Higher rates eventually enforce a sort of discipline on the drunken party in government and even in the private sector. That would be a good thing.

By Wolf Richter for WOLF STREET.

There has been a lot of hand-wringing recently among the tightening deniers. They’re now saying, in their latest barrage, that the Fed can never raise its policy rates above x%, such as 2% or whatever, because the government can never pay those higher interest rates on its huge debt and will go bankrupt. And look, they say, interest payments already jumped, and no way that the government can pay much more than that.

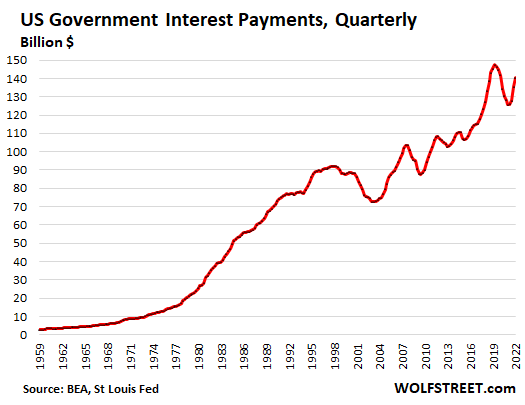

In Q1, federal interest payments on its debt jumped by 11.7% year-over-year to $140 billion. OK, they’re still down a bunch from the peak in Q2 2019 of $147 billion, but you kinda get the idea of what they’re saying:

So let’s take a look.

Only newly issued debt carries the new interest rates. Existing bonds pay the same interest they’ve always paid, until they mature. There are some exceptions, such as Series I Savings Bonds (the I-bonds folks can buy directly from the government), TIPS, floating rate notes, etc. But for most part, Treasury securities pay the interest at which they were issued until they mature. At that point, they’re replaced with new debt, and this new debt comes with the current interest.

It’s not the $30.5 trillion in total government debt that will suddenly cost more as interest rates rise, but only newly issued debt. So this higher interest expense will spread only gradually over the debt.

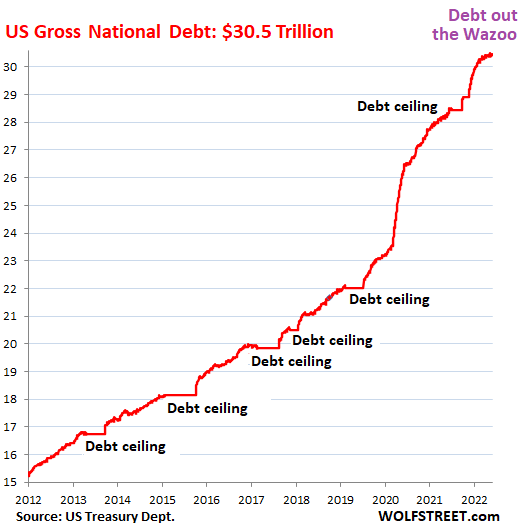

Interest expense increased sharply because of the spike in debt. Since March 2020, the gross national debt spiked by $7 trillion, or by 30%, from $23.5 trillion in March to 2020, to $30.5 trillion currently.

The spike in the debt of the Federal government since March 2020 is just stunning. But it slowed in 2022 and is now back to its pre-pandemic growth rate. Obviously, a spike like this cannot be sustained without some major, let’s say, re-arrangement, such as a big bout of inflation, I mean, oops…

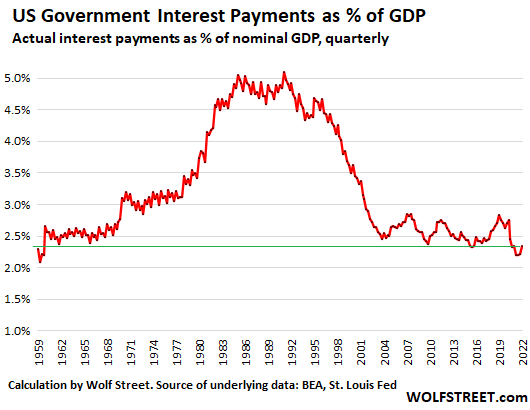

But the burden of interest expense is near historic lows. The government’s tax revenues rise with GDP and with inflation, because growth in economic activity and profits and wage inflation create higher tax revenues, and the Fed’s creature of asset price inflation created higher capital gains tax revenues, though they will go into a tailspin as assets are being repriced under QT and higher rates, and capital gains turn into capital losses.

So interest expense has been rising, but tax revenues have been rising even more quickly along with GDP, and the burden of that interest expense on the US fell to 2.21% of GDP by Q3 2021, the lowest since 1959.

In Q1 2022, interest expense as percent of GDP ticked up to 2.35%, still very near those historic lows. The increase in the percentage was in part due to the decline in GDP in Q1.

In 1985, during the Reagan years, interest payments exceeded 5% of GDP for the first time ever, and they stayed in this 5% range until 1991, when the ratio began to decline, as the lower interest rates were phasing into the debt, and as the economy grew.

For data geeks: The chart is calculated from the actual quarterly interest expense in dollars (not the seasonally adjusted annual rate) divided by quarterly nominal GDP in current dollars (not seasonally adjusted and not inflation adjusted), expressed in percent.

Yield solves all demand problems for debt. Who would want to hold Treasury securities, given this debt and inflation? But here is the thing: If people don’t want to buy 10-year Treasuries at a yield of 3% when inflation is 8%, then yield will have to rise until sellers find a buyer, and at higher yields, the buyers emerge. At some point, a 10-year Treasury paying x% in yield is going to be a great deal, and demand always emerges after some price discovery.

Yield solves those kind of demand problems. And the government will not have any trouble selling new bonds, but they’re going to carry a higher yield – and therefore a higher expense for the government, and higher income for investors.

Higher interest rates enforce discipline. Eventually, higher interest rates combined with ballooning debt levels will push interest expense up to a point where it’s taking more and more of the growing budget, and Congress will have some debates about it, and after some grandstanding and tongue-wagging and taking in the maximum amount of lobbying money, there might even be a compromise on spending and taxes because the only discipline in a capitalist system is the cost of capital.

And if the cost of capital is zero, or is below zero in real terms, and for long enough, then there is no discipline, and the drunken party just keeps going on, and the debt keeps piling up, including in the private sector, until the problem gets solved in another way: Massive inflation, but at a long-lasting and brutal expense to the economy.

Higher interest rates will enforce a sort of discipline on the drunken party, including in the private sector, and will sober up the participants, and prevent the kind of long-lasting destruction that massive inflation wreaks on the economy, and that would be a good thing.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks. This is an extremely basic fact about real business and real economics.

Engineers understand how negative feedback works. Economists do their best to guarantee that we will NEVER understand real economics.

good one poli!!!

“Economists do their best to guarantee that we will NEVER understand real economics.” Is EXACTLY the truth!!!

There’s reason it’s called the ”DISMAL…” and although ”science” is the next word in that meme,,, in fact, economics is just as much a ”science” as all the other so called ”social” sciences, which is to say they are NOT science at all, but rather ”aggregated opinion” and nothing more, ,,

ever…

There is an old joke about this:

An Engineer, Accountant and an Economist are asked, “What is two plus two?”

Engineer: “Four”

Accountant: “Well, it depends on the marginal tax rate you have at the time.”

Economist: [Closes the door and the blinds and syas with a twinkle in his eye] “What number would you like it to be?”

That remind me about the story about a job interview in the DDR (east Germany). The one that answered 2+2 is what the (communist)party want it to be got the job.

Econ in practice is even less “sciency” than social sciences… even though in principle it’s the most quantitative of them.

Econ in practice is all about propaganda on behalf of the wealthy, manufacturing public consent for policies counter to the National interest, hyping bubbles to fleece the greater fools among the sheeple, and so on.

Any Econ-Einstein’s initial search for truth too often gets suborned into a search for wealth and power…. and anyway the crowds too often prefer the eCON-men’s sweet lies to the hard truths.

The World does not want to be Saved…

Oh, they understand. They fully understand.

They just look for ways around it.

Like a spouse cheating.

Like a drunk driving learning how to not look so drunk driving.

Like the embezzling employee finding accounting tricks, and P.O. Boxes, and fake invoices. They know exactly what they are doing.

