Reverse stock splits keep them from getting delisted. But some didn’t even get that far and filed for bankruptcy, like, WOW that was fast.

By Wolf Richter for WOLF STREET.

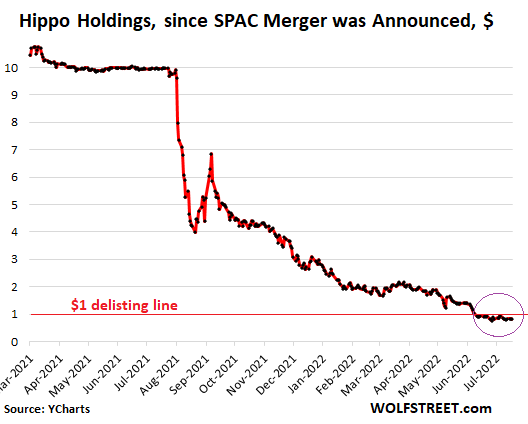

Hippo Holdings – one of the “insurance tech” unicorns that went public via merger with a SPAC and whose shares then collapsed – announced on July 20 in a proxy statement that it would hold a special shareholder meeting on August 31 via live webcast to get shareholder approval for a reverse stock split “in the range of 1-for-20 to 1-for-30.”

On July 19, Hippo disclosed that it had received a delisting notice from the New York Stock Exchange because the share price had been below $1 for over 30 trading days in a row. And to get the share price up above the delisting line, the company said it would undertake a reverse stock.

This is Hippo’s stock [HIPO] since the announcement of the merger with a SPAC in March 2021. The merger at a “valuation” of $5 billion was approved by shareholder on August 2, 2021. Less than a year later, there’s the reverse stock split. Shares closed at $0.80 today, down 93%, and the whole thing has been a giant hype-and-hoopla horror show at the tail end of the craziest stock market bubble ever, as documented in my column, Imploded Stocks (data via YCharts).

If Hippo undertakes a 1-for-20 reverse stock split, shareholders of record as of July 18 will see their shareholdings cut by 20. If I have 1,000 shares of Hippo before the reverse stock split, I will have 50 shares afterwards. And the shares, instead of being worth $0.80, will be worth for a moment 20 times as much, $16. In dollar terms, I come out even for a moment.

The thing that happens afterward in the market, as we’ve learned during the dotcom bust, is that shares often continue to sink because now there is a lot more room underneath them to sink. But at least, it staves off delisting for a while.

If the company cannot figure out how to get cash-flow positive, and if it therefore continues to burn cash, it will need to get new funds that it can incinerate, and that’s very tough in the current climate. Or maybe another company will buy it for scraps.

If those two options don’t materialize, then one day, after all the cash has gotten burned, the company vanishes, and a good time was had by all during the party, except those investors that ended up holding the barf bag.

That $1 delisting threat is hanging over a lot of companies that have gone public recently via merger with a SPAC or via IPO. And there are going to be a lot of disclosures of delisting notices, and a lot of announcements of reverse stock splits – if the companies even make it that far. And many won’t and will file for bankruptcy instead. And some already have.

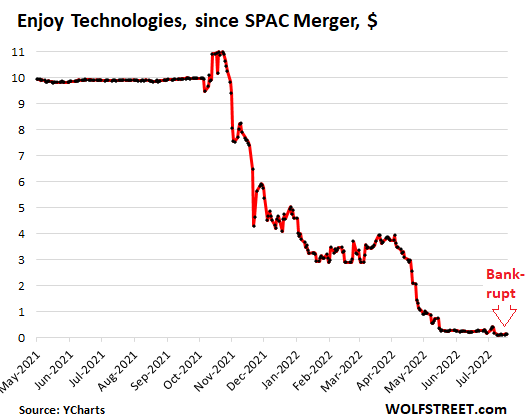

Enjoy Technology [ENJY], a delivery startup with an extra-fancy website, is one of the ones that didn’t even make it to a reverse stock split. It went public via a SPAC in October 2021 and then went to heck in nearly a straight line – practically violating the WOLF STREET dictum that “Nothing goes to heck in a straight line.”

On June 17, it disclosed that it received a delisting notice. On June 30, it disclosed that it filed for bankruptcy. By now, the stock is a goner, has already been delisted, and trades over the counter at $0.12. It will eventually go to zero, and the end users will have to ask their brokers to remove the shares from their account if they get tired of looking at them after a few years (data via YCharts).

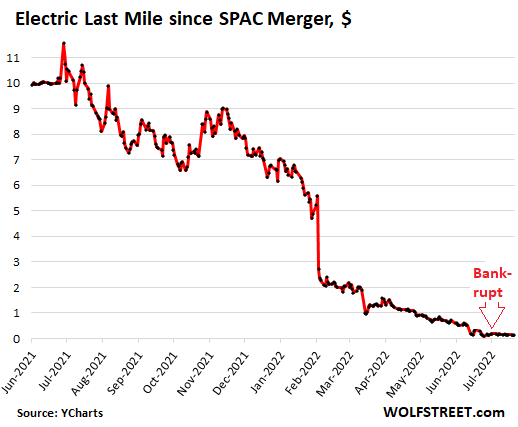

Electric Last Mile (EV conversions) never made it to a reverse stock split either; it filed for bankruptcy in June, one year after its SPAC merger, and the stock is a goner, now at $0.12 over the counter, and will go to zero (data via YCharts):

Voyager Digital (crypto platform), which IPO’ed last year with the main listing in Canada, never made it to a reverse stock split either. On July 6, it filed for bankruptcy in the US after it froze the deposits of its customers.

