Romeo, battery-pack supplier to Nikola, reached the end of its runway. Nikola, which reported $0 revenues from truck sales, is desperately trying to raise cash.

By Wolf Richter for WOLF STREET.

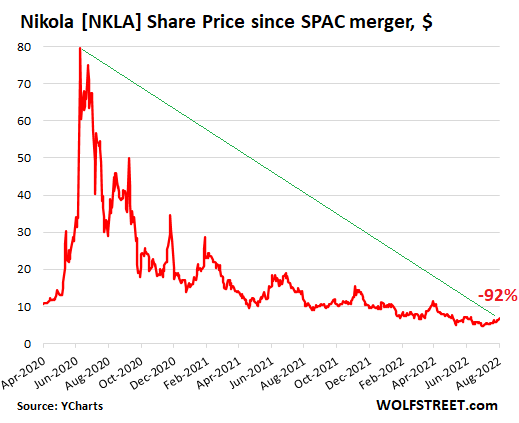

Legendary electric truck maker Nikola, which went public in June 2020 via merger with a SPAC – legendary for all the wrong reasons, such as fraud charges that it settled with the SEC for $125 million last December and a stock that has collapsed by 92% from its hype-and-hoopla high – announced today that it has made a deal to acquire battery-pack maker Romeo Power, which had gone public via merger with a SPAC in January, 2021.

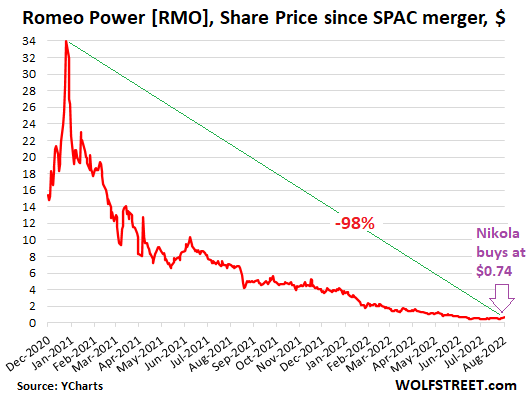

Romeo was running out of cash. In its Q1 earnings report – $11 million in revenues generating a net loss of $81 million – it had warned that it might not be able to continue as a going concern. In June, it received a delisting notice from the New York Stock Exchange. Its shares have collapsed by 98%.

The purchase price announced this morning was $0.74 per share. Romeo’s shares [RMO] closed at $0.70 today upon the news. This $0.74 a share, a 34% premium over Romeo’s July 29 closing price, represented an equity value of $144 million, Nikola said. Both Nikola and Romeo have been stars in my Imploded Stocks column.

As part of the deal, Nikola agreed to provide $35 million in “liquidity support” to Romeo through the closing of the acquisition in order to “facilitate continued operations.”

Romeo supplies battery packs to Nikola. In other words, the collapsing battery-pack maker is part of Nikola’s very reliable supply chain.

“Integrated commercial vehicle electrification platform is expected to lead to manufacturing excellence and expected annual cost savings of up to $350 million by 2026; reduce non-cell related battery pack costs by 30-40% by the end of 2023,” Nikola said today. Nikola said a lot of stuff during its legendary life, including stuff that led to fraud charges that it settled with the SEC last December for $125 million.

Romeo said today that Nikola is its largest customer – though Nikola still hasn’t reported any revenues from truck sales through Q1.

In its Q1 earnings report, Nikola still booked $0 revenues from selling trucks, though it had given out some testing models. The only revenues it booked were $1.9 million from “Service and other.” And it had a net loss of $152 million, up from a net loss of $120 million a year ago.

And this is the legendary stock of the acquirer, Nikola, since the merger with a SPAC:

Nikola is desperately trying to pick up some cash.

In May 2022, Nikola announced that funds advised by Antara Capital LP agreed to make a $200 million investment in Nikola through the purchase of Convertible Senior Notes, due in 2026, which bear an interest rate of 8.00% “if paid in cash.” Nikola can also pay the interest in kind, not in cash, but through issuance of additional notes, at an interest rate of 11.00%.