It is WE who are fooling ourselves. We really don’t want to know the truth. It is far too horrific. We don’t want to be ostracized. We want to go to all the right parties. We want to be included. We don’t want our “conspiracy” comments deleted.

To speak the truth is to offend. This how you know the world is a lie.

Layoff! All of you! WRT economics and economists!

Economists are mathematical modelers of the economy.

You create a mathematical model, put in some numbers, get out some other numbers, analyse the result.

Numbers don’t lie, but people lie about the numbers.

Wolf, I think you just took some of the worry out of at least half the country.

Depends upon what you mean by worry.

At last half the country believes that it’s all essentially “free”.

That’s not the message of this article.

Part of the inferred message is that this debt orgy and the interest cost that goes with it means lower future living standards for someone, most.

And if it isn’t inferred, it should be because that’s what’s going to happen, one way or another. Inflating the debt away isn’t cost free either because it’s someone else’s asset which means these people become poorer.

Many are going to become poorer because a lot of this debt represents prior misallocation of resources which aren’t unlimited or free.

There is never something for nothing, ever.

I found $20 once.

A friend of mine found $100. I was with her when she found it.

Ah…but you neglect to see the other half of the equation. Someone LOST $100.00. They paid. Again…nothing is free!

And furthermore…

Economists would claim that your friend did not produce anything in order to receive that $100…

In essence, her finding that $100 and putting it her pocket is recessionary…:)

I found a quarter in the parking lot

Exactly. The inference is Crystal Clear.

Does not affect the extremely wealthy. They welcome this environment as they knew what was to come and were prepared for the same.

You’ve certainly made it a lot more fun

Thank you for clearing this up Wolf. Great info as always and certainly help debunk the baloney that certain financial professional/macro analyst’s claim that FED will need to pivot in Q3 due to government default risk. Sadly his kind of talking points I would expect from MSM but this came from a YT channel that usually have pretty good info and great guests like yourself so perhaps the baloney caught my attention more than usual but remembering what you said before about it being a non-issue, just glad you clear it up again.

As a disclaimer, my wife does not allow television into our house:

There are actually humans on television predicting that the Fed will make a pivot and stop Qualitative Tightening and pivot to Qualitative Easing?

YouTube. He’s probably referring to Wealthion interviewing Like Gromen. They published 3 last week that Wolf summarily dismissed in the comments here last week.

Or ask Wolf again about his opinion, it livens up the comments.

“Or ask Wolf again about his opinion, it livens up the comments.”

LOLOLOL

Yup that’s the one…I definitely got a raise out of Wolf on that one.. Lesson learned :)

Can you link to wolf’s response? I would love to read his rebuttal to some wealthion guests.

elbowwilham – I don’t think Wolf allows links in the comments.

“What’s Behind the Collapse of so Many Stocks since Feb 2021?”

You’ll find it. It’s not a rebuttal, it’s a dismissal. Basically, Luke Gromen thinks that the Fed will blink and start dropping rates. Wolf touched on it above, but has gone into a lot of detail multiple times in the past month, and in short, he thinks Gromen is completely wrong.

Some of Wealthion’s stuff is good, but in the end they’re producing content and will bring on people just to get clicks. Bear that in mind when you listen to them.

@ Wolf –

I second the request of elbowwilham for a link ……..

It is amazing the amount of coverage some of these guys like Luke Groman get. There is a whole industry out there where a lot of GURU’s make the rounds, in many cases covering each other.

I watched an interview of Luke Groman by “Alf”, another GURU. I thought Groman made the point that when debt defaults, you have dollar destruction. Alf did not question the assertion.

I contend that that is false. Debt default does not result in dollar destruction. The dollars remain in the system.

Groman is a smart guy and knows a lot.

When you owe me $100 and then default, it destroys my $100 asset, but it also destroys your $100 liability, with the effect that you’re $100 richer and I’m $100 poorer, and on net in the overall system, nothing changes.

If people read or see or hear something often enough, they believe it. That’s why I don’t allow people to troll the comments with nonsense over and over again because eventually, people take this as reality.

All governments borrowing in the national currency can print. Everyone knows that and did. The real question is, what’s it going to be worth when it’s paid back and how will buyers of the debt perceive it.

The decision to default or “print” is a political choice and I’d say mostly psychological, but differences of opinion exist on this last part.

Same thing with QE and QT. Market sentiment moved against the FRB more recently and FRB sentiment changed with it. The difference is evident with the ECB and BOJ who are still

behind the curve”. I’m aware why they are (supposedly) doing it but it’s still a choice. They can act otherwise.

If a central bank insists on acting against market sentiment, the currency is at risk of crashing. That’s the ultimate limitation on any “printing”.

It’s not a mechanical process because people aren’t robots and have agency.

Well said.

Interest rates have been low for a while so the right financial move for the goobermint would be borrowing a lot of money with long term bonds to finance spending.

The debate over the interest is answered here but that’s not the important point. The important point is what the deficit spending is used for.

Deficit spending, especially with historically low interest rates, encourages reckless spending that seems painless since taxpayers are not seeing higher taxes. Large deficits also encourage the Fed to buy lots of bonds.

Concerning economics;

A nation consists of many households. Think of an economic or financial issue for one household. If an economic or financial policy makes sense for one household, it probably makes sense for the entire nation.

Does it make sense for a household to borrow lots of money at low interest rates to spend recklessly? No. You only get to “live large” for a while. … So it doesn’t make sense for a government to do the same thing. Like we did in 2020 and 2021.

If they are smart, the Fed won’t pivot until housing has dropped at least 40% in speculative areas, 10% in other areas.. They need to take the froth out of RE markets to reduce inflation.

Yes because we all know how reasonable and responsible our political class is, and how independent the Fed is. These people sent everyone stimulus checks whether they needed it or not, and allowed massive PPP fraud. They propped up the most massive debt bubble in history. Yes, I believe the same people will now find sobriety. /s

Wolf, you may want to keep a link to this article handy. You may need to reference it often in the comments during the coming months and years.

I think I will post updates on this quarterly. Or at least a couple of times a year. This is something to keep our eyes on.

Yes, maybe in the near future market driven price discovery may just show up unexpectedly.

Looking at the fiscaldata.treasury.gov for Average Interest Rates on US Securities (AIRUSS), shows that in January 2001the AIRUSS was 6.59%. By the time the Fed started the last balance sheet runoff, AIRUSS was at 2.49%. About midway through the 12-month runoff, it peaked at 2.59% at the end of April 2019. As you well know, the repo market was in full meltdown mode during this time. Then, it trended downward and hit 1.56% at the end of January this year. The notable drop in quarterly interest expense is nicely captured on your graph starting in 2019. The fiscal data web site only lists through May at 1.73%, so it’s reasonable to think June will end in the ballpark of 1.80%.

There’s almost $4T in 1 year treasury notes that most certainly will roll over at higher rates. Given that the national debt has grown by $10T since Trump took office, it’s reasonable to think the majority of that debt was borrowed in 3-year or less notes some of which has already been rolled over 2 to 3 times at lower and lower average rates until January of this year. There’s $13.4T in 2-10 year notes & bonds. Let’s make a reasonable assumption, since I can’t find the data, that half of it, $6.7T, is in notes of 3 year of less maturities.

I don’t see any real numbers in your article that articulates what you predict will happen to the $545B average interest paid on debt over the last four years. But, you do tend to shy away from predictions which is fine. My assumption is that you think it will rise within acceptable limits.

To me it seems reasonable that the AIRUSS over the next few years will easily top 2.59%. Before April 2019, the last time the AIRUS was 2.59% was at the end of August 2012, approaching 12 years ago. In 2006, the AIRUSS was about 5% and our debt was only $8.5T. Today, our debt is 3.6x higher.

This is where the real math that’s beyond me due to a lack of data and a really solid understanding. But, if we hit with anything close to late 70’s through early 80’s stagflation, then there’s no telling how high the AIRUSS will go: 4%, 5% or higher? My guess is that any appreciable move above 3% becomes very problematic for the total interest paid on debt. Ultimately, one would wonder if this would give JPowell justification to transform into Volcker and raise rates much higher than people think is possible in order to induce a significant recession, thereby giving creating the needed demand destruction to fairly quickly tame inflation and then lower interest rates back down to .25%. But, everyone knows the math of today’s debt means he can do that. In fact, he can’t even come close to what Volcker did, but the reality is that he doesn’t need 19% FFR to induce a recession. 4% would most likely do the trick, so this is why they know they need to stop at around 3.25 to 3.5%.

