Supply chains improve from catastrophically stressed to just very stressed.

By Wolf Richter for WOLF STREET.

Consumer spending in the US has been shifting back from goods to discretionary services, and demand for goods has fallen from the breath-taking stimulus-miracle spike in March and April 2021, as spending on services has surged. In Europe, as similar trend is beginning to evolved. And this trend back to services has started to show up in the world of container shipping.

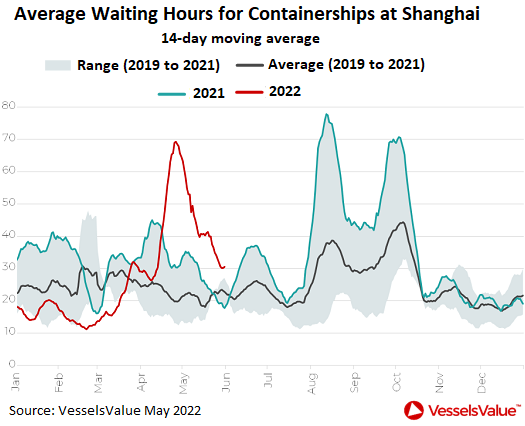

Average waiting times for container ships at Shanghai, after having spiked to nearly 70 hours in April (14-day moving average), amid the lockdowns that snarled port operations in Shanghai, have now declined to 31 hours, according to VesselsValue.

This is still the longest wait time in the data for this time of the year, about 4 hours longer than the top of the range for the same period in 2019 through 2021, but it’s a huge improvement from April and from the spikes in 2021 when average waiting hours for container ships reached nearly 80 hours in August 2021 (green):

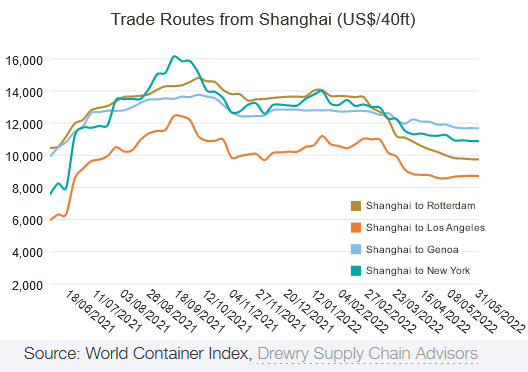

Ocean freight rates to ship containers have also declined globally from the spike that topped out in September 2021. The Drewry World Container Index has dropped by 26% from the September 2021 high of $10,377 per 40-ft container, to $7,625 as of the week ended June 2.

But this is still multiples higher than the old-normal container freight rates before the pandemic: In 2019, the Drewry World Container Index ranged from $1,200 to $1,900.

From Shanghai to Los Angeles, container freight rates fell by 30% from the peak of $12,424 in September 2021 to $8,704 in the week ended June 2. But they’re still over four times higher than they were just before the pandemic.

From Shanghai to New York, container freight rates dropped by 33% from $16,138 at the peak last September to $10,871 as of June 2 (chart via Drewry Supply Chain Advisors):

For the global trade in goods that a are shipped in containers, the past two years have been utter chaos, as a result of many factors, ranging from consolidation in the shipping industry prior to the pandemic to the historic boom in demand for goods, especially in the US, but also in Europe and elsewhere – demand that no one was ready for.

Consumer spending, fueled by many trillions of dollars in central bank and government stimulus, shifted from discretionary services to durable goods, unleashing an explosive spike in imports of goods into the US, resulting in container shortages, massive container congestion at ports and rail yards everywhere, gummed-up operations, spiking freight costs, long delays, and just utter chaos and inefficiencies that made everything much worse.

Supply chain chaos is not over.

The decline in waiting times for container ships at Shanghai, and the decline in container freight rates show that the transportation chaos is getting partially resolved. But the wait times at Shanghai are still longer than they were; and container freight rates are still multiples higher than they were, and nothing has normalized yet.