This cash gives Nikola some additional runway. But after the $152 million loss in Q1, the runway still isn’t very long, especially since Nikola wants to ramp up production, which is a huge money-suck for every manufacturer.

So it has been trying to sell more shares to raise capital. But it needs shareholder approval to increase the number of shares outstanding and raise capital. This has been complicated. Ousted Nikola founder Trevor Milton had blocked the share sale during the shareholder meeting in June, and the meeting was adjourned, and then rescheduled, and rescheduled, with another date set for Tuesday. So we’ll see how it goes.

Competition: the big truck makers with huge resources.

Nikola’s competitors in the battery electric truck market are the legacy heavy-truck makers, including Mercedes, Mack, Volvo, Peterbilt, Navistar (International), MAN, and others that actually know how to build trucks and have huge resources to build EV supply chains and ramp up production. They have dealers and service networks in place. They have well-known respected brands, and lots of big fleet customers. And they all are coming out, or have already come out, with electric trucks.

When Tesla started out making EVs, there wasn’t any competition in form of other EV makers. Today, no startup has that luxury. Competitors are everywhere. Many of them are large companies with huge resources and easy access to the capital markets, and these truck makers have dedicated large amounts of capital to bringing their electric trucks to market. So good luck muscling into this space, with a supply chain whose key link is Romeo.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

To those stupid pundits on MSM that likes tell you we are sooo near or already at the bottom of the market so you better buy the dip now, the fact that this literally fraud of a company is still not delisted and in fact actually went up in the last couple of months goes to show you we are sooo no anywhere near the bottom of a bear market, if anything just the beginning.

There’s still endless pool of hopium liquidity out there apparently, it’s only a bottom market when no one talks about stock or buy the dip anymore, sadly we’re still quite a far way off, even when high flying tech stocks are 60-70% from all time high.

Yep, very pitiful and pathetic, but all too true. The sheer abject stupidity is beyond totally mind boggling.

Hopefully the Fed is near the end of a rope in terms of fresh shots of hopium, so that some actual price discovery sets in. Certain risk takers should have some consequences, some honest losses. Else, this slippery slope continues, and eventually, steepens for everyone.

The Power of Perception over reality still reigns!

If Pelosi lands in Taiwan, without incident, mkts will zoom higher!?

-JPM

Any positive news transient or not, DIP buyers are jumping in!

Glad my ‘swing’ trading (Leveraged ETFs vs Inverse ETFs of indexes) in my IRA acct is overall doing well. one have to be nimble and watch one’s position like hawk.

Long way to go before Perception gives up against the reality.

This is a traders’ ONLY mkt

Btw, to all the companies hyping battery or nitrogen power big rig as the next big thing and replacement to ICE trucks, the science is simply not there. Common sense skeptics and Thunderfoot did some wonderful reporting on debunking Tesla electric trucks that came out in 2017, oh wait…maybe in an alternate universe it debuted. The energy density and weight simply are so far off from ROI and operating cost perspective, anyone buying into the vision it’s just wanting to believe in fairy tale.

You would think people piling any amount of serious into this stuff can at least hire science teachers or professors to do some basic math crunching and come to the conclusion of WTF..

Phoenix_Ikki,

You can keep your “science” and the BS you cited to yourself, and let fleet customers — these are the pros — decide what they want to buy. Understood?

I am a ‘fleet customer’ and I could see Nikola was a complete scam way back in 2015. Too many details to cite here.

Yes, Nikola the company was a scam. Electric trucks are real, and they’re already out there (but built by other truck makers) in small volume and they’re working just fine.

“Common sense skeptics and Thunderfoot did some wonderful reporting on debunking Tesla electric trucks”

Car and Driver disagrees with you. They have data on cost and performance and don’t come off like fossil fuel flacks.

Are you referring to Thunderfoot, the Brooklyn marketing agency, or Thunderf00t, the online designated Tesla attack troll? Let’s hope you’re not trying to provide the latter with undeserved credibility.

