One more complication in the vast global oil trade, even for the US, one of the largest producers in the world and a big exporter.

By Wolf Richter for WOLF STREET.

The US is a huge producer of crude oil and petroleum products, with huge refining capacity, huge consumption, a huge petrochemical industry, huge imports, and even bigger exports. The global oil trade is complex and vast, and it solves specific issues in the US, such as the lack of oil pipelines across the Rockies between the producing regions and the West Coast. A wide variety of products are based on crude oil, from transportation fuels to plastics, building materials, and fiber for clothing. So, if oil supplies are tight and oil gets expensive, it impacts everything.

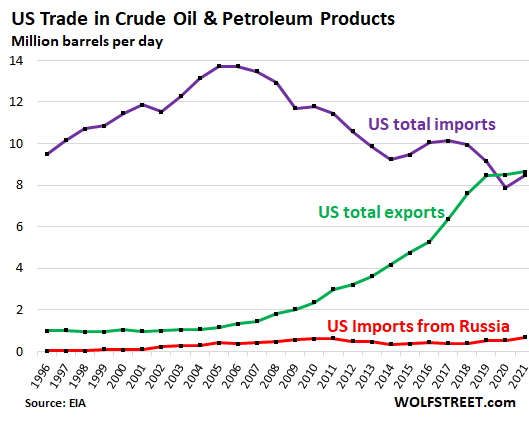

The US trade of crude oil and petroleum products (such as gasoline, diesel, jet fuel, naphtha, etc.) in 2021 involved, in barrels per day (b/d), according to EIA data:

- Imported from Russia 672,000 b/d (red line)

- Imported in total 8.47 million b/d, about half of it from Canada (purple line)

- Exported 8.63 million b/d (green line):

Amid booming production by US shale oil producers starting about a dozen years ago, imports sank and exports surged. By 2020, the US became a “net exporter” of crude oil and petroleum products (in the chart, the green line above the purple line), meaning in terms of barrels per day the US exported more than it imported.

But this is not equal to “energy independence”: The US energy sector is tightly woven into the global energy trade, and is dependent on that trade to some extent, and any sudden shift, such as the import ban, is going to cause disruption and dislocation.

And the market knows how to deal with disruption and dislocation: by pricing.

In 2021, Russia exported over 7,000,000 b/d in crude oil and petroleum products to the world. This is a massive amount, and there is no easy and ready replacement for that much production. The world depends on this oil to a large extent.

But US imports from Russia (672,000 b/d) accounted for less than 10% of Russian exports and less than 8% of US imports. And given the size of US oil production and US exports, the industry overall can handle the shift.

But Europe took about 60% of Russia’s exports and is largely dependent on Russian oil. China took about 20%.

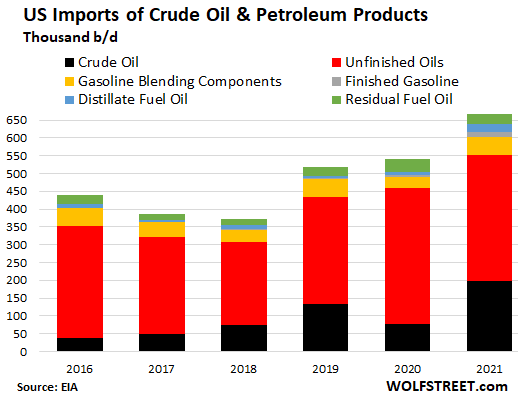

US Imports from Russia, by Category

Of the 672,000 b/d in total imports, 199,000 b/d were crude oil, according to EIA data. The rest were petroleum products, with unfinished oils accounting for over half (354,000 b/d), followed by gasoline blending components (50,000 b/d):

Where do imports of Russian crude oil and products go:

In terms of energy, the US is divided in five Petroleum Administration for Defense Districts (PADDs). The share of Russian imports are roughly:

- Ports along the Gulf Coast (PADD 3): 55%

- Ports along the East Coast (PADD 1): 25%

- Ports along the West Coast (PADD 5): 20%

The Gulf Coast is where about half of the US petrochemical industry is located.

Some specific refiners are much more exposed to Russian products than others. According to RBN Energy, this is how much to top four buyers of Russia product took in 2021:

- Valero Energy: 220,000 b/d

- ExxonMobil: 87,000 b/d

- Marathon Petroleum: 48,000 b/d

- PBF Energy: 45,000 b/d

The import ban will give companies involved in the oil trade with Russia – such as these refiners – 45 days to wind down their contracts with Russian energy suppliers. Figuring that something like this might be coming, US companies have already started to prepare for the shift to other suppliers, domestic and foreign. And pricing will sort it out. And some of it will show up – or has already shown up in anticipation – at the gas pump.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“ Figuring that something like this might be coming, US companies have already started to prepare for the shift to other suppliers, domestic and foreign. And pricing will sort it out”

It always does…

While prices can impact a budget, my concern is more about availability vs price…

Down here in hurricane country, I’m amazed by the tv gas price porn of the prices and the on the street reaction to prices…

Back in Hurricane Irma days, these same people were paying more than today without blinking an eye…

Always a good conspiracist, I think the tv crews in Cali gave the gas station owner $50 to change the sign to $8 so their camera could capture it…

Excellent comment.

Well said

Oil down 12% so far today.

Some dormant wells must have been turned back on.

Excellent post with nothing but revisionist history and false statements.

It is so good that you didn’t even get the date of the Crimea invasion right. It happened in 2014 not 2012.

Even Snopes calls your point about the removal of sanctions in 2017 mostly false as it applied only to CONSUMER goods.

The rest is nothing more than total BS and spin.

They will do 0.25% rate “hike”. Then print few extra $Trillions the following months, before they start emergency rate cuts again.

They all got PhDs, you know.

Cannot agree more. I guess we are screwed. Fed probably knows that it will crash the stock market in 3 to 4 rate hikes of 0.25%, way before it can dent the inflation running at 15% (when including housing and oil and rents). So it just wants to delay the inevitable hyperinflation that has already started!