It’s funny how your writeup didn’t get into the real numbers at play here. You’re a smart guy. Now, here’s my challenge. Go back and think about all your reckless Fed ever articles and then “speculate” what happens over the next 3-5 years if JPowell misses the landing by a wide margin, and we’re stuck with stagflation through 2026, meaning IMO inflation averages 5% starting in 2023. And, certainly translate that into projections on annual interest expense over that period, again, IMO where the average rate stays in the 3-4% range.

And, as for increased revenue, what goes up comes down. From 2008 to 2009, Federal revenue decreased $420B or about 17%. In 2021, the estimated tax revenue was $3.86T, so we’re certainly going to push into the low $4T range. A similar 17% drop from say $4.3T would be a loss of $731B. We’ll run a $1T deficit this year. Next year, the deficit in a slowing economy would be at least $1.5T.

Then 2024 is when things would get dicey, depending on how bad the recession is. By 2024, the Fed may be forced to start QE up simply to push down rates. Today, we all wonder if that will give JPowell enough time to coral inflation back under 5%. But remember, the Biden administration, Russia, the Saudi’s and the US oil producing nations are going to everything they can to keep oil prices high. And we all know that how Europe’s continued move away from Russian fossil fuel supplies do their part in maintaining long-term high prices. And none of this is under the Fed’s mandate.

If we’re in a deep recession where the average cost of diesel stays close to $4, hello stagflation. $40T x a .25% average cost of debt is $1T a year in interest expense. That seems very reasonable within 5 years. In 5 years, China may very well be on the verge of passing our GDP and have laid out plans publicly on how they plan to usurp the US dollar as the world’s reserve currency.

The crew over at WSJ have a different take. They’ve done the math:

“Total federal gross interest cost over the 12 months ending on May 31 was $666 billion. If we include the impending extra interest on Treasury bills and the maturing notes, that figure rises to $863 billion. This is a staggering cost.”

And that’s just one year’s increase. What happens when the recession comes, and inflation is still raging at 6%+ or 3x the Fed’s target? How does QE work in an environment like that?

They go on to point out that a falling stock market will lower capital-gains tax revenue. They say this is already happening, expecting a $250B shortfall this FY. And, they rightly point out diminished remittances from the Fed to the Treasury.

But, the best part is saved for last, the vicious cycle of more borrowing and ever-increasing interest expense.

I guess the answer may lie with what each person, economist or otherwise, thinks we can “afford”. I do agree with you higher yields solve demand problems, but I wonder how much closer this latest spat of grotesque debt assumption has moved the needle towards that eventual “oh crap” moment: loss of confidence in the dollar?

That’s when it all hits the fan and China will be laughing all the way to the bank and finally invades Tiawan. 3 years? 5 years? 10 years?

Thanks, Wolf!

“This is a staggering cost.”

That’s WHY I GAVE YOU THE NUMBERS so you wouldn’t fall this WSJ BS of “staggering.”

This $666 billion is the 12-month total, and I agree with that, BUT THAT’S ONLY ABOUT 2.8% OF GDP, HALF of where it was in the 1980s.

Next year, that “staggering” WSJ $863 billion will be 3.3% of GDP if the economy goes into a run-of-the-mill recession between now and then — with 0% annual growth of real GDP for the year, and 6% growth of nominal GDP due to inflation. If inflation is hotter than 6% or if the economy doesn’t go into a recession, interest expense will be below 3% of GDP, compared to over 5% during the Reagan years.

When we hit $1T in interest in the next 18 months, real GDP will most likely have tumbled to at most $19T. 1/19 is 5.3% of GDP. Likewise, tax revenues will drop below 2021 levels of $3.86T. A good estimate would be $3.8T. Taking 1/3.8, we 26% of total revenue being spent on interest on the debt. That’s scary.

And as the debt grows ever larger, that % will rise faster, especially IF stagflation remains. Once we hit $1T in annual interest expense, I just can’t imagine Wallstreet, economist, armchair quarterbacks like myself and MSNBC for that matter not taking notice. The Fed & Congress are an entirely different matter. They’ll be concocting ways to QE & profusely spend money to get us out the recession.

The next 3-5 years could get really scary in terms of what ifs. One would be the GOP takes over and we arrive at the moment where our federal government is fiscally forced into some level of austerity mode.

Agreed!

This debt-sustainability issue is one of the greatest myths out in the wild right now. Killing it will be a huge public service.

It’d be cool to model interest/GDP ratios under various interest-rate scenarios (e.g. 3% for 5 years…).

It’s surprising that Fed&FedGov aren’t already publishing / promoting this more, since it’s clear higher rates are needed and minimizing public fear about them would help the economy adjust more smoothly…

It’d also be interesting to see an interest/GDP series going back a lot further in time. Interest/FederalRevenue would also be informative since FedGov/GDP was smaller prior to current era.

“It’s surprising that Fed&FedGov aren’t already publishing / promoting this more, since it’s clear higher rates are needed and minimizing public fear about them would help the economy adjust more smoothly…”

I agree but think at least one reason why they aren’t promoting it more is the potential downside risk to asset values. If the Fed explained rates are going up significantly and they have no problem doing it from a finance or tax perspective, the immediate market correction might be significant. As it is, they can try to manage the repricing of assets more gradually, because a significant number of market participants believe a pivot is coming in the near future. Ironically, it’s the Fed’s lack of credibility that allows it to say what it will do, actually do what it says, and still have the market propped up to some degree by those anticipating an “inevitable” pivot.

Brilliant – bleeding out markets slowly via slow-fade expectations, rather than triggering a complete crash.

Government spending discipline is anti-inflationary on its own. Dollars are rerouted from being directly spent into the economy to the servicing costs of investors who hoard dollars. It’s a way of reducing the velocity of money, and reduces the need for the Fed to hurry up and mop it all up.

Biggest problem is corporate welfare ,businesses have learned to get handouts or won’t build create jobs , just look at semiconductor industry. Trying to onshore but congress won’t pay up yet ,so they will go to another country.Maybe Ukraine,Russia or China good luck

Yes, dead on!

The big Tech behemoths won’t move production to the US without a fat government handout. After years of bank bailouts, low interest rates, Fed liquidity injections, corporate tax cuts, and Covid stimulus programs, what did these companies do?

They bought back trillion$ in their own stock, kept wages and benefits low for their employees, and instead increased spending on Congressional lobbying to get another handout. End-state Capitalism and bipartisan encouragement by Congress.

But I was told corporate tax cuts would allow business to build new plants, hire more workers and pay higher wages.

Yes indeed, Harrold, that’s always the lie that we are told. Tax cuts pay for themselves they say but they never do.

Escierto,

Don’t make me Laffer.

There is corporate welfare, and then there are companies just exercising leverage.

For some industries, there are national security reasons why it’s essential to have production within your borders to ensure supply during geopolitical events. Most of these companies get lots of subsidies because they know this and want to trade their leverage for profit — exs: energy production, automobile production, weapons, and, post-COVID, mRNA-vaccine production and semiconductors .

COVID taught us that during the bad times, all the normal rules on trade are subject to change. We got screwed on masks by China, most of Europe got screwed on vaccines because India and UK prioritized themselves, China screwed itself because it lagged on mRNA vaccine development, etc.

Current velocity of money is astonishingly small. When I was in B school in the mid-80s it was about 10. Now it is about 1.18.

This is one of the best distillations of truth ever. A prime example of why this web site is sufficient in obtaining financial information.

Pure wisdom dispensed daily:

“the only discipline in a capitalist system is the cost of capital”

In terms of the stock market, the surprises are likely to be on the downside.

You missed the fact that as interest rates rise so do interest on bank reserves which means the Fed Reserve bond portfolio can and will be operating at a loss, while the interest rate profit received by the Fed Reserve– from treasury bonds and MBS held by the fed– when ZIRP was happening and returned to the treasury will be gone, driving the Federal deficit much higher. How much higher? easily into the hundreds of billions $$$$$!!!

Do not the FED decide the interest rate on bank reserves? The FED never will, but they could enforce negative rates on bank reserves and earn money on the deposits.

