Predictions a few weeks ago of peak gasoline prices have been obviated by the inflationary mindset.

By Wolf Richter for WOLF STREET.

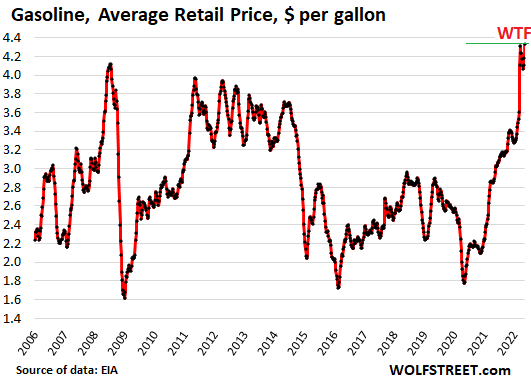

The average price of all grades of gasoline at the pump spiked to a record $4.33 per gallon on Monday, May 9, the third week in a row of increases, and was up 46% from a year ago, edging past the prior record of Monday, March 14 ($4.32), according to the US Energy Department’s EIA late Monday, based on its surveys of gas stations conducted during the day.

Gasoline price increases slap consumers directly in the face every time they get gas, and the classic ways of hiding price increases – such as making gallons smaller (shrinkflation) – would be illegal.

Adjusted for CPI inflation, it’s still not a record. In July 2008, gasoline at $4.11 would amount to $5.37 a gallon in today’s dollars. Long way to go, baby.

Back then, demand destruction rippling out of the Financial Crisis and the Great Recession toppled the price spike. We’re not there yet either – but the Fed has started to work on it.

Gasoline futures have been breath-takingly volatile since February, with huge spikes and drops, that led to a new record on Friday, but on Monday, they fell from that record (chart via Investing.com):

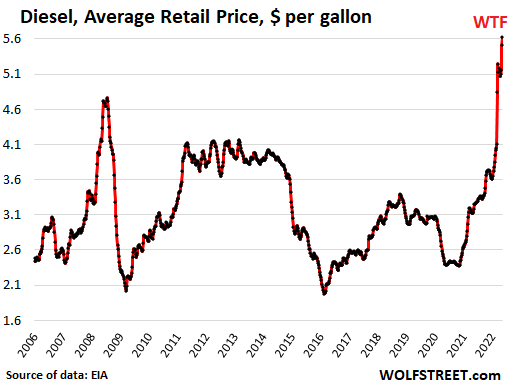

The average retail price of No. 2 highway diesel spiked to a record $5.62 a gallon at the pump on Monday, the EIA reported late Monday. Year-over-year, the price of diesel has spiked by 76%!

Adjusted for CPI inflation, that spike in diesel prices is still not a record. In July 2008, diesel peaked at $4.76 a gallon, which would be $6.22 in today’s dollars. Long way to go, baby.

Unlike gasoline, diesel doesn’t impact most consumers directly at the pump; it hits them indirectly. This price spike adds cost pressures on truckers who pass them on essentially to everything that is moved by truck, namely just about all goods sooner or later, and to whoever ends up paying for those goods, thereby piling more costs on households, offices, construction sites, and manufacturing plants.

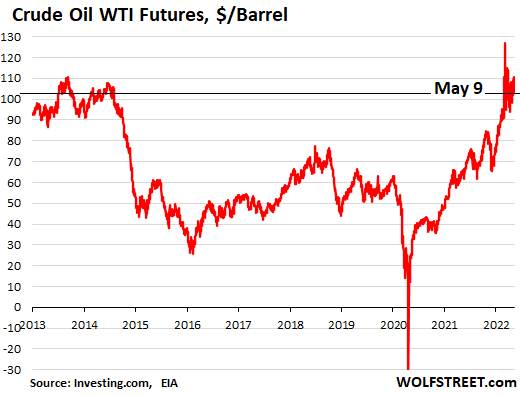

But hang on a minute… crude oil WTI futures have been in a trading range for weeks, and on Monday ended at $102 a barrel, a the lower end of the trading range that started in March, and below where it had been in 2013 and 2014, and well below the peak in July 2008, when it touched $150 a barrel.

Note the historic mind-bender back in April 2020, when WTI futures kathoomphed to minus $37 a barrel for a moment.

Adjusted for CPI inflation, that $150 a barrel back in July 2008 would be $196 in today’s dollars. So, today’s price of $102 is far below the spike of 2008 in “real” terms and doesn’t yet amount to any kind of actual oil shock.

This gap between the record gasoline and diesel prices and the far-below-record crude oil prices shows that the inflationary mindset is firmly in charge, that consumers pay whatever prices, no matter how much they gripe about it. And truckers pay the prices because there is still huge demand for transportation services in this still overstimulated economy, and they can pass on those prices, including via fuel surcharges, and their customers pay those prices and surcharges, and there hasn’t been the kind of demand destruction that would cause the price of diesel to come down – regardless of what the price of crude oil does.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Yet, I guess you mean.

There hasn’t been a enough demand destruction, yet.

The credit cards are still working!

Over time.

Just an observation on gas prices…..my friend says they are lower where he lives in Mendo county than they are here…and it has to be trucked 60 mi further.

That’s kinda like supply/demand “business acumen” Econ stuff, right?…Few have to drive far there.

The owner could easily pass some of that profit along to the clerk, who likely works two jobs and is at risk of getting beaten or shot for $80 every day.

But that’s not “good business” is it?

Therein would be an interesting experiment…a one month moritorium on all credit card useage. Watch how fast this circus folds and takes down all the freak shows and dime tosses on the midway.

Never going to happen, 30% interest rates only FOOLS ,carry a balance. For me free,free,free 30 day loans

dang – 30% interest

is that why they call me dead beat at cc companies???

or is it

I haven’t paid interest on cc since early 90’s

@joedidee…

CC companies calling me a deadbeat?? Why, that’s a personal badge of honor!!

I haven’t paid interest charges on a CC in years. And when I do use it, I pay it off the day the charge appears.

In my world, a CC is for emergency purposes only.

Yeah! F’ing finance it. The American way!

