Shorted to hedge rising output and on a bet the rally in nickel at the time would fade in 2022. Then came the sanctions.

By Wolf Richter for WOLF STREET.

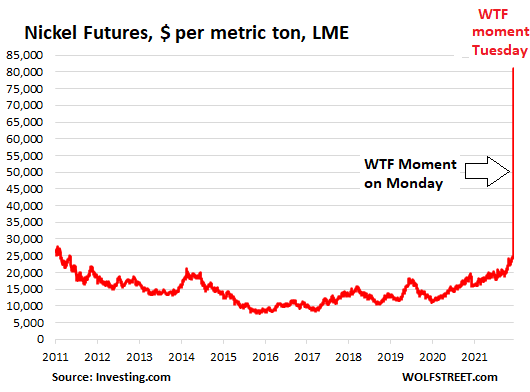

The price of nickel futures that had spiked by 73% on Monday at the London Metals Exchange in a short squeeze whose squeezed party hadn’t been identified at the time spiked by another 100% on Tuesday intraday on the LME to over $100,000 per metric ton, when the LME halted trading at a price of $81,051.

Now details emerged as to who got short-squeezed: Chinese tycoon Xiang Guangda, chairman and founder of the world’s largest nickel producer, closely-held Tsingshan Holding Group, according to Bloomberg. Xiang, forced by margin calls from his company’s broker in China, closed out part of the short position in nickel futures, and this is the result:

Tsingshan’s short position on the LME is in the range of 100,000 metric tons of nickel, sources told Bloomberg. And it could be even larger when positions taken through intermediaries are taken into account, sources told Bloomberg separately.

Xiang began building the short position late last year to hedge rising output, and because he thought the rally in nickel prices – they’d surged over 60% from mid-2020 to about $20,000 by late 2021 – would fade this year. Instead, the sanctions against Russia, a big nickel producer, caused prices to skyrocket further.

Xiang is now considering whether to exit the short position altogether, Blomberg’s sources said. To exit the short position, he would have to buy back nickel futures at these crazy prices.

At the most extreme price, the daily losses would have exceeded $2 billion on Monday, on top of the losses incurred since he started accumulating the short position.

“There is so far no indication that the loss would impact Tsingshan’s ability to operate, people familiar with the matter said,” according to Bloomberg.

The LME asks brokers – in this case a unit of a huge state-owned Chinese bank – to deposit cash for their clients’ short positions when prices rise. The broker then passes the margin call to its client, in this case Tsingshan Holding, which has to come up with the cash.

“Tsingshan itself has been struggling to pay margin calls to its brokers, according to people familiar with the situation. It’s been under growing pressure to meet the payments in recent days,” according to Bloomberg.

The LME gave the Chinese broker some extra time on Monday to collect the margin call from its client, and those payments have now been made, according to Bloomberg.

The short squeeze was further exacerbated, according to traders cited by Bloomberg, by the influence of an unidentified stockpiler who controlled between 50% and 80% of nickel warehouse warrants monitored by the LME as of February. According to Bloomberg’s sources, Anglo-Swiss commodity trading and mining giant Glencore was the dominant holder of nickel in recent months.

With prices of all kinds of commodities going haywire like this, there will likely be more chaos and sudden mega-losses in all directions.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

There is so much interconnected business going on behind the scenes.. Is it likely that these commodity swings will set off a chain reaction of financial explosions in the vein of 2008? Or is it still too early to tell?

If this drags on through March, it’s a foregone conclusion that grain prices are going to spike, due to reduced fertilizer from Ukraine & Russia. High oil prices followed by spiking food prices in aren’t a positive sign for how this ends.

when food really gets short you will know because the USA and Brazil will stop putting over %30 of their corn into ethanol

In a sane world, you are correct.

Unfortunately, we don’t live in one so I would not count on it.

There are those who have no limit to the sacrifice they are willing to incur at someone else’s expense.

The agricultural lobbies are too powerful. It’s a big club,and we’re not in it.

The new push is for huge soybean crush plants & producing biodiesel from the operations.

Bunge and Chevron just put a deal together for Bunge’s plants in Louisiana Illinois where Bunge plans to have a combined capacity of 7,000 tons per day by the end of 2024.

ADM is building a huge plant in Casselton, North Dakota. The ND legislature is wrangling over tax breaks and incentives in a meeting today. A fifteen year tax break is on the table.

Yeah, grow soybeans to fuel up the Class 8 trucks rolling down the Interstate. That seems like a smart move, eh?

Sorry, Louisiana and Illinois.

Well, Dan, all those trucks are needed to carry ethanol to the gasoline and diesel product distribution terminals for gasoline blending. Remember, all ethanol has to be trucked in tank trucks because it’s too corrosive to move by pipeline.

