pollute their minds with the BS on ZH.

“Two or more quarters in a row of negative growth” is also braindead BS because the last recession wasn’t 2 quarters, but 2 MONTHS (Feb-Apr 2020).

Don’t try to spread this braindead BS on this site.

The NBER committee that “calls” recessions is, what, 7 people? And they don’t share their methodology? I imagine not all economists accept their call as gospel.

Publius,

The NBER’s definition is the US standard. It’s like a mile is defined in the US in a specific way, and it differs from other miles, such as the Roman mile. But we use the US standard. I don’t give one iota whether you or ZH or whoever invents their own definition. Up to you. But don’t abuse my site spread this BS here.

The last thing this country needs is a simple, straight forward common sense definition for a recession. At this point what difference does it make?

“The NBER committee that “calls” recessions is, what, 7 people?”

Each of whom is far more qualified than, for example, you.

“And they don’t share their methodology?”

Google up ‘NBER methodology’. You’re welcome.

“I imagine not all economists accept their call as gospel.”

Yes, you do imagine. That’s a problem, but it is, after all, your problem, and not theirs.

LOL! How many angels can dance on the head of a pin? That’s how much the precise definition of “recession” matters.

This country has a phony economy sustained by gargantuan levels of debt-based spending. Period. Some day that will no longer be possible and when that happens, watch out below.

I stand corrected, the committee consists of 8 economists, 4 at California academic institutes, 3 at East Coast institutes, and 1 at Northwestern. A CNN article decries their lack of diversity, with the committee never having a racial minority. Also, 2 current members are married to one another, and its membership is determined by 1 person. But as long as everyone agrees that they are eminently qualified, I retract my “BS”.

Retraction accepted.

Wolf, I’m not a ZeroHedge reader but the “rule of thumb” definition of two straight quarters of negative GDP was something I remember learning in college and high school economics courses, way back in the early days of the Internet, from both liberal and conservative economics professors and teachers. Why is the rule of thumb definition now considered a braindead, fringe theory?

I already learned when I got my MBA in the 1980s what a recession is – a broad downturn in the economy, including the labor market – and that it was the NBER that calls them out. That has been standard forever.

There were 2 negative quarters in a row in 1947, and it wasn’t a recession. So it’s not like it never happened before.

And there were two recessions that did NOT have 2 negative quarters in a row (2001, 1960).

And there was the March 2020 recession, that didn’t even last two quarters. It lasted two months (March and April), with the peak in February, the plunge in March, and the trough in April.

Recession dates are by MONTH not by quarter.

So you going to say that the recessions in the US that did NOT have 2 negative quarters in a row weren’t recessions? Or that a recession that lasted two months wasn’t a recession?

Do you see how nuts these people are that promote that nonsense?

It NOT a definition that is that is solely unique to ZH!

They may like to cite it, often. But Wolf’s implication is the only media site that uses it is ZH. That is BS!

That’s who started the meme that the “definition will be changed” (April?) and then that it “was changed.” Just toxic BS. Go back some months, and you’ll see the sequence. And others picked it up from there and ran with it.

Safeway must have a labor problem. They may need to hire some more people, but they are too cheap to do so. I made a complaint to the store customer service Rep and she told me that if I wanted service at 7AM I had to flag down one of their roaming employees and have them help me navigate the self service machines. I told her I don’t use self service machines. She said self service was now the default method of checking out groceries. She said full service, having a person at the checkout line was no longer guaranteed, especially at 7AM in the morning. Most of the Safeway stores here are nearly always empty. They are probably on the brink of bankruptcy. Good!

Another private equity success story from Cerberus Capital Management.

Safeway is part of Albertsons, which is now publicly traded (ACI) after IPO in 2020.

Wikipedia’s headline paragraphs for both Safeway and Albertsons give the impression that both are still owned by Cerberus – that is badly out of date … IMHO that also reflects the lack of a decent public-relations, service-oriented mindset of all 3 organizations.

Cerebus still owns more than 30% of Albertsons and is probably still trying to squeeze more money out of them.

May be the stores are empty because it is 7 AM?

