San Francisco regular hit $6.34 on average; at Wolf’s gas station from heck, it hit $6.79, premium at $7.00.

By Wolf Richter for WOLF STREET.

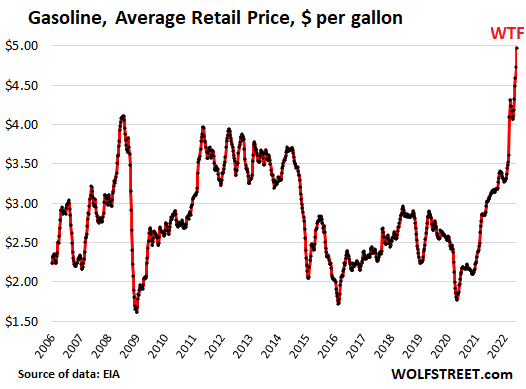

The average price of all grades of gasoline spiked by another 25 cents per gallon on Monday, June 6, from Monday last week, and by 39 cents from Monday two weeks ago, to a record $4.98 per gallon, according to the US Energy Department’s EIA late Monday, based on its surveys of gas stations conducted during the day. This was the seventh week in a row of increases. During those seven weeks, gasoline prices spiked by 91 cents.

The Consumer Price Index for April, released a month ago, had softened based in part on the decline in the price of gasoline at the time, now obviated by a new reality. Compared to a year ago, the price of gasoline spiked by 64%, with perfect timing for summer driving season.

The US West Coast is essentially cut off from the oil producing areas east of the Rockies as there is no crude oil pipeline across the mountains, and oil trains are an expensive way to get the oil across the mountains. The West Coast produces some of its own oil (California is the fourth largest oil producing state in the US), imports some from Alaska, occasionally gets some oil via oil trains, and imports the rest from other countries. But California is also a big exporter of gasoline and diesel, mostly to Latin America. How can gasoline prices be so high for locals when refineries export gasoline into competitive global markets?

Every governor of California, including Governor Gavin Newsom in 2019, asked for a probe into gasoline price fixing in the state, because the industry is run by an oligopoly, and it’s pretty clear what is happening here, but those efforts all get squashed, and nothing – I mean zero – ever comes of it.

So here we go, the average price of a gallon of regular in some key states on Monday, June 6:

- California: $6.18

- Massachusetts: $5.08

- Ohio: $4.81

- New York: $4.77

- Florida: $4.73

- Minnesota: $4.60

- Texas: $4.56

- Colorado: $4.59

Of the big cities that the EIA details separately, San Francisco nails the top spot with an average price of regular of $6.34 on June 6, followed by Los Angeles with regular at $6.13. By contrast, in Houston, the oil capital of the US, if not the world, the average gallon of regular cost $4.57 on Monday.

Gasoline futures also rose to a new record on Monday intraday, kissing $4.25 briefly before backing off a little. The weekly chart – each bar represents one week’s price movements – shows just how spiky this product has gotten (chart via Investing.com):

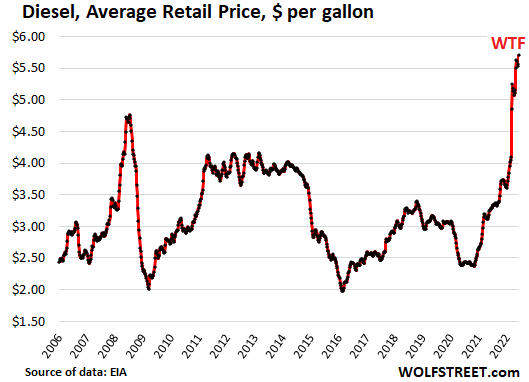

The average retail price of No. 2 highway diesel rose to a record $5.70, up by 74% from a year ago. Most consumers don’t pay for diesel directly, but nearly all goods that consumers buy sooner or later end up on a truck, and shipping costs sooner or later – though not in lockstep – get passed on and make their way into retail prices.

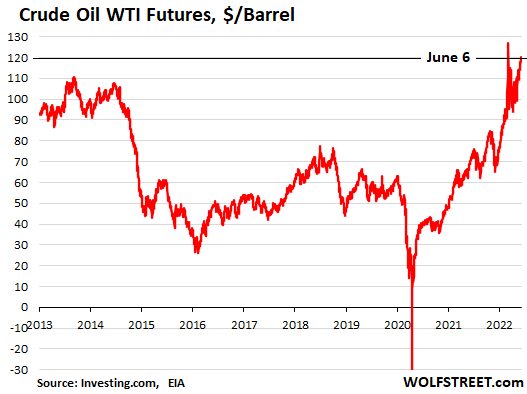

Crude oil WTI futures hit $120 a barrel during the day and are now around $119, having now clearly broken out of their trading range following the spike-and-drop in early March, but well below the peak of the spike in July 2008 of $150 a barrel.

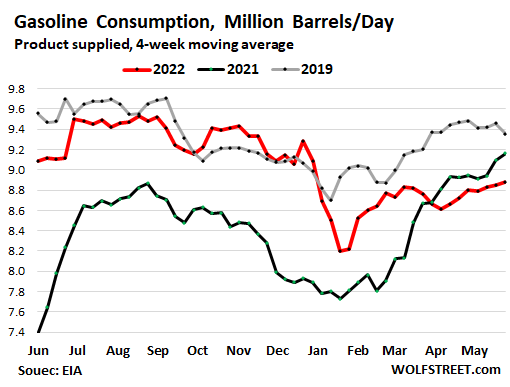

A little demand destruction for gasoline has occurred, but obviously not enough to make a dent into the price spikes. The EIA reported — based on barrels supplied by refiners, blenders, etc., and not by retail sales at gas stations — that gasoline consumption, at 8.88 million barrels per day (red line) through May 27 fell by 3.1% from the same period in 2021, and by 6.2% from the same period in 2019:

For your amusement: At my San Francisco tourist gas station from heck this Monday evening, regular was at $6.79 – I mean, $6.80 if you look closely – and premium was just a hair from $7.00. Per EIA, the average price of regular in all of San Francisco was $6.34, and in all of California it was $6.18.

And not to be left behind, Chicago, with an average price of regular of $5.58 per EIA, was caught by Wolf Street commenter “Rusty Trawler” on Monday June 6 with its own gas station from heck in Downtown, where regular was $6.65 and “ultimate” was of $7.37:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Its all due to Fed and the White House. They caused the world wide inflation. Once in a lifetime pandemic and who would have expected that prices will explode as well as stocks and real estate. This is all the doing of Fed to fill the pockets of their masters and save them. In any country that really cares for its citizens Fed would have been persecuted already but here in the US we have reelected everyone at Fed. God bless USA.

Even now Fed is not waking up, and they are jawboning. They should raise the rates to 5% overnight like they did when Covid started but in the other direction. Their mandate is full employment and stable prices. We are at full employment for years now but prices are far from stable. What are they waiting for; this is a clear violation of their mandate. How long and how openly and shamelessly will Fed keep protecting their masters, at the cost all Americans. They need to be thrown in prison.

‘In any country that really cares for its citizens…….”

Name one…..

Like it or not, China. They meant every bit when they said common prosperity. Their government is not bought out by billionaires.

You have got to be kidding. Their government is first, foremost , and only concerned with the perpetuation of their own power and hegemony. This forum would be shut down in minutes in China and Wolf would be in jail. Supremely ironic state.