There are entire states that rely on growing corn to process and simply burn……farming and especially farmland soil decay and costs (WATER) plus fertilizers. ROE is 1:1. And these people damn FDR for his WPA and other projects.

Try running for office and pointing out the obvious in these corn growing states.

SICK, very SICK….but what’s new? They bulldozed new homes by the hundreds in Victorville and dumped hundreds (if not thousands) new Honda 600’s in the ocean. Lots of people would gladly buy both now.

This is “free market” behavior? Good business practice? SICK.

They voted for a Russian invasion of Ukraine? Or is this just a canned speech that you make (and post) more or less at random?

By this logic, conservative voters really voted for 9-11.

Putin had to start preparing to invade Ukraine a long time ago.

In the terms of old EOD specialists,this is known as sympathetic detonation. Lots of that lately both literally & figuratively.

Maybe too early poor,,, but maybe just the beginning of the unraveling of the now HUGE international commodity market and SO much more out there in the ”ghost paper” reputed to be now well over 600 TRILLION USD,,, and the latter with not one bit of transparency or any oversight by any ”regulator”,,, etc., etc.

While some, perhaps many, of WE the PEONs who would LOVE TO INVEST in the stock market(s) and other clearly regulated markets,,, at least SOME of us know about the existence of these ghosts,,,

And at least some of us can figure out the likely repercussions on all the regulated markets, as has recently been shown by one such going down.

WE are indeed living in interesting times.

I am reading online that one of the Wisdom Tree funds that was triple shorted on nickel has been wiped out.

WisdomTree Terminates Triple Leveraged Nickel Product …

18 hours ago — WisdomTree Investments announced on Wednesday the Nickel 3x Daily Short exchange-traded commodity (ticker 3NIS) has been wiped out due to the …

“. . . a chain reaction of financial explosions in the vein of 2008?”

The economy has been on life support for years, and it looks permanent:

The ‘good’ news is that just about any catastrophe can be papered over if you have access to the infinite credit needed to avoid Schumpeterian creative destruction at scale. The 2008 crash was never actually resolved, and never will be, and neither will the next one. As to how much road is left to keep kicking the can, one never knows. Does one?

When sentiment changes the Greatest Bubble of All Time (GBOAT) will come to an end.

However, there is no pre-determined limit to manic psychology and no advance trigger event or supposed black swan.

Biden just banned oil imports from Russia. Wonder how this will play out for other Russian-based resources?

From what I’m seeing, Russia may implement their own export ban (raw materials and commodities).

So this means inflation is transitory, right Mr Powell?

I must be getting old because I cannot remember… aren’t there differences between commodity futures and stock futures contracts? Something about having to take delivery? Or about executing them throughout the time period versus at the end?

“I must be getting old because I cannot remember…”

Welcome to MY world.

To quote: “Zzzzzz . . .”

SpencerG = It depends on which commodity futures can be delivered on. Some are cash settled against a cash index, many are deliverable. I was always reminded to not carry a futures position past first notice day when you enter the delivery period.

Thank you Charlie. I traded stock options for a bit in the 90s but never commodity futures.

Even though most commodity futures are deliverable very few of them are actually delivered. I believe it’s as low as 5%. Most contracts are rolled or offset.

Diamond hands Xiang, diamond hands.

🤣

– In the early days (first 2 years) of the 1940-50 commodity supercycle rise, the S&P dropped from about 260 to 135

– 1970 to 1980 commodity supercycle rise, S&P dropped from about 780 tp 360 over first 2 years

– 1999 to 2009 commodity supercycle rise, the S&P dropped from about 2450 to 1280 over first 2 years

With today’s systemic leverage levels, one might expect an S&P drop of at least 50%

The question seems to be: are we at the start of a new commodity supercycle?

I think we have about 25% downtrend until we bottom out as we enter the coming recessionary/stagflation period later this year.

Unemployment Rate is at next to an all time low ~3.9% and the 10yr-2yr at ~0.24% rate has almost inverted. These two indicators have proceeded all recessions. The big issue this time is that thew Fed funds rate is at zero and they are jawboning about raising it into a recession. The real question is will they go negative rates when the market craters and employment jumps as they head into the midterms?

I don’t think they let rates go negative unless we tip into a major recession, letting them sell their balance sheet for a profit versus a loss.

That comment caught me off guard. Wolf if very clear that he believes the FED will never allow the rate to go negative. But, what if they drop into negative rates was compensated to the banks behind the scenes and equities rallied like never before. It could be a double secret handshake kind of deal.

So never say never. Plus this is the most reckless FED ever, right?

Negative rates on USD would be another reason for foreigners to abandon it as global reserve currency.

It’s one thing for those who live in the US to use a simultaneously negative yielding and depreciating currency because it’s their currency of reference and only option,

Anyone based outside the US would be nuts to hold it.

