The boom in natural gas exports creates massive demand on US production and connects US prices to the rest of the world.

By Wolf Richter for WOLF STREET.

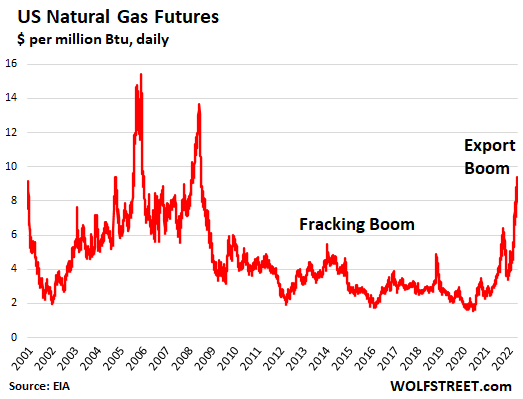

Natural gas futures spiked to $9.40 per million Btu earlier today, the highest since dirt was young, well, since the huge twin spikes between 2005 and 2008. In afternoon trading, the price dipped to around $9 again, having tripled from a year ago, when it was $2.98, and having more than tripled from the $2-3 that predominated from 2011 through the spring of 2021.

Natural gas prices can spike and plunge, periodically taking down hedge funds that got caught on the wrong side. But this time, it’s different; this time, there are large-scale structural changes in the US natural gas market that have been in the works for years: Booming exports of natural gas as LNG has created a connection to the demand and prices in the rest of the world.

And the fracking boom that caused prices to collapse in the US starting in 2009, while prices soared elsewhere, is now being leveraged to export LNG, and we already kissed those collapsed natural gas prices of $2-3 per million Btu goodbye.

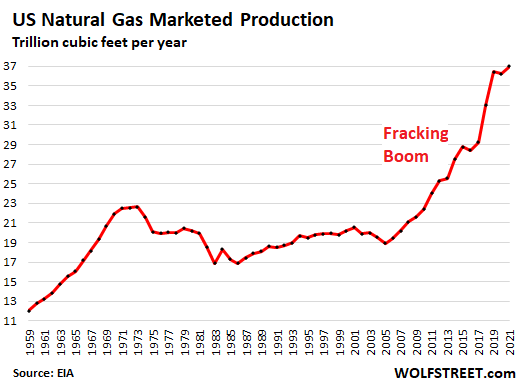

The fracking boom that took off in serious 15 years ago made the US the world’s largest producer of natural gas. Before the boom, the US had been a major natural gas net-importer (via LNG globally and via pipeline from Canada), and prices were influenced by global prices and by supply limitations in the US.

Production from the fracking boom created so much supply in the US by 2009 that the price collapsed. Between 2003 and 2021, marketed production of natural gas nearly doubled. Note the spike in production in 2018 and 2019:

This surge in production in the US triggered a series of events: Major natural gas producers, such as fracking pioneer Chesapeake, filed for bankruptcy; power production switched massively from coal to natural gas, causing coal miners to file for bankruptcy; and big industries sprouted in the US around cheap natural gas, including fertilizer producers which use natural gas as feed stock.

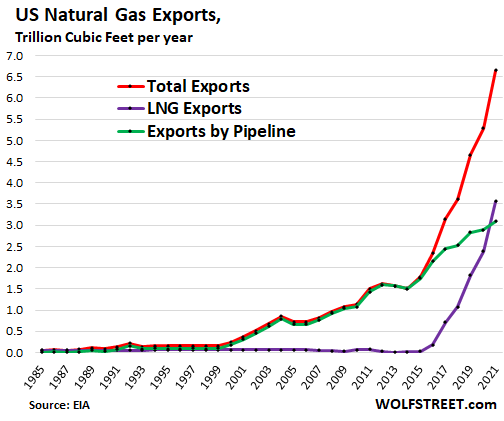

And starting in 2016, more and more LNG export terminals were being built to arbitrage the cost differential between US natural gas and global pricing of LNG; and pipeline capacity was added to export more natural gas from US producing areas near the border to Mexico.

Exports of pipeline natural gas to Mexico have grown at a steady clip (green line). But exports of LNG have exploded (purple line), starting from nearly nothing in 2016, to over 3.5 trillion cubic feet in 2021. And total exports reached 6.7 trillion cubic feet in 2021, roughly 18% of US marketed production:

LNG exports require very capital-intensive liquefaction facilities that are connected to producing areas via pipeline. Export capacity soared from less than 1 billion cubic feet per day (Bcf/d) in 2015 to about 12 Bcf/d at the end of 2021. More large-scale LNG export facilities are under construction, and still more have been approved, and still more are in earlier stages of the process.

As US export capacity continues to grow, global demand for US LNG is competing to an ever-larger extent with demand in the US, which intensifies the link between global LNG prices and US natural gas prices.

And those dirt-cheap prices of natural gas of 2009 through mid-2021 that consumers, power generators, and industrial companies benefited from, and that bankrupted many oil & gas producers that specialized in fracking for natural gas, and that bankrupted coal miners, is now a thing of the past. Much higher prices, in line with pricing globally, are what the US has to deal with now.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf-

Is there a distinction between “marketed production” and “production?” Maybe having to do with inventories?

Or are those terms interchangeable?

John H.

The distinction is between “marketed production” (natgas taken to market and sold) and “gross withdrawals” (total natgas extracted, but some of it was used to operate the equipment, etc.).

I see. It’s kinda like the FRB’s production of US dollars for use by people as opposed to production to sit in big bank’s excess reserves?

Wolf is there data about what the total liquification capacity will look like once the facilities that are under construction, approved, and beginning approval are all built? 12B CF goes to what? 15B?25B?

There is an endless stream of potential projects. As some are completed, new ones go into the pipeline. This will keep going until the arbitrage is not profitable anymore, which is when it ends. Not before. The arbitrage isn’t profitable anymore when US natgas gets too expensive to profitably liquefy it and sell the LNG to the global markets.