This is about crude oil and petroleum products, no?

POWELLINFLATION RABBLE RABBLE RABBLE

Yes Wolf, its about crude. However people are really in pain with inflation and higher crude WILL cause even higher inflation, hence this conjugation.

Your blogs about speculation will not help control prices when fed and government are printing trillions. The only way to stop hyperinflation now is Fed dumping assets or price and consumption control through Central bank digital currency, The former will fix economy after tremendous pain, the latter will kill American productivity and make us poorer or weaker but the pot will boil slowly and the frog wont jump out. Guess which path the “Government” will take.

Not to worry Wolf; to conserve energy consumption, the 55 mile per hour national speed limit will be reimposed along with odd and even lic.plate ending numbers and matching calendar days for fuel ups and EV recharging at the local stop and rob to keep the lines down, just like the ’70s. In lieu of deporting 30 million illegal energy consuming aliens back to Mexico and where ever, Mexico will become the 51st state with two new senators, but a reapportioned house of representatives to the chagrin of California, Texas, New York, and expatriates currently living the good life cheaply in the new American oil state of Mexico.

Don,

Hahahaha, I missed all that. I went to high school in Tulsa, Oklahoma, during that time of the first oil embargo. The place was BOOMING. There were no gas lines. Construction everywhere. Money was knee-deep in the streets. Tulsa called itself the “Oil Capital of the World.” Roughnecks bought boats and houses and the nicest trucks and spread the money around. Corporate headquarters of oil-and-gas firms went up like mushrooms.

Oil booms are magnificent. At the time, I had no idea what the people on the East Coast were moaning and groaning about. What gas lines?

The oil boom didn’t last long enough, but then there was another oil boom in Oklahoma (with the 2nd oil embargo), and that one blew up too (mid-1980s), and then the oil industry moved from Tulsa, Bartlesville (Phillips), and Ponca City (Conoco) to Houston and a two-decade depression set in while the US was booming in other parts. Life is not fair. Tulsa has been a sad place ever since.

WE need another PPP for the People.

A “PPPPP”: . People Patriotic Petrolium Purchase Plan

There is no reason why the FED can ‘t send each American a $100 check (credit), per week, to handle this pain caused by the Soviets.

The $100 can be direct deposited into anybody’s account who has a Credit Card, Debit Card, or Food “Stamp” Card.

No need for Banks or Checks. It is as easy as a Digital Account at the FED, and something we can build on.

For those who don’t have the above style of Credit Card, your drivers license (proof you NEED gas!!!!) can serve as identification for any bank to Issue a “FED PPPP Card”.

In time, everybody will have the Patriotic, PPPP card. In time, the FED can send credits to those who need it. Paying for your Section8 housing. Your iPhone, Good ol Food assistance, Child Day Care, Medical payments….and this will provide for dignified privacy since nobody needs to know how much assistance you are getting.

A deserving person can be credited what they deserve. Those who are domestic terrorists will be denied credit. Total Privacy. Excellent idea.

And this ID can not be demanded for proof of Identity for any voting event. That would be mean and nasty and insulting.

Every American gets $100 per week, initially. Equally. Then, to assure Equity, those in “need”, will get more. Those from disadvantage zip codes, select jobs, protected classes, etc., can of course receive more to make up for past denials and social mistakes during 1492 to 1965.

Don’t laugh nor think I’m way off. This is coming.

Good one MA,,, and I for one do NOT thing you are ”way off” in time or in benefits DUE to WE the PEONs who have been holding this economy together, so far,,, with our ”heroic efforts” to spend spend spend,,, and then spend some more, no matter our budget.

After all, as our paid political puppet politicians of each and every stripe have made damn sure WE know this is the right thing to do by doing THEIR best to spend spend spend other peoples money!!!

Everything is theoretically “on the table” for public policy, until the USD exchange rate starts falling off of a cliff. The DXY is about 98 today and the pain point is somewhere below 70.

At that point, everyone else will be “thrown under the bus” to save the Empire.

everyone else will be “thrown under the bus” to save the Empire.

correct

The Round Table led British people to WW1 and WW2, and after glorious victories –empire closed shop. British people enjoying more socialism now, than ever before WW1.

Dignified privacy? What about generically decent privacy? Also, equal privacy, don’t forget equality. All people are created equal. Peoplekind – our leader up north was mocked for that one, but isn’t that right? It’s not just about man and men anymore.

But back to the post and your comment, the finance. Expense? Cost? In the SOTU he said he had an idea – he was going to control costs. It’s amazing how he can have such a brilliant and unique idea. But I suppose that’s why he’s POTUS, and I’m not.

great- if limited to below median income percentiles.

Just wondering how old that pic is. There is .80 difference in each of the grades by me.

From what I understand, most of the fracking can’t just start right back up once it’s shut down. Not to mention most of those sites already pumped the easy stuff out of the ground. Buckle up friends…

Taken on March 6. I just went by there, and prices are still the same.

$6 is like the sound barrier. They’re scared of crossing it, it seems. And then suddenly, they’ll cross it all three of them together.

Meanwhile, in the UK, its the equivalent of over $9 a gallon

uk here too. Considering people here are still driving their kids less than .5 mile to drop their kids of at school it obviously still isn’t expensive enough.

The UK has house price “growth”, time for some petrol price “growth”, no?

Here in LA parents have no choice. The kid can’t walk two blocks because the road is six lanes of 45 mph 6 ton trucks and SUVs.

Why are people fixated on the price of Gas?

Are they “low information” voters and don’t see the far bigger picture of life?

Get permission to look in the cupboard, or pantry, or refrigerator of most home. Look at the mass of non-foods not needed, and in fact make you sick. Add up how much was spent on this junk. That is where your money is going.

The price of Gas is insignificant. Your attitude is significant.

Why not be fixated on how much Coke is sold for?. The price of Oreo cookies? The price of Potato Chips? Why gas?

