Spending on gasoline plunges due to plunge in price. “Real” spending on durable goods, amazingly, jumps for 2nd month. Services spending rises but stuck below pre-pandemic trend.

By Wolf Richter for WOLF STREET.

Something interesting happened in July to inflation-adjusted consumer income and spending. Remember when President Biden said that inflation was “zero percent” when the Consumer Price Index data came out in mid-August? Obviously, neither inflation nor CPI were 0%. CPI jumped by 8.5% in July 2022, compared to July 2021, which is how we generally discuss inflation. But the plunge in gasoline prices caused CPI to not change in July from June, so 0% change month-to-month, but 8.5% change year-over-year.

So today, the Bureau of Economic Analysis reported consumer income and spending in July. Adjusted for inflation (= “real”) by the PCE inflation measure, in July from June, the change in the “seasonally adjusted annual rates” were:

- Real personal income from all sources: +0.3%

- Real personal income without government transfer payments: +0.4%

- Real personal spending: +0.2%

Not adjusted for inflation:

Total consumer spending without adjustment for inflation increased by $23.7 billion in July from June (increase in the seasonally adjusted annual rate of spending). Spending fell in three categories, notably on gasoline due to the plunge in gasoline prices, and rose in the remaining categories:

Spending fell in these three categories, in July from June, without inflation adjustment:

- Gasoline: -$55.9 billion, as the price of gasoline has plunged

- Financial services and insurance: -$20.1 billion

- Transportation services: -$0.5 billion as airfares come down a little.

Spending rose in the remaining categories in July from June, without inflation adjustment:

- Housing and utilities: +$23.4 billion

- Other services: +$13.7 billion

- Other nondurable goods: +$11.0 billion

- Final expenditures of NPISH (Non-Profit Institutions Serving Households): +$10.8 billion

- Recreational goods and vehicles: +$9.7 billion

- Motor vehicles and parts: +$8.4 billion

- Furnishings and durable household equipment: +$7.3 billion

- Clothing and footwear: +$4.3 billion

- Food and beverages: +$3.6 billion

- Healthcare: +$2.8 billion

- Other durable goods: +$2.0 billion

- Food services and accommodations: +$1.7 billion

- Recreation services: +$1.4 billion.

Adjusted for inflation.

The BEA adjusts consumer income and spending based on its PCE inflation measure, not the CPI inflation measure. Its July PCE price index dipped by 0.1% in July from June, on a 4.8% plunge in energy prices, and was up 6.3% year-over-year.

In other words, inflation adjustments had little impact overall on income and spending growth in July from June, though they did impact year-over-year growth.

Income, adjusted for PCE inflation, rose.

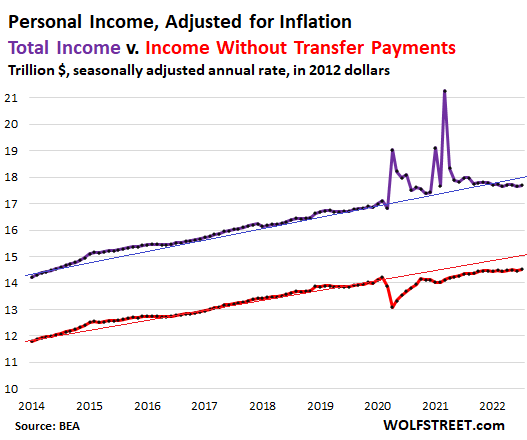

“Real” personal income from all sources rose 0.3% in July from June, undoing the dip in the prior month, and is flat with April (purple in the chart below).

This includes income from wages and salaries, dividends, interest, rentals, farms, businesses, and government transfer payments such as stimulus, Social Security, unemployment, welfare, etc., but does not include capital gains/losses.

Compared to July 2021, real income fell 1.6%; compared to July 2020, it fell 2.2%; compared to July 2019, it was up 5.9%. It dipped below pre-pandemic trend at the beginning of this year and has remained there.