Happy1, are you sure?

The Chinese government may be first, foremost , and only concerned with the perpetuation of their own power and hegemony.

Still, they know that hinges on the prosperity of their citizens. The Chinese in power may see a self interest that those in power in USA do not see.

Uruguay. Voter participation rate is over 90%. Government policies reflect the will of the people unlike this Third World regime.

Who cares about Africa. Our voting rate is 190%. USA USA

/s

If they raise rates to 5% overnight then all poor countries will default on their debts like Sri Lanka and off to heck we go

That would definitely lower prices, so I’m all for it

$8.40 per gallon in Auastralia

“$8.40 per gallon in Auastralia”

Jason,

Yeah…but this is ‘Murica, dammit!

$2.15 a litre Toronto, Canada much higher out west.

$3.50 a litre, minimum, is what toronto and all Canada needs.

UK is now $8.50 USD for a u.s gallon

It goes up around 4% a week

But Australia uses Imperial gallons which is 20% bigger than US gallons

Australia switched to metric long time ago but yes they use legacy imperial gallons sometimes

Can you look at the amounts being refined in the US and explain that Wolf? Looked unusually low versus a year ago, like 13k vs 4k now and I can’t remember the units. Also, by my estimate it looked like gas consumption is down about 20% from same time of year pre Plandemic.

Iona,

I gave you the amounts in the gasoline consumption chart. That’s based on gasoline supplied to the US market by refiners and blenders. The chart compares 2022 to 2021 and 2019, in millions of barrels per day.

Also keep in mind that refiners export a lot of gasoline and diesel — meaning that this production is not sold in the US but overseas. US refiners produce a lot more gasoline than is sold and used in the US. I discussed that under the California section, the state being a big exporter of gasoline and diesel. If have long discussed exports of petroleum products (gasoline, diesel, jet fuel, and many others) in various articles. This is a big profitable business.

$6.34 is a bargain. Isn’t it $9.60 over at Mendocino?

You think it can’t get worse? It will.

Additionally, if an “expert” is to be believed, there’s only 10 weeks of wheat supply left, and that prediction is two weeks old.

Food + Energy inflation = Winter Has Come.

I predict a lot of people in America will be eating rice come this fall.

I just traveled theough Medocino and Ft. Bragg. Gas prices were avtually lower on the isolated coadtal cities than it was in bigger cities. Inky tjought there was price gouging. It was interesting though, with all the high prices, as Wolf suggested in his article, nobody had the nerves to break the $7/gallon for premium. Again, t hi is was 3 wewks ago when I was teaveling through northeen Cal. I’m sure its worse now.

“I predict a lot of people in America will be eating rice come this fall.”

Any feelings about pet ownership? Or obesity rates?

Some projections estimate that mass die-offs from starvation will start ramping up around 2030 and that civilization will collapse around 2040, but present conditions suggest those projections could be in need of updating.

“Every society is three meals away from chaos” – Vladimir Lenin

“Every governor of California, including Governor Gavin Newsom in 2019, asked for a probe into gasoline price fixing in the state, because the industry is run by an oligopoly, and it’s pretty clear what is happening here, but those efforts all get squashed, and nothing – I mean zero – ever comes of it.”

Generally speaking, I still think it was a bad idea for the US Supreme Court (long dominated by corporatist conservatives) to legalize bribery, but that’s just me.

Nobody listens to me. I feel SO neglected.

“but those efforts all get squashed”

In a predominantly Democrat state?

“dominated by corporatist conservatives”

Those two don’t jive with each other.

BOTH parties are effectively corporate owned. Besides what should be the truth seen by your own two eyes if you take off the political propaganda filters and actually investigate, you should “follow the science” and read the 2014 Princeton University Study “Testing Theories of American Politics – Elites, Interest Groups, and Average Citizens”

Most progressives implicitly insist on an expansionary activist government that hasn’t been and can’t be captured by elites. (That is, when they aren’t trying to force everyone else who disagrees with them into doing what they want.)

No such government exists and if it ever did, it wasn’t at any scale comparable to any modern nation state for any meaningful duration if at all. In the entire documented history of the world, elites (of whatever type) invariably capture the government and use it to their own benefit at the expense of the vast majority of the population.

Believing that any other outcome is possible is a complete fantasy.

In the US specifically, to remove elite domination, end 1+1=3 political math which includes corporate limited liability and unions. By this, I am referring to the idea of groups magically creating “rights” which the members of the group don’t have.

This isn’t going to happen either since the study you referenced makes it obvious that the public is politically irrelevant. This is aside from the fact that the overwhelmingly dishonest public wants the option to plunder the elites but fails most of the time.

So, we are left with elite domination.

“Most progressives implicitly insist on an expansionary activist government that hasn’t been and can’t be captured by elites.”

Straw Man fallacy. Minus ten.

He was saying the Supreme Court was dominated by corporate conservatives.

Why aren’t’ there solar cells on California roofs?

China is extending its ban on fertilizer exports into 2023. Belarus is sanctioned and can not get access to a Baltic port to sell its potash fertilizer. Russia reduced fertilizer exports. India banned the export of wheat. The price of beans and rice may rise. It is still cheaper than meat.

Looks like all Jawboning is not working on Inflation. Also, Fed has already committed to max 0.5% rate hikes and only up to $80 Billion Balance sheet reduction without any outright asset sales. Will the $30 Billion target for MBS ever be met, given the end of refinancing boom? Will the $50 Billion treasury sale affect anything in months with more than $2 trillion tied in reverse repos?

Are we so screwed? What is the Plan?

“Why aren’t’ there solar cells on California roofs?”

They’re are lots of them — just not that many along the foggy coastal sections.

There will be ever more appearing even in those foggy zones, Wolf. The state mandates solar on all new construction and I think certain remodels. Regardless of how foggy the conditions.

I live in San Francisco, and the building next to us has solar panels on top. I should ask the guy about it. We’re in a less-foggy part of SF, and most of the time, the fog burns off by mid-morning. So maybe if the panels are cheap enough, it can be a good deal. I really should ask him. It’s an interesting question.

About the only place in the Bay Area where solar panels won’t work is probably Daly City. Now that’s one seriously foggy city. Batman would be at home there. Solar panels? Not so much.

Some projections estimate that mass die-offs from starvation will start ramping up around 2030 and that civilization will collapse around 2040, but present conditions suggest those projections could be in need of updating.

Unlikely. Global population is likely to peak by 2040 followed by a prolonged unstoppable drop. The greatest problem of the next hundred years will be population decline. It already is in Japan and soon will be in China. Africa is the only continent with population surplus going forward 30 years.

But I guess the assumption that population decline is a problem is based entirely on economics that link growth directly to financial gains and sustainable growth is seen as stagnation or decline. When a paradigm shift is necessary due to the normal state of affairs being normal, it will occur I suspect but not before.

I’m with Thomas Malthus: if things are mismanaged enough, die-offs are absolutely on the menu. Humans are blind to their self-congratulatory “reward-seeking” crossing over into outright toxic levels. We aren’t getting there, we are full-on arriving there. All the idiot pleasures and conceits of the 20th century are now presenting the bill. Who will pick up the check? We will.

I think countries with ample resources should continue to grow.

