Another stock gets added to my Imploded Stocks column.

By Wolf Richter for WOLF STREET.

Shares of Lyft got shookalacked in afterhours trading today after the company reported Q1 earnings – another huge loss, this time $197 million, bringing the total loss over the past five years to $7.1 billion, which takes a lot of doing for a taxi enterprise to be losing such piles of money.

Shares started plunging as the executives were discussing their outlook, and by the time they got done jabbering, the stock [LYFT] had plunged 26% to $22.85, back into the neighborhood of the March 2020 low, and down 74% from the high, which was the artificially hyped fake share price right out the gate on the first day of trading in March 29, 2019. And so now, Lyft has earned itself a place on my rapidly growing list of Imploded Stocks (data via YCharts).

This mess comes a week after Lyft had restated its 2021 results. In the April 29 filing with the SEC, Lyft said that an “accounting error” had occurred in its reporting for 2021, with the result that the loss was understated, and the actual loss for the year was increased to $1.06 billion.

The first day of trading was a classic hype-and-hoopla operation, staged by Wall Street firms to pull a bag over investors’ heads, or at least allow them to think that there would be a greater fool out there that they could sell those misbegotten shares to. But the company has by now lost $7.1 billion and continues to lose piles of money, and continues to thackamuffle its investors.

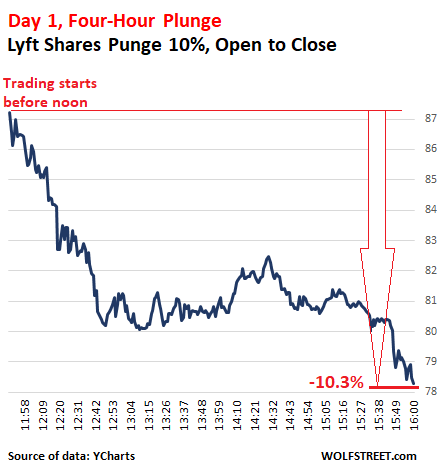

The hype-and-hoopla at the IPO on March 29, 2019, was huge, and the stock didn’t start trading until noon, but it didn’t last long. Just about instantly, the shares began to tank, dropping 10% during the first day, actually just during the first four hours, the beginning of an epic long hard decline that now amounts to 74%.

This is the chart I used on March 29, 2019 to depict the first day of trading:

During the call with analysts today, executives saw revenues for Q2 that were shy of the expectations, and they saw an “adjusted EBITDA” – a homemade metric of positive cashflow when in fact the company is losing a ton of money – of $10-$20 million when Wall Street analysts were expecting on average $83 million of “adjusted EBITDA.”

Lyft said all the wrong things. The number of riders it said it had during the quarter fell short of expectations and worse, they were down from Q4. And to attract and retain drivers, it paid out heavily on driver incentives, and worse, it said that it would pay out even more for driver incentives.

Like Uber, Lyft operates a taxi enterprise that cannot make money under GAAP and wasn’t designed to make money under GAAP but was designed to bamboozle investors with revenue growth and homemade metrics – and now it turns out, even those have been falling short.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It seems as though most retail traders aren’t sitting in on these earnings calls so when a drop like this occurs it seems as though the MM’s collectively decide “sell it all” now.

Bad news for years seemed to do little to prices, I don’t mean like pandemic bad news, more like “we don’t make money and don’t know how” bad news. Now all of a sudden huge dumps are the norm after warnings where as that never mattered in the last.. 10 years?

Anywho, I get a few emails a day from Zillow notifying me of price drops. Haven’t seen those in 18mo.

Something is very shifty lately with Zillow’s “Zestimates”.

In more than one city I’ve seen houses with estimated prices about 40-50% higher than what they actually sold for 3-4 years ago.

Come to Southwest Florida where the Zestimate is 100% of what the home sold for 12-18 months ago (and people are getting that price for now).

That sounds about right. Some markets are in a more insane bubble than others, and all markets are in an insane bubble. In case you’ve been asleep since 2020: think 20% YOY appreciation for two years.

Real estate is finally tanking in Canada with prices down 6.8 percent to 29 percent from the February peak this year. All the people who rode on the coattails of the Chinese could end up as roadkill. Major price drops in Markham and Richmond Hill. Townhouses down more than 20 percent from the February peak in those two cities.

They pay no dividends so there isn’t even a cushion on the way down. Only the folks with their heads in the sand are OK with the naked risk.

Until they open their statements.

I’ll bet Lyft’s executives are not losing money.

Puber and Gryft

The poor suckers that drive for them…

Fleet Management Numbers show that Net/Net

Most driver/contractor/sucker..

Ends up working for about 10-12 Dollars per hour after all expenses…

Most Drivers are not sophisticated..

They don’t “Run the Numbers”

They just run for a paycheck.. running to survive..

But sooner or later.. all the bills are due and the 2 year old car has 200K on it!!

They smell a rat and stop driving.. plus the gross reality of letting strangers into the back of your car all day to do .. whatever..

It only takes one or two pukers.. to give your car that “Fresh Puke Tang” even after a heavy clean…

Hence the need for more and more recruiting..

The last few times I rode.. a Taxi was cheaper!! – And the driver and service were better!!

I wonder if one can invest in Taxi Licenses??