There is no slow down in consumer spending.

People are fighting to pay over MSRP for cars available in the lot.

Bidding war raging in housing market.

Hotels/AirBnBs are booked months in advance.

Restaurants are packed.

Unless and until people start tightening their purses, I don’t see any impact.

I know inflation is high but I just don’t see the impact yet.

The “free market” solution to reducing a potentially “successful” businessman’s gas pump’s “gallon definition” would be to further shrink nasty socialist government in the area of weights and measures and enforcement.

All Gov’t is just freeloading off taxpayers, anyway, right?

I’m sure their trade organization has a lobbyist or two on the job.

In ref to hiding prices by “shrinkflation” as noted in article….illegal yes, but not impossible to get around. Especially with people hating their own government becoming so popular….which is all just PR from those who stand to benefit from it.

Some private outfit manufactures gas pumps….

with cleverly hidden calibration adjustments?

Hi Wolf,

We are seeing various calls that inflation wil peak in May.. as we have seen every other month before it of course!.I was just wondering where you think US CPI % will get to this year and/or when the peak might be?Is this like in Japan was for a few years in early 90’s when rates went to 7%/8% before deflation came in as a result of the asset bubble deflation and assets got hosed and then cash/t-bills became king like it was in the US after 1987.Are we seeing a repeat here do you think?or is this one “different”!!!?

Thanks,

Arthur

Arthur Pollock,

I can predict when (reported) inflation will be at its lowest this year; in October – the month whose inflation number is used to set the S. S. increase for the next year.

Plus the mid terms are in November.

“We’ve beaten inflation …… although our votes caused it in the first place”

“Pick us if you don’t want Roe to be overturned ….. although we had 40 years to turn it into the law of the land”

Scums.

with fuel prices increasing(diesel) and many supply chains in disarray

big corporates are announcing price increases across the board

in home building arena, many prices DOUBLE over night

silicon went from$6.95 to $14.95 at homeless depot last month

for 11 oz tube

—

my guess is we have another YEAR of run away inflation

can’t wait to see Jerry powel take on QT in july

—

will he or won’t he capitulate

jo… Walrusmart had sillycone for $10 for a tube just today. GE brand. A whole rack of it. (I was there buying oil for the old M3’s… as it’s about 1/2 the cost than at one of the auto supply stores)

SS COLAs are based on the average of third quarter CPI-W readings. So the relevant months are July, August, and September.

But the final number can be calculated when the September CPI-W is released, which is in October, and I cover this when the data comes out in October. I also give an estimate of the COLA when the July and August data come out. Last year, my estimates were pretty close.

Arthur Pollock,

If you look at the chart of year-over-year CPI in the 1970s and 1980s in the US, you will see huge ups and downs, and lots of smaller wobbles. I expect that now too.

I expect ups and downs, for a bunch of reasons, including how year-over-year percentage changes work, in that they’re a function of two factors: the base year (level a year ago) and the current reading. A bump in the base year will lower the reading in the current year. And we will see that, and then those will reverse.

There are also other factors. Inflation is a game of Whack-a-mole. One thing pops up as another declines. So prices in used cars are now backing off from the huge spike, but the CPI for rents is increasing … that kind of thing.

I don’t want to guess where CPI will be by the end of the year or next year. But I predict that it will fluctuate and remain overall much higher than in the past few years.

The deflation of asset bubbles exercises downward pressure on consumer price inflation. I expect that, and we’re seeing a little of it already. A big decline in stocks, housing, bonds, and cryptos will sap demand for consumer goods, and will have some salubrious effect on inflation. That’s why I think the Fed doesn’t have to take short-term interest rates to 10%. But maybe 3.5% or 4% with plenty of QT, and falling asset prices will do the job of bringing inflation down. This would be much better for the economy, and might not cause much of a recession. This would be the “soft-ish landing” – for the economy and employment, not for asset prices.

The last paragraph rings home for me. When your portfolio keeps growing at a good clip, you think, sure, let’s go for it.

When your portfolio is shrinking, nope, tighten up the discretionary spending.

I think I see that already in the very high-end performance car inventory of the Minneapolis Porsche dealer. Anecdotal for sure, but perhaps a reflection of where affluent consumers are these days.

Damn high prices in the produce department of my grocery store.

Non-oxy 91 octane was $4.70 in St Paul this morning.

Sorry, should have said used Porsche inventory.

What’s “non-oxy” I have never seen it on a pump…at least in letters big enough that I noticed it. I’m in North CA. Also you mentioned E-10 in our F-1 talk…..what does that refer to?

I speak very fluent chemistry.

Thanks.

On your anecdotal comment, poverty trickles up.

Forget it. I’ll look it up. Too hard to keep checking.

“Non-oxy” means none of that stupid midwest pork WPA ethanol program in it. Burning food.

I’ll find E-10, but probably spend the rest of the day at the F-1 site.

NBay,

This Sunday, 15 May, at 3:00pm CDT (not sure how it transfers to PDT on the network’s schedule), on CNBC, the MotoGP race from LeMans will be aired.

E-10 is ten percent ethanol. Both my Aprilia & M4 recommend avoiding any ethanol in the fuel. Ideally, a 93 octane gas with no ethanol would be the best. Mixing with a bit of aviation fuel into the non-oxy 91 octane would be the ultimate combo, but unless I would take one of them to Brainerd (Minnesota) International Raceway, the fuel I use works well enough.

For older small engine lawn mowers and garden tools, non-oxy is the only way to go IMO. I feel fortunate to have a source for it.

Thanks Dan. Other than an INSANE about 2:1 (probably 1:1) ROE from food and farmland, fertilizer, etc, and water waste, what’s the main beef with ethanol in ICE? All tuning, or does it degrade stuff or burn dirty, make acids?

I’ll be sure to catch that race, weekends are for laying on my back and saving pain pills. Even with Kenny Roberts technique, sliding/drifting on two wheels is scary, even to watch, I never had the finesse for it, even on Sunday Morning Rides, but in dirt it’s total fun. I even discovered the berm shot own my own doing motocross at 15, but had to be told to physically throw it sideways on the 1/4 mi track.