SoFi Technologies [SOFI] last week already obtained approval from shareholders for an eventual reverse stock split, if the company decides to go that route. The company started out as a student-loan operator and stock trading platform, and then got into crypto trading. In early 2021, it merged with one of Chamath Palihapitiya’s SPACs. The shares had peaked at $28.26 in February 2021, which gave it a market cap of around $25 billion. Since then, shares have plunged 75% to $6.97. And $18 billion in market cap have vanished. In Q1, the company lost $115 million, but shares remain well above the delisting line for now.

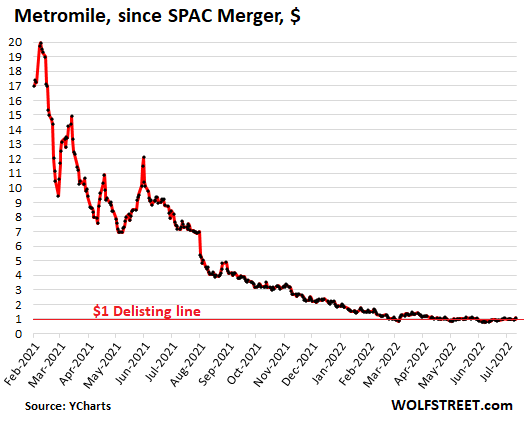

Metromile [MILE], another insurance tech AI unicorn SPAC that lost a ton of money, this one specialized in auto loans, is a good candidate for a delisting notice and reverse stock split. It currently trades at $1.05 and has traded as low as $0.75. If it trades below $1 for 30 days, get ready (data via YCharts):

Among our other Imploded Stocks, the SPAC and IPO heroes that have dropped at least temporarily near or below $1 are:

- Vroom [VRM] (used car dealer)

- Shift Technologies [SFT] (used car dealer)

- Cazoo [CZOO] (used car dealer in the UK). Currently at $0.57 a new low. Losing money, cutting jobs, the whole bit.

- Velodyne Lidar [VLDR] (EV tech)

- Cenntro Electric [CENN] (Australian lingerie brand that pivoted to EVs)

- Desktop Metal [DM] (3D printing)

- Buzzfeed [BZFD] (online publishing)

- Dave Inc. [DAVE] (Mark Cuban backed fintech personal finance), now at $0.68.

A reverse stock split doesn’t solve the company’s viability problem. It only resolves the delisting threat at least for a little while. If the company cannot get its act together and generate positive cash flows, it will still vanish, and the stock will still go to zero, even after the 1-for-gazillion reverse stock split.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Sounds like good times.

All those paper millionaires…

Gone.

I felt a disturbance in the force. As if a thousands of disrupting tech workers suddenly cried out in terror and were suddenly silenced.

Think of those million dollar crack shacks not being able to be flipped!!!

Bitcon keeps rising from the dead, yet making lower highs on its rallies. The bottom still needs to drop out to flush out the last of the “true believers.”

Bitcoin will be like owning a collectable. It might always have some value as long as people think it has value. Comic books, baseball cards. etc.

What will that value be? $1k USD or $100k USD.

Why should BTC be worth anything?

Like all cryptos, its very existence is a side consequence of the global asset mania. No, it really isn’t “different this time”.

Once the mania ends, the psychology creating this “value” disappears with it.

BTC and all crypto are actually nothing, so it only stands to reason it should be worth nothing.

AF,

Crypto is a consequence of 10-20 years of CorruptFiat print-dilution ZIRP.

Since ZIRP ain’t goin’ nowhere long term (Western G’s too broke to survive sans ZIRP for long) then the demand for some version of an honest store of value will persist (be it BitCoin or whatever)

2banana said: ” All those paper millionaires…

Gone.”

———————————————

The same thing is happening to those millionaires who actually have $1,000,000 cash ………………..

Somebody is always trying to take your money if you are not a thoughtful shopper, no matter what you are buying.

Goes for even of you are not buying anything!

How come this guy never talks about any positives like Dwac or Cfvi hmmmmmm

Well, one reason might be because both have zero revenue, according to CNBC.com

Any others you want to bring up?

JT,

They’re still just blank check companies and they have not yet merged with anything, you silly dude hmmmmmmm.

DWAC made an announcement of a merger, upon which its shares spiked to $175 (“Trump”), but it hasn’t actually merged yet with anything, and shares have since then kathoomphed by 80% to $32… and it’s on my list of IMPLODED STOCKS, hahahaha

JT,

On second reading of your comment, I now suspect that you were being sarcastic and that I just fell for it. You can’t be really that dumb. It has to be sarcasm. That’s now my base case – that you were being sarcastic, and I just didn’t get it the first time around because I’m a little slow about these things. If this wasn’t sarcasm, please confirm.

first one!

nope

Must be the reverse split time shift!