Look what happened to taxi licenses in NYC. Bubbles burst sooner or later.

I agree @ taxi is cheaper. On my last ride, I decided to brave it and damn the consequences and the taxi came out 50% cheaper!

A taxi is great unless you’re in a city where there aren’t many of those, or cities where these pseudo-taxies have run the old companies out of business. In my metropolis, Uber and Lyft are basically it. A cab can take an hour to show up or not show up at all and never let you know they aren’t coming. I would NEVER drive others around, though, no matter how desperate I get. Even if Walmart was the only other employment option.

Uber and Lyft are like so many other corporations where they pretend to offer people a way to make a decent income only to suck off all the profit and leave the worker/self-employed with all the bills. Looking at you, eBay/Etsy/Poshmark/Amazon Marketplace and a dozen other companies

How any of these companies can lose money is a mystery.

Apps been built and is cheap to run.

Advertisements are near zero and staff wages minimal.

Drivers pay for the fuel / tires / services/ depreciation by use.

They pay for the insurance and the phones / Mobile connection fees.

I think they are asset stripping and moving takings around using dubious shell companies.

5 years and a burn of $7,500,000,000 for what? That is $1.5 billion a year ….. I am not stupid and there is something very fishy in the paperwork for P&L

The IRS should go right through these shifty companies

You are describing sentiment, as that’s all that keeps this company from reflecting its “true” value which should be exactly zero.

This is a mania stock only able to get financing due to the credit mania. In normal market conditions, this company either would not have obtained funding at all or would have been cut loose a long time ago.

Zillow lists 12 properties for sale in our area. If we go on Redfin there is over 112 listings. Our neighbor listed their house 2 weeks ago and it never did show up on Zillow. Sold 2 days after open house and had only 5 offers. It sold 50K over asking. The pool of buyers this time last year, on a house down the street, had 20 offers the first open house day and sold for 100K over asking price. The housing industry is shaking. Interesting times.

Hey Wolf, Love you Wolfisms! I hope your unique lexicon continues to grow. They are Wolfmazing!

The bloodletting in the stock-verse makes it seem as if a horde of axe wielding vikings passes through the NYSE trading floor quite regularly… Now Wolf, which stocks do you think can stand for a ‘Blood Eagle’? they seem a bit wimpish to me…

The principle of a hollow prize was immortalised by Dickens in the form of a Haversham Cake. A layer of icing with no real substance inside.

So many companies that you have identified, like Lyft, conform to this old idea.

But investors in them want it be otherwise and that wanting drives their investment decisions. That wanting, when subsequently frustrated, will generate resentment of anyone else that they can think of to blame for their own poor decisions. Their losses will hurt too much for them to own them.

If housing prices crash and foreclosures rise in significant numbers, the same will apply.

In situations like this it may be wise to be modest.

“In situations like this it may be wise to be modest.”

Which shows that it is best to learn humility BEFORE acquiring seven billion dollars worth of humiliation.

I am well and truly gobsmacked. And I am resisting the urge to wallow in Schadenfreude with very little success.

Extra points for the reference to Dickens, btw.

Love the Dickens reference

This also seems to be true of the housing market up here in Canada. Chants of “RE here never goes down” and “Get in while you can” have caused young people to over-bid for million dollar shoe boxes and forego due diligence measures such as inspections. Once the baby duck bubbly, gifted from the agent, goes still, the young couple starts to notice the shoddy construction.

A friend of mine, flabbergasted with exorbitant winter heating costs, tried to figure out why? A small hole cut into the drywall revealed that the insulation had been completely left out, no doubt forgotten in the wild dash to fix “supply issues”. He is now in a drawn-out legal battle with the developer.

To your point, it seems that many today are living in the Haversham Cake.

“A small hole cut into the drywall revealed that the insulation had been completely left out”

I’ve seen worse. I know of a developer who neglected to wire the electrical receptacles in a new government building. Shortly after completion the roof caved in. Fortunately the developer had political connections so there were no consequences.

Prices are tanking in Canada and will hit the freefall stage (July, August and September) if Tiff puts in two .5 percent interest rate hikes in June and July. I hope they let prices crater rather than giving up on interest rate increases and letting inflation spike.

Here’s the link:

https://www.canadianmortgagetrends.com/2022/05/the-latest-in-mortgage-news-gta-home-prices-down-22-from-february/

Momentum is great on the way up. Everyone is a genius.

Not so great on the way down……

Every “genius and their cats were distributing stock tips and advices, between bouts of self-aggrandization of their paper profits.

On the way down, we hear crickets.

You missed a headline opportunity Wolf: “Lyft goes Pfft”

LOL

Well

There is the Casino, Called Wall Street

Layers of Insiders make Bank..

With inside info and “Fees” for all their friends..

IPO’s first in, first out..

Then there are the Flocks…

Retail Investors to be Shorn a few times a year…

A Senior Executive at a Buyout Target said to me:

All the Senior Decision Makers in our Company have been

Given all sorts of Benefits and Gains that accrue, no matter what happens..

It they approve the Big Capital Buyout Deal..

How could anyone say NO?

We all know this deal will load the target co. with way too much debt and that the target co. is buying itself at a vastly inflated price, from it’s own debt..

But really..

Who can say no?

