Sales volume plunged in Sydney and Melbourne. Rate hikes bite, yet the Reserve Bank of Australia just started hiking.

By Wolf Richter for WOLF STREET.

The Reserve Bank of Australia (RBA) raised its policy rate three times this year, including twice by 50 basis points in May and July, from record lows, to 1.35%, and is expected to hike again at its meeting on August 2, in response to inflation which in the second quarter spiked to 6.1%, from 5.1% in the first quarter, and from 3.5% in the fourth quarter last year. And Australia’s phenomenal and record-indebted housing bubble has started to react, though rates are still ridiculously low, amid this surge of inflation.

“The rate of growth in housing values was slowing well before interest rates started to rise,” said CoreLogic’s Research Director, Tim Lawless in the report on the Australian housing market. “However, it’s abundantly clear markets have weakened quite sharply since the first rate rise on May 5.”

“Although the housing market is only three months into a decline, the national Home Value Index shows that the rate of decline is comparable with the onset of the global financial crisis (GFC) in 2008, and the sharp downswing of the early 1980s,” he said.

“In Sydney, where the downturn has been particularly accelerated, we are seeing the sharpest value falls in almost 40 years,” he said.

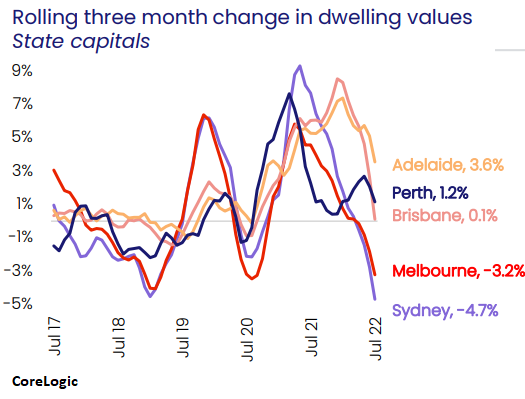

In five of the eight capital cities, home prices fell in July from June, led by Sydney (-2.2%) and Melbourne (-1.5%). For the three months through July, prices fell by 4.7% in Sydney and by 3.2% in Melbourne.

Even in the markets where prices still rose (Perth, Adelaide, and Darwin), there has been a “sharp slowdown” in the pace of price gains since the first interest rate hike in May, CoreLogic said.

This chart shows the price change on a rolling three-month basis for the big five capital cities (chart via CoreLogic):

“Housing market conditions are likely to worsen as interest rates surge higher through the remainder of the year,” the report said.

Housing prices had weakened before the pandemic, with actual price drops on a rolling three-month basis occurring in Sydney, Melbourne, Perth, and Brisbane. When the pandemic hit, the RBA cut interest rates to 0.35%, which caused home prices to spike across Australia by ultimately 28.6% from the onset of the pandemic in 2020.

This table shows the price changes in the eight capital cities (houses and condos) for July: month-to-month, for three months through July, and year-over-year. Median prices in Australian dollars:

| July MoM | Three months | YoY | Median, A$ | |

| Sydney | -2.2% | -4.7% | 1.6% | 1,087,000 |

| Melbourne | -1.5% | -3.2% | 0.3% | 792,000 |

| Brisbane | -0.8% | 0.1% | 22.1% | 782,000 |

| Adelaide | 0.4% | 3.6% | 24.1% | 650,000 |

| Perth | 0.2% | 1.2% | 5.5% | 560,000 |

| Darwin | 0.5% | 1.9% | 5.3% | 507,000 |

| Canberra | -1.1% | -0.9% | 12.1% | 926,000 |

| Hobart | -1.5% | -1.3% | 10.1% | 723,000 |

Sales plunged in Sydney and Melbourne.

Sales plunged by 40% in Sydney over the three months through July, from the same period last year; in Melbourne, sales plunged by 26%, according to CoreLogic estimates.

But sales jumped in Adelaide by 22% and in Perth by 7%.

“There is a good chance the number of properties sold in the second half of this year and into 2023 will continue to trend lower as higher interest rates, a more cautious lending environment, and a reduction in household confidence continues to weigh on housing demand,” CoreLogic said.

Supply.

Total listings in Sydney were 8% higher than the five-year average for this time of the year, and in Melbourne they were 10% higher. But in Brisbane, Adelaide, and Perth, listings were 30% below the five-year average.