Real personal income without transfer payments rose 0.4% in July from June, eking out a new record. Compared to a year ago, it rose 1.3%; compared to two years ago, it rose 6.2%; compared to July 2019, it rose 4.9%. But it remains below pre-pandemic trend:

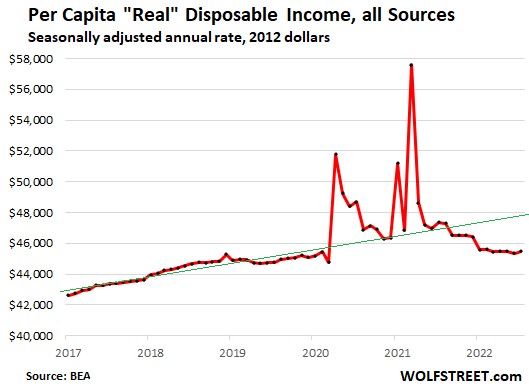

Per-capita “real” disposable income rose. Boiled down to the per-person level, and based on what’s left over after taxes, per-capita “real” disposable income rose 0.2% in June, seasonally adjusted annual rate, but was down 4.0% from July 2021, and was down 6.6% from July 2020, and up just 1.6% from July 2019 (in “2012 dollars” to adjust for inflation). It has fallen far below pre-pandemic trend (green line):

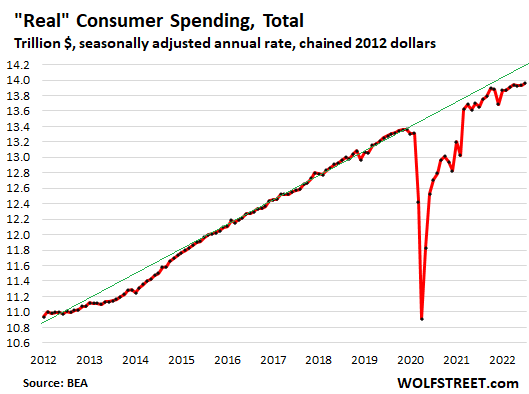

“Real” spending on goods and services rose, eking out a new record.

Consumer spending on goods and services in July, adjusted for inflation, rose 0.2% from June, was up 2.2% from July 2021, up 9.9% from July 2020, and up 5.1% from July 2019. It remains below the pre-pandemic trend (green line):

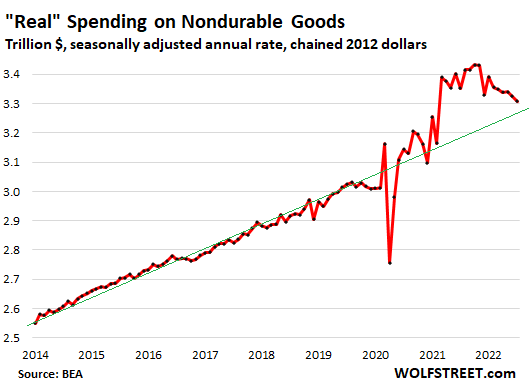

“Real” spending on non-durable goods continues to revert to trend after pandemic bubble. Inflation-adjusted spending on food, fuel, household supplies, and other nondurable goods fell in July by 0.5% from June, which includes the plunge in spending on gasoline due to the plunge in prices. From July 2021: -1.3%. But from July 2020: +5.2%; and from July 2019: +9.4%. This spending continues to revert from the stimulus spending binge toward pre-pandemic trend (green line).