Good review–been done for generations with mining promotions on the Vancouver Stock Exchange. Not to keep listed but to reduce the number of shares outstanding for the next promotion. Called a roll back.

Penny mining stocks have been the ruin of many poor men. They burned through cash without finding the mother lode.

Best to make sure you know who you’re betting on, before you find out you were funding burned out opioid addicts like “Gold Rush Alaska.”

Great article as always. Are you able to easily query the stock prices over the past 30 days to see how many are around $1? It would be interesting to see over time if the number is increasing. I’m not sure if you had to manually look up the price for the list at the bottom or if you can easily get a list of all companies that are in this situation. I imagine there are always companies at risk of being delisted but the question is are there even more at this moment in time?

So, anyone ask how the crypto stays alive? The illegal syndicates need to keep the crypto fantasy going. There will always be lots of dirty laundry to clean. We’re corrupt enough to ‘regulate’ the laundromat. If the banks can make some vig. If that doesn’t work out too well, then ‘bail’ the speculators and their crooked friends out. Gives a whole new meaning to ‘rinse, wash and repeat.’

@Josh – there are some great websites and stock-screening tools for that. I believe there are more total delistings to date this year than in the prior couple of years.

I’ve got a weekly automated Imploded Stocks list, and was hoping to post something when it reached 1000, but it keeps hanging out around 800-900.

After a couple months (I’m slow…) I figured out that’s because the delistings are clearing out the bottom of the list. So now I’m trying to count up all the delistings. But that’s more work to tally out the data.

So I’ve been playing around a bit with it, but got overloaded. I’m hoping to have an article for Wolf one of these days.

Velodyne Lidar makes real stuff that they sell to prominent companies.

But their financials are ugly!

Q1 2022 $6MM sales, nearly $50MM operating loss.

Is that really sustainable?

Ford Motor liquidated its stake in Velodyne at the end of last year.

Sales revenue halved between two quarters, while cost-of-goods stayed roughly the same. Seems like they had to cut prices to maintain what sales they got, or the parts shortage has hit them hard.

My guess is that they are their own worst enemy. They are essentially a niche industrial sensor supplier, which is a very profitable business in my experience with great margins, but it’s never going to be high growth like a consumer market. However, as their main customers were driverless car developers, they sold the stock as if their sensors would go into every car on the planet. That appears to have brought lots of new competition to the market and I imagine the space is now massively oversupplied and margins will evaporate.

FWIW, I have a friend who works for one of the big first-tier auto suppliers, and they are working on their own 3D imaging system for OEMs (she won’t tell me details, but I believe it is time-of-flight, similar to the iPhone sensor). Velodyne is a high end product that is useful for R&D but I doubt the spinning mirror tech will be what eventually ends up in any kind of consumer vehicle anytime in the near future.

SPX daily for entertainment only :

1) Yesterday bar was the smallest bar in the last 7TD, on the same volume. Yesterday, SPX was pumping muscles. Tues, July 19 close was the first close above June 27 high, a setup bar. Yesterday higher high, a trigger.

2) DM flipped on July 15, 4TD ago. SPX might close June 9/10 gap, cont up until the end of next week, forming a neckline.

3) The cloud is red, but T&K had a bullish flip. Both T&K will lose their lows next Wed, both will move up, but T the faster line will be quicker.

4) Most people are bearish, but PnF x3, 33.333/box is bullish, possibly forming a three/ four months base til Aug/Sept with May 12 low, a Messi.

No volume… a few whales could be running another Bull Trap, leading to the next Bear Crap after the Fed meeting next week…

Just when you thought the SPACs couldn’t be any worse of a deal.

It’s a great deal …. for the peddlers, just like Bitcoin.

In reality SPACs are just another wealth transfer mechanism.

A wealth transfer method that Wolf called out AS THEY WERE BEING ISSUED… so how come the SEC couldn’t see that?

Look at the history of prior major regulatory legislation.

This will answer your question for you.

The rot started LONG ago. Remember when the Dems rolled back Glass Steagal?

The United Scammers of America is just getting started. Look forward to more scams

***spitting my drink across the room***

“Australian lingerie brand that pivoted to EVs”

Perhaps beautiful women in lingerie will help this company sell more EVs.

Or they are all dogs with no takers, unless the famous Oz beer comes to the rescue.

Fusion sales: put the lingerie ladies in the EV showroom and pump both models at the same time.

Converts adrenaline muscle stimulation into EV battery charge. One must be sitting in the sensor filled driving seat and not looking at the lingerie models while driving, or the car is disabled.

The EV’s have great headlights…..

On the MotoGP starting grid, the umbrella holding ‘helpers’ also have nice looking taillights.

Yes please, I’ll have an Aprilia RS-GP. To go. Grazie.

Yeah, that one is a real head-scratcher. So was SoFi… a number of years back I almost re-did my student loan with them but decided they weren’t offering anything better. How do you go from servicing federal student loans into slinging crypto and stocks??

Desperation, greed and FOMO.

Classic speculative-bubble-peak behaviors.

Edward Chancellor’s book is full of similar examples going back centuries.

Wolf set us up with this one. I am sure he had a chuckle while posting it!