Don’t get me wrong. I have serious issues with Tesla and its operations in general and with Elon Musk in particular, but my reservations are real and without any need to make stuff up.

If you must disparage somebody do it for what they really are.

The high cost of battery production, the environmental impact of the production of batteries from the beginning of their life cycle to the end of their life cycle, the degradation of batteries over their lifespan, and the fact they also use a limited finite resource from the earth to operate is a serious issue going forward. They are the weak link of electric vehicles IMHO, and are merely a stop gap until another power source is capable of being implemented. I appreciate the efforts Musk has made to advance EV technology, but long term I hope Musk isn’t putting all of his eggs into the battery basket, and is doing some R&D on some alternative power sources to power his EVs.

Add in the danger of battery fires – very, very difficult to extinguish, emit clouds of toxic smoke, and result in the complete destruction of the vehicle.

Something like 260 people a year die in ICE fires. Ice fires are shitty too and lead to the complete destruction of the vehicle.

Change “battery” to “gasoline” and “Musk” to “Ford” and your post would fit right in to a 1908 newspaper. Also a reminder that prior to petroleum, the country (and the whole world really) ran on whale oil. Lighting, lubrication, cosmetics, etc. Whaling was a huge industry (relative to the rest of the economy) for almost 100 years. “Moby Dick” was “The Fast and the Furious” of its time. Things change.

Did you mean hydrogen?

It takes more energy to produce hydrogen then it makes

Flea-hm, kinda like ethanol?

may we all find a better day.

“It takes more energy to produce hydrogen then it makes”

How much is that? Show us your calculations.

PEMFCs have an efficiency of 83%, so clearly you don’t know what you’re talking about.

The fact that you can’t distinguish between Nitrogen and Hydrogen shows you flunked Second Grade Science.

As always…No Free Lunch!

Maybe they can make a “bad bank” out of it. Roll up a whole bunch of zombie companies into one, and then save on the bankruptcy fees.

I think you’re on the right track here. One zombie still has some borrowing capacity. They use that to buy the other zombie. This is very likely to be the early investors using the “better” company to bail out themselves and their cronies. They know very well neither will ever sell a meaningful amount of product.

Rats taking the last piece of cheese then jumping the sinking ships.

“ I think you’re on the right track here. One zombie still has some borrowing capacity. They use that to buy the other zombie”

The money was borrowed from a distressed entity company investment firm, although I can’t understand why…

I don’t think either has IP or patents worth that kind of jack…

Jeremy, Your comment made me laugh out loud,

I assume that was your objective.

It feels good to laugh.

Yeah, it’s either laugh or cry. Glad to be of service!

Jeremy – I gotta laugh too, – maybe distressed SPAC inverse ETF’s are on the way – LOL

Martok, with ticker symbol PNZI.

Martok

Inverse ETF on the SPAC is already there!

This is more exiting that just speculating in pink sheet penny stocks!

“Both Nikola and Romeo have been stars in my Imploded Stocks column.”

You should have a special category for “Supernovas.”

A company that produces nothing doesn’t “face competition” from companies that produce vehicles. That’s not the obstacle. The obstacle is that Nikola is completely fake.

Thanks for noticing! Why isn’t that sort of stuff stopped by the SEC who is supposed to be protecting customers from SECURITIES FRAUD?

Governments tend to be reactive, not proactive.

Look at Sarbanes-Oxley after Enron, Dodd-Frank after the GFC, and so many other examples.

Anyway, the SEC was warned that Madoff was doing exactly what he was in fact doing, and they found nothing.

Goldman Sachs

That’s the funniest joke so far today. Thanks for posting it, made me laugh out loud.

Have a great day!

Ready for a tax hike to pay for more cops on the beat? Pretty hard to police when half the drivers are speeding (high on funny money). But the fake trucks did stand out.