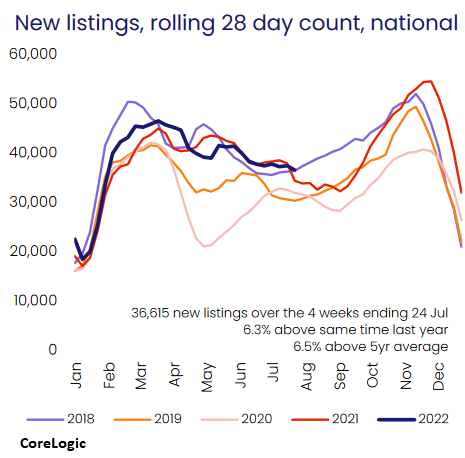

New listings across Australia in the four weeks through July 24 were 6.3% higher than last year at this time and 6.5% above the five-year average and are likely to ramp up through the spring, which is now approaching in Australia, “at a time when demand is likely to be lower,” the report said.

“A more substantial flow of advertised stock against a backdrop of falling demand is great news for active buyers, who will have more choice and less urgency, but bad news for vendors, who could find selling conditions become more challenging as advertised stock levels rise,” Lawless said. Yes, two sides to every deal (chart via CoreLogic):

Rate hikes to hit existing mortgages as rates reset.

Australia’s mortgage market differs from the US mortgage market. The most common mortgages for owner-occupied homes are mortgages with a “variable rate” that adjusted with changes in the market and mortgages with a “fixed rate” that are fixed for only one to five years.

The share of “fixed rate” mortgage origination of total originations peaked between July and August 2021 at 46%, according to the housing finance data by the Australian Bureau of Statistics, cited by CoreLogic.

“Due to record high levels of debt, indebted households are more sensitive to higher interest rates, as well as the additional downside impact from very high inflation on balance sheets and sentiment,” CoreLogic noted.

“Borrowers who locked into a fixed term mortgage rate through the pandemic growth cycle will be facing a significant refinancing burden next year,” CoreLogic said.

“RBA analysis is forecasting a surge in fixed loan expiries throughout the second half of next year,” CoreLogic said. “Many of these borrowers could be moving from mortgage rates around the high 1% to low 2% range to a mortgage rate closer to 6% or higher.”

“The risk of a rise in distressed property sales due to debt servicing challenges is at least partially offset by extremely tight labour markets and high repayment buffers, in the form of savings and offset accounts, accumulated over the COVID period,” CoreLogic said.

And given the spike in home prices, when households, who’ve owned the home for over a year, get in trouble with their mortgage payments, they can always sell the home and pay off the mortgage, assuming that home prices don’t unwind the entire spike of the pandemic or more.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The medium home price in Australia is twice what the USA. either they don’t have that many homes or the people out there make a ton of money

1. the exchange rate. Prices are in Australian dollars. 1 USD = 1.42 AUD

2. Then compare Sydney, Australia’s most expensive market, to the most expensive markets in the US, such San Francisco or New York City or Boston.

They only peripherally suffer from the inflation rip off by the banksters’ “Federal” Reserve — only to the extent they hold US dollars. Hence, they do not pay for the corruption “tax” that US banksters parasites collect from us largely via their “Fed.” Even with lower incomes, they will thereby do better.

They will be hurt by the commodities’ prices crashing as the CCP implodes China’s real estate, local governments, and economy. (Who knew: the world’s most effective, anti-communist organization was the CCP through its incompetence? LOL) However, Australia has so many resources, if they were a company, I would buy their stock.

I can’t imagine agreeing to what basically sounds like a blank check for a house (or anything else).

I know. I’m a crazy American.

No, you’re actually just using common cents, for the halibut!

Real estate, oil, money markets, and the related sentiments, are still very synchronized globally, pretty instantly. Even China can’t completely wall itself off.

People will probably do what there doing in CHINA,just stop paying mortgages. I could see this as a worldwide contagion,as idiotic central banks printed money into confetti

That’s a sure way to quickly become homeless.

They got used to it during the pandemic. Gov to the rescue along with student loans.

As the debt free sharpen their pitchforks.

Crowds rulewhat to do with empty homes = nothing

Anthony A.

Back during the subprime mortgage bust, it was reported that someone living in a town in Oregon ask their mayor, “If 10 percent of home owners in town stopped paying their real estate taxes, would you foreclose on all those home owners?” His answer was definitely not. He said that if word got around that that many people had stopped paying their RE taxes, everyone else might stop paying.

Perhaps the same might apply to mortgage payments.

I don’t know, and I agree on taxes not being paid. My EX didn’t pay her property tax for 10 years before they started asking….

But with mortgages, I would believe the Banks (or whomever owns the paper) wouldn’t let it go unpaid too awful long.

Not if every single person does it.

Safety in numbers.

Contagion could certainly spread from China to Australia, Canada, New Zealand and the west coast of America if home prices keep on falling in China. Foreign money will have to unload properties abroad to cover all the losses back in China.