Thanks again.

Dan, never mind..again…See a bit below…I blew it between being pissed and back pain.

All the Fed needs to do to promote equality is to crash assets. Bottom 50% unaffected since they don’t own any.

Yes, and my quarterly Wealth Disparity Monitor is going to track this. Q1 should start to show some interesting turns of events. The data will come out in a couple of months.

Don’t think so. Assets going down 50% is going to cause those with assets to cut back on spending and that will feed through the economy until people start getting laid off.

Maybe the bottom 20% who are receiving all income from government might be unaffected.

Yes Old school,

Many of those living $20-100M life styles may be forced into $10-50M lifestyles….or worse, from $5M into $1-2M lifestyles!

Oh the humanity of it all!

Wolf’s graph may even just show 2 lines, some day……..

Never mind Dan, I read up on it and am more pissed off at this engine wrecking stupidity than ever. But it buys votes and make-work pork jobs for small farmers who lost all jobs due to Corporate farming in the midwest. What a waste of resources! The once happy little farm town (Grant NE) my ex fiancé grew up in is now applying for “blighted community” state funs. Sad what corps do to people.

Note it is TOTALLY banned in ALL avgas….don’t want wealthy folks to crash, due to Gen Aviation engine problems, do we?

I think a concept that is lost on many is the thinking that all crude oil is the same, and therefore can be refined the same into it’s constituent consumable parts like diesel and gasoline. The fact is that American refineries are producing at or above nameplate capacity and that prices simply aren’t high enough to refine anymore American Light Tight Oil (LTO) found in the Permian and Bakken basins.

It will either take the world producing more forms of heavier crude sold into the global market – i.e OPEC, or America deciding to make it economically viable to permit and construct new refineries. It’s hard to see either happening, and therefore it’s hard to see gasoline prices falling much further than 5-10 % from here. Barring a major economic recession that is.

SnakeEater,

” American refineries are producing at or above nameplate capacity and that prices simply aren’t high enough to refine anymore American Light Tight Oil (LTO) found in the Permian and Bakken basins.”

That’s an often-cited red herring. The US exports and imports huge quantities of various grades of crude oil and petroleum products. This is a massive trade that is very global. For example, California, which is cut off from the US producing regions east of the Rockies (no pipeline), imports large amounts of crude oil, refines it, and exports large amounts of petroleum products such as gasoline, diesel, and jet fuel to Latin America, including Mexico. California is also the 4th largest crude-oil producing state in the US, producing a variety of grades, in conventional wells, fracking, and off-shore. This vibrant trade renders your concerns irrelevant.

In 2020 and 2021, US exports of crude oil and petroleum products exceeded imports:

Wolf, were any of the Russian imports processed, and the resulting products exported and included in the US export total?

This will give you some answers and details:

https://wolfstreet.com/2022/03/08/how-much-russian-crude-oil-petroleum-product-does-the-us-import-where-does-it-go-how-much-impact-will-the-russian-oil-ban-have/

Thank you Wolf. It was certainly handled differently at each of the three coasts, between the crude (light and heavy), and the products and components also imported. Mexico and South America certainly enjoyed the exports from our Gulf refineries.

Is there a correlation between high oil/gas prices and a recession?

In my opinion YES everything is tied to energy, manufacturing,transportation heating your home . This is biggest inflation producer. Well now have to ride my bicycle to grocery store ,see you later

I put myself in a place and lifestyle where energy prices would not be an issue. It can be done. Just saying, in a world of choices and trade-offs, those who lead with the chin can hardly complain when their choices turn out to have (predictable and repeating) costs … Is that supposed to be someone else’s fault? Someone else’s problem?

I go to the store on foot.

Nearest store is 25 miles. Goo Luck

“I put myself in a place and lifestyle where energy prices would not be an issue. It can be done.”

THIS

Except we keep bailing out the companies and people who refuse to do this. And when you suggest it they then call you mean names and ignore you and print more money! God bless America ;)

Chiming in late, I agree Americans are incredibly wasteful and consume massive amounts of energy for non-essential, indeed frivolous and stupid purposes. Spoiled, soft Americans have no idea what’s going to hit them, or maybe they’re getting an idea…

But some uses of energy are essential. I live a relatively austere life by choice but must heat the house. Even with most of the thermostats set at 62-64F all winter, heating the house is by far the largest component of my personal energy use (having calculated how much heating oil is used and how much CO2 is emitted, approx 3 tons per person).

Just had the oil tank topped off yesterday – heating oil is up to $5.94 per gallon!!

Gen Z,

An oil shock can drive up inflation which then causes the Fed to raise interest rates to cool demand, which then can cause a recession. We haven’t seen an oil shock since the 1970s.

In 2008, what powered the Great Recession was the collapse of the housing market, the mortgage crisis, the Financial Crisis, the near collapse of the banking system, the collapse of some major banks (Lehman was the largest that wasn’t bailed out), that brought consumers to a halt in their tracks, which was then followed by large-scale layoffs. The brief spike of crude oil at the time barely mattered with the financial system blowing up due to the mortgage crisis.

Today, the US is the largest producer of crude oil, petroleum products, and natural gas in the world, and areas that are producing oil (more or less in nearly all states) benefit hugely from an oil boom. So an oil shock today is also an oil boom. There is a lot of technology and high-dollar labor involved in the oil and gas industry. And it is booming today!

Basically, no mass unemployment like what happened in 2009? I remember my Millennial friends having a very hard time getting a full time job from 2010-2015.

Wolf,

Was anything fixed from the GFC? If so what?

There are two huge changes:

1. The residential mortgage risks were shifted from the banks to investors via MBS held by investors, and to the government via government-backed MBS held by everyone including the Fed.

2. The big banks have a huge amount of good capital, after years of mega profits, thanks to interest rate repression, which spared them having to pay depositors any interest. This saved them trillions of dollars, and some of this became their core capital. They’re much better capitalized than they were in 2007. And they can take very big credit losses, of the type that they couldn’t take before.