Euro zone imposes negative rates on its bank reserves held at the central bank. The European banks are corporate basket-cases that have only gone down for past 20 years. Deutsche bank from 120 to under 10, bnp parabas 266 to 47. Italian and spanish banks are worse with several going banko. So, unless Congress changes the fed reserve act, the fed will keep paying interest to the banks on their reserves. The Fed Res did not and does not want to raise interest rates as they know the damage it will do to the Fed GVT balance sheet and that’s why they have let inflation run hot for 18mos. and continue to do so with an inflationary 1.5% ffr. But when push comes to shove and rates need to go substantially higher the banks balance sheets will be more of a concern than the Fed Gvt balance sheet!

Greg,

“The Fed Res did not and does not want to raise interest rates as they know the damage it will do to the Fed GVT balance …”

It really doesn’t matter what the facts say, tightening-deniers just don’t ever give up. They keep twisting and turning, and exposing themselves to ridicule after ridicule. And yes, Greg, you belong to the group that I ridiculed with this article and in prior articles about rate hikes and QT, and that I will continue to ridicule as the Fed raises rates further and does QT.

An institution that can, at will, create all the currency they want, can never go bankrupt.

The country? The citizens? That is not the concern of the Fed. This Federal Corporation, as are all corporations, is beholden to the stock holders.

Marcus Aurelius,

“That is not the concern of the Fed. This Federal Corporation, as are all corporations, is beholden to the stock holders.”

Nope. The Fed is a hybrid organization:

1. The 12 regional Federal Reserve Banks (such as the New York Fed, the St. Louis Fed, the Dallas Fed, the San Francisco Fed…) are corporations owned by the financial institutions in their districts.

2. The Federal Reserve Board of Governors is a US government agency, and Powell, Brainard, etc. are employees of the US government. The board members are nominated by the President and confirmed by the Senate.

Wolf said: “Nope. The Fed is a hybrid organization:

1. The 12 regional Federal Reserve Banks (such as the New York Fed, the St. Louis Fed, the Dallas Fed, the San Francisco Fed…) are corporations owned by the financial institutions in their districts.

2. The Federal Reserve Board of Governors is a US government agency, and Powell, Brainard, etc. are employees of the US government. The board members are nominated by the President and confirmed by the Senate.”

—————————————————–

and, who calls the shots? Who will ultimately be favored? the financial institutions or the people?

“The people”??? Hahahaha. “Favored”???? Hahahaha. No, “the people” get to pay for it all. That’s how that works.

Wolf said: “The people”??? Hahahaha. “Favored”???? Hahahaha. No, “the people” get to pay for it all. That’s how that works.”

—————————-

agreed. So why take issue with the assertion of Marcus Aurelius “The country? The citizens? That is not the concern of the Fed. This Federal Corporation, as are all corporations, is beholden to the stock holders.”

The FED is beholden to the financiers. It is financiers first, the Government a distant second. and as you point out the people last. The whole objective of the FED is to make sure the bankers own and control the country.

“So why take issue with the assertion of Marcus Aurelius…”

MA said something about the Fed that was factually wrong and needed to be corrected because it’s important: “That is not the concern of the Fed. This Federal Corporation,…”

The Fed is a hybrid, part gov agency, part corporations.

Wolf said: ” 2. The Federal Reserve Board of Governors is a US government agency, and Powell, Brainard, etc. are employees of the US government. The board members are nominated by the President and confirmed by the Senate.”

————————————————-

And it’s absolutely disgusting that our US Government uses tax dollars to pay for the larcenous bastards whose primary purpose is the creation of a bankers paradise with an indebted citizenry.

Wolf said: ” MA said something about the Fed that was factually wrong and needed to be corrected because it’s important: “That is not the concern of the Fed. This Federal Corporation,…”

The Fed is a hybrid, part gov agency, part corporations.”

—————————————

Thanks for the clarification. Understood. However, Marcus Aurelius was correct that the country or the people is not a concern of the FED. There concern is the Banks, and it is an insult that the FED is shielded by a bastardized hybrid status as part Government agency and their “employees” are paid with government money. The citizens pay for their own debt subjugation, by a bunch of pompous manipulative thieves.

Then the 7,000 or so US member banks would simply WITHDRAW their vast excess reserves from inside the Federal Reserve. The Federal Reserve can and does set IOER (Interest On Excess Reserves) as one of the only 3 interest rates they do set and they better be careful of what they set IOER to or they’ll lose the excess reserves they are keeping for the US banks.

“… one of the only 3 interest rates they do set”

The Fed sets 5 rates, currently:

Federal funds rate target range, 1.50% – 1.75%.

Interest it pays the banks on reserves, 1.65%.

Interest it charges on overnight Repos, 1.75%.

Interest it pays on overnight Reverse Repos (RRPs), 1.55%.

Primary credit rate it charges banks, 1.75%.

The banks can withdraw excess reserves, but not the reserves the banks are required to hold. The central bank would come out on top anyway.

Greg,

Nah. Bank reserves at the Fed have already plunged by $1.1 trillion (-26%) in six months, from $4.25 trillion in Dec 2021 to $3.15 trillion now, and QT will bring them down further.

Reverse repos will go to near zero over the next few years as QT takes trillions of dollars of liquidity out of the system.

So the Fed will be paying a higher interest rate on a much lower base.

The Fed will continue to earn a ton of interest on its shrinking securities holdings. Those holdings might come down by $4 trillion, or maybe by $5 trillion, but there will still be about $4 trillion left, and as it gets rolled over, those new securities will pay the higher coupon interest, thereby increasing the Fed’s interest income.

The fear-mongering about the Fed is in the wrong place.

The amount that the Fed remitted to the Treasury was NEVER “hundreds of billions $$$$$.” It maxed out at $118 billion in 2015. Yes, it will go down to roughly to where it used to be before QE, as in 2007 and 2008:

Wolf, my comment is the fed does not want to raise interest rates and point proven by letting inflation run red hot for almost 2 years now. If they were serious about inflation the ffr would be at 10%!

So, you and the fed are wrong!

as rates go higher zero will be remitted to the Fed gvt and the Fed will be losing $$$ as it pays interest on bank reserves. The taxpayer will be on the hook.

That is the big question: is the Fed belatedly “getting serious”, as they now say?

I think they are. They have to restore credibility now (and fast), or else everything gets a lot worse later.

But denial MUST abound, because, at the end of every bubble someone has to take the losses, and those who will ARE hoping they won’t, or else else wouldn’t be holding the deflating assets.

Don’t Fight The Fed…

This big hole that you’re digging. Scoop shovel or trench shovel?

@ Wolf – Brilliant commentary.

as usual

The Fed can simply forgive whatever amount of debt it wishes. This is profoundly DEflationary, but is the flipside of creating new cash to buy debt in the first place.

Message to Wolf:

It’s not “the government” that pays the interest on its debt, it’s you (“the american taxpayer”) through taxes and inflation.

So if that’s all hunky dory, good for you.

Franz Beckenbauer,

Sure, every idiot knows that government spending, including on interest, is funded by taxes, fees, and borrowing. And I’m paying taxes in the US, no problem. You’re not in the US, you’re in some other country, and so you’re not paying taxes in the US, you’re paying taxes somewhere else, possibly at much higher rates than we do here. So go and enjoy.

All US citizens, regardless of where they live, pay US taxes on all their worldwide income. I pay just as much tax, state and federal, as I would if I still lived in the state I moved from to become an expat. The ex- part of expat doesn’t mean ex-taxes.

OC Franz may not be a US citizen. But you don’t know that.

I don’t know anything about anybody here except what commenters say about themselves, and his personal pronouns for all the years he has posted here, indicate that “they” “you” etc. are the Americans, him not being included. It’s never “we” or “I.” This stuff gets to be pretty obvious after you’ve been doing this for a long time.

“Obviously, a spike like this cannot be sustained without some major, let’s say, re-arrangement, such as a big bout of inflation, I mean, oops…”

What about currency crises, Wolf? What are your thoughts on the level of debt (relative to JDP) at which the $ could crash?

I realize Japan is at 250%, but they are still an exporting nation.

It’s all relative in terms of exchange rates. So far, the dollar is one of the cleanest dirty shirts out there.

Wolf let’s do a article on zombie companies ,should be a long list

Actually Japan is currently a net importer … significant change 2017-2022!