The folks who shop super earlier in the morning tend to be older. I remember walking in a Walmart at 7am and I was the only guy without white hair.

It’s a weird choice to have that customer base interact with self-service machines without support. At least push that policy to a different time.

So, while maybe it’s a you problem is funny, swamp might be onto something. Typical Safeway workers probably hate the morning shift. Ageism might be the root of it.

I am a retail worker and older customers tend to be the ones who are cranky and demanding. They are the ones who yell at us. I work with a young woman who purposely is scheduled for later shifts because old customers in the morning would make her cry. Not all of course, some are very sweet, but there is a clear correlation between angry customers and older age. I say that as someone who is no spring chicken himself.

Jason,

Funny thing, youths used to pump gas, check tire pressure and wipe windshields. Courteously. They used to carry old ladies’ groceries out to their cars. It was called service it was called a job. It was called doing something for your fellows, adding to others’ day. If old people (who are quite prevalent, maybe for a good reason, like survivability) make you cry, by all means, take some more meds and stay home. Talk to your chat bot “friends.” Humans are frictional and difficult. Welcome to planet earth.

There employees are gathering groceries for pick up ,everything is going self service .No employee s no benifits no wages .There probably making way more money

Flea,

Yep, I noticed a lot of employees tied up with gathering groceries for pick up. Also, I found that at the Deli the workers there seem to be tied up with phone orders. One reason I shopped at 7AM is because of Covid. No one in there to give me Covid. Worked pretty good for the past 2 1/2 years. Now that Covid has wound down things are so screwed up at Safeway that I am refusing to shop there any more unless it is a dire emergency item that I ran out of. I told the moron customer service rep that I was posting a negative review of my experiences at Safeway on a Web site that is read by 300,000 people. Wolf would know the exact figure.

Self-service very late or very early with roaming employees at the large grocery chain where I used to live in the Chicago area sometimes resulted in a shopping cart of expensive booze rolled out the doors at 100% off.

Whoever got the booze lost value. They helped raise their own mortality stats.

They probably sold the booze. No one drinks a shopping cart full of expensive booze.

Self checkout is a great way to test out philosophical questions.

Is it against the Ten Commandments to steal from a robot, owned by a corporation, when the technology is so complicated and buggy that “mistakes” are inevitable?

If they don’t employ my friends and neighbors, then F’ em.

I went into a WalMart in Boise last month. There were only 2 full-service checkout lines and about 20 self-service kiosks. That was new to me.

We are being trained to help ourselves while businesses reduce labor costs. However, I am curious on the uptimes of the kiosks. How much does the self-service Kiosk repair person make compared to a checker?

How busy is the repair person? How much are these fancy kiosks that make sure the weight of the item matches the weight put in the bag? How much theft is occurring?

I am not saying there is a recession in effect at the moment, no.

But unemployment is generally a lagging, not leading indicator, when it comes to the economic cycle.

Consider the 2008 recession:

Interest rates started rising in June 2004, hitting a peak in July 2006.

Unemployment hit a trough in early 2007, and peaked in April 2010.

Nobody likes to wait these days, but a interest rate rise induced recession takes time. The Fed didn’t understand the impact of lags in 2006 and time will tell if they have learned anything since then.

The unemployment rate lags, but the upward hook in initial and continued unemployment claims is leading-to-coincident as an indicator.

The only real question is how high does the upward hook have to go before it’s considered a positive signal…

Some Guy,

“But unemployment is generally a lagging, not leading indicator, when it comes to the economic cycle.”

RTGDFA and look at the charts: unemployment claims are a LEADING indicator, and they have to reach about 350,000+ before there is enough deterioration for a recession. I explained all that, and you can see it in the charts.

I agree Wolf. It’s not the ‘70s anymore. It’s shoot first…

Wolf,

I think what’s missing is that recession calls are a backwards look. So the recession call is made AFTER the data has come in, AFTER the graphs are made, AFTER unemployment has spiked, etc. Looking at those charts, someone might say that when claims get near a recent historic bottom, a recession SEEMS to follow not too long after that.

By the way, berating EVERYONE who comments on here was comical at first, but now it’s getting a little old. I scroll through your responses because I believe you have great insight and cold hard facts. Now it’s you berating someone because they had an OPINION.