BOIL has been boiling.

Unlike most of the economy, this is capitalism working the way it should. Marginal companies went bankrupt instead of getting bailouts. Presumably their wells and mines are still there.

The cure for low prices is low prices.

And the cure for high prices will be high prices, driving a profit incentive to expand production, and not just in the US.

And where production can’t be expanded, alternatives will be found.

“I will bankrupt the coal industry…”

Basically said by a sitting president and a senator/sec of state who almost was president.

That ain’t capitalism.

WEF in control – you have no worries

George Soros approves this message

Well, looks like the bankrupting the coal industry is working out as well as reducing the ruble to rubble with those moronic backfiring sanctions.

Coal industry is close to become debt free and they enjoy for the coming years absurd Price/earnings ratio’s of 2-3. Money is coming out of their ears and more than one of them is expected to give over 30% dividend for the year.

Of course, this all can change on a dime when we finally have that fusion reactor or —lol— mined enough toxic metals for those batteries that last only 10-20 year or we finally find a way to generate —at night when those EVs are charging— electricity from star light.

” as well as reducing the ruble to rubble with those moronic backfiring sanctions”

Ruble is actually higher vs dollar and the euro than before the sunctions.

As far as the metals in batteries, Elon said they will be mining on Mars by 2025. They practice digging tunnels already.

Nobody can buy Rubles except Russians, so does it matter what it’s worth?

What was not mentioned in this article is that there are strong facts that U.S. Nat Gas production is peaking…. so, all those who are betting on a never ending increase in supply to offset non domestic demand are going to CONTINUE to be SHOCKED by how high U.S. Nat Gas rises over the next 6 months.

America is called the “Saudi Arabia of Coal.”

Literally, they are sitting on a 200 year massive supply of cheap and plentiful energy source.

And, I bet for $40 billion, they could make about as clean as natural gas.

True, but what company would invest that much money? It would effect new quarters earnings release and executive bonuses.

Same for the UK and Germany, in fact the UK has a 1000 years of coal…stupidly, closed coal mines are extreamly expensive to open up again…………

Oooh, I don’t think that’s right Anthony. British coal fields are pretty worked over. Remaining seams are thin and deep. 1000 years really is a l o n g time in the life of an exploitable resource. If you’ve got a reference for this estimate, please provide . . .

You sound the peak oilers back in the early 2000’s. I was one of them, until fracking in oil shale came along. It’s going to continue to go up but not because there’s a true peak production due to finite recourses. The US Just along the northern slope of AK is between 25 & 157 tcf of recoverable methane hydrates that can be tuned into “natural gas”. And it’s almost everywhere along the ocean floor. At the current natural gas prices, most likely almost all of it would be recoverable. FYI – there are 1.44T barrels of recoverable oil in the Green River basin in WY. Again, at current above $100 a barrel, most of it would be recoverable.

Kenneth M Luskin,

It’s not that they can’t. It’s that they don’t want to. Too many of them have gone bankrupt when prices crashed, and too many investors got wiped out, and none of them want production to rise to where the price crashes again. They’re cash flow machines for the first time ever, and they’re loving it, and they swore they’re not going to screw it up again.

Agreed. And as long as the current administration stays in place, they’ll make sure production is throttled. So, this is as much a political game as it is a financial / company profitability game. Either way, the consumer is in for a very long haul in terms of fossil fuel prices. I’m not even sure if a mild recession would dent prices much.

Correct. They really do not want to screw it up (again).

Yes, and Oak Tree Capital along with other institutions bought up a lot of the distressed Natural Gas producers assets/debt in 2019-2020 at a huge discount. JP Morgan just bought out a large natural gas storage facility which will give them a huge advantage in their futures market trading desk.

As I have recently commented, it was a bargain this past January to keep my home heated for about six bucks a day in nat gas costs.

And yesterday, two Minnesota State Administrative judges issued a ruling that the $660 million hit that companies like Xcel Energy, CenterPoint (my supplier in Minneapolis) and Minnesota Energy Resources Corp took a year prior will be passed on to consumers.

The Minn. Attorney General argued that the utilities should not be able to collect any of the $660 M in “extraordinary storm costs” from February 2021. But, the judges ruled, “The utilities’ strategies were sound and the $660 M in extra costs were “prudently” incurred.”

So next winter, nat gas will cost a hell of a lot more in the Twin cities, eh?

Could be worse though. Europe is already hit hard, and it will only get more expensive across the pond, I’d bet.

A wood stove is a beautiful thing.

And…can’t be hacked.

Don’t worry. The greenies will come after your ability to chop down & split trees on your own property. I could see them banning n hydraulic wood splitting equipment ; )

Henry Hub spot is over $9 per MMBTU today. The media is not reporting on this, of course. There’s a cat 5 hurricane offshore, when it hits, and it’s hitting now.

Is this good news or bad news? Or both?

Will there be lots of new Fed and state tax revenue?

Are supplies plentiful for the future?

Will the U.S. cave in from fracking? More wastewater, etc?

Will the average citizen benefit?

Will the gas corps spend the profits mostly on share buyback which is the norm nowadays?

Maybe the Shadow knows.

Greedy hand of the govt gonna be looking for

“windfall” profits, I guess Pelosi isnt long energy :)

Not sure where the govt was when companys were going belly up.

Brant, I guess the general answer to all your questions is “Yes”, except for the average citizen getting any benefit from all this.

Didn’t the last time oil, gasoline and nat gas prices reach this high, a recession happened a few months later?

Gen Z,

Sooner or later, there is always a recession. Anything that came before the recession – “my cat got run over by a car three months before the recession started” – will trigger questions like yours many years later after everyone forgot the real reason.