I’m glad somebody else was a bit shook from that. I was a little worried that with the craziness of the past while, this wasn’t an unusual pivot any more. So many strange companies came about in the near-ZIRP world.

AF,

Crypto is a consequence of 10-20 years of CorruptFiat print-dilution ZIRP.

Since ZIRP ain’t goin’ nowhere long term (Western G’s too broke to survive sans ZIRP for long) then the demand for some version of an honest store of value will persist (be it BitCoin or whatever)

Only in Australia ?

Again, pure wisdom dispensed daily. Wolf Richter has done a superb job of documenting the demise of the greatest asset bubble in our lifetime. Much like other crashes, they do not “Go to Heck in a Straight Line”, which of course gives us the opportunity to profit.

Buying SRTY and SQQQ on this bear market bounce (note the steepness of the rally). About 27% invested. Where’s the top of the bounce of the Russell 2000? 1900? 2100? I plan to keep dry powder up to 2100, then go all in and hold my breath. The peak might come after the FOMC meeting July 27 (if they raise by a full point, we might see a peak before the bottom falls out). One thing is certain. The markets will be headed lower after this bounce.

Don’t get greedy and be sure to get back into cash as the account balance hits new highs.

It’s working thanks to Wolf Richter’s thorough reporting and analysis of this, the monster asset bubble.

Nice note of sobriety. I was thinking, are happy days here again? The brain loves that dopamine feeling!

but i am shaken awake, recalling, with the tradition of being data driven here, another leg of stiff rate hikes is at hand. Not that I was set to plunge into electric lingerie.

The market is betting that the Fed u-turns and starts lowering rates by December. That’s the crux of this bear market bounce. If they do, then their bets are right. If they don’t, then this rally will evaporate.

“The market is betting that the Fed u-turns and starts lowering rates by December. That’s the crux of this bear market bounce. ”

Yes. As long as suckers are around this will be in play. And the spin is market is forward looking.

IMO, not gonna happen without inflation coming down like lightning. Also QT is going to increase come September. As it is “transitory” inflation has generally thrashed the Fed’s credibility.

I don’t think it’s going to happen at all. The Fed lost enthusiasm for QE in 2014 and they wouldn’t have done it if not for the pandemic. I think they want out regardless of inflation.

Harry Houndstooth,

Thanks for the very kind words.

I know that you know this. But I do want to point out publicly here that SRTY and SQQQ are scary instruments, too scary for me. They serve a purpose. But just a little beyond that purpose, they become destructive.

What is SRTY and SQQQ? I’m sure these abbreviations help move your prose along, but I’m mystified by most of these usages. I just looked both of these initial codes up and still have no idea what you are talking about. Please, some mercy on those of us who don’t read any financial press except Wolfstreet.

Stock ticker symbols. Plug them into search on a site like Google Finance.

And, don’t buy them ;-)

Be sure to get a long-term chart and you’ll know why Wolf avoids them both. They’re not long-term investments.

Harry’s a swing trader with a lot of experience.

Call your broker and ask the terms for shorting both tqqq & sqqq at the same time. It is a true winning trade. My brokers’ terms are so crazy that you can’t do it.

So many gamblers….still.

There won’t be a 100 basis point increase on July 27th.

That’s if they don’t blow it up early this time – it has happened pretty much as you’ve said three times in a row now, at least. Feasting on the hopes of the retail investors, fleecing them just when they least expect it – but why not move it up a little bit, just in case someone else beats them to it?

1) Nerd is back. Natgas might cont to rise because Germany is on diet.

2) They want to raise reserves from 60% to 90% just in case.

3) Next winter prices might fall, not rise, because Nerd will be at full

capacity, so will be the German reserves. The crisis will be over, at least for a while.

4) Two Nerds are better than one. EU is bunch of Nerds…

Dragon trying to resign ,they won’t let him next bond contagion or black swan?

Drags= italy

History as stress test, showing not who is right, but who is left.

Great quote.

I’ve been trying to figure out a good stock/index ticker to monitor European natural gas prices as distinguished from US prices. Happen to know one.

Natural Gas has been a very good invextment/bet for me this year:-)

The success or failure of a SPAC venture isn’t actually relevant. The purpose of a SPAC is to avoid regulatory oversight and make insiders a lot of money, at the expense of outside investors, regardless of the outcome.

I recommend them very highly to people I don’t like.

The little side channels of cash up front to insiders were there. This was not a “people’s revolution” that would do an end run around the sharp insiders.

Some major meme shell games, old wine in new bottles:

a. Long ago (1999) it was, append “dot com” to firm name, without viable business model; sell shares.

b. 2020 era, add meme phrases: fintech, SPAC, crypto, ins-tech, EV

c. Have no viable business model but a cool office with exposed brick and NFT screens.

d. Say you are disrupting and end-running around musty old Wall Street elites, for the sake of the little guy, while mostly end-running around meaningful regulations,and distancing little guys from their loose cash.

e. This fraud “industry” can challenge finance, insurance and real estate as dominant in the USA.

There are very good reasons why people should throw money at me, but some reasons are better than others.

Is your name blackrock

‘blackrock’? That’s my handle on ZH. ‘elizabeth_holmes’ was taken.