There is a ground rule: if you don’t read the article, fine, and you’re welcome to comment, no problem, but don’t comment on the article, don’t comment on what you think the article said, don’t comment on the headline, etc.

If you didn’t read the article, comment on something else. Many people are doing that, and it’s fine. This could be an anecdote of someone you know who lost a job or whatever.

I need people to understand this and stick to it, or else this is going to turn into chaos, and I’ll end up having to shut down the comments, as I did with my previous site, and as many other sites have done.

The Real Estate market has completely collapsed here in the Swamp. No sales, no listings, no one is making any money. You’ll be seeing RE agents on the street corners along with the panhandlers. We’re in a recession or if you look at some industries like RE, it’s a depression. Rentals are the only bright spot. Still doing good even in this environment.

I thought the RE agents went back to the tennis courts when things got slow…..Oh, wait, that’s California RE agents! LOL

What ever happened to Network Capitol Funding. The lender from Irving California was on the air 7 years here WMAL and now is no longer. Did they go out of busieness?? Or what. A lender just wrote us a bad check. Bounced at two banks here. What the f$ck is going on??????

Las Vegas is the same. Properties are going down 10% per month for the past 3 months (yes, down 30% already) based on recent in-contract listings.

A recession starts then the unemployment rate increases. For the past 14 years, central banks have navigated uncharted waters and lands. For this reason, what we will soon see will be something that no one will expect. I believe it will all start with the implosion of the Chinese real estate market … They will probably have to invent another pandemic to force people to stay indoors and try to avoid riots … and then … who knows …

I think what’s coming is a credit crunch.

I don’t know how badly the China economic crisis will affect the USA, but they are in for years of economic stagnation ala Japan due to their equally as bad demographic crisis. The Chinese population is expected to peak by 2030 and may actually contract significantly by 2050, barring any efforts to increase immigration which is not likely to happen. Europe is already in a demographic crisis, and Russia is speeding up their own demographic crisis. The USA is expected to have flat population growth into 2050, yet most of the population growth is going to be in the middle east and sub-Saharan Africa.

This is a global contagion with bond markets all connected,if China blows up every country bonds go down too. Bonds are just a different name for a loan .Great Reset or ww 3

I agree with the consumers still being out in force but don’t agree with the labor numbers. Unemployment is just a measure of the people who want to work but can’t find employment.

Better measures are:

Labor Participation Rate which is currently at 62.15 versus a recent high of 63.5% pre-COVID.

Employment Population Ratio which is currently at 60% versus 61% also pre-COVID.

Both of those numbers had been rising but have started to plateau.

Either work is not available or people don’t want/need to work. Regardless of their reasons, the economy is not as strong as it should be.

Russel,

“Unemployment is just a measure of the people who want to work but can’t find employment.”

RTGDFA

I’m so sick of this braindead BS by people who never read the articles. The article was about claims for unemployment insurance, people filing for unemployment benefits.

Adios.

Are you looking at prime age LFPR? Need to consider boomer retirements.

Also, claims should be normalized as % of population. Would help show how tight the labor market is.

I think recession is on the way. Consumers are still spending for now, but their money ain’t buying as much which tells me that somebody ain’t producing as much.

Also, as mentioned, unemployment numbers not only lag, but only represent those who intend to work.

Then you have home buyers on strike which reaches deep into the economy.

Throw global issues in the mix and it doesn’t look good. We don’t live in a vacuum.

Hey Wolf, what about total number of workers employed? How do these unemployment figures relate to that as a percentage of the overall workforce?

It’s interesting because part of the ‘Great Resignation’ I’m sure is the ‘Great Retirement’ as baby boomers leave the workforce. Has the workforce shrunk because of that?

What would be really interesting (if anyone actually tracks it) is the distribution of age in the overall workforce. How big a wave is coming close to retirement over the next few years?

RTGDFA

The article is about unemployment claims — people filing for unemployment insurance.

I’m so sick of this BS by people who never read anything.

And by that token, they probably won’t read your response either!