Japan is restrictive on immigrants. If they had open boarders and gave immigrants a lot of freebies like the U.S., there population would grow.

I think we will continue to see an influx of immigrants from the South America and Central America.

Their standard of living is so much better here and the U.S. has lots of resources like food, oil, etc.

Look at all the immigrants that flooded Europe a few years ago. Europe is short on resources but if you offer free stuff, they will come.

Reduce speed limits on highways by at least 10 km/h— Saves around 290 kb/d of oil use from cars, and an additional 140 kb/d from trucks. [Note: kb/d = thousands of barrels a day]

Work from home up to three days a week where possible

— One day a week saves around 170 kb/d; three days saves around 500 kb/d

Car-free Sundays in cities — Every Sunday saves around 380 kb/d; one Sunday a month saves 95 kb/d

Make the use of public transport cheaper and incentivize micromobility, walking, and cycling — Saves around 330 kb/d

Alternate private car access to roads in large cities — Saves around 210 kb/d

Increase car sharing and adopt practices to reduce fuel use — Saves around 470 kb/d

Promote efficient driving for freight trucks and delivery of goods — Saves around 320 kb/d

Using high speed and night trains instead of planes where possible — Saves around 40 kb/d

Avoid business air travel where alternative options exist — Saves around 260 kb/d

Reinforce the adoption of electric and more efficient vehicles —Saves around 100 kb/d

So there’s nothing we can do then.

> “Every society is three meals away from chaos” – Vladimir Lenin

Lenin was 8 kinds of crazy, but aside from the whole Marx thing, the most quotable guy ever — neck and neck with Churchill, in my mind.

“There are decades where nothing happens; and there are weeks where decades happen.”

I think Lenin also said in a speech “We shall now proceed to construct the socialist order”.

Or, maybe it was Jerome Powell. I can’t remember.

Back in the day, I had to go to a busy street corner in LA or San Francisco to listen to the straggly bearded man wearing a frock on a street corner shouting “The End is Nigh, Repent!” at the moon.

Now, instead of having to read his misspelled mimeograph, I can read a similar perfectly spell-checked post on any reputable blog.

“ Back in the day, I had to go to a busy street corner in LA or San Francisco to listen to the straggly bearded man wearing a frock on a street corner shouting “The End is Nigh, Repent!” at the moon.”

Fast forward…

And now we are that man….

:)

“Fast forward…

And now we are that man….”

Some of us are! That’s what makes this blog great!

Wolf supplies the data and facts and we all civilly debate possible future outcomes.

There are extremes on all sides. Many predicted outcomes are in the middle. Based on history, extremes are very rare.

Somewhere in this debate, there is the actual future but nobody knows for sure.

Except for Jay Powell, who controls the strings of any possible outcome. Unless the strings break….

WWJPD?

Seen it all Bob

“Based on history, extremes are very rare.”

Historically, we are already in one of those

‘extremes”. Based on the data of course.

They didn’t oppose Citizens United to prevent corporate influence. They opposed it to prevent corporate influence that would benefit the right. They never wanted to stop influence coming from the media, teachers’ unions, left wing political PACs and so forth

I have been homeless, living in my van, the last three years. I thought Democrats cared about people like me? Guess not. Food and Gas are pretty much the only things I buy. I gave up on housing because I saw the suffering of the neoliberals and their need for two houses. I saw the dire straights of people just wanting that bigger house and their need to rent their ADU on AirBnB to afford it.

I already eat rice, well not rice because it is hard to cook in a van.

Neoliberals control 40% of the government. The other 40% are fascists. Those that do care are the progressives and they lose to the other 80% just due to numbers alone.

Yeah right. Spoken like a true blue California liberal. Enjoying the rampaging inflation and exorbitant gas prices that the green deal woke administration who care so much have brought you? Are you going to cry when the House and Senate get flipped in November?

“Enjoying the rampaging inflation and exorbitant gas prices that the green deal woke administration who care so much have brought you?”

Straw Man fallacy. Minus ten. You’re repeating Faux News talking points.

Unamused – What statement do you disagree with?

“rampaging inflation” at >8%

“exorbitant gas prices” see comments above

“green deal woke administration”

Yes its Hi Gas prices in Mendocino ( town of ) no one buys Gas their however. Its the only Gas station in Town. Only answer would be price controls that’s most likely not going to happen but could be on the horizon who Knows.

Everyone drives to Fort Bragg CA 12 Miles North where it is around

$6 these day a little Less at some stations.

it all started with the Fed Promoting World Inflation with trump approval

As the world turns is their no escaping it Now is their ? if so where ? what country is that ?

However if your making 25 to50 Million each year or less who cares ?

Just think Gas could be $ 300 per gallon makes no difference.

Just look at the national News each day ? seems we are way past Inflation

Better yet, don’t look at the national news. Any day.

Since I track this after every USDA report each month (been doing this for 40+ years), the world has 124 days supply of wheat, but if you take China out of the mix, the world has 71 days supply-right on your number. But if you track the worlds major wheat exporters, we have 53 days supply. Interesting that China holds around 51% of the worlds wheat stocks, next is India at 6%. China understands hungry people revolt.

$6.34 is equal to 29.2 cents per gallon from around 1920 to 1964.

29.2 cents per gallon is a great price.

SocalJimObjects,

“Isn’t it $9.60 over at Mendocino?”

Hahahaha, yes that sure was perfect clickbait that made the national news for dumb people to click on. Mendocino is a small touristy place wedged against the coast, and is not easy to get to, and it’s pretty far away from any bigger town, Ft. Bragg being the next one, and there is ONE gas station in Mendocino. They can charge whatever they want to and might trap a few tourists that run out of gas there. Most locals just fill up in Ft. Bragg where they have to go to do their major shopping, etc.

Another famous gas station is the Sun Gas station that is closest gas station to the Orlando FL airport.

They were charging almost $6/gallon for Disney tourists returning rental cars back in 2015.

Location, Location, Location…….

SocalJimObjects wrote: “Additionally, if an “expert” is to be believed, there’s only 10 weeks of wheat supply left, and that prediction is two weeks old.

Food + Energy inflation = Winter Has Come. ”

FYI wheat harvesting in the USA begins around mid-July.

On my calendar, that is about 6 weeks away.

In Texas they grow winter wheat.

In Florida, I’m down to 12 weeks of ribeyes in my freezer…

Getting frisky out there…

There is definitely price fixing going on — I’ve never seen a situation where there is almost no variation in pricing over a 200 mile radius (I live near Philly). But this is a clear benefit for climate change and perhaps a timely kick in the pants to wean us off our addiction to F-250s and Range Rovers.

“ There is definitely price fixing going on — ”

Ya think?

Let’s do the math…

I was selling everything I made at $3 a gallon…

Now I’m selling everything I make at $5 a gallon…

Economics 101 tells you your product was mispriced for demand…

As the Wolfster is fond of saying, reduce demand and the the pricing will correct…

Your actual concern should be availability vs price….

Heh, yep.

California has always been around a dollar more than surrounding areas. When ever I go down the coast, I always fill up in southern oregon. Then turn east at Mt Shasta and make for Reno NV. That way you can get down to Utah or Arizon without paying the insane CA taxes.

Hwy 89 thru the national forests is scenic with light traffic. Last time thru (summer of 2019) I practically had the road to myself.