Because it is easy and somebody evil is linked to this evil stuff. We are still blaming Rockefeller for stopping the waste and LOWERING the price. Sure he went on to be one of the 7-9 founders of the FED and IncomeTax system, etc. but there was never a oil shortage during his time.

Today we blame the evil Arabs and Russians. Hey, we buy it. All of us can cut back. All of us could easily cut back with our driving techniques, planning the trip, combining trips, etc. etc.

Oh, someone mentions that I was “Rich”. I am not. I am upper middle class by Income. I fall in the lower part of the “Top 5%”. I am land rich due to buying vacant housing lots since 1977 with my dad. I sell what I need to pay the property taxes, but keep adding to the lots. Been doing this for 50 years when my Dad educated me about how and why “cheap” suburban land, in FL. was going to vanish with all the EPA and Zoning, etc. One used to clear-cut the land and dredge the swamps, etc and build boring flat lots that look liked the Gaza stip. You could buy them for $2,000. Direct access to the Gulf of Mexico were about $15,000 back then while today they are at $1Million+

Norway $13 a gallon.

In the UK the gallon is the imperial gallon which is 20% bigger than the US gallon.

But doesn’t UK have, in most areas, good enough public transport that many folks don’t require cars?

UK has never had really great public transport like on the continent. However due to privatisation, and lack of interest from successive governments, public transport is now antiquated and/or ridiculously expensive, especially if you live outside London.

Wolf,

$6.399 in San Luis Obispo, CA today.

Ouch!

$4.59 for regular is the highest price I’ve seen so far here in the Swamp. What a bargain! I burned nearly a whole tank going to the Trucker’s Rally in Hagerstown Maryland.

Good article Wolf. Pricing is absolutely how these inefficiencies will be resolved. Russia will get less for its oil because fewer nations want to buy it right now… and those who don’t want to buy it from Russia will have to pay more to get it from the other oil producers. We are fortunate in the U.S. that we don’t get much from Russia… but Europe has a real problem on their hands…

IF (and only IF) they follow our lead.

Nope, guaranteed nations are already cutting backroom deals to get that rusky oil. Israel and several euro countries have probably already done so.

Exactly.

It’s Business. Not personal.

If any Nation, or People for that matter, had any dignity, we would not even have these problems

That is exactly the point. Israel and anyone else isn’t paying “market prices” for Russian oil… why bother when they can go to “the market” and pay those prices? Russia will have to sell its oil to WILLING buyers and it will have to discount it to do so. China and India are the most likely beneficiaries since they are large enough to replace Europe.

Which means that OPEC oil will go to Europe and the U.S. instead (for a premium since it is no longer competing with Russian oil).

Like I said… this is all going to boil down to pricing to account for each and every inefficiency. This is going to take a decade to unravel… by which time Putin and the rest of the decision makers will be gone.

Silly thought but with Europe dragging on sanctions for Russian petro and prices continuing to go up for crude, doesnt this basicly neglect the US intent to inflict pain with sanctions on Russia? I suppose if we were a larger user it would be different…. who is losing here?

On one hand you hear Oxy CEO Vicki Hollub say that the US Oil Industry is in dire straits with the Permian Basin wells getting on in age and supply chain issues/labor shortages impacting the ability to expand capacity.

But on the other hand (as Wolf pointed out in a past article), no one wants to upset that $120/bbl apple cart at this point by expanding output too significantly. My guess is we’ll see oil hit $150-200/bbl and then settle down toward $100 over time.

Sad fact is gasoline & diesel won’t be coming back down to earth anytime soon!

Oil prices always trade in fairly narrow ($20 to $40 price ) bands for decades at a time. Any significant price spikes outside of those bands are short lived. Oil is not going to $150 or $175 or $200 or ridiculously $300 anytime soon, nor likely to do so for a long time to come. What we are seeing however is more the result of significant under investment by all the majors for sometime, who have done stock buy backs like so many other industries who are hollowing out their futures, rather than investing properly in E&P or R&D respectively.

The cause of under investment may be that the predicted price level was to low. Note that the amount of oil possible to recover is very dependent of the price of oil.

Do not forget shareholder activism toward ESG and the green movement trounced the ability of many companies to invest in future oil products…

Possibly the ESG alarm clock just went off and “woke” them up…

In wells already dug?

No. In these they can lift much more, but why should they?

Restraints, of any type, decrease production and this increases prices.

If all the fields were open, how low could the price go?

“In wells already dug?”

Wells are not “dug”.

They are drilled. Some are even fracced or plugged and abandoned, but they are not “dug”.

It’s all about EROEI. Corn ethanol? For every unit of energy you put into growing, harvesting, refining and transporting corn ethanol, you get about 1.3 units of energy out. Tar sands in Alberta? About 5:1, then carried down the Keystone to export cuz we can’t refine it. When it approaches 1:1, M. King Hubbert’s prediction will come true, and we all go over Seneca’s Cliff, 50+/- years after he predicted it

Hey Wolf are there any other blogs you recommend? I visit yours daily and recommend it to anyone who has a passing interest in these things.

I was curious what, if any, blogs you frequent for various other data. Hell, doesn’t even have to be financial if it’s a nice little escape from the mania.

I frequent the data, not the blogs that write about the data. That’s my job, and it’s a dirty job, but I do it so you don’t have to do it :-]

YES you do WR!!! And even though you add SOME opinionating,,, yours is usually fair and mostly moderate especially compared with SO many others.

Exactly why I read here first, the articles and usually ALL the commentariat, and contribute as much as the ”budget” allows!!!

Wish WE the PEONs had your kind of reporting of, ”the facts and just the facts” in regards to all subjects instead of the constant blathering of the bloggers and others who frequently appear to have NO CLUE how badly they are mangling the data.

Thanks again for your work.

I’m saving up for you for doing it for me :-]

Thanks Wolf.

Best on the net.

Thanks from me too WR

oilprice.com is pretty strong/accessible for newbies to energy issues.