The Fed knows this, and has mentioned it, and if the Fed wants to, it can let her rip.

I expect some hedge funds to blow up, and a few bond funds and some other funds. I don’t expect big banks to blow up. Some smaller ones, sure, particularly some smaller banks that are heavily concentrated in commercial real estate. And there will be losses for banks, but the big banks can handle them though their shareholders might gripe and dump the shares, and they might drop a lot.

Slowly starting ,this is just the beginning

So if the bigger banks are A OK, then why not raise rates and let savers get back some of the money that has been stolen from them the past 12 years? Why have they kept them rock bottom with only two short years of reprieve?

Isn’t it also within the realm of possibilities that the A OK TBTF banks in the US get dragged down by their less healthy counter parts in the EU?

Not many data points but to the extent it is available, yes.

Early 1970’s with the OPEC embargo, late 1970’s during the Iran hostage crisis, Gulf War I, and GFC.

Or maybe it is just oil companies and refiners behaving as they always have. Oligopolies price fix and in an environment of headline inflation numbers have the inventive and the required “cover” to price fix higher.

So explain price fixing at -$37 per barrel.

I thought that was more of a delivery/storage aberration…

Actual oil was never exchanged at that price.

This always comes up when gas prices spike.

Apparently, this collusion was so successful which explains why Exxon reported massive losses during 2020/ 2021. Other oil majors did too. I guess that was a mirage.

Should be easy enough to prove or disprove. Check the history of the retail price versus gasoline futures. I haven’t done it.

Unless of course, someone is now going to claim that the futures are manipulated also.

That was purely a trading event. As the price neared $0 speculators piled on the long side thinking it could not go negative. They were overwhelmed by sellers who squeezed them out and covered there shorts at negative prices. I watched at my trading platform with amazement. If I remember correctly it closed at -$12 that day and was back to $10 the following day. Had you had a spare tanker sitting around you could have pocketed 50 million in cash and had someone fill up your tanker. Probably several traders taken out on that one. Important lesson for futures traders about how irrational a market can get.

Banana-

A VERY stupid knee-jerk response to a good comment….your MO.

It was just futures traders doing their gambling thing…people who never even touch actual oil…..I see no point in anyone who doesn’t take delivery playing there…..”market makers” my ass…just more financial parasites we don’t need.

One thing to note about diesel is that it’s practically identical to number 2 fuel oil, which is still used by a significant percentage of people in the Northeast to heat their homes. I’ve heard stories of prices over $6.00 a gallon (and there aren’t any road taxes on these) If prices don’t come down by the fall, hard times are going to be coming.

I walk my dog early mornings with a retired friend who paid $1000 to about a week ago to fill his oil tank. He was not happy..

A refill of 170 gallons of heating oil cost me $940. Fortunately spring is on its way in Boston.

Negative 40 dollars/barrel oil. Two years ago.

I think the only difference between the two is a red dye is added to diesel to exempt it from fuel taxes to be used for heating oil.

There is no price gouging here. These are not the speculators you are looking for.

Power of the Farce is strong with this one. “Move along.”

Heard someone say that when the USA was / is fossil fuel independent that high oil prices aren’t the same as in the 70’s.

It mainly moves money around within US economy from certain consumers to other consumers as in the booms in fracking and the jobs created there largely offset the higher prices everyone pays. Remember the stories of people moving to N. Dakota and tripling their salary. Most lose, but some prosper and spend.

Energy independence is better than not, but I doubt it’s a wash.

The proportion who directly benefit from higher oil prices isn’t that high. Indirectly it’s somewhat higher, like in the Houston economy as a whole. Another group benefits from dividends and any higher stock prices, if it happens.

I agree it happens in Norway or other countries where the economic stimulus is very high per capita, but I doubt anywhere else.

Today we have a reverse oil embargo, we sanction them, which will drive prices down.

I work with a lot of the guys who were in the oil industry during the boom. Nearly all of them, like good consumers and the stupidity of being young men; lost all that money on crap like cars and toys. Not to mention the cost of living up there where everyone prices gouges on everything.

I have been traveling to quite a few NE American cities lately.

Rush hour is as bad as pre covid.

Which is interesting given:

– Work at home is still big

– Record high gas prices

Stayed a recent weekend in Gatlinburg TN, in the Smokie mountains. I have never seen it busier. At least every other License Plate was from another state one or two driving days away.

Where’s Wolf’s “GAS STATION FROM HELL” when we really need it? A picture is worth a thousand words.

I put Ethanol Free gasoline in my Hemi. The price, here finally, reached $5 Federal Reserve Paper Notes per gallon.

So, now I am paying about the same price for Gasoline as from 1865 to 1964. (I know. Gasoline was a waste product and was dumped into Oil Creek, and set on fire some times !!!)

It is amazing how, for over a Century, the price of gasoline has not gone up.

Back when John Davidson Rockefeller was running his kerosene still, a barrel of oil was about $4. John Archibald was offering $4 a barrel when on a buying trip to Titusville. (He ended up as one of the top executives of Standard Oil Trust.). Today, this would be $100+ a barrel.

It is incredible to me that we pay the same for gasoline for about 150 years. That shows the incredible “power” of Free Enterprise Capitalism versus State Controlled Capitalism.

(This comment would not be complete unless I leave one of my snarky remarks: This is why the price of gasoline is meaningless to me. It’s cheap, even at 5 paper notes per gallon)

MA wrote: “It is incredible to me that we pay the same for gasoline for about 150 years. That shows the incredible “power” of Free Enterprise Capitalism versus State Controlled Capitalism.”

That got me to wondering what gas costs today in Russia.

Russia Gasoline prices, 09-May-2022

Russia Gasoline prices

Litre Gallon

RUB 51.800 196.084

USD 0.742 2.809

EUR 0.702 2.657

U.S. Gallon

Gasoline prices per litre, octane-95: We show prices for Russia from 31-Jan-2022 to 09-May-2022. The average value for Russia during that period was 51.85 Russian Rouble with a minimum of 51.79 Russian Rouble on 31-Jan-2022 and a maximum of 51.89 Russian Rouble on 28-Feb-2022. For comparison, the average price of gasoline in the world for this period is 130.57 Russian Rouble. Use the drop menu to see the prices in gallons.