I haven’t looked at a long-term chart of the S&P 500 in a long time but your data is off.

The S&P never reached your range in your fist two examples and only the lower range in 1999-2009.

In the latter, it reached about 1550 in both March 2000 and October 2007. That was the peak of the decade.

I’m not sure what index you are using, because it could not have been the DJIA either

Given the level of systemic leverage today, the ultimate decline should exceed 90%, depending upon definition of cycle.

There is the bull market from the last five minutes, days, weeks, years….

This is the greatest asset and debt mania ever. Much bigger and more widespread than any which preceded it.

The actual fundamentals vary depending upon location but in the US and Europe are actually mediocre to awful, much worse than say, on the eve of the Great Depression at the 1929 market peak.

Oops ( a big oops)

Meant to say “real S&P dropped,” i.e. adjusted for inflation.

Info seen in Stifel Market Commentary/Strategy dated 2/27/22 – charts on p. 5

And the fed hasn’t even started raising rates. How does that figure into your super cycle predictions?

Someone got busted over the head with a bag of nickles. Pow! 💰💥

War is bad for business, unless, of course it’s good for business.

The Rules of Acquisition are very clear about this.

Who says you can’t have it both ways?

When I worked for Anaconda (Copper and brass manufacturing plants), war years were the best years! But once the wars were over, it was back to losing money on water tube, strip and wire.

So if I got this straight, Corporation X can say deposit $50 of your cash before we pump the gas and we’ll refund what’s left if any, but this motherf*cker is accomodated with shutting down the market until he gets a “Pay Now!” notice while sitting on the toilet in the morning because they couldn’t interupt his chow mein mealtime. Sounds like someone else got the fortune cookie that reads “You’re Screwed!!”. Wonder if he also has a stake in the company that makes those?

What?

Well……grandpa…….you worked your entire life…….put in tons of extra hours……..very thrifty……..never spent much on yourself……..saved a good amount of cash……invested wisely……..

I’ve never tried it but the Friskies brand might be the better choice.

Be sure and thank all the globalists at the polls.

Well……grandma…….you worked your entire life…….put in tons of extra hours……..very thrifty……..never spent much on yourself……..saved a good amount of cash……invested wisely……..

I’ve never tried it but the Friskies brand might be the better choice.

Be sure and thank all the globalists at the polls.

So isn’t now the time to short nickel?

I’m going long on dimes.

For the nickel, not the silver, what a world…

Their short was worth a plugged nickel.

That’s some margin call.

So if the tycoon was short he was hedging his production and he lost billions on paper which are offset by the profits he makes selling his product.

Ambrose Bierce,

Read the second part of the sentence in the article:

Xiang began building the short position late last year to hedge rising output, and because he thought the rally in nickel prices – they’d surged over 60% from mid-2020 to about $20,000 by late 2021 – would fade this year.

The only problem I see for him, is that the price is high and demand is probably low, and no way he can sell enough at spot to cover his short losses. Wonder what the BE price was when he entered the contract. He left a lot of money on the table. Dumping that short is what drives the price higher. Not sure why he was on margin?

Never trade on margin. He should have known that.

AB – Speaking from experience in the agricultural business, most all hedge their production that they have in hand meaning they sell futures to cover their production before the physical commodity is sold. I imagine it works the same in the metals market. The next stage of the transaction occurs when the business then sells that physical production, then either buys back that futures sale contract or exchanges (swap futures) with buyer of said commodity at an agreed upon price usually within the trading range that day.

Also, businesses sometimes will sell futures out ahead in the deferred futures contracts before the physical commodity is even produced. Question then becomes how far out do you hedge (sell futures) without having the physical commodity in hand (not yet produced) but not sold. That can get dicey. If the market moves higher each day, that generates a margin call against that short position, then the business ponies up the money to the broker each day that happens to guarantee his position. If the market reverses lower, then he gets money put back into his futures account that day. If the market locks “limit up”, the short cannot get out of his position. If the market screams higher again, then buyers of the physical back away from the market creating “no bid”. You better have a good relationship with your banker to handle any and all margin calls. The worst thing to happen is if the banker forces liquidation of the short and refuses to provide any more money to meet margin calls, especially if said commodity has yet to be produced, or was over-estimated on what they thought they’d produce (that’s called speculation – selling more than what you have or estimate to have down the road).

I have been in on million dollar a day margin calls and they are no fun, but we made money. Lost in futures on one side of the ledger but made money in the cash sale. Why, because we already had the physical commodity (and a good banker). Why is this done? Most are “basis” traders and trade the spread between cash and futures.

Charlie – thanks for that explantion. Matt Levine from Bloomberg covered the same story and mentioned that commodity producers could end up net short and get margin calls, I didn’t understand how that could happen (they MAKE the stuff – how could they be short?) – you filled in the gaps.