SCBD-have found myself substituting Wolf’s excellent establishment for any serious reliance on the SEC for some time, now (personal responsibility, caveat emptor, etc.)…

(Like VVNV, i don’t engage in today’s markets as i can’t afford to gamble in them conducted as they are. i do, however, like to know the numbers of those trucks appearing to regularly zero-in on me…).

may we all find a better day.

Honestly, I think that all the information was there to make a smart financial decision. The problem is that most people investing in the stock market are doing zero investment analysis.

A few of the SPACs will turn out to be great investments. Just because a company is generating no income or is losing money doesnt mean it has zero value. There are companies that are still in the technology development stage that come to market and that offers investors an opportunity to invest similar to venture capitalists. If you dont understand how to invest like that, then just dont do it.

The problem is the easy money policies that inflate stock prices to ridiculous values. Another problem is the impact of indexes on stock prices.

Buffett says to be greedy when others are fearful and fearful when others are greedy. When it comes to SPAC stocks, the market is more in the fearful mode than the greedy mode. But only a few of them are gems, and most of them are still overvalued, after 90% declines.

The problem isnt that these companies went public, but that Wall Street investment banks intentionally created bubbles and then blew the bubble apart. It is how Wall Street transfers money from your pocket to theirs.

I’d short them and never have to cover but it would cost more than it’s worth.

Anyone remember Boston Markets IPO ? Mid 90s, lots of hype, all the successful youngish people bought in. BM filed for bankruptcy in 1998. Still around and have good food. So Companies go public and sometimes just to make the founders rich. I remember feeling on the outside when my Peers were in on that IPO. Hype is worth millions if you are an investment banking type. Like GS tells the workforce, eat what you kill. Caveat Emptor is reality. Markets are mostly like a big poker game. The only things I know for sure are that that the Fed can amp all of our “enthusiasm” but they can also be the party crasher. I also know that placing bets on good long term performing stocks, at half off, reduces a lot of risk. So here’s to SP at 3000.

Yes sir. 3000 sounds good, Mr Werthan. 2000 sounds better.

500 sounds better although even that is somewhat overvalued.

Now I want a Chicken Carver sandwich and a side of their mac and cheese…Thanks!

1) NQ monthly log for entertainment only. Option #1, bearish : NQ breached/testing the Jan/Sept 2018 highs uptrend Lazer, on the way down to : 9.5K-10K approaching the Jan 2004/Oct 2007 highs Lazer. That step one for the Mar 2020/ Nov 2021 bull run.

2) After a bounce to a lower high, next year, sharply down to about 5K in late 2024, visiting an uptrend channel coming from :

Oct 2002 low to Mar 2009 low // parallel from Oct 2007 high.

That’s for the big trend.

3) Option #2 : after 2022 low, a new all time high, to 20K in late 2024.

4) We don’t know what will happen next in the casino.

Jackass NDX S-wave : down from Feb 2020 to Mar 2020 low, up to 2021

high, complete a round trip to 2020 high, to 9.5K-10K, or less. That’s Jackass NDX stage #1.

One could nit write a better script for the future movie that will be written. Maybe Milton will sell his book rights as another SPAC,

Wall Street gets to use the SEC has their smoke screen for the regulatory approval for fleecing shareholders and stock buyers. I saw the results of these IPOs not through SPACs but through IPOs for the oil and gas MLPs in the 2010 – 2020 decade. MEMP now Amplify Energy after bankruptcy to name one.

Super-activist SEC is tightening down on more dodgy practices than can be counted. (Some are legitimately controversial, as we have heard in several recent public comment periods.) If the other team gets in 2024, watch all that unravel. The populist memes are just window dressing and distraction plastered on the front of a massive financial de-reg party.

Movie? The G-G-Grandkids tell me Romeo has already been made into a video game.

Romeo Wherefore Art Thou? – Double Games

doublegames.com › … › HOLIDAY GAMES

Return to the unshakeable characters of William Shakespeare and play with them in Romeo Wherefore Art Thou?, a new online Platformer game!