“Foreign money will have to unload properties abroad to cover all the losses back in China.”

Are they the same investors? My understanding is that families buy local real estate as a form of investment/savings, whereas the Chinese who invest overseas are the uber-wealthy and want to protect their monies from the Chinese government.

‘People’ in China are not ‘stopping paying their mortgages’ and the only impacted class of that happening in the People’s Republic of China affects UNFINISHED HOUSING UNITS ON WHICH DEPOSITS WERE PAID BY FOR WHICH THE CONSTRUCTION IS NOT FINISHED BY FAILING DEVELOPERS INCLUDING EVERGRANDE and that affects only about 1% of mortgages in the PRC.

I read that as well regarding people stopping their mortgage payments in China.

That’s probably going to work out real well as the Chinese government is known for being really humanitarian and empathetic to the subjugates, I mean citizens.

Why wouldn’t I want to give confetti to my mortgage holder?

I am seeing price reduction on local housing. Not so much on new housing in my area but I have had seen in some cities in Texas there are big 5% and 10% price drops on new houses.

National Home builder stocks are doing great. The drop in mortgages must have Wall Street excited ? I saw a new 450k home get cut to $400k while the interest rate has now dropped from 5.9% to 5% from last month. So the person looking at this house a month ago with a 20% down payment would have a $2400 / month payment. It is now $2000/month. That might get people who jumped on the fence a month ago to jump back off an look to buy a house. That is a 16% reduction in a mortgage payment. Anyway….maybe we get a binge of house buying here.

Bankrate had a 30 year today at 5% and no points and the 15 year at 3.99% and no points.

Actually been seeing 30yrs fixed going down, now at 5.125 at my credit union. Understanding that nothing goes to heck in a straight line, wonder if 30yrs is back down under 5 if we will all of sudden see an unexpected surge in sales once again….the dreaded anything to keep these prices as high as possible. If sales pick back up, can probably expect to see less price reduction.

Surge? I’d be surprised. To get any kind of surge, you’d need to go down to below 3%, at least. Here’s a historical chart:

https://wolfstreet.com/wp-content/uploads/2022/07/US-mortgage-rate-2022-07-25-Freddie-Mac-CS.png

3% probably would need the Fed to CUT rather than it holding, or raising, rates. I see little chance of that happening over the near term without inflation cratering and widespread layoffs.

Just because homes are a bit more affordable won’t get all the speculators back whom were driving the top with their all “cash” offers. They were attracted by the action, but have run into a lack of greater fools challenge. The appetite for sitting on empty houses for an indefinite period or making marginal gains with high transaction costs is fairly low.

No more shrimp for the barbie I’m afraid

Crocodiles dun ate the housing market.

Wouldn’t it be nice to see by early next year, we see all the bubblicious markets all around the world implode even more all at the same time. It’ll be like firework around the world on New Year’s Eve…I can picture it in my head like that last scene from Kingsmen when all the heads explode at the same time. Sure it’s a pipe dream for us folks on the sideline, probably the worse nightmare scenarios for people enjoying the asset gain for the last decade or so..

I hope your wish comes true and the sooner the better!

Why? That wouldn’t benefit anyone and would make no sense.

As opposed to turning first time homebuyers into indentured debt serfs?

I think it will benefit those who want to buy a house, but won’t or can’t pay more than FMV.

How do you propose it benefits buyers? So the price comes down. How many are going to write a check for it? Close to zero.

So the interest rate climb offsets the decline in prices and the buyers are marching in place.

However, those that have a significant down payment might do okay as they can (someday) refinance if rates drop or they can pay it off sooner because the debt is less. Of course, there’s the vulture capitalists that might just outbid them and they’re in the same quagmire that they are today.

R u a realtor

Central Bankers need to have skin in the game. skin they lose when massive housing bubbles they are responsible for go bust and ruin lives. Aussie has along way to fall same as New Zealand. Their whole economy in many cities is build around housing.

Australia CPI inflation rose 6.1% from Jun Qtr 2021 to June Qtr 2022.

Their vacancy rate is at its lowest point on record at 1%.

Rising labor and materials costs caused some builders to declare bankruptcy due to unfavorable contract terms.

The 6.1% inflation measure vastly understates the cost in the building industry.

Builders company’s are going under due to taking in fixed price contracts that had not provision for the huge spike in costs of construction.

We now have a change of government in Australia that is dismantling Laws that controlled Union misbehaviour on work sites.