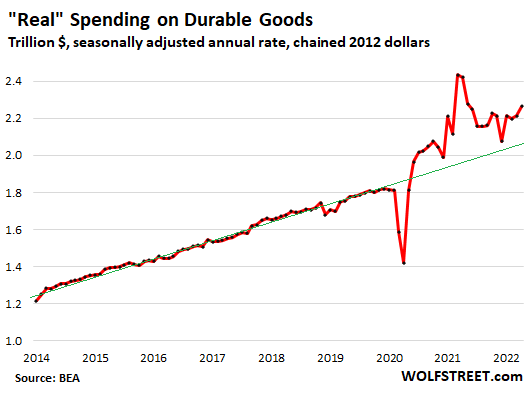

In the US, the boom in durable goods – many of which are imported or are assembled in the US with imported components, such as new vehicles – was driven from already high levels to fantastical levels in March and April 2021, following the third round of stimulus checks. Even adjusted for inflation, “real” spending on durable goods during the pandemic just blew the lid off. And supply chains could never be ready for the explosion in demand.

Since the peak in March and April 2021, real spending (adjusted for inflation) on durable goods has dropped by 6.5% but it remains at nosebleed levels.

Spending on durable goods continues to be held down by the shortages of new vehicles, which is a big component of durable goods, and I’m not sure what this chart would look like if dealer lots across the US were chock-full with new cars and trucks that consumers could actually buy on the spot, rather than trying to get on endless waiting lists:

For transportation issues and supply chain snarls to get resolved, consumer demand for durable goods would have to decline further and by quite a bit to somewhere near pre-pandemic trend (green line), and that isn’t happening just yet. Maybe some more Fed tightening could do the job:

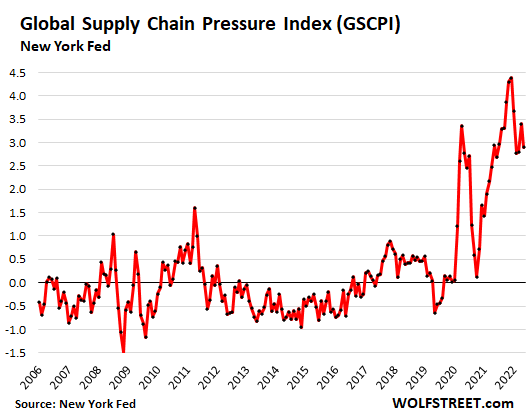

In response to the supply chain crisis, the New York Fed has developed a new index, the Global Supply Chain Pressure Index (GSCPI), based on data from global transportation costs and the supply chain-related components of Purchasing Managers’ Indexes (PMIs) from manufacturers in the US, China, the Eurozone, Japan, South Korea, Taiwan, and the UK.

Global supply chain pressures peaked in November and December 2021, and then declined, but over the past four months, have flattened after the dip in May. As the New York Fed said today, this suggest “for now, a stabilization of global supply chain pressures at historically high levels”:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

A recent article on Marketplace cites a report by the World Bank and S&P Global Market Intelligence, which “ranked the efficiency of more than 350 ports worldwide based on how long ships had to wait at port last year. Los Angeles and Long Beach, which handle more than 40% of all maritime imports to the U.S., came in dead last for efficiency.”

USA! USA!

I am SO ashamed. Glad they’re not MY project.

This is about wait times in Shanghai, not Los Angeles and Long Beach, LOL

If waits on the US west coast are going to be worst in the world then shippers from Shanghai to LA/LB can take their time.

Interdependcies are, well, complicated, so backups have a way of cascading. Shipping has been glitchy worldwide for the last couple of years. It’s not just Shanghai. Rotterdam is highly automated and well-invested but is stuck with downstream problems in rail and truck, same as the US. Bottom-rung positions in transportation logistics aren’t glamorous jobs and labor shortages are endemic. Things have gone to hell in a handbasket since Bowersox departed and aren’t likely to clear up any time soon.

The union members at the LA and LB ports make well over $150k per year median and there is a years long waitlist to join.

So much for “glamor” and labor shortages.

It is a labor monopoly squeezing a national chokepoint using b*llshit work rules that destroy efficiency.

They are behaving exactly like monopolists in the Left’s worst fantasies of capitalism but because the union gives a cut of loot to the DNC, nary a word is uttered – despite *many* disruptions to the national economy over the years.

“the union gives a cut off the loot to the DNC”

I am begging some of you to log off of Facebook and touch some grass.