In case you have forgotten: The Great Recession was triggered by the housing bust which triggered the mortgage crisis which started to take down the US banks which started to take down global banks which triggered what has come be called the Global Financial Crisis. Energy is minuscule compared to the global banking system collapsing. And consumers saw it and stopped consuming, and businesses saw it and froze in their tracks, and consumption went down the shitter, which became the Great Recession.

Wolf-

You said “In case you have forgotten: The Great Recession was triggered by the housing bust…”

Is it impertinent to ask what caused the “housing bust?”

I propose the following thinking played a big part:

“Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.”

– Paul McCulley, Pimco, as quoted by Paul Krugman, Dubya’s Double Dip, New York Times, August 2, 2002

Yes, agreed. Easy money.

Also, fraud, John. Bill Black has done extensive work on fraudulent lending in subprime leading up to the Great Recession — the roots of the dodgy behaviour go all the way back to the S&L crisis, for those of you old enough to remember, and were exacerbated by an unwillingness of regulators to enforce laws on the books because of a prevailing “markets regulate themselves” ideology.

Thank you, eg.

I stayed at the Phoenician Hotel once, in a previous life. Post Keating era.

I also have a working Silverado S&L phony savings bank. It has a window and an oblique mirror inside with a seemingly floating money bag in it. Deposit a dime, and it seems to disappear.

Endless fun for the grandson, though he’s figured out how to open the secret compartment and remove the contents.

Just like the real Silverado!

I was there , too, John.

Boarded up S&Ls everywhere covered with with graphitti…”Bank of FDIC…new branches opening daily”.

But the funniest part was the fallout from opening the books.

$100K loan….the collateral?…..guarantee a certain HS kid would sign with OU…..(would disappoint your son, I guess…)

Gotta beat Texas at the Red River Shootout, ya know?

Remember the big “I told you so, Boz” billboard on fwy to OKC ?

Sadly, morons and trolls have taken over this comment section…..so I’m gone….enjoy!

But I got a good laugh from your “machine”.

PS: Wonder if Switzer is still a “free market” fan.

…wherever he went….

Hi Wolf,

I think it is normal for an oil price spike to lead to a recession. I had the misfortune to graduate after the second oil crisis had caused a jump in oil prices. We got a recession then. I’m with Gen Z on this one. Energy is what powers our economy, and it underpins everything else. The Great Recession’s housing bust was well and truly due, but it might not have happened JUST THEN but for oil going to $140/barrel.

Jim Spriggs,

You’re just wrong. It seems you don’t understand the modern US economy. You’re basing this on some memory of the 1970s. There are a lot points I could make, but don’t have enough time. So just a few:

1. The US is NOW the largest oil and natural gas producer in the world, and a net exporter of natural gas, crude oil and petroleum products. A price spike in those commodities doesn’t go to Saudi Arabia anymore (as it did in 1973) but to the US-based industries with very high wages and lots of requirements for US-made equipment and supplies. The US oil and gas industry, and the industries that supply it, are BOOMING because of the price spike, and it’s a huge part of the US economy, pays high wages, and includes manufacturing of the equipment and tech products needed to produce.

2. In terms of consumption for transportation purposes, oil has lost much of its weight since 1973. It’s just not a big thing anymore. So forget that.

3. But oil for the petrochemical industry is now a huge thing (but wasn’t as much in 1973), and the petrochemical industry in the US is huge, and it is passing on just fine the higher costs of the input products. And this industry is booming.

4. Look at consumer spending, up, up, up, even adjusted for inflation, no matter what the price of gasoline. And consumer spending = 70% of GDP.

5. The idea that a price spike of oil in 2008 was a big event when the financial system was collapsing is just ludicrous and not worth discussing. People who say that the Great Recession was caused by the price spike in oil are utterly clueless about what really happened. When the financial system (banks!) collapses, there is no economy anymore.

6. What will cause a recession is IF the Fed tightens enough to crack down on inflation, which is what happened in the early 1980s. The way to crack down on inflation is to lower demand = recession.

Ouch! You’ve slapped me around there Mr. Richter!

It seems more than likely that I don’t understand the modern US economy. Or the old one. Guilty as charged.

However it does seem that the economy growing is correlated with increasing energy consumption. That the price of the energy is immaterial . . . unlikely!

Don’t know if you’d be swayed by the arguments put by Gail the Actuary at her “Our Finite World” blog. (Stay away from the comments section if you go there!)

Sure the gambling banks were a disaster and would bring down the economy.

But your point number 2, – I don’t understand. You wouldn’t be saying that oil for transport is immaterial, surely? 100% of aviation and trucking is oil powered. Cars only slightly less than 100%. Shipping? Oil! Railroads: freight by diesel, commuter rail electric. Do you mean that fuel costs have fallen as a proportion of the overall transport sector cost? And therefore fuel is relatively unimportant?

Soooo,

Heating oil doubled…

Nat gas tripled…

And people think house prices in the South are going to go down when it’s 75 degrees in January…

Interesting to see how that plays out next spring…

We are prepared for the worst here in Texas! /s

Have you guys discovered air conditioning yet?

Or electricity, for that matter.

According to the mainstream media, the Southwest is in for a rather toasty summer

But it’s 95 degrees with 99.99% humidity in the summer while cool mountain breezes keep those northern homes comfortable.

You are gonna pay one end or another unless in LA or SF.

And there, you are just gonna pay.

2b,

True that…

Although I was being a little sarcastic,I think a brutally cold winter with the heating cost increases might be just enough for a lot of folks to say the hell with it…

Instead of visiting Florida in the winter, how bout we move to Florida and visit you in the summer…

That’s what my girlfriend from Michigan does…

She just got back there in 54 degrees and rain and was quite vociferous about how cold she was.. :)

Sunshine is overrated, 54 degrees and rain is almost perfect.

54 degrees is a great temp to work in, not so good if you are retired…. Try living and working in places like Texas in the summer with no air con…… It will be interesting if electricity prices zoom, which, with the almost total lack of investment in commodities, is guaranteed.