A growth recession won’t be any obstacle to the markets. While CPI came in hot the same surprise in GDP will light a fire under things. Can the Fed raise rates MORE than it already is, without crashing the [Main St] economy? This smells like 2008, but RE is solid, [banks are not going to write down property values don’t care what median price in a low volume market might say]. The Fed has the tools [but mostly they will rescue the corporate bonds, where the jobs are, where the consumer shops – treasuries are a political football] at the end of the day they want the growth, they need the growth and they will have the growth. I hope y’all bought your tip bonds while you had the chance. The mortgage rate in 1960 was about 5%, [higher than it is now] and ten years later you were sitting pretty. Wages were up, and blue collar joes where banking on their house. If any of this sounds familiar.

If RE is solid then I am trying to understand why big time sales volume down and beginning of price reduction.

The stronger the market, job market and sign of no recession the stronger FED is to hike rates to tame inflation.

The elephant in the room is Inflation and is the wild card as well.

The better the economic numbers, the more the Fed stays on inflation the better we are coming out the other end. We just had a decade of subpar growth, and uber low interest rates (you can still lock in a pretty good mortgage number) now we should have a decade of economic growth ( led by pandemic stimulus, and pent up demand) We’re going to ride that elephant. The inflation we have will be resolved with more US domestic investment.

Pent up demand for what?

That last graph consumer spending. Crazy. There are 132 million households in the U.S. That means on average, each household spent 106k on stuff.

Americans are busily converting the world’s remaining resources into must-have items they can forget about in the basement. WALL-E was a documentary.

The neighbors’ pet rock died. They’re holding a burial service.

A small donation to your local gravel company is requested in lieu of flowers. There will be five minutes of “stone cold” silence to honor the bereaved.

Whoa! How does that work out….. seems high

Yep. That seems high. But most of the spending is done by a few and not the whole.

The graph said 14 trillion in consumer spending for 2022. Divide 14 trillion by 132 million families.

But if some Wall Street Hedge Fund exec buys a $20 million dollar house. He just spent the equivalent amount as 200 families.

Then he takes a couple $50k vacations.

My (single guy) net worth puts me in the 80th percentile of US household net worth. I am SO FAR from wealthy, I am stretching every dime to live, seriously frugally. Zero eating out, travel, etc. This view of the financial health of the 79 households below me (per every 100) horrifies me.

I think of mayflies dancing in the sun, carefree. Is it sheer faith-based hopium on Uncle Fed? Buying “experiences” looks different once one experiences life in a tent under a freeway.

“I am stretching every dime to live, seriously frugally. Zero eating out, travel, etc.”

phleep, maybe a part time job will help you a bit?

Hmm…downgrade the after the stock falls 40%. Thanks but no thanks. What to think? This might be a bottom (stock). In the past it seems like analyst give upgrades at the top and downgrades at the bottom.

——————————————————————–

Analysts from Bank of America cutting their rating on shares of three homebuilders in a note out Thursday as the housing market faces an economic slowdown.

Rafe Jadrosich at Bank of America Global Research downgraded shares of Lennar (LEN) to Underperform from Neutral, and shares of KB Home (KBH) and Toll Brothers (TOL) to Neutral from Buy, as rising interest rates challenge affordability for buyers.

“New home demand has reset lower over the last three months following two years of unprecedented growth,” Jadrosich wrote. “Homebuilder earnings and industry data indicate a sharp demand deceleration in June/July as a result of worsening affordability and lower consumer confidence.”

In mid-year, 2000, analysts began downgrading the dot-com stocks from “buy” to “hold”. What else is new?

Bloomberg says 20 million households, 1 in 6, are behind on utility bills.

Even with low unemployment, times are bleak for a lot of people.

This inflation is cruel, there’s another cold hard winter in store. Will the heat be turned off maybe some are wondering?

How many were behind on their utility bills in July 2019??? How much has it changed?

Some people are always behind on their utility bills. That is very common. And 20 million sounds about right. That’s about HALF of the subprime-rated consumers. So that appears to be the normal condition.

Unless the study that Bloomberg cited can tell me how that changed from 2019, the line is just bunkum.