Would second this. It’s the Houston Chronicle site dedicated to oil and gas, with the articles written by professional energy journalists, not random bloggers.

So the average american cuts back a bit, demand falls, problem solved…

The average American? Cutting back? That’s a good one.

Whenever I read this type of sentiment, I always assume the author is writing about someone else cutting back, not them.

AF,

I don’t know…most Wolfstreet readers are fairly hacked off at 20 years of ZIRP (presumably because they are inclined to save/conserve) while ZIRP is the greasy lubricant used by DC pimps to “quantitatively ease” their myopic political supporters (at the expense of the saving/conserving class).

As these things go, my guess is that the average Wolfstreet’er is less likely to be into blind, orgiastic consumption.

ABSOLUTELY TRUE !!!

LK,

I hear you, but it is at least good to know that shifting from 15 mpg SUVs/trucks to long available 45 mpg hybrids would in practice mitigate a lot of US oil consumption issues pretty quickly.

When the SUV/truck addicted get wrung out enough by high gas prices/played out enough at the orgy of their own short-sightedness, there is at least a physical alternative (as there has been for 22 yrs).

It would be interesting if Wolf ran a poll on basic questions of saving vs consuming. Do we have a savings account? Debt to assets ratio? Do we have indirect stocks via 401k? Day traders? Crypto traders?

What is wrong with a SUV/Truck?

It is a “free economy”, still, and you…yes, YOU….have a choice.

Others have a choice. That is what bothers the Karens and Tobys.

Leave others alone to spend their money their way.

It is called Pro Choice.

Its this kind of “logic” in your post that shows many people have what is commonly called “heads up their a**.

So first of all how are people going to switch to hybrids pretty quickly?

Are there enough hybrids in the market to buy?

Do the people have the funds to be able to buy a hybrid when they are having trouble paying the cost of the gasoline?

Would they even be able to sell their current SUV or truck for a price that would allow them to switch to a hybrid?

Would the additional savings of switching from a SUV even with its high running costs to a hybrid make it worthwhile.

You see in real life these questions must be answered before jumping to conclusion such as in your post.

Ask Jimmy Carter how that pitch flies

That was then LC,,, this is now::!!

While comparing POTUS characters then and now might be amusing for some,,, it is clearly NOT relevant for anything else, especially the economic issues, as WR has pointed out followed by several of the commentariat on here.

And BTW, though always an independent who does not favor or vote either ”party” and wish they would go away sooner rather than later,,, IMHO, Carter was NOT really any kind of ”politician” as per LBJ et alia of that time,,, and paid dearly for it from start to finish of his time as POTUS.

OTOH,,, Carter is probably THE BEST ”former” POTUS USA has ever seen, so far.

Certainly appears EXTREMELY good in light of recent examples of all stripes…

Well it takes all types, but then putting Carter at the top of your list greatly diminishes your character.

Carter has to have been one of the worst Presidents of all time.

Dwight D. Eisenhower has to be put miles ahead of Carter and ahead of many, many others.

Carter was the best. The ONLY scientist prez ever. I know he was good because he pissed my lobbyist uncle and pals off…”What’s a GD Scientist doing in the White House?”

“For a successful technology, reality must take precedence over public relations, for nature cannot be fooled”

-Richard Feynman

Few manager/lawyer/political/financial/PR types know who he is and did….probably few here, too.

I have read that most of the gas we use in Oregon and Washington comes from a refinery in Cherry Point Washington that was built to handle crude oil from the North Slope of Alaska. But in recent years the flow of oil down through the Alaska pipeline has dropped in half, and a large part of that reduced volume was backfilled from Russia. So I expect that soon we will rivaling or beating the folks in California for gas prices.

You probably heard a misconception. Lack of demand=low price to supplier, that is capitalism, suppliers need revenue. Low price, supplier’s cut cost=low production, that’s what was coming from the pipeline you refer to. Oil producers have to pay to pump, irregardless of their selling price, so why pump more when the price they sell for is low.

Source please.

Perhaps you could provide some detail because I doubt it. What percent, according to you, comes from Russia?

Seneca’s Cliff,

I just checked earlier today: California, which also relied on dwindling Alaskan crude, doesn’t import much if any Russian product. Russian product is not in the top 10.

It has been alleged many times that our high price of gasoline is the result of collusion by the major refiners in the state. Every governor promises an investigation, and then poof, nothing.

Oil hitting the US West Coast is overwhelming heavy sour crude from Alaska, California and South America. The west coast refiners are built to handle this crude, but can more optimally run with some blending of a lighter, sweeter crude. Russian lite crude via the trans Siberian pipeline is one the few light crudes available to the west coast. The amount imported is low because the Russian oil is needed for blending purposes

scott,

“Oil hitting the US West Coast is overwhelming heavy sour crude from Alaska, California and South America.”

In terms of California, in 2021: the state produced 28.9% of its refinery inputs, imports from Alaska dwindled to 14.9% of refinery inputs, and imports from foreign sources rose to 56.2%.

Of that 56.2% from foreign sources:

49.4% from Saudi Arabia, Iraq, Brunei, Nigeria, and Angola

40.8% from Latin America (Ecuador, Colombia, Mexico, and Brazil)

9.7% from other.

Saw on CNBC: 3% from Russia.

Canada 61%, Mexico 10%, Saudi 6%, and Colombia 3%.

I thought the Saudi provided 99% of the dino honey to USA 🤷🏻♂️

I predict the next run up on commodity are the bags of fertilizer that Putin shat in

Percent of WHAT???? Percent of imports? percent of consumption? percent of consumption plus exports combined???

A percentage of the proportional fraction of.

Arrived at through an extensive process of advanced deduction, informed by careful narrative selection, that facilitates advancing to the original discussion position.

Imported crude oil = dino honey. AKA the dark cocaine, coca cola’s other flavor, manna from the first testament god.