High energy prices don’t help.

The plunging yen doesn’t help either.

Irrelevant as long as the total foreign balance is positive (trade and current account) Japan could care less. Japan still runs a positive current account which more than offsets any trade deficit.

Once the total foreign balances turn negative Japan is in a heap of trouble.

Valuable comments Wolf, and in basic terms actually simple when explained like this. I am not sure however, that the discipline you speak of will emerge. They are too used to just blowing everything and once the economy starts to wane with the higher interest rates it would not surprise me for them to reverse course and start QE again.

A trillion here, a trillion there, and pretty soon you’re talking real money.

1) Inflation 100 history : for 60 years, between 1920 and 1980 the

trend was up. Inflation was wild, spiking between minus 14% and 22%.

2) Since the late 80’s inflation is trending down in a channel. Options :

3) Option #1 : The lower boundaries are in negative territory for over a decade. The current spike might normalize and return to the channel. Eventually it will test the 2009 low, or breach it, in negative territory.

We don’t know when, how…

4) Option #2 : We cannot ignore the 60 years uptrend between 1920 and 1980. The current spike is a test of the old trend. The 8.6% is not good enough.

Inflation might rise to the 12% – 16% area. We don’t know when, how

and how many tests, before giving up.

Inflation was negative in the 1930s, right in the middle of your ‘trend’.

1) Higher inflation rates and higher gov interest rates are two different

animals.

2) Gravity between US & Germany will limit the rise of US interest rates.

3) Higher inflation reduce US national debt in real terms and increase tax

collection. Small businesses benefit from higher interest rates

4) No harm is done (to the gov) until unemployment rise beyond 4.5%- 5%

along with SPX closing < June 2022 low.

5) Paying $200B interest/y : JP click $200B credit to the gov for $200B gov bills/ notes.

6) Don't worry be happy, because : UK, Germany, Japan, India… are our

best friend. China….

“Small businesses benefit from higher interest rates”

???

“The only discipline in a capitalist system is the cost of capital.” Truer words were never spoken. That is a quote for the ages. F**king brilliant.

Yes, I second that!

Money (capital) must have value (cost).

That is rule number one in my book. When that rule is broken, there are consequences; such as the inflation we have now.

Wolf has done a great job reporting on another consequence, which is the rise and fall of zombie companies. Cost-free capital has fueled up these money burning machines to the n*th degree. If you run a company that does not make a profit, death will eventually be your fate. And that is how it should be, I reckon.

Absolutely. And as soon as central banks decide to create new money to circumvent this discipline, the road to perdition begins.

Sounds like we’re good for at least another generation. Don’t blame us baby boomers anymore. Order more wine. Only in America. And so on.

For some reason, debt bugs the hell out of me but that must be a personal mind problem. Now I know why politicians don’t seem the least bit worried about any silly budget. It’s all about who can grab the most money.

What role does the FED play in this exercise?

If there are no buyers because of low rates, does the FED step in and buy the bonds?

Reread…

You may have missed the part that says rates will come up until there are buyers….

The Fed won’t be buying… that’s what got us into this mess to start with…

Been there. Done that. NOW THE FEDERAL RESERVE WILL INCREASINGLY BE DUMPING BONDS (US TREASURIES) and so are foreigners. How’s that going to work out except to push yields sharply upwards?

Looking forward to it. I’d love to back up the truck and buy 10-year Treasuries with a yield of 6%. Not sure we’ll get there, but if we do…

@ Wolf – 6%? sounds risky.

So you are going to buy something with a yield of 6%, but don’t know what the inflation rate will be at that time?

What if inflation is running at 8%? 10%

Are you still going to buy?

QuestionTime,

What are the better alternatives at those inflation rates and at these still ridiculous asset prices? Invest in crypto and lose 100%? Invest in stocks and lose 50%? Invest in gold, which nearly doubled over the past few years, and go nowhere for years and not earn any yield?

With a 10-year Treasury with a coupon of 6%, at least I KNOW I would make 6% a year = 60% over 10 years, plus I get 100% of my money back after 10 years.

If I put $1,000 into a 10-year 6% Treasury, after 10 years, I will have $1,600 after 10 years.

If I put $1,000 in crypto, I will have $0 after 10 years.

If I put $1,000 into stocks, I may have $700 ($500 principal + $200 in dividends) after 10 years – see the stock markets of China, Japan, Spain, Italy, Germany (DAXK), etc. They never went back to their bubble highs.

If I put $1,000 into RE at today’s prices, I may have $600 after 10 years, and I would have had to pay for the carrying costs, minus tax benefits. If it’s rental property, I will get some revenues to cover the carrying costs, and I get the tax benefits. But I might still be in the hole at today’s prices.

Those are the risk factors you have to look at if you’re speculating about the future.

That’s also why generally you don’t want to put all your eggs into one basket. But it could be that all your five baskets are terrible deals because we’re coming out of the Everything Bubble and there may not be any good deals for years to come, and you may be lucky getting 6% a year, for 10 years, when inflation = 8%, even though that’s a terrible deal, but less terrible than the other deals.

Danlxyz,

Please read the section in the article, titled “Yield solves all demand problems for debt.” It answers your questions.

It will be fun to watch Republicans try to balance the budget (like needs to happen during inflationary times). They have talked a good game for the past decade or so… but they ran John Boehner out of Washington on a rail after he tried to strike the “Grand Bargain” with Barack Obama and balance the budget. Obama may have blown up that particular negotiation but Boehner’s enforcement of Sequestration was the only thing holding spending down from 2013 to 2015. Then he was gone…

Unless they increase payroll taxes, the Medicare Part A fund for those 65+ might become insolvent in 2028.

The reason it will be insolvent is the interest rate repression undertaken from 2008 to 2016 that caused the fund to lose over a trillion in lost interest income.

That’s a nonsense statement — though it’s used a lot. It won’t be “insolvent.” Medicare is a pay-as-you-go insurance program, like ALL insurance, from health insurance to auto insurance. People pay into it, and then some of them will need to be paid out of it. Medicare does have a fund, but it doesn’t need to have a fund. Benefits can be paid out of the flow of receipts (premiums paid via payroll deductions, Part B premiums, etc.) And if the receipts are not enough to cover benefits – like ALL insurance – then premiums are raised. That’s why healthcare premiums and auto insurance premiums and home owner insurance premiums always go up.

I would only caution that in a recession tax receipts tend to fall sharply.

Yes, this has to be a consideration if you want to look forward.

I guess they’ll just plaster over the shortfall with more debt, hoping for a break later with low rates to make up for it.

I do that when I’m snowboarding and a patch of ice comes. just ride flat and accelerate and hope there will be a chance to slow down later!

Thanks Wolf. The other dynamic is that the Fed owns almost a third of outstanding treasuries. Interest it receives is rebated back to the govt after expenses incl realized losses on holdings. So interest cost on whatever the Fed holds is close to zero. Because of this, hard not to see implicit or explicit pressure on the Fed to let it’s balance sheet continue to grow

Yes, the Fed remits most of its interest income back to the Treasury, but before QE that remittance was in the $30 billion range. At the peak in 2015, it was $118 billion. These remittances will drop back to the 2007/8 range over the next few years. No biggie, in a $6 trillion budget and rising:

Ok so knowing a tiny bit about this kind of data do you have a chart that tells us the rate of exchange of these debts. Its is ok to see this chart as what is at any moment but it could hiding a balloon of change coming down the pipe. Think of it like this some companies take out debt and pay interest on that debt but some of it comes due. If it comes due today that would be bad, but if you have a few years time to get to the next easing cycle then your fine. Same for sovereign finance.

US Treasury securities come due on their maturity date. This is tracked and you can look it up. Maturities range from 1-month Treasury bills which mature in 30 days, to 30-year bonds which mature in 30 years. For each security, the maturity date is fixed and known. There are zero surprises in this.

For years as the Social Security account grew, it reduced the federal deficit. Now it will start to increase the federal deficit as the surplus gets drawn down.

This also means, at the margin, that there will be one less captive buyer of government debt going forward.

The real question is how long this inflationary situation continues. If it just for a year or two, then not a huge deal, but if we go 5-10 years (stagflation) then it could be not so nice.