Thanks for calling this out. I have seen this headline pop up all over . I totally agree with your assessment. Also how did they come up with the data. I went to the site NEADA that Bloomberg referenced. It is a an organization that asks the government for money to provide low income people with money to pay their energy bills. There is no published report I can find. There was a snippet and from what I can tell, they got some information from a few utility companies and then interpolated the rest. Well, one of the companies was PG&E which had 24% of their customers who were behind on their bill. I think that skewed the report a bit. The other 3 companies were around 11%.

Thanks for calling me out, I needed it. One just can’t take for granted any of the media click-bait BS. I’ll stick to Wolfstreet for real facts and the National Enquirer for media journalism.

Construction layoffs should be starting soon if recent trends continue much longer. New housing transactions are down significantly as a result of mortgage rate increases, and rates will likely stay above 5% for a long time.

If your product sales are down 20%, don’t you have to lay off some workers and contractors? If so, couldn’t this have a big economic impact, given construction workers spend every penny they make on trucks, boats, houses, beer, etc.

Curious, what’s the relationship between me and sf? MF looked at least ‘aight and I wonder if firms/labor shifts between them?

Also, can a construction guy explain if layoffs are a big thing in construction? Do laborers get unemployment? I know there are all these contractor/subs etc that happens, but I don’t know how it works between the guy paying and the dude swinging the hammer.

Sorry, meant to say multifam and single fam construction, if that was unclear.

Here in Minnesota, MF housing is popping up like crazy. Good looking buildings, good looking units. SF homes are also popping up like crazy, albeit in the exurbs. When you say laborers, if you mean W2 workers, then yes they get unemployment. Contractors/subs for the most part don’t get unemployment. I work in remodeling as a sub, which in my opinion is unrelated to new construction, and it has slowed down.

Maybe it just solved the labor shortage in the construction industry, to where builders finally get the workers to do the work? There is a lot of that going on.

There’s a back log of projects, many builders were booked for the next few years. This is going to take time to work itself out even with a recession.

To avoid a RTGDFA response, I’ll preface this by making it clear that I’m talking about unemployment claims!

I agree that unemployment claims typically signal a recession, and are definitely an immediate indicator. But, maybe job openings is an important number to keep an eye on this time. I wonder if unemployment claims are kept artificially low because of low labor participation (at its lowest since the 70s). Early retirees and moms who voluntarily left a job to stay home aren’t going to be eligible to make unemployment claims when household budgets get tight. I suspect that there are a lot of folks still riding out their cash-out refi money and other byproducts of money printing. Maybe going into the next recession it would be wise to watch for labor participation rising while job openings fall? In other words, people start re-entering the workforce but they can’t find a job easily. Rising unemployment claims may have a lag this time around since employers are short handed due to all kinds of artificial forces… Rather than going straight to layoffs which do lead to more unemployment claims, some employers may find that their currently low headcount in a hot economy becomes a sufficient headcount in a slowing economy. I’m starting to see the very beginnings of this in my own industry… No layoffs, but softening labor hours, less overtime, and less hiring. Nonetheless, this could still take a while and there’s no proper recession until those 10M+ job openings fall off substantially, which should happen prior to mass layoffs.

I think you may be over-thinking this somewhat. There is such a huge sink of job vacancies out there that anyone laid off is likely getting another job so quickly (and often earning more money) that many are going to skip filing a UI claim.

Given this, like you said, I would concentrate looking at job openings as a forward-looking metric.

Max, companies are usually overweight on headcount during the good times. But recently we’ve experienced an economic boom in which companies couldn’t hire enough. Companies would normally turn to layoffs pretty quickly as an answer to a drop in demand because they have plenty of fat to cut. But if a company is staffed too thin to begin with, then softening demand simply means that their current staffing level becomes comfortable… They may significantly slow their hiring, but they don’t need layoffs. And yes, you make a great point about a strong labor market being able to absorb those who lose a job… Put our points together and it goes something like this: Fewer workers get laid off and those who do are able to find jobs reasonable quickly. Both forces can act to keep unemployment claims low.

It seems like we’re pretty much in agreement regarding what to watch. I don’t think it’s really not a matter of over thinking anything. We’re each just looking at different sides of the same coin.