Our construction industry in moving into a perfect storm

Most of the “West” seems to be tracking the same pattern — low rates during pandemic led to a housing bubble, inflation hit towards the end of the pandemic, central banks raising rates because of inflation, and sales are plunging.

The “housing shortage” because of local factors appears to be no more than puffing by agents fueling the frenzy of transactions. Sure, all housing is local but when we’re seeing this pattern happening everywhere with comparable economies, it looks like this is not a localized, or even national event, but was driven by coordinated monetary policy that’s now all going the opposite direction.

That housing prices are already at a decline in some international markets seems to make it even more inevitable we’ll get some nominal declines in the USA. Fingers crossed it’s not as bad as GFC.

“Most of the “West” seems to be tracking the same pattern …”

My thoughts, exactly.

And this makes things interesting – using a wave analogy, we might observe constructive interference which in this case will be destructive :)

Energy costs . Much of the “West” went cancel culture on fossil fuels.

China and India more than taking up the slack.

China isn’t a good comparison to the us because their population doesn’t have a lot of good investment options. Their people overinvest in re.

India and the west have a pretty big gap developmentally. I am also unsure what their central bank has been doing during the pandemic.

The “West” onoh, have relatively similar economies and we’re doing the same monetary policy. That we are seeing parallels suggest that a big cause of the housing price spikes in the usa was mostly monetary policy. That, in turn, helps us understand how things might go.

I just don’t see much around that I can get excited about. Even if the houses sold for half price, the taxes, insurance and maintenance are a heavy burden.

I have to say it’s been quite impressive observing the sheer velocity of asking price reductions here in the Northeast; not much of a surprise when word of mouth from realtors is that demand has fallen off a cliff. We’ll see if the recent move lower in mortgage rates has any lasting power. If so, price declines may be softened and/or postponed. Alternatively, a moonshot back to 6% for the 30yr will probably mean a steady decline in housing in most markets right into holiday season.

So much for the theory that markets solve everything.

It might be a different story if markets weren’t rigged or were regulated, but really, when is that going to happen?

On a different topic, baitcoin is useful for catching fish. Really stupid fish. Mostly by-catch that gets thrown overboard.

If only monetary policy didn’t create ridiculous cheap money and government didn’t create and then attempt to regulate moral hazard, ridiculous housing bubbles never would have occurred to start or would have collapsed long before it threatened to bring down the whole financial system.

The “free market” didn’t create this housing bubble. It was crony capitalism buying big government.

Correct ! but at 2.00pm today the Reserve bank will be forced to raise again. I suspect by 0.5%, bringing the rate up to 1.85%… Yes a whopping 1.85%.

Oh dear, so the conundrum is, if your an Australian with a big bank roll you are forced to move that money to the US to get a superior return and the local banks also feel the pinch from that and are forced to borrow US 10and 30 for funds.

Emergency rates have created an emergency in the Everything Bubble.

Confirmed just now. RBA cash rate target now 1.85%. With CPI at 6.1%, gap = negative 4.25%.

AUS trails the US where respective figures are 2.25%, 9.1% and negative 6.8%, or thereabouts.

So no money flight to US. And if you chart the last 30 years you will see the RBA follows the FED up and down.

Also similar in behaviour. Both are like a laggard salmon that waited too long to swim up river.

Further, AUS retail banks have long borrowed very roughly a third of their capital from international wholesale markets, mostly in US$.

“The “free market” didn’t create this housing bubble. It was crony capitalism buying big government.”

Truer words were never spoken. Vulture capitalism at its finest.

Is this why rates dropped almost 1% in a month

Wolf, well done with this article. Australian Economy is about houses and holes (mining).

I Came here from Oregon in 2010, and kept waiting for a housing crash like post the GFC in the US….didn’t happen. Even though, as you see below, housing is essentially the economy.

Chinese have 56% of their net worth tied up in housing.

Australians have a close 51%

Americans have close to ~35%

The stock market moved a lot this year, housing moves a little slower. Don’t underestimate the governments ability to bring in more foreigners to keep the Ponzi going…

Martin North of Digital Financial Analytics (search YouTube). Has much to say on this debate.

There is a really good interview with Michael Hudson about the economy in Australia connected strongly (if not entirely) to real estate. Good reading and makes sense to someone living here.

“Don’t underestimate the governments ability to bring in more foreigners to keep the Ponzi going…”

Did the government bring you in from Oregon in 2010?

“I Came here from Oregon in 2010”

That makes you one of those hated foreigners, now doesn’t it?

Are you keeping the Ponzi going?

Foreigners are not hated in Australia.

The vast majority of Australians (excepting the same small number of rednecks that inhabit both our countries) welcome foreigners and their contributions to building the most successful multi-cultural country in the world.