Third song, second side:

“Romeo was restless, he was ready to kill

He jumped out the window ’cause he couldn’t sit still

Juliet was waiting with a safety net

He said, “Don’t bury me ’cause I’m not dead yet.”

Ah, people, companies who’s business is to burn money, need to die.

“$11 million in revenues generating a net loss of $81 million.”

And it was “bought” by Nikola for an equity value of $144 million?

“I want to know about the mystery dance

Cause I’ve tried and I’ve tried

And I’m still mystified”

-Elvis Costello, My Aim Is True

I went to business school in the 80’s. If I had dreamed this scenario up; Broke company with no sales buys another broke company with no sales all backed by synthetic pool of money put together for no specific purpose. And had presented it in a paper, one of two things would have happened. a) I would have been flunked for showing zero ability to learn any of the concepts of finance, capital formation and business organization taught at that time, or b) I would have been flunked out because I was presenting a concept that was a fraudulent criminal activity that in no way resembled a legitimate business activity. How we have fallen.

Indeed. These idiots who came up with this SCAM BS NONSENSE are nothing other than blooming IDIOTS AND MORONS and the SEC is to blame for not issuing cease and desist orders to them.

They seem to have made a good amount of money and aren’t in prison, who’s the idiot here?

This is the same SEC whose former Director of Corporate Finance Bill Hinman had a multi-million dollar interest in a law firm that was a member of the Ethereum Enterprise Alliance and Hinman just happened to pull some string to designate Ethereum as a non security so that they could avoid complying with all those pesky burdensome invested related registration that the SEC demands…not to mention that same law firm is all wrapped up in the Chinese IPO Canaan that sells Ethereum mining hardware.

> all backed by synthetic pool of money put together for no specific purpose.

Oh, there is a purpose. You are not cynical enough. The are suckers on at least two fronts: investors sold on this, with a fee locked in, and junior creditors who will be thrown overboard, leaving a few slices of some value for the alpha predators. Then some leftover corpse can be shined up and sold again to the suckers. In that storied past, they might have called this, “burning the furniture.” It all relies on echelons of dumber money.

I am about to teach another crop of young and hopeful people about law and a bit of finance. Sigh. We start with the ideal and descend into the real.

It is very likely that Nikola HAD to buy this company or it would have no source for battery packs and so this is a matter of trying to keep the story going.

There is always a possibility that a company like this actually makes it and provides investors with a massive pay-off. I dont know enough about Nikola to know. It doesnt seem to have anything unique and even though BEV cars have massive growth potential, the high capex and low margins make it a bad business in general.

When will people ever learn that Wall Street is just a big f**k the little guy game.

The original founders of these companies and the private equity early investors all cash out at 10x or more on their original investments when they IPO these companies to the idiot retail investors who never seem to learn their lessons.

Many years ago I was sitting in a Madison Avenue NY restaurant next to some very well known Wall Street guys. In their conversation they spoke about how their MINIMUM cash out on all their deals was 7X … and guess who the buyers were … the lemming little guys who at up all their hype.

11 Madison Park?

These companies are performing a disinflationary service by burning through money right? ;)

Until Uncle Powell restores their bottles of Cristal and Italian vacations.

So, “my firm loses hundreds of millions, and your firm loses hundreds of millions, and if we combine them, we’ll do great”

“I sell at a loss, but make it up in higher volumes”

This isn’t “Though the Looking Glass”, it is well Beyond the Looking Glass

Hey, “everybody says its a great opportunity, buy in or you’ll suffer FOMO”

“Romeo was running out of cash. In its Q1 earnings report – $11 million in revenues generating a net loss of $81 million”

“As part of the deal, Nikola agreed to provide $35 million in “liquidity support” to Romeo through the closing of the acquisition in order to “facilitate continued operations.”

Doesn’t Romeo’s Q1 earnings report show a net loss of $81m in Q1?

My calculator must be broken, somebody please double check this.

Won’t that $35m “liquidity support” be gone in about a month?

Help me!