“When you drive interest rates down…all the way out….it FORCES investors to take bigger steps on the risk spectrum. Cheap money is the fuel for a financial speculator.” former Fed Gov Fisher

So, they “fueled” the stock speculator and FORCED the investor to take more risk, ie they skewed risk /return ratios and PE considerations….they messed with reality, ….. and the Fed viewed that as success. Is that what the Fed is there to accomplish? The great pump, the markets that soared, the people who got the first whisper…. did very well.

(source of quote: “The Power of the Fed” PBS, 8:30 mark of video)

I have often said that Fuckedcompany.com (Google it) needs to be revived. However, Wolf’s Imploded Stocks serves as a better version, chronicling the effect of gravity on the stock prices of insolvent companies.

Fuckedcompany.com – Aren’t they the makers of Fukitol? I take 1000 mg/day.

Man, I forgot all about f-c-.com! Thanks for the reminder.

Pud said he is friends with too many tech execs now to run the site again. Also he “lost” all of the old site data.

So if it returns, it will have to be someone else’s.

At the time I think he was making $75,000/month or more from the site. He sold subscriptions to the raw data of people reporting layoffs, then only published a fraction.

or

Lyft is Shyt

Wolf. Why do you believe they could never make money under GAAP? Thanks

They might some day, a little bit, after revenue growth stalls, and the cost cutters get serious, and the dump their expensive real estate, etc…. But they’re a huge company with $1 billion in quarterly revenues. What are they still waiting for? These are the best of times, and they can’t make money with these revenues?? You see, when this happens there is a structural problem.

The sad/maddening thing is there probably is a viable company buried within uber/lyft/etc – but its revenue scale is smaller so it gets ignored inside and outside of the companies.

While the unit economics of *single passenger* “ride share” (sharing with whom, the driver?) look intractably similar to the already existing taxi industry (albeit with fewer barriers to entry) – true “shared rides” (computer coordinating/routing/scheduling *multiple* passenger pickups/drop offs) would fundamentally improve unit economics for everybody.

True sharing (empowered by computing power) would lower per mile costs for all users – while increasing revenue per trip for drivers/companies.

This is the theoretical benefit of buses/mass transit – except those entities tend to devolve into political corruption and bureaucratic self-serving (creating hugely unnecessary costs and crippling services pointlessly).

True car “share” (2+ simultaneous passengers) would enter into the current void between taxi service (one passenger) and mass transit (huge system costs/waste and pointlessly poor frequency).

There is a decent size niche there – just nothing as falsely enormous as what Uber and Lyft promised.

You may be correct, but can it be done at a competitive price at any scale?

I have used Uber on occasion for short trips but not recently. Last time was pre-pandemic.

I can see it having viability in high density urban cores.

Not anywhere else at any meaningful scale. It’s still too expensive to provide drivers with adequate compensation, cover operating costs which are spiking, and leave much of anything left over as a profit while charging the passenger a fare they will regularly pay.

Users up to now have loved it because the cost has been subsidized by those losing money providing the funding.

They will love it a lot less at market price.

Agree completely. Taxi companies were already optimized to provide the lowest sustainable cost of transportation for a single passenger, and it’s not like drivers were being overpaid.

Augustus-

Uber and Lyft were actually getting into this business for a few years before the pandemic made it unacceptable to put multiple strangers in a car.

I used Uber pool and Lyft pool (forgot if that’s their brand name for it) for a few years before the pandemic, and it actually worked incredibly well. Drivers would pick up passengers, and drop them off, all along the way to your destination. Given enough customers and drivers, and a big enough computer to crunch all the possibilities and optimize ride schedules and routes in realtime, you could provide true ride sharing without inconveniencing people too much.

I personally found that, say for a 45 minute trip to the airport, using Uber Pool would increase the trip by 5-10 minutes, while the fare would be about half. That’s a true advantage that would revolutionize taxi operations.

Unfortunately for Uber and Lyft though, this is a pure software problem, and software solutions have a tendency to be copied (hence two companies, Uber and Lyft :-). There’s nothing stopping an actual taxi company from using the same algorithms to dispatch their taxis and implement a ride sharing service as well. Indeed, some forward-looking city government might mandate that all taxis in their city use one app for dispatch that then optimizes all taxi rides in this way. The reductions in traffic alone would be worth it in busy city downtowns like Manhattan and Chicago.

All these companies that are “not making money”… let’s not forget there are hundreds of employees making 100k+ a year, and tens making 1,000,000+ a year. kind of like “non-profits” – such a scam.

Yes, there’s that element. Investor-funded stimulus. That’s why housing in startup meccas like San Francisco and Silicon Valley gets hit when these high-income folks lose their jobs as their startups shed workers or shut down. This is very predictable and everyone around here knows this.

Both Lyft and Uber are nothing more than fancy taxi companies. Prior to these two, no taxi company ever made it to unicorn status, so what makes these two different?

The best take on the whole thing is by someone called Hubert Horan. Let me warn you though, it might take a full day or a week to get through his articles. But in them, he runs through the economics of Uber in great details and the reasons why the later will not ever be profitable.

They have a website.

And an app.

Don’t forget the pink mustache. It makes all the difference.