Wolf – will any of these increases show up in the CPI numbers for May this week, or do we have to wait for July? Does this affect the CPI and therefore the need for more Fed rate hikes…..Asking for a friend.

CPI data is collected around the middle of the month, I believe (based on my memory). So we will likely see the increases through mid-May, not the last few weeks. Those will show up in the June CPI.

Canada is already talking about a three quarters of a percent increase in the Bank of Canada rate this July before the May CPI is released up in Canada.

U.S. petroleum production is 1.1 million barrels/day higher than this time last year (EIA). As the price of oil goes up, drilling and exploration increases. Sanctions are causing disruptions in the energy supply chain. Decarbonization people shutdown a pipeline construction project from Canada to the U.S. There are fracking bans in some nations.

After exploration, drilling takes on average seven years before anything is produced. Worse than that, I don’t really see that much exploration in the USA, that could be for political reasons….

What a crock of sheet.

Wells can be drilled and put into production within weeks.

Anthony,

“…drilling takes on average seven years before anything is produced.”

Good lordy. Is that on the moon? On Mars?

Don’t be surprised Lobo, it was even faster in “The Beverly Hills”

Maybe he’s including all of the time needed for approvals?

It took Exxon a little over 5 years from drilling to first production in Guyana

Sheesh. This is the US, not Guyana.

Offshore wells take the longest time to get crude to a refinery. Once a drilling permit is obtained (leaving out the MMS nonsense and lease approvals), a drilling platform needs to be put in place, wells drilled (fluids tested, etc), topside processing equipment chosen and installed, pipelines laid on the ocean floor, shore-side connections made, etc……this could take a couple of years.

On land, with drilling permit in hand, about 30 days to drill, a week to frac, a month to complete the well and place pad equipment (tanks, separators, plumbing, gas sales line (if needed), etc and off to the races we go! This is for proven and developed reserves.

An oil well costs ~ 1->10 million to drill depending terrain composition, offshore, on-shore, location, depth, …., and it can come dry or with such low production it is not economically feasible. And oil field can have tens, hundreds, thousands of wells drilled (over its lifespan), producing anything between a few hundred bbl/d to tens of thousands (the very good ones). There is a need for associated infrastructure, pipelines, gas and water removal units…, dont even start if it is and offshore platform, detail engineering and construction alone will take already

minimum 2 years if everything goes really smooth (it never does). And once a new oil field is discovered and sized (with a few positive test wells that already can take a few years to perform), project coordination (typically between several oil companies), risk assessment, SHE, financing…, project engineering offers and selection, we are talking easily years before the engineering and construction even starts. Then oil fields start with low production, ramping it up through the years for careful optimization of the oilfield output, too fast production typically means fast depletion rates and a lot of oil left in the ground, unrecoverable. So yes, putting a discovered oil field into production is a long and resouce intensive process

In the US, we’re not talking about new oil fields, we’re talking about known shale plays that have been drilled for years and continue to be drilled.

World’s slowest drill rig? Rotates once per hour?

“Continued inflation must finally end in the crack-up boom, the complete breakdown of the currency system.”

Ludwig von Mises

“Continued inflation must finally end in the crack-up boom, the complete breakdown of the currency system.”

Ludwig von Mises

Old Louie was a master of the obvious.

Wolf, I know it is a longer term concern, but what is your take on Chevron’s CEO saying there will be new oil refineries built in the U.S.? Obviously California’s refineries are getting more bucks for shipping refined fuel to Latin America than they are by selling it on the West Coast. Can that continue if refinery capacity is capped?

With prices this high, I see the world’s oil companies taking their sweet time increasing production.

The oil companies create artificial shortages, and use those as an excuse to “rip the eyes out of the muppets” (to quote an Enron trader). They then scream “environmentalist” whenever someone in the media notices.

Petrochemicals are like Ali Baba’s cave after the 40 thieves met their job-related accidents and stopped filling the cave with loot. Ali Baba knew there were lots of valuables in the cave, but didn’t have an inventory. Thus, he knew that some day the cave would be empty – but didn’t know how long this would take.

Rather than simply living off the cave’s riches until they were gone, Ali Baba used those riches to set up a sustainable business. This let Ali Baba and his descendants prosper long after the cave was empty.

Too many people treat our petrochemical reserves like a trust fund kid living high on the hog by spending the fund’s principal, then finding out that the trust fund is empty and going bankrupt. The time to start transitioning to sustainable practices is now – when the last petrochemical resources have been extracted, it’ll be too late.

NOTE: fracking contaminates ground water. Drinking water is shaping up to be more valuable than oil soon, due to scarcity. Might be a good idea to value drinking water over natural gas.

These solutions rely on the mean intelligence of humans being FAR higher than it is. Good luck with that. Humans brains SHRANK on average since the hunting and gathering days.

Makes perfect sense. Gasoline consumption will decline. I said before that the peak was likely 2018/2019. ICE vehicles have become a lot more efficient, including hybrids. Now higher gasoline prices are shifting purchases to more economical vehicles, such as sedans and compact SUVs from pickups and big SUVs, and there is huge demand for EVs, and they don’t use gasoline at all. Diesel and jet fuel demand might grow, but gasoline demand will decline. I think that’s a given, and refiners are being realistic about it.

XOM just topped $100/share today. Up from $32/share in 2020.

300% gain? It must be where all of the tech/bitcoin bubble money is sloshing.

Real capital investment in refineries and mining are decade long projects. Whose going to invest a billion dollars in doing something real with the political risk. Best to just get the instant return by buying back your stock.

And with higher interest rates investmensts become more expensive.

In addition to a political risk, there is an economical risk. What is the price of oil and petrol ten years from now?

Better to take the instant return.

Old School-

Oil discovery and production is indeed a long-cycle capital type industry. I’m no expert, but I think it has always been subject to technological upheavals, too:

“So often over the history of the oil industry it is said that technology has gone about as far as it can and that the “end of the road” for the oil industry is in sight. And then new innovations dramatically expand capabilities. This pattern would be repeated again and again.”

– Daniel Yergin, The Quest: Energy Security and the Remaking of the Modern World

But what if it is the financial side of the oil industry that is at “the end of the road”?

No more money to long-cycle capital type industry.

Demand for gasoline peaked in 2018/2019 and at the time was barely above 2007. Gasoline consumption in the US will go down because new ICE vehicles are lot more efficient than they were, including hybrids, and because purchase patterns have shifted to more economical vehicles from gas guzzlers, given the high prices, and because EVs, for which there is huge demand and not nearly enough supply, don’t use gasoline at all.

Refiners also produce other products, such as diesel, jet fuel, and other fuels and lubricants and materials, and that demand may continue to grow, but not gasoline.

The US is a big exporter of gasoline and diesel, including California, as stated in the article. And exports demand might continue to grow.

So the question is how much do you really want to invest in this industry with declining domestic demand?

So do ya think gas pumps are able to display 2 digets in the dollar column? or are we in for another round of gas being sold by the half gallon while new pumps are ordered and installed….. If current pumps can display 2 digets, I wonder if it’s just a “1” or a full range of numerals….. Anyone remember the first round of this, when gas over a dollar was unimaginable ? Maybe the end is really coming…….