Yes, SPACs were misused, but that doesnt mean every company that came out as a SPAC is a money-pit.

People who throw money into companies on a lark get what they deserve. If you dont have the knowledge to evaluate financial performance and uncertain future cash flows, then just dont get into individual stock investing. There are a few gems in the SPAC mess that are highly undervalued at the moment.

As Warren Buffet says, Be greedy when others are fearful and fearful when others are greedy.

But also do your homework.

That’s the whole point of a SPAC: there’s no homework. You’re entirely at the mercy of your own bad judgement.

@gametv – you said this:

“As Warren Buffet says, Be greedy when others are fearful and fearful when others are greedy.”

He sure as hell wasn’t talking about investing in SPAC’s or penny stocks – Geeeeeeez!

You better do YOUR homework, – sounds like your dog “ate it”

Read up on how WB values a stock and value investing, and who his mentor was!

Great, maybe some SPACs are investment successes. You posted one down the page, HIMS, which to date is a 37% loser if you bought in the pre-acquistion phase.

Got another one?

gametv said: “There are a few gems in the SPAC mess that are highly undervalued at the moment.”

———————————

please name them.

re ” “There are a few gems in the SPAC mess …” please name them.”

SLDP is one SPAC that seems like a legit, speculative emerging tech company with great prospects, and upside.

Thanks Issac S.

The German 3M hit ZERO. DET 10Y is rising to 1.37%.

When inflation finally turns look for emerging markets to explode.

Why exactly would markets do that? Because you want them to? By then, there will be $90 billion a month in QT and way higher interest rates. Markets have been inflated by 15 years of QE and interest rate repression. That era is over.

You just threw ice water on his pipe dream.

might keep him from getting burned ………..

Thanks for expressing this so concise Wolf, it says what a lot of us have been sensing but couldn’t put so well into words. Seems like a lot of investor conventional wisdom and things “taken for granted” over the past 4 decades have to be re-evaluated, since it’s the first time since early 80’s that the US and world have been suffering inflation at such a rampant level. This completely changes the investment picture and the thinking of the Fed, what the Fed prioritizes and what the Federal Reserve can actually do to prop up markets and assets. (Even the MMT’ers at least traditionally admit that it’s mainly inflation introducing the most potent restriction on loose policy)

One of the things we’ve been talking about esp is whether one of the most common pieces of conventional wisdom, “time in the market beats timing the market”, can really be taken for granted anymore. It was repeated to our group ad nauseum ever since we made our first small mutual fund purchases, but we have to wonder if it really makes sense in an inflationary environment with the Fed looking to the lessons from Volcker, and the dangers to the economy and whole society that runaway inflation can result in.

Our first thoughts are that at very least, it greatly increases the horizon to recoup a falling investment even in an index fund or real estate esp with the valuations as high as they are now. Seems like less of a slam dunk to say for sure that the investment value will re-trace back upward when the Fed of necessity, has to be constantly occupied with making sure that inflation doesn’t get even worse and Americans start really losing it when they can’t afford rent and food. And so, chronically higher interest rates and QT (and the Fed consistently unwinding its balance sheet), therefore more and more downward pressure on equities to find a more sensible ex. P to E ratio or other reasonable valuation, and for home prices to fall back to be in line with incomes in the region. (And if recalling correctly, some stock indexes have never really re-traced previous highs, or at least taken decades to come back–including in the United States in some periods, aside from after 1929?) Hard to know for sure but we always appreciate your wisdom and quality data!

Wolf – The timing was after interest rates peak and start to come down. EMs are currently the lowest class from a P/E ratio. Had questions myself and threw it against the wall to get feedback from your following. I had the same concerns you stated. QT should make the dollar stronger which is definitely a headwind for EMs.

That may end up being true, but if that relies on interest rates peaking, I’d guess the calendar will be saying 2024 or 2025 by then.

“Low P/E ratios” can as easily return-to-the-mean by way of the “E” decreasing, rather than the “P” increasing.

P.S. Sovereign Debt Crises are amping up globally. Things are likely to get worse before they get better.

stop while you’re behind …………

EM is facing a currency crisis though, isn’t it? Or do you think the second there is a downturn the fed goes back to ZIRP and QE infinity?

That is what is being peddled now. Recession on, the Fed hikes gone.

About a year ago, Neil McCoy Ward (YT channel) put out a series entitled “Great Depression Diaries”. Very recommended for many reasons.

However, one of the things he mentioned was that prior to the great depression they also had SPACs. After watching the series, I sold all my tech or SPAC related stock and bought metals, mining, uranium, etc. They’re still doing ok. For now.

Unfortunately, I believe that when the economic MOAB comes this time, everything will be worthless for quite a long time.

Thanks for recommending that. Always been interested in the run-up to the Depression, seems a lot of hidden economic history that never really got taught in our econ classes. And a lot ways history is rhymeing, or at least lessons we should be quickly learning.

@Miller: “The Forgotten Man” is a good read.

Clete – Immediately checked out the audiobook yesterday and started listening to it on the way home. Very depressing (pardon the expression) as this was the birth of big government in America.

misc.etc. – Materials are good for a slowdown but suffer once recession hits. Generally consumer staples, health care and utilities are where you want to be. They thrive in both arenas.