Some of the causes for the spike in fuel price is also related to the following

“Following a series of explosions and a catastrophic fire that took days to extinguish, Philadelphia Energy Solutions — the largest oil refinery on the East Coast — is shuttering its South Philadelphia facility in two weeks, laying off more than 1,000 employees and causing gasoline futures to spike.”

https://www.foxbusiness.com/energy/philadelphia-refinery-will-close-why-it-matters

This occurred in 2019 after low margins for refineries for years And the lack of investment.

Refiners for decades have been battling oversupply and decking margins shifting supply chains and lack of supply.

I’m sure Russia oil situation decline in production in areas where refineries were located (North Sea, EU russian oil imports, Nigeria refineries decline output etc.)

To build a new refinery in 2022/23 with the increases in steel, lack of supply, push for EV etc. and inflation running at 8 percent would take a brave soul.

Yeah but gas was cheap in early 2021. These refinery issues are long-term issues, counted in many years and decades. What we have now is a sudden issue.

Can we have a chart, going back to around 1910 till present, of the price of gas, in 10 cents silver dimes? Today, one silver dime is “worth” about 2.45 paper notes.

When we talk about price, we have to define what unit we determine price in. We should compare the price of gas to the price in Silver Dollars and not change the pricing mechanism to paper notes during the analysis. Such a price chart is meaningless.

It would be like making a chart of Global Temperature, but using Centigrade, Kelvin, or Fahrenheit indiscriminately. We must commit to one standard only.

Example, using Centigrade, we notice the Global Temperature in the Middle ages was higher than today. Then, we notice the Global Temperature during the height of the Roman Empire was higher than The Middle Ages and Today, AND, the Global Temperature during the Minoan Era was even higher than the Roman Times, which was higher than the Middle Ages Warming which was higher than Today’s Global Warming. But, that is only true if you exclusively use only one of the Temperature Scale System.

Shhhh, the woke precinct thought police will be after you son…

I’d just be happy with sources

You can’t measure the value of 90% silver coinage now versus 1965 and prior the way you are trying to do it.

Silver isn’t used as functioning money. It’s bought by metal advocates as a store of value but has no role in the monetary system.

Silver is primarily bought as another form of speculation, not for payment except by those who are anticipating a SHTF scenario.

That’s why US coin silver sells at a huge premium to the value of the metal content. It also has huge buy-sell spreads.

A US silver dime has .07236oz with a melt value of about $1.50. The $.95 premium (in your example) isn’t relevant to anyone my age or younger (I was born in 1965) because we never used silver dimes as change.

For someone my age or younger, the relevant comparison is the number of ounces or fractions of an ounce.

By this standard, an ounce of silver at spot is worth about five gallons retail. Add slightly more in fabricated form.

By comparison, in February 1976 or 1977, I recall selling silver selling at $5.25. I don’t remember the exact gas price, but silver could buy more than now.

What was the silver in a dime worth in 1910? The value of silver in a silver dollar must’ve been approaching $1 by 1968, when redemption of silver certificates was ended.

Congress set the broad requirements for silver content in US coinage in 1793, with a few changes later, as the melt value of some mintages overtook the face value. Business strike Silver dollars since 1794 Flowing Hair until 1935 Peace contain approximately 0.77344 net troy ounce. Two halves or four quarters or ten dimes or any combination thereof that adds up to a dollar through 1964 contained 0.7236 Troy ounces of silver officially as noted above, but for trading purposes junk silver is usually figured at 0.715 Troy ounces per dollar face value due to the silver having been worn down from years of circulation and handling. As reference: avoirdupois ounce =437.5grains, troy ounce =480grains : numismatic value is a different subject.

You’ll be dead long before the shit hits the fan so I wouldn’t waste so much time with convoluted examples. Enjoy the few years you have left

With modern medicine tech him and other boomers *might* get to see how bad it gets.

MA

What kind of TOTAL gibberish is that screed?!!

That wouldn’t even pass muster as Exxon or Fox spin and PR.

You had better see a doctor about your mental degradation, or just plead drunk or something.

No, I don’t care to waste my time unwinding all that BS.

And WHO is the “WE” that “noticed” all that crap? Has age related bipolar disease set in? Like brain cells overloaded loaded with beta plaque?

…sheesh…

I expect some of the increase in prices is the result of the supply disruptions coming out of Russia. Different countries are refusing to buy Russian crude, meaning they are buying from somewhere else, taking some else’s crude. Increased shipping and logistic costs will result. Not to mention not all crude is the same. Refineries take crude that best suits economically their facilities and local product needs. You can substitute or even retool your refinery, or buy/sell short/surplus product on the market, but all that takes time/money. In other words, Market distortions resulting from the War in Ukraine are undoubtedly part of the price increase.

just had dinner with an old workmate – he now lives in spain – he was relating how when he listens to the news its all doom-gloom- disaster – but when he goes out the restaurants – bars- nightclubs are packed – he recently was going to take his granddaughter to look at colleges and usually travels first class – he was informed all first class seats are sod out through augest – such are the conditions in europe at the moment

Europe was under much tighter lockdowns and still has to fully rebound. Reality will catch up.

What do you mean, “rebound”? And “Europe” in relation to Covid-19?

The EU deals with external borders. Inside the EU, Covid-19 is up to member states, so Everybody did their own thing.

Denmark had pretty solid growth all the way through our “lockdowns”, only some hotels and restaurants where whinging and they are all shitty employers anyway (and they even got bailed out to whinge another day). Not even the recent Ukrainian refugees will work for them :).

The “just let it rip”-crowd generally did pretty badly and they are still doing badly, probably because they do Everything half-assed. They are simply “back to normal” now.

During a pandemic, it becomes harder to hide how shit you are at running things and it becomes very visible when they are stacking dead pensioners like cordwood in ice-rinks and breaking out respirators and ABC-tents from the 1980’s “USSR is Coming” vintage collection, that nobody alive knows how to work (perhaps because Gramps just croaked while on palliative care).