The allegedly slow and inefficient ports of LA and LB and their workers moved record amounts of cargo during the Fed-driven pandemic consumer goods demand mania. Far more than they did before, despite COVID tearing through the workforce.

Of course, there’s only so much real estate on the docks, so despite the workers efforts, and despite the terminal operators converting every unused square foot on those terminals to temporary parking or “decking” (container stacking) areas, they were all simply overwhelmed by the sheer amount of stuff being bought with the excess liquidity sloshing through the system.

That excess liquidity is going away, and the flotillas of containerships off the California coast has shriveled considerably, on its way to zero.

It turns out that when the economy is not massively distorted by artificial demand, along with equipment (railcars, empty containers) and labor (port truckers) shortages, the ports can operate just fine.

Pea Sea,

I’n not sure about grass, but I do know that grains go out of the PNW from three export terminals; Kalama & Tacoma, Washington and Portland, Oregon. There is a joint (OK, there’s the grass, eh?) venture between two Minnesota companies, CHS and Cargill, called TEMPCO.

In fiscal year 2021, TEMPCO handled almost 540 million bushels of grain that was exported to 11 countries; primarily to China, Japan & South Korea.

I doubt that the number of bushels this year will equal the 2021 figures, but we will see.

The machinery that transfers the grain from rail cars into the cargo ships is pretty amazing. I wonder if “Seneca’s Cliff” in Portland has seen it in action?

Dan Romig,

I’m from “fly over country” and yes, I have visited the EGT export grain terminal in the PNW. We were the first “tour” group to visit the facility and were met at the gate with union protesters but they did let our tour bus into the facility. We were told by the company representatives that they had the most advanced automated export grain facility in the PNW, i.e. why there were protestors. They could load a grain ship with just 3 people there. I’ve toured several export elevators and this one was definitely the most efficient I have seen, but that was 10 years ago.

There’s a world of difference between the Teamsters members that are making $150k/year inside the port and the contractor-drivers who haul the containers of out of the port. Those poor sods are making below minimum wage and have left in droves.

No matter how well-operated the port itself is, if you don’t have trucks to remove the containers from the port, it’ll eventually fill up and stop.

In addition, the warehouses where most of those containers are unloaded were largely staffed with illegal immigrants. Trump’s reign of terror against those people resulted in many of them leaving the country. Now we have a labor shortage in the warehouses. It’s physically demanding and dangerous work and there aren’t many people willing to do it.

Everything is interconnected, and there are a LOT of singular problems that will have to be solved in order to get the system running smoothly again.

You need to post this over on Seeking Alpha.

I allow SA to republish one article per week, and they do. They choose. And they do the posting. It shows up on SA usually about two days later.

Una,

Three guesses as to the efficiency murdering entity whose stranglehold on those ports is notorious.

The ports are a chokepoint and that entity bleeds the entire nation to enrich itself.

Not to throw you into a muse, but could the first guess be an association formed by people with a common interest or purpose?

Yes, just like the evil monopolist corporations.

It’s railroads and trucking ,not unions

All kinds of hands are in his, each holding tightly to possession of assets, and a demand for more pay. The whole system is sort of a bottleneck, or I might say, very frictional.

Only a buyers’ strike, I think, can reverse the trend. By then, if the stickiness of this in history is any guide, sellers will start chasing buyers with falling prices. That is, the few buyers who didn’t blow all their cash off at this top.

Then again, the Fed could get its awkward hands in the pie and mess it up again, and keep it from discovering true equilibrium prices. The gov has been manipulating many prices since the 1930s, often expressly to keep them high. I recall selling some stocks in early ’09, wondering where the bottom would be, and the next day Bernanke made a big announcement, undoing any wisdom to my move. The hand on the scales sometimes helps, but makes it devilish to plan, or preserve value. The risk of a cash and credit explosion is always with us.

Alternate ports should be available to pick up some of the slack. In Canada, for instance, there is a deep water port at Prince George, B.C. It has Canada’s first Foreign Trade Zone, and CN Rail’s got a base there. Diversion of some flow to there should help.

You mean Prince Rupert. It lacks capacity and is a long way over the Rockies to anywhere. Prince George is 400 km inland.

I’m way over my limit here. Sorry.