Nikola had to buy Romeo before bankruptcy to avoid the unpleasant news and questions in this case.

Sometimes the small fraudulent companies will come back to the market with a new story. The actors most likely will.

The reality of WFH: Google CEO Sundar Pichai warns workers they aren’t PRODUCTIVE or focused enough and calls on them to think of ways to speed up product development after revenue growth slowed to 13%

Google boss Sundar Pichai told employees last Wednesday during a meeting their productivity is lacking and that they need to come up with ideas to help the company become more creative.

Or more likely, Google is learning that its ability to grow is not infinite. It’s easier to go from a $10 million company than a $20 million company than from a $1 trillion company to a $2 trillion company.

Google like any other major corp….. they have hired too many employees over the yrs. How many product owners you gonna need, seriously?

Anyone who used Google PPC ads knows that the problem for Google is that they have run out of advertising space – they basically have been increasing the ad load for a decade and now they cant shove more ads above the fold on money keywords. There is minimal growth in search volume and so as a result, the organic growth is running out.

Google has created a culture of young, intelligent, but completely undisciplined workers who have been coddled and allowed to let their own political beliefs get in the way of innovation and customer satisfaction (such as the censorship of things they dont like).

I really dont see them turning this culture around and honestly, the company hasnt really created any organic growth in new businesses that are meaningful.

anecdotal evidence – we have a young couple that live in our neighborhood- he is a dentist ( 3 offices plus dental lab) she is an attorney- we had not seen them for some time so we invited them over for dinner – interesting – she had been head of the bankruptcy practice at a large law firm but after 2008 bankruptcies trended down to the point her entire department (32 attorney’s total) she now has a 3 day a week wfh as a single practitioner working for the electric company – she went from 350-400 k to 120k – his story is opposite – pre covid he worked 4 days per week – he has 11 dentists working for him and 3 techs in the lab- post covid he works 2-3 days per week – I don’t know the numbers for him but he told us his income post covid is 38% greater then pre-covid and he works much less so they can travel extensively ( that is why we have not seen them) his most profitable office is in a really bad area – no dental insurance – low income – BUT they have ca$h! lots of it very busy very profitable – used his ppp check to buy Tesla ( he can depreciate it on his taxes because its a delivery vehicle for the lab) this explain a lot – there are millions of couples like this

Yep. PPP was a huge giveaway to the well off.

Makes me wonder whether Congress intended it that way, rather than just being sloppy.

Dentist and a lawyer?

What is their dinner convo like?

This is two black holes that have sucked up and burned all of the available cash from the useful idiots that were surrounding them.. Now, combined into an even larger cash black hole, they have extended their reach to a few more useful idiots to suck up a little more cash fodder.

Anyone know what their combined burn rate is?

Only in post-GFC America could a company that was uncovered as an outright fraud still be “in business” and buying a similarly doomed company with other people’s money.

I wonder why EVs and green energy (solar, hydrogen, etc.) seem to be so dominated by fraud and shady business practices? I guess it’s easy to round up freshly printed investor cash to burn if you have a futuristic feel-good story to sell. I mean there’s plenty of fraud in just about every industry, but green investments, in particular, are just crawling with it. It’s rare to find a legitimate company with a viable business model in that space.

It’s not just EV SPACs, but SPACs in general and IPOs and the hype and hoopla during 2020 and 2021, fueled by the Fed’s idiotic monetary policies that removed all rational constraints, where no matter what just flew. Those are the signs of a magnificent bubble – I call it consensual hallucination – and it’s blowing up. This is why I’m documenting this era in my Imploded Stocks column. It’s far worse than during the dotcom bubble.

Not Sure

Fraud in America

Why do you think, Madeoff was NOT ‘uncovered’ for 20 yrs until Dec ’08!

Bear mkt slowly pulls the cover off of all ‘Zombie’ Cos, if ONLY if Mr. Powell increase the rate beyond baby steps!

“I wonder why EVs and green energy (solar, hydrogen, etc.) seem to be so dominated by fraud and shady business practices?”