Russell “Materials are good for a slowdown but suffer once recession hits.”

Initially, I was going to go for recession safe bets, like alcohol. But I’m concerned about the lack of grain in the fall. There might not be any beer/alcohol, or anything else if things go as badly as some people are predicting.

I’m not looking for any short term gains, but I will check them out. Thank you

There will always be beer.

“I was going to go for recession safe bets, like alcohol. But I’m concerned about the lack of grain in the fall.”

A good whisky should placate your concerns. Balvenie won’t have a problem with grain shortages for fifteen years, although most buyers go for the 12-yo. It’s for people who know where they’re going and just want to get there.

US crop failures are likely to be less catastrophic than Europe’s, but they’re all bound to catch up with you in a few years when The Great Global Population Decline begins, still well ahead of The Collapse of Civilization around 2040.

Gather ye rosebuds while ye may . . .

I looked up Neil McCoy Ward and I can’t see any qualifications – do you happen to know what they are?

Europe is fighting inflation, filling natgas reserves, raising the deposit rate.

DX is down.

Smart investors are looking through the ashes of the SPAC carnage and finding a few gems. My favorite is HIMS. Growing 70%+ year over year, 75% margins, but it got whacked with all the SPACs. Now rebounding ferociously. Management keeps low-balling estimates and over-delivering. Years and years of massive growth to come.

SPAC was just a way of coming public that was misused. Investors need to do their due diligence. Mispriced assets are potential opportunity for smart investors who know how to see the difference between value and FUD.

Many of the SPAC businesses that were pure hype will continue to fall, a select few others will rebound and make fortunes.

If you bought HIMS at the $10 SPAC offering, you’re still down 37%. So maybe the strategy is to find the SPACs that haven’t completely cratered and look for the gems that need a little polishing?

I’m really curious – out of all the SPACs, what’s worked. So far, the best bet is losing $37 on $100.

Wolf… thanks for the article on dotcom 2.0.

Watching this unraveling is amazing and always goes to prove that people don’t pay attention to history and for the most part don’t learn.

🤪💸🤪💸😬😬

WOLF – I kind of disagree with one premise of your articles. You seem to indicate that the story is that inflation will be persistent with all the money expansion out there. I actually think that what we are seeing is that the American economy is incredibly fragile and that even with massive monetary stimulus and giving away cash to people, the inflation in most areas is going to be quite transitory (energy prices are driven by other issues right now, so that might not be transitory).

If I am correct, then what will unfold is:

– As bank balances drop to pre-pandemic levels and credit card debt hits pre-pandemic levels, the economic tailwinds to consumer spending will dry up fast

– Long term bond rates might move a little higher, but will not explode higher, despite the massive bond-buying campaign that the Fed underwent. In fact, I am proposing that the Fed will not be able to get even close to selling off all those bonds on its balance sheet before the economy begins to tank and inflation reverses and we even have deflationary pressures.

– Home prices will tank due to the unaffordability of mortgage payments. This will lead to a 2-3 year decline in prices that take them down 40-50% off peaks in many areas. The only thing that will stop this decline is if interest rates fall again to near zero (sub-3% for mortgages).

– The fall in home equity will result in consumer spending tanking even further.

My core premise is that the Fed is doing very little to actually reduce their balance sheet, but the economy is already poised to tank. This is due to an incredibly weak economy that is built on a mountain of unsustainable debt and very little real productivity.

The only thing keeping America solvent are the benefits of the technology boom, but the economic benefits dont extend to the full population, so economic disparities will continue to grow.

Your points seem to be tangential to me. Exactly what premise are you arguing with?

> You seem to indicate that the story is that inflation will be persistent with all the money expansion out there.

Wolf’s been saying that the Fed (and the other major central banks are on this path) are on the QT path, but they’re very far behind. We’ve already seen 10% -ish inflation in the last year. That will persist, absent some deflationary event, in other words, that $1 out of every 2020 dollar is gone forever.

You’ve hedged home prices falling with bond rates falling (mortgage rates falling). This is one of the core arguments going on around here, will the Fed stick to QT, or will they relent?

Wolf’s gone on record saying that we’re not in a recession… yet.

What exactly are you arguing?

Overnight Reverse Repurchase Agreements seem to be on a trend line that is headed consistently up and away. When can we expect this trend line to begin straight line to heck? Up north of $2T as of today

“But at least, it staves off delisting for a while.”

ha ha funny

Good article, but as a small correction, Metromile ( MILE ) will most likely not be delisted or do a reverse split, but only because they are being acquired by Lemonade, a deal that was announced last November. Metromile stockholders will receive one LMND share for every 19 MILE shares.

Shareholders of both companies have approved the merger, Metromile’s latest SEC filing ( June 14 ) says ” The Company and Lemonade have received approval from the Department of Justice under the Hart-Scott-Rodino Act and are awaiting other required regulatory approvals. The transaction is now expected to close early in the third quarter of 2022, subject to customary closing conditions and receipt of the foregoing approvals.” So MILE stock is trading just under LMND / 19 until the merger completes.

CEO of ENJOY Ron Johnson in the website video “…so we have invented the next disruption in commerce”. I think what he meant to say was “We have invented the next disruption of your ability to engage in commerce by fleecing you”.