Uber & Lyft don’t have a fancy image, which is why other new services are taking their upscale customers. The stock prices reflects these upscale customers fleeing to new more secure companies in high margin cities. The other services provide company owned cars and full time employee drivers. A less transient more secure workforce.

When I drove a Yellow Cab in the late 1960 era in the city of angels, FIRST was a couple of days of paid training by the UNION during which I learned a TON, in spite of having been driving for over ten years.

Next was a thorough class in map reading — no GPS — and ”manners.”

Two experiences with the uberati have been sufficient for us never to call them again, with the first driver totally lost, the second ride over an hour late.

Nuff said: Pet has it right, once more.

“ The other services provide company owned cars and full time employee drivers. A less transient more secure workforce.”

People who operate every day at a higher standard of professional expectations willingly pay a premium for professional transportation services…

I would, too…

I would much rather ride with the professional, uniformed driver in an Escalade versus the green haired, tattooed and pierced chick in the Corolla…

“ When I drove a Yellow Cab in the late 1960 era in the city of angels…”

VVNV,

My friend,

You should seriously write a book…

Title it….. “There I was…”

Each chapter would be like ….

“ There I was… Los Angeles, 1966…”

shookalacked

thackamuffle

When are you releasing the WolfStreet dictionary 😀?

This is fine and proper Don Martin verbiage. Lyft shares will continue to go spladap.

When the concept gets funding for an IPO and so Lyft off 🤣🤣

Google just show just 3 or 4 hits for each word, and they’re either wolfstreet, or some other site that seems to have slightly rewritten Wolf’s text to pass it off as their own…

Anyone care to contribute a definition so that I can use them correctly in future?

Incorrect usage of those technical terms is part of the fun.

Meanwhile Warren Buffet just encouraged everyone to pour their hard earned money to the S&P in both good times and bad times.

Either way I expect a lot of Pikachu faces in a year or two.

Do you mean the wide eyed and stunned Pikachu face as opposed to the happy and content Pikachu face?

I think he was referring to the one with a bullet hole between the eyes… :)

Buffet tends to have very sound logic. If I understand him correctly he favors most people running a 90% sp500 and 10% cash portfolio. If you buy this portfolio every year for 30 years and then sell off 3% or 4% in retirement for 30 years you should do better than most people as the friction cost is so low and you are not giving up 1% per year to a financial advisor.

Last I saw index funds still outperform 80% plus of managers once you get out to long time horizons which is what investing is about.

Wall Street hates index funds and buy and hold stock picking because there is very little money to be made by a middleman. They love futures, options and derivative products because there is still money to be made there.

Death to bond funds – Long live bond funds!

The only way my debased Fed-bucks can earn that “to the moon” casino money over any considerable time is to take on absurd levels of risk. A whole generation has now been primed to expect casino action and flashing lights. Who in consumer capitalism counsels patience? Well, a durable guy as old as the hills. His luck included living and investing through an incredible (postwar) runup, but he bridged some screwy periods well. Nice to have that sort of running start though: lots of good sense in a time when it would be rewarded (best run of economic prosperity in human history). Now, who can say whether markets will behave this way, or have been given over to game-ification at all levels?

Very intelligent. This is a side that should be shared with savers and investors, especially young ones. But it’s not just being in front of prosperity that has driven that last decades of returns. It’s being in front of market altering FED and Government actions — i.e. 401K’s and the more obvious money creation.

They drove the herd.

His logic has never considered the financial circumstances of the majority of retail “investors”.

Even for someone who wants to follow his advice, life has a tendency of getting in the way, at the wrong time. Everyone isn’t worth $100B like he is or whatever the number is now.

It’s the same logic I have read in advocating individuals approach “investing” as an institutional buyer.

Institutions aren’t human beings. They don’t lose their jobs or have to pay the light bill. If one goes broke, it won’t have to work for the rest of your or my life and can’t become homeless.

What I am describing, the probability is a lot higher now than it has ever been, because the financial markets are in a mania with an economy of fake “growth” and a society with fake stability.

That’s what happened in 2008 with the GFC. Millions saw their portfolio crash, then they lost their job, and then they lost their home to foreclosure. All at once.

Doesn’t matter that it was a supposed “black swan” event. The goal of every individual if they perform proper risk management is to maintain or increase their living standards and quality of life.

This is entirely different than “beating the market”, outperforming some benchmark, or maximizing returns.

If anyone wants to do that great, but then they deserve to eat all the losses they incur at their own expense, not anyone else. This includes ending up destitute.

Spot on! All those breathless studies that show S&P returns over 40 years beating everything are correct *if you stay in the market*. But the average retail investor doesn’t. Even if he has nerves of steel, life gets in the way, especially in recessions when stocks are already down, and they’ll often sell at the worst of times to cover things like job loss, medical bills, etc.

When people study the *actual* returns of retail investors who invest in stocks (i.e. people who buy and sell as needed, pay taxes each time you sell, etc.) they find that the return is about the same as investing in a 30-year treasury bond. IOW, you can avoid all the heartache of the stock market and still get pretty much the same return if you buy a simple bond. And the marked reduction in volatility on that bond means you’re much more likely to stay invested during market downturns than you will be with stocks.

You are right. I personally had to cash out of the stock market about seven years ago when I got injured on active duty as a Reservist. I fell through a bunch of cracks in the system and haven’t really recovered financially yet.