The Plague did not cause a recession, but it did make the economic graphs go batshit crazy. I find that intriguing.

Early stages of 2023 budgeting – told to expect budget for compensation to increase by 2.5%. What a joke. Management and the ivory towers haven’t gotten it pounded into their heads yet that the status quo isn’t working for the peasant class anymore. I’ve never felt so much ‘pressure’ in the air and general unease/unrest/discontent like I do now. I see what the median incomes are for areas of the country I am familiar with and it’s depressing to think about what it would be like to live on that.

But at the same time – labor market is still TIGHT as the graphs show. HR has no idea how to hire top talent, so you have to work the back channels and compete FIERCELY (aka pay up) for talent.

” I’ve never felt so much ‘pressure’ in the air and general unease/unrest/discontent like I do now. ”

For as much as I dislike subjective “feely” statements like this in business – I agree 100%. I run a technology firm, sub-30 employees. We’ve had very stable staffing retention for 25+ years, substantial quarterly bonuses, perks out the wazoo. Great culture.

This year, something has broken in peoples’ minds:

The amount of angst among my staff is absolutely off the charts this year, and is manifesting itself in two divorces, lots of illnesses, “anxiety days off” and general malaise. I have *never* seen anything like this.

I thought 2020 would break peoples’ minds – turns out, it’s 2022.

Agreed on the labor remaining extremely tight. We’re in a situation where we have very little leverage with our staff, which unfortunately results in us having to tolerate a lot of misbehavior that would never be allowable in the past. It’s weighing heavily on my management team who know that we cannot afford to lose these people….but we cannot afford to keep them, either.

Mish is absolutely correct – so long as the labor market stays strong and cash is sloshing around, none of this is going to correct.

Inflation is worse than the plague because the dead don’t care about the price of food.

The job market remains red hot and so does consumer spending. Demographics support droves of Baby Boomers exiting the workforce and retiring over the coming years which should keep the job market tight and support continued wage gains. This could be a mitigating factor in preventing a more significant layoff situation from unfolding in the near future. Earnings may miss expectations stock prices may fall but if large numbers of employees are retiring concurrently, existing staff at functional, profitable companies may be spared. Glass half full outlook but it may take longer than we think for unemployment numbers to reach recession territory.

One can retire from a place which still has a pension to trigger the payouts, then work somewhere else, including a competitor in the same field, perhaps taking some time off in between.

the chart shows unemployment claims begin to rise slightly from low levels preceding a recession, but spike at the end of the recession. It is a lagging indicator to recession and to equity prices, not leading.

This is called a blow-off top. Inflation and shortages are raging so hot that people are starting to spend in order to not lose the value of their cash.

This is going to end very badly. Either Powell raises rates enough to drop inflation back below 2%, or inflation goes absolutely vertical and reaches 20+% by year’s end. There are no soft landings here. The piper must be paid, one way or another.

We are supposedly in a very “mild” recession, and yet according to Bloomberg, 20 million US households are behind on their power bills. So consumers are skipping their utility bills in order to consume? I am not sure what to think here. Everything is hunky dory or the wheels are about to come off?

Also the job numbers, could it simply be that people are taking multiple jobs to survive?

You might want to read the comments . This utility info is discussed above.

SocalJimObjects,

I’ll just repeat my comment from above:

How many households were behind on their utility bills in July 2019??? How much has it changed?

Some people are always behind on their utility bills. That is very common. And 20 million sounds about right. That’s about HALF of the subprime-rated consumers. So that appears to be the normal condition.

Unless the study that Bloomberg cited can tell me how that changed from 2019, the line is just bunkum.

And ru82’s reply to my comment above:

Thanks Wolf.

Wolf wrote:

“Looking back over the decades, all the way to the double dip recession in the early 1980s, we can see how low today’s initial unemployment claims still are compared to recessionary periods (grey areas) and the periods leading up to the recessions.

Historically, initial claims rose into the 350,000+ range before there was enough weakness in the labor market for a recession.”

This argument seems fundamentally sound and consistent with the data shown on the charts BUT it seems odd that it’s stated in absolute figures rather than relative to the total number of employed people.