Same reason Musk is in the businesses he’s in, because there’s cheap/free govt money to be taken advantage of! Where there’s govt handouts there’s always going to be fraud, waste, and abuse.

Wolf, thank you as always for these great articles. Low rates and Fed asset purchases have made for the perfect set up to see yet another bubble implode. Looking forward to your continued coverage and our continued entertainment.

The Power of Perception over reality still reigns! Never under estimate the power of perception, engineered by Fed’s PUT since ’09!

Let’s see what will happen when bells ring at 4pm!

As I mentioned in another article, the market is basically taunting the Fed. Basically saying “We don’t believe you! You’re never going to materially tighten! You have no credibility, and you’re all bark and no bite.”

It’s going to take a lot for the Fed to prove to the market that its serious this time. It’s rate hikes and so far, slow QT hasn’t done the trick. They need to outright start selling assets off the balance sheet, and need to raise in August. Anything short of that, will not be believable.

Einhal

Exactly!

Even if indexes hit red, deep or otherwise, DIP buyers are going to keep buying. Unless Fed discards ‘baby’ steps in raising rate, accelerate it and also accelerate the QT from the current snail pace.

It’s just the mind boggling inane pit of hopium and nothing else.

Off topic for the thread so please forgive me. I am thinking about Wolf’s article later in the week regarding the FED balance sheet. I am trying to get my head around the MBS side of QT. I know that it has been decreasing and sorta understand how. I went back and reread Wolf’s QT article but I am still unsure. Could someone give me a quick synopsis of how MBS is rolling off the balance sheet. Especially if they do not have enough short term dated MBS to meet the obligation. Are they using prepayments to paydown longer dated MBS? Are they selling longer dated MBS? I just seems to me the FED does not have enough short dated MBS obligations to meet the roll-off numbers, how do they make up the difference? Am I just wrong?

What you’re missing is that every monthly payment gets sent to them. It’s not like with treasury bills, that have no coupon and don’t pay off until maturity.

So even if the 30 year loan doesn’t “mature” in a given month, the underlying homeowner is still making mortgage payments that get passed through.

So what you are saying is there is a natural rate of decay in MBS related to amortization of the loan. So the plan is to decrease new debt purchases to let this amortization actually decrease the balance sheet by the desired amount (combined with maturity and prepayments)?

You’re welcome. And yes, exactly. They really shouldn’t be making any new purchases though, in my opinion, at least for the first few months.

One thing to bear in mind though is that the payments at the beginning of the schedule are more composed of interest, and the ones at the end are more principal. So for loans that were originated in the last year or two, more of the monthly payments will be interest.

Whops, meant to start the above reply with, Thank You for the swift reply!

My problem is that with housing prices up a huge amount, they should have liquidated ALL of the MBS back into the markets. That would help to reduce housing demand and get prices back down to something resembling normal. This should have been done in 2021 and 2022, it could have prevented the housing bubble that will now turn ugly.

All planned for corporations to buy on the cheap ,until squatters take over when no one can afford rent,.

Wolf addresses this regularly, one recent example: https://wolfstreet.com/2019/03/20/feds-new-balance-sheet-plan-get-rid-of-mbs/

Venkarel,

“how MBS is rolling off the balance sheet.”

MBS rarely “roll off” via maturities. The way they come off the balance sheet is via “pass-through principal payments” and by being “called.”

There are three ways for now in which they come off the balance sheet (the Fed could also decide to sell them, but that it’s not now doing that):

1. Pass-through principal payment from mortgages getting paid off: When the underlying mortgages get paid off, such as when the house is sold or when the mortgage is refinanced, the mortgage servicer (the company to which the homeowner sent the mortgage payments such as Rocket Mortgage) gets these payments and forwards them to the entity that securitized the mortgages into MBS (such as Fannie Mae), which then forwards those principal payments to the holders of the MBS (such as the Fed).