Then again I have sort of come to realize that the stock market is a rigged game… the best companies get bought off by the hedge funds so the index funds are just indexes of the middling to poor companies.

I think Warren figured out that, in the long run, the Fed will make sure things turn out good for the financiers.

Remember Warren lent money to Goldman Sachs in 2008….

I suspect he knew the Treasury and Fed would save them….

and I suspect he knows the true motivation of the powers that be….to enrich a certain group…and he decided to be part of that group. Joining now might be a caution….

Warren is brilliant, but he is still a bankster.

He is the biggest single bankster – he literally underwrites the entire insurance industry as the “insurer of insurers”.

All of his brilliant stock picks are simply taking the ginormous float from these insurance operations (and now Geico too) and investing them in cash producing companies like one of the largest mobile home makers – that runs an effective loan sharking operation.

So kudos for him for being super good at what he does, but what he does is ultimately one of the major drivers of the FIRE economy: Finance, Insurance and Real Estate.

I am less sanguine about stocks going forward. We have just gone through a literally historic 2 decades of money printing – the stock market has gone up enormously, unsurprisingly.

Not the least bit clear to me that overall stock market performance will be positive for the next decade, much less meet/beat inflation.

Can we even call it “stock picking” when you benefit from privileged information and extremely advantageous contract terms that no one else get?

Perhaps his brilliance is not in “picking” stocks but in negotiating deals with extremely high yield-to-risk ratio. It’s similar to Apple getting special treatment from suppliers thanks to the amount of cash it can unleash and to the crazy volume of the order.

The biggest fallacy with Warren Buffett is that he is considered in investor, which in reality he is not. He is a hedge fund investor of the largest publicly traded hedge fund. When I throw money into a 401K plan or buy a few shares of stock, my investments aren’t going to move the market. His investments do move the market, so I don’t understand how he gets lauded as some type of investor when he really is running companies in the boardroom.

“Keep these great updates coming!

Have you glanced at the NNN real estate niche lately? Its ready to fall off the table since NNN investments are really long bonds in disguise. (And you know what long bonds are doing…….on the verge of a 1/2% boost by the fed tomorrow!”

A long time ago, in a faraway place, the board of a public company with results this poor would remove and replace the CEO.

However…the two founders run the company, AND they each have golden shares. Lyft has a tough management culture, everyone’s job is at risk every day…except for those two guys.

AND, of course both of them unloaded 99% of their shares in multiple rounds of secondary and at IPO.

They’ll probably get sweet gigs consulting for McKinsey.

LeClerc said: “golden shares” ……”unloaded 99% of their shares in multiple rounds of secondary and at IPO.”

————————————–

does one not negate the other? why are they still around?

“does one not negate the other? why are they still around?

Being at the top is an ego boost. And along with that are many perks and a huge salary and maybe some juicy stock options. It would be hard to leave the golden palace.

Wolf, could you share your thoughts on the Ruble being pegged to gold and commodities, and now plans about pegging Yuan to Gold as well? Is is possible the Fed must raise rates to defend the dollar in this situation to defend their fiat?

It is stunning how the Ruble has recovered all the losses since then.

Thanks

Defend the dollar? It’s at a two year high and crushing every other fiat out there. Ask the gold bugs if the dollar needs defending.

Yes, well it’s purchasing power has been crushed in its home country. The dollar has been getting toasted in terms of goods and services purchasing power.

John Apostolatos,

A verbal promise of a currency peg like this isn’t worth the paper it’s written on. It means nothing. It’s propaganda that some people just love to consume. So have fun with it.

Explain why the ruble is strengthening at the moment.

My uneducated explanation is that the Russians are wising up.

Selling your gas and getting back euro’s is like a free loan to the EU with negative interest rate. Or if paid in USD, a free loan for uncle Sam with an effective negative interest rate when you add the money printing and inflation to it.

Getting paid in Rubles or exchanging immediately for Rubles creates a surplus of Euro’s and shortage of Rubles and result in Ruble going up and Euro weakening.

Normally this would be a bad thing since it would curtail your exports but the population in general loves a stronger currency so they can buy more stuff from China. And it makes the guy looking out at Gumps at the other side of that red sqaure more popular.

And the funny thing is, from a trade balance perspective, the Russians are actually doing the right thing.

Nobody can buy Rubbles, so it doesn’t really matter what its tied to now does it?

“Nobody can buy Rubbles…”

Barney and Betty are not for sale at any price. Fred and Wilma, on the other hand, are complete whores.

We’re a long way from the days when a currency was just a name for a specific amount of gold.

Lyft gives a new meaning to the phrase “Getting taken for a Ride”.

After putting up loosing more brain cells watching the program dramatizing the creature that is Uber this is almost anticlimactic. 🤪🤡🤑

Thanks for this article Wolf-

Some perspective on how GAAP differs from “homemade EBITDA” would be helpful. Also some perspective on how ginned-up earnings numbers, so scorned AFTER the dot-com bust, wormed their way back into the IPO process.

Perhaps this issue would be a great dry-run for the new Disinformation Governance Board in their quest for “truth?”

To make your own EBITDA, you throw out the things that lose you money and keep the things that make you money.