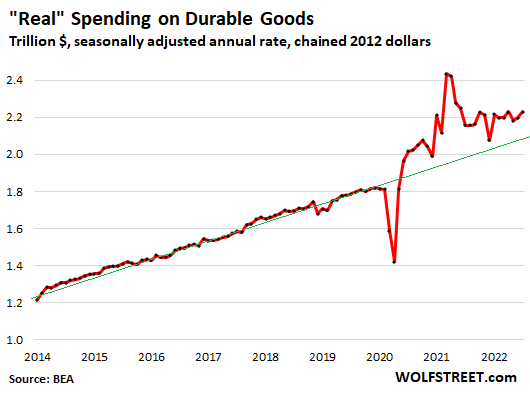

“Real” spending on durable goods, amazingly, jumped again. Americans just don’t want to slow down their purchases of stuff, it seems. Inflation-adjusted spending on vehicles, appliances, electronics, furniture, and other durable goods jumped by 1.5% in July from June, and the second month in a row of increases, and was up by 3.4% from July 2021, up 10.6% from July 2020, and up 24.7% from July 2019.

These are big increases (inflation adjusted!), as Americans have been refusing to throttle back this durable-goods spending to pre-pandemic trend; just not happening, though everyone, including me, thought it would (green line).

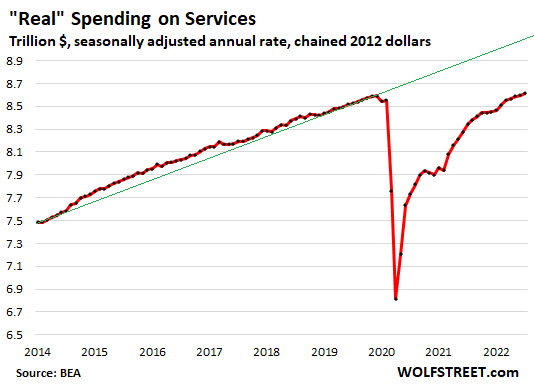

Spending on services, adjusted for inflation, ticked up. “Real” spending on services – healthcare, housing, education, travel, sports events, haircuts, repairs, subscriptions, streaming, etc. – rose by 0.2% in July from June, by 3.3% from July 2021, by 11.4% from July 2020, and by just 1.0% from July 2019.

It remains sharply below pre-pandemic trends, having run roughly in parallel with pre-pandemic trend since March without catching up.

The share of spending on services remained at 61.9% of total spending in July, unchanged for the past three months, and remains below the share of around 64% during normal times, while spending on durable goods and nondurable goods still run above pre-pandemic trends.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The fact that people aren’t pulling back should mean that rates need to go much higher. It’s an inflationary mindset.

A truly inflationary mindset, IMO, would see spending crazily increased: people dumping dollars into almost any other asset.

I agree that rates should go higher, because there should be a big reset after the years of low rates. And that would point toward employments drops, recession, deflation. And it would mean savers and legitimate businesses would stop being punished with an “inflation tax” for the benefit of heedless spenders, phony no-revenue businesses, and raw speculators.

not only it means that rates need to go much higher, but it tells us that the FED is not at all serious enough about doing real QT to drain out most all of the excess liquidity it injected into the system that caused this hyper-inflation situation to begin with. A real agressive QT would also drain the massive margin debt driving all this hot money running up the stock market to further fund the inflation mind-set and raise consumer/business sentiments to spend more. So long as interest rates are lower than the true inflation rates, and people have the previously injected QE/helicopter stimulus “money” then consumers will keep paying up for ever higher prices that companies can charge, and corporate profits (thus stock prices) will be expected to rise, further fueling the inflation mindset. The Fed being so behind the curve is going to set up a far bigger crash to come… Look out below…

I am looking at the charts and this is not an inflationary mindset. Real spending on goods and services is trending below the trendline of the past 5 years. It looks to me like it is going to flatline and then roll over.

My guess is that once home prices start to tank, the spending on durable goods will finally get hit.

Powell continues to talk tough about inflation, but they have not really taken much action at reducing the balance sheet.

Not that I am denying inflation, but I think the economy is quite sick and is only propped up with excessively low interest rates. Merely keeping interest rates at this level will be enough, over another 6 months, to crush inflationary pressures.