Japan is instructive of how it is possible to run continuous high deficits (and keep rates low). But the Japanese government is technically bankrupt. Any rate increase would quickly blow a hole in the already horrible budget situation. We really don’t want to go that far down the road.

I believe SS payments have exceeded SS taxes since some where around 2010. Reagan had raised SS taxes before the revenues were needed.

In terms of just contributions versus benefits:

But then there is also interest income from the securities in the Trust Fund — see the effect of the Fed’s interest rate repression?

Which gives you the change in the trust fund balance:

https://wolfstreet.com/2021/11/11/status-of-social-security-and-the-trust-fund-fiscal-2021-beware-of-vicious-dog/

SS Trust : $2.7T, slightly below peak, yet contributions lag payment.

Where is the money coming from.

Interest on the trust fund …

This is a pay as you go welfare program for seniors. The wife and I are on the SS dole. The “trust fund” is IOUs from the other side of the government. If SS taxes do not fund SS payments, which has been true since 2010, they go to the other side of the government for a handout. A trust fund of nonmarketable government securities is a “trust fund” of IOUs.

Richard Greene,

“The “trust fund” is IOUs from the other side of the government.”

Hahahaha… just like the Treasury securities that I hold in my account. Treasury securities are the most conservative investment, and that’s what the Trust Fund is invested in, thank god, so it doesn’t plunge like the stock market.

And thank god they’re non-marketable, or else they would have to be written up and down on a daily basis. But they’re NEVER sold, and market price is irrelevant because the Trust Fund gets paid face value when they mature, and there is no need to write them up or down.

This is common practice. The Treasurys in my TreasuryDirect account don’t get written up or down either to mark them to market. I get paid interest, and when they mature, I get paid face value (and if they’re bills, I get paid face value plus interest). The Trust Fund operates on the same basis. It’s a good deal. Check it out.

READ THIS:

https://wolfstreet.com/2021/11/11/status-of-social-security-and-the-trust-fund-fiscal-2021-beware-of-vicious-dog/

Perhaps, I am misreading: But in essence the monster that we are fearing isn’t the one that is coming to kill us all.

We fear debt interest payments that can’t be made.

The monster that’s going to kill us is inflation.

So we’re back to Klaus being right: We won’t own anything because it will all be unaffordable.

How is any of this good?

Items that are purchased with loans will have downward pressure on price as interest rates rise in response to inflation.

RE is one example, but it is very slow to react, and it also depends on price levels prior to the onset of inflation. If they are high, as is now the case, they will drop. In the past (70s) they were low prior to onset, and therefore didn’t react the same way. Prices of some things are also limited by wages, but that limiter becomes weak if a wage price spiral occurs. In spite of any such limiters, inflation is a truly horrible monster, as you have observed.

Where will Klaus hide when this plays out,peons 99% wealthy1% not good odds

As long as central banks have printing presses, default is never the risk – inflation is. This is the central fallacy behind the idiocy of Modern Monetary Theory (MMT). Great! Governments (in league with central banks) can’t default – they destroy you instead with hyperinflation.

The problem with tightening is it will create more debt because budget deficits due to ‘entitlements’ will be even less covered by shrinking tax revenue (deflated $$ and shrinking economy/GDP). They can only tighten until something breaks, and many things are currently in process of breaking at once.

Tightening causes the overhang of zombie corporate debt and some consumer debt to go into default. It will get restructured, some of it in bankruptcy court, and the economy will emerge with less debt. That’s a good thing. The expense of that debt blow-up will be paid for by investors, and they got paid for years to carry that risk. That’s how it is SUPPOSED to work.

Good article Wolf… I ran off to look at Tax Receipts over the last few years and it has moved up the Wazoo as well. Capital Gains?

https://fred.stlouisfed.org/series/W006RC1Q027SBEA

Yes, plus wage inflation which generates more income taxes, and record corporate profits, which generate more income taxes.

Corporate profits are now severely sagging and many corporations have losses, not profits.

We are in a new place as debt levels are at record. Maybe we are going to find out if the arm wrestling champ is Mr. Market or the central banks. In the end if it gets bad enough it is Mr. Market voting with his feet on whether the currency is worth holding or not. Sovereign bond market is money with a maturity date on it. There is always an alternative if the central bank screws you over enough.

I am in the camp the Fed will never get to 4% at least for more than a month or two. Housing and car market will be dead at 4% Fed rate. When you are not building any houses or cars the Fat Lady will start singing.

There are some credible people who think the Fed is going to do a Volcker, because they can only affect demand – not supply.

And the Fed can only affect supply by crushing wealth/wealth effect.

Fed funds rate is still minuscule though, so hitting 4% by November seems unlikely even with more 0.75% rate hikes. But consider 0.5% to 0.75% hikes through the end of 2023…

Crushing the housing market is only bad (to the Fed) if it is unintentional, and the crushing would be skewed to the first time home buyers. The wealthy people get much higher interest income on their cash hoards to offset.

Crushing the new house construction market and the new car market puts a lot of people out of work is my point. If you put 5 – 10% of workforce out of work everything changes in a hurry.

Plus I saw a chart yesterday that showed people are borrowing the most money as you go into a recession. It’s just the natural way of things I believe that employment and debt is at the max just when the party is over. Then it’s time to go home and sober up.

The pendulum swings both ways.

Cheaper construction supplies and cheaper automobiles will be a boon for some people.

Harrold, consumer price index and other price indexes may come down. Prices on the other hand may not go down less in liqvidation sales. Be not surprised that availability of many types of goods go down too.

Yes but you are losing sight of the fact that said massive job loss is exactly the goal if the Fed wants to reduce demand.

Crushing new house construction also reduces demand.

“I am in the camp the Fed will never get to 4% at least for more than a month or two.”

If the interest rate cycle bottomed and the bond bull market ended in 2020, interest rates are destined to “blow out” later, past the 1981 peak. The “reason” isn’t evident yet because psychology doesn’t reflect the actually mediocre to terrible fundamentals.

The US isn’t exempt from reality.

History of money is interesting and you might be correct.

One thing I am pretty certain is true is if interest rates do go up much there are going to be a lot of haircuts on the debt. If you can’t afford the interest payment then it gets to be a legal or political fight over who is going to eat the losses.

Money is powerful weapon. Inflation is a regressive tax on the poor. Inflation is policy decision about who is going to take it up the rear end.

Look no further than Turkey where inflation is around 70%.

Those people in Turkey who took out loans at 7% two years ago are golden.

FED has wanted to raise rates for years and now they have an excuse.

Do not bet on a pivot.

The FED is going to punch the economy in the nuts with interest rate rises until the economy loses its inflation woody.

Things are out of control and, pathetically, that is out only inflation reigning tool.

Do not blame the FED. We have failed to evolve our economic system and its controls. We are stuck in the mid twentieth century.

We need to evolve to a more inflation resistant model with better control tools.

“Do not blame the FED. We have failed to evolve our economic system and its controls. We are stuck in the mid twentieth century.

We need to evolve to a more inflation resistant model with better control tools.”

What are you even talking about?

There are no such tools or model. It’s a failure of central planning, the government “managing” the economy through fiscal and monetary policy. The idea that new and “improved” central planning will lead to a better outcome is nonsensical.

Great write up.

The main issue going forward is de-dollarization: specifically embodied in the Eurodollar market.

Between the ongoing euro economic collapse plus the secondary effects of the Central Bank of Russia freeze (which now appears to have been Eurodollar deposits), plus sanctions impact on the commodities market makers (Pozsar BW III thesis), will we see structurally falling foreign purchasing of US Treasuries?

Time will tell.

Seems like Europe may be in political trouble this time. As weaker countries bond prices start to blow out somebody is going to be unhappy with the solution to solve the problem.

That’s been a perennial issue for decades though so nothing about “this time” that’s different, nor is it political trouble–every currency and currency union has a problem with different members on different economic and financial track. It’s a problem here in the US too, with more productive states effectively subsidizing less productive ones, and value of the dollar in practice not the same in different regions of the US (hence the mess we often run into with COL adjustments and salaries in different parts of the country). We can paper over it in the US by calling the currency “a dollar” in different regions but what it actually buys you varies considerably. In practice the EU is getting stuck having to do the same thing, some regions get subsidized (while they “subsidize” the more productive regions with their workers), that’s always how it works. And if anything Europe is much stronger politically this time due to unity in the face of Russia’s Ukraine blunder (and China’s growing trade strength), as one of our leaders once said, the Eurozone is as much a political union (and administrative) than economic one, it stays together because it has to.