Yes, just eliminate parentheses and negative signs on the income statement until someone reminds you of the error.

Earnings Based on Iffy Tricks and Dubious Accounting.

Around the dot-com boom and bust, I heard it as:

Earning Before I Tricked Dumb Auditors

Just wanted to offer ‘Borzorked’ for the Wolfstreet vocabulary. Origin is a part of Brooklyn you should probably not visit

We ordered a lyft yesterday morning at 6am, first driver blew us off, second wanted $150 after tip and tax. Round trip would be $250+

We drove to the airport $35 day parking for four days.

The lyft business model doesnt work, it was designed for driverless cars which is a long way off…

I think the key problem with a company like this is that the business doesn’t scale well. The costs per ride don’t go down much when they grow in size. So they burn tons of capital to “buy” a large market share, but this large size doesn’t translate into significant cost advantages. Despite of all the cash burn, they are not building a sustainable competitive advantage over their peers.

But I guess the founders will walk away with hundreds of millions of US$. Like that WeWork dude. Didn’t he walk away with $1 billion or so? Amazing how people fall for this kind of sht every time!

There was a pretty good discussion at the Berkshire Hathaway meeting about how the public invest markets have degenerated to such a gambling shtshow.

I blame the Fed as manias are historical fact of stock markets and the Fed pumping up the stock market with the wealth affect is going to be their biggest policy error since inception. The Fed created the mania, let’s see if they can stop a panic when it starts.

Blame 401K’s and other Government sponsored, lobbyist backed, tax deferred retirement and savings plans (cloverdale 429 college saving) plans as well.

Then encourage mass blind stock market investing, on a regular basis, Good for consistent support even in the face of gross overvaluation.

It’s a combination of government created moral hazard, financial intermediation moral hazard and manic public psychology. Moral hazard alone doesn’t create a mania. Government created moral hazard is a reflection of manic psychology, as public officials don’t live in a bubble world independent from everyone else. The FRB and other central banks have been infected with the same manic psychology.

Stupid business model,taxi,s were already in eWarren also stated he thought ,there will probably be a one world currency,grandpa is in the know

Insert PT Barnum quote here.

Panic arrives quickly, then trust builds slowly. Eventually trust is abused. Rinse and repeat.

Panic may happen quickly, but getting there has been a painfully slow process. This market should have been feared for years.

I don’t think it was ever disclosed after the lawsuits were settled how much Neuman walked away from WeWork with.

The losers of this game are on display. So much super-hyped disruption has turned out decimation.

Endless books were published cheerleading on Uber’s disruptions.

This counter-movement isn’t done yet. A few survivors, as always, will crawl from the wreckage. A bit of progress will be made.

Dance of Shiva and Vishnu, value destruction and creation.

There is no guarantee that any progress will be made at all because there is no guarantee that human living conditions are destined to rise “upward and onward” indefinitely. That’s the equivalent of a modern religious belief.

I’m going to guess that most people (in the US at least) believe in some kind of “Star Trek” type future. I’ll take the “under” on this outcome too.

The end of western cultural predominance will put an end to this belief, either mostly or entirely.

I’m placing my bets on the future global Islamic conquest, presumably after China has a run at the top.

There are signal moments when times change (at least, looking back on it). These often seem ludicrous in hindsight. There was the AOL-Time Warner merger fiasco on the eve of the dotcom crash.

There was also Enron’s deal with Blockbuster, supposedly to bring streaming video into homes. A closer look showed a stunt for attention and the whiff of high tech charisma, plastered over a woefully insufficient financial and technical infrastructure, to prop up stock values. (The execs were all running on stock options and the company was leveraged on its stock.)

Somebody (I can’t recall the source offhand) lately suggested Elon’s twitter deal might be such a moment. But I can’t say.

‘It’ is a casino. The idea ‘it’ will discern the true value of financial assets is pure con. Keynes observed that a casino atmosphere guarantees that capital formation is likely to be ‘ill done’. All is pure narrative. Pure storytelling that guarantees price fixing manipulated by brokers, banks and shareholder insiders. Only common sense, a modest understanding of bookkeeping and national finances can give honest guidance.

At the risk of seeming cruel, I still believe that investors who go in for firms which avoid GAAP deserve whatever happens to them.

There are reasons why there used to be laws against conveyance fraud and requirements for taxis to be licensed: because bad things happen when there aren’t.

Systematic financial exsanguination is fashionable these days. One must be careful.

I learned a new word today – exsanginate.

Thank you una.

Exsanguinate.

Damn spellcheck

You’re very welcome.

Xanthocroid is also a word. It could be used to describe an investor upon exsanguination.

I’m a show-off. Don’t encourage me.

Is GAAP sufficient?

Look at Amazon’s income boost due to the Rivian IPO.

You had better know GAAP rules, read financial footnotes, and hope you don’t get Enron’d (defrauded with Auditor complicity). Very few have the skill and patience to do all that. It takes a large portfolio to justify the time expenditure.

$7.1 billion ain’t what it used to be.

A year and a half trade schools cost about $30K, The gov might lyft

them by absorbing 30% – 50% of the cost.