The Fed is talking tough, but not really taking major actions. They think they can talk inflation down, without really ramping up interest rates or reducing the balances.

Yeah, this 0.75% increases isn’t cutting it. Tells me they aren’t serious in resolving this mess.

One wonders what percentage of this retail therapy & how much of this is back to school supplies, haircuts and dorm room/flop house furnishings. It’s that time of year.

I know the party line is that Americans are just lousy with money right now, but that is not readily detectable to me among my friends, colleagues & neighbors. Hopefully that means people are saving for the winter.

Anecdotally, I feel like Millennials & Gen Z kids seem less flashy & more frugal to me in general. They go from pedicab or barista gigs to writing code & making bank for a few years, all while living beneath their means so that they can comfortably slum it.

I love it how the graphs look just like are over inflated stock market. Just like that picture is not looking so well I assume this picture will look different in the future.

Probably the toughest economic fight you can wage, the Fed is about to go to battle against the US consumer. It’s going to get scary when the spending charts fall off a cliff, major global slowdown coming. I think medium sized business will be the first wave of defaults as spending slows, the costs from inflation need to be supported by rising prices and revenues. But for now, it appears we are still living that sweet money printing simulation lifestyle.

We force Chinese companies to reveal accounting reports .But let zombie companies in America steal right in front of our eyes .This will end badly ,but what’s really important is worldwide drought no food in 2 years ,hope elites and there families like worms

Just renewed my auto policy, premium increased by 25%. This was a surprise as risk and drivers/vehicles on the policy had not changed. Tried to shop the policy and could not find a cheaper rate.

Bottom line – I was told as the value of vehicles is increasing so is the insurance cost. Makes sense but was unexpected.

More indirect inflation

Both value and repair costs increasing, check…

My friend just got slammed by a hit-and-run that totaled her car. Fortunately, my friend was not injured. The airbags went off for the scum who hit her. Do we have enough law enforcement left to track this down at repair shops?

Why did they run?

1) Impaired?

2) No insurance due to irresponsibility and high prices?

In Chicago, it is usually becasue of no license or stolen vehicle.

Bob,

A lot of these hit & runs are by illegal aliens. In their country is is normal and acceptable to do a hit & run. Happened to me many times here with minor fender benders in parking lots.

Maybe, if you notice 20 b out of insurance and financial services. Could be liquidation of your robinhood account but it also could mean dropping life or even auto insurance seems feasible. The things that you can’t hold in your hand go first. Regardless of how important they may turn out to be. I have experienced this in 2009.

If Wolf could clone himself and send his double up to Canada that would be great, at this point I understand US state of economy 1000x better than my own country’s lol

Seba

“I understand US state of economy …..”

Indeed. Wolf reminds me of my macroeconomics prof in grad school. Great source of information and insights, seemingly unavailable elsewhere. I hope folks will send him a few bucks if they can manage.

Wolf does coverage of Canada, very well, from time to time.

If he does do that, I propose the alter handle Seismic Tiger for his doppelgänger.

High Priest Powell: “….using our tools forcefully to bring demand and supply into better balance.”

Just wondering. What happened to the “invisible hand” of the marketplace?

nsa

” What happened to the “invisible hand” of the marketplace?”

It disappeared.

It never existed outside of a textbook.

Will Emerson (Wall Street guy), Margin Call (great movie!):

“… People wanna live like this in their cars and big f**kin’ houses they can’t even pay for …. The only reason that they all get to continue living like kings is cause we got our fingers on the scales in their favor. I take my hand off and then the whole world gets really f**kin’ fair really f**kin’ quickly and nobody actually wants that. They say they do but they don’t. They want what we have to give them but they also wanna, you know, play innocent and pretend they have no idea where it came from. …”

That’s why I study history: to get a baseline for actual reasonable expectations, outside of this modern mire of spoiled and bewildered complainers.

The best way for the 87,000 new IRS hires to raise revenue is to throw thumbtacks on the streets all over the country. Anyone caught driving around them can then be fined for tacks evasion.