They will just tape a large 1 in front of the display to show cost per gallon above 9.99

seems to have been done elsewhere in the past, though i do not remember when and where i saw it

Just move the decimal point and there is no problem.

We have one station in town you can buy non ethanol gas. His pumps are so old it doesn’t show an accurate price. You just tell him how many gallons you bought and he punches it out on a calculator.

As these are digital displays rather than mechanical, I expect it’ll just be a simple display change. Or, as you say, they could switch to per liter pricing, and force people to learn how to multiply by 8. (A liter’s close enough to a quart for this quick-and-dirty conversion to give a close answer. Or, given cell phones, install a liter-to gallon price calculator app.)

There was a recent article (May 19) that claimed that the modification of the pump displays was already underway. In Auburn, WA a station reprogrammed their displays as their 100 octane “race gas” was getting close to that benchmark. The 4 digit accommodation was accomplished by getting rid of the 9/10 ($5.89.9) that is in common practice.

This is an indicator of the friction that rapidly changes prices cause. It causes everyone a lot of time to stay on top of price change situations. It’s a drag on the real economy for consumers, investors and businesses.

There’s 4 quarts in a gallon.

3.8 liters = 1 gallon

The can just give up on the silly fractions of a cent, as in “6 79 9/10” and round to full cents, such as “6 80,” and then they have an extra box available and can post “10 80”

Dont give them nifty ideas Wolf!

We removed the following refineries from total U.S. operable capacity after they closed:

The Philadelphia Energy Solutions refinery in Philadelphia, Pennsylvania: 335,000 b/cd

The Shell refinery in Convent, Louisiana: 211,146 b/cd

The Tesoro (Marathon) refinery in Martinez, California: 161,000 b/cd

The HollyFrontier refinery in Cheyenne, Wyoming: 48,000 b/cd

The Western Refining refinery in Gallup, New Mexico: 27,000 b/cd

The Dakota Prairie refinery in Dickinson, North Dakota: 19,000 b/cd

2019 and 2020

Capacity declining exports and consumption down from 2019.

Phillips 66 Alliance refinery in Plaquemines parish south of Belle Chasse, LA, flooded by Ida, will no longer refine oil after fifty years. The refinery in Chalmette is hanging by a thread. I used to drive past both on my way to work in Venice some years back. Working outside the levee during high tide at night, glad that’s over with alligators becoming a dangerous nuisance in the area. There’s no other employment opportunities down there beyond sport and commercial fishing, which is suffering from fuel prices now, and oil rig servicing, going gangbusters into a forecasted generosity of bad storms this season. Noticing fewer pleasure boats in the Back Bay and the Sound, same as eleven or so years ago when gas was pricey.

Also in yesterday’s farm news from Grand Forks:

“Renewable Diesel Demand Driving ND Soy Crush Boom”

Marathon Petroleum will take the soybean oil from the ADM crush facility in Spiritwood, North Dakota, refine it to make renewable diesel in Dickinson and send it by rail to the West Coast.

Marathon Senior Vice President of Strategy and Development Dave Heppner says the states with a low carbon fuel standard drive demand. “That includes the California market or Oregon and Washington,” said Heppner. “As the production comes online and consumers request a carbon-friendly product, the demand will continue to expand across the nation.”

“Soybean oil’s role in renewable diesel production production is the reason North Dakota has the crush plant.” said North Dakota Governor Doug Burgum at the groundbreaking ceremony last Thursday.

It was a Cargill malt barley plant, which is being converted. The plan is to run through and process up to 150,000 bushels of soybeans each day by next year’s harvest season when it is completed.

Converting food into fuel? Is this wise?

Also, Biden’s order to increase alcohol levels in gasoline from 10% to 15% will further strain food production. Also, many older cars cannot run on E15 fuel.

My two bits: none if the above seems well thought out.

It is also less energy dense, so miles per gallon will further decrease.

There are a thousand ways vegetable oils are used for cooking and added to recipes so it’s essential. At least making ethanol just uses the starch in the corn kernel leaving behind the proteins and that product is called distillers grain and is a high quality animal feed source. Biodiesel—-BAD, Ethanol is a bit iffy.

Ethanol is made from corn, corn is fertilizer intensive = more inflation.

Ethanol can be made from other suitable plant crops that are more efficient, and don’t use a valuable food crop like corn that requires high inputs of water, fertilizer, and pesticides.

There have been successful experiments performed where ethanol is made from Switchgrass (Panicum virgatum) a US native perennial prairie grass (search for an article in Scientific American called “Grass Makes Better Ethanol than Corn Does – Scientific American”).

In France, they are experimenting with using cup plant (Silphium perfoliatum) to make ethanol. It is a large perennial US prairie species that has significant biomass and has additional benefits of providing wildlife value to pollinator and birds (seeds).

Both Switchgrass and Cup plant require little inputs once established and have much higher EROIs than corn.

Only in the corrupt USA run by a bunch of greedy morons do we use a valuable food crop with an inefficient EROI of about 1:1 or 1.2.5:1. But the corn lobby must love it.

Sorry that should be EROI of 1.25:1 for corn.

In the southeast parts of Brazil, no-till sugarcane to ethanol yields an 8 to 1 EROI.

(Source: December, 2020, The CIGR Journal, ‘Energy analysis of sugarcane potential ethanol production from published data: a case study in Campos de Goytacazes — Brazil’)

Turning corn from America’s farms into (fuel) ethanol is criminal.

Turning soybeans from America’s farms into diesel is criminal.

Crime pays for some ….

Stuffing food into gas tanks when food costs are rising exponentially sounds like something humans would do.

Dan Romig,

See my comment here on the stupidity of growing food for fuel. My comment was about ethanol in gasoline. Same applies here. The farm lobby always wins, no matter what.

Cargill et al win. The once thriving happy little farming town of Grant NE where my ex-fiance grew up is now a state certified blighted town. Family farms were all bought up, and desperate for jobs, they all work for Cargill et al, or moved to where the damned ethanol plants are. At least the WPA was cheaper and didn’t waste resources, not the least of which is water and good farm land. NOBODY gets elected to anything in the whole “farm belt” unless they are all for it…what’s the first question asked in the National primaries? ” You like ethanol?”

All for 1:1 ROE..(MAYBE a tiny bit more)..Corporate Socialism at it’s very finest.

Making ICE fuel in ONLY one year, when it took stupid nature millions of years to make it!

Man, are we Americans genius “Innovators” or what?

Those WFH folks who thought they would never have to go in again are going to get rammed hard when it becomes clear they don’t have that option.

How does that work with E part of the ESG corporation virtue signaling?

Full disclosure: I have no financial position in CRE going down the toilet.

And, the US Supreme court is parachuting in to torpedo the E part. There will be no problems staying warm!

Think how high gas prices will be with all those extra commuters.

The government is already working on a 10 point list to reduce oil consumption. One is working from home 3 days a week. Another is a 4 day work week.

These could eventually become laws.

Retail average is $4.98 and futures price is around $4.25.

That’s a spread of about 74c. Does the futures (or spot “wholesale”) price differ elsewhere in the world? If so, how much?

Spread doesn’t seem that large to me.

Let’s look ahead 6 months,when home heating season comes and it costs triple to heat homes .Might be some executives swinging from trees,people get crazy when food supplies are extinct,or freeze to death

Not exactly the same thing. You are referring to a different end product.