Is this the same Ron Johnson that wrecked J.C. Penny?

Sadly….Yes that is him.

Look at the intro video on the ENJOY website. What a POS idea!!!!

😂😂🤣😜😜

Corporations recycle CEOs like sports teams recycle head coaches.

Question – Why would you hire someone that failed in a previous capacity?

Answer – We had to get someone with CEO experience.

Sorry – The logic fails me.

Wallstreet genius, time to get super creative. How about bundling all thos SPACs into bundles like CDO and slap on a catchy name to it and keep the gravy train going still a little longer.

Am I late to the party on this idea or has this already be done already? If so, I totally wouldn’t be surprise.

The inclusion of Desktop Metal in the imploded stocks list catches my eye because the daughter of one of our customers went to work there before their public listing, so we had a conversation about them at a business dinner. “Keep an eye out for the IPO” was said by someone at the table, so I googled them periodically to see where they went. Never invested a penny, and it had been a while since I looked. Yikes.

Plus we briefly flirted with buying a 3D printer for prototyping, but never quite found a compelling enough reason to do so. Ours CNC machines are basically already 3D printers… just working with a different media.

Lots of these “tech companies” are certainly scams, but DM always appeared to be TRYING to improve the world with real inventions and R&D instead of just slinging used cars or delivering pizzas to inflate a stock price. It’s a little disheartening to see them still struggle to find a financially-viable niche, but maybe that whole “3D printing for production” is easier said than done.

As much as I root for Carvana and Uber to crash and burn, I would like to see tech like DM work.

We used 3d printer for confirming that impeller design met efficiency targets. Took several hours to print one out about 15 years ago. Once design was confirmed you would make injection molding tooling so you could make same part in better material in one minute. Can’t see the technology being used for medium volume production.

Really amazed that Ignite isn’t on this list. In fact, looking at 1 yrs history, they are up 55%. Crazy world we live in, that company should’ve gone insolvent loong time ago. I can being Dan B’s personal piggy bank is a viable business strategy

Wish is next

They should call them special shareshredder meetings.

Truth in advertising and all that.

Housing market is weird. Just typing our some off the top comments in my head.

Mortgage originations are at a 22 year low but median house prices just hit an all time high of $416k. Existing homes sales are cratering yet the average time a house sits on the market dropped to 16 days. The opposite should be happening.

Interest rates are predicted to go up again but home builder stocks have been strong the past month and broke out of the long downtrend.

With another rate hike looming I am sort of confused. I have some puts on the home builders but the stocks actually look strong and are up 20% from there lows a month ago so I am exiting my shorts. Residential Home builders stocks look as if bottom is in for now.

Why are they rising? I read more and more of these builders are getting into the rental business so I guess they are not totally dependent on new home buyers to keep growing? Crazy. From what I read there still is a shortage of houses in goods neighborhoods.

I guess if people cannot afford a house with these higher interest rates or they do not want to buy at a peak price…then they look to rent and the current rental market is very strong. Rental vacancies rates are historically low and are at 5.6%. Lowest reading since 1985.

Here is what is a little different this time. During the start of HB1 in 2003, vacancies rates were already at 9.6% which was an ATH going back to 1960s. But that did not stop builders from builders from building spec homes and flippers kept trying to flip. Then as things deteriorated, the vacancy rate rose to 11% at the peak of the housing bubble.

I wonder if homes converted to short term rentals (AIRBNB) skew the vacancy rate % lower?

If you are a landlord and you look at the current rental vacancy rates, yit would make you think I need to build more rentals because rental vacancy rates are at a 40 year low.

—————————————————–

Some of the largest builders in the country are now jumping to add to the rental inventory. Last year, Lennar Corp. (NYSE: LEN) partnered with Centerbridge Partners and Allianz Real Estate to build and acquire more than $4 billion worth of single-family rental homes. PulteGroup Inc. (NYSE: PHM) also agreed to develop 7,500 single-family rental homes for Invitation Homes Inc.

“A lot of people want to buy a single-family home, but for whatever reason, they’re credit challenged,” Lennar’s Western Regional President Jeff Roos said. “There’s a great deal of demand. There’s an underserved market.”

An example is in the NASCAR team hub of Mooresville, North Carolina, north of Charlotte, where American Homes 4 Rent has built a new 200-home rental development with a pool and fitness center. As an added benefit, the company offers landscaping and maintenance as part of the monthly rent.

Post-COVID Americans found they like the flexibility of working at home when possible. This means many don’t want to be tied to a mortgage and, at the end of a lease, have the ability to move to another locale if they want to.

” Existing homes sales are cratering yet the average time a house sits on the market dropped to 16 days. The opposite should be happening. ”

Not sure where you’re sourcing that data because I don’t see that anywhere. Are you looking at one local or nationally?

IF it’s correct maybe it’s because of bulk sales from one company to another, IDK.

Just why did anyone ever ‘think’ there was any value in any of these at any time in their short and infamous history?

AT&T USED TO BE A ‘WIDOWS AND ORPHANS’ STOCK; NOT NOW

AT&T stock in danger of worst slide in two decades after earnings

I could become a “widows and orphans” stock once more! “Widows and Orphans” are exactly what will be left after the invested fathers commit suicide upon seeing the family fortune destroyed by the stock collapse…

There are no safe stocks right now.