This situation is pretty typical before a bust. French booms in the 1700’s, the roaring 20’s and late 90’s in the US. Debt fueled boom, that pops is the norm.

Fed might demonstrate they are the greatest of all time, but they definitely will not own up to it. They are creature of the US world empire, so what would you expect?

Worth noting that crude is a raw feedstock, while fuel at the pump goes through midstream pipelines/tankers, distilation (different depending on location/season), and then transportation to station. All of these are labor intensive.

Comparing oil prices to pump prices is like comparing cost of milk to cost of protien powder or aresol whipped cream.

“Comparing oil prices to pump prices is like comparing cost of milk to cost of protien powder or aresol whipped cream.”

Agree. Over time, inflation increases the cost of converting the raw material of many commodities into a finished product. So, the commodity spot price can stay flat or even decrease yet the retail product costs more.

Over at the “Economic Collapse” blog, I believe the author quoted Wolf without acknowledgment, when one can read this sentence appearing there:

“Shares [PLTR] kathoomphed 22% so far today, and 84% from the peak in January 2021, to $7.40 a new all-time low.”

See what I see?

I find that completely Fluxoplageristic!

Spilfered, kernicked, and non-borrowed it would seem.

Nice catch Marcus! Wolf will have to get the word theft police after Michael Snyder.

We are at $2.10/liter here on Vancouver Island-almost $8/gallon.

The cost of Lumber was up from 300 in Mar 2020 to 1,700 in May

2021 – when BC Canada is mud, fear & greed at peak – to 800 in May 2022.

Well when you print more money in one year (2020) then you did in all the years from 2008 until 2019, you’ll have crazy price swings.

Adjusted for the fx rate (at $1C=$0.78US), the price is only slightly higher than my local Chevron station in the SF East Bay. Yesterday, regular was going for $6.06US. For seniors who can take advantage of public transit, a ride on the BART rapid transit line starts at $0.75.

Gasoline is oligopoly.

Price is fixed.

No shortage.

No cost increases to produce it.

Buyers without choice.

Just makes everyone want electric even more.

The price of gasoline is not fixed. The price difference between Chevron and Costco for a gallon of regular gas in my county is typically about 50 cents, sometimes more. Buyers do have a choice. And if you don’t want to drive at all, there is public transit or Uber/Lyft.

When you increase money supply, cost of goods increases, it’s almost never a shortage issue.

1) US is 3,000 x 1,500.

2) England : 350 x 350. The cost of trucking in England is much smaller

than in US, unless they extend to Europe.

3) Trucks can make money only in regional areas where trucks are full both ways, round trip.

4) The major cities have little to sell, besides online data, cyber, media, banking,

meta, fear and greed…and homeless people.

> The major cities have little to sell, besides online data, cyber, media, banking, meta, fear and greed…and homeless people.

Looking back pre-Internet, everybody wanted off the farm and out of the mines to the cities which provided good wages and culture — education, performing arts, good medical services, etc.: the service economy now fashionably derided by some.

Some rural infrastructure such as health care and airports is declining without the postwar welfare state props.

flip, 1866 – 1910 the Gilded age when the industrial north was booming and the south was dying…

Industrial Chicago slaughter houses produced meat products and Nikola Tesla. Pittsburgh coal & steel, Detroit Ford, SF Stanford, NY GE…

and tp.

The masses position themselves in a state of dependence on energy with zero margin for error, as they did with stock prices. Then, when markets (US dollar included) do what they do, the screams ascend, as if some earthly or celestial parent figure is to blame, and/or should do something to rescue them from their plight. Which is utterly common and predictable and cyclical. Nobody made them buy those absurd vanity vehicles, and expect to go anywhere any time with a finger snap at low cost.

This has been going on nonstop for eons. Is now somehow unique and different?

I have yet to see actual malnutrition in this major US city, which is a fixture worldwide. The people don’t even drive old cars. The cars are clean though there is a radical drought. Lots of delusion around.

I call it “Prosperity Disease”

Yep…in other places in the world people try to look poorer than they really are.

aka “Industrial Disease” (Dire Straits: Love Over Gold/1982)

I also immediately thought of that song!

‘ Nobody made them buy those absurd vanity vehicles, ‘

‘made’ no, but ‘encouraged with highly sophisticated and devious well proven strategies’ perhaps.

Not everyone can be as smart as you….as you let us know.

His walking to the market strategy is brilliant… up until the point when a hungry person relieves him of his cocoa puffs on his stroll home.

“Everyone has a plan until they get punched in the mouth”.

Mike Tyson, wasn’t it?

Yup.

Your post sums up much of what’s wrong with modern American society. It’s always someone else’s fault.

Limited to no personal accountability in this country and it’s plainly evident with the direction the country is heading.

If you take away the feedback in any closed loop system, that system is going to hit the rails, fast. Same thing with the behavior of people.

We all have to make the big choices.

1. Where and how to find shelter.

2. Where and how to feed ourselves.

3. Where and how to get around.

4. What are you going to wear?

5. How you going to take care of yourself when you can’t work.

We all do it differently.

I have yet to see actual malnutrition in this major US city,

I think it is impossible to miss the signs of malnutrition:

The obese, not just above healthy BMI, but bloated up so they can barely waddle, many people are in their teens and twenties, huffing and panting with the exertion of just getting out of their cars!

Sure, they are eating something to get that fat. But, it is hard to pack 20000 kalories per day into a persons diet without processed food.

PS:

It is not so surprising “Americans” are so angry all the time: Fat people are powerlifters. They are struggling to lift 250 kilos or more on shaky ground, flooded with hormones, and all the while people are talking to them and distracting them from all angles.

It’s like messing with the gym rats during workouts, they will get pretty angry too! Only, they are only lifting heavy for a few hours, not 24/7.

One can be FAT with malnutrition. It is perhaps “why” they are fat.

You eat cheap, refined, low nutrient food, you pack on the calories (fat) and spike your insulin.