The book value of the MBS shrinks each time by the amount of the pass-through principal payment. This reduces the amount of the MBS on the Fed’s balance sheet. These pass-through principal payments don’t involve a gain or loss for the Fed. It’s just cash that flows to the Fed.

2. MBS is “called”. After a bunch of years, the remaining book value of the MBS may have shrunken so much that Fannie Mae decides to “call” the MBS and repackage the small amount of remaining mortgage debt into a new MBS. When Fannie Mae “calls” the MBS, they also come off the Fed’s balance sheet. There is no gain or loss involved here either.

3. Pass-through principal payments from regular monthly mortgage payments. Pass-through principal payments occur when monthly mortgage payments are made, and the principal portion is forwarded by the servicer to Fannie Mae, which then forwards it to the Fed. This reduces the book value of the MBS as well, which reduces the amount of MBS on the Fed’s balance sheet.

Thanks Wolf, thank you everyone else. I got it now. Next is to think of the implications.

The Fed is in an incredibly uncomfortable position, Warns Nomura chief strategist Charlie McElligott in a note this morning.

The Fed’s problem is simple – the market has reflexively built-in a message that not just ‘Peak Fed Tightening’ is behind us already – but that we’re about to cut Rates in early ’23, as evidenced by US 10Y Real Yields collapsing 70bps in two weeks—which has then dictated a wholesale risk-asset explosion higher from Equities to Credit to Long Duration, as US financial conditions then impulse ease in an extremely counter-productive dynamic for the Fed’s “inflation fighting” mandate”

Fed sent a wrong message in the last Q&A press conference.

They really didn’t. They sent just the message they wanted to. The fact that the audience wasn’t listening doesn’t mean they sent the wrong message.

Einhal

Mr. Powell said on that press conference that Fed is close to ‘neutral’ rate without defining that number.

Is that hawkish or Dovish?

Mkt perceived as dovish and the mkts zoomed. What you and I think are immaterial to Mr. Mkt.

I ignored the power of perception ( along with investor sentiment) for a very long time and paid the price for it. There is no longer logic or rationality under this Fed.

With ‘swing’ trading, it matters little. Swing trading of leveraged ETfs vs the inversed kind of major 3 indexes, volatility of the mkts makes little difference. I do sell 80% of the longs before closing time. Working fine. I wish I should done this a long time ago!

If the REALITY reigns over PERCEPTION my core portfolio responds appropriately.

Again NOT for every one especially novice. Long experience of being in the mkt,since ’82, has taught me to flexible especially, When Fed has intentionally destroyed the Free Mkt Capitalism and allowed no more price discovery

I just sold 90% all my long 3x leveraged ETFs on indexes. But I nibble if they keep going down. My guess is tomorrow, Perception tries again! Rinse & repeat.

Again, NOT for every body and can do it only in IRA accts.

I didnt realize that Nikola had dropped all their plans for making cars and was only focused on Semi-trucks. I just wonder how they make that work when Tesla seems to have failed at making the range and economics of it work?

The one EV startup I still like is Arrival, because they have reinvented the whole factory production process and if it works, it is capex light, flexible to produce many lower volume models on the same line and creates a lower cost product than anything at a similar feature set. They just need to prove they can actually make the vehicles. And they need to get it done in time, before they burn through the remaining 500 million.

Most of the upstart BEV companies are making vehicles the same way as traditional manufacturers, so they have no real technology advantage.

Tesla will do around $15 billion in free cash flow this year. You can certainly make a strong case that it is overvalued but we are way past the point of arguing over whether Tesla is viable

ANNOUNCEMENT:

Relating to the use of analysis to determine the strength of a given security,

The Term “PE” fka Price to Earnings ratio, has been redefined.

Heretofore, the term “PE” is to be defined and interpreted as “Propensity to Evaporate”

-Zero or less indicates massive loss of investment but you are “smart money”.

-1 to 3 indicates uncoolness and a “sell” recommendation.

-Above3 and you are no longer considered “smart money”, and subject to being banned from Facebook, Twitter, and TikTok.