Tesla, for example, will have to invest massive amounts in solar power, just to keep their Giga places cool enough to work in…

I joined the HS football team in San Antonio in order to get out of gym class. A guy that is naturally slow from the west shore of Lake Michigan is third string. The believed a lot in physical training so we ran 40 stands of forty bleachers high just for kicks.

I was so exhausted from 93F and Gulf humidity that my grandmother was absolutely convinced that I was on Heroin.

Besides they made you wear the same full uniform for a week without allowing it to be taken home to wash. I still can smell the wretching stink of the locker room. I don’t pay attention to sports since, or now.

The team at OU had the absolute best housing on campus, across the street from the best pick-up bar near campus. They even had sand trucked in for a “Beach Party Day”. Bikini-city!

Also jobs at a local GM plant for $15/hr (showing up for work was not necessary)

The school you choose DOES matter, sorry about your sports experience.

Bar had some Irish name…O’Connel’s?…anyway, green beer at 6am on St. Pat’s day

“I joined the HS football team in San Antonio in order to get out of gym class.”

Erle,

Robt. E. Lee, by any chance?

Heating is easier and cheaper than air conditioning. A sweater is easy to add when required. Some aspects of climate change, if true, will also work against your thesis.

Great stuff.

Any picks?

Im long AR, DVN, MPLX, XOM, ET, MGY, CTRA

MUR (not really a gas play) ,but looking strong

best of the lot?

Train has already left the station on those picks.

Time to buy those were when oil was at zero (I know not really but you get the point).

Think 12 months from now.

I didnt say when I bought them.

Your picks?

Chris

Some of the above stocks + a few but predominantly ETFs

XLE, OIL, GUSH, FCG, FTXN, NGS, FENY, OXY, CNQ. I manage my entire family portfolio of total of 6! Some of the taxable accounts need alternate stocks/ETFs NOT to run foul of 30 days wash rule. I have also leap puts on some these stocks/ETfs as a hedge in case, demand destruction goes on, more than expected!

Why? Humongous DEBTS compared to GFC!

Fed Balance sheet from less 1 T to 9 Trillions

$ large CBers (fed, BOJ, ECB & PBOC) 5.1 T in ’08. Now 31.5 Trillions, highest in human history!

No country in human history has prospered by spending debt on debt!

If one thinks Fed can do ‘miracles’ good luck!

Currently most NG companies are hedged due to the volatility and potential for price drops so the companies themselves have a mix of benefits from this recent spike in gas futures price.

The 5 year NG strip can frequently paint a different picture. I’ll have to go look.

Not a benefit to the american consumer but good to american gdp and overall economic health having a robust energy economy

Ya, that is what I was told when I called asking why my gas heating prices have gone up, when the price of nat gas was so low.

I was told they hedge with long calls. However, the same excuse going the other way must be true now, because they rise now too. Bottom line, prices to the consumers are not reflected in the price of gas. They go up all the time, just not as much when nat gas is cheaper.

If you’re interested in researching US and Canadian O&G E&P companies participating in this natural gas and natural gas liquid boom please see EQT, OXY, AR, VET, FANG, DVN, MRO, BIREF, CTRA, PXD…just to name a few. With the vastly increased natural gas strip prices Wolf mentioned in his piece above these producers are virtually PRINTING Free Cash Flow (FCF). Most are using their FCF funds wisely…paying down debt and conducting stock buybacks like there’s no tomorrow. Really something to observe.

So…while the “HI-VALUATION” Silicon Valley “unicorn” stocks are down 50-60-70-80-90% since November…take a look at the price action on these O&G E&P stocks during that same timeframe. Yes…WOW is right. And most pay significant dividends as well. In fact many have begun a base dividend + variable dividend = TOTAL DIVIDEND program to distribute the massive FCF they’re accumulating.

I’ll leave a discussion on DIRTY FILTHY COAL for another day…however its experiencing a similar boom as a result of our sky-high natural gas prices. EVERYTHING IN OUR ENERGY MARKET IS INTERCONNECTED. We’ve come the full circle. So if you think about it…the climate zealots who wanted to wean us off fossil fuel essentially overnight…have not only NOT accomplished that goal…they’ve in fact driven many back to DIRTY FILTHY COAL!! OK…off my soapbox…

Just dwelling on that thought about energy having it’s day.

Energy and commodities are at the base of the pyramid, the foundation of real money and wealth. They are the things that are necessary to make everything that is sold or bartered. The top of the pyramid are ideas about things that just have no atoms or molecules, like derivatives and crypto, Ethereal fantasy stocks are not far below them. Commodities like gold, titanium, iron, silver, uranium, oil, gas and periodic table things are what the universe forms when planets like earth begin their relatively short life. Gold is formed from black hole type heat and pressure, and last a very long time. When the going gets tough the world embraces real stuff, like the stuff that gives us the energy to survive. The closest thing to real money

its not it’s

Possessive?…think IT IS…Contraction?..but still not as bad as the physics moron””’s take on things.

LMFAO…morons DO have their place in the big scheme of things….

hmm, now i’m craving an ‘It’s It’…

may we all find a better day.

So we had two movies called “It”……the plural has to be Its…other than that “it” is a weird word?

Had a physics prof once that if you asked him a question and used the word “it”, he stopped you cold and said, “What’s the “it”?

Still not the worst language to be trapped in, but that’s just here say.

The Ancient Greeks were cool….they had seven words for “love”…and if ya wiki “Sumptary Laws” the Greek example used is funny as hell….they were NOT uptight like us, that’s for sure.

Americium!…sp?

NBay-have always been thankful for being a native ‘murican speaker (well, the Californiun’ dialect, anyway…), can’t imagine carrying a higher level of jumbled palaver (and ellipses) than i do as a of matter of course…

may we all find a better day.