Meanwhile, your body still wants the nutrients, and thus starts the hunger pains, along with the insulin collapse triggering you desire for sugars.

So, you are again, and again, and again, not getting what your body needs, just the cheap carbohydrate refined sugar candy food.

Eat the highest nutritional food, with the least caloric value, and never, ever eat for “taste” or for social events.

“Adjusted for CPI inflation, it’s still not a record. In July 2008, gasoline at $4.11 would amount to $5.37 a gallon in today’s dollars. Long way to go, baby.”

I don’t know exactly at what point the economy is termed Hyper-Inflation but what do you call the last fifteen years for your savings with no interest paid?

Either you lost big time holding cash or now your stocks and bonds are tanking even faster. Oh well, still yet, most folks are hitting the streets more focused on abortion while having been systematically robbed.

Lots of big RVs for sale out here with prices dropping.

But still lots of big-arse pickups gunning it down the street – the death roar of a species going extinct.

Just like the dinosaurs, which were the most successful species on Earth until Chicxulub hit.

The big RVs, if diesel, will at best get ~10 mpg. That’s $0.63/mile for fuel alone at today’s prices. If the diesel prices stay at +$2/gal here in the mid atlantic, I also expect the diesel mall crawlers to plummet in price fairly soon. $180 fill-ups get old really fast! In this area, that’s $900/month for most that use these vehicles as commuters.

A month or so ago when I was filling my truck up a young guy in his 20s pulled up to the diesel pump on the other side of me in a brand spanking new Ford F250 Platinum diesel. If the entry price of the truck isn’t enough to make your eyes water, he had another $5,000+ worth of suspension and tires on it.

What really captured my attention was the fact that I had been pumping for what seemed like 5 minutes, yet he pulled in, pumped for a bit, then hung up the pump and was getting back into his truck before I finished. When I hung up the pump I decided to look on the other side to see how much diesel he purchased. $20, which wasn’t even 4 gallons.

I was left wondering if that’s as much as he could afford to purchase at a time. I’ll never have the answer, but I got the impression this kid was living well beyond his means. The only time I can remember putting small amounts of fuel in a vehicle was back in high school.

How much is that truck new?

His truck? $100k easy right now.

That young guy is paying so much per month. An expert like Wolf can tell you most new car sales are leases or loans.

That explains why he has an expensive vanity truck but can’t fill the tank.

What got my attention the other day was it costing $25 to fill my lawnmower gas can.

My battery drive lawn mower works great, although I admit the price of electricity is going up.

If gas prices are high now why fill it up now, the prices might drop tomorrow? Might go up, might go down. Perhaps he was making a wager.

Harrold,

“How much is the monthly payment??” That’s all they want to know.

I drove through a fairly poor area a few months ago. So many fancy pickups in the driveways of houses worth less than the truck.

I have noticed the very same thing.

Another interesting sight, is the front lawn and driveway filled with 4-5 cars, all really nice, in front of a dump house. The cars are worth far more than the house.

So, I begin to think why they don’t sell every care, keep one, and take the money and buy a bigger, nicer home?

Peak oil, peak chaos.

Welcome to California, in Bay Area you get to pay up to $6.19 gal. I feel like I am in Europe in the 80’s!

Let’s see. Housing Bubble. Check. Gasoline at record highs. Check. Seems quite 2006-2008 like, ya know, right before total s.hitshow.

It’s an ominous moment in history (not unprecedented. I swear the next person who says “unprecedented time we live in” is gonna get it from me). The global economy is moving into a crisis-phase that is part GFC, part Dot Com bust, part 70’s stagflation, part Great Depression. Throw in the myriad other looming crises, including the very immediate threat of ATOMIC HOLOCAUST, and I think we’re headed for some hard times.

Very precedented, but most people don’t know economic history … even their own in some cases. Much less studying their parents’ and grandparents’ histories and how they handled the crises of their time…

OK, just for you WS:

Great Great grandparent sold everything and moved from Europe to buy 1/2 section farmland north of Milwaukee, opened a store and farmed.

Great grandparent sold it all to build house in Chicago and Saint Joe for the summer retired to coastal CA just before the crash of ’29.

Grandpa sold it all to buy a large sailboat to sail the world.

Parents ”partied like no tomorrow” until start of WW2.

All of them died, so what? We all gonna die, and sooner accepted better the party thereafter, eh?

Eat, Drink, and be happy, for tomorrow we dine.

When I was a young boy, in time of crisis my father would just open another quart of Vodka. That’s how he got thru it. Unfortunately, he never made it past age 62. From what I can tell, that’s how his father handled bad times too. But they both came out of the Pennsylvania coal mines and economics was not taught in 4th grade.

I decided that was not for me and I learned a real good lesson from them.

VVN, we are both about the same age, but both from way different backgrounds. We both served in the military about the same years too, I bet (1964 – 1968 for me).

The Fed did some unprecedented things after GFC that put us in unprecedented negative rates and an unprecedented housing, bond, stock bubble at the same time with an unanchored fiat currency.

Not everything is gloom and doom.High fuel prices ? One might consider moving back to the City and enjoying heavily subsidized public transportation.

“Bronx tenants on verge of buying their apartments for $2,500 each”

Article features photo of this bld and street address.

Long story short:

Wimpy Landlord got tired of being NYC Landlord and started selling apartments in his building to his tenants for $2,500.

I am trying to decide what’s better for me: remaining Big Bad LeRoy Brown in Chicago South Side, buying a 3bd 2bth house in Riverdale for $6,800,

Or moving to NYC, becoming Snake Plissken and buying apt in the Bronx for $2,500.

Bronx is much different than it was 40 years ago.

Its very trendy now.

Buy in the Bronx, walk to the new Yankee stadium and watch the games. No need to spend on high priced gasoline. You might need to “carry” though.

I tried public transportation to save time/money, never again. The number of times it was late on schedule, the homeless fighting invisible aliens, and how rainy days bring out people’s body odor. It sucks.

Governments can go too far and make running a business working for nothing like a slave.