People love to hate the oil companies. I was pointing out that the markup isn’t that high, not to me anyway. It’s slightly less than 20%. I’m not familiar with all the reasons for regional differences, other than local taxes.

Interesting point. People love to b!tech about buying stuff they need, but love to brag about buying their “wants” – the fancy car, the vacation home, the European vacation. Price of gas goes up at the pump 20% or the price of a pound of their favorite snack goes up a couple bucks and it’s the end of the world. It just shows how childish people are.

Didn’t see nothing happening in Texas when people were freezing to death…

Heating oil was topped off in May, price was $5.94 / gallon.

We use about 8-900 gallons / year so that at that rate it will cost approx. $5-6000 to heat the house, which is roughly double what it has been the last few years.

And the house is not balmy, all the thermostats but one are set at 62-64F.

I am amazed at the relative prices of gas in the US vs France. Our prices are lower now than they were several weeks ago, now “only”

$8.90/gal prem and $8.60 /gal diesel. considering the oil companies are blaming a lot of the oil price hike on Russia –Ukraine war. I think there is a lot of stealing going on the US. At the current relative trajectories looks like your prices will soon be higher than ours.

I am amazed at the relative prices of gas in the US vs France. Our prices are lower now than they were several weeks ago, now “only”

$8.90/gal prem and $8.60 /gal diesel. considering the oil companies are blaming a lot of the oil price hike on Russia –Ukraine war. I think there is a lot of stealing going on the US. At the current relative trajectories looks like your prices will soon be higher than ours.

Lower fuel costs? How dare you!

I live in Cali. Oh boy, am I glad to drive a Prius! It’s slow but the mileage is amazing. As far as the economy, it seems to me somedody wants inflation and they are going to do the best they can to get it. But what the heck do I know…

Move your ass over and get out of the left lane… jeez…

:)

This is starting to look like beginning of MAD MAX move

We are about to see who has been swimming naked. You might even find yourselves at a nude beach.

“Welcome to the party. Pal!”

There is also an article out today saying Biden is raising the ethanol level requirement to 15% which is going to do a lot of harm to vehicles built pre 2001 and small engines. This will likely cost American consumers hundreds of millions of dollars in damage to cars and equipment, on top of unreasonably high prices. It is just one stupid decision after another with this administration. A true war on America.

Jdog,

Misconceptions here.

You should blame Biden for having caved to the conservative farm lobby that has been lobbying for this for a long time.

1. Corn farmers – yes, including right-wing corn farmers – want to increase the ethanol content, and they’ve been lobbying for it. Biden just cave to the farm lobby.

2. Gasoline with 15% ethanol (E15) has been a popular fuel in the Midwest where much of the ethanol is produced.

3. Engines can handle E15 gasoline just fine, and it has been used for many years for winter driving.

4. In April, the administration lifted the ban on E15 gasoline for SUMMER DRIVING. E15 was banned for summer driving due to issues with ozone. It has not been banned for winter driving.

5. This is a farm subsidy program, paid for by gasoline users. Corn farmers have long lobbied for more ethanol content in gasoline. About 40% of corn grown in the US is turned into ethanol for gasoline.

6. I think it’s a bad idea to grow food specifically to burn it. If you turn organic waste products into alcohol or methane, great. But growing food specifically for fuel is stupid. Yet the conservative corn farmer lobby always seems to get its wish.

They the farmers were burning corn in 1930 /s when it was 10 cents a bushel,my grandma never burned any took the dime

#3. The sticker by the gas cap on my 2022 model car says 10% ethanol max.

The sticker on my bottle of vodka says 100 proof…

A much better use of corn in my humble opinion…

Yes, it certainly is a farm lobby issue as it takes a chemical plant to convert the corn to ethanol and energy input is making that reaction happen. And lets not forget that ethanol is not pipelined to terminals for blending into gasoline because of the corrosive properties of the ethanol. It all has to be trucked and those trucks burn a lot of diesel to get it to the terminals.

A win for the farmers and a PIA for the petroleum industry.

The strength and money behind any agricultural lobby is not the farmers, but the corporations who stand to make money turning the farm produce into products. So corn farmers might want to push for ethanol mandates to guarantee they’ll be able to sell all the corn they can grow, but it’s the companies that build and operate the ethanol plants that do the actual lobbying in Congress.

Alcohol is corrosive and can degrade plastic, rubber or even metal parts in the fuel system that weren’t engineered to use alcohol-bearing fuel.

Gummed-up fuel systems, damaged tanks and phase separation caused by stray moisture infiltrating fuel systems have plagued many consumers since this mixture debuted, and the problems will only get worse if government policy to increase the proportion of ethanol to gasoline is implemented.

Gasoline that has 15% ethanol causes more damage to vehicles than previously known, a coalition of oil companies and automakers said Tuesday.

Increasing ethanol content from the standard 10% blend to 15% can cause problems including fuel system component swelling, erratic fuel level indicators, faulty check-engine lights and failure of other parts that can lead to breakdowns.

Coordinating Research Council (CRC) found use of fuel known as E15 could damage valve and valve seat engine parts in some tested vehicles, which included a number of popular brands, and possibly affect millions of cars and trucks.

E15 has essentially been approved for a subset of the auto fleet; model year 2001 and newer. However, a partial waiver has been issued and E15 is not approved for any non-road use. This includes boats, ATVs, and, of course, lawn and garden equipment. “The EPA knows this because when they tested it, it all failed,” Kiser points out. “And by failed I mean (E15) destroyed the product.”

As I fueled up my ’16 M4 Sunday, with 91 octane gasoline without ethanol @ $5.30 per, my BMW owner’s manual states:

“Fuels with a maximum ethanol content of 10%, i.e., E10 may be used for refueling.”

As I fueled up my ’19 Aprilia Tuono V4 1100 today, with 91 octane gasoline without ethanol @ $5.60 per (same station in St. Paul, MN), my bike’s owner’s manual states:

“Do not use gasoline with an ethanol content higher than 10%: This could damage the fuel system components and/or comprise engine performance.”

Now, there is the option of having my M4 tuned by Steve Dinan at CarBahn Autoworks. He puts a computer mapping system into the engine that adjusts, on the fly, to whatever ethanol and octane is in the fuel supply. Of course, the components that feed the fuel into the injectors are set up for a higher E15 type of fuel also.

Nope, we’ll leave ’em all stock, and run with E ZERO.

I see tons of carb problems in small engines from ethanol.

This may be one of the most important commentaries on growing grain for fuel you will read in your lifetime.

Just saying.

Harry Houndstooth

Not a Biden thing. The agriculture/farm industry lobby love the silly ethanol mandate and they are one of the most powerful lobbies in Washington. My “conservative” farmer friends here in corn country don’t like to admit how easy their job is, and how they are the biggest welfare pigs standing at the public trough.

Recently had a debate with a farmer friend who was worried about farm profitability land values when electric cars inevitably reduce fuel consumption. He was obviously not taking into account the tricks that would be played politically to keep that from happening.

In two words: PRICE GOUGING. Nothing more, nothing less.

Facilitated by stupid greedy consumers. Greedy for their standardized summer “experiences.”