You forgot about these other spending components…I’m going to be spending more on my taxes so that a bunch of psych majors don’t have to pay back their loans and those psych majors are going to be spending more on boba and avocado toast. See, it all works out and the economy will be just fine. What could possibly go wrong?

You are spending more on your taxes for a) all the PPP loans that were forgiven, including to members of congress and b) for the defense department which knows no bounds on spending.

Good work wolf your prediction about the fed coming out to correct the expectations of a pivot was spot on. Although it does not seem like the market listened, even counting todays drop. Fed credibility definitely not restored yet, if it ever does.

If “credibly definitely not restored yet” means Powell wants the market to think he’s Volcker 2.0, than yeah. But I don’t know how the market can make that read based on gems like “At some point, as the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases.”

Powell doesn’t believe, or wants to signal/telegraph that he believes, that a severe recession is required to tame inflation. I don’t think the average player in the market believes it either. A lot of folks seem to be betting that inflation may subside on what is already baked in, supply chains sorted, temporary global disruptions fading away, interest rate hikes towards the overall long term average of 4.6%, and planned QT. This may or may not result in a recession, but they don’t seem to be sweating it too much except as to the high-fliers like tech stocks, bitcoin, etc.

You and others may believe the Fed should aggressively hike to 20% lest we repeat the 70s-80s. You may, and definitely others, have bet your money where your beliefs are that Fed is continuing to let inflation get out of hand. But I wouldn’t assume that the Fed or the market will suddenly concede you’re right in the near term. Optimism seems fairly well-spread.

That being said, that type of potentially pre-mature optimism is classic bear trap territory.

Powell will keep jawboning and the market will keep rallying unless and until he actually does something noteworthy. Snails pace hikes and qt, the market knows he’s bluffing until he isn’t.

I am long volatility and today was a pretty nice day, but you know, like Charlie Brown trying to kick the football and Lucy pulls it away, again, I wanna say the Fed has done this rug pull to me, and not in small sums either. I hope the avocado toast crowd is toasting this weak-spined charade. We had whatm two times at least in the last ten years the Fed flinched, big time, at the first vaguely seroius market squeals.

“ Fed credibility definitely not restored yet, if it ever does.”

Df, or anyone for that matter…

You should take a dive in the Wolfster archives and see what the Fed was saying then…

Wolf’s Fed articles in July 2018 and July 2019 are particularly poignant…

The avocado toast thing was shagged out five or six exits back. Besides, I’m not a millennial and I love the stuff.

Nobody rags on Boomers too much for their vastly more dubious affections, (weight lifting, Kenny G, Potpourri, weather channel).

I’m Gen X. We suck, also.

Bulfinch,

Boomers here in California have loved avocado toast for longer than millennials have been alive. Avocado grows in the state, and one of the commenters here owned an avocado grove and occasionally discussed it. Ripe avocado has been used instead of butter or mayo for a long time on things like sandwiches and toast, and it’s absolutely delicious, and has always been delicious. Blaming/crediting millennials for avocado toast is silly, but they do like nice food, and so it hit home with them as well.

Markets are down 3%+ today. At least part of the message got through.

https://wolfstreet.com/2022/08/26/markets-tank-while-im-waiting-for-the-powell-was-dovish-tightening-deniers-to-fan-out-and-clean-up-this-mess

Yep, Wolf. That’s for sure. I think anyone that jumped back into the market over what seemed like a classic bear trap should have their head examined. First, because I’m a passive investor, for trying to time the market and call a bottom. Second, for thinking that Fed was going to “pivot” because you believe in a Fed put while the inflation fire is still burning. The votes care way more about what they pay at the pump or the supermarket than worrying about rich people’s brokerage statements.