I remember a guy I think on this sight from NJ who stopped paying his ever increasing property taxes on a rental and was just going to milk all the rent from the property he could and then let the county take it when they finished the legal process.

No doubt milking the people who ride the bus.

As a shipper, I follow the Trucker Report Forum and happened to look today on the Truck Paper at used Dry Van and Reefer trailers.

Lots of truckers on the forum are either shutting down and staying home until things get better, or they are selling both the truck and the trailer and either retiring or finding another line of work because you can’t make any money at $2-2.50 a mile on the spot market when diesel is $5.50-6.80 a gallon.

Unlike last year, there are tons of used Dry Vans and Reefers for sale but still for astronomical prices.

Imagine what will happen when all the lease ops and new owner ops who are paying 2k/wk on an overpriced truck note have no way to pay for operating costs.

If you had your own truck and trailer 5 years ago you cleaned out. If you bought in 2021 and started up, you’re dead in the water waiting on the inevitable shark.

XLE topped at 83. Chart looks like a wily coyote moment.

Lat week I posted about how my neighborhood gas station’s prices were going DOWN… not UP.

That didn’t last long at all. It had been $3.63 for a few weeks… then dropped to $3.58 for a day or two… and then went to $3.69, $3.79, and $3.89 in rapid succession.

And yes, I know that my area’s prices are low. The benefits of having an oil refinery in your town… not much in the way of transport and storage costs.

$3.99 RUG 87 octane at several stations here north of Houston. No station here wants to put up the BIG $4 number. But D2 is $509.9.

I wonder if there will a surge in demand for backyard undergound gasoline storage tanks at private homes. If gasoline gets to $8/gallon or higher this could become a reality. Is this legal I wonder?

This was a brief fad among the wealthy back in the late 70s when gas spiked to $1 and there were lines and shortages. I don’t see the benefit when prices are high but there’s no supply problem, unless you’re anticipating a Mad Max scenario.

My parents did that in the 1970s. They put a diesel tank on my grandmother’s farm for fueling their car with. The car (a Mercedes) turned out to be a lemon… and I don’t think they ever got as much use out of the storage tank as they would have liked since it was too far away.

PS: There are definitely laws against it nowadays. Fire codes, OSHA, EPA regulations, etc. I think you are usually limited to 25 gallons of gasoline stored at a residential location. You can probably get away with more at a farm but even then there will be regulations you have to follow.

You want to be careful of buying any land that has old fuel storage. State and fed regulated clean-up is not cheap. Watch out for buying those cute buildings in the country that used to be a filling station in its dim dark past.

Gasoline doesn’t store well. There are stabilizers you can add but that only extends the life to maybe 6 – 8 months?

Almost all the ”commercial” farmers in the county in flyover we lived in from’99 to ’16 had diesel tanks of 500 gallons or more, in some cases much more. Most of the rest of the farmers used horses and mules.

Wasn’t much presence of ANY regulations there, but very little spillage because the relatively high cost during most of that time period.

EVERY pump had special nozzles that prevented use in cars or PU trucks, with one exception, and you had to have a state ( NOT county ) certification of farm/off road use to be able to use that pump, for those who did not have delivery straight to their tank(s).

The two fuels were different colors, and if caught using the off road in any on road vehicle, the fines were very large.

In the farmland, there are fuel tanks to run the equipment, both diesel and gasoline. No it is not legal, and there are occasional checkpoints made by law enforcement that makes it unwise to put it in an over-the-road vehicle.

Farm diesel has red dye, “Solvent Red 26 or 164,” in it. Johnny Law looks into the fuel tank to see what you’re using every now and again when you’re on the road in a PowerStroke F-350.

But when you’re running a big axial-flow combine down hundreds of acres, you ain’t filling up at the local gas station.

I got held up by the one-armed outdoor bandit for $100.

VEGAS = hahaha

1) Winnebago weekly, RV mfg : up to 83 on Mar 2021, down to 51 on

Apr 4 2022, getting support from : Feb 24 lo/ Mar 2 hi 2020 backbone

and ma200. Current price : 56.

2) After a wave up, WGO might drop to 20-23, or breach Mar 2020 low.

3) At the lows SF will buy WGO RV to solve the housing problems.

1) SPY daily 3PM : a spring under yesterday low, a hammer at the

bottom, after a downtrend, with a large buying tail, on low vol.

under Feb 24 low. Wait for confirmation.

2) There is a downtrend line connecting Jan low and today low. If

the next wave up will rise between Mar 29 high and Nov 22 2021 high,

this structure will look like a megaphone, usually a reversal pattern of the wave from Mar 2020 to Nov 22 2021.

3) The market will tell us where it wants to go.

4) SPY at around 400 is market makers easy to remember number.

Next for S&P 3700!?

followed by 3200

finally at 2600? by the middle next summer?

Wonder at what level the Financial media will start broadcasting, these are ‘dirt cheap’ stocks?

For reference, in Dennark gas in currently $9/gallon at the pump; up ~100% from a tear ago. Diesel is $8.5. We’re complaining too but my sense is that ppl know that it’s not the government’s fault.

Not the government’s fault?

Truckers now paying $1700 to fill up, on site loan officers to finace. Even if we pay $10/gal to fill up our catch fire Kia’s, traffic will still snarl.

If the fuel to run a truck costs more than the operator is paid to deliver goods, then many trucks will stop running.

Ice-9.

If there aren’t enough trucks running, the mileage rates will go up until there are enough trucks running, and the higher rates will be passed on ultimately to the consumer. Just watch it, heading your way.

LeClerc,

Player Piano

It’s because of Russia. Europe used to be get a lot of its diesel from Russia. Europe is now pulling diesel from the US in large quantities which is leading to the shortages in the Northeast markets.

I watched many neighbors purchase new gas-guzzling SUVs and trucks during the pandemic, and a few RVs, at big premiums over sticker. They are getting blasted now on refills. Also, hard to find RV parts and long wait for service. I didn’t hear complaints at first, but now the grumbling has started. It will rise to a dull roar soon enough. Deals to be had on used vehicles in 24 months? We’ll see.