CME group has futures NG going out 5 years by month and 2025 is currently priced around 3.50 . The out years are thinly traded with small volumes but are posted. Mid year 2023 drop to 5 plus . Healthy energy business good for USA but much of the growth from the reckless Fed from 2008 on did not include energy companies who experienced declines in price of their commodities and resulted in many bankruptcy’s as noted here.

That is all well and good. I talked to our NG supplier to tag along with them to hedge our natgas costs for at least five years into the future and I offered full cover on the contracts. No dice. They don’t do that with smaller customers even on no margin. They raise the price and you are expected to take it.

If you listen closely you can hear the sound of the US middle class getting crushed.

Nearly half the country, 47%, now self-identifies as poor or working poor. That number is expected to increase until the statistical series is discontinued in a couple of years.

The good news is that it’s not going to hell in a straight line.

The bad news is that it’s almost there.

Well,… Heck!!!

Much if not most of the middle class has only been “middle class” essentially my entire adult life either due to artificially cheap credit and/or very low credit standards.

If the long-term bond cycle ended in 2020, these inflated living standards will reverse, exactly as should be expected when its primarily artificial prosperity based upon increasing debt.

The sound of the US middle class getting crushed had been squelched to the tinkly sound of keyboards geting clicked, fretting over false binaries, never mentioning the one true binary of rich vs poor.

Our electrical plants here in the northern midwest have been transiting from coal to natural gas. Our heating is already natural gas. So a double whammy.

I have a coal fireplace in my house but cannot get coal.

Yeah, you used to be able to buy cannel coal for home heating. Was a Northeast thing, but available in larger cities in the norther Midwest. No more.

Back to charcoal maker hermit huts way out in the woods?

This might add to the discussion of nat gas and electricity costs this summer:

“NERC’s 2022 Summer Reliability Assessment warns that several parts of North America are at elevated or high risk of energy shortfalls this summer due to predicted above-normal temperatures and drought conditions over the western half of the United States and Canada. These above-average seasonal temperatures contribute to high peak demands as well as potential increases in forced outages for generation and some bulk power system equipment.”

– North American Electric Reliability Corp article 5/18/22: Extreme Weather Heightens Reliability Risks this Summer

As LNG and other energy prices are spiking (along with questionable sources of supply) will there be second thoughts about decommissioning nuclear plants? Just wondering.

Utility-scale renewable energy prices are now less than half the cost of nuclear.

That’s a No.

You’re never going to get the right answers asking the wrong questions.

Unamused, I think you missed some nuance: the question is about whether or not to decommission existing facilities, so the sunk capital costs matter here.

Decommissioning usable capacity during a time of shortage is usually utterly foolish.

The marginal cost of electricity from an operational power station is inherently much lower than from any new power station. The operational station just has to keep running. The new power station has to be built so there’s a huge capital cost that has to be paid off.

The only exception would be if the nuclear station is truly breaking down and the question was “spend $2 billion repairing the nuclear plant, or build a new renewable plant?”

“The only exception would be if the nuclear station is truly breaking down”

Um, okay, let’s play with that. Since all nuclear plants have a planned lifecycle, after which they are decommissioned, one can only expect that they are all breaking down.

In point of fact they’re being decommissioned because they don’t make economic sense and are getting more senseless every year. I imagine you’ll be externalizing the cost of long-term radioactive waste storage at public expense, already huge. Naughty naughty.

Nice try on the ‘sunk cost’ red herring, though. When the other side resorts to logical fallacies I can sit back calmly over a brandy, confident that the debate is over except the bluster, depending on how much bluster you have.

Re “Since all nuclear plants have a planned lifecycle, after which they are decommissioned”

If only lifecycles followed plans…

I believe part of the issue is that many are being decommissioned before obsolescence. Political, not economic decisions are being made.

Feel free to return with some hard data if you have some.

Here’s Wikipedia on the Diablo Canyon nuclear station in California:

“In 2016, PG&E announced that it plans to close the two Diablo Canyon reactors in 2024 and 2025, stating that because California’s energy regulations give renewables priority over nuclear, the plant would likely only run half-time, making it uneconomical.[3] (Nuclear plants are used for base load in order to spread their large fixed costs over as many kWh of generation as possible.)[3] In 2020, experts at the California Independent System Operator (CAISO) warned that when the plant closes the state will reach a “critical inflection point”, which will create a significant challenge to ensure reliability of the grid without resorting to more fossil fuel usage, and could jeopardize California’s greenhouse gas reduction targets.[8][9][10] In 2021 the California Energy Commission and CAISO warned that the state may have summer blackouts in future years as a result of Diablo’s closure coinciding with the shutdown of four natural gas plants of 3.7GW total capacity, and the inability to rely on imported electricity during West-wide heat waves due to reduced hydroelectric capacity (from the decades-long drought) and the closure of coal plants.[11] A 2021 report from researchers at MIT and Stanford states that keeping Diablo Canyon running until 2035 would reduce the state’s carbon emissions from electricity generation by 11% every year, save the state a cumulative $2.6 billion (rising to $21 billion if kept open until 2045), and improve the reliability of the grid.[12][13][14][15] “

Asking the wrong questions? By asking nothing you learn nothing. I asked a simple question about existing power sources. Are they viable, practical, and safe? I have no idea, that’s a plant by plant question. All I know is that the world took energy supplies for granted (just like computer chips) and now they’re finding out how really vulnerable they are to outside suppliers. Without energy nothing else happens. I’m old enough to have been through the oil embargoes of the 1970’s, waiting in line forever for a few gallons of gas, if they had any at all. Like a bear market some of you out there have no idea what it’s like. P.S. How many fitments did Edison go though before he found the right one that worked?

filaments not fitments. Proofread, who me?

“You’re never going to get the right answers asking the wrong questions.”