Nonsense

The EU or Eurozone doesn’t have to stay together. The UK left the EU and escaped that roach motel. It’s the elites who think as you describe, not necessarily the citizenry.

We’ll see how unified the EU and Eurozone are when they can’t get enough gas or other essentials.

EU are dimwits for allowing US to dictate their foreign policy. The conflict was entirely avoidable, if NATO had told Ukraine it couldn’t join, as it should have.

Security guarantees aren’t free. The US is overextended geopolitically and lacks the resources to make good on existing commitments.

Think inflation and shortages are bad now? Just wait and see what happens if the US gets directly involved in a meaningful “hot war”. Politicians and MSM will be glad to volunteer the sacrifice at the public’s expense.

I don’t know how many security commitments the US has (explicit or implicit) but failing to defend any of them (by choice or military defeat) could lead to a diplomatic and economic disastrous loss of credibility.

AF,

I’ve worked and stayed in Europe and no, it is NOT the elites who think this way, it absolutely is the people on the ground who want the EU to stay together. This does not mean they’re happy about everything, they want reforms but very few Europeans want to go so far as dissolve the EU–even the nationalist parties once pushing this have pulled back completely, focusing more on limiting immigration. You make a mistake by trying to hold up the UK as an example–Britain never wanted to be a part of the European Union and never joined the Eurozone, and as an island country with its own unique trade arrangements it’s in a unique situation. (And even then post-Brexit hasn’t been very smooth.) Wildly different case for the contiguous countries on the Continent, for trade, political, security, education, basic social reasons there really is no alternative to the EU. But yes, it does need reforming.

The US Dollar will simply continue rising on the DXY and the Euro is rapidly dropping to parity (1:1) with the US Dollar which is now back to almost 105 on the DXY today.

Might go to parity. Dollar is strong because Euro and Yen are currently basket cases.

If you get a chance watch Gunlach explain why he is short term dollar bull, but believes it is going below 75 in the next year or two. Basically trade deficit and government deficit too big to keep dollar strong in the long term is his opinion.

I also believe the USD is approaching a peak though hope I am wrong as it’s my currency of reference.

If this happens, I expect it to eventually go noticeably lower than 75. As to how that would happen, one possibility is the break-up of the Eurozone where the countries with historically weaker currencies are out.

Wow. Going from 105 where it is now to below 75? That’s breathtaking and I am not being sarcastic.

A weak euros and weak yen is good for european and japanese exporters

DXY is a total mess these days due to all the volatility from inflation and the varied, sporadic, spotty attempts from central banks to tackle it while fiscal policymakers fumble around trying to find their own way, all the while the ruble collapses into wastepaper while BoJ likes having some inflation for the yen. So it’s hard to conclude anything at all from currency markets in this environment. DXY absolutely does not indicate strength or confidence in the dollar, otherwise we wouldn’t be having this runaway inflation where the purchase power of the dollar keeps dropping off a cliff in real terms (including for key essentials like housing, gas and food). The inflation is the true reflection of a currency’s value and it’s bad for USD, even worse than many Euro countries (at least for ones where prices for some key staples are under better control). It’s why the Fed is going full Volcker right now, alternative is more erosion in confidence of US dollar as store of value.

I’ve posted before and every time the post has been deleted:

The US$ is going up because of all the derivative shorts in place on it.

It will continue to go up until the shorts have covered and then it will fall.

Don’t censor me again,

“I’ve posted before and every time the post has been deleted”

Hahahaha, BS, your comment to this effect has not been deleted because it’s the first time you made this comment. You’re logging in with a different screen name and a different fake email each time, but with the same IP address in Sydney, Australia. And I just checked, and nope, that line was just more BS from you.

USD is like democracy, it’s the worst form of currency except for all the others.

And, please, gold is not a perfect solution. There are serious trade-offs with gold standard currencies. Many modern day gold supporters’ ancestors were super anti-gold when you look at political preferences, history, and geography. Go read William Jennings Bryant “Cross of Gold” speech, who represented rural farmers views on inflation.

If people want to talk about their book, it’s pretty simple. If you owe a lot of fixed debt, inflation is cool. If you are a creditor, or own a lot of assets priced in the currency, inflation sucks.

Even by that standard the USD strength is questionable, again the currencies right now are fluctuating all over the place atm for all kinds of reasons that have nothing to do with strength or confidence in the currency, and it all gets shot to heck further by central banks being all over the map. Some old friends of mine trade on the FX markets and many joke that they envy the stability of the crypto guys at times–there’s no rhyme or reason for half the moves on the major or minor currencies. If anything Swiss franc seems to be the one held in highest regard, and RMB gets more volume out of sheer necessity from trade, but it’s hard to conclude anything from the forex gyrations. Look to reserve holding levels and inflation to get a real sense of a currency’s value and confidence, while the dollar is by no means the worst, it’s suffered a nasty erosion of its value and reserve holdings with the latest inflation wave, another reason the Fed has to be more aggressive with QT and rate hikes.

I’m not so sure. Norwegian krone has negative debt and Swiss has constitutional limits on the debt. Both are outside EU so avoid a common debt.

The us had to issue debt in Swiss francs and deutchmarks at one point…

Dear Wolf

Do you think the effects of high interest rate on employment and investments ?

Thank you

ispanyolca,

It will reduce the ridiculously high number of unfilled job openings and bring them back into the normal range. The labor market will loosen up some, and hopefully, the “labor shortages” will disappear, so that companies can actually hire the people they want to hire without having to poach them from other companies.

Investments will be repriced. The higher interest rates will cause companies and investors to make more prudent decisions about capital allocations. A lot of the zombie companies will be restructured in bankruptcy court, and investors will take losses on that. All of these are good things. Higher interest rates are good for the economy long term because they enforce better decision making.

“Higher interest rates are good for the economy long term because they enforce better decision making.”

—

A silver lining. Thanks for the clarity!

Thank you for your clarification. We will see it.

I agree. 0-2% interest rates are too low and encourage bad capital allocations. But too high for too long and we risk real estate asset repricing, which can be brutal on the economy because it has a greater participation rate.

No clue on how you square peg that round hole. You need some inflation to at least mitigate asset repricing, but not too much or the problem gets even worse. I guess I look at interest rates and inflation as poison vs. medicine, it’s all circumstantial and contingent with the central bankers or doctors more like gamblers than gods.

We can only hope. Encourage saving and investment…wow!!!

Seems like modern macro economist miss the history lesson of prosperity that people are not a factor in an equation but need proper incentives to be productive.

You can’t play games with taxes and inflation and take half of people’s hard earned labor and expect them to be productive. They make a rational decision it’s better to get in the wagon instead of pulling it.

Encourage saving? Where did that get you for the last ten years?

Finally! An analysis of what I’ve been searching for forever and have never found. Thank you!!!

Interesting and Thought Provoking.

Thank you for the work and for sharing

Do governments, at the moment, have the ability to curb spending,……………… probably not……but i do believe in six impossible things before breakfast…..

Anthony – At the moment, probably not. Several times I’ve lived in vibrant, productive areas that generated lots of taxes and government usually spent much, maybe saved some, then spent that on misjudgements of real world infrastructure costs or “emergencies”. Every public piggy bank gets broken open eventually. Governments could curb spending, but it’s an attack on an entrenched, organized something -ocracy. Their future is assured, your’s is secondary. Not feasible to eradicate some invasive species and bureaucrats are that. They’re like unionized palmetto bugs. If the debt load across governments and the governed wasn’t so debilitating and sapping economic strength, the perceived future might be brighter and people might be more accepting of life without every latest luxury, because they wouldn’t have to watch the government blowing their savings and their kids futures, and could kick them out if they didn’t mind the store. But people who owe so much they can’t get ahead look at the government in a worse mess and lose hope of fixing anything. As it is, honest bookkeeping would have closed our (US) store years ago, and we’re in good company. As a financial practicality, we can’t handle the truth. As a social sign of the times, we wouldn’t believe it if we heard it.