To me, the producers and consumers are the reason that futures exist – give each side some predictability. True speculation is when you have no intent of delivering the contract. But now I see, a producer could end up contracting to sell stuff they can’t produce.

LOL. My holdings of old Canadian “nickels” are up over 340%.

Finding a buyer for my stash, however, might be difficult.

I rue the day I protested getting that Canadian nickel in change from the cashier and requesting a real American one.

It really says it all about the debasement of fiat versus commodities.

They had to make fiat coins out of metal, so they used a cheap one and made it small so the real value of the metal was far less than the “value” written on the token, to capture the seigniorage.

But then they debased fiat so much the value of the metal in the coin came to exceed the face value.

They outdid themselves.

“Stable prices” and “Moderate long-term interest rates” have left the building.

Jim Grant has a good observation that goes something like this: That which seems impossible often happens in financial markets.

The LME does not operate in the way that you think.’Trading on a margin’ is not the same as a daily margin call whereby the brokers (who are the counterparty) require the short to pony up the difference in value between the cost to close the short sale based on yesterdays prices and todays prices.

The margin calls happen daily as a matter of routine. That way, the naked short can only go bust for one days change in market value rather that the whole accumulated loss.

it is called ‘marking to market’.

‘hedging’ is something else entirely whereby the losses on any short paper position on the LME are offset by a corresponding increase in value of the actual, physical metal. The problem normally happens when an assumed ‘hedge’ is discovered to be a speculative short position… ‘he who sells what isn’t hisn’t, buys it back or goes to prison. -anonymous LME saying

LME cancelled the trades, I believe.

I wonder what increases in the ‘Hobo’ Nickle market .. if there be one, might gain from all this crazy??

I’m talkin REAL Hobos – Not some gaseous etf junk!

Wish I owned a few of those …

You’re describing a niche segment with no scale within a relatively illiquid market which isn’t much of a market at all. The price isn’t connected to Nickel bullion.

The only actually liquid collectible coinage are “generics”, mostly US: better grade more common Morgan and Peace dollars along pre-1933 gold.

Some other US and a very low minority of non-US coinage is somewhat liquid (a lot easier to sell since COVID) but that’s a function of affluence and “good times”. It’s contingent on the mania for its “investment” prospects.

Wheat is not as crazy as nickel, but like all commodities in this environment, the Ukraine war is changing buy/sell relationships and disrupting just in time inventory management. In wheat’s example, we are dealing with a tight supply/demand balance sheet. This is measured several ways, but an easy one is the days supply of a food staple based on current demand.

Right now, the world has 129 days supply of wheat with a few production problems showing up in major wheat producing areas. If you pull China’s supply and demand out of the picture, the rest of the world has 78 days supply of wheat. Narrowing down a little further, the 7 major wheat exporters have 50 days supply of wheat.

USDA puts out these numbers each month and will release another update Wednesday Mar 9. You may not agree with their numbers, but they can be like a bad ref call in a basketball game. You may not agree with it, but it is official (click on the chart to enlarge):

Thank you Charlie! Great data.

I can’t believe how much China plays a factor in wheat

You are witnessing now huge blunders from the US and Britain to a certain extent, in the materials and Energy sectors that will have untold implications for the US economic recovery “ if there was any” .

The interconnected and fluidity of the global economy is facing great challenges ever since the “stupidity viruses” have been unleashed on the unwitting “ predominantly western populations “.

These challenges will be now exacerbated by the imposition of huge pressures on various sectors and companies in the west.

This will ultimately be a great opportunity for those waiting in dark corridors to ascend to the for and pounce on the dollar’ hegemony.

For the average American citizen , this will spill disasters of great proportions.

This is very sad to witness, it gives me No consolation that the repetitive warnings that various commentators have voiced in the last two years that epidemics lead to wars fell on deaf ears.

It will be all “Scheisse” from here on.

Congratulations to you Wolf… this article just made it into the Google NEWS section instead of just the ALL section.

WisdomTree Nickel 3x Daily Short exchange-traded commodity fund went to zero today.

Anyone using a 3X narrowly focused short ETF was eventually going to go to zero if they stayed in it long enough.

Three sigma on the entire stock market usually is around 50% which to me means any 2X or 3X product involving equities will wipe you out if you stay in long enough.

London metals exchange. Purpose. Discuss.

The LME story is going to be huge – either a huge problem or a huge coverup, or both…

According to sources that know better than I do:

1) LME owned by the Hong Kong Stock Exchange

2) Tsingshan Holding Group facing Margin calls

3) CCBI (China Construction bank) is the broker

Chinese Gov’t controlled corporations may be involved in steering the resolution. London is just a location not an indication of ownership or, apparently, legal jurisdiction.