You ask a question because you don’t know the answer. You start with a hypothesis. If you already knew it was the wrong question you wouldn’t need to ask it. If no one ever asked a wrong question it would impede discovery.

w.c.l.,

There already are “second thoughts.” Congress passed the bipartisan infrastructure law that includes a $6 billion bail-out package for nuclear power companies to extend the life of some old reactors. Nuclear power keeps on giving, I mean taking from taxpayers.

If renewable energy had been subsidized in the amounts shoveled at coal, gas, petroleum, and nuclear over the last several years we would not now be having this discussion. Instead, we’d be watching those issues rapidly fading in the rear-view mirror, soon to be remembering them with a certain smug disdain.

We’d only be able to watch our fading issues during clear days and/or when the wind is blowing. Some issues would fade, but we’d be hitting a wall of new problems lurking in the darkness left by unreliable base-load generation.

Renewable generation is not the problem. Storage is, but it’s not clear that subsidies would have helped the storage problem all that much. Not to mention, lithium mining is quite ugly and worn-out wind turbine blades are an environmental headache. That and the millions of dead birds killed by giant bird-swatter or solar death ray.

All options always carry trade-offs. I can guarantee that huge renewable subsidies in the past would have led to many solutions as well as many new disasters to deal with. Sorry, but we have no silver bullets.

Birds will easily learn the wind currents around them…fast. Might even play with them like porpoises do with bow wakes.

The ravens here stand 4 ft from cars going 70mph and keep picking at whatever food was thrown out or roadkill they dragged to the side….pre tenderized for them.

That anti wind power argument is for the birds.

Thank you, didn’t know that. Will look it up for details.

Nah, nukes can keep on “giving” for 10 to 50 thousand years or more.

I can hear the silverfish in my plastic baseboards cheering….they want the whole apt.

Gotta give a hand to the Empire. It got the dumb-ass in-bred EU to respond to the un-edible “fruits” of its 8 year long Borderlands Project. They responded by ditching cheap pipeline gas and pay 500% more for Empire LNG. I would be wearing a blue sky over wheat patch also if I could get in on that racket. I will not get the patch but I will be paying 300% more to keep my ass warm this winter. Hey, I ain’t gonna complain too much because the Empire may hook me up to a windmill and tell me to STFU and pray that the wind blows. I do love my 3 year old Nat Gas furnace but if push comes to shove I have a wood stove in the basement and in the upstairs living room. Gonna enjoy the show and the snow.

“I ain’t gonna complain too much because the Empire may hook me up to a windmill and tell me to STFU and pray that the wind blows.”

Just a thought, but if you got your own windmill it might give you a way to profit from all that hot air you produce.

Renewable energy was cost-competitive even before gas prices tripled, and now its cost advantages are becoming pronounced. Renewable energy costs keep falling. All others – coal, gas, nuclear – keep rising, and don’t come back down to where they were after they spike.

DR DOOM,

Complain to the US companies that are the LNG exporters. They invested 10s of billions of dollars over the past decade to export LNG, and that additional demand for natural gas in the US is driving up the price in the US.

The US exporters are the ones you need to blame. Their profit motive is to arbitrage cheap US natural gas and expensive global demand. And they borrowed 10s of billions of dollars to do this arbitrage, and they’re doing it, and YOU are paying for their profits. Get used to it. That’s how capitalism works, my friend.

Yup, capitalism. Example: Which is more efficient. buying one Senator or two Representatives?

Cheap natural gas made large scale desalination more or less affordable in certain locations where adequate supplies of water were not available. You can fire up the wood stove in Vermont if gas gets too expensive, but what do you do if your live in Tampa and half your water comes from gas fired desalination. I think property on the Great Lakes might be the smart investment in the coming years.

When I left the Floriduh around 2004-5 there were over 100 municipal injection wells in South FL. They exist to inject partially treated sewage back into the aquifers. Otherwise the ground could cave into a sinkhole. Sinkholes get big in FL. Weird too, with stories of trees wandering around the yard.

Side story; There was so much prozac and other antidepressants in the rivers from municipal waste that SHARKS tested positive for prozac.

There aught to be solar concentrating desalination plants down in The Duh. It’s shiny as hell down there. Has anyone tried that?

“Sinkholes get big in FL. Weird too, with stories of trees wandering around the yard.”

🤣😂🤣😂🤣😂

Sometimes the posts here are better than going to a stand-up comedy joint.

It sounds funny when I imagine a tree picking up roots and octopus walking over to mate with the mailbox.

But trees “sliding” across the yard really happened to people I knew in Central FL growing up. I can still hear the twangy word descriptions.

The most fun places to ride our motorcycles was in sinkholes because there were no hills anywhere else. They happened frequently. One ate a whole Porsche dealership in Winter Park. I’m pro sinkhole. Turn off the injection wells. Bring it back!

“ but what do you do if your live in Tampa and half your water comes from gas fired desalination”

Primary water in Lower SE US comes from the Floridan aquifer…

Flows from north to south… quite something…

Primary concern in coastal cities is salt water intrusion in existing wells… very expensive to drill new ones…

The real windfall was public transport, they have been running their fleets on CNG. In S.A. motorists are dual use, propane or NG. There is probably some tech out there to run an ICE with LNG. Or turn the fuel to steam and run a turbine. We don’t need the grid, that’s the main argument against EVs.

This makes no sense

Figures that under the Biden administration, the USA did more for coal and gas production than anyone I can remember, while Nixon birthed the EPA. Because Europe will probably be huge buyers of our LNG and the Northern USA might look the other way on coal after this upcoming winter.

Huh, maybe Manchin really is the president.

He’s talking about Surreal America (S.A.), where he constructs his sequence of thoughts and conclusions.

https://www.lngindustry.com/liquid-natural-gas/21022014/westport_introduces_its_westport_ice_pack_lng_tank_system_/

SA is South America, J.A.