Listened to the BBC reading of “The Hitchhikers Guide to the Galaxy” at night on the Port Bolivar beach almost forty years ago, public radio was scarce and apolitical then in Texas.

More interesting would be state, county and city debt. None of those entities can create money to pay their debts. Illinois and Chicago might be worst-case examples with businesses and productive people leaving because of high taxes, crime and regulations.

Cities can and do file for bankruptcy to shed debts. States still cannot file for bankruptcy, but Puerto Rico was a (not very effective) work-around. I think it would be good for states to be able to file for bankruptcy and shed their debts that way, and muni-bond investors will take those risks if they get paid a higher yield. That’s how it should be.

Trust me we have the same problems going on down in Texas, Florida, North Carolina and Arizona where most of my family lives. Despite its reputation Texas is not a low-tax state, the property tax in Texas is some of the most burdensome in the nation (it’s worse than California) and Texas also has some of the dumbest regulations too. That’s a big reason behind the power company disaster in 2021 with many Texans literally freezing to death in their homes as power and water pumps were often down for days or weeks, there were some smart regulations put in place, but others that were clearly designed to favor politically donating insiders that blocked a flexible response. Even conservatives down here are made at Abbott about that. As for businesses, some big names like Tesla capture headlines but some are leaving Texas too, for their own reasons. And crime? That’s most states in the US right now. Yeah, Illinois has some serious problems in these areas but they’re hardly alone.

should read, “mad at Abbott about that”

It costs money to run governments. If they don’t get it here (income taxes), they’re going to get it over there (sales and property taxes , fees, or something else). Nobody rides for free.

Yes, indeed. That’s a factor forgotten by far too many of the companies and individuals who talk about moving to state X or Y because “it’s such a nice looking state with no income tax”. For at least basic infrastructure, health needs and education, those funds have to come from somewhere, and if income tax isn’t paying, something else is gonna be taxed to the moon, and if you don’t know what it is–it probably means you’re the one being set up to be the tax cash cow. Florida has the same thing going (also high sales and property taxes and a nasty corporate income tax), and Delaware.. don’t even get me started on.

The level of public debt and the cost of financing doesn’t become a problem due to some arbitrary threshold. It’s psychological based upon the market’s pricing of the currency and debt. That’s what triggers a debt or currency crisis.

I think it was the BIS which performed a study concluding that 90% debt/GDP was the problem point but it’s not absolute. Japan passed that point years ago while more recently, Spain ran into trouble somewhere around 54% or 62%. (I read conflicting numbers.)

Correct…

But I believe it was Rogoff/Reinhart in a paper a few years back that suggested the 90%…

Found it… New York Times op-ed… April, 2013…

A good follow up was in The New Yorker shortly afterwards…

Carmen Reinhart was interviewed on Bloomberg yesterday. Her specialty is sovereign debt crisis vs Yellen who specialty was as a labor economist.

I don’t know if it’s me or not but Yellen seems dumb as a box of rocks compared to Reinhart, but maybe Yellen is just a prostitute for powers that be. Didn’t she get $5 million from Wall Street for giving some speeches? What ever happened to avoiding even the appearance of conflict of interest?

+++

Re Yellen

Or anybody else who bounces between Fed/Treasury or vice versa.

Given the downward spiral of the American economy (real or financial) it is like watching the human embodiment of debt monetarization and national decline.

A senility shuffling bits of paper from one pocket to another, endlessly, as the room about them burns.

But Zimbabwe Ben Bernanke was as bad, and more arrogant.

“We have a technology…”, indeed.

The government debt is mostly in 1 and 2 year treasuries. it won’t be long at all before they are paying 3% on 30T. Sure, they won’t feel any pain in Q3 ’22, but in 2024 they will. That doesn’t seem very far away, even if Wolf will have written 200 articles between now and then.

I’m hardly reassured that they’re financially healthy from you saying “relax, they won’t see the problem at least until their debt matures”

I have ridden the roller coaster up and down over the last few years with the two year. Been quiet a ride, but it was better than being further out on the curve. I wouldn’t have slept very well with a 10 year Treasury.

Nathan,

“The government debt is mostly in 1 and 2 year treasuries.”

Nope. The average maturity of the outstanding balance of (publicly traded) Treasury securities is 62 months (5 years, 2 months).

Treasury securities held in gov pension funds, the SS trust fund, etc., have longer maturities on average.

“Higher interest rates will enforce a sort of discipline on the drunken party……..”

It may go on for a while in the US as the debt is made up of a bunch of different securities, but not as long as you think.

First, the government needs to raise money to cover the constant deficits which will face higher rates immediately. That is around a trillion or so a year.

Second it will have to roll over the amount of debt maturing as well.

Third, it will have to raise more funds to cover the interest on the new debt as the interest rates may be higher. This is especially true for the short term maturities that are being rolled over.

There are about $4 trillion in one year T Bills outstanding which will be rolled over and subject to the higher interest rates over the next six months or so.

2022 will also be the year with the most T-note roll overs as well. That is another $4 trillion or so.

That means about $9 trillion is going to be refinanced at higher rates in less than one year.

And looking at the recent changes in issuance of different maturities of Fed debt shows that most has been moved from the short end of T-Bills to short term notes with duration of 1 to 3 years. So that will also need to be refinanced in a short period of time.

The current average interest rate on the outstanding tradable T-Bills is 0.07%. The current average on the outstanding tradable T-notes balance is 1.47%.

And for those that are keeping track it means that for every 1/4% increase in the Fed discount rate if passed on its entirety to the debt markets means $10 billion or increase in cost of current T-bill balances (if not changed) and $30 billion for T-notes( if not changed).

As the amount of debt will increase over time that also means the above numbers will increase as time passes.

So, no the average maturity is meaningless.

Nathan, all the more reason to get inflation under control *now*, correct? And the higher and faster they jack up rates *now*, the sooner they get inflation under control. Then they can go back to issuing debt near the old rate levels. The worst thing the government could do, if they want to minimize their long term high rate debt obligation, is to dilly dally, as they have been doing for over twelve months at this point. A 1.5% to 1.75% effective funds rate is a joke in the face of 8%+ inflation.

The concluding paragraph infers higher interest rates will prevent destruction from inflation. That is true, only, if interest rates go high enough to curb inflation. Currently, it is too little, too late. Destruction is coming if the FED doesn’t react more decisively.

Hello everyone.

How does the trade balance play in this scheme?

It doesn’t.

With the real inflation rate so much higher than interest rates the debt is now being inflated away.

Government really sprayed money around when pandemic hit. Some were net winners and some were and are going to be net losers. I was a net loser overall I guess.

My son-in-law has a good attitude about government handouts and said he figured out early on if he was going to make something of himself he would miss out on the government candy and it doesn’t bother him.

The debt is constantly being inflated away.

Anyone looking at things linearly will possibly or likely conclude it’s sustainable. Government spends more and more but GDP always increases while central bank debases currency enough to perpetually cheat savers.

Eventually savers go somewhere else, physically if necessary. Or, a catastrophic non-linear “black swan” occurs “out of the blue”, like the Russia-Ukraine War which I predict will ultimately trigger much bigger geopolitical “blowback” wreaking havoc on the US budget, US economy, and US geopolitical standing.

Most people routinely ignore basic math when the (implied) outcome is contrary to their personal preference.

But it’s more than that. There are fundamental drivers (physical events and psychological outcomes) which are outside the control of any individual or the (US) government which the vast majority implicitly rely on to maintain the status quo. The human driven events (psychological) invariably come “out of the woodwork” during someone’s bear market, possibly somewhere else.

Once this mania and the fake “growth” that comes with it is over, that’s what’s going to happen when the bear market matures sufficiently, making obvious the mediocre to awful fundamentals hidden in plain sight.

It’s impossible to truly inflate public debt away though, at least not anymore. The higher costs just mean government allocations go up too with new budgets and appropriations. Many payouts are pegged to inflation, and when unpaid debts roll over they’re hit by the higher interest rates too. If it was so easy as just inflating away debts then the Ottomans, British, Romans and other past imperial powers would have done it without trouble. Instead, their inflationary crises helped to bring down their empires and even lead to the collapse of their states.

Who cares if they can’t pay the interest on the massive US debt. When I can’t pay my bills nobody gives a crap. They have billions for every other pet project, social program, black hole government spending. Pay the higher interest and shut up.