In any trade, there are always two sides. Again, mean IQ of humans is just too low to cope with this collective action problem. First to go with be their formerly cheap “conveniences,” already decaying. And cheap because the planet wreckage was not priced in, but simply piling up. But physics and biology and climate will price those suckers in, regardless. Nature has a beautiful, awful elegance and justice.

This is the REAL distributive justice.

Facilitated by stupid greedy consumers. Greedy for their standardized summer “experiences.”

I just returned from an 8-week camping/climbing/biking trip across most western states. It’s a beautiful country we live in if you can see through the human waist.

If everyone lived like me, the human race would be extinct before long…child free by choice and my IQ is average on a good day. It was clear to everyone four decades ago that overpopulation would be the end. I mean, how many spent appliances, broken down cars, and piles of trash does a person need in their front yard anyway?

Average markup of less than 20% is price gouging?

The markup from the suppliers is the hundred of per cent and they need to be slammed with windfall gasoline taxes immediately.

Nope. Why is it OK for Apple to have a 3 times higher net profit margin than Exxon. If you want the product to be there when you want it you have to let the price mechanism work. If you want to buy gas $1 cheaper than current market price, there will not be any as they would be selling it to you at a loss.

They’re really going to have to cook the cpi numbers at the next reporting. What would the cpi actually be if done under the standards of the 80’s? I bet close to 20%.

Regardless, we all saw this coming. Some were predicting $7 a gallon gas two years ago.

Barron’s: Oil Has to Hit $135 a Barrel to ‘Rebalance’ the Market, Says Goldman

Gas is more expensive in CA for a variety of reasons, geographic isolation from pipelines, specialized smog reducing formula, state taxes, refinery capacity and proximity, etc. Places with less expensive gas in the US are the inverse of these factors. Oil is an oligopoly but market factors are way more important. And remember the left is supposed to be happy about high energy prices because it makes renewables look better.

I don’t know how it translates into the retail market but the western oil majors (the four remaining “seven sisters”) are far less dominant globally versus many decades ago.

Most all of the difference is state taxes and fees which along with the federal tax of 18 cents per gallon add up to around $1.20 per gallon on each gallon of gas sold in California.

Yes, declare war on the producers of energy. That strategy has worked so well up to now. Next we can declare war on the food producers, and that should have even more catastrophic results for the people. Stupid decisions have stupid results.

They do protest too much, don’t you think? In reality, our elites pushing the green new deal are rooting for high fossil fuel prices. Their dream come true. Progress, you know.

Reflecting the true costs of the benefits. Clawing the real costs back into the trades. A conservative concept, no?

Inflation is always a monetary phenomenon.

it’s the war of the banking class on the working class.

US gas stations need to show prices in liters. Always feels much cheaper.

UK diesel today is up to $10 per US gallon and $13 per UK gallon… Trucking companies are wasting a fortune on fuel… But the pumps only say $2-3 (per liter), so nobody really cares. It feels cheap.

Yeah, like the new Amazon stock price. Just going up $50 to $170 will be back to all-time highs. No problem.

So, no one here is buying Oil or gasoline futures?

Bay & Taylor !

What a nice city it is …

Energy intelligence group Rystad Energy says oil & gas firms’ profits are set to smash records reaching $834 billion in 2022, due to corporate profiteering.

Meanwhile, the International Monetary Fund says the fossil fuel industry gets $5 Trillion in subsidies every year, mostly because they’re holding the global economy hostage and will flatten it if the ransom isn’t paid.

Forbes reports that politicians with an ‘R’ after their name have received 97% of Big Oil’s political donations to members of the House Energy and Commerce’s oversight subcommittee. The ROI is believed to be several hundred percent.

The Bentley runs on hydrogen we generate ourselves, and no, my chauffeuse does not want to talk to you.

The wages of sin are enormous, as is the ROI when investing in politicians who aren’t progressives.

Remember when the fracking guys all got hammered? Did they not pay the politicians back then? Are they paying them now? What is really different? I think corporate political donations should be illegal, but they don’t seem to explain these crazy price swings.

Most of those profits aren’t by US based companies or from US sales. Add up the reported profits of ExxonMobil, Shell, Chevron, BP, and the smaller ones operating in the US and It doesn’t come close to $834B.

What do you suppose the differentials are in operating a gas station in California vs any other state in the country are?

Gas prices at the pump don’t just reflect the costs of the commodity itself. What is the price of milk in California compared to Texas? Beef? Cars?

CA gas taxes are a large portion of the differential which, at 66.9 cents per gallon, are the highest in the nation. Arizona tax, by comparison, is 19 cents. The above is as of 2021.

The “summer” vs. “winter” gas is also part of it (but AZ and other states have similar blends) as well.

And do not forget the gas tax leveraged to annual inflation. CA voters failed to recall the gas tax or Newsom so they are going to get the fleecing they voted for.

According to the National Association for Convenience and Fuel Retailing (NCAS), gas prices differ for three reasons: taxes, fuel blends, and margins. This means the role taxes play in price varies by state. The average price of regular gas right now in Bakersfield, California is $5.78 per gallon. All retailers must assess the 18.4-cent federal gas excise tax. That’s on top of the state’s additional taxes and fees.

The California gas tax is 51.1 cents per gallon and is expected to rise again in July. Sales tax accounts for about 10-11 cents per gallon. So, you paying about 80 cents per gallon in taxes.

Now let’s talk fees. According to Stillwater Associates, an organization that deals in transportation fuels markets, there are three fees that you pay for gas. The Underground Storage Tank fee is about 2 cents per gallon. This fee goes into a fund that provides “financial assistance to the owners and operators of underground storage tanks to remediate conditions caused by leaks, reimbursement for third-party damage and liability, and assistance in meeting federal financial responsibility requirements.”

The Fuels Under the Cap fee, which is part of the state’s Cap & Trade (C&T) program, which looks to offset greenhouse gas emissions, is about 15 cents per gallon.

And finally, the Low Carbon Fuel Standard fee is about 22 cents per gallon. This is tied to the fact that California is the only state that requires unique fuel blends. It’s more costly to produce and raises the cost at the pump.

You are paying 39 cents per gallon in fees.

In total, people in California are paying an average of $1.19 in taxes and fees per gallon of gas.

In other states, they also pay lots of taxes, including the federal tax. You should have pointed out the difference between CA and another state such as TX, for this to make any sense here.

The bottom line is all that matters and the fact is that California has the highest or second highest total taxes/fees on gasoline and diesel of $1.19 per gallon which is what I detailed above and that accounts for most of the differences around the country in prices at the pump.

Consumers brought this on themselves, they ripped off their masks and got behind the wheel. Well its pay to play. A million dead and $10 gasoline. They bought second and third homes they don’t use. They pay hundreds a month to store crap they don’t use. They quit going to work to spend more time spending money they don’t have. They own a closet full of semi-automatic weapons to protect their goods. Conspicuous consumption is a constitutional right?

“Conspicuous consumption is a constitutional right?”

I spent half my money on gambling, alcohol, and wild women. The other half I wasted.

And the monastery thanks you…. :)

AB:

Or could all of the above be the result of misguided government policies?

Corporations spend a lot of money for those misguided government policies.

Big Oil Donated $383,000 To The Lawmakers Grilling Its Executives About Gas Prices. Almost All The Contributions Went To Republicans, who mostly asked about tee times.