Umm, no. That would make Canada subject to tariffs for importation to USA. Nobody wants that. The largest commercial port in Western Canada is Vancouver, and it’s pretty well maxed out. It’s also the only major port in Western Canada, and very limited in how it could possibly grow. Prince Rupert (not Prince George) has major constraints on the size of the port, the size of the railhead, and the impacts of weather.

The USA is expanding Seattle/Tacoma and Everett, and Anchorage, but those are multi year (decades) in the works. Even then the problem is not the water side, but the truck and rail capabilities of the areas. Frankly, unless the people living in and around ALL of the west coast ports are willing to give up land for more roads and rail access there’s only a limited amount of room for improvement. You are talking not only a huge infrastructure push, but a major change in cities that are among the most expensive in the world for property, and politically not aligned with business.

It would be fantastic if Long Beach or Seattle could be as technologically advanced as Rotterdam, but there’s not a politician in the USA who’d advance that cause.

No problem contract Boring company put railroads underground plenty of room

It took 10 years for Seattle to bore 3 miles of road to move HWY 99 underground. At that rate you’re looking at a 200 year project just to open up Port of Seattle.

That’s nothing. It took the San Francisco Bay Area over 20 years to build the new section of the Bay Bridge (the old section partially collapsed during the 1989 Loma Prieta earthquake).

Will this have an impact on inflation?

A little bit, if we’re lucky and patient. Those prices will have to come down hard year-over-year to make an impact, and then it won’t be huge, or maybe it will only increase the profit margins of the importers. There is no straight line between container freight costs and consumer price inflation.

“If we’re lucky and patient”: Tried that with crude and gas prices hoping that govt jawboning will work. Its just going in the other direction!

Now will hope that Fed JawBoning will “Reverse” inflation and bring prices down…. “If we’re lucky and patient”

Good article. My friend buys car parts from China and elsewhere, and he reports a massive easing in delivery times to Europe during the past month. He thinks the worst is over.

Nothing soft about a bullwhip.

Every company I talk to is interested in profitability now (weird how they can say this with a straight face) – mortgages are 5.5% – and personal savings rate is approaching all time low.

The orders might still be rolling in but a lot of this stuff will sit on the shelf.

“From Shanghai to Los Angeles, container freight rates fell by 30% from the peak of $12,424 in September 2021 to $8,704 in the week ended June 2. But they’re still over four times higher than they were just before the pandemic.”

Are we comparing rates without fuel costs involved?

And are we also accounting for empty container ( no revenue) return trip?

I ask because my cousin ( shrimp boats) was considering docking her boats because the fuel costs ($5000 per week increase) was getting close to making a 3 week trawl close to break even…

Container rates have fuel cost factored in. This is known as BAF (Bunker Adjustment Factor). Congestion at the ports is lessening.

Fishing is a very different business.

China open higher oil prices! The worst may just be starting.

I am seeing inflation rolling through about everything. Last week in our state it was announced that homeowners insurance was going up I believe 11%. This week it was announced that local county was requesting property tax increase of about 2.5%.

Local police and fire fighters are asking for double digit raises.

British company “Core Power” (they have office in Washington, DC too) secured backing from 20 largest container shipping companies and started building nuclear-powered container ships.

Their website is not particularly informative (dem damn wily cagey Brits !) yet info somehow manages to escape and assumes the form of articles in reputable maritime mags.

Reactor type is MSR i.e. Molten Salt Reactor.Fuel consumption by weight is 1 metric ton of LEU (low enriched uranium) in 30 YEARS, compared to 200 metric tons of diesel fuel used DAILY by regular container ships.

Long time ago in the 60’s United States built nuclear-powered cargo ship “NS Savannah” with pressurized-water type nuclear reactor rated 75MW. She was decommissioned in 1974 yet the commemorative website “NS Savannah” is out there.

Daily tanker rates for distillate, on the other hand…

Inflation is like a volcano, the pressures of the underlying magma build and build until it is pushed out the volcano. Inflation’s underlying pressures in all things shipping and fuel keep building and building so expect the eruption of inflation to continue or even become explosive.

Like toothpaste, once inflation is out of the tube, you can’t push it back in.

We are in deep trouble folks, votes and policies have consequences.