Join a union do your apprenticeship,come out in end a trained journeyman ,with benefits and pension. No debt ,seems simple ,but you might have to work and get dirty. Flea

These clowns on CNBC, like Jim Cramer, never talk about the sorry balance sheets of these shithole companies like Lyft and Uber. Never mention how much short term and long term debt they have. Is that deliberate to hoodwick the audiance or are they so dumb they don’t know how to read a Corporate accounting report, or is the corporate accounting report a bunch of lies? Which is it?

Swamp: After watching Jon Stewart’s exchange with Jim Cramer several years ago where Cramer openly admitted how they could manipulate stock prices with rumors, I realized that CNBC and its pundits and guests are definitely not clowns – they are dishonest people participating in a glorified gambling den. The financial news they provide is just incidental.

Uber reported a loss of $5.93 billion in its first quarter. How could anyone recommend a buy.

It’s just a little itsy bitsy gully.

Some Uber & Lyft investors are waiting it out for Level 5 fully automated driving, which will reduce the biggest expense (drivers’ labor costs) to nearly zero, to be replaced by very large one-time fixed costs to acquire the fleet & maintenance costs thereafter. Do you think they’ll have a realistic business model after then?

“Do you think they’ll have a realistic business model after then?”

No, because who needs Uber and Lyft when those vehicles are available? No one, because Uber and Lyft are all about recruiting drivers to drive passengers, and those vehicles don’t need driers, so automakers who make and own those vehicles will run those services (apps), and their existing dealer networks will manage and service the vehicles. That’s the subscription model of transportation coming to a curb near you.

No taxi business will do same thing

Wolf, 2yr UST is now at 2.83%.

Are you buying?

Already did at the last auction at the end of April. But the yield got pushed down right before the auction :-]

I only bought a small slice. I’ll buy shorter maturities over the next few months at auction, also in small slices. Yields are going up, and it’s a balancing act. I also want to stay liquid for events.

After a banner 2021 with average bonuses exceeding $250,000 for the first time, investment bankers are starting to fret about their compensation & even job prospects, according to a BI report. Goldman’s year-to-date bonus pool for 2022 is 2/3rds of last year’s.

Yes, markets are tanking, IPOs are dead, SPACs are dead, M&A is stalling, Wall Street fees are plunging, and those folks are going to make a whole lot less money.

The Everything Bubble on Wall Street was fun while it lasted.

New tag line for Wolfstreet.com – “Welcome to the Implodium”

Hotels are doing very well. Marriott just had a good earning call and they have been trending up the past 4 months while the rest of the market has been trending down. The consumer are willing to pay higher prices for hotel rooms and the hotel industry says consumers saved a lot of money during covid and now are willing to spend it on travel.

Airlines said the same thing. Consumers do not seemed phased by higher prices yet.

Same with car rental companies. People are paying more per day than ever berfore.

This is consistent with the shift from purchases of durables to purchases of services which has been occurring. Just put everything on the card, evidenced by increasing card balances. Now rates are increasing. What could go wrong?

Marriot has cut services dramatically. You no longer can expect daily maid service or room service.

I’ve heard that Disney has done the same. Imagine paying $700 a night for glorified motel room and not getting room service.

I paid $160 for what could actually be considered a “flea bag motel” a month or so ago while on the road. They didn’t even have ice anymore. Really screwy rates.

Good thing the CEO is focused on woke nonsense while the company loses 3/4 of its value.

My understanding is, private investors who were in unicorn tech businesses have vanished, as well as retail stockholders in public companies. That expanded private market was maybe based on expectations of retail bagholders to show up and buy the stocks eventually?

The game of musical chairs has frozen for the moment. There is enough cash out thereto provide a floor and a big buy on a big dip though.

C’mon man. WTF ! We Boomers just figured how to use the app and now it looks like it’s all heading into the shitter. What’s next? No replacement parts from Mongomery Ward for corsets? Outrageous.

Why is the stock of this incredibly unprofitable company still $22.75 a share?

Should be more like $2.75, and I’m being generous.

Patience, Bam_Man, patience!

$21.12 and falling, Bam.

Perhaps going to zero in a straight line.

Lyft driver annual income averages about $30k (Indeed).

An oilfield tanker truck driver may earn $75k or more.

And now neither can afford food, fuel, vacations or anything else beyond their basic needs. Soon, some of the basics will be on the chopping block too, just in time for more Government fees (tax) on everything, and the necessary increases in income and asset taxes.

Boys and girls:

“A rose, by any other name, smells just as sweet” So it is that “tax and spend , by any other name, is just as destructive”.

I don’t understand this share value decline.

Aren’t the massive upsides on profits per share an attraction for price appreciation?

Lake Mead is a metaphor for the market. As the lake recedes due to the drought, barrels containing corpses are being exposed. The authorities expect to find lots more…

LOL. Gruesome, but funny too.

My $0.02…Uber and Lyft solved one glaring problem with the taxi industry. That is making the ordering process easy and transparent. Before them, you had two options to hitch a private car ride. One is waiting outside a busy street for a taxi to show up. The other is by calling a rude dispatcher and waiting for an open-ended amount of time. With Uber and lift, we got an easy confirmation, accurate ETA for an order, without the hassle of trying to hail a cab on the fly. Paying was always awkward too, especially when the drivers couldn’t take cards.