Surely 350K initial claims in 1980 is a much bigger problem than 350K initial claims would be in 2022 given that the total employed population is so much higher now than in 1980. So wouldn’t the number now need to be a lot higher to be signaling an upcoming recession e.g. 450-500K?

Earlier this year, media outlets were reporting that initial claims was at a 50+ year low. It dropped to just 166K in March which was the lowest since a 162K reading in Nov 1968. But surely 166K is really an all-time low relative to the employed population which must be much higher now than in 1968. What am I missing?

There are a shortage of workers. That’s due to a sharp rise (+2.6 million) in disabled people 16+ since the start of 2021. That could be due to “long COVID”. Or maybe “climate change.” Or it could be something else.

https://fred.stlouisfed.org/series/LNU00074597

Since I’m in debunk mode:

The chart you linked shows “population with a disability” 16 years and older. This includes many old and very old people, teenagers, people who are working, and people who are not working. It’s not a measure of employment.

The BLS (whose data this is) also says that 19.1% of the population with disabilities is employed, compared to 63% of the population without disabilities.

The BLS also says that the reason the ratio of employment is lower is because there are a lot of old people in that group who wouldn’t work anymore anyway: “The lower ratio [population-employment ratio] among people with a disability reflects, in part, the older age profile of people with a disability; older people are less likely to be employed regardless of disability status.”

https://www.bls.gov/opub/ted/2022/19-1-percent-of-people-with-a-disability-were-employed-in-2021.htm

Thanks for taking the time to debunk. Or as they say in the modern era, to “fact-check” my claim.

So if we assume for a moment (Popper’s falsification approach) that there were in fact no new disabled people in spite of the large increase in the series, what’s the reason for the 2.6 million new people added to the series during 2021-2022? I’m not sure I saw an explanation for why the numbers increased (by 2.6 million) in your “debunk” attempt. What changed from 2020 to 2022 that would explain the rise?

Note: I am not trying to claim there are 32 million disabled people 16+. Your debunk does a great job of explaining why this isn’t true.

My point is entirely about noticing the large, recent change in the number of self-reported disabled people, at the same time we have a labor shortage, and proposing explanatory power for said labor shortage from this unexpected, surprising, and as-of-yet-unexplained increase in self-reported disability during the 2021-2022 timeframe.

I claim the series is telling us, a bunch of people are now saying: “I can’t work anymore because I’m hurt.” What do you claim the +2.6 million self-reported disabled people in the series are telling us?

I really appreciate being debunked. It helps me to look more closely at my own assumptions. Thank you.

Click on the BLS link I linked. First chart. It will open your eyes.

Given your encouragement, I went off and did some math. Here’s what I saw:

If we wanted to answer the question: how many of my 2.6 million “newly disabled” group were not working, we can use your series to find the answer. We multiply that newly-disabled 2.6 million by (100 – 19.1% = 80.9%) yielding the not-working-while-disabled count of about 2.1 million.

And after doing a bit more math, I now see that my 2.1 million provides less than half of the explanation for the labor shortage we’re seeing right now.

Because: CLF16OV is just now back to (roughly) 2020 levels, while CNP16OV is up by 4.5 million since 2020. (I’m sure you know both of these series the same way I do). So basically we have 4.5 million more people 16+, none of whom are working or looking for a job.

Here’s a related question. Who is taking care of those 2.1 million newly disabled-and-not-working people? Perhaps their family members? I went through a disability recently. My family had to take care of me during that time. I’m guessing that would be true for others if they were seriously taken out by – say – “long COVID.” Or something else.

Some reports yesterday, Thursday 2022-08-25, (afternoon,) reported as many as four million workers in USA alone still on the sidelines from what is now called long covid.

It certainly will be of great interest going forward to see many of these kinds of reports, especially by formerly respected sources, after a few years of fact checking and so forth…

OTOH and FWIW:::

”Take it easy” Wolf: don’t let the buzzards grind you down, which they certainly will, but only if you let them…

Thanks again for all your wonderful work.

Regarding the savings rate reports…showing levels down to 2009…

The banks have been terribly late (like the Fed) in raising rates on savings.