Last year, I turned on my pool heater in late April so I could swim before it gets naturally tolerable sometime in June. NG bill was outrageous. So, haven’t turned it on yet this year, and now (thanks for the heads-up, Wolf) I don’t think I will all season.

I guess I can sit and look at the pool with a tall glass of “Kentucky Lemonade”. At least we ain’t got locusts.

Halibut,

The solution is to swim in cold water. “Cold water swimming” is a thing. I do it in the Bay year-round. It’s very enjoyable. Just you, your Speedo, a neoprene cap to keep your brain warm, and goggles, and you’re good to go. It would save you a ton of money, and it’s incredibly invigorating. Warm up afterwards through exercise (riding a stationary bike will do, lifting weights, but not too heavy, etc. is also good; any good exercise will do).

You’re braver than I am. I’ll take the plunge soon, but it’s gotta be a wee bit warmer than SF bay for me.

Drain it, open a skateboard park, and pick up some extra cash, you are going to need it.

It’s also great natural birth control.

Jerry!!!!! Tell her about shrinkage!!!!

On the contrary. Wait till the equipment starts getting blood flow again… your wife of many decades is going to flee :-]

Oh, it’s a thing indeed. A bad thing. Water below 75F should be banned!

Back onto (almost) topic, this natural gas surge has me rethinking HVAC. We’re building a house later this year, and we’ve planned on using gas for forced air heat. It’s historically so much cheaper than electric heating (heat pumps). Well, maybe that has changed. Crap!

Proper siting and a build with heat sink walls/ windows facing south can do a lot of that for for free…radiant piping in the floors from a very efficient ( heat pump) hot water heater would mitigate costs as well…

If I were building new, that would be a primary concern…

If it’s well thought out, it can be very functional and attractive…

Incorporated at building would be negligible cost, I would think…

COWG, radiant is nice but then you still need a/c, so you are doubling up on systems. $$$$. And as far as south-facing for solar heat gain, arrrrrrgggggggg, the genius of Title 24 forces us to limit the SHGC of our windows to a low level that is more appropriate for a cooling climate (along the coast, we are definitely in a nearly heating only climate). Figures.

Wolf, I’ve been wanting to ask, could you swim home from Alcatraz? When I was in SF a few years ago I thought I could easily swim that far except for hypothermia.

Current needs to be going to right way, too. Sometimes the current will do most of the work, but you need to angle right or you’ll end up under the GGB. Probably a good idea to time it when no major ship traffic is passing between, too. Friends have done that swim 100s of times. Me? NEVER, NFW.

Yes, I swam from Alcatraz. It’s not far, about 1.25 miles to our swim club. Gorgeous swim. But you’ve got to get the tides right, or else you end up in Japan. And you’re crossing a busy shipping channel, with container ships coming at you at 15 knots. So not recommended on your own. We do club swims from there; we have to register with the Coast Guard, and they keep the ships outside the Golden Gate during the swim. And there are some boats that pilot the swimmers.

Can a good swimmer unaccustomed to the cold make it?

My old swim was in the Gulf of Mexico, water routinely got above 90 with 100 degree air temp. I’d swim down deep and just sit there to cool off. My biggest hazards were sharks and stingrays. I’d wait for the dolphins to go by then swim out to the channel marker figuring the dolphins would ward off sharks.

Eventually the dolphins recognized me and turned around towards me, but I always swam away due to ptsd from when a dolphin popped up out of murky water once when swimming laps around a charter sailboat at anchor while overnight sailing in the Caloosahatchee bay area with family. Late that night we saw silhouettes of sharks lit up by phosphorescent plankton all over under the boat and I realized the dolphin-porpoise was warning me to get out of the water.

All I saw was big giant fish, big giant teeth, big fin, and I swam back to the boat as fast as I could without taking a breath. Primal fear. They are big. I knew it was a dolphin but my lizard brain totally imprinted that moment.

But even that couldn’t stop me from skinnydipping at night. Such is the male urge. I’d go skinnydipping with alligators when I was younger just to go skinnydipping, but that’s another story (we’d tell the girls their grunts were just frogs). If you swim through the phosphorescent plankton underwater at night with your eyes open they bounce off your eyeballs and it’s like the Star Wars credits.

Eventually the dolphins figured out who I was and would follow me as I rode my bike on the beach herding shore birds which was a pastime of mine. The old farts looked at me lie I was a mutant but growing up in floriguh I was used to that look.

I swam next to stingrays all the time. They are harmless unless stepped upon. You just had to push water down hard on the sand with your hand and some kicks before touching back down in the sand to let them scoot off. You do not want to get stung by a stingray. Like a million bee stings per square millimeter. People get nasty disfiguring injuries from a stingray worse than a brown recluse.

otishertz,

“Can a good swimmer unaccustomed to the cold make it?”

Maybe some people can. It helps to have some blubber. I’m too scrawny for cold water. So it took me a while to get used to it. Now I love it. Regardless, when you get in, you will get the cold shock, everyone does, and you have to train to brain to handle it and not panic. People drown when they fall into cold water, get the cold shock, and panic. It goes away after a little while, but you need to learn to manage it.

Great story about the dolphins.

Handle the panic like with Wim Hof Method? Never thought of it like that… Overcoming a momentary panic. That’s a helpful way to look at cold shock in the water.

I’ve experienced something similar at Brietenbush in OR going from a hot spring hot tub to a cold tub. It did really feel great after the suffering and temporary shock or panic.

Yep Wolf,

I used to sail fast dingies and sailboards (mainly in the English spring and Autumn when the winds were stronger)…..you get used to how to breath when falling into cold water and yes we had wet suits on with the saiboards but it was cold……..saying that our seas and lakes never really warm up that much in the summer lol

When abalone diving you ALWAYS save plenty urine for the WORST part.

Pure wisdom dispensed daily.