The idea of using Average Joe’s extra automotive capacity versus a dedicated fleet of cars and employee drivers was mostly just a cost-shifting scheme. It costs money to operate a car, and Uber/Lyft offloaded that expense onto drivers by claiming they were independent contractors. Drivers are finally wising up to those costs and just quitting because the juice ain’t worth the squeeze.

Once had an Uber driver in San Fran tell me he used to make $100k a year working quite a bit in a regular cab. And Uber cut that by over half and he was ready to just walk away.

The only reason they were cheaper than cabs was by screwing the driver out of a decent wage, and by burning investor cash to build market share over taxis.

Something like “Curb” seems to make more sense for the taxi industry. With it, Taxi companies and offload the dispatching services to an app, and just focus on drivers and cars. Better experience all around.

Those fantasy valuations for a glorified taxi booking service blow my mind!

Your statement about killing the cab market by flooding it with cheap drivers without a cab medallion is what this all about.

Neo-liberalism is not a business model, it is an anti-union agenda using cheap Fed money/debt to root out any last vestige of organized labor.

Great irony is that they use two-levels of ‘socialism’ or rather collectivism to inflict their money-losing, labor-killing business model on the world. After they set up the deal, Lyft goes to the ‘market’. where they can get pension funds and other pools of public funds to back them. Then they use to the collective value of the drivers themselves, and their car purchases, where they take their skim.

Lyft/Uber is a skim, with no added value. Investors who now have to value their capital, will take these guys to zero.

Very few cities have taxi medallions.

There was an article by one of Wolf’s guest columnists (John McNellis) a couple of years ago talking about how the food delivery apps would fail in the end. His point was that Silicon Valley makes money when it comes up with something new that costs a fortune in up-front fixed expenses and next to nothing in variable expenses.

“Here’s the rub: You can scale intellectual property, you can’t scale labor. Your millionth pizza costs as much to deliver as your first.”

That is the problem with these ride sharing companies. You are right that their software solved a real problem with taxis… but Curb is the solution that makes money… not Uber or Lyft. It just doesn’t make MUCH money since it is not a “disruptor” like the VC want to invest in.

The FED just raised by 50 basis points and the market loves it. Going parabolic. WOOHOOOOO!!!

Skirmish Line is forming!

“The FED just raised by 50 basis points and the market loves it.”

Mister Market doesn’t suffer from algolagnia. He actually rather enjoys it. That could change when he has to refinance his margin debt, although it’s possible the Plunge Protection Team had inside information and got in ahead of the call.

Market is taking off because JP said inflation looks like it has peaked and may have dropped a bit the past two months.

From what I gathered or interpreted is there is not guarantee of any future rate hikes. It will be a case by case decision in future meetings. Market loves that news.

They also are not going to reduce the balance sheet until the start of June. LOL Somebody asked him why not know. He gave some type of answer but it sounds like they are chickening out on the balance sheet reduction.

“He gave some type of answer but it sounds like they are chickening out on the balance sheet reduction.”

This is wishful thinking by speculators. They will be reducing their balance sheet. And, NEWSFLASH: Inflation is still roaring, and will continue to.

Has anybody noticed how the speculators keep saying “they won’t raise again” every time they raise? I even read people who were saying yesterday that the FED wouldn’t even be raising today. There is some serious KOOL-AID flowing.

ru82,

“They also are not going to reduce the balance sheet until the start of June. LOL”

That’s exactly as they explained in the minutes: announce in May, start in June, phase in over three months. Zero surprise.

ru82,

“From what I gathered or interpreted is there is not guarantee of any future rate hikes. ”

Nope. He did take 75 basis points off the table for now. But 50 basis points next meeting, maybe 50 basis points a few more meetings.

Typical bear-market spike. There’s nothing like a bear-market rally powered by short-covering.

You mean you’re not going “all-in” Wolf? C’mon, YOLO!

Judy Sheldon was on CNBC and said the truth. Same as the PHD economist and former Congressman Bratt said in VA. You need at least 7.5% Fed Funds rate to break even with inflation. This .5% rate hike is just chump change. Fed is still stimulating the economy and Inflation and will be for the next two years. This Fed policy will not work. Inflation will continue and may accelerate until civil order starts to break down.

In my view Powell should have done everyone a great service and announced his resignation.

1) The Fed raised rate by .50% today. JP is hawkish. He will raise rates

and reduce assets.

2) Fed assets – RRP = Fed net assets.

3) The Fed will raise rates, reduce RRP, providing liquidity, reduce

assets, keeping net assets constant.

Ridership is being subsidized to the tune of almost $1 billion per year and ridership is still declining? That’s an accomplishment.

> Ridership is being subsidized to the tune of almost $1 billion per year and ridership is still declining? That’s an accomplishment.

Indeed!

The upside: the less we move around, the less we pollute the environment :-). We’ve never before had the chance to not only work from home, the bulk of the entertainment options are also delivered to us at home through streaming.

Why go out? Capitalism is a hostile environment for real humans :-)

I’d appreciate removal of the previous comment. It was intended as a reply to the comment by ru82 in the following article and I still can’t find the Delete button. Much appreciated.

I doubt that these “service-oriented to serve those who aren’t starving yet” types of companies like Lyft are sustainable.

As the middle class feels less safe, they will cut back on passing burdens to the lower middle class.