Good points as always Wolf. It’s hard to separate the import/export of different types of crude & the products that it creates. Bottom-line is we are net exporter of ‘crude’ and ‘products’ (just barely).

https://kimray.com/training/types-crude-oil-heavy-vs-light-sweet-vs-sour-and-tan-count

With Joe in love with Iran, you can be certain the Saudis will not be making

up the difference.

I read they would not even take his call…

Saw that too this morning d,,, and thought, ”Why would a ”Crown Prince” want to take a call from a ”Clown Prince”???

With the possibility both of those P words might be spelled somewhat differently,,, LOL

Go ahead and ”moderate” WR,,, but only after you get a laugh out of it, eh

Quit poppin’ yur P’s and out with it man! Are you calling them a “Pair of Ponce’s” or just playing with your pronunciations.

Maybe someone called them and offered them something better, in two years time, after Biden loses his reelection over high gas prices?

I have been waiting for someone to break this down into easily understandable charts and graphs. I can ALWAYS count of Wolf to give me critical info at the right time!! Thank you Wolf!

Yes! The trouble is, Wolfs charts are so pretty, a lot of people pass on reading the article! I actually limit the view to a paragraph and a chart, before revealing the next grouping!

Here in the UK we don’t import that much from Russia but the bit we do is difficult to replace. I’m talking especially about diesel. It appears 18% of our diesel comes from Russia, which explains why the pump prices for diesel have exploded. The rest we can almost produce ourselves or cadge a bit from someone else. On the natural gas side, we have never bought that much from Russia, we produce a good deal of our own and import the rest from from Norway and the USA. It will be interesting to see where this extra oil (and gas) comes from.

Good points.

How does the currency exchange work if they export to Europe? Are they still paid in dollars? If not, where will Russia get dollars from?

The ruble has already lost more than 50% of its value since their invasion started, and it’s dropping daily. And today, Fitch downgraded Russia’s rating into the junk territory, to ‘C’ from ‘B’. Fitch says that a default is imminent as sanctions and trade restrictions have undermined its willingness to service debt.

It may be worth noting that another large oil producer also saw it’s rating collapse to ‘C’, which is still its rating. It happened because, according to the Financial Times, like Russia today, it also once tried to move its economy away from dollars and more toward China. But they failed.

In fact, their socialist leader even threw in the towel, and said on TV in 2019:

“This process which they call dollarisation can be useful for the recovery and for unleashing the country’s productive forces and for the functioning of the economy,” he said. “It is an escape valve. Thank God it exists.”

Russia borders China which makes it more feasible than the country I infer you have in mind. The distances are a factor, but necessity is a big motivator.

China will presumably use the situation to their advantage but won’t sit around and let the Russian economy collapse, not if they can prevent it.

They may not openly and publicly buy Russian oil, but it’s a given they will do it.

They know they are the next target.

Absolutely agree – if Russia will collapse under US pressure, then China is guaranteed to be the next target of US financial sanctions. So I expect to see China doing all it could to prop up Russia, and China could do quite a bit, both to support Russia and to hurt United States.

Correct, for starters, they can stockpile oil and other commodities to make it unavailable to anyone who has a dispute with them. They have stockpiled commodities in the past and can easily afford to do more.

Interesting, does the US have that much of an economic influence on China that would not also be detrimental to the US?

They may do so indeed AF,,, but IMHO today’s situation is analogous to the situation for ”GREAT BRITAIN” when India and Egypt left.

IOWs, it seems very likely USA will end up, as did England, holding on to the very ”dregs” of their colonial empire, which continues for England.

And even though USA does not now and never did have the same relationship with our ”empire”,,, in fact, we do have many similar such relations.

The sooner the better to let go of all such ”colonial type” relationships and get back to taking better,,, much better care of our home lands IMO.

One part of oil import/export from the USA that do not show here and may be interesting. How is the balance in import of plastics, fertilizer and other bulk products made from oil and gas?

Over half- >354 thousand of the > 672 thousand according to the article.

Another Wolf article describing data that has interesting insights about macroeconomic reality. For me, this evoked thoughts of how oil is ingrained in the basic genetics of American culture and economics.

It reminds me of a seminal book describing the history of oil in the United States: “The Prize: The Epic Quest for Oil, Money & Power” by Daniel Yergin.

Today I sat pressed intensely backward into the seat of my sister’s Tesla, as she accelerated to demonstrate. It seemed to have more smoother stronger Gs than I remember my old buddy showing off to me riding in his Ford Cobra ICE (manual gear shift halts the increase in Gs).

So although I’ve viewed the Tesla fan-people as awkwardly cultish, it makes me suspect that the big oil culture is headed toward retro-history.

Still, I regret selling my coal stock just before the latest energy surge.

This debacle will likely stretch out the 0 fossil fuel emissions time variable with new “emergency data”

that sheds light on the

unsettled predictions of near term “end o the world” scare tactics.

“Unsettled” by Koonin is a

a good data driven book showing this research.

Freely let the people decide?

Will governments, and those Billionaire Families who own the governments, let the people decide?

Will these same people free up the economics of the EV-vs-ICE to determine the true costs, or will they continue to lie?

I think, as we dwell on where the Oil is coming from, we need to dwell on where the Electricity is coming from.

Also, we may be trading foreign control over our lives due to Oil, for foreign control over our lives due to Nickel, Copper, Titanium, Wheat, Aluminum, Palladium, Crop fertilizer, etc. Perhaps an incredibly stupid move?

We have all the oil, natural gas, uranium, tidal, thermal, hydro-power, and coal to be completely “free” of those who hate us. But, perhaps, we are insane. Putin wants Europe. The Saudi Family wants to exterminate Israel.

We want “green energy”. There is no such thing. We are insane. Our enemies are not.

We need to fully and honestly discuss this.

“ Today I sat pressed intensely backward into the seat of my sister’s Tesla, as she accelerated to demonstrate”

Reminds me of the ride at Cedar Point called Top Thrill Dragster, 0 to 120 in under 4 seconds. Yeah, pretty cool what electricity can do to a car. Or an F150.