Excited to read your take as I think you are way more respectful of inflation-fighter Powell than I am. I look at where interest rates were, hovering around 0%, and am not blown away by 0.75% increases. Even if there was no inflation you should have been raising by that amount towards 3-4%, just to give yourself powder for the next change in the business cycle.

I think inflation is driving this bus. If it doesn’t go down, Fed will keep tightening until it does unless whomever is president starts appointing doves (possible as there are Keynesians in both political parties). If it does go down, Fed will tighten more to be safe, signal a slow down, and then, if inflation looks good, “pause” and evaluate.

I wonder if people’s stress response to the pandemic (now that things have eased) hasn’t turned into a spending/consumption addiction to mask their loss of confidence/hope in their future. Something like “the party isn’t over till the last dollar is spent.”

GDP announcement was a non event. It may have confirmed the short term flat but nearly double digit inflation number earlier. Can’t stop inflation without hurting growth. Don’t do it Jerome. So when do the new stimulus checks come out?

Nothing screams America quite like all the heads of banking policy meeting at a resort town with multimillion dollar mega homes to plan the next recession.

California is solving this by sending COLA checks to the poor.

The Fed government is sending relief to couples making less than 250K for student loans.

I agree that couples making more than 250K are not suffering with inflation.

However, they vote. Even if they made enough to support the tax increases, they may not see it that way at the polls. Dangerous times.

Jerome can and should keep trying to beat inflation to help us all.

Our current administration hasn’t threatened his job yet, unlike 2019 when times were good.

Hi Wolf.

As a WFHer please join me in a Friday Happy Hour. I’m drinking Yuengling.

I don’t think Yuengling has made it to the Bay area yet. I have some in the fridge but I’m a wee bit east of there.

Yuengling is the oldest family run brewery in the USA. Dick Yuengling is the CEO and owner; fifth generation. In business 190 years in Pottsville, PA.

Near me, in New Ulm, Minnesota, August Schell Brewing has been on the job since 1860. Still family owned and run.

Can’t. I’m still at work, for a few more hours.

Used to drink Yuengling when I was living in Arlington. Liked it.

I’m a boring college teacher but I acknowledge we need your cohort to take the first losses. Don’t blame me, it’s the siren call of evolution.

“Americans have been refusing to throttle back this durable-goods spending to pre-pandemic trend”

I don’t know… Seems like they’re definitely losing their enthusiasm. Durable goods spending remains above trend, but it’s gone essentially flat, dancing around ~$2.2T in real terms for 13-14 months, and it could easily cross the trendline this year. We’re clearly past the spikes brought on by free money hand-outs. Non-durables are plummeting back to trend, aided by lower fuel costs as the article points out, and that could easily be under trend within a couple months.

Almost every chart is flat or dropping in real terms. A couple are returning to pre-pandemic trend in a hurry, and lots of them are below trend and staying there. None of them are really following the slope of the trendline.

Given that real income has flatlined well below trend for a while now, I’d say that the other charts are all signaling that those transfer payment spikes coupled with other financial adrenalin shots (cash-out refi, PPP, UE) are fading, maybe just at the tip of the iceberg. Consumers might be out-hobbling inflation for a little while longer, but it’s clear that inflation is eating the consumer’s lunch, nibble by nibble. Real growth in sales of goods, assets, and services cannot be sustained indefinitely by flat real income. Revolving consumer credit may be relatively low (only a little above 2008 levels), but it’s growing at perhaps the fastest rate on-record, and that isn’t going to float the American consumer forever.

Politicians know the debt will never be repaid,at some point a new digital monetary system will reset financial markets,maybe a barter system oil for food gold for oil only problem is everyone thinks there products are worth more than there neighbors.When will people realize that printed- digital money is a bartering tool ,to exchange for food beer cars whatever you want to buy,but is being destroyed by printing .As a wise man said The Meek Will Inherit The Earth

Small point in list:

“Healthcare: $2.8 billion”

Shouldn’t that be +$2.8 billion?