It’s the politicians kamikaze green policies shutting down fossil fuel production and lockdown polices causing severe supply shortage. No amount interest rate rise policy will fix the inflation, it will only make it worst.

“Shutting down FF production”… you do know we’re pumping around as much as ever, right? “Lockdown policies” should actually reduce consumption.

Dude, WTF are you talking about?

Would be nice to be able to model effect on inflation with this rise in NG. Could be much higher than anticipated in the energy models. Power NG Factory usage transport the list is endless on the downstream effects. Fed will have to raise even more and maybe faster.

Obviously the elephant in the room is US foreign policy forcing Europe to disconnect from Russian gas. This policy supply shock has been at least 10 years in the making so it’s fitting that American consumers should join their European counterparts in sharing the pain this winter.

Russian gas supply cannot easily be replaced by European operators or redirected by Russian suppliers for that matter. It will take years. The real loser here will be Asia. They will end up with shortages as the Europeans outbid for them for the remainder of the year to meet their newly legislated 80% fall reserve requirements. It will get very ugly unless the Ukrainian situation gets resolved this summer.

In southeast Asia, there is no need for heating in the winter months. However, if one lives in a tropical-like climate, cold seems a lot colder. Now I tend to want to use my little space heater when temperature drops below 68. But I’m a pampered “farang” (Thai word meaning guava, which they use to describe white people because here guavas are large, pear-shaped, and white inside)

Much of my life I swam a mile about three times a week (mostly lap-swimming, but sometimes in other venues like the coastal waters of Cyprus). But now a plunge into cold water would take a lot more fortitude.

I rue selling my ARLP coal stock last year. I’d bought on the way down during covid crash (falling knife). And was glad to get out with some pocket change profit. But I’d be 10K richer if I’d held on to it.

How will this gas boom affect America?

1) Creation of a sovereign wealth fund (like Norway’s)

2) Dutch disease resulting in a further hollowing out domestic industries

These are all private companies, not government entities. So there won’t be a sovereign wealth fund. There will be some millionaires and billionaires maybe.

Wow, this is crazy. California imports 90% of its NG, and is the biggest importer of electricity (from Arizona). Even with its green energy, the thought of future costs make even my hands start to shake.

WOLF, what’s in store down the line for Cali and the rest of the states that depend on i?

Like Japan and Germany, they import nearly all their energy and export high-value products.

I am going with natural gas prices collapsing sometime soon. Supply and Demand. Markets may be discombobulated right now, but the bottom line is that America has decades worth of it underground. So does Qatar. So does Russia.

Ironically the “Green Revolution” means that the only way to profit from Natural Gas is to sell it sooner rather than later. These nations don’t have decades to get rid of it. Use it or lose it.

Nah,

The green revolution will fail as it’s based on false maths that windmills will save the world…….We have just had a winter in Europe where for three months the wind didn’t blow…why do you think we are importing so much natural gas, which Europe went mad about last Autumn as the wind dropped……………..

Yeah… Texas had that problem LAST winter. Too much of their electric generating capacity was in wind power that was known to drop off in the wintertime. It just took one “Arctic Clipper” to show the folly of that.

That said… this is early days. So early that we are still learning not to get too far out over our skis on adopting highly variable energy sources. So early that it won’t be long before the Green Revolution looks longingly at nuclear power (and hydro) as a solution for what ails the planet.

SpencerG,

That’s self-contradictory BS. And it has been thoroughly been dunked many times. Use your head. BECAUSE everyone, including the grid operator, knew that wind wasn’t a big factor that time of the year, the entire grid was set up from get-go to NOT rely on wind during that time of the year, and no one relied on it. What went out were: natural gas power plants, coal-fired power plants, one nuclear reactor, and assorted natural gas infrastructure. Duh!

We covered this in detail here. I cannot believe people still try to spread this BS.

I don’t understand why we have to pick sides on every issue. What’s wrong with oil, gas, coal, nuclear, solar, wind, and methane out of grandpa’s ass? Use it all. We need all the energy we can get. Christ.

You don’t “use it or lose it”. It’s in the ground and can be taken as needed. Or you can liquefy it and store it aboveground in special tanks. Or you can store produced nat gas in an underground salt dome for later use. Lots of possibilities.

There will come a point at which the Green Energy revolution actually does provide a real reduction in the need for petroleum. MY personal guess is when the “Greens” expand their definition of “Green Energy” to include nuclear power.

At that point, the nations that have it in the ground will see its value drop like a stone. Like coal did for instance. I have seen some estimates of that point being in eight to ten years. That is why there is a race on to get it out of the ground and sell it now. If they don’t pump it out and sell it now… they may never get the chance to do so (at a profit) in the future.

Yeah, what the heck use are plastics and fertilizer anyway.

The other similar point for the US, is diesel. If Europe is willing to pay one dollar a gallon more for diesel then you know where all the diesel will go….

When US and global Natgas prices equalize coal could become the low cost/preferred source of energy again. At that point nobody is going to care how clean/dirty it is. The 200 year supply better be there.

Just looked at ARCH coal stock. From $30 to $170 in 2 years. Holy Moly!

The green movement is killing the US energy industry, and it will soon impact natural gas unless there is a change of leadership. The energy industry is not going to invest mass sums of money in developing new resources when the government is telling them they are going to outlaw them. Stupid decisions have stupid consequences.

And propane, the heating fuel of many rural folks who do not have access to natural gas, is accelerating in price too. Propane is a by-product of natural gas production.

Oh! NG prices are going up. It’s a good thing wages are up, and the prices of everything else are 100% stable right now.

…would have a bit more patience with those so violently opposed to renewables if they could demonstrate that the human population is successfully upping the ‘production numbers’ of atmospheric oxygen, freshwater, and truly arable soils-we’re in a significant decline of our centuries of deep discount on those resources…

may we all find a better day.