Oil is a non-renewable resource, it should be expensive.

For myself, it doesn’t impact me much, I don’t own a car (taxis and uber are plentiful where I live). My electricity is powered by domestic natural gas, solar, wind, and Hydro – insulated from Russia gas spike. Now that there is a war in central Europe, airlines are going bankrupt, flights are all discounted, travel is cheap.

Calculate cost of ownership for EV with oil North of $100. America is a wealthy superpower, they’ll just print more money. The revolution is here baby!

I only put 2,300 miles on my Subaru last year. This gas spike will not affect me. Worst case, I can use public transportation.

Business use is also tax deductable.

LOL, Swamp you have a Subaru in Florida?

I also agree that I put extremely low mileage on my vehicle as well, probably about as many as Swamp did.

I can’t help but wonder whether if the government’s response to COVID was at least in part to destroy demand for OPEC products…

The cost of living for almost everything is downstream from energy costs. No one will escape the effects but some can profit from it anyway.

You would be surprised. I am currently working on an offshore oil project in the GOM, and our subsea engineers are finding that many old wells are refilling with product. We are currently working to reinstate and tie back old wells.

We are held back by overbearing USCG requirements for mariners, and certain government policy, but most importantly the labour market. The “good old boys” have put a sour taste in the mouths of the younger generation, and many are not coming back. These are good paying 6 figure jobs that no one will take due to the unrelenting BS of working for an offshore oil company.

Vessel day rates are increasing at a blistering pace, and all newer OSV’s are getting pulled out of cold stack. While there are delays, there are quite a few drillships heading back to the gulf to begin drilling. However these projects take years, not weeks.

Alberta heavy crude is constrained by pipeline bottlenecks more than lack of reserves.

Oil is not a finite resource that is only dwindling, and saying otherwise is ignorant, anti-science drivel. Oil is simply not all from old fossils like boomers were taught in school. Drillers now routinely completely tap out wells then come back a few years later and find more oil. Did a bunch of old fossilized dinosaurs and fauna suddenly appear there? No.

Please stop spouting outdated info, it helps no one.

Factually, oil is finite. Wells and basins can and do run dry, or dry to at least a point where practical production becomes impossible. And there’s a finite number of wells possible. I know this basic factual information about oil production, despite being so very far from an expert on the subject matter.

Conventionally drilled horizontal oil wells only (typically) recovers about 20% of the reservoir of oil available. This is one reason why horizontal drilling has been able to “reach” “stranded” oil in old reservoirs.

Also, over time in old, conventional reservoirs, stranded oil MAY migrate into an older area of previously recovered oil. This does not happen in all oil reservoirs due to differences in geologic formations.

Chim,

Damn!

Here is a good place to start learning learn about fossil fuels, respect for geological time, and also the evidence for the first life on earth, possibly as early as 3.5 BILLION years ago.

It is also for the people just babbling away about fossil fuel in the comments below, who should all know better.

Nothing on a ball in space is INFINITE….in fact it’s just a math concept. (maybe we do pick up a little something from meteorites now and then……)

https://en.wikipedia.org/wiki/Kerogen

I have plenty of Federal Reserve Notes.

The price of oil has no impact on me.

See, each of us has taken personal steps, freely, to live our lives, mutually, with each other, as each of us, practicing CHOICE, express diversity and multi economic and cultural expression.

I am wowed with this tolerance expressed by us all. This is the dream of the 60’s. To “drop out” as each of us wanted. To “do our own thing”.

Congratulations, everyone.

All crude oil is not the same to refiners. Russian crude is a heavy crude, which some refineries are designed to incorporate into their feedstock, especially along the gulf. some in a large proportion. They are not designed to run light crudes. We used to import quite a bit from Venezuela. That’s why we all of a sudden are trying to make nice with them.

Great article!

It would be interesting useful to see some breakdown of how professional portfolio managers view the oil stocks, and how that’s evolving. Percent of portfolio invested in Oil/gas industry, compared to market capitalization ratios v. Market.

I suspect that:

A) Portfolio managers have been underweighted of late, and

B) There is some significant “window-dressing” occurring now

My sense is that there have been several waves since 1970 when portfolios were over- or under- weighted on the industry.

So China gets Russian oil & gas at a discount while the West pays the premium prices?

Excellent analysis by Wolf, which can be a good start for trying to understand the complexities of the energy markets.

So many additional factors go into this equation. For example the political push for “green” energy has caused most of the oil and MLP’s to cut back on cap ex, reduce debt. buy back stock because they are running much larger free cash flow. A boon to stockholders today but dangerous for the future when that cap ex will be missed.

Another example, generally each refinery is built or optimized to produce certain products from certain grade of oil ( light sweet, heavy sour, etc. ). A refinery cannot just switch from one to another in short term, so it must plan ahead to obtain the desired grade. Cap ex projects to substantially modify production are measured in years not months or weeks.

An excellent site is “ourfiniteworld” with author Gail Tverberg. Evolved from the old “oil drum”. Covers energy issues in depth with excellent comments. Another is “oilprice”. Both .com sites.

A brief visit to one of those sites might educate Chim above. But I think that person is willfully delusional on the matter of infinite oil supply.

Peak oil has not played out the way many of the peak oil supply pessimists, such as Matt Simmons, thought it would have by now. But many people seem to need to believe we will have what we have now, this world we know and love so much, we will continue to have, for many decades or even centuries to come. As in – just fix a few things, and it will be fine.

Yes, the advent of horizontal drilling and figuring out how to get oil out of hard shale deposits has changed the game. RIP Matt.

Good sites, thanks Robert!

Reading some of the comments here expressing the sentiments that this oil price spike will not really affect them because (1) they don’t drive too much (2) their electricity use doesn’t come from oil (3) they live in a place (probably city) where they have access to public transportation or uber, etc.

I think we are missing the bigger picture of the importance of cheap and readily available form of energy is to our entire structure of modern society. For one thing, we need to realize how important oil and its products is to our food production. When oil prices continue to increase all aspect of society will be affected, and especially if you live in a crowded city. (1) food production (2) food and goods distribution (3) all byproducts of oil/petroleum.