Large PA employer of 15k hard working people said 3% annual wage increase effective Aug 1st.

Are people leaving, looking for other jobs?

Unemployment is low so people can find jobs and move around in jobs so they appear to not give a hoot to inflation, or racking up balances at 15+% interest on their credit cards appears to be no problem. All of this is keeping inflation fueled.

It appears from historical numbers that for inflation to get back under 5%, the unemployment rate has to be over 5%, may even have to be in the 7-8% range for at least 12-18 months.

This would be equivalent to inflicting enormous amount of pain on the public which I’m not sure Mr. Powell, or our politicians, have the galls to do.

Our economic ills where they are now, caused by politician’s and Mr. Powell’s own follies, now require catastrophic surgery without anesthesia.

Does Mr. Powell have the guts to do it and does the public have the guts to bear it?

Not doing this surgery will likely result in runaway inflation akin to gangrene..

It is interesting that gasoline prices are going down but so is CONSUMPTION. The EIA figures show that gasoline consumption has dropped by about 8% since the same time last year. This has been going on for week-after-week since the start of the war in Ukraine.

And it is a good thing for the fight against inflation. It is a sign that Americans “inflationary mindset” can be broken. They will respond rationally to inflation and make long-lasting adjustments… combining trips to save on gas, picking the more fuel efficient car to make a trip in, turning a car off while waiting in a drive-through (or skipping the drive-thru altogether), even buying a more fuel-efficient car for the long-term. Just because gas prices have come down doesn’t mean that Americans abandon their newly learned conservation lessons.

In some ways, gasoline is easy. People conserve where they can and it has an immediate (and noticeable) impact. Other things require you to spend money in order to save money. Buying a lawnmower because you are going to start mowing your own lawn instead of paying for a service will show up as an increase in “Real Spending” INITIALLY… probably as Durable Goods (“Furnishings and durable household equipment”)… but will have noticeable deflationary effects in pretty short order.

It took fifteen years of QE for America to see Inflation take off… Fed-bashers expecting it to be solved in fifteen weeks or even fifteen months are just being silly.

What I find amazing in this comment section is the complete disconnect in logic as far as the Federal reserve raising interest rates and its impact on the economy. Every week there are people who are saying that the Fed isn’t doing enough, it has lost its credibility, we are certainly spiraling towards hyperinflation. And then 30 seconds later it is all HOUSONG CRASH prices for homes will crash! With these home prices even a tiny increase in interest rates massively impacts mortgage payments. Housing affordability has already collapsed. The same is happening with cars, they are so expensive even the small interest rate increases thus far have substantially impacted car loan payments. There are hundreds of zombie companies that are so in debt they can’t afford 3% interest rates let alone anything higher. When prices have gotten this far out of whack you don’t need a nuke to tame them; a pin is all it takes to pop a bubble. My personal prediction: student loan repayments restart in January, people have forgotten that something like 99% of borrowers have been spending what they would have put towards those payments meaning the effect will be DEFLATIONARY as money is drained away from goods and services to make loan payments. This will hit consumer discretionary spending, especially the already hard hit department stores, hardest, causing a wave of store closures at many retailers that will finally, FINALLY, put the nail in the supply chain crisis coffin. Right now a lot of demand is “fake” it is just inventory building by companies that got screwed initially during reopening and seeing delivery times increase and now want to hold 12 months inventory instead of 2. Once the discretionary spending drops due to loan repayments kicking back in the retailers will cool down their orders, which will allow manufacturers to finally hit their desired inventory levels as they won’t be running as fast as they can just to satisfy drunk retailers, and they will cut orders from suppliers. Retail demand jumped 10%, but wanting to hold more inventory, retailers ordered 20% more, manufacturers seeing a 20% rise increased orders from suppliers 30% to hold more inventory, suppliers order 40% more raw materials. Once this inventory build slows down a huge chunk of inflationary pressure dissipates. All this is before adding in QT doubling in September and further rate increases.