Carnival stock leads S&P 500 losers after analyst sees equity offering causing ‘panic’

CCL -11.00%

Yahoo: Jim Rogers says ‘Worst bear market in my lifetime’ and sees Stocks down long term

I have to wonder if any SPAC has been a successful investment. CNBC has some kind of SPAC index that shows 1 year performance that’s very slightly green, so some of these must have been wildly successful to cancel out these 90% declines. I have to wonder when these things get delisted or bankrupt, how would an index account for it? It’d be interesting to see a hypothetical basket of SPACs – let’s say you invested $1000 in every SPAC that had a successful merger (ie. removing the ones that returned investor money) and tracked the overall return, including the ones where you lost everything.

RockHard,

The CNBC index you’re talking about, the “CNBC SPAC 50 Index,” tracks the 50 largest pre-merger SPACs up to the date they merge. They all trade around $10 until they merge or announce a merger. Once they merge with a target company, such as Hippo, they come off the index. The index does NOT track the SPAC stocks after the merger. That’s why the index doesn’t move much. So none of the stocks discussed in this article or any of the prior articles are in the index because they’re all post-merger SPAC stocks.

I noticed in your charts that on their way down to Zeroland, these firms all had a series of “dips”.

Wonder if there is data showing how many “BTFD” folks are still holding their shares, or how many squeaked out on the tiny short lived peaks.

Isn’t this a bit like timing your jump into the air as your run away elevator hits the bottom of the shaft?? It all ends badly regardless.

CreditGB,

Every single one of these shares is owned by someone. So the question is if the BTFD folks could get out in time. And the answer is: Some yes, but they sold it to someone who then rode the shares down. And other BTFD buyers are still holding the shares.

Some bought at $0.76 and sold at $1.07, and made some money. And someone bought them at $1.07 and now sits at $0.12 while the company filed for bankruptcy.

They will keep shuffling the shares back and forth, well after the legal entity has disappeared, and those shares no longer represent anything. But someone will still buy them at $0.01 in the hopes of doubling their money by selling them at $0.02. In the end, interest will fade, and there won’t be any buyers. And then every one of these shares will be stuck in some brokerage account, and folks cannot get rid of them, and they’ll have to ask their broker to remove them from their account.

The small and short peaks on the charts must be prior BTFDers getting out, but to your point, at the peril the the new BTFDers.

I must have missed the email redefining “greater fools” to “BTFD”

Back in the day, you could at least use those shares to wall paper the half bath room, but their digital shares are, well like many things digital, “useless”.

Thanks for the clarification.

I think I need to go long on a SPAC that has went from $1 to $30 in one day. Gotta be some action there. What could go wrong? The experts on cable all say the Fed will pivot before September and turn the taps back on. I am going to get rich. I hope I can get in before they go up.

Things will be coming to a head around election time. Inflation still very high and job layoffs should be kicking in by then.

So muck for “I want a hippopotamus for Christmas”

The Bob who cried Wolf – You’ll get a pot-bellied pig and like it.

I happen to work for a SPAC. Ask me if it is part of my portfolio.

Jed – Do tell!

Wolf might do a tremendous public service by putting out a Serious Reminder to all workers out there – don’t invest more than 5-10% of your net worth in the shares of your employer!

Some people get too excited and go all-in on their own company. But then if your employer runs into trouble you lose both your investment and your job income, leaving you 100% screwed.

That double whammy destroyed a lot of families in 1999-2002 and 2007-2009.

Always keep your investments diversified away from your employer, so you have a safety cushion in case of job loss.

Good point Wisdom Seeker. Remember which company used to actively encourage their employees to invest in the company’s shares? Enron. Very sad that some employees did just that and were ruined when Enron collapsed.

Many public firms both ponzis and legit encourage employees to invest in their shares. Key man incentives also come in the form of shares or options to buy. As always, the investor needs to understand what they are buying. I was fortunately employed by a legit company making money and the options were extremely attractive and very helpful. You don’t need to be on the inside to see what is going on with any firm. Just have to look and analyze their public info. With so many sources of info, no longer difficult to do, and easier to do than ever in the past.

But, you can lead an investor horse to water but can’t make him drink the obvious data. ….Or something like that..:-)

OH SNAP. Something just Snapped.

hahaha , just saw that and was about to comment. Oops 30+ % down, good times for all the dip buyers recently.

What sucks is that, apparently the way SNAP stock is structured will allow the founders a lot of wiggle room to cash out and still have control. Even on the ride down these guys will just be fine, dip buyers will get to buy some extra bags

You forgot Grab holdings

Their share price is at $2.70, too far above the $1 delisting line. And I’m not aware of an announced reverse stock split or a bankruptcy filing. So it doesn’t qualify for this article yet.

Please do not use IPO as a verb (e.g. IPO’ed). The proper way is “go public”; e.g. it went public with much fanfare, or it will go public this year.

You shoulda “googled” this. Back in the day, we xeroxed things. English is wonderful in its flexibility, whether you like it or not makes zero difference to English.

Thank U Wolf.