I think unless one lives on a farm that has the ability to provide food (vegetables, fruits and meats) and able to produce these things without buying much from the outside world, and has reliable solar power and heating sources (fire wood for example), then he doesn’t have to worry about the incoming crisis.

Having a Tesla is good right now, but it won’t carry anybody through when gas prices hits $10 or more a gallon. Because it’s not just whether we can continue to drive around living our lives, but it’s the question whether food and things we need can be delivered to us at an affordable price.

You must wonder how the spike in oil will affect our burgeoning trade deficits.

For now, in terms of barrels, the US exports more crude oil and petroleum products than it imports. Both export prices and import prices are rising. And in dollar terms, they will push up both the value of imports and exports. So overall, it should not have a big impact on the value of the trade deficit (exports minus imports).

Unless I am reading the EIA wrong…we consume about 8 million b/d more than we produce.

eia.gov

Yes, you’re massively comparing apples and oranges. The EIA says no such thing. See my comment below with figures.

That must be why your guys are in Venezuela now.

To sell them some oil.

Franz Beckenbauer,

Hahahaha, that’s hilarious. No, just kidding about this being hilarious. But we sell our hydrocarbons to you people in Germany.

“products” is the key term

A discussion of CRUDE OIL must separate the two.

How will this spike affect the junk bond market? Are credit spreads starting to widen?

According to the EIA

we consume 20.6 million barrels a day and produce 12 million barrels a day. (2022 projection)

The mantra is that we were a net exporter under Trump, the numbers dont support that.

I suspect, for logistical reasons, we did some exporting, but “net” is not accurate unless someone can point to other data.

“In September 2019, the United States exported 89,000 barrels per day (b/d) more petroleum (crude oil and petroleum products) than it imported, the first month this has happened since monthly records began in 1973.” …” a decrease in U.S. crude oil imports from an average of 9 million b/d in 2009 to 7.0 million b/d in 2019 “. So in Trump’s last year, even though for one month we were a net exporter, for 2019 we still imported on average 7 million a day.

For 2020 consumption was 18 million b/d vs production of 11.28 b/d.

The most frightening moment was when the light weight Energy Sec was asked ….

“How can we increase domestic production?” She laughed in a manner suggesting that notion is diametrically opposite to her proscribed political duties.

She was also asked “What is our daily oil consumption/production” and did not have an answer, dumbstruck.

“… consume 20.6 million barrels a day and produce 12 million barrels a day. (2022 projection)”

That’s massively apples and oranges. Your first figure includes crude oil, petroleum products, natural gas liquids (ethane, butane, etc.), renewable fuels (biodiesel), alcohols blended into gasoline, etc. But the second figure is only crude oil production. Not even in the same ballpark.

To try to get closer to an apples to apples comparison. From the EIA:

Production of petroleum and other liquids, in 2021:

Field production: 16.58 MMb/d

Renewable Fuels & Oxygenate Plant Net Production: 1.13 MMb/d

= 18.64 MMb/d total product supplied from domestic production

Stock change: -0.53 MMb/d

Imports: 8.47 MMb/d

Exports: 8.63 MMb/d

Consumption, roughly:

Refinery and blender net inputs: 17.69 MMb/d

“apples and oranges.”

True enough

speaking of CRUDE

But EIA shows on their website data 2021 CRUDE production at 11.18 million barrels a day

CRUDE net imports 3.13 million barrels a day

and this was cut from the EIA website

““In September 2019, the United States exported 89,000 barrels per day (b/d) more petroleum (crude oil and petroleum products) than it imported, the first month this has happened since monthly records began in 1973.” …” one month

You can start here:

https://www.eia.gov/dnav/pet/pet_sum_snd_a_ep00_mbblpd_a_cur.htm

That is curious.

https://www.eia.gov/outlooks/steo/data/browser/#/?v=9

shows production at 11.18 for 2021

your link shows 16.58 production 2021….same site

READ the headline of the chart you linked: CRUDE OIL PRODUCTION. CRUDE OIL

Repeat after me: CRUDE OIL.

A fracked well produces a large variety of liquids and gases, of which CRUDE OIL is just one of them. How many times do I need to repeat this and cite the EIA and give you links, and you still refuse to study this and understand this, and instead you’re dogging me with your refusal to learn and to look and to read.

You need to spend some time studying this before you comment on hydrocarbons again.

Here is crude oil and other liquids production, 16.6 MMb/d in 2021:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MTTFPUS2&f=M

What most people fail to understand is that prices are set by marginal supply and demand, not total supply and demand. For goods such as petroleum, both short-term supply and demand are inelastic. Thus small changes in the quantity supplied results in large price changes.

Speaking of ‘missing the bigger picture’:

Fracking = degradation of groundwaters and its’ natural flows + increases in earthquake activity.

Oil may be the ‘life’ blood of economies but water is…life.

When I was reading some oil well drilling logs from 1920 at the North Westbrook Unit of Chevron’s at Big Spring, Texas back a few years ago when I was working in the oilfield, there were handwritten notes as to the fraccing pressures used to break the formation. The fraccing operation in oil production is not new, although it has been greatly improved over the last 100 years.

Without oil zone penetration by force, we would have very little oil production. Gone are the days when oil wells were under so much gas pressure that just entering the formation brought up oil.

The problem is not how the USA will deal with elimination of Russian oil imports; the problem is how Europe can ween itself off Russian oil. Continued funding of Putin’s Stalinist wars can only lead to WW 3. Canada is building a pipeline to the Pacific (sorry, wrong ocean). 2.5 million barrels per day is shipped to European countries, including Germany, Italy, the Netherlands, Poland, Finland, Lithuania, Greece, Romania and Bulgaria.

Ideas anyone?

Ideas?

Nuclear for Electrical production

Nuclear for Coal-to-Gas synthesis.