30% of Australians were born overseas. Hating all those good people would be just too exhausting.

Sure, the silent majority don’t like to see “yacht people” laundering money here and don’t like to see “boat people” jumping queue.

But they overwhelmingly support a “goldilocks” level of orderly immigration. Not too small so as to limit gross economic demand, and not too large so as to burden the supply curves of infrastructure and housing.

I don’t know Jim from Oregon, but I have little doubt that my life is better for having him here.

Goldilocks level of immigration: enough that I can hire a cheap gardener or nanny, but not enough that my own job is threatened…

Another American posting BS about Australia.

Unlike the USA, Australia doesn’t have a problem with immigration- the illegal kind that the USA has been experiencing for most of the last 50 years or so except for a few recent years when immigration law was actually enforced.

We have no “sanctuary” cities, towns, or states either.

The people coming to Australia are much wealthier and more highly educated than those sneaking in across the USA border. They bring their families, assets, and experience.

We also take a number of refugees a year (30,000 or so) from various countries too which has led to numerous problems in many cases.

And as far as “keeping the Ponzi growing” there has been something called the virus pandemic which has totally altered the flow of people into and out of Australia internationally as well as domestically.

During the pandemic there was no net increase in population from immigration. In fact the opposite happened: many people left Australia and the usual number of people that come to Australia stopped especially students, backpackers, and immigrants.

Domestically people moved from the big cities Melbourne and Sydney to outer country areas in the states or to Queensland which had a freer policy regarding lock downs.

We had lock downs, curfews, travel restrictions, work from home rules and all sorts of crap in Sydney and Melbourne, especially Melbourne.

Melbourne actually lost population (estimates are about 60,000 people) as a result of the pandemic. Prior to the pandemic the population of Melbourne had been growing between 150,000 to 200,000 a year. Melbourne had an increase in population every year since at least 1950 until the pandemic.

And finally as far as having “hated foreigners” here, 58% of the people in Melbourne had one or both parents born overseas, about 1/3 of the people speak two or more languages at home (Greek, Italian, Mandarin, Vietnamese and Cantonese the biggest).

Melbourne RE makes for an interesting case study, doesn’t it. Population declined in a period when dwelling prices went to the moon.

Not a Supply issue, and not a population-driven Demand issue.

Some mix of M2 expansion, interest rate suppression, the rich getting richer, and the aspiring rich suffering FOMO.

Now the pendulum has turned. And like all good pendulums, it will accelerate towards its lowest point.

Great to see an article on the Australian property market. What a beast! Housing is a religion in Australia. Many are the believers. We have had almost uninterrupted growth in property for over 20 years. Australians are conditioned to believe that property only goes one way. And there are a huge number of people who will roll off sub 2% rates over the next two plus years. Precarious is an understatement.

Excellent comment. You nailed it!

– There is an “outfit” that measures the affordability of housing in 8 countries. It publishes a report every year. In the 2022 report an increasing amount of cities are considered to be “(severely) unaffordable”. In the category “severely unaffordable” there are also a number of cities in New Zealand (Auckland) and Australia. No wonder, prices were bound to go down again. I am only surprised to see how long it took for prices to start falling.

– A LOT OF australian mortgages (> 50%) have variable rates. I.e. that if rates rise this month then a mortgage holder will have to pay higher interest rate next month.

The Reserve Bank of Australia hiked its policy rate by another 50 basis points today (August 2 in Australia), to 1.85%. So this housing market is going to get interesting.

There’s still time to sell in the US if you have to.

I just lowered the prices on several newly finished homes in DFW by 6% and got solid contracts within a week. Price? Still 15%+ above the price for the same house this time last year.

“But, Uncle Ian, Aussie home prices can only go up. It’s much different over here and we’re going to buy another investment home this weekend.”

Hope springs eternal. Lessons are only learned, they cannot be taught.

Oh, i didn’t think you wanted to talk about the Australian market.

As we say in Australia, our economy is built on “houses in holes,” and both will disappear soon.

“Even in the markets where prices still rose (Perth, Adelaide, and Darwin), there has been a “sharp slowdown” in the pace of price gains since the first interest rate hike in May, CoreLogic said.”

Oh no, what a disaster.

MIKE

Agreed. Wolf’s charts are always stupendous. In this case, they reflect home supply in AUS, much like US, is now trending as normal.

As rates go up in AUS / US, more “normalization” should occur. Not saying there will be no correction, but “plunging” prices accompanied by “skyrocketing” inventory ?

Methinks not.

Whatever happens will be blamed on a dingo.

No, Dinky died a few years ago…😉