Is that why I am having a hard time getting tee times on my local courses here in Texas. I though it was the WFH folks “working during the day” hogging those tee times.

(well, we do have a lot of Republicans here too).

The Texas electrical grid is expected to fail any day the temperature in Dallas exceeds 100°F. Any other time it comes as a surprise.

It’s a seasonal thing, winter and summer. In winter they blame it on windmills that freeze up in Texas but almost never anywhere else in the world. In summer they blame it on Critical Race Theory. The real reason it fails is because it’s optimized for profitability and not reliability, like just about everything in the US that can be used to overexploit powerless minions.

It’s not just Texas. It happens pretty much anywhere corporations run the show. Portions of the grid run by Pacific Gas & Electric haven’t seen an inspector since they were built sixty years ago, which is why PG&E is notorious for forest fires.

unamused:

You, once again, missed the point.

Nothing to do with “corporations”. More to do with incompetent leadership.

unamused, what does all that have to do with my tee time? I can play golf without electrical power.

And yes, it’s hot here and going to 106 F by Thursday here on the north side of Houston. Right now it’s almost 100 F with no brownouts. If I’m not posting later this week it’s because I’m either on the golf course or have no power or both.

It’s called Freedom.

It’s also summer. In Texas. In the early to mid eighties, overloading of the electrical grid was common in rapidly growing areas that outran the infrastructure construction in Central Texas west of ih35. Most living-needed things there were pretty cheap then, but electricity wasn’t. Inefficiently supplied by municipalities and a gaggle of co-ops, it sounds like that situation hasn’t been resolved satisfactorily yet with regard to reliability. Constructed subdivisions had problems connecting to sewer and water too, some sat empty for months. You could hear and see transformers blowing along hwy 360 in the summer of ’84 as the custom houses went up. The Edwards Plateau makes Central Texas more beautiful and interesting than Amarillo or Hereford or Robstown or Victoria, but it’s not an easy place to build. If the squareheads (Texas Germans) hadn’t broken trail for the enviro-acolytes many years ago, it would be a tedious, dusty Waco yet.

This is poetry.

My nearby used car dealership has moved its inventory of full-size gas guzzling pickup trucks off the front row and moved the mid-sized crossovers to the front.

Lucky guy! here in Houston, all rows are trucks and big SUVs.

We all have choices that include walking to work or a bicycle,both are free and society would be much heathier ,then demand goes down with prices

My naturally aspirated V8 guzzles so much gas that I sometimes think it’s drinking it parked in the garage.

I should join a V8 Anonymous group.

Hi. My name is Halibut and I drive a V8.

They should turn fish into gasoline.

That reminds me: ether go fill the tank with premium now that I had my chicken and rice lunch!

And if you do not like these boom bust cycles, tax consumption not income and discourage speculation in residential real estate, as the link in my name, above, elaborates.

A Black Rock VP on Bloomberg yesterday says he thinks we hit peak inflation for this cycle.

Also said the U.S. has seen higher inflation then any other developed country because we also had the most stimulus.

He thinks the FED will not get ahead of inflation by hitting it hard, but will be very apprehensive as they move forward looking for any of the recessionary indicators to tap on the brakes.

Also… Another person said the Ukraine war is 3% of the 8% inflation. Supply chain issues is 2%, So a good goal would be to get it down to below 5% and if the war ends, inflation would drop 3% more to 2%

Just repeating what they said.

So long as they keep printing mass quantities of money, the inflation will continue. At least up to the point where the economy implodes.

I drove past my boring deep Contra Costa suburbia Shell station today and saw the first 7 handle ever.

$7.09 for premium. Ouch.

“He thinks the FED will not get ahead of inflation by hitting it hard, but will be very apprehensive as they move forward looking for any of the recessionary indicators to tap on the brakes.”

And The Fed will therefore fail to either control inflation or prevent a recession, as I have predicted. They want to have it both ways, and as a result won’t have it either way. The financial and economic distortions and corruptions are so serious and so entrenched that there really aren’t any good solutions to either one.

It can be very difficult to get a genie back in the bottle. Some people would say it’s impossible.

Politifact says there probably won’t be food shortages in the US this year. Not this year. Probably. They are expected in Europe, Africa, and south Asia. This year. Probably.

There may not be food shortages in the US, but you can bet that some of the US food supply will be diverted to Europe for increased profits which will drive price increases here also.

IF you have food they will come

In the demand schedule of all products and services, there is an elastic segment. At some level, an increase in price reduces total revenue, and vice versa. If, during the 1973 upward spiral of oil prices, M*Vt had not increased, there would have been a massive diversion of purchasing power from non-petroleum products. The whole country would have experienced, in varying degrees, the depression that afflicted the automotive industry.

To say, therefore, that falling oil prices will bring down prices and interest rates, and that rising oil prices are inflationary and will increase interest rates, is to ignore the fact that inflation is primarily a monetary phenomenon.

I saw in news yesterday that the OPEC has said that the prices for crude oil will remain same for US but will increase for Asia. I am not sure what role this has in determining prices at national level (as I don’t know how prices are determined at national level) and if this may help (little bit) with containing inflation. Any thoughts?

gasoline exports were at a 3 1/2 year high during the week ending May 27…the 4 week moving average of oil + all petroleum products exports was at an all time high…

You will be able to buy the S&P below 3500. It is a LOCK.

I have no idea what world the cheerleaders on CNBC are living in.

We could be looking at another lost decade in the stock market.

The answer to inflation is more oil in the short term with a gradual long term transition to non fossil fuels. Blinders on both political parties prevent a pragmatic solution.

As it stands “At the peak, gasoline price shocks add 5.7 percentage points to annualized inflation. “ This is Dallas fed Kilian and Zhou, November 2021. Basically energy drives half of inflation. Think indirect, not direct cost if you disagree.

The indirect impact of energy cost on inflation is enormous.

Policy of current administration needs to be ramped up oil production in the US because we make it more responsibily than outside US. It also needs to support incentives for more green energy. Let the oil producer choose between paying a tax to the government or getting a credit in the same amount to fund green energy.

The true lever to reduce inflation is increased energy production. Since oil and gas production will not increase, what are we left with? Yes, you guessed it massive interest hikes by the Fed. Polarization over pragmatism is not a helpful direction.

Go ahead Wolf, tell me I’m an idiot again.

Growing consensus among economists is we are past peak inflation, lol.

Please post real gasoline prices based on inflation over the same time period. I don’t think the prices are extreme as they appear.

They’re not extreme. Consumers will tell you when they’re extreme: they cut back massively, and you will see massive demand destruction. We’ve only seen a little demand destruction.

Wow! The picture of Wolf’s “GAS STATION FROM HECK” should be renamed the “GAS STATION FROM HELL” . I’m sure the people lined up to pay those prices aren’t saying “Heck”

We got one “GAS STATION FROM HELL” here which I’ve been monitoring. Its the same Exxon gas station 2 blocks from where I used to live, when I got up at 3AM to be the first one at the pump during the Carter gas line fiasco in 1979. I’d take Carter’s gas lines before this insanity.

Posting $5.99 for regular yesterday. Its heading for $7/gallon in the next week or so.

There is no one lined up at the gas station from heck. Locals go there only in emergencies to get enough to drive to a cheaper station. But rental car folks fill up their cars before they return them to the rental car agencies that surround this area.