Put Telsa and his Techs to research the use of Nuclear by-products.

Clean coal

There’s a lot of conflicting information about oil supplies out there, but the one constant bit of “information” throughout my lifetime has been that we only have 20 years worth of oil left. So, I assume that, 20 years from now, we’ll only have another 20 years until we run out.

Yes, I’ve always said, somewhat tongue in cheek, that we’re going to run out of clean air to breathe before we’ll run out of oil to burn :-]

But it will be a little too hot to breathe in most places before it’s “unclean”.

And it’s kind of a moot point as many other things will go to heck first.

Hope you allow the link below, this is about fossil fuel, and Kerogen is not only used as proof of first life, but the beginning of ALL fossil fuel.

Well sure…the peak oil pessimists that made a name for themselves 15 or 30 years back, guys like like Matt Simmons – have been proven wrong. The sky is falling, the sky is falling! Alas one day Chicken Little proves right. Nobody can know when though.

Because we really don’t know the source of oil.

I would love to take the time to calculate how many barrels of oil we can get from each Dinosaur.

We know the average size and we can approximate how much oil we can get from the guts and soft tissue. We can even duplicate the rotting process and purification using Elephants. We may be able to estimate how many actually lived. But, we would have to assume the vast majority that died ended up as Dino food, and not potential Texas Tea.

Then, with PV = nRT, we can figure out how much Pressure and Temperature it takes to turn this biomass into hydrocarbon chains (where we are only re-arranging the existing organic matter….which is all hydrocarbon chains to begin with)

Because, were there enough Barneys to produce the BILLIONS of barrels of oil we burn every singe day, for 365 days for over 100 years? Were there Billions of Barneys?

Really?

Also, why is the deeper the well, the lighter and sweeter the oil? Deeper you go, the more pure. Perhaps the deeper we drill, the closer to the source? But the problem is, Tectonic Plate data and Carboniferous Plant grown studies put the oil reservoirs way beneath the Barneys, who are also in the wrong place……………….

Something is wrong.

Thanks for reminding me just how much I thoroughly despised studying thermodynamics.

Nevertheless, that was funny.

Old whaling data could have

some good animal/oil info.

FYI oil is abiotic

… the first oil that made people rich was whale oil. Of course you can try the same proportions from a long dead black oil two recently killed whale-

Blubber yielded 50–80 percent oil by weight, bones 10–70 percent, and meat 2–8 percent.

prevailing theory is oil is not dinosaurs but squashed transformed sea algae, many oil bearing formations have microfossils mostly dinoflagellates. Most of the largest oil deposits are in areas where shallow warm seas were. Hence the salt caps and salt domes as oil catching geologies, the salt domes and salt field are the remains of dried up seas.

Coal is ancient trees before fungi appeared there was not many things to rot trees so they became covered and embedded and became coal (carboniferous period) once fungi appeared the trees then rot instead.

“Something is wrong.”

Yes, your entire post and premise.

You need to go to school and get a degree in math along with one in geology.

Geez, the trash that gets posted here.

I thoroughly enjoyed that random sampling of scientific piecemeal babbling IGNORANCE.

Maybe you will all forgive me for not knowing investing?

In Matt’s book, Twilight in the Desert (2005), he predicted $100/bbl oil, although he was off on Ghawar field decline and peak oil worldwide. But, then again, the Saudi’s do not publish their proven reserves and most of their fields are in waterflood recovery.

Wolf,

Thank you for consistent, high quality, easy to understand graphs. You never seem to play games sometimes seen in graphs posted by some sites, such as y-axis distortions that can escape detection and lead to erroneous conclusions.

A lot of analysts are predicting $5/gallon national average gas soon.

A combination of crude price and winter to summer formulation changes – with summer formulations being slightly more expensive inherently and the switchover always tricky in balancing remaining stocks vs. new supply.

So $6 gasoline average in California is by no means out of the picture – and maybe we’ll see $10/gallon gas in the Beverly Hills Mobil station.

A lot of analysts are predicting $5/gallon national average gas soon.

Maybe. But demand destruction may short circuit a $5 price. Remember the old energy truism ” A cure for high oil prices is high oil prices’ as it stimulates supply through conservation and production eventually.

Russia doesn’t have the oil to sell anyway. The Russian energy sector has been in decline for decades, the Russian economy is a kleptocracy. Then at each turn more sanctions were applied: esp US drilling technology. Very likely the entire Ukraine war was started to cover up the failure. NG deliveries to Europe in the Gazprom line were flowing backwards. Listening to Yergin, who rationalizes Russia’s dropoff in deliveries, fails to note years of mismanagement and corruption which have taken their toll. The nature of their insular regime, in 1989 no one knew their system was about to collapse.

How oil will be transacted in the future might be the bigger picture. Trade will not be hindered in the long run by a reserve currency. Oil is too important to all the economies of the World.

Excellent article.

I read about three dozen websites every day and wondered why an article like this one was not found elsewhere. Seems like an important subject.

Putin just said oil is going to $300/gallon!

Talking his book? Wishful thinking? Dreaming? Trying to avert a state default? What might his reasons be for saying this? Think hard! When a hedge fund says something like this, what do you think???

I don’t believe oil will get anywhere near $200/barrel. We’ll be in a major recession well before then. All the money being sucked out of the economy to pay for basic transportation is money that can’t be spent elsewhere. Add in Fed tightening and we are heading for Stagflation.

The only exception I noticed is Condo sales here are going through the roof. We’re back to the pandemic levels of 7 days a week 18 hour workdays just to keep up with the workload. Nearly all the sales are in two and four unit buildings that have been renovated and are unoccupied. Condos are the only housing that is affordable right now.

Condos are the 21st century mobile home. I remember paying 10K for a single wide in the 70s. That would be about $15 a sq ft. Formaldehyde in the walls of course.

Bye bye cheap energy! Fracking is expensive and the oil ring goes down quickly!

If economy grow the energy problem fall down us.

Sorry by my english

Best four you!