Thus many may have, should have run to treasuries. I assume treasury holdings by individuals does not show up in Savings Rate reports, thus showing less savings than there really are.

Anyone know for sure?

In the States, do we have any data on the relationship between initial jobless claims, extension of jobless claims, and how those relate to new Social Security claims by those under age 65? Including the numbers on Medicaid? Is there evidence that once unemployment benefits run out that there are corresponding Social Security “disability” claims?

Is it possible, or perhaps even probable, that the Social Security and Medicaid system has become the subsistence platform for the “not in the workforce” numbers? Put plainly, it is the very basis of the welfare state?

ICE deported over 59,000 people last year. They prioritized efforts to deport felons. Not sure how large the illegal work force is.

Part of the yield curve is flat to inverted. The 6 month T-bill yields 3.25%, same as the 30 year T-bond.

Bankrate_dot_com has 1 year CD’s paying 2.5%.

Ever since the FED started hiking, the “Powell pivot” crowd has been crowing about an imminent recession. Almost to the day. Wishful thinking, methinks. The reality is that we are nowhere near a recession. The amount of money sloshing around out there is almost unfathomable.

The roads are still jam-packed with vehicles, people are vacationing and spending money like never before. Recession? LMFAO. Uh, NO.

And if the FED tries to pull some chintzy rate hike BS, like 50 basis points, then the stock market will catch fire again over the perceived “coming pivot,” and this inflation will continue roaring as it has not abated in the least. Not that 75 basis points is going to stop it, but the FED credibility thing is a real problem now.

That Jackson Hole press conference he gave today was very hawkish. I have to imagine that’s going to thin the “Powell pivot crowd” a bit.

“Restoring price stability will likely require maintaining a restrictive policy stance for some time.” Ouch.

Now I’m just waiting patiently for Wolf’s article on it.

I’m waiting for the article too. I also think the speech was hawkish, but I’m interested in seeing how Powell’s speech is interpreted by others given the wildly divergent opinions following his press conference in July.

Not to argue subtle details, but to say “inflation will continue roaring as it has not abated in the least.” isn’t fully aligned with reality. Inflation YoY has come down from about 11.9% in March to about 9.4% today, largely due to a reduction in Transportation costs (Fuel).

Has inflation been tamed to allow a ‘Fed Pivot’? Hardly, so I do agree with your premise.

I’m waiting for the coming pause in rate hikes, and yes it’s coming because the Fed keeps bringing it up (maybe after another couple hikes). But I don’t see QT ending until the labor market finally cools significantly, which is still a while down the road, so the narrative may have to change. Instead of praying for loose monetary policy, it could be loose fiscal policy. Politicians to the rescue! If the Fed doesn’t pump assets with easy money, politicians will just hand it out. We’re talking tax incentives, “cancellation” of debt, direct cash-hand outs, programs, various new deals green and otherwise, or whatever else the politicians cook up that we can’t even imagine yet. All of the necessary precedents have been set and we’ve crossed the Rubicon. It really doesn’t matter whether the (D)s or (R)s are in power, they’re just the same ol’ car with 2 different badges slapped on. We’ve entered an era where politics and ideology are just pantomime, moral hazard is meaningless, and our political system is simply a contest showing which party can buy more votes.

Your “pivot” ain’t comin’, Linus.

No pivot anytime soon, nor did I say there would be. I even said they won’t back off of QT until the labor market cools a lot. They will almost certainly pause rate hikes at some point in the not-terribly-distant future because they’ve said they would in plain English many times. A pivot would only come once the jobs market has suffered enough to really dampen inflation. That’s also dependent on what inflationary hand-outs the politicians cook up. When? 6 months, 3 years? Don’t know. But if we are thrown into a weak jobs market and something causes credit markets to freeze up (a Lehman moment of some sort), they’ll pivot faster than you can say “quantitative easing.”

I’m surprised that you of all the commenters on here, Depth Charge, are sure that the Fed is suddenly a righteous inflation fighter. Make no mistake, the scumbags at the Fed will sell us regular folk down the river the minute they get the chance. If you’re waiting for the Fed to intentionally hold tight into deflationary conditions, there ain’t enough time in the universe.